Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DESTINATION XL GROUP, INC. | d508160d8k.htm |

1

Exhibit 99.1

Destination XL Group, Inc. |

Certain

information contained in this presentation, including, but not limited to, cash flows,

operating margins, store counts, earnings expectations for fiscal 2012 and estimates through

fiscal 2016, constitute forward-looking statements under the federal securities

laws. The discussion of forward-looking information requires management of the

Company to make certain estimates and assumptions regarding the Company's strategic

direction and the effect of such plans on the Company's financial results. Such

forward-looking statements are subject to various risks and uncertainties that

could cause actual results to differ materially from those indicated.

Such

risks

and

uncertainties

may

include,

but

are

not

limited

to:

the

failure

to

implement the Company's business plan for increased profitability and growth in the

Company's retail stores sales and direct-to-consumer business, the failure to achieve

improvement

in

the

Company's

competitive

position,

changes

in

or

miscalculation

of

fashion

trends, extreme or unseasonable weather conditions, economic downturns, a weakness in

overall

consumer

demand,

trade

and

security

restrictions

and

political

or

financial

instability

in

countries where goods are manufactured, increases in raw material costs from inflation and

other factors, the interruption of merchandise flow from the Company's distribution

facility, competitive pressures, and the adverse effects of natural disasters, war,

acts of terrorism or threats

of

either,

or

other

armed

conflict,

on

the

United

States

and

international

economies.

These, and other risks and uncertainties, are detailed in the Company's Annual Report on Form

10-K filed with the Securities and Exchange Commission for the fiscal year ended

February 2, 2013 filed on March 15, 2013 and other Company filings with the Securities

and Exchange Commission.

Destination

XL

Group,

Inc.

assumes

no

duty

to

update

or

revise

its

forward-

looking statements even if experience or future changes make it clear that any projected

results expressed or implied therein will not be realized.

2

Safe Harbor |

Who

is Destination XL Group, Inc.? 3

Largest multi-channel specialty

retailer in niche men’s big and

tall (B&T) market

Offering unique blend

of wardrobe solutions

Private label & leading

apparel name brands |

DXLG by the Numbers

4

Active customers

Enrolled in loyalty program

Highest rated retailer

in 2011 CSI

Customer Survey

Retail

Direct

Retail Stores

Brands

Customer

Satisfaction |

Who

is Our Customer? 5

Males with a waist size 40”

and

greater (40M men).

Determined by physical

characteristic, not demographic.

Not dependent on age, income,

race or nationality

Seeking greater selection in size.

