Attached files

| file | filename |

|---|---|

| EX-3.5 - GOFF, CORP | ex3-5.htm |

| EX-3.6 - GOFF, CORP | ex3-6.htm |

| EX-3.4 - GOFF, CORP | ex3-4.htm |

| EX-10.2 - GOFF, CORP | ex10-2.htm |

| EX-10.3 - GOFF, CORP | ex10-3.htm |

| EX-10.4 - GOFF, CORP | ex10-4.htm |

| EX-10.5 - GOFF, CORP | ex10-5.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) March 6, 2013

GOFF, CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

333-176509

|

27-3129919

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

Carrera 43 A # 1-50, Torre Proteccion,

Piso 6, San Fernando Plaza, Medellin, Colombia

|

N/A

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code 087-154-7690

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management's Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

|

·

|

our anticipated exploration programs and our ability to manage the programs effectively;

|

|

·

|

our ability to identify commercially recoverable quantities of tungsten;

|

|

·

|

our ability to keep up with rapidly changing technologies and evolving mining industry standards.

|

|

·

|

our dependence on the growth in demand for tungsten; and

|

|

·

|

the loss of key members of our senior management.

|

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this report only:

|

·

|

the “Company,” “we,” “us,” and “our” refer to the business of GOFF, Corp., a Nevada corporation (as well as our wholly owned subsidiary Golden Glory Resources Inc, a Nevada corporation.);

|

|

·

|

“Exchange Act” refers the Securities Exchange Act of 1934, as amended;

|

|

·

|

“SEC” refers to the Securities and Exchange Commission;

|

|

·

|

“Securities Act” refers to the Securities Act of 1933, as amended; and

|

|

·

|

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States.

|

ITEM 3.03 MATERIAL MODIFICATION TO RIGHTS OF SECURITY HOLDERS

Designation of Series “A” Preferred Stock

On March 6, 2013 our sole director approved the designation of 10,000,000 shares of Series “A” Preferred Stock, par value $0.001 per share. The attributes of the Series “A”: Preferred Stock include, but are not limited to, the following:

|

·

|

the Series A Preferred Stock shall share rateably with the holder of our Common Stock in any dividends;

|

|

·

|

the Series A Preferred Stock shall be entitled to vote as a class in respect of any proposed creation of a class of securities ranking equal or senior to the Series “A” Preferred Stock, and the consent of at least seventy-five percent of the shares of Series “A” Preferred Stock outstanding at the time shall be required prior to the authorization of any such equal or senior class of securities;

|

2

|

·

|

except where it is entitled to vote the Series A Preferred Stock shall be entitled to vote with the holders of the Company's Common Stock as a class at the rate of seventy-five (75) common share votes per share of Series A Preferred Stock;

|

|

·

|

the holder of any shares of Series “A” Preferred Stock may, at such holder's option, elect to convert all or any portion of the shares of Series A Preferred Stock held by such person into a number of fully paid and non-assessable shares of Common Stock equal to thirty (30) shares of Common Stock for each share of Series A Preferred

|

The above description of the Series “A” Preferred Stock is a summary and is qualified entirely by the description of the designations, powers, preferences and relative and other special rights and the qualifications, limitations and restrictions set out in the Certificate of Designation included as Exhibit 3.4 of this report.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

ITEM 3.02 UNREGISTERED SALES OF EQUITY SECURITIES

Share Cancellation Agreement and Issuance of Series “A” Preferred Stock

On March 8, 2013 we entered into a Cancellation Agreement with our director and sole officer, Warwick Calasse, pursuant to which Mr. Calasse tendered for cancellation 158,750,000 share of our common stock held by him in consideration of the issuance to him of 5,000,000 shares of our Series “A” Preferred Stock. The agreement was entered into as a condition of the Assignment Agreement with Golden Glory Resources S.A. described below. Information with respect Mr. Calasse’s beneficial ownership of our securities is contained in section of the Current Report entitled Security Ownership Of Certain Beneficial Owners And Management. These securities issued to Mr. Calasse were issued in an offshore transaction relying on Regulation S and/or Section 4(2) of the Securities Act of 1933, as amended

Acquisition of Option to Purchase La Frontera Mining Concession

On March 8, 2013, through our wholly owned subsidiary, Golden Glory Resources Inc., we entered into an Assignment Agreement with Golden Glory Resources S.A. (“Golden Glory Panama”), a company incorporated under the laws of Panama, we acquired an option to purchase a 100% interest in and to a certain Columbian mining concession known as La Frontera (The Frontier) Project, code number LGC-15011, located in the Aguadas region, Caldas Department, Republic of Colombia.

In consideration of the assignment of rights, we issued to Golden Glory Panama 5,000,000 shares of our Series “A” Preferred Stock, and have agreed to assume all obligations of Golden Glory Panama pursuant to the Assignment Agreement dated January 21, 2013 (the “Underlying Assignment Agreement”) between Golden Glory Panama, as assignee, and Sertesaz Ltd., and C&ENER SA, the current Colombian owners which own 60% and 40% of the concession, respectively. The securities issued to Golden Glory Panama were issued in an offshore transaction relying on Regulation S and/or Section 4(2) of the Securities Act of 1933, as amended.

To date, Golden Glory Panama has satisfied an aggregate of $70,000 in respect of payment obligations pursuant to the Underlying Assignment Agreement. In order to exercise our option to purchase La Frontera Project we will be required to satisfy the following additional payments and exploration expenditures:

|

·

|

an aggregate of $120,000 payable in six equal quarterly installments beginning March 31, 2013;

|

|

·

|

an aggregate of $40,000 payable in two equal installments by September 30, 2015 and December 31, 2015, respectively;

|

|

·

|

an annual payment of approximately $12,500 (beginning August 20, 2013) in respect of state surface fees for the property;

|

|

·

|

completion of a $1,500,000 work program by March 7, 2015 with the following requirements:

|

|

o

|

$250,000 in expenditures by March 7, 2014;

|

3

|

o

|

$500,000 in expenditures by March 7, 2015;

|

|

o

|

$750,000 in expenditures by March 7, 2016; and

|

|

o

|

General and administrative expenses included in the work program budget shall not exceed $200,000.

|

|

·

|

a royalty equal to $2 per ounce of gold, payable per ounce from production, for every ounce of gold up to 5 million ounces that is designated as a “Proven” reserve pursuant to an independently prepared technical report in accordance with Canadian National Instrument 43-101,

|

As a result of the acquisition we have entered the business of mineral exploration and are now an exploration stage mining company engaged in the identification, acquisition, and exploration of metals and minerals with a focus on gold and diamond mineralization on our La Frontera Property. For further details on our business, please see the section entitled “Business” beginning on page 2.

