Attached files

| file | filename |

|---|---|

| EX-10.1 - SHARE EXCHANGE AGREEMENT, DATED MARCH 21, 2013, AMONG THE COMPANY, ALLERAYDE AND MICHAEL RHODES. - STRAGENICS, INC. | f8k032113ex10i_resource.htm |

| EX-4.1 - FORM OF 6% CONVERTIBLE PROMISSORY NOTE. - STRAGENICS, INC. | f8k032113ex4i_resource.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 21, 2013

RESOURCE EXCHANGE OF AMERICA CORP.

(Exact name of registrant as specified in its charter)

|

Florida

|

333-157565

|

26-4065800

|

||

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

||

|

of Incorporation)

|

File Number)

|

Identification Number)

|

|

1 Meadow Road, New Balderton, Newark

Nottinghamshire, UK NG243BP

|

|

(Address of principal executive offices)

|

|

44-1636-613609

|

|

(Registrant’s Telephone Number)

|

|

273 Walt Whitman Road, Suite 306 Huntington Station, NY 11746

|

|

(former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

This Current Report on Form 8-K is being filed by Resource Exchange of America Corp. We are reporting the acquisition of a new business and providing a description of this business and its audited financials below.

USE OF DEFINED TERMS

Except as otherwise indicated by the context, references in this Report to:

|

●

|

The “Company,” “we,” “us,” or “our,” are references to the combined business of the Company and Allerayde.

|

|

●

|

“UK” refer to the United Kingdom;

|

|

“Allerayde” refers to Allerayde SAB Limited, a limited liability company incorporated under the laws of UK.

|

|

|

●

|

“Pound” and “£” refers to the legal currency of the United Kingdom;

|

|

●

|

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States;

|

|

●

|

“Securities Act” refers to the Securities Act of 1933, as amended; and

|

|

●

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended.

|

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On March 21, 2013, we entered into a Share Exchange Agreement with Allerayde and Mike Rhodes, the sole member of Allerayde (the “Allerayde Stockholder”) (the “Share Exchange Agreement”). Pursuant to the Share Exchange Agreement, on March 21, 2013 the Allerayde Stockholder transferred 100% of the membership interests of Allerayde held by him, in exchange for an aggregate of 75,872,411 newly issued shares of our Common Stock. The shares of our Common Stock acquired by the Allerayde Stockholders in such transactions constitute approximately 98.97% of our issued and outstanding Common Stock on a fully-diluted basis giving effect to the share exchange.

The Share Exchange Agreement contains representations and warranties by us, Allerayde and the Allerayde Stockholder which are customary for transactions of this type such as, with respect to the Company: organization, good standing and qualification to do business; capitalization; subsidiaries, authorization and enforceability of the transaction and transaction documents; financial condition; valid issuance of stock, consents being obtained or not required to consummate the transaction; litigation; compliance with securities laws; the filing of required tax returns; and no brokers used, and with respect to Allerayde: authorization, capitalization, and title to the membership interests of Allerayde being exchanged.

The foregoing description of the terms of the Share Exchange Agreement is qualified in its entirety by reference to the provisions of the Share Exchange Agreement which is included as Exhibit 10.1 of this Current Report and is incorporated by reference herein.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

Reference is made to the disclosure set forth under Item 1.01 of this report, which disclosure is incorporated herein by reference.

On March 21, 2013, we completed the acquisition of Allerayde pursuant to a Share Exchange Agreement. The acquisition was accounted for as a recapitalization effected by a share exchange. Allerayde is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of Allerayde, the acquired entity, have been brought forward at their book value and no goodwill has been recognized.

2

Our Corporate Structure

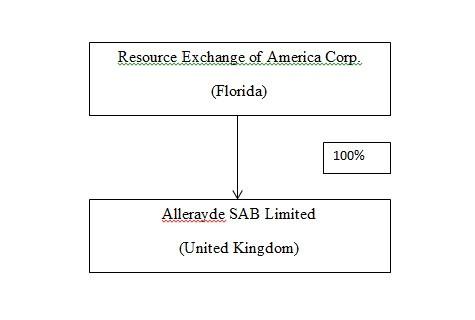

Following our acquisition of Allerayde, Allerayde became our direct, wholly-owned subsidiary. The following diagram sets forth the structure of the Company as of the date of this Report:

Our Corporate History

Resource Exchange of America Corp., formerly Mobieyes Software, Inc. (the “Company”), was incorporated under the laws of the State of Florida on January 15, 2009. On February 23, 2010, the Company changed its name to Resource Exchange of America Corp. After the consummation of the Share Exchange Transaction referred to in Item 1.01, Allerayde became a wholly-owned subsidiary of the Company, and the Company is engaged in the business of developing and manufacturing allergy management products in the United Kingdom and other countries such as the U.S. and Canada.

Allerayde was incorporated on January 13, 2012 in United Kingdom by Michael Rhodes and was 100% owned by Mr. Rhodes. Mr. Rhodes is the Chief Executive Officer of Allerayde.

DESCRIPTION OF BUSINESS

Product Offering

The Company is engaged in the business of developing and manufacturing an innovative anaphylaxis pen product and other consumer health care products for allergy and eczema patients. Our founder, Mr. Rhodes introduced into the UK market Epipen, the existing anaphylaxis pen brand leader in the 1990s, and sold it to the National Health Service (“NHS”) since 1993, and Epipen are available through prescriptions from physicians. Subsequently, Mr. Rhodes developed his own anaphylaxis pen, Anapen. In 2000, Mr. Rhodes sold the rights of manufacturing and distributing Anapen to Lincoln Medical. Since 2008, Mr. Rhodes continued researching the market and identifying possibilities for potentially re-entering the market with a new solution to the management of anaphylaxis.

AAAPen®

The Company’s principal product is the AAAPen®. The AAAPen® is a new anaphylaxis pen for the emergency treatment of anaphylaxis, the severe allergic shock, which may be identified by various rapid onset symptoms following exposure to certain allergens—such as insect venoms, peanuts, seafood, latex, etc.— that have caused symptoms from different leveled reactions. When the first signs of anaphylaxis being experienced, the AAAPen® shall be used.

