Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDEAVOUR INTERNATIONAL CORP | d496871d8k.htm |

| EX-99.1 - EX-99.1 - ENDEAVOUR INTERNATIONAL CORP | d496871dex991.htm |

Fourth Quarter 2012

Earnings Review

March 6, 2013

Exhibit 99.2 |

2

2012

Fourth

Quarter

and

Year

End

–

Financial/Operational

Sales Volumes and Physical Production

•

Q4 sales volumes averaged over 11,500 barrels of oil equivalent per day

(“boepd”) up 171% from the comparable quarter in 2011

•

Year-over-year average sales volumes increased 133%

•

Year-over-year average daily physical production increased 131%

•

2012 production was 70% from the U.K. and 30% from the U.S.

•

Year-end production exit rate was approximately 10,400 boepd

Two wells at Bacchus brought on production

Completed the acquisition of an additional 23.43% working interest in Alba

Revenues up $159 million year-over-year

Commenced drilling at the Rochelle development

U.K. proved reserves increased 186% year-over-year

Completed an exchange of assets in the Pennsylvania Marcellus

|

3

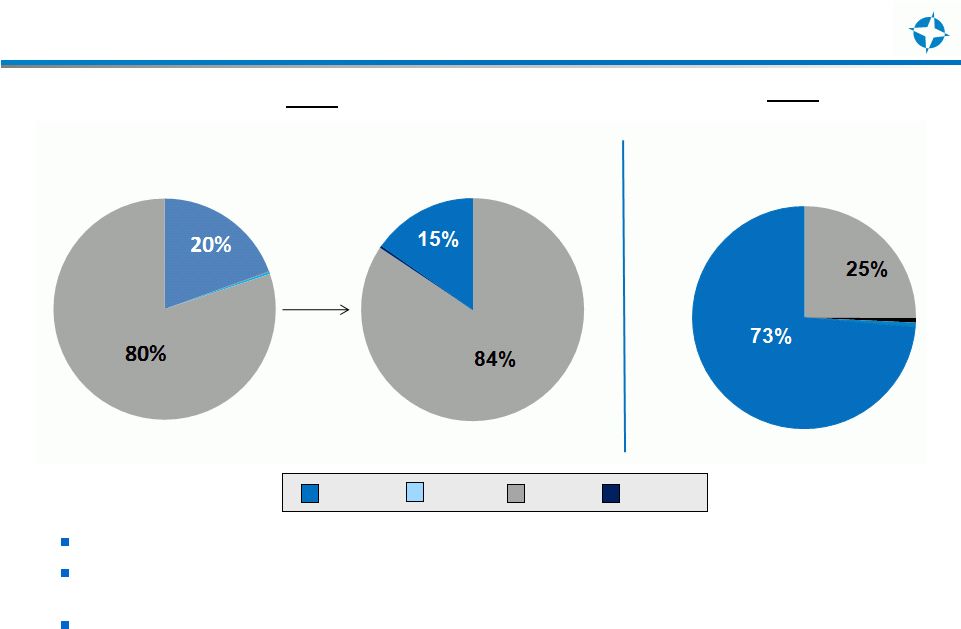

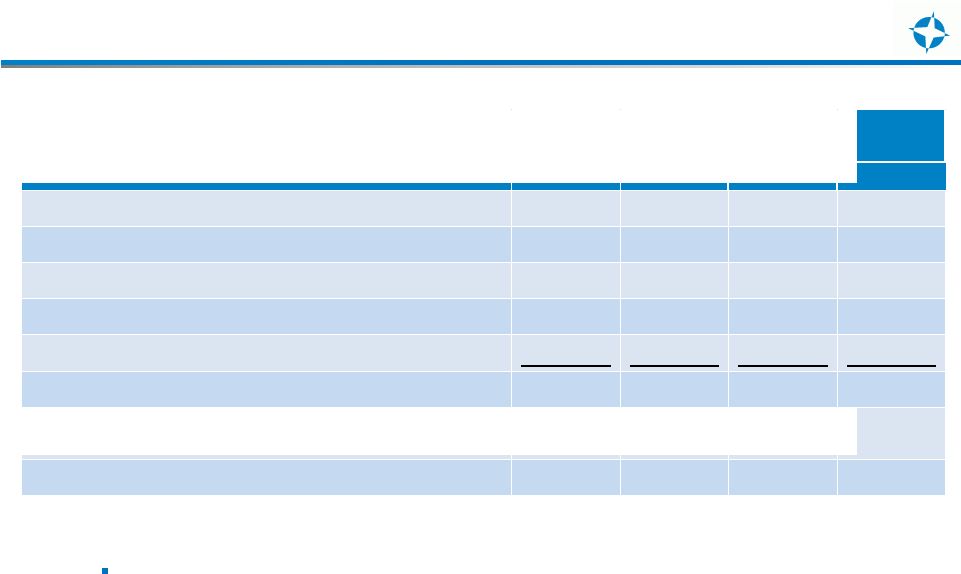

Production Volumes (BOE per day)

2012

2011

Q3 Sales = 11,006

Q4 Sales = 11,541

Q4 Sales = 4,253

US Gas US Oil UK Oil

UK Gas

Year-over-year sales volumes up 133%

Physical production volume for the fourth quarter averaged 10,300 boepd and 7,873

boepd for the full year of 2012

Fourth Quarter realized prices

•

Oil and condensate price = $105.76 per barrel

•

Gas price = $2.86 per Mcf |

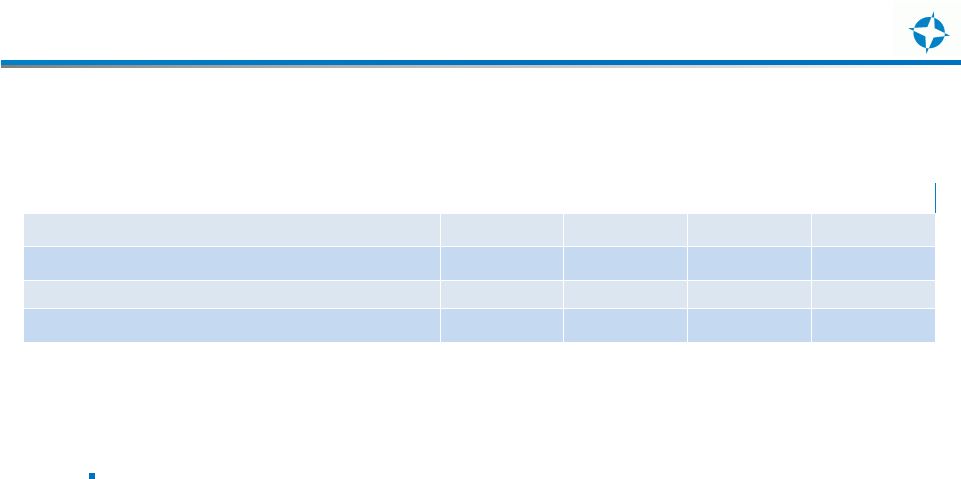

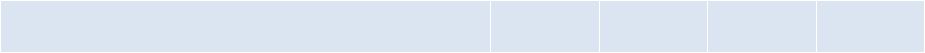

4

Summary Financial Results

Revenues

increase

265%

from

2011

to

2012

driven

by

increase

U.K.

crude

oil

production

at Alba and Bacchus, as well as improving Brent crude oil prices.

Measure ($in millions, except per share data)

