Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Diamond Foods Inc | d492311d8k.htm |

February 2013

Diamond Foods

Building Sustainable Premium Brands

Exhibit 99.1 |

1

Important Information

This presentation includes forward-looking statements, including statements

about our future financial and operating

performance

and

results,

competitive

advantages

of

our

products,

progress

on

brand

growth

strategies, impact of walnut supply, trends in promotional spend, estimated cost

savings from optimizing cost

structure

and

possible

restructuring

of

our

balance

sheet.

These

forward-looking

statements

are

based

on our assumptions, expectations and projections about future events only as of

the date of this presentation, and

we

make

such

forward-looking

statements

pursuant

to

the

“safe

harbor”

provisions

of

the

Private

Securities Litigation Reform Act of 1995.

Many of our forward-looking statements include discussions of

trends

and

anticipated

developments

under

the

“Risk

Factors”

and

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations”

sections

of

the

periodic

reports

that

we

file

with

the

SEC.

We

use

the

words

“anticipate,”

“believe,”

“estimate,”

“expect,”

“intend,”

“plan,”

“seek,”

“may”

and

other

similar expressions to identify forward-looking statements that discuss our

future expectations, contain projections

of

our

results

of

operations

or

financial

condition

or

state

other

“forward-looking”

information.

You also should carefully consider other cautionary statements elsewhere in this

presentation and in other documents we file from time to time with the

SEC. We do not undertake any obligation to update forward-

looking

statements

to

reflect

events

or

circumstances

occurring

after

the

date

of

this

presentation.

Actual

results may differ materially from what we currently expect because of many risks

and uncertainties, such as:

risks

relating

to

our

leverage

and

its

effect

on

our

ability

to

respond

to

changes

in

our

business,

markets

and

industry;

increase

in

the

cost

of

our

debt;

ability

to

raise

additional

capital

and

possible

dilutive

impact

of raising such capital; risks relating to litigation and regulatory proceedings;

uncertainties relating to relations with

growers; availability and cost of walnuts and other raw materials; increasing competition and

possible

loss

of

key

customers;

and

general

economic

and

capital

markets

conditions.

