Attached files

| file | filename |

|---|---|

| 8-K - HORIZON BANCORP INC /IN/ | hb_8k0327.htm |

A NASDAQ Traded Company - Symbol HBNC

Forward-Looking Statements This presentation may contain forward-looking statements regarding the financial performance, business, and future operations of Horizon Bancorp and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future results or performance. As a result, undue reliance should not be placed on these forward-looking statements, which speak only as of the date hereof. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions, and although management believes that the expectations reflected in such forward-looking statements are accurate and reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause our actual results to differ materially include those set forth in “Item 1A Risk Factors” of Part I of Horizon’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012. Statements in this presentation should be considered in conjunction with such risk factors and the other information publicly available about Horizon, including the information in the filings we make with the Securities and Exchange Commission. Horizon does not undertake, and specifically disclaims any obligation, to publicly release any updates to any forward-looking statement to reflect events or circumstances occurring or arising after the date on which the forward-looking statement is made, or to reflect the occurrence of unanticipated events, except to the extent required by law.

Corporate Profile Shares Outstanding 8.6 Million Market Cap (1) $ 175.6 Million Total Assets (2) $ 1.8 Billion Total Deposits (2) $ 1.3 Billion Locations 29 Ownership (3) Market cap based on price at the close of business on March 22, 2013 at $20.33 per common share Total Assets & Deposits as of December 31, 2012 Insider ownership as of January 1, 2013; 8,693,471 shares issued and outstanding used for calculation * - Insiders - Employee Benefit Plans - Institutional & Mutual Funds 8% 18% 25%

Shares Outstanding 8.6 Million Market Cap (1) $ 175.6 Million Total Assets (2) $ 1.8 Billion Total Deposits (2) $ 1.3 Billion Locations 29 Ownership (3) Market cap based on price at the close of business on March 22, 2013 at $20.33 per common share Total Assets & Deposits as of December 31, 2012 Insider ownership as of January 1, 2013; 8,693,471 shares issued and outstanding used for calculation * - Insiders - Employee Benefit Plans - Institutional & Mutual Funds 8% 18% 25%

Horizon Achieves New Milestones in 2012 All-Time Stock Price High of $19.68 on December 20, 2012 CMV of $20.33 as of March 22, 2013 2012 Total Shareholder Return of 74.4% Two Dividend Increases 3:2 Stock Split Successful Merger & Integration with Heartland Community Bank New Offices in Kalamazoo and Valparaiso New Office in Indianapolis New Branch Under Construction in Greenwood Record Gain on Sale of Mortgage Loans Solid Reduction in Non-Performing Loans Good Commercial Loan Growth – Kalamazoo & Indy Purchased State of the Art Mortgage Processing & Internet / Mobile Banking Software *