3

The AAAPen®, a third generation device after Epipen and Anapen, avoids many of the technical shortcomings and high costs of manufacturing of the earlier devices. Benefiting from Mr. Rhode’s previous experience with Epipen and Anapen as well as our collaboration with allergy specialists and patient support groups, we anticipate the AAAPen® will deliver higher reliability than existing products in the market at a selling price of approximately half of the current leader’s in the anaphylaxis treatment field. There are certain possible side effects associated with using the AAAPen® that patients shall be cautious about, including headache, nausea and vomiting, dizziness, paleness, sweating, anxiety and nervousness, shaking (usually of the hands), palpitations, tachycardia, arrhythmias, and difficulties with breathing. AAAPen® is a working prototype that is developed by Allerayde. An AAAPen® consists of the following three components: (i) an auto-injector unit, the drug delivery device, which is assembled with (ii) a syringe unit, which contains (iii) a generic drug, adrenaline. Adrenaline is a naturally occurring catecholamine secreted by the adrenal medulla in response to exertion or stress. It is a sympathomimetic amine which is a potent stimulant of both alpha and beta adrenergic receptors and its effects on target organs are complex. It is the medicinal product of choice to provide rapid relief of hypersensitivity reactions to allergies or to idiopathic or exercise induced anaphylaxis.

Below is a picture of an AAAPen® prototype.

Here is how an AAAPen® functions: in the event of anaphylaxis, the auto-injector in the AAAPen® will deliver a pre-set dose of adrenaline intra muscularly to the patient. The patient shall inject the AAAPen® only into the anterolateral aspect of the thigh. The injected area may be lightly massaged for 10 seconds following injection. Each AAAPen® is for single use only. Our initial plan is to develop and make available the AAAPen® with two dosages: 0.15mg of adrenaline in each AAAPen® for children and 0.3mg for adults, both delivered from a 1 in 1000 concentration solution. Our product will be prescribed by clinicians from hospital and family practice. In some markets, e.g. Spain, Portugal, Greece and Canada, our product will be available over the counter.

The AAAPen® has been developed with an improved performance and lower costs of manufacture and distribution than its competitors. The Company believes that AAAPen® has a strong list of features as follows:

|

·

|

Long Shelf Life--Expected to be 24 months from the date of manufacture (to be determined upon the test data)

|

|

·

|

Low Failure Rate— Expected to be less than 1 in 1,000 persons

|

|

·

|

Storable at a wide range of temperatures—Expected to be available for storage at 2-30 Celsius degrees

|

|

·

|

No specific storage requirements

|

|

·

|

Acceptable power of injection—Not too powerful nor too weak when patients are applying the AAAPen® and trying to penetrate outer clothing

|

|

·

|

Toleration of significant shock-- The AAAPen® should be able to withstand the force of dropping, significant vibration and other shocks without loss of function such as breaking of seals, unplanned firing of the auto injector etc.

|

|

·

|

Latest technology

|

4

|

·

|

Not light sensitive – Adrenaline solutions are light sensitive. However, the auto-injector on the AAAPen® incorporates a closable viewing window which protects the adrenalin solution from the light when closed.

|

|

·

|

Avoid Needle-stick injury – The needle of the auto-injector can be easily retracted after used, which will avoid the risk of infection from using the needle when patients fire the auto-injector.

|

|

·

|

One concentration of adrenaline—The AAAPen® will have a single concentration of 1:1000, but only half of the volume will be used for children’s doses, resulting in a reduction in production cost and avoidance of potential wastage. The 1:1000 concentrations also has better stability in terms of a longer shelf life compared to other marketed products which have different concentrations for adult (typically 1:1000) and child (typically 1:2000) doses.

|

|

·

|

Possibility of extra dosage forms

|

|

●

|

Short chain of distribution

|

One significant advantage of the AAAPen® is the pricing advantage because Allerayde’s supplier of auto-injectors utilizes the latest automatic manufacturing techniques that enable a low production cost. The production cost of the AAAPen® is only about half of the nearest competitor’s (Epipen).

On the next stage of the development of the AAAPen®, the Company will make minor modifications to the auto-injector unit to accommodate a specific syringe as the most suitable device for achieving the best stability of the adrenaline by optimizing the formulation, filling the adrenaline in a none-oxygen atmosphere, and designing all syringe component parts, including the barrel and stoppers to be made of silicon.

Allergy, Asthma and Eczema Prevention and Treatment Products

Allerayde is also engaged in developing and manufacturing products for the prevention and relief of allergy, asthma and eczema. The products are available in the following categories:

Barrier Covers

The barrier covers are clinically proven (the clinical study was published in the “Journal of Allergy and Clinical immunology” by Ernhert et. al. in July 1992) and available in three versions to cater into various niche needs. All covers are available for mattresses, pillows and duvets for all standard sizes and customized sizes, being very breathable, allergen proof, hot washable, very durable and comfortable. The barrier covers are made of a tightly woven microfiber. The microfiber has a pore size of less than 3 microns, significantly smaller than allergen particles, therefore, making the cover impenetrable for the allergen particles.

Supplementary products to the barrier covers are duvets and pillows with dust proof outer cloth and hot washable polar blankets. All barrier cover products are made of hot washable materials as hot washing is required to extinguish dust mites in textiles.

Eczema Garments

Allerayde’s eczema garments are clinically proven and effective in preventing eczema and other inflammatory skin conditions (the clinical study was published in “A Multi-Centre Clinical Trial To Evaluate The Properties of a New Microfibre (Exalon™) Garment In Patients With Severe Atopic Dermatitis/Eczema” by Prof. M Fartasch et. al.). According to our clinical study, the specially woven microfiber, developed originally for burns treatment units, helps eczema patients break the itch scratch cycle, and provides the users with maximum comfort at the same time. The suits are available as one piece for infants and two-piece for older children and adults.

In some clinical studies, the garments were shown to be superior to routinely recommended garments by over 80% in all parameters, with the effects (such as reduction in symptom scores, itching, sleeplessness and frequency of waking) being seen in less than 7 days.

Advantages for Barrier Covers and Eczema Garments

We expect our barrier covers and eczema garments to have technical and cost advantages. The technical advantages of the eczema garments include our latest textile technology which can weave a microfiber material with a pore size significantly smaller than the allergen particles and maintain the shape of the microfiber material. The microfiber used in the sleep-suits was specifically developed to embrace the characteristics required to alleviate skin inflammation. Sleep-suits are required to reduce the discomfort of skin inflammation, the major cause of the itch/scratch cycle. The specific microfiber we use helps to break this cycle, giving the patient improved comfort and relief from symptoms. For the barrier covers, the technical advantages include preventing exposure to allergens and meeting the patients’ need for comfort. The barrier cover has high water vapor transmission, which reduces the feeling of being hot and clammy. In addition, it is soft to touch, silent in use and washable in hot water. Further, our barrier cover has cost advantage, which manufacturing costs are less than those of our competitors.

