Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

(Mark one)

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2012

|

|

|

or

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGEACT OF 1934

|

|

For the transition period from _____________ to _____________

|

|

Commission file number: 001-33695

WESTINGHOUSE SOLAR, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

90-0181035

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

1475 S. Bascom Ave., Suite 101

|

|

|

Campbell, CA

|

95008

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(408) 402-9400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes o No x

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such requirements for the past 90 days. Yes x No o

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference to Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes o No x

The aggregate market value of the Common Stock held by non-affiliates of the registrant, based on the closing sales price of the Common Stock as reported on The NASDAQ Capital Market on June 30, 2012, was approximately $6.6 million. For purposes of this computation, all officers and directors of the registrant are deemed to be affiliates.

As of March 25, 2013, 38,414,049 shares of common stock of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Selected portions of the Registrant’s definitive proxy statement for the 2013 annual meeting of stockholders are incorporated by reference into Part III of this Form 10-K, which will be filed with the SEC within 120 days after December 31, 2012.

WESTINGHOUSE SOLAR, INC.

TABLE OF CONTENTS

|

Page No.

|

|||||

| 2 | |||||

| 10 | |||||

| 18 | |||||

| 18 | |||||

| 18 | |||||

| 18 | |||||

| 19 | |||||

| 20 | |||||

| 21 | |||||

| 29 | |||||

| 30 | |||||

| 56 | |||||

| 56 | |||||

| 56 | |||||

| 57 | |||||

| 57 | |||||

| 57 | |||||

| 57 | |||||

| 57 | |||||

| 58 | |||||

| 62 | |||||

| 63 | |||||

PART I

As used in this Annual Report on Form 10-K, unless otherwise indicated, the terms “we,” “us,” “our” and “the Company” refer to Westinghouse Solar, Inc. (“Westinghouse Solar”) and its subsidiaries.

Our Annual Report on Form 10-K for 2012, and information we provide in our Annual Report to Stockholders, press releases, telephonic reports and other investor communications, including those on our website, may contain forward-looking statements with respect to anticipated future events and our projected financial performance, operations and competitive position that are subject to risks and uncertainties that could cause our actual results to differ materially from those forward-looking statements and our expectations.

Forward-looking statements can be identified by the use of words such as “expects,” “plans,” “will,” “may,” “anticipates,” “believes,” “should,” “intends,” “estimates” and other words of similar meaning. These statements constitute forward-looking statements within the meaning of the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our then current beliefs, projections and estimates with respect to future events and our projected financial performance, operations and competitive position.

Such risks and uncertainties include, without limitation, our ability to raise capital to finance our operations, the effectiveness, profitability and marketability of our products, our ability to protect our intellectual property rights and proprietary information, general economic and business conditions, the impact of technological developments and competition, adverse results of any legal proceedings, the impact of current, pending or future legislation and regulation of the solar power industry, our ability to enter into acceptable relationships with one or more manufacturers for solar panel components and the ability of such contract manufacturers to manufacture products or components of an acceptable quality on a cost-effective basis, our ability to attract or retain qualified senior management personnel, including sales and marketing and technical personnel and other risks detailed from time to time in our filings with the SEC, including those described in Item 1A below. We do not undertake any obligation to update any forward-looking statements.

Item 1. Business.

Overview

We are a designer and manufacturer of solar power systems and solar panels with integrated microinverters (which we call AC solar panels). Our products are designed for use in solar power systems for residential and commercial rooftop customers. We design, market and sell these solar power systems to solar installers, trade workers and do-it-yourself customers in the United States and Canada through distribution partnerships, our dealer network and retail home improvement outlets. We have historically sourced our components (such as solar panels and inverters) from manufacturers such as Suntech Power Holdings Co. Ltd. (Suntech), Light Way Green New Energy Co., Ltd (Lightway) and Enphase Energy (Enphase). We are actively working with CBD Energy Limited, a diversified renewable energy company based in Sydney, Australia (CBD) or related entities, to produce Westinghouse Solar modules at a supplier facility in Australia. The processes to obtain necessary product certifications for both U.S. and Australian distribution are currently underway and are expected to be completed by early in the second quarter of 2013. Prior to September 2010, we were also in the solar power system installation business and we had completed over 4,300 solar power installations for customers in California, New York, New Jersey, Pennsylvania, Colorado and Connecticut since the commencement of our operations in 2001. In early 2009, we closed our non-California offices on the east coast and in Colorado and began distributing our solar power systems to customers outside of California. By mid-2010, it became clear to us that the business and profit potential of the design and manufacturing business was better than that of being an installer. Thus, in September 2010, we made the strategic decision to exit our California solar panel installation business and expand our solar panel distribution network to dealers and other installers in California, by far the largest solar market in the United States. Our business is now focused solely on design and manufacturing activities, and sales of our solar power systems to solar installers, trade workers and retailers through distribution partnerships, our dealer network and retail home improvement outlets.

On May 9, 2012, we announced the execution of an agreement and plan of merger with CBD, which contemplates a merger in which CBD would become our parent company, subject to shareholder approvals and other customary closing conditions. CBD and the Company are working toward completion of the Form F-4 Registration Statement and Proxy Statement, planned to be filed in the coming weeks with the Securities and Exchange Commission. While the targeted completion of merger has been repeatedly delayed, the companies currently anticipate merger closing early in the third quarter of 2013. In the meantime, our supply relationships have been disrupted, our revenue has declined significantly and we have had to implement significant cost reductions and lay off many of our employees.

The Company was incorporated as Akeena Solar, Inc. (Akeena Solar) in February 2001 in the State of California and elected at that time to be taxed as an S Corporation. During June 2006, we reincorporated in the State of Delaware and became a C Corporation. On August 11, 2006, we entered into a reverse merger transaction (the “Merger”) with Fairview Energy Corporation, Inc. (“Fairview”). Pursuant to the merger agreement, the stockholders of Akeena Solar received one share of Fairview common stock for each issued and outstanding share of Akeena Solar common stock. Our common shares were also adjusted from $0.01 par value to $0.001 par value at the time of the Merger. Subsequent to the closing of the Merger, the former stockholders of Akeena Solar held a majority of Fairview’s outstanding common stock. Since the stockholders of Akeena Solar owned a majority of the outstanding shares of Fairview common stock immediately following the Merger, and the management and board of Akeena Solar became the management and board of Fairview immediately following the Merger, the Merger was accounted for as a reverse merger transaction and Akeena Solar was deemed to be the acquirer. The assets, liabilities and the historical operations prior to the Merger are those of Akeena Solar. Subsequent to the Merger, the consolidated financial statements include the assets, liabilities and the historical operations of Akeena Solar and Fairview from the closing date of the Merger.

On May 17, 2010, we entered into an exclusive worldwide license agreement that permits us to manufacture, distribute and market our solar panels under the Westinghouse name. On July 22, 2010, we announced that we will operate under the name “Westinghouse Solar” and, effective July 23, 2010 at the opening of the market, our stock began trading under the stock symbol “WEST” on the NASDAQ Capital Market. In September 2012, our common stock was delisted from the NASDAQ Capital Market and we began trading on the OTCQB under the stock symbol “WEST”. CBD has applied for listing on the NASDAQ Stock Exchange, to be effective upon consummation of the merger. CBD intends to delist from the ASX upon merger closing, subject to shareholder approval.

