Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PUBLIC SERVICE ELECTRIC & GAS CO | d498784d8k.htm |

Forward Looking Statement

Readers are cautioned that statements contained in this presentation about our

future performance, including future revenues, earnings, strategies,

prospects, consequences and all other statements that are not purely

historical, are forward- looking statements for purposes of the safe

harbor provisions under The Private Securities Litigation Reform Act of

1995. When used herein, the words “anticipate”,

“intend”, “estimate”, “believe”,

“expect”, “plan”, “should”, “hypothetical”, “potential”,

“forecast”, “project”, variations of such words and similar

expressions are intended to identify forward-looking

statements. Although we believe that our expectations are based on

reasonable assumptions, they are subject to risks and uncertainties and we

can give no assurance they will be achieved. The results or developments

projected or predicted in these statements may differ materially from

what may actually occur. Factors which could cause results or

events to differ from current expectations include, but are not limited

to: •

adverse changes in the demand for or the price of the capacity and energy that

we sell into wholesale electricity markets,

•

adverse changes in energy industry law, policies and regulation, including

market structures and a potential shift away from competitive markets

toward subsidized market mechanisms, transmission planning and cost

allocation rules, including rules regarding how transmission is planned

and who is permitted to build transmission in the future, and

reliability standards, •

any inability of our transmission and distribution businesses to obtain

adequate and timely rate relief and regulatory approvals from federal

and state regulators, •

changes in federal and state environmental regulations that could increase our

costs or limit our operations,

•

changes in nuclear regulation and/or general developments in the nuclear power

industry, including various impacts from any accidents or incidents

experienced at our facilities or by others in the industry, that could

limit operations of our nuclear generating units,

•

actions or activities at one of our nuclear units located on a multi-unit

site that might adversely affect our ability to continue to operate that

unit or other units located at the same site,

•

any inability to balance our energy obligations, available supply and

risks, •

any deterioration in our credit quality or the credit quality of our

counterparties, including in our leveraged leases,

•

availability of capital and credit at commercially reasonable terms and

conditions and our ability to meet cash needs,

•

changes in the cost of, or interruption in the supply of, fuel and other

commodities necessary to the operation of our generating units, delays

in receipt of necessary permits and approvals for our construction and

development activities, •

delays or unforeseen cost escalations in our construction and development

activities,

•

any inability to achieve, or continue to sustain, our expected levels of

operating performance,

•

any equipment failures, accidents, severe weather events or other incidents

that impact our ability to provide safe and reliable service to our

customers, •

increase in competition in energy supply markets as well as competition for

certain rate-based transmission projects,

•

any inability to realize anticipated tax benefits or retain tax credits,

•

challenges associated with recruitment and/or retention of a qualified

workforce, •

adverse performance of our decommissioning and defined benefit plan trust fund

investments and changes in funding requirements, and changes in

technology and customer usage patterns.

For further information, please refer to our Annual Report on Form 10-K,

including Item 1A. Risk Factors, and subsequent reports on Form

10-Q and Form 8-K filed with the Securities and Exchange

Commission. These documents address in further detail our

business, industry issues and other factors that could cause actual results to

differ materially from those indicated in this presentation. In

addition, any forward- looking statements included herein represent

our estimates only as of today and should not be relied upon as

representing our estimates as of any subsequent date. While we

may elect to update forward-looking statements from time to time

3

Exhibit 99 |

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Net Income reported in

accordance with accounting principles generally accepted in the United

States (GAAP). Operating Earnings is a non-GAAP financial

measure that differs from Net Income because it excludes gains or losses

associated with Nuclear Decommissioning Trust (NDT),

Mark-to-Market (MTM) accounting, and other material one-time

items. PSEG presents Operating Earnings because management

believes that it is appropriate for investors to consider results

excluding these items in addition to the results reported in accordance with

GAAP. PSEG believes that the non-GAAP financial measure of

Operating Earnings provides a consistent and comparable measure of

performance of its businesses to help shareholders understand

performance trends. This information is not

intended to be viewed as an alternative to GAAP information.

The last slide in this presentation includes a list of items excluded from

Income from Continuing Operations to reconcile to Operating Earnings,

with a reference to that slide included on each of the slides where the

non-GAAP information appears.

