Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TrueBlue, Inc. | a2013q1ir8-k.htm |

Q1 2013 Investor Presentation

Certain statements made by us in this presentation that are not historical facts or that relate to future plans, events or performances are forward-looking statements that reflect management’s current outlook for future periods, including statements regarding future financial performance. These forward-looking statements are based upon our current expectations, and our actual results may differ materially from those described or contemplated in the forward–looking statements. Factors that may cause our actual results to differ materially from those contained in the forward-looking statements, include without limitation the following: 1) national and global economic conditions, including the impact of changes in national and global credit markets and other changes on our customers; 2) our ability to continue to attract and retain customers and maintain profit margins in the face of new and existing competition; 3) new laws and regulations that could have a materially adverse effect on our operations and financial results; 4) significant labor disturbances which could disrupt industries we serve; 5) increased costs and collateral requirements in connection with our insurance obligations, including workers’ compensation insurance; 6) the adequacy of our financial reserves; 7) our continuing ability to comply with financial covenants in our lines of credit and other financing agreements; 8) our ability to attract and retain competent employees in key positions or to find temporary employees to fulfill the needs of our customers; 9) our ability to successfully complete and integrate the MDT Personnel and other acquisitions that we may make from time to time; and 10) other risks described in our filings with the Securities and Exchange Commission, including our most recent Form 10-K and Form 10-Q filings. Use of estimates and forecasts: Any references made to 2013 or 2014 are based on management guidance issued Feb. 6, 2013, and are included for informational purposes only and are not an update or reaffirmation. Any other reference to future financial estimates are included for informational purposes only and subject to factors discussed in our 10-K and 10-Q filings. Forward-Looking Statement page 2

TrueBlue Investment Highlights • Specialized leader in blue-collar staffing • Well-positioned in growing staffing market • Significant upside as construction market rebounds • Compelling organic growth strategies • Successful acquisition strategy • Strong operating leverage • Solid balance sheet supports growth page 3

Specialized Leader in Blue-Collar Staffing General labor, on demand Specialized skills for manufacturing & logistics Skilled trades for energy, industrial, & construction projects Aviation mechanics & technicians Truck drivers page 4

A Credible Business Leader Best Practices by DHS/ICE Partner National Agreement Forbes Most Trustworthy Companies page 5

Revenue and Industry Mix *Brand revenue amounts rounded to the nearest $5 million. page 6 2012 Sales by Industry Energy and Industrial 10% Wholesale Trade 8% Retail 7% Services & Other 14% Aviation 9% Construction 20% Transportation 12% Manufacturing 20% Labor Ready $835M Centerline $60M CLP $230M Spartan Staffing $140M PlaneTechs $130M 2012 Revenues = $1.4 Billion*