Northwest Indiana/Southwest Michigan… The Right Side of Chicago

29 Current Locations 2 *

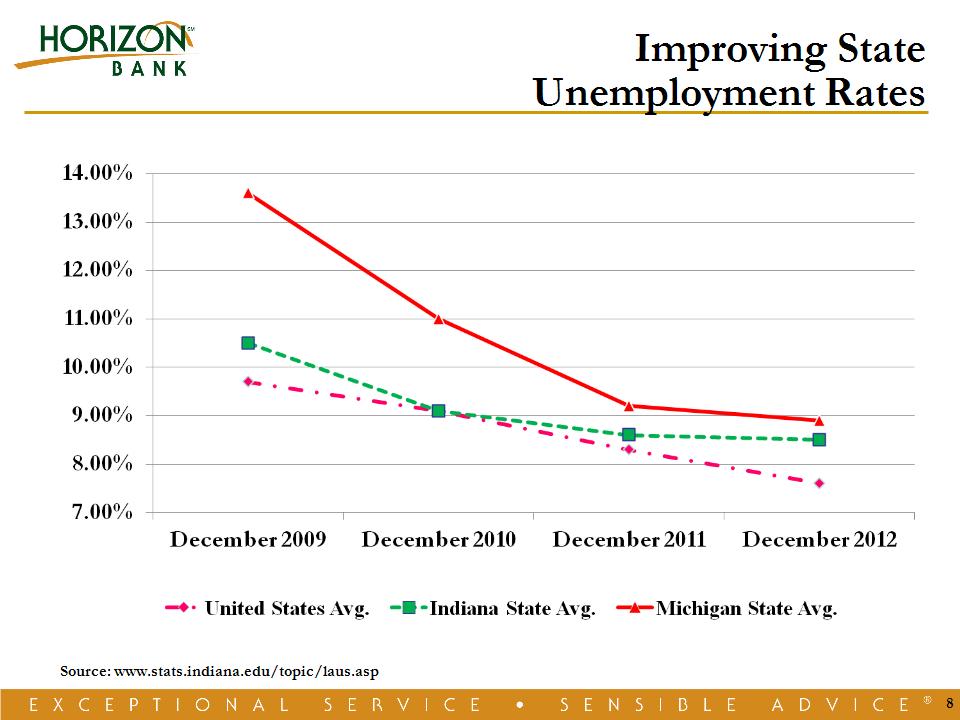

Improving State Unemployment Rates Source: www.stats.indiana.edu/topic/laus.asp *

Horizon’s Story Financial Strength Consistent Performance Superior Returns Stable Growth A Company on the Move

Record Earnings “Thirteen” Consecutive Years 12-Year CAGR 16.1% Dollars in Millions 55% *

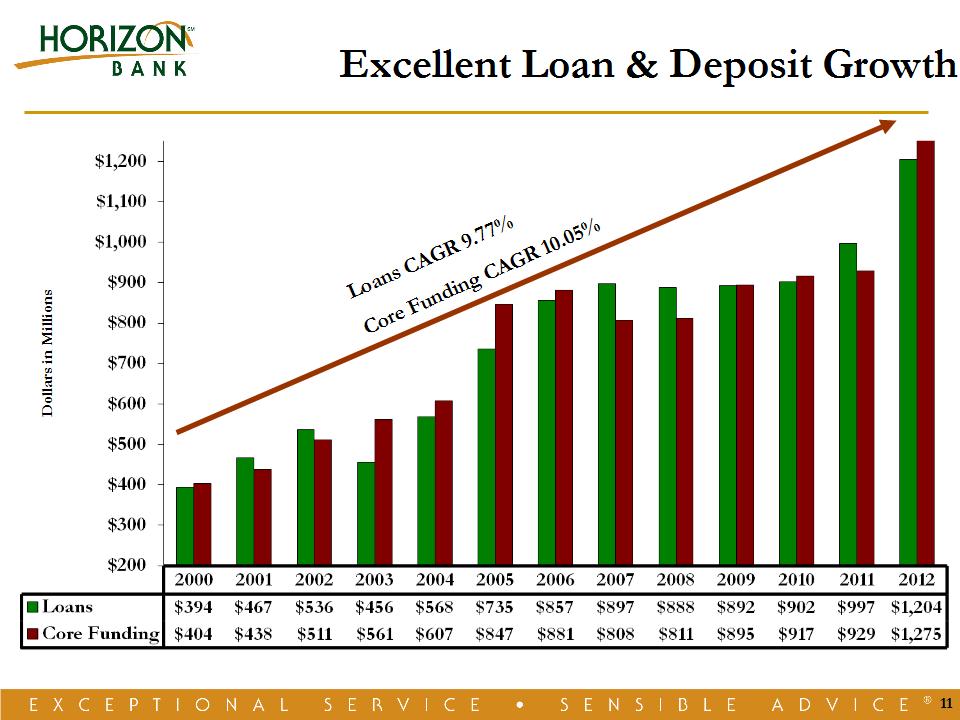

Dollars in Millions Loans CAGR 9.77% Core Funding CAGR 10.05% Excellent Loan & Deposit Growth *