Diamond

Foods

separately reports financial results using non-GAAP financial measures; a

reconciliation of Diamond’s financial results determined in

accordance with GAAP can be found in our press release. |

2

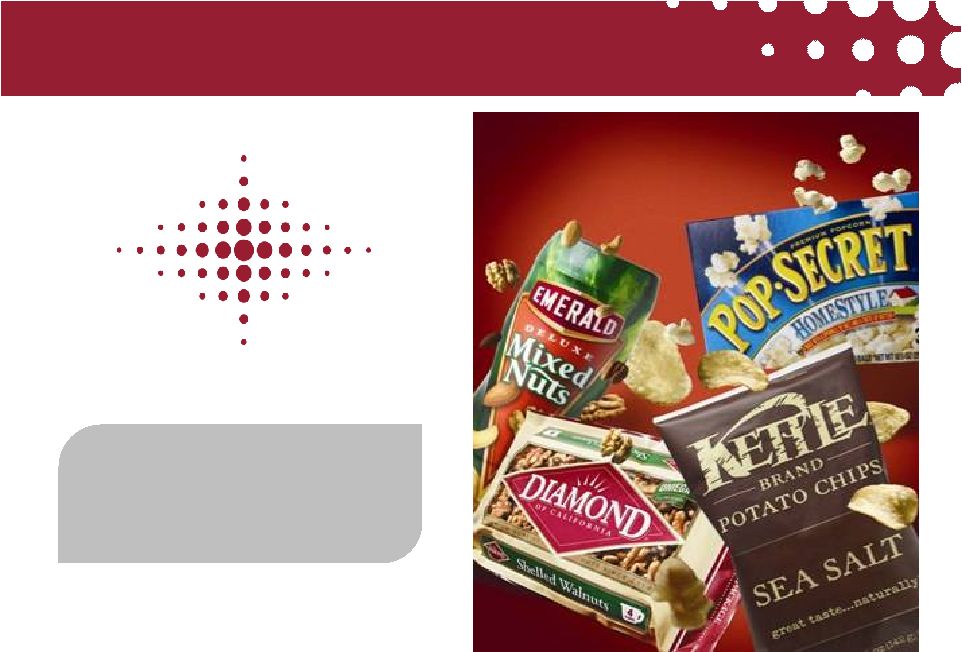

Who we Are

Building a company focused

on sustainable, profitable

growth

Diamond is an innovative

packaged food company

focused on building and

energizing brands |

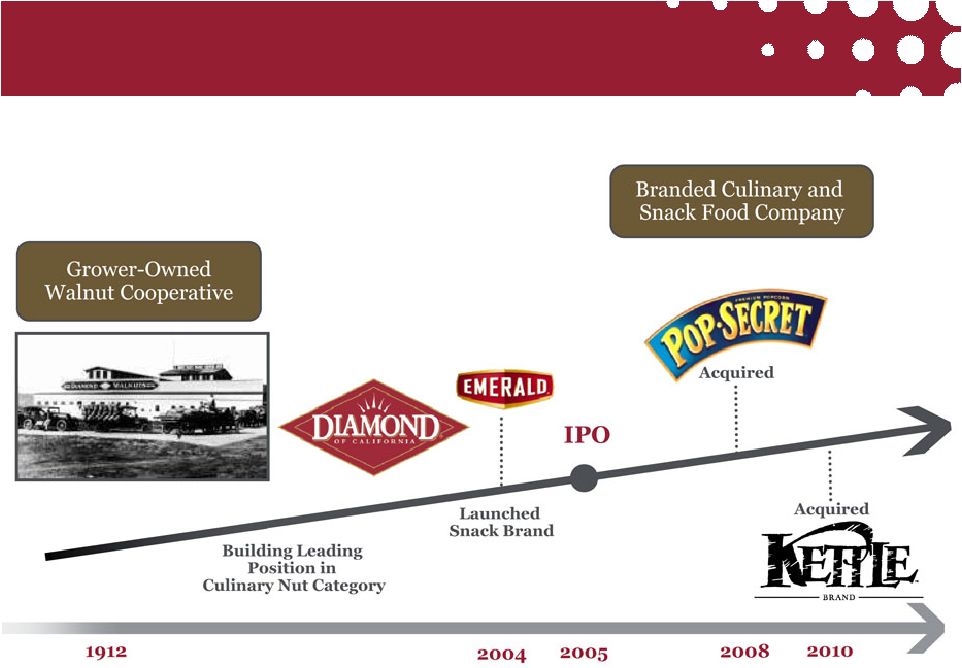

3

Company History |

4

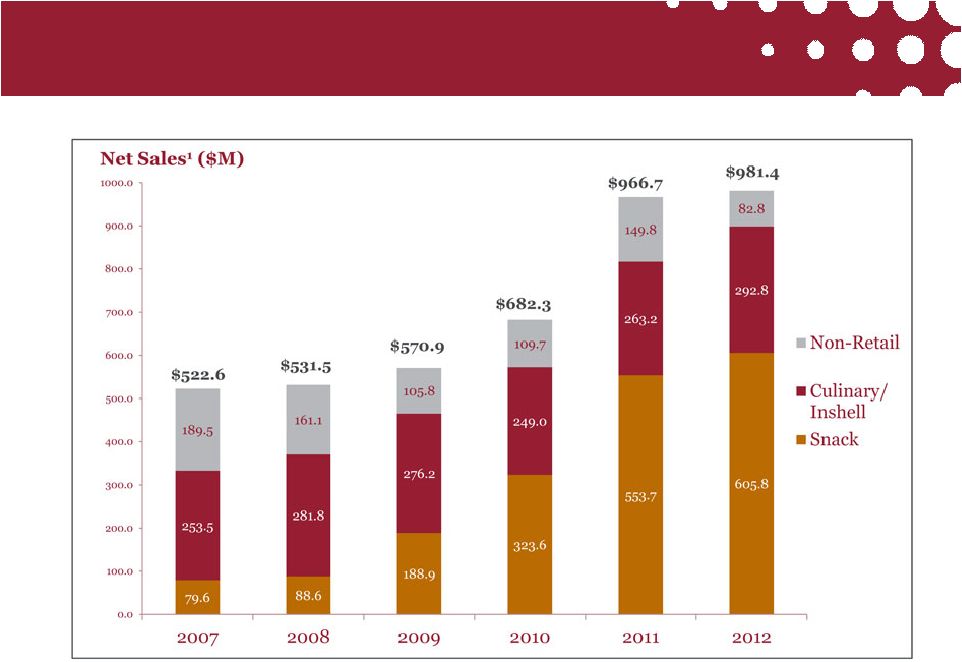

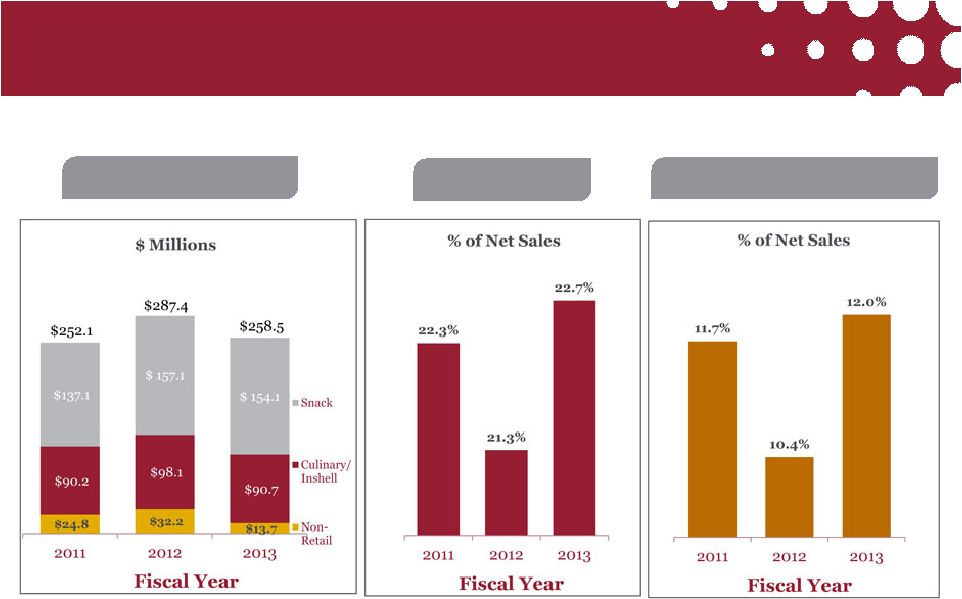

Revenue Mix Has Changed Significantly

Over Time

1

Numbers rounded |

5

Our brands compete in large and growing categories, possess insulating

competitive advantages and have the range to allow us to compete in

complimentary segments. Transformation into a Branded Snack Player

Brands in the Portfolio

Category Size¹

($B)

$1.1B

$6.0B

$0.9B

$5.8B/$0.2B

$3.4B

6

Category Growth¹

(%)

6.7%

4.9%

0.7%

6.2%/4.0%

5.4%

Brand Position

#1

#3³

#2

#2/#1

2,4

#3

7

Market Share

24.4%¹

6.3%

1,3

22.3%¹

2.6%/58.4%²

4.4%

Brand Highlights

Branded

category leader

with 100 years

of history

Brand extended

to broader U.S.

Grocery

convenient

breakfast

category in 2011

Has gained 400

basis pts of

share in past

three years

5

Leading potato

chip brand in

natural

segment; over

3x the size of the

next largest

brand

Leading

premium potato

chip brand in

U.K. Named to

U.K.

“Superbrands”