We changed our name from “Akeena Solar, Inc.” to “Westinghouse Solar, Inc.” effective on April 6, 2011. On April 13, 2011, we effected a reverse split of our common stock at a ratio of 1-for-4.

Our Corporate headquarters is located at 1475 S. Bascom Ave., Campbell, CA 95008. Our telephone number is (408) 402-9400. Additional information about Westinghouse Solar is available on our website at http://www.westinghousesolar.com . The information on our web site is not incorporated herein by reference.

Strategy

Our philosophy is simple: “we believe that producing clean electricity directly from the sun is the right thing to do for our environment and economy.” Since our founding, we have concentrated on serving the solar power needs of residential and commercial customers tied to the electric power grid.

The solar power industry is rapidly evolving, but is still at an early stage and is highly fragmented. The prospects for long-term worldwide demand for solar power have attracted many new solar panel manufacturers, as well as a multitude of design/integration companies. We expect the commodity manufacturing segment of the industry to consolidate as more solar panel manufacturing capacity comes online.

Accordingly, strategy primarily includes:

|

·

|

Developing and commercializing our solar panel technology optimized for the residential and commercial markets.

|

|

·

|

Reducing installation costs and improving the aesthetics and performance of solar systems compared to ordinary, commercially available solar equipment.

|

|

·

|

Promoting and enhancing our company's brand name and reputation.

|

Based on our experience as a solar power system designer and integrator, we believe we understand certain areas in which costs for installations can be significantly reduced. In 2007, we introduced a new “plug and play” solar panel technology (under the brand name “Andalay”) which we believe significantly reduces the installation time, number of parts and costs, as well as provides superior reliability and aesthetics for customers, when compared to other solar panel mounting products and technology.

In February 2009, we announced a strategic relationship with Enphase, a leading manufacturer of microinverters, to develop and market Andalay solar panel systems with ordinary AC house current output instead of high voltage DC output. We introduced Andalay AC panel products and began offering them to our customers in the second quarter of 2009. Andalay AC panels cost less to install, are safer, and generally provide higher energy output than ordinary DC panels.

On September 10, 2010, we announced that we were expanding our distribution business to include sales of our Westinghouse Solar Power Systems directly to dealers in California and that we were exiting the solar panel installation business. We had already transitioned to a design and manufacturing business model with a distribution network in other parts of the United States and in Canada. As a result, beginning with the third quarter of 2010, our installation business has been reclassified in our financial statements as discontinued operations. The exit from the installation business was essentially completed at the end of the fourth quarter of 2010. Since May 2010, we have been marketing our AC solar panels under the Westinghouse Solar brand, for which we have licensed exclusive rights from Westinghouse Electric Corporation.

Industry

Electric power is used to operate businesses, industries, homes and offices and provides the power for our communications, entertainment, transportation and medical needs. As our energy supply and distribution mix changes, electricity is likely to be used more for local transportation (electric vehicles) and space/water heating needs. According to the Edison Electric Institute, the electric power industry in the U.S. is over $218 billion in size, and will continue to grow with our economy.

According to a 2011 report from the U.S. Energy Information Administration (http://www.eia.gov/energy_in_brief/article/renewable_electricity.cfm), electricity in the U.S. is generated from the following: coal – 42%, natural gas – 25%, nuclear – 19%, oil – 1%, with renewable energy contributing 13%. “Renewable Energy” typically refers to non-traditional energy sources, including hydroelectric, wind and solar energy. Due to continuously increasing energy demands, we believe the electric power industry faces the following challenges:

|

·

|

Limited Energy Supplies. The primary fuels that have supplied this industry, fossil fuels in the form of oil, coal and natural gas, are limited. Worldwide demand is increasing at a time that industry experts have concluded that supply is limited. Therefore, the increased demand will probably result in increased prices, making it more likely that long-term average costs for electricity will continue to increase.

|

|

·

|

Generation, Transmission and Distribution Infrastructure Costs. Historically, electricity has been generated in centralized power plants transmitted over high voltage lines, and distributed locally through lower voltage transmission lines and transformer equipment. As electricity needs increase, these systems will need to be expanded. Without further investments in this infrastructure, the likelihood of power shortages (“brownouts” and “blackouts”) may increase.

|

|

·

|

Stability of Suppliers. Since many of the major countries who supply fossil fuel are located in unstable regions of the world, purchasing oil and natural gas from these countries may increase the risk of supply shortages and cost increases.

|

|

·

|

Environmental Concerns and Climate Change. Concerns about global warming and greenhouse gas emissions has resulted in the Kyoto Protocol, various states enacting stricter emissions control laws and utilities being required to comply with Renewable Portfolio Standards, which require the purchase of a certain amount of power from renewable sources. Currently, within the U.S., there are approximately 30 states with established RPS standards.

|

Solar energy is the underlying energy source for renewable fuel sources, including biomass fuels and hydroelectric energy. By extracting energy directly from the sun and converting it into an immediately usable form, either as heat or electricity, intermediate steps are eliminated. We believe, in this sense, solar energy is one of the most direct and unlimited energy sources.

Solar energy can be converted into usable forms of energy either through the photovoltaic effect (generating electricity from photons) or by generating heat (solar thermal energy). Solar thermal systems include traditional domestic hot water collectors (DHW), swimming pool collectors, and high temperature thermal collectors (used to generate electricity in central generating systems). DHW thermal systems are typically distributed on rooftops so that they generate heat for the building on which they are situated. High temperature thermal collectors typically use concentrating mirror systems and are typically located in remote sites.

Anatomy of a Solar Power System

Solar power systems convert the energy in sunlight directly into electrical energy within solar cells based on the photovoltaic effect. Multiple solar cells, which produce DC power, are electrically interconnected into solar panels. A typical 180 watt solar panel may have 72 individual solar cells. Multiple solar panels are electrically wired together. The number of solar panels installed on a building are generally selected to meet that building’s annual electrical usage, or selected to fill available un-shaded roof or ground space.

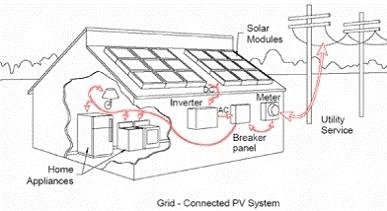

Ordinary solar power systems have solar panels that are electrically wired to a central inverter, which converts the power from DC to AC and interconnects with the utility grid. The following diagram schematically shows an ordinary DC solar power system:

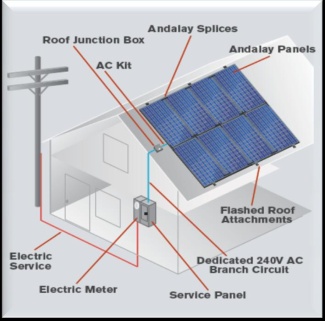

Westinghouse Solar AC panels also include integrated micro-inverters that produce AC power, eliminating the need for a central inverter. The following diagram schematically shows a typical Westinghouse Solar AC solar power system.

