Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Reven Housing REIT, Inc. | Financial_Report.xls |

| EX-21 - EXHIBIT 21 - Reven Housing REIT, Inc. | v337734_ex21.htm |

| EX-14.1 - EX-14.1 - Reven Housing REIT, Inc. | v337734_ex14-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Reven Housing REIT, Inc. | v337734_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Reven Housing REIT, Inc. | v337734_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Reven Housing REIT, Inc. | v337734_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-54165

Reven Housing REIT, Inc.

(Name of registrant as specified in its charter)

| Colorado | 84-1306078 | |||

| (State or Other Jurisdiction of Incorporation) |

(I.R.S. Employer Identification Number) |

7911 Herschel Avenue, Suite 201

La Jolla, CA 92037

(Address of principal executive offices)

(858) 459-4000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Act):

| Large accelerated filer o | Accelerated filer o | |

| Non-accelerated filer o | Smaller reporting company x | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes o No x

State the aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $359,055.

State the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 8,350,000 shares as of March 28, 2013.

TABLE OF CONTENTS

| Page | ||||

| PART I | ||||

| Item 1. | Business | 3 | ||

| Item 1A. | Risk Factors | 7 | ||

| Item 1B. | Unresolved Staff Comments | 7 | ||

| Item 2. | Properties | 7 | ||

| Item 3. | Legal Proceedings | 7 | ||

| Item 4. | Mine Safety Disclosures | 7 | ||

| PART II | ||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Repurchases of Equity Securities | 7 | ||

| Item 6. | Selected Financial Data | 8 | ||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 9 | ||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 11 | ||

| Item 8. | Financial Statements and Supplementary Data | 12 | ||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 24 | ||

| Item 9A. | Controls and Procedures | 24 | ||

| Item 9B. | Other Information | 24 | ||

| PART III | ||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 25 | ||

| Item 11. | Executive Compensation | 27 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 28 | ||

| Item 13. | Certain Relationships and Related Transactions and Director Independence | 29 | ||

| Item 14. | Principal Accountant Fees and Services | 29 | ||

| PART IV | ||||

| Item 15. | Exhibits and Financial Statement Schedules | 31 | ||

| Signatures | 32 |

| 2 |

CAUTIONARY NOTICE

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Those forward-looking statements include our expectations, beliefs, intentions and strategies regarding the future. Such forward-looking statements relate to, among other things, our market, strategy, competition, development plans, financing, revenues, operations, general economic conditions and compliance with applicable laws. These and other factors that may affect our financial results are discussed more fully in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this report. Market data used throughout this report is based on published third party reports or the good faith estimates of management, which estimates are based upon their review of internal surveys, independent industry publications and other publicly available information. Although we believe that such sources are reliable, we do not guarantee the accuracy or completeness of this information, and we have not independently verified such information. We caution readers not to place undue reliance on any forward-looking statements. We do not undertake, and specifically disclaim any obligation, to update or revise such statements to reflect new circumstances or unanticipated events as they occur, and we urge readers to review and consider disclosures we make in this and other reports that discuss factors germane to our business. See in particular our reports on Forms 10-K, 10-Q, and 8-K subsequently filed from time to time with the Securities and Exchange Commission.

PART I

Item 1. Business

Overview

We are engaged in the acquisition of portfolios of occupied and rented single-family houses throughout the United States in accordance with our business plan. Our business plan involves (i) acquiring portfolios of rented houses from investors who have bought the homes at what we believe were attractive prices, repaired the houses as needed, and rented them; and (ii) receiving current income from rentals and appreciation of houses. For our acquisitions, we employ strict underwriting procedures for operating costs, re-leasing costs and capital improvement costs and obtain third party reports for physical condition and valuation due diligence.

We had limited operations during 2012. Our first acquisition closed in November 2012, when we acquired five single-family homes located in the Atlanta, Georgia, metropolitan area. As of the date of this annual report, we have acquired a total of nine single-family homes, all of which are located in the Atlanta, Georgia, metropolitan area. To further execute our business plan, we will need to raise additional funding. We are currently in the process of reviewing potential opportunities to purchase portfolios of rented houses in our target markets across the United States and are seeking additional investment opportunities.

We intend to take all necessary steps to qualify as a real estate investment trust (“REIT”) under the Internal Revenue Code, as amended (the “Code”). However, no assurance can be given that we will qualify or remain qualified as a REIT.

Our History

The Company was originally incorporated on April 26, 1995, in the State of Colorado under the name “Colorado Security Patrol Inc.” to provide a variety of security services on both a residential and commercial basis. The Company was not successful in generating sufficient revenues from this business. On March 12, 2007, the Company filed an amendment to its Articles of Incorporation changing its name to “Bureau of Fugitive Recovery, Inc.” and expanded its operations to include the tracking and apprehension of offenders who had failed to appear in court or had otherwise had their bond revoked. The Company has had minimal revenues since its inception.

Since the change in control transaction in which Chad M. Carpenter, our current Chairman of the Board, President, Chief Executive Officer and Chief Financial Officer, acquired a majority of the issued and outstanding shares of our common stock on July 2, 2012, the Company has been engaged in its current real estate business. In connection with the change in our business, on July 5, 2012, our shareholders, on the recommendation of the Company’s board of directors, approved an amendment of the Company’s Restated Articles of Incorporation to change the Company’s name to “Reven Housing REIT, Inc.” from “Bureau of Fugitive Recovery, Inc.” The Company filed the Articles of Amendment with the Colorado Secretary of State effectively changing its name to “Reven Housing REIT, Inc.” on August 9, 2012.

| 3 |

In this report, unless expressly provided otherwise, “Reven,” the “Company,” “we,” “us,” and “our” refer to Reven Housing REIT, Inc., a Colorado corporation and its wholly-owned subsidiary.

Our Business

Acquisition Criteria

We are engaged in the acquisition of portfolios of tenant occupied single-family houses (“SFR”) throughout the United States. Our investment objective is yield therefore all SFR portfolios must be fixed, leased and occupied.

