Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cole Real Estate Investments, Inc. | d497156d8k.htm |

| EX-99.2 - EX-99.2 - Cole Real Estate Investments, Inc. | d497156dex992.htm |

| EX-99.1 - EX-99.1 - Cole Real Estate Investments, Inc. | d497156dex991.htm |

| EX-99.4 - EX-99.4 - Cole Real Estate Investments, Inc. | d497156dex994.htm |

A

Transformational Transaction: A Highly Attractive Real Estate Portfolio and A Leading

Real Estate Investment Manager Exhibit 99.3 |

2

Disclaimer

This presentation may be deemed to be solicitation material in respect of the charter

amendments to be presented to Cole Credit Property

Trust

III,

Inc.’s

(“CCPT

III”)

stockholders

for

consideration

at

the

2013

annual

stockholders’

meeting

of

CCPT

III.

CCPT

III

expects to file a proxy statement with the Securities and Exchange Commission

(“SEC”) in connection with the 2013 annual stockholders’

meeting. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT

DOCUMENTS FILED

WITH

THE

SEC

WHEN

THEY

BECOME

AVAILABLE,

BECAUSE

THEY

WILL

CONTAIN

IMPORTANT

INFORMATION.

You may obtain a

free

copy

of

the

proxy

statement

and

other

relevant

documents

filed

with

the

SEC

at

the

SEC’s

website

at

www.sec.gov.

Copies

of

the documents filed by CCPT III with the SEC will be available free of charge by directing a

written request to Cole Credit Property Trust III, Inc., 2325 East Camelback Road,

Suite 1100, Phoenix, Arizona, 85016, Attention: Investor Relations. CCPT III and its

directors and executive officers and other members of management may be deemed to be participants in the

solicitation

of

proxies

in

respect

of

the

charter

amendments

to

be

considered

at

the

2013

annual

stockholders’

meeting

of

CCPT III.

Information regarding the interests of CCPT III’s directors and executive officers in the

proxy solicitation will be included in CCPT III’s definitive proxy

statement. This presentation contains a description of the merger agreement

pursuant to which CCPT III will acquire Cole Holdings Corporation

(“Cole Holdings”). A copy of the merger agreement will be filed as an exhibit

to a Form 8-K CCPT III will file with the SEC. The description of the merger

agreement contained in this presentation does not purport to be complete and is qualified in its entirety

by reference to the full text of the merger agreement. |

3

Forward-Looking Statements

In addition to historical information, this presentation contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking

statements, which are based on current expectations, estimates and projections about the

industry and markets in which CCPT III operates, include beliefs of and assumptions

made by CCPT III’s management, and involve risks and uncertainties that could

significantly

affect

the

financial

results

of

CCPT

III.

Words

such

as

“may,”

“expects,”

“anticipates,”

“intends,”

“plans,”

“believes,”

“projects,”

“seeks,”

“estimates,”

“would,”

“could”

and “should”

and variations of such words and similar expressions are intended to

identify such forward-looking statements, which generally are not historical in nature.

Such forward-looking statements include, but are not limited to, statements about

the benefits of the business combination transaction involving CCPT III and Cole Holdings,

future financial and operating results, and the combined company’s plans, objectives,

expectations and intentions. All statements that

address

operating

performance,

events

or

developments

that

we

expect

or

anticipate

will

occur

in

the

future

—

including

statements

relating

to

earnings

accretion,

cash

flow

growth,

AUM

growth,

rent and occupancy growth, changes in sales or

contribution volume of developed properties, future dividend levels, an anticipated NYSE

listing, increased liquidity, capital raising capabilities,

availability

of

capital

and

general

conditions

in

the

geographic

areas

where

we

operate

—

are

forward-looking

statements. These statements are not guarantees of future performance and involve certain

risks, uncertainties and assumptions that are difficult to predict. Although we believe

the expectations reflected in any forward-looking statements are based on

reasonable assumptions, we can give no assurance that our expectations will be attained and

therefore, actual outcomes and results may differ materially from what is expressed or

forecasted in such forward-looking statements. Some of the factors that may affect

outcomes and results include, but are not limited to: (i) national, international, regional

and local economic climates, (ii) changes in financial markets, interest rates, credit

spreads, and foreign currency exchange rates, (iii) changes in the real estate markets, (iv)

continued ability to source new investments, (v) increased or unanticipated competition for

our properties, (vi) risks associated with acquisitions, (vii) maintenance of real

estate investment trust status, (viii) availability of financing and capital, (ix) changes in demand

for developed properties, (x) risks associated with the ability to consummate the merger and

the timing of the closing of the merger, and

(xi)

those

additional

risks

and

factors

discussed

in

reports

filed

with

the

SEC

by

CCPT

III

from

time

to

time.

