Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIDELITY SOUTHERN CORP | a8-k3x28x13.htm |

March 2013

2 This presentation contains forward-looking statements that reflect our current expectations relating to present or future trends or factors generally affecting the banking industry and specifically affecting our operations, markets and services. These forward-looking statements are based upon assumptions we believe are reasonable and may relate to, among other things, the difficult economic conditions and the economy’s impact on operating results, credit quality, liquidity, capital, the adequacy of the allowance for loan losses, changes in interest rates, and litigation results. These forward-looking statements are subject to risks and uncertainties. These trends and events include (1) risks associated with our loan portfolio, including difficulties in maintaining quality loan growth, greater loan losses than historic levels, the risk of an insufficient allowance for loan losses, and expenses associated with managing nonperforming assets, unique risks associated with our construction and land development loans, our ability to maintain and service relationships with automobile dealers and indirect automobile loan purchasers, and our ability to profitably manage changes in our indirect automobile lending operations; (2) risks associated with adverse economic conditions, including risk of a continued decline in real estate values in the Atlanta, Georgia, metropolitan area and in eastern and northern Florida markets, conditions in the financial markets and economic conditions generally and the impact of recent efforts to address difficult market and economic conditions; a stagnant economy and its impact on operations and credit quality, the impact of a recession on our consumer loan portfolio and its potential impact on our commercial portfolio, changes in the interest rate environment and their impact on our net interest margin, and inflation; (3) risks associated with government regulation and programs, including risks arising from the terms of the U.S. Treasury Department’s (the “Treasury’s”) equity investment in us, and the resulting limitations on executive compensation imposed through our participation in the TARP Capital Purchase Program, uncertainty with respect to future governmental economic and regulatory measures, including the ability of the Treasury to unilaterally amend any provision of the purchase agreement we entered into as part of the TARP Capital Purchase Program, the winding down of governmental emergency measures intended to stabilize the financial system, and numerous legislative proposals to further regulate the financial services industry, the impact of and adverse changes in the governmental regulatory requirements affecting us, and changes in political, legislative and economic conditions; (4) the ability to maintain adequate liquidity and sources of liquidity; (5) our ability to maintain sufficient capital and to raise additional capital; (6) the accuracy and completeness of information from customers and our counterparties; (7) the effectiveness of our controls and procedures; (8) our ability to attract and retain skilled people; (9) greater competitive pressures among financial institutions in our market; (10) failure to achieve the revenue increases expected to result from our investments in our growth strategies, including our branch additions and in our transaction deposit and lending businesses; (11) the volatility and limited trading of our common stock; and (12) the impact of dilution on our common stock. The Corporation does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which the forward-looking statement is made. Forward-Looking Statements

3 This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in their analysis of the Corporation’s performance. Management believes that these non- GAAP financial measures allows better comparability with prior periods, as well as with peers in the industry who also provide a similar presentation provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrating the effects of significant gains and charges in the current period. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other. Use of Non-GAAP Financial Measures

4 • Founded in 1974 • Largest publicly traded community banking franchise headquartered in Atlanta – $2.5 billion in total assets – 31 branches in Georgia and one branch in Jacksonville, Florida – Successfully completed two FDIC-assisted transactions since October 2011 • Actively traded stock – Traded on NASDAQ with the ticker LION – Market cap ~$170 million – Average daily volume ~25,000 shares • Balanced ownership profile – Insider ownership ~35% – Institutional ~44% • Well-positioned for growth opportunities Overview of Fidelity Southern Corporation

