Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | d499500d8k.htm |

March 12, 2013

Continued Market Leadership

through Execution and Innovation

Credit

Suisse

15 Annual

Global

Services

Conference

©

2013 Broadridge Financial Solutions, Inc.

Broadridge and the Broadridge logo are registered trademarks of Broadridge

Financial Solutions, Inc. Exhibit 99.1

th |

1

Forward-Looking Statements

This

presentation

and

other

written

or

oral

statements

made

from

time

to

time

by

representatives

of

Broadridge

may

contain

“forward-

looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995.

Statements that are not historical in nature, and

which

may

be

identified

by

the

use

of

words

like

“expects,”

“assumes,”

“projects,”

“anticipates,”

“estimates,”

“we

believe,”

“could

be”

and other words of similar meaning, are forward-looking statements. In

particular, statements regarding our “Fiscal Year 2013 Financial

Guidance”

are forward-looking statements. These statements are based on

management’s expectations and assumptions and are subject to risks and

uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include

those

risk

factors

discussed

in

Part

I,

“Item

1A.

Risk

Factors”

of

our

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

June

30,

2012

(the “2012 Annual Report”), as they may be updated in any future reports

filed with the Securities and Exchange Commission. All forward-

looking statements speak only as of the date of this presentation and are expressly

qualified in their entirety by reference to the factors discussed in the

2012 Annual Report. These risks include: the success of Broadridge in retaining and selling additional services to its

existing clients and in obtaining new clients; Broadridge’s reliance on a

relatively small number of clients, the continued financial health of those

clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations

affecting the investor communication services provided by Broadridge; declines in

participation and activity in the securities markets; overall market and

economic conditions and their impact on the securities markets; any material breach of Broadridge security affecting its

clients’

customer information; the failure of Broadridge’s outsourced data center

services provider to provide the anticipated levels of service; any

significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; Broadridge’s

failure to keep pace with changes in technology and demands of its clients;

Broadridge’s ability to attract and retain key personnel; the impact of

new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-

looking statements that may be made to reflect events or circumstances that arise

after the date made or to reflect the occurrence of unanticipated events,

other than as required by law. Non-GAAP Financial Measures

In certain circumstances, results have been presented that are not generally

accepted accounting principles measures (“Non-GAAP”) and

should be viewed in addition to, and not as a substitute for, the Company’s

reported results. Net earnings, diluted earnings per share and

pre-tax earnings margins excluding Acquisition Amortization and Other Costs and

Restructuring and Impairment Charges are Non-GAAP measures.

These

measures

are

adjusted

to

exclude

costs

incurred

by

the

Company

in

connection

with

amortization

and

other

charges

associated with the Company’s acquisitions, and the termination of the Penson

outsourcing services agreement, as Broadridge believes this information

helps investors understand the effect of these items on reported results and provides a better representation of our actual

performance. Free cash flow is a Non-GAAP measure and is defined as cash

flow from operating activities, less capital expenditures and purchases of

intangibles. Management believes this Non-GAAP measure provides investors with a more complete understanding of

Broadridge’s underlying operational results. These Non-GAAP measures

are indicators that management uses to provide additional meaningful

comparisons between current results and prior reported results, and as a basis for planning and forecasting for future periods.

Accompanying this presentation is a reconciliation of Non-GAAP measures to the

comparable GAAP measures. Use of Material Contained Herein

The

information

contained

in

this

presentation

is

being

provided

for

your

convenience

and

information

only.

This

information

is

accurate

as of the date of its initial presentation. If you plan to use this

information for any purpose, verification of its continued accuracy is your

responsibility. Broadridge assumes no duty to update or revise the

information contained in this presentation. You may reproduce

information contained in this presentation provided you do not alter, edit, or

delete any of the content and provided you identify the source of the

information as Broadridge Financial Solutions, Inc., which owns the copyright.