2012

2011

2012

2011

Oil and Gas Revenues

97.6

$

16.6

$

219.1

$

60.1

$

Operating Expenses

23.9

$

2.8

$

58.5

$

17.7

$

Adjusted cash flow from Operations

73.7

$

13.8

$

160.6

$

42.4

$

Three Months

Ended Dec. 31,

Full Year |

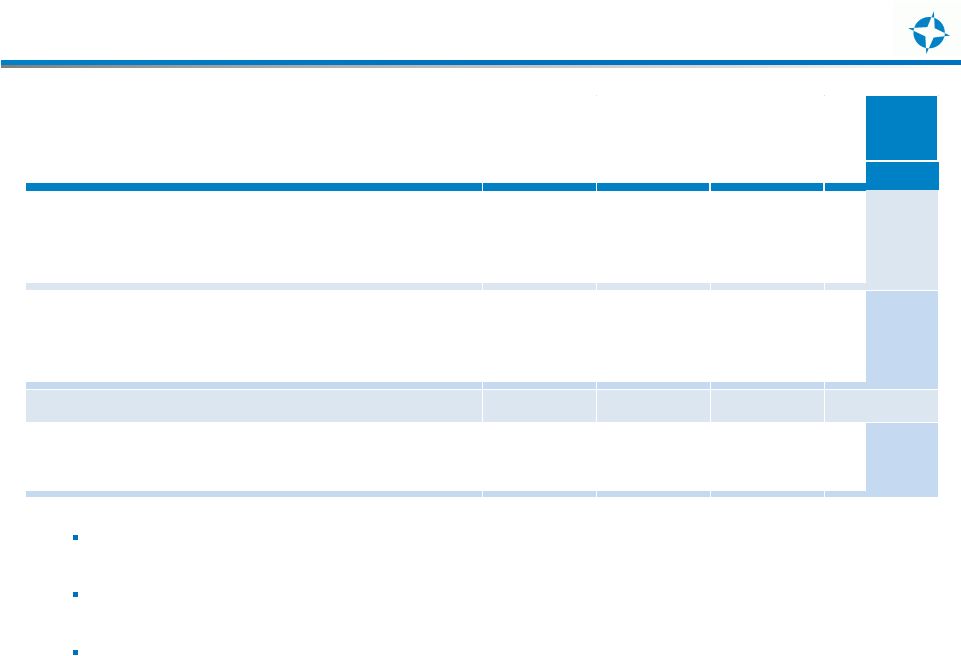

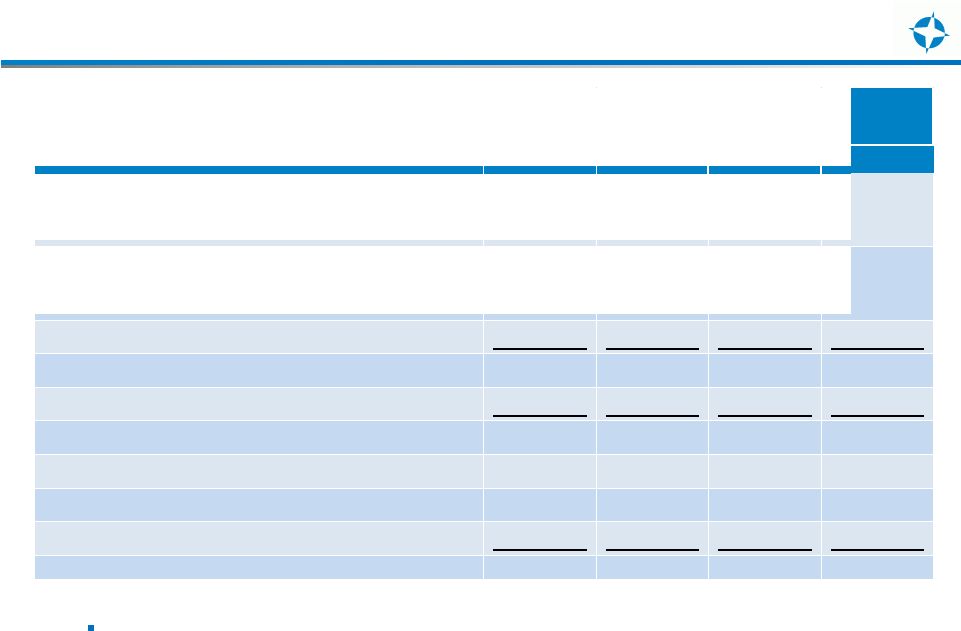

5

Key Business Metrics

Yearly OpEx costs were up due to increased production and a one time inventory

cost of $9.7 million ($7/barrel) related to the Alba purchase in the third

quarter of 2012. DD&A increased year-over-year due to a larger

working interest and increased production at Alba, along with first

production at Bacchus and higher decommissioning costs estimates.

Interest expense increased due to the High Yield offering and Revolving Credit

facility, partially offset by repayment of the Senior Term Loan and

Subordinated Notes. Capitalized interest increased year-over-year due

to work in progress associated with Rochelle and Bacchus.

Measure

($ expense per BOE)

2012

2011

2012

2011

Operating Expenses (OpEx)

Consolidated

$22.53

$7.10

$20.33

$14.31

U.K.

$23.83

$15.84

$25.67

$22.21

U.S.