5

Sales and Marketing

Channels

Allerayde will acquire sales via direct sales for the AAAPen® and e-commerce for the consumer products. In all Allerayde direct markets, we will use contracted or self-employed sales personnel to conduct direct sales. Direct sales refer to a market being managed by Allerayde through its own subsidiaries and not direct sales to customers. In terms of personnel, Allerayde’s anaphylaxis pen and its allergy prevention products will respectively have a General/Sales Manager. Allerayde in the UK will require more support staffs in quality assurance, human resource, information technology and marketing assistance.

However, the need for direct sales would be greatly reduced because we plan to submit the application as a generic product for the AAAPen®, with relevant national regulatory authorities such as the Food and Drug Administration (“FDA”) in the USA and Medicines and Healthcare products Regulatory Agency (“MHRA”) for the UK and Europe, which will save on our marketing costs. In the USA, virtually every state has adopted laws and/or regulations that encourage the substitution of drug products to the cheapest available generic product. Most state laws require that either substitution be limited to drugs on a specific list or it be permitted for all drugs except those prohibited by a particular list. Under the FDA regulations, drugs listed under Section 505 of the Federal Food, Drug, and Cosmetic Act (the “Act”) (commonly known as the Orange Book) can be substituted with generic alternatives and the list details Approved Drug Products with Therapeutic Equivalence Evaluations (known as “AB-rated drugs”). Allerayde believes that the AAAPen® will qualify as a generic product and will apply to be classified as an AB-rated drug through the abbreviated new drug application (ANDA) process as set out by FDA. Once classified as an AB-drug, AAAPen® will have the lowest pricing among all currently available anaphylaxis pens and it would be the suggested generic substitute when prescribed by doctors and dispensed by pharmacists (AB-rated drugs can be dispended by the pharmacists without permission of doctors). There is no current law/regulation in other key territories (UK, France, Germany and Canada) like the Act, but there is prescription software such as Scriptswitch in the U.K. (http://www.scriptswitch.com/) which promotes the cheapest available generic products at the point when the doctor is writing the prescription. Due to the fact that AAAPen® will be marketed at a price around 50% less than its main competitors, we believe that it is very probable that AAAPen® would be presented as the cheapest generic product through the Scriptswitch.

In addition to the above, Allerayde will inform opinion leaders (leaders in the field of allergy clinicians in this case) and all specialists through presentations, personal visits and relevant medical exhibitions. The recommendations of opinion leaders are followed by the general medical professionals. The number of opinion leaders in this field is limited. Our promotion efforts will focus on pharmacy stores to promote the availability of our new generic pen because pharmacy stores will be our major clients. We will ensure to present the specifications of the anaphylaxis pen with its pricing benefits and superior performance and will endeavor considerable marketing and sales efforts to all medical centers, general practitioner and health authorities (currently Primary Care Trust). To market in the health authorities is important because in the U.K., there are a number of health authorities which have centralized purchasing contracts to designate the medical device for the hospitals in the regulated area. We plan to negotiate a centralized contract with the health authorities in the U.K. We believe that both the personal skills and experience of our marketing officers and the external sales forces will lead to good marketing influence in medical centers with allergy clinics or departments. For the consumer products, although direct sales are minimal, there will be office staff to handle product orders and other daily business requests.

Marketing and Public Relations

We plan to market our products through extensive public relationship (“PR”) specialist, and specialist conference event coverage which is an essential tool of creating synergy of our selling proposition to both of the prescribers and medical professionals (including doctors, nurses and pharmacists).

For the AAAPen®, we will create a package of promotional tools to approach the medical professionals, pharmaceutical suppliers and patients or patient groups. The marketing tools will include a professional catalogue, mail shots, country specific websites, full literature, videos, training units, medical conference and exhibitions attendance, and other highly selective advertising methods. All such materials will be made available to distributors as well. Moreover, our previous experience gained from marketing Epipen and Anapen will be fully utilized to maximize the social influence of our products.

In addition, we work closely with patient support groups and consumer PR agencies. Thus, the product benefits and the AAAPen®’s patient-friendly features will also be fully enforced to create social awareness of the reliability of our products.

United Kingdom National Health Service (NHS) Recommendation

We had extensive discussions with various NHS officials, including NHS Primary Care Trust (“PCT”) Chairman Tom Freemantle. Based on the discussion and our current plans regarding product quality and pricing, we expect that it is highly possible for the AAAPen® to become a recommended product of choice (the standard procedure for generic products) throughout the UK. The NHS currently has 55% of all of its prescription medicine with a generic alternative and in certain practices the number is more than 90% (Source: The Association of the British Pharmaceutical Industry). This is the result of PCT’s introducing a new software program which recommends “generic” product —i.e. the cheapest alternative at the point of purchase – when prescribing to the patient. The software program, such as Scriptswitch, is already in use in 4,600 family medical practices. We estimate that the AAAPen® will be described as a generic alternative to Epipen and as a result, it is very likely that clinicians will prescribe it.

6

International Recognition

We will market the AAAPen® directly in the key markets of the UK, Ireland, France, Germany, USA and Canada, through our own subsidiaries which will be formed in the upcoming years. In addition, for other markets in the world, we will market through carefully selected distributors. We have been in negotiation with potential distributors for several export markets and have identified those distributors for the markets in Scandinavia, Switzerland, Eastern Europe, Australia/New Zealand. We are still in the early stages of discussion with the potential distributors for Spain, Italy, and Portugal.

Customers

Customers of AAAPen®

Customers for AAAPen® are divided in to five categories:

|

●

|

prescribing clinician

|

|

●

|

pharmacy stores (in-hospital pharmacy stores, wholesale and retail pharmacy stores)

|

|

●

|

healthcare providers (e.g. NHS in the UK and medical insurance companies in the US)

|

|

●

|

individual patients

|

|

●

|

distributors

|

Our target customers are composed of five categories: clinicians, patients, pharmaceutical companies, healthcare providers and distributors. We understand that the functionality of the product is the key to clinicians and patients. For clinicians and healthcare providers, price is a major concern. Similarly, pharmacies are influenced by ease of supply, costs as well as profit margins. Distributors require not only a good product, acceptable margins and ready availability, but also marketing and technical support. Because our product is at low cost and easy to store and use, we are confident that our products will be popular among the five categories of customers.

