Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Summer Infant, Inc. | a13-1145_48k.htm |

Exhibit 99.1

|

|

March 2013 Investor Presentation 25th Annual ROTH Conference March 19, 2013 |

|

|

Slide Show Presentation Recipients of the Slide Show and other interested persons are advised to read all reports and other filings made by Summer with the Securities and Exchange Commission under the Securities Act of 1933, as amended, and Securities Exchange Act of 1934, as amended, including, but not limited to, Summer’s Annual Report on Form 10-K for the year ended December 31, 2012. You can obtain a copy of any of these filings, without charge, by directing a request to Summer Infant, Inc., 1275 Park East Drive, Woonsocket RI 02895, or on the Internet at the SEC’s website, www.sec.gov. Use of Non-GAAP Financial Information This presentation includes certain financial information not derived in accordance with generally accepted accounting principles (“GAAP”). This presentation includes references to EBITDA, which is defined as income before interest and taxes plus depreciation, amortization, deal-related fees and non-cash stock option expense. Summer believes that the presentation of this non-GAAP measure provides information that is useful to investors as it indicates more clearly the ability of Summer’s assets to generate cash sufficient to pay interest on its indebtedness, meet capital expenditure and working capital requirements and otherwise meet its obligations as they become due. The presentation of this additional information should not be considered in isolation or as a substitute for results prepared in accordance with GAAP. Summer has included a reconciliation of this information to the most comparable GAAP measures in its filings with the Securities and Exchange Commission. 2 |

|

|

Certain statements in this presentation that are not historical fact may be deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and Summer intends that such forward-looking statements be subject to the safe harbor created thereby. Such forward-looking statements include statements regarding the market position of Summer; the growth prospects of Summer; anticipated sales and operating results; the development of new products; demand for cautions that these statements are qualified by important factors that could cause actual results to differ materially from those reflected by such forward-looking statements. Such factors include the concentration of Summer’s business with retail customers; the ability of Summer to compete in its industry; Summer’s dependence on key personnel; Summer’s reliance on foreign suppliers; the costs associated with pursuing and integrating strategic acquisitions; the costs associated with protecting intellectual property; and other risks as detailed in Summer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, and subsequent filings with the Securities and Exchange Commission. The information contained in this presentation is accurate as of the date set forth on the cover page. Summer assumes no obligation to update the information contained in this presentation. Safe Harbor 3 |

|

|

Designer, marketer, and distributor of branded juvenile health, safety and wellness products for babies and toddlers aged 0 3, sold principally to large North American and UK retailers Company Snapshot Product Innovation & Customer Relationships Drive Summer Infant’s Success 4 |

|

|

Key Strategies to Return to Profitable Growth Launch Innovative Products Build Core Brands Execute Operational Excellence Diversify Customer Base 5 |

|

|

Launching Innovative Products Driving product differentiation for retail partners Providing “good-better-best” price points Leveraging solidified development team Planning significant new product launches throughout 2013 Focused on core product categories Using Innovation to Win at Retail with Better Selling, Higher Margin Products 6 |

|

|

Launching Innovative Products Monitors Feeding Peek plus Internet baby monitor system 5-star review on Babiesrus.com 2nd Generation Expected 2H 2013 Platform-based innovation Creating calm natural experiences between mom & baby Tru-Clean Sterilizing System All-in-one design 7 |

|

|

Launching Innovative Products Bath Gear Lil’ Luxuries Baby Bath Quiet, motorized water jet for spa effect Differentiation for retail customers Fuze Travel System with Prodigy Car Seat Award-winning car seat, lightweight European-inspired stroller, innovative modular design Bentwood Collection-Bassinet & High Chair Northern European-inspired design American functionality 8 |

|

|

Launching Innovative Products Furniture Nursery Bryant Simple Adjust Innovation in safety Symphony Bassinet/Crib Innovation in space & value Resting Up napper Insight-based innovation focused on trends SwaddleMe Stages Fashion & function driving multiple purchases 9 |

|

|

Building Brands Centered on core brands Concluding license agreements Hired Chief Marketing Officer Focus on first-time prenatal mom Expanded digital presence New e-commerce platform to support consumer relations Brand-specific marketing Public relations Pediatricians & celebrity endorsers Social media 10 |

|

|

2012 2015 goal Diversifying Customer Base 15% International Sales % of Total 20% Product differentiation by channel Leverage retail relationships and distributors in Canada, UK and Australia Grow with customers globally TRU, Walmart, Target and Mothercare International Target new customers in attractive markets Expand small- to mid-size customer base 11 |