$15.33

$4.08

$8.00

$10.69

Depreciation, depletion and amortization (DD&A)

Consolidated

$22.86

$19.89

$23.11

$21.45

U.K.

$25.67

$39.08

$28.85

$38.61

U.S.

$7.31

$13.23

$9.88

$13.58

General and Administrative Expense (G&A)

$5.37

$8.51

$7.32

$14.46

Interest Expenses

Cash

$14.93

$15.59

$21.27

$16.40

Non-cash

$4.95

$16.84

$7.94

$20.29

Three Months

Ended Dec. 31,

Full Year |

6

Adjusted EBITDA

Adjusted EBITDA increased 426% year-over-year as a result of

increased U.K. oil production and improving commodity prices.

Measure

($ in millions, except per share data)

2012

2011

2012

2011

Net Income (loss)

(6.5)

$

(44.6)

$

(126.2)

$

(131.0)

$

Unrealized (gain) loss on derivatives

(7.3)

2.7

(5.1)

(8.4)

Net Interest Expense

21.1

12.6

83.9

44.4

Letter of Credit Fees

9.5

-

21.9

-

Loss on early extinguishment of debt

-

-

21.7

0.4

Depreciation, depletion and amortization

24.3

7.8

66.5

26.5

Impairment of U.S. oil and gas properties

6.0

36.9

53.0

65.7

Income tax expense (benefit)

17.6

(4.8)

14.2

27.1

Adjusted EBITDA

64.7

$

10.6

$

129.9

$

24.7

$

Weighted-average basic

shares

outstanding

(in millions)

46.6

39.2

42.5

36.0

Adjusted EBITDA per basic share

$1.39

$0.27

$3.06

$0.69

Three Months

Ended Dec. 31,

Full Year |

7

Adjusted Net Income (Loss)

Revenues from increased production in the U.K. North Sea were offset by increased

interest expense and Letter of Credit fees.

Measure

($ in millions, except per share data)

2012

2011

2012

2011

Net Income (loss)

(6.5)

$

(44.6)

$

(126.2)

$

(131.0)

$

Impairment of U.S. oil and gas properties

6.0

36.9

53.1

65.7

Unrealized (gain) loss (net of tax)

(7.4)

1.9

(7.3)

(10.3)

Loss on early extinguishment of debt

-

-

17.8

0.4

Deferred Tax Expense releated to U.K. tax rate change

0.2

-

8.5

25.5

Net Income (loss) as Adjusted

(7.7)

$

(5.8)

$

(54.1)

$

(49.7)

$

Weighted-average basic

shares

outstanding (in millions)

46.6

39.2

42.5

36.0

Adjusted earning (loss) per basic share

(0.17)

$

(0.15)

$

(1.27)

$

(1.38)

$

Three Months

Ended Dec. 31,

Full Year |

8

Capex Update

The increase in AROs during 2012 reflects the higher amount of abandonment

retirement obligations due to the increased working interest at Alba and

timing of payment obligations at other fields.

Measure ($ in millions)

2012

2011

2012

2011

Development Capital

U.K.

41.7

$

21.0

$

157.7

$

62.0

$

U.S.

-

3.8

4.9

8.6

Exploration Capital

U.K.

5.4

3.3

14.6

34.5

U.S.

0.6

7.1

9.1

65.0

Other

0.2

1.7

3.5

5.3

Total Direct Oil & Gas Capex

47.9

36.9

189.8

175.4

Acquisitions

-

5.0

190.8

50.0

47.9

41.9

380.6

225.4

Capitalized Interest

6.8

4.8

26.9

14.7

Capitalized G&A

4.6

2.9

19.3

15.0

Asset Retirement Obligations (AROs)

