Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ESSA Bancorp, Inc. | d497525d8k.htm |

|

Certain

statements

contained

herein

are

“forward-looking

statements”

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933

and

Section

21E

of

the

Securities

Exchange

Act

of

1934. Such forward-looking statements may be identified by reference to a future

period or periods, or by the use of forward-looking terminology, such as

“may”, “will”, “believe”, “expect”,

“estimate”, “anticipate”, “continue”, or similar terms or variations on those terms, or

the negative of those terms. Forward-looking statements are subject to numerous

risks and uncertainties, including, but not limited to, those related to the economic

environment, particularly in the market areas in which ESSA Bancorp, Inc. (the

“Company”) operates, competitive products and pricing, fiscal and monetary

policies of the U.S. Government, changes in government regulations affecting financial

institutions, including regulatory fees and capital requirements, changes in prevailing

interest rates, acquisitions and the integration of acquired

businesses, credit risk management, asset-liability management, the financial and

securities markets and the availability of and costs associated with sources of

liquidity. The Company wishes to caution readers not to place undue reliance on

any such forward-looking statements, which speak only as of the date made.

The Company wishes to advise readers that the factors listed above could affect the

company’s financial performance and could cause the Company’s actual results

for future periods to differ materially from any opinions or statements expressed with

respect to future periods in any current statements. The Company does not undertake and

specifically declines any obligation to publicly release the result of any revisions which may

be made to any forward-looking statements to reflect events or circumstances after

the date of such statements or to reflect the occurrence of anticipated or

unanticipated event. Forward Looking Statements |

ESSA

Bancorp 2012 In Review

Focusing on First Bank Acquisition as a Public Company

•

First Star Bank acquisition, which closed July 31, 2012, greatly

expanded scope & reach in the Lehigh Valley with 9 new branches

•

Total assets increased 30% to approximately $1.4 billion in 2012

compared to $1.1 billion in 2011

•

Loans increased 29% to approximately $950 million in 2012

compared to $738 million in 2011

o

Originated $157 million in loans

o

Modified additional $70 million in loans

•

Deposits increased 56% to approximately $996 million in 2012

compared to $638 million in 2011 |

We continue

to closely monitor risk management parameters in this challenging economic

environment. •

Credit Quality –

o

Utilize our time honored underwriting guidelines

o

Work with customers needing assistance

•

Interest Rate Risk –

Limit exposure to long-term, fixed rate credits

in anticipation of interest rates rising

•

Capital Management

o

Dividends –

We continue to distribute quarterly dividends to

our stockholders (our 19

th

consecutive dividend was paid on

12/31/12).

o

Stock Repurchases –

ESSA has completed four stock

repurchase programs and has started a fifth buyback for

another 10% of our shares, or 1.3 million

o

Mergers & Acquisitions |

Upon the

acquisition of First Star Bank, management moved quickly to integrate the operation

