Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BUCKEYE PARTNERS, L.P. | d498320d8k.htm |

Morgan

Stanley Midstream MLP and Diversified Natural Gas Corporate Access Day

New York, NY

March 6, 2013

©

Copyright 2013 Buckeye Partners, L.P.

Exhibit 99.1 |

LEGAL

NOTICE/FORWARD-LOOKING STATEMENTS ©

Copyright 2013 Buckeye Partners, L.P.

2

This presentation contains “forward-looking statements” that we believe to be

reasonable as of the date of this presentation. These statements, which include

any statement that does not relate strictly to historical facts, use terms such as “anticipate,” “assume,” “believe,”

“estimate,” “expect,” “forecast,” “intend,”

“plan,” “position,” “predict,” “project,” or “strategy” or the negative connotation or other

variations of such terms or other similar terminology. In particular, statements,

express or implied, regarding future results of operations or ability to generate

sales, income or cash flow, to make acquisitions, or to make distributions to unitholders are forward-looking statements.

These forward-looking statements are based on management’s current plans,

expectations, estimates, assumptions and beliefs concerning future events impacting

Buckeye Partners, L.P. (the “Partnership” or “BPL”) and therefore involve a number of risks and uncertainties, many of

which are beyond management’s control. Although the Partnership believes that its

expectations stated in this presentation are based on reasonable assumptions, actual

results may differ materially from those expressed or implied in the forward-looking statements. The factors

listed in the “Risk Factors” sections of, as well as any other cautionary language

in, the Partnership’s public filings with the Securities and Exchange Commission,

provide examples of risks, uncertainties and events that may cause the Partnership’s actual results to differ materially

from the expectations it describes in its forward-looking statements. Each

forward-looking statement speaks only as of the date of this presentation, and the

Partnership undertakes no obligation to update or revise any forward-looking statement. |

INVESTMENT

HIGHLIGHTS •

Over 125 years of continuous operations, with a 26-year track record as a publicly traded

MLP on the NYSE

•

Market capitalization over $5.0 billion

•

Lower cost of capital realized from elimination of GP IDRs

•

Investment grade credit rating with a conservative approach toward financing growth

•

Increased

geographic

and

product

diversity

resulting

from

recent

acquisitions

•

Growth opportunities to unlock significant value from acquisition of assets from

major

petroleum

companies

-

“Terminal

Franchise”

•

Opportunities

for

significant

internal

growth

projects

on

legacy

and

recently

acquired

assets

•

Paid cash distributions each quarter since formation in 1986

Petroleum storage tanks at our Macungie terminal in Pennsylvania

Aerial view of BORCO’s six offshore jetties with tank farm in the distance

©

Copyright 2013 Buckeye Partners, L.P.

3 |

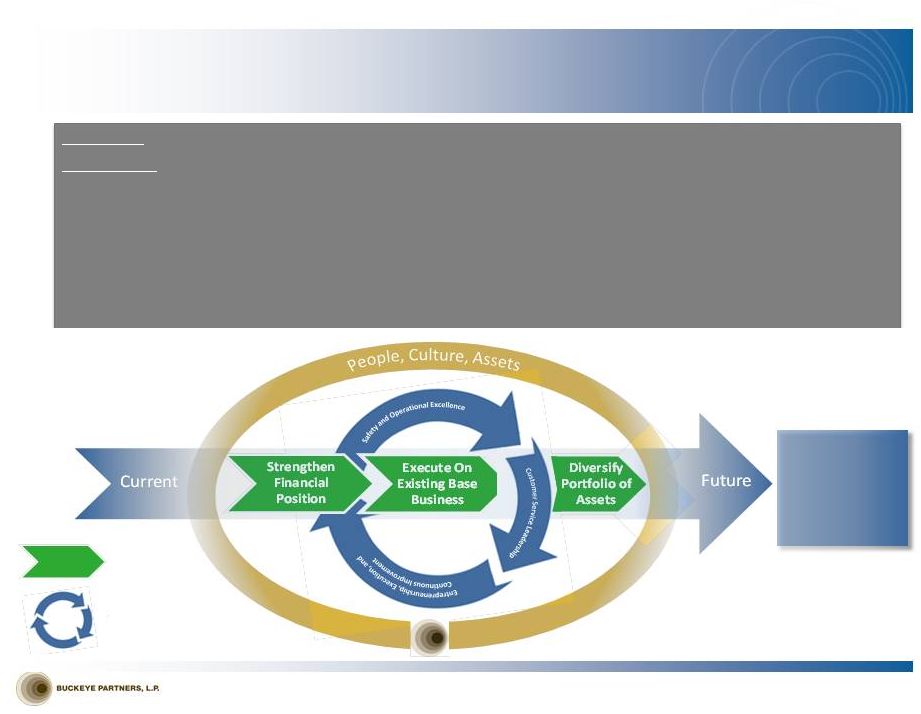

BUCKEYE’S

STRATEGY 4

©

Copyright 2013 Buckeye Partners, L.P.

Key Component

Guiding Principle

Generate

Exceptional

Financial

Returns to

Unitholders

An unwavering commitment to safety, environmental responsibility, regulatory compliance, and

personal integrity Best-in-class customer service and sophisticated commercial

operations Operational excellence that provides consistent, reliable performance at the

lowest reasonable cost An entrepreneurial approach toward logistical solutions to

profitably expand and optimize Buckeye’s portfolio of global energy A commitment to

consistent execution and the continuous improvement of our operations, projects and people

•

•

•

•

•

Our

Vision:

Buckeye

-

the

logistical solutions partner of choice for the global energy business

Our Mission: To deliver superior returns to our investors through our talented, valued

employees and our core strengths of

assets |

ORGANIZATIONAL

OVERVIEW Three Business Operating Units

(1) See Appendix for Non-GAAP Reconciliations

©

Copyright 2013 Buckeye Partners, L.P.

