Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SCHLUMBERGER LIMITED/NV | d502401d8k.htm |

Exhibit 99

Thank you and good morning ladies and gentlemen. I would like to start by thanking Howard Weil and Bill Sanchez in particular for the invitation to speak at this conference.

Today I would like to cover three main subjects. First, I will discuss the outlook for our industry against the backdrop of the global economic environment. Second, I will review our recent financial results in terms of both growth and margins. And third, I will look closer at the main growth markets for our business in 2013 and how we are positioned there.

In doing so, I will aim to show you that our industry will continue to offer very good growth opportunities. And that Schlumberger, with our unmatched technology offering, integration capabilities, and international leverage is in a unique position to outperform the market in both growth and returns over the coming years.

But before we start, let’s get the formalities out of the way. Some of the following statements are forward-looking. Actual results may differ materially. Please see our most recent Form 10-K filed with the SEC.

With that let’s look at the industry fundamentals.

1

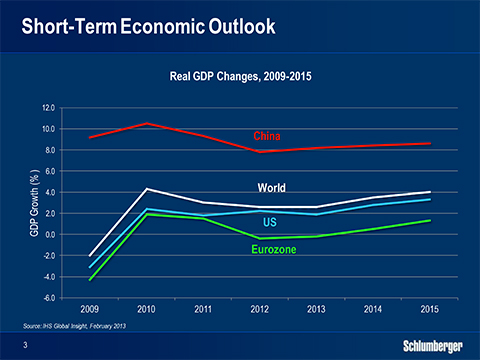

For the past four years the global economy has faced continued uncertainty. Compared to the environment one year ago when the risk of a global double-dip recession was still significant, the macro-economic outlook now seems to offer more positive news. The Chinese economy is improving with growth having accelerated for several quarters in a row, supported by strong domestic demand and reviving exports.

In the U.S., recovery in the housing market seems imminent, and relatively encouraging employment data could be announcing a faster recovery. The situation has become brighter in the Eurozone as political agreements are reached and investment flows begin to return. In line with this view, forecasters expect the global economy to grow at around 2.5% in 2013, similar to what we saw in 2012.

So in summary, while the global economic growth is still facing uncertainty, recent data as well as sentiments are showing positive signs.

2

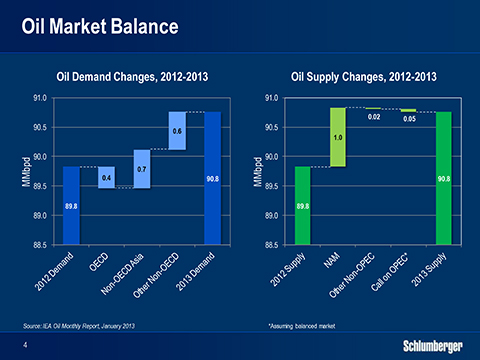

Based on this macro-economic outlook, supply and demand in the oil market in 2013 are expected to be similar to what we saw last year. Demand is forecast to increase by around 1%, or about 900,000 bopd, driven by the non-OECD economies in general.

China will account for almost half of the net global year-on-year increase, while demand in the OECD economies will continue the declining trend that began in 2005. On the supply side, the continuing surge in North American output from light tight oil will by itself be almost equal to the global demand increase.

Outside North America, several non-OPEC countries show disappointing production trends with their output dropping year-on-year as a result of project delays and challenges in overcoming production decline. This will leave the call on OPEC production almost unchanged at a level above the group’s production target of 30 mbopd.

As a result the oil market is expected to remain tight and this will continue to support oil prices in the band that we have now seen since 2011.

3

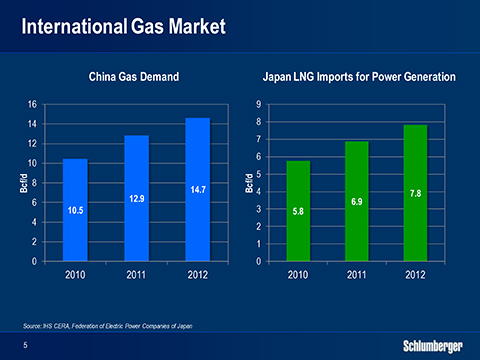

The gas markets continue to follow quite separate trends.