Solar Electric Cells. Solar electric cells convert light energy into electricity at the atomic level. The conversion efficiency of a solar electric cell is defined as the ratio of the sunlight energy that hits the cell divided by the electrical energy that is produced by the cell. By improving this efficiency, we believe solar electric energy becomes competitive with fossil fuel sources. The earliest solar electric devices converted about 1%-2% of sunlight energy into electric energy. Current solar electric devices convert 5%-25% of light energy into electric energy (the overall efficiency for solar panels is lower than solar cells because of the panel frame and gaps between solar cells), and current mass produced panel systems are substantially less expensive than earlier systems. Effort in the industry is currently being directed towards the development of new solar cell technology to reduce per watt costs and increase area efficiencies.

Solar Panels. Solar electric panels are composed of multiple solar cells, along with the necessary internal wiring, aluminum and glass framework, and external electrical connections. Although panels are usually installed on top of a roof or on an external structure, certain designs include the solar electric cells as part of traditional building materials, such as shingles and rolled out roofing. Solar electric cells integrated with traditional shingles is usually most compatible with masonry roofs and, while it may offset costs for other building materials and be aesthetically appealing, it is generally more expensive than traditional panels. Westinghouse Solar’s design integrates racking wiring and grounding components directly into the panel resulting in an integrated solution that reduces by 80%, the amount of rooftop solar components resulting in a solar power system that reduces the amount of field assembly, thereby increasing reliability and performance, while providing a better looking design.

Inverters. Inverters convert the DC power from solar panels to the AC power used in buildings. Grid-tie inverters synchronize to utility voltage and frequency and only operate when utility power is stable (in the case of a power failure these grid-tie inverters shut down to safeguard utility personnel from possible harm during repairs). Inverters also operate to maximize the power extracted from the solar panels, regulating the voltage and current output of the solar array based on sun intensity. Westinghouse Solar’s AC solution incorporates an integrated micro-inverter on each panel which improves system performance, is more reliable, safer for installers and homeowners, and reduces the amount of installation labor.

Monitoring. There are two basic approaches to access information on the performance of a solar power system. DC systems with central inverters collect the solar power performance data from the central inverter and then transmit that data to a digital hardware display. AC systems utilizing microinverters collect the solar power performance data of each panel and transmit panel-level and combined system data via the internet to a centralized database. AC system data on the performance of each panel and total system can then be accessed from any device with a web browser, including personal computers and cell phones.

Net Metering. The owner of a grid-connected solar electric system may not only buy, but may also sell, electricity each month. This is because electricity generated by the solar electric system can be used on-site or fed through a meter into the utility grid. Utilities are required to buy power from owners of solar electric systems (and other independent producers of electricity) under the Public Utilities Regulatory Policy Act of 1978 (PURPA). When a home or business requires more electricity than the solar power array is generating (for example, in the evening), the need is automatically met by power from the utility grid. When a home or business requires less electricity than the solar electric system is generating, the excess is fed (or sold) back to the utility and the electric meter actually spins backwards. Used this way, the utility serves as a backup to the solar system similar to the way in which batteries serve as a backup in stand-alone systems.

Solar Power Benefits

The direct conversion of light into energy offers the following benefits compared to conventional energy sources:

|

·

|

Economic — Once a solar power system is installed, the cost of generating electricity is fixed over the lifespan of the system. There are no risks that fuel prices will escalate or fuel shortages will develop. In addition, cash paybacks for systems range from 5 to 25 years, depending on the level of state and federal incentives, electric rates, annualized sun intensity and installation costs. Solar power systems at customer sites generally qualify for net metering to offset a customer’s highest electric rate tiers, at the retail, as opposed to the wholesale, electric rate.

|

|

·

|

Convenience — Solar power systems can be installed on a wide range of sites, including small residential roofs, the ground, covered parking structures and large industrial buildings. Solar power systems also have few, if any, moving parts and are generally guaranteed to operate for 20-25 years resulting, we believe, in low maintenance and operating costs and reliability compared to other forms of power generation.

|

|

·

|

Environmental — We believe solar power systems are one of the most environmentally friendly way of generating electricity. There are no harmful greenhouse gas emissions, no wasted water, no noise, no waste generation and no particulates. Such benefits continue for the life of the system.

|

|

·

|

Security — Producing solar power improves energy security both on an international level (by reducing fossil energy purchases from hostile countries) and a local level (by reducing power strains on local electrical transmission and distribution systems).

|

|

·

|

Infrastructure — Solar power systems can be installed at the site where the power is to be used, thereby reducing electrical transmission and distribution costs. Solar power systems installed and operating at customer sites may also save the cost of construction of additional energy infrastructure including power plants, transmission lines, distribution systems and operating costs.

|

We believe escalating fuel costs, environmental concerns and energy security make it likely that the demand for solar power systems will continue to grow. The federal government, and several states, have put a variety of incentive programs in place that directly spur the installation of grid-tied solar power systems, so that customers will “purchase” their own power generating system rather than “renting” power from a local utility. These programs include:

|

·

|

Rebates — to customers (or to installers) to reduce the initial cost of the solar power system, generally based on the size of the system. Many states have rebates that can substantially reduce initial costs.

|

|

·

|

Tax Credits — federal and state income tax offsets directly reducing ordinary income tax. There is currently a 30% federal tax credit for solar power systems.

|

|

·

|

Accelerated Depreciation — solar power systems installed for businesses (including applicable home offices) are generally eligible for accelerated depreciation.

|

|

·

|

Net Metering — provides a full retail credit for energy generated.

|

|

·

|

Feed-in Tariffs — are additional credits to consumers based on how much energy their solar power system generates. Feed-in Tariffs set at appropriate rates have been successfully used in Europe to accelerate growth.

|

|

·

|

Renewable Portfolio Standards — require utilities to deliver a certain percentage of power generated from renewable energy sources.

|

|

·

|

Renewable Energy Credits (RECs) — are additional credits provided to customers based on the amount of renewable energy they produce.

|

|

·

|

Solar Rights Acts — state laws to prevent unreasonable restrictions on solar power systems. California’s Solar Rights Act has been updated several times in past years to make it easier for customers of all types and in all locations to install a solar power system.

|

|

·

|

PPA's — Power Purchase Agreements, or agreements between a solar power system purchaser and an electricity user under which electricity is sold/purchased on a long-term basis.

|

|

·

|

Leases — in which the solar equipment is owned by a third party entity and repaid over time by the host customer.

|

Challenges Facing the Solar Power Industry

We believe the solar power industry faces three key challenges:

|

·

|

Customer Economics — In many cases, the net (after applicable incentives) cost to customers for electricity produced by a solar power system at the customer’s site is comparable to conventional, utility-generated power. We believe lower equipment (primarily solar panels) and installation costs would reduce the total cost of a system and increase the potential market for solar power.

|

|

·

|

System Performance and Reliability — We believe that a design that incorporates factory assembly of an integrated solar power system versus field assembly provides a more reliable solution. A system with these characteristics will deliver improved system performance and allow the customer to achieve the shortest possible payback.

|

|

·

|

Aesthetics — We believe that customers prefer solar panels that blend into existing roof surfaces with fewer shiny parts, mounted closely to the roof surface and have more of a “skylight” appearance than the traditional rooftop metal framed solar panels raised off the roof.

|

Competition

The solar panel design and manufacturing industry is in its early stages of development and is highly fragmented, consisting of many large and small companies. Worldwide, the manufacturers of rooftop solar panels include Suntech, Sharp, Yingli, Trina, SunPower, Sanyo, SolarWorld, LG and Samsung.