ITEM 5.06 CHANGE IN SHELL COMPANY STATUS

Our management has determined that, as of the closing of the Assignment Agreement with Golden Glory Resources S.A. described above, our company has ceased to be a shell company as defined in Rule 12b-2 of the United States Securities Exchange Act of 1934, as amended.

ITEM 8.01 - OTHER EVENTS

Incorporation of Golden Glory Resources Inc.

On February 22, 2013 we incorporated a wholly owned subsidiary, Golden Glory Resources Inc., a Nevada corporation.

FORM 10 INFORMATION DISCLOSURE

As disclosed elsewhere in this report, on March 7, 2013, through our wholly owned subsidiary, Golden Glory Resources Inc., pursuant to an Assignment Agreement with Golden Glory Resources S.A. (“Golden Glory Panama”), a company incorporated under the laws of Panama, we acquired option to purchase a 100% interest in and to a certain Columbian diamond mining concession known as La Frontera (The Frontier) Project, code number LGC-15011, located in the Aguadas region, Caldas Department, Republic of Colombia. Item 2.01(f) of Form 8-K states that if the registrant was a shell company, as we were immediately before the acquisition of assets under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10.

Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to our company after the acquisition of La Frontera Project, unless otherwise specifically indicated.

BUSINESS

General Overview

We were incorporated on July 12, 2010 under the laws of the state of Nevada. Our principal offices are located at 9 Carrera 43 A # 1-50, Torre Proteccion, Piso 6, San Fernando Plaza, Medellin, Colombia Our telephone number is 087-154-7690.

Our initial business plan was to provide web-based networking and job-placement services for employers and individuals seeking employment in the UK and Ireland. We were unable to implement our initial business plan due to our inability to obtain adequate financing, and to prevailing negative conditions in the financial and employment markets since our incorporation.

4

Since our inception, we have focused our limited managerial and financial capacity almost entirely on the registration of a resale prospectus on form S-1 which was declared effective on November 10, 2011.

On February 14, 2012 our common shares became eligible for quotation on the OTC Bulletin Board under the symbol GOFF.OB. However, there have been no public trades of our common shares to date.

Due to our ongoing inability to implement our initial business plan, in fiscal 2012, our management began evaluating various alternatives available to our company to ensure our continuation as a going concern and to preserve our shareholders’ investment in our common shares.

In accordance with board approval, we filed a Certificate of Change dated January 22, 2013 with the Nevada Secretary of State to give effect to a forward split of our authorized, issued and outstanding shares of common stock on a 25 new for one (1) old basis, such that our authorized capital will be increased from 75,000,000 to 1,875,000,000 shares of common stock and correspondingly, our issued and outstanding shares of common stock was increased from 11,440,000 to 286,000,000 common shares, all with a par value of $0.001. The forward stock split became effective with the Over-the-Counter Bulletin Board at the opening of trading on January 24, 2013. Our new CUSIP number is 36190U206.

On February 26, 2013, we received resignations from Gary O'Flynn, as President, Chief Executive Officer, Treasurer, Secretary and Director of our company, and Patrick Corkery, as a director of our company. Their resignations were not the result of any disagreements with our company regarding its operations, policies, practices or otherwise. Concurrently with Mr. O'Flynn's and Mr. Corkery's resignations, we appointed Warwick Calasse as President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer and as a member to our Board of Directors, effective February 26, 2013.

Also on February 26, 2013, Mr. Calasse acquired an aggregate of 108,750,000 shares of our common stock from Mr. O'Flynn, our former Director and Officer, and Mr. Corkery, our former Director, for an aggregate consideration of $25,000. The funds used for this share purchase were Mr. Calasse's personal funds. Mr. Calasse's 108,750,000 shares amount to approximately 38% of our currently issued and outstanding common stock. In conjunction with the sale of the shares, Mr. O'Flynn and Mr. Corkery each provided us with releases from any debt owed to each, respectively, by our company. Both the share purchase agreement and the release are filed as exhibits to this Current Report on Form 8-K.

On February 28, 2013 we entered into a consulting agreement with our sole officer and director, Warwick Calasse, regarding the provision of his management services as president and chief executive officer of the our company. The term of the agreement is 12 months, subject to renewal or early termination by mutual consent of the parties. In consideration of Mr. Calasse’s services for the 12 month term, on February 28, 2013, we issued to Mr. Calasse 100,000,000 shares of our common stock. As a result of the transaction, Mr. Calasse held approximately 54.08% of our currently issued and outstanding common shares.

On March 4, 2012, anticipation of the events announced in this Current Report, and further to the consent of the holders of a majority of our common shares, we filed a Certificate of Amendment with the Nevada Secretary of State to authorize 100,000,000 preferred shares with a par value of $0.01. Pursuant to the amendment, our board of directors may fix and determine the designations, rights, preferences or other variations of each class or series of preferred stock issued from time to time. Our authorized capital will now consists of 1,875,000,000 shares of common stock and 100,000,000 shares of preferred stock, each with a par value of $0.001.

Business Subsequent to the Closing of the Acquisition

On March 8, 2013, as a result of our acquisition of an option to purchase La Frontera Project we have abandoned our former business plan and entered the business of mineral exploration and are now an exploration stage mining company engaged in the identification, acquisition, and exploration of metals and minerals with a focus on gold and diamond mineralization on La Frontera Property.

5

Since we are an exploration stage company, there is no assurance that a commercially viable mineral reserve exists on any of our current or future properties. To date, we do not know if an economically viable mineral reserve exists on our property and there is no assurance that we will discover one. Even if we do eventually discover a mineral reserve on our property, there can be no assurance that we will be able to develop our property into a producing mine and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

We intend to conduct exploration and development programs on La Frontera Project and to satisfy our obligations under the terms of the Assignment Agreement with Golden Glory Resources S.A. (“Golden Glory Panama”) for the purchase of a 100% interest in the propert. For a description of La Frontera Project please see the section entitled “Properties” beginning on page 12.

