Attached files

| file | filename |

|---|---|

| 8-K - ROSE FEBRUARY 2013 INVESTOR PRESENTATION - NBL Texas, LLC | form8-krosefebppt.htm |

Exhibit 99.1

REDEFINED

BUILDING VALUE IN UNCONVENTIONAL RESOURCES

Rosetta Resources Inc.

February 2013 Investor Presentation

2012 Highlights

4

Includes capitalized interest and other corporate costs

By Region

By Region

By Category

By Category

2013 Plans and Capital Program ($640-700 Million1)

• Run five- to six-rig program in Eagle Ford area

• Continued focus on liquids-rich development

• Drill 75-80 wells and complete approximately 60-65 in

2013

2013

• About half in Gates Ranch with remainder in Karnes Trough,

Briscoe Ranch and Central Dimmit areas

Briscoe Ranch and Central Dimmit areas

• Allocate 10 percent to new ventures opportunities

• Fund base capital program from internally-generated

cash flow supplemented by borrowings under current

credit facility, if necessary

cash flow supplemented by borrowings under current

credit facility, if necessary

• Generate approximately 30 percent production growth

over 2012

over 2012

5

1. 2013 Guidance, February 25, 2013

• Leverage high-graded asset base

• Maintain position as a leading Eagle Ford player

• Develop inventory of approximately 500 MMBoe with 15 years of drilling opportunities

• Expand production base with about 12 percent of inventory developed

• Successfully execute business plan

• Grow total production and liquids volumes

• Lower overall cost structure and improve margins

• Capture firm transportation and processing capacity

• Test future growth opportunities

• Evaluate previously untested Eagle Ford acreage

• Continue testing optimal Eagle Ford well spacing

• Pursue new growth targets through blend of acquisitions and new ventures

• Maintain financial strength and flexibility

• Low leverage

• Sizable liquidity

• Active hedging program

Company Strategy

6

LEVERAGE HIGH-GRADED ASSET BASE

7

• Since 2009, proved reserves more than tripled;

total risked resources nearly tripled

total risked resources nearly tripled

• Total project inventory, including PUDs,

grew from 150 MMBoe to 496 MMBoe

• About 12 percent of inventory developed

and on production

• Growth driven by Eagle Ford Shale

• Transformed total proved liquids mix

2009: 15% 2011: 54%

2010: 40% 2012: 58%

• From 2009 through 2012, divested 36 MMBoe

of proved reserves for properties that no

longer fit operating model

of proved reserves for properties that no

longer fit operating model

• Divested 11 MMBoe in 2012

• Strong reserve replacement in 2012

• 482 percent from the drill-bit

• 472 percent from all sources

Significant Growth in Asset Net Resources

8

Divested 11 MMBoe

Quarterly Production Performance

9

|

% Liquids

|

14

|

19

|

24

|

29

|

33

|

46

|

51

|

49

|

52

|

59

|

60

|

62

|

|

62 -

|

63

|

|

% Oil

|

5

|

7

|

10

|

12

|

15

|

18

|

19

|

22

|

22

|

24

|

30

|

26

|

|

30

|

|

52 - 56

47 - 51

Eagle Ford Growth Profile

10

Eagle Ford production averaged

44.2 MBoe/d during 4Q 2012

44.2 MBoe/d during 4Q 2012

• 62% total liquids

• 26% oil / 36% NGLs

MBoe/d

Exit Rate Guidance

(As of 12/10/2012)

Reaffirmed 2/25/2013

52 - 56 MBoe/d

2012 Program

62 wells

62 wells

January Average

Production

Production

47.4 MBoe/d

29% Oil / 34% NGLs

SUCCESSFULLY EXECUTE BUSINESS PLAN

11

Top 20 Eagle Ford Operators

12

Top 20 Eagle Ford Operators include APC, BHP, CHK, COP, CRK, CRZO, EP, EOG, GeoSouthern, Hunt, Lewis, MRO, MTDR, MUR, PXD, PXP, RDS, ROSE, SM, TLM.

