Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - PINNACLE FOODS INC. | d440526dex51.htm |

| EX-1.1 - EX-1.1 - PINNACLE FOODS INC. | d440526dex11.htm |

| EX-23.2 - EX-23.2 - PINNACLE FOODS INC. | d440526dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 15, 2013

Registration No. 333-185565

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pinnacle Foods Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2000 | 35-2215019 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

399 Jefferson Road

Parsippany, New Jersey 07054

(973) 541-6620

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

M. Kelley Maggs, Esq.

Senior Vice President, Secretary and General Counsel

399 Jefferson Road

Parsippany, New Jersey 07054

(973) 541-6620

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| With copies to: | ||

| Richard A. Fenyes, Esq. Edward P. Tolley III, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017-3954 (212) 455-2000 |

Kirk A. Davenport II, Esq. Ian D. Schuman, Esq. Latham & Watkins LLP 885 Third Avenue, Suite 1000 New York, New York 10022-4834 (212) 906-1200 | |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering |

Proposed Maximum Aggregate Offering |

Amount of Registration Fee | ||||

| Common Stock, par value $0.01 per share |

33,350,000 |

$20.00 |

$667,000,000 |

$90,978.80(3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes shares/offering price of shares of common stock that the underwriters have the option to purchase. See “Underwriting (Conflicts of Interest).” |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | $86,273 of such fee was previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| Subject to Completion, dated March 15, 2013. |

PROSPECTUS

29,000,000 Shares

Pinnacle Foods Inc.

Common Stock

This is an initial public offering of shares of common stock of Pinnacle Foods Inc. We are offering shares of our common stock.

Prior to this offering, there has been no public market for our common stock. We currently expect that the initial public offering price of our common stock will be between $18.00 and $20.00 per share. Our common stock has been approved for listing on The New York Stock Exchange (the “NYSE”) under the symbol “PF.” After the completion of this offering, affiliates of The Blackstone Group L.P. will continue to own a majority of the voting power of all outstanding shares of our common stock. As a result, we will be a “controlled company” within the meaning of the corporate governance standards of the NYSE. See “Principal Stockholders.”

Investing in our common stock involves risk. See “Risk Factors” beginning on page 16 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to us(1) |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriting (Conflicts of Interest).” |

To the extent that the underwriters sell more than 29,000,000 shares of our common stock, the underwriters have the option to purchase up to an additional 4,350,000 shares from us at the initial public offering price, less the underwriting discounts and commissions, within 30 days of the date of this prospectus.

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2013.

| Barclays | BofA Merrill Lynch |

| Credit Suisse | ||||||

| Goldman, Sachs & Co. | ||||||

| Morgan Stanley | ||||||

| UBS Investment Bank | ||||||

| Blackstone Capital Markets | ||||||||||||||

| BMO Capital Markets | ||||||||||||||

| C.L. King & Associates | ||||||||||||||

| Janney Montgomery Scott | ||||||||||||||

| Macquarie Capital | ||||||||||||||

| Piper Jaffray | ||||||||||||||

| Stephens Inc. | ||||||||||||||

| Stifel | ||||||||||||||

Prospectus dated , 2013.

Table of Contents

Table of Contents

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize be delivered to you. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. Neither we nor the underwriters are making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus or such other date stated in this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

| Page | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 16 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 36 | ||||

| 37 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 | |||

| 73 | ||||

| 88 | ||||

| 115 | ||||

| 117 | ||||

| 121 | ||||

| 126 | ||||

| 134 | ||||

| Certain United States Federal Income Tax Consequences to Non-U.S. Holders |

136 | |||

| 139 | ||||

| 140 | ||||

| 147 | ||||

| 147 | ||||

| 147 | ||||

| F-1 | ||||

Unless otherwise indicated or the context otherwise requires, financial data in this prospectus reflects the consolidated business and operations of Pinnacle Foods Inc. and its consolidated subsidiaries.

The consolidated financial statements included in this prospectus are presented in U.S. Dollars rounded to the nearest thousand, with amounts in this prospectus rounded to the nearest million. Therefore, discrepancies in the tables between totals and the sums of the amounts listed may occur due to such rounding. The accounting policies set out in the audited consolidated financial statements contained elsewhere in this prospectus have been consistently applied to all periods presented.

i

Table of Contents

We obtained the industry, market and competitive position data used throughout this prospectus from internal company surveys and management estimates as well as from industry and general publications and research, surveys and studies conducted by third parties. We believe these internal company surveys and management estimates are reliable; however, no independent sources have verified such surveys and estimates. Third-party industry and general publications, research, studies and surveys generally state that the information contained therein has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these studies and publications is reliable, we have not independently verified any of the data from third-party sources and cannot guarantee its accuracy and completeness.

We use data provided by Symphony IRI Group, Inc. (“SIG”). Unless we indicate otherwise, retail sales, market share, category and other industry data (other than household penetration which is for the 52-week period ended December 23, 2012) used throughout this prospectus for all categories and segments are for U.S. brands and for the 52-week period ended December 30, 2012. This data includes retail sales in supermarkets with at least $2 million in total annual sales but excludes sales in mass merchandisers, club stores, drug stores, convenience stores and dollar stores. Retail sales are dollar sales estimated by SIG and represent the value of units sold through supermarket cash registers for the relevant period. Market share is our percentage of the overall category and is calculated using retail dollar sales. In the second half of fiscal 2012, SIG began including in their data Wal-Mart Stores, Inc. (“Wal-Mart”) and other retailers not previously measured, and we plan to begin using this expanded data in fiscal 2013.

We view shelf-stable pickles, table syrup, frozen and refrigerated bagels, frozen pancakes/waffles/French toast and pie/pastry fruit fillings as distinct categories. We view the cake/brownie mixes and frostings category as consisting of cake and cupcake mixes, brownie mixes and frostings. We view the frozen vegetables category as consisting of frozen plain vegetables, frozen prepared vegetables and select frozen side dishes including vegetables. We view the frozen complete bagged meals category as consisting of frozen full-calorie multi-serve dinners, excluding non-bag items. We view the frozen prepared seafood category as consisting of frozen prepared fish/seafood and frozen prepared shrimp. We view the single-serve frozen dinners and entrées category as consisting of full-calorie single-serve frozen dinners and entrées and select frozen handheld entrees. We view the frozen pizza-for-one category as consisting of total frozen pizza of 12 ounces per unit or less (for single serve packages, or individual units within multi-serve packages), excluding French bread crust and diet-positioned varieties. We view the canned meat category as consisting of shelf-stable prepared chili, shelf-stable lunch meats, shelf-stable Vienna Sausage and shelf-stable potted meats.

We view our business as comprised of 12 major product categories, which are categories in which our brands’ net sales exceed $50 million and which collectively comprise over 93% of our North American Retail net sales.

