Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Coeur Mining, Inc. | d488798dex991.htm |

| 8-K - FORM 8-K - Coeur Mining, Inc. | d488798d8k.htm |

NYSE: CDE

| TSX: CDM

Superior proposal to acquire Orko Silver

(Updated for 2012 mineral reserves and resources estimates from the original conference call

presentation of February 13, 2013.)

February 18, 2013

Exhibit 99.2

NYSE: CDE

| TSX: CDM |

NYSE: CDE

| TSX: CDM

2

Cautionary Statement

This presentation contains forward-looking statements within the meaning of securities

legislation in the United States and Canada, including expectations regarding the

enterprise value of Orko Silver Corp. (“Orko”), the value of Coeur d’Alene Mines Corporation (“Coeur”) shares and Orko shares, the consideration to

be issued pursuant to the proposal, the ability of Coeur and Orko to consummate the transaction

on the terms and in the manner contemplated thereby, and Coeur’s estimated

production data, expected operating schedules, results of operations, mineral reserves and resources, expected capital costs and other

expected operating data, share purchases and permit and other regulatory approvals. Such

forward-looking statements are identified by the use of words such as

“believes,”

“intends,”

“expects,”

“hopes,”

“may,”

“should,”

“will,”

“plan,”

“projected,”

“contemplates,”

“anticipates”

or

similar

words.

Actual

results,

performance,

achievements,

production,

operating

schedules,

results

of

operations,

mineral

reserves

and

resources,

capital

costs

and

permit

and

regulatory

approvals could differ materially from those projected in the forward-looking statements.

The factors that could cause actual results to differ materially from those in the

forward-looking statements include: (i) the risk factors set forth in Coeur’s reports on Form 10-K and Form 10-Q; (ii) the risk that permits necessary for

the

planned

Rochester

expansion

may

not

be

obtained,

(iii)

risks

and

hazards

inherent

in

the

mining

business

(including

environmental

hazards,

industrial

accidents, weather or geologically related conditions); (iv) changes in the market prices of

gold and silver; (v) uncertainties inherent in Coeur’s production, exploratory and

developmental activities, including risks relating to permitting and regulatory delays and disputed mining claims; (vi) any future labor disputes or

work stoppages; (vii) uncertainties inherent in the estimation of gold and silver ore reserves;

(vii) changes that could result from Coeur’s future acquisition of new mining

properties or businesses; (ix) reliance on third parties to operate certain mines where Coeur owns silver production and reserves; (x) the loss of any third-

party smelter to which Coeur markets silver and gold; (xi) effects of environmental and other

governmental regulations; (xii) risks inherent in the ownership or operation

of

or

investment

in

mining

properties

or

businesses

in

foreign

countries;

(xiii)

the

worldwide

economic

downturn

and

difficult

conditions

in

the

global

capital and credit markets; and (xiv) Coeur’s possible inability to raise additional

financing necessary to conduct its business, make payments or refinance its debt.

Actual

results,

developments

and

timetables

could

vary

significantly

from

the

estimates

presented.

Readers

are

cautioned

not

to

put

undue

reliance

on

forward-

looking

statements.

Coeur

disclaims

any

intent

or

obligation

to

update

publicly

these

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events or otherwise. Coeur disclaims any intent or obligation to update publicly such

forward-looking statements, whether as a result of new information, future

events

or

otherwise.

Current

resource

estimates

include

disputed

and

undisputed

claims

at

Rochester.

While

Coeur

believes

it

holds

a

superior

position

in

the

ongoing claim dispute, Coeur believes an adverse legal outcome would cause it to modify resource

estimates. Donald J. Birak, Coeur's Senior Vice President of Exploration and a qualified

person under Canadian National Instrument 43-101, supervised the preparation of

the

scientific

and

technical

information

contained

in

this

presentation.

For

a

description

of

the

key

assumptions,

parameters

and

methods

used

to

estimate

mineral reserves and resources, as well as data verification procedures and a general discussion

of the extent to which the estimates may be affected by any known environmental,

permitting, legal, title, taxation, socio-political, marketing or other relevant factors, please see the Technical Reports for each of Coeur's

properties, and the technical report for Orko’s La Preciosa property, as filed on SEDAR at

www.sedar.com, the mineral resources estimates for the La Preciosa Property contained in

this presentation are derived from the La Preciosa technical report. Donald J. Birak did not have access to, and did not verify, the data

underlying the technical information respecting the La Preciosa property contained in this

presentation. |

NYSE: CDE

| TSX: CDM

3

Cautionary Statement (Cont’d)

Cautionary

Note

to

U.S.

Investors

–

The

United

States

Securities

and

Exchange

Commission

permits

U.S.

mining

companies,

in

their

filings

with

the

SEC,

to

disclose only those mineral deposits that a company can economically and legally extract or

produce. We use certain terms in this presentation, such as “measured,”

“indicated,”

“inferred”,

and

“resources”

that

are

recognized

by

Canadian

regulations,

but

that

SEC

guidelines

generally

prohibit

U.S.

registered

companies

from

including

in

their

filings

with

the

SEC.

U.S.

investors

are

urged

to

consider

closely

the

disclosure

in

our

most

recent

Form

10-K

and

Form

10-Q

which may be obtained from us, or from the SEC’s website at http://www.sec.gov.

This document relates to Coeur d’Alene Mines Corporation’s (“Coeur”)

proposed acquisition (the “Transaction”) of Orko Silver Corp. Shares of Coeur’s

common stock (the “Coeur Shares”) issuable upon (i) the exercise of warrants (the

“Warrants”) to acquire Coeur Shares to be issued by Coeur in connection with

the proposed Transaction and (ii) the exchange of exchangeable securities (the

“Exchangeable Shares”) to be issued by a subsidiary of Coeur in connection with

the proposed Transaction which may be registered pursuant to a registration statement on Form

S-4 to be filed with the U.S. Securities and Exchange Commission (the

“SEC”) or issued pursuant to an available exemption. This document is not a substitute for any registration statement or any other document that Coeur may

file

with

the

SEC

or

send

to

its

shareholders

in

connection

with

the

offer

and/or

issuance

of

Coeur

Shares

in

connection

with

the

exercise

of

the

Warrants

and

exchange of the Exchangeable Shares. Investors who may receive Warrants or Exchangeable

Shares in the Transaction are urged to read Coeur’s registration statement on Form

S-4, if and when filed, including the prospectus, and all other relevant documents that may be filed with the SEC as and if they become

available because they will contain important information about the issuance of Coeur Shares

upon the exercise of any Warrants and exchange of any Exchangeable Shares. All

documents, if and when filed, will be available free of charge at the SEC’s website (www.sec.gov). You may also obtain these documents

by contacting Coeur’s Investor Relations department at Coeur d’Alene Mines

Corporation; Investor Relations; (208) 665-0345; wyang@coeur.com. This document

does not constitute an offer to sell or the solicitation of an offer to buy any

securities. Non-U.S.

