Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - Cooper-Standard Holdings Inc. | d493374d8ka.htm |

Cooper Standard

Fourth Quarter & Full Year 2012 Earnings Call

February 26, 2013

Exhibit 99.2 |

cooperstandard

2

Safe Harbor

This presentation includes “forward-looking statements” within the meaning of U.S.

federal securities laws, and we intend that such forward-looking statements be subject to

the safe harbor created thereby. We make forward-looking statements in this presentation and may make such statements in

future filings with the SEC. We may also make forward-looking statements in our press releases or

other public or stockholder communications. These forward-looking statements include

statements concerning our plans, objectives, goals, strategies, future events, future revenue or performance,

capital expenditures, financing needs, plans or intentions relating to acquisitions, business trends,

and other information that is not historical information. When used in this presentation, the

words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” or

future or conditional verbs, such as “will,” “should,” “could,” or

“may,” and variations of such words or similar expressions are intended to identify

forward-looking statements. All forward-looking statements, including, without limitation,

management’s examination of historical operating trends and data are based upon our

current expectations and various assumptions. Our expectations, beliefs, and projections are expressed in good faith and we

believe there is a reasonable basis for them. However, no assurances can be made that these

expectations, beliefs and projections will be achieved. Forward-looking statements are not

guarantees of future performance and are subject to significant risks and uncertainties that may cause actual

results or achievements to be materially different from the future results or achievements expressed

or implied by the forward-looking statements.

There are a number of risks and uncertainties that could cause our actual results to differ materially

from the forward-looking statements contained in this presentation. Important factors

that could cause our actual results to differ materially from the forward-looking statements we make herein include,

but are not limited to: cyclicality of the automotive industry with the possibility of further

material contractions in automotive sales and production effecting the viability of our

customers and financial condition of our customers; global economic uncertainty, particularly in Europe; loss of large

customers or significant platforms; supply shortages; escalating pricing pressures and decline of

volume requirements from our customers; our ability to meet significant increases in demand;

availability and increasing volatility in cost of raw materials or manufactured components; our ability to

continue to compete successfully in the highly competitive automotive parts industry; risks associated

with our non-U.S. operations; foreign currency exchange rate fluctuations; our ability to

control the operations of joint ventures for our benefit; the effectiveness of our lean manufacturing and other

cost savings plans; product liability and warranty and recall claims that may be brought against us;

work stoppages or other labor conditions; natural disasters; our ability attract and retain key

personnel; our ability to meet our customers’ needs for new and improved products in a timely manner or

cost-effective basis; the possibility that our acquisition strategy may not be successful; our

legal rights to our intellectual property portfolio; environmental and other regulations; legal

proceedings or commercial and contractual disputes that we may be involved in; the possible volatility of our

annual effective tax rate; our ability to generate sufficient cash to service our indebtedness, obtain

future financing, and meet dividend obligations on our 7% preferred stock; our underfunded

pension plans; significant changes in discount rates and the actual return on pension assets; the possibility of

future impairment charges to our goodwill and long-lived assets; the ability of certain

stockholders to nominate certain members of the board of directors; and operating and financial

restrictions imposed on us by our bond indenture and credit agreement.

There may be other factors that may cause our actual results to differ materially from the

forward-looking statements. All forward-looking statements attributable to us or

persons acting on our behalf apply only as of the date of this presentation and are expressly qualified in their entirety by the

cautionary statements included herein. We undertake no obligation to update or revise

forward-looking statements to reflect events or circumstances that arise after the date

