Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Northern Tier Energy LP | d510381dex231.htm |

| EX-23.2 - EX-23.2 - Northern Tier Energy LP | d510381dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 28, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Northern Tier Energy LP

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 2911 | 80-0763623 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

38C Grove Street, Suite 100

Ridgefield, Connecticut 06877

(203) 244-6550

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Peter T. Gelfman

Vice President, General Counsel and Secretary

38C Grove Street, Suite 100

Ridgefield, Connecticut 06877

(203) 244-6550

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Douglas E. McWilliams Vinson & Elkins L.L.P. 1001 Fannin, Suite 2500 Houston, Texas 77002-6760 (713) 758-2222 |

M. Breen Haire Baker Botts L.L.P. 910 Louisiana Street Houston, Texas 77002 (713) 229-1234 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to Be Registered |

Proposed Maximum Aggregate Offering Price (1)(2) |

Amount of Fee (1)(2) | ||

| Common units representing limited partner interests |

$385,000,000 | $52,214 | ||

|

| ||||

|

| ||||

| (1) | Calculated in accordance with Rule 457(o). |

| (2) | Includes common units issuable upon exercise of the underwriters’ option to purchase additional common units. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated March 28, 2013

PROSPECTUS

Northern Tier Energy LP

Common Units

Representing Limited Partner Interests

The securities to be offered and sold using this prospectus are currently issued and outstanding common units representing limited partner interests in us. All of the common units offered by this prospectus are being sold by Northern Tier Holdings LLC, as the selling unitholder. Northern Tier Holdings LLC owns 100% of our general partner and, giving effect to this offering, % of our common units (or % if the underwriters exercise in full their option to purchase additional common units). We will not receive any proceeds from the sale of the common units by the selling unitholder in this offering.

Our common units are listed on the New York Stock Exchange under the symbol “NTI.” On March 27, 2013, the last reported sales price of our common units on the New York Stock Exchange was $30.01 per common unit.

Investing in our common units involves risks. See “Risk Factors” on page 18 to read about factors you should consider before buying our common units.

| Per Common Unit | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds to the selling unitholder |

$ | $ | ||||||

To the extent that the underwriters sell more than common units, the underwriters have the option to purchase up to an additional common units at the initial public offering price less the underwriting discount.

Neither the Securities and Exchange Commission nor any state securities regulators has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common units on or about , 2013.

| Barclays | BofA Merrill Lynch | Goldman, Sachs & Co. | Citigroup | Credit Suisse | UBS Investment Bank |

| Deutsche Bank Securities | J.P. Morgan | |

| Macquarie Capital | TPG Capital BD, LLC |

Prospectus dated , 2013.

Table of Contents

Table of Contents

Prospectus Summary

| 1 | ||||

| 18 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

24 | |||

| 26 | ||||

| 27 | ||||

| 33 | ||||

| 35 | ||||

| 47 | ||||

| 48 | ||||

| Investment in Northern Tier Energy LP by Employee Benefit Plans |

61 | |||

| 62 | ||||

| 68 | ||||

| 68 | ||||

| 68 | ||||

| A-1 |

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the common units offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

Table of Contents

Industry and Market Data

This prospectus includes industry data and forecasts that we obtained from industry publications and surveys, public filings and internal company sources. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. Statements as to our ranking, market position and market estimates are based on independent industry publications, government publications, third-party forecasts and management’s estimates and assumptions about our markets and our internal research. While we are not aware of any misstatements regarding our market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in this prospectus.

Trademarks and Trade Names

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

ii

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus and in the documents incorporated herein by reference. You should read the entire prospectus and the other documents incorporated herein by reference, as described under “Where You Can Find More Information,” before investing in our common units. Unless otherwise indicated, the information presented in this prospectus assumes that the underwriters’ option to purchase additional common units from the selling unitholder is not exercised. We have provided definitions for certain terms used in this prospectus in the “Glossary of Industry Terms Used in this Prospectus” beginning on page A-1 of this prospectus.

Unless the context otherwise requires, the terms “we,” “us,” “our,” “Successor” and “Company” refer to Northern Tier Energy LP and its subsidiaries. References to our “general partner” refer to Northern Tier Energy GP LLC. References to “Northern Tier Holdings” refers to Northern Tier Holdings LLC, the owner of our general partner. References to “ACON Refining” refer to ACON Refining Partners, L.L.C. and certain of its affiliates and to “TPG Refining” refer to TPG Refining, L.P. and certain of its affiliates. References to the “Marathon Acquisition” refer to the acquisition by us of our St. Paul Park, Minnesota refinery, a 17% interest in the Minnesota Pipe Line Company, our convenience stores and related assets from Marathon Petroleum Corporation, completed in December 2010. We refer to the assets acquired in the Marathon Acquisition as the “Marathon Assets.”

Northern Tier Energy LP

We are an independent downstream energy limited partnership with refining, retail and pipeline operations that serves the PADD II region of the United States. We operate our assets in two business segments: the refining business and the retail business. For the year ended December 31, 2012, we had total revenues of $4.7 billion, operating income of $571.0 million, net income of $197.6 million and Adjusted EBITDA of $739.7 million. For the year ended December 31, 2011, we had total revenues of $4.3 billion, operating income of $422.6 million, net income of $28.3 million and Adjusted EBITDA of $430.7 million. For a definition, and reconciliation, of Adjusted EBITDA to net earnings, see “—Summary Historical Condensed Consolidated Financial and Other Data.”

Refining Business

Our refining business primarily consists of an 81,500 barrels per calendar day (“bpd”) (84,500 barrels per stream day) refinery located in St. Paul Park, Minnesota. Our refinery has a complexity index of 11.5, which refers to the ability of a refinery to produce finished products based on its investment intensity and cost relative to other refineries. Our refinery’s complexity allows us to process a variety of light, heavy, sweet and sour crudes into higher value refined products.

We are one of only two refineries in Minnesota and one of four refineries in the Upper Great Plains area within the PADD II region. The PADD II region covers Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Ohio, Oklahoma, Tennessee and Wisconsin. Our strategic location allows us direct access, primarily via the Minnesota Pipeline, to what we believe are abundant supplies of advantageously priced crude oils. Of the crude oil processed at our refinery in the years ended December 31, 2012 and 2011, approximately 47% and 51%, respectively, was Canadian crude oil and the remainder was primarily comprised of light sweet crude oil from the Bakken Shale in North Dakota. Many of these crude oils have historically priced at a discount to the U.S. benchmark West Texas Intermediate crude oil (“NYMEX WTI”). Further, over the past twelve months, NYMEX WTI has traded at an additional discount relative to waterborne crude oils, such as Brent crude oil (“Brent”).

1

Table of Contents

We expect to continue to benefit from our access to these growing crude oil supplies. By 2030, according to the Canadian Association of Petroleum Producers (“CAPP”), total Canadian crude oil production is expected to grow to 6.2 million bpd from 2011 production of 3.0 million bpd. Crude oil production from the Bakken Shale in North Dakota has also increased significantly, helping to grow crude oil production in North Dakota from approximately 98,000 bpd in 2005 to approximately 769,000 bpd as of December 2012, and is expected to continue to grow due to improvements in unconventional resource production techniques.