Although we believe that this information is reliable, we cannot guarantee its accuracy and completeness, nor have we independently verified it. Although we are not aware of any misstatements regarding the industry data that we present in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

We own a number of registered and common law trademarks in the United States, Canada and other countries, including Amazing Glazes®, Appian Way®, Birds Eye®, Bernstein’s®, Brooks®, C&W®, CasaRegina®, Celeste®, Chocolate Lovers®, Comstock®, Country Kitchen®, Duncan Hines®, Erin’s Gourmet

ii

Table of Contents

Popcorn®, Farmer’s Garden®, Freshlike®, Fun Frosters™, Frosting Creations®, Hartford House®, Hawaiian Style Bowls®, Hearty Bowls™, Hearty Hero®, Hungry-Man®, Hungry-Man Sports Grill®, Hungry-Man Steakhouse™, Husman’s®, It’s Good to be Full®, Lender’s®, Log Cabin®, Lunch Bucket®, Magic Minis®, McKenzie’s®, Milwaukee’s®, Moist Deluxe®, Mrs. Butterworth’s®, Mrs. Paul’s®, Nalley®, Open Pit®, Ovals®, Riviera®, Satisfy Your Craving®, Signature Desserts®, Simple Mornings®, Simply Classic™, Snack’mms®, So Moist. So Delicious. And So Much More.®, Stackers®, Snyder of Berlin®, Steamfresh®, Taste the Juicy Crunch™, That’s the Tastiest Crunch I’ve Ever Heard!®, The Original TV Dinner™, Tim’s Cascade Snacks®, Treet®, Van de Kamp’s®, Vlasic® and Wilderness®. We also have applications pending with the United States Patent and Trademark Office for a number of trademarks, including ParchmentBake™, Lil’ Griddles™, Power Lunch™, Thick N Rich™, It’s Always Vegetable Season™, Nobody Brings the Bite Like Vlasic™ and Discover the Wonder of Vegetables™. We own the trademark Snyder of Berlin while an unrelated third party owns the trademark Snyder of Hanover. Per a court order, the use of the trademark must include the word “Snyder” in combination with the words “of Berlin.” We protect our trademarks by obtaining registrations where appropriate and opposing any infringement in key markets. We also own a design trademark registration in the United States, Canada, and other countries on the Vlasic stork.

We manufacture and market certain of our frozen food products under the Swanson brand pursuant to two royalty-free, exclusive and perpetual trademark licenses granted by Campbell Soup Company. We manufacture and market certain of our frozen breakfast products under the Aunt Jemima brand pursuant to a royalty-free, exclusive (as to frozen breakfast products only) and perpetual license granted by The Quaker Oats Company, a subsidiary of PepsiCo Inc. We have a license agreement granting us an exclusive, royalty bearing, perpetual license to use certain Armour trademarks in the United States. Under the license agreement, Smithfield Foods, Inc., as successor to ConAgra, Inc., the licensor, grants us a license for the use of various Armour trademarks in conjunction with shelf-stable products within the United States. We own and maintain Armour registrations in many other countries. We also manufacture and market frozen complete bagged meals under the Voila! trademark pursuant to a royalty-free exclusive and perpetual license granted by Voila Bakeries, Inc. In 2011, we applied for a patent for our new Duncan Hines Frosting Creations™ products.

Solely for convenience, the trademarks, service marks, and tradenames referred to in this prospectus are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, and tradenames. All trademarks, service marks and tradenames appearing in this prospectus are the property of their respective owners.

iii

Table of Contents

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in this prospectus, is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information presented under the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” and the consolidated financial statements and the notes thereto, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of certain factors such as those set forth in the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements.”

Unless the context otherwise requires, all references herein to the “Company,” “we,” “our” or “us” refer to Pinnacle Foods Inc. and its consolidated subsidiaries. The historical financial statements and financial data included in this prospectus are those of Pinnacle Foods Inc. and its consolidated subsidiaries.

Our Company

We are a leading manufacturer, marketer and distributor of high-quality, branded food products in North America, with annual net sales of $2.5 billion in fiscal 2012. Our brands are leaders in many of their respective categories, and we hold the #1 or #2 market share position in 10 of the 12 major product categories in which we compete. Our brand portfolio enjoys strong household penetration in the United States, where our products can be found in over 85% of U.S. households. Our products are sold through supermarkets, grocery wholesalers and distributors, mass merchandisers, super centers, convenience stores, dollar stores, drug stores and warehouse clubs in the United States and Canada, as well as in military channels and foodservice locations. Given our diverse portfolio of iconic brands with attractive market positions, our business generates significant and stable cash flows that we believe will enable us to pay regular dividends to our shareholders, reduce our debt and drive value creation through both reinvestment in our existing brands and periodic strategic acquisitions.

From fiscal 2008 through fiscal 2012, we grew our net sales and Adjusted EBITDA by approximately 59% and 91%, respectively, and expanded our Adjusted EBITDA margin by 2.9 percentage points. Over the same period, our earnings increased from a net loss of $28.6 million in 2008 to net earnings of $52.6 million in fiscal 2012. See “—Summary Historical Consolidated Financial Data” for our definition of Adjusted EBITDA and a reconciliation of our net earnings (loss) to Adjusted EBITDA. On December 23, 2009, we acquired all of the common stock of Birds Eye Foods, Inc. (the “Birds Eye Acquisition”), a transaction that significantly expanded our presence in frozen foods and positioned Pinnacle as the 5th largest frozen food manufacturer in the United States. At the time of the Birds Eye Acquisition, the Birds Eye Foods Inc. (“Birds Eye”) portfolio included an expanding platform of healthy, high-quality frozen vegetables and frozen meals, as well as a portfolio of primarily branded shelf-stable foods that were complimentary to our existing product offerings. In fiscal 2010, all aspects of the Birds Eye business were fully integrated with Pinnacle.

In addition to reinvestment in our brands and making periodic strategic acquisitions, we have also deployed our significant cash flows to reduce our debt. Our cash flow generation has enabled us to pay down approximately $350 million of the $3.0 billion of debt we incurred in connection with the acquisition of the Company by affiliates of The Blackstone Group L.P. in April 2007 and the Birds Eye Acquisition in December 2009.

1

Table of Contents

Our operations are managed and reported in three operating segments: the Birds Eye Frozen Division, the Duncan Hines Grocery Division and the Specialty Foods Division. The Birds Eye Frozen Division and the Duncan Hines Grocery Division, which collectively represent our North American Retail operations, include the following brands:

| Birds Eye Frozen Division |

Industry Category |

Market Share 52 Weeks Ended 12/30/12 |

Category Rank (1) |

|||||||

| Major Pinnacle Brands: |

||||||||||

| Birds Eye |

Frozen vegetables | 27.2 | % | #1 | ||||||

| Birds Eye Voila! |

Frozen complete bagged meals | 25.1 | % | #2 | (2) | |||||

| Van de Kamp’s |

Frozen prepared seafood | 18.8 | % | #2 | ||||||

| Mrs. Paul’s |

||||||||||

| Lender’s |

Frozen and refrigerated bagels | 45.7 | % | #1 | ||||||

| Celeste |

Frozen pizza for one | 11.3 | % | #4 | ||||||

| Hungry-Man |

Full-calorie single-serve frozen dinners and entrées | 8.5 | % | #3 | ||||||

| Aunt Jemima |

Frozen pancakes/waffles/French toast | 8.5 | % | #2 | ||||||

| (1) | Rank among branded manufacturers, excluding private label. |

| (2) | Pinnacle is the #2 competitor and Birds Eye Voila! is the #1 ranked individual brand in the frozen complete bagged meals category. |

| Duncan Hines Grocery Division |

Industry Category |

Market Share 52 Weeks Ended 12/30/12 |

Category Rank (1) |

|||||||

| Major Pinnacle Brands: |

||||||||||

| Duncan Hines |

Cake/brownie mixes and frostings | 25.8 | % | #2 | ||||||

| Vlasic |

Shelf-stable pickles | 31.3 | % | #1 | ||||||

| Mrs. Butterworth’s |

Table syrup | 17.6 | % | #2 | ||||||

| Log Cabin |

||||||||||

| Armour |

Canned meat | 18.5 | % | #2 | ||||||

| Brooks |

||||||||||

| Nalley |

||||||||||

| Comstock |

Pie/pastry fruit fillings | 36.0 | % | #1 | ||||||

| Wilderness |

||||||||||

| (1) | Rank among branded manufacturers, excluding private label. |

In addition to our North American Retail operations, the Specialty Foods Division consists of a regional presence in snack products (including Tim’s Cascade and Snyder of Berlin), as well as our foodservice and private label businesses. As part of our ongoing strategic focus over the last several years, we have deemphasized certain low-margin foodservice businesses, particularly foodservice pickles in fiscal 2012, and private label businesses for the benefit of our higher margin branded food products. We believe that this effort will be substantially completed in 2013.