Values convenience, selection

and fit over price. |

6

Our Current Casual Male XL Stores |

7

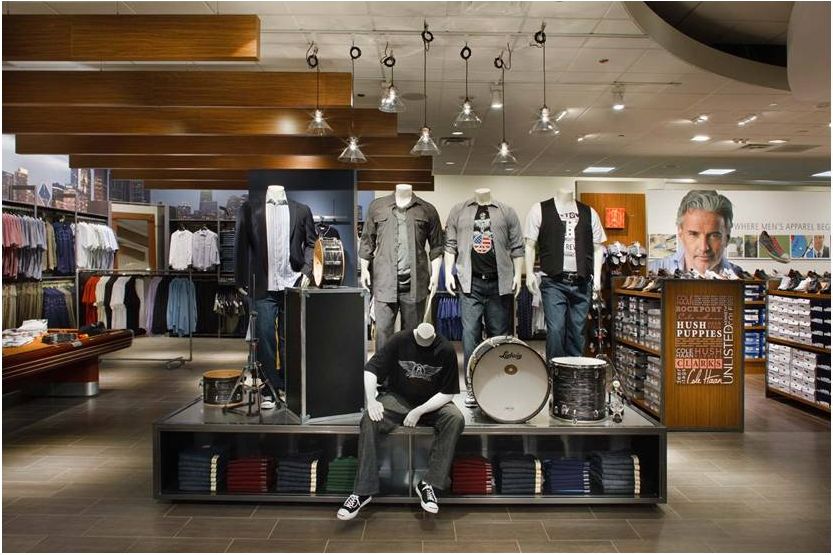

What Our Customer Wants

Large

changing

rooms

More brand

selections

On-site

tailoring

Bright

atmosphere

Suggested

wardrobe

solutions

Wide aisles

One-stop

shopping |

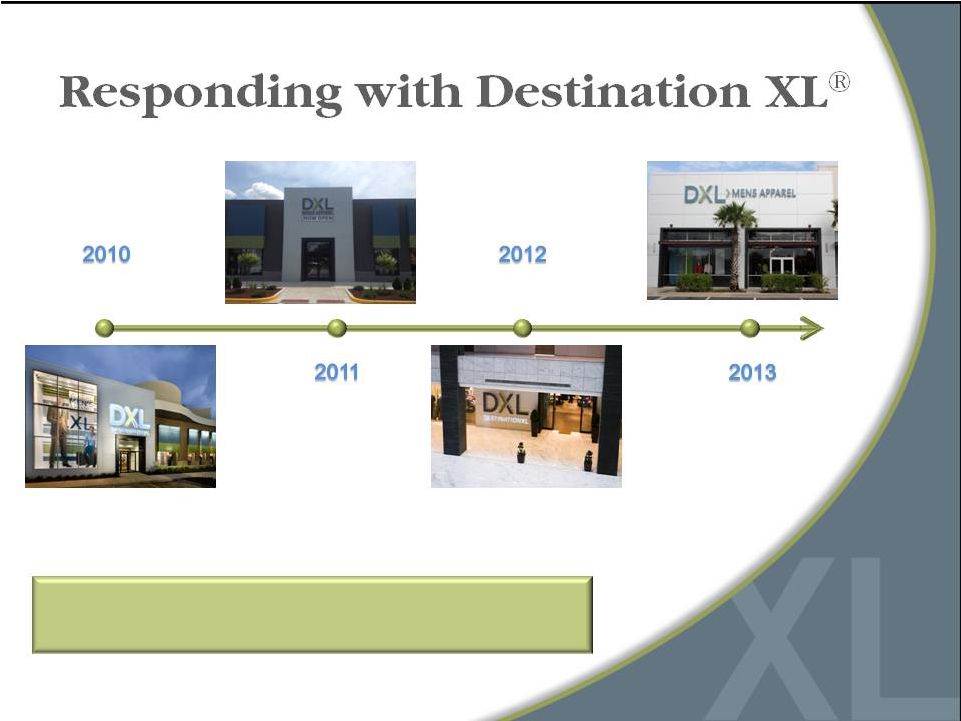

8

Opened 4 DXL

concept stores

Opened 32

DXL stores

Opened 12

DXL stores

Opportunity for accelerated growth and profitability

Expect to Open

~60 DXL stores |

9

*

*

*

* |

10

|

11

*

*

*

*

**** |

12

*

*

*

* |

13

* |

14

Large Selection of Name Brands |

15

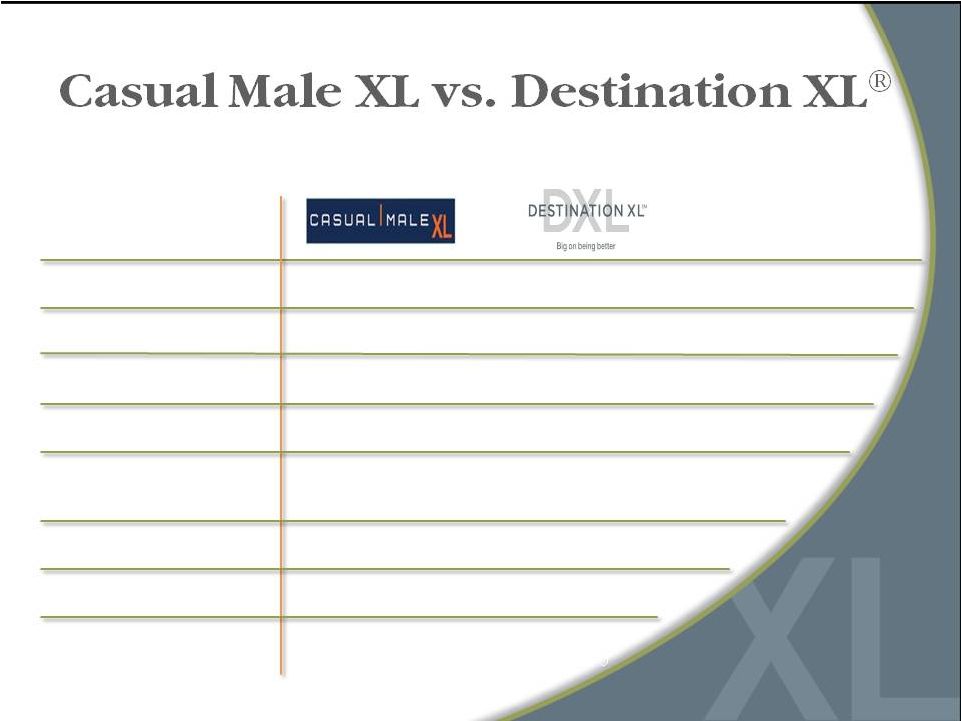

Average

Store size

3,600 sq. ft.

8,400 sq. ft.

Sales per sq. ft.

$172

$147 ($230 by 2016)