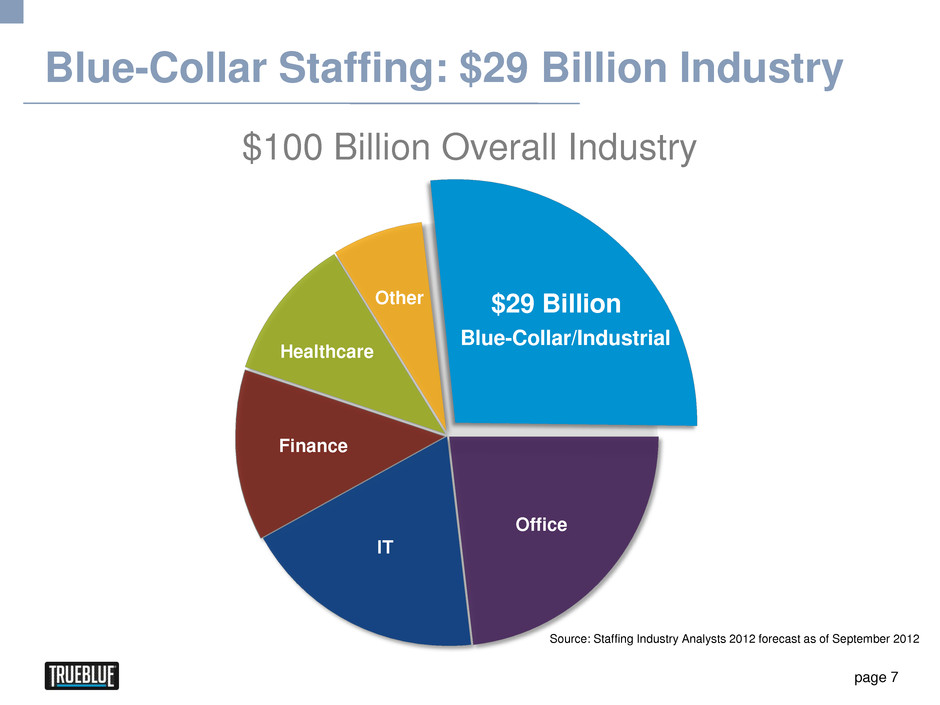

Blue-Collar Staffing: $29 Billion Industry $25 Billion Industrial/ Blue-Collar Other Finance Healthcare Office IT Blue-Collar/Industrial Source: Staffing Industry Analysts 2012 forecast as of September 2012 $29 Billion $100 Billion Overall Industry page 7

Blue-Collar Staffing: Strong Future Growth 2016 Market Forecast 2012 Market page 8 $36B $29B Source: Staffing Industry Analysts, Moody’s economic forecasts, TrueBlue estimates

Staffing Industry: Current Growth Drivers • Economic volatility & uncertainty • Skilled labor shortages • Increased government regulation • Aging workforce • Flexible workforce • Improve productivity • Compliance with regulations • Access talent page 9 STAFFING INDUSTRY SOLUTIONS BUSINESS DISRUPTORS

Customers Double Use of Temp Staffing 2009 Recovery 1991 Recovery 2003 Recovery 2x Temp Jobs as Percentage of Total Jobs Added page 10 16% 8% 8% Source: Bureau of Labor Statistics. Measures number of jobs added from help supply services as a percentage of total non-farm payroll. Timeframe measured is 41 months from the start of the recoveries: August 1991, May 2003, and September 2009.

Staffing Industry Growth Drivers: Affordable Care Act Focus How Affordable Care Act • Employers with more than 50 full-time employees (30+ hours per week) must either offer affordable health coverage or pay a penalty • Provide employers with flexible solutions to comply with ACA law page 11 Opportunity Situation Opportunity i

Staffing Industry Growth Driver: Construction Focus How Situation Opportunity Construction • Construction employment near historic lows • Positive momentum for housing starts; construction employment to follow page 12 • Significant construction revenue increase • Multiplier effect on logistics, retail and services i

Poised for Construction Rebound page 13 Source: BofA Merrill Lynch Research, BLS, Census Bureau Ho u sin g Starts (1000s; lags fi v e q trs. ) Constru c tion Jobs (as pe rc e nt of labo r forc e ) Construction Jobs Lag Housing Starts

TrueBlue: Strong Construction Upside page 14 Historic Construction Trends 2006 2012 Construction Upside Scenario 1 Scenario 2 Mix 33% 20% 25% 30% Revenue $ 450M $ 280M $ 435M $ 525M Incremental EBITDA* $ 30M+ $ 50M+ * Based on incremental construction EBITDA margin assumptions of 20 percent. See 2013 Outlook Operating Income to EBITDA Reconciliation slide.

Staffing Industry Growth Driver: Manufacturing Focus How Situation Opportunity Manufacturing • U.S. Manufacturing Renaissance • Increased incentives to “reshore” including increasing wages in China, offshore product quality concerns • Decline in energy costs • Provide flexible, skilled labor force • Closer-to-customer improves service page 15 Opportunity