Within our divisions, we actively manage our portfolio by segregating our business into Leadership Brands and Foundation Brands. Our Leadership Brands enjoy a combination of higher growth and margins, greater potential for value-added innovation and enhanced responsiveness to consumer marketing than do our Foundation Brands and, as a result, we focus our investment spending and brand-building activities on our Leadership Brands. By contrast, we manage our Foundation Brands for revenue and market share stability and for cash flow generation to support investment in our Leadership Brands, reduce our debt and fund other corporate priorities. As a result, we focus spending for our Foundation Brands on brand renovation and targeted consumer and trade programs.

Our Leadership Brands are comprised of Birds Eye, Birds Eye Voila!, Duncan Hines, Vlasic, Van de Kamp’s, Mrs. Paul’s, Mrs. Butterworth’s and Log Cabin. Historically, our Leadership Brands have received

2

Table of Contents

approximately 80% of our marketing investment and the majority of our innovation investment. Our Birds Eye and Birds Eye Voila! brands combined have annual retail revenue across all retail channels in excess of $1 billion, and our remaining Leadership Brands collectively have annual retail revenue of approximately $900 million across all retail channels. In fiscal 2012, our Leadership Brands accounted for approximately 55% and 70% of our consolidated net sales and gross profit, respectively, and approximately 65% and 74% of our North American Retail net sales and gross profit, respectively.

Competitive Strengths

We believe the following competitive strengths differentiate us from our competitors and contribute to our ongoing success:

Actively Managed Portfolio of Iconic Food Brands with Leading Market Positions

We actively manage our diverse portfolio of iconic food brands that participate in attractive product categories. Our well-recognized brand portfolio enjoys strong household penetration in the United States, where our products can be found in over 85% of U.S. households. Our brands are leaders in their respective categories, holding the #1 or #2 market share position in 10 of the 12 major product categories in which we compete.

We have prioritized our investment spending and brand-building activities behind our Leadership Brands, given their higher growth and margins, greater potential for value-added innovation and enhanced responsiveness to consumer marketing, as compared to that of our Foundation Brands. We manage our Foundation Brands for stability in sales, market share and cash flow, with a focus on ongoing quality upgrades, competitive pricing and strong merchandising and trade programs. Our brand prioritization strategy is focused on ensuring that the strong, stable cash flows from our Foundation Brands are deployed for reinvestment in marketing and on-trend innovation for our higher-margin Leadership Brands, as well as for debt reduction and other corporate priorities. From fiscal 2008 through fiscal 2012, net sales of our Leadership Brands grew at a compounded annual growth rate, or CAGR, of 2%, compared to our Foundation Brands, which were flat. Gross profit margin for our Leadership Brands was 30% of net sales in fiscal 2012, compared to 20% of net sales for our Foundation Brands in fiscal 2012.

Strong Innovation and Marketing Capabilities Focused on Leadership Brands

Since 2009, we have substantially enhanced our organizational capabilities in the areas of new product innovation and consumer marketing. We have improved our in-house innovation capabilities by augmenting and upgrading our innovation team, with the construction of a new state-of-the-art Research and Development (“R&D”) facility in our Parsippany, New Jersey headquarters. This facility co-locates our sales, marketing and operations teams with our entire company-wide R&D team, and better enables us to leverage the innovation experience of senior management. Additionally, we have increased investment in consumer insights and employee innovation training. Our Renewal Rate, which we define as gross sales from products introduced within the last three years as a percentage of current year gross sales, has nearly doubled since the Birds Eye Acquisition to 9.4% in fiscal 2012, compared to 5.0% in fiscal 2009 for Pinnacle before the Birds Eye Acquisition. Gross sales represents net sales before returns, discounts, trade, slotting and coupon redemption expenses and other allowances. Recent examples of successfully launched innovations include Duncan Hines Frosting Creations custom-flavor frosting system, Duncan Hines Decadent cake mixes, Vlasic Farmer’s Garden artisan-quality pickles, Birds Eye Chef’s Favorites enhanced vegetable side dishes and Birds Eye Voila! family size complete bagged meals. We intend to continue to invest in innovation that enables us to further differentiate our brands in the marketplace.

To complement our accelerated innovation efforts, we have also focused and enhanced our marketing investments behind our Leadership Brands. We have partnered with best-in-class branded consumer advertising,

3

Table of Contents

digital and media agencies to develop high impact marketing programs implemented across television, print, social and digital media. From fiscal 2008 through fiscal 2011, our consumer marketing investments behind our Leadership Brands increased at a CAGR of 6%, while investment spending declined 14% in fiscal 2012 due to our planned shift of investment spending into trade promotions during a period of heightened competitive activity and significant consumer price sensitivity. We intend to increase marketing investments behind our Leadership Brands over time, as the volume trends and promotional environment in the broader food industry normalize.

Operational Excellence Driving Continued Gross Margin Improvement

Our operational excellence program, a company-wide core productivity initiative called Maximizing Value through Productivity (MVP) is designed to generate annual core productivity savings in procurement, manufacturing and logistics in the range of 3% to 3.5% of our annual Cost of products sold. In fiscal 2012, we realized core MVP productivity savings of 3.1%. In addition, in fiscal 2012, our supply chain footprint consolidation initiatives also drove significant, incremental productivity savings of 0.9% of Cost of products sold. These productivity savings, combined with selective retail price increases and our active commodity hedging program, have been instrumental in mitigating input cost inflation in periods of significant inflationary pressure, such as fiscal 2012, and driving gross margin expansion in periods of more modest inflation. We also pursue other initiatives to drive incremental improvement in our gross margin, including improving our product mix through new product innovation and low-margin SKU rationalization, increasing the effectiveness of our trade promotional spending and realizing synergies from acquisitions. Furthermore, our gross margin benefits from our diversified input cost basket in which no single commodity accounted for more than 9% of our total Cost of products sold in fiscal 2012.

In fiscal 2011, we completed two manufacturing plant consolidations designed to optimize our manufacturing footprint and reduce our supply chain costs. In fiscal 2012, we initiated the consolidation of a third manufacturing plant and terminated the use of a third party storage facility. The combined ongoing annualized benefit to Cost of products sold from these projects is estimated at approximately $28 million, with fiscal 2012 benefiting by approximately $16 million and 2013 expected to benefit by an additional $7 million. The remaining $5 million in incremental ongoing annualized savings are expected to be realized in 2014. From fiscal 2008 through fiscal 2012, we have expanded our gross margin as percentage of net sales by 1.9 percentage points and our Adjusted gross margin as percentage of net sales by 3.1 percentage points. See “—Summary Historical Consolidated Financial Data” for our definition of Adjusted gross profit and a reconciliation of our gross profit to Adjusted gross profit.