Build out costs

$50

$70

Occupancy costs

$30

$30

Dollars per

transaction

$97

$137

Style choices

600

2,000

Private label brands

10

15

Name brands

8

30 |

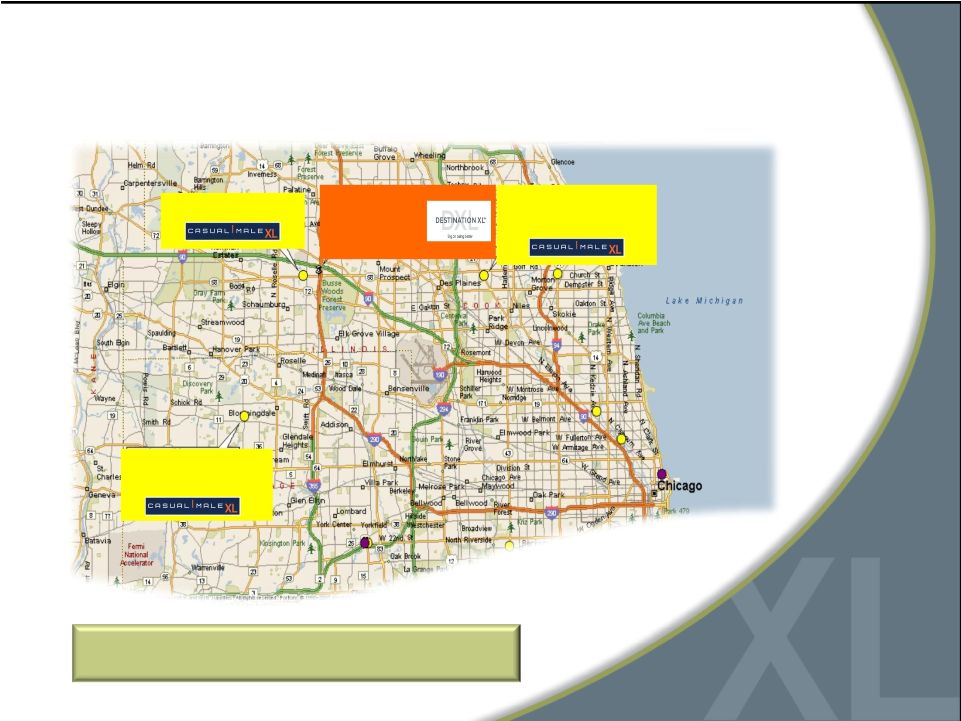

9451 Schaumburg, IL

9183 Niles, IL

11.4 miles

9512 Bloomingdale, IL

11.2 miles

Market Consolidation to DXL

Chicago Metro

Customers are willing to drive up to 20 miles

DXL

Schaumburg, IL

0.9 miles

16 |

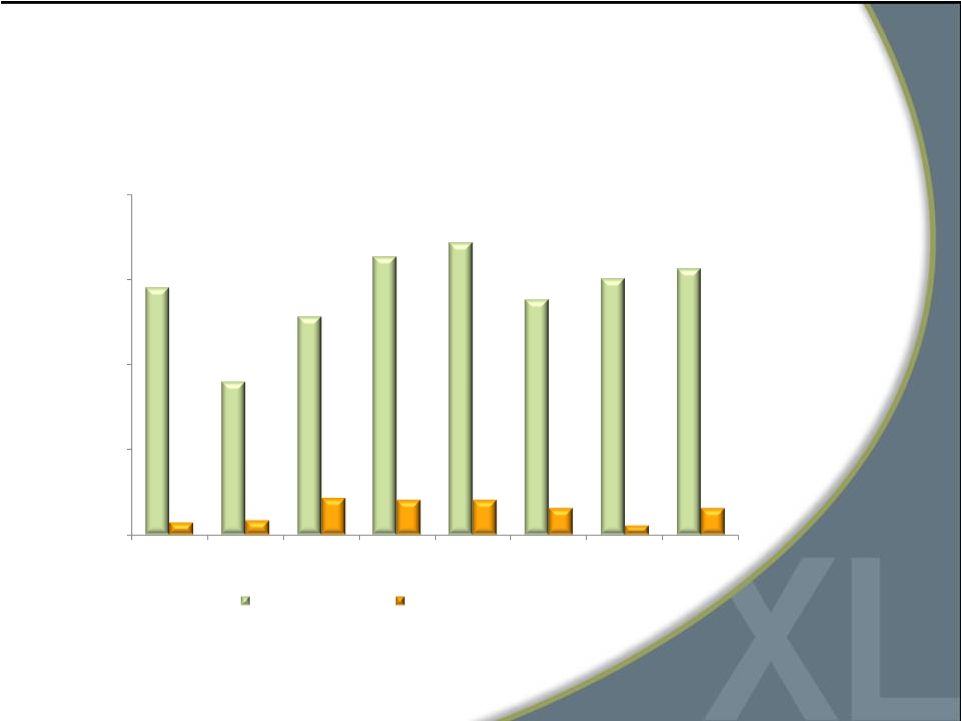

17

DXL Comps Reflect Growth Opportunity

** Total DXLG Comparables consist of all stores, including DXL stores and

direct channel

* The 16 DXL stores opened for more than 1 year produced a 7.6% comp in Q4

2012 20.0%

15.0%

10.0%

5.0%

0.0%

14.5%

0.7%

9.0%

0.8%

2.1%

2.0%

2.0%

1.5%

0.5%

1.5%

12.8%

16.3%

17.1%

13.8%

15.0%

*

15.6%

Q3 2011

Q4 2011

FY 2011

FY 2012

Q1 2012

Q2 2012

Q3 2012

Q4 2012

DXL Comparables

Total DXLG Comparables** |

18

Compelling DXL Returns

Expect greater store productivity

Better leveraging of expenses --