CCPT

III

does

not

make any undertaking with respect to updating any forward-looking statements appearing in

this presentation. |

4

A Highly Attractive Portfolio and A Leading Investment Manager

COLE HOLDINGS

PREMIER REAL ESTATE INVESTMENT MANAGER

WITH COMPELLING GROWTH PROFILE

CCPT III

HIGH-QUALITY COMMERCIAL

REAL ESTATE PORTFOLIO

(1)

BILLION

COMMERCIAL

REAL ESTATE AUM

$12.4

99%

OCCUPANCY

BASED ON SQUARE FEET

76

MILLION

SQUARE FEET

(3

)

47

350

PROFESSIONALS

36

INDUSTRY SECTORS

2,000 +

PROPERTIES MANAGED

12.7

YEARS

WEIGHTED AVERAGE

REMAINING LEASE TERM

(2)

34

YEARS

COMMERCIAL REAL ESTATE

EXPERIENCE

•

Proven Real Estate

Investment Manager

•

Management Continuity

•

Accretive Transaction

•

Increased Dividend

•

Liquidity

•

Greater Access to

Capital Markets

•

New Fee Income

•

Elimination of Management

Fee Expense

THE PROPOSED TRANSACTION WILL

PROVIDE IMPORTANT BENEFITS, INCLUDING:

1,014

PROPERTIES

OWNED

Notes: See About the Data on page 22 for footnote information. Data is unaudited as of

12/31/2012.

STATES |

5

Transformational Transaction |

6

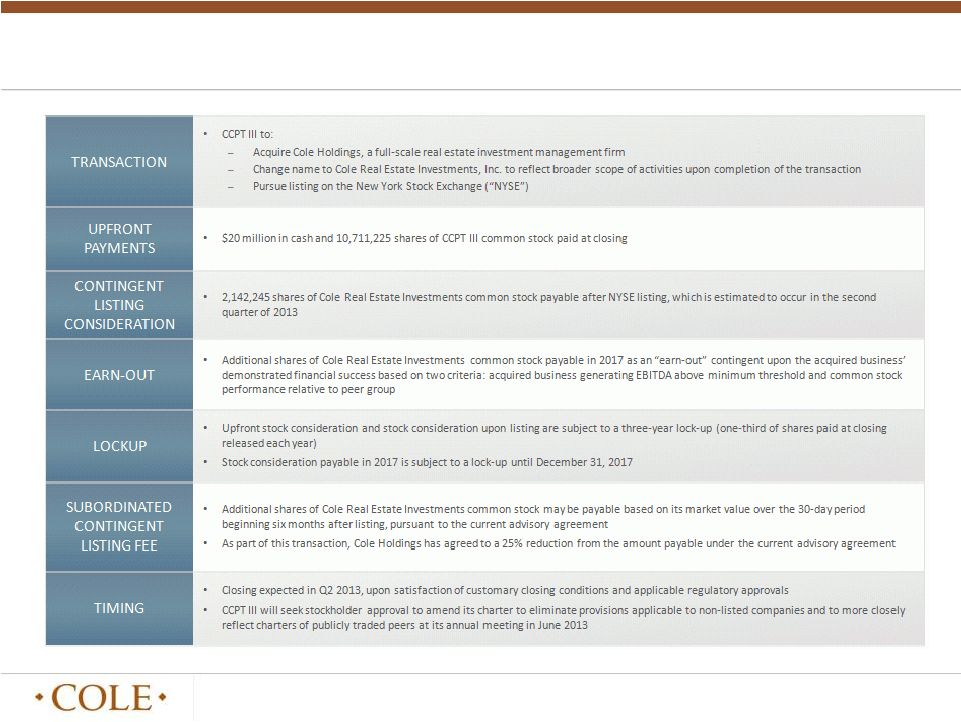

Key Terms of the Transaction |

7

Second Largest Publicly-Traded REIT in the Net-Lease Sector Upon Listing

Ranked by Gross Book Assets

Source: Latest publicly available financials.