Competition

We are a mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Compliance with Government Regulation

We are committed to complying with and are, to our knowledge, in compliance with, all governmental and environmental regulations applicable to our company and our properties. Permits from a variety of regulatory authorities are required for many aspects of mine operation and reclamation. We cannot predict the extent to which these requirements will affect our company or our properties if we identify the existence of minerals in commercially exploitable quantities. In addition, future legislation and regulation could cause additional expense, capital expenditure, restrictions and delays in the exploration of our properties.

Research and Development Expenditures

We have incurred $Nil in research and development expenditures over the past two fiscal years.

Employees

Currently, we do not have any employees. We have entered into consulting agreements with Warwick Calasse, our president, chief executive officer, treasurer, secretary and director, regarding the provision of his services to our company as executive officer. Our directors, executive officer and certain contracted professionals play an important role in the running of our company. We do not expect any material changes in the number of employees over the next 12 month period. We intend to outsource contract employment as needed.

We will engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our financing efforts and exploration programs.

Subsidiaries

Our sole and wholly owned subsidiary is Golden Glory Resources Inc., a Nevada corporation.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

6

RISK FACTORS

Our business operations are subject to a number of risks and uncertainties, including, but not limited to those set forth below:

Risks Associated With Mining

Our property is in the exploration stage. There is no assurance that we can establish the existence of any mineral resource on our property in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business could fail.

We have not established that it contains any mineral reserve, nor can there be any assurance that we will be able to do so. If we do not, our business could fail.

A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a "reserve" that meets the requirements of the Securities and Exchange Commission's Industry Guide 7 is extremely remote; in all probability our mineral resource property does not contain any 'reserve' and any funds that we spend on exploration will probably be lost.

Even if we do eventually discover a mineral reserve on our property, there can be no assurance that we will be able to develop our property into a producing mine and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we might discover on our property, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to remain in compliance. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

If we establish the existence of a mineral resource on our property in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the resource, and our business could fail.

7

If we do discover mineral resources in commercially exploitable quantities on our property, we will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that such a resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our company.

Mineral exploration, development and production involves many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration for mineral resources and, if we discover a mineral resource in commercially exploitable quantity, our operations could be subject to all of the hazards and risks inherent in the development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material adverse impact on our company.

Mineral prices are subject to dramatic and unpredictable fluctuations.

We expect to derive revenues, if any, either from the sale of our mineral rights or from the extraction and sale of ore. The price of those commodities has fluctuated widely in recent years, and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of any of our exploration properties and projects, cannot accurately be predicted.

The mining industry is highly competitive and there is no assurance that we will continue to be successful in acquiring mineral claims. If we cannot continue to acquire properties to explore for mineral resources, we may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely un-integrated. We compete with other exploration companies looking for mineral resource properties. While we compete with other exploration companies in the effort to locate and acquire mineral resource properties, we will not compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of mineral products. Therefore, we will likely be able to sell any mineral products that we identify and produce.

In identifying and acquiring mineral resource properties, we compete with many companies possessing greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that we will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations.

Risks Related To Our Company

The fact that we have not earned any operating revenues since our incorporation raises substantial doubt about our ability to continue to explore our mineral properties as a going concern.

We have not generated any revenue from operations since our incorporation and we anticipate that we will continue to incur operating expenses without revenues unless and until we are able to identify a mineral resource in a commercially exploitable quantity on our mineral property and we build and operate a mine. We had cash in the amount of $5,653 as of December 31, 2012. At December 31, 2012, we had working capital deficit of $19,911. We incurred a net loss of $48,261since inception. We estimate that our average monthly operating expenses will be approximately $48,000, including mineral property costs, professional

8

services and administrative costs and exploration expense. Should the results of our planned exploration require us to increase our current operating budget, we may have to raise additional funds to meet our currently budgeted operating requirements for the next 12 months. As we cannot assure a lender that we will be able to successfully explore and develop our mineral property, we will probably find it difficult to raise debt financing from traditional lending sources. We have traditionally raised our operating capital from sales of equity securities, but there can be no assurance that we will continue to be able to do so. If we cannot raise the money that we need to continue exploration of our mineral property, we may be forced to delay, scale back, or eliminate our exploration activities. If any of these were to occur, there is a substantial risk that our business would fail.

These circumstances lead our independent registered public accounting firm, in their report dated September 27, 2012, to comment about our company’s ability to continue as a going concern. Management has plans to seek additional capital through a private placement of its capital stock. These conditions raise substantial doubt about our company’s ability to continue as a going concern. Although there are no assurances that management’s plans will be realized, management believes that our company will be able to continue operations in the future. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event our company cannot continue in existence.” We continue to experience net operating losses.

We intend to issue additional shares of common stock or preffered stock, which would reduce investors' percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 1,875,000,000 shares of common stock and 100,000,000 Preferred Shares, each with a par value $0.001 per share, of which 227,250,000 common shares and 10,000,000 Series “A” Preferred shares are issued and outstanding. The future issuance of common stock or preferred stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock or preferred stock issued in the future on an arbitrary basis. The issuance of common stock or preferred stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

If we do not obtain additional financing, our business will fail.

At December 31, 2012, we had cash on hand of $5,653, and we had accumulated a deficit of $48,261 in business development expenses. Our current burn rate is the cost associated with costs of being a reporting issuer and is projected to increase substantially once our exploration operations begin. We anticipate that additional funding will be needed for general administrative expenses and marketing costs. We intend to raise the required funds through equity or debt financing however we have no definitive arrangements to secure any additional capital. There is no guarantee that we will be able to raise additional capital and because of this our business may fail. We have not generated any revenue from operations to date. The specific cost requirements needed to maintain operations will depend upon the success of our planned exploration program and is subject to a wide possible variance.