list in 2012

2

2 |

6

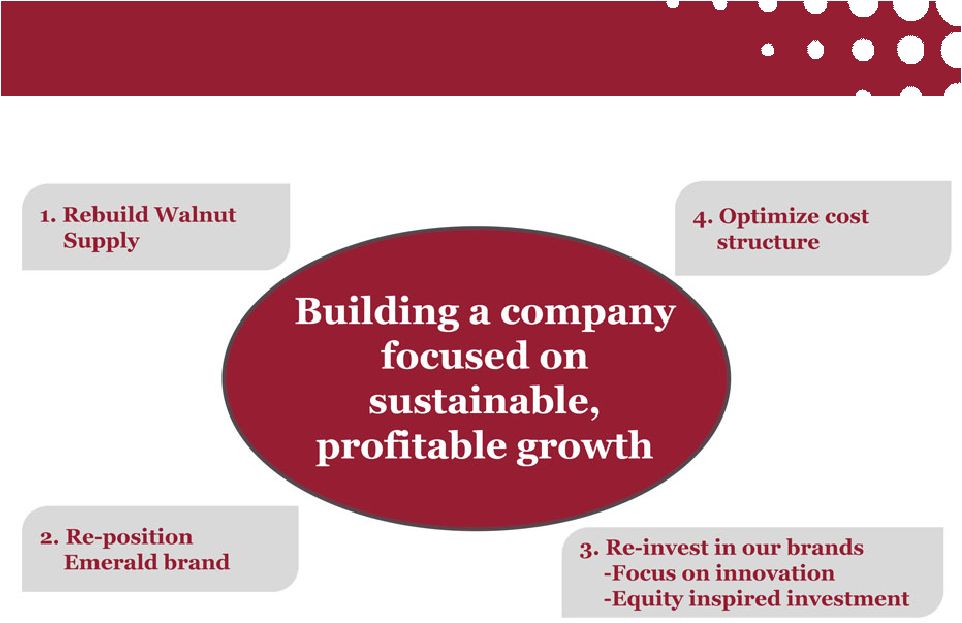

Diamond is Focused on Four Key Initiatives |

7

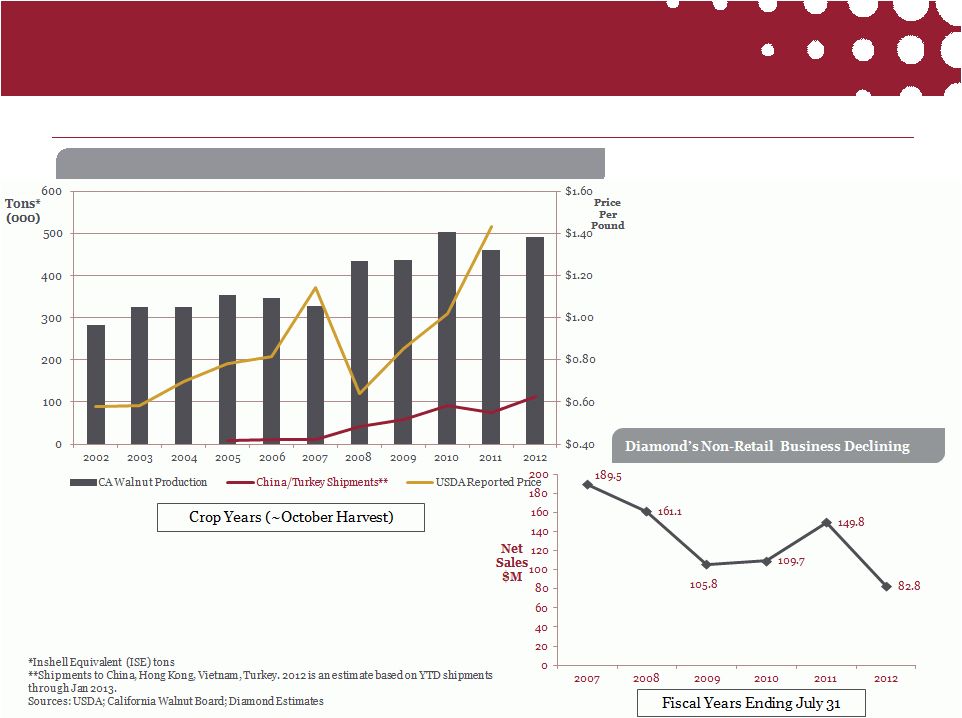

1. Rebuild Walnut Supply

Both Price and Supply of Walnuts Have Grown Rapidly

California Walnut Production , China/Turkey Demand and Reported Price

|

8

1.

Competitive pricing and contract terms

2.

Grower incentives

3.

Expanded grower services team

4.

Grower Advisory Board

5.

Continued leadership in grower services

6.