Characteristics of each target segment

|

Clinician

|

Healthcare provider

|

Pharmacy

|

Patient

|

Distributor

|

|

|

Functionality

|

+++

|

++

|

++

|

+++

|

+++

|

|

Ease of Use

|

++

|

+

|

++

|

+++

|

+++

|

|

Storage

|

+

|

+

|

++

|

+++

|

+++

|

|

Size

|

+

|

+

|

+

|

+++

|

+++

|

|

Shelf life

|

++

|

+++

|

+

|

+++

|

+++

|

|

Durability

|

+

|

+

|

+

|

+++

|

+++

|

|

Availability

|

++

|

++

|

++

|

+++

|

+++

|

|

Back up

|

+++

|

+

|

++

|

+++

|

+++

|

|

Price

|

++

|

+++

|

++

|

+

|

+++

|

Customer for Barrier Covers and Eczema Garments

Customers for allergen avoidance and eczema clothes are divided in to four categories:

|

●

|

the recommending clinicians (including paediatrician, respiratory physician, dermatologist, allergist, ear, nose and throat physician, and immunologist)

|

7

|

●

|

healthcare providers (private and public)

|

|

●

|

the patient and parents of patients

|

|

●

|

distributors

|

Among the four categories of customers, the most important ones are clinicians and patients. If Allerayde is able to market its allergen products as the preferred product of the prescribing doctor, it will generate volume sales without significant marketing activities and under this circumstance, the allergen products would become the preferred products for the physicians and patients.

Industry Background

The Market for AAAPen®

Overview

Peanut is one of the major causes of anaphylaxis. The recent estimate of peanut allergy patients is about 1% of the population in the UK, 1.5% in Canada, and around 0.8% in the U.S. (Source: “Prevalence of peanut sensitisation in a population of 4,137 patients referred to allegologists,” Morisset, Moneret-Vautrin, Kanny, Rance, Bosse, Buard, Gallen, CIBBA). Recently published figures show that 1.4% of all school-age children are at risk of anaphylaxis to peanuts in the U.K. (Source: “Prevalence of peanut sensitisation in a population of 4,137 patients referred to allegologists,” Morisset, Moneret-Vautrin, Kanny, Rance, Bosse, Buard, Gallen, CIBBA). The population affected by allergy is even larger adding insect venom allergy and severe sensitivity to latex into the category of allergy. The indications are that the incidence of anaphylaxis is increasing in the developed world. In the U.S., the number of people with allergic sensitivities that put them at risk for anaphylaxis may be as high as 40.9 million (Source: “Neugut AI, Ghatak AT, Miller RL. Anaphylaxis in the United States: an investigation into its epidemiology,” Arch Intern Med. 2001;161:15-21). There are 1.3 million to 13 million people who are allergic to insect stings. (Source: “The diagnosis and management of anaphylaxis,” J Allergy Clin Immunol. 1998;101(6 pt 2):S465-S528). Food allergies affect 5.4 million to 7 million people in the U.S. (Source: “Prevalence of peanut and tree nut allergy in the US determined by a random digit dial telephone survey,” Sicherer SH, Muñoz-Furlong A, Burke AW, et al. J Allergy Clin Immunol. 1999;103:559-562). There are 2.7 million to 16 million people who are allergic to latex. (Source: “The prevalence of anti-latex IgE antibodies in 1000 volunteer blood donors,” Ownby DR, Ownby HE, McCullough J, Shafer AW. J Allergy Clin Immunol. 1996;97:1188-1192). From the above facts and figures, it is clear that the prevalence of food allergies and associated anaphylaxis appears to be on the rise so these figures could be considered conservative. According to a study released in 2008 by the Centers for Disease Control and Prevention, about an 18% increase in food allergy was seen between 1997 and 2007 (“Food allergy among U.S. children: Trends in prevalence and hospitalizations,” Amy M. Branum, M.S.P.H. and Susan L. Lukacs, D.O., M.S.P.H., NHCS Data Brief No. 10, Oct. 2008). An even greater increase in the prevalence of peanut allergy showing that cases among children tripled between 1997 and 2008 in the U.S. (Source: “US prevalence of self-reported peanut, tree nut, and sesame allergy: 11-year follow-up,” Sicherer SH, Muñoz-Furlong A, Godbold JH, Sampson HA).

Once registered with the relevant national health authority (e.g. MHRA in the UK), AAAPen® will appear on official lists of the prescribing authorities authorized products and be integrated in to standard software such as Scriptswitch for clinicians to prescribe information. In most of the countries, it is the prescriber’s responsibility to order prescription. Therefore, as the future clinically approved product with a comparatively low listing price, the AAAPen® will have a very broad market.

Multiple Units and Sell-by Dates

One of the major reasons for the market growth is that the number of units held by each patient is increasing, particularly in countries where the patients’ awareness for health issues is raising, such as the U.S. A typical patient in the U.S. usually has multiple units of anaphylaxis pens. The reason is that he can access to the auto-injectors from a jacket pocket, in a briefcase, in the car, in the kitchen at home or at the office or any other proximate place. The market trends have shown a steady growth in the number of units held by each patient.

A second reason is that the adrenaline auto-injector has a certain shelf life, depending on how it is manufactured and stored. Thus, it will need to be replaced with an entire new unit within six to twenty four months. Both of these factors significantly increase the volume of units required.

Market Growth

The major markets for adrenaline auto-injectors are the U.S., Canada, the U.K., Germany, France and Ireland at present, with several other countries at an early stage (including Scandinavia, Switzerland, Netherland and Brazil). Indications are that many other countries will take up pens in the coming years, some of which have major potential, such as Japan due to its current low sales of anaphylaxis pens and its large population.

8

The Market for Allergy, Asthma and Eczema Prevention and Treatment Products

Based on the statistics from leading Allergy Societies, British Society For Allergy and Clinical Immunology, European Allergy and Clinical Immunology Society, and the American Academy of Allergy, allergy affects up to 40% of the population in the world. More specifically, house dust mite allergy affects up to 25% of the world’s population. Statistics also show that the incidence of both mite allergy and allergy in general rapidly increase over the last 30 years. The most common symptoms associated with house dust mite allergy are asthma, eczema and rhinitis, all of which are managed by expensive yet ineffective drug therapy. Since the 1980s, there has been a move to supplement the drug therapy with environmental measures.

Like the allergy market, the last 30 years has witnessed a rapid rise for the eczema market. However, unlike asthma and rhinitis, the standard treatments for eczema are very poor. Thus, patients have no choice but turn to alternatives. In several markets (e.g., the U.K. and Germany), healthcare providers began to consider using clinically effective garments. There is a potential to make this market larger than that for house dust mite allergy.