Underwriting Details

| Portfolio Size Sought: | 25-500 rented homes per transaction | |

| Target Rental Yield: | Class A Gross Rental Yield = 15% to 18% | |

| Class B Gross Rental Yield = 18%+ | ||

| Expenses: | 50% or less (including property management, maintenance, tax, insurance, vacancy, home owners association fees, and credit loss) | |

| Tenants: | Tenants must not be in default or late on rent payments | |

| Maintenance: | All deferred maintenance must be fixed or will be deducted from the purchase price | |

| Management: | Preference for hiring existing property management company |

Target Markets

|

§ Houston, TX § Dallas, TX § Austin, TX § San Antonio, TX § Forth Worth-Arlington, TX

§ Raleigh, NC § Charlotte, NC

§ Virginia Beach, VA

§ San Jose, CA § Los Angeles, CA § Anaheim, CA § San Francisco, CA § San Diego, CA |

§ Phoenix, AZ § Tucson, AZ

§ Tampa, FL § Fort Lauderdale, FL § Miami, FL § Orlando, FL

§ Oklahoma City, OK § Tulsa, OK

§ Nashville, TN § Memphis, TN |

§ Las Vegas, NV

§ Atlanta, GA

§ Denver, CO

§ Salt Lake City, UT

§ Louisville, KY

§ Richmond, VA

§ Indianapolis, IN

§ Chicago, IL |

| 4 |

The UPREIT Option

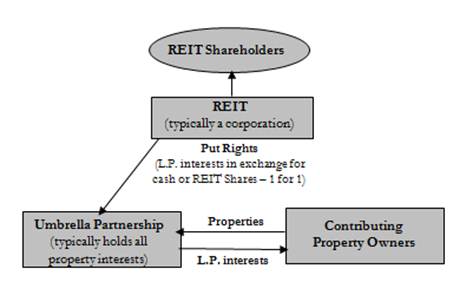

As part of our business plan, we may, but are not required to, structure future portfolio acquisitions using an “umbrella partnership REIT” (“UPREIT”) structure. Specifically, portfolio acquisitions could be structured as a contribution of property by sellers to the REIT’s operating partnership (the “OP”) in exchange for the limited partnership interests in the OP (“OP Units”), in lieu of cash. Such contributions can generally be structured in a manner that allows the seller to defer the recognition of taxable gain. The seller, through the OP Units, would be able to participate in any distributions from the assets owned by the OP and, because the OP Units are convertible to shares in the REIT, the seller benefits from appreciation of the REIT shares over time. When a seller converts its OP Units into REIT shares, the gain that was deferred upon contribution of the property to the OP is triggered, but the seller is now holding publically traded shares that may be sold or otherwise monetized in order to pay the resulting tax. The diagram below illustrates an example of the UPREIT structure.

As indicated above, no assurance can be given that we will qualify or remain qualified as a REIT, and furthermore, there can be no assurances that we will implement the UPREIT structure.

Competition

We face competition from many entities engaged in real estate investment activities, including individuals, other real estate investment companies including newly formed REITs, and real estate limited partnerships. Our competitors may enjoy significant competitive advantages that result from, among other things, having substantially more available capital, a lower cost of capital and enhanced operating efficiencies. Further, the market for the rental of properties is highly competitive. We also face competition from new home builders, investors and speculators, as well as homeowners renting their properties.

| 5 |

Employees

As of March 28, 2013, we employed one full-time employee, who is not represented by a labor union. We believe that our relationship with our employee is satisfactory.

Available Information

Our website is located at www.revenhousingreit.com. The information on or accessible through our website is not part of this annual report on Form 10-K. A copy of this annual report on Form 10-K is located at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports and other information regarding our filings at www.sec.gov.

| 6 |

| Item 1A. | Risk Factors |

As a "smaller reporting company" defined in Item 10(f)(1) of Regulation S-K, we are electing scaled disclosure reporting obligations and therefore are not required to provide the information requested by this item.

| Item 1B. | Unresolved Staff Comments |

We have no unresolved staff comments.

| Item 2. | Properties |

As of March 28, 2013, we owned nine single-family homes encompassing an aggregate of 12,989 rentable square feet, which were 100% occupied. The following is a summary of our real estate properties as of March 29, 2013:

| Property | Location | Date Acquired | Monthly Rent (1) | Occupancy | ||||||||

| 7220 Little Fawn Parkway | Palmetto, GA | 11/07/2012 | $775 | 100% | ||||||||

| 5242 Station Circle | Norcross, GA | 11/07/2012 | $900 | 100% | ||||||||

| 615 Cowan Road | Covington, GA | 11/07/2012 | $875 | 100% | ||||||||

| 110 Bear Run Ct. | Palmetto, GA | 11/07/2012 | $800 | 100% | ||||||||

| 4860 Lost Colony | Stone Mountain, GA | 11/07/2012 | $900 | 100% | ||||||||

| 1740 Camden Forrest Trail | Riverdale, GA | 01/10/2013 | $875 | 100% | ||||||||

| 11352 Michelle Way | Hampton, GA | 01/10/2013 | $825 | 100% | ||||||||

| 205 Highgate Trail | Covington, GA | 01/10/2013 | $875 | 100% | ||||||||

| 924 Lake Terrace Drive | Stone Mountain, GA | 01/10/2013 | $875 | 100% | ||||||||

| $ | 7,700 | 100% | ||||||||||

_____________________

| (1) | Adjusted to reflect any contractual tenant concessions. |

| Item 3. | Legal Proceedings |

As of the date of this report, there are no pending legal proceedings to which we or our properties are subject.

| Item 4. | Mine Safety Disclosures |

Not applicable.

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Repurchases of Equity Securities |

Market Information

Our common stock has been quoted on the OTC Bulletin Board since December 2010. From December 2010 to August 2012, our common stock was quoted on the OTCBB under the symbol BRFG. Since August 2012, our common stock has been quoted under the symbol RVEN. There had been no trading of our common stock until December 2012. The high and low sale prices for our common shares on the OTCBB during the quarterly period ended December 31, 2012 are both $1.02. However, we consider our common stock to be “thinly traded” and any reported sale prices may not be a true market-based valuation of the common stock.

| 7 |

Holders of Record

As of March 28, 2013, there were approximately 75 holders of record of our common stock.

Dividend Policy

We have never declared or paid cash dividends on our common stock. We presently intend to retain earnings to finance the operation and expansion of our business.

Equity Compensation Plan Information

In September 2012, we adopted, and our stockholders approved, our 2012 Incentive Compensation Plan, or 2012 Plan, pursuant to which 5,002,500 shares of our common stock are reserved for issuance to employees, directors, consultants, and other service providers. The 2012 Plan allows for incentive awards to eligible recipients consisting of:

| · | Options to purchase shares of common stock, that qualify as incentive stock options within the meaning of the Internal Revenue Code; |

| · | Non-statutory stock options that do not qualify as incentive options; |

| · | Restricted stock awards; and |

| · | Stock appreciation rights. |

As of the date of this annual report, we have not granted any options under our 2012 Plan nor have we granted any non-Plan options. All 5,002,500 shares of our common stock initially reserved for issuance under our 2012 Plan remain available for future issuance to employees, directors, consultants, and other service providers. The following table sets forth certain information as of December 31, 2012 about our 2012 Plan and the non-Plan options.

| Plan Category | (a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

(b) Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

(c) Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected In Column (a)) | ||||

| Equity compensation plans approved by security holders | -0- | $ | N/A | 5,002,500 | |||

| Equity compensation plans not approved by security holders | -0- | $ | N/A | -0- | |||

| Total | -0- | $ | N/A | 5,002,500 | |||

| Item 6. | Selected Financial Data |

As a "smaller reporting company" defined in Item 10(f)(1) of Regulation S-K, we are electing scaled disclosure reporting obligations and therefore are not required to provide the information requested by this item.

| 8 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This information contained in this report contains forward-looking statements that relate to expectations, beliefs, projections, future plans and strategies, anticipated events and similar expressions. Forward-looking statements may be identified by use of words such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” or “potential” or similar words or phrases which are predictions of or indicate future events or trends. Statements such as those concerning potential acquisition activity, investment objectives, strategies, opportunities, other plans and objectives for future operations or economic performance are based on the Company’s current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties, including the Company’s ability to successfully (i) acquire real estate investment properties in the future, (ii) to execute future agreements or understandings concerning the Company’s acquisition of real estate investment properties and (iii) be able to raise the capital required to acquire any such properties. Any of these statements could prove to be inaccurate and actual events or investments and results of operations could differ materially from those expressed or implied. To the extent that the Company’s assumptions differ from actual results, the Company’s ability to meet such forward-looking statements, including its ability to invest in a diversified portfolio of quality real estate investments, may be significantly and negatively impacted. You are cautioned not to place undue reliance on any forward-looking statements and the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, future events or other changes.