Significant increase in investment in Diamond brand culinary nuts

1. Rebuild Walnut Supply

Actions we are taking |

9

2. Re-Position the Emerald brand

From: Top Line Focus

To: Sustainable Growth Focus

Focusing the portfolio on “insulated”

items

< 90 SKUs

> 250 SKUs |

3.

Re-invest in our Brands 10 |

3.

Re-invest in our Brands: Pop Secret (I) Pop-Secret Reducing

Reliance on Promotional Spend while Improving Market Share

Promoted/Non-Promoted Sales*

Market Share *

*52 Week Periods in U.S. xAOC

Source: Nielsen

11 |

3.

Re-invest in our Brands: Pop Secret (II) Pop-Secret Investing

in Consumer Support and Innovation Search

Social

Digital

Media

12 |

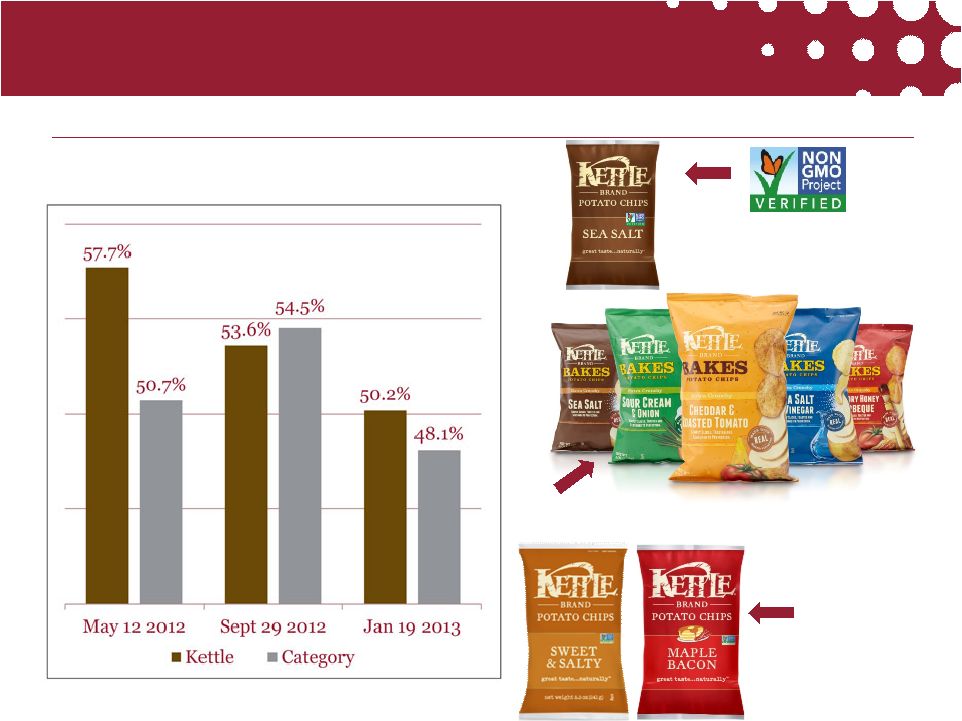

Kettle focus more balanced between innovation and promotional spending

Percent of Sales Sold on Promotion*

*Premium Kettle style segment of potato chip category

Source: Nielsen U.S. >$2MM, 12 week periods

First Potato Chip with Non-

GMO Project Verification

Only Baked Potato Chip made with real sliced potatoes

New On-Trend

Flavors

3. Re-invest in our Brands: Kettle Brand

13 |

Source: Nielsen U.S. Food, 52 weeks ended Jan 19, 2013

3. Re-invest in our Brands: Diamond of

California

Diamond, the branded leader in Culinary Nuts supported by marketing focused on

foodies, bakers and cooks who value quality 14

|

4.