5

Domestic Pipelines & Terminals

•

~6,000 miles of pipeline with ~100 delivery locations

•

~100 liquid petroleum product terminals

•

~42 million barrels of liquid petroleum product storage capacity

International

Pipelines

&

Terminals

•

~30 million barrels of storage capacity at 2 terminal facilities

in The Bahamas (~25 million) and Puerto Rico (~5 million)

•

Deep water berthing capability to handle ULCCs and VLCCs

in The Bahamas

•

Announced expansion of 4.7 million barrels at Bahamian facility nearing

completion, with 1.9 million barrels placed in service 2

nd

half 2012, 1.6

million placed into service during Q1 2013, and 1.2 million barrels expected

to be placed into service during Q3 2013

Buckeye Services

Natural Gas Storage

•

~30 Bcf of working natural gas storage capacity in Northern California

Energy Services

•

Markets refined petroleum products in areas served by Domestic Pipelines &

Terminals

•

5 terminals with ~1 million barrels of storage capacity

Development & Logistics

•

Operates and/or maintains third-party pipelines under agreements with

major oil and gas and chemical companies

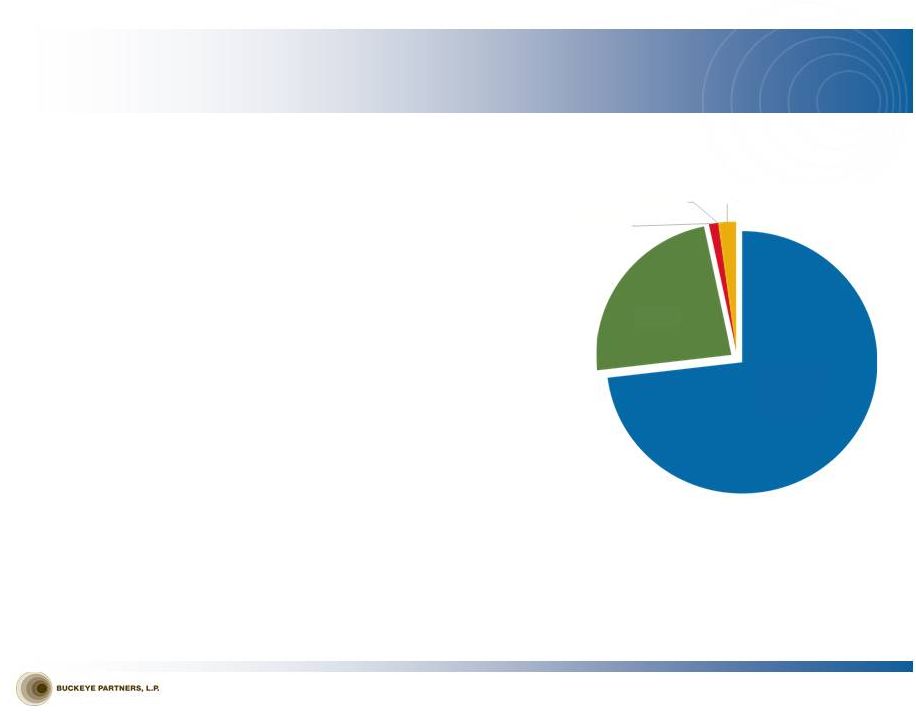

73.1%

23.6%

1.1%

0.1%

2.1%

2012 ADJUSTED EBITDA

(1) |

BUCKEYE SYSTEM

MAP ©

Copyright 2013 Buckeye Partners, L.P.

6 |

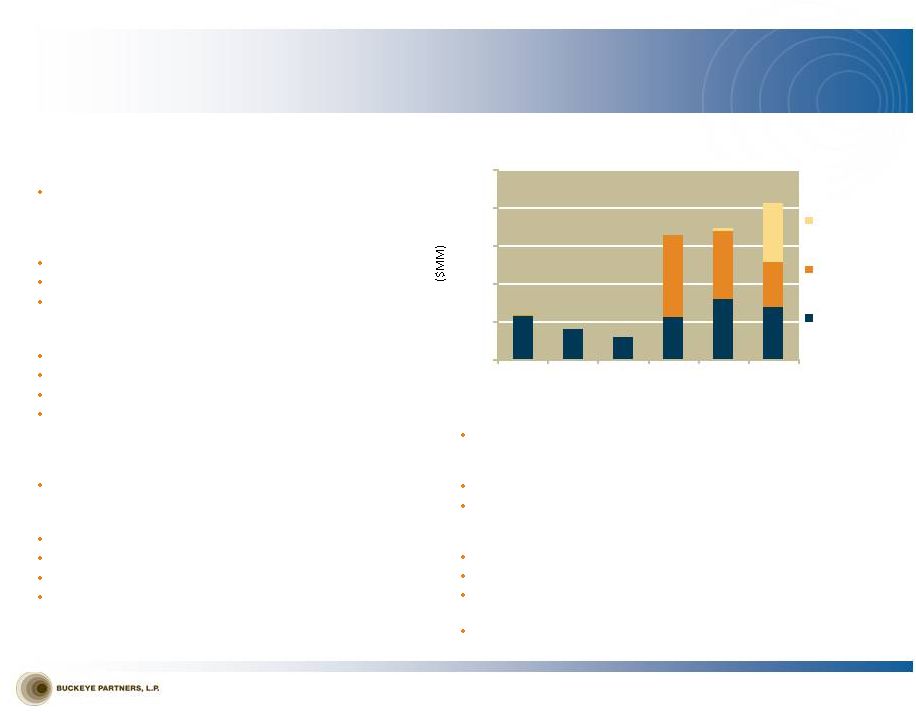

VALUE

CREATION/GROWTH DRIVERS $4 Billion Invested Since 2008

©

Copyright 2013 Buckeye Partners, L.P.