137.2

16.2

140.7

16.8

Total Capital Expenditures

196.5

$

65.8

$

567.5

$

271.9

$

Three Months

Ended Dec. 31,

Full Year |

9

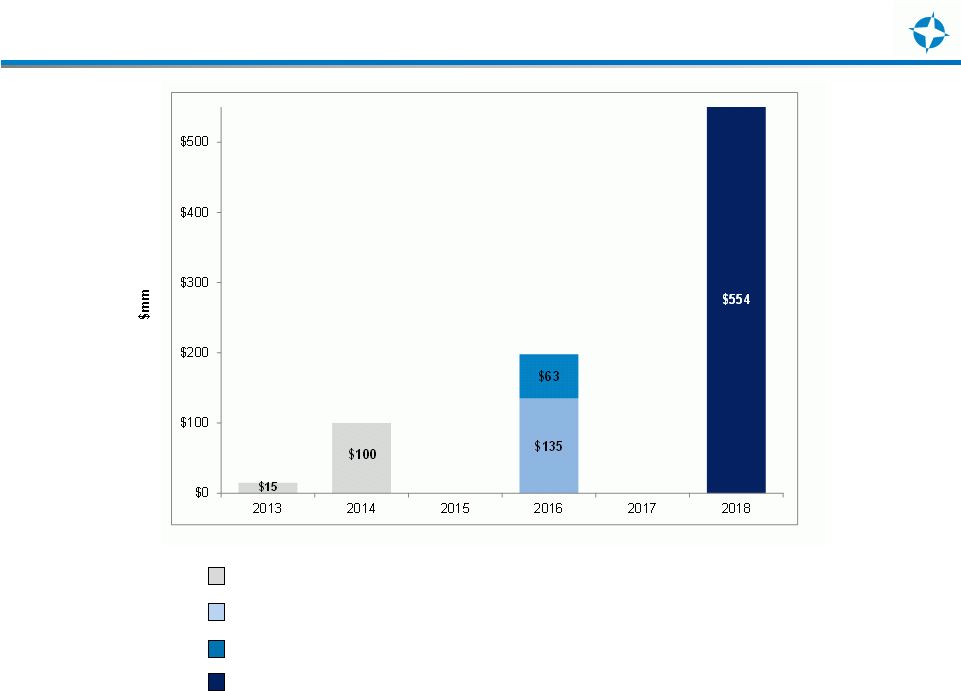

Debt Maturity Schedule

Convertible Notes due 2016 ($18.51 per share conversion price)

Convertible Bonds due 2016 ($16.52 per share conversion price)

Senior Notes due 2018

Revolving Credit Facility due 2013/2014 |

2013

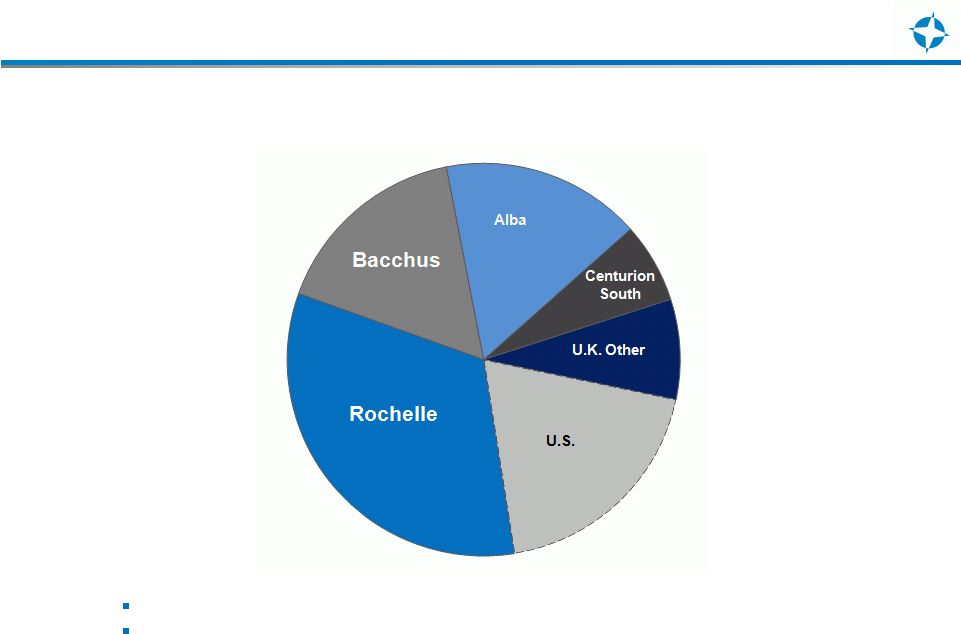

Direct Capital Expenditures 10

Rochelle and Bacchus represent 60% of the planned spend in the U.K.

U.S. budget is second half of the year weighted and is largely discretionary.

U.K. = $140 million -

$150 million

U.S. = $30 million -

$ 40 million |