5 Experienced Management Team & Board Company Management Board of Directors • Four lead executives have over 80 years of combined service at LION • Strong insider ownership (approximately 35%) aligns the interests of management and shareholders Years of LION Name Position Fidelity Service Ownership James B. Miller, Jr. Chairman, Chief Executive Officer 36 19.4% Fidelity Southern Corporation Fidelity Bank LionMark Insurance Company H. Palmer Proctor, Jr. President 23 1.7% Fidelity Southern Corporation Fidelity Bank Secretary & Treasurer, LionMark Insurance Company Stephen H. Brolly Chief Financial Officer 7 0.1% Fidelity Southern Corporation Fidelity Bank LionMark Insurance Company David Buchanan Vice President 18 1.3% Fidelity Southern Corporation Executive Vice President, Fidelity Bank President, LionMark Insurance Company Years of LION Name Fidelity Service Ownership James B. Miller, Jr. 36 19.4% Chairman & CEO, Fidelity Southern Board Member, Berlin American Companies Board Member, Interface, Inc. Board Member, American Software Major General (Ret) David R. Bockel 16 0.2% Executive Director, Reserve Officers Association of the United States Wm. Millard Choate 3 1.2% President, Choate Construction Company Dr. Donald A. Harp, Jr. 5 0.1% Minister Emeritus Adjunct Professor, Candler School of Theology Adjunct Professor, Emory University Kevin S. King, Esq 15 0.2% Of Counsel, Isenberg & Hewitt PC William C. Lankfor , Jr. 3 0.1% Managing Member, Moore Stephens Tiller LLC H. Palmer Proctor, Jr. 23 1.7% President, Fidelity Southern & Fidelity Bank Secr tary & Treasurer, LionMark Insurance Company W. Clyde Shepherd III 15 2.0% President, Plant Improvement Co., Inc. President, Toco Hill, Inc. Rankin M. Smith, Jr. 26 1.5% Owner & Manager, Seminole Plantation

6 Investment Highlights • Only sizable community banking franchise concentrated in Atlanta • Benefiting from Atlanta’s continued economic turnaround • Strong brand recognition has contributed to growth in core deposits • Steady asset growth through cycle • Diversified and profitable earnings streams

7 Atlanta Market Share (1) Source: SNL Financial Data as of 6/30/12 (1) Defined as the Atlanta-Sandy Springs-Marietta, GA MSA (2) Map excludes branch in Jacksonville, FL Premier Atlanta Community Bank Concentrated Branch Footprint (2) • 31 branches in the Atlanta MSA • Atlanta is the second largest MSA in the Southeast 2012 2012 Total 2012 HQ Deposits Market Assets Rank Institution State ($bn) Share ($bn) 1 SunTrust Banks Inc. GA $31.6 27.0 % $172.0 2 Wells Fargo & Co. CA 22.4 19.1 1,235.7 3 Bank of America Corp. NC 20.4 17.4 1,647.5 4 BB&T Corp. NC 7.8 6.7 180.2 5 Synovus Fina cial Corp. GA 3.7 3.2 26.0 6 Regions Financial Corp. AL 3.4 2.9 121.3 7 PNC Financial Services Group Inc. PA 2.4 2.0 291.8 8 United Community Banks Inc. GA 2.0 1.7 6.7 9 Fidelity Southern Corp. GA 2.0 1.7 2.4 10 Community & Southern Holdings Inc. GA 1.3 1.1 2.6 Columbus Atlanta Athens LION branch

8 • The city’s unemployment rate has decreased from 10.8% in January 2010 to 8.7% as of January 2013 • Atlanta was recently ranked as the 4th best city in the U.S. for economic development projects by Site Selection magazine • Atlanta has the 8th most small businesses in the U.S. Source: U.S. Bureau of Labor Statistics, The Atlanta Monitor, Metro Atlanta Chamber, SNL Financial Atlanta Market Highlights Attractive Markets 88.59 96.61 84.00 86.00 88.00 90.00 92.00 94.00 96.00 98.00 Atlanta S&P/Case-Shiller Home Price Index in 2012 Projected 2017 Median Household Income $65,758 $55,272 $51,777 $57,536 $30,000 $40,000 $50,000 $60,000 $70,000 Atlanta Georgia Southeast US

9 Focused on the Consumer Consumer Banking Focus 2012 ATL Monthly Deposit Market Checking Share Rank Institution Fee 1 SunTrust Banks, Inc. $7 2 Wells Fargo & Co. $7 3 Bank of America Corporation $9 4 BB&T Corporation $10 5 Synovus Financial Corporation $10 6 Regions Financial Corporation $8 7 PNC Financial Services Group, Inc. FREE 8 United Community Banks, Inc. $8 9 Fidelity Southern Corporation FREE 10 Community & Southern Holdings, Inc. FREE