3.

Spirit pro forma for CCPT II acquisition. All data per Spirit January 2013 Investor

presentation. 4.

Gross book assets plus disclosed real estate depreciation. Spirit gross book value represents

the sum of Spirit 3Q12 and CCPT II 3Q12 disclosed numbers.

5.

Gross book assets based on purchase price of total assets

6.

Based on straight-line annualized rental revenue

O

(1)

COLE

REAL ESTATE

INVESTMENTS

(2)

SRC

(3)

WPC

LXP

NNN

EPR

GROSS BOOK ASSETS

(4)

$ 9.6

$7.4

(5)

$ 7.3

$ 4.7

$ 4.6

$ 4.3

$ 3.3

NUMBER OF PROPERTIES

3,528

1,014

2,012

423

220

1,622

182

SQUARE FOOTAGE (MM)

~50.0+

43.1

54.3

38.5

41.2

19.2

13.9

NUMBER OF TENANTS

N/A

562

300+

124

N/A

300+

250+

NUMBER OF STATES

49

+ PR

47

48

41

+ Europe

41

47

36

OCCUPANCY

98%

99%

99%

99%

97%

98%

98%

WEIGHTED AVERAGE LEASE LENGTH (YRS)

11.4

12.7

(6)

10.6

8.9

7.1

12

N/A

% OF RENT FROM TOP 5 TENANTS

~20%

20.7%

(6)

29%

29%

13%

24%

52%

% OF RENT FROM

INVESTMENT

GRADE

TENANTS

34%

42%

(6)

19%

34%

49%

N/A

N/A

CREDIT RATINGS (S&P / MOODY’S)

BBB / Baa1

N/A

TBD

N/A

N/A

BBB / Baa2

BB / Baa3

All metrics, except gross book assets, based on wholly-owned assets and consolidated joint

ventures and excludes unconsolidated joint ventures, mortgage notes receivable and

commercial mortgage-backed securities. Data is unaudited as of 12/31/2012.

1.

2.

Pro forma for January 2013 closing on acquisition of ARCT. Data per Realty Income

September 2012 Investor Presentation and 2012 10K.

|

8

CCPT III: Property Type and Geographic Diversification

GEOGRAPHIC DIVERSIFICATION

Notes: Property Type Diversification based on purchase price of total assets. Geographic

Diversification based on wholly owned assets and consolidated joint ventures and excludes

unconsolidated joint ventures, mortgage notes receivable and commercial mortgage-backed

securities. Data is unaudited as of 12/31/2012. PROPERTY TYPE DIVERSIFICATION

49.3%

SINGLE-TENANT

RETAIL

18.6%

MULTI-TENANT

RETAIL

17%

SINGLE-TENANT

OFFICE

7.5%

SINGLE-TENANT

INDUSTRIAL

4.8%

DEBT INVEST.

2.8%

JOINT VENTURE &

CONSTRUCTION IN

PROGRESS |

`

CCPT III: Industry and Tenant Diversification

CCPT III’s high-quality tenants represent industry leaders in the pharmacy, consumer

goods, restaurant, home improvement and technology sectors

9

Notes: Trade names shown are those of tenants of properties owned by CCPT III. CCPT III is not

affiliated or associated with, is not endorsed by, does not endorse, and is not sponsored by

or a sponsor of the tenants or of their products or services pictured or mentioned. The names,

logos and all related product and service names, design marks and slogans are the

trademarks or service marks of their respective companies. Data is unaudited as of 12/31/2012. TOP 10 INDUSTRIES