Optimize Cost Structure Operations

•

Capacity rationalization

•

Productivity

•

Transportation and

Warehousing

•

Supplier Contracts

•

Formulation and

Packaging Optimization

Sourcing

SG& A

Cost savings estimated to be in the range of $20-40M

15 |

4. Optimize Cost Structure

Manufacturing Footprint

Beloit, WI

Salem, OR

Norwich, England

Stockton, CA

Van Buren, IN

Doubled

capacity in

2012

Added additional 25%

capacity in 2011

Consolidating

all Emerald

production

Added

packaging

capacity in

2011/2012

Recently closed Fishers, IN

Emerald production facility

Production Facility

Co-Pack Facility

16 |

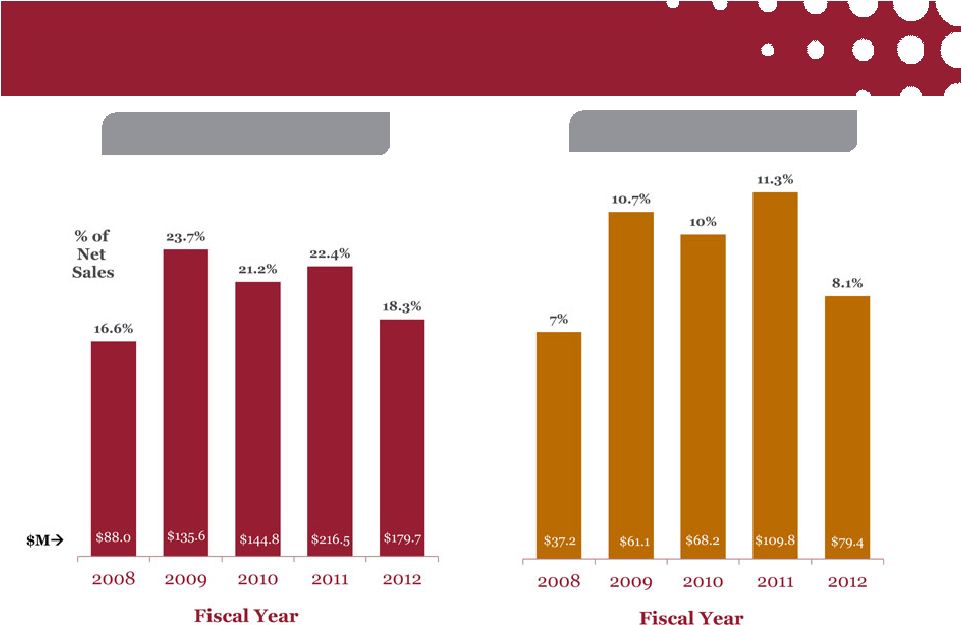

* Calculated as Earnings before Interest and Taxes, excluding costs associated

with acquisitions and integration , warrant liability expense, certain SG&A costs related to Audit

Committee investigation, re-statement related expenses., consulting fees,

retention and severance, stock based compensation and depreciation and amortization.

Financial Performance

Gross Margin

Adjusted EBITDA* Margin

17 |

Q1

Performance Over Past Three Years Gross Margin

Revenue –

Net Sales

Adjusted EBITDA* Margin

* Calculated as Earnings before Interest and Taxes, excluding costs associated

with acquisitions and integration , warranty liability expense, certain SG&A costs related to Audit

Committee investigation, re-statement related expenses., consulting fees,

retention and severance, stock based compensation and depreciation and amortization.