Strong Free Cash Flow Conversion

Our business generates an attractive Adjusted EBITDA margin and also benefits from modest capital expenditure and working capital requirements and approximately $1 billion in net operating loss carryovers (“NOLCs”), which combined have resulted in strong and stable unlevered free cash flows. Our Adjusted EBITDA margin benefits from the quality of our brand portfolio and our lean and nimble organization structure, with selling, general and administrative expenses, excluding marketing investment and one-time items, consistently representing approximately 8% of net sales. Our well-maintained manufacturing facilities and strategic use of co-packers limit our maintenance capital expenditure requirements, and our significant NOLCs and other tax attributes minimize our cash taxes.

We believe our strong free cash flows will enable us to maximize shareholder value through paying a regular dividend, reducing our indebtedness, strategically deploying our capital to fund innovation and organic growth opportunities and financing value-enhancing acquisitions.

4

Table of Contents

Proven M&A Expertise with Significant Opportunity

We have substantial experience in sourcing, executing and integrating value-enhancing acquisitions. We maintain a highly-disciplined approach to M&A, focusing on opportunities that add new iconic brands to our portfolio and/or allow for strong synergy realization.

In December 2009, we completed the $1.3 billion purchase of Birds Eye. The Birds Eye Acquisition added approximately $1 billion in net sales, including the Birds Eye and Birds Eye Voila! brands, enhanced our operating margins, and added scale to our frozen food business, making us the 5th largest frozen food manufacturer in the United States. The integration of Birds Eye was largely completed within six months of the acquisition, and the synergies we achieved exceeded our original estimates. Similarly, in 2006, we completed the acquisition of Armour and successfully integrated the business within four months. The Armour acquisition added approximately $225 million in net sales and was immediately accretive to our operating margins.

Our strong existing platforms in the Birds Eye Frozen and Duncan Hines Grocery segments facilitate a large addressable market and broad set of potential acquisition targets. We believe our scale, management depth, integration expertise and access to capital will allow us to consider both small and large acquisitions in the future and to seamlessly integrate them to drive maximum value creation.

Experienced, Hands-On Management Team and Board of Directors

Our management team has a demonstrated history of delivering strong operating results. From fiscal 2008 through fiscal 2012, we have enhanced our business mix through active portfolio management, including focused innovation and marketing and the successful integration of a transformative, value-enhancing acquisition that dramatically increased the scale and scope of our business. Our management team, which has been strengthened with the recent addition of several highly-experienced executives, has extensive food industry experience and includes several executives who have managed significantly larger businesses and have led numerous acquisition integrations. Our management team is complimented by an experienced Board of Directors, which includes several individuals with a proven track record of successfully managing and acquiring consumer businesses.

Our Strategy

We intend to profitably grow our business and create shareholder value through the following strategic initiatives:

Drive Growth Through Focus on Leadership Brands

Our Leadership Brands are among our highest-growth and highest-margin businesses and enjoy greater potential for value-added innovation and enhanced responsiveness to consumer marketing. Our brand prioritization strategy is focused on ensuring that the strong, stable cash flows from our Foundation Brands are, among other uses, reinvested in marketing and on-trend innovation for our higher-margin Leadership Brands. We believe our formalized innovation processes, upgraded R&D capabilities, increased investments in consumer insights, and partnership with best-in-class branded consumer advertising, digital and media agencies will enable us to continue to introduce successful new products and drive brand growth through high-impact marketing programs. We believe this strategy, which will focus the majority of our consumer marketing investments and new product innovation efforts on our Leadership Brands, will drive higher-margin revenue growth across our portfolio.

Expand Margins By Leveraging Productivity and Efficient Organization Structure

We believe we are well-positioned to continue to expand our margins. Our company-wide focus on productivity, which includes both our core productivity initiative, MVP, and our supply chain footprint consolidation

5

Table of Contents

initiatives, along with selective pricing actions and our active commodity hedging program, are intended to mitigate input cost inflation in periods of significant inflationary pressure and more than offset input cost inflation in periods of modest input cost inflation. In addition, our focus on improving our product mix, enhancing the effectiveness of our trade promotions, realizing synergies from acquisitions and leveraging our efficient organizational structure are expected to further drive margin expansion over time. We believe our lean, nimble structure and efficient internal processes will continue to enhance our decision-making and speed of execution. Our flat structure, which has enabled us to hold our overhead costs (i.e., selling, general and administrative expenses, excluding marketing investment and one-time items) at approximately 8% of net sales, allows for a high level of connectivity between senior management and our operations and customers, ensuring senior management engagement in key business decisions.

Deliver Strong Free Cash Flow Through Tight Working Capital Management, Focused Capital Spending and Minimal Cash Taxes

We believe we are well-positioned to profitably grow our business and generate strong free cash flow through our combination of attractive Adjusted EBITDA margins, modest working capital requirements, limited maintenance capital expenditures and low cash taxes that result from our approximately $1 billion in NOLCs and other tax attributes, which we believe will result in minimal cash taxes through 2015 and modest annual cash tax savings beyond 2015. Our well-maintained manufacturing facilities and strategic use of co-packers limit our capital expenditure requirements, and our ongoing focused management of working capital also benefits our free cash flow.

Acquire Value-Enhancing Food Brands

We intend to proactively pursue value-enhancing acquisitions in the packaged food industry, utilizing a disciplined approach to identify and evaluate attractive acquisition candidates. We believe we can leverage our scale, management depth and integration expertise, along with our access to capital, to continue our track record of making value-accretive acquisitions. We believe the combination of consolidating selling, general and administrative functions, leveraging our scale in procurement, optimizing supply chain and manufacturing operations, cross-marketing brands across categories and further developing retailer relationships will continue to enable us to drive acquisition synergies in future transactions we may pursue.

Return Value to Shareholders Through Debt Reduction and Regular Dividend Payments

We believe our capital structure and strong free cash flow enables us not only to invest in our Leadership Brands to drive organic growth and fund value-enhancing acquisitions, but also to continue to strengthen our balance sheet through debt reduction and to return capital to our shareholders through regular dividend payments. Upon the consummation of this offering, we intend to pay a regular quarterly cash dividend of approximately $0.18 per share. See “Dividend Policy.”

Risks Related to Our Business and this Offering

Investing in our common stock involves substantial risk, and our ability to successfully operate our business is subject to numerous risks, including those that are generally associated with operating in the packaged food industry. Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our common stock.

6

Table of Contents

Corporate History and Information

Pinnacle Foods Inc. was incorporated in Delaware on July 28, 2003 under the name “Crunch Holding Corp.”

On April 2, 2007, Pinnacle Foods Inc. was acquired by, and became a wholly owned subsidiary of, Peak Holdings LLC, an entity controlled by investment funds affiliated with The Blackstone Group L.P. (“Blackstone”). We refer to this merger transaction and related financing transactions as the Blackstone Transaction. As a result of the Blackstone Transaction, Blackstone currently owns through Peak Holdings LLC approximately 98% of the common stock of Pinnacle Foods Inc. In connection with this offering, we expect that Peak Holdings LLC will be dissolved. After giving effect to the dissolution of Peak Holdings LLC and this offering, Blackstone will beneficially own approximately 70.6% of our issued and outstanding common stock (assuming no exercise of the underwriters’ option to purchase additional shares) or 68.0% of our issued and outstanding common stock (assuming full exercise of the underwriters’ option to purchase additional shares).