Our location also allows us to distribute our refined products throughout the midwestern United States. Our refinery produces a broad slate of refined products including gasoline, diesel, jet fuel and asphalt, which are then marketed to resellers and consumers primarily in the PADD II region. Approximately 80% and 79% of our total refinery production for the years ended December 31, 2012 and 2011, respectively, was comprised of higher value, light refined products, including gasoline and distillates.

We also own various storage and transportation assets, including a light products terminal, a heavy products terminal, storage tanks, rail loading/unloading facilities and a Mississippi river dock. Approximately 78% and 83% of our gasoline and diesel volumes for the years ended December 31, 2012 and 2011, respectively, were sold via our light products terminal to our company-operated and franchised SuperAmerica branded convenience stores, Marathon branded convenience stores and other resellers. We have a contract with Marathon to supply substantially all of the gasoline and diesel requirements for the independently owned and operated Marathon branded convenience stores in our marketing area. Beginning in December 2012, we initiated a crude oil transportation business in North Dakota to allow us to purchase crude oil at the wellhead in the Bakken Shale while limiting the impact of rising trucking costs for crude oil in North Dakota.

Our refining business also includes our 17% interest in the Minnesota Pipe Line Company LLC (the “Minnesota Pipe Line Company”), which owns and operates the Minnesota Pipeline, a 455,000 bpd crude oil pipeline system that transports crude oil (primarily from Western Canada and North Dakota) for approximately 300 miles from the Enbridge pipeline hub at Clearbrook, Minnesota to our refinery. The Minnesota Pipeline has historically transported the majority of the crude oil used and processed in our refinery.

Retail Business

As of December 31, 2012, our retail segment operated 166 convenience stores under the SuperAmerica brand and also supported 70 franchised convenience stores, which are also operated under the SuperAmerica brand. These convenience stores are located primarily in Minnesota and Wisconsin and sell various grades of gasoline and diesel, tobacco products and immediately consumable items such as beverages, prepared food and a large variety of snacks and prepackaged items. Our refinery supplied substantially all of the gasoline and diesel sold in our company-operated and franchised convenience stores for the years ended December 31, 2012 and 2011.

We also own and operate SuperMom’s Bakery, which prepares and distributes baked goods and other prepared food items for sale in our company-operated and franchised convenience stores and other third party locations.

Refining Industry Overview

Crude oil refining is the process of separating the hydrocarbons present in crude oil for the purpose of converting them into marketable finished, or refined, petroleum products such as gasoline, diesel, jet fuel, asphalt and other products. Refining is primarily a margin-based business where both the feedstock (primarily crude oil) and the refined products are commodities with fluctuating prices. In order to increase profitability, it is important for a refinery to maximize the yields of high value finished products and to minimize the costs of feedstock and operating expenses.

2

Table of Contents

According to the EIA, as of January 1, 2012, there were 134 oil refineries operating in the United States, with the 14 smallest each having a refining capacity of 14,000 bpd or less, and the 10 largest having capacities ranging from 327,000 bpd to 560,500 bpd.

High capital costs, historical excess capacity and environmental regulatory requirements have limited the construction of new refineries in the United States over the past 30 years. According to the EIA, domestic operating refining capacity has increased approximately 4% between January 1982 and January 2012 from 16.1 million bpd to 16.7 million bpd. Much of this increase in capacity is generally the result of efficiency measures and moderate expansions at various refineries, known as “capacity creep,” but some significant expansions at existing refineries have occurred as well. During this same time period, more than 110 generally smaller and less efficient refineries that had limited access to a wide variety of crude oils or were unable to profitably process feedstock into a marketable product mix were closed.

According to the EIA, total demand for refined products in PADD II, which is the region in which we operate, has represented approximately 26% of total U.S. refined products demand from 2007 to 2011. Within PADD II, refined product production capacity is currently insufficient to meet demand. For example, according to the EIA, due to product supply shortfalls within PADD II, net receipts of gasoline, distillate (inclusive of jet fuel and kerosene) and jet fuel/kerosene from domestic sources outside of PADD II comprised approximately 17%, 14% and 14%, respectively, of demand for these products. Refining capacity in the PADD II region has decreased approximately 3% between January 1982 and January 2012 from approximately 3.8 million bpd to approximately 3.6 million bpd, while more than 25 refineries in the PADD II region have ceased operations. The refined product volumes that are necessary to satisfy the demand in excess of PADD II production are primarily sourced from domestic refineries located outside of PADD II, specifically from the U.S. Gulf Coast.

Our Business Strategy

Our primary business objective is to grow our cash flows from operations over the long-term by executing the following business strategies:

| • | Make Distributions Equal to the Available Cash We Generate Each Quarter. The board of directors of our general partner adopted a policy under which distributions for each quarter will equal the amount of available cash we generate each quarter. We do not intend to maintain excess distribution coverage in order to stabilize our quarterly distributions or to otherwise reserve cash for future distributions. In addition, our general partner has a non-economic interest and no incentive distribution rights, and, accordingly, our unitholders will receive 100% of our cash distributions. |

| • | Focus on Optimizing Crude Oil Supply. We are focused on optimizing our crude oil purchases for our refining operations and minimizing our crude oil feedstock costs. Our strategic location and our refinery’s complexity allow us to receive and process a variety of light, heavy, sweet and sour crude oils from Western Canada and the United States, many of which have historically priced at a discount to the NYMEX WTI price benchmark. |

| • | Focus on Growth Opportunities. We intend to pursue opportunities to grow our business both organically and through acquisitions within the refining, logistics and retail marketing industries. |

| • | Organic Growth Projects. We plan to continue to make investments to enhance the operating flexibility of our refinery, to improve our crude oil sourcing advantage and to grow our retail business. We intend to pursue organic growth projects at the refinery to improve the yield of light products we produce and the efficiency of our operations, which we believe should improve profitability. We also plan to make investments in logistics operations, including trucking, terminal and pipeline facilities, to enhance our crude oil sourcing flexibility and to reduce related crude oil purchasing and delivery costs. We also intend to invest in the growth of our retail business with the ultimate objective of having a dedicated outlet for all of our refinery’s gasoline |

3

Table of Contents

| production. We believe that this retail strategy should allow our refinery to reduce its reliance on the wholesale market, improve the capacity utilization of our refinery and increase our profitability. |

| • | Evaluate Accretive Acquisition Opportunities. We will selectively pursue accretive acquisitions within our refining and retail business segments, both in our existing areas of operations as well as in new geographic regions that would diversify our operating footprint. In evaluating acquisitions within the refining industry, we will consider, among other factors, sustainable performance of the targeted assets through the refining cycle, access to advantageous sources of crude oil supplies, attractive demand and supply market fundamentals, access to distribution and logistics infrastructure, and potential operating synergies. |