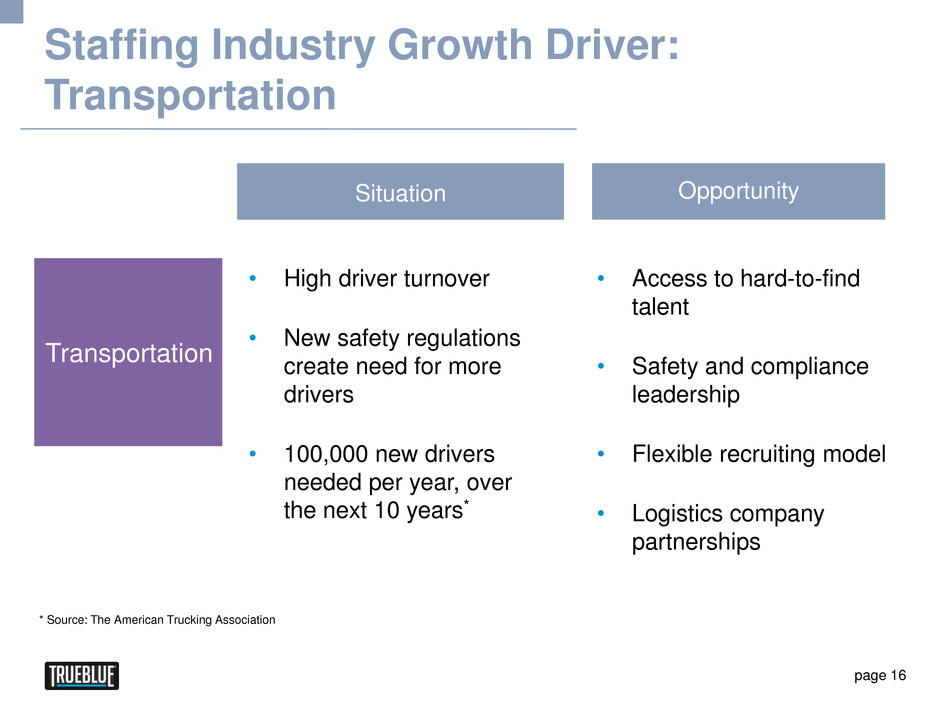

Staffing Industry Growth Driver: Transportation Focus Situation Transportation • High driver turnover • New safety regulations create need for more drivers • 100,000 new drivers needed per year, over the next 10 years* page 16 • Access to hard-to-find talent • Safety and compliance leadership • Flexible recruiting model • Logistics company partnerships * Source: The American Trucking Association Situation Opportunity i

Staffing Industry Growth Driver: Energy Focus How • Growing energy independence • Skilled worker shortages • More than 100,000 new jobs in the solar industry by 2016* • Deliver and manage skilled work force in remote areas • Deep technical knowledge within green industries • Partner with green industry trades schools to fill skilled- worker gap • Business process improvements, not just service features Energy and Industrial Situation page 17 * Source: The Solar Energy Industry Association Opportunity

TrueBlue Growth Strategies Focus How page 18 Specialization • Industry expertise • Local sales strategies • National sales and service Specialization Current • Additional vertical experts • More local sales people • Account executives • Permanent placement business Future Consideration

TrueBlue Growth Strategies Focus How Technology • Texting • Electronic placement • Pay cards • Fill more orders, faster • Higher quality, more workers page 19 Technology Current Opportunity • Electronic hiring process • Social media recruiting • Enhanced database Future Consideration

TrueBlue Growth Strategies Focus How Why How Technology page 20 Centralization • Branch consolidations • Common processes • Specialized job duties Centralization Current Opportunity • Satellite recruiting branches • National recruiting efficiencies • Additional branch consolidations Future Consideration

Successful Acquisition Strategy Focus How Considerations Technology page 21 • ROIC* • Strategic fit • Cultural fit • Limited financial risk • New business capabilities • Talent • • • • * Return on invested capital Acquisitions Considerations Results