On November 18, 2009, our indirect wholly-owned subsidiary Pinnacle Foods Group LLC entered into a Stock Purchase Agreement with Birds Eye Holdings LLC and Birds Eye, pursuant to which Pinnacle Foods Group LLC acquired all of the issued and outstanding common stock of Birds Eye from Birds Eye Holdings LLC. At the closing of the Birds Eye Acquisition on December 23, 2009, Pinnacle Foods Group LLC purchased all of the outstanding shares of Birds Eye’s common stock, par value $0.01 per share, for $670.0 million in cash, together with the assumption of Birds Eye’s debt of $670.4 million, resulting in the total acquisition cost of $1,340.4 million.

Our principal executive offices are located at 399 Jefferson Road, Parsippany, New Jersey 07054, and our telephone number is (973) 541-6620. We maintain a website at www.pinnaclefoods.com. The information contained on our website or that can be accessed through our website neither constitutes part of this prospectus nor is incorporated by reference herein.

7

Table of Contents

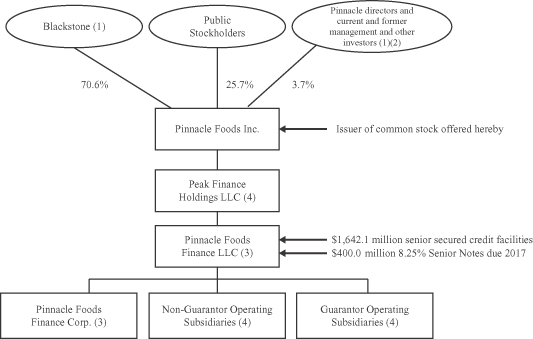

Organizational Structure

The following diagram illustrates our organizational structure after giving effect to the consummation of this offering, the dissolution of Peak Holding LLC and the repayment with proceeds of this offering of certain indebtedness.

| (1) | In connection with the dissolution of Peak Holdings LLC, Blackstone and the other equity holders of Peak Holdings LLC (including certain of our directors and officers) will receive shares of our common stock, and in certain instances, equity awards with respect to our common stock, in respect of their ownership in Peak Holdings LLC. The allocation of shares of our common stock among Blackstone and the other equity holders of Peak Holdings LLC will be determined based upon the valuation of us derived from the initial public offering price. |

| (2) | Includes the equity awards to be received in connection with the dissolution of Peak Holdings LLC assuming the midpoint of the estimated price range set forth on the cover of this prospectus. The actual number of shares and equity awards to be issued in connection with the dissolution of Peak Holdings LLC will be determined based upon the valuation of us derived from the initial public offering price. |

| (3) | Pinnacle Foods Finance LLC is the borrower under our senior secured credit facilities which, as adjusted to reflect this offering, will consist of a $795.2 million term loan B facility, $637.9 million of which will mature in October 2016, subject to springing maturities as described under “Description of Indebtedness,” and $157.3 million of which will mature in April 2014, $398.0 million of Tranche E term loans which will mature in October 2018, subject to springing maturities as described under “Description of Indebtedness,” $448.9 million of Tranche F term loans which will mature in October 2018, subject to springing maturities as described under “Description of Indebtedness,” and a $150.0 million revolving credit facility that mature in April 2017, subject to springing maturities as described under “Description of Indebtedness.” Pinnacle Foods Finance LLC and Pinnacle Foods Finance Corp. are co-issuers of $400.0 million aggregate principal amount of 8.25% Senior Notes due 2017. Pinnacle Foods Finance Corp. was formed solely to act as a co-issuer of the notes, has only nominal assets and does not conduct any operations. See “Description of Indebtedness.” |

| (4) | The obligations under the senior secured credit facilities are fully and unconditionally guaranteed by Peak Finance Holdings LLC and, subject to certain exceptions, each existing and future direct or indirect wholly-owned domestic subsidiary of Pinnacle Foods Finance LLC. The notes are guaranteed on a full, unconditional, joint and several basis by each of Pinnacle Food Finance LLC’s wholly-owned domestic subsidiaries, other than Pinnacle Foods Finance Corp. |

8

Table of Contents

The Offering

| Common stock offered |

29,000,000 shares. |

| Underwriters’ option to purchase additional shares of common stock |

4,350,000 shares. |

| Common stock to be outstanding immediately after this offering |

112,881,939 shares (or 117,231,939 shares if the underwriters exercise in full their option to purchase additional shares). |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions, will be approximately $520.7 million (or approximately $598.8 million, if the underwriters exercise in full their option to purchase additional shares), based on the assumed initial public offering price of $19.00 per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus. For sensitivity analysis as to the offering price and other information, see “Use of Proceeds.” |

| We intend to use a portion of the net proceeds from this offering to redeem $465 million in aggregate principal amount of our 9.25% Senior Notes due 2015 at a redemption price of 100%. We intend to use the remaining net proceeds, together with cash on hand, to repay $86 million of our senior secured term loan B facility maturing in April 2014 (the “Tranche B Non-Extended Term Loans”). We will pay the fees and expenses related to this offering (other than underwriting discounts and commissions) and the use of proceeds therefrom (including the payment of accrued and unpaid interest) with cash generated from operations. |

| Risk factors |

See “Risk Factors” beginning on page 16 and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Dividend policy |

We intend to pay a regular quarterly cash dividend of approximately $0.18 per share on our common stock, subject to the discretion of our Board of Directors and our compliance with applicable law, and depending on, among other things, our results of operations, financial condition, level of indebtedness, capital requirements, contractual restrictions, restrictions in our debt agreements and in any preferred stock, business prospects and other factors that our Board of Directors may deem relevant. Our ability to pay dividends on our common stock is limited by the covenants of our senior secured credit facilities and the indentures governing our senior notes and may be further restricted by the terms of any future debt or preferred securities. We do not currently believe that the restrictions contained in our existing indebtedness will impair our ability to pay regular quarterly cash dividends as described above. See “Dividend Policy” and “Description of Indebtedness.” |

9

Table of Contents

| NYSE ticker symbol |

“PF” |

| Conflicts of interest |

Affiliates of Blackstone Advisory Partners L.P. own (through their investment in Peak Holdings LLC) in excess of 10% of our issued and outstanding common stock. Because Blackstone Advisory Partners L.P. is an underwriter and its affiliates own in excess of 10% of our issued and outstanding common stock, Blackstone Advisory Partners L.P. is deemed to have a “conflict of interest” under Rule 5121 (“Rule 5121”) of the Financial Industry Regulatory Authority, Inc. Accordingly, this offering is being made in compliance with the requirements of Rule 5121. Pursuant to that rule, the appointment of a “qualified independent underwriter” is not required in connection with this offering as the members primarily responsible for managing the public offering do not have a conflict of interest, are not affiliates of any member that has a conflict of interest and meet the requirements of paragraph (c)(12)(E) of Rule 5121. Blackstone Advisory Partners L.P. will not confirm sales of the securities to any account over which it exercises discretionary authority without the specific written approval of the account holder. See “Underwriting (Conflicts of Interest).” |