| • | Maintain Low Leverage and Significant Liquidity in Our Business. We benefit from a number of sources of liquidity that provide us with financial flexibility during periods of volatile commodity prices, including cash on hand, our revolving credit facility, trade credit from our crude oil suppliers and other mechanisms. For example, we are party to a crude oil supply and logistics agreement with J.P. Morgan Commodities Canada Corporation (“JPM CCC”) to supply our refinery’s crude oil feedstock requirements, which helps reduce the amount of working capital required in our refinery operations. We manage our operations prudently with a focus on maintaining low leverage and sufficient liquidity to meet unforeseen capital needs. As of December 31, 2012, we had approximately $404.8 million of available liquidity, comprised of $272.9 million of cash on hand and $131.9 million available for borrowing (which is net of $36.5 million in outstanding letters of credit) under our $300 million revolving credit facility. Our available liquidity will vary depending on several factors, including fluctuations in inventory and accounts receivable values as well as cash reserves. Cash for distributions to our unitholders will be funded from this cash on hand. However, sufficient liquidity will be maintained to manage our operations. Additionally, we seek to maintain low leverage. Our ratio of total debt as of December 31, 2012 to Adjusted EBITDA for the year ended December 31, 2012 was 0.4 to 1.0, which provides us further financial and operating flexibility. |

| • | Selectively Engage in Hedging Activities to Ensure Sufficient Cash Flows to Service Our Fixed Obligations. We plan to systematically evaluate the merits of entering into commodity derivatives contracts to hedge our refining margins with respect to a portion of our gasoline and diesel production. We may engage in these activities with the purpose of ensuring that we have sufficient cash flows to meet our fixed cost obligations, service our outstanding debt and other liabilities, and meet our capital expenditure requirements. Commodity derivatives contracts that we may enter into include either exchange-traded contracts in the form of futures contracts or over-the-counter contracts in the form of commodity price swaps that reference benchmark indices. As of December 31, 2012, approximately five million barrels of our future gasoline and diesel production remained hedged under commodity derivatives contracts. Our initial hedge positions for 2011 and 2012 production were established at the time of the Marathon Acquisition, and our plan is to hedge a lesser amount of production than we hedged at the time of the acquisition. Consequently, we plan to increase our exposure to the gross refining margins that we would realize at our refinery on an unhedged basis over time. For the year ended December 31, 2012, we settled contracts covering approximately three million barrels of our 2012 gasoline and diesel production and recognized a loss of approximately $44.6 million. In addition, during the second quarter of 2012, we reset the price of our contracts for the period of July 2012 through December 2012 and recognized a loss of approximately $92 million. We used $92 million of the net proceeds from our initial public offering to settle the majority of these obligations. The remainder of these deferred losses of approximately $30 million will be paid through the end of 2013. |

4

Table of Contents

Our Competitive Strengths

We have a number of competitive strengths that we believe will help us to successfully execute our business strategy:

| • | Strategically Located Refinery with Advantageous Access to Crude Oil Supply. Our refinery is located on approximately 170 acres along the Mississippi River in a strategically advantageous area within the PADD II region. The refinery has the ability to source a variety of crude oils, including heavy Canadian crude oils and light North Dakota crude oils, primarily via the Minnesota Pipeline. Our refinery also has access to crude oils from Cushing, Oklahoma, the U.S. Gulf Coast and other foreign markets. The ability to source and process multiple types of crude oil enables us to capitalize on changing market conditions and, we believe, increase our profitability. For the year ended December 31, 2012, approximately 47% of the crude oil processed at the refinery was Canadian crude oil, with the remainder comprised of locally produced U.S. crude oils, mostly from the Bakken Shale in North Dakota. Historically, we have purchased our crude oil at a discount to the NYMEX WTI as a result of our close proximity to plentiful sources of crude oil in Western Canada and North Dakota. Over the five years ended December 31, 2012, we realized an average discount of $2.31 per barrel of crude oil purchased for our refinery when compared to the average NYMEX WTI price per barrel over the same period. More recently, the increase of the discount at which a barrel of NYMEX WTI traded relative to Brent has allowed refineries, such as ours, that are capable of sourcing and utilizing crude oil that is priced more in line with NYMEX WTI, to realize relatively lower feedstock costs and benefit from the higher refined product prices resulting from higher Brent prices. |

| • | Attractive Regional Refined Products Supply/Demand Dynamics. In recent years, demand for refined products in the PADD II region has exceeded regional production, resulting in a need for imports from other regions, specifically from the U.S. Gulf Coast region. Our inland location means that foreign and coastal domestic refiners seeking to access our marketing area would incur additional transportation costs. Over the five years ended December 31, 2012, our refinery has realized an average price premium of $2.35 per barrel for its gasoline and distillates production relative to the prices used in calculating the U.S. Gulf Coast 3:2:1 crack spread and an average price premium of $1.69 per barrel relative to the benchmark PADD II Group 3 3:2:1 crack spread (the “Group 3 3:2:1 crack spread”), in each case assuming a comparable rate of two barrels of gasoline and one barrel of distillate (see footnote 4 in “—Summary Historical Condensed Consolidated Financial and Other Data”). |

| • | Substantial Refinery Operating Flexibility. Since 2006, approximately $246 million (including $194 million from January 2006 through November 2010 and $52 million from our inception date of June 23, 2010 through December 31, 2012) has been invested in upgrades and capital projects to modernize the St. Paul Park refinery, improve its operating flexibility, increase its complexity and meet U.S. environmental, health and safety requirements, including revamping the gas oil hydrotreater in 2006 to allow for the production of ultra low sulfur diesel. As a result of these capital expenditures, we believe that we will be able to comply with known prospective fuel quality requirements without incurring significant capital costs or substantially increased operating costs. In addition, we have significant redundancies in our refining assets, which include two crude oil distillation and vacuum towers, two reformers, two sulfur recovery units and five hydrotreating units. These redundancies allow us to continue to receive and process crude oil and other feedstocks in the event a unit goes out of service and allows for increased maintenance flexibility as a redundant unit may be used without having to shut down the entire refinery in the case of a major unit turnaround. |

Our refinery has a complexity index of 11.5. Our refinery’s complexity means we can process lower cost crude oils into higher value light refined products, including transportation fuels, such as gasoline and distillates. Gasoline and distillates comprised approximately 80% and 79% of our total refinery production for the years ended December 31, 2012 and 2011, respectively.

5

Table of Contents

| • | Strong Refinery Operating and Safety Track Record. Our refinery has a strong operating and safety track record as evidenced by our high mechanical availability and low recordable incidents. This performance is due to, among other things, the periodic upgrades and maintenance performed at our refinery. Our refinery recorded mechanical availability of 95.8%, 96.6% and 96.6% for the years ended December 31, 2010, 2011 and 2012 respectively, with an average annual mechanical availability of 96.8% from 2005 through 2012, inclusive. We measure our safety track record primarily through the use of injury frequency rates as determined by the Occupational Safety and Health Administration (“OSHA”). Our refinery had OSHA Recordable Rates of 0.23, 0.52 and 1.16 during the years ended December 31, 2010, 2011 and 2012, respectively, with an average annual OSHA Recordable Rate of 0.99 during the period from 2005 through 2012, inclusive. |

| • | Integrated Refining and Retail Distribution Operations. Our business is an integrated refining operation with significant storage assets and a retail distribution network comprising, as of December 31, 2012, 166 company-operated and 70 franchised convenience stores, all of which are operated under the SuperAmerica brand. For the years ended December 31, 2012 and 2011, we sold 78% and 83% of our gasoline and diesel volumes, respectively, via our eight-bay bottom-loading light products terminal located at the refinery, primarily to our retail distribution network and, to a lesser extent, other resellers. Our refinery supplied substantially all of the gasoline and diesel sold in our company-operated and franchised convenience stores during these periods. We also have a contract with Marathon to supply substantially all of the gasoline and diesel requirements of 90 independently owned and operated Marathon branded convenience stores. In addition, we also have (i) a seven-bay heavy products terminal located on the refinery property, (ii) rail facilities for shipping liquefied petroleum gases and asphalt and for receiving butane, isobutane, crude oil and ethanol and (iii) a barge dock on the Mississippi River used primarily for shipping vacuum residuals and slurry. |