made or to reflect the occurrence of unanticipated events. |

Jeff Edwards

Chief Executive Officer

Executive Overview

Fourth Quarter and Full Year 2012 |

cooperstandard

4

Executive Overview

•

Strategy

•

Managing European downturn

•

Emerging market expansions

•

Key leadership appointments to facilitate growth |

cooperstandard

5

First 120 Day CEO Plan

Day

0-45

Listen & Learn

Define the Vision

/ Path Forward

Unwavering

Execution

•

Met with Top 50 management

•

Met with plant management

teams

•

Visited global tech centers

•

Visited facilities in 9 countries

•

Engaged with 11 customers

•

Met with 6 business partners

Day

45-120

Day

120+

•

Determine capabilities

•

Analyze current portfolio

performance

•

Explore organization model

•

Determine human capital

needs

•

Create vision

•

Develop strategic priorities

•

Install process capabilities

•

Create priorities for capital and

innovation

•

Prioritize organizational

resources |

cooperstandard

Key Elements to Success

•

Make shareholder value creation our over-arching objective

•

Have relentless

focus

on

our

customers

–

develop

deep

insight

into their needs and consistently beat our competition in most

effectively serving such needs

•

Achieve

profitable

growth

–

grow

the

top

line

and

expand

margins

•

Invest in our people and excel in the few essential capabilities

required to win

•

Build an operating model that enables and sustains success –

transform our people into a distinct competitive advantage

6 |

cooperstandard

7

Strategic Priorities

•

Focus on our customers, develop deep insight

into their needs and how to most effectively serve them

•

Finalize product growth strategy

•

Accelerate profitable growth …

Brazil, India, China,

Southeast Asia

•

North America –

continue to invest in infrastructure to

support growth

•

Restructure Europe manufacturing footprint

–

Serbia, Romania (complete), Turkey and Poland

•

Focus on building centers of excellence within

our global functional organizations

•

Invest in Russia and Indonesia footprint |

Financial Overview

Fourth Quarter and Full Year 2012

Allen Campbell

Chief Financial Officer |

cooperstandard

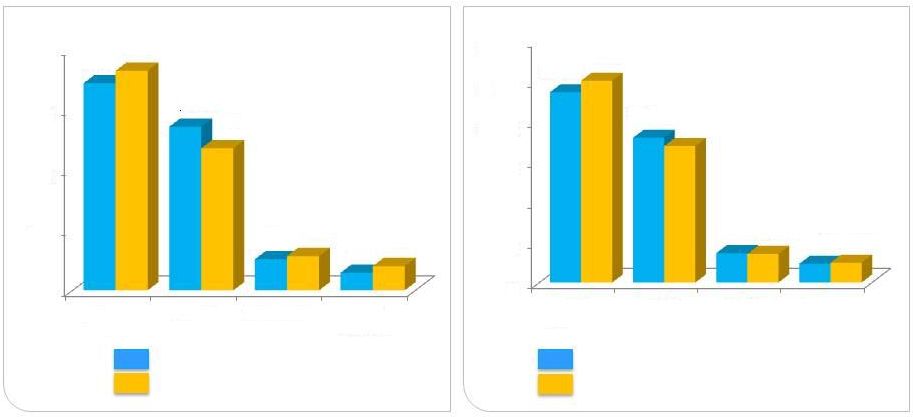

Q4 and FY 2012 Revenue

9

$ USD Millions

Q4 2011 Revenue: $695.7

Q4 2012 Revenue: $697.1

FY 2011 Revenue: $2,853.5

FY 2012 Revenue: $2,880.9

Note: Numbers subject to rounding

$0

$100

$200

$300

$400

North

America

Europe

Asia Pacific

South

America

$343.6

$271.4

$51.5

$29.1

$364.5

$235.8

$56.7

$40.1

$0

$300

$600

$900

$1,200

$1,500

$1,800

North

America

Europe

Asia Pacific

South

America

$1,417.3

$1,078.2

$218.5

$139.5

$1,503.7

$1,016.6

$213.2

$147.4 |

cooperstandard

Q4 and FY 2012 Performance

$ USD Millions, except per share amounts

Q4 2011

Q4 2012

FY 2011

FY 2012

Sales

695.7

697.1

2,853.5

2,880.9

Gross Profit

97.6

99.7

450.6

438.9

SGA

66.7

74.8

257.6

281.3

Operating Profit

22.9

(2.1)

125.2

103.3

Net Income

23.2

(9.9)

102.8

102.8

Fully Diluted EPS

$0.84

($0.70)

$3.93

$4.14

Adjusted EBITDA

66.6

70.9

324.1

298.0

% Margin

9.6%

10.2%

11.4%

10.3%

Note: Numbers subject to rounding

10 |

cooperstandard

EBITDA and Adjusted EBITDA Reconciliation

11

$ USD Millions

Net income

Provision (benefit) for income tax expense

EBITDA

Restructuring

Adjusted EBITDA

Twelve Months Ended Dec 31, 2012

Net interest expense

Depreciation and amortization

EBITDA and Adjusted EBITDA are Non-GAAP measures. Reference comments on slide

20 Net gain on partial sale of joint venture

(31.5)

