Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SANTO MINING CORP. | Financial_Report.xls |

| EX-23 - CONSENT OF GBH CPA'S - SANTO MINING CORP. | exhibit231.htm |

| EX-5 - OPINION AND CONSENT OF ANSLOW & JACLIN LLP - SANTO MINING CORP. | exhibit51.htm |

As filed with the Securities and Exchange Commission on March 15, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SANTO MINING CORP.

(Exact Name of Registrant in its Charter)

|

Nevada |

2860 |

27-0518586 |

|

(State or other Jurisdiction of |

(Primary Standard Industrial Classification |

(IRS Employer Identification No.) |

|

Incorporation) |

Code) |

|

Ave. Sarasota #20, Torre Empresarial, Suite 1103

Santo Domingo, Dominican Republic

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

State Agent & Transfer Syndicate Inc.

112 North Curry Street

Carson City, NV 89703-4934

(Name, Address and Telephone Number of Agent for Service)

Copies of communications to:

Gregg E. Jaclin, Esq.

Anslow & Jaclin, LLP

195 Route 9 South, Suite 204

Manalapan, NJ 07726

Tel. No.: (732) 409-1212

Fax No.: (732) 577-1188

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

|

Non-accelerated filer |

¨ |

Smaller reporting company |

x |

|

(Do not check if a smaller reporting company) |

|

| |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

Proposed |

|

|

Proposed |

|

|

|

| ||||

|

|

|

|

|

|

Maximum |

|

|

Maximum |

|

|

Amount of |

| ||||

|

Title of Each Class of Securities |

|

Amount to be |

|

|

Offering Price |

|

|

Aggregate |

|

|

Registration |

| ||||

|

to be Registered |

|

Registered (1) |

|

|

Per Share (2) |

|

|

Offering Price |

|

|

Fee |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Common Stock, par value $0.00001 per share, |

|

|

8,950,000 |

|

|

$ |

0.16 |

|

|

$ |

1,432,000 |

|

|

$ |

195.32 |

|

|

Total |

|

|

8,950,000 |

|

|

|

0.16 |

|

|

$ |

1,432,000 |

|

|

$ |

195.32 |

|

|

|

(1) |

Pursuant to Rule 416 under the Securities Act of 1933, as amended, this Registration Statement shall be deemed to cover the additional securities (i) to be offered or issued in connection with any provision of any securities purported to be registered hereby to be offered pursuant to terms which provide for a change in the amount of securities being offered or issued to prevent dilution resulting from stock splits, stock dividends or similar transactions and (ii) of the same class as the securities covered by this Registration Statement issued or issuable prior to completion of the distribution of the securities covered by this Registration Statement as a result of a split of, or a stock dividend on, the registered securities. |

|

|

|

|

|

|

(2) |

Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) of the Securities Act of 1933, as amended, based on the average of the high and low prices of the common stock of the registrant as reported on the OTC Bulletin Board on March 8, 2013. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED MARCH 15, 2013 |

8,950,000 Shares of Common Stock

SANTO MINING CORP, INC.

This Prospectus relates to the resale of up to 8,950,000 shares of our common stock, par value $0.00001 per share, which may be offered by the selling stockholder, Hanover Holdings I, LLC, a New York limited liability company, or Hanover. The shares of common stock being offered by the selling stockholder are issuable pursuant to a common stock purchase agreement dated as of March 11, 2013 between us and Hanover, or the Purchase Agreement. See the section of this Prospectus entitled “Equity Enhancement Program with Hanover” for a description of the Purchase Agreement and the section entitled “Selling Stockholder” for additional information regarding Hanover.

We are not selling any securities under this Prospectus and will not receive any of the proceeds from the resale of shares of our common stock by the selling stockholder under this Prospectus, however, we may receive gross proceeds of up to $16,000,000 from sales of our common stock to Hanover under the Purchase Agreement.

Hanover may offer all or part of the shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. We provide more information about how Hanover may sell its shares of common stock in the section titled “Plan of Distribution” on page 52. We will pay the expenses incurred in connection with the offering described in this Prospectus, with the exception of brokerage expenses, fees, discounts and commissions, which will be paid by the selling stockholder. In addition, we issued 1,044,264 shares of our common stock to Hanover as an initial commitment fee for entering into the Purchase Agreement and we may issue additional commitment shares to Hanover under certain circumstances described in this Prospectus. Hanover is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended, or the Securities Act.

Our common stock is quoted on the Over-the-Counter Bulletin Board, or the OTCBB, under the ticker symbol “SANP.” On March 8, 2013, the closing price of our common stock was $0.15 per share.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 6 to read about factors you should consider before investing in shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus Is: _____________, 2013

TABLE OF CONTENTS

|

|

Page |

|

Prospectus Summary |

2 |

|

The Offering |

4 |

|

Risk Factors |

6 |

|

Special Note Regarding Forward-Looking Statements |

14 |

|

Use of Proceeds |

15 |

|

Dilution |

15 |

|

Selling Stockholder |

16 |

|

Market for Common Equity and Related Stockholder Matters |

18 |

|

Description of Business |

19 |

|

Description of Property |

29 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 |

|

Directors, Executive Officers and Corporate Governance |

46 |

|

Executive Compensation |

48 |

|

Security Ownership of Certain Beneficial Owners and Management |

50 |

|

Certain Relationships and Related Transactions, and Director Independence |

51 |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

51 |

|

Equity Enhancement Program With Hanover |

51 |

|

Plan of Distribution |

54 |

|

Description of Securities to be Registered |

59 |

|

Legal Matters |

59 |

|

Experts |

59 |

|

Where You Can Find More Information |

59 |

|

Index To Consolidated Financial Statements |

60 |

1

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this Prospectus. This summary does not contain all the information that you should consider before investing in the common stock of Santo Mining Corp. (referred to herein as the “Company,” “we,” “our,” and “us”). You should carefully read the entire Prospectus, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the accompanying financial statements and notes before making an investment decision.