In the international markets, the combination of strong demand growth in China and Japan have pushed LNG prices in the region close to oil parity, and will continue to support them as limited additional LNG capacity is expected to come on line in the coming year.

In the European market, lower demand has been offset by declining regional supply and by competition with Asia for LNG cargoes. European spot prices have therefore increased over the past few months.

4

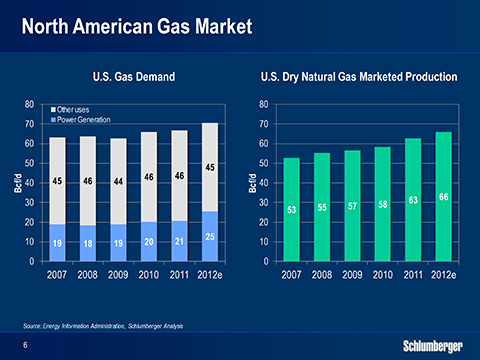

The North American gas market offers a very different picture.

In spite of reduced drilling activity in the dry gas basins U.S. gas production has continued to grow and is now 25% higher than 5 years ago, driven largely by higher demand from the power producers.

The fact that electricity generation can relatively easily switch back to coal if natural gas prices rise significantly, will likely cap both prices and dry-gas-related drilling activity in the short term, unless there is an unexpected softening of existing production levels.

5

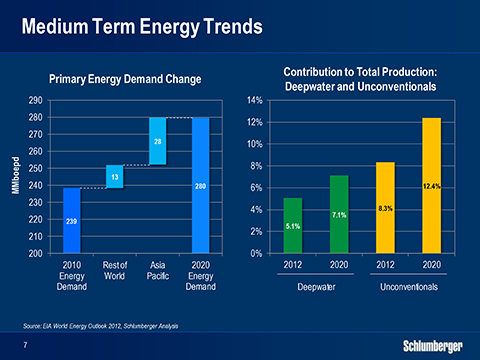

Looking further ahead, primary energy demand will continue to grow throughout the current decade, driven by continuing growth in the developing countries with Asia-Pacific representing the largest share of the increase. To meet this demand, unconventional and deepwater resources will continue to gain importance.

For unconventional resources, North America will remain the center of activity with light tight oil being the primary objective. In the international unconventional plays, the short-term focus will still be on pilot projects but activity and production will likely start to become more meaningful in the second half of this decade.

The production from deepwater fields will continue to grow as the successful exploration activities of recent years lead to a new development cycle. Central to the deepwater cycle will be the drive towards increased recovery through more sophisticated subsea developments involving closer integration between reservoir, wells and a complete subsea processing plant.

Overall, we expect well-related capex and opex to grow steadily throughout the decade driven by exploration, new developments and higher investments to offset mature production decline.

In this environment, our customers are likely to further elevate their focus on reducing finding, development and lifting costs. We believe this will lead them to re-assess how they can better utilize the capabilities of the leading service companies.

6

Over the past decade, the prevailing operator approach towards the service industry has been procurement-driven, engaging a multitude of fragmented providers and generally selecting suppliers based on the lowest price.

We expect this direction, which puts the entire integration responsibility on the E&P companies and rarely delivers the lowest total cost, to gradually be replaced by a more progressive approach targeting a completely new level of system optimization and integration that unlocks significant trapped value in the currently sub-optimized E&P value chain.

We are already seeing an emerging trend where our key customers are seeking much closer partnerships with us. This includes more collaborative problem solving utilizing our complementary expertise and further leveraging our wide technology offering, integration capabilities, and global footprint.

We expect this trend to strengthen in the coming years favoring broad integrators like Schlumberger over players with narrower offerings technical capabilities and geographical reach.

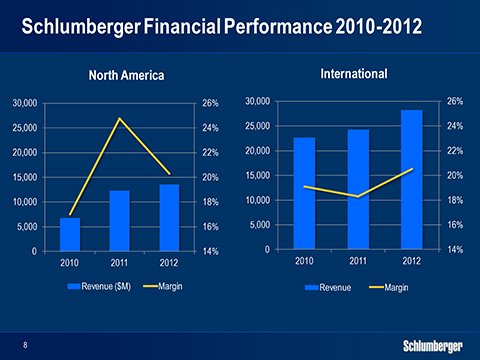

Switching back to the present, I would now like to briefly review our recent financial results before I talk about our 2013 growth prospects.

