Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GULFMARK OFFSHORE INC | d508082d8k.htm |

GulfMark Offshore, Inc

Q1 2013 Investor Relations Update |

Forward

Looking Statements 2

Cautionary Statement Regarding Forward-Looking Statements

NYSE:

GLF

www.GulfMark.com Certain

statements and information in this presentation may constitute “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. The words “believe,”

“expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,”

“would,” “could” or other similar expressions are intended to identify

forward-looking statements, which are generally not historical in nature. These

forward-looking statements are based on our current expectations and beliefs concerning future developments and

their potential effect on us. While management believes that these forward-looking statements are

reasonable as and when made, there can be no assurance that future developments affecting us

will be those that we anticipate. All comments concerning our expectations for future revenues

are based on our forecasts for our existing operations. Our forward-looking statements involve

significant risks and uncertainties (some of which are beyond our control) and assumptions that could

cause actual results to differ materially from our historical experience and our present

expectations or projections. Among the important factors that could cause actual results to

differ materially from those in the forward-looking statements include, but are not limited to: the price of oil and gas

and its effect on offshore drilling, vessel utilization and day rates; industry volatility;

fluctuations in the size of the offshore marine vessel fleet in areas where the Company

operates; changes in competitive factors; delays or cost overruns on construction projects, and

other material factors that are described from time to time in the Company’s filings with the SEC, including the registration

statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2012,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Consequently, the

forward-looking statements contained herein should not be regarded as representations that

the projected outcomes can or will be achieved. These forward-looking statements speak only as of the date

hereof. We undertake no obligation to publicly update or revise any forward-looking statements

after the date they are made, whether as a result of new information, future events or