| • | Experienced and Proven Management Team. Our management team is led by our President and Chief Executive Officer, Hank Kuchta, who has over 30 years of industry experience and was formerly President and Chief Operating Officer of Premcor Inc. Premcor operated four refineries in the United States with approximately 750,000 bpd of refining capacity at the time of its sale to Valero Energy Corporation in April 2005. Prior to Premcor, Mr. Kuchta served in various management positions at Phillips 66 Company, Tosco Corporation and Exxon Corporation. Our President of refinery operations, Greg Mullins, previously worked at Marathon for over 30 years and has extensive experience in all aspects of refinery operations and management as well as major project development and project management. Several members of our management team, including our President and Chief Executive Officer; our Vice President and Chief Operating Officer; our Vice President, Marketing; our Vice President, Human Resources; and our Vice President, Chief Information Officer, have experience working together as a management team at Premcor. |

Recent Developments

Quarterly Distribution

On February 11, 2013, we announced that the board of directors of our general partner declared a cash distribution attributable to the fourth quarter of 2012 of $1.27 per unit. The cash distribution was paid on February 28, 2013 to unitholders of record on February 21, 2013.

Our Relationship with ACON Refining and TPG Refining

ACON Refining Partners, L.L.C. and certain of its affiliates (“ACON Refining”) and TPG Refining, L.P. and certain of its affiliates (“TPG Refining”) indirectly control and own a substantial majority of the economic

6

Table of Contents

interests in Northern Tier Holdings LLC. Northern Tier Holdings LLC owns 100% of Northern Tier Energy GP LLC, our general partner, and prior to this offering, 66.3% of our units.

ACON Investments, L.L.C., an affiliate of ACON Refining, and certain other of its affiliates (“ACON Investments”) manage private equity funds. ACON Investments has executed investments in upstream and midstream oil and gas companies as well as in energy infrastructure and energy services. TPG Global LLC (together with its affiliates, “TPG”), an affiliate of TPG Refining, is a leading private investment firm with approximately $54.7 billion of assets under management as of December 31, 2012. TPG has extensive global experience with investments in the energy sector.

Our Management

We are managed and operated by the board of directors and executive officers of our general partner, which is owned by Northern Tier Holdings. Following this offering, % of our common units will be owned by Northern Tier Holdings (or % if the underwriters exercise in full their option to purchase additional common units). Northern Tier Holdings, as the owner of our general partner, has the right to appoint all members of the board of directors of our general partner, including the independent directors. Our unitholders are not entitled to elect our general partner or its directors or otherwise directly participate in our management or operation.

Neither our general partner nor its affiliates receives any management fee, but we will reimburse our general partner and its affiliates for all expenses they incur and payments they make on our behalf. Our partnership agreement provides that our general partner will determine in good faith the expenses that are allocable to us.

Our operations are conducted through, and our operating assets are owned by, our wholly-owned subsidiary, Northern Tier Energy LLC, and its subsidiaries. All of the employees who conduct our business are employed by Northern Tier Energy LLC and its subsidiaries. Northern Tier Energy LP does not have any employees.

Conflicts of Interest and Fiduciary Duties

Our general partner has a legal duty to manage us in good faith. However, the officers and directors of our general partner also have fiduciary duties to manage our general partner in a manner beneficial to its indirect owners, which include ACON Refining, TPG Refining and entities in which our President and Chief Executive Officer holds an ownership interest. As a result, conflicts of interest may arise in the future between us and our unitholders, on the one hand, and our general partner and its owners, on the other hand. Our partnership agreement limits the liability and reduces the duties owed by our general partner to our unitholders. Our partnership agreement also restricts the remedies available to our unitholders for actions that might otherwise constitute a breach of our general partner’s duties. By purchasing a common unit, the purchaser agrees to be bound by the terms of our partnership agreement, and each unitholder is treated as having consented to various actions and potential conflicts of interest contemplated in the partnership agreement that might otherwise be considered a breach of fiduciary or other duties under Delaware law.

7

Table of Contents

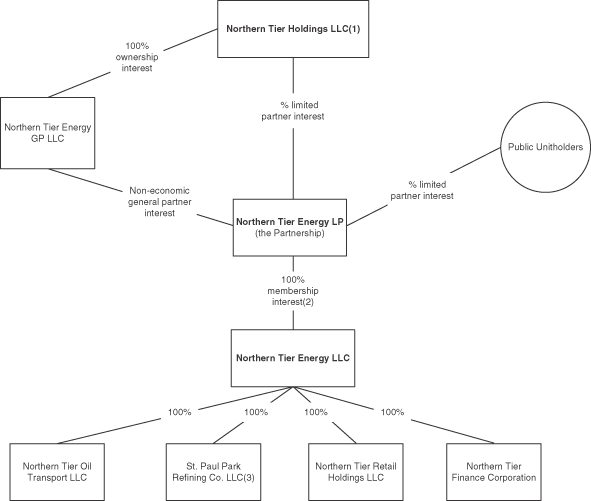

Organizational Structure

The following diagram depicts our ownership and organizational structure upon the closing of this offering:

| (1) | All of the common interests in Northern Tier Holdings are owned by Northern Tier Investors, LLC, a Delaware limited liability company, the sole member of which is Northern Tier Investors LP, a Delaware limited partnership. All of the Class A Common Units in Northern Tier Investors LP are held by ACON Refining (48.75%), TPG Refining (48.75%) and entities in which Hank Kuchta has an ownership interest (2.5%). All of the limited liability company interests in the general partner of Northern Tier Investors LP, NTI GenPar LLC, a Delaware limited liability company, are held equally by ACON Refining and TPG Refining. Marathon holds a $45 million preferred interest in Northern Tier Holdings. |

| (2) | Northern Tier Energy Holdings LLC, which elected to be treated as a corporation for federal income tax purposes in connection with the closing of our initial public offering, is a wholly owned subsidiary of Northern Tier Energy LP and holds a 0.01% membership interest in Northern Tier Energy LLC. |

| (3) | Includes 17% of the limited liability company interests of Minnesota Pipe Line Company, LLC and 17% of the stock of MPL Investments, Inc. |

8

Table of Contents

Principal Executive Offices and Internet Address

Our principal executive offices are located at 38C Grove Street, Suite 100, Ridgefield, Connecticut 06877, and our telephone number at that address is (203) 244-6550. Our website is located at www.ntenergy.com. We expect to make our periodic reports and other information filed with or furnished to the Securities and Exchange Commission (the “SEC”), available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