7

Organic Growth Capital Spending

(4)

$0

$80

$160

$240

$320

$400

2008

2009

2010

2011

2012

2013P

Perth Amboy

BORCO

Domestic Assets

(excl. Perth

Amboy)

$91.5

$261.9

$63.8

$46.5

$276.9

$330.0

Transformation of Perth Amboy terminal into highly efficient, multi-

product storage, blending, and throughput facility with crude unit

train offloading capability

Storage expansion and terminal enhancements at BORCO facility

Construction of crude oil storage tanks, capacity increases in pipeline

interconnectivity, and assessment of potential crude unit train

capabilities within our Chicago complex

Truck loading rack upgrades in the Midwest

Refurbishment of tanks across the domestic system

Butane blending, vapor recovery, and additive system installations

planned for numerous terminal facilities across our system

Completion of modifications at Albany terminal, allowing the handling

of both crude oil and ethanol unit trains

Perth Amboy, New Jersey Marine Terminal,

$260.0

million

BORCO Marine Terminal, $1.7 billion

BP Pipeline & Terminal Assets, $165.0 million

Maine Terminals and Pipeline, $23.5 million

Buy-in of BPL’s general partner, 20 million units issued

Yabucoa, Puerto Rico Terminal, $32.6 million

Opelousas, Louisiana Terminal, $13.0 million

Blue/Gold Pipeline and Terminal Assets, $54.4 million

Lodi Natural Gas Storage, $442.4 million

Farm & Home Oil Company

(2)

, $146.2 million

(3)

Niles and Ferrysburg, Michigan Terminals, $13.9 million

Albany, New York Terminal, $46.9 million

2009

2008

2010

2011

2012

Additional Equity Interest in West Shore Pipe Line Company,

$13.5 million

(1)

Excludes acquisitions with a value of $10 million or lower (2)

Now Buckeye Energy Services (3)

Buckeye sold the retail division of Farm & Home Oil Company in 2008 for

$52.6 million (4)

Estimate provided is mid-point of expected organic growth capital spend range 2013 Capital Projects

Recent Transactions

(1) |

CRUDE

DIVERSIFICATION ©

Copyright 2013 Buckeye Partners, L.P.

8

•

Albany, NY

•

Multi-year contract signed with Irving Oil in October 2012

to provide crude oil services, including off-loading unit

trains, storage, and throughput

•

Albany terminal has two ship docks on the Hudson River,

allowing transport of crude oil directly to Irving’s facility

•

Perth Amboy, NJ

•

Constructing capability to off-load crude unit trains

•

Transportation options include ship, barge, and

potentially pipeline

•

Woodhaven, MI

•

Offload Bakken crude from railcars and transport via

pipeline to an Ohio refinery

•

BORCO (Freeport, Bahamas)

•

Multi-year agreement signed in April 2012 to support 1.2

million barrel expansion of facility

•

Latin America crude developments forcing producers to

find large storage locations with blending capabilities and

segregation for multiple qualities of crude

•

Advanced marine infrastructure and service capabilities

provide competitive advantage over other marine

terminals in the region

With the emergence of the Bakken and Utica shale plays, as well as new crude developments in

Latin America, Buckeye is looking at ways to leverage its assets to provide crude oil

logistics solutions to producers and refiners wherever possible.

Source: PFC Energy

Crude Blending & Staging

To West

Coast

To Asia

To Gulf

Coast

To Europe

From Latin

America |

Domestic

Pipelines & Terminals ©

Copyright 2013 Buckeye Partners, L.P.

9 |

DOMESTIC

PIPELINES & TERMINALS OVERVIEW ©

Copyright 2013 Buckeye Partners, L.P.

10

Petroleum storage tanks at our Macungie terminal in Pennsylvania

Pipelines & Terminals segment represents Buckeye’s

largest segment contribution to Adjusted EBITDA

Over 6,000 miles of pipeline located primarily in the

Northeast and Midwest United States moving nearly

1.4 million barrels of liquid petroleum products per day

with more than 100 delivery points

Approximately 100 liquid petroleum product storage

terminals located throughout the United States

Approximately 42 million barrels of storage capacity

Terminal Throughput Volumes

Pipeline Throughput Volumes

(1)

(1)

Pipeline volumes exclude contribution from the Buckeye NGL Pipeline

sold in January of 2010

1,483.4

1,395.4

1,323.1

1,316.3

1,358.1

1,385.6

0

500

1,000

1,500

2,000

2007

2008

2009

2010

2011

2012

482.3

464.4

471.9

562.5

742.8

897.3

0

250

500

750

1000

2007

2008

2009

2010

2011

2012 |

PERTH AMBOY

OVERVIEW Facility Overview

•

•

•

Only ~ 6 miles from Buckeye Linden complex

•

Pipeline, water, rail, and truck access

•

Strategically situated on New York Harbor as a NYMEX

delivery point

•

•

2.7 MMBbls of active refined product storage

•

1.3 MMBbls of refurbishable refined product storage

•

0.8 MMBbls of heavy oil refurbishable storage

•

•

•

©

Copyright 2013 Buckeye Partners, L.P.

11

Note: Facility

located in Perth

Amboy, NJ.

Green line

indicates

approximate

property

boundaries

(1)

One of the barge docks is currently out of service.