Broadridge and the Broadridge logo are registered trademarks of Broadridge

Financial Solutions, Inc. |

2

Broadridge is a strong, resilient business

with significant growth potential

History of market leadership

–

Proven ability to address increasingly complex customer needs

through technology

–

Innovation and thought leader in industry for >50 years

Strong position in large and attractive markets

–

Leader in investor communications and global securities

processing –

Resilient through financial crisis due to mission-critical nature of

services –

Deeply respected by industry and regulators

–

Room for expansion into naturally adjacent markets

–

Leading the digital transformation of financial communications through

Broadridge

Fluent

SM

,

the

next

meaningful

step

forward

in

client

engagement

Excellent team

–

Results-driven and deeply experienced management team aligned

with long-term interests of shareholders

–

Highly engaged associates -

one of the best large companies to work for in

NY

1

for

6

th

consecutive

year

1. As recognized by the NY Society of Human Resources in

2008-2013 |

3

Our market position is differentiated

and sustainable

Recurring Fee Revenue

Investor Communication Solutions

$B

1.5

0.5

2012

2007

Growth through difficult

market environment

•

Proxy services for ~85%

of outstanding

shares in US

•

Processed >600 billion shares in 2012

•

Used by >5,500 institutional investors

globally

•

Eliminates >50%

of physical mailings

•

~450K

votes through mobile apps during

2012 proxy season

New businesses

Tuck-in acquisitions

Broadridge is well positioned to accelerate growth

and continue driving strong free cash flow

~7% CAGR

Securities Processing Solutions

Enable clients

to process in

>50 countries

Processes >$4.5 trillion

(average) in equity and

fixed income trades per

day

1.0 |

4

Investor Communication

Solutions

Securities Processing

Solutions

We are the leader in several markets

Market

Rank

Bank/Broker-Dealer

Regulatory

Communications

Broker-Dealer

Transactional

Communications

Corporate Issuer

Regulatory

Communications

Mutual Fund Proxy

Mail and Tabulation

Market

Rank

US Brokerage

Processing

US Fixed Income

Processing

Canadian Brokerage

Processing

#1

#1

#1

#1

#1

#1

#1

1. Marketshare based on Broadridge estimates

1

1 |

5

Investor Communication Solutions (ICS)

A Leader in Financial Communications |

6

Mutual Fund—Natural adjacencies

Transaction reporting

Imaging and workflow, etc.

Mutual Fund—Core

Retirement processing

Data aggregation

Marketing communications

Proxy/solicitation

Large and attractive markets –

Investor

Communications is a $10B+ market

BBD—Emerging products

Global proxy and communications

Tax reporting and outsourcing

Security class actions

Advisor services

Bank/Broker-Dealer (BBD)—Core

Regulatory communications

(proxy, interims, etc.)

Customer communications

(transaction statements, etc.)

Total addressable market $10B+ fee revenue

Issuer

Transfer agency

Shareholder analytics

Investor communications

BBD—Natural adjacencies

Enterprise archiving

On-boarding

International tax reclaim

$1.3B

$0.9B

$2.0B

$3.0B

$1.8B

$1.7B

Sources: BCG, Bain, Patpatia, Broadridge estimates |

7

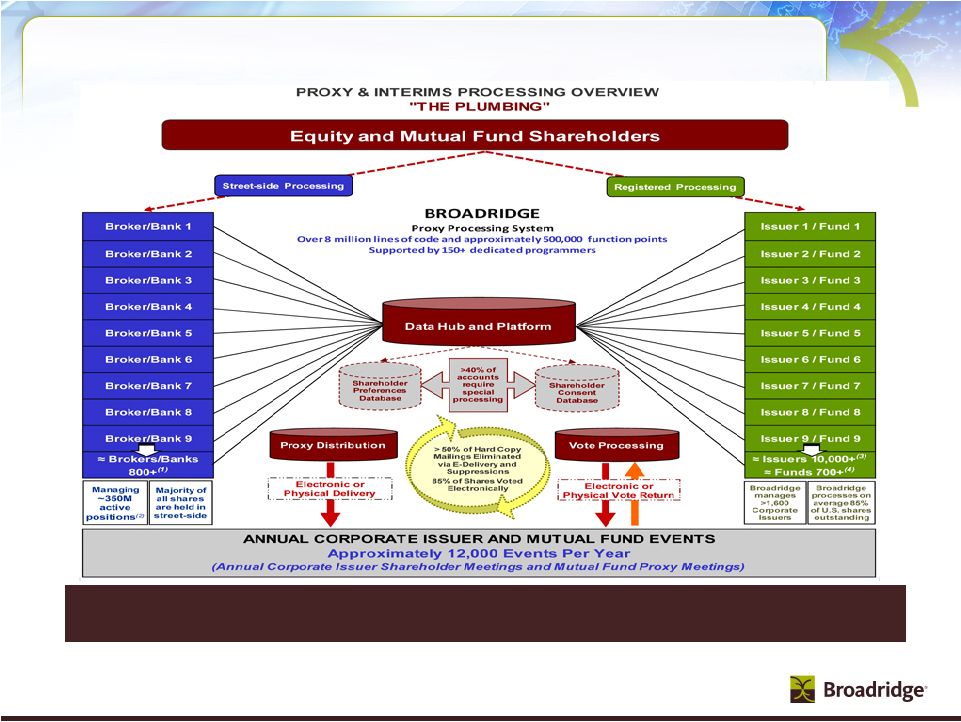

ICS Unique Business Systems Processing Model

Proxy and Interim processing system is the “plumbing”

supporting the voting

process for corporate governance

(1)