Competition

Competition of AAAPen®

The original product in the market, Epipen, is the major competitor, and Anapen is a distant second. Another product, Jext has recently entered the market but little data is yet available.

The market leader, Epipen, has been available for about 35 years and has been little modified from its original design and military origins since the Cold War. In recent years, the Epipen manufacturer has incurred several major problems including two worldwide product recalls and supply difficulties. The storage requirement for Epipen is also restricted, instructed to be kept at room temperature (25°C, 77°F) and has specific storage requirements, such as keeping away from light. The second competitor in the market is Anapen. It was developed in the late 1990s and was recently available to the market. The mechanism of Anapen is not strong and its needle length is short, leading to a subcutaneous delivery rather than an intra-muscular delivery in some cases. For Jext, indications from financial statements from Allergy Laboratories Copenhagen suggest the production price of Jext is relatively high. Sales price in the UK for one single unit of Jext is £45.

By learning from the above information of our competitors, we endeavor to design a product that has significant improvements on a variety of features over Epipen and Anapen. The AAAPen® will have the optimal needle length and spring strength and a very low failure rate. In addition, after being used, it can be retracted though the medical needle devices, which feature is unique. Other features include that its shelf life is expected to be long, being 24 months subject to the final confirmation of lab testing. It can also be stored at a wide range of temperatures without any specific storage requirement.

More importantly, AAAPen® has pricing advantage. The end user prices of both Epipen and Anapen are dictated by the high costs of manufacture and the length of the distribution chain. Allerayde has invested a very large amount of time into sourcing high quality components at low cost in order to create a product with a unit production cost that is significantly lower. Another reason for the high price of Epipen and Anapen is that they are manufactured by pharmaceutical companies whose margin expectations typically far exceed medical device companies like us.

In addition to the pricing advantage, we expect that it is possible to establish a much shorter distribution chain with significant cost savings than the one of our competitors.

Furthermore, we believe that our product design and cost model will be difficult to be copied in Europe and for the foreseeable future based on our extensive research into manufacturers of auto-injectors and syringe fillers.

It is foreseeable that aggressive pricing by Allerayde will allow it to gain market share in a short time. It is recognized that this will cause the market to shrink in revenue in the short term, even though the number of units continues to grow. Our competitors will see a shrinking market in revenue terms and a massive reduction in profitability with limited opportunity to redesign and retool to compete. It is our view that this will cause at least some of our current competitors to reduce interest rather than compete aggressively as the anaphylaxis market is relatively small and focused for major pharmaceutical companies.

Competition of Allergy, Asthma and Eczema Prevention and Treatment Products

The competition in the barrier cover market is fragmented with no recognized global brand of consequence. Major players in the U.S. are Allergy Network, Allergy Control, Allergy Solutions and Mission Allergy, who all have similar offers. The pricings of our competitive products are relatively high. In Europe, there are no major suppliers of barrier cover. For eczema garments, there are no major players of consequence in any market; all are serviced by relatively small providers. Therefore, we believe that our products’ superior quality in preventing eczema and other inflammatory skin conditions will allow us to be a strong player in the market.

9

Employees

The Company has currently 1 employee.

The Company plans to increase our staff number in the upcoming five years. During 2013, Allerayde will run with its key management team, including a Finance Director. A qualified person who has experience from pharmaceuticals companies and two part time fulfillment staff will start in 2014. Staff levels will then be built up both in the UK and for its subsidiaries by the end of 2015. In the U.K., there will be four senior managers/directors and ten other positions, including positions like order processing, marketing, information technology, human resources, warehousing and quality assurance. For the subsidiaries in France, Germany and Canada which we plan to establish in the upcoming year, there will be six more positions in each market. In the U.S., we will hire a general manager and six sales/order processing personnel.

Supply and Manufacture

We plan to engage one auto-injector manufacturer, and one syringe filler manufacturer. The syringe filler manufacturer will be responsible for sourcing the needle and making the glass syringe and the adrenalin solution. Firstly, the syringe filler manufacturer produces the sources for the requisite syringe, and fills in the adrenalin formulation provided by the adrenaline supplier. Syringes come in different sizes: the required size for the AAAPen® is a 2.25 ml glass syringe. We have identified a manufacturer and are in negotiations for the non-exclusive supply of the 2.25 ml pre-filled glass syringes. The next step is that the syringe manufacturer delivers the sealed syringe with the pre-filled adrenaline to the auto-injector manufacturer who produces the auto-injector by containing the syringe. Lastly, either the syringe filler manufacturer or the auto-injector manufacturer will complete the process of assembling. At this time, Allerayde anticipates that the syringe filler manufacturer will also be responsible for combining the auto-injector and syringe components to create the AAAPen® for the European market. For the North American market, Allerayde anticipates the auto-injector manufacturer will combine the auto-injector and syringe components in order to create the AAAPen®. We are in confidential negotiations with potential suppliers and manufacturers. All the potential suppliers and manufacturers are fully registered and licensed with all relevant national authorities. The potential contractors have their facilities in different locations in the world, including Europe, Taiwan and mainland China, with a current capacity well in excess of our requirements in the first 5 years.

After the AAAPen® is produced, it would be held by contracted partners who are responsible for dispatching directly to either the Company or its subsidiaries, or distributors for supply to wholesale and hospital pharmacy. For the supply to customers, the products will be shipped to distribution warehouse centers.

We estimate that the Company’s units will require warehousing space of up to 100 m2 per market in Europe and 200 m2 the market in U.S., with each being staffed by orders clerks and warehouse personnel.

All of Allergy, Asthma and Eczema Prevention and Treatment Products manufacturing is carried out by Karapharm in France and AirMask in Italy. Additional capacity will be brought on line to satisfy the North American market when volume levels require it. Supply of these products is through national distributors, with no multi-market approach.

Research and Development

Research and Development for adrenaline auto-injector

There are currently two phases of research and development. The first phrase is to finalize developing the AAAPen®. In the second phrase, we will focus on the development of a communicator device in the AAAPen® as introduced below. The communicator technology will be developed in conjunction with relevant research departments by a product specialist or a university with special knowledge in the field. In both cases, all work will be performed by external partners under the management and guidance of Mike Rhodes. We estimate the total costs for the initial pen will be $750,000 and for the communicator device $150,000. Below are the details of two phrases:

Phase 1

We plan to finalize the last stage of AAAPen® development and complete stability and sterility testing of the adrenalin syringe.