7

Looking at our financial results over the past three years, we have grown EPS by an average of 17% per year in spite of our two main markets showing very different behavior. In North America, we undertook a fundamental restructuring of our land business in 2010, which has translated into significantly stronger relative performance versus our competitors, as seen by our 2012 margin performance in particular.

The leverage we have towards the US Gulf of Mexico and the balance of our offering on land following the Smith transaction clearly contribute to these results. However the intrinsic performance of our pressure pumping business still represents a major driver for our improved North American results.

In the international markets, we have seen steady growth in activity over the past three years while margins in 2010 and 2011 remained challenged due to a range of market factors. In 2012 however, we saw more technology sell-up as well as early signs of moderate price improvements on smaller contracts.

This, combined with strong focus on execution and cost management, allowed us to grow revenue by 16% on the back of an 8% growth in rig activity. At the same time, operating income grew 31% while margins were up 230 basis points. Going forward we aim to build on the positive momentum we have created in both the North American and international parts of our business.

8

I would now like to take a closer look at some of the main growth drivers for Schlumberger in 2013, namely the Middle East, Russia, Sub-Saharan Africa and China. For each of these markets I will highlight how we have established clear leadership positions through targeted strategies and long-term investments, and how this has created a platform for sustainable outperformance going forward.

So let’s start off with the Middle East.

9

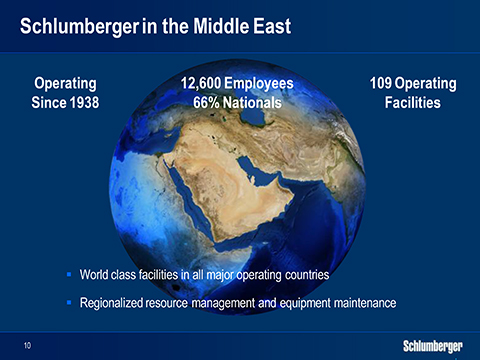

The Middle East has played a central role in our industry, and for Schlumberger for more than 70 years, holding nearly half of the world’s oil reserves and practically all of the world’s spare oil production capacity.

Looking at our set-up in the region, we have a longstanding relationship with all the major customers. We have systematically recruited and built a local workforce over the past 30 years, today counting over 12,000 employees with more than 65% of them being from the region. Our homegrown Middle Eastern nationals are also progressing well in the management ranks, holding 60% of the top 30 management positions within the region as well as 25% of the top 30 management positions globally.

In terms of infrastructure, we have consistently invested in our business and today have world-class facilities in all the major Middle Eastern countries. In addition, we have established a regional transportation network run from the UAE that manages all our shipments into the Middle East as well as within the region.

We also have ongoing projects aimed at centralizing asset and materials management as well as repair and maintenance. This will allow us to further improve asset utilization and reduce working capital by taking advantage of the import and export agreements between the GCC countries.

10

Turning to the 2013 activity outlook, we expect strong growth in most of the Middle Eastern countries driven by higher spend in both exploration and development activities. In addition, a number of key contract wins in 2012 will contribute positively to our market share in 2013.

11

Our largest operation in the region is by far Saudi Arabia where activity is driven by the continuous development of the country’s large oil production base and by the growing domestic demand for natural gas.

The rig count in the Kingdom has grown steadily over the past year and is set to reach around 170 rigs by the end of 2013. On land, the focus continues to be on conventional oil and gas developments and on management of mature production. Exploration for unconventional gas has started, but is still limited to smaller pilot projects. Offshore operations are moving into deepwater areas following last year’s conventional gas discovery in the Red Sea.

Schlumberger has been operating in Saudi Arabia since 1941. In 2010 we opened one of our largest operational facilities in the world in Al-Khobar. This together with facilities in Udhailiyah and Dhahran provides a strong infrastructure platform to service all the oil and gas fields in the country.

In addition to ongoing operations involving most of our 16 product lines, we have owned a 49% stake in the Arabian Drilling Company since 1971. This joint venture operates more than 20 high-performance drilling rigs in the Kingdom on a variety of projects both offshore and on land.