Gates Ranch

13

Summary

• 26,500 net acres in Webb County

• 96 completions as of 12/31/2012

• 1Q - 3Q 2012: 28 completions

• 4Q 2012: 12 completions

• 332 well locations remaining under current

55-acre spacing assumptions

55-acre spacing assumptions

• 20 wells drilled awaiting completion

Average Well Characteristics

• Well Costs: $6.5 - $7.0 million

• Spacing: 475 feet apart or 55 acres

• Composite EUR: 1.67 MMBoe

• F&D Costs: $4.05/Boe

• Condensate Yield = 65 Bbls/MMcf

• NGL Yield = 110 Bbls/MMcf

• Shrinkage = 23%

Well Performance on 55 acres

Compared to similar offsetting wells spaced at 100 acres

Compared to similar offsetting wells spaced at 100 acres

These 9 wells are our largest

continuous group of producing wells

spaced on 55 acres

continuous group of producing wells

spaced on 55 acres

These 9 wells are performing in

line with comparable offsetting

wells drilled and completed early

in the development of the area

and spaced on 100 acres …

line with comparable offsetting

wells drilled and completed early

in the development of the area

and spaced on 100 acres …

Composite Type Curve - 1.7 MMBoe

(23% Oil / 32% NGLs)

South Type Curve - 1.9 MMBoe

North Type Curve - 1.4 MMBoe

Gates Ranch Well Performance - North and South Areas

15

Discovery well:

Shortest lateral at

3,500’ and only

3,500’ and only

10 frac stages

Eagle Ford Multiple Takeaway Options

16

Gas Transportation Capacity

Firm gross wellhead gas takeaway

• 245 MMcf/d today

Four processing options - Gathering (Plant)

• Regency (Enterprise Plants)

• Energy Transfer “ETC” Dos Hermanas (King Ranch)

• Eagle Ford Gathering (Copano Houston Central)

• ETC Rich Eagle Ford Mainline (LaGrange/Jackson)

Net 3-stream takeaway increases with higher

contribution of oil-weighted volumes

contribution of oil-weighted volumes

Oil Transportation Capacity

Gates Ranch, Briscoe Ranch and Central Dimmit Co.

• Plains Crude Gathering - Firm gathering capacity of

25,000 Bbls/d to Gardendale hub with up to 60,000 Bbls

storage; operating since April 2012

25,000 Bbls/d to Gardendale hub with up to 60,000 Bbls

storage; operating since April 2012

• Access to truck and rail loading and pipeline

connections

connections

Karnes Trough

• Rosetta-owned oil truck-loading facility operating since

late July 2012

late July 2012

• Trucking readily available

Pricing assumptions included in Appendix

Well-positioned to move

new production to

market with access to

multiple midstream

service providers

new production to

market with access to

multiple midstream

service providers

TEST FUTURE GROWTH OPPORTUNITIES

17

19

Briscoe Ranch

Summary

• 3,545 net acres in southern Dimmit County

• 4 completions as of 12/31/2012

• 3Q 2012: 3 completions

• 64 well locations remaining

• 3 wells drilled awaiting completion

Average Well Characteristics

• Well Costs: $6.5 - $7.0 million

• Spacing: 425 feet apart or 50 acres

• Condensate Yield: 80 Bbls/MMcf

• NGL Yield: 130 Bbls/MMcf

• Shrinkage: 23%

Future Activity

• Planned full development activity will last

well into 2016

well into 2016

*Seven-day stabilized rate

Discovery Well Initial Rate* - 10/2011

1,990 Boe/d, 68% Liquids

(850 Bo/d, 490 B/d NGLs, 3,900 Mcf/d)