Phase 2

Further product development will take place over the first three years. The Company will focus on creating the first mobile communication drug delivery device which will be built up on the prototype of the generic AAAPen®. The auto-injector will be modified to have an emergency homing communication device integrated that triggers automatically when the syringe is used. The auto-injector technology will be further utilized to develop additional emergency treatments for other shock states in the future 5 years. Development expenditure for these additional products designed to broaden and diversify Allerayde’s product range will come from revenue generated by AAAPen®.

10

Research and Development for Allergy, Asthma and Eczema Prevention and Treatment Products

New additions to the product range have been developed and are in the phase to finalize. The first development is a range of pillows and duvets with a dust proof layer incorporated as an outer layer. The second development is a new house dust mite removal spray based on neem oil (an essential oil) which is safe to both humans and pets and has a long term effect.

To complete the range of garments for eczema patients, a new development is ongoing. This range will be undergarments for children and adults (T-shirts, pants, socks, leggings, etc.) for all day wear, with an antimicrobial built in to the fiber. This new material has undergone clinical studies and the garments have been compared to other materials and effect measured in patients with eczema.

Intellectual Property

We own the trademark AAAPen®. In addition, Allerayde is a recognizable trademark and a trade name that is established in the U.K. and EU.

The syringe filler and an auto-injector will be supplied by contract manufacturers who hold their own intellectual property rights. These components will be used by Allerayde without the requirement of license from the manufacturers. Allerayde will register for an EU-wide license for the syringe filler of AAAPen® as a product variation from the current syringe filler. The successful completion of this registration will result in Allerayde obtaining a license to market the AAAPen® in Europe. It will take approximately 12 months to obtain MHRA’s license. On completion of the registration, we will receive an MHRS product license. We will also register the syringe filler in the U.S., and the licensing and approval process with FDA should take 24 months. In Canada, the licensing and approval process with Health Products and Food Branch (HPFB) should take less than 15 months.

Government Regulation and Approval

To take the product to market, we also need to submit registration for the syringe filler to the MHRA in the UK (or equivalent in other EU countries) with Mutual Recognition Process for the EU being sought at the same time.

The MHRA registration process usually takes several months. Firstly, we need to negotiate with our contractors on our product manufacturing process. Secondly, we present our manufacturing process to the MHRA which will decide whether our product registration process shall be classified as a generic product registration process or an abridged registration process. Both require the same data and have similar costs (generic is slightly cheaper) and timescales. In the U.K. (applicable to whole EU), accelerated study data can be used for submission, which is 6 months from starting testing (this applies to Canada also but not the US where real time data is required). Following the submission, the MHRA has to come back within 3 months with any further requests if any. The applicant then has a month to answer and re-submit. Following this, the MHRA will register the product within 3 months. The above timings are all estimation giving a worst case scenario of 12 months from the initial submission.

Registration will be for the adrenaline syringe filler which will go through as a generic as the product uses a standard recipe and dosage. Three pre-production batches will need to be prepared for stability testing, which has to be submitted at the time of registration. Registration will be sought in Canada, USA and other markets subsequently. Our contracted manufacturer has a full registration department and they will provide registration and approval services for the AAAPen® with MHRA as part of our contracted manufacturer agreement.

Both potential contract manufacturers have full MHRA and FDA approval and are inspected between every 3 to 5 years.

In the distribution of our products, there will be an inspection in every three years to maintain a wholesale dealers (to deal with pharmaceuticals) license for the UK and Europe. We currently have no wholesale dealer’s license and plan to apply one. This wholesale dealer’s license requires an application to MHRA which involves inspection of the storage and distribution center and a quality procedure manual and approval of a qualified person (usually a pharmacist or chemist) who will be monitoring the deliveries and dispatches to and from the storage and distribution center. This process should take less than 3 months.

Environment Matters

We are not aware of any environment control regulations with respect to our production process. We are not currently subject to any pending actions alleging any violations of applicable environmental laws or regulations, nor have we been punished or reprimanded for violating any such laws or regulations. We aim to develop our business without compromising environmental protection.

DESCRIPTION OF PROPERTY

The Company owns an office for its research and development activities at European Space Agency Business Incubation Center, Harwell, Oxford, United Kingdom.

11

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Directors, Executive Officers, Promoters, and Control Persons

The following table sets forth the name and position of our current sole executive officer and director.

|

Name

|

Age

|

Position

|

||

|

Michael J. Rhodes

|

58

|

Chairman, CEO, Director

|

Michael J Rhodes – Chairman, CEO, Sole Director

Michael Rhodes has over 30-year experience in pharmaceutical, medical diagnostic and consumer healthcare industry, specializing in the field of allergy. He worked with Pharmacia for over 10 years, and becoming Divisional Director ultimately responsible to the Swedish parent company for the management of a division of over 50 people and a turnover of over £13 million. His experience includes the introduction of Epipen in the early 1990s and subsequently developing the Anapen adrenaline auto-injector. He was instrumental in creating the market for adrenaline auto-injectors in the UK and Ireland in the early 1990’s and went on to initiate the marketing of adrenaline pens via Anapen in the majority of Europe with great success in France, Holland, Germany, Scandinavia, Portugal and Greece. He has been successful in selling to the medical profession and the setting up of distributors in Europe and North America. He sold his interest in Anapen in February 2000.

He led the development of the third generation anaphylaxis pen, AAAPen®, and the concept of a communicator device following extensive research.

He identified the market need for allergen avoidance as early as 1989 and he researched the market and pioneered barrier covers as a key product area. In 1990 he established Allerayde UK Limited to supply barrier covers and associated allergy prevention products in the U.K. and Ireland and created and developed the allergen avoidance market in the U.K. by working closely with leading allergy clinicians. Through ongoing product development, product range additions and developing products locally or by sourcing them from around the world, he has ensured that Allerayde products continue to be among the very best and most effective in the marketplace.

EXECUTIVE COMPENSATION

The Company currently does not have any compensatory arrangements with any officers. No officer received any compensation from the Company during the last two fiscal years. Officers will be incentivized by an agreed remuneration package of share options and or bonus payments, these are to be discussed upon appointment and no employee agreements are currently in force.

DIRECTOR COMPENSATION

The Company currently does not have any compensatory arrangements with any directors. No director received any compensation from the Company during the last two fiscal years. There were no options outstanding as of the date of this Report.