occupancy, labor productivity and

local/district management

Projecting higher 4-wall profits than

combined profits of individual stores

Targeting between 25%-30% store

operating margin

Potential to capture additional

market share

Attract new customers

Better cross-selling environment to

capture greater share of apparel

wallet from existing customers

Opportunity to improve

operating margins

Expect to increase margins

significantly after the transition to

DXL is complete

and profitability |

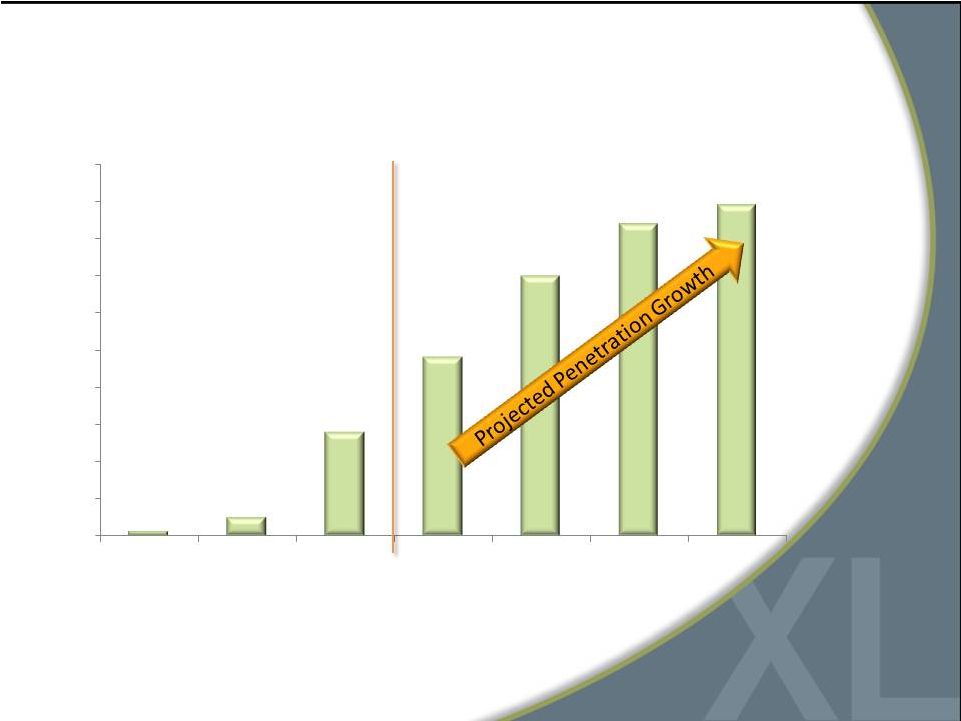

19

Accelerated DXL Openings

2015 Store Count Target

Destination XL

®

215-230

Casual Male XL

Outlet

~60

Rochester Clothing

3-4

Accelerated rollout based on

success of DXL stores in 2011

500

450

400

350

300

250

200

150

100

50

0

2010

2011

2012

2013

2014

2015

Total Stores:

(460)

(450) (412)

(348-358) (308-318) (283-298) |

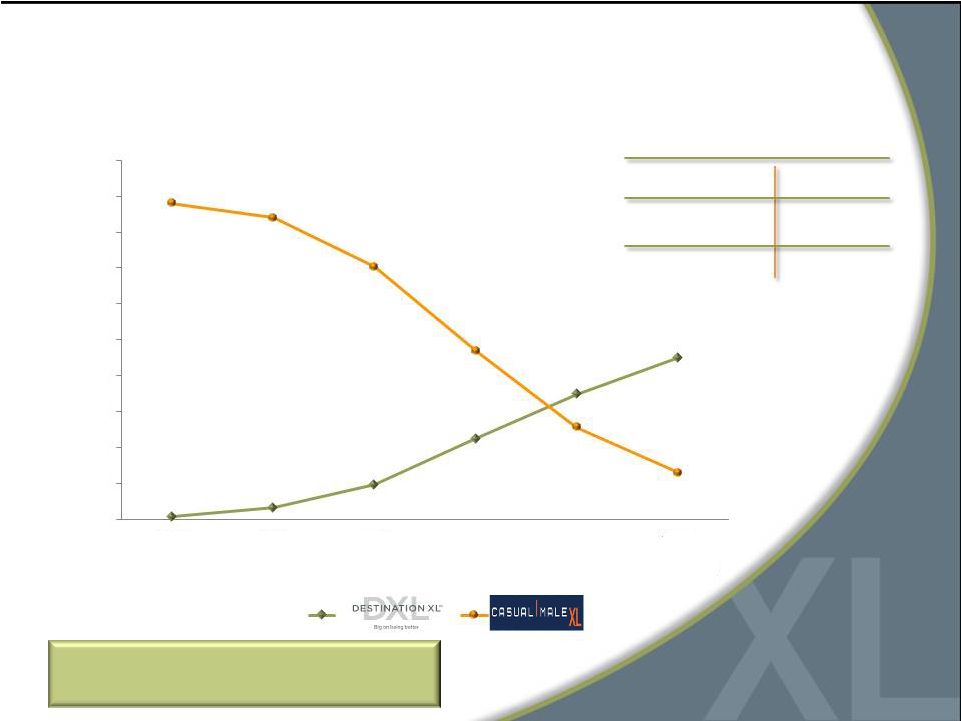

20

DXL Sales Increase as % of Total Revenue

* DXL sales include direct sales via the DestinationXL.com website.