We do not currently have any arrangements for financing. Obtaining additional funding will be subject to a number of factors, including general market conditions, investor acceptance of our business plan and initial results from future exploration activities. These factors may impact the timing, amount, terms or conditions of additional financing available to us. The most likely source of future funds available to us is through the sale of additional shares of common stock or advances from our sole director.

Because our officer and directors have other business interests, they may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Our officer and director, Warwick Calasse, will only be devoting limited time to our operations. Mr. Calasse will handle most of the company's day to day operations and intends to devote 10 to 20 hours of his week to our business affairs until such a time as a cash salary can be drawn. Because our sole officer and director will only be devoting limited time to our operations, our operations may be sporadic and occur at times which are convenient to him. As a result, operations may be periodically interrupted or suspended which could impede the development of our business or result in the cessation of operations.

9

Because our sole executive officer has no experience or training in the field of mineral exploration our business has a higher risk of failure.

Our sole executive officer, Warwick Calasse, does not have experience or training in the field of mineral exploration. Because of this lack of experience there is a risk that some of the strategic or operational factors needed to achieve exploration or production milestones may be overlooked. If we are unable to achieve exploration or production milestones required to exercise our option to purchase La Frontera Project, our business could fail or require additional financing beyond our current budget.

Because we our sole executive officer has limited training and experience in financial accounting and management, our business has a higher risk of failure.

Our business has a sole executive officer, Warwick Calasse, who has limited training in financial accounting and management; however, he is responsible for our managerial and organizational structure, which will include preparation of disclosure and accounting controls. When the disclosure and accounting controls referred to above are implemented, he will be responsible for the administration of them. Should he not have sufficient experience, he may be incapable of creating and implementing the controls which may cause us to be subject to sanctions and fines by the SEC which ultimately could cause an investor to lose their investment. Mr. Calasse’s limited training and experience in financial accounting and management my result in a material misstatement of our Company's financial statements. In addition due our Company's lack of accounting personnel we may be unsuccessful in maintaining effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements of our financial statements.

Because our sole executive officer controls 66.37% of the voting rights attached to our issued and outstanding securities, he can make and control corporate decisions that may be disadvantageous to minority shareholders.

Our sole executive officer, Warwick Calasse, controls approximately 66.37% of the voting rights attached to our issued and outstanding securities. Accordingly, he will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations, and the sale of all or substantially all of our assets. He will also have the power to prevent or cause a change in control. The interests of our officers and directors may differ from the interests of the other stockholders and thus result in corporate decisions that are disadvantageous to other shareholders.

U.S. investors may experience difficulties in attempting to effect service of process and to enforce judgments based upon U.S. federal securities laws against the company and its non-U.S. resident officers and directors.

We are organized under the laws of State of Nevada, but our sole officer and director is a non-U.S. resident. Consequently, it may be difficult for investors to affect service of process on Warwick Calasse in the United States and to enforce in the United States judgments obtained in United States courts against him based on the civil liability provisions of the United States securities laws. Since our assets will be located in Columbia and other non-US countries it may be difficult or impossible for U.S. investors to collect a judgment against us. In addition, any judgment obtained in the United States against us may not be enforceable in the United States.

We have limited experience as a public company.

We have a limited operating history as a public company and our management has no experience in complying with the various rules and regulations, which are required of a public company. As a result, we may not be able to operate successfully as a public company, even if our operations are successful. We plan to comply with all of the various rules and regulations, which are required of a public company. However, if we cannot operate successfully as a public company, your investment may be adversely affected. Our inability to operate as a public company could be the basis of your losing your entire investment in us.

As a public company we will incur additional costs including but not limited to the following: Audit, Legal, SEC fees, Transfer Agent, and EDGAR filing fees. These costs are expected to run between $15,000 and $35,000 per year.

10

We do not expect to pay dividends in the foreseeable future.

We have never paid any dividends on our common stock. We do not expect to pay cash dividends on our common stock at any time in the foreseeable future. The future payment of dividends directly depends upon our future earnings, capital requirements, financial requirements and other factors that our board of directors will consider. Since we do not anticipate paying cash dividends on our common stock, a return on your investment, if any, will depend solely on an increase, if any, in the market value of our common stock

Risks Associated with Our Common Stock

If a market for our common stock does not develop, shareholders may be unable to sell their shares.

There is currently no market for our common stock and we can provide no assurance that a market will develop. On February 14, 2012 our common stock became eligible for quotation on the Over the Counter Bulletin Board, however no market for our common stock has since developed and no public trade of our common stock has occurred. If no market is ever developed for our shares, it will be difficult for shareholders to sell their stock. In such a case, shareholders may find that they are unable to achieve benefits from their investment.

Trading on the OTC Bulletin Board may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the OTC Bulletin Board service of the Financial Industry Regulatory Authority. Trading in stock quoted on the OTC Bulletin Board is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTC Bulletin Board is not a stock exchange, and trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on a quotation system like NASDAQ or a stock exchange like NYSE Amex. Accordingly, shareholders may have difficulty reselling any of their shares.

Our stock is a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations and FINRA’s sales practice requirements, which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common stock.

11

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the Financial Industry Regulatory Authority believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The Financial Industry Regulatory Authority ’ requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

Any additional funding we arrange through the sale of our common stock will result in dilution to existing shareholders.

We must raise additional capital in order for our business plan to succeed. Our most likely source of additional capital will be through the sale of additional shares of common stock. Such stock issuances will cause stockholders' interests in our company to be diluted. Such dilution will negatively affect the value of investors' shares.

Other Risks

Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common stock.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the next twelve months.

Personnel Plan

We do not expect any material changes in the number of employees over the next 12 month period. We do and will continue to outsource contract employment as needed.

Off-Balance Sheet Arrangements

There are no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Our principal capital resources have been through the subscription and issuance of common stock, although we have also used stockholder loans and advances from related parties.