Unless we indicate otherwise or the context otherwise requires, all information in this prospectus:

| • | assumes (1) no exercise of the underwriters’ option to purchase additional shares of our common stock; (2) an initial public offering price of $19.00 per share, the midpoint of the estimated price range set forth on the cover of this prospectus; |

| • | gives effect to the 55.2444-for-1 stock split of our common stock, which occurred on March 12, 2013; |

| • | gives effect to 83,869,232 shares of our common stock (including 1,455,361 shares of restricted stock issued in respect of unvested Class B PIUs of Peak Holdings LLC) issued to Blackstone and other equity holders of Peak Holdings LLC (including certain of our directors and officers) in connection with the dissolution of Peak Holdings LLC; and |

| • | does not reflect (1) 426,653 shares of common stock issuable upon the exercise of 426,653 options outstanding as of March 8, 2013, at a weighted average exercise price of $10.01 per share, of which 181,865 were then vested and exercisable, (2) approximately 2,400,000 shares of common stock issuable upon the exercise of approximately 2,400,000 options which are expected to be granted under our new 2013 Omnibus Incentive Plan in connection with this offering, the actual number of which will be determined based on the actual price of the shares of our common stock in this offering, (3) 81,945 shares of restricted stock which we intend to issue to certain holders of Class B PIUs of Peak Holdings LLC and (4) 7,362,694 shares of common stock available for future issuance under our new 2013 Omnibus Incentive Plan, which we intend to adopt in connection with this offering. See “Management—Compensation Discussion and Analysis—Compensation Arrangements to be Adopted in connection with this Offering.” |

10

Table of Contents

Summary Historical Consolidated Financial Data

The table below presents our summary historical consolidated financial data as of the dates and for the periods indicated. We derived the summary historical consolidated financial data for each of the fiscal years ended December 26, 2010, December 25, 2011 and December 30, 2012 and the summary consolidated balance sheet data as of December 25, 2011 and December 30, 2012 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the summary consolidated balance sheet data as of December 26, 2010 from our audited consolidated balance sheet, which is not included in this prospectus. Share and per share data in the table below has been retroactively adjusted to give effect to the 55.2444-for-one stock split which occurred on March 12, 2013.

Our historical results are not necessarily indicative of future operating results. Because the data in this table is only a summary and does not provide all of the data contained in our consolidated financial statements, the information should be read in conjunction with “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus.

| ($ in millions) |

(52 weeks) Fiscal year ended December 26, 2010 |

(52 weeks) Fiscal year ended December 25, 2011 |

(53 weeks) Fiscal year ended December 30, 2012 |

|||||||||

| Statement of Operations Data: |

||||||||||||

| Net sales |

$ | 2,436.7 | $ | 2,469.6 | $ | 2,478.5 | ||||||

| Cost of products sold |

1,834.4 | 1,854.7 | 1,893.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

602.3 | 614.9 | 584.6 | |||||||||

| Operating expenses |

||||||||||||

| Marketing and selling expenses |

172.3 | 171.6 | 169.7 | |||||||||

| Administrative expenses |

110.0 | 80.5 | 89.4 | |||||||||

| Research and development expenses |

9.4 | 8.0 | 12.0 | |||||||||

| Goodwill impairment charges |

— | 122.9 | — | |||||||||

| Other expense (income), net |

45.5 | 48.6 | 29.8 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

337.2 | 431.6 | 300.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| Earnings before interest and taxes |

265.1 | 183.3 | 283.7 | |||||||||

| Interest expense |

236.0 | 208.3 | 198.5 | |||||||||

| Interest income |

0.3 | 0.2 | 0.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Earnings (loss) before income taxes |

29.4 | (24.8 | ) | 85.3 | ||||||||

| Provision (benefit) for income taxes |

7.4 | 22.1 | 32.7 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net earnings (loss) |

$ | 22.0 | $ | (46.9 | ) | $ | 52.6 | |||||

|

|

|

|

|

|

|

|||||||

11

Table of Contents

| ($ in millions) |

(52 weeks) Fiscal year ended December 26, 2010 |

(52 weeks) Fiscal year ended December 25, 2011 |

(53 weeks) Fiscal year ended December 30, 2012 |

|||||||||

| Net earnings (loss) per share: |

||||||||||||

| Basic |

$ | 0.32 | $ | (0.58 | ) | $ | 0.65 | |||||

| Diluted |

$ | 0.30 | $ | (0.58 | ) | $ | 0.61 | |||||

| Weighted average shares outstanding: |

||||||||||||

| Basic |

68,434,982 | 81,315,848 | 81,230,630 | |||||||||

| Diluted |

73,638,195 | 81,315,848 | 86,494,546 | |||||||||

| Cash Flow: |

||||||||||||

| Net cash provided by (used in): |

||||||||||||

| Operating activities |

$ | 257.0 | $ | 204.2 | $ | 202.9 | ||||||

| Investing activities |

(81.3 | ) | (109.4 | ) | (77.7 | ) | ||||||

| Financing activities |

(134.3 | ) | (59.0 | ) | (184.1 | ) | ||||||

| Balance sheet data (at end of period): |

||||||||||||

| Cash and cash equivalents |

$ | 115.3 | $ | 151.0 | $ | 92.3 | ||||||

| Working capital (1) |

344.4 | 408.7 | 404.1 | |||||||||

| Total assets |

4,491.6 | 4,451.6 | 4,400.0 | |||||||||

| Total debt (2) |

2,803.5 | 2,756.0 | 2,608.9 | |||||||||

| Total liabilities |

3,596.5 | 3,606.3 | 3,511.3 | |||||||||

| Total shareholders’ equity |

895.1 | 845.4 | 888.7 | |||||||||

| Other Financial Data: |

||||||||||||

| North American Retail net sales |

$ | 2,023.9 | $ | 2,066.9 | $ | 2,081.7 | ||||||

| Adjusted gross profit (3) |

698.5 | 694.0 | 674.9 | |||||||||

| Adjusted EBITDA (4) |

446.9 | 449.7 | 426.1 | |||||||||

| Capital expenditures |

81.3 | 117.3 | 78.3 | |||||||||

| (1) | Working capital excludes notes payable, revolving debt facility and current portion of long-term debt. |

| (2) | Total debt includes notes payable, revolving debt facility and current portion of long-term debt. |

| (3) | Adjusted gross profit is defined as gross profit before depreciation, certain non-cash items, acquisition, merger and other restructuring charges and other adjustments noted in the table below. Our management uses Adjusted gross profit as an operating performance measure. We believe that the presentation of Adjusted gross profit is useful to investors because it is consistent with our definition of Adjusted EBITDA (defined below), a measure frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies in industries similar to ours. In addition, we also use targets based on Adjusted gross profit as one of the components used to evaluate our management’s performance. Adjusted gross profit is not defined under United States Generally Accepted Accounting Principles (“GAAP”), should not be considered in isolation or as substitutes for measures of our performance prepared in accordance with GAAP and is not indicative of gross profit as determined under GAAP. |

The following table provides a reconciliation from our gross profit to Adjusted gross profit for the fiscal years ended December 26, 2010, December 25, 2011 and December 30, 2012.

| (52 weeks) | (52 weeks) | (53 weeks) | ||||||||||

| ($ in millions) |

Fiscal year ended December 26, 2010 |

Fiscal year ended December 25, 2011 |

Fiscal year ended December 30, 2012 |

|||||||||

| Gross profit |

$602.3 | $614.9 | $584.6 | |||||||||

| Depreciation expense (a) |

53.5 | 65.0 | 73.0 | |||||||||

| Non-cash items (b) |

38.2 | 3.0 | (1.2 | ) | ||||||||

| Acquisition, merger and other restructuring charges (c) |

4.3 | 9.9 | 16.9 | |||||||||

| Other adjustment items (d) |

0.2 | 1.3 | 1.6 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted gross profit |