2010

2011

2012

2013

2014

2015

2016

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1%

5%

28%

48%

70%

84%

89% |

21

2012

Opened

32

DXL

stores

/

Closed

70

stores

Operating

margins

were

approximately

3.5%

CapEx

was

$32.4M

Accelerated Rollout of DXL |

22

2013

Open

57-

64

DXL

stores

/

Close

110-119

stores

Sales

of

$415

-

$420M

Expected

borrowing

level

of

$10

-

$15M

at

year

end

Commence

new

marketing

strategy

with

incremental

$10M

spend

Lease

exit

and

asset

impairment

charges

in

the

range

of

$3-$4M

Operating

margins

of

~

breakeven

to

0.5%

CapEx

expected

to

peak

at

$45M

2014

Open

60

DXL

stores

/

Close

99

stores

Annual

sales

growth

of

~

10%

-

15%

Expected

borrowing

level

of

$10

-

$15M

at

year

end

Lease

exit

and

asset

impairment

charges

in

the

range

of

$3-$4M

Operating

margins

of

~4%

CapEx

expected

to

be

$40M

Accelerated Rollout of DXL

1

Net of subleases

2

Net of expected tenant allowances

1

2

1 |

23

2015

Complete

rollout

with

215

-

230

opened

DXL

stores

and

Closure

of

remaining

63

Casual

Male

XL

anchor

stores

Annual

sales

growth

of

~10%

–

15%

Operating margins gain traction and increase to ~8%

(from 4.2% in ‘11)

Expected

ending

cash

balance

of

$5

-

$10M

CapEx

expected

to

be

approximately

$38M

Lease exit and asset impairment charges in the range

of $2-$3M

Accelerated Rollout of DXL

1

Net of subleases

2

Net of expected tenant allowances

1

2 |

24

2016

Full

benefit

of

DXL

concept

drives

revenue

>$600M

Open

average

of

10

DXL

stores

per

year

Operating

margins

>10%

Accelerated Rollout of DXL

Generating

free

cash

flow

in

the

range

of

$60

-

$70M

|

25

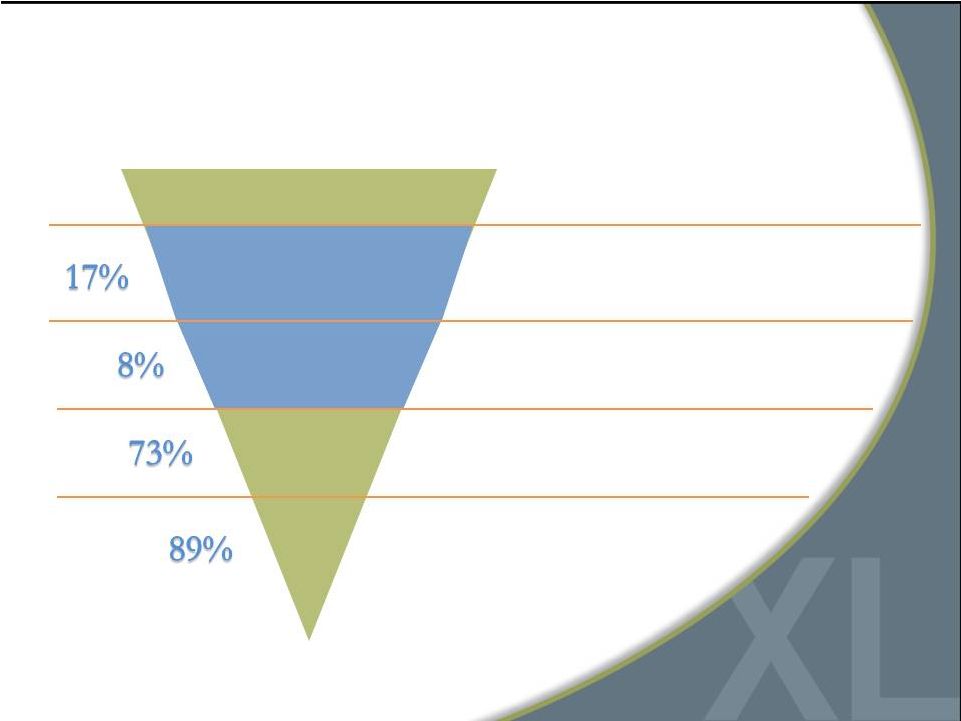

Increased Awareness = Opportunity

DXL Customer Purchase Funnel*

Addressable Population

Aware of DXL

Visiting DXL

Purchasing

from DXL

Repeat

DXL’s

addressable

market

is

primarily

men

with

over

40”

waist

Awareness of DXL is low across its markets, directly impacting

ability to attract new customers

Of those aware of DXL, only 8% are visiting the store

73% of those that visit the store make a purchase

89% of those that make a purchase

intend to return

*Based on consumers’

stated responses per L.E.K’s survey within DXL markets

Source: L.E.K analysis |

26

Grow direct

business with new website

Paradigm shift in marketing improves awareness

Target “end-of-rack”

customers

Attract

a

broader

customer

audience

with

one-stop-shop

Capture greater wallet share with DXL concept

Opportunity to Grow Market Share

Addressable Market = 40M Customers

1.5M Currently Active Customers

Goal = Grow Customers by 40% Over 3 Years |

27

Increased awareness by 100%

in new markets & 38% in

established markets

“End-of-rack”

customer

base grew by 38%

Launched test campaign in 5 markets:

Memphis, Minneapolis, Denver, Atlanta and Oklahoma City

Built Stronger Brand

to Attract and Serve

Customers

Results Demonstrate

Ability to Grow

Market Share |

28

Established Effective Marketing Mix

15% sales

24% traffic

64% new customer purchases

84% web traffic

7% web sales

38% market awareness

Established Market

Memphis DXL Opened in 2010

6-Week Test Demonstrated TV, Radio and Digital is

Most Effective Marketing Combination |

29

DXL Test TV Commercial

Marketing to Customers in “No Man’s Land”

|

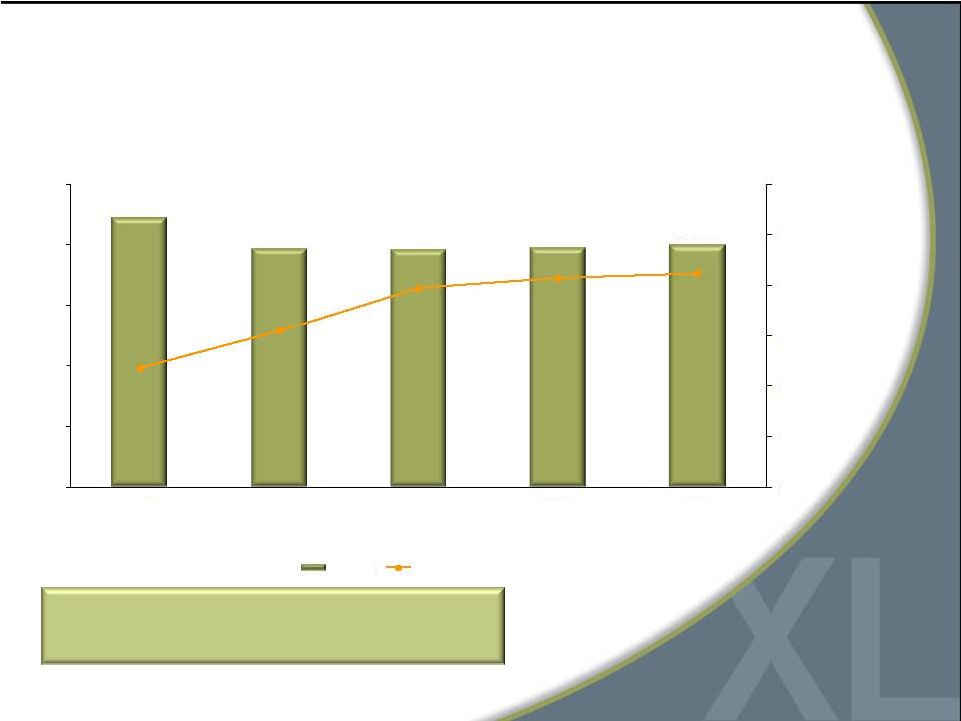

•

Increase marketing spend as percent of sales from 4.6% to 6.7%

•

Launch national DXL Media marketing campaign in spring 2013

2013 Marketing Spend

$M

Total 50% Increase YOY

to Drive DXL Awareness

30

DXL Media

Direct

Digital

Visual

Loyalty

Other

2012

2013

0

10

20 |

Financial Performance

31 |

Q4

2012 Results •

Comparable sales increased 0.5% and total sales were $114.9M

•

DXL stores represented 18% of comparable retail sales

•

Comp sales for Casual Male XL stores decreased 2.3%

•

U.S. direct e-commerce sales increased 13%

•

Income from continuing operations was $4.2 million,

or $0.09 per diluted share

32 |

33

Sales and Gross Margin

Strong gross margins provide opportunity for

significant sales leverage

Revenue ($ mm)