We believe the principal competitive factors in the solar panel manufacturing industry include:

|

·

|

Quality;

|

|

·

|

Price;

|

|

·

|

Installation cost; and

|

|

·

|

Company reputation

|

We believe that our competitive advantages as a designer and manufacturer of our solar panels include:

|

·

|

Integrated DC and AC Panels Dramatically Reduce Installation Costs. Our Westinghouse Solar technology significantly reduces the installation complexity, parts and costs, as well as providing superior reliability and aesthetics for customers when compared to other solar panel mounting products and technology. In 2007 we introduced our DC panels, which offer the following advantages to our customers: (i) low profile panel design looks like a beautiful, energy producing skylight and eliminates unsightly racking and exposed wires; (ii) built-in wiring connections that improve reliability; (iii) 70% fewer roof-assembled parts and 50% less roof-top labor required; (iv) 25% fewer roof attachment points; (v) complete compliance with the National Electric Code and UL wiring and grounding requirements. In 2009 we introduced our AC panels, which deliver 5-25% more energy compared to ordinary panels, produce safe household AC power and have built-in panel level monitoring, racking, wiring, grounding and microinverters. With 80% fewer parts and 5 – 25% better performance than ordinary DC panels, we believe our AC panels are an ideal solution for solar installers, trade workers and do-it-yourself customers.

|

|

·

|

Proprietary Technology. We have received three U.S. patents and six international patents for our technology, and have 23 more U.S. and foreign patents pending.

|

|

·

|

Brand Recognition. We are working to rapidly expand our distribution business and sales of our Westinghouse Solar Power Systems. We are seeking to take full advantage of the very strong worldwide brand equity that the Westinghouse name currently enjoys, and to emphasize that our solar panels are safer, more reliable and easier to install than other products on the market today.

|

Our Services and Products

We are active in the solar power industry as a designer and manufacturer of solar power systems. We specify the design of our proprietary solar panels and contract with existing, experienced solar panel manufacturers for the supply of our Westinghouse Solar labeled solar panels. We help these manufacturing partners source unique components of our panels (typically microinverters and special frame hardware).

Westinghouse Solar Panel Technology

Based on our previous experience as a solar power installer, we believe we understand certain areas in which costs for installations can be significantly reduced. In September 2007, we introduced a new “plug and play” solar panel technology, originally launched under the brand name Andalay, which we believe significantly reduces the installation time and costs, as well as providing superior reliability and aesthetics, when compared to other solar panels.

Installation costs for a solar power system are generally proportional to the area of panels installed. Thin film and amorphous solar cell technologies, although offering solar panels that are less expensive on a cost per watt basis, are generally less efficient (producing fewer watts per square foot) and correspondingly more expensive to install. Therefore, we believe that Westinghouse Solar technology becomes even more useful for the new generation of less expensive but lower efficiency solar panels. Westinghouse Solar panel technology is generally applicable to all framed rooftop solar cell technologies, including silicon, amorphous silicon, thin film and concentrators.

Customers

In 2012, we market and sell to a network of authorized dealers and distributors across the United States and Canada. We are planning to expand our distribution channel to include Australia in the second quarter of 2013. Our Westinghouse Solar Authorized Dealer program provides installation companies with the opportunity to differentiate themselves from ordinary solar installers through product and program offerings we extend exclusively to our established Dealers. In addition to the ability to sell and install Westinghouse Solar products, Westinghouse Solar Dealers benefit from the ability to leverage the Westinghouse brand, and leverage critical marketing support to help them grow their business.

Suppliers

Historically, we obtained virtually all of our solar panels, built to our specifications, from Suntech and Lightway. We currently have no pending orders with either Suntech or Lightway, and we do not anticipate receiving further solar panels from thm. We are actively working with CBD to produce Westinghouse Solar modules at a supplier facility in Australia. The processes to obtain necessary product certifications for both U.S. and Australian distribution are currently underway and are expected to be completed by early in the second quarter of 2013. Pursuant to our agreement with Enphase, they provide us with micro-inverters. We purchase small assembly, racking and packaging components from a variety of domestic and foreign suppliers.

Sales and Marketing

Our sales and marketing program incorporates a marketing mix of print, web, social and other media advertisements as well as participation in industry trade shows and individual discussions with prospective dealers. As we onboard dealers under our sales and marketing program, we rely on the skill of our sales team. We regularly evaluate the effectiveness of our sales team and marketing efforts using sales management software and make tactical marketing and sales changes as indicated to achieve and maintain cost effectiveness.

Intellectual Property

Andalay Solar Panel

We have three U.S. patents (Patent No. 7,406,800, Patent No. 7,832,157 and Patent No. 7,866,098) that cover key aspects of our Andalay solar panel technology, as well as U.S. Trademark No. 3481373 for registration of the mark “Andalay.” In addition to these U.S. patents, we have 6 foreign patents. Currently, Westinghouse Solar has nine issued patents and 23 other pending U.S. and foreign patent applications that cover the Andalay technology working their way through the USPTO and foreign patent offices.

The following table provides a summary of our patents:

|

Country of issuance

|

Patent Number

|

Date of Expiration

|

|||

|

United States

|

7,406,800 |

May 18, 2025

|

|||

|

United States

|

7,832,157 |

November 16, 2027

|

|||

|

United States

|

7,866,098 |

January 11, 2028

|

|||

|

Australia

|

2,005,248,343 |

May 18, 2025

|

|||

|

India

|

243,626 |

May 18, 2025

|

|||

|

Mexico

|

274,182 |

May 18, 2025

|

|||

|

Korea

|

751,614 |

May 18, 2025

|

|||

|

China

|

200580015652.1 |

May 30, 2032

|

|||

|

Canada

|

2,566,296 |

October 23, 2032

|

|||

We have registered with the United States Patent and Trademark Office the trademark “Instant Connect” (Reg. No. 4,290,244 and 4,290,245) for the designation of our patented “plug and play” solar panel. We have also registered with the United States Patent and Trademark Office the trademark “Akeena” for providing consulting services in the field of energy systems, technical information via a global computer network in the field of renewable energy systems, and renewable energy systems, namely, photovoltaic systems composed of photovoltaic solar panels, batteries, voltage regulators, inverters, racks and electrical controls, as well as the installation of such systems.