|

|

Leveraging Customer Relationships Strategic relationships with key US, Canadian & UK retailers Buying decisions made mid-year for next calendar year Working together to develop product solutions Providing differentiation for greater channel penetration 12 |

|

|

Executing Operational Excellence Ending license programs with Carter’s and Disney to reduce royalty expenses Product line SKU rationalization Down 54% from 2,400 in January 2012 to 1,100 active SKUs in March 2013 Anticipate additional 20 25% reduction in 2013 Direct Import program Significantly shorter delivery times All major customers will be converted by end of 2013 Closed PA facility, consolidated “overflow” warehouse in CA; consolidating France warehouse into UK Reduce G&A expenses by 10% YOY in 2013 13 |

|

|

US birth rate predicted to increase 2.6% in 2013 after low birth rates for several years Industry is estimated to be $12 billion worldwide Consumer focus on quality, safety, innovation and style Strong retailer commitment to juvenile category due to halo effect Market Dynamics Poised to Capitalize on Positive Market Trends 14 |

|

|

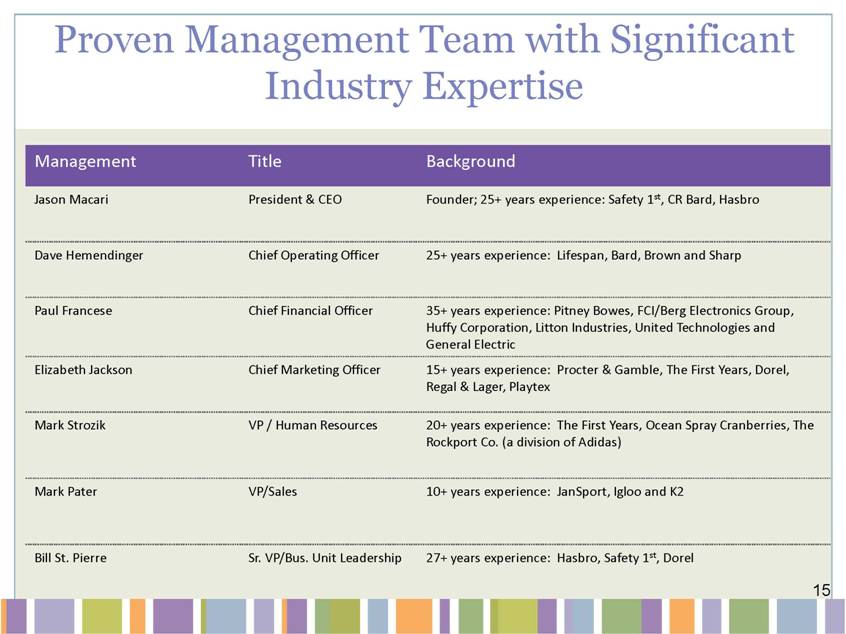

Proven Management Team with Significant Industry Expertise Management Title Background Jason Macari President & CEO Founder; 25+ years experience: Safety 1st, CR Bard, Hasbro Dave Hemendinger Chief Operating Officer 25+ years experience: Lifespan, Bard, Brown and Sharp Paul Francese Chief Financial Officer 35+ years experience: Pitney Bowes, FCI/Berg Electronics Group, Huffy Corporation, Litton Industries, United Technologies and General Electric Elizabeth Jackson Chief Marketing Officer 15+ years experience: Procter & Gamble, The First Years, Dorel, Regal & Lager, Playtex Mark Strozik VP / Human Resources 20+ years experience: The First Years, Ocean Spray Cranberries, The Rockport Co. (a division of Adidas) Mark Pater VP/Sales 10+ years experience: JanSport, Igloo and K2 Bill St. Pierre Sr. VP/Bus. Unit Leadership 27+ years experience: Hasbro, Safety 1st, Dorel 15 |

|

|

Financial Highlights 16 |

|

|

Financial Priorities G&A Reduction Selling Expense Control Strong Working Capital Mgmt. 17 |