Business Overview

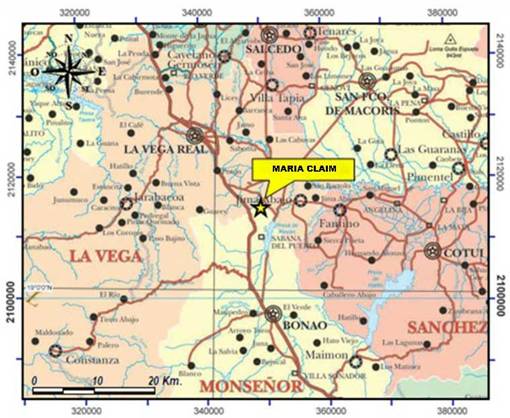

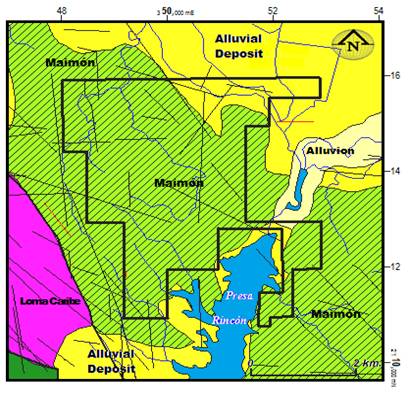

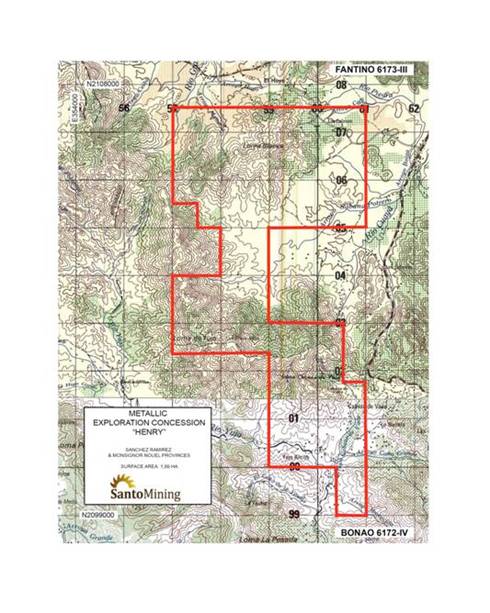

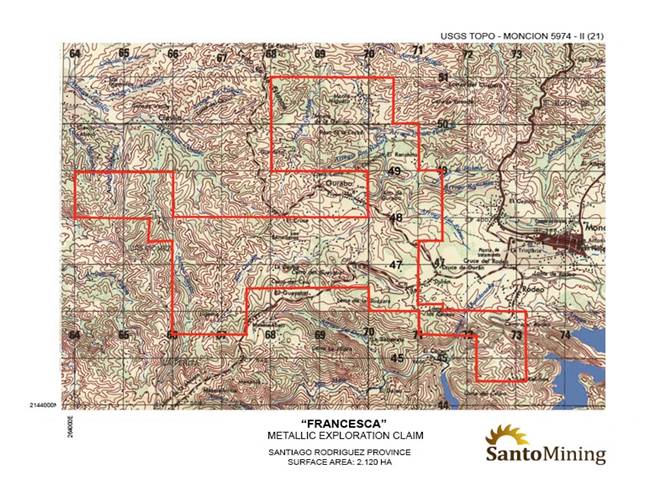

Santo Mining Corp. is a company which acquires various metallic exploration concession applications in the Dominican Republic for the purpose of exploration and extraction. We target near-term production opportunities in the Dominican Republic, in areas geologically similar to Pueblo Viejo, one of the largest sulfide gold deposits in the Western Hemisphere. Our vision is to define deposits and extract metals from both alluvial deposits that require minimal processing and bulk-tonnage, open-pit oxide and sulfide gold deposits where poly-metallic ores with economic concentrations of precious and base metals may be extracted and transported to local or offshore processing plants and refineries.

The Company plans to combine rapid exploration methodology with innovative operational and logistical approaches to ensure the efficient and effective extraction of gold and other metals in the future.

Our exploration projects create an alternative opportunity for investors. Each of our metallic exploration concession application areas lie within high-potential geology–which may have similar characteristics as Pueblo Viejo, one of the world’s largest sulifde gold deposit. Each metallic exploration concession applications is ideally situated for our geology team approach to exploration.

This swift mobilization and on-site sampling analysis capability was developed to drive growth and value in the near and long terms. Our metallic exploration concession applications are 100% owned, and lie in the core of the mineral rich Hispaniola Gold-Copper Back-Arc.

Recent Developments

Equity Enhancement Program with Hanover Holdings I, LLC

Common Stock Purchase Agreement

On March 11, 2013, which we refer to as the Closing Date, we entered into the Purchase Agreement with Hanover. The Purchase Agreement provides that, upon the terms and subject to the conditions set forth therein, Hanover is committed to purchase up to $16,000,000, which we refer to as the Total Commitment, worth of the Company’s common stock, which we refer to as the Shares, over the 36-month term of the Purchase Agreement.

From time to time over the term of the Purchase Agreement, commencing on the trading day immediately following the date on which the Registration Statement of which this Prospectus is a part is declared effective by the Securities and Exchange Commission, or the Commission, the Company may, in its sole discretion, provide Hanover with draw down notices, each referred to as a Draw Down Notice, to purchase a specified dollar amount of Shares, which we refer to as the Draw Down Amount, over a 10 consecutive trading day period commencing on the trading day specified in the applicable Draw Down Notice, which we refer to as the Pricing Period, with each draw down subject to the limitations discussed below. The maximum amount of Shares requested to be purchased pursuant to any single Draw Down Notice cannot exceed 300% of the average daily trading volume of the Company’s common stock for the five trading days immediately preceding the date of the Draw Down Notice, which we refer to as the Maximum Draw Down Amount.

2

Once presented with a Draw Down Notice, Hanover is required to purchase a pro rata portion of the applicable Draw Down Amount on each trading day during the applicable Pricing Period on which the daily volume weighted average price for our common stock, or VWAP, equals or exceeds a floor price determined by the Company for such draw down, which we refer to as the Floor Price. If the VWAP falls below the applicable Floor Price on any trading day during the applicable Pricing Period, the Purchase Agreement provides that Hanover will not be required to purchase the pro rata portion of the applicable Draw Down Amount allocated to that trading day. The per share purchase price for the Shares subject to a Draw Down Notice will be equal to 92.5% of the arithmetic average of the five lowest VWAPs that equal or exceed the applicable Floor Price during the applicable Pricing Period, except that if the VWAP does not equal or exceed the applicable Floor Price for at least five trading days during the applicable Pricing Period, then the per share purchase price will be equal to 92.5% of the arithmetic average of all VWAPs that equal or exceed the applicable Floor Price during such Pricing Period. Each purchase pursuant to a draw down will reduce, on a dollar-for-dollar basis, the Total Commitment under the Purchase Agreement.

The Company is prohibited from issuing a Draw Down Notice if (i) the amount requested in such Draw Down Notice exceeds the Maximum Draw Down Amount, (ii) the sale of Shares pursuant to such Draw Down Notice would cause the Company to issue or sell or Hanover to acquire or purchase an aggregate dollar value of Shares that would exceed the Total Commitment, or (iii) the sale of Shares pursuant to the Draw Down Notice would cause the Company to sell or Hanover to purchase an aggregate number of shares of the Company’s common stock which would result in beneficial ownership by Hanover of more than 4.99% of the Company’s common stock (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the rules and regulations thereunder). The Company cannot make more than one draw down in any Pricing Period and must allow 24 hours to elapse between the completion of the settlement of any one draw down and the commencement of a Pricing Period for any other draw down.

Additionally, on the Closing Date, Hanover deposited $90,000, as an Administrative Fee, into an escrow account, which was disbursed to the Company promptly after the filing with the Commission of the Registration Statement of which this Prospectus is a part. The Company paid to Hanover a commitment fee equal to $167,500 (or 1.047% of the Total Commitment under the Purchase Agreement) in the form of 1,044,264 restricted shares of the Company’s common stock, which we refer to as the Initial Commitment Shares, calculated at a price equal to the arithmetic average of the VWAPs over the 10 trading day period immediately preceding the Closing Date. The Initial Commitment Shares, together with 1,100,000 Additional Commitment Shares, described below, are being registered for resale in this Registration Statement. The Initial Commitment Shares and the Additional Commitment Shares, if any, are subject to a “dribble out” agreement between the Company and Hanover, whereby Hanover has agreed to sell no more than one-tenth of the Initial Commitment Shares and the Additional Commitment Shares, on a pro-rata basis, during the 10-week period immediately following the effective date of the Registration Statement of which this Prospectus is a part, except that if the VWAP falls below $0.10 for any trading day during such 10-week period, the dribble out will automatically cease to apply.