NUMBER OF

LEASES

% OF

ANNUAL RENT

TOP 10 TOTAL

1,074

60.6%

RESTAURANT

324

10.3%

GROCERY

72

9.0%

DRUGSTORE

134

9.0%

DISCOUNT STORE

220

7.6%

HOME AND GARDEN

66

5.4%

PET SUPPLIES

48

4.4%

WAREHOUSE CLUB

7

4.3%

HEALTHCARE

57

3.9%

FINANCIAL SERVICES

60

3.5%

CONVENIENCE STORE

86

3.2%

TOP 10 TENANTS

NUMBER OF

LEASES

% OF

ANNUAL RENT

WALGREENS

76

5.0%

ALBERTSON'S

34

4.3%

PETSMART

41

4.1%

CVS

58

3.9%

BJ'S WHOLESALE CLUB

3

3.4%

APOLLO GROUP

1

2.6%

WAL-MART

8

2.5%

L.A. FITNESS

17

2.5%

AMAZON.COM

3

2.5%

KOHL'S

20

2.4%

TOP 10 TOTAL

261

33.2% |

10

CCPT III: Long-Term Leases to High-Quality Tenants

CREDIT RATING OF RATED TENANTS

37.6%

BBB+ / BBB / BBB-

1.6%

B-

and Below

12.2%

BB+ / BB / BB-

15.6%

B+ / B

20.1%

A+ / A / A-

12.9%

AAA / AA+ /

AA / AA-

LEASE EXPIRATIONS

62.3%

10-20 YEARS

12.9%

7-10 YEARS

7.1%

20+ YEARS

9.3%

5-7 YEARS

3.1%

0-3 YEARS

5.3%

3-5 YEARS

Notes: Lease Expirations based on straight-line rental revenue and assume no renewals are

exercised. Based on annualized straight-line rental revenue, approximately 59.4% of CCPT III’s

tenants are rated by S&P; of the 59.4%, approximately 70.6% are rated investment

grade. S&P credit ratings are as of 1/16/2013. Data is unaudited as of 12/31/2012.

|

Experienced

Management Team and Platform 352 PROFESSIONALS

CAPITAL

MARKETS

140 PROFESSIONALS

REAL ESTATE

TRANSACTIONS

REAL ESTATE

STRATEGY

REAL ESTATE

OPERATIONS

EXECUTIVE AND

OTHER

IT AND

FACILITIES

Sales, Shareholder Services,

Investor & Broker Dealer

Relationships, and Other

Support Functions

Acquisitions,

Dispositions and Legal

& Risk Management

Underwriting and

Investment Strategy

& Research

Real Estate Finance,

Property Management &

Operations, and Leasing

Accounting,

Human Resources,

and Administrative

Information Technology

and Facilities Management

JEFF HOLLAND, CFA

HEAD OF CAPITAL MARKETS

16 YEARS OF EXPERIENCE

BlackRock | Raymond James

McKinsey & Company

MITCHELL SABSHON

CHIEF OPERATING OFFICER

27 YEARS OF EXPERIENCE

Goldman Sachs | Lehman Brothers

Skadden Arps

THOMAS W. ROBERTS

MANAGING DIRECTOR

OF REAL ESTATE

25 YEARS OF EXPERIENCE

Opus West | Koll Company

KIRK McALLASTER, CPA

CHIEF FINANCIAL OFFICER

(REITS AND REAL ESTATE FUNDS)

21 YEARS OF EXPERIENCE

Deloitte | Coopers & Lybrand

DAVID LYNN, Ph.D.