GAAP

Measures

–

We

supplement

the

reporting

of

our

financial

information

determined

under

United

States

generally

accepted

accounting

principles (U.S. GAAP) with certain non-U.S. GAAP financial measures, including cash

operating costs, operating cash flow, adjusted earnings, and Adjusted EBITDA. We

believe that these adjusted measures provide meaningful information to assist management, investors and analysts in understanding our financial

results and assessing our prospects for future performance. We believe these adjusted financial

measures are important indicators of our recurring operations because

they

exclude

items

that

may

not

be

indicative

of,

or

are

unrelated

to

our

core

operating

results,

and

provide

a

better

baseline

for

analyzing

trends

in

our

underlying businesses. We believe operating cash flow, adjusted earnings, and Adjusted EBITDA

are important measures in assessing the Company's overall financial performance.

|

NYSE: CDE

| TSX: CDM

4

Transaction Highlights

Attractive

Orko’s key asset, the La Preciosa project, is one of the largest undeveloped silver

deposits in the world

Long-life mine potential with compelling economics assuming open pit mine plan

Large-scale development opportunity with significant exploration upside

Mining friendly jurisdiction with well-developed local infrastructure

Further diversifies Coeur’s portfolio by jurisdiction and across a larger

platform of assets

Proven ability to develop large-scale, world class projects similar to La Preciosa

Once developed, La Preciosa is expected to deliver significant growth to all Coeur

shareholders

Disciplined

Accretive

on

an

NAV

and

mineral

resource¹

per

share

basis

Acquisition represents just 18% of Coeur’s market cap

Coeur’s cash flow and strong liquidity position available to support La Preciosa’s

development

Consistent with Coeur’s stated M&A strategy

1. Does not include inferred resources.

Solidifies Coeur’s position as a leading growth-oriented silver producer

Strategic |

NYSE: CDE

| TSX: CDM

5

Transaction Summary

Offer

C$2.70 per share based on the closing price of Coeur’s shares on February 12, 2013

0.0815 Coeur shares and C$0.70 cash per Orko share (total cash component of C$100 million;

cash / stock mix will be at the election of Orko shareholders, subject to

pro-ration) In addition, Orko shareholders will receive 0.01118 warrants for

each Orko share. Each full warrant is

exchangeable for four years at a strike price of US$30 per common share of Coeur

Represents a 25% premium to the implied value of Orko shares under the First Majestic

transaction as of February 12, 2013, and 71% to the unaffected Orko share price

on December 14, 2012

Structure

Implies ~C$384 million in transaction value, including the value

of warrants

74% stock / 26% cash consideration mix including warrants

Utilizes C$100 million of Coeur existing cash and ~11.6 million new Coeur shares

89% CDE / 11% Orko pro forma ownership (not including warrants)

Process and

timing

5 business days for First Majestic to match from February 13, 2013

Proposed agreement subject to customary closing conditions and Orko shareholders’

vote

No Coeur shareholder vote required

Closing expected in 2Q 2013

Coeur

pro

forma

Orko Board has unanimously concluded Coeur’s offer constitutes a Superior Proposal

1. See slide 7 and Appendix slides for tons, grade and effective date for La Preciosa mineral

resources and Coeur’s mineral reserves and resources. Silver equivalents use gold and silver prices of

$1,643 and $30.78 per ounce respectively; 2. For production estimates, refer to page 10.

871 million oz of Ag eq reserves and M&I resources; 261 million oz of Ag eq inferred

resources¹ Potential for 27 million oz of combined annual

pro forma silver production² |

NYSE: CDE

| TSX: CDM

6

Benefits of the Transaction

Adds significant new production and future

cash flow to Coeur’s existing profile

Enhances portfolio diversity over a larger

number of assets

Improved geopolitical risk profile

Accretive to NAV and total mineral resources

per share

1

Extensive drilling has identified large resource

with expansion potential

Supplements development profile and allows

Coeur to deliver growth to all shareholders

Once on-line, La Preciosa would represent

Coeur’s third global top-ten silver mine as

ranked by production

Long mine life and significant cash flow

contribution are expected to support other

forms of returning of capital to shareholders

Coeur Shareholders

Coeur has the technical experience and the financial resources

to successfully develop La Preciosa

Superior proposal to the First Majestic stock

offer

Attractive consideration mix, with C$100 million

cash component providing immediate value

realization and upside participation through

shares and warrants

Opportunity to participate in the upside of La

Preciosa with potential large-scale open pit

mine plan

Highly liquid Coeur shares trading at an

attractive valuation, demonstrated by buyback

program and analysts’

price targets

Gain exposure to a diverse set of open pit and

underground operations located in five

different countries

Attractive silver / gold profile of ~75% / ~25%

pro forma for this transaction

Orko Shareholders

1. Does not include inferred resources. |

NYSE: CDE

| TSX: CDM

7

Overview of La Preciosa

1

Located in the Durango State of Mexico, 47 km northeast of

the city of Durango and 45 minutes from an international

airport

Together with adjacent mineral concessions, project covers

~32,400 hectares of contiguous mining claims

October 25, 2012: silver resource estimate of 99 million oz

indicated and 140 million oz inferred (42% indicated & 58%

inferred)

+99% of Indicated mineral resources within an open pit

configuration

1

~91% of the potential resource value is silver (based

upon $30.78 / Ag ounce Ag and $1,643 / Au ounce)

Coeur envisions developing La Preciosa as a large-scale, open

pit operation to maximize value

Significant infrastructure in place

Access by paved highway

8 km to national power grid

8 km to rail lines

Located in the heart of Mexico’s prolific Sierra Madre Mining Belt,

which hosts large silver deposits such as Fresnillo

Contained Metal

Tonnes

(million)

Ag Grade

(g/t)

Ag

(million oz)

Au

(million oz)

Indicated resources

Open-Pit

29.6

104

99.0

0.2

Underground

0.1

99

0.2

0.0

Total indicated

29.7

104

99.2

0.2

Inferred Resources

Open-Pit

47.7

86

131.9

0.2

Underground

2.0

124

7.6

0.0

Total Inferred

49.7

87

139.5

0.3

Orko Project

Historic/producing mines or Ag deposits

Legend

1. Based on information derived from the technical report entitled, “La Preciosa Silver

Deposit, Updated Mineral Resource Estimate Statement, Durango, Mexico”, prepared

by Mining Plus, dated November 5, 2012 as filed on SEDAR.

Durango

MEXICO

Guanacevi

La Cienaga

La Parilla

San Martin

Colorada

Fresnillo

Zacatecas

Penasquito

San Sebastian

Sierra de Ramirez

Velardeña

Platosa

Avino

El Cairo

Coneto

Pitarrilla

Inde

Durango

Gomez Palacio/Torreon

La Preciosa

Project |

NYSE: CDE

| TSX: CDM

8

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Mexico is a Mining-Friendly Jurisdiction

2012 ranking of countries for mining investment

Mexico rankings by category

Note: For simplicity, rankings shown do not reflect ties.

Mexico rank

Economic system

Tie 5

Political system

Tie 6

Social issues

Tie 13

Permitting delays

Tie 2

Corruption

5

Currency stability

Tie 7

Tax regime

Tie 1

57

52

51

45

43

41

39

37

36

36

33

32

32

30

29

29

28

27

26

25

22

22

19

17

16

Australia

Canada

Chile

Brazil

Mexico

United States

Colombia

Botswana

Peru

Ghana

Namibia

Mongolia

Tanzania

Argentina

India

Philippines

China

Indonesia

Zambia

South Africa

Kazakhstan

Papua New Guinea

D.R. Congo

Bolivia

Russia

Total points

Source: Behre Dolbear’s – 2012 ranking of countries for mining investment. Rank

|

NYSE: CDE

| TSX: CDM

9

La Preciosa Expected to Become One of the World’s

Leading Silver Mines

Production Benchmarking

Source: The Silver Institute, 2011.

1. For production estimates, refer to page 10.

La Preciosa

future production

potential of

~7-9 million

oz

1

32.2

30.3

13.6

10.1

8.8

8.4

7.1

6.5

6.1

5.9

5.9

5.5

5.3

Rank

Mine/Country

Operating Company

Production (Million of ozs)

1

Cannington, Australia

BHP Billiton

2

Fresnillo, Mexico

Fresnillo plc

3

Dukat, Russia

JSC Polymetal

4

Uchucchacua, Peru

Compania de Minas Buenaventura

5

Palmarejo, Mexico

Coeur

6

Palancata, Peru

Hochschild Mining/International Minerals

7

Gumuskoy, Turkey

Eti Gumus, A.S.

8

San Bartolomé, Bolivia

Coeur

9

Pirquitas, Argentina

Silver Standard

10

Greens Creek, U.S.