In 2012, the Company significantly changed its business operations upon a change of control event. On July 2, 2012, Chad M. Carpenter purchased an aggregate of 5,999,300 shares of the outstanding common stock of the Company from certain of the Company’s stockholders in a private transaction. As consideration for the shares, Mr. Carpenter paid a total purchase price of $128,605 in cash from his personal funds. In connection with the transaction, an aggregate of 1,650,000 shares of the Company’s outstanding common stock were returned to treasury for cancellation. Immediately upon the closing of the transaction, Mr. Carpenter became the majority shareholder of the Company and beneficially owned stock representing 71.8 percent of the outstanding voting shares of the Company.

As a result of the above change in control and management, the Company is now pursuing a new business. The Company intends to acquire portfolios of occupied and rented single-family houses throughout the United States in accordance with its new business plan. The Company’s business plan involves (i) acquiring portfolios of rented houses from investors; and (ii) receiving income from rental property activity and future profits from sale of rental property at appreciated values.

In November 2012, the Company made its first acquisition of 5 rental homes. Four additional homes were purchased under the same contract subsequent to year end in January 2013. To carry out its business plan, the Company will need additional funding. The Company is currently in the process of pursuing potential transactions to purchase portfolios of rented houses in its target markets across the United States and is seeking additional equity and debt capital in order to fund these acquisitions. There can be no assurance that such capital will be available on favorable terms or at all or that any additional capital that the Company is able to obtain will be sufficient to meet its needs.

The Company intends to take all necessary steps to qualify as a REIT under the Code. However, no assurance can be given that the Company will qualify or remain qualified as a REIT.

Liquidity and Capital Resources

The Company did not generate any significant revenues in 2012. As of December 31, 2012, the Company’s cash balance was $5,763. Operations have been funded by short term notes and advances from Mr. Carpenter and his affiliated entity. As a result of the Company’s limited working capital, operations have been limited. Until additional funds are raised in order to pursue the Company’s business plan and generate material revenues, activities will be restricted.

For the year ended December 31, 2011, the Company did not pursue any investing activities. This was also the case for the first six months of 2012. However, the Company pursued new portfolio acquisitions in the second half of 2012 and completed its first purchase in November 2012 of 5 homes for a total cost of $343,410. Subsequent to year end, an additional 4 homes were purchased for a cost of approximately $263,000.

For the year ended December 31, 2011, the Company did not pursue any financing activities. This was also the case for the first six months of 2012. However, the Company has been actively pursuing new sources of debt and equity during the second half of 2012.

On July 2, 2012, the Company issued convertible promissory notes to four accredited investors in the aggregate principal amount of $52,789 (the “Notes”). The maturity date of the Notes was July 2, 2013, and the Notes bore interest at a rate of 10 percent per annum payable in full on the maturity date and are unsecured.

Chad M. Carpenter, the President, Chief Executive Officer, Chief Financial Officer and a member of our board of directors, is one of the investors in the Notes. The Company issued a Note in the principal amount of $26,395 to Mr. Carpenter prior to Mr. Carpenter joining the Company.

On October 18, 2012, the Company issued additional convertible promissory notes to five accredited investors in the aggregate principal amount of $500,000. The maturity date for these notes is the earlier of December 31, 2013, or upon the Company raising $5 million of equity capital. The notes bear interest at a rate of 10 percent per annum payable in full on the maturity date and are unsecured. Upon the Company successfully raising additional capital, the Notes may be exchanged by the holders for such securities of the Company at the same price and on the same terms and conditions being offered to the other investors in such financing, and the principal and accrued interest under the Notes will be applied towards the purchase price of such security. The Notes may be prepaid in whole or in part at the Company’s option without penalty. Proceeds from the Notes were utilized for property acquisitions and to fund payables and operations of the Company.

| 9 |

Chad M. Carpenter was one of the individuals investing in this new note round and the Company issued a note for $225,000 to Mr. Carpenter in exchange for his additional investment.

Additionally the Notes issued on July 2, 2012 bearing a principal balance of $52,789, were cancelled and exchanged, along with the accrued interest due of $1.563, for new notes bearing terms identical to the $500,000 note round explained above.

On January 3, 2013, the Company issued additional promissory notes to certain accredited investors in the aggregate principal amount of $500,000. The notes contain the same terms and conversion provisions as the prior notes issued. Of the additional $500,000 loaned in January 2013, $400,000 was advanced by Reven Capital, LLC, an affiliated company owned 100% by Mr. Carpenter.

The Company has been pursuing short term debt and other financing in order to fund its operations and to provide capital for acquisitions.

The Company currently has no other agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit, stock offerings or any other sources.

The Company’s ability to become a viable entity is dependent on its ability to raise future debt and equity capital in order to purchase assets under its new business plan or to fund its ongoing operations. The Company’s inability to raise funds for the above purposes will have a severe negative impact on its ability to remain a viable company.

Results of Operations

For the year ended December 31, 2012, the Company had total rental income of $6,750. Legal and accounting expenses totaled $396,797, general and administrative expenses were $132,261. Legal and accounting expenses were amounts paid primarily for services necessary for the Company’s change of operations and for developing documents necessary to pursue future acquisitions and capital activities. Interest and depreciation totaled $71,188. Rental expenses were $1,006. Net income from discontinued operations was $334. As a result, the Company had a net loss of $594,168 for the year ended December 31, 2012.

For the year ended December 31, 2011, the Company had revenues of $46,850. The cost of those revenues was $4,425, resulting in a gross profit of $42,425. The Company incurred legal and accounting expenses of $26,675, general and administrative expenses of $16,640, and interest expense of $1,200. As a result, the Company had a net loss of $2,090 for the year ended December 31, 2011. These amounts are presented as discontinued operations on the accompanying statement of operations for 2011.

Operating results have decreased significantly and expenses have increased over the past year due to the Company’s decline in operations and a focus on developing a new viable business plan along with the costs necessary to restructure the Company’s operations and prepare for the Company’s planned expansion of operations and ongoing capital search.