with ESSA. •

Immediately began to upgrade branch facilities internally and

externally

o

New ESSA technology

o

New ESSA signage

o

ESSA marketing materials -

enhancing our visibility and creating

a more welcoming environment for customers and employees

o

Integration of systems to build efficiencies

•

The acquisition of First Star was immediately beneficial to ESSA’s

financial outlook

o

Lower dilution than anticipated, decreasing the payback period

to less than 2 years

o

Reduced First Star’s expenses by over 30%

o

Retired high interest junior subordinated and FHLB debt that we

expect will generate meaningful savings for the combined

company going forward |

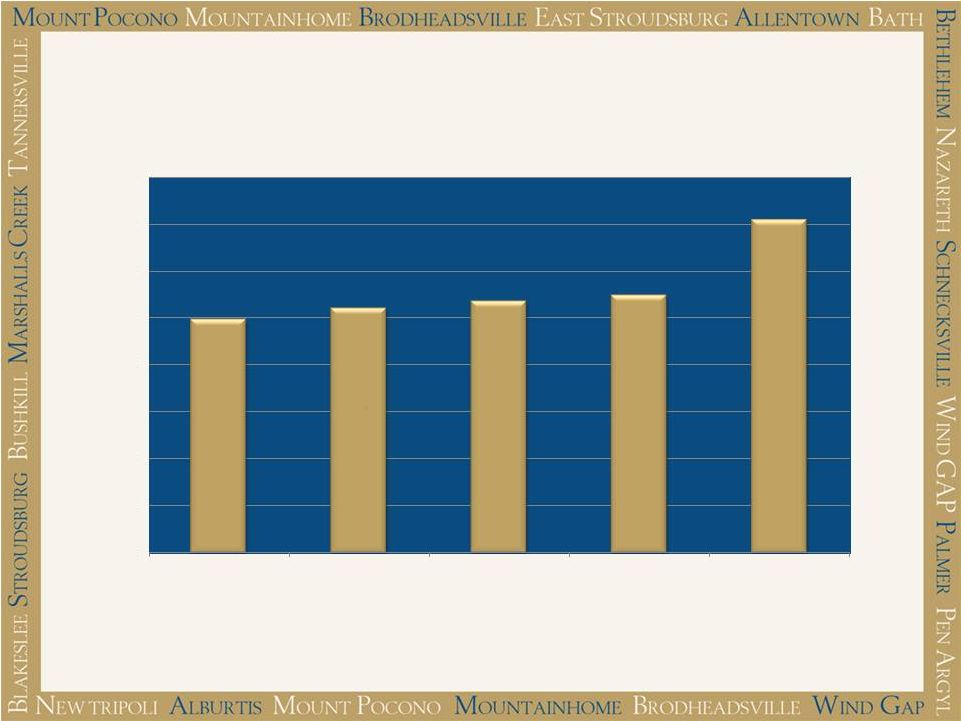

