Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BILL BARRETT CORP | d510988d8k.htm |

Exhibit 99.1

2012 Annual Report Rocky Mountain Oil Growth

Fellow Shareholders Uinta Basin Our Company enters 2013 well positioned to build increasing value from our oil development programs while continuing to realize value from our established asset base. We spent the past two years transitioning our portfolio to have a better balance of oil, natural gas and natural gas liquids. In an environment of changing, and sometimes volatile, commodity prices, a more balanced portfolio improves our flexibility to optimize returns and to drive growth in cash flow. The transition to increase the oil mix in our portfolio took time and capital but was a necessary step to improve long-term shareholder value. We enter 2013 with two scalable R. Scot Woodall Chief Executive Of?cer, oil development programs that offer substantial oil production growth through the President and Chief Operating Of?cer development of nearly 3,000 identified gross drilling locations, complementing our large natural gas development assets. Given the current outlook for oil, natural gas and natural gas liquids prices, we plan to actively drill only in our oil development programs in 2013. Looking back at this time last year, Rocky Mountain natural gas prices were $2.20 per MMBtu and the full With approximately 155,000 net year outlook was well under $3.00 per MMBtu – 10 year lows. As a result, we discontinued all drilling activity acres, the Uinta Oil Program is the Company’s premier oil develop- at our West Tavaputs natural gas program and reduced activity at our Gibson Gulch natural gas-natural gas ment project. A 63% increase in proved reserves and improved liquids program. Late in the year, following a collapse in natural gas liquids prices, we discontinued all drilling drilling efficiencies drive long-term in Gibson Gulch. Our primary goal for the year was to drive 80% growth in oil production through increasing development of this play. the scale of operations at the Uinta Oil Program and building upon our newly acquired position in the Denver-Julesburg (DJ) Basin. We achieved 80% growth in oil production along with a 66% increase in oil reserves, we achieved scale in the Uinta by expanding to a five rig program and added an approximate 40,000 net acre position in the DJ Basin, successfully building scale in that program. DJ Basin We achieved 80% growth in oil production along with a 66% increase in oil reserves. Despite meeting targeted oil growth and successfully building the oil portfolio, 2012 was a very challenging year for our Company. The very low natural gas and natural gas liquids prices, in combination with increased debt to fund the expansion of our two oil programs, weighed heavily on the stock performance. 2013 is a fresh start, and we have the right assets and the right people to drive profitable growth and to unlock value. We have a very focused strategy: realize value from the two core oil programs that we built over the past two years. We intend to do this through successful operational execution. We have a reputation for being an excellent operator, and we intend to translate the success we have proven in the past at our natural gas plays into our oil programs where our team will be highly focused on improving EURs (expected ultimate recoveries, a term used to define the volume of hydrocarbon recovered per well), optimizing capital expenditures, reducing daily operating costs and realizing the strongest pricing for our products. The DJ Basin is a core oil program At the Uinta Oil Program we will run a four-rig drilling program, developing our substantial 155,000 net acre with a sizable acreage position built position in the basin. Our program will include testing the significant upside potential of down-spacing from over the past two years. In 2012, we increased DJ Basin proved reserves 160 to 80 acres. We will continue to implement cost savings measures on both the capital and operating side 82% and gross drilling locations by while working to identify the best markets for the oil produced from this basin. a multiple of four. The DJ program offers significant upside.

West Tavaputs We have a very focused strategy: realize value from the two core oil programs that we built over the past two years. In the DJ Basin we will run a two rig pr ogram focused on development and delineation of our 40,000 net acres located in the Northeast Wattenberg. Our excellent position in the basin was mostly acquired in the third quarter of 2012, and our 2013 drilling program will seek to increase proved reserves across our acreage position, identify potential for multi-well pad drilling and down-spacing, continuously improve drilling techniques to increase EURs, and focus on cost savings through economies of scale. The Northeast Wattenberg program offers sizable upside through each of these measures as well as additional measures being tested by other companies in the area, including extended reach laterals, producing from additional horizons and down-spacing. This is an exciting program. Our 2013 plan is supported by a strong balance sheet and liquidity position as well as approximately 70% of projected production hedged at currently favorable pricing. We also are committed to executing our 2013 plan with no increase in total debt from year-end 2012. Our financial management will include prudent portfolio West Tavaputs remains the Company’s largest natural gas management. We plan to sell certain assets that the Company does not plan to invest in during the coming years. development resource with nearly 1 Tcfe of proved, probable and Specifically, our objectives for 2013 include: possible reserves. • 50%-plus growth in oil production • Excellent execution by our team to realize improved EURs and deliver measurable cost savings that will translate into higher returns from our programs • Delineation of our Northeast Wattenberg acreage position, de-risking our oil resources and realizing upside value from this key acquisition • Manage 2013 debt to be at, or lower than, year-end 2012 debt levels Piceance Basin • Position our Company for growth in cash flow in 2014 I would also like to thank Fred Barrett for his dedication and service to Bill Barrett Corporation. He achieved a ten-year track record of growth for our Company and was integral in creating a company that maintains very high standards for integrity, honesty, hard work, corporate responsibility, safety and environmental stewardship. Mr. Barrett resigned in January 2013. We wish him all the best in his future endeavors. We have ample opportunity for value creation and are very well positioned to realize it. I look forward to an exciting 2013. Sincerely, The Gibson Gulch natural gas R. Scot Woodall program offers exposure to both oil and NGLs, providing superior Chief Executive Officer, President and Chief Operating Officer economics. March 8, 2013