TRANSACTIONS WITH RELATED PERSONS, PROMOTERS AND CONTROL PERSONS; CORPORATE GOVERNANCE

Transactions with related persons

Our policy is that a contract or transaction either between the Company and a director, or between a director and another company in which he is financially interested is not necessarily void or void-able if the relationship or interest is disclosed or known to the board of directors and the stockholders are entitled to vote on the issue, or if it is fair and reasonable to our company.

Except as disclosed in the Company’s Quarterly Reports on Form 10-Q for the quarters ended September 30, June 30 and March 31 of 2012, the Company was not a party to any transaction (where the amount involved exceeded the lesser of $120,000 or 1% of the average of our assets for the last two fiscal years) in which an director, executive officer, holder of more than five percent of our common stock, or any member of the immediate family of any such person have or will have a direct or indirect material interest and no such transactions are currently proposed.

On March 21, 2013, the Company issued 75,872,411 shares of Common Stock to Mike Rhodes, our newly appointed President, CEO and director, in exchange for his 100% ownership in Allerayde SAB Limited, a U.K. limited liability company pursuant to a Share Exchange Agreement. As of result of such share exchange transaction, Allerayde SAB Limited became our wholly-owned subsidiary.

12

Director Independence

Our securities are not listed on a national securities exchange or in an inter-dealer quotation system which has requirements that directors be independent. We do not have majority of independent directors.

Committees of the Company’s Board of Directors

Because our board of directors currently consists of only one member, we do not have a standing nominating, compensation or audit committee. Rather, our full board of directors performs the functions of these committees. Also, we do not have a “financial expert” on our board of directors as that term is defined by Item 401(e)(2) of Regulation S-K. We do not believe it is necessary for our board of directors to appoint such committees because the volume of matters that come before our board of directors for consideration permits the sole director to give sufficient time and attention to such matters to be involved in all decision making. Additionally, because our Common Stock is not listed for trading or quotation on a national securities exchange, we are not required to have such committees. In considering candidates for membership on the Board of Directors, the Board of Directors will take into consideration the needs of the Board of Directors and the candidate's qualifications. The Board of Directors will request such information as:

|

●

|

The name and address of the proposed candidate;

|

|

●

|

The proposed candidates resume or a listing of his or her qualifications to be a director of the Company;

|

|

●

|

A description of any relationship that could affect such person's qualifying as an independent director, including identifying all other public company board and committee memberships;

|

|

●

|

A confirmation of such person's willingness to serve as a director if selected by the Board of Directors; and

|

|

●

|

Any information about the proposed candidate that would, under the federal proxy rules, be required to be included in the Company's proxy statement if such person were a nominee.

|

Once a person has been identified by the Board of Directors as a potential candidate, the Board of Directors may collect and review publicly available information regarding the person to assess whether the person should be considered further. Generally, if the person expresses a willingness to be considered and to serve on the Board of Directors and the Board of Directors believes that the candidate has the potential to be a good candidate, the Board of Directors would seek to gather information from or about the candidate, including through one or more interviews as appropriate and review his or her accomplishments and qualifications generally, including in light of any other candidates that the Board of Directors may be considering. The Board of Director's evaluation process does not vary based on whether the candidate is recommended by a shareholder.

The Board of Directors will, from time to time, seek to identify potential candidates for director nominees and will consider potential candidates proposed by the Board of Directors and by management of the Company.

Code of Ethics

Our Board of Directors will adopt a new code of ethics that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer. The new code will address, among other things, honesty and ethical conduct, conflicts of interest, compliance with laws, regulations and policies, including disclosure requirements under the federal securities laws, confidentiality, trading on inside information, and reporting of violations of the code.

Meetings of the Board of Directors

During its fiscal year ended December 31, 2012, the Board of Directors did not meet on any occasion, but rather transacted business by unanimous written consent.

Board Leadership Structure and Role in Risk Oversight

Our Board recognizes that the leadership structure and combination or separation of the chief executive officer and chairman roles is driven by the needs of the Company at any point in time. Currently, Mr. Rhodes serves as the sole director of our Board and Chief Executive Officer. We have no policy requiring the combination or separation of leadership roles and our governing documents do not mandate a particular structure. This has allowed, and will continue to allow, our Board the flexibility to establish the most appropriate structure for our company at any given time.

Immediately following the completion of the Share Exchange Transaction, the size of our management team will be increased in order to manage our expanded operations, risks and resources.

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company's Common Stock as of the date herein by (i) each stockholder known by the Company to be the beneficial owner of more than 5% of the Company's Common Stock and (ii) by the directors and executive officers of the Company. The person or company named in the table has sole voting and investment power with respect to the shares beneficially owned.

|

Name and Address of Beneficial Owner(1)

|

Amount, Nature and Percentage of Beneficial Ownership (2)

|

||

|

(Officers and Directors)

|

|||

|

Mike Rhodes (Chairman and CEO)

|

75,872,411 shares (voting)

|

98.97%

|

|

|

All Directors and Officers, as a Group

|

75,872,411 shares (voting)

|

98.97%

|

|

|

(5% Securities Holders)

|

|||

| Mike Rhodes (Chairman and CEO) | 75,872,411 shares (voting) |

98.97%

|

|

|

(1)

|

The address for the sole officer and director is at 1 Meadow Road, New Balderton, Newark, Nottinghamshire, NG24 3BP, UK.

|

|

(2)

|

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Beneficial ownership also includes shares of stock subject to options and warrants currently exercisable or exercisable within 60 days of the date of this table. In determining the percent of common stock owned by a person or entity as of the date of this Report, (a) the numerator is the number of shares of the class beneficially owned by such person or entity, including shares which may be acquired within 60 days on exercise of warrants or options and conversion of convertible securities, and (b) the denominator is the sum of (i) the total shares of common stock outstanding on as of the date of this Report (75,872,411 shares), and (ii) the total number of shares that the beneficial owner may acquire upon exercise of the derivative securities. Unless otherwise stated, each beneficial owner has sole power to vote and dispose of its shares.

|

LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. There are currently no legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON

EQUITY AND RELATED STOCKHOLDER MATTERS

The Company’s Common Stock is quoted on the OTQB, but there has been no reported trading in the Company’s Common Stock during its two fiscal years ended December 31, 2012 and 2011.

Prior to the share exchange transaction described above, Allerayde was a privately held company and there was no trading in its common stock.

As of the date of this Report, there were approximately 8 holders of record of the Company’s Common Stock.