44.8

122.7

238.8

25.8

-

298.0

Inventory fair value

-

102.8

Acquisition costs

-

Impairment charges

10.1

Payments to former CEO and transition cost

11.5

Others

-

Stock based compensation

9.8

Noncontrolling interest deferred tax valuation reversal

2.0

Note: Numbers subject to rounding |

Cooper

Standard Non-Consolidated Joint Venture Sales Joint Venture

Partner

Product

Country

Huayu-Cooper Sealing

SAIC/HASCO

Sealing

China

Nishikawa Cooper

Nishikawa Rubber

Sealing

U.S.

Nishikawa Tachaplalert Cooper

Nishikawa Rubber

Sealing

Thailand

Sujan CSF India

Magnum Elastomers

AVS

India

$ million

$2,854

$2,881

$3,175

$3,288

Non-Consolidated Sales up 27%

cooperstandard

12

Non-Consolidated JV

Sales in Asia Pacific, as reported

Sales in other regions, as reported

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

2011

2012

$2,802

$2,824

$52

$57

$321

$407 |

cooperstandard

Q4 and FY 2012 Cash Flow and Key Financial Ratios

Note: Numbers subject to rounding

Cash Balance as of December 31, 2011

$ 361.7

Cash used

(91.1)

Cash Balance as of December 31, 2012

$ 270.6

ABL Revolver

125.0

Letters of Credit

(27.0)

Total Liquidity

$ 368.6

($ USD Millions)

Q4 2012

FY 2012

Cash from business

$38.9

$204.3

Pension funding -

US

(3.3)

(30.1)

Changes in operating assets & liabilities

70.8

(89.8)

Cash from operations

106.4

84.4

Capital expenditures

(39.6)

(131.1)

Cash from (used) in operations including CAPEX

66.8

(46.7)

Acquisition of business, net cash acquired

-

(1.1)

Purchase of noncontrolling interest

(2.0)

(2.0)

Proceeds from sale of assets

5.6

14.6

Dividends –

Preferred Stock

(1.7)

(6.8)

Financing activities

1.6

(5.5)

Repurchase of preferred stock

(1.9)

(6.8)

Repurchase of common stock

(16.3)

(36.9)

Foreign exchange/other

0.7

0.1

Net cash used

$52.8

$(91.1)

•

Net leverage = $212.8 million

•

Net leverage ratio = 0.7

•

Interest coverage ratio = 6.7

•

No major debt maturity until 2018

Key Financial Ratios

13 |

cooperstandard

14

2013 Guidance

•

Sales growth: 1% to 2%

•

Capital expenditures: $150 million

-

$170 million

•

Cash restructuring: $40 million -

$50 million

•

Cash taxes: $35 million -

$45 million

Guidance assumptions:

•

North American production:

15.6 million units

•

Europe (including Russia) production:

18.7 million units

•

Average full exchange rate:

$1.25 / 1 Euro |

Questions & Answers |

cooperstandard

16

Summary

•

Complete 120 day plan

•

Align organization to support customer

•

Leverage footprint and capabilities to win global

platforms

•

Attract and retain key talent to drive growth

–

Appointed Asian and European Presidents

–

Appointed executive to oversee emerging markets

•

Continue a relentless focus on our customers

through global support and innovation |

Appendix |

cooperstandard

18

Net Leverage Ratio as of Dec 31, 2012

(1)

Includes cash and non-cash restructuring.

(2)

Proportionate

share

of

restructuring

costs

related

to

FMEA

joint

venture.