CHIEF INVESTMENT STRATEGIST

25 YEARS OF EXPERIENCE

ING Clarion | AIG Global Real Estate

AvalonBay Communities

AARON HALFACRE, CFA

CHIEF MARKETING OFFICER

15 YEARS OF EXPERIENCE

BlackRock | Green Street Advisors

STEPHAN KELLER

CHIEF FINANCIAL OFFICER

20 YEARS OF EXPERIENCE

UBS

Seamless integration of the same real estate management

platform that has acquired and managed the real estate

assets of CCPT III since its inception

CHONG P. HUAN

HEAD OF TECHNOLOGY &

INFRASTRUCTURE

20 YEARS OF EXPERIENCE

Citi | AIG | New York Life

MARC NEMER

PRESIDENT AND

CHIEF EXECUTIVE OFFICER

15 YEARS OF EXPERIENCE

Latham & Watkins | Skadden Arps

CHRISTOPHER H. COLE

EXECUTIVE CHAIRMAN

34 YEARS OF EXPERIENCE

Founder, Cole

Real Estate Investments

42 PROFESSIONALS

15 PROFESSIONALS

59 PROFESSIONALS

79 PROFESSIONALS

17 PROFESSIONALS

11 |

12

Robust Real Estate Resources

•

Leasing Team: 10

•

Enhances property values

through high occupancy,

balanced tenant mix, and

attractive economics

•

Employs statistical analysis to

drive economics and

measure leasing performance

•

Utilizes a national geographic

coverage model

•

Real Estate Acquisitions

Team: 20

•

“On the ground”

deal

sourcing team with

–

In-depth knowledge of

primary, secondary and

tertiary property

markets

–

Strong, strategic

relationships with

leading national and

regional brokerage firms

•

Over $3.9 billion of

transactions in 2012:

–

$1.2 billion single-tenant

retail

–

$1 billion multi-tenant

retail

–

$1 billion office and

industrial

–

Over $700 million of

dispositions

A broad range of real estate acquisition, portfolio strategy, financing, management, and

leasing capabilities to optimize individual assets and entire portfolios

•

Underwriting Team: 9

–

Credit/tenant

underwriting

–

Site inspections

•

Investment Strategy

and Research Team: 5

–

1 Post Doctorate, 1

Master of Quantitative

Finance, 1 CFA

–

Market Research

–

Portfolio construction

and optimization

LEASING

REAL ESTATE TRANSACTIONS

REAL ESTATE STRATEGY

•

Property Management

and Operations Team: 43

•

Manages over 76 million

square feet and over 2,000

properties

•

Capability to manage stand-

alone properties as well as

power centers

•

Utilizes regional geographic

coverage model with offices

in Phoenix, Atlanta, Chicago

and Orlando

•

Oversees all major capital

and repair projects, tenant

expansions and build-to-suit

program

PROPERTY MANAGEMENT

•

Real Estate Finance Team: 7

•

Obtains unsecured/secured

lines of credit and first

mortgage financing

•

Secured $1.65 billion worth of

financing in 2012

REAL ESTATE FINANCE

REAL ESTATE LEGAL

•

Finance and Accounting

Team: 55

•

16 CPAs

•

22 Big 4 public

accounting alumni

FINANCE & ACCOUNTING

•

Real Estate Legal Team: 21

•

Provides transaction support

and risk management |

13

Industry Leading Transactions Platform

1

U.S. SINGLE-TENANT

ACQUISITIONS

PAST TEN YEARS

3

ALL U.S. PROPERTY

TYPES ACQUISITIONS

PAST FIVE YEARS

Real Capital Analytics, North America, US

Transactions closed or under contract. Status dates: Excludes joint venture

investments. Data as of December 31, 2012. 1

U.S. SINGLE-TENANT

RETAIL ACQUISITIONS

PAST TEN YEARS

1

U.S. SINGLE-TENANT

OFFICE ACQUISITIONS

PAST THREE YEARS

#

#

#

# |

14

Comprehensive Capital Raising Capabilities

•

Client Segmentation and

Targeting Capability

•

Registered Investment Advisor

Channel

Demographics

•

Product Specialists

•

Thought-leadership Research

•

Sales Ideas

•

Partnership Campaigns

•

Industry Trends

•

Digital Marketing

•

Public Relations/

Advertising

•

Broker-Dealer Firms

(1)

: 480

Selling Agreements

•

Relationship Management

Team: 13

•

Campaigns: Customized to

Partner Focus Themes

•

Number of Events

in 2011: 501

•

Co-sponsor Firm

Events: 368

•

“Essential Partner”

Business Model

A broad range of capital raising capabilities to meet the needs of our distribution

partners •

2012 Assets Raised:

$1.28 billion

•

Average Shareholder

Investment : $36,000

•

Number of

Salespeople: 70

•

Dedicated Virtual

Team: 7

•

Channels: Retail, Registered

Investment Advisors,

Institutional

•

Advisors with Sales: 13,375

•

2012 Market Share

(2)

: 12%

•

Consultative/Educational

Approach

•

19 Representatives

•

Investor Services: 160,000

•

Shareholder Accounts

•

Average Daily Call Volume:

625

•

New Business

Transactions: 3,000/mo.

