Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SEALED AIR CORP/DE | d492553d8k.htm |

SEALED AIR CORPORATION

JP Morgan Global High Yield and Leveraged Finance Conference

February 25, 2013

Carol P. Lowe –

Senior Vice President & Chief Financial Officer

Tod S. Christie -

Treasurer

Exhibit 99.1 |

Safe

Harbor and Regulation G Statement 1

•

This presentation contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements can be

identified by such words as “anticipates,” “believes,” “plan,”

“assumes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans to,” “will” and similar expressions.

Examples of these forward-looking statements include 2013 financial expectations and assumptions

associated with our 2011-2014 Integration & Optimization Program, availability and

pricing of raw materials, success of our growth programs, economic conditions, and the success

of pricing actions. These statements reflect our beliefs and expectations as to future events

and trends affecting our business, our consolidated financial position and our results of

operations. A variety of factors may cause actual results to differ materially from these

expectations, including general domestic and international economic and political conditions

affecting packaging utilization; changes in our raw material and energy costs; credit ratings;

competitive conditions and contract terms; currency translation and devaluation effects,

including Venezuela; the success of our financial growth, profitability and manufacturing

strategies and our cost reduction and productivity efforts; the effects of animal and

food-related health issues; pandemics; environmental matters; regulatory actions and legal

matters; and the successful integration of Diversey. For more extensive information, see

“Risk Factors” and “Cautionary Notice Regarding Forward-Looking Statements,”

which appear in our most recent Annual Report on Form 10-K, as filed with the Securities

and Exchange Commission, and as revised and updated by our Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K. While we may elect to update these forward-looking

statements at some point in the future, we specifically disclaim any obligation to do so,

whether as a result of new information, future events, or otherwise.

•

Our management uses non-U.S. GAAP financial measures to evaluate the Company’s performance,

which exclude items we consider unusual or special items. We believe the use of such financial

measures and information may be useful to investors. We believe that the use of non-U.S.

GAAP measures helps investors to gain a better understanding of core operating results and

future prospects, consistent with how management measures and forecasts the Company's

performance, especially when comparing such results to previous periods or forecasts. For

important information on our use of non-U.S. GAAP financial measures and information,

including reconciliations of such non-U.S. GAAP financial measures and information to

comparable U.S. GAAP measures and information, please refer to the financial tables and information

provided in our earnings release. |

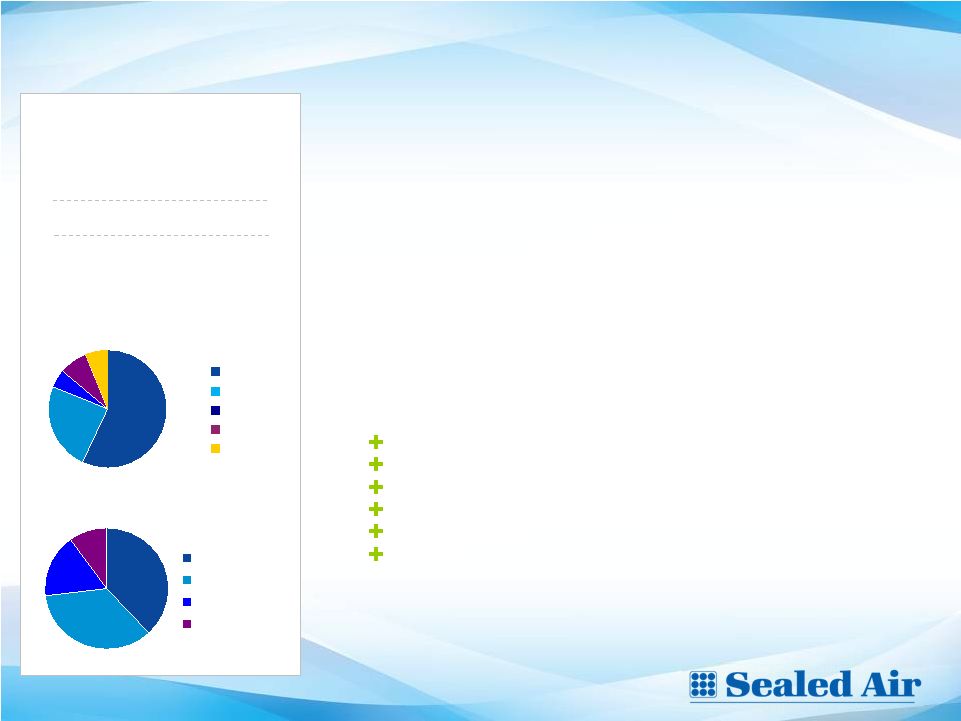

Premium global provider with #1 or #2 position in our principal

applications

2

(1)

Please see Sealed Air’s February 19, 2013 earnings press release for a

definition of developing regions. •

Food and Beverage (F&B)

–

Food Packaging and Food Solutions businesses, along with Diversey food and

beverage hygiene solutions business •

Protective Packaging (PP)

–

Protective Packaging and Specialty Materials (formerly part of Other)

•

Institutional and Laundry (I&L)

–

Building services, food service, health care, hospitality and retail markets

•

Medical Applications and New Ventures (Other category)

•

Geographic Reporting structure

–

North America

–

Europe

–

Latin America

–

AMAT (Asia, Middle East, Africa and Turkey)

–

Japan and Australia/New Zealand

49% F&B

28% I&L

21% PP

2% Other

Diversified Revenue

Geographical Reach

39% N. Am

33% Europe

11% L. Am

10% AMAT

7%

Japan/ANZ

24% Developing

regions

(1)

$7.6B |

3

2013: Focus on Quality of Earnings

•

Improving Profitability

–

Pricing Discipline

–

Deliver cost synergies and manage cost structure

•

Resource Prioritization

–

Repayment of debt

–

Dividends

–

R&D productivity

•

Alignment of Management Goals

–

Productivity: Support expenses measured in

relation to profitability –

Achieving Plan: Adjusted EBITDA

–

Cash Flow: Reduced investment in working

capital 3 |

4

Food & Beverage: Value Creation In Operations and Downstream

•

We protect customers’

products from farm to fork

and add value through operational efficiency and

waste reduction

•

Distinct Competitive Advantages:

Focused on food safety, shelf life extension, brand enhancement

and operational efficiency

Breadth to address hygiene, water/energy management, packaging

and integrated solutions

Only provider with a total system solution

Long-standing relationships and large installed equipment base

Global footprint serves multi-national & local customers

Solutions designed for operational efficiency & lower waste

Fast Facts

$50B global industry with

2-3% p.a. growth rate (‘11-‘16)

#1 position in targeted app’s

2012 SNAPSHOT

Sales: $3.7B

Sales Mix by Geography:

Sales Mix by End Sector:

N. Am

Europe

L. Am

AMAT

J/ANZ

40%

28%

14%

6%

12%

*FM=Fresh meat (all types); S&P=Smoked & Processed; Other: Microwavable meals, Fluids;

C&H=Cleaning & Hygiene. All include their related equipment sales.