Hecla Mining

11

Arcata, Peru

Hochschild Mining

12

Saucito, Mexico

Fresnillo plc

13

San Jose, Argentina

Hochschild Mining/McEwen Mining

14

Imiter, Morocco

Societe Metallurgique d’Imiter

15

Alamo Dorado, Mexico

Pan American Silver Corp. |

NYSE: CDE

| TSX: CDM

10

Opportunity to Develop La Preciosa as a Large-Scale,

Open Pit Mine

2011 PEA¹

Highlights

Re-Engineering La Preciosa Project

Outlines an open pit/underground operation

Mine life of 12 years

Annual production of 6.8 million oz of Ag

and 12,000 oz of Au

Capital costs of $270 million

5,000 tpd operation

Cash costs of $11.84/oz Ag

Base case IRR of >20%

Coeur believes developing La Preciosa as an open pit adds significant long-term value

Significant diligence conducted and re-engineering

under way

Coeur believes developing La Preciosa as a large-

tonnage, open pit operation will maximize value

~7-9

million

oz

of

annual

silver

production²

+15 year initial mine life

Reduced mining risk

Enhance overall project economics

Coeur believes shallow dipping vein, rock

mechanics, and grade issues make underground

mining challenging

AMEC commenced work on a new PEA

1.

2. 7-9 million ounces contributed by La Preciosa using assumptions and parameters

contained in 2011 PEA and assumption of open-pit mining with higher throughput. The

PEA, June 30, 2011, (“2011 PEA”) is preliminary in nature, includes inferred mineral resources that are considered too speculative geologically to have the economic

considerations applied to them that would enable them to be categorized as mineral

reserves. There is no certainty that the preliminary economic assessment will be realized. |

NYSE: CDE

| TSX: CDM

11

A Premier Americas Focused Silver Mining Company…

Palmarejo

San Bartolomé

Rochester

Kensington

La Preciosa

Operating NAV = ~$1.8bn

Orko

Coeur

Pro forma

Source: Select equity research.

Endeavor

Operating NAV = ~$0.4bn

Operating NAV = ~$2.2bn

Operating NAV = ~$1.8bn

Orko

Coeur

Pro forma

Operating NAV = ~$0.4bn

Operating NAV = ~$2.2bn

Mexico

Bolivia

United States

Australia

41%

29%

28%

1%

52%

24%

23%

1%

100%

41%

28%

16%

13%

1%

100%

34%

23%

13%

11%

1%

19%

Operating NAV contribution by mine and jurisdiction ($bn) – Increased Focus on

Mining-Friendly Jurisdictions |

NYSE: CDE

| TSX: CDM

12

…With Increased Growth Potential

Source: Equity research, Public disclosure, Company projections.

1. For production estimates, refer to page 10.

Note: Company information where available and equity research.

~7-9 million¹

~25-27

18

Million ounces

Pro forma for

La Preciosa

2012

Silver

Production

–

Orko

Provides

Significant

Growth

Potential

0

5

10

15

20

25

30

35

40

45

Fresnillo

Coeur

pro forma

Pan American

Silver

Wheaton

Coeur

Hochschild

Silver

Standard

First Majestic

Hecla

Silvercorp

Endeavour

Fortuna |

NYSE: CDE

| TSX: CDM

13

Expanding Portfolio of Assets, with a Track Record of

Developing, Starting-Up, and Operating Large-Scale Projects

Overview of Coeur d’Alene assets

Operation

Investment

Feasibility stage project

Note: R&R figures pro forma for La Preciosa.

Improved portfolio

Coeur has recent experience with similar sized

projects that are relevant to La Preciosa

San Bartolomé: 2008 start up; $238 million

capital cost

Palmarejo: 2009 start up; $353 million

capital cost

Kensington: 2010 start up; $435 million

capital cost

Rochester: 2011 re-start; $27 million capital

cost

XX

Start up/re-start year

La Preciosa provides Coeur with an enhanced

growth profile, reduced geopolitical risk, and

greater diversity in mining-friendly Mexico

Kensington Mine, Alaska

2012: 82,125 oz Au

2013E:

108,000

-

114,000

oz

Au

2010

Rochester Mine, Nevada

2012: 2.8 million oz Ag; 38,071

oz Au

2013E:

4.5

-

4.9

million

oz

Ag;

44,000

-46,000

oz

Au

2011

Palmarejo Mine, Mexico

2012: 8.2 million oz Ag; 106,038

oz Au

2013E: 7.7 -

8.3 million oz Ag;

98,000

–

105,000

oz

Au

2009

La Preciosa, Mexico

Indicated resources:

Ag : 99 million oz

Au: 0.2 million oz

Inferred resources:

Ag: 140 million oz

Au: 0.3 million oz

Joaquin Silver-Gold Project¹

Argentina

San Bartolomé

Mine, Bolivia

2012: 5.9 million oz Ag

2013E:

5.3

-

5.7

million

oz

Ag

2008

Endeavor Mine, Australia

2012: 0.7 million oz Ag

2013E: 0.5 –

0.6 million oz Ag

Total

1,2

Silver

Ounces

(millions)

Gold

Ounces

(000s)

Proven & Probable

Reserves

220

1,988

Measured &

Indicated Resources

404

2,618

Inferred Resources

206

1,035

1. Mineral reserves and resources effective December 31, 2012 except Endeavor effective June

30, 2012. See slides in the Appendix for tons and grade pertaining to reserves and resources; 2. Includes La Preciosa |

NYSE: CDE

| TSX: CDM

14

Transaction Highlights

Attractive

Disciplined

1.

Based on La Preciosa indicated mineral resources only.

Solidifies Coeur’s position as a leading growth-oriented silver producer

Strategic

Orko’s key asset, the La Preciosa project, is one of the largest undeveloped silver

deposits in the world

Long-life mine potential with compelling economics assuming open pit mine plan

Large-scale development opportunity with significant exploration upside

Mining friendly jurisdiction with well-developed local infrastructure

Further diversifies Coeur’s portfolio by jurisdiction and across a larger

platform of assets

Proven ability to develop large-scale, world class projects similar to La Preciosa

Once developed, La Preciosa is expected to deliver significant growth to all Coeur

shareholders

Accretive on an NAV and mineral resource¹

per share basis

Acquisition represents just 18% of Coeur’s market cap

Coeur’s cash flow and strong liquidity position available to support La Preciosa’s

development

Consistent with Coeur’s stated M&A strategy |

15

Appendix |

Substantial

and Sustainable Annual Production

Base

(Not Including La Preciosa)