We have also registered the trademarks “Double Your Power” and “Andalay” with the United States Patent and Trademark Office for two goods classes: providing computer software for photovoltaic systems for evaluating electric consumption, determining system sizing, estimating electrical output, estimating customer costs, and estimating financial life cycle savings, for use by consumers and businesses; and, installation of renewable energy systems, namely photovoltaic systems composed of solar panels, batteries, voltage regulators, inverters, racks and electrical controls. Additionally, we have applications currently pending with the United States Patent and Trademark Office to expand the goods classes for “Double Your Power” and “Andalay.”

Since May 2010, we have been marketing our AC solar panels under the Westinghouse Solar brand, for which we have licensed exclusive rights from Westinghouse Electric Corporation.

Employees

As of March 25, 2013, we had 7 employees, of which 2 were sales and marketing employee, 4 were general and administrative employees and 1 was research and development employees. All employees were full-time employees. Our employees are not party to any collective bargaining agreement and we have never experienced an organized work stoppage. We believe our relations with our employees are good.

Item 1A. Risk Factors.

Our Annual Report on Form 10-K for 2012, and information we provide in our press releases, telephonic reports and other investor communications, may contain forward-looking statements with respect to anticipated future events and our projected financial performance, operations and competitive position that are subject to risks and uncertainties that could cause our actual results to differ materially from those forward-looking statements and our expectations. Future economic and industry trends that could potentially impact revenue, profitability, and growth remain difficult to predict. The factors underlying our forecasts and forward-looking statements are dynamic and subject to change. As a result, any forecasts or forward-looking statements speak only as of the date they are given and do not necessarily reflect our outlook at any other point in time.

Risks Relating to Our Business

We will need additional capital in the future to fund our business, and financing may not be available.

We expect our currently available capital resources and cash flows from operations to be insufficient to meet our working capital and capital expenditure requirements. Our cash requirements will depend on numerous factors, including the amount of our sales, the timing and levels of products purchased, pricing, payment terms and credit limits from manufacturers, the availability and terms of asset-based credit facilities, the timing and level of our accounts receivable collections, and our ability to manage our business towards profitability.

We expect to need to raise additional funds through public or private debt or equity financings or enter into new asset-based or other credit facilities, but such financings will likely dilute our stockholders. We cannot assure you that any additional financing that we may need will be available on terms favorable to us, or at all. In addition, on May 9, 2012 we announced the execution of an agreement and plan of merger which contemplates a merger in which CBD would become our parent company. This event may diminish our independent access to additional financing. If adequate funds are not available or are not available on acceptable terms, we may not be able to take advantage of business opportunities, develop new products or otherwise respond to competitive pressures. In any such case, our business, operating results or financial condition could be materially adversely affected.

We are dependent upon our solar panel suppliers for regular shipments of products; however we have not been timely in payment to them in recent periods, which has resulted in disruption in our supply of products. If we do not quickly establish replacement sources of supply, our operations will be further adversely affected.

Historically, we obtained virtually all of our solar panels from Suntech. On March 25, 2011, we entered into a volume supply agreement for a new generation of our solar panel products with Lightway, and in August 2011, we began purchasing solar panels from Lightway. Both Suntech and Lightway manufacture panels for us that are built to our unique specifications. We have a limited amount of remaining inventory on hand as of December 31, 2012, and although we believe we can find alternative suppliers for solar panels manufactured to our specifications, the disruption or loss of our current primary component supply relationships would be disruptive to our operations. In recent months, because of our cash position and liquidity constraints, we have been late in making payments to both of our panel suppliers. On March 30, 2012, pursuant to our Supply Agreement with Lightway, we issued 1,900,000 shares of our common stock to Lightway in partial payment of our past due account payable to them. The shares were valued at $1,045,000. On May 1, 2012, Suntech America filed a lawsuit against us for breach of contract, alleging that it delivered products to us and has not received full payment, and seeking payment of approximately $990,000. On July 31, 2012, we and Suntech entered into a settlement of this dispute, which allows and requires us make payment of the account balance over time, with the unpaid balance accruing interest at 10% per annum. Because of our inability to make scheduled settlement payments, on March 15, 2013, Suntech entered a judgment against us in the amount of $946,438. As of March 28, 2013, Suntech has not sought to enforce its judgment. Unless we are able to satisfy our prior panel suppliers payment for product orders, our prior suppliers may file additional lawsuits, which could result in decreased sales and revenue for us, and adversely affect our customer relationships and result in cancelled orders.

We currently do not have any unshipped orders for solar panel product pending with Suntech or Lightway, and we have not received any shipments of panels since April 2012. Our supply relationship with Lightway is currently stalled. We are actively working with CBD to produce Westinghouse Solar modules at a supplier facility in Australia. Unless we are able to secure alternative sources of supply, our inventory and revenue could diminish significantly, causing further disruption to our operations.

We are dependent upon our key suppliers for the components used in our systems and we must arrange for cost competitive manufacturing of our proprietary solar panels in order to grow our business; our suppliers are dependent upon the continued availability and pricing of silicon and other raw materials used in solar modules .

Historically, we obtained virtually all of our solar panels from Suntech and Lightway. Both Suntech and Lightway manufactured panels for us that were built to our unique specifications. We have a limited amount of remaining inventory on hand as of December 31, 2012. We are actively working with CBD to produce Westinghouse Solar modules at a supplier facility in Australia. The processes to obtain necessary product certifications for both U.S. and Australian distribution are currently underway and are expected to be completed by early in the second quarter of 2013.

It is critical to the growth of our revenue that our products be high quality while offered at competitive pricing. We believe that we will need to reduce the unit production cost of our products over time to obtain and maintain our ability to offer competitively priced products. Our ability to achieve cost reductions will depend on our ability to maintain favorable supplier contracts and to increase sales volumes so we can achieve economies of scale. We cannot provide assurance that we will be able to achieve any such production cost reductions. If we fail to negotiate better terms and maintain our relationships with our current suppliers or develop new supplier relationships, we may not achieve production cost reductions necessary to competitively price our products, which could adversely affect or limit our sales and growth.

We are currently subject to market prices for the components that we purchase, which are subject to fluctuation beyond our control. An increase in the price of components used in our systems could result in an increase in costs to our customers and could have a material adverse effect on our revenues and demand for our products.

Interruptions in our ability to procure needed components for our systems, whether due to discontinuance by our suppliers, delays or failures in delivery, shortages caused by inadequate production capacity or unavailability, financial failure, manufacturing quality, or for other reasons, would adversely affect or limit our sales and growth. There is no assurance that we will continue to find qualified manufacturers on acceptable terms and, if we do, there can be no assurance that product quality will continue to be acceptable, which could lead to a loss of sales and revenues.

The U.S. Government imposed tariffs on solar panels manufactured in China causing the prices we pay for solar panels to increase. This could cause customer demand for our products to decrease.