42%

15%

10%

15%

19%

FM*

S&P*

Dairy

Other*

C&H* |

5

Food & Beverage: Achieved Volume and Margin Improvement

•

•

Hygiene Sales Organic Growth: 5.6%

•

Food Pkg. & Sol. Org. Growth: 1.7%

•

•

Hygiene Sales Organic Growth: 4.1%

•

Food Pkg. & Sol. Org. Growth: 2.1%

•

•

•

•

Food and Beverage

Net Sales Trends

Net Sales ($M)

Adj. EBITDA ($M)

172

259

547

Q4 2011

978

175

247

564

Q4 2012

986

PF Net Sales ($M)

PF Adj. EBITDA ($M)

3740

708

3777

2053

987

2061

1015

690

14.3%

15.6%

154

139

534

527

14.3%

14.0%

2011

2012

2011

2012

Hygiene

Food

Solutions

Food

Packaging

Q4 Net Sales: +2.4% organic growth

2012 Net Sales: +2.4% organic growth

Q4

Adjusted

EBITDA

growth

of

10.4%

2012 FY Pro Forma Adjusted EBITDA growth

of 1.3%

Largest

growth

drivers:

Developing

regions:

Brazilian

beef

production,

new

products

Challenges:

North

American

protein

supply

constraints,

product

mix

Q4 2011

Q4 2012

Please see Sealed Air’s February 19, 2013 earnings press release for important information about

the use of non-U.S. GAAP financial measurers, including applicable reconciliations to U.S.

GAAP financial measures.

All results are on a continuing operations

basis. |

6

Institutional & Laundry: Reducing the “Total Cost to Clean”

•

Provide innovative, integrated cleaning, hygiene,

food safety and infection prevention solutions

•

Focused on growth in five sectors

•

Distinct Competitive Advantages:

Cost savings through operational efficiencies and Integrated

solutions

Market leadership in Europe & developing regions (80% of sales)

Global footprint serves multi-national & local customers,

Building service contractor sector dominance

Integrated Floor care Solutions ( Machines, Cleaning tools &

Chemicals) -

TASKI

®

Industry and Application expertise to ensure adherence to

protocols, optimal use of resources (water, effluence, energy),

Strong Distributor relationships

Emerging Markets leadership

Fast Facts

$30B global industry with

2-3% p.a. growth rate (‘11-‘16)

#1, #2 position

globally, #1 in

floor care solutions 2012 Snapshot

Sales: $2.1B

Sales Mix by Geography:

Sales Mix by End Sector:

11%

12%

11%

12%

9%

10%

33%

BSC**

Food Svc

Retail

Lodging

Hlthcare

Other

Distrib

Facility

Management &

BSC

Retailers

Hospitality

Food Service

Healthcare

**BSC=Building Service Contractors

25%

45%

9%

18%

3%

N. Am

Europe

L. Am

AMAT

Japan/ANZ |

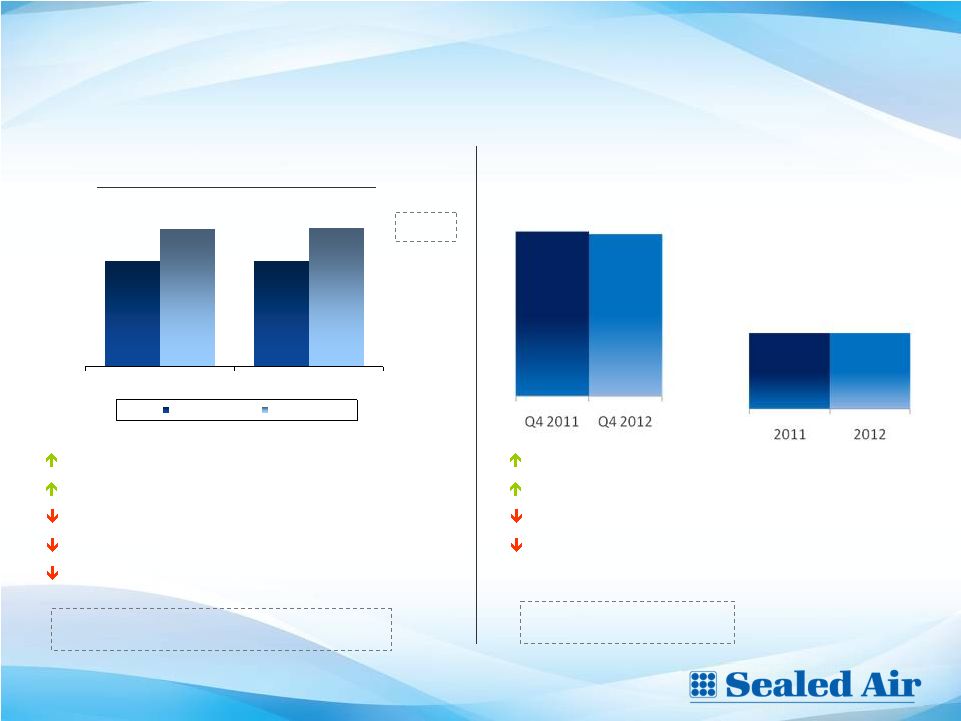

7

Institutional and Laundry: Adjusted EBITDA and Margin Improvement

•

Q4 Net Sales: -0.1%; +2.3% organic growth

•

+1.6% price/mix

•

+0.7% volume

•

2012 Net Sales: -4.5%, +0.2% organic growth:

•

+2.2% price/mix

•

-2.0% volume

•

Q4 Adjusted EBITDA growth of 9.1%

•

2012 FY Pro Forma Adjusted EBITDA decline

of -10.5%

•

•

Institutional & Laundry

Net Sales Trends

Please see Sealed Air’s February 19, 2013 earnings press release for important

information about the use of non-U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures. All

results are on a continuing operations basis. Net Sales ($M)