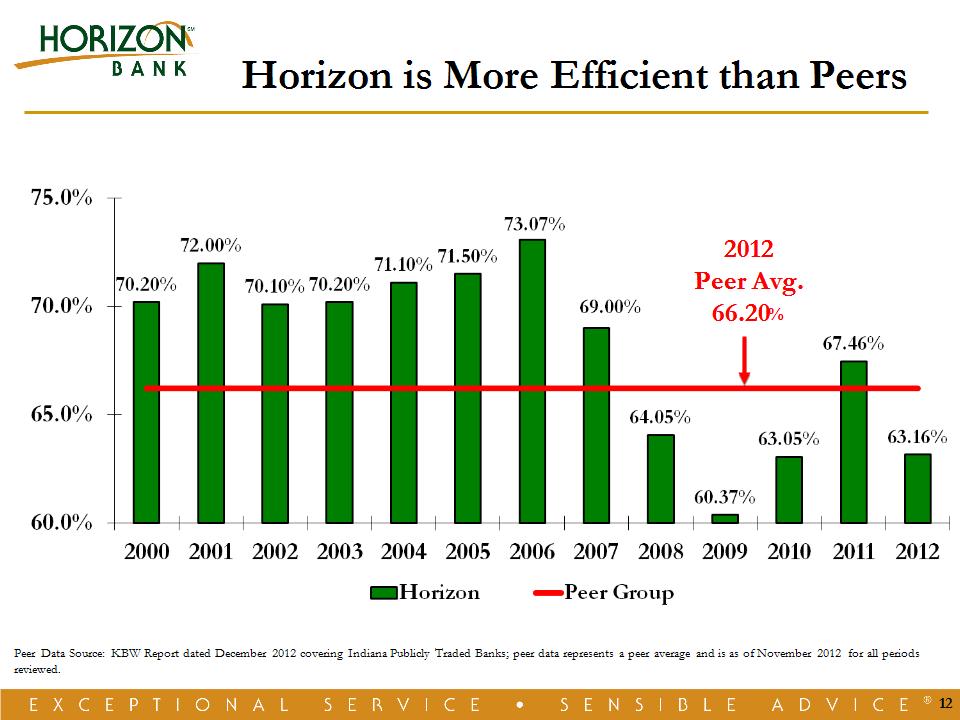

Horizon is More Efficient than Peers 2012 Peer Avg. 66.20% Peer Data Source: KBW Report dated December 2012 covering Indiana Publicly Traded Banks; peer data represents a peer average and is as of November 2012 for all periods reviewed. *

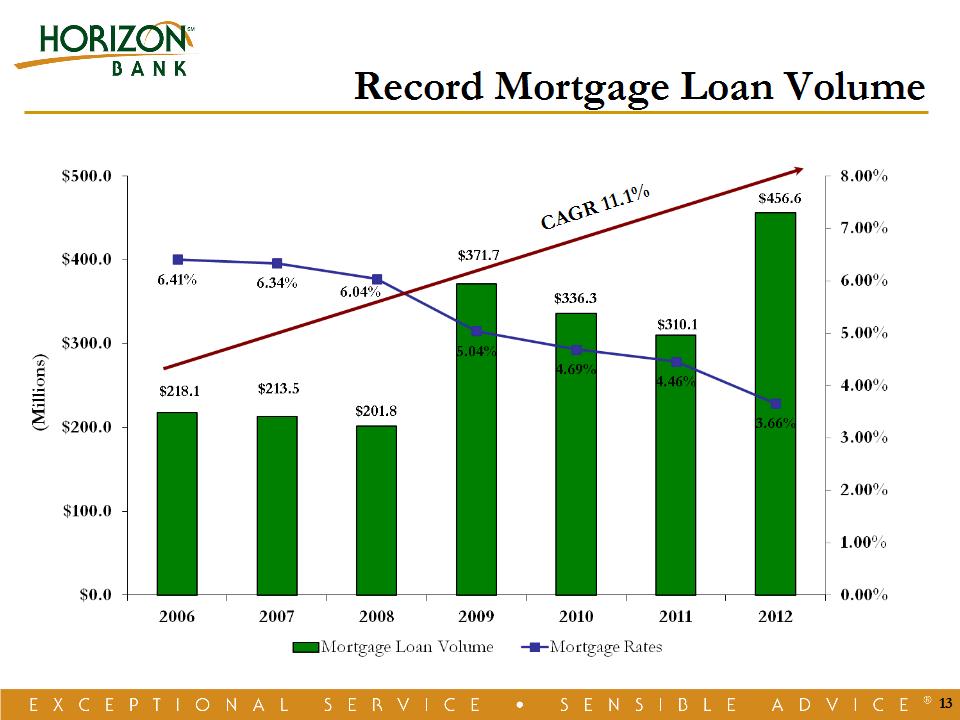

Record Mortgage Loan Volume CAGR 11.1% *

Balanced & Complementary Business Model #1 – Business Banking #2 – Retail Banking #3 – Wealth Management #4 – Retail Mortgage Banking #5 – Mortgage Warehousing Complementary Revenue Streams that are Counter-Cyclical to Varying Economic Cycles *