otherwise. |

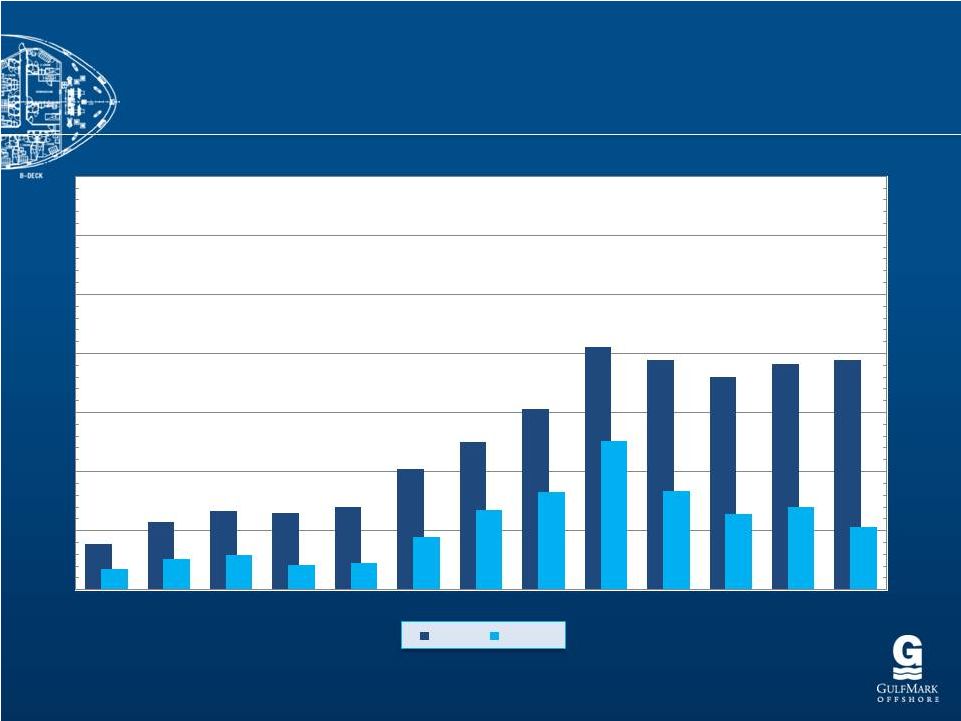

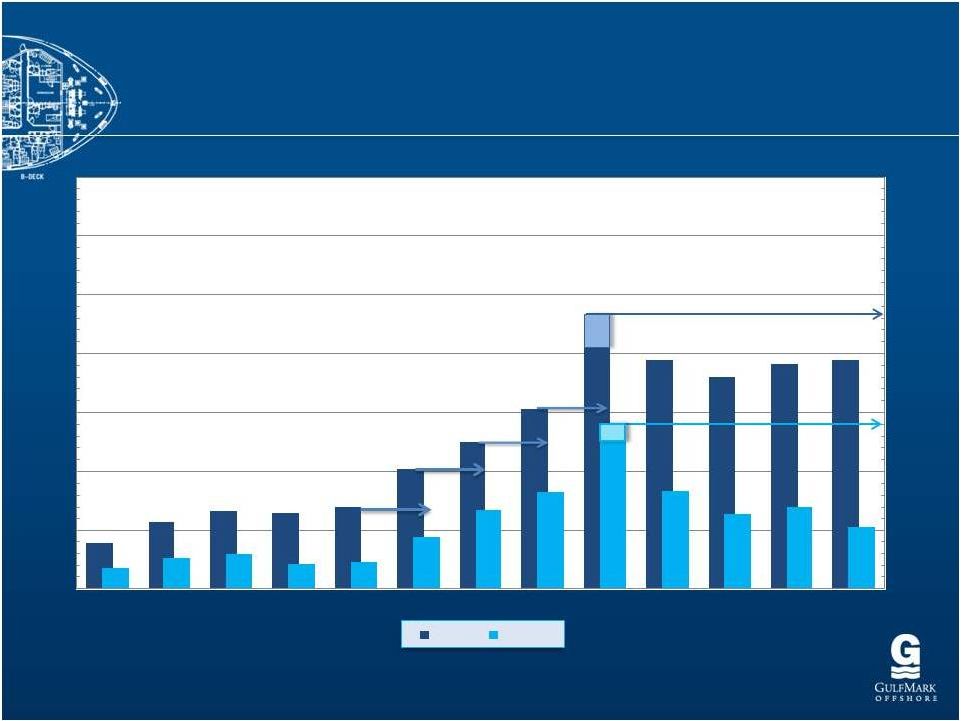

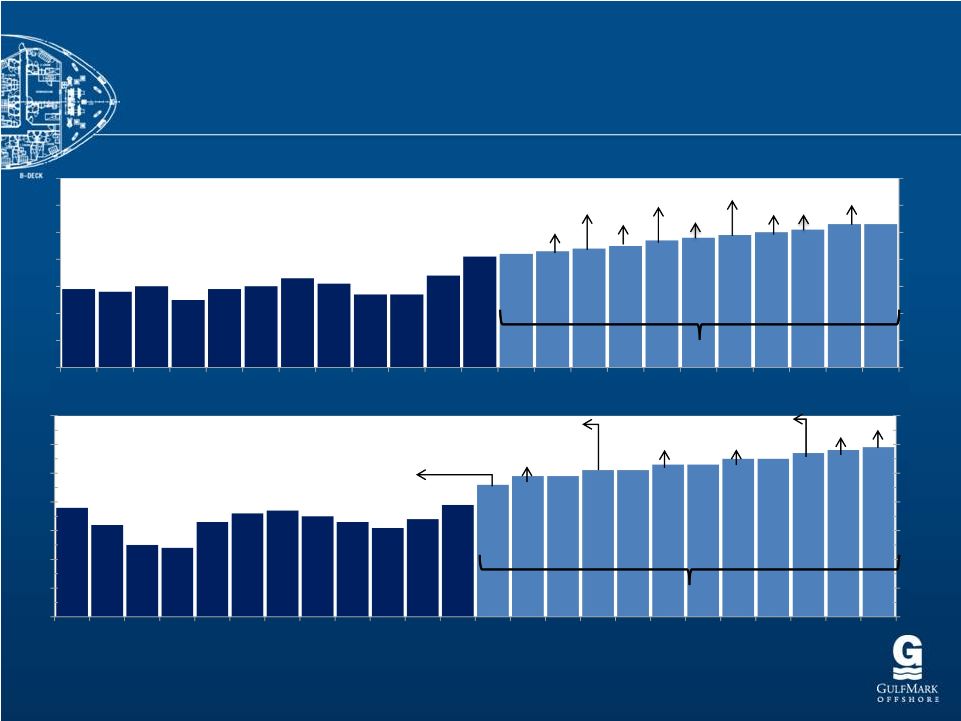

Long Term Revenue & EBITDA

(in millions of dollars)

3

* Note: Adjusted for Special Items, See Supporting Information at the end of this

Presentation $600

$700

$500

$400

$300

$200

$100

$0

$600

$700

$500

$400

$300

$200

$100

$0

2000

2001

2002

2003

2004

2006

2005

2007

2008

2009

2010

2011

2012

Revenue

EBITDA* |

4

* Note: Adjusted for Special Items, See Supporting Information at the end of this

Presentation •

Pro Forma for July 1, 2008 Acquisition

•

Prior Up-Cycle Incremental EBITDA Margins Average 72%

•

Substantial Fleet Upgrades Since 2008

•

11 New Vessels Beginning in 2013

68%

100%

71%

53%

Long Term Revenue & EBITDA

(in millions of dollars)