534

Adj. EBITDA ($M)

PF Net Sales ($M)

PF Adj. EBITDA ($M)

196

219

7.2%

7.9%

9.8%

9.2%

Q4 2011

Q4 2012

Q4 2011

Q4 2012

2232

2132

2011

2012

534

2011

2012

Challenges

:

Europe

–

Gov’t/Educ.,

Consumer

Brands, and Building Service contractors due to lower

equipment orders, Southern Europe

Largest

Growth

Drivers:

New

customers

in

China/India and Brazil/Mexico, New healthcare business

39

42 |

8

Protective Packaging: Focused on Sustainable & Efficient Delivery

•

Packaging solutions that provide efficiency and

sustainability from factory floor to the customer’s

door

•

Revenue mix by channel:

–

~80%

via

business

supply

distributors

–

sold

to

businesses

representing 400+ SIC codes (largely industrial use)

–

~15% direct (OEMs, E-commerce, Fulfillment firms)

–

~5% at retailers

•

Distinct Competitive Advantages:

Innovative: market and technical leadership

Broadest, high performance, sustainable solutions offer

Total system: operational efficiency, ease of use, less waste

Unparalleled customer support: sales, service, design labs

Strong channel partnerships

Global footprint for multi-national and local customers

Fast Facts

$18B global industry with

~3% p.a. growth rate (‘11-‘16)

Leader in targeted applications

2012 SNAPSHOT

Sales: $1.6B

Sales Mix by Geography:

Sales Mix by End Sector:

38%

35%

17%

10%

Cushioning

Core*

Shrink

Pack Sys*

*Core=Bubblewrap, PakNatural loose fill, Jiffy mailers; Pack Sys=NewAir IB,

PriorityPak, Fill-Air, FilTeck, PackTiger, FasFil EZ, RapidFill 57%

24%

5%

8%

6%

N. Am

Europe

L. Am

AMAT

Japan/ANZ |

9

Protective Packaging: Gains in Adjusted EBITDA and Margin

•

Q4 Net Sales: +0.6%; 1.5% organic growth

•

2.6% volume

•

(1.1)% price/mix

•

2012 Net Sales: -1.1%; 1.4% organic growth

•

1.4% volume

•

-0.2% price/mix

•

Q4 Adjusted EBITDA growth of 4.2%

•

2012 FY Adjusted EBITDA growth of 1.4%

•

Largest

growth

drivers:

E-commerce

application systems in North America, and new

customers

•

Challenges:

Competitive pricing environment

with not all market participants seeking raw material

cost recovery. Pricing actions in place for 1H 2013.

Protective Packaging Segment

Net Sales Trends

Net Sales ($M)

Adj. EBITDA ($M)

PF Net Sales ($M)

Adj. EBITDA ($M)

Please see Sealed Air’s February 19, 2013 earnings press release for important information about

the use of non-U.S. GAAP financial measurers, including applicable reconciliations to U.S.

GAAP financial measures.

All results are on a continuing operations

basis. |

10

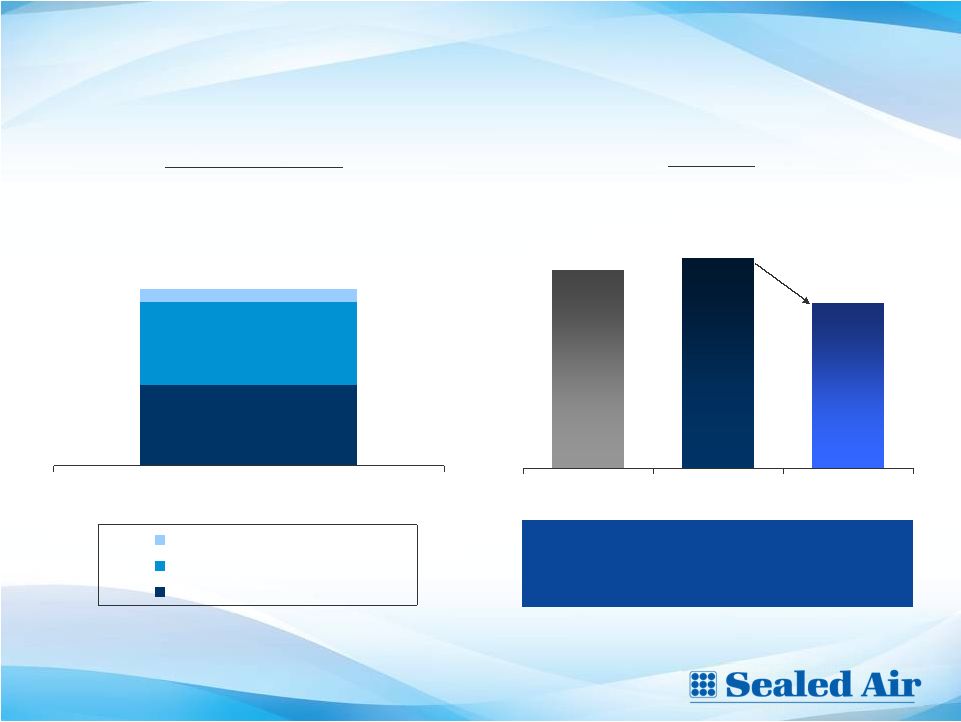

Consolidated Adjusted EBITDA Performance

Fourth Quarter 2012

229

229

267

269

Actual

Constant Dollar

Q4 2011

Q4 2012

Cost synergies

Volume

Price Cost Spread

SG&A Expenses

Currency

($ in millions)

Q4-12 YEAR-OVER-YEAR

Adjusted

EBITDA

Performance

Volume

Synergies

Currency

SG&A Expenses

Reported U.S. GAAP Net Earnings/(Loss):

Q4-2012: $174M, Q4-2011: $(60)M, 3Q-2012: $74M

11.7%

13.5%

11.7%

+17%

13.5%

13.5%

7785

7648

13.5%

13.5%

996

996

Reported U.S. GAAP Net Sales:

2011: $5.6B, 2012: $7.6B

12.8%

13.0%

2012

PF Net Sales ($M)

2012

PF Adj. EBITDA ($M)

Please see Sealed Air’s February 19, 2013 earnings press release for important information about

the use of non-U.S. GAAP financial measurers, including applicable reconciliations to U.S.