Horizon’s Sound Credit Culture

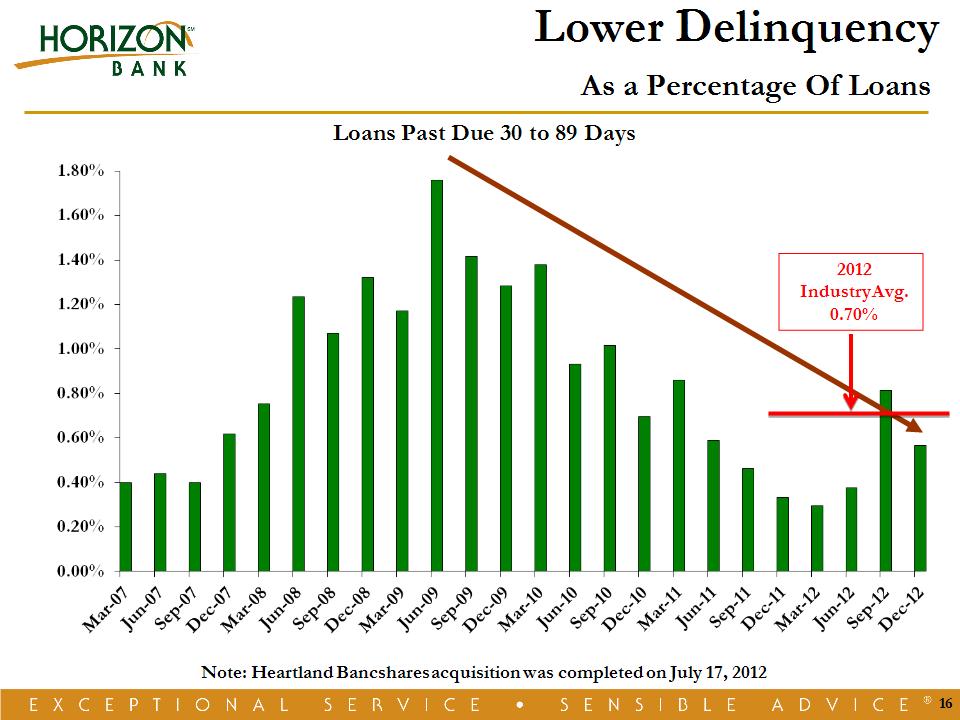

Lower Delinquency As a Percentage Of Loans Loans Past Due 30 to 89 Days 2012 Industry Avg. 0.70% Note: Heartland Bancshares acquisition was completed on July 17, 2012 *