12

Saudi Arabia is also home to one of six Schlumberger research centers. Our decision to open this center in 2006 was based on the need to address regional technical challenges as well as our desire to establish research facilities in locations close to our customers. The center is staffed by 28 scientists and engineers, including a growing number of Saudi nationals, and has filed more than 100 patents since 2006.

Our longstanding relationship with Saudi Aramco and our continuous investment in people, technology, infrastructure and local Research and Development (R&D) puts us in a prime position to capitalize on the significant growth potential in Saudi Arabia.

13

Within the Middle East, Iraq is another very fast growing market for us. We first started operations in Iraq in the late 1930s and continued up until the early 1990s. In spite of being shut down for the past two decades, we continued to recruit Iraqi talent into our global operations and we also maintained our business network in the country. This allowed us to rapidly deploy a very capable operations team with the required local knowledge when we re-entered the country in late 2009. This team quickly built the needed infrastructure while carefully managing the security, contractual and operational risks in this very challenging market.

Our base in Rumaila, opened in 2010, is now hosting most of our 16 product lines and is staffed by almost 1,000 engineers, operators, technical specialists and petrotechnical experts, of whom more than 35% are Iraqis. We operate 16 rigs under integrated project management and integrated services contracts, and we work for the majority of the operators in the country.

Our world-class maintenance facility provides a strong operational foundation and enables us to provide call-out services on rigs where our competitors are unable to perform. With our market share gains over the past year, we expect to generate more than $600 million revenue in Iraq in 2013 with good profitability.

14

Turning now to Russia, the continued growth in activity in this region is driven by a strong focus on maintaining oil production at current levels, further supported by a range of tax incentives to stimulate E&P investment.

In 2013, we expect solid growth both offshore in Sakhalin and the Caspian Sea as well as on land in Timano-Pechora and Western Siberia. In addition, we see strong growth in the Yamal region where we were awarded all services for the first integrated Arctic project. We also continue to be active with marine seismic surveys in the Kara Sea. A large part of the 2013 activity will be focused on the development and management of mature production but we also see continued exploration work on land in East Siberia and Yamal, and offshore in the Black, Baltic and Barents Seas.

Since our return to Russia in the early 1990s, we have had a focused strategy of investing in Russian people, infrastructure and technology with the goal of establishing a tailor-made offering for the Russian market. Today our operational footprint spans all the major oil and gas regions. We employ close to 14,000 people of whom 96% are Russian nationals in over 137 locations, including operational bases, engineering and manufacturing centers, a research center in Moscow, and a product development center in Novosibirsk.

15

In 2012, we opened two state-of-the-art facilities in Sakhalin, Russia and Aktau, Kazakhstan representing a combined investment of 70 million dollars. The key to success in the Russian oilfield market is having fit-for purpose technology, whether on land in Siberia, offshore Sakhalin, or in the Arctic. With this in mind we have carefully built our offering over the past two decades through in-country R&D and targeted Merger and Acquisition (M&A) activity.

By way of examples we have developed a tailor-made ESP pump for the Russian market in our Tyumen Product Center. We have also developed a new family of PDC bits designed to overcome specific challenges in the Russian market. And our HiWAY* fracturing technology which has penetrated markets in 15 countries worldwide, was developed in our Novosibirsk product center.

In addition to these engineering and manufacturing successes, we have established a significant research program in Russia which is managed by our research center in Moscow. This center, opened in 1998, now houses more than 100 researchers and capitalizes on a collaborative academic network in Russia covering more than 40 projects and involving over 250 Russian scientists.

16

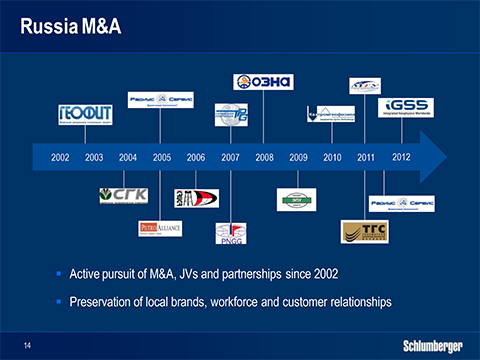

In addition to internal R&D efforts, we have also been active on the M&A side over the past decade buying a number of Russian service and technology companies. The first of these were Geofit in 2002, the Siberian Geophysical Company in 2004, and Petro Alliance in 2005, which together provided a range of wireline and well construction services together with drilling and workover rigs.