10 Core Deposit Base Demand Deposits $382 18% NOW / Money Market $639 31% Savings $329 16% Retail Time Deposits $315 15% Jumbo Time Deposits $347 17% Brokered Deposits $57 3% Deposit Composition Growing Core Deposit Base Dollars in millions Data as of 12/31/12 Core deposits defined as total deposits less time deposits greater than $100,000 Atlanta peer institutions include all banks and thrifts headquartered in the Atlanta-Sandy Springs-Marietta, GA MSA • LION’s cost of deposits is in the bottom quartile of all banks and thrifts headquartered in the Atlanta MSA $1.13 $1.29 $1.37 $1.54 $1.56 $1.64 $1.65 $1.723.37% 2.50% 1.50% 0.95% 0.65% 0.57% 0.55% 0.54% 3.34% 0.75% 0.00% 1.00% 2.00% 3.00% 4.00% $0.00 $0.50 $1.00 $1.50 $2.00 2008 2009 2010 2011 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Core Deposits ($bn) Cost of Deposits (%) ATL Peer Cost of Deposits (%)

11 Non-Retail Activity Map

12 Sustained Growth Steady Balance Sheet Growth ($bn) Data as of 12/31/12 Acquired assets include all assets acquired through FDIC-assisted acquisitions as of the time of announcement Atlanta peer institutions include all banks and thrifts headquartered in the Atlanta-Sandy Springs-Marietta, GA MSA $1.69 $1.76 $1.85 $1.95 $2.23 $2.48 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 $2.50 2007 2008 2009 2010 2011 2012 ($bn ) Legacy Assets Acquired Assets Year-over-Year Asset Growth (%) 2007 2008 2009 2010 2011 2012 LION 2.26% 4.54% 5.01% 5.07% 14.88% 10.85% ATL Peers 15.53% 9.24% 7.34% 0.30% (2.04%) (0.52%) '07 - '12 CAGR LION 7.99% ATL Peers 1.00%

13 Asset Generation Dollars in millions Data as of 12/31/12 • Solid asset generation platform offers strategic flexibility • LION has produced approximately $10 billion in loans since 2008 • Over $5.8 billion in loans sold to third parties since 2008, with 88% of loans sold coming from the Mortgage business segment • Continued noninterest income generation through servicing loans ($3.2 billion in loans serviced for others as of December 31, 2012) $880 $1,245 $1,281 $2,258 $0 $800 $1,600 $2,400 2009 2010 2011 2012 Retained Sold $37 $68 $105 $98 $0 $50 $100 $150 2009 2010 2011 2012 Retained Sold $281 $464 $644 $733 $0 $300 $600 $900 2009 2010 2011 2012 Retained Sold Mortgage Production ($mm) SBA Loan Production ($mm) Indirect Loan Production ($mm)

14 Loan Portfolio Loan Portfolio Composition ($mm) Loan Growth ($bn) • Indirect auto lending specialty • Low CRE and C&D concentrations • Commercial loans have grown at an average quarterly rate of 14.6% over the last four quarters Total loans of $1.8 billion as of December 31, 2012 (1) C&D $101 6% Residential $129 7% CRE - Owner Occupied $264 15% CRE - Non Owner Occupied $184 10% C&I $67 4% Installment & Other $35 2% Indirect Auto $921 52% Acquired Covered $77 4% $1.45 $1.44 $1.42 $1.61 $1.76 $1.83 $1.96 $2.00 $2.08 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 2007 2008 2009 2010 2011 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Consumer Loans Acquired Loans Other Loans Dollars in millions Data as of 12/31/12 (1) Excludes loans held for sale