Cash Requirements

We intend to conduct exploration activities on our newly optioned property over the next twelve months. We estimate our operating expenses and working capital requirements for the next twelve month period to be as follows:

|

Estimated Expenses For the Next Twelve Month Period

|

||||

|

General, Administrative, and Corporate Expenses

|

$ | 200,000 | ||

|

Property Option Payments

|

$ | 80,000 | ||

|

Exploration

|

$ | 300,000 | ||

|

Total

|

$ | 580,000 | ||

12

At present, our cash requirements for the next 12 months outweigh the funds available to maintain or develop our properties. Of the $580,000 that we require for the next 12 months, we had $5,653 in cash as of December 31, 2012. In order to improve our liquidity, we intend to pursue additional equity or debt financing from private investors or possibly a registered public offering. Other than as set out below, we currently do not have any arrangements in place for the completion of any further private placement financings and there is no assurance that we will be successful in completing any further private placement financings. If we are unable to achieve the necessary additional financing, then we plan to reduce the amounts that we spend on our business activities and administrative expenses in order to be within the amount of capital resources that are available to us.

Results of Operations.

The following summary of our results of operations should be read in conjunction with our audited financial statements for the period from inception to June 30, 2011 and for the year ended June 30, 2012, and our interim financial statements for the period ended December 31, 2012.

Our operating results for the periods from July 12, 2010 (date of inception) to June 30, 2011, for the year ended June 30, 2012, for the three and six month periods ended December 31, 2012, and for the period from July 12, 2010 (date of inception) to December 31, 2012 are as follows:

|

Three Months

Ended

|

Six Months

Ended

|

Year Ended

|

Period From

July 12, 2010

(date of inception) to

|

Period From

July 12, 2010

(date of inception) to

|

||||||||||||||||

|

December 31,

|

December 31,

|

June 30,

|

June 30

|

December 31

|

||||||||||||||||

|

2012

|

2012

|

2012

|

2011

|

2012

|

||||||||||||||||

|

Operating Expenses

|

$ | 11,010 | $ | 15,168 | $ | 28,677 | $ | 4,416 | $ | 48,261 | ||||||||||

|

Other Expenses

|

$Nil | $Nil | $Nil | $Nil | $Nil | |||||||||||||||

|

Net Income (Loss)

|

$ | (11,010 | ) | $ | (15,168 | ) | $ | (28,677 | ) | $ | (4,416 | ) | $ | (48,261 | ) | |||||

Revenues

We have not earned any revenues since our inception to the period ended December 31, 2012 and we do not anticipate earning revenues in the near future.

Expenses

Our expenses for the periods from July 12, 2010 (date of inception) to June 30, 2011, for the year ended June 30, 2012, for the three and six month periods ended December 31, 2012, and for the period from July 12, 2010 (date of inception) to December 31, 2012 are as follows:

|

Three Months

Ended

|

Six Months

Ended

|

Year Ended

|

Period From

July 12, 2010

(date of inception) to

|

Period From

July 12, 2010

(date of inception) to

|

||||||||||||||||

|

December 31,

|

December 31,

|

June 30,

|

June 30

|

December 31

|

||||||||||||||||

|

2012

|

2012

|

2012

|

2011

|

2012

|

||||||||||||||||

|

Consulting Fees

|

$ | 3,300 | $ | 3,935 | $ | 6,000 | $Nil | $ | 9,935 | |||||||||||

|

General and Administrative

|

$ | 2,817l | $ | 4,677 | $ | 10,414 | $ | 4,416 | $ | 19,509 | ||||||||||

|

Professional Fees

|

$ | 4,893 | $ | 6,556 | $ | 12,263 | $Nil | $ | 18,819 | |||||||||||

13

Liquidity and Financial Condition

Our financial position as at June 30, 2011, June 30, 2012, and December 31, 2012, is as follows:

|

June 30,

|

June 30,

|

December 31,

|

||||||||||

|

2011

|

2012

|

2012

|

||||||||||

|

Current Assets

|

$ | 24,759 | $ | 1,565 | $ | 5,653 | ||||||

|

Current Liabilities

|

$ | 825 | $ | 6,308 | $ | 25,564 | ||||||

|

Working Capital (Deficiency)

|

$ | 23,934 | $ | (4,743 | ) | $ | (19,911 | ) | ||||

Cash Flows

|

Six Months

Ended

|

Year Ended

|

Period From

July 12, 2010

(date of inception) to

|

Period From

July 12, 2010

(date of inception) to

|

|||||||||||||

|

December 31,

|

June 30,

|

June 30

|

December 31

|

|||||||||||||

|

2012

|

2012

|

2011

|

2012

|

|||||||||||||

|

Net cash provided by (used in) Operating Activities

|

$ | (13,717 | ) | $ | (26,194 | ) | $ | (4,416 | ) | $ | (44,327 | ) | ||||

|

Net cash provided by (used in) Financing Activities

|

$ | 17,805 | $ | 3,000 | $ | 29,175 | $ | 49,980 | ||||||||

|

Increase (Decrease) in Cash during the Period

|

$ | 4,088 | $ | (23,194 | ) | $ | 24,759 | $ | 5,653 | |||||||

|

Cash, Beginning of Period

|

$ | 1,565 | $ | 24,759 | $Nil | $Nil | ||||||||||

|

Cash, End of Period

|

$ | 5,653 | $ | 1,565 | $ | 24,795 | $ | 5,653 | ||||||||

Going Concern

Our financial statements have been prepared on a going concern basis, which implies that we will continue to realize our assets and discharge our liabilities in the normal course of business. Our company incurred net losses of $48,261since Inception (July 12, 2010) to December 31, 2012 and has nominal operations and no revenue, raising substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that might be necessary if the company is unable to continue as a going concern.

The continuation of our business is dependent upon obtaining further financing, meeting our contractual obligations with respect to our La Frontera Property, completing a successful program of exploration on La Frontera Project, and, finally, achieving a profitable level of operations. We will seek additional sources of capital through the issuance of debt or equity financing, but there can be no assurance we will be successful in this regard. What’s more, the issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

There are no assurances that we will be able to obtain further funds required for our continued operations. We will pursue various financing alternatives to meet our immediate and long-term financial requirements. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis, we will be unable to conduct our operations as planned, and we will not be able to meet our other obligations as they become due. In such event, we will be forced to scale down or perhaps even cease our operations.

14

Critical Accounting Policies

Basis of Presentation and Interim Financial Statements

The financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“US GAAP”) and are expressed in U.S. dollars. The Company’s fiscal year end is June 30.