(3)

Non-cash stock amortization expense and non-cash stock option expense for

grants issued at emergence from bankruptcy. (4)

Impairment charges related to goodwill ($2.8 million) and fixed assets ($7.3

million) (5)

Executive compensation for retired CEO and recruiting costs related to search for

new CEO (6)

Noncontrolling interest deferred tax valuation reversal

Note: Numbers subject to rounding

($ USD Millions)

Three Months Ended

Twelve

Months

Ended

Mar 31,

2012

Jun 30,

2012

Sep 30,

2012

Dec 31,

2012

Dec 30,

2012

Net income

$ 23.8

$ 77.3

$ 11.6

$ (9.9)

$ 102.8

Provision for income tax expense

8.1

(46.2)

5.4

1.2

(31.5)

Interest expense, net of interest income

11.2

10.8

11.3

11.5

44.8

Depreciation and amortization

31.6

30.5

29.1

31.5

122.7

EBITDA

$ 74.7

$ 72.4

$ 57.4

$ 34.3

$ 238.8

Restructuring

(1)

6.1

(0.5)

10.2

13.0

28.8

Noncontrolling interest restructuring

(2)

(0.3)

-

(0.2)

(2.5)

(3.0)

Stock-based compensation

(3)

2.7

2.2

2.4

2.5

9.8

Impairment charges

(4)

-

-

-

10.1

10.1

Payment to former CEO and transition cost

(5)

-

-

-

11.5

11.5

Noncontrolling deferred tax valuation reversal

(6)

-

-

-

2.0

2.0

Adjusted EBITDA

$ 83.2

$ 74.1

$ 69.8

$ 70.9

$ 298.0

Net Leverage

Debt payable within one year

32.6

Long-term debt

450.8

Less: cash and cash equivalents

(270.6)

Net Leverage

212.8

Net Leverage Ratio

0.7 |

cooperstandard

19

Adjusted EBITDA as a Percent of Sales as of Dec 31,2012

Note: Numbers subject to rounding

($ USD Millions)

(1)

Includes cash and non-cash restructuring.

(2)

Proportionate

share

of

restructuring

costs

related

to

FMEA

joint

venture.

(3)

Non-cash stock amortization expense and non-cash stock option expense for

grants issued at emergence from bankruptcy. (4)

Impairment charges related to goodwill ($2.8 million) and fixed assets ($7.3

million) (5)

Executive compensation for retired CEO and recruiting costs related to search for

new CEO (6)

Noncontrolling interest deferred tax valuation reversal

Three Months Ended

Twelve

Months

Ended

Mar 31,

2012

Jun 30,

2012

Sep 30,

2012

Dec 31,

2012

Dec 30,

2012

Net income

$ 23.8

$ 77.3

$ 11.6

$ (9.9)

$ 102.8

Provision for income tax expense

8.1

(46.2)

5.4

1.2

(31.5)

Interest expense, net of interest income

11.2

10.8

11.3

11.5

44.8

Depreciation and amortization

31.6

30.5

29.1

31.5

122.7

EBITDA

$ 74.7

$ 72.4

$ 57.4

$ 34.3

$ 238.8

Restructuring

(1)

6.1

(0.5)

10.2

13.0

28.8

Noncontrolling interest restructuring

(2)

(0.3)

-

(0.2)

(2.5)

(3.0)

Stock-based compensation

(3)

2.7

2.2

2.4

2.5

9.8

Impairment charges

(4)

-

-

-

10.1

10.1

Payment to former CEO and transition cost

(5)

-

-

-

11.5

11.5

Noncontrolling

deferred

tax

valuation

reversal

(6)

-

-

-

2.0

2.0

Adjusted EBITDA

$ 83.2

$ 74.1

$ 69.8

$ 70.9

$ 298.0

Sales

765.3

734.5

684.0

697.1

2,880.9

Adjusted EBITDA as a percent of Sales

10.9%

10.1%

10.2%

10.2%

10.3% |

cooperstandard

Non-GAAP Financial Measures

20

EBITDA and adjusted EBITDA are measures not recognized under Generally

Accepted Accounting Principles (GAAP) which exclude certain non-cash and

non- recurring items.

When analyzing the company’s operating performance, investors should use

EBITDA and adjusted EBITDA in addition to, and not as alternatives for, net

income (loss), operating income, or any other performance measure derived in

accordance with GAAP, or as an alternative to cash flow from operating

activities as a measure of the company’s performance. EBITDA and

adjusted EBITDA have limitations as analytical tools and should not be

considered in isolation or as substitutes for analysis of the company’s

results of operations as reported under GAAP. Other companies may report

EBITDA and adjusted EBITDA differently and therefore Cooper Standard’s

results may not be comparable to other similarly titled measures of other

companies. |