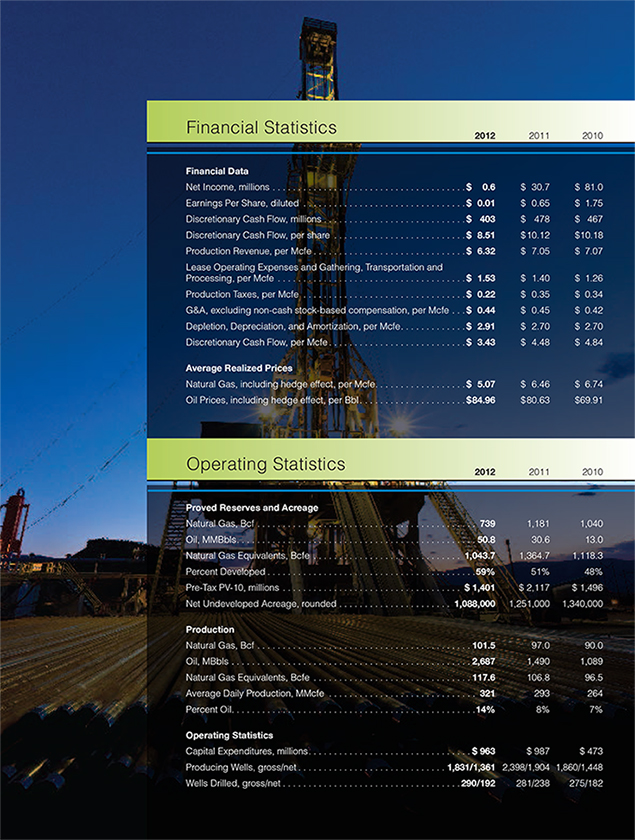

Financial Statistics 2012 2011 2010 Financial Data Net Income, millions $ 0.6 $ 30.7 $ 81.0 Earnings Per Share, diluted $ 0.01 $ 0.65 $ 1.75 Discretionary Cash Flow, millions $ 403 $ 478 $ 467 Discretionary Cash Flow, per share $ 8.51 $10.12 $10.18 Production Revenue, per Mcfe $ 6.32 $ 7.05 $ 7.07 Lease Operating Expenses and Gathering, Transportation and Processing, per Mcfe . $ 1.53 $ 1.40 $ 1.26 Production Taxes, per Mcfe $ 0.22 $ 0.35 $ 0.34 G&A, excluding non-cash stock-based compensation, per Mcfe . $ 0.44 $ 0.45 $ 0.42 Depletion, Depreciation, and Amortization, per Mcfe . $ 2.91 $ 2.70 $ 2.70 Discretionary Cash Flow, per Mcfe . $ 3.43 $ 4.48 $ 4.84 Average Realized Prices Natural Gas, including hedge effect, per Mcfe $ 5.07 $ 6.46 $ 6.74 Oil Prices, including hedge effect, per Bbl . $84.96 $80.63 $69.91 Operating Statistics 2012 2011 2010 Proved Reserves and Acreage Natural Gas, Bcf . 739 1,181 1,040 Oil, MMBbls . 50.8 30.6 13.0 Natural Gas Equivalents, Bcfe . 1,043.7 1,364.7 1,118.3 Percent Developed .59% 51% 48% Pre-Tax PV-10, millions . $ 1,401 $ 2,117 $ 1,496 Net Undeveloped Acreage, rounded 1,088,000 1,251,000 1,340,000 Production Natural Gas, Bcf 101.5 97.0 90.0 Oil, MBbls . 2,687 1,490 1,089 Natural Gas Equivalents, Bcfe . 117.6 106.8 96.5 Average Daily Production, MMcfe . 321 293 264 Percent Oil 14% 8% 7% Operating Statistics Capital Expenditures, millions $ 963 $ 987 $ 473 Producing Wells, gross/net . 1,831/1,361 2,398/1,904 1,860/1,448 Wells Drilled, gross/net . 290/192 281/238 275/182