The accompanying financial statements have been prepared by the Company without audit. In the opinion of management, all adjustments (which include only normal recurring adjustments) necessary to present fairly the financial position, results of operations, and cash flows at December 31, 2012, and for all periods presented herein, have been made.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted. It is suggested that these condensed financial statements be read in conjunction with the financial statements and notes thereto included in the Company’s June 30, 2012 audited financial statements.

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Cash and cash equivalents

The Company considers all highly liquid instruments with a maturity of three months or less at the time of issuance to be cash equivalents. As at December 31 and June 30, 2012, the Company did not have any cash equivalents.

Basic and Diluted Net Loss per Share

The Company computes net loss per share in accordance with ASC 260, Earnings per Share. ASC 260 requires presentation of both basic and diluted earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing net loss available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti dilutive. As at December 31 and June 30, 2012, the Company did not have any potentially dilutive shares.

Recent Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

PROPERTIES

As of the date of this current report, our executive and administrative offices are located at 9 Carrera 43 A # 1-50, Torre Proteccion, Piso 6, San Fernando Plaza, Medellin, Colombia. We believe these facilities are adequate for our current needs and that alternate facilities on similar terms would be readily available if needed.

15

As of the date of this current report on Form 8-K, we hold an option to acquire a 100% interest in La Frontera Project pursuant to an option agreement entered into by our subsidiary. For a description of the option agreement, please see the section entitled “Business” above.

La Frontera Project

Location and Access

The LGC-15011 Project, known as “La Frontera” or “The Frontier”, is located in the northern department of Caldas, Republic of Columbia (LGC‐15011 has 30% area in the department of Antioquia), in the village of Puente Piedra, in the municipality of Aguadas. The Project is situated in the Cordillera Central of the Andes Mountains and is bounded by the Magdalena River on the east and the Cauca River on the west.

The county of Aguadas sits approximately 40 kilometers away from La Pintada (Antioquia) and may be accessed from la Pintada by unpaved road with an approximate aggregate travel time of four hours. Travel from La Pintada is by unpaved road through Aguadas (40 kilometers /90 minutes) and Encimadas (20 kilometers over 90 minutes). From Encimadas, which sits at 2,400 meters above sea level (masl), the project site is accessed by descending to an elevation of 1,8000 masl to the river Arma. Travel is by unpaved mountain road with highly variable conditions. Travel time from Encimadas is approximately one hour and fifteen minutes. The site is accessible year round and exploration activities are not subject to seasonal interruption.

Local Resources and Infrastructure

According to the Departamento Administrativo Nacional de Estadistica (“DANE”) census of 2005, the municipality of Aguadas had a population of 22,307. Basic resources are available in the municipality of Caldas including emergency medical services, temporary accommodations, and fuel. Any mining development on the Project would have access to the national electrical transmission grid. Water supply and cellular phone coverage in the area are limited.

Legal Status

The mining concession contract LGC-15011 was registered in the National Mining Registry o August 21, 2012 and expires on August 21, 2042. It is in the first year of the concession contract term. According to the certificate from the National Mining registry, the mining concession contract is duly registered and is in the exploration phase. Collectively, the title covers approximately 1227.94 hectares made up of 21 exploitation licenses.

In accordance with Colombian law, the holder of the mining licenses has a right to access the parcel of land covered by such mining Licenses and may perform exploration and exploitation work on them, subject to indemnification for damages to the owners of such parcel of land that may arise from such access, and the activities carried on by the holder of the mining licenses.The limits of the Project were map-staked and therefore no boundary markers exist. As of the date of this report, none of the licenses have been surveyed.

Mineral Licenses in Colombian Law

Mineral rights in Colombia are reserved to the federal government and governed by the Colombian Mining Code. The Colombian Mining Code has been changed and amended on several occasions. The oldest version relevant to the LGC-15011 Project is Decree 2685 of 1988 (the “Previous Mining Code”), which has been replaced and superseded in its entirety by Law 685 of 2001, as amended by Law 1382 of 2010 (the “Modified Mining Code”). The mining law is administered by the Ministry of Mines and Energy. By means of Decree 4134 of 2011, Ingeominas, the former mining Authority, was liquidated and divided into two entities: the Agencia Nacional Minera (National Mining Agency), which grant mining concessions and perform follow-up and control duties on granted mining titles, and the Servicio Geológico Colombiano (Colombian Geological Survey), which is in charge of performing studies to identify the availability of natural resources in the Colombian subsoil.

16

Exploitation Licenses, as governed by Decree 2655 of 1988, are legal permits to exploit minerals in a map-staked area. These Licenses were granted for a term of ten years, and as provided in Article 46 of Decree 2655, it is possible for the title holder to opt for one of two Options at the end of the ten-year period: (i) an extension of the License for another ten years, after which there is no legal possibility to extend the exploitation period, or (ii) conversion into a Concession Agreement, covering a map-staked area and in good standing for a period of up to thirty years, with additional extensions possible. Both Exploitation Licenses and Concession Agreements are drawn using the UTM co-ordinate system.

In Colombia, mineral Concession Agreements consist of three phases, namely, the exploration, construction, and exploitation phases, and are governed by Law 685 of 2001 as modified by Law 1382 of 2010. Under the Modified Mining Code, the exploration phase is for a three-year period, which can be extended for up to four additional two-year periods for a maximum of eleven years. During the exploration phase, annual surface payments, Cánon Superficiario (“Canon”), are payable to the Colombian government on the basis of one minimum daily salary per hectare. The current Canon rate is COP18.856 per hectare (approximately US$10.6/ha). The surface payment is calculated as one minimum daily wage per contracted hectare per year for the first five years of the exploration phase. During years six and seven of the exploration phase, the payment increases to 1.25 minimum daily wages per contracted hectare per year, and in years eight to eleven it increases to 1.5 minimum daily wages per contracted hectare per year. Upon completion of the exploration phase of a Concession, the construction phase is for a period of three years and may be extended for a period of one year, after which it enters its exploitation phase, in which Canon fees are no longer payable but are replaced by a production royalty payable to the Colombian government.