Growth Opportunities

•

Near-term plans to transform existing terminal into a highly

efficient, multi-product storage, blending, and throughput facility

•

Potential for crude, gasoline, distillate, ethanol, asphalt, or 6 oil

service that can be optimized as market needs evolve

•

Pipeline planned for direct interconnect to Buckeye Linden

complex

•

Project initiated to allow handling of Bakken-sourced crude oil via

rail and ship

Strategic Rationale

•

•

•

BPL purchased facility from Chevron (closed in July 2012)

Approximately 5 MMBbls total storage capacity

4 docks (1 ship, 3 barge

(1)

) with water draft up to 37'

Improves connectivity and service capabilities for

customers to increase Buckeye system utilization

Provides for security and diversity of product supply for

Buckeye’s customers by connecting waterborne product

supply with end destination markets across the Buckeye

system

Provides customers with storage at New York Harbor, a

highly liquid NYMEX settlement point

Located at the southwest end of New York Harbor on

the Arthur Kill

Capital investment period supported by multi-year

storage, blending, and throughput commitments from

Chevron

~250 acre site with significant undeveloped acreage for

expansion potential |

PERTH AMBOY

COMMERCIAL STRATEGY ©

Copyright 2013 Buckeye Partners, L.P.

12

(1)

Petroleum

Administration

for

Defense

Districts

PADD

(1)

1 Market Opportunity

•

Perth Amboy is in a highly attractive location in the

New York Harbor with access to the large local PADD

1 market

•

The PADD 1 region has ~36% of the U.S.

population and relies on PADD 3 and international

imports and transfers of refined products to meet

market demand

•

All U.S. Northeast product not produced by local

refineries must be supplied either through import

or inter-PADD transfers, increasing storage

capacity demand in the New York Harbor

•

New York Harbor NYMEX delivery point: nexus of

U.S. Northeast petroleum flows

•

Significantly more trading liquidity than

Philadelphia market

Buckeye Business Strategy

•

Multi-mode takeaway capacity (pipe, water, rail, truck)

connected to the Buckeye system and inland

distribution network

•

Balanced focus on imports/exports for clean products

(gasoline, distillates, jet) and dirtier fuels (crude, fuel

oil, asphalt)

•

Pipeline constraints and poor facility configurations

(tank-to-tank communication) at some existing

terminals in New York Harbor result in inefficiencies

•

Ability to complement storage with local product

distribution via truck rack

•

Strong interest expressed for a Bakken/Utica crude

solution, bunker fuel growth, and asphalt

terminalling/supply

•

Facilitates U.S. Northeast product flow and logistics

•

Secures and diversifies access to product supply

•

Extension of the product value chain with BORCO

•

Opportunity to tie-in imports and exports to/from

the U.S.

We believe optimal facility configuration with simultaneous operations and high-speed

takeaway capacity will give Perth Amboy competitive advantages in the marketplace

|

DOMESTIC

PIPELINES & TERMINALS GROWTH POTENTIAL Crude Diversification:

•

Multi-year agreement to support transformation

of the Albany marine terminal to handle crude

via rail and ship for major oil refiner

•

Contracted to offload approximately 8,600 bpd

of Bakken crude for refinery customer at

Woodhaven, MI facility

•

Perth rail facility being constructed

Butane Blending:

•

Significant growth driven by strong blending

margins

•

Improved blending efficiencies and oversight

•

Opportunities for further locational deployment

of blending capabilities

Propylene Rail Facility (completed in 4Q 2012):

•

Construction of new propylene storage at East

Chicago facility

•

Rail loading capability added

©

Copyright 2013 Buckeye Partners, L.P.

13

Utica Shale

Opportunity:

•

Development is

in early stages,

but industry

consensus is that

crude logistics

solutions will be

needed

•

Buckeye has

presence in area

and has

opportunity to

utilize existing

infrastructure,

including ROW

and underutilized

lines, to be key

logistics provider

Chicago Complex Crude Oil and Other Opportunities:

•

Construction of additional storage capacity to leverage asset footprint in

Chicago to take advantage of changing crude oil slates in the market

•

Exploring crude rail opportunities

•

Project underway to increase capacity in refined products pipeline

interconnectivity within the complex

PROJECTS

Primary

Utica

Shale

Other Projects In Progress:

•

Storage expansions at existing domestic terminals, including Pittsburgh

and Opelousas terminals

Utica Shale

Opportunity: |

FERC ORDER

DEVELOPMENTS Buckeye Pipe Line’s Market-Rate Program

©

Copyright 2013 Buckeye Partners, L.P.

14

“Show Cause”

Proceeding Pertaining to Buckeye Pipe Line Company, L.P.’s (“BPL Co.”)

Innovative Rate-Setting System Airlines’

Complaint

“Show Cause” order issued by FERC on March 30, 2012, pursuant to protest of a single

airline shipper in the NYC area after BPL Co. had filed for routine, system-wide

tariff increases

BPL Co.’s rate increase filings also rejected at the time of the “show cause”

order

Multiple filings by BPL Co. and protesting party throughout 2012 Resolved

by issuance of FERC order on February 22, 2013, which provided for the following:

BPL Co. permitted to continue charging current rates BPL Co.

granted full market-based-rate authority in markets previously found by FERC to be competitive markets, in which BPL Co.

generated $137 million of revenue from interstate transportation service in 2012 BPL Co.

allowed to file future rates in its remaining markets, in which BPL Co. generated $126 million of revenue from interstate

transportation service in 2012 pursuant to any of the methodologies permitted by FERC

regulations, including in accordance with the generic FERC index

Treatment of NYC market rate still pending outcome of two other filings, as discussed below

(Airlines’ Complaint and Market-Based Rates Application for New York City

Market)

Earlier program utilized by BPL Co. now discontinued On

September 20, 2012, four airlines filed a complaint at FERC challenging BPL Co.’s tariff rates for transporting jet fuel to three NYC airports

–

the same movements that were the subject of the March protest that led to the “show

cause” proceeding.

On October 10, 2012, BPL Co. filed its answer to the complaint, and additional filings were

made by the parties in October and November. No third parties have filed to

intervene in the complaint proceeding.