4 |

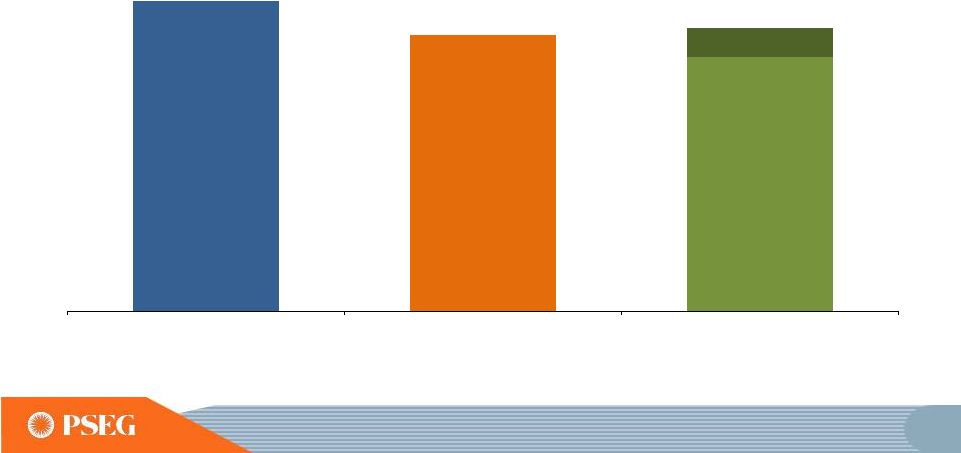

9

2013 Operating Earnings Guidance

$2.74

$2.44

$2.25 -

$2.50 E

2011 Operating Earnings*

2012 Operating Earnings*

2013 Guidance

* SEE PAGE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING

OPERATIONS TO RECONCILE TO OPERATING

EARNINGS. E = ESTIMATE. |

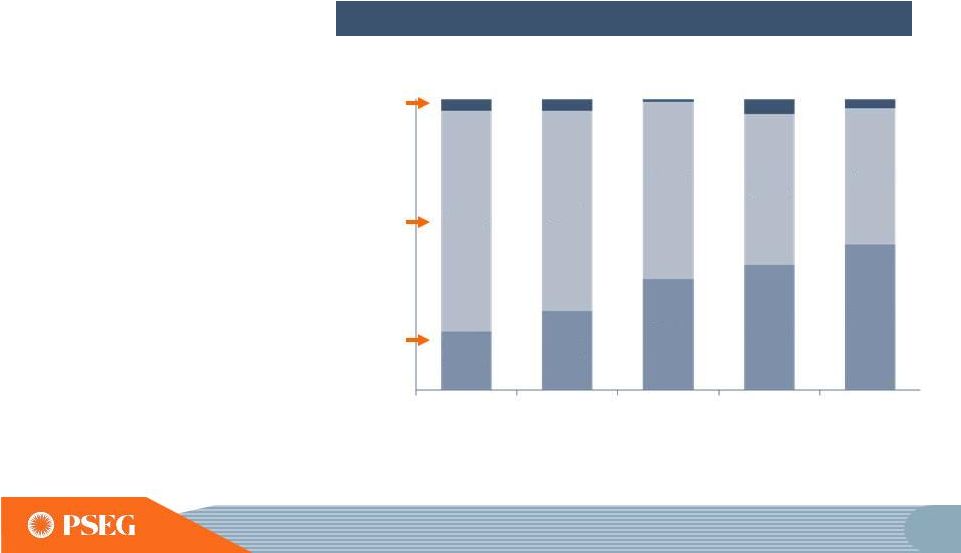

10

2013 Operating Earnings

*

*SEE PAGE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING OPERATIONS TO

RECONCILE TO OPERATING EARNINGS; ALL PERIODS REFLECT TEXAS IN

DISCONTINUED OPERATIONS. E = ESTIMATE. Investment in the

regulated business

has changed the

earnings mix

Our 2009-2013

investment focus has

brought us to a 50/50

mix for 2013

PSE&G’s 2013-2017

Energy Strong Program

and ongoing transmission

investments will support

continued growth in

PSE&G’s earnings

Percent of Operating Earnings Contribution by Subsidiary

PSE&G

Power

Other

$2.74

$2.44

$2.25 -$2.50E

$3.09

$3.12

69%

61%

52%

47%

76%

20%

27%

38%

43%

50%

2013E

2012

2011

2010

2009 |

47

PSE&G’s 2013 operating earnings

is benefiting from transmission growth and

cost containment initiatives

E= ESTIMATE

*SEE SLIDE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING OPERATIONS TO

RECONCILE TO OPERATING EARNINGS. |

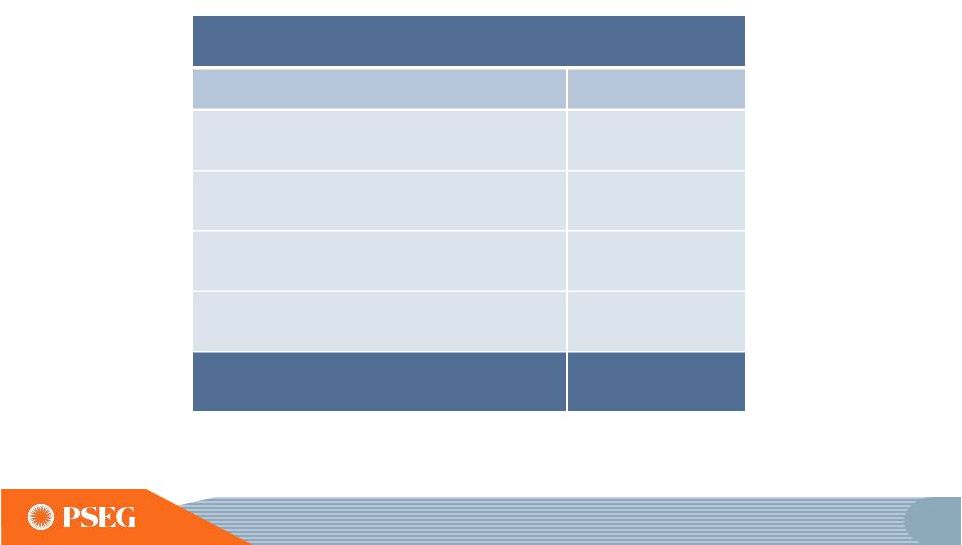

89

2013 guidance in same range as 2012

PSEG Operating Earnings

$ Millions (except EPS)