Regulation of Exploitation Licenses, on the contrary, is not divided into three phases but consists of a single ten-year period in which exploitation can take place, and in which production royalties are payable to the Colombian government on the basis of grams extracted. No Canon fees are payable for Exploitation Licenses. Under Decree 2685 of 1988, Exploration Licenses were granted as a previous stage to the granting of an Exploitation License; under those, the title holder was entitled to explore the area for the purpose of determining the existence of mineral reserves, for a term of one to five years, depending on the area to be explored. Exploitation Licenses were granted for small scale mining not exceeding 250,000 m3 of extraction per year per License.

Permitting

Under an exploration License, early stages of exploration including geological mapping and stream or soil geochemistry do not require permits, as long as the surface of the License is not disturbed. Exploration activity involving soil disturbance, including trenching and road and drill pad construction requires an environmental management plan. Drilling requires a take water permit and a water discharge permit. The Client is in possession of all permits required for surface exploration and has submitted environmental management plans for the proposed work.

Historical Exploration and Artisanal Mining

Traditional (Artisanal) mining has taken place on the La Frontera Project, which poses potential for liability based on the frequent violation of mining and environmental laws by traditional miners (including their use of hazardous substances such as cyanide). Accordingly, requests have been filed for the suspension of exploitation activities on La Frontera Project by such traditional miners

Geological Setting and Mineralization

Regional Geology

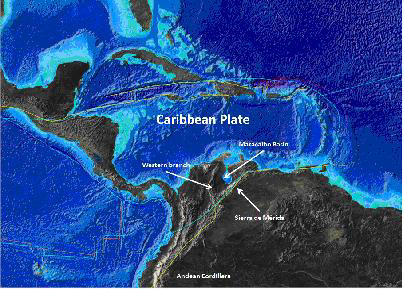

The La Frontera Property is situated within the Eastern Cordillera in northeastern Colombia. The Eastern Cordillera bifurcates at a point south of the Maracaibo Basin. The western branch swings to the northwest, while the eastern branch maintains the northeast trend and continues as the Sierra de Merida in Venezuela, to the east of the Maracaibo Basin (Figure 1).

17

Figure 1. Caribbean plate tectonics.

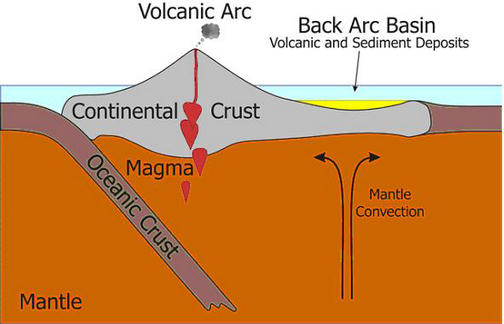

It is believed that the migration of the Caribbean Plate to the east is responsible for the splitting of the Andean Cordillera in the three branches (Western, Central, and Eastern Cordillera). This process is thought to have incorporated subduction events (Figure 2) which were responsible of the magmatic events in the area, both porphyries and volcanics.

Figure 2. The presence of a subduction zone explains the presence of the magmatic events in the region. The picture also reflects the environment for the back-arc basin.

18

The emplacement of porphyry bodies is usually controlled by regional fault structures and zones of fractured rock. The intrusive bodies themselves may be composed of a single intrusion or, as is more likely the case at La Frontera Project, of multiple intrusions. Geological evidence shows that the igneous bodies that generated porphyry ores were emplaced at relatively shallow levels in the crust (less than 4 km) and that they might have provided the magma source for the generation of large volcanoes on the surface which have since been eroded away. Where several intrusions of magma are present, it is common for mineralization to be related to the latest intrusions, which tend to be most differentiated. This is our working model for La Frontera Project.

The presence of phenocryts in the intrusions indicates that their magmas were partially crystalline when emplaced and that crystallization of the remaining melt occurred rapidly.

The worldwide distribution of porphyry deposits is controlled by orogenic belts, where deformation of the crust is caused by the collision of two of the Earth's tectonic plates. Two types of orogenic belts host porphyry deposits: those created by the subduction of oceanic crust beneath continental crust along a continental margin, as in our case, and those found along island arcs where two oceanic plates are colliding. The numerous deposits located along the west coast of South America are perhaps the best example of a group of porphyry deposits formed by subduction along a continental margin. A look at the age of the different intrusives within the Western, Central, and Eastern Cordillera clearly indicates an increase in age towards the East, which supports the author idea of the influence of the Caribbean Plate on the fragmentation of the Andean Cordillera within Colombia.

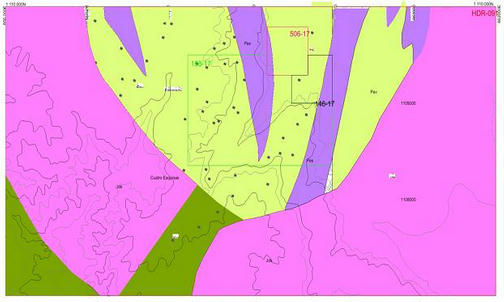

The regional geology consists of a collation of Paleozoic metamorphic rocks belonging to the Cajamarca Group, whose general directional train is N - S to N - NE, in the Jurassic intruded by the batholith Sonson. In general, the metamorphic grade is observed in the outcrops is medium to low Fig. 3).

Figure 3. Regional geology of the area. In yellow the Sonson Batholith

19

Cajamarca Group

Metamorphic rocks belonging to the Cajamarca group include the following:

|

·

|

Pes - phyllites and quartzschists: The phyllites, outcrop in packages elongated north south direction. Rocks are finely laminated, commonly folded with veins and milky quartz lenses parallel to the foliation with quartz and sericite as major minerals, epidote seen as accessories, plagioclase and ilmenite.

|

|

·

|

Pev - green schist: Chloritic schists actinolitícos Son-green, interspersed sequentially with sericíticos quartz schists. The foliation is well defined. The main minerals are quartz, chlorite and actinolite, a lesser amount of epidote is observed bands.

|

|

·

|

Jds Sonson Batholith: Granitic rocks, medium to fine grained, light gray, with quartz, plagioclase, muscovite and hornblende less. Metamorphic rocks intruded Cajamarca group, and emerges to the East and West of the study area. A sequence of rocks ranging from granite to diorite cuarzodioritas through granodiorites.

|

|

·

|

Kia Cretaceous sedimentary rocks: Sedimentary rocks for conglomeratic deposits, clay and shale.

|

|

·

|

Quaternary deposits: Conformed by sand and silt, located in the alluvial terraces of rivers and streams in the region.

|

Local Geology

The veins on the property are embedded in metamorphic rocks belonging to the Cajamarca Group which is affected by the Sonsón Batholith. They note two main structural trends N45 ° E and N70-90 ° W, which correspond with the trends of the veins in the area mapped.