Registration Rights Agreement

In connection with the execution of the Purchase Agreement, on the Closing Date, the Company and Hanover also entered into a registration rights agreement dated as of the Closing Date, or the Registration Rights Agreement. Pursuant to the Registration Rights Agreement, the Company has agreed to file the Registration Statement of which this Prospectus is a part with the Commission to register for resale 8,950,000 Shares, which includes the 1,044,264 Initial Commitment Shares and 1,100,000 Additional Commitment Shares, on or prior to March 15, 2013, which we refer to as the Filing Deadline, and have it declared effective at the earlier of (A) the 90th calendar day after the earlier of (1) the Filing Deadline and (2) the date of which the Registration Statement of which this Prospectus is a part is filed with the Commission and (B) the fifth business day after the date the Company is notified by the Commission that the Registration Statement will not be reviewed or will not be subject to further review, which we refer to as the Effectiveness Deadline. The effectiveness of the Registration Statement of which this Prospectus is a part is a condition precedent to our ability to sell common stock to Hanover under the Purchase Agreement.

3

If the Registration Statement of which this Prospectus is a part is not declared effective by the Effectiveness Deadline, the Company is required to issue to Hanover additional shares of the Company’s common stock, which we refer to as the Additional Commitment Shares, equal to the quotient obtained by dividing (a) $167,500 by (b) the arithmetic average of the VWAPs over the 10 trading day period immediately preceding the Effectiveness Deadline, rounded up to the nearest whole share. We are registering 1,100,000 Additional Commitment Shares in the Registration Statement of which this Prospectus is a part.

The Company has agreed to file with the Commission one or more additional registration statements to cover all of the securities required to be registered under the Registration Rights Agreement that are not covered by this Prospectus, in each case, as soon as practicable, but in no event later than the applicable filing deadline for such additional registration statements as provided in the Registration Rights Agreement.

The Offering

As of March 14, 2013, there were 65,396,269 shares of our common stock outstanding, of which 32,576,749 shares were held by non-affiliates of the Company, excluding the 1,044,264 Initial Commitment Shares that we have already issued to Hanover under the Purchase Agreement. Although the Purchase Agreement provides that we may sell up to $16,000,000 of our common stock to Hanover, only 8,950,000 shares of our common stock are being offered under this Prospectus, which represents (i) 1,044,264 shares of common stock that we issued to Hanover as Initial Commitment Shares, (ii) 1,100,000 shares of common stock that we may be required to issue to Hanover as Additional Commitment Shares and (iii) 6,805,736 shares of common stock that we may issue to Hanover as Shares pursuant to draw downs under the Purchase Agreement. If all of the 8,950,000 shares offered under this Prospectus were issued and outstanding as of March 14, 2013, such shares would represent approximately 12.21% of the total number of shares of our common stock outstanding and 27.47% of the total number of outstanding shares of our common stock held by non-affiliates, in each case as of March 14, 2013.

At an assumed purchase price of $0.13875 (equal to 92.5% of the closing price of our common stock of $0.15 on March 8, 2013), and assuming the sale by us to Hanover of all of the 6,805,736 Shares being registered hereunder pursuant to draw downs under the Purchase Agreement, we would receive only approximately $944,295 in gross proceeds. If we elect to issue and sell more than the 6,805,736 Shares offered under this Prospectus to Hanover, which we have the right, but not the obligation, to do, we must first register for resale under the Securities Act any such additional Shares, which could cause additional substantial dilution to our stockholders. Based on the above assumptions, we would be required to register an additional approximately 108,509,586 shares of our common stock to obtain the balance of $15,055,705 of the Total Commitment that would be available to us under the Purchase Agreement. We are currently authorized to issue 450,000,000 shares of our common stock. The number of shares ultimately offered for resale by Hanover is dependent upon the number of shares we ultimately sell to Hanover under the Purchase Agreement.

The Total Commitment of $16,000,000 was determined based on numerous factors, including our estimated exploration and operating expenses for the next two years. While it is difficult to estimate the likelihood that the Company will need the full Total Commitment, we believe that the Company may need the full Total Commitment under the Purchase Agreement.

|

Common stock offered by Selling Stockholder |

8,950,000 shares of common stock, consisting of:

· 1,044,264 shares of common stock that we issued to Hanover as Initial Commitment Shares;

· 1,100,000 shares of common stock that we may be required to issue to Hanover as Additional Commitment Shares; and

· 6,805,736 shares of common stock that we may issue to Hanover as Shares pursuant to draw downs under the Purchase Agreement. |

8

|

Common stock outstanding before the offering |

65,396,269 shares of common stock. |

|

|

|

|

Common stock outstanding after the offering |

73,302,005 shares of common stock. |

|

|

|

|

Use of proceeds |

We will not receive any proceeds from the sale of shares by the selling stockholder. However, we will receive proceeds from the sale of Shares to Hanover pursuant to the Purchase Agreement. The net proceeds received under the Purchase Agreement will be used for general corporate and working capital purposes and acquisitions or assets, businesses or operations or for other purposes that the Board of Directors, in its good faith deem to be in the best interest of the Company. |

|

|

|

|

OTCBB Trading Symbol |

SANP |

|

|

|

|

Risk Factors |

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors”. |

Corporate Information

Our principal office is located at Ave. Sarasota #20, Torre Empresarial, Suite 1103, Santo Domingo, Dominican Republic. Our telephone number is 1-809-535- 9443.

CERTAIN TERMS USED IN THIS PROSPECTUS

When this Prospectus uses the words “we,” “us,” “our,” and the “Company,” they refer to Santo Mining Corp. “Commission” refers to the Securities and Exchange Commission. When this Prospectus uses the word “Property,” “Claim,” or “Mine”, it refers to a “metallic exploration concession application” which according to the Dominican Mining Law grants the holder with certain preferential rights. Upon issuance, an exploration concession grants the holder the exclusive right to explore within its boundary limits for up to a six year period. It also grants the holder the exclusive right to apply for an exploitation concession valid up to a seventy-five year period.

5

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this Prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated into this Prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risk Related to Our Business

We have a limited operating history with significant losses and there can be no assurance that we can achieve or maintain profitability.

We have yet to establish any history of profitable operations. We have not generated any revenues since our inception and do not anticipate that we will generate revenues which will be sufficient to sustain our operations. We expect that our revenues will not be sufficient to sustain our operations for the foreseeable future. Our profitability will require the successful commercialization of our mining Property. We may not be able to successfully commercialize our mines or ever become profitable.

Our independent registered public accounting firm has expressed doubt about our ability to continue as a going concern.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements for the years ended July 31, 2012 and 2011, respectively, with respect to their doubt about our ability to continue as a going concern. As discussed in Note 3 to our consolidated financial statements for the year ended July 31, 2012, we have generated operating losses since inception, and our cash resources are insufficient to meet our planned business objectives, which together raises doubt about our ability to continue as a going concern.

We may not be able to secure additional financing to meet our future capital needs.