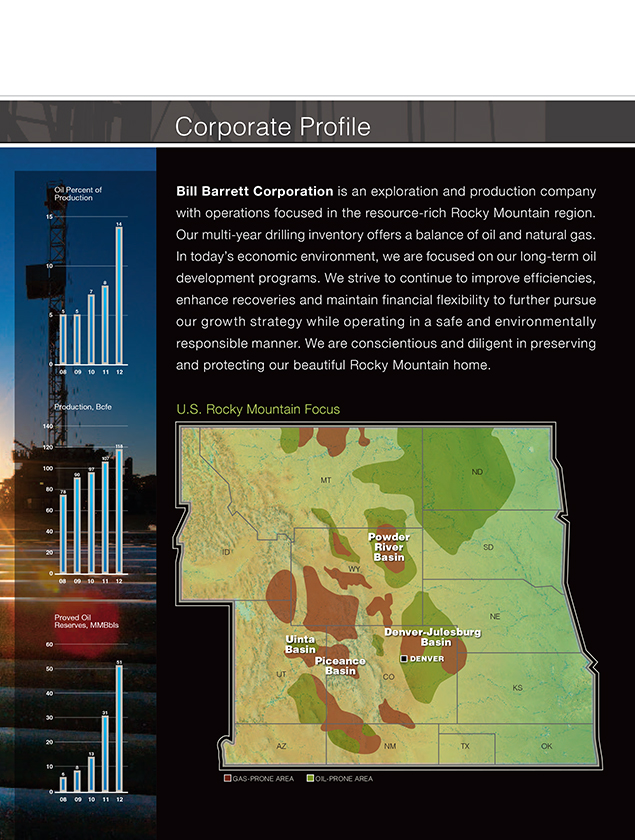

Corporate Pro?le Oil Percent of Bill Barrett Corporation is an exploration and production company Production 15 with operations focused in the resource-rich Rocky Mountain region. 14 Our multi-year drilling inventory offers a balance of oil and natural gas. In today’s economic environment, we are focused on our long-term oil 10 8 development programs. We strive to continue to improve efficiencies, 7 enhance recoveries and maintain financial flexibility to further pursue 5 5 5 our growth strategy while operating in a safe and environmentally responsible manner. We are conscientious and diligent in preserving 0 and protecting our beautiful Rocky Mountain home. 08 09 10 11 12 Production, Bcfe U.S. Rocky Mountain Focus 140 120 118 107 100 97 ND 90 MT 80 78 60 40 Powder River SD 20 ID Basin WY 0 08 09 10 11 12 Reserves, Proved Oil MMBbls NE Denver-Julesburg Uinta Basin 60 Basin DENVER 51 Piceance 50 Basin UT CO KS 40 30 31 20 AZ NM TX OK 13 10 8 6 GAS-PRONE AREA OIL-PRONE AREA 0 08 09 10 11 12