Briscoe Ranch Type Curve

21

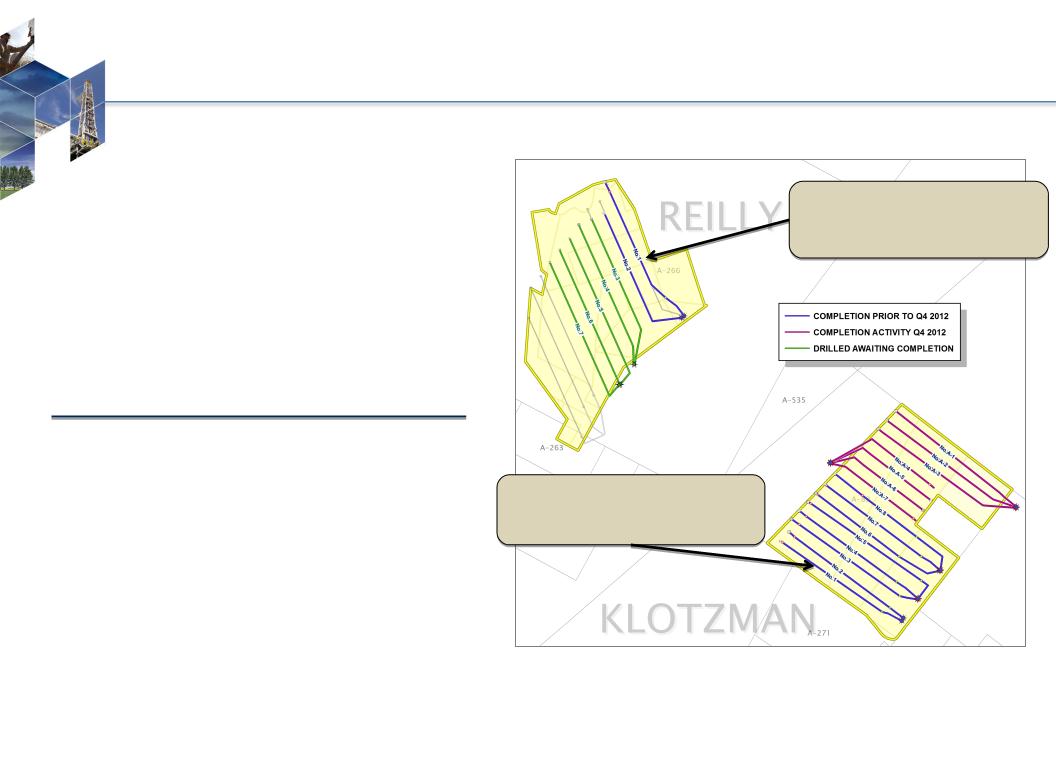

Karnes Trough Area

SUMMARY

• 1,900 net acres; located in oil window

• 17 total completions as of 12/31/2012

• 1Q & 2Q 2012: 9 completions

• 4Q 2012: 7 completions

• 8 well locations remaining to be completed

• 5 wells drilled awaiting completion

• Well Costs: $7.5 - $8.0 million

• Activity planned through mid-2013

Klotzman (Dewitt County)

• 15 total completions as of 12/31/2012

• 1Q & 2Q 2012: 7 completions

• 4Q 2012: 7 completions

• Rosetta-owned oil truck terminal operating

since late July 2012

since late July 2012

Reilly (Gonzales County)

• 2 completions as of 12/31/2012

• 1Q 2012: 1 completion

• 2Q 2012: 1 completion

• 5 wells drilled awaiting completion

*Seven-day stabilized rate

Klotzman 1H

Discovery Well Initial Rate* - 11/2011

3,033 Boe/d, 81% Oil

(2,450 Bo/d, 250 B/d NGLs, 2,000 Mcf/d)

Adele Dubose 1H

Delineation Well Initial Rate* - 2/2012

1,463 Boe/d, 76% Oil

(1,109 Bo/d, 153 B/d NGLs, 1,200 Mcf/d)

Klotzman Type Curve

23

Central Dimmit County Area

Summary

• 8,100 net acres in Dimmit County

• 5 completions as of 12/31/2012

• 2Q 2012: 2 completions

• 3Q 2012: 1 completion

• 122 well locations remaining

• 4 wells drilled awaiting completion

• Average Well Costs:

• L&E $6.5 - $7.0 million

• Vivion & Light Ranch $5.5 - $6.0 million

*Seven-day stabilized rate

Light Ranch 1H

Discovery Well Initial Rate* - 10/2010

987 Boe/d, 78% Liquids

(510 Bo/d, 260 B/d NGLs, 1,300 Mcf/d)

Vivion 1H

Discovery Well Initial Rate* - 9/2011

680 Boe/d, 89% Liquids

(506 Bo/d, 102 B/d NGLs, 436 Mcf/d)

Lasseter & Eppright 1

Discovery Well Initial Rate* - 9/2012

1,228 Boe/d, 76% Liquids

(667 Bo/d, 262 B/d NGLs, 1,792 Mcf/d)

Light Ranch

• 3 total completions as of 12/31/2012

• 2Q 2012: 2 completions

Vivion

• 1 completion as of 12/31/2012

Lasseter & Eppright

• 1 completion as of 12/31/2012

• 3Q 2012: 1 completion (discovery)

24

Lopez Farm-In

Summary

• 505 net acres in Live Oak County

• Farm-In from Killam Oil

• BPO: 100% WI, 75% NRI

• APO: 65% WI, 48.75% NRI

Average Well Characteristics

• Well Costs: $7.5 - $8.0 million

• Spacing: 60 acres

Future Activity

• 1 well planned in 1Q 2013

Eagle Ford Inventory

+/- 900 net wells remaining as of 12/31/2012

+/- 900 net wells remaining as of 12/31/2012

* Denotes roughly 12,000 net acres in the liquids window of the play.