Figure 4. Local geology of the license.

Metamorphic Rocks

In an area were observed greenish black shales with chlorite and actinolite (Fig. 5). These shales are interbedded with black shales and phyllites gray along the creek Peñoles.

20

Figure 5. Green schists from Los Peñoles Creek

The direction of the foliation in these rocks has a NS trend also shows a strong jointing.

On the Peñoles Creek we find quartz-schist outcrop with graphite (Figure 6) that show a predominant foliation N10-20 º W E/45-55 in contact with the batholith with a porphyritic texture. There is also a zone of lighter quartzites with carbonatic alteration. The presence of disseminated sulphides in shales is moderate, mainly filling fractures.

Figure 6. Quartz graphitic schists in the area

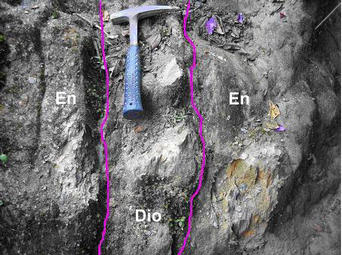

Igneous Rocks

These rocks are observed mostly towards the outspring of the Quebrada Peñoles, intruding the metamorphic rocks of the Cajamarca complex.

They are intrusive igneous rocks, which correspond to granodiorites and diorites belonging to Sonson Batholith. Examples of these rocks can be found on the road leading to the house of Mr. Fernando Candamil to births of Peñoles Quebrada (Fig. 7) and in the middle of the Q. Peñoles near the house of Mariano Candamil where there is an intermediate phase of the batholith; porphyritic igneous rock found in small size and without tectonic deformation (recent intrusions) towards SE - NW, which controls the course of the creek for a distance of 50 to 60m (the general trend of the gorge is NE).

21

Figure 7. Dioritic dyke of the Sonson batholith intruding metamorphic rocks of the Cajamarca Group.

Sedimentary Rocks

The Quaternary deposits are characterized by matrix-supported flow dissected exposed in some areas along the creek. Overlying this unit and other in-situ rocks we have alluvials/delluvial sedimentary formations dominated mainly by fragments of block size and some igneous metamorphic rocks. Within these deposits one can find some quartz blocks up to 1m in diameter. The latter may come from the veins found in the middle of the creek.

Structure

In the vicinity of the study area the main structural feature is oriented N45 º E which is the main orientation of the Peñoles Creek, plus small faults trending NW, as mapped in some of the adits.

Structurally the middle of the creek Peñoles presents an interesting layout of multiple veins with three main trends: N58-60 º E/70-90 º W, N30-35 º E/50-80 ° E and S55-80 ° E/80 ° E. These faulting allowed multiple intrusions of small igneous intrusions.

Mineralization

The mineralogy of the epithermal gold deposits is highly diverse. In general, gold-rich pyrite is the major ore mineral. Cu sulphides, Cu-Bi sulphides, and various tellurides including Au tellurides, Au-Ag tellurides, hessite, Te-bearing tetrahedrite-tennantite, and native Te occur. Native Au is commonly enclosed in pyrite, tetrahedrite, and bornite. W-bearing phases, such as Cu-W sulphides and huebnerite, may be locally abundant and the alteration halo of mineralized veins consists of alunite, jarosite, kaolinite, and quartz. Phyllic and propylitic alteration has also been described.

The geological setting as interpreted by the Author indicates the evolution of a subduction zone probably associated to an interaction of the Caribbean Plate with the Andean Cordillera. There are evidences of a multiple-pulse intrusion, especially shown by the overlap of the different hydrothermal aureoles. A rapid cooling of some of these magmatic bodies is evident from the presence of porhyritic structure.

22

Geologist current interpretation of the model of mineralization consists of a large tonnage, low grade disseminated gold, porphyry with subordinated amounts of silver and lead. Within the intrusive, we find zones of increased fracturing (breccia to tectonic gauge) that served as a conduit for the hydrothermal fluids and they form quartz veins or highly silicified zones with moderate to abundant sulphides, including significant amounts of galenite. These are low tonnage, high grade bodies, which are the main targets of the artisan mining (Fig. 9.

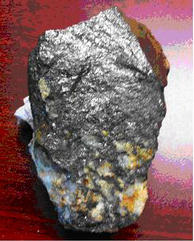

Figure 9. Quartz vein with abundant sulphides, including galenite.

Alteration

There are abundant indications of hydrothermal alteration in the area, including iron oxide, argillic, kaolinite/alunite, and silisic alterations (Fig. 10). All of them are indicative of hydrothermal alterations associated to felsic intrusives. The company intends to purchase satellite images for the interpretation of hydrothermal alterations.

Figure 10. Abundance iron and hydroxile alteration with a significant amount of manganese.

23

Drilling

No drilling has been completed in the area.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 8, 2013 certain information with respect to the beneficial ownership of our common stock by each stockholder known by us to be the beneficial owner of more than 5% of our common stock and by each of our current directors and executive officers. Each person has sole voting and investment power with respect to the shares of common stock. Beneficial ownership consists of a direct interest in the shares of common stock, except as otherwise indicated.

|

Name and Address of Beneficial Owner

|

Amount and Nature of

Beneficial Ownership

|

Percentage

of Class(1)

|

||||||

|

Warwick Calasse, President, Chief Executive Officer,

Treasurer, Secretary, and Director

24 Gardener Road, Arcturus

Ruwa, Zimbabwe, South Africa

|

350,000,000 | (2) | 66.37 | % | ||||

|

Directors and Executive Officers as a Group(1)

|

350,000,000 | 66.37 | % | |||||

|

Golden Glory Resources S.A.(4)

Suite 1-A, #5 Calle Eusebio A.