$600

$700

$500

$400

$300

$200

$100

$0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

$600

$700

$500

$400

$300

$200

$100

$0

Revenue

EBITDA* |

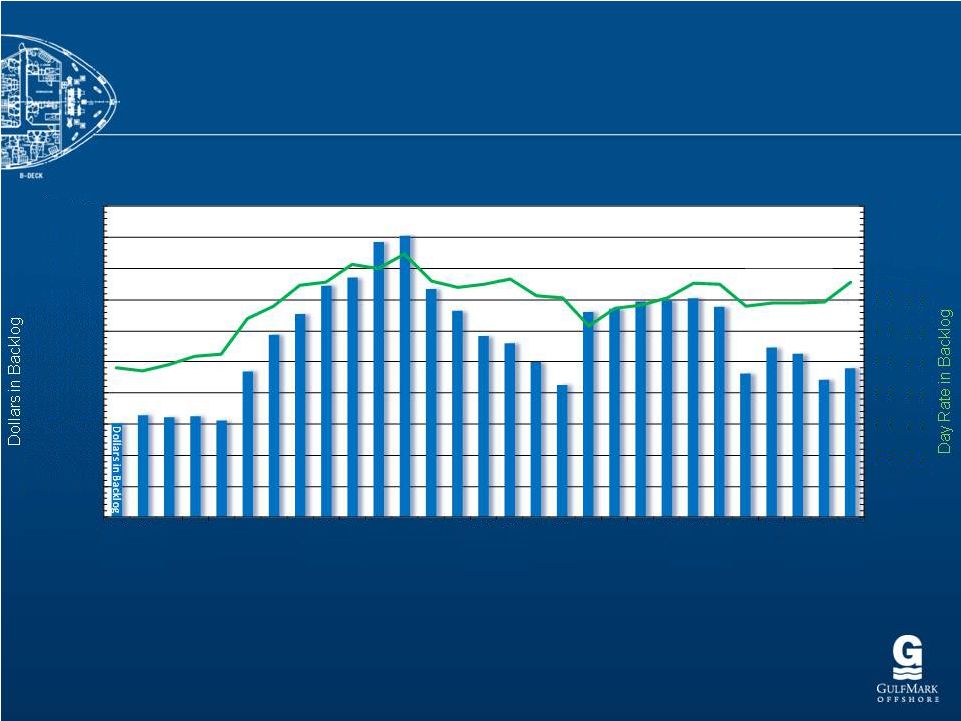

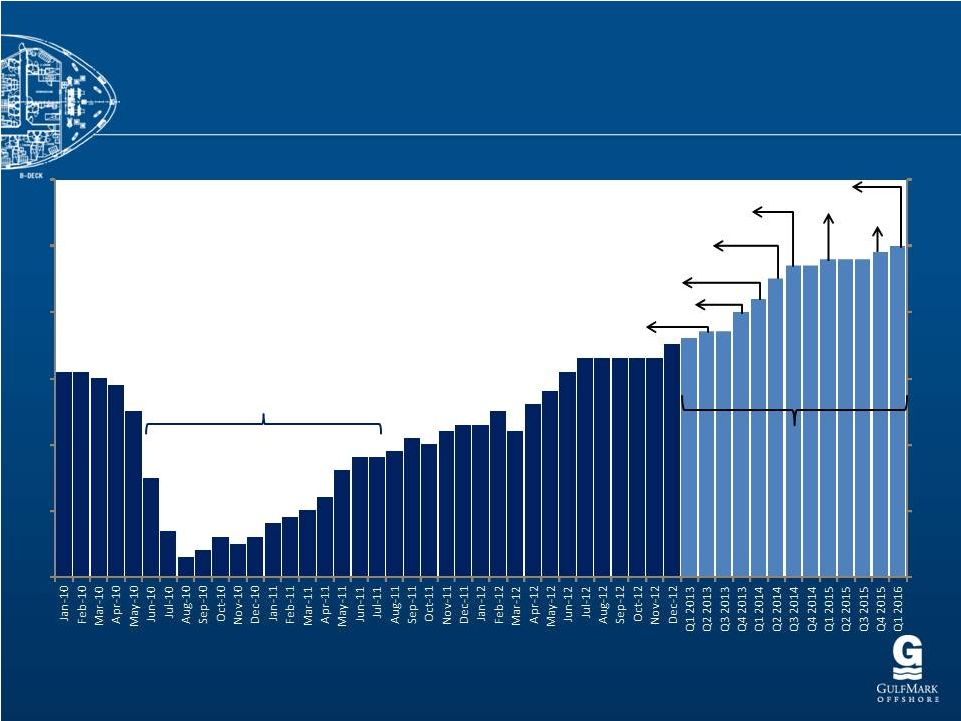

5

Total Revenue in Backlog

(in thousands of dollars)