2013E

PSEG Power

$535 -

$600

PSE&G

$580 -

$635

PSEG Energy Holdings/Parent

$25 -

$35

Operating Earnings*

$1,140 -

$1,270

2013 Earnings Guidance

$2.25

-

$2.50

E = ESTIMATE

*SEE SLIDE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING OPERATIONS TO

RECONCILE TO OPERATING EARNINGS. |

102

PSEG Summary

•

Operating

Earnings

Guidance

for

2013

of

$2.25

-

$2.50

per

share

with earnings mix shifting to 50% regulated

•

Double digit operating earnings growth at PSE&G starting in 2013,

and continuing through 2015 driven by transmission investments

and approved programs

•

Power’s continued focus on operational excellence, market expertise

and financial strength reduces risk in low price environment

•

Strong Balance Sheet and Cash Flow support full capital program

without the need for equity

•

Long history of returning cash to the shareholder through the common

dividend, with opportunity for further growth |

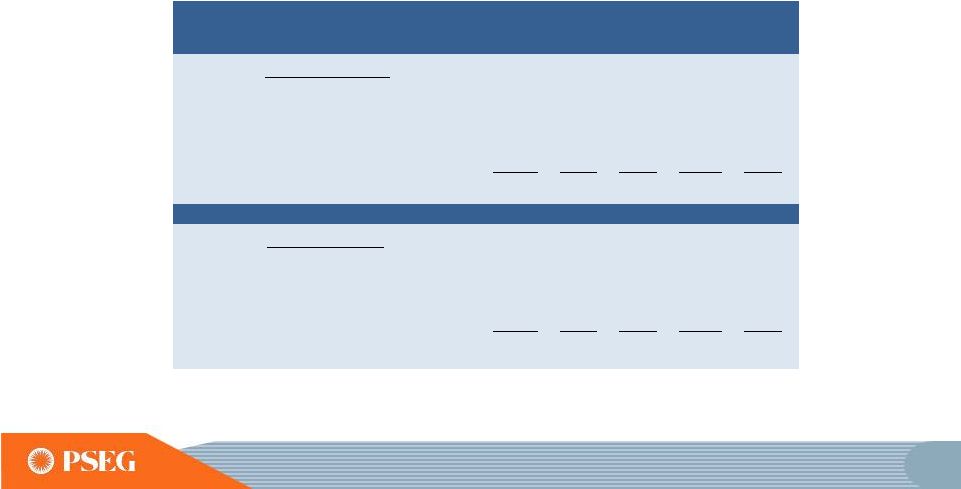

Items Excluded from Income from

Continuing Operations to Reconcile to Operating Earnings

A

PLEASE SEE PAGE 4 FOR AN EXPLANATION OF PSEG’S USE OF OPERATING

EARNINGS AS A NON-GAAP FINANCIAL MEASURE AND HOW IT DIFFERS FROM NET

INCOME. 2012

2011

2010

2009

2008

Earnings

Impact

($

Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

52

$

50

$

46

$

9

$

(71)

$

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

(10)

107

(1)

(11)

14

Lease Transaction Activity (Energy Holdings)

36

(173)

-

29

(490)

Storm O&M (PSEG Power)

(39)

-

-

-

-

Market Transition Charge Refund (PSE&G)

-

-

(72)

-

-

Gain (Loss) on Asset Sales and Impairments (Energy Holdings)

-

34

-

-

(13)

Total Pro-forma adjustments

39

$

18

$

(27)

$

27

$

(560)

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

507

507

508

Per

Share

Impact

(Diluted)

Gain (Loss) on NDT Fund Related Activity (PSEG Power)

0.10

$

0.10

$

0.09

$

0.02

$

(0.14)

$

Gain (Loss) on MTM (PSEG Power)

(0.02)

0.21

-

(0.02)

0.03

Lease TransactionActivity (Energy Holdings)

0.07

(0.34)

-

0.05

(0.96)

Storm O&M (PSEG Power)

(0.08)

-

-

-

-

Market Transition Charge Refund (PSE&G)

-

-

(0.14)

-

-

Gain (Loss) on Asset Sales and Impairments (Energy Holdings)

-

0.06

-

-

(0.03)

Total Pro-forma adjustments

0.07

$

0.03

$

(0.05)

$

0.05

$

(1.10)

$

For the Year Ended

December 31,

Reconciling

Items

Excluded

from

Continuing

Operations

to

Compute

Operating

Earnings

(Unaudited)

Pro-forma Adjustments, net of tax |