We anticipate needing significant capital to conduct further exploration and development needed to bring our existing mining Property into production and/or to continue to seek out appropriate joint venture partners or buyers for certain mining properties. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

Funding from our Purchase Agreement with Hanover may be limited or be insufficient to fund our operations or to implement our strategy.

6

Under our Purchase Agreement with Hanover, upon effectiveness of the Registration Statement of which this Prospectus is a part, and subject to other conditions, we may direct Hanover to purchase up to $16,000,000 of our shares of common stock over a 36-month period. Although the Purchase Agreement provides that we may sell up to $16,000,000 of our common stock to Hanover, only 8,950,000 shares of our common stock are being offered under this Prospectus, which represents (i) 1,044,264 shares of common stock that we issued to Hanover as Initial Commitment Shares, (ii) 1,100,000 shares of common stock that we may be required to issue to Hanover as Additional Commitment Shares and (iii) 6,805,736 shares of common stock that we may issue to Hanover as Shares pursuant to draw downs under the Purchase Agreement.

At an assumed purchase price of $0.13875 (equal to 92.5% of the closing price of our common stock of $0.15 on March 8, 2013), and assuming the sale by us to Hanover of all of the 6,805,736 Shares being registered hereunder pursuant to draw downs under the Purchase Agreement, we would receive only approximately $944,295 in gross proceeds. If we elect to issue and sell more than the 6,805,736 Shares offered under this Prospectus to Hanover, which we have the right, but not the obligation, to do, we must first register for resale under the Securities Act any such additional Shares, which could cause additional substantial dilution to our stockholders. Based on the above assumptions, we would be required to register an additional approximately 108,509,586 shares of our common stock to obtain the balance of $15,055,705 of the Total Commitment that would be available to us under the Purchase Agreement. We are currently authorized to issue 450,000,000 shares of our common stock. Depending on the price at which Shares are ultimately sold, we may have to increase the number of our authorized shares in order to issue Shares to Hanover.

There can be no assurance that we will be able to receive all or any of the Total Commitment from Hanover because the Purchase Agreement contains certain limitations, restrictions, requirements, conditions and other provisions that could limit our ability to cause Hanover to buy common stock from us. For instance, the Company is prohibited from issuing a Draw Down Notice if the amount requested in such Draw Down Notice exceeds the Maximum Draw Down Amount or the sale of Shares pursuant to the Draw Down Notice would cause the Company to sell or Hanover to purchase an aggregate number of shares of the Company’s common stock which would result in beneficial ownership by Hanover of more than 4.99% of the Company’s common stock (as calculated pursuant to Section 13(d) of the Exchange Act and the rules and regulations thereunder). Moreover, the Company cannot make more than one draw down in any Pricing Period and must allow 24 hours to elapse between the completion of the settlement of any one draw down and the commencement of a Pricing Period for any other draw down. Also, as discussed above, there must be an effective registration statement covering the resale of any Shares to be issued pursuant to any draw down under the Purchase Agreement, and the Registration Statement of which this Prospectus is a part covers the resale of only 6,805,736 Shares that may be issuable pursuant to draw downs under the Purchase Agreement. These registration statements may be subject to review and comment by the staff of the Commission, and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these registration statements cannot be assured.

The extent to which we rely on Hanover as a source of funding will depend on a number of factors, including the amount of working capital needed, the prevailing market price of our common stock and the extent to which we are able to secure working capital from other sources. If obtaining sufficient funding from Hanover were to prove unavailable or prohibitively dilutive, we would need to secure another source of funding. Even if we sell all $16,000,000 of common stock under the Purchase Agreement with Hanover, we will still need additional capital to fully implement our current business, operating plans and development plans.

Our business and operating results could be harmed if we fail to properly manage our growth.

Our business may experience periods of rapid change and/or growth that could place significant demands on our personnel and financial resources. To manage possible growth and change, we must continue to try to locate skilled geologists, mappers, drillers, engineers, technical personnel and adequate funds in a timely manner.

The development and operation of our mining projects involve numerous uncertainties.

7

Mine development projects, including our planned projects, typically require a number of years and significant expenditures during the development phase before production is possible.

Development projects are subject to the completion of successful feasibility studies, issuance of necessary governmental permits and receipt of adequate financing. The economic feasibility of development projects is based on many factors such as:

· estimation of reserves;

· anticipated metallurgical recoveries;

· future gold, copper, and silver prices; and

· anticipated capital and operating costs of such projects.

Our mine development projects may have limited relevant operating history upon which to base estimates of future operating costs and capital requirements. Estimates of proven and probable reserves and operating costs determined in feasibility studies are based on geologic and engineering analyses.

Any of the following events, among others, could affect the profitability or economic feasibility of a project:

· unanticipated changes in grade and tonnage of material to be mined and processed;

· unanticipated adverse geotechnical conditions;

· incorrect data on which engineering assumptions are made;

· costs of constructing and operating a mine in a specific environment;

· availability and cost of processing and refining facilities;

· availability of economic sources of power;

· adequacy of water supply;

· adequate access to the site;

· unanticipated transportation costs;

· government regulations (including regulations relating to prices, royalties, duties, taxes, restrictions on production, quotas on exportation of minerals, as well as the costs of protection of the environment and agricultural lands);

· fluctuations in metal prices; and

· accidents, labor actions and force majeure events.

Any of the above referenced events may necessitate significant capital outlays or delays, may materially and adversely affect the economics of a given property, or may cause material changes or delays in our intended exploration, development and production activities. Any of these results could force us to curtail or cease our business operations.

Mineral exploration is highly speculative, involves substantial expenditures, and is frequently non-productive.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. Few prospects that are explored end up being ultimately developed into producing mines. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. We cannot assure you that our mineral exploration efforts will be successful. The risks associated with mineral exploration include:

· the identification of potential economic mineralization based on superficial analysis;

· the quality of our management and our geological and technical expertise; and

· the capital available for exploration and development.

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities. Because of these uncertainties, our current and future exploration programs may not result in the discovery of reserves, the expansion of our existing reserves or the further development of our mines.

8

The price of gold, copper, and silver are highly volatile and a decrease in the price of gold, copper, or silver would have a material adverse effect on our business.

The profitability of mining operations is directly related to the market prices of metals. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations of metals from the time development of a mine is undertaken to the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop our mining property at a time when the price of metals makes such exploration economically feasible and, subsequently, incur losses because the price of metals decreases. Adverse fluctuations of the market prices of metals may force us to curtail or cease our business operations.

Mining risks and insurance could have an adverse effect on our profitability.

Our operations are subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as unusual or unexpected geological formations, environmental pollution, personal injuries, flooding, cave-ins, changes in technology or mining techniques, periodic interruptions because of inclement weather and industrial accidents. Although maintenance of insurance to ameliorate some of these risks is part of our proposed exploration program associated with those mining properties we have an interest in, such insurance may not be available at economically feasible rates or in the future be adequate to cover the risks and potential liabilities associated with exploring, owning and operating our property. Either of these events could cause us to curtail or cease our business operations.

We face significant competition in the mineral exploration industry.

We compete with other mining and exploration companies possessing greater financial resources and technical facilities than we do in connection with the acquisition of exploration properties and leases on prospects and properties and in connection with the recruitment and retention of qualified personnel. Such competition may result in our being unable to acquire interests in economically viable gold, copper, and silver exploration properties or qualified personnel.