In 2005, we also took a 40% stake in Radius, which has become the leading downhole drilling-tool company in Russia. We subsequently secured the remaining shares in 2012. In 2011, we sold our drilling rigs to Eurasia Drilling in return for their well construction services-company and a preferred supplier agreement for more than 200 Eurasia rigs in Western Siberia.

Fundamental to the entire M&A strategy in Russia has been our desire to pursue convergence rather than integration as we bring the Russian companies into Schlumberger. Rather than applying our standard way of operating to the new companies, we have preserved their identities, strengths, local brand names, and Russian faces to the market. In addition, we have only made available at their request the systems expertise and technology that would further enhance their market position.

17

This has created a strong, fit-for-purpose local portfolio which offers a wide footprint and deployment mechanism for high-end technologies from our global product lines. The breadth of this overall technology offering, together with the strength of our Russian people and infrastructure, leaves us primed to further capitalize on the large and fast growing Russian oilfield services market.

18

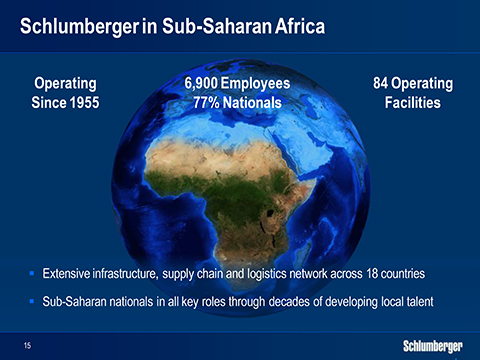

The third growth region I would like to highlight is Sub-Saharan Africa, where traditionally most of the activity has been centered in Angola and Nigeria. In recent years we have seen significant growth in exploration activity throughout the region, with numerous oil discoveries along the West coast and gas discoveries in the East. Add to this the pre-salt finds in the Angolan Kwanza basin and the region has quickly become one of the fastest growing oilfield markets in the world.

Operations in this part of the world are about as complex as they get, not only from a technology standpoint but also in terms of infrastructure, supply chain, transportation and operations support.

19

To address these challenges we have been actively investing for several years. Currently we have 84 operational bases in the region covering activity in 18 countries, with another seven projects ongoing to further expand and develop our infrastructure.

Similar to our approach in the Middle East we have established our own transportation network in the region and true to our principles we have also continuously invested in people over the past four decades. Today our workforce totals 6,900 employees with 77% of them being Sub-Saharan nationals, including all four of our GeoMarket managers. The advantage this gives us should not be underestimated.

20

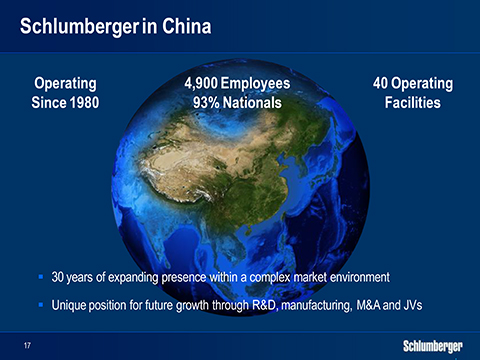

The final region I would like to cover is China, where activity growth is driven by three main themes: maximizing production from conventional resources, accelerating unconventional gas development, and pursuing deepwater exploration and development.

Looking first at our traditional Chinese customers, we have recently seen strong growth in the demand for our high-end technology and expertise. The reasons for this include the growing technical complexity of their domestic projects, their need to meet development schedules and production targets, and the fact that the capabilities of their internal service companies alone are not enough to effectively address their challenges.

At the same time, the customer base in China is also expanding quickly after shale activity was opened up to a wide range of companies outside the traditional E&P industry. While we see solid activity growth in the shale gas basins in the medium term, we still expect the strongest activity growth in 2013 to come from offshore areas and complex conventional land developments.

21

We have been working in China since 1980. Today, we are present with almost all of our product lines supplying products and services from a total of 40 operating bases spread around the country. We have more than 4,500 employees, of whom 93% are Chinese nationals, and we have over 1,000 senior Chinese employees on international assignment throughout our global operations.