Total Assets (in

$ thousands) 993,482

1,042,119

1,071,997

1,097,480

1,418,786

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

9/30/08

9/30/09

9/30/10

9/30/11

9/30/12 |

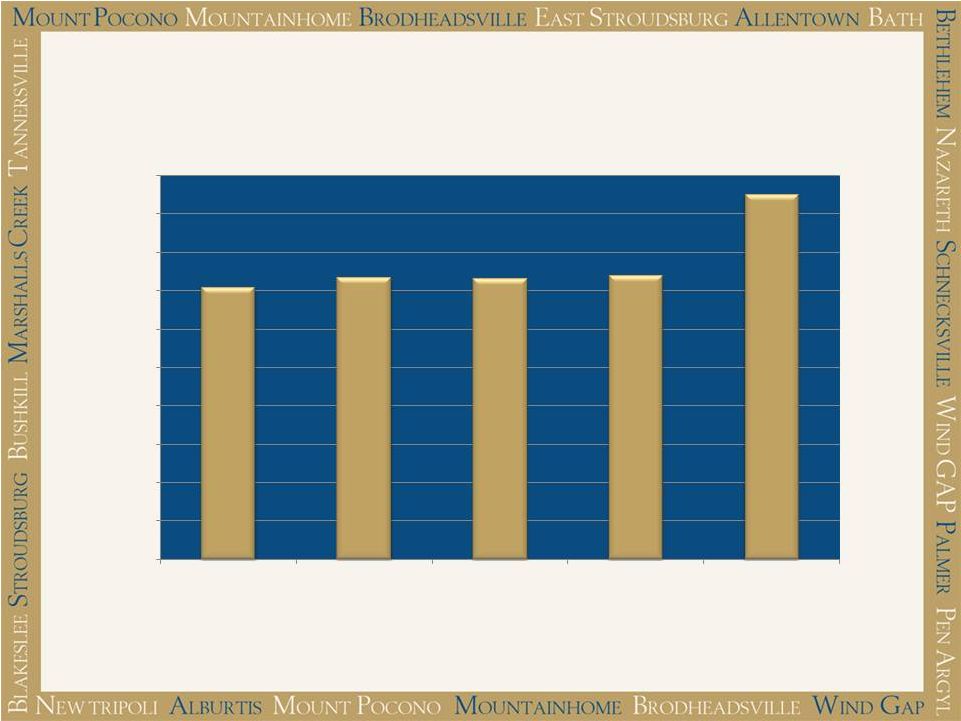

Total Loans (in

$ thousands) 706,890

733,580

730,842

738,619

950,355

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

1,000,000

9/30/08

9/30/09

9/30/10

9/30/11

9/30/12 |

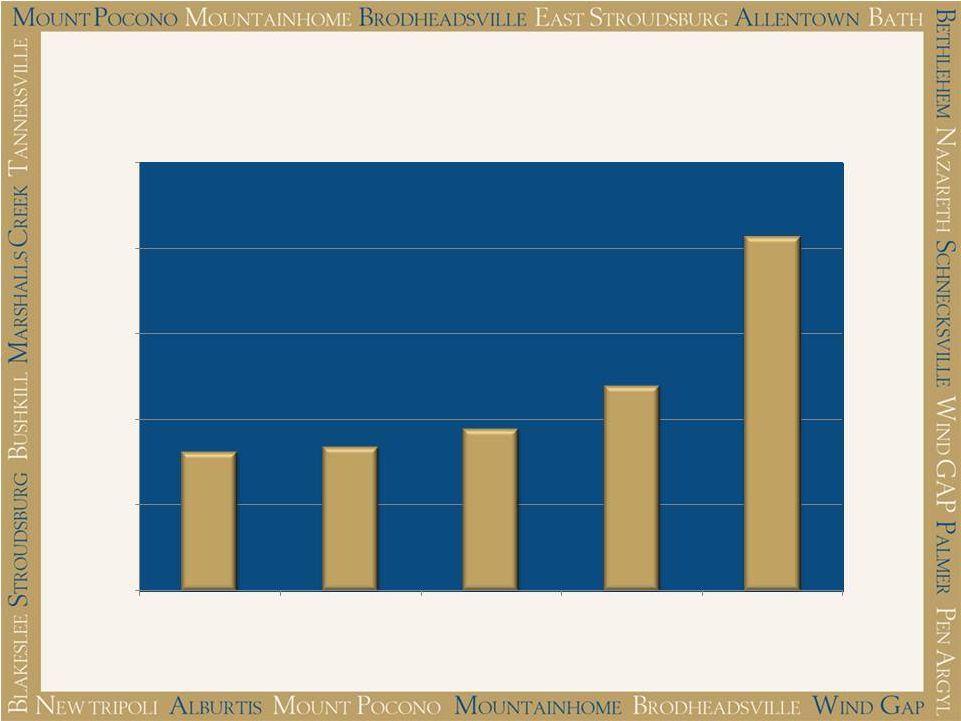

Commercial &

Municipal Loans (in $ thousands) 81,355

84,340

94,488

119,997

206,746

0

50,000

100,000

150,000

200,000

250,000

9/30/08

9/30/09

9/30/10

9/30/11

9/30/12 |

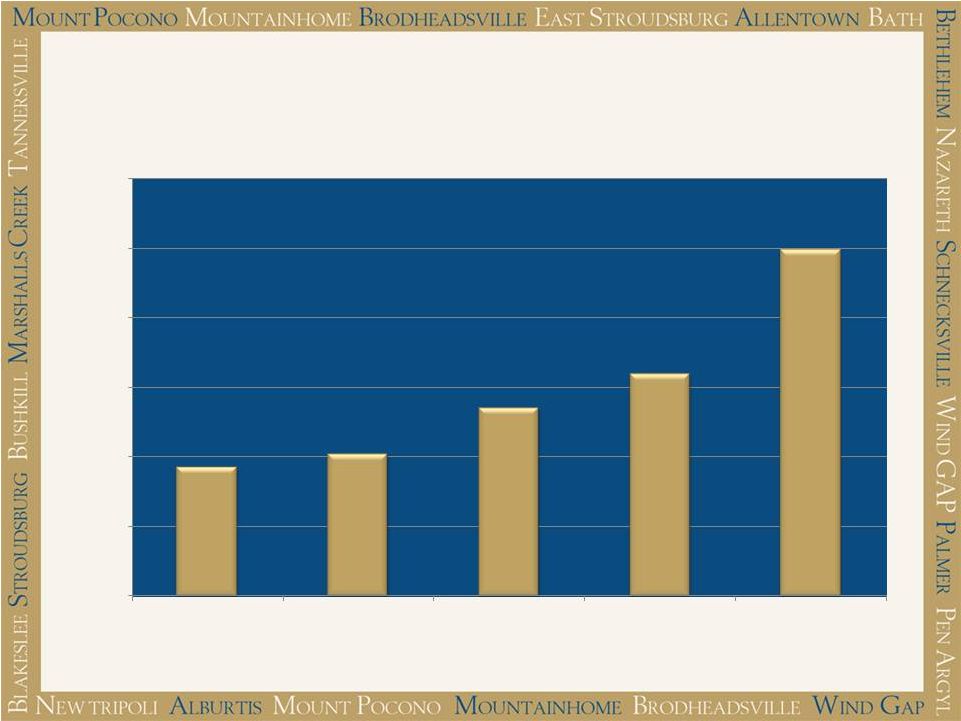

Total Deposits

(in $ thousands) 370,529

408,855

540,410