We may not have access to the supplies and materials needed for exploration, which could cause delays or suspension of our operations.

Competitive demands for contractors and unforeseen shortages of supplies and/or equipment could result in the disruption of planned exploration activities. Current demand for exploration drilling services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times in our exploration programs. Furthermore, fuel prices are rising. We will attempt to locate suitable equipment, materials, manpower and fuel if sufficient funds are available. If we cannot find the equipment and supplies needed for our various exploration programs, we may have to suspend some or all of them until equipment, supplies, funds and/or skilled manpower can be obtained.

Attraction and retention of our qualified personnel is necessary to implement and conduct our mineral exploration programs.

Our future success will depend largely upon the continued services of our Board members, executive officers and other key personnel. Our success will also depend on our ability to continue to attract and retain qualified personnel with mining experience. Key personnel represent a significant asset for us, and the competition for qualified personnel is intense in the mineral exploration industry.

We may have particular difficulty attracting and retaining key personnel in the initial phases of our exploration programs. We do not have key-person life insurance coverage on any of our personnel. The loss of one or more of our key people or our inability to attract, retain and motivate other qualified personnel could negatively impact our ability to complete our exploration programs.

9

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail, and you could lose your entire investment.

We have not yet started exploration of our Claims, and thus have no way to evaluate the likelihood that we will be successful in establishing commercially exploitable reserves of gold or other valuable minerals on our Claims. You should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of gold or other minerals in any of our Claims. In such a case, we may be unable to continue operations, and you could lose your entire investment.

If we discover commercial reserves of gold on our mineral property, we can provide no assurance that we will be able to successfully advance Claims into commercial production. If we cannot commence commercial production, we may not be able to achieve revenues.

Our current mineral property does not contain any known bodies of gold. If our exploration program is successful in establishing gold of commercial tonnage and grade on our Claims, we will require additional funds in order to advance the Claims into commercial production. In such an event, we may be unable to obtain any such funds, or to obtain such funds on terms that we consider economically feasible, and we may be unable to generate revenues.

As our business assets are located in the Dominican Republic and our directors and officers are outside of the United States you may be limited in your ability to enforce U.S. civil actions against our assets or our directors and officers. You may not be able to receive compensation for damages to the value of your investment caused by wrongful actions by our director.

Our business assets are located in the Dominican Republic and our directors and officers are located outside of the United States. Consequently, it may be difficult for U.S. investors to affect service of process within the U.S. upon our assets or our directors or officers, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under U.S. Federal Securities Laws. A judgment of a U.S. court predicated solely upon such civil liabilities may not be enforceable in the Dominican Republic by a Dominican Republic court if the U.S. court in which the judgment was obtained did not have jurisdiction, as determined by the Dominican Republic court, in the matter. There is substantial doubt whether an original action could be brought successfully in Dominican Republic against any of our assets or our directors and officers predicated solely upon such civil liabilities. You may not be able to recover damages as compensation for a decline in your investment.

Our chief executive officer and sole director is also our largest stockholder and controls a significant percentage of our common stock.

Alain French, our President Chief Financial Officer, Secretary, Treasurer, Principal Financial Officer, Principal Accounting Officer and director beneficially owns approximately 51.25 % of our issued and outstanding common stock. As a result, this stockholder is able to exercise significant influence over most matters requiring approval by our stockholders, including the election of directors and the approval of significant corporate transactions. Such a concentration of ownership may have the effect of delaying or preventing a change in control of us, including transactions in which stockholders might otherwise receive a premium for their shares over then current market prices.

There is substantial doubt as to whether we will continue operations. If we discontinue operations, you could lose your investment.

The following factors raise substantial doubt regarding the ability of our business to continue as a going concern: (i) the losses we incurred since our inception; (ii) our lack of operating revenues since inception through the date of this prospectus; and (iii) our dependence on the sale of equity securities to continue in operation. We have signed a Purchase Agreement with Hanover, for up to $16,000,000 through sales of our common stock. We anticipate that we will incur increased expenses without realizing enough revenues from operations. We therefore expect to incur significant losses in the foreseeable future. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue our business. If we are unable to obtain additional financing from outside sources and eventually produce enough revenues, we may be forced to curtail or cease our operations. If this happens, you could lose all or part of your investment.

10

We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in developing mineral reserves.

The natural resource market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We will be competing with many exploration companies that have significantly greater personnel, financial, managerial and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

Our lack of any operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We do not have any material operating history, which makes it impossible to evaluate our business on the basis of historical operations. Furthermore, we have pursued the business of mineral exploration and development for a short time, and thus our business carries both known and unknown risks. As a consequence, our past results may not be indicative of future results. Although this is true for any business, it is particularly true for us because of our lacking any material operating history.

The prices of metals are highly volatile and a decrease in metal prices can have a material adverse effect on our business.

The profitability of natural resource operations are directly related to the market prices of the underlying commodities. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations in the metals market from the time exploration for a mine is undertaken and the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop a minerals property at a time when the price of the underlying metals make such exploration economically feasible and, subsequently, incur losses because metal prices have decreased. Adverse fluctuations of metals market prices may force us to curtail or cease our business operations.

Mining operations generally involve a high degree of risk.

Mining operations are subject to all the hazards and risks normally encountered in the exploration, development and production of base or precious metals, including unusual and unexpected geological formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Mining operations could also experience periodic interruptions due to bad or hazardous weather conditions and other acts of God. Milling operations are subject to hazards such as equipment failure or failure of retaining dams around tailing disposal areas, which may result in environmental pollution and consequent liability.

If any of these risks and hazards adversely affect our mining operations or our exploration activities, they may: (i) increase the cost of exploration to a point where it is no longer economically feasible to continue operations; (ii) require us to write down the carrying value of one or more mines or a property; (iii) cause delays or a stoppage in the exploration of minerals; (iv) result in damage to or destruction of mineral properties or processing facilities; and (v) result in personal injury, death or legal liability. Any or all of these adverse consequences may have a material adverse effect on our financial condition, results of operations, and future cash flows.

11

Our properties are located in the Dominican Republic and are subject to changes in Dominican Republic political conditions and government regulations.

The Claims are located in the Dominican Republic. Change and uncertainty in the Dominican Republic could lead to changes in existing government regulations affecting mineral exploration and mining. Our business activities in the Dominican Republic may be adversely affected by changing governmental regulations relating to the mining industry. More generally, shifts in political conditions may increase the cost of conducting our business or maintaining our properties. Finally, the Dominican Republic’s status as a developing country may make it more difficult to obtain required financing for our projects.

Risks Related to Ownership of Our Common Stock

If we are unable to adequately fund our operations, we may be forced to voluntarily file for deregistration of our common stock with the Commission.

Compliance with the periodic reporting requirements required by the Commission consumes a considerable amount of both internal, as well external, resources and represents a significant cost for us. We estimate our annual reporting expenses to be $55,000. If we are unable to continue to devote adequate funding and the resources needed to maintain such compliance, while continuing our operations, we may be forced to deregister with the Commission.

The sale of securities by us in any equity or debt financing could result in dilution to our existing stockholders and have a material adverse effect on our earnings.