A group of solar panel manufacturers with domestic U.S. production facilities requested the U.S. Government to impose tariffs on the import of solar panels manufactured in China, based on allegations of unfair competition and of subsidization of prices for Chinese-made solar panels by the Chinese Government. In March 2012, the United States Commerce Department issued a preliminary decision imposing tariffs between 2.9% and 4.73%. In May 2012, a further decision by the Commerce Department was issued providing for a provisional tariff averaging 31% on 61 Chinese manufacturers caused by “dumping” solar panels into the U.S. market at prices below their actual cost. On October 11, the Commerce Department announced its final decision on these tariffs affirming its preliminary findings that modules containing cells of Chinese origin are subject to anti-dumping and countervailing duties (AD/CVD) when imported into the United States. The AD rates to be applied at the border range from 7.78% to 21.19% for participating respondents and up to 239.42% for non-participants. The CVD rates range from 14.78 to 15.97%. The AD and CVD rates will be applied collectively. The final step in the proceedings occurred on November 7, 2012, when the International Trade Commission (ITC) rendered a final affirmative injury determination concluding that the subject Chinese imports caused injury to U.S. manufacturers of crystalline-silicon solar cells and modules. The ITC also decided that the AD and CVD duties should not apply retroactively and rendered a negative "critical circumstances" determination. Thus, the effective dates were March 26, 2012 for CVD duties and May 25, 2012 for AD duties. Given the large current market share of solar panels manufactured in China, the imposition of these tariffs will have had far reaching, industry-wide effects, and have been disruptive to many established supply relationships. In fact, the imposition of these tariffs have caused prices for solar power systems in the United States to increase and resulted in reduced market demand for the purchase of solar power systems.

Our historical solar panel suppliers, Suntech and Lightway, both manufactured panels for us in China. As a result, aggregate AD and CVD duties of 30.66% (for Lightway) and 35.97% (for Suntech) were imposed on our purchases. The resulting increase in our product prices has harmed our competitive position in selling our products, and adversely affected our results of operations.

We have experienced significant customer concentration in recent periods, and our revenue levels could be adversely affected if any significant customer fails to purchase products from us at anticipated levels.

The relative magnitude and the mix of revenue from our largest customers have varied significantly quarter to quarter, but have been concentrated on a small number of large customers. During the twelve months ended December 31, 2012, two customers have accounted for a significant portion of our revenues:, Lennox International Inc. (Lennox), a global leader in the heating and air conditioning markets and Lennar Corporation (Lennar), a leading national homebuilder. Through December 31, 2012, Lennar had historically only ordered solar power systems from us for installation on 234 new homes, which was below their 600 home order commitment volume. No further orders have been received from Lennar since April 25, 2012. On December 28, 2012, we filed a complaint against Lennar in the United States District Court for the Southern District of Florida stating claims for breach of contract under a supply agreement with us. The volume of orders from key customers is difficult to predict. Fluctuations in order levels from significant customers could cause our revenue levels to correspondingly fluctuate, and the failure by any significant customer to maintain anticipated order levels could cause our revenue to fall short of expectations and adversely affect our results of operations.

We may fail to realize some or all of the anticipated benefits of our shift to a design and manufacturing business model in California and throughout North America, which may adversely affect the value of our common stock.

The success of our exit from the solar system installation business in California in September 2010, and our shift to focus exclusively on a design and manufacturing business model will depend, in large part, on our ability to successfully expand our distribution channels to include authorized dealers in California, as well as elsewhere in North America and Australia, and to accelerate the growth of our design and manufacturing business. California is the largest state in the country for solar products, accounting for approximately 50 percent of the U.S. market. Therefore, we continue to pursue developing distribution channel partners in California and are beginning to develop distribution channels in Australia given our merger plans with CBD.

If we are not able to achieve the expansion of our design and manufacturing business and meet our revenue growth and cost reduction objectives within the anticipated time frame, or at all, the anticipated benefits and cost savings of our change in strategic focus and our restructuring may not be realized or may take longer to realize than expected, and the value of our common stock may be adversely affected.

Specifically, risks in the operations of our business in order to realize the anticipated benefits of the change to a design and manufacturing business model include, among other things:

|

·

|

failure to arrange for cost competitive manufacturing of our proprietary solar panels;

|

|

·

|

failure to find and develop distribution relationships with new channel partners, particularly in the California and Australia market;

|

|

·

|

failure to successfully manage existing distribution relationships;

|

|

·

|

the loss of key employees critical to the ongoing operation of our business;

|

|

·

|

failure to effectively coordinate sales and marketing efforts to communicate the capabilities of our company;

|

|

·

|

unpredictability and delays in the timing of projected distribution orders, and resulting accumulation of excess product inventory;

|

|

·

|

failure to focus and develop our distribution product and service offerings quickly and effectively;

|

|

·

|

failure to successfully develop new products and services on a timely basis that address the market opportunities; and

|

|

·

|

unexpected revenue attrition or delays.

|

In addition, the shift in our business model may result in additional or unforeseen expenses, and the anticipated cost reduction benefits may not be realized.

We are exposed to risks associated with the weak global economy, which increase the uncertainty of project financing for solar installations and the risk of non-payment from customers.

The continuing tight credit markets and weak global economy are contributing to an ongoing slowdown in the solar industry, which may worsen if these economic conditions are prolonged or deteriorate further. The market for installation of solar power systems depends largely on commercial and consumer capital spending. Economic uncertainty exacerbates negative trends in these areas of spending, and may cause customers to push out, cancel, or refrain from placing orders, which may reduce our net sales. Difficulties in obtaining capital and adverse market conditions may also lead to the inability of some customers to obtain affordable financing, including traditional project financing and tax-incentive based financing and home equity based financing, resulting in lower sales to potential customers with liquidity issues, and may lead to an increase of incidents where our customers are unwilling or unable to pay for systems they purchase, and additional bad debt expense for us. Further, these conditions and uncertainty about future economic conditions make it challenging for us to obtain equity and debt financing to meet our working capital requirements to support our business, forecast our operating results, make business decisions, and identify the risks that may affect our business, financial condition and results of operations. If we are unable to timely and appropriately adapt to changes resulting from the difficult macroeconomic environment, our business, financial condition or results of operations may be materially and adversely affected.

Our technology may encounter unexpected problems or may not be protectable, which could adversely affect our business and results of operations.

Our technology is relatively new and has not been tested in installation settings for a sufficient period of time to prove its long-term effectiveness and benefits. Problems may occur with products or their underlying components that are unexpected and could have a material adverse effect on our business or results of operations. We have been issued several U.S. and foreign patents that cover our Andalay solar panel technology. We have several other pending patent applications covering Andalay technology. Ultimately, we may not be able to realize the benefits from any patent that is issued.

Because our industry is highly competitive and has low barriers to entry, we may lose market share to larger companies that are better equipped to weather a decline in market conditions due to increased competition.

Our industry is highly competitive and fragmented, is subject to rapid change and has low barriers to entry. Competition in the solar power services industry may increase in the future, partly due to low barriers to entry, as well as from other alternative energy sources now in existence or developed in the future. Increased competition could result in price reductions, reduced margins or loss of market share and greater competition for qualified technical personnel. There can be no assurance that we will be able to compete successfully against current and future competitors. If we are unable to compete effectively, or if competition results in a deterioration of market conditions, our business and results of operations would be adversely affected.