25

FINANCIAL STRENGTH

AND FLEXIBILITY

AND FLEXIBILITY

26

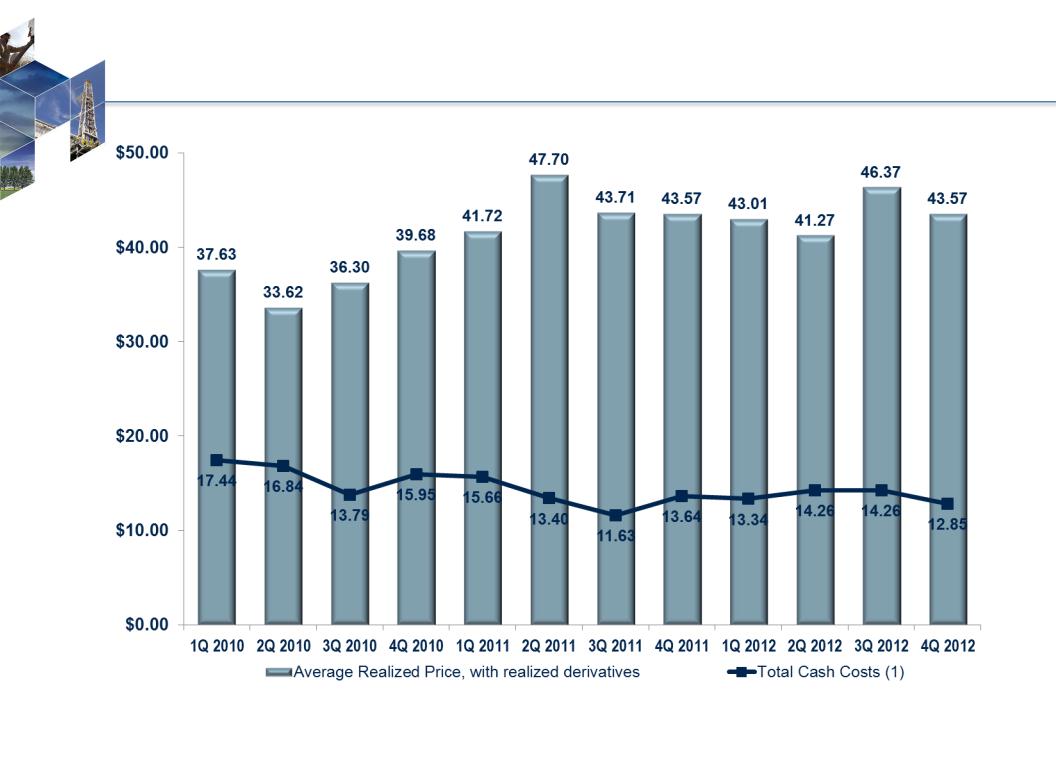

Margin Expansion

27

1. Total cash costs (a non-GAAP measure) calculated as the sum of all average costs per Boe, excluding DD&A and stock-based compensation representing average cash costs

incurred by oil, NGL and natural gas producing activities. Not intended to replace GAAP statistics but to provide additional information helpful in evaluating trends and

performance.

incurred by oil, NGL and natural gas producing activities. Not intended to replace GAAP statistics but to provide additional information helpful in evaluating trends and

performance.

Commodity Derivatives Position - February 25, 2013

$40.64**

$41.96**

$81.52

X

$117.07

$83.33

X

$109.63

$94.15

$92.10

28

Debt and Capital Structure

350

250

883

879

29

410

1,214

Note: As of February 25, 2013, total debt is $425 million.

($MM)

($MM)

Adequate liquidity available to fund 2013

$640-$700 million capital program

$640-$700 million capital program

• Borrowing base raised in April, 2012

based on performance

• $400 million of $625 million borrowing

base available as of February 25th

Liquidity

30

Developing High-Graded Asset Base

• Focused on liquids-rich targets in Eagle Ford with significant project inventory

• Completed divestiture of South Texas legacy natural gas assets; redeployed proceeds

Executing Business Plan

• Grew proved reserves 25 percent versus 12/31/2011; more than double year-end 2010