Any sale of common stock by us in a future private placement offering could result in dilution to the existing stockholders as a direct result of our issuance of additional shares of our capital stock. In addition, our business strategy may include expansion through internal growth, by acquiring complementary businesses, by acquiring or licensing additional brands, or by establishing strategic relationships with targeted customers and suppliers. In order to do so, or to finance the cost of our other activities, we may issue additional equity securities that could dilute our stockholders’ stock ownership. We may also assume additional debt and incur impairment losses related to goodwill and other tangible assets if we acquire another company and this could negatively impact our earnings and results of operations.

We do not intend to pay dividends for the foreseeable future.

For the foreseeable future, we intend to retain any earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on our common stock. Accordingly, investors must be prepared to rely on sales of their common stock after price appreciation to earn an investment return, which may never occur. Investors seeking cash dividends should not purchase our common stock. Any determination to pay dividends in the future will be made at the discretion of our board of directors and will depend on our results of operations, financial condition, contractual restrictions, restrictions imposed by applicable law and other factors our board of directors deems relevant.

The application of the Securities and Exchange Commission’s “penny stock” rules to our common stock could limit trading activity in the market, and our stockholders may find it more difficult to sell their stock.

Our common stock is currently trading at less than $5.00 per share and is therefore subject to the Securities and Exchange Commission’s (“SEC”) penny stock rules. Penny stocks generally are equity securities with a price of less than $5.00. Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The broker-dealer must also make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes subject to the penny stock rules. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our securities, which could severely limit their market price and liquidity of our securities. These requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to resell our common stock.

12

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We are engaged in the business of exploring and, if warranted and feasible, developing natural resource properties. Our Claims are in the exploration stage only and are without proven reserves of natural resources. Accordingly, we have not generated any revenues nor have we realized a profit from our -operations to date and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of natural resources, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

We may conduct further offerings in the future in which case investors' shareholdings will be diluted.

Since our inception, we have relied on sales of our common stock and warrants to fund our operations. We have signed a Purchase Agreement with Hanover, for up to $16,000,000 through sales of our common stock. Under the Purchase Agreement with Hanover, we may sell a substantial number of shares of our common stock to Hanover at prices that are at a discount to the then current market price of our common stock. We may conduct further equity offerings in the future to finance our current projects or to finance subsequent projects that we decide to undertake. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, investors' percentage interests in us will be diluted. The result of this could reduce the value of current investors' stock.

The sale or issuance of our common stock to Hanover may cause dilution and the sale of the shares of common stock acquired by Hanover, or the perception that such sales may occur, could cause the price of our common stock to fall.

Under the Purchase Agreement with Hanover, upon effectiveness of the Registration Statement of which this Prospectus is a part, and subject to other conditions, we may direct Hanover to purchase up to $16,000,000 of our shares of common stock over a 36-month period. The number of shares ultimately offered for sale by Hanover under this Prospectus is dependent upon the number of shares ultimately purchased by Hanover under the Purchase Agreement. Depending on market liquidity at the time, the sale of a substantial number of shares of our common stock to Hanover under the Purchase Agreement, or the anticipation of such sales, could cause the trading price of our common stock to decline, could result in substantial dilution to existing stockholders and could make it more difficult for us to sell equity or equity-related securities in the future.

We are registering an aggregate of 8,950,000 shares of common stock under this prospectus pursuant to the Purchase Agreement and the Registration Rights Agreement. Notwithstanding Hanover’s beneficial ownership limitation set forth in the Purchase Agreement, if all of the 8,950,000 shares offered under this Prospectus were issued and outstanding as of March 14, 2013, such shares would represent approximately 12.21% of the total number of shares of our common stock outstanding and 27.47% of the total number of outstanding shares of our common stock held by non-affiliates, in each case as of March 14, 2013. The resale of these shares into the public market by Hanover could depress the market price of our common stock and result in substantial dilution to our existing stockholders.

Moreover, at an assumed purchase price of $0.13875 (equal to 92.5% of the closing price of our common stock of $0.15 on March 8, 2013), and assuming the sale by us to Hanover of all of the 6,805,736 Shares being registered hereunder pursuant to draw downs under the Purchase Agreement, we would receive only approximately $944,295 in gross proceeds. If we elect to issue and sell more than the 6,805,736 Shares offered under this Prospectus to Hanover, which we have the right, but not the obligation, to do, we must first register for resale under the Securities Act any such additional Shares, which could cause additional substantial dilution to our stockholders. Based on the above assumptions, we would be required to register an additional approximately 108,509,586 shares of our common stock to obtain the balance of $15,055,705 of the Total Commitment that would be available to us under the Purchase Agreement. We are currently authorized to issue 450,000,000 shares of our common stock. Because the actual purchase price for the Shares that we may sell to Hanover will fluctuate based on the VWAP of our common stock during the term of the Purchase Agreement, we are not able to determine at this time the exact number of shares of our common stock that we will issue under the Purchase Agreement and, therefore, the exact number of shares we will ultimately register for resale under the Securities Act. The resale of such a substantial number of shares of our common stock relative to our current market capitalization into the public market by Hanover could significantly depress the market price of our common stock and cause substantial dilution to our existing stockholders.

13

Subject to certain conditions, we generally have the right to control the timing and amount of any sales of our shares to Hanover, except that the Purchase Agreement contains certain limitations, restrictions, requirements, conditions and other provisions that could limit our ability to cause Hanover to buy common stock from us. For instance, we are prohibited from issuing a Draw Down Notice if, among other things, the amount requested in such Draw Down Notice exceeds the Maximum Draw Down Amount or the sale of Shares pursuant to the Draw Down Notice would cause the Company to sell or Hanover to purchase an aggregate number of shares of the Company’s common stock which would result in beneficial ownership by Hanover of more than 4.99% of the Company’s common stock (as calculated pursuant to Section 13(d) of the Exchange Act and the rules and regulations thereunder). The per share purchase price for the Shares subject to a Draw Down Notice will be equal to 92.5% of the arithmetic average of the VWAPs over a certain number of trading days during the applicable Pricing Period as set forth in the Purchase Agreement. Accordingly, Hanover will pay less than the then-prevailing market price for our common stock, and the actual purchase price for the Shares that we may sell to Hanover will fluctuate based on the VWAP of our common stock during the term of the Purchase Agreement. As a result, Hanover may ultimately purchase all, some or none of the shares of our common stock offered pursuant to this Prospectus and, after it has acquired shares, Hanover may sell all, some or none of those shares. The sale of these shares of our common stock to Hanover under the Purchase Agreement, or the anticipation of such sales, could cause the trading price of our common stock to decline, could result in substantial dilution to existing stockholders and could make it more difficult for us to sell equity or equity-related securities in the future.

You may experience immediate dilution in the book value per share of the common stock you purchase.

Because the price per share of our common stock being offered may be substantially higher than the net tangible book value per share of our common stock, you may suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. If you purchase shares of common stock in this offering at the current market value, you may suffer immediate and substantial dilution in the net tangible book value of the common stock. See “Dilution” in this Prospectus for a more detailed discussion of the dilution which may incur in connection with this offering.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus contains certain forward-looking statements. When used in this Prospectus or in any other presentation, statements which are not historical in nature, including the words “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” “may,” “project,” “plan” or “continue,” and similar expressions are intended to identify forward-looking statements. They also include statements containing a projection of revenues, earnings or losses, capital expenditures, dividends, capital structure or other financial terms.