MDT Acquisition

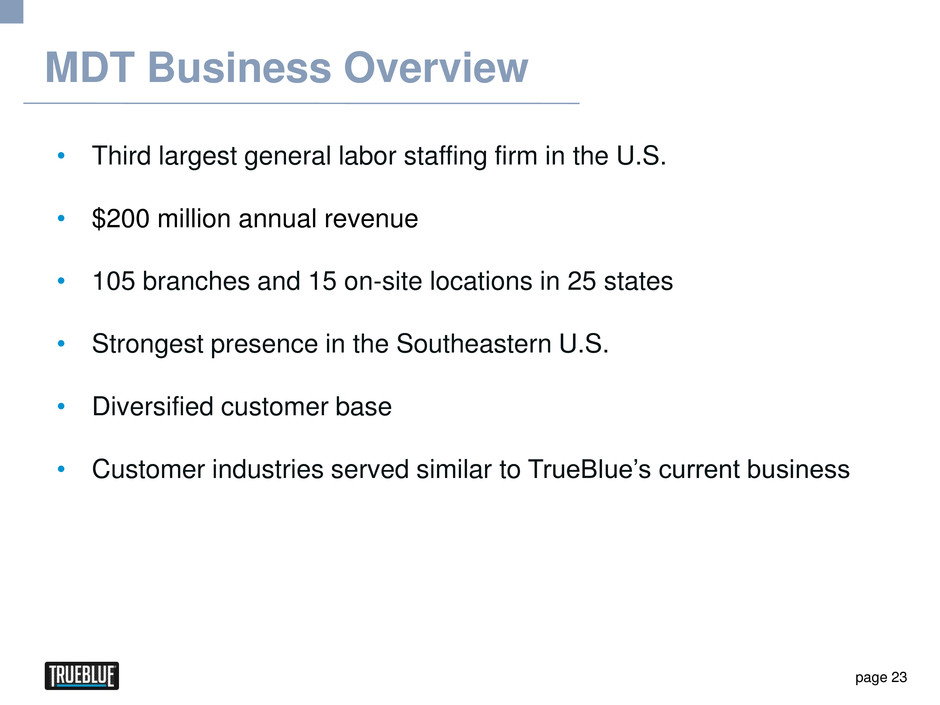

MDT Business Overview • Third largest general labor staffing firm in the U.S. • $200 million annual revenue • 105 branches and 15 on-site locations in 25 states • Strongest presence in the Southeastern U.S. • Diversified customer base • Customer industries served similar to TrueBlue’s current business page 23

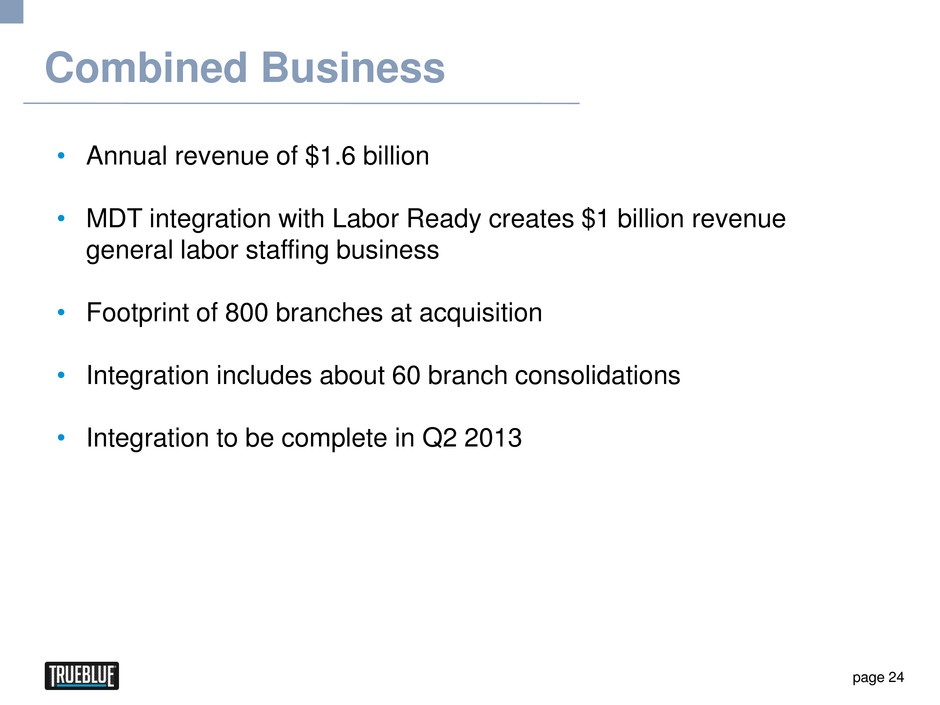

Combined Business • Annual revenue of $1.6 billion • MDT integration with Labor Ready creates $1 billion revenue general labor staffing business • Footprint of 800 branches at acquisition • Integration includes about 60 branch consolidations • Integration to be complete in Q2 2013 page 24