$0

$2,500

$5,000

$7,500

$10,000

$12,500

$15,000

$17,500

$20,000

$22,500

$25,000

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

$900,000

$1,000,000

Q4

2005

Q1

2006

Q2

2006

Q3

2006

Q4

2006

Q1

2007

Q2

2007

Q3

2007

Q4

2007

Q1

2008

Q2

2008

Q3

2008

Q4

2008

Q1

2009

Q2

2009

Q3

2009

Q4

2009

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Day Rate in

Backlog |

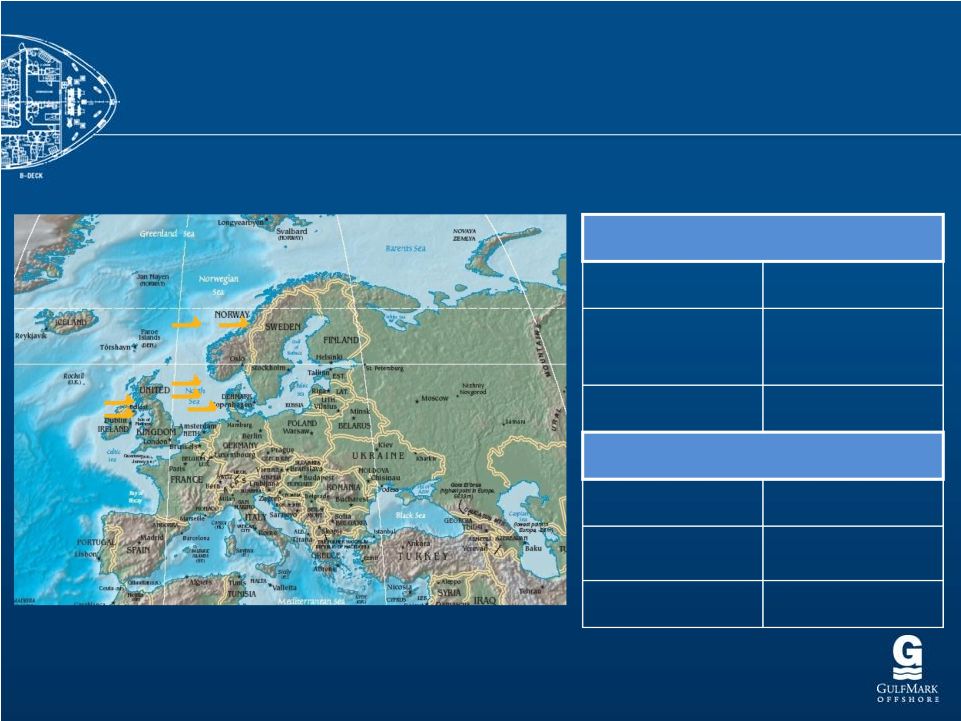

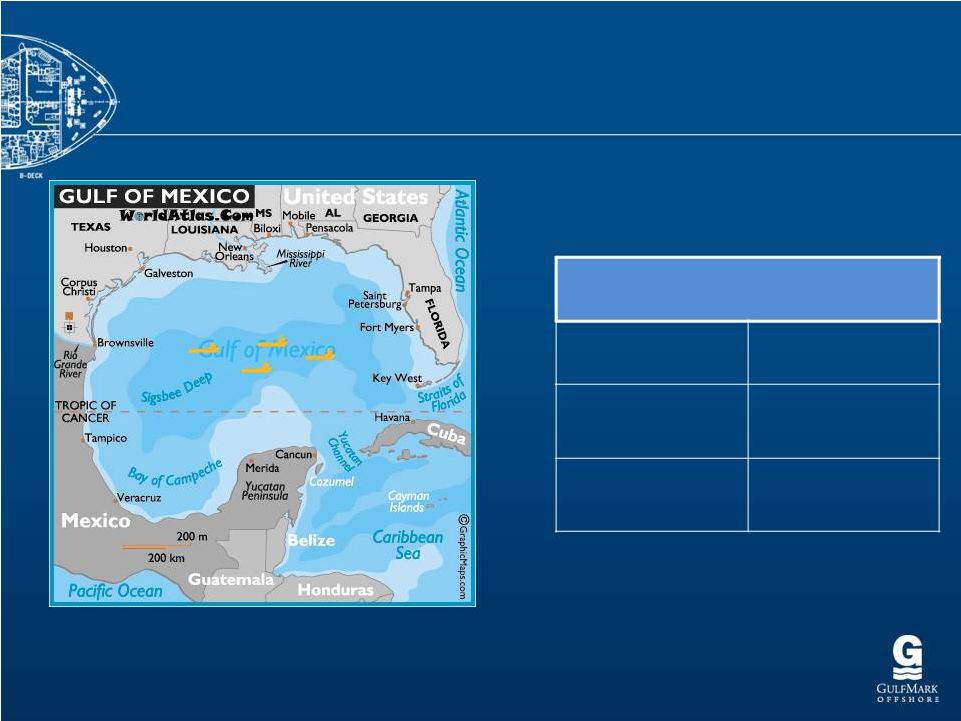

Brazil

PSV

SpV

1 US Gulf

PSV

15

FSV

2 6

Global Vessel Diversification

West

Africa

AHTS 2

PSV

1 Mexico

AHTS

2 Trinidad

PSV

2

FSV

1 North Sea

PSV

20

AHTS

SpV

1

Worldwide

PSV

48

AHTS

17

FSV

3

SpV

2

Total

70

SE Asia

PSV

4

AHTS 12

Revenue Breakout by Region –

Year Ended December 31,

2012

North Sea

42%

Southeast

Asia

16%

13%

29%

Gulf of Mexico

Gulf of Mexico