$500

$400

$300

$200

$100

$0

2008

2009

2010

2011

2012

$443.9

$393.9

$392.0

$395.9

$399.6

42.7%

44.2%

45.9%

46.3%

46.5%

50%

48%

46%

44%

42%

40%

38%

Revenue

Gross Margin |

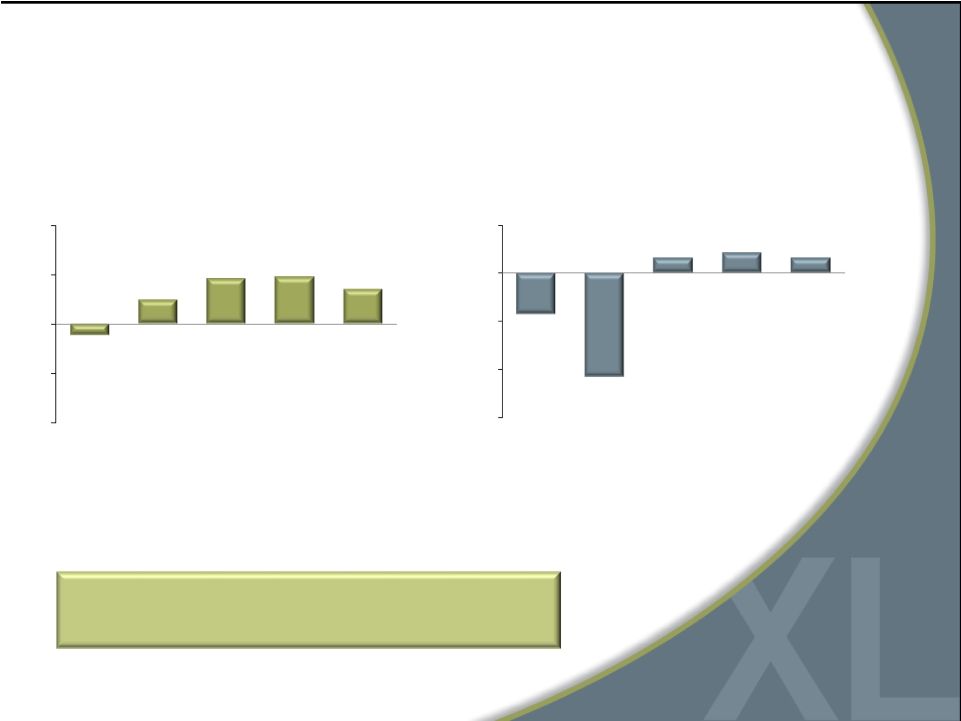

34

* Before impairment charge of $23.1m

Operating Margin & Comparable Sales

(continuing operations)

Focus on improving operating margins

through greater DXL sales

CMRG Annual Historic Operating Margin

10%

(10%)

(5%)

5%

0%

2008

2009

2010

2011*

2012

5%

(15%)

(10%)

0%

(5%)

2008

2009

2010

2011

2012

CMRG Historical Annual Comp Sales

2.4%

4.6%

4.7%

3.5%

(1.1)%

(10.8)%

1.5%

2.1%

1.5%

(4.3)% |

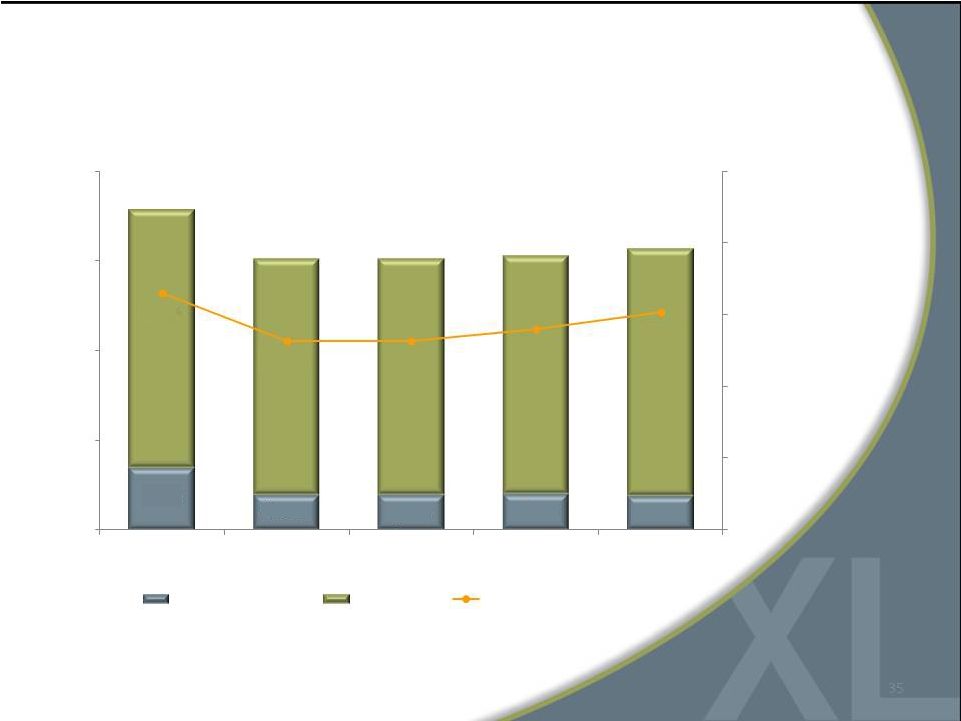

35

Strict Expense Management

39.9%

37.9%

37.9%

38.4%

39.1%

($ mm)