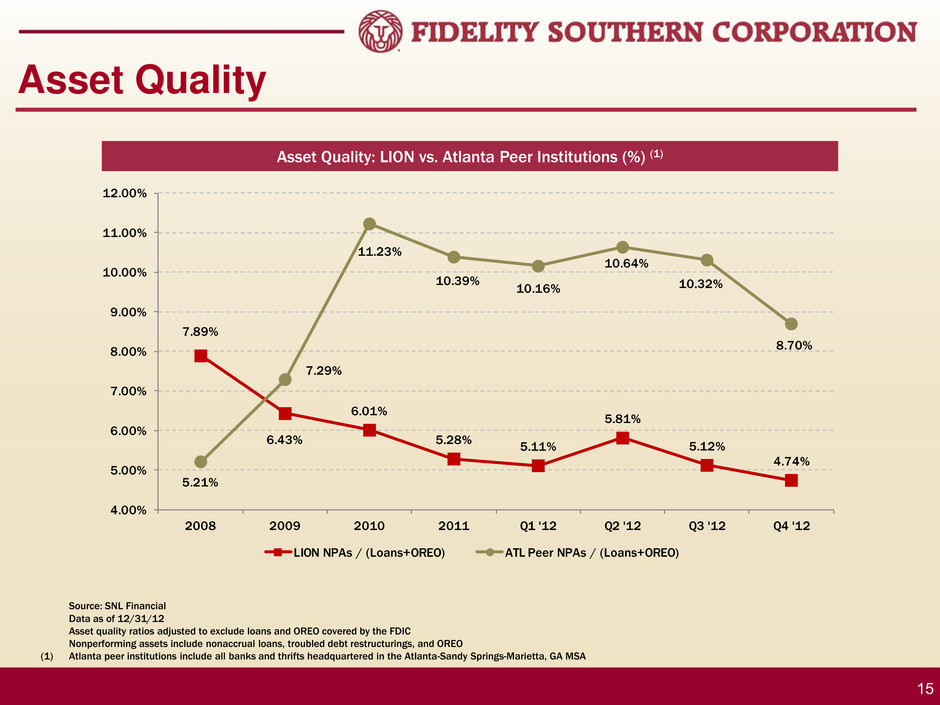

15 Asset Quality 7.89% 6.43% 6.01% 5.28% 5.11% 5.81% 5.12% 4.74% 5.21% 7.29% 11.23% 10.39% 10.16% 10.64% 10.32% 8.70% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 2008 2009 2010 2011 Q1 '12 Q2 '12 Q3 '12 Q4 '12 LION NPAs / (Loans+OREO) ATL Peer NPAs / (Loans+OREO) Asset Quality: LION vs. Atlanta Peer Institutions (%) (1) Source: SNL Financial Data as of 12/31/12 Asset quality ratios adjusted to exclude loans and OREO covered by the FDIC Nonperforming assets include nonaccrual loans, troubled debt restructurings, and OREO (1) Atlanta peer institutions include all banks and thrifts headquartered in the Atlanta-Sandy Springs-Marietta, GA MSA

16 Material Fee Income Stream Noninterest Income Detail Noninterest Income / Average Assets (%) Quarterly Annual Noninterest Income Q4 '12 Q3 '12 2012 2011 Mortgage Banking Activities $18,653 $14,755 $56,332 $24,663 Other 3,013 5,634 10,611 3,273 Indirect Lending Activities 1,477 2,164 6,414 5,891 Service Charges on Deposit Accounts 1,122 1,259 4,694 4,143 Other F es and Charg s 883 841 3,360 2,613 SBA Lending Activities 715 2,107 4,944 8,463 Bank Owned Life Insurance 323 330 1,307 1,315 Securities Gains -- 4 307 1,078 Total Noninterest Income $26,186 $27,094 $87,969 $51,439 1.30% 3.41% 0.78% 0.50% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 No nin te re st Inc om e / A vg A ss et s ( %) LION ATL Peers • Mortgage banking ctivities increased over 100% in 2012 – LION currently has the 2nd highest purchase mortgage market share in the Atlanta MSA • Solid balance in mortgage banking business between purchase and refinancing activities • Total funded loan volume for the fourth quarter of $768 million represented a 72% increase over the year-ago quarter • Highest ratio of noninterest income / average assets in the Southeast among banks greater than $2.0 billion in assets Dollars in thousands Data as of 12/31/12; mortgage market share data as of 2012 Atlanta peer institutions include all banks and thrifts headquartered in the Atlanta-Sandy Springs-Marietta, GA MSA

17 2011 2012 TCE / TA 5.31 % 5.78 % Leverage Ratio 9.83 10.18 Tier 1 Common Ratio 6.30 6.73 Tier 1 Ratio 11.85 12.06 Total Capital Ratio 13.70 13.43 Capital Position LION Capital Ratios Data as of 12/31/12 (1) Based on 2013 EPS estimate of $1.14 and 2014 EPS estimate of $1.08, per FactSet as of 3/15/13 • Tangible common equity increased $24.5 million in 2012 • Assuming First Call estimates for 2013 and 20 4, LION expects to generate over $36.4 million in capital over the next two years (1) • Will consider raising additional capital only for attractive opportunities • Would consider non-common options for capital