Gulf of Mexico

Rest of Americas

Americas

42%

6

1 |

The GulfMark Fleet

7 |

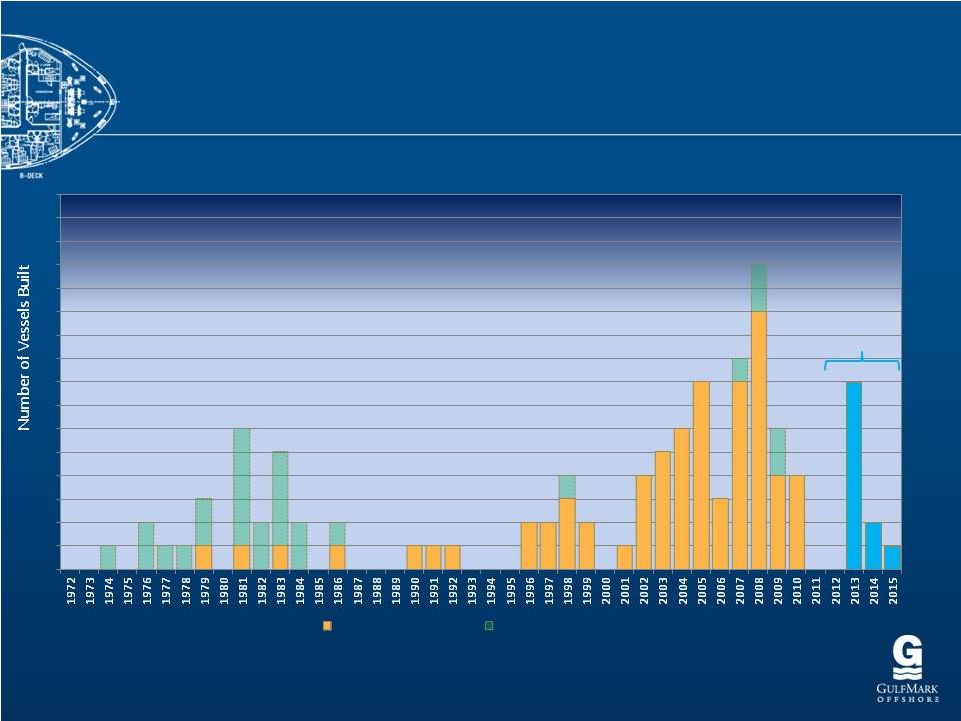

Young & Versatile Fleet

8

Number of Vessels GulfMark Built Per Year

New Build

Deliveries

16

15

14

13

12

11

10

9

8

7

6

5

4

3

2

1

0

16

15

14

13

12

11

10

9

8

7

6

5

4

3

2

1

0

Vessels in Current Fleet

Vessels not in Current Fleet |

Building For

Our Future 9

Significant number of new generation rigs on order

Increasing Activity both in the North Sea and New Frontiers

Industry call for higher specification vessels to meet increasing regulatory

demands:

•

Deeper Waters and Harsher Environments

•

Increased cargo carrying capacity and flexibility

•

Enhanced Green

Footprint and offering greater safety support |

10

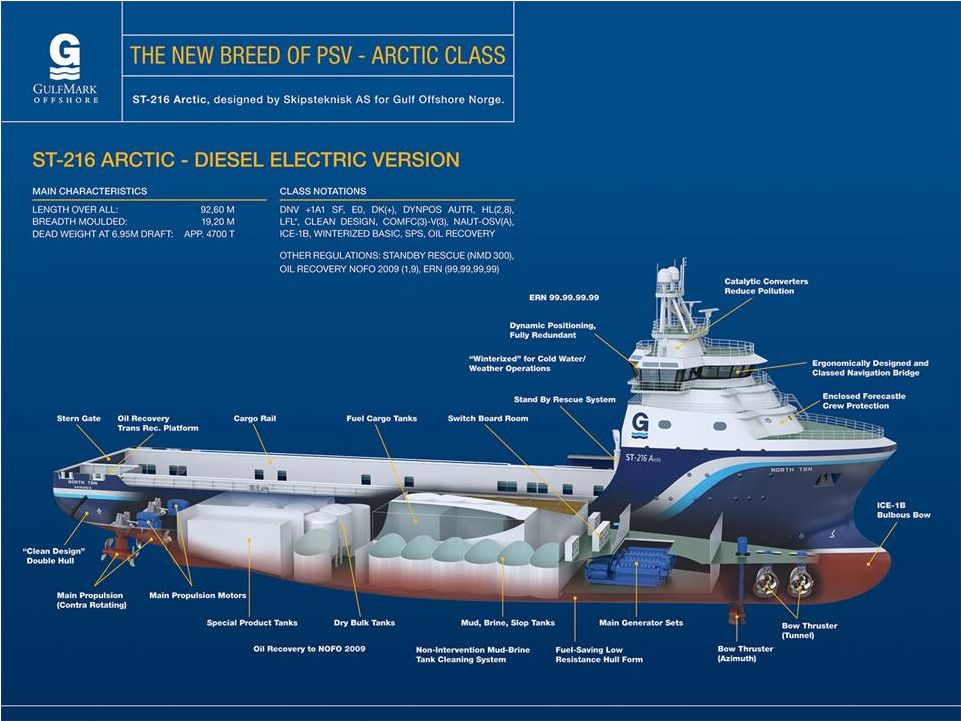

New Build Program Overview

Two MMC 887 300 Class DP 2 (Europe)