$698.5 | $694.0 | $674.9 | |||||||||

|

|

|

|

|

|

|

|||||||

12

Table of Contents

| (a) | Includes accelerated depreciation from plant closures of $0.7 million for fiscal year 2010, $14.1 million for fiscal year 2011 and $21.0 million for fiscal year 2012. |

| (b) | Non-cash items are comprised of the following: |

| (52 weeks) | (52 weeks) | (53 weeks) | ||||||||||

| ($ in millions) |

Fiscal year ended December 26, 2010 |

Fiscal year ended December 25, 2011 |

Fiscal year ended December 30, 2012 |

|||||||||

| Non-cash compensation charges (1) |

$0.4 | $0.2 | $0.1 | |||||||||

| Unrealized losses (gains) resulting from hedging activities (2) |

0.7 | 1.6 | (1.3 | ) | ||||||||

| Other impairment charges (3) |

— | 1.3 | — | |||||||||

| Effects of adjustments related to the application of purchase accounting (4) |

37.1 | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-cash items |

$38.2 | $3.0 | $(1.2 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Represents non-cash compensation charges related to the granting of equity awards. |

| (2) | Represents non-cash gains and losses resulting from mark-to-market obligations under derivative contracts. |

| (3) | For fiscal year 2011, represents a plant asset impairment on the previously announced closure of the Tacoma, Washington facility of $1.3 million. |

| (4) | For fiscal year 2010, represents expense related to the write-up to fair market value of inventories acquired as a result of the Birds Eye Acquisition. |

| (c) | Acquisition, merger and other restructuring charges are comprised of the following: |

| (52 weeks) | (52 weeks) | (53 weeks) | ||||||||||

| ($ in millions) |

Fiscal year ended December 26, 2010 |

Fiscal year ended December 25, 2011 |

Fiscal year ended December 30, 2012 |

|||||||||

| Restructuring charges, integration costs and other business optimization expenses (1) |

$4.1 | $9.3 | $16.9 | |||||||||

| Employee severance and recruiting (2) |

0.2 | 0.6 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total acquisition, merger and other restructuring charges |

$4.3 | $9.9 | $16.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | For fiscal year 2010, primarily represents integration costs related to the Birds Eye Acquisition. For fiscal year 2011, primarily represents restructuring charges and consulting and business optimization expenses related to the closings of the Tacoma, Washington and Fulton, New York facilities. For fiscal year 2012, primarily represents restructuring charges and consulting and business optimization expenses related to the closings of the Tacoma, Washington, Fulton, New York and Millsboro, Delaware facilities. |

| (2) | Represents severance costs paid or accrued to terminated employees. |

| (d) | Other adjustment items are comprised of the following: |

| (52 weeks) | (52 weeks) | (53 weeks) | ||||||||||

| ($ in millions) |

Fiscal year ended December 26, 2010 |

Fiscal year ended December 25, 2011 |

Fiscal year ended December 30, 2012 |

|||||||||

| Other (1) |

$0.2 | $1.3 | $1.6 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total other adjustments |

$0.2 | $1.3 | $1.6 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | For fiscal year 2010, represents miscellaneous other cost. For fiscal year 2011 and fiscal year 2012, primarily represents the recall of Aunt Jemima product, net of insurance recoveries. |

| (4) | Adjusted EBITDA is defined as net earnings (loss) before interest expense, taxes, depreciation and amortization (“EBITDA”) and other adjustments noted in the table below. Our management uses Adjusted EBITDA as an operating performance measure. We believe that the presentation of Adjusted EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies in industries similar to ours. In addition, targets for Adjusted EBITDA are among the measures we use to evaluate our management’s performance for purposes of determining their compensation under our incentive plans. |

13

Table of Contents

| EBITDA and Adjusted EBITDA do not represent net earnings or loss or cash flow from operations as those terms are defined by GAAP and do not necessarily indicate whether cash flows will be sufficient to fund cash needs. In particular, Adjusted EBITDA includes certain non-cash, extraordinary, unusual or non-recurring charges that are deducted in calculating net earnings or loss. However, these are expenses that vary greatly and are difficult to predict. Because not all companies use identical calculations, these presentations of EBITDA and Adjusted EBITDA are not necessarily comparable to other similarly titled captions of other companies. In addition, under the credit agreement governing our senior secured credit facilities and the indentures governing our senior notes, our ability to engage in activities such as incurring additional indebtedness, making investments and paying dividends is tied to a ratio based on Adjusted EBITDA. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Covenant Compliance.” |

| The following table provides a reconciliation from our net earnings (loss) to EBITDA and Adjusted EBITDA for the fiscal years ended December 26, 2010, December 25, 2011 and December 30, 2012. |

| (52 weeks) | (52 weeks) | (53 weeks) | ||||||||||

| ($ in millions) |

Fiscal year ended December 26, 2010 |

Fiscal year ended December 25, 2011 |

Fiscal

year ended December 30, 2012 |

|||||||||

| Net earnings (loss) |

$22.0 | $(46.9) | $52.6 | |||||||||

| Interest expense, net |

235.7 | 208.1 | 198.4 | |||||||||

| Income tax expense (benefit) |

7.4 | 22.1 | 32.7 | |||||||||

| Depreciation and amortization expense |

78.1 | 88.5 | 98.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| EBITDA |

$343.2 | $271.8 |

|

$381.7 |

| |||||||

|

|

|

|

|

|

|

|||||||

| Non-cash items (a) |

$71.5 | $152.2 |

|

$0.1 |

| |||||||

| Acquisition, merger and other restructuring charges (b) |

27.5 | 20.3 | 23.3 | |||||||||

| Other adjustment items (c) |

4.7 | 5.5 | 21.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$446.9 | $449.7 | $426.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| (a) | Non-cash items are comprised of the following: |

| (52 weeks) | (52 weeks) | (53 weeks) | ||||||||||

| ($ in millions) |

Fiscal year ended December 26, 2010 |

Fiscal year ended December 25, 2011 |

Fiscal

year ended December 30, 2012 |

|||||||||

| Non-cash compensation charges (1) |

$4.7 | $1.1 | $0.9 | |||||||||

| Unrealized (gains) losses resulting from hedging activities (2) |

0.7 | 1.6 | (1.3 | ) | ||||||||

| Goodwill impairment charge (3) |

— | 122.9 | — | |||||||||

| Other impairment charges (4) |

29.0 | 26.6 | 0.5 | |||||||||

| Effects of adjustments related to the application of purchase accounting (5) |

37.1 | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-cash items |

$71.5 | $152.2 | $0.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Represents non-cash compensation charges related to the granting of equity awards. |

| (2) | Represents non-cash gains and losses resulting from mark-to-market adjustments of obligations under derivative contracts. |

| (3) | For fiscal year 2011, represents goodwill impairments on the Frozen Breakfast ($51.7 million), Private Label ($49.7 million) and Food Service ($21.5 million) reporting units. |

| (4) | For fiscal year 2010, represents an impairment for the Hungry-Man tradename ($29.0 million). For fiscal year 2011, represents tradename impairments on Aunt Jemima ($23.7 million), Lenders ($1.2 million) and Bernstein’s ($0.4 million), as well as a plant asset impairment on the previously announced closure of the Tacoma, Washington facility ($1.3 million). For fiscal year 2012, represents tradename impairments of Bernstein’s ($0.5 million). |

| (5) | For fiscal year 2010, represents expense related to the write-up to fair market value of inventories acquired as a result of the Birds Eye Acquisition. |