On February 22, 2013, FERC issued an order setting the matter for hearing, but such hearing is

to be put on hold pending the outcome of FERC-ordered settlement discussions

between the parties, which are to be facilitated by a FERC-appointed settlement judge.

In 2012, deliveries of jet fuel to the NYC airports generated approximately $32 million of BPL

Co.’s revenues. The complaint is not directed at BPL Co.’s rates for service

to other destinations, and it has no impact on the pipeline systems and terminals owned by Buckeye’s other

operating subsidiaries. |

FERC ORDER

DEVELOPMENTS (Continued) Buckeye Pipe Line’s Market-Rate Program

©

Copyright 2013 Buckeye Partners, L.P.

15

Market-Based Rates Application for New York City Market

On October 15, 2012, BPL Co. filed an application with FERC seeking authority to charge

market-based rates for deliveries of refined petroleum products to the NYC market. If FERC

grants the application, BPL Co. would be permitted prospectively to set its rates in response to competitive forces, and the airlines’

cost-based challenges to BPL Co.’s jet fuel delivery rates to the NYC airports would

be moot with respect to future rates.

Buckeye believes that the New York City-area market is robust and highly

competitive. The New York Harbor is one of the world’s most active refined

petroleum products markets. Within this market, BPL Co.’s customers have access to numerous existing alternatives, via

pipeline, barge, and truck, to transport refined products. The three airports are

located near other active products pipelines or barge docks and, with reasonable

investment, should be able to access alternative jet fuel supplies efficiently and economically.

On December 14, 2012, four airlines filed a joint protest of BPL Co.’s market-based

rates application, specifically pertaining to jet fuel transportation to three NYC

airports - the same movements that were the subject of the March 2012 protest that led to the “show cause”

proceeding. The protest is not directed at BPL Co.’s market-based rates application

pertaining to movements of any other products or to any other destinations in the NYC

market.

On January 14, 2013, BPL Co. filed its answer to the protest. Additional filings were

also made by the parties in January and February 2013. Buckeye cannot predict when FERC

will act on the application or what it will do. |

International Pipelines & Terminals

©

Copyright 2013 Buckeye Partners, L.P.

16 |

©

Copyright 2013 Buckeye Partners, L.P.

17

INTERNATIONAL PIPELINES AND TERMINALS

(1)

Excludes non-cash amortization of unfavorable storage contracts.

81%

12%

7%

BORCO 2012 REVENUE

(1)

Storage (take or pay)

Berthing (variable)

Other Ancillary (variable)

66%

21%

13%

BORCO 2012 LEASED CAPACITY

Fuel Oil

Crude Oil

•

World-class marine storage terminal for crude oil, fuel oil, and refined

petroleum products

•

24.9 MMBbls capacity

•

Located in Freeport, Bahamas, 80 miles from Southern Florida and

920 miles from New York Harbor

•

Deep-water access (up to 91 feet) and the ability to berth VLCCs and

ULCCs

•

Capacity leased under take or pay contracts

•

World-class customer base

•

Variable revenue generation from ancillary services such as berthing,

blending, bunkering, and transshipping

•

Hub for international logistics

•

Announced expansion of 4.7 million barrels nearing completion with

3.5 million barrels delivered to date and 1.2 million barrels expected

to be placed into service in 2013; room to double storage capacity if

market conditions permit

BORCO

•

Well maintained facility with superior blending/manufacturing

facilities

•

4.6 million barrels of refined petroleum product, fuel oil, and crude

oil storage capacity

•

Strategic location supports a strong local market and also provides

regional growth opportunities

•

Long-term fee-based revenues supported by multi-year volume

commitments from Shell

Yabucoa, Puerto Rico

Refined

products |

BORCO COMMERCIAL

OPERATIONS BORCO’s

location

and

deep

water

access,

make

it

uniquely

positioned

to

capture

the

global

storage, build-bulk, break-bulk, and blending services market

18

©

Copyright 2013 Buckeye Partners, L.P.

Blending and Crude

Staging

Break-bulk

Build-bulk

Select examples of blending services provided at BORCO include: Blending of fuel oil from Caribbean and South American refineries for delivery to Asia Blending of clean products from Asia for delivery throughout the U.S. East Coast, the

Caribbean, and Latin America markets

Blending of heavy / light crude oil from various areas for delivery to U.S. Gulf Coast

refineries

There is growing demand for blending capabilities at BORCO, including the following: Increasing production of heavy, lower-quality crudes from South America, which require

additional infrastructure to blend with lighter, sweeter grades

–

Blending of Brazilian Peregrino and Papa Terra heavy crudes with diluent or lighter crudes As international regulations require more use of cleaner burning transportation fuels, there

is growing demand for BORCO's blending services Potential to add butane and ethanol storage/blending capabilities Build-bulk operations consist of receiving smaller-sized vessels from regional

draft- restricted ports, aggregating product in large tankage, and then exporting

in larger-sized vessels for long-haul transport e.g - Delivering cargoes of heavy fuel oil from Latin America to BORCO in Aframax

vessels, blending with lighter fuel oil from the U.S. Gulf Coast, and building bulk fuel

oil blends that are then exported to Asia Pacific in VLCCs Break-bulk operations consist of receiving large-sized vessels from long-haul

destinations and then breaking those volumes into smaller cargos suitable for export

to regional draft restricted ports e.g. - Receiving large cargo imports of clean products (diesel/gasoline) from India and