9

Table of Contents

The Offering

| Selling unitholder |

Northern Tier Holdings LLC, a Delaware limited liability company. |

| Common units offered by the selling unitholder |

common units. |

| Option to purchase additional common units |

The selling unitholder has granted the underwriters a 30-day option to purchase up to an aggregate of additional common units. |

| Immediately before this offering, the selling unitholder owned 60,922,500 common units, representing an approximate 66.3% limited partner interest in us. Following this offering, the selling unitholder will own common units, or common units if the underwriters exercise in full their option to purchase additional common units, representing an approximate % and % limited partner interest in us, respectively. |

| Units outstanding before and after this offering |

91,956,017 common units. |

| Use of proceeds |

We will not receive any of the proceeds from the sale of the common units by the selling unitholder. See “Use of Proceeds.” |

| Distribution policy |

On February 11, 2013, the board of directors of our general partner declared a $1.27 per common unit distribution payable to holders of record of common units as of February 21, 2013. The cash distribution was paid on February 28, 2013. This distribution reflected available cash (as described below) for the three months ended December 31, 2012. |

| We expect within 60 days after the end of each quarter to make distributions to unitholders of record on the applicable record date. |

| The board of directors of our general partner adopted a policy pursuant to which distributions for each quarter will be in an amount equal to the available cash we generate in such quarter. Distributions on our units will be in cash. Available cash for each quarter will be determined by the board of directors of our general partner following the end of such quarter. We expect that available cash for each quarter will generally equal our cash flow from operations for the quarter excluding working capital fluctuations, less cash needed for maintenance capital expenditures, reimbursement of expenses incurred by our general partner and its affiliates, debt service and other contractual obligations and reserves for future operating or capital needs that the board of directors of our general partner deems necessary or appropriate, including reserves for our turnaround and related expenses. |

| We do not intend to maintain excess distribution coverage for the purpose of maintaining stability or growth in our quarterly distribution or to otherwise reserve cash for distributions, and we do not intend to incur debt to pay quarterly distributions. We expect to finance major growth initiatives either through debt or equity issuances. |

10

Table of Contents

| Because our policy will be to distribute an amount equal to all available cash we generate each quarter, our unitholders will have direct exposure to fluctuations in the amount of cash generated by our business. We expect that the amount of our quarterly distributions, if any, will vary based on our operating cash flow during such quarter. As a result, our quarterly distributions, if any, will not be stable and will vary from quarter to quarter as a direct result of variations in, among other factors, (i) our operating performance, (ii) cash flows caused by, among other things, fluctuations in the prices of crude oil and other feedstocks and the prices we receive for finished products, (iii) our working capital requirements, (iv) capital expenditures and (v) cash reserves deemed necessary or appropriate by the board of directors of our general partner. Such variations in the amount of our quarterly distributions may be significant. Unlike most publicly traded partnerships, we do not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time. The board of directors of our general partner may change our distribution policy at any time. Our partnership agreement does not require us to pay distributions to our unitholders on a quarterly or other basis. |

| Incentive distribution rights |

None. |

| Subordination period |

None. |

| Issuance of additional units |

Our partnership agreement authorizes us to issue an unlimited number of additional units, units with rights to distributions or in liquidation that are senior to our common units, and rights to buy units for the consideration and on the terms and conditions determined by the board of directors of our general partner, without the approval of our unitholders. See “Common Units Eligible for Future Sale” and “The Partnership Agreement—Issuance of Additional Partnership Interests.” |

| Limited voting rights |

Our general partner manages and operates us. Unlike the holders of common stock in a corporation, our unitholders will have only limited voting rights on matters affecting our business. Unitholders will have no right to elect our general partner or our general partner’s directors on an annual or other continuing basis. Our general partner may be removed by a vote of the holders of at least two-thirds of the outstanding units, including any units owned by our general partner and its affiliates (including Northern Tier Holdings). Following completion of this offering, Northern Tier Holdings will own an aggregate of approximately % of our outstanding common units (or approximately % of our outstanding common units if the underwriters exercise their option to purchase additional common units in full). This will give Northern Tier Holdings the ability to prevent removal of our general partner. See “The Partnership Agreement—Voting Rights.” |

| Call right |

If at any time our general partner and its affiliates (including Northern Tier Holdings) own more than 90% of the outstanding common units, our general partner will have the right, but not the obligation, to |

11

Table of Contents

| purchase all, but not less than all, of the units held by unaffiliated unitholders at a price not less than their then-current market price, as calculated pursuant to the terms of our partnership agreement. See “The Partnership Agreement—Call Right.” |

| Material federal income tax consequences |

For a discussion of the material federal income tax consequences that may be relevant to prospective unitholders, see “Material Federal Income Tax Consequences.” |

| Exchange listing |

Our common units are listed on the New York Stock Exchange (“NYSE”) under the symbol “NTI.” |

| Conflict of interest |

Affiliates of TPG Capital BD, LLC, an underwriter of this offering, own (through their interest in Northern Tier Holdings LLC) in excess of 10% of our issued and outstanding common units; therefore, a “conflict of interest” is deemed to exist under FINRA Rule 5121(f)(5)(B). In addition, because affiliates of TPG Capital BD, LLC will receive (through their interest in Northern Tier Holdings LLC, as selling unitholder) more than 5% of the net proceeds of this offering, a “conflict of interest” also exists under FINRA Rule 5121(f)(5)(C)(ii). Accordingly, this offering will be made in compliance with the applicable provisions of FINRA Rule 5121. See “Underwriting—Conflicts of Interest” and “Use of Proceeds.” |

12

Table of Contents

Summary Historical Condensed Consolidated Financial and Other Data

The following tables present certain summary historical condensed consolidated financial and other data. The combined financial statements for the eleven months ended November 30, 2010 represent a carve-out financial statement presentation of several operating units of Marathon, which we refer to as “Predecessor.” The historical combined financial data for periods prior to December 1, 2010 presented below do not reflect the consummation of the Marathon Acquisition and the transactions related thereto or our capital structure following the Marathon Acquisition and the transactions related thereto. Northern Tier Energy LLC was formed on June 23, 2010 and entered into certain agreements with Marathon on October 6, 2010 to acquire the Marathon Assets. At the closing of the Marathon Acquisition on December 1, 2010, Northern Tier Energy LLC acquired the Marathon Assets. Northern Tier Energy LLC had no operating activities between its inception date and the closing date of the Marathon Acquisition, although it incurred various transaction and formation costs which have been included in the period June 23, 2010 (inception date) through December 31, 2010 (the “2010 Successor Period”). Upon the closing of our initial public offering, the historical consolidated financial statements of Northern Tier Energy LLC became the historical consolidated financial statements of Northern Tier Energy LP.

The summary historical financial data as of December 31, 2011 and 2012 and for the eleven months ended November 30, 2010, the 2010 Successor Period and the years ended December 31, 2011 and 2012 are derived from audited financial statements and the notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2012, which is incorporated herein by reference.