18 |

Overview of Selected Elements of the

Balance Sheet

Bank Revolving Credit

Facility

Bank Term Loan facility

Kettle Guaranteed Loan

Oaktree Senior Notes

Oaktree Warrants

•

Libor + 550 basis points, with 1.25% floor

•

Maturity: Feb 25, 2015

•

Approximately $133M outstanding on the $255M revolving

facility as of Jan 31, 2013

•

Revolving credit facility decreases to $230M in July, 2013

•

$218M balance on term loan on October 31, 2012

•

Quarterly term payments $909K

•

Low interest,

fixed rate loan

•

Established as

part of Beloit

plant expansion

•

$18.2M balance

as of Oct 31, 2012

•

$225M unsecured senior notes

•

12% coupon, PIK at company’s option for first two years

•

Call premium, currently 101%, goes to 112% on May 29, 2013

•

Maturity 2020

•

For ~4.4M shares with exercise price of $10 per share

•

Implied ownership of 16.4% on fully diluted basis at close

19 |

Diamond Foods

Building a company focused

on sustainable, profitable

growth

20 |

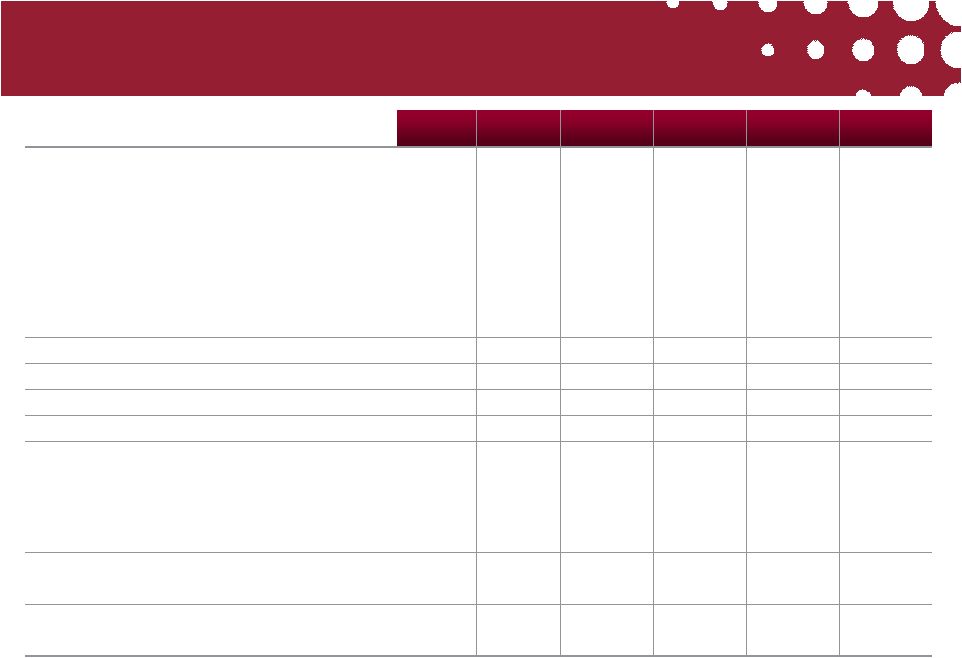

Non-GAAP Reconciliation

($Millions, except per share amounts)

Q1’13

2012

2011

2010

2009

2008

GAAP Net Sales

$258.5

$981.4

$966.7

$682.3

$570.9

$531.5

GAAP Cost of Sales

$199.9

$801.7

$750.2

$537.5

$435.3

$443.5

GAAP Operating Expense

$54.7

$230.4

$162.9

$109.6

$89.8

$64.1

Adjustment for acquisition and integration

related expenses; loss on warrant liability;

stock based compensation; asset

impairment; forbearance fees; fees for tax

projects; certain SG&A costs

1

($18.0)

($92.6)

($20.4)

($12.1)

--

--

Non-GAAP Operating Expense

$36.7

$137.8

$142.5

$97.5

$89.8

$64.1

Non-GAAP Income from Operations

$21.9

$41.9

$74.0

$47.4

$45.8

$23.9

Stock-based compensation expense

$1.2

$9.2

$7.7

$3.7

$3.9

$6.9

Depreciation and Amortization

$7.9

$28.3

$28.1

$17.2

$11.4

$6.4

Adjusted EBITDA

$31.0

$79.4

$109.8

$68.2

$61.1

$37.2

GAAP Interest

$13.9

$34.0

$23.9

$10.2

$6.3

$1.0

GAAP Income Tax Expense (Benefit)

$0.6

$1.7

$3.1

$7.5

$14.9

$8.1

Tax effect of Non-GAAP adjustments

$2.4

($4.1)

$7.0

$4.8

$0.4

--

Non-GAAP Income Tax Expense (Benefit)

$3.0

($2.4)

$10.1

$12.4

$15.3

$8.1

GAAP Net Income

($10.7)

($86.3)

$26.6

$15.7

$23.7

$14.8

Non-GAAP Net Income

$5.2

$12.7

$39.9

$24.8

$24.3

$14.8

GAAP EPS Diluted

($0.49)

($3.98)

$1.17

$0.82

$1.44

$0.91

Non-GAAP EPS Diluted

$0.21

$0.58

$1.76

$1.29

$1.47

$0.91

1

Related primarily to audit committee investigation, restatement related expenses,

consulting fees, retention and severance 21 |