Going Concern

The Company has suffered losses from operations, has a working capital deficit, and stockholders' deficit. The Company in all likelihood will be required to make significant future expenditures in connection with its new business plan of acquiring portfolios of rental homes along with incurring general and administrative expenses. These conditions raise substantial doubt about the Company’s ability to continue as a going concern should the Company not be successful in raising new capital.

The Company may raise additional capital through the sale of its equity securities, through an offering of debt securities, or through borrowings from financial institutions. By doing so, the Company hopes to generate revenues from the rental of its future acquired residential home portfolios. Management believes that actions presently being taken to obtain additional funding will provide the opportunity for the Company to continue as a going concern.

Off-Balance Sheet Arrangements

The registrant had no material off-balance sheet arrangements as of December 31, 2012.

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The following represents a summary of our critical accounting policies, defined as those policies that we believe are the most important to the portrayal of our financial condition and results of operations and that require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effects of matters that are inherently uncertain.

| 10 |

Property Acquisitions

The Company accounts for its acquisitions of real estate in accordance with FASB ASC 805, Accounting for Business Combinations, Goodwill, and Other Intangible Assets which requires the purchase price of acquired properties be allocated to the acquired tangible assets and liabilities, consisting of land, building, and identified intangible assets, consisting of the value of above-market and below-market leases, the value of in-place leases, unamortized lease origination costs and security deposits, based in each case on their fair values.

The Company allocates the purchase price to tangible assets of an acquired property (which includes land and building) based on the estimated fair values of those tangible assets, assuming the property was vacant. Fair value for land and building is based on the purchase price for these properties. The Company also considers information obtained about each property as a result of its pre-acquisition due diligence, marketing and leasing activities in estimating the fair values of the tangible and intangible assets and liabilities acquired.

The total value allocable to intangible assets acquired, which consists of unamortized lease origination costs and in-place leases (including an above-market or below-market component of an acquired in-place lease), are allocated based on management’s evaluation of the specific characteristics of each tenant’s lease and the Company’s overall relationship with that respective tenant. Characteristics considered by management in allocating these values include the nature and extent of the existing business relationships with the tenant, growth prospects for developing new business with the tenant, the remaining term of the lease and the tenant’s credit quality, among other factors. As of December 31, 2012, management has determined that no value is required to be allocated to intangible assets, as the leases assumed are short-term with values that are insignificant.

Income Taxes

The Company accounts for income taxes pursuant to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 740, Income Taxes. Under FASB ASC 740, deferred taxes are provided on a liability method, whereby, deferred tax assets are recognized for deductible temporary differences and operating loss carry forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

The Company accounts for uncertain tax positions in accordance with FASB ASC 740, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under FASB ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. As of December 31, 2012 and 2011, the Company does not have a liability for unrecognized tax uncertainties. The Company’s policy is to record interest and penalties on uncertain tax positions as income tax expense. As of December 31, 2012 and 2011, the Company has no interest or penalties related to uncertain tax positions.

The Company is subject to routine audits by taxing jurisdictions, however, currently no audits for any tax periods are in process. Management believes it is not subject to examinations by tax authorities for tax years prior to 2008.

Pursuant to the Internal Revenue Code, Sections 382 and 383, use of the Company’s net operating loss and credit carry forwards are limited if a cumulative change in ownership of more than 50% occurs within a three-year period. Management believes that such a change has taken place as of July 2, 2012. The Company has not yet performed an assessment on the potential limitation on net operating loss and credit carry forwards.

Warrant Issuance and Note Conversion Feature

The Company accounts for the proceeds from the issuance of convertible notes with detachable stock purchase warrants and embedded conversion features in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 470-20, Debt with Conversion and Other Options. Under FASB ASC 470-20, the proceeds from the issuance of a debt instrument with detachable stock purchase warrants shall be allocated to the two elements based on the relative fair values of the debt instrument without the warrants and of the warrants themselves at the time of issuance. The portion of the proceeds allocated to the warrants is accounted for as additional paid-in capital and the remaining proceeds are allocated to the debt instrument which resulted in a discount to debt which is amortized and charged as interest expense over the term of the note agreement. Additionally, pursuant to FASB ASC 470-20, the intrinsic value of the embedded conversion feature of the convertible notes payable is included in the discount to debt and amortized and charged to interest expense over the life of the note agreement.

New Accounting Pronouncements

The registrant has adopted all recently issued accounting pronouncements. The adoption of the accounting pronouncements, including those not yet effective, is not anticipated to have a material effect on the financial position or results of operations of the registrant.

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk |

As a "smaller reporting company" defined in Item 10(f)(1) of Regulation S-K, we are electing scaled disclosure reporting obligations and therefore are not required to provide the information requested by this item.

| 11 |

| Item 8. | Financial Statements and Supplementary Data |

Index To Financial Statements

| Page | |

| Reports of Independent Registered Public Accounting Firms | 13-14 |

| Consolidated Balance Sheets at December 31, 2011 and 2012 | 15 |

| Consolidated Statements of Operations for the Years Ended December 31, 2011 and 2012 | 16 |

| Consolidated Statements of Changes In Stockholders’ Deficit for the Years Ended December 31, 2011 and 2012 | 17 |

| Consolidated Statements of Cash Flows for the Years Ended December 31, 2011 and 2012 | 18 |

| Notes to Consolidated Financial Statements | 19 |

| 12 |

RONALD R. CHADWICK, P.C.

Certified Public Accountant

2851 South Parker Road, Suite 720

Aurora, Colorado 80014

Telephone (303)306-1967

Fax (303)306-1944

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Reven Housing REIT, Inc.

(formerly Bureau of Fugitive Recovery, Inc.)

La Jolla, California

I have audited the accompanying balance sheet of Reven Housing REIT, Inc. (formerly Bureau of Fugitive Recovery, Inc.) as of December 31, 2011, and the related statements of operations, stockholders' equity and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audit provides a reasonable basis for my opinion.

In my opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Reven Housing Reit, Inc. (formerly Bureau of Fugitive Recovery, Inc.) as of December 31, 2011, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered recurring losses from operations, a condition that raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| Aurora, Colorado | /s/ Ronald R. Chadwick, P.C. |

| February 24, 2012 | RONALD R. CHADWICK, P.C. |

| 13 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Reven Housing REIT, Inc.