GAAP financial measures.

All results are on a continuing operations

basis. |

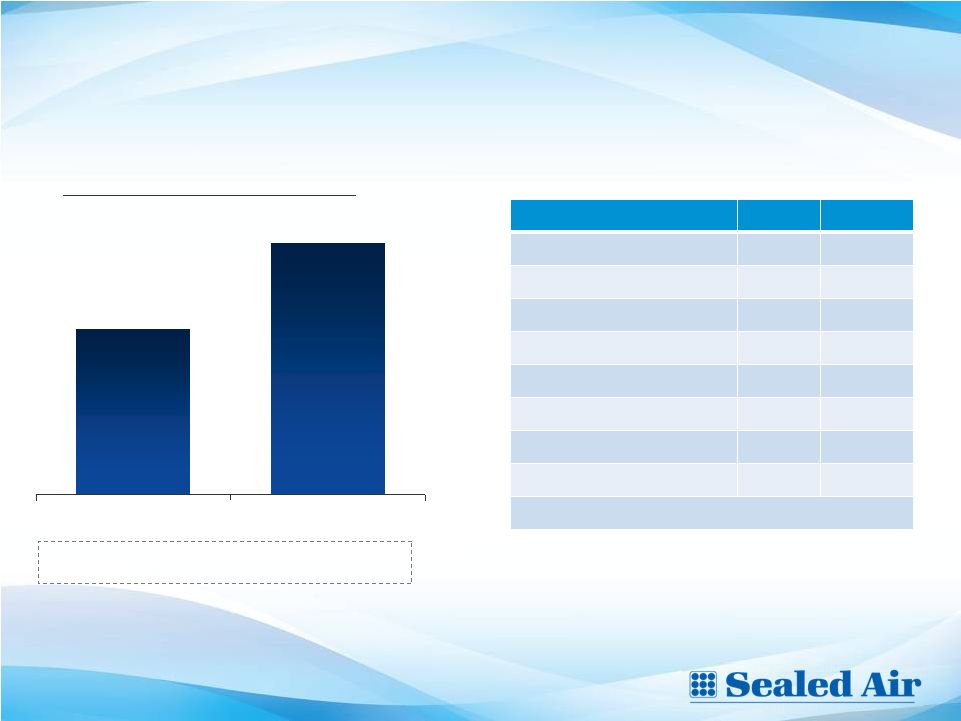

11

11

Adjusted Free Cash Flow and Working Capital

($ in millions)

266

405

4Q-2012

YTD

Free Cash Flow Performance

Reported U.S. GAAP Net Income:

Q4 2012

$(11)M (Loss) YTD-2012 = $(1.3)B

* Working

Capital

includes

the

impact

of

foreign

currency

translation

and

is

defined

as

Trade

Accounts

Receivable,

Inventory

and

Trade

Accounts

Payable.

Please see Sealed Air’s February 19, 2013 earnings press release for important

information about the use of non-U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures. All

results are on a continuing operations basis. Adjusted Free Cash Flow

Q412

2012

Adjusted Net Earnings

$ 69.9

$ 200.5

Amortization of Intangibles

25.2

97.7

Non-cash Interest & Taxes

94.2

103.0

Depreciation and Amortization

12.6

170.1

Capital Expenditures

(26.6)

(124.4)

Changes in Working Capital*

91.0

(41.8)

Adjusted Free Cash Flow

$ 266.3

$ 405.1

*Currency impact on FY working capital: $(14) |

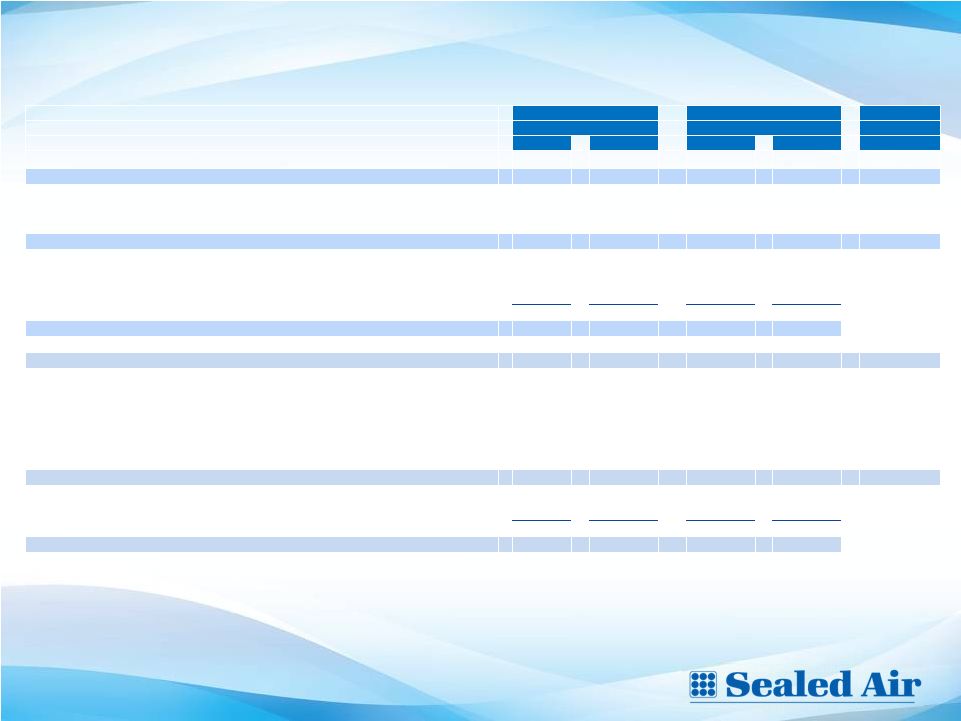

680

700

112

December 2012

AR Securitization

Revolving Credit Facility

Cash & Cash Equivalents

12

12

Liquidity & Net Debt

($ in millions)

Liquidity Position

1,492

5,262

5,131

4,779

Dec 2011

Sept 2012

Dec 2012

Net Debt

Full year net debt reduction includes

use of $313 million from proceeds of

Diversey Japan

(483)

Please see Sealed Air’s February 19, 2013 earnings press release for important information

about the use of non-U.S. GAAP financial measurers, including applicable reconciliations to

U.S. GAAP financial measures.