• Increased Gates Ranch recoveries

• Ensured sufficient firm take-away capacity

• Recorded strong 2012 production growth and exit rates

Testing Growth Opportunities

• Increased Gates Ranch inventory

• Added discovery in another Eagle Ford area

• Pursuing new growth targets through blend of acquisitions and new ventures

Maintaining Financial Strength and Flexibility

• Debt-to-capitalization ratio in the 30 percent range

• Approximately $440 million in liquidity as of late February 2013

Summary

31

REDEFINED

BUILDING VALUE IN UNCONVENTIONAL RESOURCES

APPENDIX

33

|

|

|

2013

|

|||

|

|

|

|

|||

|

$/BOE

|

|

|

|

|

|

|

Direct Lease Operating Expense

|

|

$ 2.15

|

-

|

$ 2.40

|

|

|

Insurance

|

|

0.07

|

-

|

0.08

|

|

|

Ad Valorem Tax

|

|

0.65

|

-

|

0.75

|

|

|

Treating and Transportation

|

|

4.20

|

-

|

4.65

|

|

|

Production Taxes

|

|

1.50

|

-

|

1.65

|

|

|

DD&A

|

|

11.75

|

-

|

12.90

|

|

|

G&A, excluding Stock-Based Compensation

|

|

3.20

|

-

|

3.55

|

|

|

Interest Expense

|

|

1.30

|

-

|

1.40

|

|

34

2013 Expense Guidance

As of December 10, 2012 (Reaffirmed February 25, 2013)

As of December 10, 2012 (Reaffirmed February 25, 2013)

• Volumes and Product Mix

• 2013 exit rate 52 - 56 MBoe/d; 62%-63% total liquids

• Averaged 47.4 MBoe/d in January 2013 (Oil 29%, NGLs 34%)

• 2013 oil percentage approximately 30%

• 2013 production on an overall upward trend; back-end loaded

• Treating & Transportation fees impacted by mix changes

• Crude Oil Pricing

• Average realized price continues to approximate WTI

• NGL pricing (Mont Belvieu Benchmark)

• Firm fractionation capacity

• Adjust for fractionation fees approximately $3 to $4 per barrel

• Adjust for reported 2013 derivative activity, including ethane

• Pricing estimates based on % of WTI not as correlative

Annual Guidance - Framing For Quarterly Models

35

|

|

4Q 2012

|

2012

|

2011

|

2010

|

|

Daily rate (MBoe/d)

|

44.3

|

37.2

|

27.6

|

22.9

|

|

Oil% / NGLs%

|

26% / 36%

|

26% / 33%

|

18% / 26%

|

9% / 13%

|

|

|

$/Boe

|

$/Boe

|

$/Boe

|

$/Boe

|

|

Average realized price (without realized derivatives)

|

$42.58

|

$42.10

|

$42.45

|

$32.98

|

|

Average realized price (with realized derivatives)

|

$43.57

|

$43.63

|

$44.18

|

$36.85

|

|

Direct lease operating expense

|

$2.46

|

$2.42

|

$2.72

|

$4.52

|

|

Workovers / Insurance / Ad valorem tax

|

0.72

|

0.70

|

0.75

|

1.58

|

|

Lease operating expense

|

$3.18

|

$3.12

|

$3.47

|

$6.10

|

|

Treating and transportation

|

3.55

|

3.81

|

2.22

|

0.83

|

|

Production taxes

|

1.27

|

1.23

|

1.20

|

0.71

|

|

General and administrative costs¹

|

3.38

|

3.69

|

4.59

|

5.04

|

|

Interest expense

|

1.47

|

1.79

|

2.11

|

3.23

|

|

Total cash costs2

|

$12.85

|

$13.64

|

$13.59

|

$15.91

|

|

Cash Margin2 (without realized derivatives)

|

$29.73

|

$28.46

|

$28.86

|

$17.07

|

|

Cash Margin2 (with realized derivatives)

|

$30.72

|

$29.99

|

$30.59

|

$20.94

|

Margin Improvement

36

1. Excludes stock-based compensation expense

2. Total cash costs (a non-GAAP measure) is calculated as the sum of all average costs per Boe, excluding DD&A and stock-based compensation. Cash Margin (a non-GAAP measure) is

calculated as the difference between average realized equivalent price and total cash costs. Management believes this presentation may be helpful to investors as it represents average

cash costs incurred by our oil, NGL and natural gas producing activities as compared to average realized price based on revenue generated. These measures are not intended to replace

GAAP statistics but rather to provide additional information that may be helpful in evaluating trends and performance.

calculated as the difference between average realized equivalent price and total cash costs. Management believes this presentation may be helpful to investors as it represents average

cash costs incurred by our oil, NGL and natural gas producing activities as compared to average realized price based on revenue generated. These measures are not intended to replace

GAAP statistics but rather to provide additional information that may be helpful in evaluating trends and performance.