Marketing Expense

Total SG&A

SG&A as a Percentage of Sales

$0

$50

$100

$150

$200

$177.3

$149.2

$148.4

$152.0

$156.4

30%

33%

36%

39%

42%

45%

2008

2009

2010

2011

2012

$34.1

$19.1

$19.0

$19.6

$18.5 |

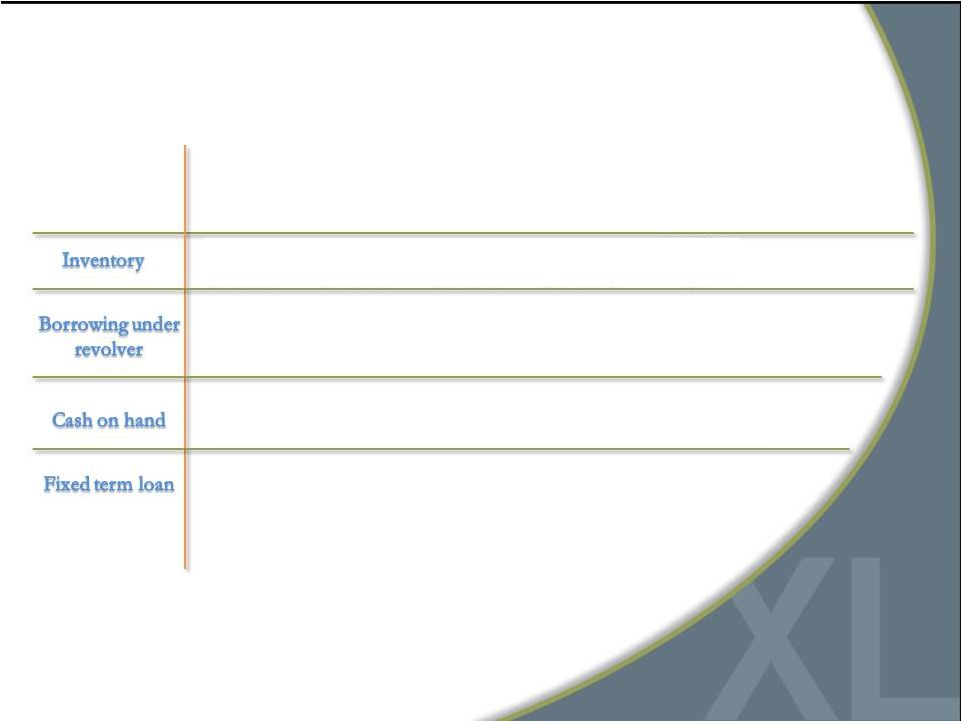

2008

2009

2010

2011

2012

$98.6M

$90.0M

$92.9M

$104.2M

$104.2M

$38.7M

$3.5M

$0

$0

$0

$5.0

$4.3

$4.1M

$10.4M

$8.2M

$12.5M

$7.6M

$0

$0

$0

36

Strong Debt-Free Balance Sheet |

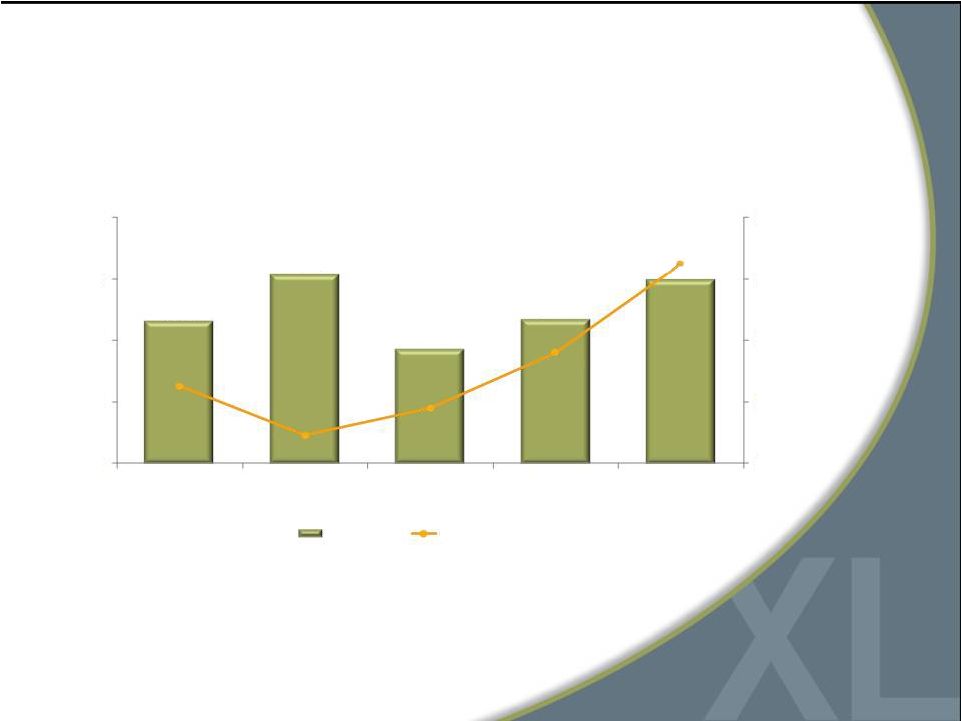

37

Cash Flow and Capital Expenditures

$40

$30

$20

$10

$0

$23.2

$30.8

$7.6

$23.4

$29.9

$32.4

$40

$30

$20

$10

$0

2008

2009

2010

2011

2012

($ mm)

CAPEX

Cash Flow

$12.6

$4.6

$9.0

$18.0 |

38

Why Invest in DXLG?

Accelerated conversion to DXL

concept creates compelling

investment opportunity

Strong gross margins; Ability

to greatly improve operating

margins

Significant market share/sales

growth opportunity

Leader in large and growing

B&T

market

Three-year $150M investment

in DXL rollout to be funded

primarily by free cash flow

and deferred tax benefits

Strong balance sheet

with borrowing capacity |

For additional information:

Jeffrey Unger

Destination XL Group, Inc.

V. P. Investor Relations

561-482-9715 Office

561-543-9806 Cell

jeffunger@usa.net

www.destinationxl.com

39 |