Europe and breaking those volumes into smaller cargos situated for export to the

U.S., Mexico, the Caribbean, and Central/South America |

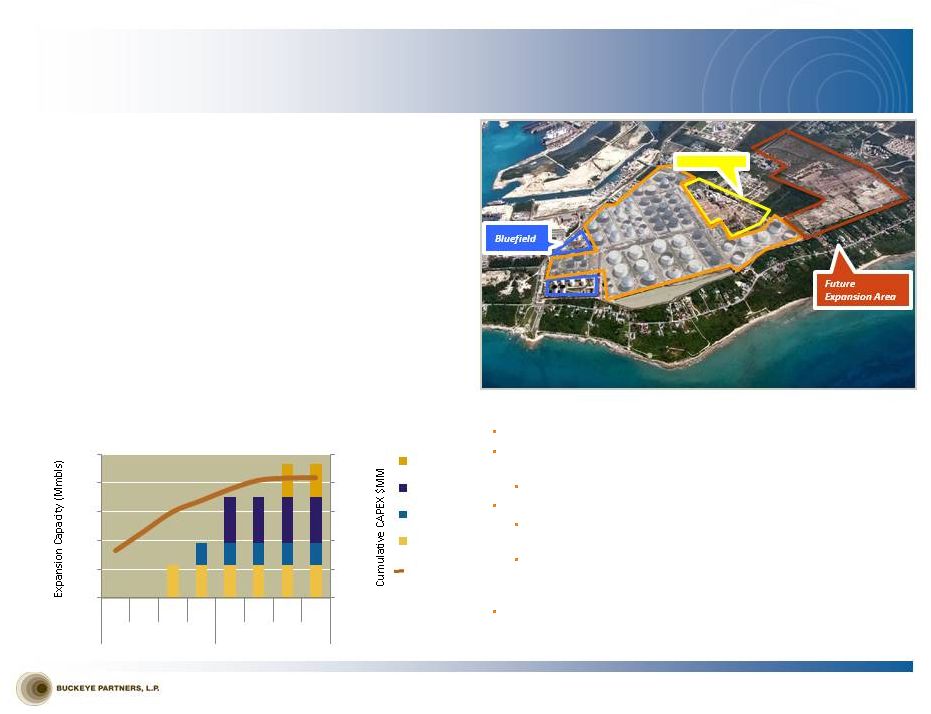

Capex

INTERNATIONAL INTERNAL GROWTH PROJECTS

EXPANSION AND OTHER GROWTH OPPORTUNITIES

©

Copyright 2013 Buckeye Partners, L.P.

19

•

Expanded storage capacity by 3.5 million barrels, with an additional 1.2

million barrels of crude oil storage expected to be in service in the third

quarter of 2013; 4.7 million barrel expansion fully leased

•

Constructed ample berthing capacity to allow future expansion without

incremental marine infrastructure spend

•

Designed facility to accommodate multiple product segregations to

enable blending and maximum flexibility for changes in facility

requirements

•

Improved simultaneous operations to move product in and out of the

facility at the same time

•

Provided critical infrastructure redundancy to ensure business

continuity

•

Improved loading and unloading rates to allow for reduced berthing

time

•

Laid ground work for future expansion by optimizing facility

configuration

BORCO

Expansion

Capacity

(1)

–

millions

of

barrels

(1)

Graph reflects expected midpoint of capital spend range. Dates represent expected date that

capacity is placed in service. BORCO

Capital

Investment

Since

Acquisition

(~$320

million):

Yellowfield

$0

$50

$100

$150

$200

$250

0

1

2

3

4

5

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

2012

2013

Bluefield 2

Bluefield 1

Yellowfield 1

Significant

land

available

for

further

expansion

Other Internal Growth Opportunities

Potential

for

staging

of

crude

oil

resulting

from

Latin

American

production

expected to come online over the next decade

Provides optionality to multiple end-market destinations

Bunkering Opportunities –

Blended Fuel Oil

BORCO is the logical, geographical, optimum spot for a new “Bunker

filling station”

2014 Panama Canal expansion to allow passage of Suezmax vessels

expected to lead to 20-30% increase in traffic, BORCO location ideal to

service the incremental vessels

Yabucoa, Puerto Rico facility provides opportunities for jet fuel and crude

storage, as well as fuel oil supply and bunkering

Yellowfield 2 |

©

Copyright 2013 Buckeye Partners, L.P.

20

Buckeye Services |

BUCKEYE SERVICES

OVERVIEW ©

Copyright 2013 Buckeye Partners, L.P.

21

Energy Services

Development & Logistics

Natural Gas Storage

•

Buckeye Energy Services (“BES”) markets a wide range

of refined petroleum products and other ancillary

products in areas served by Buckeye’s pipelines and

terminals

•

Strategy for mitigating basis risk included a reduction

of refined product inventories in the Midwest and

focusing on fewer, more strategic locations for

transacting business

•

Recently reduced costs by right-sizing the

infrastructure for reduced geographic focus

•

Contributed approximately $25 million in revenues to

Domestic Pipelines & Terminals in 2012, while also

providing valuable insight on demand and pricing

support for our terminalling and storage business

•

Buckeye Development & Logistics (“BDL”) operates and/or

maintains third-party pipelines under agreements with

major oil and gas and chemical companies

•

BDL is also responsible for identifying and completing

potential acquisitions and organic growth projects for

Buckeye

•

BDL services offered to customers

•

Contract operations

•

Project origination

•

Asset development

•

Engineering design

•

Project management

•

Buckeye’s

Lodi

Gas

Storage

facility

is

a

high

performance

natural

gas

storage

facility

with

approximately

30

Bcf

of

working gas capacity in Northern California serving the greater San Francisco Bay Area

•

Revenue is generated through firm storage services and hub services

•

The

facilities

collectively

have

a

maximum

injection

and

withdrawal

capability

of

approximately

550

million

cubic

feet

per day (MMcf/day) and

750 MMcf/day, respectively

•

Lodi’s

facilities

are

designed

to

provide

high

deliverability

natural

gas

storage

service

and

have

a

proven

track

record

of safe and reliable operations |

Financial

Overview ©

Copyright 2013 Buckeye Partners, L.P.