The forward-looking statements in this Prospectus are based upon our management’s beliefs, assumptions and expectations of our future operations and economic performance, taking into account the information currently available to them. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties, some of which are not currently known to us that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial condition we express or imply in any forward-looking statements. These forward-looking statements are based on our current plans and expectations and are subject to a number of uncertainties and risks that could significantly affect current plans and expectations and our future financial condition and results.

14

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Prospectus might not occur. We qualify any and all of our forward-looking statements entirely by these cautionary factors. As a consequence, current plans, anticipated actions and future financial conditions and results may differ from those expressed in any forward-looking statements made by or on our behalf. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented herein.

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares by the selling stockholder. However, we will receive proceeds from the sale of Shares to Hanover pursuant to the Purchase Agreement. The net proceeds received from any such sales of Shares to Hanover under the Purchase Agreement will be used for general corporate and working capital purposes and acquisitions or assets, businesses or operations or for other purposes that the Board of Directors, in its good faith deem to be in the best interest of the Company.

DILUTION

The following information is based upon the Company’s unaudited balance sheet as filed in the Company’s Form 10-Q on December 17, 2012, for the period ended October 31, 2012, the net tangible book value of the Company’s assets as of October 31, 2012 is $136,678.

“Dilution” as used herein represents the difference between the offering price per share of shares offered hereby and the net tangible book value per share of the Company’s common stock after completion of the offering. Dilution in the offering is primarily due to the losses previously recognized by the Company.

The net book value of the Company at October 31, 2012 was $136,678 or $0.00212 per share. Net tangible book value represents the amount of total tangible assets less total liabilities. Assuming that all of the shares offered hereby were purchased by investors (a fact of which there can be no assurance) as of October 31, 2012, the then outstanding 64,352,005 shares of common stock, which would constitute all of the issued and outstanding equity capital of the Company, would have a net tangible book value $136,478 (after deducting commissions and offering expenses) or approximately 0.00212 per share.

At an assumed purchase price of $0.13875 (equal to 92.50% of the closing price of our common stock of $0.15 on March 8, 2013), we will be required to issue an aggregate of 115,315,315 shares of common stock, if the full amount of $16,000,000 is exercised pursuant to the Purchase Agreement.

Assuming a 25% decrease to the purchase price of $0.13875 (equal to 92.50% of the closing price of our common stock of $0.15 on March 8, 2013), we will be required to issue an aggregate of 153,753,754 shares of common stock, if the full amount of $16,000,000 is exercised pursuant to the Purchase Agreement.

Assuming a 50% decrease to the purchase price of $0.13875 (equal to 92.50% of the closing price of our common stock of $0.15 on March 8, 2013), we will be required to issue an aggregate of 230,630,631 shares of common stock, if the full amount of $16,000,000 is exercised pursuant to the Purchase Agreement.

The dilution associated with the offering and each of the above scenarios is as follows:

15

|

shares issued |

|

|

153,753,754 |

|

|

230,630,631 |

| ||||

|

Offering price |

$ |

0.13875 |

|

|

$ |

0.104 |

|

$ |

0.069 |

| |

|

Net Tangible Book Value Before Offering (per share) |

$ |

0.00212 |

|

|

$ |

0.00212 |

|

|

$ |

0.00212 |

|

|

Net Tangible Book Value After Offering (per share) |

$ |

0.08981 |

|

|

$ |

0.07399 |

|

|

$ |

0.05470 |

|

|

Dilution per share to Investors |

$ |

0.04894 |

|

|

$ |

0.03008 |

|

|

$ |

0.01467 |

|

|

Dilution percentage to Investors |

|

35% |

|

|

|

29% |

|

|

|

21% |

|

SELLING STOCKHOLDER

This Prospectus relates to the possible resale from time to time by the selling stockholder of any or all of the shares of common stock that have been or may be issued by us to Hanover under the Purchase Agreement. For additional information regarding the issuance of common stock covered by this prospectus, see “Equity Enhancement Program with Hanover” below. We are registering the shares of common stock pursuant to the provisions of the Registration Rights Agreement we entered into with Hanover on March 11, 2013 in order to permit the selling stockholder to offer the shares for resale from time to time. Except for the transactions contemplated by the Purchase Agreement and the Registration Rights Agreement, Hanover has not had any material relationship with us within the past three years.

The table below presents information regarding the selling stockholder and the shares of common stock that it may offer from time to time under this Prospectus. This table is prepared based on information supplied to us by the selling stockholder, and reflects holdings as of March 14, 2013. As used in this Prospectus, the term “selling stockholder” includes Hanover and any donees, pledgees, transferees or other successors in interest selling shares received after the date of this Prospectus from the selling stockholder as a gift, pledge, or other non-sale related transfer. The number of shares in the column “Maximum Number of Shares of Common Stock to be Offered Pursuant to this Prospectus” represents all of the shares of common stock that the selling stockholder may offer under this Prospectus. The selling stockholder may sell some, all or none of its shares in this offering. We do not know how long the selling stockholder will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling stockholder regarding the sale of any of the shares.

Beneficial ownership is determined in accordance with Rule 13d-3(d) promulgated by the Commission under the Exchange Act, and includes shares of common stock with respect to which the selling stockholder has voting and investment power. The percentage of shares of common stock beneficially owned by the selling stockholder prior to the offering shown in the table below is based on an aggregate of 65,396,269 shares of our common stock outstanding on March 14, 2013. Because the purchase price of the shares of common stock issuable under the Purchase Agreement is determined on each settlement date, the number of shares that may actually be sold by the Company under the Purchase Agreement may be fewer than the number of shares being offered by this Prospectus. The fourth column assumes the sale of all of the shares offered by the selling stockholder pursuant to this Prospectus.

|

|

Number of Shares of Common Stock Owned Prior to Offering |

Maximum Number of Shares of Common Stock to be Offered Pursuant to this Prospectus |

Number of Shares of Common Stock Owned After Offering | ||

|

|

Number(1) |

Percent(2) |

|

Number(3) |

Percent(2) |

|

Hanover Holdings I, LLC (4) |

1,044,264 |

1.60% |

8,950,000 |

-0- |

* |

* Represents beneficial ownership of less than one percent of the outstanding shares of our common stock.

16

(1) This number represents the 1,044,264 shares of common stock we issued to Hanover on March 11, 2013 as Initial Commitment Shares in consideration for entering into the Purchase Agreement with us. In accordance with Rule 13d-3(d) under the Exchange Act, we have excluded from the number of shares beneficially owned prior to the offering (i) all of the shares that may be issued to Hanover as Additional Commitment Shares under the terms of the Purchase Agreement, because the issuance of such shares is dependent on whether the registration statement of which this prospectus is a part is declared effective on or prior tothe earlier of (A) June 13, 2013 and (B) the fifth business day after the date the Company is notified by the SEC that the Company’s Registration Statement will not be reviewed or will not be subject to further review and (ii) all of the shares that Hanover may be required to purchase under the Purchase Agreement, because the issuance of such shares is solely at our discretion and is subject to certain conditions, the satisfaction of all of which are outside of Hanover’s control, including the registration statement of which this prospectus is a part becoming and remaining effective. Furthermore, the maximum dollar value of each put of common stock to Hanover under the Purchase Agreement is subject to certain agreed upon threshold limitations set forth in the Purchase Agreement. Also, under the terms of the Purchase Agreement, we may not issue shares of our common stock to Hanover to the extent that Hanover or any of its affiliates would, at any time, beneficially own more than 4.99% of our outstanding common stock.