The summary historical consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Financial Statements and Supplementary Data” included in our Annual Report on Form 10-K for the year ended December 31, 2012, which is incorporated herein by reference.

| Predecessor | Successor | |||||||||||||||||

| Eleven Months Ended November 30, 2010 |

June 23, 2010 (inception date) to December 31, 2010 |

Year Ended December 31, |

||||||||||||||||

| 2011 | 2012 | |||||||||||||||||

| (Dollars in millions, except per barrel/gallon data) | ||||||||||||||||||

| Consolidated and combined statements of operations data: |

||||||||||||||||||

| Total revenue |

$ | 3,195.2 | $ | 344.9 | $ | 4,280.8 | $ | 4,653.9 | ||||||||||

| Costs, expenses and other: |

||||||||||||||||||

| Cost of sales |

2,697.9 | 307.5 | 3,512.4 | 3,584.9 | ||||||||||||||

| Direct operating expenses |

227.0 | 21.4 | 257.9 | 254.1 | ||||||||||||||

| Turnaround and related expenses |

9.5 | — | 22.6 | 26.1 | ||||||||||||||

| Depreciation and amortization |

37.3 | 2.2 | 29.5 | 33.2 | ||||||||||||||

| Selling, general and administrative expenses |

59.6 | 6.4 | 88.7 | 88.3 | ||||||||||||||

| Formation and offering costs |

— | 3.6 | 7.4 | 1.4 | ||||||||||||||

| Contingent consideration (income) loss |

— | — | (55.8 | ) | 104.3 | |||||||||||||

| Other (income) expense, net |

(5.4 | ) | 0.1 | (4.5 | ) | (9.4 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

169.3 | 3.7 | 422.6 | 571.0 | ||||||||||||||

| Realized losses from derivative activities |

— | — | (310.3 | ) | (339.4 | ) | ||||||||||||

| Unrealized (losses) gains from derivative activities |

(40.9 | ) | (27.1 | ) | (41.9 | ) | 68.0 | |||||||||||

| Bargain purchase gain |

— | 51.4 | — | — | ||||||||||||||

| Interest expense, net |

(0.3 | ) | (3.2 | ) | (42.1 | ) | (42.2 | ) | ||||||||||

| Loss on early extinguishment of debt |

— | — | — | (50.0 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings before income taxes |

128.1 | 24.8 | 28.3 | 207.4 | ||||||||||||||

| Income tax provision |

(67.1 | ) | — | — | (9.8 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 61.0 | $ | 24.8 | $ | 28.3 | $ | 197.6 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings per common unit basic and diluted |

— | — | — | $ | 1.38 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

13

Table of Contents

| Predecessor | Successor | |||||||||||||||||

| Eleven Months Ended November 30, 2010 |

June 23, 2010 (inception date) to December 31, 2010 |

Year Ended December 31, |

||||||||||||||||

| 2011 | 2012 | |||||||||||||||||

| (Dollars in millions, except per barrel/gallon data) | ||||||||||||||||||

| Consolidated and combined statements of cash flow data: |

||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||

| Operating activities |

$ | 145.4 | $ | — | $ | 209.3 | $ | 308.5 | ||||||||||

| Investing activities |

(29.3 | ) | (363.3 | ) | (156.3 | ) | (28.7 | ) | ||||||||||

| Financing activities |

(115.4 | ) | 436.1 | (2.3 | ) | (130.4 | ) | |||||||||||

| Capital expenditures |

(29.8 | ) | (2.5 | ) | (45.9 | ) | (30.9 | ) | ||||||||||

| Other data: |

||||||||||||||||||

| Adjusted EBITDA(1) |

$ | 220.1 | $ | 9.9 | $ | 430.7 | $ | 739.7 | ||||||||||

| Refinery segment data: |

||||||||||||||||||

| Refinery feedstocks (bpd): |

||||||||||||||||||

| Light and intermediate crude |

55,402 | 59,872 | 56,722 | 60,326 | ||||||||||||||

| Heavy crude |

18,693 | 14,777 | 20,730 | 21,453 | ||||||||||||||

| Other feedstocks/blendstocks |

5,971 | 6,487 | 3,698 | 2,072 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total throughput |

80,066 | 81,136 | 81,150 | 83,851 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Refinery product yields (bpd): |

||||||||||||||||||

| Gasoline |

41,080 | 42,485 | 40,240 | 40,825 | ||||||||||||||

| Distillates |

22,201 | 26,258 | 24,841 | 27,113 | ||||||||||||||

| Asphalt |

9,532 | 9,099 | 9,888 | 11,434 | ||||||||||||||

| Other |

8,145 | 4,011 | 7,110 | 5,158 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total production |

80,958 | 81,853 | 82,079 | 84,530 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Refinery gross product margin per barrel of throughput(2) |

$ | 12.86 | $ | 9.94 | $ | 20.11 | $ | 29.62 | ||||||||||

| SPP Refinery 3:2:1 crack spread (per barrel)(3) |

$ | 15.12 | $ | 16.07 | $ | 27.92 | $ | 36.17 | ||||||||||

| Group 3 3:2:1 crack spread (per barrel)(3) |

$ | 9.34 | $ | 9.88 | $ | 25.37 | $ | 28.80 | ||||||||||

| Retail segment data: |

||||||||||||||||||

| Gallons sold (in millions) |

316.0 | 29.1 | 324.0 | 312.4 | ||||||||||||||

| Retail fuel margin per gallon (for company-operated stores)(4) |

$ | 0.17 | $ | 0.16 | $ | 0.21 | $ | 0.18 | ||||||||||

| December 31, 2011 | December 31, 2012 | |||||||

| (Dollars in millions) | ||||||||

| Consolidated and combined balance sheets data: |

||||||||

| Cash and cash equivalents |

$ | 123.5 | $ | 272.9 | ||||

| Total assets |

998.8 | 1,136.8 | ||||||

| Total long-term debt |

301.9 | 282.5 | ||||||

| Total liabilities |

686.6 | 653.0 | ||||||

| Total equity |

312.2 | 483.8 | ||||||

| (1) | EBITDA is defined as net earnings before interest expense, income taxes and depreciation and amortization. Adjusted EBITDA is defined as EBITDA before turnaround and related expenses, stock-based compensation expense, gains (losses) from derivative activities, contingent consideration fair value adjustments, formation costs, bargain purchase gain and adjustments to reflect proportionate EBITDA from the Minnesota Pipeline operations. We believe Adjusted EBITDA is an important measure of operating performance and provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. We also believe Adjusted EBITDA may be used by some investors to assess the ability of our assets to generate sufficient cash flow to make distributions to our unitholders. |

Adjusted EBITDA, as presented herein, is a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP. We use non-GAAP financial measures as supplements to our GAAP results in order to provide a more complete understanding of the factors and trends affecting our

14

Table of Contents

business. Adjusted EBITDA is a measure of operating performance that is not defined by GAAP and should not be considered a substitute for net (loss) earnings as determined in accordance with GAAP.

Set forth below is additional detail as to how we use Adjusted EBITDA as a measure of operating performance, as well as a discussion of the limitations of Adjusted EBITDA as an analytical tool.

Operating Performance. Management uses Adjusted EBITDA in a number of ways to assess our combined financial and operating performance, and we believe this measure is helpful to management and investors in identifying trends in our performance. We use Adjusted EBITDA as a measure of our combined operating performance exclusive of income and expenses that relate to the financing, derivative activities, income taxes and capital investments of the business, adjusted to reflect EBITDA from the Minnesota Pipeline operations. In addition, Adjusted EBITDA helps management identify controllable expenses and make decisions designed to help us meet our current financial goals and optimize our financial performance. Accordingly, we believe this metric measures our financial performance based on operational factors that management can impact in the short-term, namely the cost structure and expenses of the organization.