22 |

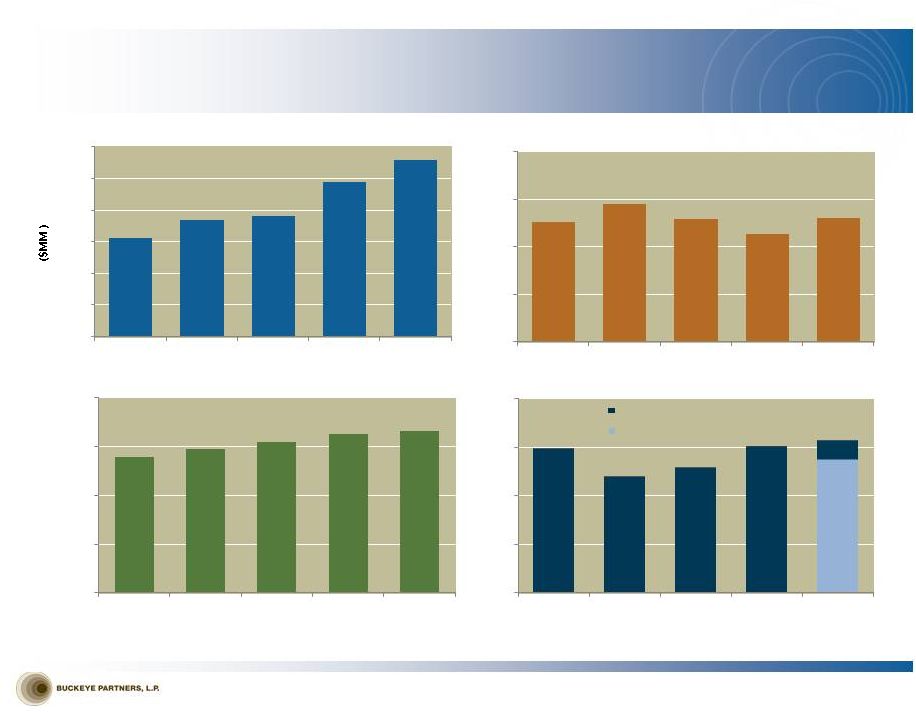

FINANCIAL

PERFORMANCE ©

Copyright 2013 Buckeye Partners, L.P.

23

Adjusted EBITDA ($MM)

(1)

Cash Distribution Coverage

(1)(2)

(1)

See Appendix for Non-GAAP Reconciliations

(2)

Distributable cash flow divided by cash distributions declared for the respective periods

(3)

Long-term debt less cash and cash equivalents divided by Adjusted EBITDA (adjusted for pro

forma impacts of acquisitions); calculation as per BPL Credit Facility (4)

Pro

forma

leverage

as

of

December

31,

2012,

to

reflect

impact

of

$350 million January 2013 equity issuance

Net LT Debt/Adjusted EBITDA

(3)

Leverage, as reported

Pro forma leverage

$313.6

$370.2

$382.6

$487.9

$559.5

$0

$100

$200

$300

$400

$500

$600

2008

2009

2010

2011

2012

$3.475

$3.675

$3.875

$4.075

$4.150

$0.00

$1.25

$2.50

$3.75

$5.00

2008

2009

2010

2011

2012

1.01x

1.16x

1.03x

0.91x

1.04x

0.00x

0.40x

0.80x

1.20x

1.60x

2008

2009

2010

2011

2012

4.47x

3.62x

3.89x

4.55x

4.14x

(4)

0.00x

1.50x

3.00x

4.50x

6.00x

2008

2009

2010

2011

2012

4.74x

Cash Distributions per Unit |

INVESTMENT

SUMMARY Stability and Growth

©

Copyright 2013 Buckeye Partners, L.P.

24

•

Proven

26-year

track

record

as

a

publicly

traded

partnership

through

varying

economic

and

commodity

price

cycles

•

Management

continues

to

drive

operational

excellence

through

its

best

practices

initiative

•

Recent acquisitions provide Buckeye with increased geographic and product diversity, including

access to international logistics opportunities, and provide significant near-term

growth projects •

July 2012 acquisition of marine terminal facility in Perth Amboy, NJ from Chevron furthers

Buckeye’s strategy to create a fully integrated and flexible system that offers

unparalleled connectivity and service capabilities; provides significant near-term

growth opportunities at attractive multiple •

World-class

BORCO

marine

storage

terminal

with

24.9

million

barrels

of

storage

capacity

for

crude

oil

and

liquid

petroleum products in Freeport, Bahamas, with opportunity for significant additional capacity

expansion; serves as important logistics hub for international petroleum product

flows •

Diversified portfolio of assets provides balanced mix of stability and growth and is well

positioned to take advantage of changing supply and demand fundamentals for crude and

refined petroleum products to drive improved returns to unitholders

|

Non-GAAP

Reconciliations ©

Copyright 2013 Buckeye Partners, L.P.

25 |

BASIS OF

REPRESENTATION; EXPLANATION OF NON-GAAP MEASURES ©

Copyright 2013 Buckeye Partners, L.P.

26

Buckeye’s equity-funded merger with Buckeye GP Holdings, L.P. (“BGH”) in

the fourth quarter of 2010 has been treated as a reverse merger for accounting

purposes. As a result, the historical results presented herein for periods prior to the completion of the merger are those of BGH, and

the diluted weighted average number of LP units outstanding increase from 20.0 million in the

fourth quarter of 2009 to 44.3 million in the fourth quarter of 2010. Additionally,

Buckeye incurred a non-cash charge to compensation expense of $21.1 million in the fourth quarter of 2010

as a result of a distribution of LP units owned by BGH GP Holdings, LLC to certain officers of

Buckeye, which triggered a revaluation of an equity incentive plan that had been

instituted in 2007.