Silver Production

2012 Silver Production by Mine (millions of ounces)

2012 Gold Production by Mine (millions of ounces)

Gold Production

106,038

38,071

257

82,125

Palmarejo

Rochester

Martha

Kensington

46,115

72,112

157,062

220,382

226,491

250,000-

265,000

2008

2009

2010

2011

2012

2013E

12.0

16.9

16.8

19.1

18.0

18.0-19.5

2008

2009

2010

2011

2012

2013E

Palmarejo

Rochester

Martha

Endeavor

San Bartolomé

2.8

5.9

8.2

NYSE: CDE

| TSX: CDM

16

0.3

0.7 |

NYSE: CDE

| TSX: CDM

17

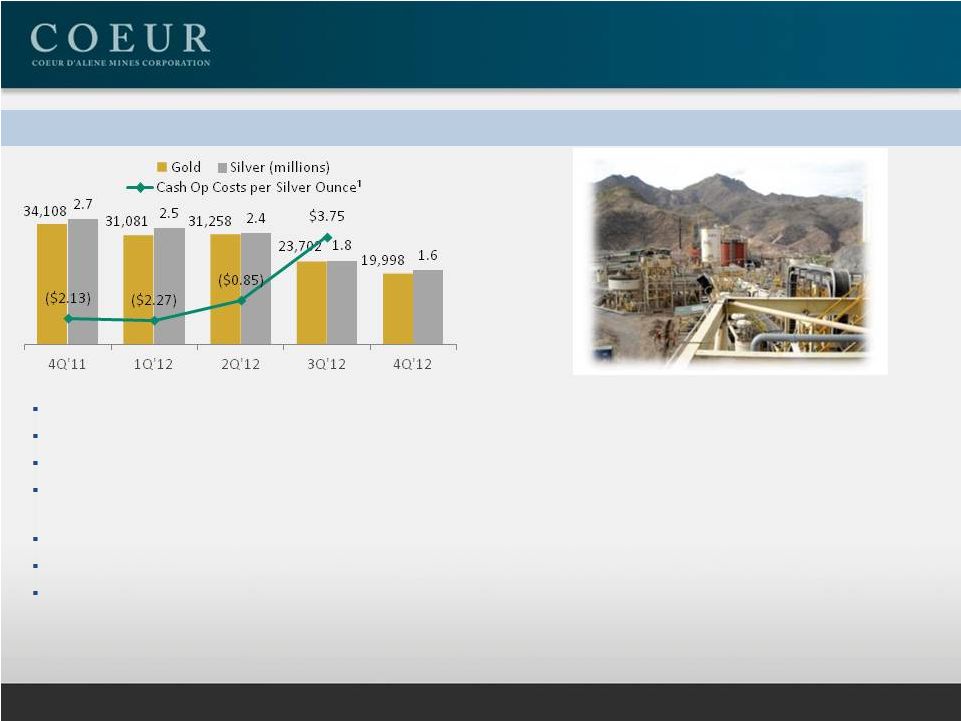

Palmarejo –

Solid Silver and Gold Producer and

Major Cash Flow Generator

Quarterly Production & Cash Operating Costs¹

World’s 5th largest primary silver mine. Silver-gold operation located in

northern Mexico Expect

to

commence

initial

underground

production

from

Guadalupe

satellite

operation

in

2013

Proven and probable reserves of 53.1 million silver oz and 665,000 gold oz²

M&I resources of 45.7 million silver oz and 964,000 gold oz and inferred resources of 22.1

million silver oz and 457,000 gold oz²

First nine months 2012 metal sales of $362.7 million

First

nine

months

2012

operating

cash

flow¹

of

$199.9

million

2013E:

7.7

-

8.3

million

silver

oz

and

98,000

–

105,000

gold

oz

1. Non-GAAP measure. Please see reconciliation tables to U.S. GAAP in appendix to this

presentation. Coeur expects to report cash operating costs per ounce with financial results on or about 2/21/13.

2. At Dec. 31, 2012. The Company expects to be filing its latest technical report on SEDAR,

associated with its 2012 operating results. The last technical report as filed on SEDAR was “Palmarejo Project, SW

Chihuahua State, Mexico, Technical Report”, dated January 1, 2012.

|

NYSE: CDE

| TSX: CDM

18

San Bartolomé

–

Long-Lived Silver Producer

Quarterly Production & Cash Operating Costs¹

World’s 8th largest primary silver mine

100% silver operation in Bolivia

Proven and probable reserves of 109.1 million silver oz²

M&I resources of 45.5 million silver oz and inferred resources of 3.3 million silver

oz² First nine months 2012 metal sales of $141.0 million

First

nine

months

2012

operating

cash

flow¹

of

$56.8

million

2013E:

5.3

–

5.7

million

silver

oz

2.0

1.6

1.5

1.5

1.3

$9.18

$10.21

$11.05

$12.13

4Q'11

1Q'12

2Q'12

3Q'12

4Q'12

Silver (millions)

Cash Op Costs per Silver Ounce¹

1. Non-GAAP measure. Please see reconciliation tables to U.S. GAAP in appendix to this

presentation. Coeur expects to report cash operating costs per ounce with financial results on or about 2/21/13.

2. At Dec. 31, 2012. The Company expects to be filing its latest technical report on SEDAR,

associated with its 2012 operating results. The last technical report as filed on SEDAR was “San Bartolomé, Potosi,

Bolivia, Technical Report”, dated January 1, 2012.

|

NYSE: CDE

| TSX: CDM

19

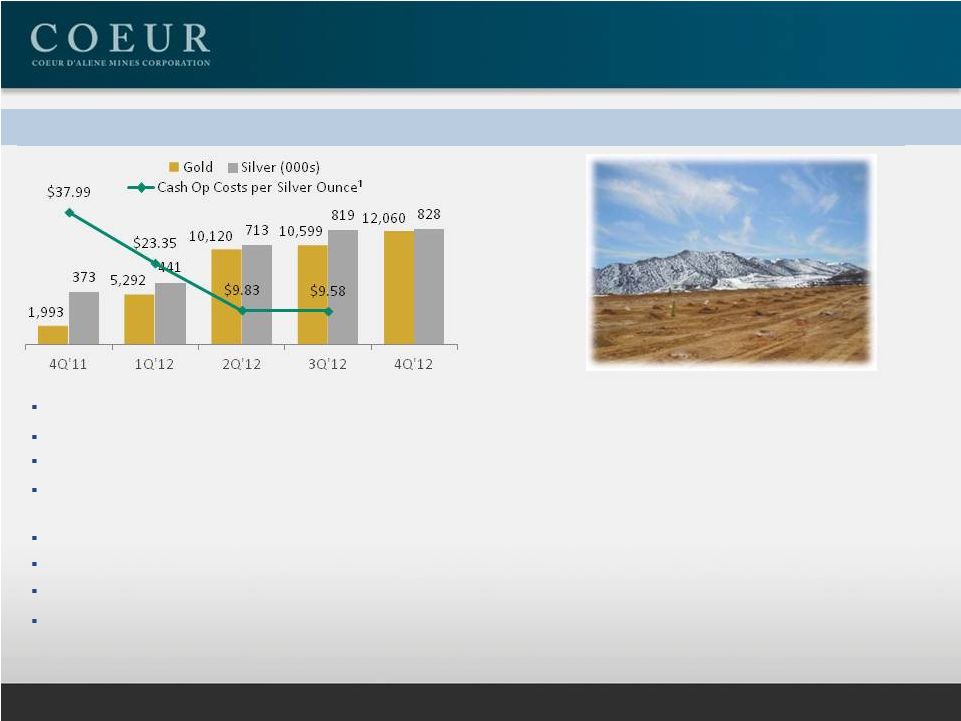

Rochester –

Production Continues to Rise

Quarterly Production & Cash Operating Costs¹

Silver-gold operation located in Nevada

In operation since 1986

Proven and probable reserves of 44.9 million silver oz and 308,000 gold oz²

M&I

resources

of

120.7

million

silver

oz

and

865,000

gold

oz

and

inferred

resources

of

27.2

million

silver

oz

and

123,000 gold oz²

First nine months 2012 metal sales of $89.2 million

First

nine

months

2012

operating

cash

flow¹

of

$32.0

million

2013E

production

of

4.5

–

4.9

million

silver

oz

and

44,000

–

46,000

gold

oz

High return investment opportunity with planned expansion of leach pad capacity

1. Non-GAAP measure. Please see reconciliation tables to U.S. GAAP in appendix to this

presentation. Coeur expects to report cash operating costs per ounce with financial results on or about 2/21/13.