Limitations. Other companies, including other companies in our industry, may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. Adjusted EBITDA also has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations include that Adjusted EBITDA:

| • | does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; |

| • | does not reflect changes in, or cash requirements for, our working capital needs; |

| • | does not reflect our interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; |

| • | does not reflect the equity income in our Minnesota Pipe Line Company investment, but includes 17% of the calculated EBITDA of Minnesota Pipe Line Company; |

| • | does not reflect realized and unrealized gains and losses from hedging activities, which may have a substantial impact on our cash flow; |

| • | does not reflect certain other non-cash income and expenses; and |

| • | excludes income taxes that may represent a reduction in available cash. |

15

Table of Contents

The following table shows the reconciliation of net earnings, the most directly comparable GAAP measure, to EBITDA and Adjusted EBITDA for the eleven months ended November 30, 2010, the 2010 Successor Period and the years ended December 31, 2011 and 2012:

| Predecessor | Successor | |||||||||||||||||

| Eleven Months Ended November 30, 2010 |

June 23, 2010 (inception date) to December 31, 2010 |

Year Ended December 31, |

||||||||||||||||

| 2011 | 2012 | |||||||||||||||||

| (In millions) | ||||||||||||||||||

| Net earnings |

$ | 61.0 | $ | 24.8 | $ | 28.3 | $ | 197.6 | ||||||||||

| Adjustments: |

||||||||||||||||||

| Interest expense |

0.3 | 3.2 | 42.1 | 42.2 | ||||||||||||||

| Income tax provision |

67.1 | — | — | 9.8 | ||||||||||||||

| Depreciation and amortization |

37.3 | 2.2 | 29.5 | 33.2 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA subtotal |

165.7 | 30.2 | 99.9 | 282.8 | ||||||||||||||

| Minnesota Pipe Line Company proportionate EBITDA |

3.7 | 0.3 | 2.8 | 2.8 | ||||||||||||||

| Turnaround and related expenses |

9.5 | — | 22.6 | 26.1 | ||||||||||||||

| Equity-based compensation expense |

0.3 | 0.1 | 1.6 | 0.9 | ||||||||||||||

| Unrealized losses (gains) on derivative activities |

40.9 | 27.1 | 41.9 | (68.0 | ) | |||||||||||||

| Contingent consideration (income) loss |

— | — | (55.8 | ) | 104.3 | |||||||||||||

| Formation and offering costs |

— | 3.6 | 7.4 | 1.4 | ||||||||||||||

| Loss on early extinguishment of debt |

— | — | — | 50.0 | ||||||||||||||

| Bargain purchase gain |

— | (51.4 | ) | — | — | |||||||||||||

| Realized losses on derivative activities |

— | — | 310.3 | 339.4 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 220.1 | $ | 9.9 | $ | 430.7 | $ | 739.7 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| (2) | Refinery gross product margin per barrel of throughput is a per barrel measurement calculated by subtracting refinery costs of sales from total refinery revenues and dividing the difference by the total throughput for the respective periods presented. Refinery gross product margin is a non-GAAP performance measure that we believe is important to investors in evaluating our refinery performance as a general indication of the amount above our cost of products that we are able to sell refined products. Each of the components used in this calculation (revenues and cost of sales) can be reconciled directly to our statements of operations. Our calculation of refinery gross product margin may differ from similar calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. |

The following table shows the reconciliation of refinery gross product margin per barrel of throughput for the eleven months ended November 30, 2010, the 2010 Successor Period and the years ended December 31, 2011 and 2012:

| Predecessor | Successor | |||||||||||||||||

| Eleven Months Ended November 30, 2010 |

June 23, 2010 (inception date) to December 31, 2010 |

Year Ended December 31, |

||||||||||||||||

| 2011 | 2012 | |||||||||||||||||

| (In millions, except gross margin per barrel data) | ||||||||||||||||||

| Refinery revenue |

$ | 2,799.8 | $ | 312.2 | $ | 3,804.1 | $ | 4,212.6 | ||||||||||

| Refinery costs of sales |

2,455.9 | 287.2 | 3,208.5 | 3,303.7 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Refinery gross product margin |

$ | 343.9 | $ | 25.0 | $ | 595.6 | $ | 908.9 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Throughput (barrels) |

26.8 | 2.5 | 29.6 | 30.7 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Refinery gross product margin per barrel of throughput |

$ | 12.86 | $ | 9.94 | $ | 20.11 | $ | 29.62 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| (3) | We use the Group 3 3:2:1 crack spread as a benchmark for our refinery. The Group 3 3:2:1 crack spread is expressed in dollars per barrel and is a proxy for the per barrel margin that a sweet crude oil refinery would |

16

Table of Contents

| earn assuming it produced and sold at PADD II Group 3 prices the benchmark production of two barrels of gasoline and one barrel of ultra low sulfur diesel for every three barrels of light, sweet crude oil input. |

Our SPP Refinery 3:2:1 crack spread is derived using a similar methodology as the Group 3 3:2:1 crack spread and is calculated by taking the sum of (i) two times our weighted average per barrel price received for our gasoline products plus (ii) our average per barrel price received for distillate, divided by three; then subtracting from that sum our weighted average cost of crude oil supply per barrel. The SPP Refinery 3:2:1 crack spread is not a full representation of our realized refinery gross product margin because the Group 3 3:2:1 crack spread is composed only of gasoline and distillate, whereas our refinery gross product margin is calculated using all of our refined products including asphalt and other lower margin products.

| (4) | Retail fuel margin per gallon is calculated by dividing retail fuel gross margin by the fuel gallons sold at company-operated stores. Retail fuel gross margin is a non-GAAP performance measure that we believe is important to investors in evaluating our retail performance. Our calculation of retail fuel gross margin may differ from similar calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. |

The following table shows the reconciliation of retail gross margin to retail segment operating income for the eleven months ended November 30, 2010, the 2010 Successor Period and the years ended December 31, 2011 and 2012:

| Predecessor | Successor | |||||||||||||||||

| Eleven Months Ended November 30, 2010 |

June 23, 2010 (inception date) to December 31, 2010 |

Year Ended December 31, |

||||||||||||||||

| 2011 | 2012 | |||||||||||||||||

| (In millions) | ||||||||||||||||||

| Retail gross margin: |

||||||||||||||||||

| Fuel margin |

$ | 54.3 | $ | 4.7 | $ | 66.5 | $ | 56.1 | ||||||||||

| Merchandise margin |

81.4 | 6.5 | 86.3 | 86.3 | ||||||||||||||

| Other retail margin |

17.7 | 1.3 | 20.0 | 17.7 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Retail gross margin |

153.4 | 12.5 | 172.8 | 160.1 | ||||||||||||||

| Expenses: |

||||||||||||||||||

| Direct operating expenses |

94.9 | 10.2 | 126.6 | 118.8 | ||||||||||||||

| Depreciation and amortization |

12.4 | 0.5 | 7.2 | 7.5 | ||||||||||||||

| Selling, general and administrative |

19.6 | 1.3 | 25.0 | 25.1 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Retail segment operating income |

$ | 26.5 | $ | 0.5 | $ | 14.0 | $ | 8.7 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

17

Table of Contents

An investment in our common units involves a significant degree of risk. You should carefully consider the risk factors and all of the other information included in this prospectus and the documents we have incorporated by reference into this prospectus, including those in Item 1A “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012 before making an investment decision. Any of these risks and uncertainties could have a material adverse effect on our business, financial condition, cash flows and results of operations could be materially adversely affected. If that occurs, we might not be able to pay distributions on our common units, the trading price of our common units could decline materially, and you could lose all or part of your investment.