One MMC 879 280 Class DP2 (Europe)

Two UT 755 XL 250 Class DP2 (Europe)

Two ST-216 300 Class Arctic DP2

(Europe) Two 280 Class PSV DP2 (US)

Two 300 Class PSV DP2 (US) |

New Build and Vessel Enhancement

Program Summary

11

•

North Sea

•

7 Newbuild Vessels

•

North Sea vessels hedged in EUR

•

DP2 Green PSVs (300 Class (2), 300 Class Arctic (2), 280 Class (1), 250 Class

(2)) •

Staggered delivery of Newbuilds-

2Q 2013 through 1Q 2014

•

U.S. GOM

•

4 Newbuild US Flagged Vessels for Approximately $170 million

•

DP2 Green PSVs (280 Class(2), 300 Class (2))

•

Staggered delivery -

3Q 2013 through 1Q 2015 |

12

2012

Phase

1:

190’

to

230’

Three

Vessels

Completed

2011-12

Avg. Cost Per Vessel

$2.2 million

Avg. Incremental Days Out of Service

77

Avg. Day Rate % Increase

+40%

Avg. Utilization Percentage Increase

18%

Estimated Payback Period (Including

Opportunity Cost)

10.5 months

Return on Net Capital Employed

117%

U.S.

GOM

–

Stretch

Program

•

Completed Three 190’

Vessels in 2011-2012

•

Two Complete During Q1 2013, One Currently in Process

•

Four Additional 190’

Vessels Will Become Stretch Program Candidates During 2015

•

Next Steps –

210 Class 260 Class

•

10 Vessel Candidates, First Vessel to Enter Shipyard in Q2 2013

New Build and Vessel Enhancement

Program Summary, Cont’d |

Building For Our Future: 2013 & Beyond

(U.S. dollars, in millions)