All results are on a continuing operations

basis. |

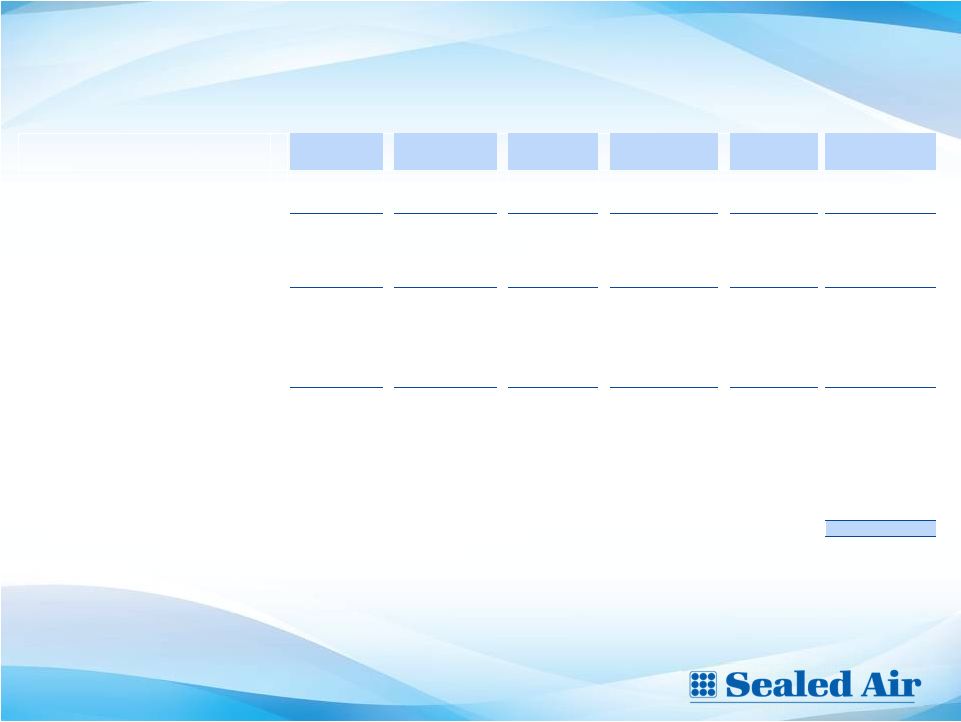

13

Q4 Actions have amended covenants to provide ample flexibility

and have extended our maturity schedule

330

408

400

750

425

750

450

925

8

150

760

150

2013

2014

2015

2016

2017

2018

2019

2020

2021

2033

= Senior Secured Credit Facilities (term loans) = $1.655B

= W.

R.

Grace

Settlement

**

= Bonds (associated interest rate) =

$2.925B Updated Debt Maturity Schedule*

($ millions)

12.0%

7.875%

8.125%

8.375%

6.875%

* For more detail, please see Sealed Air’s Form 8-K filing dated

11/19/2012 **Reflects estimated cash liability at December 31, 2013. Exact

timing of the settlement is unknown. 6.5%

Updated

Covenant:

Net

Total

Leverage

Ratio*

(fiscal

year

ending

December

31

st

)

2012

2013

2014

2015

2016+

5.50

5.25

4.50

3.75

3.25

Weighted average interest rate

Is approx. 6.4% |

FY2013 Outlook

•

Management estimates achieving the following full year results:

–

Net Sales between approximately $7.7 billion and $7.9 billion

–

Adjusted EBITDA between approximately $1.01 billion and $1.03 billion

–

Earnings Per Share between approximately $1.10 and $1.20 per share

–

Free Cash Flow approximately $300 million to $350 million

•

Compares with $280 million in 2012

14

Adjusted EPS guidance excludes the payment of the W. R. Grace settlement, as the

exact timing of the settlement is unknown. Final payment of the W. R.

Grace settlement is expected to be accretive to adjusted EPS by approximately $0.13 annually following the payment date under

the assumption of using a substantial portion of cash on hand for the payment and

ceasing to accrue interest on the settlement amount. Additionally,

guidance excludes any non-operating gains or losses that may be recognized in 2013 due to currency fluctuations in Venezuela.

Please see Sealed Air’s February 19, 2013 earnings press release for important information about

the use of non-U.S. GAAP financial measurers, including applicable reconciliations to U.S.

GAAP financial measures.

All results are on a continuing operations

basis. |

SEALED AIR CORPORATION

Earnings Conference Call

Fourth Quarter 2012

Q&A

Please see Sealed Air’s February 19, 2013 earnings press release for important information about

the use of non-U.S. GAAP financial measurers, including applicable reconciliations to U.S.

GAAP financial measures.

All results are on a continuing operations

basis. |

SEALED AIR CORPORATION

Earnings Conference Call

Fourth Quarter 2012

Appendix

Please see Sealed Air’s February 19, 2013 earnings press release for important information about

the use of non-U.S. GAAP financial measurers, including applicable reconciliations to U.S.

GAAP financial measures.

All results are on a continuing operations

basis. |

2012

Adjusted EPS Calculation 17

2012

Net Sales

$ 7,648

Adjusted EBITDA

996.0

Interest expense

(385.0)

Depreciation and amortization

(321.0)

Non-cash profit sharing

(1)

(18.9)

Adjusted Pre-tax Earnings

271.1

Core income tax provision

26.1%

Core income taxes

70.7

Adjusted Net Earnings

200.4

Diluted shares outstanding

211.2

Adjusted EPS

$

0.95

Reported U.S. GAAP Measures (from Continuing Operations):

2012 Net Sales: $7.6B, Operating Loss: $(0.8)B; Net Loss $(1.3)B

(1)

Contributions to be made in Sealed Air common stock

Please see Sealed Air’s February 19, 2013 earnings press release for important information about

the use of non-U.S. GAAP financial measurers, including applicable reconciliations to U.S.

GAAP financial measures.