La Jolla, California

We have audited the accompanying consolidated balance sheet of Reven Housing, REIT, Inc. (the “Company”) as of December 31, 2012, and the related consolidated statements of operations, stockholders’ deficit, and cash flows for the year then ended. The Company’s management is responsible for these consolidated financial statements. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Reven Housing REIT, Inc. as of December 31, 2012, and the results of its operations and cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in note 1 to the consolidated financial statements, the Company has suffered losses from operations, has a working capital deficit, and stockholder’s deficit that raise substantial doubt its ability to continue as a going concern. Management’s plans in regard to this matter are also described in note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of the uncertainty.

| San Diego, California | /s/ PKF |

| March 28, 2013 | PKF Certified Public Accountants A Professional Corporation |

| 14 |

REVEN HOUSING REIT, INC. AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

December 31, 2011 and 2012

| 2011 | 2012 | |||||||

| ASSETS | ||||||||

| Cash | $ | - | $ | 5,763 | ||||

| Advance to property manager | - | 3,375 | ||||||

| Deferred stock issuance costs | - | 50,000 | ||||||

| Residential homes, net of accumulated depreciation of $1,400 | - | 342,010 | ||||||

| Assets of discontinued operations | 599 | - | ||||||

| Total Assets | $ | 599 | $ | 401,148 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

Convertible notes payable - officer, net of $123,430 debt discount | $ | - | $ | 128,746 | ||||

Convertible notes payable, net of $122,364 debt discount | - | 127,635 | ||||||

| Convertible notes payable - shareholders, net of $25,539 debt discount | - | 26,638 | ||||||

| Accrued expenses | - | 119,978 | ||||||

| Accrued interest and security deposits | - | 14,770 | ||||||

| Related party advance | - | 266,877 | ||||||

| Liabilities of discontinued operations | 17,790 | - | ||||||

| Total Liabilities | 17,790 | 684,644 | ||||||

| Commitments and contingencies (Note 7) | ||||||||

| Stockholders' Deficit | ||||||||

| Preferred stock, $.001 par value; | ||||||||

| 25,000,000 shares authorized; | ||||||||

| No shares issued & outstanding | - | - | ||||||

| Common stock, $.001 par value; | ||||||||

| 100,000,000 shares authorized; 10,000,000 and 8,350,000 shares | ||||||||

| issued & outstanding at December 31, 2011 and 2012, respectively | 10,000 | 8,350 | ||||||

| Additional paid-in capital | 20,000 | 349,513 | ||||||

| Accumulated deficit | (47,191 | ) | (641,359 | ) | ||||

| Total Stockholders' Deficit | (17,191 | ) | (283,496 | ) | ||||

| Total Liabilities and Stockholders' Deficit | $ | 599 | $ | 401,148 | ||||

The accompanying notes are an integral part of the consolidated financial statements.

| 15 |

REVEN HOUSING REIT, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Years Ended December 31, 2011 and 2012

| 2011 | 2012 | |||||||

| Rental income | $ | - | $ | 6,750 | ||||

| Operating expenses: | ||||||||

| Rental expenses | - | 1,006 | ||||||

| Legal and accounting | - | 396,797 | ||||||

| General and administrative | - | 132,261 | ||||||

| Interest expense | - | 69,788 | ||||||

| Depreciation expense | - | 1,400 | ||||||

| - | 601,252 | |||||||

| Loss from continuing operations | - | (594,502 | ) | |||||

| (Loss) income from discontinued operations, net of taxes | (2,090 | ) | 334 | |||||

| Net loss | $ | (2,090 | ) | $ | (594,168 | ) | ||

| Net loss per share from continuing operations | ||||||||

| (Basic and fully diluted) | $ | - | $ | (0.06 | ) | |||

| Net loss per share from discontinued operations | ||||||||

| (Basic and fully diluted) | $ | - | $ | - | ||||

| Weighted average number of | ||||||||

| common shares outstanding | 10,000,000 | 9,170,492 | ||||||

The accompanying notes are an integral part of the consolidated financial statements.

| 16 |

REVEN HOUSING REIT, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

For the Years Ended December 31, 2011 and 2012

| Common Stock | ||||||||||||||||||||

| Shares | Amount | Additional Paid-in Capital | Accumulated Deficit | Total | ||||||||||||||||

| Balance at December 31, 2010 | 10,000,000 | $ | 10,000 | $ | 20,000 | $ | (45,101 | ) | $ | (15,101 | ) | |||||||||

| Net loss for the year | - | - | - | (2,090 | ) | (2,090 | ) | |||||||||||||

| Balance at December 31, 2011 | 10,000,000 | $ | 10,000 | $ | 20,000 | $ | (47,191 | ) | $ | (17,191 | ) | |||||||||

| Shares returned to treasury | (1,650,000 | ) | (1,650 | ) | 1,650 | - | - | |||||||||||||

| Fair market value of note conversion feature and warrants issued | - | - | 327,863 | - | 327,863 | |||||||||||||||

| Net loss for the year | - | - | - | (594,168 | ) | (594,168 | ) | |||||||||||||

| Balance at December 31, 2012 | 8,350,000 | $ | 8,350 | $ | 349,513 | $ | (641,359 | ) | $ | (283,496 | ) | |||||||||

The accompanying notes are an integral part of the consolidated financial statements.

| 17 |

REVEN HOUSING REIT, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended December 31, 2011 and 2012

| 2011 | 2012 | |||||||

| Cash Flows From Operating Activities: | ||||||||

| Net loss | $ | (2,090 | ) | $ | (594,168 | ) | ||

| Net loss (income) from discontinued operations | 2,090 | (334 | ) | |||||

| Adjustments to reconcile net loss to | ||||||||

| net cash used for operating activities: | ||||||||

| Amortization of debt discount | - | 56,530 | ||||||

| Depreciation expense | - | 1,400 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Advance to property manager | - | (3,375 | ) | |||||

| Deferred stock issuance costs | - | (50,000 | ) | |||||

| Accrued expenses, accrued interest and security deposits | - | 131,958 | ||||||

| Related party advances | - | 266,877 | ||||||

| Net cash used for operating activities - continuing operations | - | (191,112 | ) | |||||

| Net cash (used for) provided by operating activities - discontinued operations | (890 | ) | 334 | |||||

| Net cash used for | ||||||||

| operating activities | (890 | ) | (190,778 | ) | ||||

| Cash Flows From Investing Activities: | ||||||||

| Acquisition of residential homes | - | (343,410 | ) | |||||

| Net cash used for | ||||||||

| investing activities | - | (343,410 | ) | |||||

| Cash Flows From Financing Activities: | ||||||||

| Proceeds from convertible notes payable | - | 554,352 | ||||||

| Payments on notes payable | - | (15,000 | ) | |||||

| Net cash provided by | ||||||||

| financing activities | - | 539,352 | ||||||

| Net (Decrease) Increase In Cash | (890 | ) | 5,164 | |||||

| Cash at the Beginning of the Year | 1,489 | 599 | ||||||

| Cash at the End of the Year | $ | 599 | $ | 5,763 | ||||

| Supplemental Disclosure of Non-Cash Investing and Financing Activities | ||||||||

| Debt discount for allocation of proceeds to warrants | ||||||||

| and beneficial conversion feature of debt | $ | - | $ | 327,863 | ||||

| Supplemental Disclosure: | ||||||||

| Cash paid for interest | $ | - | $ | 2,790 | ||||

| Cash paid for income taxes | $ | - | $ | - | ||||

The accompanying notes are an integral part of the consolidated financial statements.

| 18 |

REVEN HOUSING REIT, INC. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2011 and 2012

NOTE 1. ORGANIZATION, OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Reven Housing REIT, Inc. and Subsidiary (the “Company”) (formerly known as Bureau of Fugitive Recovery, Inc.) was incorporated in the State of Colorado on April 26, 1995. The Company provided bounty hunting services for bail bond businesses through July 2, 2012.