18 Source: SNL Financial Data as of 12/31/12 Excludes merger targets Texas ratio defined as nonperforming assets plus loans 90 days past due as a percentage of tangible common equity and loan loss reserve Acquisition Opportunities by Market Summary of Acquisition Opportunities Market Expansion Opportunities Evaluating banks and thrifts headquartered in Atlanta, Chattanooga, Jacksonville, Nashville, and Savannah MSAs according to the following criteria: • Whole Bank: Assets $200 million – $1.0 billion and TX Ratio < 75% • FDIC: Leverage Ratio < 3.5% Whole Bank Potential FDIC # of Assets # of Assets State Banks ($mm) Banks ($mm) Atlanta 12 $4,426 6 $1,222 Chattanooga 4 2,510 -- -- Jacksonville 2 814 1 111 Nashville 17 6,454 -- -- Savannah 1 436 -- -- Total: 36 $14,639 7 $1,333 10 1 2 12 1 2 3 5 6 1 0 6 12 18 Atlanta Chattanooga Jacksonville Nashville Savannah N um be r o f O pp or tu ni tie s Whole Bank < $500 mm Whole Bank > $500 mm Potential FDIC Potential FDIC Opportunities Whole Bank Opportunities < $500 mm Whole Bank Opportunities > $500 mm

19 Source: SNL Financial Data for the twelve months ended 12/31/12 Peers include all Southeast major exchange traded institutions with assets between $1.0 and $5.0 billion and NPAs/Assets less than 7.5%; excludes merger targets (1) Excludes loans held for sale Financial Performance vs. Peers Loans / Deposits (%) (1) Net Interest Margin (%) ROAA (%) ROATCE (%) 1.08% 0.42% 0.00% 0.30% 0.60% 0.90% 1.20% LION Peer Median 85.9% 76.5% 40.0% 55.0% 70.0% 85.0% 100.0% LION Peer Median 16.85% 5.15% 0.00% 5.00% 10.00% 15.00% 20. 0 LION Peer Median 3.77% 3.94% 1.00% 2.00% 3.00% 4.00% 5.00% LION Peer Median

20 Price Performance 0.0 25.0 50.0 75.0 100.0 125.0 150.0 LION S&P 500 KRX Peers Source: SNL Financial Pricing data as of 3/19/13 Peers include all Southeast major exchange traded institutions with assets between $1.0 and $5.0 billion and NPAs/Assets less than 7.5%; excludes merger targets Price Performance Since 12/31/07 40.1% 5.4% (19.3%) (20.7%)

21 Market Valuation vs. Peers Source: SNL Financial Pricing data as of 3/19/13 Peers include all Southeast major exchange traded institutions with assets between $1.0 and $5.0 billion and NPAs/Assets less than 7.5%; excludes merger targets (1) Includes all peers that have analyst estimates for 2014 EPS Price / Tangible Book Value (%) Price / 2014 EPS (x) (1) 301% 249% 248% 190% 185% 181% 175% 167% 162% 155% 139% 136% 126% 126% 125% 125% 125% 122% 121% 119% 118% 118% 116% 110% 94% 89% 55% 39% 400% 300% 200% 100% 0% OZRK FNBN HOMB PNFP RNST MSL SBCF CHFN CTBI SYBT ABCB BKYF PLMT SFNC CCBG FBNC STBZ FUBC YAVY LION BNCN PSTB CSFL NBBC FFKT HTBI FFKY FSGI 35.4x 28.0x 24.3x 21.9x 20.5x 16.9x 16.0x 15.5x 15.5x 15.3x 14.4x 14.4x 14.1x 13.8x 12.5x 12.5x 12.3x 11.1x 0.9x 10.9x 10.7x 10.4x 10.2x 0.0x 10.0x 20.0x 30.0x 40.0x CCBG HTBI SBCF FFKT FUBC OZRK CSFL PSTB STBZ PNFP FBNC SFNC HOMB RNST MSL SYBT CTBI YAVY NBBC ABCB LION BNCN BKYF Median: 126% Median: 14.4x

22 Attractive Investment Opportunity • Significant scarcity value as a $2.5 billion bank headquartered in Atlanta • Experienced management team with significant ownership • Asset generation platform attached to a low-cost core deposit franchise • Unique lending strategy and strong fee income provide points of differentiation • Attractive valuation at current multiples • Well-positioned for economic recovery in Atlanta and the Southeast