All results are on a continuing operations

basis. |

Q4

2012 Adjusted EBITDA Bridge 18

229

-11

17

35

-22

7

12

267

($ millions)

Please see Sealed Air’s February 19, 2013 earnings press release for important

information about the use of non-U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures. All

results are on a continuing operations basis. Q4 2011

Volume

Price-Cost

Spread

Synergies

SG&A

SARs

Other

Q4 2012 |

Reconciliation of US GAAP Gross Profit and Operating Profit To

Non U.S. GAAP Adjusted Gross Profit and Operating Profit

19

Three Months Ended

Year Ended

Year Ended

($ in millions)

December 31,

December 31,

December 31,

2012

2011

2012

2011

2011

Revised

(2)

Revised

(2)

Pro Forma

(3)

U.S.

GAAP

gross

profit

-

continuing

operations

$

651.3

$

631.4

$

2,544.3

$

1,600.3

$

2,616.0

As a % of total net sales

32.9%

32.2%

33.3%

28.8%

33.6%

Segment special items

(4)

7.4

15.9

18.0

16.4

5.0

Non-U.S.

GAAP

adjusted

gross

profit

-

continuing

operations

$

658.7

$

647.3

$

2,562.3

$

1,616.7

$

2,621.2

As a % of total net sales

33.3%

33.0%

33.5%

29.1%

33.7%

Gross profit from discontinued operations

18.8

40.9

114.0

40.9

Total non-U.S. GAAP adjusted gross profit

$

677.5

$

688.2

$

2,676.3

$

1,657.6

U.S.

GAAP

operating

profit

-

continuing

operations

$

118.2

$

47.5

$

(881.2)

$

429.4

$

596.0

Special items:

Restructuring charges

32.3

52.4

142.4

52.2

53.4

Costs related to the acquisition and integration of Diversey

2.6

34.1

7.4

64.8

-

Segment special items

(5)

38.1

24.2

1,397.1

24.2

31.1

Non-U.S.

GAAP

adjusted

operating

profit

-

continuing

operations

$

191.2

$

158.2

$

665.7

$

570.6

$

680.5

9.7%

8.1%

8.7%

10.3%

8.7%

Operating profit from discontinued operations

8.2

17.9

34.2

17.9

Total non-U.S. GAAP adjusted operating profit

$

199.4

$

176.1

$

699.9

$

588.5

As a % of total net sales

10.1%

9.0%

9.2%

10.6%

The Company is working to finalize its goodwill and other intangible assets

impairment analysis prior to the filing of its Annual Report on Form

10-K for the year ended December 31, 2012, and as a result may incur additional impairment

charges

(4) For 2012, these items primarily consist of costs associated with our 2011 - 2014 Integration

and Optimization program, including asset impairment charges in 2012. For 2011, these items primarily consist of the step-up in inventories as a result the purchase accounting for the

acquisition of Diversey. These items are not part of our on-going business and are not expected to

have a continuing impact on our consolidated results. (5) For 2012, these items are certain one-time costs that were included in our segments' operating

results. For 2012, these items primarily include the impairment charges recorded for impairment of goodwill and other intangible assets and in-process research and development. For

2011, these costs primarily include the step-up in inventories mentioned above and costs related to

the implementation of our European principal company structure. These items are not part of our ongoing business and are not expected to have a continuing impact on our

consolidated results.

The amounts presented for 2012 are subject to change prior to the filing of our upcoming Annual Report

on Form 10-K. In November 2012, we sold our Diversey Japan business. The financial results of the Diversey Japan

business are reported as discontinued operations, and, accordingly all previously reported financial information has been revised.

The pro forma information included in this supplemental information consist of estimates based on

historical data of Diversey and illustrate the effects of our acquisition of Diversey, assuming it had been completed on January 1, 2011. The unaudited pro forma results are not

necessarily indicative of the results of operations that would have actually occurred had the

acquisition been completed as of that date, nor are they indicative of future operating results of the combined company. The pro forma results reflect adjustments made in accordance with

Article 11 of Regulation S-X. We have changed certain estimates and assumptions supporting the pro

forma information to reflect the sale of the Diversey Japan business, the refinement of estimates and assumptions related to the amortization of acquired intangible assets,

additional policy harmonization and foreign currency exchange rates.

(1)

(2)

(3) |

Revised Segment and Consolidated Adjusted Operating Profit and

Adjusted EBITDA

(1)(2)

Three Months Ended March 31, 2012

Food & Beverage

Institutional

& Laundry

Protective

Packaging

Medical Applications

and New Ventures

Restructuring

and other costs

Total Segments

and Other

Net Sales

$

895.1

$ 510.2

$ 391.3

$

48.8 NA

$

1,845.4 Operating profit

$

82.3

$

(0.7)

$ 50.9

$

(0.6)

$

(48.8)

$

83.1 Add:

Business

segment

special

items

(3)

2.4

5.5

0.1

-

48.8

56.8

Adjusted operating profit

84.7

4.8

51.0

(0.6)

-

139.9

as a % of net sales

9.5%

0.9%

13.0%

-1.2%

7.6%

Depreciation and amortization

41.4

30.7

9.7

2.7

NA

84.5

Segment and Other Adjusted EBITDA

$

126.1

$ 35.5

$

60.7

$

2.1

$

-

$

224.4 as a % of net sales

14.1%

7.0%

15.5%

4.3%

12.2%

Segment and Other Adjusted EBITDA

$

224.4 Non-cash profit sharing

expense 7.8

Other income and expense

(4.0)

Add:

Other

special

items

(4)

0.2

Consolidated Adjusted EBITDA

$

228.4 as a % of net sales

12.4%

20

The Company is working to finalize its goodwill and other intangible assets

impairment analysis prior to the filing of its Annual Report on Form

10-K for the year ended December 31, 2012, and as a result may incur additional impairment

charges

During the fourth quarter of 2012, we began to operate under a new business division structure for our

segment reporting structure. The new segment reporting structure consists of three global business

divisions: Food & Beverage, Institutional & Laundry, Protective Packaging and an

“Other” category, which includes our Medical Applications and New Ventures businesses. This new structure replaced our

legacy seven business unit structure and Diversey's legacy four region-based structure. The changes

to the segment structure have no effect on the historical consolidated results of operations. Prior period

segment results have been conformed to the new segment presentation. In November 2012,

we sold our Diversey Japan business. The financial results of the Diversey Japan business are reported as discontinued operations, and, accordingly all previously reported financial

information has been revised. (3) These special

items consist of certain one-time costs or charges that were included in our segments' operating results, including non-cash impairment charges recorded for impairment of goodwill and

other intangible assets and in-process research and development. These special items also include

costs associated with our 2011 - 2014 Integration and Optimization Program.