Represents Broadridge’s estimated total number of brokerage firms

and banks in the U.S. and international markets (2)

Represents Broadridge’s estimated total number of positions

managed by U.S. brokers and banks (3)

Represents Broadridge’s estimated total number of corporate

issuers in the U.S. (4)

Represents

total

number

of

Fund

Sponsors

in

the

U.S.

who

manage

over

16,000

funds

including

Mutual

Funds,

Closed-end

Funds,

ETFs

and

UITs,

according

to

the

Investment Company Institute’s 2009 Investment Company Year Book

|

8

Securities Processing Solutions (SPS)

A Leader in Financial Processing |

9

Sources: Tower Group, Chartis, Aite, IM2, Broadridge internal estimates

Technology and Operations spend adds

~$14B to our SPS addressable market

Securities and investment firms’

overall technology and operations

spend is over $100 billion and growing at 5%

$1.2B

$2.8B

~$5.0B

Adjacent markets

Middle-office

Buy-side services

Derivatives processing

Fixed Income market

data and analytics

~$5.2B

North American BPO

Middle-

and back-office

Data center services

Select corporate functions

US Brokerage Processing

Core equities and fixed income

Global Processing

Core equities and fixed income

Global BPO

Reconciliations

Total addressable market ~ $14B fee revenue |

10

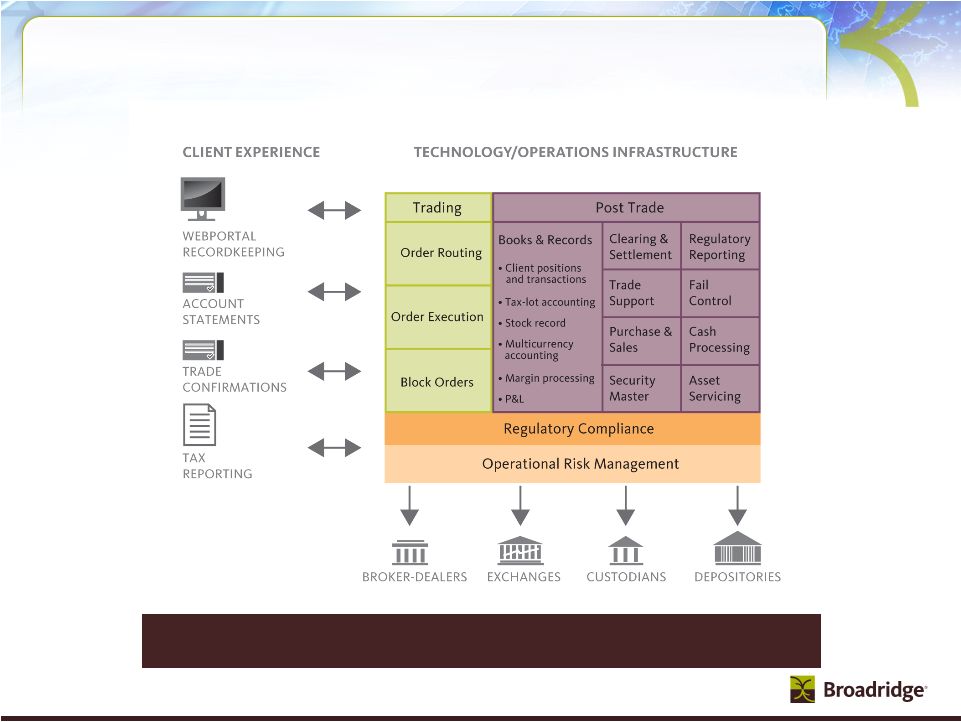

Broadridge global processing behind the scenes

Broadridge simplifies complex processes |

11

Our financial strategy is a key part of our

value creation strategy

~40% dividend payout, but expect no less than 72 cents

per share annually subject to Board approval

Organic growth with limited financial risk

–

Avoid significant balance sheet risk

–

Invest in projects delivering at least 20% IRR

–

Recurring

closed

sales

averaged

~$120M

in

each

of

the

last

3

years.

This

includes

large

transactions

(>$5M)

which

are

lumpy

and

therefore

impact

quarter

over

quarter

comparisons

Tuck-in acquisitions with clear growth profile and returns

–

Accretive to growth, margins, and earnings

–

>20% IRR in conservative business case

–

On track to generate ~$185M fee revenue (~$250M in total revenue) with

~$50M in EBITDA or >25% margins in FY13

Long-term

investment-grade

debt

rating

–

Adjusted

Debt/EBITDAR

ratio¹

target

is

2:1

Excess cash used opportunistically to offset dilution and reduce

share count through buybacks

1. Adjusted Debt/EBITDAR ratio calculated as (Debt + 8x Rent Expense) / (EBITDA +

Rent Expense) |