14

Table of Contents

| (b) | Acquisition, merger and other restructuring charges are comprised of the following: |

| (52 weeks) | (52 weeks) | (53 weeks) | ||||||||||

| ($ in millions) |

Fiscal year ended December 26, 2010 |

Fiscal year ended December 25, 2011 |

Fiscal year ended December 30, 2012 |

|||||||||

| Expenses in connection with an acquisition or other merger costs (1) |

$0.9 | $8.8 | $2.3 | |||||||||

| Restructuring charges, integration costs and other business optimization expenses (2) |

25.5 | 9.5 | 20.0 | |||||||||

| Employee severance and recruiting (3) |

1.1 | 2.0 | 1.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total acquisition, merger and other restructuring charges |

$27.5 | $20.3 | $23.3 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | For fiscal year 2010, primarily represents costs related to the Birds Eye Acquisition as well as other expenses related to due diligence investigations. For fiscal year 2011, primarily represents an $8.5 million legal settlement related to the Lehman Brothers Specialty Financing claim described in more detail in Note 12 to our audited consolidated financial statements included elsewhere in this prospectus and in “Business—Legal Proceedings.” For fiscal year 2012, primarily represents expenses related to this offering and due diligence investigations. |

| (2) | For fiscal year 2010, primarily represents employee termination benefits and lease termination costs related to the closing of the Rochester, New York office and integration costs related to the Birds Eye Acquisition. For fiscal year 2011, primarily represents restructuring charges and consulting and business optimization expenses related to the closings of the Tacoma, Washington and Fulton, New York facilities. For fiscal year 2012, primarily represents restructuring charges and consulting and business optimization expenses related to the closings of the Tacoma, Washington, Fulton, New York, Green Bay, Wisconsin and Millsboro, Delaware facilities. |

| (3) | For fiscal year 2010, fiscal year 2011 and fiscal year 2012, represents severance costs paid or accrued to terminated employees. |

| (c) | Other adjustment items are comprised of the following: |

| (52 weeks) | (52 weeks) | (53 weeks) | ||||||||||

| ($ in millions) |

Fiscal year ended December 26, 2010 |

Fiscal year ended December 25, 2011 |

Fiscal year ended December 30, 2012 |

|||||||||

| Management, monitoring, consulting and advisory fees (1) |

$4.5 | $4.6 | $4.7 | |||||||||

| Other (2) |

0.2 | 0.9 | 16.3 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total other adjustments |

$4.7 | $5.5 | $21.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Represents management/advisory fees and expenses paid to an affiliate of Blackstone pursuant to the Amended and Restated Transaction and Advisory Fee Agreement (the “Advisory Agreement”), dated as of December 23, 2009, between Pinnacle Foods Finance LLC and an affiliate of Blackstone. We intend to terminate the Advisory Agreement in accordance with its terms in connection with the completion of this offering. See “Use of Proceeds.” |

| (2) | For fiscal year 2010, represents miscellaneous other cost. For fiscal year 2011, primarily represents a gain on the sale of the Watsonville, California property and costs for the recall of Aunt Jemima product of $1.1 million, net of insurance recoveries. For fiscal year 2012, primarily represents $14.3 million of the premiums paid on the redemption of $150.0 million of 9.25% Senior Notes due 2015, the redemption of $199.0 million of 10.625% Senior Subordinated Notes due 2017 and the repurchase and retirement of $10.0 million of 9.25% Senior Notes due 2015, and costs for the recall of Aunt Jemima product of $2.1 million, net of insurance recoveries. |

15

Table of Contents

An investment in our common stock involves risk. You should carefully consider the following risks as well as the other information included in this prospectus, including “Selected Historical Consolidated Financial Data,”“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, before investing in our common stock. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. However, the selected risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition or results of operations. In such a case, the trading price of the common stock could decline and you may lose all or part of your investment in our Company.

Risks Related to Our Business

We face significant competition in our industry, which could cause us to lose market share, lower prices, or increase advertising and promotional expenditures. Our success also depends on our ability to predict, identify and interpret changes in consumer preferences and develop and offer new products rapidly enough to meet those changes.

The food products business is highly competitive. Numerous brands and products compete for shelf space and sales, with competition based primarily on product quality, brand recognition and loyalty, price, trade promotion, consumer promotion, customer service, and the ability to identify and satisfy emerging consumer preferences. We compete with a significant number of companies of varying sizes, including divisions, subdivisions, or subsidiaries of larger companies. Many of these competitors have multiple product lines, substantially greater financial and other resources available to them, and may be substantially less leveraged than Pinnacle. In addition, private label is a significant competitor, particularly in the frozen vegetables, shelf-stable pickles, table syrup, frozen and refrigerated bagels, and pie/pastry fruit fillings categories. We may not be able to compete successfully with these companies and private label. Competitive pressures or other factors could cause us to lose market share, which may require us to lower prices, increase marketing and advertising expenditures, or increase the use of discounting or promotional campaigns, each of which would materially and adversely affect our margins and could result in a decrease in our operating results and profitability.

Our success depends on our ability to predict, identify, and interpret the tastes and dietary habits of consumers and to offer products that appeal to those preferences. There are inherent marketplace risks associated with new product or packaging introductions, including uncertainties about trade and consumer acceptance. If we do not succeed in offering products that consumers want to buy, our sales and market share will decrease, resulting in reduced profitability. If we are unable to accurately predict which shifts in consumer preferences will be long-lasting, or are unable to introduce new and improved products to satisfy those preferences, our sales will decline. In addition, given the variety of backgrounds and identities of consumers in our consumer base, we must offer a sufficient array of products to satisfy the broad spectrum of consumer preferences. As such, we must be successful in developing innovative products across a multitude of product categories. Finally, if we fail to rapidly develop products in faster-growing and more profitable categories, we could experience reduced demand for our products, or fail to expand margins.

We are also subject to the effect that the overall economic conditions have upon consumer sentiment and retail sales.

If we lose one or more of our major customers, or if any of our major customers experience significant business interruption, our results of operations could be adversely affected.

We have several large customers that account for a significant portion of our sales. Wal-Mart and its affiliates are our largest customers and represented approximately 25% of net sales in each of the fiscal years 2012, 2011 and 2010, respectively. Cumulatively, including Wal-Mart, our top ten customers accounted for

16

Table of Contents

approximately 60% of net sales in fiscal year 2012, 60% of net sales in fiscal year 2011 and 61% of net sales in fiscal year 2010.

We do not have long-term supply contracts with any of our major customers. The loss of one or more major customers, a material reduction in sales to these customers as a result of competition from other food manufacturers, or the occurrence of a significant business interruption of our customers’ operations would result in a decrease in our revenues, operating results, and earnings and could adversely affect the market price of our common stock.

In addition, as the retail grocery trade continues to consolidate and our retail customers grow larger and become more sophisticated, our retail customers may demand lower pricing and increased promotional programs. If we fail to use our sales and marketing expertise to maintain our category leadership positions to respond to these trends, or if we lower our prices or increase promotional support of our products and are unable to increase the volume of our products sold, our profitability and financial condition may be adversely affected.

For the manufacturing, co-packing and distribution of many of our products, we primarily rely on single source providers where a significant disruption in a facility or loss of arrangements could affect our business, financial condition, and results of operations.

With the exception of our Birds Eye’s frozen vegetable products which are produced in two facilities (Waseca, Minnesota and Darien, Wisconsin, which has approximately three times the production capacity of the Waseca location), none of our products are produced in significant amounts at multiple manufacturing facilities or co-packers. Significant unscheduled downtime at any of our facilities or co-packers due to equipment breakdowns, power failures, natural disasters, or any other cause could materially adversely affect our ability to provide products to our customers, which would have a material adverse effect on our business, financial condition and results of operations.