(4) These special items primarily consist of certain one-time costs or charges that were included in

other income and expense on our consolidated statements of operations, including an other-than-temporary

impairment on one of our equity method investments in a joint venture

(1)

(2)

(3)

(4)

50.9 |

Revised Segment and Consolidated Adjusted Operating Profit and

Adjusted EBITDA

(1)(2)

Three Months Ended June 30, 2012

Food & Beverage

Institutional

& Laundry

Protective

Packaging

Medical Applications

and New Ventures

Restructuring

and other costs

Total Segments

and Other

Net Sales

$ 922.6

$ 560.5

$ 390.8

$

50.7 NA

$

1,924.6 Operating profit

$

69.9

$ 20.9

$

46.7

$

(1.0)

$

(28.0)

$

108.5 6.0

7.4

0.4

-

28.0

41.8

Adjusted operating profit

75.9

28.3

47.1

(1.0)

-

150.3

as a % of net sales

8.2%

5.0%

12.1%

-2.0%

7.8%

Depreciation and amortization

36.5

32.4

9.5

2.7

NA

81.1

Segment and Other Adjusted EBITDA

$ 112.4

$ 60.7

$

56.6

$

1.7

$

-

$

231.4 as a % of net sales

12.2%

10.8%

14.5%

3.4%

12.0%

Segment and Other Adjusted EBITDA

$

231.4 Non-cash profit sharing

expense 1.8

Other income and expense

(29.2)

Add: Other special items

23.6

Consolidated Adjusted EBITDA

$

227.6 as a % of net sales

11.8%

21

(1)

During

the

fourth

quarter

of

2012,

we

began

to

operate

under

a

new

business

division

structure

for

our

segment

reporting

structure.

The

new

segment

reporting

structure

consists

of

three

global

business

divisions:

Food

&

Beverage,

Institutional

&

Laundry,

Protective

Packaging

and

an

“Other”

category,

which

includes

our

Medical

Applications

and

New

Ventures

businesses.

This

new

structure

replaced

our

legacy

seven

business

unit

structure

and

Diversey's

legacy

four

region-based

structure.

The

changes

to

the

segment

structure

have

no

effect

on

the

historical

consolidated

results

of

operations.

Prior

period

segment

results

have

been

conformed

to

the

new

segment

presentation.

(2)

In November 2012, we sold our Diversey Japan business. The financial results of the

Diversey Japan business are reported as discontinued operations, and, accordingly all previously reported financial information has been revised.

(3)

(3) These special items consist of certain one-time costs or charges that were

included in our segments' operating results, including non-cash impairment charges recorded for impairment of goodwill and other intangible assets and in-

(4)

(4) These special items primarily consist of certain one-time costs or charges

that were included in other income and expense on our consolidated statements of operations, including an other-than-temporary impairment on one of our

equity method investments in a joint venture

The Company is working to finalize its goodwill and other intangible assets

impairment analysis prior to the filing of its Annual Report on Form

10-K for the year ended December 31, 2012, and as a result may incur additional impairment

charges

process research and development. These special items also include costs associated with our 2011 -

2014 Integration and Optimization Program. (3)

(4)

Add: Business segment special items |

Revised Segment and Consolidated Adjusted Operating Profit and

Adjusted EBITDA

(1)(2)

Three Months Ended September 30, 2012

Food & Beverage

Institutional

& Laundry

Protective

Packaging

Medical Applications

and New Ventures

Restructuring

and other costs

Total Segments

and Other

Net Sales

$ 935.5

$ 527.2

$ 388.9

$

48.7 NA

$

1,900.3 Operating profit

$ (228.1)

$ (976.1)

$

52.9

$

(1.6)

$

(38.1)

$

(1,191.0) Add:

Business

segment

special

items

334.9

1,001.2

1.0

0.1

38.1

1,375.3

Adjusted operating profit

106.8

25.1

53.9

(1.5)

-

184.3

as a % of net sales

11.4%

4.8%

13.9%

-3.1%

9.7%

Depreciation and amortization

34.9

32.6

10.4

4.3

NA

82.2

Segment and Other Adjusted EBITDA

$ 141.7

$ 57.7

$

64.3

$

2.8

$

-

$

266.5 as a % of net sales

15.1%

10.9%

16.5%

5.7%

14.0%

Segment and Other Adjusted EBITDA

$

266.5 Non-cash profit sharing

expense 4.7

Other income and expense

1.2

Add:

Other

special

items

0.5

Consolidated Adjusted EBITDA

$

272.9 as a % of net sales

14.4%

22

(1)

During

the

fourth

quarter

of

2012,

we

began

to

operate

under

a

new

business

division

structure

for

our

segment

reporting

structure.

The

new

segment

reporting

structure

consists

of

three

global

business

divisions:

Food

&

Beverage,

Institutional

&

Laundry,

Protective

Packaging

and

an

“Other”

category,

which

includes

our

Medical

Applications

and

New

Ventures

businesses.

This

new

structure

replaced

our

legacy

seven

business

unit

structure

and

Diversey's

legacy

four

region-based

structure.

The

changes

to

the

segment

structure

have

no

effect

on

the

historical

consolidated

results

of

operations.

Prior

period

segment

results

have

been

conformed

to

the

new

segment

presentation.

(2)

In November 2012, we sold our Diversey Japan business. The financial results of the

Diversey Japan business are reported as discontinued operations, and, accordingly all previously reported financial information has been revised.