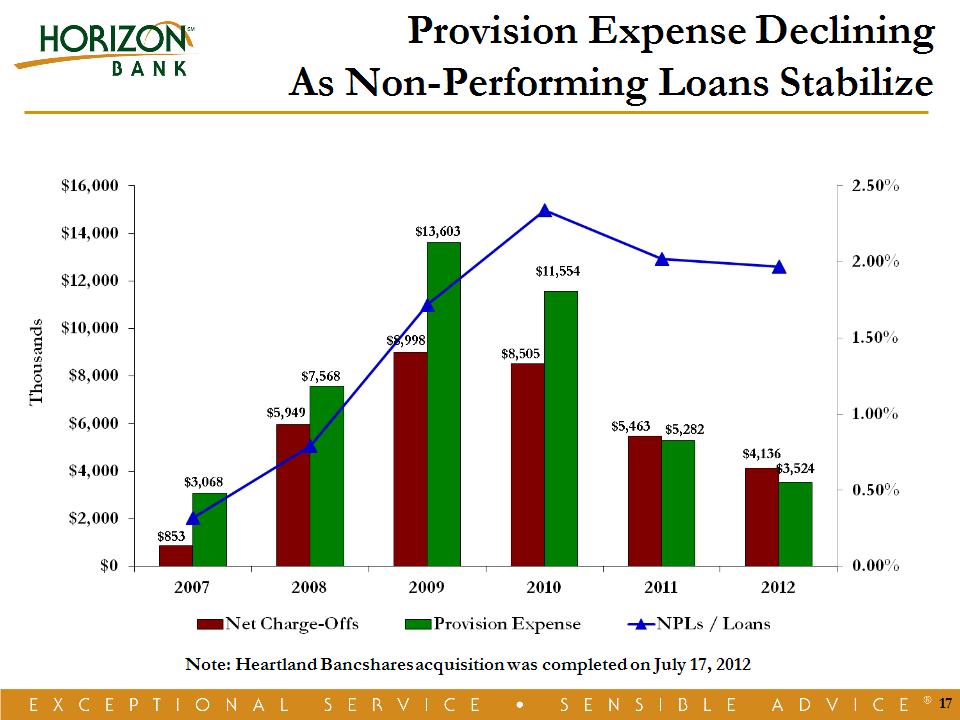

Provision Expense Declining As Non-Performing Loans Stabilize Note: Heartland Bancshares acquisition was completed on July 17, 2012 *

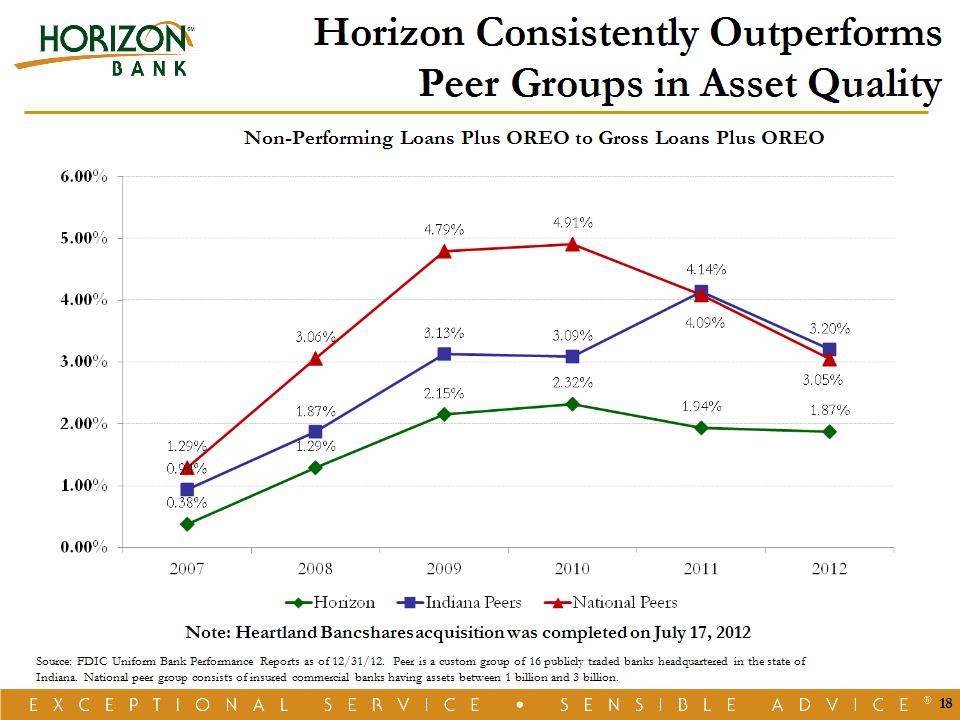

Note: Heartland Bancshares acquisition was completed on July 17, 2012 Horizon Consistently Outperforms Peer Groups in Asset Quality Source: FDIC Uniform Bank Performance Reports as of 12/31/12. Peer is a custom group of 16 publicly traded banks headquartered in the state of Indiana. National peer group consists of insured commercial banks having assets between 1 billion and 3 billion. Non-Performing Loans Plus OREO to Gross Loans Plus OREO *