There was a change of control for the Company when on July 2, 2012; Chad M. Carpenter purchased an aggregate of 5,999,300 shares of the outstanding common stock of the Company from certain of the Company’s stockholders in a private transaction. As consideration for the shares, Mr. Carpenter paid a total purchase price of $128,605 in cash from his personal funds. In connection with the transaction, an aggregate of 1,650,000 shares of the Company’s outstanding common stock were returned to treasury for cancellation. Immediately upon the closing of the transaction, Mr. Carpenter became the majority shareholder of the Company and beneficially owned stock representing 71.8 percent of the outstanding voting shares of the Company.

The Company is now engaged in a new business and has formerly changed its name from the Bureau of Fugitive Recovery, Inc. to “Reven Housing REIT, Inc.”. The Company intends to acquire portfolios of occupied and rented single-family houses throughout the United States in accordance with its new business plan. The Company’s business plan involves (i) acquiring portfolios of rented houses from investors; and (ii) receiving income from rental property activity and future profits from sale of rental property at appreciated values.

Discontinued Operations

On July 2, 2012, the Company discontinued operations related to the Bureau of Fugitive Recovery, Inc. upon Chad M. Carpenter becoming the majority shareholder of the Company. Accordingly, the former operations are classified as discontinued operations in the accompanying consolidated statements of operations. The assets and liabilities of the former company are separately reflected on the consolidated balance sheet.

Earnings per share attributable to discontinued operations were $0.0 and $0.0 for 2012 and 2011, respectively.

Going Concern

The Company has suffered losses from operations, has a working capital deficit, and stockholders' deficit. Further, a company owned by the majority stockholder has provided significant advances to the Company for operations. The Company in all likelihood will be required to make significant future expenditures in connection with its new business plan of acquiring portfolios of rental homes along with incurring additional general and administrative expenses. These conditions raise substantial doubt about the Company’s ability to continue as a going concern should the Company not be successful in raising new capital.

To carry out its business plan, the Company will need to seek additional funding and may raise additional capital through the sale of its equity securities, through an offering of debt securities, and/or through borrowings from financial institutions. There can be no assurance that such capital will be available on favorable terms or at all or that any additional capital that the Company is able to obtain will be sufficient to meet its needs. The Company is currently in the process of reviewing potential opportunities to purchase portfolios of rented houses in its target markets across the United States and is seeking additional investment opportunities. By doing so, the Company hopes to generate revenues from the rental of its future acquired residential home portfolios. Management believes that actions presently being taken to obtain additional funding will provide the opportunity for the Company to continue as a going concern.

Basis of Accounting

The accompanying consolidated balance sheet is presented in conformity with accounting principles generally accepted in the United States of America ("GAAP").

Principals of Consolidation

The accompanying financial statements consolidate the accounts of the Company and its wholly-owned subsidiary Reven Housing Georgia, LLC. All significant inter-company transactions have been eliminated in consolidation.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less as cash equivalents.

| 19 |

Advances to Property Manager

Advances to property manager represent the amount of security deposits which are held by the property manager on behalf of the Company.

Deferred Stock Issuance Costs

Deferred stock issuance costs represent amounts paid for consulting services in conjunction with the anticipated raising of additional capital to be performed within one year.

Warrant Issuance and Note Conversion Feature

The Company accounts for the proceeds from the issuance of convertible notes with detachable stock purchase warrants and embedded conversion features in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 470-20, Debt with Conversion and Other Options. Under FASB ASC 470-20, the proceeds from the issuance of a debt instrument with detachable stock purchase warrants shall be allocated to the two elements based on the relative fair values of the debt instrument without the warrants and of the warrants themselves at the time of issuance. The portion of the proceeds allocated to the warrants is accounted for as additional paid-in capital and the remaining proceeds are allocated to the debt instrument which resulted in a discount to debt which is amortized and charged as interest expense over the term of the note agreement. Additionally, pursuant to FASB ASC 470-20, the intrinsic value of the embedded conversion feature of the convertible notes payable is included in the discount to debt and amortized and charged to interest expense over the life of the note agreement.

Revenue Recognition

Revenue for bounty services is recognized on an accrual basis after services have been performed under contract terms, the service price to the client is fixed or determinable, and collectability is reasonably assured. Property is leased under rental agreements of varying terms (generally one year) and revenue is recognized over the lease term on a straight-line basis.

Income Taxes

The Company accounts for income taxes pursuant to FASB ASC 740, Income Taxes. Under FASB ASC 740, deferred taxes are provided on a liability method, whereby, deferred tax assets are recognized for deductible temporary differences and operating loss carry forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

The Company accounts for uncertain tax positions in accordance with FASB ASC 740, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under FASB ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. As of December 31, 2012 and 2011, the Company does not have a liability for unrecognized tax uncertainties. The Company’s policy is to record interest and penalties on uncertain tax positions as income tax expense. As of December 31, 2012 and 2011, the Company has no interest or penalties related to uncertain tax positions.

The Company is subject to routine audits by taxing jurisdictions, however, currently no audits for any tax periods are in process. Management believes it is not subject to examinations by tax authorities for tax years prior to 2008.

Pursuant to the Internal Revenue Code, Sections 382 and 383, use of the Company’s net operating loss and credit carry forwards are limited if a cumulative change in ownership of more than 50% occurs within a three-year period. Management believes that such a change has taken place as of July 2, 2012. The Company has not yet performed an assessment on the potential limitation on net operating loss and credit carry forwards.

Incentive Compensation Plan

During 2012, the Company established the 2012 Incentive Compensation Plan (“2012 Plan”). The 2012 Plan allows for the grant of options and other awards representing up to 5,002,500 shares of the Company’s common stock. Such awards may be granted to officers, directors, or employees of the Company or any related entity. Under the 2012 Plan, options may be granted at an exercise price greater than or equal to the market value at the date of the grant, for owners of 10% or more of the voting shares, at an exercise price of not less than 110% of the market value. Awards are exercisable over a period of time as determined by a committee designated by the Board of Directors, but in no event longer than ten years. No awards have been granted as of December 31, 2012.

Net Loss Per Share

Net loss per share is computed by dividing the net loss by the weighted average number of shares of common stock outstanding. Warrants, stock options, and common stock issuable upon the conversion of the Company's preferred stock (if any), are not included in the computation if the effect would be anti-dilutive and would increase the earnings or decrease loss per share. As of December 31, 2012 there are no shares that are potentially dilutive.

| 20 |

Financial Instruments

The carrying value of the Company’s financial instruments, as reported in the accompanying consolidated balance sheets, approximates fair value.