(2) Applicable percentage ownership is based on 65,396,269 shares of our common stock outstanding as of March 14, 2013.

(3) Assumes the sale of all shares being offered pursuant to this Prospectus.

(4) The business address of Hanover is c/o Magna Group, 5 Hanover Square, New York, New York 10004. Hanover’s principal business is that of a private investment firm. We have been advised that Hanover is not a member of the Financial Industry Regulatory Authority, or FINRA, or an independent broker-dealer, and that neither Hanover nor any of its affiliates is an affiliate or an associated person of any FINRA member or independent broker-dealer. We have been further advised that Joshua Sason is the Chief Executive Officer of Hanover and owns all of the membership interests in Hanover, and that Mr. Sason has sole power to vote or to direct the vote and sole power to dispose or to direct the disposition of all securities owned directly by Hanover.

17

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Public Market for Common Stock

Our common stock has been trading on the OTCBB under the symbol SANP since May 3, 2012. The OTCBB is a quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter, or the OTC, equity securities. An OTCBB equity security generally is any equity that is not listed or traded on a national securities exchange. The following table shows, for the periods indicated, the high and low bid prices per share of our common stock as reported by the OTCBB quotation service. These bid prices represent prices quoted by broker-dealers on the OTCBB quotation service. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not represent actual transactions.

Price range of common stock

The following table shows, for the periods indicated, the high and low bid prices per share of our common stock as reported by the OTCBB quotation service. These bid prices represent prices quoted by broker-dealers on the OTCBB quotation service. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not represent actual transactions.

|

Fiscal July 31, 2013 |

Fiscal July 31, 2012 | ||||||||||||

|

|

|

High |

|

Low |

High |

|

Low | ||||||

|

First Quarter (August 1– October 31) |

|

$ |

11.00 |

|

$ |

0.47 |

|

$ |

--(1) |

$ |

--(1) | ||

|

Second Quarter (November 1– January 31) |

|

$ |

1.30 |

|

$ |

0.18 |

|

$ |

--(1) |

$ |

--(1) | ||

|

Third Quarter (February 1- April 30)(through March 8, 2013) |

|

$ |

0.20 |

|

$ |

0.14 |

|

$ |

--(1) |

$ |

--(1) | ||

|

Fourth Quarter (May 1- July 31) |

|

$ |

-- |

|

$ |

-- |

$ |

4.00 |

$ |

2.00 | |||

|

| |||||||||||||

|

(1) |

A public market for our common stock did not exist prior to May 3, 2012. | ||||||||||||

Holders

As of March 8, 2013, we had 8 shareholders of record of our common stock. Because shares of our common stock are held by depositaries, brokers and other nominees, the number of beneficial holders of our shares is substantially larger than the number of stockholders of record.

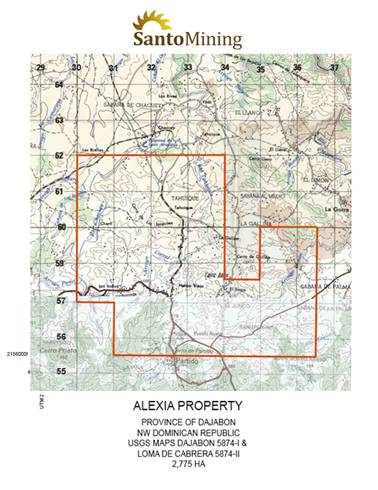

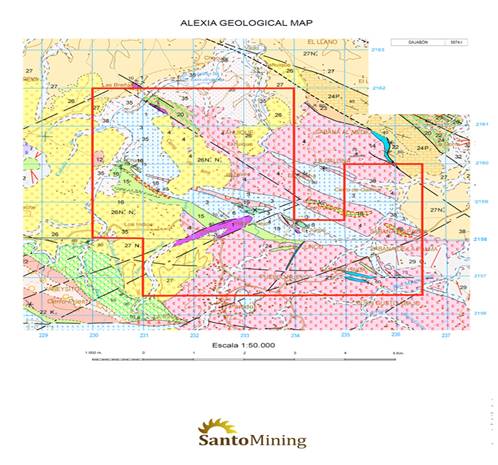

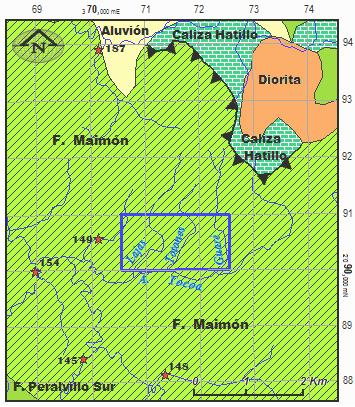

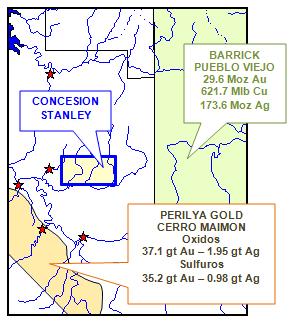

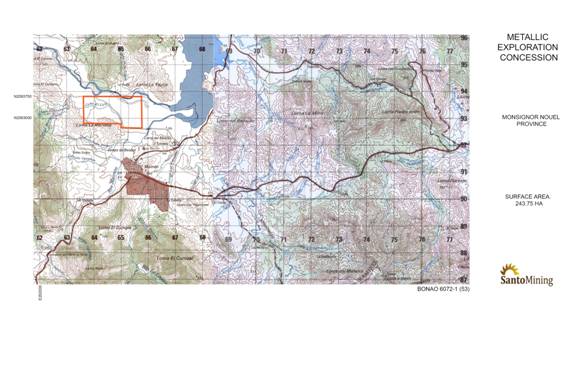

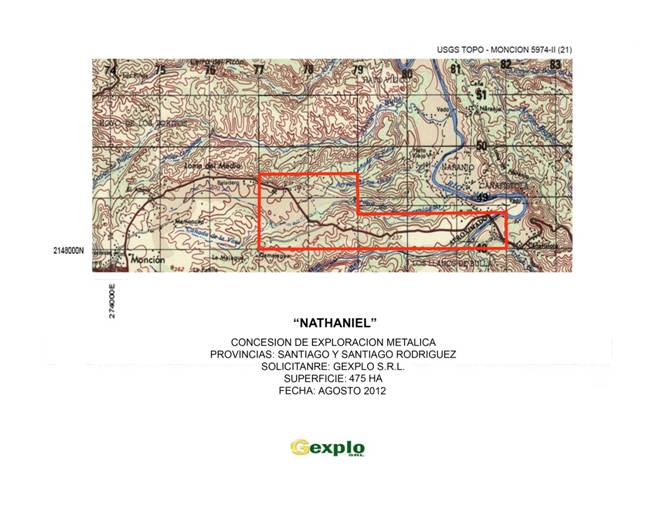

Dividends