2. At Dec. 31, 2012. The Company expects to be filing its latest technical report on SEDAR,

associated with its 2012 operating results. The last technical report as filed on SEDAR was “Rochester, Nevada,

USA, Technical Report”, dated January 1, 2011. |

NYSE: CDE

| TSX: CDM

20

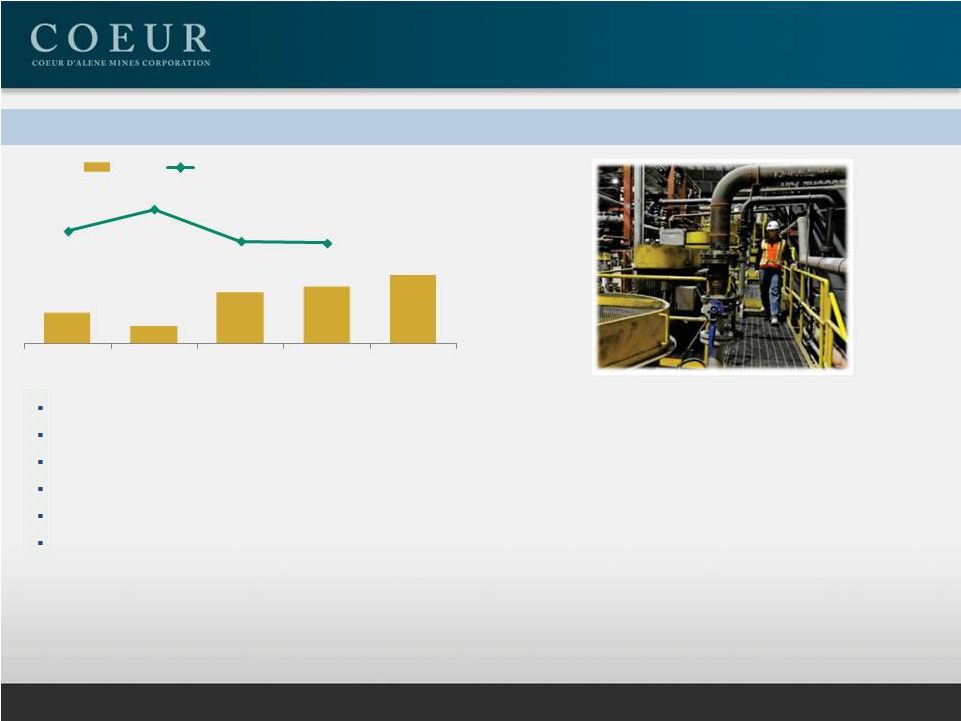

Kensington –

Record Quarterly Production in 4Q 2012

Quarterly Production & Cash Operating Costs¹

100% gold operation located in southeast Alaska

Proven and probable reserves of 1.0 million gold oz²

M&I resources of 0.5 million gold oz and inferred resources of 0.2 million gold

oz² First nine months 2012 metal sales of $68.0 million

First nine months 2012 operating cash flow¹

of $0.1 million; resumed full production rate in April 2012

2013E:

108,000

–

114,000

gold

oz

13,047

7,444

21,572

24,391

28,717

$1,807

$2,709

$1,348

$1,298

4Q'11

1Q'12

2Q'12

3Q'12

4Q'12

Gold

Cash Op Costs per Silver Ounce¹

1. Non-GAAP measure. Please see reconciliation tables to U.S. GAAP in appendix to this

presentation. Coeur expects to report cash operating costs per ounce with financial results on or about 2/21/13.

2. At Dec. 31, 2012. The Company expects to be filing its latest technical report on SEDAR,

associated with its 2012 operating results. The last technical report as filed on SEDAR was “Kensington Gold Mine,

Southeast Alaska, USA”, dated January 1, 2010.

|

NYSE: CDE

| TSX: CDM

21

Pipeline

Growth:

Joaquin

Silver-Gold

Project

Advancing Significant Silver Asset

1. At Dec. 31, 2012. The Company expects to be filing its latest technical report on SEDAR,

associated with its 2012 operating results. The last technical report as filed on SEDAR was “Joaquin Project, Santa

Cruz, Argentina Technical Report”, dated September 21, 2012.

Potential significant silver producer

Consolidated ownership by acquiring remaining 49% interest in Joaquin in

December 2012

Potential to add significant silver production and cash flow with further

exploration upside

Project fits Company’s stated financial and operating criteria

Measured and Indicated resources of 65.2 million silver ounces¹

and Inferred

resources of 3.1 million silver ounces

Mineral resources being updated to include all drilling data subsequent to

September 2012 Technical Report

Accelerating feasibility work

Positive results from initial metallurgical tests

Subsequent development decision will be based on economics and assessment

of political and business environment in Argentina

Exploration upside

Doubled silver Measured and Indicated resources in September 2012¹

Continuing exploration drilling to expand and upgrade resources

The La Negra and La Morocha deposits account for less than 5% of

the total

28,400 ha land package, double the size of Palmarejo |

NYSE: CDE

| TSX: CDM

22

Non-GAAP to U.S. GAAP Reconciliation

Adjusted EBITDA¹

Adjusted EBITDA Reconciliation (in thousands of

US$)

LTM 3Q 2012

3Q 2012

2Q 2012

1Q 2012

4Q 2011

Net income

$22,491

$(15,821)

$22,973

$3,975

$11,364

Income tax provision

109,163

17,475

23,862

15,436

52,390

Interest expense, net of capitalized interest

29,800

7,351

7,557

6,670

8,222

Interest and other income

(9,753)

(12,664)

3,221

(5,007)

4,697

Fair value adjustments, net

25,687

37,648

(16,039)

23,113

(19,035)

Loss on debt extinguishments

3,886

–

–

–

3,886

Depreciation and depletion

224,626

52,844

61,024

52,592

58,166

Adjusted EBITDA

$405,900

$86,833

$102,598

$96,779

$119,690

1. Coeur expects to report fourth quarter and full year 2012 audited financial results on

Thursday, February 21, 2013. |

NYSE: CDE

| TSX: CDM

23

Non-GAAP to U.S. GAAP Reconciliation (Cont’d)

Operating Cash Flow –

Consolidated¹

1. Coeur expects to report fourth quarter and full year 2012 audited financial results on

Thursday, February 21, 2013. Operating Cash Flow Reconciliation

(in thousands of US$)

3Q 2012

2Q 2012

1Q 2012

4Q 2011

3Q 2011

Cash provided by operating activities

$79,735

$113,203

$17,002

$87,412

$181,911

Changes in operating assets and liabilities

Receivables and other current assets

5,648

(10,319)

2,956

(8,904)

10,513

Prepaid expenses and other

2,481

2,857

(4,774)

8,839

8,697

Inventories

13,762

(3,097)

24,722

17,574

(23,234)

Accounts payable and accrued liabilities

(24,342)

(14,276)

53,929

(7,452)

(26,930)

Operating cash flow

$77,284

$88,368

$93,835

$97,469

$150,957 |

NYSE: CDE

| TSX: CDM

24

Non-GAAP to U.S. GAAP Reconciliation (Cont’d)

Operating Cash Flow –

Palmarejo¹

1. Coeur expects to report fourth quarter and full year 2012 audited financial results on

Thursday, February 21, 2013. Operating Cash Flow Reconciliation (in thousands of

US$) 3Q 2012

2Q 2012

1Q 2012

4Q 2011

3Q 2011

Cash provided by operating activities

$58.2

$90.5

$65.3

$70.9

$104.7

Changes in operating assets and liabilities

Receivables and other current assets

(4.1)

(12.5)

5.4

5.7

(0.8)

Prepaid expenses and other

(0.8)

0.5

(1.9)

(3.2)

3.4

Inventories

2.5

(11.5)

4.6

9.9

(16.2)

Accounts payable and accrued liabilities

(0.9)

(3.4)

8.0

(5.9)

0.1

Operating cash flow

$54.9

$63.6

$81.4

$77.4

$91.2

Operating Cash Flow –

San Bartolomé¹

Operating Cash Flow Reconciliation (in thousands of US$)

3Q 2012

2Q 2012

1Q 2012

4Q 2011

3Q 2011

Cash provided by operating activities

$19.8

$31.0

$(27.4)

$22.3

$78.1

Changes in operating assets and liabilities

Receivables and other current assets

7.1

(0.7)

2.2

0.2

5.0

Prepaid expenses and other

0.8

4.4

(2.8)

4.6

0.2

Inventories

5.0

(3.4)

4.7

2.9

(7.2)

Accounts payable and accrued liabilities

(21.5)

(6.5)

44.1

(1.3)

(26.5)

Operating cash flow

$11.2

$24.8

$20.8

$28.7

$49.6 |

NYSE: CDE

| TSX: CDM

25

Non-GAAP to U.S. GAAP Reconciliation (Cont’d)

Operating Cash Flow –

Kensington¹

1. Coeur expects to report fourth quarter and full year 2012 audited financial results on

Thursday, February 21, 2013. Operating Cash Flow Reconciliation (in thousands of

US$) 3Q 2012

2Q 2012

1Q 2012

4Q 2011

3Q 2011

Cash provided by operating activities

$5.0

$(12.5)