Security Deposits

Security deposits represent amounts deposited by tenants at the inception of the lease. These amounts have been allocated from the purchase price of the residential homes (Note 2). Security deposits amounted to $3,375 at December 31, 2012.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the balance sheet date and reported amounts of expenses for the periods presented. Accordingly, actual results could differ from those estimates. Significant estimates include assumptions used to value warrants and conversion features associated with notes payable (Note 3). Further, significant estimates include assumptions used to determine the allocation of purchase prices of property acquisitions (Note 1).

Property Acquisitions

The Company accounts for its acquisitions of real estate in accordance with FASB ASC 805, Accounting for Business Combinations, Goodwill, and Other Intangible Assets which requires the purchase price of acquired properties be allocated to the acquired tangible assets and liabilities, consisting of land, building, and identified intangible assets, consisting of the value of above-market and below-market leases, the value of in-place leases, unamortized lease origination costs and security deposits, based in each case on their fair values.

The Company allocates the purchase price to tangible assets of an acquired property (which includes land and building) based on the estimated fair values of those tangible assets, assuming the property was vacant. Fair value for land and building is based on the purchase price for these properties. The Company also considers information obtained about each property as a result of its pre-acquisition due diligence, marketing and leasing activities in estimating the fair values of the tangible and intangible assets and liabilities acquired.

The total value allocable to intangible assets acquired, which consists of unamortized lease origination costs and in-place leases (including an above-market or below-market component of an acquired in-place lease), are allocated based on management’s evaluation of the specific characteristics of each tenant’s lease and the Company’s overall relationship with that respective tenant. Characteristics considered by management in allocating these values include the nature and extent of the existing business relationships with the tenant, growth prospects for developing new business with the tenant, the remaining term of the lease and the tenant’s credit quality, among other factors. As of December 31, 2012, management has determined that no value is required to be allocated to intangible assets, as the leases assumed are short-term with values that are insignificant.

NOTE 2. RESIDENTIAL HOMES, NET

On November 9, 2012 and January 10, 2013, Reven Housing Georgia, LLC (a wholly owned subsidiary of Reven Housing REIT, Inc.) completed the acquisition of nine residential homes (the “Homes”), pursuant to a Purchase and Sale Agreement (“PSA”), dated July 30, 2012 as amended on August 12, 2012, October 16, 2012 and January 7, 2013. Five of the Homes were purchased on November 10, 2012 at a total cost including closing expenses of $343,410. The remaining four homes were purchased subsequent to year end at a cost of approximately $263,000.

In accordance with ASC 805, the Company allocated the purchase price of the properties acquired on November 9, 2012 as follows:

| Total | ||||||||||||

| Residential | Purchase | |||||||||||

| Land | Homes | Price | ||||||||||

| 7220 Little Fawn Parkway, Palmetto, Georgia | $ | 12,874 | $ | 53,142 | $ | 66,016 | ||||||

| 5242 Station Circle, Norcross, Georgia | 13,631 | 56,171 | 69,802 | |||||||||

| 615 Cowan Road Covington, Georgia | 14,009 | 57,686 | 71,695 | |||||||||

| 110 Bear Run Ct., Palmetto, Georgia | 12,874 | 53,221 | 66,095 | |||||||||

| 4860 Lost Colony, Stone Mountain, Georgia | 13,631 | 56,171 | 69,802 | |||||||||

| $ | 67,019 | $ | 276,391 | $ | 343,410 | |||||||

The nine Homes are located in various cities in Georgia, consisting of approximately 12,989 rentable square feet and are located on approximately 2.35 acres of land. The Homes are 100% leased on short-term leases expiring on various dates through December 31, 2013.

Residential homes purchased by the Company are recorded at cost. The Homes are depreciated over the estimated useful lives using the straight-line method for financial reporting purposes. The estimated useful life for the residential homes is estimated to be 27.5 years. Depreciation expense was $1,400 and $0 for the years ended December 31, 2012 and 2011, respectively.

NOTE 3. CONVERTIBLE NOTES PAYABLE

On July 2, 2012, the Company issued convertible promissory notes to four accredited investors in the aggregate principal amount of $52,789 (the “Notes”). The maturity date of the Notes was July 2, 2013 and the Notes bore interest at a rate of 10 percent per annum payable in full on the maturity date and are unsecured.

Chad M. Carpenter, the President, Chief Executive Officer, Chief Financial Officer and a member of the Company’s Board of Directors, is one of the investors in the Notes. The Company issued a Note in the principal amount of $26,395 to Mr. Carpenter prior to Mr. Carpenter joining the Company.

| 21 |

On October 18, 2012, the Company issued additional convertible promissory notes to five accredited investors in the aggregate principal amount of $500,000 (“October Notes”). The maturity date for these notes is the earlier of December 31, 2013, or upon the Company raising $5 million of equity capital. The notes bear interest at a rate of 10 percent per annum payable in full on the maturity date and are unsecured. Upon the Company successfully raising additional capital, the October Notes may be exchanged by the holders for such securities of the Company at the same price and on the same terms and conditions being offered to the other investors in such financing, and the principal and accrued interest under the October Notes will be applied towards the purchase price of such security. The October Notes may be prepaid in whole or in part at the Company’s option without penalty. Proceeds from the October Notes were utilized for property acquisitions and to fund payables and operations of the Company.

Chad M. Carpenter was one of the individuals investing in this new note round and the Company issued a note for $225,000 to Mr. Carpenter in exchange for his additional investment.

Additionally, the Notes issued on July 2, 2012 bearing a principal balance of $52,789, were cancelled and exchanged, along with the accrued interest due of $1,563, for new notes bearing terms identical to the October Notes round for an aggregate principal balance of $554,352.

Warrant Issuance and Note Conversion Feature

In connection with the issuance of the above Notes, the Company also issued to the investors 5-year detachable warrants exercisable for shares of the Company’s common stock issued (the “Warrants”). The exercise price of the Warrants will be the same as the price per share of the equity securities sold to investors in the qualified equity financing and each Warrant provides for 100% warrant coverage on the principal amount of the related Note.

The fair value of the warrants were determined using the Black-Scholes valuation model that uses assumptions for expected volatility, expected dividends, and the risk-free interest rate. Expected volatilities are based on weighted averages of the selected peer group of thirteen companies as the Company has no trading history and are estimated over the expected term of the warrants. The risk-free rate is based on the U.S. Treasury yield curve at October 18, 2012 (date of issuance) for the period of the expected term. Accordingly, the fair value of the proceeds attributable to warrants of $163,982 and the debt beneficial conversion feature of $163,931 totaling $327,863, have been recorded as an increase in additional paid-in capital and as a corresponding discount to the notes payable. The discount is being amortized over the term of the notes payable using the interest method. The amount of the discount amortized and included in interest expense on the consolidated statements of operations for the year ended December 31, 2012 was $56,530.