13

Vessels Under

Construction

Vessel Type

Initial

Operating

Region

Estimated

Construction

Cost

Estimated

Average Annual

EBITDA

Implied EBITDA

Multiple

300 Class

PSV

North Sea

$37.0

$8.2

4.5x

300 Class

PSV

North Sea

$37.0

$8.2

4.5x

280 Class

PSV

North Sea

$34.0

$7.7

4.4x

300 Class Arctic

PSV

North Sea

$58.0

$10.8

5.4x

300 Class Arctic

PSV

North Sea

$60.0

$10.8

5.6x

250 Class

PSV

North Sea

$31.0

$7.4

4.2x

250 Class

PSV

North Sea

$31.0

$7.4

4.2x

US 280 Class

PSV

Americas

$36.0

$6.5

5.5x

US 280 Class

PSV

Americas

$36.0

$6.5

5.5x

US 300 Class

PSV

Americas

$48.0

$8.8

5.5x

US 300 Class

PSV

Americas

$48.0

$8.8

5.5x

Total

$456.0

$91.1

5.0x |

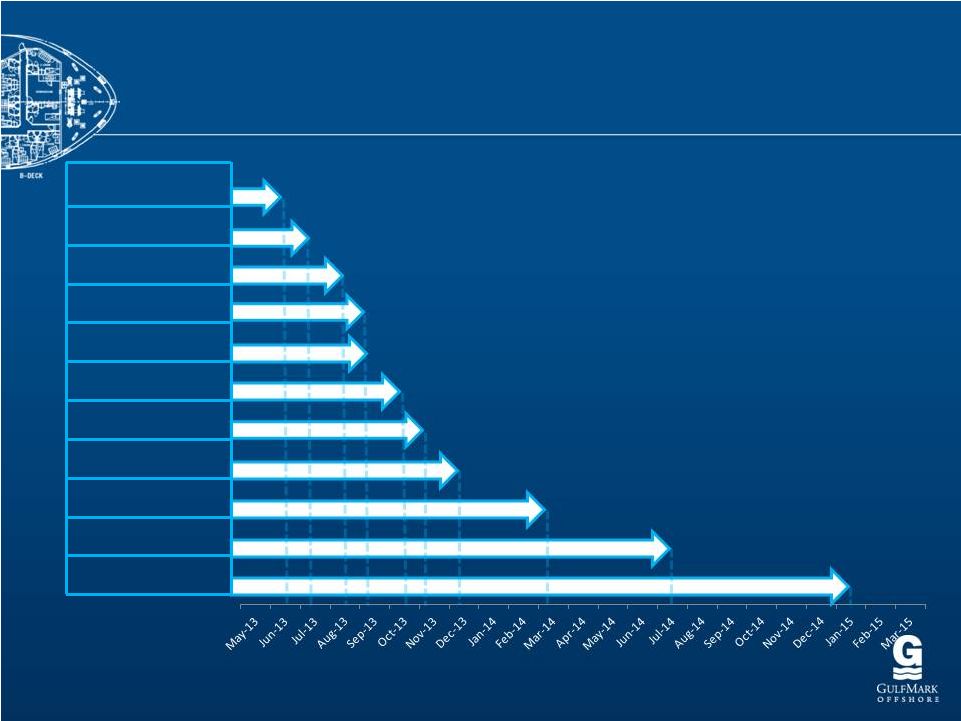

New Build Delivery Schedule

14

300 Class Europe

300 Class Artic Europe

280 Class Europe

300 Class Europe

280 Class US

250 Class Europe

300 Class Artic Europe

280 Class US

250 Class Europe

300 Class US

300 Class US |

Market

Drivers

15 |

Rig Growth in the North Sea

16

Source: IHS Petrodata , Carnegie Research

Floating Rigs

Active

42

Scheduled

Arrivals/Activations

(through 2015)

15

% Increase

36%

Jackups

Active

42

Scheduled Arrivals

(through 2015)

11

% Increase

26% |

Rig Growth in the North Sea

17

Source: IHS Petrodata

Jackups

Floating Rigs

Planned

Planned

0

10

20

30

40

50

60

70

0

10

20

30

40

50

60

70

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Q1

2013

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Q3

2014

Q4

2014

Q1

2015

Q2

2015

Q3

2015

Q4

2015

0

10

20

30

40

50

60

70

0

10

20

30

40

50

60

70

2009

2001

2002

2003

2004

2005

2006

2007

2008

2010

2011

2012

Q1

2013

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Q3

2014

Q4

2014

Q1

2015

Q2

2015

Q3

2015

Noble Regina Allen

Prospecter 1

ENSCO 120

Maersk XL

Enhanced 1

Maersk XL Enhanced 3,

Seadrill TBA #2

Noble Sam

Turner

Seadrill TBA

#1

ENSCO 121,

West Linus

Maersk XL

Enhanced 2

COSL Promoter ,

Leiv Erikson

Stena Carron,

Island Innovator

Eirik Raude

Songa Equinox,

Ocean Patriot

Deepsea Aberdeen,

Songa Endurance

Songa Encourage, Bollsta Dolphin

Songa Enabler

Atwood Advantage, Sedco 712

North Dragon |

Floating Rig Growth in the U.S. GOM

18

Source: IHS Petrodata –

February 2013

Floating Rigs in U.S. GOM

Active

36

Scheduled Arrivals

(through Q1 2016)

14

% Increase

39% |

Floating Rig Growth in the U.S. GOM

Moratorium and Recovery

Planned

0

10

20

30

40

50

60

0

10

20

30

40

50

60

West Auriga, Ocean Confidence,

Noble Globetrotter II

West Vela, Maersk Drsh Tbn 1

Pacific Sharav

Sevan UDW 3

Noble Bob Douglas,

Maersk Deepwater Advanced 2

Rowan Renaissance

Transocean

TBN 1

Transocean TBN 2

Helix 534

19

Source: Barclays, IHS Petrodata

Deepwater Invictus, |

Worldwide Sub Sea –

Driving the Future

20

Source:

Douglas-Westwood’s World Subsea Vessel Operations Market Forecast

2012-2016 Sub Sea Activity is Continuing to Expand

•

Subsea Demand Expected to Increase 33% and

Annual Expenditure double to $20.3 Billion by 2016

•

Set to Top $77 Billion Over Next Five Years

•

Increase of 63% Over Previous Five Year Period

•

Sub Sea Work Requires Newer, More Specialized

Vessels and Support Equipment

FPSO

Spending

–

Projected

•

Between 2013 and 2017, $91bn Will be Spent on Floating

Production

Systems

(FPS)

-

an

Increase

of

100%

over

the

Preceding Five-Year Period.