A Company on the Move

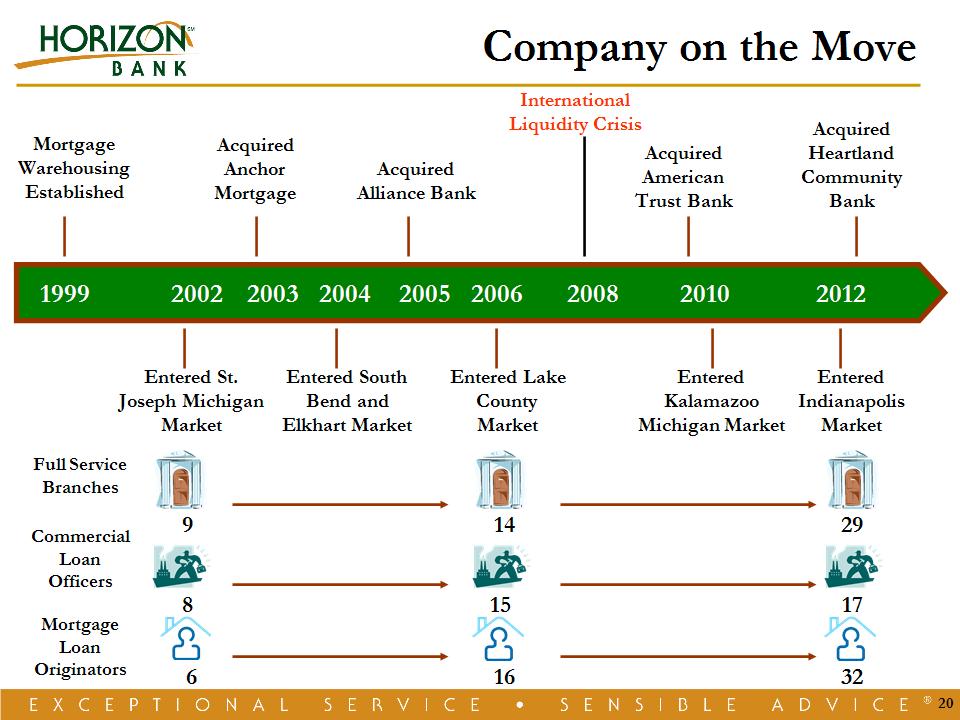

Company on the Move 1999 2004 2005 2012 Mortgage Warehousing Established Entered St. Joseph Michigan Market Entered South Bend and Elkhart Market Acquired Alliance Bank Entered Lake County Market Acquired American Trust Bank Entered Kalamazoo Michigan Market Entered Indianapolis Market Acquired Heartland Community Bank 2010 2006 2002 2003 Acquired Anchor Mortgage 2008 International Liquidity Crisis Mortgage Loan Originators 6 16 32 Full Service Branches 9 14 29 Commercial Loan Officers 8 15 17 *

Highly Regarded In Our Communities Nine out of Ten Customers - Would Refer a Friend Best Bank – The News Dispatch Readers Poll - Eleven out of Last Twelve Years Best Wealth Management Company – NW Indiana Business Quarterly Best Place to Work – NW Indiana Business Quarterly Family Friendly Work Policies – Clarian Award *