A summary of the assumptions used to value the warrants and the beneficial conversion feature are as follows:

| Risk-free interest rate | 0.79 | % | ||

| Expected stock volatility | 48 | % | ||

| Time to expiration (years) | 5 | |||

| Fair value of common stock | $ | 1.00 | ||

| Expected dividends | $ | 0.00 |

NOTE 4. ACCRUED EXPENSES

Significant components of accrued expenses are as follows:

| 2011 | 2012 | |||||||

| Legal fees | $ | - | $ | 119,978 | ||||

NOTE 5. INCOME TAXES

Significant components of the Company's deferred tax assets and liabilities are as follows:

| 2011 | 2012 | |||||||

| Deferred tax assets: | ||||||||

| Start-up costs | $ | - | $ | 20,000 | ||||

| Net operating losses | 4,000 | 210,000 | ||||||

| Total | 4,000 | 230,000 | ||||||

| Valuation allowance | (4,000 | ) | (230,000 | ) | ||||

| Net deferred tax assets | $ | - | $ | - | ||||

Realization of deferred tax assets is dependent upon sufficient future taxable income during the period that deductible temporary differences and expected carry-forwards are available to reduce taxable income. The Company records a valuation allowance when, in the opinion of management, it is more likely than not, the Company will not realize some or all deferred tax assets. As the achievement of required future taxable income is uncertain, the Company recorded a valuation allowance. The valuation allowance increased by $226,000 and by $400 during 2012 and 2011, respectively. At December 31, 2012, the Company had federal net operating loss carry-forwards of approximately $538,000. The federal tax loss carry-forwards will begin to expire in 2026 and 2019 respectively, unless previously utilized.

Expected income tax by applying the statutory income tax rate to net loss differs from the actual tax provision as follows:

| 2011 | 2012 | |||||||

| Tax computed at the federal statutory rate | $ | (400 | ) | $ | (210,000 | ) | ||

| State taxes | - | (16,000 | ) | |||||

| Change in valuation allowance | 400 | 226,000 | ||||||

| Total provision | $ | - | $ | - | ||||

NOTE 6. RELATED PARTY TRANSACTIONS

At December 31, 2012, the Company had convertible notes payable outstanding to Chad M. Carpenter in the amount of $252,176, as described more fully in Note 3.

At December 31, 2012, the Company had convertible notes payable outstanding to certain shareholders of the Company in the amount of $52,177.

At December 31, 2012, the Company owed Reven Capital, LLC $266,877 for advances made for operating expenses incurred during 2012. The advances are due on demand, unsecured and are non-interest bearing. Included in these amounts is $18,000 for rent paid on behalf of the Company by Reven Capital, LLC. The Company sub-leases office space on a month-to-month basis from Reven Capital, LLC. Reven Capital, LLC is wholly-owned by Chad M. Carpenter.

For the year ended December 31, 2012, the Company paid $50,000 for consulting services to a company in which a Board of Director member of the Company is the Senior Managing Principal. Additionally, in conjunction with the consulting services agreement, the Company is obligated to pay an amount equal to five percent of any funds raised attributable to the efforts of this company.

| 22 |

NOTE 7. COMMITMENTS AND CONTINGENCIES

Property Management Agreement

The Company has entered a property management agreement with HomeSpot Property Management in which the Company will pay six percent of gross rental receipts.

NOTE 8. SUBSEQUENT EVENTS

On January 3, 2013, the Company issued additional convertible promissory notes to certain accredited investors in the aggregate principal amount of $500,000. The terms and conversion feature of these notes are the same as those previously issued (Note 3). Of the additional $500,000 in additional promissory notes issued, $400,000 was issued to Reven Capital, LLC, an affiliated company 100% owned by Chad M. Carpenter. In conjunction with these notes, the Company paid Reven Capital, LLC approximately $225,000 of the amount owed as related party advance at December 31, 2012.

The Company acquired four homes on January 10, 2013, as described more fully in Note 2.

On March 4, 2013, the Company entered into an employment agreement with Mr. Carpenter commencing March 4, 2013. The Employment Agreement will provide for, among other things, (i) an initial term of five years; (ii) a base salary at an annual rate of $240,000 commencing on the date on which the Company has received at least $10,000,000 of capital; (iii) bonuses ranging from 50% to 200% of his base salary based on the satisfaction of performance criteria to be established by the Board of Directors; (iv) a severance payment equal to two times the sum of his annual base salary and target bonus plus a lump-sum payment equal to the greater of 1% of the value of the Company at the time of notice of termination or $2,000,000, less any gross amounts received or realized by Mr. Carpenter in respect of any stock options or equity awards granted to him during his employment in the event that Mr. Carpenter’s employment is terminated by the Corporation without cause, Mr. Carpenter leaves for good reason as specified in the Employment Agreement or the Employment Agreement is not extended by the Company without cause or by Mr. Carpenter for good reason (the “Severance Payment”); and (v) payment to Mr. Carpenter of the Severance Payment in the event Mr. Carpenter’s employment is terminated by the Company without cause or by Mr. Carpenter for good reason during the 18-month period following a change in control of the Company.

| 23 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

On December 31, 2012, our Board of Directors approved the dismissal of Ronald R. Chadwick, P.C. as our independent registered public accounting firm and the engagement of PKF, Certified Public Accountants, A Professional Corporation as our new independent registered public accounting firm, as reported in our Form 8-K filed on January 4, 2013.

Other than a going concern qualification, Chadwick's audit reports on our financial statements as of and for the year ended December 31, 2011, and for the year ended December 31, 2010 (the "Reporting Periods"), did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the Reporting Periods, the subsequent interim periods, and through December 31, 2012, there were (i) no disagreements between us and Chadwick on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Chadwick, would have caused Chadwick to make reference to the subject matter of the disagreement in their reports on the financial statements for such years, and (ii) no "reportable events" as that term is defined in Item 304(a)(1)(v) of Regulation S-K.

During the Reporting Periods, which were our two most recent fiscal year ends, the subsequent interim periods, and through December 31, 2012, we have not consulted PKF, Certified Public Accountants, A Professional Corporation on any of the matters or events set forth in Regulation S-K Item 304(a)(2).

| Item 9A. | Controls and Procedures |

(a) Evaluation of Disclosure Controls and Procedures.

Our management, with the participation of our chief executive officer and chief financial officer evaluated the effectiveness of our disclosure controls and procedures pursuant to Rule 15a-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Based upon that evaluation and for the reasons stated in section (c) below, our management, including our chief executive officer and chief financial officer, concluded that our disclosure controls and procedures were effective as of December 31, 2012 in ensuring all material information required to be filed has been made known in a timely manner.

(b) Changes in internal control over financial reporting.

There were no changes to our internal control over financial reporting, as defined in Rules 15a-15(f) under the Exchange Act that occurred during the year ended December 31, 2012 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

(c) Management’s report on internal controls over financial reporting.