$1.1

$9.3

$8.6

Changes in operating assets and liabilities

Receivables and other current assets

2.3

4.6

(10.3)

(5.1)

5.0

Prepaid expenses and other

0.5

(0.5)

(1.0)

0.5

1.3

Inventories

1.8

9.9

3.3

(10.1)

(1.3)

Accounts payable and accrued liabilities

(2.3)

(0.9)

(0.9)

1.3

0.9

Operating cash flow

$7.3

$0.6

$(7.8)

$(4.1)

$14.5

Operating Cash Flow –

Rochester¹

Operating Cash Flow Reconciliation (in thousands of US$)

3Q 2012

2Q 2012

1Q 2012

4Q 2011

3Q 2011

Cash provided by operating activities

$7.3

$10.1

$(7.1)

$(11.4)

$0.9

Changes in operating assets and liabilities

Receivables and other current assets

0.6

(0.1)

0.3

(0.2)

0.2

Prepaid expenses and other

0.2

(1.0)

1.4

0.7

0.7

Inventories

6.5

3.9

11.2

14.2

5.9

Accounts payable and accrued liabilities

(1.6)

(1.1)

1.4

0.1

(5.0)

Operating cash flow

$13.0

$11.8

$7.2

$3.4

$2.7 |

NYSE: CDE

| TSX: CDM

26

Non-GAAP to U.S. GAAP Reconciliation (Cont’d)

Cash Operating Costs¹

1. Coeur expects to report fourth quarter and full year 2012 audited financial results on

Thursday, February 21, 2013. (In thousands except ounces and per ounce costs)

Three months ended September 30,2012

Palmarejo

San

Bartolomé

Kensington

Rochester

Martha

Endeavor

Total

Total cash operating cost (Non-US GAAP)

$6,878

$18,504

$31,660

$7,853

$4,461

$2,241

$71,597

Royalties

–

1,879

–

1,441

100

–

3,420

Production taxes

–

–

–

–

–

–

–

Total cash costs (Non-US GAAP)

$6,878

$20,383

$31,660

$9,294

$4,561

$2,241

$75,017

Add/Subtract:

Third party smelting costs

–

–

(3,141)

–

(541)

(605)

(4,287)

By-product credit

39,034

–

–

17,506

124

–

56,664

Other adjustments

424

720

2

85

798

–

2,029

Change in inventory

2,337

(1,166)

(1,639)

(5,871)

1,539

345

(4,455)

Depreciation, depletion and amortization

33,997

4,161

11,512

2,061

66

898

52,695

Production costs applicable to sales, including

depreciation, depletion and amortization (US GAAP)

$82,670

$24,098

$38,394

$23,075

$6,547

$2,879

$177,663

Production of silver (in thousand ounces)

1,833,109

1,525,725

–

819,349

92,698

140,267

4,411,148

Cash operating cost per silver ounce

$3.75

$12.13

–

$9.58

$48.12

$15.97

$9.05

Cash costs per silver ounce

$3.75

$13.36

–

$11.34

$49.20

$15.97

$9.83

Production of gold (ounces)

–

–

24,391

–

–

–

24,391

Cash operating cost per gold ounce

–

–

$1,298

–

–

–

$1,298

Cash cost per gold ounce

–

–

$1,298

–

–

–

$1,298 |

NYSE: CDE

| TSX: CDM

27

Non-GAAP to U.S. GAAP Reconciliation (Cont’d)

Cash Operating Costs¹

(In thousands except ounces and per ounce costs)

Three months ended June 30,2012

Palmarejo

San

Bartolomé

Kensington

Rochester

Martha

Endeavor

Total

Total cash operating cost (Non-US GAAP)

$(2,009)

$16,249

$29,083

$7,008

$5,942

$4,204

$60,477

Royalties

–

1,457

–

510

124

–

2,091

Production taxes

–

–

–

641

–

–

641

Total cash costs (Non-US GAAP)

$(2,009)

$17,706

$29,083

$8,159

$6,066

$4,204

$63,209

Add/Subtract:

Third party smelting costs

–

–

(2,820)

–

(1,444)

(1,449)

(5,713)

By-product credit

50,363

–

–

16,295

157

–

66,815

Other adjustments

124

117

7

229

26

–

503

Change in inventory

14,060

4,950

(10,165)

(3,931)

2,297

(202)

7,009

Depreciation, depletion and amortization

42,741

4,070

9,719

2,060

631

1,592

60,813

Production costs applicable to sales, including

depreciation, depletion and amortization (US GAAP)

$105,279

$26,843

$25,824

$22,812

$7,733

$4,145

$192,636

Production of silver (in thousand ounces)

2,365,484

1,470,342

–

712,706

107,895

240,168

4,896,595

Cash operating cost per silver ounce

($0.85)

$11.05

–

$9.83

$55.07

$17.50

$6.41

Cash costs per silver ounce

($0.85)

$12.04

–

$11.45

$56.21

$17.50

$6.97

Production of gold (ounces)

–

–

24,572

–

–

–

24,572

Cash operating cost per gold ounce

–

–

$1,348

–

–

–

$1,348

Cash cost per gold ounce

–

–

$1,348

–

–

–

$1,348

1. Coeur expects to report fourth quarter and full year 2012 audited financial results on

Thursday, February 21, 2013. |

NYSE: CDE

| TSX: CDM

28

Non-GAAP to U.S. GAAP Reconciliation (Cont’d)

Cash Operating Costs¹

(In thousands except ounces and per ounce costs)

Three months ended March 31,2012

Palmarejo

San

Bartolomé

Kensington

Rochester

Martha

Endeavor

Total

Total cash operating cost (Non-US GAAP)

$(5,643)

$16,253

$20,168

$10,303

$5,708

$4,127

$50,916

Royalties

–

2,036

–

609

82

–

2,727

Production taxes

–

–

–

12

–

–

12

Total cash costs (Non-US GAAP)

$(5,643)

$18,289

$20,168

$10,924

$5,790

$4,127

$53,655

Add/Subtract:

Third party smelting costs

–

–

(1,083)

–

(1,975)

(788)

(3,846)

By-product credit

52,526

–

–

8,957

141

–

61,624

Other adjustments

244

(194)

7

87

57

–

201

Change in inventory

(1,268)

(4,487)

(2,001)

(10,403)

(320)

(601)

(19,080)

Depreciation, depletion and amortization

37,761

4,219

6,604

1,642

520

1,644

52,390

Production costs applicable to sales, including

depreciation, depletion and amortization (US GAAP)

$83,620

$17,827

$23,695

$11,207

$4,213

$4,382

$144,944

Production of silver (ounces)

2,482,814

1,591,292

–

441,337

122,793

247,958

4,886,194

Cash operating cost per silver ounce

($2.27)

$10.21

–

$23.35

$46.48

$16.64

$6.29

Cash costs per silver ounce

($2.27)

$11.49

–

$24.75

$47.15

$16.64

$6.85

Production of gold (ounces)

–

–

7,444

–

–

–

7,444

Cash operating cost per gold ounce

–

–

$2,709

–

–

–

$2,709

Cash cost per gold ounce

–

–

$2,709

–

–

–

$2,709

1. Coeur expects to report fourth quarter and full year 2012 audited financial results on

Thursday, February 21, 2013. |

NYSE: CDE

| TSX: CDM

29

Non-GAAP to U.S. GAAP Reconciliation (Cont’d)

Cash Operating Costs¹

(In thousands except ounces and per ounce costs)

Three months ended December 31,2011

Palmarejo

San

Bartolomé

Kensington

Rochester

Martha

Endeavor

Total

Total cash operating cost (Non-US GAAP)

$(5,730)

$18,332

$24,035

$14,191

$4,386

$1,647

$56,861

Royalties

–

3,279

–

–

98

–

3,377

Production taxes

–

–

–

124

–

–

124

Total cash costs (Non-US GAAP)