637,924

995,634

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

9/30/08

9/30/09

9/30/10

9/30/11

9/30/12 |

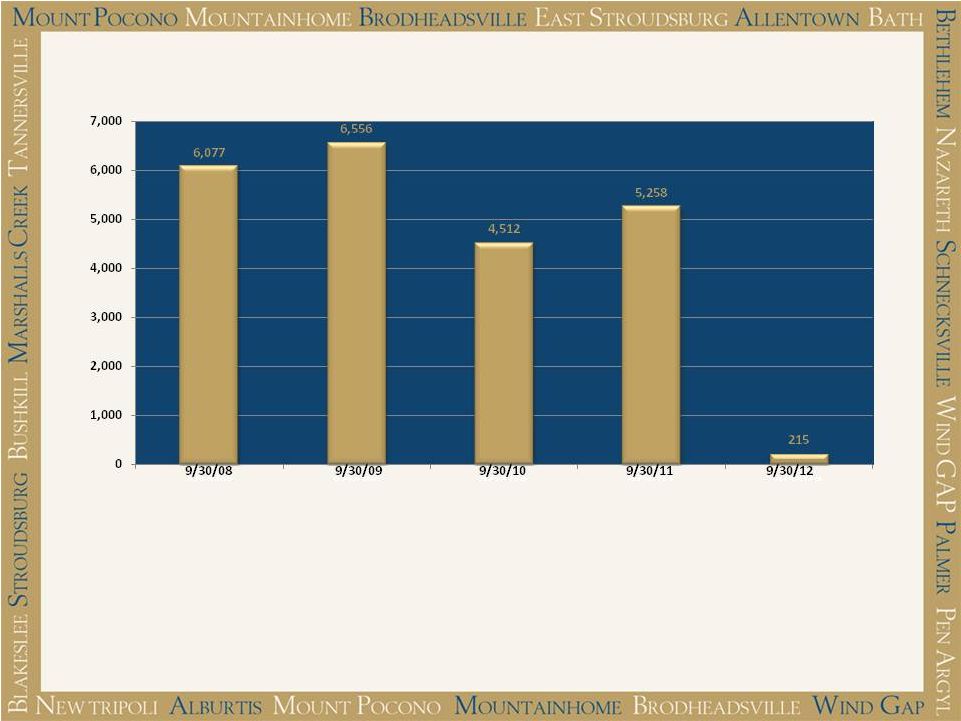

Net Income (in

$ thousands) The Bank’s earnings in 2012 reflect expenses related to the

acquisition and also payoff of wholesale borrowings. These borrowings were

paid off when the Federal Reserve Bank announced

details

of

their

third

quantitative

easing

program,

or

QE3,

in

September

2012;

signaling that lower interest rates would continue for an extended period of time.

The acquisition expenses were well within what we anticipated and are detailed in our

regulatory reporting and shareholder communications. |

Stockholders’

Equity (in $ thousands)