Board of Directors Corporate Information Jim W. Mogg, Chairman of the Board, Past Chairman of DCP Midstream Partners Corporate Office Carin M. Barth, President of LB Capital, Inc. 1099 Eighteenth Street, Suite 2300 Kevin O. Meyers, Past Senior Vice President, Exploration and Production, Denver, Colorado 80202 Americas of ConocoPhillips and President of ConocoPhillips Canada Telephone: 303-293-9100 Fax: 303-291-0420 William F. Owens, Former Governor of Colorado www.billbarrettcorp.com Edmund P. Segner, Past President and Chief of Staff of EOG Resources, Inc. Randy I. Stein, Tax, Accounting and Business Consultant, Former Principal of Investor Relations PricewaterhouseCoopers LLP Jennifer C. Martin Vice President – Investor Relations Michael E. Wiley, Past Chairman and Chief Executive Of?cer of Baker Hughes Incorporated investor_relations@billbarrettcorp.com Of?cers Annual Shareholders’ Meeting Our Annual Shareholder’s Meeting R. Scot Woodall, Chief Executive Of?cer, President and Chief Operating Of?cer will be held at 8:30 a.m. (MDT) Robert W. Howard, Chief Financial Of?cer and Treasurer on Friday, May 10, 2013, Francis B. Barron, Executive VP – General Counsel and Corporate Secretary at The Ritz-Carlton, Denver Terry R. Barrett, Senior Vice President – Geosciences 1881 Curtis Street David R. Macosko, Senior Vice President – Accounting Denver, Colorado 80202 Larry A. Parnell, Senior Vice President – Engineering, Planning and Business Development Transfer Agent Stephen W. Rawlings, Senior Vice President – Operations Computershare Trust Company, N.A. Huntington T. Walker, Senior Vice President – Land 250 Royall St. Canton, MA 02021 Duane J. Zavadil, Senior Vice President – Government and Regulatory Affairs 1-866-683-2961 (dedicated line) 1-800-522-6645 (main) Michael R. Craig, Vice President – Information Technology www.cpushareownerservices.com/cpuportal/index.jsp William M. Crawford, Vice President – Finance Independent Auditors Jennifer C. Martin, Vice President – Investor Relations Deloitte & Touche LLP Stuart E. Nance, Vice President – Marketing Denver, Colorado Troy L. Schindler, Vice President – Drilling Independent Reservoir Engineers Monty D. Shed, Vice President – Production Netherland, Sewell & Associates, Inc. Michelle Vion, Vice President – Human Resources Dallas, Texas DISCLOSURE STATEMENTS Non-GAAP Measures Non-GAAP Measures in this report include Discretionary Cash Flow, Please reference our filings with the Securities and Exchange Commission Pre-tax PV10 and G&A, excluding non-cash stock-based compensation (“SEC”) for further information related to the following disclosures. Reference This report contains these non-GAAP measures because management believes that they the accompanying Annual Report on Form 10-K for the year ended December are useful to investors evaluating the Company’s operating performance. These measures 31, 2012, as well as Current Reports on Form 8-K and Quarterly Reports on Form are widely used in the oil and natural gas industry, including by research analysts, in 10-Q, specifically including the Form 8-K filed with the SEC on February 22, 2013, the valuation, comparison and recommendation of investments. Of note, the calculation regarding our Fourth Quarter and Full-Year 2012 Results. SEC filings are posted of these measures may vary substantially from company to company depending upon to the Company’s website at www.billbarrettcorp.com. You may also obtain SEC accounting methods, internal decisions, and capital structure, and there are signi?cant filings by calling 1-800-SEC-0330 or at www.sec.gov. limitations in using these measures. The Company encourages readers to consider these Forward-Looking Statements non-GAAP measures along with the Company’s reported financial statements under This report contains forward-looking statements regarding the Company’s future plans GAAP. The computations and reconciliations of Discretionary Cash Flow may be found in and expected performance based on assumptions the Company believes to be reason- the Company’s Current Report on From 8-K filed February 22, 2013. Pre-tax PV10 is the able. A number of potential risks and uncertainties could cause actual results to differ discounted future cash ?ows of the Company as presented in the accompanying Form materially from these statements. Please reference “Risks Related to the Oil and Natural 10-K, without considering the effect of income taxes. G&A, excluding non-cash stock-Gas Industry and Our Business” in the accompanying Form 10-K for descriptions of based compensation is discussed in the accompanying Form 10-K. such risks and uncertainties. The Company encourages readers to consider these factors Reserve Disclosure and assumes no obligation to publicly revise or update any forward-looking statements. The SEC permits oil and gas companies to disclose probable and possible reserves in New York Stock Exchange Certification their ?lings with the SEC. The Company does not plan to include probable and possible New York Stock Exchange Rule 303A. 12(a) requires the chief executive of?cers of reserve estimates in its ?lings with the SEC. listed companies to certify that they are not aware of any violations by their companies The Company has provided internally generated estimates for probable and possible of the Exchange’s corporate governance listing standards. This annual certification by reserves in this report. The estimates conform to SEC guidelines. They are not prepared or the chief executive of?cer of Bill Barrett Corporation has been ?led with the New York reviewed by third-party engineers. Our probable and possible reserve estimates are deter-Stock Exchange. In addition, Bill Barrett Corporation has ?led Exhibits to the accompa-mined using strip pricing, which we use internally for planning and budgeting purposes. nying Form 10-K for the SEC certi?cations required for the chief executive of?cer and The Company’s estimate of probable and possible reserves is provided in this report chief ?nancial of?cer under Section 302 of the Sarbanes-Oxley Act. because management believes it is useful additional information that is widely used by the investment community in the valuation, comparison and analysis of companies.