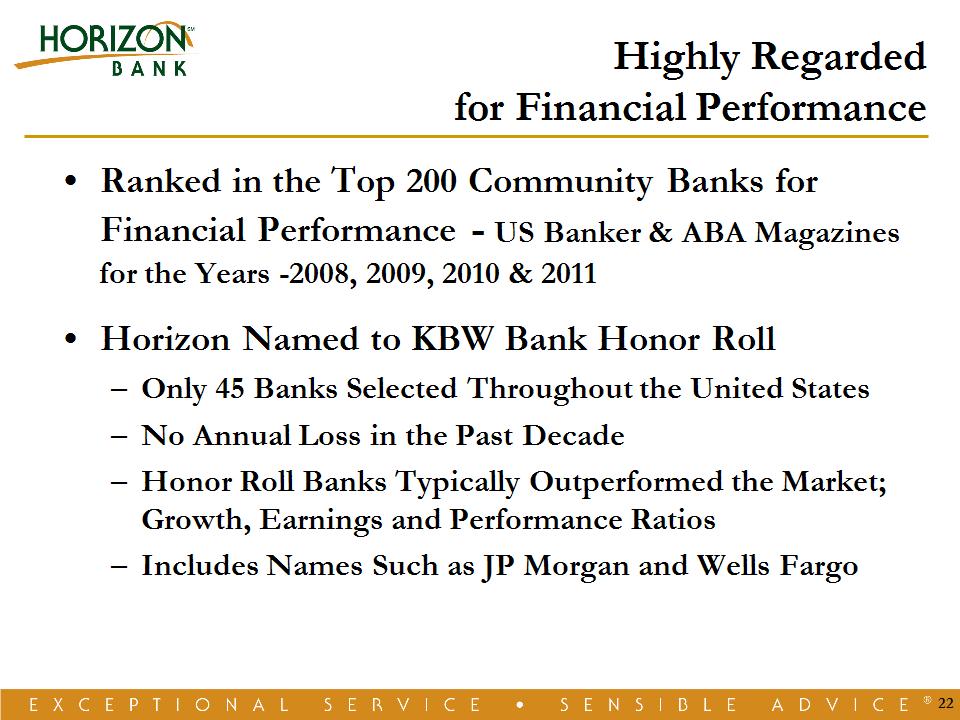

Highly Regarded for Financial Performance Ranked in the Top 200 Community Banks for Financial Performance – US Banker & ABA Magazines for the Years -2008, 2009, 2010 & 2011 Horizon Named to KBW Bank Honor Roll Only 45 Banks Selected Throughout the United States No Annual Loss in the Past Decade Honor Roll Banks Typically Outperformed the Market; Growth, Earnings and Performance Ratios Includes Names Such as JP Morgan and Wells Fargo *

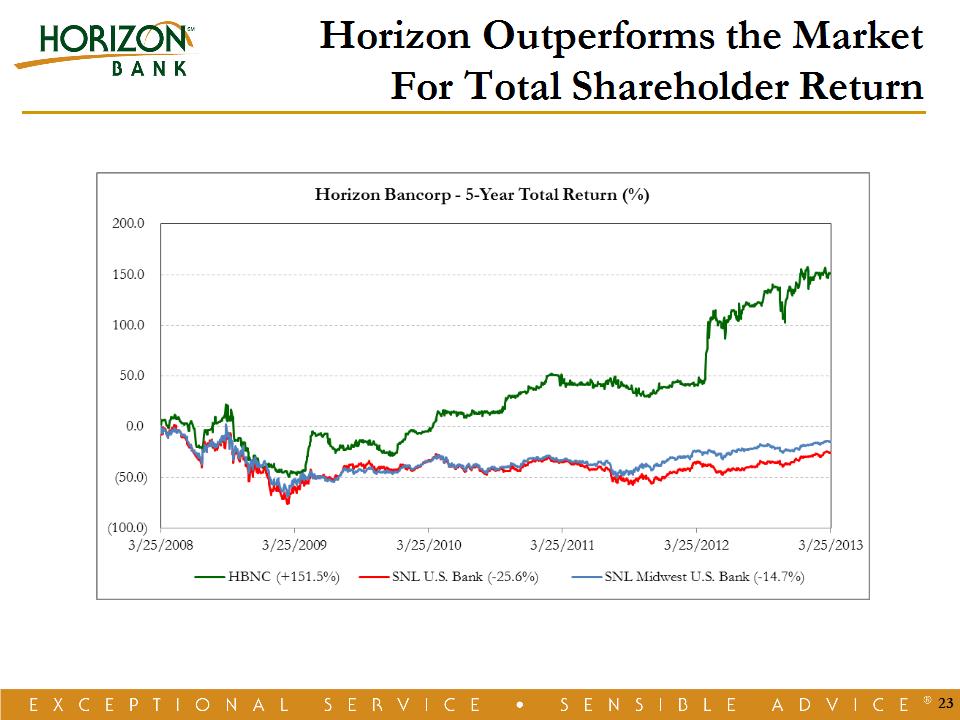

Horizon Outperforms the Market For Total Shareholder Return *

A NASDAQ Traded Company - Symbol HBNC