|

|

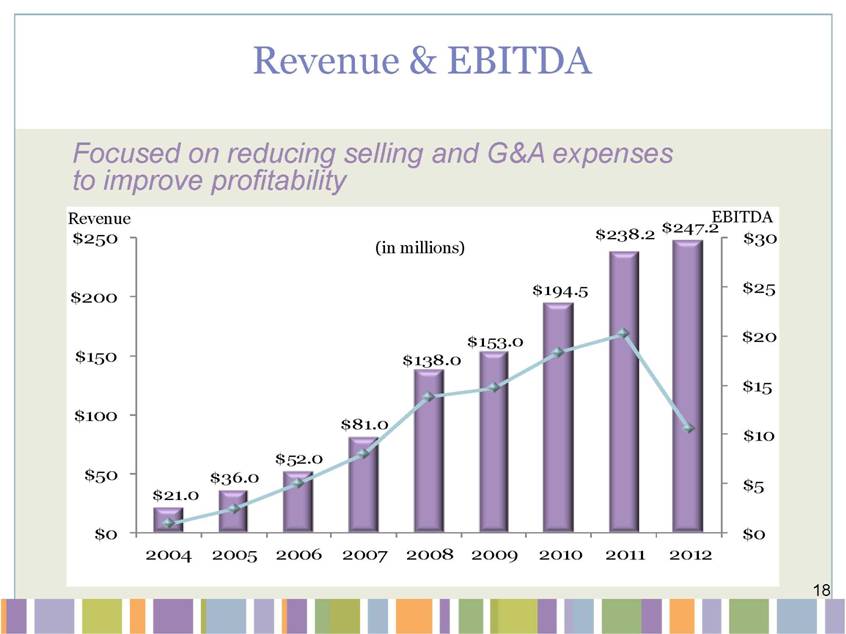

$21.0 $36.0 $52.0 $81.0 $138.0 $153.0 $194.5 $238.2 $247.2 $0 $5 $10 $15 $20 $25 $30 $0 $50 $100 $150 $200 $250 2004 2005 2006 2007 2008 2009 2010 2011 2012 Revenue & EBITDA (in millions) Focused on reducing selling and G&A expenses to improve profitability Revenue EBITDA 18 |

|

|

Capitalization Successfully refinanced credit facility in February 2013 Secured $80 million asset-based loan supported by inventory and receivable assets Entered into $15 million term loan 19 |

|

|

Working Capital Management Extending payment terms with majority of suppliers Shortening customer payment terms Increasing direct import programs Implementing integrated ordering process Improving cash position Cost containment initiatives Price increases Tighter controls over promotional costs 20 |

|

|

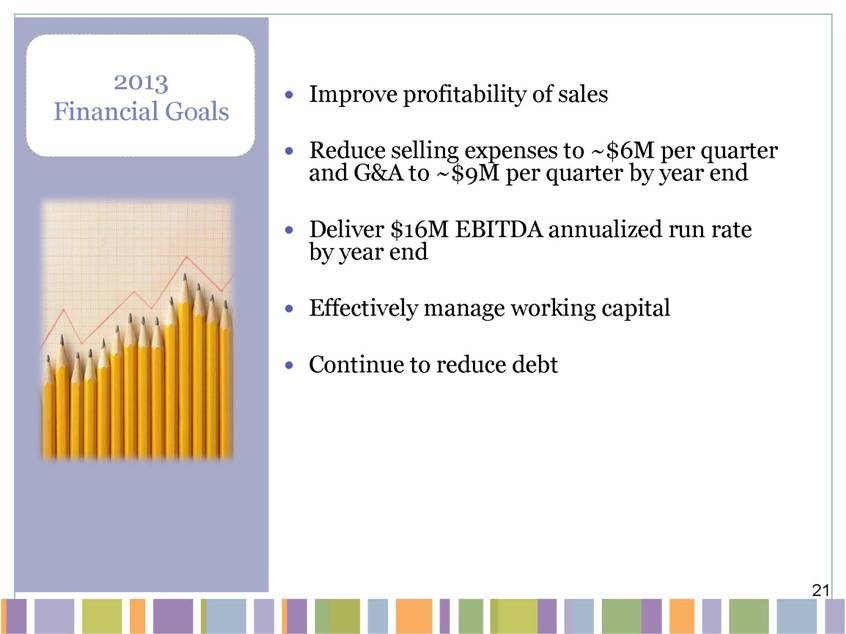

2013 Financial Goals Improve profitability of sales Reduce selling expenses to ~$6M per quarter and G&A to ~$9M per quarter by year end Deliver $16M EBITDA annualized run rate by year end Effectively manage working capital Continue to reduce debt 21 |

|

|

Key Strategies to Return to Profitable Growth Launch Innovative Products Build Core Brands Execute Operational Excellence Diversify Customer Base 22 |