Adjusted EBITDA and distributable cash flow are measures not defined by GAAP. Adjusted EBITDA

is the primary measure used by our senior management, including our Chief Executive

Officer, to (i) evaluate our consolidated operating performance and the operating performance of

our business segments, (ii) allocate resources and capital to business segments, (iii)

evaluate the viability of proposed projects, and (iv) determine overall rates of return

on alternative investment opportunities. Distributable cash flow is another measure used by our senior

management to provide a clearer picture of Buckeye’s cash available for distribution to

its unitholders. Adjusted EBITDA and distributable cash flow eliminate (i) non-cash

expenses, including, but not limited to, depreciation and amortization expense resulting from the significant capital

investments we make in our businesses and from intangible assets recognized in business

combinations, (ii) charges for obligations expected to be settled with the issuance of

equity instruments, and (iii) items that are not indicative of our core operating performance results and business

outlook.

Buckeye believes that investors benefit from having access to the same financial measures used

by senior management and that these measures are useful to investors because they aid

in comparing Buckeye’s operating performance with that of other companies with similar operations.

The Adjusted EBITDA and distributable cash flow data presented by Buckeye may not be

comparable to similarly titled measures at other companies because these items may be

defined differently by other companies. Please see the attached reconciliations of each of Adjusted

EBITDA and distributable cash flow to net income. |

NON-GAAP

RECONCILIATIONS ©

Copyright 2013 Buckeye Partners, L.P.

27

Net Income to Adjusted EBITDA ($000)

2008

2009

2010

2011

2012

Net income attributable to BPL

26,477

49,594

43,080

108,501

226,417

Interest and debt expense

75,410

75,147

89,169

119,561

114,980

Income tax expense (benefit)

801

(343)

(919)

(192)

(675)

Depreciation and amortization

50,834

54,699

59,590

119,534

146,424

EBITDA

153,522

179,097

190,920

347,404

487,146

Net

income

attributable

to

noncontrolling

interests

affected

by

merger

(1)

153,546

90,381

157,467

-

-

Amortization of unfavorable storage contracts

-

-

-

(7,562)

(10,994)

Gain on sale of equity investment

-

-

-

(34,727)

-

Non-cash deferred lease expense

4,598

4,500

4,235

4,122

3,901

Non-cash unit-based compensation expense

1,909

4,408

8,960

9,150

19,520

Equity plan modification expense

-

-

21,058

-

-

Asset impairment expense

-

59,724

-

-

59,950

Goodwill impairment expense

-

-

-

169,560

-

Reorganization expense

-

32,057

-

-

-

Adjusted EBITDA

(2)

313,575

370,167

382,640

487,947

559,523

Adjusted Segment EBITDA

Pipelines & Terminals

253,790

302,164

346,447

361,018

409,055

International Operations

-

-

(4,655)

112,996

132,104

Natural Gas Storage

41,814

41,950

29,794

4,204

6,118

Energy Services

9,443

19,335

5,861

1,797

524

Development & Logistics

8,528

6,718

5,193

7,932

11,722

Total Adjusted EBITDA

(2)

313,575

370,167

382,640

487,947

559,523

(1)

On November 19, 2010, Buckeye merged with Buckeye GP Holdings L.P.

(2)

In 2010, Buckeye revised its definition of Adjusted EBITDA to exclude non-cash

unit-based compensation expense, the 2010 non-cash equity plan modification expense and income attributable to

noncontrolling

interests

affected

by

the

merger

for

periods

prior

to

our

buy-in

of

our

general

partner.

These

amounts

were

excluded

from

Adjusted

EBITDA

presented

for

2008,

2009

and

2010

in

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2010,

as

amended. |

NON-GAAP

RECONCILIATIONS ©

Copyright 2013 Buckeye Partners, L.P.

28

Net Income to Distributable Cash Flow ($000)

(1)

On November, 19, 2010, Buckeye merged with Buckeye GP Holdings L.P.

(2)

In 2011, Buckeye revised its definition of Distributable Cash Flow to exclude amortization of

deferred financing costs and debt discounts. Distributable Cash Flow for 2008-2010 have been restated to exclude those amounts for

comparison purposes.

(3) Represents cash distributions declared and paid for limited partner units (LP

units) outstanding as of each respective period. Distributions with respect to the Class B units outstanding on the record date for each quarter ended

during 2011 and 2012 were paid in additional Class B units rather than in cash.

2008

2009

2010

2011

2012

Net income attributable to BPL

26,477

49,594

43,080

108,501

226,417

Depreciation and amortization

50,834

54,699

59,590

119,534

146,424

Net

income

attributable

to

noncontrolling

interests

affected

by

merger

(1)

153,546

90,381

157,467

-

-

Gain on sale of equity investment

-

-

-

(34,727)

-

Non-cash deferred lease expense

4,598

4,500

4,235

4,122

3,901

Non-cash unit-based compensation expense

1,909

4,408

8,960

9,150

19,520

Equity plan modification expense

-

-

21,058

-

-

Asset impairment expense

-

59,724

-

-

59,950

Reorganization expense

-

32,057

-

-

-

Non-cash senior administrative charge

1,900

475

-

-

-

Amortization of unfavorable storage contracts

-

-

-

(7,562)

(10,994)

Write-off of deferred financing costs

-

-

-

3,331

-

Amortization

of

deferred

financing

costs

and

debt

discounts

(2)

1,737

3,134

4,411

4,289

1,699

Goodwill impairment expense

-

-

-

169,560

-

Maintenance capital expenditures

(28,936)

(23,496)

(31,244)

(57,467)

(54,425)

Distributable Cash Flow

212,065

275,476

267,557

318,731

392,492

Distributions

for

Coverage

ratio

(3)

209,412

237,687

259,315

351,245

376,177

Coverage Ratio

1.01x

1.16x

1.03x

0.91x

1.04x |