MARKETING

NATIONAL ACCOUNTS

SALES

CLIENT SERVICE

•

Used Across All Channels:

Wirehouse, Independent

Broker-Dealer, and Registered

Investment Advisor

•

Uniform Compliance Process

•

Comprehensive Education and

Training

•

Supervisory Oversight

DISCIPLINED SALES PROCESS

•

Standard Non-listed REITs,

Daily NAV Products, Limited

Partnerships, Share Class

Modeling, and Separate

Accounts

PRODUCT STRUCTURING

MARKET INTELLIGENCE

1.

Reflects participating dealer agreements entered into during offering stages of Cole Credit

Property Trust III, Inc., Cole Credit Property Trust IV, Inc., Cole Corporate Income Trust, Inc.

and Cole Real Estate Income Strategy (Daily NAV), Inc. Data is unaudited as of

12/31/2012. 2.

Source: Robert A. Stanger & Co., Inc.; includes equity and mortgage LPs, LLCs, and

non-listed REITs. |

Consistent

Market Leadership Source: Robert A. Stanger & Co., Inc., based on annual capital

raise by the sponsor. Notes: Healthcare Trust of America was distributed by American

Realty Capital. The corporate logos used in this chart that are registered trademarks are the property of their respective owners.

Cole is the only non-listed REIT sponsor on the leader board 5 years in a row

TOP 5 REAL ESTATE SPONSORS

15

2008

2009

2010

2011

2012

1

st

2

nd

3

rd

4

th

5

th |

Immediately

Accretive and Poised for Greater Growth Source: Robert A. Stanger & Co., Inc.;

includes equity and mortgage LPs, LLCs, and non-listed REITs; ranking by sponsor.

INDUSTRY GROSS SALES

EQUITY RAISED

($ in billions)

2008

2009

2010

2011

2012

COLE MARKET SHARE

11%

16%

18%

16%

12%

COLE RANKING

#3

#1

#1

#2

#2

•

Cole Real Estate Investments is continuously developing new products and

seeking to open new channels for distribution

•

With the ability to offer multiple investment vehicles (e.g. listed shares,

non-listed

offerings),

Cole

Real

Estate

Investments

will

appeal

to

a

broader

range of current and potential investors

•

All future growth opportunities will directly benefit the CCPT III

stockholders as income and valuation are realized

•

CCPT

III

is

acquiring

a

large,

profitable

real

estate

investment manager

on an immediately accretive basis

•

Assuming a $1.3 billion capital raise over a 12 month period, the asset

management business would generate approximately $90 million in

incremental revenue for the combined company

•

Over $6 billion has been raised in the past 5 years alone

–

Consistently averaging $100 million of new capital per month

16

$1.1

$1.0

$1.4

$1.3

$1.3

$9.6

$6.1

$8.1

$8.3

$10.3

$0

$2

$4

$6

$8

$10

$12

2008

2009

2010

2011

2012

COLE

INDUSTRY

CURRENT INCREMENTAL VALUE

SIGNIFICANT GROWTH OPPORTUNITY |

17

Significant Market Share Opportunity Exists

Notes: See About the Data on page 22 for footnote information. Past performance does not

guarantee future results. •

Cole has captured over 3% share of all real estate assets under management in the

insurance and independent channels –

Capturing 14% of new inflows invested into non-listed REITs on average for the past

five years

–

Expectations of an incremental 5% opportunity from new advisors in Current Retail channel and

4% in New Core Retail channel

•

Replicating 3% share of institutional and subadvisory real estate allocations would equate to

a significant opportunity

–

Attaining 1% share of all Institutional real estate allocations and 5% share of all

subadvisory real estate allocations may be conservative

–

3% share of these new distribution channels could be as much as $90 billion

CHANNEL

TOTAL

AUM

(2)

MIN.