Strategic Rationale • Significant market share growth • Increases scale in our general labor staffing business • Branch consolidation synergies drive operating leverage • Attractive purchase price at 4x EBITDA* • Infusion of new talent, including industry-experienced sales force • Good cultural fit * Based on 2014 estimate; assumes full year of revenue and certain synergies. See 2013 Outlook Operating Income to EBIDA Reconciliation slide. page 25

Deal Summary Purchase Price: $48 Million* Consideration: $12 Million cash $36 Million debt Note Terms: Five-year term + five one-year extensions 15-year principal amortization schedule LIBOR, plus 150 basis points Structure: Asset Purchase $8 Million Tax Asset * Additional $7 million paid at closing to reimburse Seller for excess working capital. page 26

Financial Review

Strong Operating Leverage Incremental Revenue $100 Gross Profit Generated $26 Operating Expense Associated with Incremental Revenue $(9) – (11) Incremental EBITDA ≈$15 * Reflects an approximation of the incremental EBITDA that management believes can be achieved, in general, with favorable revenue growth and current gross margin, revenue mix and geographic footprint. See 2013 Outlook Operating Income to EBITDA Reconciliation slide. Organic growth from existing geographies ≈15% incremental EBITDA margins* page 28

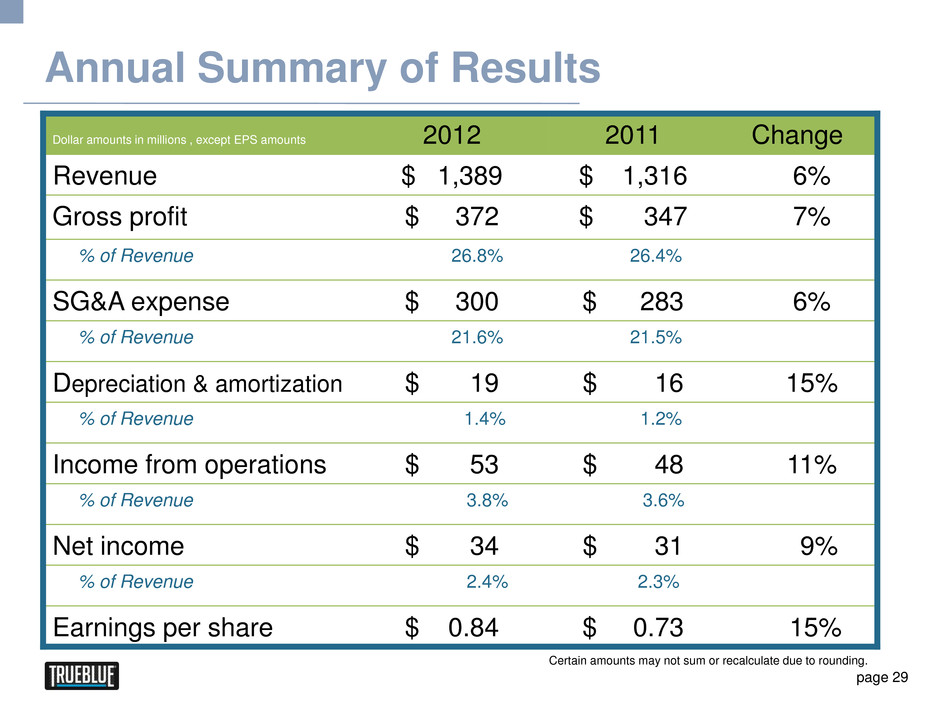

Annual Summary of Results Dollar amounts in millions , except EPS amounts 2012 2011 Change Revenue $ 1,389 $ 1,316 6% Gross profit $ 372 $ 347 7% % of Revenue 26.8% 26.4% SG&A expense $ 300 $ 283 6% % of Revenue 21.6% 21.5% Depreciation & amortization $ 19 $ 16 15% % of Revenue 1.4% 1.2% Income from operations $ 53 $ 48 11% % of Revenue 3.8% 3.6% Net income $ 34 $ 31 9% % of Revenue 2.4% 2.3% Earnings per share $ 0.84 $ 0.73 15% Certain amounts may not sum or recalculate due to rounding. page 29

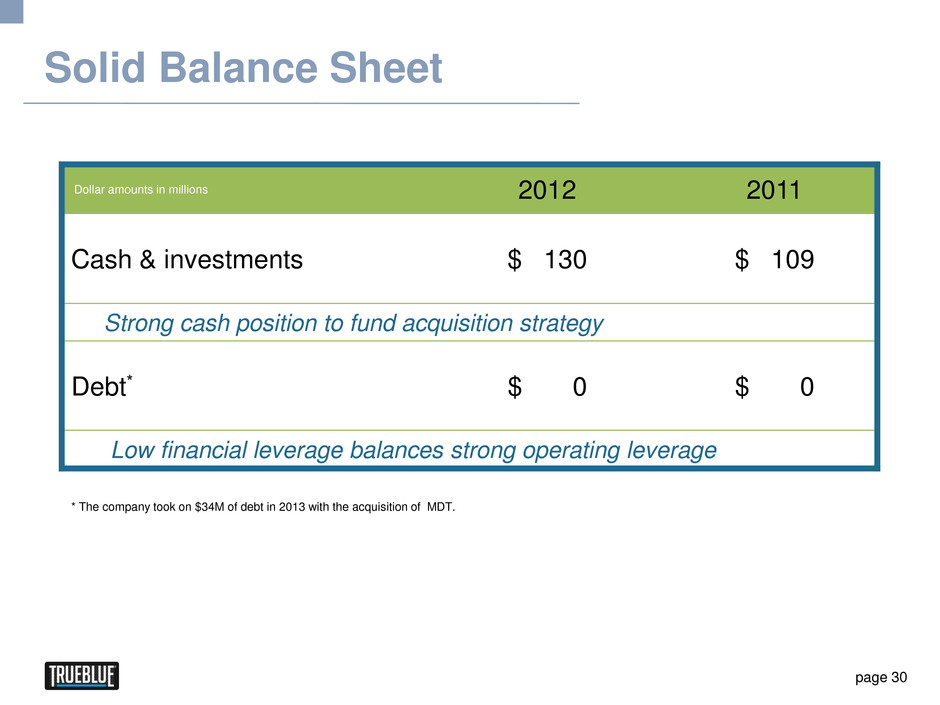

Solid Balance Sheet 2012 2011 Cash & investments $ 130 $ 109 Strong cash position to fund acquisition strategy Debt* $ 0 $ 0 Low financial leverage balances strong operating leverage page 30 Dollar amounts in millions * The company took on $34M of debt in 2013 with the acquisition of MDT.