The Company has never paid a cash dividend on its common stock and has no present intention to declare or pay cash dividends on the common stock in the foreseeable future. The Company intends to retain any earnings which it may realize in the foreseeable future to finance its operations. Future dividends, if any, will depend on earnings, financing requirements and other factors.

The transfer agent for the Company's common stock is Vstock Transfer, LLC, 77 Spruce Street, Suite 201, Cedarhurst, NY 11516.

RECENT SALES OF UNREGISTERED SECURITIES;

USE OF PROCEEDS FROM REGISTERED SECURITIES

Reference is made to the disclosure set forth under Item 3.02 of this report, which disclosure is incorporated herein by reference.

14

DESCRIPTION OF SECURITIES

The Company’s authorized capital stock consists of 400,000,000 shares of common stock, with a par value of $0.0001 per share, and 100,000,000 shares of preferred stock, with a par value of $0.0001 per share (“Preferred Stock”).

Common Stock

The Company’s common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy, subject to any voting rights granted to holders of any Preferred Stock. Holders of the Company’s common stock representing fifty percent (50%) of the Company’s capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of the Company’s stockholders. The Company’s Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to any preferential rights of any outstanding series of Preferred Stock created by the Company’s Board of Directors from time to time, the holders of shares of the Company’s common stock will be entitled to such cash dividends as may be declared from time to time by the Company’s Board of Directors from funds available therefore.

Subject to any preferential rights of any outstanding series of Preferred Stock created from time to time by the Company’s Board of Directors, upon liquidation, dissolution or winding up, the holders of shares of the Company’s common stock will be entitled to receive pro rata all assets available for distribution to such holders.

Holders of the Company’s common stock have no preemptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Preferred Stock

The Company’s Board of Directors is authorized by its Articles of Incorporation to issue Preferred Stock from time to time in one or more series with such designations, preferences and relative participating, optional or other special rights and qualifications, limitations or restrictions, thereof, as shall be stated in the resolutions adopted by the Company’s Board of Directors providing for the issuance of the Preferred Stock. The Company’s Board of Directors is authorized, within any limitations prescribed by law and the Company’s Articles of Incorporation, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of Preferred Stock.

Convertible Promissory Notes

The Company issued to two accredited investors 6% Convertible Promissory Notes in the respective principal amounts of $20,000 and $66,709 (the “Notes”) respectively on August 31, 2012 and November 16, 2012. The following description is qualified in its entirety be reference to provisions of the Notes, a form of which is included as Exhibit 4.1 to this Current Report and is incorporated by reference herein.

Interest. The outstanding principal amount of the Notes shall bear interest at the rate of 6% per annum. Interest is be payable on the Maturity Date (as defined below) in cash or, at the option of the Company, in a number of the shares of Common Stock equal to the quotient obtained by dividing the amount of interest by the Conversion Price (as defined below).

Maturity. The Notes will mature on the first anniversary from the date of the issuance of the Notes (the “Maturity Date”).

Conversion. The holders of the Notes, during any time before the Maturity Date, shall have the option to convert the Notes into a number of shares of Common Stock equal to the quotient obtained by dividing the sum of any unpaid principal amount and interest by the Conversion Price. The “Conversion Price” is the average of the trading price of the Common Stock, as further provided in the Notes, during the immediately preceding 30 business days prior to conversion.

Events of Default. Standard events of default, including, without limitation, non-payment of principal or interest, enforcement proceedings, and insolvency, winding-up and other market standard analogous events. The Company is provided a grace period of 10 business days to cure any event of default. Upon the occurrence of an Event of Default, the Notes shall automatically mature, and the entire unpaid principal amount of Notes, plus all accrued and unpaid interest through the date of payment, shall become immediately due and payable.

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Florida law allows the Company to indemnify its directors, officers, employees, and agents, under certain circumstances, against attorney's fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on its behalf, and under certain circumstances to advance the expenses of such litigation upon securing their promise to repay us if it is ultimately determined that indemnification will not be allowed to an individual in that litigation.

15

Article IX of the Articles of Incorporation of the Company provide that it shall indemnify all directors, officers and agents to the fullest extent permitted by Florida law as provided within 2011 Florida Statutes Section 607.0850 or any other law in effect or as it may hereafter be amended.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore unenforceable.

At the present time, there is no pending litigation or proceeding involving a director, officer, employee or other agent of ours in which indemnification would be required or permitted. We are not aware of any threatened litigation or proceeding which may result in a claim for such indemnification.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Commission , located on 100 F Street NE, Washington, D.C. 20549, Current Reports on Form 8-K, Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and other reports, statements and information as required under the Exchange Act.

The reports, statements and other information that we have filed with the Commission may be read and copied at the Commission's Public Reference Room at 100 F Street NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

ITEM 3.02 UNREGISTERED SHARES OF EQUITY SECURITIES.

On March 21, 2013, we issued 75,872,411 shares of our Common Stock to the sole Allerayde Stockholder in exchange for all of the issued and outstanding capital stock of Allerayde pursuant to the Share Exchange Agreement. We did not receive any cash consideration in connection with the Share Exchange Transaction.

The above issuances of shares of our Common Stock were conducted in accordance with a safe harbor from the registration requirements of the Securities Act under Regulation S thereunder or an exemption from the registration requirements of the Securities Act under Section 4(2) by virtue of compliance with the provisions of Regulation D under the Securities Act.

Reference is made to the disclosure set forth under Item 2.01 of this report, which disclosure is incorporated herein by reference.

As a result of the closing of the share exchange with the Allerayde Stockholder, the Allerayde Stockholder now own approximately 98.97% of the total outstanding shares of our Common Stock on a fully-diluted basis giving effect to the share exchange.

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

Immediately prior to the closing of the Share Exchange Transaction, Mark Dresner, currently CEO and a director of the Company resigned from all his positions as director and/or officer of the Company. His resignation as an officer and director of the Company was effective immediately on March 21, 2013. Also effective immediately prior to the closing of the Share Exchange Transaction on March 21, 2012, Michael J. Rhodes was appointed as the President, Chief Executive Officer and director of the Board. Currently, there was no compensating arrangements with our sole officer and director.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| 4.1 | Form of 6% Convertible Promissory Note. | |

| 10.1 |

Share Exchange Agreement, dated March 21, 2013, among the Company, Allerayde and Michael Rhodes.

|

16

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

RESOURCE EXCHANGE OF AMERICA CORP.

|

||

|

Date: March 25, 2013

|

By:

|

/s/ Michael Rhodes

|

|

|

|

|

Michael Rhodes

|

|

|

|

|

Chief Executive Officer & President

|

|

17