$(5,730)

$21,611

$24,234

$14,315

$4,484

$1,647

$60,362

Add/Subtract:

Third party smelting costs

–

–

(1,881)

–

(516

(483)

(2,880)

By-product credit

57,501

–

–

3,344

242

–

61,068

Other adjustments

233

608

–

266

97

–

1,204

Change in inventory

(5,054)

(869)

9,407

(13,722)

(296)

(112)

(10,646)

Depreciation, depletion and amortization

42,646

6,021

7,016

1,152

474

750

58,059

Production costs applicable to sales, including

depreciation, depletion and amortization (US GAAP)

$89,596

$27,370

$38,577

$5,356

$4,486

$1,802

$167,187

Production of silver (ounces)

2,690,368

1,997,416

–

373,589

129,972

111,723

5,303,068

Cash operating cost per silver ounce

($2.13)

$9.18

–

$37.99

$33.75

$14.74

$6.19

Cash costs per silver ounce

($2.13)

$10.82

–

$38.32

$34.50

$14.74

$6.85

Production of gold (ounces)

–

–

13,299

–

–

–

13,299

Cash operating cost per gold ounce

–

–

$1,807

–

–

–

$1,807

Cash cost per gold ounce

–

–

$1,807

–

–

–

$1,807

1. Coeur expects to report fourth quarter and full year 2012 audited financial results on

Thursday, February 21, 2013. |

NYSE: CDE

| TSX: CDM

30

Non-GAAP to U.S. GAAP Reconciliation (Cont’d)

Cash Operating Costs¹

(In thousands except ounces and per ounce costs)

Three months ended September 30,2011

Palmarejo

San

Bartolomé

Kensington

Rochester

Martha

Endeavor

Total

Total cash operating cost (Non-US GAAP)

$(2,607)

$19,210

$25,000

$12,912

$4,660

$3,068

$62,153

Royalties

–

3,217

–

827

234

–

4,278

Production taxes

–

–

–

260

–

–

260

Total cash costs (Non-US GAAP)

$(2,607)

$22,337

$25,000

$13,999

$4,894

$3,068

$66,691

Add/Subtract:

Third party smelting costs

–

–

(3,096)

–

(566)

(808)

(4,470)

By-product credit

51,185

–

–

2,433

198

–

53,816

Other adjustments

435

111

–

117

290

–

953

Change in inventory

15,099

7,637

2,443

(5,193)

3,328

949

24,263

Depreciation, depletion and amortization

41,174

6,062

9,568

556

237

914

58,511

Production costs applicable to sales, including

depreciation, depletion and amortization (US GAAP)

$105,286

$36,147

$33,915

$11,912

$8,381

$4,123

$199,764

Production of silver (ounces)

2,250,818

2,051,426

–

351,717

118,523

137,843

4,910,327

Cash operating cost per silver ounce

($1.16)

$9.32

–

$36.71

$39.31

$22.26

$7.57

Cash costs per silver ounce

($1.16)

$10.89

–

$39.80

$41.29

$22.26

$8.49

Production of gold (ounces)

–

–

25,687

–

–

–

725,687

Cash operating cost per gold ounce

–

–

$973

–

–

–

$973

Cash cost per gold ounce

–

–

$973

–

–

–

$973

1. Coeur expects to report fourth quarter and full year 2012 audited financial results on

Thursday, February 21, 2013. |

NYSE: CDE

| TSX: CDM

31

Non-GAAP to U.S. GAAP Reconciliation (Cont’d)

Cash Operating Costs¹

(In thousands except ounces and per ounce costs)

Nine months ended September 30,2012

Palmarejo

San

Bartolomé

Kensington

Rochester

Martha

Endeavor

Total

Total cash operating cost (Non-US GAAP)

$(774)

$51,006

$80,911

$25,164

$16,110

$10,571

$182,988

Royalties

–

5,372

–

1,959

305

–

7,636

Production taxes

–

–

–

1,255

–

–

1,255

Total cash costs (Non-US GAAP)

$(774)

$56,378

$80,911

$28,378

$16,415

$10,571

$191,879

Add/Subtract:

Third party smelting costs

–

–

(7,044)

–

(3,959)

(2,843)

(13,846)

By-product credit

141,923

–

–

42,758

422

–

185,103

Other adjustments

792

642

17

401

882

–

2,734

Change in inventory

15,129

(703)

(13,805)

(20,206)

3,516

(457)

(16,526)

Depreciation, depletion and amortization

114,499

12,450

27,836

5,763

1,216

4,134

165,898

Production costs applicable to sales, including

depreciation, depletion and amortization (US GAAP)

$271,569

$68,767

$87,915

$57,094

$18,492

$11,405

$515,242

Production of silver (in thousand ounces)

6,681,407

4,587,359

–

1,973,392

323,286

628,393

14,193,197

Cash operating cost per silver ounce

($0.12)

$11.12

–

$12.75

$49.82

$16.82

$7.19

Cash costs per silver ounce

($0.12)

$12.29

–

$14.38

$50.76

$16.82

$7.82

Production of gold (ounces)

–

–

53,407

–

–

–

53,407

Cash operating cost per gold ounce

–

–

$1,515

–

–

–

$1,515

Cash cost per gold ounce

–

–

$1,515

–

–

–

$1,515

1. Coeur expects to report fourth quarter and full year 2012 audited financial results on

Thursday, February 21, 2013. |

NYSE: CDE

| TSX: CDM

32

Non-GAAP to U.S. GAAP Reconciliation (Cont’d)

Cash Operating Costs¹

(In thousands except ounces and per ounce costs)

Nine months ended September 30,2011

Palmarejo

San

Bartolomé

Kensington

Rochester

Martha

Endeavor

Total

Total cash operating cost (Non-US GAAP)

$(3,014)

$49,946

$72,199

$17,787

$12,981

$9,926

$159,825

Royalties

–

8,281

–

1,734

587

–

10,602

Production taxes

–

–

–

728

–

–

728

Total cash costs (Non-US GAAP)

$(3,014)

$58,227

$72,199

$20,249

$13,568

$9,926

$171,155

Add/Subtract:

Third party smelting costs

–

–

(9,122)

–

(2,366)

(2,390)

(13,878)

By-product credit

139,842

–

–

6,554

706

–

147,102

Other adjustments

1,208

298

19

256

462

–

2,243

Change in inventory

1,216

(196)

7,015

(3,005)

(869)

45

4,206

Depreciation, depletion and amortization

116,584

16,387

28,823

1,655

81

2,398

165,928

Production costs applicable to sales, including

depreciation, depletion and amortization (US GAAP)

$255,836

$74,716

$98,934

$25,709

$11,582

$9,979

$476,756

Production of silver (ounces)

6,351,120

5,503,951

–

1,018,844

399,630

501,638

13,755,183

Cash operating cost per silver ounce

($0.47)

$9.07

–

$17.46

$32.48

$19.79

$6.36

Cash costs per silver ounce

($0.47)

$10.58

–

$19.87

$33.95

$18.85

$7.18

Production of gold (ounces)

–

–

75,121

–

–

–

75,121

Cash operating cost per gold ounce

–

–

$961

–

–

–

$961

Cash cost per gold ounce

–

–

$961

–

–

–

$961

1. Coeur expects to report fourth quarter and full year 2012 audited financial results on

Thursday, February 21, 2013. |

NYSE: CDE

| TSX: CDM

33

Coeur’s Mineral Reserves

Grade (oz/ton)

Contained ounces (000)

Year end 2012

Location

Short tons (000)