Our new technology is gradually penetrating the land market and we are also introducing new business models to further our technology sales. We are already leasing our UniQ* land seismic system to Chinese customers and we are in the process of introducing the SPARK* fracturing model as well as the Integrated Project Management (IPM) and Schlumberger Production Management (SPM) business models.

Our R&D activity in China is spearheaded by our software engineering centre in Beijing, opened in July 2000, and now housing 300 people, of whom 90% are Chinese. In 2012 we opened the Schlumberger China Petroleum Institute, which provides petrotechnical expertise for exploration and development of both conventional and unconventional resources to our customers in China. We have also developed a strong manufacturing footprint in China with three plants outside Shanghai focused on perforating, completions, and drilling tools and with a further three plants coming on line in Shanghai in 2013.

22

In addition to these organic developments we are supplementing our China growth plan with ongoing M&A activity and local partnerships. Most noticeable is the acquisition of the drilling services company JHP in 2009 and the 20% stake we took in Anton Oil in 2012. And through the joint ventures we made with CoPower in 2010 and with the Chongqing Bureau of Geology and Mineral Resources in 2012 we continue to create additional growth vehicles in the Chinese market.

23

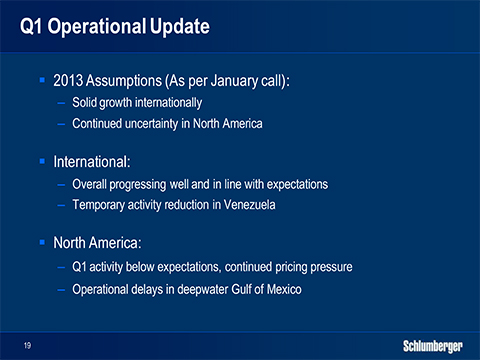

Before I close let me give you a quick operational update for the first quarter.

As stated in the January call, we are expecting the market trends seen in 2012 to continue in 2013 with solid growth in the international markets, and flattish year-over-year rig activity and stabilizing pricing levels in North America Land.

First-quarter activity in the international markets is progressing well, and is in line with expectations. Venezuela is an exception, where we are temporarily reducing activity due to our previously highlighted collection issues. While we are confident that we will ultimately resolve the situation, we have decided to only recognize revenue in line with our collections in the first quarter.

In North America, first-quarter activity is coming in below expectations as our customers have re-activated fewer rigs than they initially indicated. Asset utilization has recovered from the holiday slowdown. Drilling efficiency is strong and lower guar costs will provide some relief, but none of these factors are changing the fundamental issue, which is still pricing.

We continue to see negative pricing pressure in many product lines in the first quarter, with active participation from our principal competitors, reinforcing the somewhat unclear outlook for the North America land market at this stage.

For us, first-quarter activity in the US Gulf of Mexico is also temporarily impacted by operational delays associated with the replacement of subsea connector bolts on the deepwater rigs. However, we still expect the overall contribution from our US Gulf of Mexico operations to be on target for the full year.

Overall, we maintain our stated goal of double-digit growth in earnings per share for 2013, provided North America land activity and pricing levels fall in line with our stated expectations for the year, and that we reach a solution in Venezuela.

24

Ladies and gentlemen, in summary let me leave you with the following points:

The overall outlook for oilfield services remains favorable on the back of a slow but steady recovery in the global economy and we expect continued growth in E&P spending levels in the coming years. Our growth will, in the near term, be driven by the international markets as the outlook for rig activity and pricing levels in North America continues to be uncertain.

Following the 2010 restructuring of our land business our North America, our results in 2012 were second to none and we will continue to build on this momentum going forward. At the same time, our international leadership position remains intact and continues to be protected by carefully executed long-term strategies, backed by unmatched investment levels.

Going forward, we see a trend emerging where our key customers seek to unlock more value from the E&P value chain by engaging closer with the leading service providers. This will favor broad integrators like Schlumberger.

The combination of all these factors leaves Schlumberger poised to continue to outperform the market going forward in terms of growth in earnings per share. And I am proud to lead our organization forward with that very clear goal in mind.

Thank you very much.

25

26