The risks included in this prospectus and the documents we have incorporated by reference into this prospectus are not the only risks we face. We may experience additional risks and uncertainties not currently known to us, or as a result of developments occurring in the future. Conditions that we currently deem to be immaterial may also materially and adversely affect our business, financial condition, cash flows and results of operations, and our ability to pay distributions to unitholders.

18

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes “forward-looking statements.” The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” “attempt,” “appears,” “forecast,” “outlook,” “estimate,” “project,” “potential,” “may,” “will,” “are likely” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate, and any and all of our forward-looking statements in this prospectus may turn out to be inaccurate.

Forward-looking statements appear in a number of places in this prospectus, including “Summary,” and include statements with respect to, among other things:

| • | our ability to make distributions on the common units; |

| • | the volatile nature of our business; |

| • | the ability of our general partner to modify or revoke our distribution policy at any time; |

| • | our business strategy and prospects; |

| • | technology; |

| • | our cash flows and liquidity; |

| • | our financial strategy, budget, projections and operating results; |

| • | the amount, nature and timing of capital expenditures; |

| • | the availability and terms of capital; |

| • | competition and government regulations; |

| • | general economic conditions and trends in the refining industry; |

| • | effectiveness of our risk management activities; |

| • | our environmental liabilities; |

| • | our counterparty credit risk; |

| • | governmental regulation and taxation of the refining industry; and |

| • | developments in oil-producing and natural gas-producing countries. |

Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, those summarized below:

| • | the overall demand for hydrocarbon products, fuels and other refined products; |

| • | our ability to produce products and fuels that meet our customers’ unique and precise specifications; |

| • | the impact of fluctuations and rapid increases or decreases in crude oil, refined products, fuel and utility services prices and crack spreads, including the impact of these factors on our liquidity; |

| • | fluctuations in refinery capacity; |

| • | accidents or other unscheduled shutdowns or disruptions affecting our refinery, machinery, or equipment, or those of our suppliers or customers; |

19

Table of Contents

| • | changes in the cost or availability of transportation for feedstocks and refined products; |

| • | the results of our hedging and other risk management activities; |

| • | our ability to comply with covenants contained in our debt instruments; |

| • | labor relations; |

| • | relationships with our partners and franchisees; |

| • | successful integration and future performance of acquired assets, businesses or third-party product supply and processing relationships; |

| • | our access to capital to fund expansions, acquisitions and our working capital needs and our ability to obtain debt or equity financing on satisfactory terms; |

| • | environmental liabilities or events that are not covered by an indemnity, insurance or existing reserves; |

| • | dependence on one principal supplier for merchandise; |

| • | maintenance of our credit ratings and ability to receive open credit lines from our suppliers; |

| • | the effects of competition; |

| • | continued creditworthiness of, and performance by, counterparties; |

| • | the impact of current and future laws, rulings and governmental regulations, including guidance related to the Dodd-Frank Act; |

| • | shortages or cost increases of power supplies, natural gas, materials or labor; |

| • | weather interference with business operations; |

| • | seasonal trends in the industries in which we operate; |

| • | fluctuations in the debt markets; |

| • | potential product liability claims and other litigation; |

| • | changes in economic conditions, generally, and in the markets we serve, consumer behavior, and travel and tourism trends; and |

| • | changes in our treatment as a partnership for U.S. income or state tax purposes. |

These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could have material adverse effects on our future results. Our future results will depend upon various other risks and uncertainties, including those described elsewhere in this prospectus under the heading, “Risk Factors” and in the documents incorporated by reference. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. All forward-looking statements attributable to us are qualified in their entirety by this cautionary statement.

20

Table of Contents

The common units to be offered and sold using this prospectus will be offered and sold by the selling unitholder named in this prospectus. We will not receive any proceeds from the sale of such common units.

Affiliates of TPG Capital BD, LLC, an underwriter of this offering, own (through their interest in Northern Tier Holdings LLC) in excess of 10% of our issued and outstanding common units; therefore, a “conflict of interest” is deemed to exist under FINRA Rule 5121(f)(5)(B). In addition, because affiliates of TPG Capital BD, LLC will receive (through their interest in Northern Tier Holdings LLC, as selling unitholder) more than 5% of the net proceeds of this offering, a “conflict of interest” also exists under FINRA Rule 5121(f)(5)(C)(ii). Accordingly, this offering will be made in compliance with the applicable provisions of FINRA Rule 5121. See “Underwriting—Conflicts of Interest.”

21

Table of Contents

PRICE RANGE OF COMMON UNITS AND DISTRIBUTIONS

Our common units are listed on the New York Stock Exchange under the symbol “NTI.” The last reported sales price of the common units on March 27, 2013 was $30.01. As of March 28, 2013, we had issued and outstanding 91,956,017 common units, which were held of record by 6 unitholders. The following table sets forth the range of high and low sales prices of the common units on the New York Stock Exchange, as well as the amount of cash distributions paid per common unit for the periods indicated.

| Common Unit Price Ranges |

Cash Distributions per Common Unit(1) |

|||||||||||

| Quarter Ended |

High | Low | ||||||||||

| March 31, 2013 (through March 27, 2013)(2) |

$ | 33.24 | $ | 23.62 | ||||||||

| December 31, 2012 |

$ | 27.11 | $ | 19.97 | $ | 1.27 | ||||||

| September 30, 2012 (from July 26, 2012)(3) |

$ | 21.27 | $ | 13.00 | $ | 1.48 | ||||||

| (1) | Distributions are shown for the quarter with respect to which they were declared. |

| (2) | The distribution attributable to the quarter ending March 31, 2013 has not yet been declared or paid. |

| (3) | The distribution attributable to the quarter ended September 30, 2012 represents a prorated distribution for the period from the closing of our initial public offering through September 30, 2012 and was paid on November 29, 2012 to unitholders of record as of November 21, 2012. |

22

Table of Contents

We expect within 60 days after the end of each quarter to make distributions to unitholders of record on the applicable record date. The board of directors of our general partner adopted a policy pursuant to which distributions for each quarter will equal the amount of available cash we generate in such quarter. Distributions on our units will be in cash. Available cash for each quarter will be determined by the board of directors of our general partner following the end of such quarter. We expect that available cash for each quarter will generally equal our cash flow from operations for the quarter excluding working capital fluctuations, less cash needed for maintenance capital expenditures, reimbursement of expenses incurred by our general partner and its affiliates, debt service and other contractual obligations and reserves for future operating or capital needs that the board of directors of our general partner deems necessary or appropriate, including reserves for our turnaround and related expenses. In advance of scheduled turnarounds at our refinery, the board of directors of our general partner currently intends to reserve amounts to fund expenditures associated with such scheduled turnarounds. Such a decision by the board of directors may have an adverse impact on the available cash in the quarter(s) in which the reserves are withheld and a corresponding mitigating impact on the future quarter(s) in which the reserves are utilized. Actual turnaround and related expenses will be funded with cash reserves or borrowings under our revolving credit facility. We do not intend to maintain excess distribution coverage or reserve cash for the purpose of maintaining stability or growth in our quarterly distribution. We do not intend to incur debt to pay quarterly distributions. We expect to finance our major growth initiatives either through debt or equity issuances.