•

A Total of 121 Floating Production Units are Forecast to

be Installed -

a 37% Increase |

Financial Information

21 |

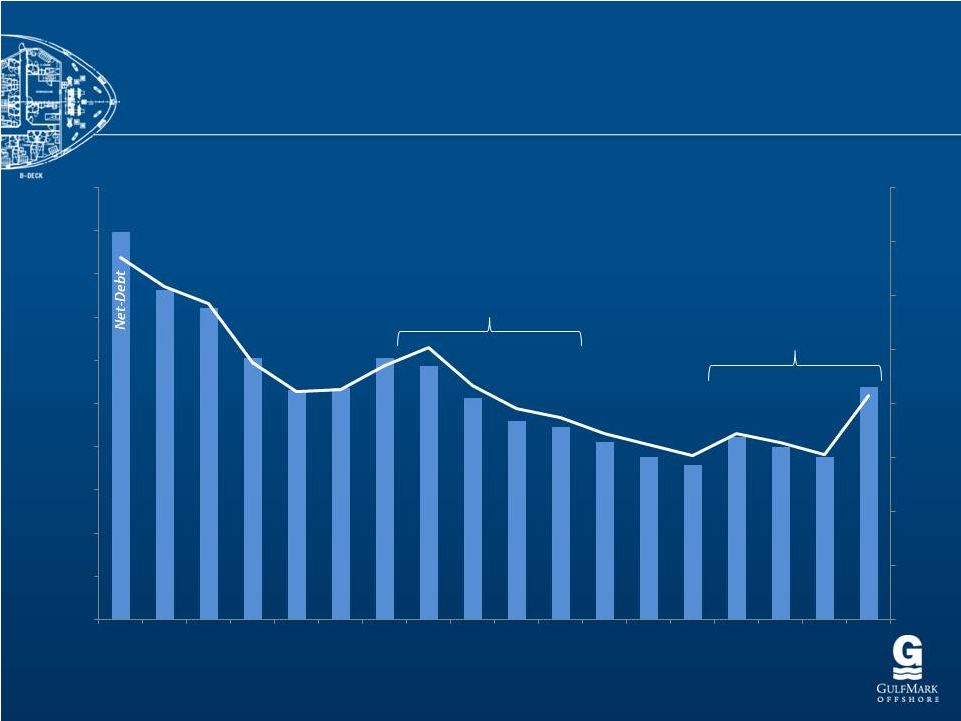

22

Net Debt Position

$500,000

$450,000

$400,000

$350,000

$300,000

$250,000

$200,000

$150,000

$100,000

$50,000

$0

Q3 2008

Q4 2008

Q1 2009

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

40%

35%

30%

25%

20%

15%

10%

5%

0%

Net-Debt to

Total Book

Capitalization

Finalization of Previous New-

Build Program

Initiation of Current

New-Build Program |

23

Investment Highlights

Industry Leaders in QHSE Performance & People Development

Global Presence and Diverse Operations Expertise

Financial Stability & Flexibility to Pursue Opportunities

Growth through Both Acquisition and New Construction

Young, Versatile, High-Specification Fleet |

Reconciliation of Adjusted EBITDA

24

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Net (loss) income

$24.0

$0.5

($4.6)

$38.4

$89.7

$99.0

$183.8

$50.6

($34.7)

$49.9

$19.3

Interest expense, net

10.9

12.8

17.0

18.4

14.4

4.8

12.8

19.9

20.7

21.6

22.9

Income tax (benefit)

3.0

0.2

(6.5)

3.4

3.0

30.2

11.7

(2.1)

(12.7)

4.7

2.7

Depreciation & Amortization

21.4

28.0

26.1

28.9

28.5

30.6

44.3

53.0

57.0

59.6

59.7

EBITDA

59.3

$

41.5

$

32.0

$

89.1

$

135.6

$

164.6

$

252.6

$

121.5

$

30.2

$

135.8

$

104.6

$

Adjustments:

Impairment

-

-

-

-

-

-

-

46.2

97.7

1.8

1.2

Debt refinancing costs

-

-

6.5

-

-

-

-

-

-

-

4.4

Accounting Change

-

-

7.3

-

-

-

-

-

-

-

-

Other

(2.5)

1.3

(1.5)

(0.5)

0.1

0.3

(1.6)

1.2

(0.1)

2.3

1.8

Adjusted EBITDA

$56.8

$42.8

$44.3

$88.6

$135.7

$164.9

$251.0

$168.8

$127.8

$139.9

$111.9

EBITDA is defined as net income (loss) before interest expense, net,

income tax provision, and depreciation and amortization, which includes impairment. Adjusted

EBITDA is calculated by adjusting EBITDA for certain items that we

believe are non-cash or unusual, consisting of: (i) loss from unconsolidated ventures; (ii) minority

interest;

and

(iii)

other

(income)

expense,

net.

EBITDA

and

Adjusted

EBITDA

are

not

measurements

of

financial

performance

under

GAAP

and

should

not

be

considered

as an alternative to cash flow data, a measure of liquidity or an

alternative to income from operations or net income as indicators of our operating performance or any other

measures of performance derived in accordance with GAAP. EBITDA and

Adjusted EBITDA are presented because we believe they are used by security analysts, investors

and other interested parties in the evaluation of companies in our

industry. However, since EBITDA and Adjusted EBITDA are not measurements determined in accordance

with GAAP and are thus susceptible to varying calculations, EBITDA and

Adjusted EBITDA as presented may not be comparable to other similarly titled measures of other

companies. |