Our profitability depends, in part, on our success and brand recognition and we could lose our competitive advantage if we are not able to protect our trademarks and patents against infringement, and any related litigation could be time-consuming and costly.

We believe that the “Westinghouse” name has significant value and recognition in the North American market, and that our “Andalay” brand has gained substantial recognition by customers in certain geographic areas. We have registered the “Andalay” trademark with the United States Patent and Trademark Office. Use of our trademarks or similar trademarks by competitors in geographic areas in which we have not yet operated could adversely affect our ability to use or gain protection for our brand in those markets, which could weaken our brand and harm our business and competitive position. In addition, any litigation relating to protecting our trademarks and patents against infringement could be time consuming and costly.

We may have warranty obligations to Real Goods Solar, Inc. that could adversely affect our results of operations.

In connection with our exit from the solar system installation business in California, Real Goods Solar, Inc. (Real Goods) agreed to undertake primary, “first responder” responsibility for future warranty service obligations relating to the approximately 800 installations for SunRun that we have previously completed (the “WS Installations”). We retain secondary warranty responsibility on the WS Installations, in the event that Real Goods fails to perform the warranty. We will reimburse Real Goods for actual warranty service work completed by Real Goods related to these “first responder” installations. Other than solar panels and inverters that are covered under the manufacturer warranty, we provided our customers for WS Installations a 5-year or a 10-year warranty. We have accrued, and included within “Liabilities of Discontinued Operations” in our consolidated balance sheets for December 31, 2012 and December 31, 2011, a liability of approximately $1.1 million, to cover these warranty obligations. That amount is intended to cover both the WS Installations and certain installation projects assigned to Real Goods. The terms of the Warranty Agreements provided that we establish an escrow account as a source of funds from which to satisfy our obligation to pay Real Goods for its fees and reimburse it for its expenses for warranty work performed by it pursuant to the Warranty Agreements which are not paid to Real Goods from the company directly. In March 2011, we entered into an Escrow Agreement with Real Goods and deposited $200,000 into an escrow fund. The amount is reflected in long-term assets of discontinued operations in our consolidated balance sheets. The escrow deposit will be released to us in the amount of $40,000, or one-fifth of the remaining escrow funds, per year after each of the fifth through the ninth anniversary of the escrow agreement. If Real Goods fails to perform under the assigned warranty coverage, or the actual warranty expenses exceed the amounts we have accrued, we could incur significant unexpected additional expenses, which would adversely affect our results of operations.

Impairment charges could reduce our results of operations.

In accordance with the provisions of Financial Accounting Standards Board (FASB) Accounting Standard Codification (ASC) 350, Goodwill and Other Intangible Assets (ASC 350), we test intangible assets with indefinite useful lives for impairment on an annual basis, and on an interim basis if an event occurs that might reduce the fair value of the reporting unit below its carrying value. We also assess the fair value of our inventory and other tangible assets as of the end of each reporting period. During the year ended December 31, 2012, we recorded a $206,000 non-cash inventory write-down, which represented an adjustment to the carrying value of our older, smaller-format solar panels and older micro-inverter inventory to reflect the decline in market prices compared to our original cost, a $65,000 write-off of accumulated inventory overhead costs and a $112,000 non-cash inventory write-off of obsolete inventory. As a result of our exit from the installation business, during the year ended December 31, 2010, we impaired approximately $2.0 million for inventory, equipment and other assets no longer needed in our business. We may determine that further asset impairment charges are needed in the future. Although any such impairment charge would be a non-cash expense, further impairment of our tangible or intangible assets could materially increase our expenses and reduce our results of operations.

Our success depends on our key personnel, including our executive officers, and the loss of key personnel or the transition of key personnel, including our Chief Executive Officer, could disrupt our business.

Our success greatly depends on the continued contributions of our senior management and other key sales, marketing and operations personnel. These employees may voluntarily terminate their employment at any time. We may not be able to successfully retain existing personnel or identify, hire and integrate new personnel; and we do not have key person insurance policies in place for these employees. Since May 7, 2012, Margaret Randazzo, our Chief Financial Officer, has acted as our Chief Executive Officer.

If we are unable to attract, train and retain highly qualified personnel, the quality of our services may decline and we may not successfully execute our internal growth strategies.

Our success depends in large part upon our ability to continue to attract, train, motivate and retain highly skilled and experienced employees, including technical personnel. Qualified technical employees periodically are in great demand and may be unavailable in the time frame required to satisfy our customers’ requirements. While we currently have available technical expertise sufficient for the requirements of our business, expansion of our business could require us to employ additional highly skilled technical personnel. We expect competition for such personnel to increase as the market for solar power systems expands.

There can be no assurance that we will be able to attract and retain sufficient numbers of highly skilled technical employees in the future. The loss of personnel or our inability to hire or retain sufficient personnel at competitive rates of compensation could impair our ability to secure and complete customer engagements and could harm our business.

Unexpected warranty expenses or service claims could reduce our profits.

We maintain a warranty reserve on our balance sheet for potential warranty or service claims that could occur in the future. This reserve is adjusted based on our ongoing operating experience with equipment and installations. It is possible, perhaps due to bad supplier material or defective installations, that we would have actual expenses substantially in excess of the reserves we maintain. Our failure to accurately predict future warranty claims could result in unexpected profit volatility.

Risks Relating to Our Industry

We have experienced technological changes in our industry. New technologies may prove inappropriate and result in liability to us or may not gain market acceptance by our customers.

The solar power industry (and the alternative energy industry, in general) is subject to technological change. Our future success will depend on our ability to appropriately respond to changing technologies and changes in function of products and quality. If we adopt products and technologies that are not attractive to consumers, we may not be successful in capturing or retaining a significant share of our market. In addition, some new technologies are relatively untested and unperfected and may not perform as expected or as desired, in which event our adoption of such products or technologies may cause us to lose money.

A drop in the retail price of conventional energy or non-solar alternative energy sources may negatively impact our profitability.

We believe that an end customer’s decision to purchase or install solar power capabilities is primarily driven by the cost and return on investment resulting from solar power systems. Fluctuations in economic and market conditions that affect the prices of conventional and non-solar alternative energy sources, such as decreases in the prices of oil and other fossil fuels, could cause the demand for solar power systems to decline, which would have a negative impact on our profitability. Changes in utility electric rates or net metering policies could also have a negative effect on our business.

Existing regulations, and changes to such regulations, may present technical, regulatory and economic barriers to the purchase and use of solar power products, which may significantly reduce demand for our products and services.

New government regulations or utility policies pertaining to solar power systems are unpredictable and may result in significant additional expenses or delays and, as a result, could cause a significant reduction in demand for solar energy systems and our services. For example, there currently exist metering caps in certain jurisdictions which effectively limit the aggregate amount of power that may be sold by solar power generators into the power grid.