(3)

(3) These special items consist of certain one-time costs or charges that were

included in our segments' operating results, including non-cash impairment charges recorded for impairment of goodwill and other intangible assets and in-

(4)

(4) These special items primarily consist of certain one-time costs or charges

that were included in other income and expense on our consolidated statements of operations, including an other-than-temporary impairment on one of our

equity method investments in a joint venture

The Company is working to finalize its goodwill and other intangible assets

impairment analysis prior to the filing of its Annual Report on Form

10-K for the year ended December 31, 2012, and as a result may incur additional impairment

charges

process research and development. These special items also include costs associated with our 2011 -

2014 Integration and Optimization Program. (3)

(4) |

Revised Segment and Consolidated Adjusted Operating Profit and

Adjusted EBITDA

(1)(2)

Three Months Ended December 31, 2012

Food & Beverage

Institutional

& Laundry

Protective

Packaging

Medical

Applications

and New Ventures

Restructuring

and other costs

Total Segments

and Other

Net Sales

$ 986.4

$ 533.6

$ 407.4

$

50.4 NA

$

1,977.8 Operating profit

$ 114.8

$

3.6

$ 57.0

$

(22.3)

$

(34.9)

$

118.2 Add:

Business

segment

special

items

9.7

6.8

1.9

19.7

34.9

73.0

Adjusted operating profit

124.5

10.4

58.9

(2.6)

-

191.2

as a % of net sales

12.6%

1.9%

14.5%

-5.2%

9.7%

Depreciation and amortization

29.4

31.6

8.7

3.4

NA

73.1

Segment and Other Adjusted EBITDA

$ 153.9

$ 42.0

$

67.6

$

0.8

$

-

$

264.3 as a % of net sales

15.6%

7.9%

16.6%

1.6%

13.4%

Segment and Other Adjusted EBITDA

$

264.3 Non-cash profit sharing

expense 4.6

Other income and expense

(38.2)

Add:

Other

special

items

36.2

Consolidated Adjusted EBITDA

$

266.9 as a % of net sales

13.5%

23

(1)

During

the

fourth

quarter

of

2012,

we

began

to

operate

under

a

new

business

division

structure

for

our

segment

reporting

structure.

The

new

segment

reporting

structure

consists

of

three

global

business

divisions:

Food

&

Beverage,

Institutional

&

Laundry,

Protective

Packaging

and

an

“Other”

category,

which

includes

our

Medical

Applications

and

New

Ventures

businesses.

This

new

structure

replaced

our

legacy

seven

business

unit

structure

and

Diversey's

legacy

four

region-based

structure.

The

changes

to

the

segment

structure

have

no

effect

on

the

historical

consolidated

results

of

operations.

Prior

period

segment

results

have

been

conformed

to

the

new

segment

presentation.

(2)

In November 2012, we sold our Diversey Japan business. The financial results of the

Diversey Japan business are reported as discontinued operations, and, accordingly all previously reported financial information has been revised.

(3)

(3) These special items consist of certain one-time costs or charges that were

included in our segments' operating results, including non-cash impairment charges recorded for impairment of goodwill and other intangible assets and in-

(4)

(4) These special items primarily consist of certain one-time costs or charges

that were included in other income and expense on our consolidated statements of operations, including an other-than-temporary impairment on one of our

equity method investments in a joint venture

The Company is working to finalize its goodwill and other intangible assets

impairment analysis prior to the filing of its Annual Report on Form

10-K for the year ended December 31, 2012, and as a result may incur additional impairment

charges

process research and development. These special items also include costs associated with our 2011 -

2014 Integration and Optimization Program. (3)

(4)

57.0 |

Revised Segment and Consolidated Adjusted Operating Profit and

Adjusted EBITDA

(1)(2)

Year Ended December 31, 2012

Food & Beverage

Institutional

& Laundry

Protective

Packaging

Medical

Applications

and New Ventures

Restructuring and

other costs

Total Segments

and Other

Net Sales

$ 3,739.6

$ 2,131.5

$ 1,578.4

$

198.6 NA

$

7,648.1 Operating profit

$

38.9 $ (952.3)

$ 207.5

$

(25.5)

$ (149.8)

$

(881.2) Add:

Business

segment

special

items

(3)

353.0

1,020.9

3.4

19.8

149.8

1,546.9

Adjusted operating profit

391.9

68.6

210.9

(5.7)

-

665.7

as a % of net sales

10.5%

3.2%

13.4%

-2.9%

8.7%

Depreciation and amortization

142.2

127.3

38.3

13.1

NA

320.9

Segment and Other Adjusted EBITDA

$ 534.1

$ 195.9

$ 249.2

$

7.4

$

-

$

986.6 as a % of net sales

14.3%

9.2%

15.8%

3.7%

12.9%

Segment and Other Adjusted EBITDA

$

986.6 Non-cash profit sharing

expense 18.9

Other income and expense

(70.2)

Add:

Other

special

items

(4)

60.5

Consolidated Adjusted EBITDA

$

995.8 as a % of net sales

13.0%

24

(1)

During

the

fourth

quarter

of

2012,

we

began

to

operate

under

a

new

business

division

structure

for

our

segment

reporting

structure.

The

new

segment

reporting

structure

consists

of

three

global

business

divisions:

Food

&

Beverage,

Institutional

&

Laundry,

Protective

Packaging

and

an

“Other”

category,

which

includes

our

Medical

Applications

and

New

Ventures

businesses.

This

new

structure

replaced

our

legacy

seven

business

unit

structure

and

Diversey's

legacy

four

region-based

structure.

The

changes

to

the

segment

structure

have

no

effect

on

the

historical

consolidated

results

of

operations.

Prior

period

segment

results

have

been

conformed

to

the

new

segment

presentation.

(2)

In November 2012, we sold our Diversey Japan business. The financial results of the

Diversey Japan business are reported as discontinued operations, and, accordingly all previously reported financial information has been revised.

(3)

(3) These special items consist of certain one-time costs or charges that were

included in our segments' operating results, including non-cash impairment charges recorded for impairment of goodwill and other intangible assets and in-

(4)

(4) These special items primarily consist of certain one-time costs or charges

that were included in other income and expense on our consolidated statements of operations, including an other-than-temporary impairment on one of our

equity method investments in a joint venture

The Company is working to finalize its goodwill and other intangible assets

impairment analysis prior to the filing of its Annual Report on Form

10-K for the year ended December 31, 2012, and as a result may incur additional impairment

charges

process research and development. These special items also include costs associated with our 2011 -

2014 Integration and Optimization Program. |

Regional Sales Performance

Fourth Quarter 2012

Latin

America

Reported: +7.5%

Organic: +13.2%

North

America

Reported: +2.3%

Organic: +2.1%

*Organic sales refers to unit volume and price/mix performance

and does not include the impact of currency translation

25

Japan/ANZ

Reported: +2.0%

Organic: -0.1%

Europe

Reported: -5.6%

Organic: -1.8%

AMAT

Reported: +9.6%

Organic: +9.7%

Please see Sealed Air’s February 19, 2013 earnings press release for important information about

the use of non-U.S. GAAP financial measurers, including applicable reconciliations to U.S.

GAAP financial measures.

All results are on a continuing operations

basis. |