REAL ESTATE ALLOCATION

(2)

COLE OPPORTUNITY

(3)

% OF TOTAL AUM

REAL ESTATE (RE) AUM

% OF RE AUM

CAPITAL RAISE

ASSETS

(4)

Current Retail

$3.4T

6.6%

$224B

5%

$11B

$22B

Insurance and Independent Broker -

Dealers

(Fee and Commission)

New Core Retail

$8.6T

5.0%

$430B

4%

$17B

$34B

Wirehouse, Regional, Bank, RIA,

and Bank Broker-Dealers

Institutional

$11.0T

7.0%

$770B

1%

$8B

$16B

Subadvisory

$3.7T

5.0%

$185B

5%

$9B

$18B

TOTAL

$27.0T

6.0%

$1.6T

3%

$45B

$90B

(1) |

18

Merger Benefits Summary

SCALE

•

CCPT III is one of the largest REITs focused on the net-lease commercial real estate

sector, and following a listing, Cole Real Estate Investments would be the second

largest publicly-traded REIT in the net-lease sector CONSISTENCY

•

CCPT III stockholders will continue to benefit from the knowledge and operational

efficiencies resulting from seamless integration

of

the

same

real

estate

management

platform

that

has

acquired

and

managed

the

real

estate

assets

of

CCPT

III

since its inception

VALUE

•

Transaction is expected to be immediately accretive to CCPT III’s funds from operations

and to support an increase in the Company’s annualized dividend rate to $0.70 per

share upon closing LIQUIDITY

•

Stockholders will have even greater access to liquidity/flexibility to sell or retain shares

based on public market value Represents opportunity to achieve a liquidity event

substantially earlier than was previously anticipated for CCPT III stockholders

ACCESS

•

Cole Real Estate Investments will have the opportunity not only to continue raising capital

from retail distribution channels, but also to increase its access to institutional

investors and related capital sources Better positioned to seek other accretive

opportunities beyond organic capital raising opportunities GROWTH

•

Cole Real Estate Investments will benefit from its new income stream of fees earned from the

management of other real estate vehicles as well as the efficiencies resulting from

the elimination of its external management fees POTENTIAL

•

This

transformational

transaction

creates

a

historic

opportunity

to

participate

in

the

next

evolution

of

real

estate

asset

management

Making even more obtainable the goal of being the premier, trusted brand in real estate, and

the most capable partner in delivering best-in-class long-term results

Creating

a

new

paradigm

in

real

estate

asset

management

that

can

provide

financial

advisors

and

investors

with

sound

investment strategies and innovative investment vehicles |

19

Roadmap to Completion

•

List Cole Real Estate Investments

on NYSE promptly after charter

is amended

•

Announce transaction

•

Seek stockholder approval to

amend CCPT III’s charter at the

annual meeting

June 2013

April -

May

2013

•

Expected closing in Q2 2013, subject

to satisfaction of customary closing

conditions and applicable regulatory

approvals

June 2013 |

20

About the Data

Slide Notes: “A Highly Attractive Portfolio and A Leading Investment Manager”

Slide Notes: “Significant Market Share Opportunity Exists”

Based on wholly-owned assets and consolidated joint ventures and excludes unconsolidated

joint ventures, mortgage notes receivable and commercial mortgage-backed

securities. Data is unaudited as of December 31, 2012.

Weighted Average Remaining Lease Term is based on annualized straight-line rental

revenue. Total Square Feet includes building and ground-lease square footage.

1.

2.

3.

1.

2.

3.

4.

As of 12/31/2012, Independent and Insurance AUM is $3.4T, and current allocation to real

estate is 6.6% ($224B); Cole’s market share at $6.6B in capital raise ($12B in

AUM) is 2.9%. New Flows share is a 5 year average (14.2% = $1.21B average Cole flows / $8.5B

average industry flows) (Robert A. Stanger & Co., Inc.).

AUM is as of the end of 2011 (Cerulli Associates). Current Retail allocation to real estate is

6.6% (Cerulli Associates). Other Minimum Real Estate Allocations are an average

assumption based on Cerulli Associates, Investment News, and other publications.

Cole Opportunity is our projection for market share within real estate allocations.

Assets based on 50% loan-to-value ratio.

|