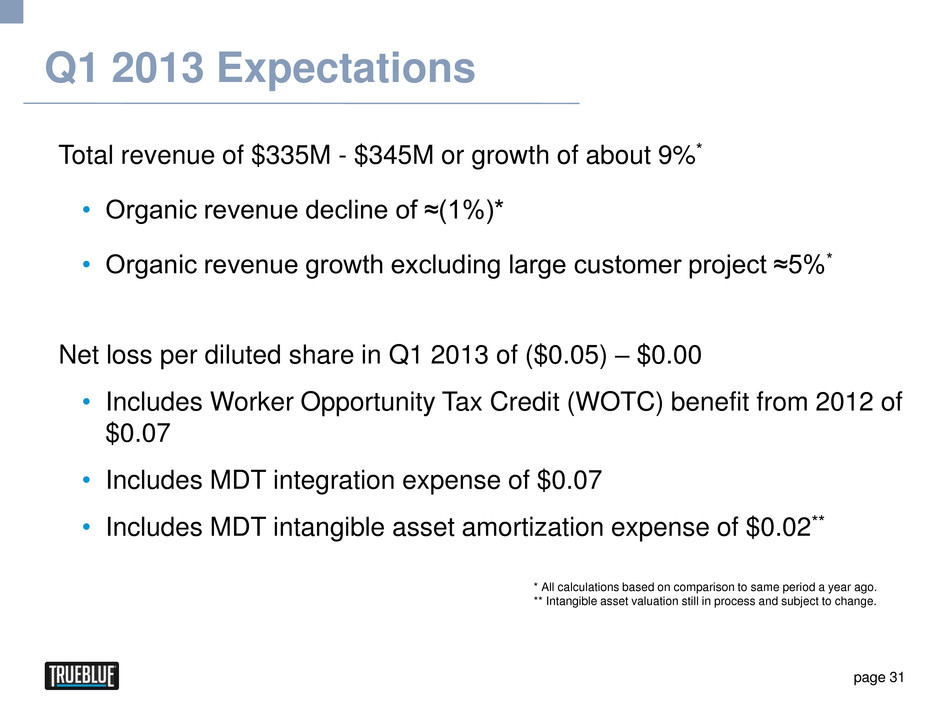

Q1 2013 Expectations Total revenue of $335M - $345M or growth of about 9%* • Organic revenue decline of ≈(1%)* • Organic revenue growth excluding large customer project ≈5%* Net loss per diluted share in Q1 2013 of ($0.05) – $0.00 • Includes Worker Opportunity Tax Credit (WOTC) benefit from 2012 of $0.07 • Includes MDT integration expense of $0.07 • Includes MDT intangible asset amortization expense of $0.02** * All calculations based on comparison to same period a year ago. ** Intangible asset valuation still in process and subject to change. page 31

2013 Full-Year Outlook * Represents the expected year over year reduction in project work in 2013 for our top aviation-related customer. ** Centralization of common operating processes and deployment of mobile technology offerings. *** Integration costs related to the MDT acquisition and one-time reorganization costs related to branch efficiencies. ****See 2013 Outlook Operating Income to EBITDA Reconciliation slide. page 32 Core Business Large Customer Headwind* MDT Acquisition Branch Efficiencies** TrueBlue Total Revenue 1,465 $ (50) $ 185 $ 20 $ 1,620 $ Total Revenue Growth 5% -4% 13% 1% 17% Gross Profit 388 (10) 37 5 420 Gross Margin % 26% 20% 20% 25% 26% SG&A 311 - 35 (3) 343 EBITDA**** 77 (10) 2 8 77 Integration / Other *** - - 6 2 8 Adjusted EBITDA**** 77 $ (10) $ 8 $ 10 $ 85 $

2013 Outlook Operating Income to EBITDA Reconciliation *Adjusted EBITDA excludes one-time integration costs related to the MDT acquisition and one-time reorganization costs related to branch efficiencies from EBITDA. EBITDA and Adjusted EBITDA are key measures used by management in evaluating performance. EBITDA and Adjusted EBITDA should not be considered a measure of financial performance in isolation or as an alternative to operating income (loss) in the Statement of Operations in accordance with GAAP, and, as presented, may not be comparable to similarly titled measures of other companies. page 33 Core Business Large Customer Headwind MDT Acquisition Branch Efficiencies TrueBlue Total Income (loss) from operations 57 $ (10) $ (4) $ 8 $ 51 $ Depreciation & amortization 20 - 6 - 26 EBITDA* 77 (10) 2 8 77 Integration / other - - 6 2 8 Adjusted EBITDA* 77 $ (10) $ 8 $ 10 $ 85 $

TrueBlue Investment Highlights • Specialized leader in blue-collar staffing • Well-positioned in growing staffing market • Significant upside as construction market rebounds • Compelling organic growth strategies • Successful acquisition strategy • Strong operating leverage • Solid balance sheet supports growth page 34