200.1

185.5

171.6

161.7

175.4

0

50

100

150

200

250

2008

2009

2010

2011

2012 |

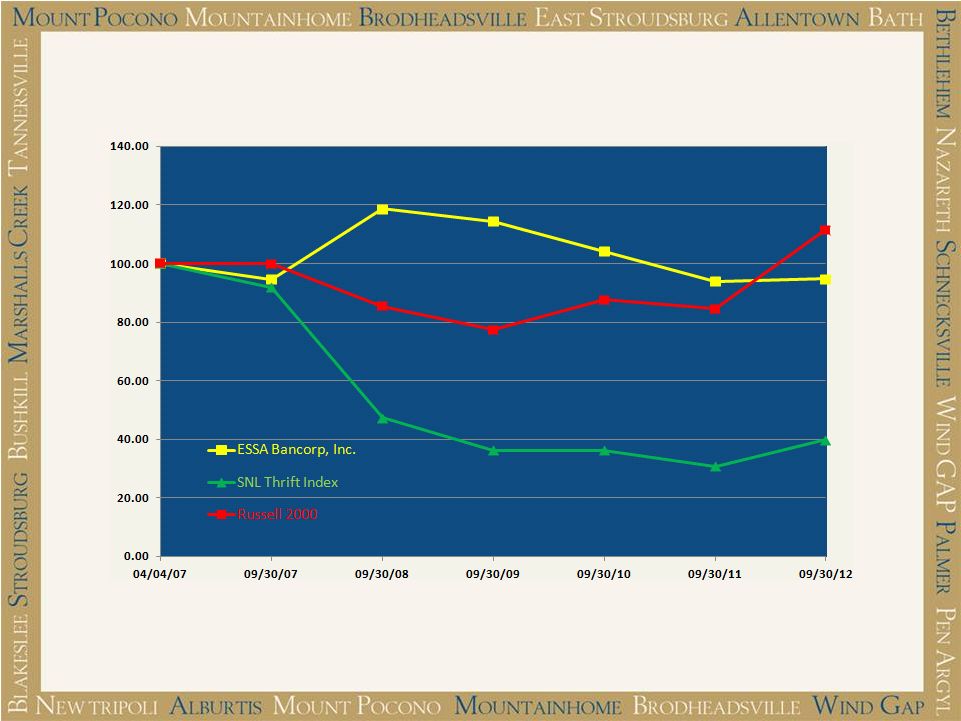

Total Stock

Return Performance Source: SNL Financial LC, Charlottesville, NC

|

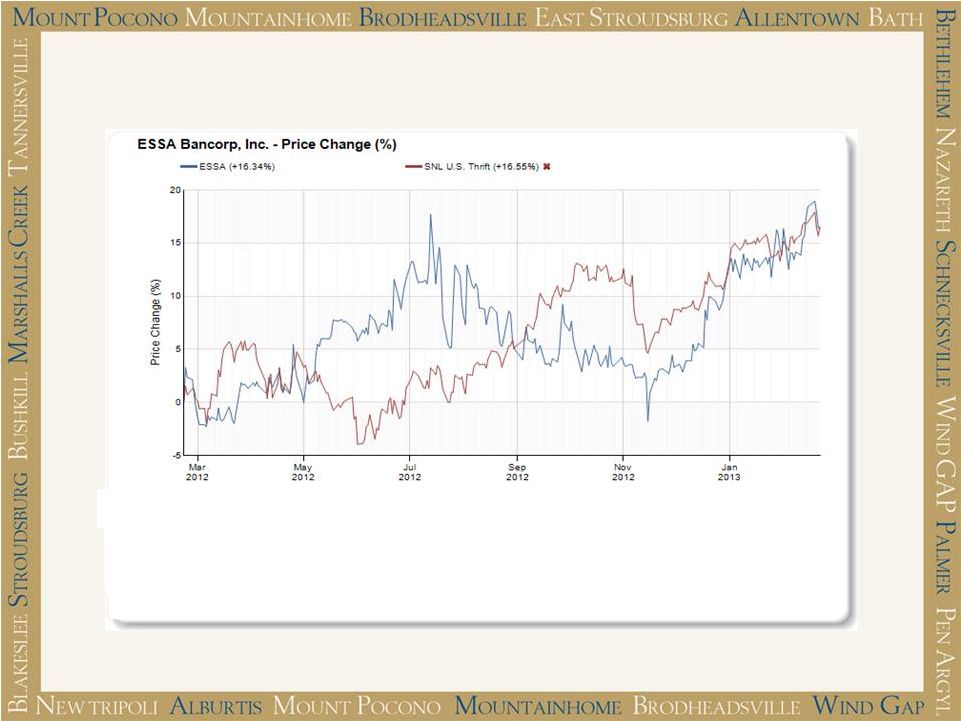

Stock Price

Performance Source: SNL Financial LC, Charlottesville, NC

|

ESSA

Institutional Shareholder Activity 2012 ESSA became a growth and accelerated earnings

story •

Even

with

change

in

orientation

from

a

“value

play”

to

a

long-term

“growth play,”

stock price kept pace with bank index

•

New growth investors have bought into the stock

•

Many committed value investors maintained positions in ESSA

•

Some value and deep value investors exited as ESSA no longer met

investing model

•

Net-net, buys and sells balanced out

•

Ended FY 1Q 2013 with more institutional shareholders and a more

diverse institutional shareholder mix than ever

•

Daily trading volume/liquidity very strong |

The

Right

Way

to

Bank

encompasses

all

aspects

of

ESSA’s

culture.

By

continually

doing the “right thing”

again and again, we remain a relevant, strong financial

institution that will weather the challenges of our industry.

•

We remain a Safe, Sound, and Secure Institution

We are well capitalized -

Tier 1 Capital Leverage Ratio of 11.1%

Non-performing assets/assets 1.92%

Low Texas Ratio of 16.47% (MRQ)

•

We are well positioned to enhance the Bank’s value

Our asset growth is generating higher revenues, accounting for an

increase in earnings per share

Geographic growth into the Lehigh Valley presents new opportunities

Offering a full range of retail and business products/services

Traditional Banking Products & Services

Asset Management & Trust Services

Investment Services

Advisory Services

Talented team of employees provide high level of personal service,

attention, and professionalism

Investment in systems to support a larger entity |