Our business depends on the availability of rebates, tax credits and other financial incentives; reduction, elimination or uncertainty of which would reduce the demand for our products and services.

Many states offer incentives to offset the cost of solar power systems. These systems can take many forms, including direct rebates, state tax credits, system performance payments and Renewable Energy Credits (RECs). Moreover, the federal government currently offers a 30% tax credit for the installation of solar power systems. Businesses may also elect to accelerate the depreciation on their system over five years. Uncertainty about the introduction of, reduction in or elimination of such incentives or delays or interruptions in the implementation of favorable federal or state laws could substantially increase the cost of our systems to our customers, resulting in significant reductions in demand for our services, which would negatively impact our sales.

If solar power technology is not suitable for widespread adoption or sufficient demand for solar power products does not develop or takes longer to develop than we anticipate, our sales would decline and we would be unable to achieve or sustain profitability.

The market for solar power products is emerging and rapidly evolving, and its future success is uncertain. Many factors will influence the widespread adoption of solar power technology and demand for solar power products, including:

|

·

|

cost effectiveness of solar power technologies as compared with conventional and non-solar alternative energy technologies;

|

|

·

|

performance and reliability of solar power products as compared with conventional and non-solar alternative energy products;

|

|

·

|

capital expenditures by customers that tend to decrease if the U.S. economy slows; and

|

|

·

|

availability of government subsidies and incentives.

|

If solar power technology proves unsuitable for widespread commercial deployment or if demand for solar power products fails to develop sufficiently, we would be unable to generate enough revenue to achieve and sustain profitability. In addition, demand for solar power products in the markets and geographic regions we target may not develop or may develop more slowly than we anticipate.

Risks Relating to our Common Stock

We were delisted from the Nasdaq Capital Market and there is a limited trading volume for our common stock on the OTCQB.

In September 2012, our common stock was delisted from the Nasdaq Capital Market. Our common stock, which currently trades on the OTCQB, does not have substantial trading volume. As a result, relatively small trades of our common stock may have a significant impact on the price of our common stock and, therefore, may contribute to the price volatility of our common stock. Because of the limited trading volume in our common stock and the price volatility of our common stock, you may be unable to sell your shares of common stock when you desire or at the price you desire. The inability to sell your shares in a declining market because of such illiquidity or at a price you desire may substantially increase your risk of loss.

In addition, the delisting of our common stock from the Nasdaq Capital Market could materially adversely affect our ability to raise capital on terms acceptable to us or at all and could adversely affect institutional investor interest.

Our stockholders may be diluted by the conversion of our preferred stock and the exercise of warrants; in the event we have a “change of control” or if we fail to comply with the terms of the Preferred Stock, we may be in default and face demands for redemption and significant penalties.

On February 17, 2011, we entered into a Securities Purchase Agreement with accredited investors, pursuant to which we sold to such investors our Series B 4% Convertible Preferred (“Series B Preferred”), and our Series K Warrants. On October 18, 2012, we entered into a Securities Purchase Agreement with accredited investors, pursuant to which we sold to such investors our Series C 8% Convertible Preferred (Series C Preferred). On February 15, 2013, we entered into a Securities Purchase Agreement with accredited investors pursuant to which we sold to such investors our Series D 8% Convertible Preferred Stock (Series D Preferred), and together with the Series B and C Preferred (the “Preferred Stock”). The conversion price of the Preferred Stock is subject to adjustment downward in the event that we sell common stock (or securities convertible into or exercisable for shares of common stock) at an effective price below the conversion price of such Preferred Stock. If the price adjustment provisions are triggered, then the number of shares of common stock issuable upon conversion of the Preferred Stock are subject to increase. When the investors convert our Preferred Stock, our stockholders may experience dilution in the net tangible book value of their common stock. In addition, the sale or availability for sale of the underlying shares in the marketplace could depress our stock price. Except for the Series D Preferred, we have registered all of the underlying shares of common stock relating to the Preferred Stock and our outstanding warrants. As a result, the investors could resell the underlying shares immediately upon issuance, which may result in significant downward pressure on the market price of our stock. In connection with the Series D Preferred we have granted the purchasers “piggy-back” registration rights to include the underlying shares of common stock issuable upon conversion of the Series D Preferred in future registration statements, if any are filed by us.

In addition, the terms of our Preferred Stock include various agreements and negative covenants on our part. In the event we fail to comply with those provisions, or if a “change of control” of the Company occurs, it could constitute a “triggering event” (as defined in the Certificates of Designation which designate the rights of the two series of Preferred Stock), and the holders of our Preferred Stock could then demand that all of the outstanding shares of Preferred Stock be redeemed for cash (in certain circumstances generally within our control), or under certain circumstances, for shares of our common stock. Any such demand for redemption in cash could have a material adverse affect on our financial position and liquidity, and any demand for redemption in stock could have a material dilutive effect for our stockholders. In addition, in certain such triggering events, the dividend rate on our outstanding Preferred Stock is subject to increase to 18% per annum thereafter.

Future sales of common stock by our existing stockholders may cause our stock price to fall.

The market price of our common stock could decline as a result of sales by our existing stockholders of shares of common stock in the market, or the perception that these sales could occur. These sales might also make it more difficult for us to sell equity securities at a time and price that we deem appropriate. As of March 25, 2013, we had 38,414,049 shares of common stock outstanding (which includes 18,320 unvested shares of restricted stock granted to our directors and our employees), 347 shares of Series D Preferred that are convertible into 3,470,000 shares of common stock, 310 shares of Series C Preferred that are convertible into 6,200,000 shares of common stock, 2,209.686 shares of Series B Preferred that are convertible into 39,774,348 shares of common stock, and we had warrants to purchase 3,398,045 shares of common stock and options to purchase 575,199 shares of common stock outstanding.

All of the shares of common stock issuable upon exercise of our outstanding vested options will be freely tradable without restriction under the federal securities laws unless purchased by our affiliates. The shares of common stock issuable upon exercise of our outstanding warrants are generally covered by effective registration statements which permit the underlying shares issuable upon their exercise to be freely tradable in the public market.

Our stock price may be volatile, which could result in substantial losses for investors.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in response to various factors, many of which are beyond our control, including the following:

|

·

|

technological innovations or new products and services by us or our competitors;

|

|

·

|

announcements or press releases relating to the energy sector or to our business or prospects;

|

|

·

|

additions or departures of key personnel;

|

|

·

|

regulatory, legislative or other developments affecting us or the solar power industry generally;

|

|

·

|

our ability to execute our business plan;

|

|

·

|

operating results that fall below expectations;

|

|

·

|

volume and timing of customer orders;

|

|

·

|

industry developments;

|

|

·

|

economic and other external factors; and

|

|

·

|

period-to-period fluctuations in our financial results.

|

|

·

|

future developments relating to the status of a business combination with CBD.

|

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also significantly affect the market price of our common stock.

Risks Relating to Our Company

If the Merger contemplated by the Merger Agreement with CBD does not occur or continues to be delayed, it could have a material adverse effect on our business, results of operations, and financial condition.