Silver

Gold

Silver

Gold

Proven Reserves

Rochester

Nevada, USA

56,304

0.54

0.004

30,501

230

Martha

Argentina

–

–

–

–

–

San Bartolomé

Bolivia

1,187

2.92

–

3,460

–

Kensington

Alaska, USA

647

–

0.277

–

179

Endeavor

Australia

2,258

4.32

–

9,757

–

Palmarejo

Mexico

5,747

4.67

0.061

26,858

348

Total Proven Reserves

66,143

70,577

757

Probable Reserves

Rochester

Nevada, USA

23,619

0.61

0.003

14,396

78

Martha

Argentina

–

–

–

–

–

San Bartolomé

Bolivia

41,699

2.53

–

105,628

–

Kensington

Alaska, USA

4,020

–

0.208

–

837

Endeavor

Australia

2,508

1.43

–

3,588

–

Palmarejo

Mexico

7,105

3.69

0.045

26,251

317

Total Probable Reserves

78,951

149,863

1,231

Proven and Probable Reserves

Rochester

Nevada, USA

79,923

0.58

0.004

44,896

308

Martha

Argentina

–

–

–

–

–

San Bartolomé

Bolivia

42,886

2.54

–

109,088

–

Kensington

Alaska, USA

4,667

–

0.218

–

1,016

Endeavor

Australia

4,766

2.80

–

13,345

–

Palmarejo

Mexico

12,852

4.13

0.052

53,110

665

Total Proven and Probable Reserves

145,094

220,439

1,988

Mineral Reserves and Mineral Resources |

NYSE: CDE

| TSX: CDM

34

Mineral Reserves and Mineral Resources (Cont’d)

Coeur’s Measured and Indicated Resources (Excluding Reserves)

Grade (oz/ton)

Contained ounces (000)

Year end 2012

Location

Short tons (000)

Silver

Gold

Silver

Gold

Measured Resources

Rochester

Nevada, USA

135,558

0.47

0.004

53,921

498

Martha

Argentina

–

–

–

–

–

San Bartolomé

Bolivia

–

–

–

–

–

Kensington

Alaska, USA

382

–

0.239

–

91

Endeavor

Australia

10,639

1.98

–

21,088

–

Palmarejo

Mexico

3,186

7.13

0.099

22,720

315

Joaquin

Argentina

5,942

4.58

0.003

27,191

19

Lejano

Argentina

–

–

–

–

–

Total Measured Resources

155,707

134,920

924

Indicated Resources

Rochester

Nevada, USA

128,724

0.44

0.003

56,795

367

Martha

Argentina

57

13.57

0.017

775

1

San Bartolomé

Bolivia

20,040

2.27

–

45,463

–

Kensington

Alaska, USA

2,224

–

0.196

–

435

Endeavor

Australia

302

10.23

–

3,090

–

Palmarejo

Mexico

20,526

1.12

0.032

23,021

649

Joaquin

Argentina

11,398

3.33

0.004

37,980

42

Lejano

Argentina

1,233

2.42

0.008

2,983

10

Total Indicated Resources

184,504

170,108

1,504 |

NYSE: CDE

| TSX: CDM

35

Mineral Reserves and Mineral Resources (Cont’d)

Coeur’s Measured and Indicated Resources (Excluding Reserves) (Cont’d)

Grade (oz/ton)

Contained ounces (000)

Year end 2012

Location

Short tons (000)

Silver

Gold

Silver

Gold

Measured and Indicated Resources

Rochester

Nevada, USA

264,283

0.46

0.003

120,717

865

Martha

Argentina

57

13.57

0.017

775

1

San Bartolomé

Bolivia

20,040

2.27

–

45,463

–

Kensington

Alaska, USA

2,606

–

0.202

–

526

Endeavor

Australia

10,941

2.21

–

24,179

–

Palmarejo

Mexico

23,712

1.93

0.041

45,741

964

Joaquin

Argentina

17,340

3.76

0.004

65,171

61

Lejano

Argentina

1,233

2.42

0.008

2,983

10

Total Measured and Indicated Resources

340,210

305,028

2,427 |

NYSE: CDE

| TSX: CDM

36

Mineral Reserves and Mineral Resources (Cont’d)

Coeur’s Inferred Resources

Grade (oz/ton)

Contained ounces (000)

Year end 2012

Location

Short tons (000)

Silver

Gold

Silver

Gold

Inferred Resources

Rochester

Nevada, USA

45,643

0.60

0.003

27,201

123

Martha

Argentina

204

4.75

0.005

969

1

San Bartolomé

Bolivia

2,826

1.17

–

3,319

–

Kensington

Alaska, USA

704

–

0.244

–

172

Endeavor

Australia

3,527

1.09

–

3,836

–

Palmarejo

Mexico

11,903

1.86

0.038

22,104

457

Joaquin

Argentina

1,060

2.94

0.003

3,113

4

Lejano

Argentina

3,307

1.73

0.006

5,713

19

Total Inferred Resources

69,174

66,254

775

Notes to the above Mineral Reserves and Resources. 1.

Effective December 31, 2012 except Endeavor effective June 30, 2012. Joaquin’s Mineral Resources reflect Coeur’s 100% ownership of the project after acquiring the remaining 49% in

December 2012.

2. Metal prices used for Mineral Reserves were $27.50 per ounce of silver and

$1,450 per ounce of gold, except Endeavor at $2,200 per metric ton of lead, $2,200 per metric ton of zinc and

$34 per ounce of silver. 3. Metal

prices used for Mineral Resources were $33 per ounce of silver and $1,700 per ounce of gold except Endeavor at $2,200 per metric ton of lead, $2,200 per metric ton of zinc and

$34 per ounce of silver. 4.

Mineral Resources are in addition to Mineral Reserves and have not demonstrated economic viability.

5. Palmarejo Mineral Reserves and Resources are the addition of Palmarejo, Guadalupe and La

Patria.

6. Current Mineral Resources are inclusive of disputed and undisputed claims at Rochester.

While the Company believes it holds superior position in the ongoing claim dispute, the Company

believes an adverse legal outcome would cause it to modify Mineral Resources. 7.

Rounding of short tons and troy ounces, as required by reporting guidelines, may result in apparent differences between tons, grade and contained metal content.

8. For details on the estimation of Mineral Resources and Reserves for each

property, please refer to the Technical Report on file at www.sedar.com.

|

NYSE: CDE

| TSX: CDM

37

Mineral Reserves and Mineral Resources (Cont’d)

La Preciosa Mineral Resources

Category

Cutoff

g/t Ag

Tonnes

Ag

Grade (g/t)

Silver Ounces

Au

Grade (gt)

Gold

Ounces

Open Pit

Indicated

25

29,600,000

104

99,000,000

0.20

190,400

Inferred

25

47,700,000

86

132,000,000

0.16

245,400

Underground

Indicated

60

50,000

99

200,000

0.16

280

Inferred

60

1,960,000

124

7,600,000

0.21

13,200

Note: Data as per latest technical report filed on SEDAR. Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability; Open pit resources stated as

contained within a potentially economically minable pit shell; Strip Ratio of 13:1; Pit

optimization is based on assumed silver and gold prices of US$25.90/oz, US$1,465/oz, respectively, mill

recoveries of 88%, 78% respectively, mining costs of US$1.45/t, and a processing costs of

US$17.25/t and G&A cost of US$4.35/t; Break-even cut-off grades used were 25 g/t Ag for open

pit mill material and 60 g/t Ag for underground material; Silver equivalency is based on unit

values calculated from the above metal prices, and assumes 100% recovery of all metals;

Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the

estimate, and numbers may not add due to rounding; George Cavey, P.Geo., is the

Qualified Person responsible for the preparation of the scientific and technical information

related to La Preciosa that is included in this presentation. |

NYSE: CDE

| TSX: CDM

38

Contact Information

Head Office:

Coeur d’Alene Mines Corporation

505 Front Avenue

Coeur d’Alene, Idaho 83816-0316

Main Tel:

(208) 667-3511

Tickers:

CDE: NYSE; CDM: TSX

Website:

www.coeur.com

Mitch Krebs

President and Chief Executive Officer

Wendy Yang

Mike Harrison

Vice President, Investor Relations

Vice President, Business Development

(208) 665-0345

(208) 651-6428

wyang@coeur.com

mharrison@coeur.com |