Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PIONEER NATURAL RESOURCES CO | d485439d8k.htm |

| EX-99.1 - EX-99.1 - PIONEER NATURAL RESOURCES CO | d485439dex991.htm |

Fourth

Quarter 2012 Earnings February 14, 2013

Exhibit 99.2 |

2

Forward-Looking Statements

Except for historical information contained herein, the statements, charts and graphs in

this presentation are forward-looking statements that are made pursuant to the

Safe Harbor Provisions of the Private Securities Litigation Reform Act of

1995. Forward-looking statements and the business prospects of Pioneer

are subject to a number of risks and uncertainties that may cause Pioneer's actual

results in future periods to differ materially from the forward-looking statements.

These risks and uncertainties include, among other things, volatility of commodity

prices, product supply and demand, competition, the ability to obtain

environmental and other permits and the timing thereof, other government

regulation or action, the ability to obtain approvals from third parties and

negotiate agreements third parties on mutually acceptable terms, the receipt of

approvals required to consummate the Company’s Southern Wolfcamp joint interest

transaction, litigation, the costs and results of drilling and operations,

availability of equipment, services, resources and personnel required to complete

the Company's operating activities, access to and availability of transportation,

processing, fractionation and refining facilities, Pioneer's ability to replace

reserves, implement its business plans or complete its development activities as scheduled,

access to and cost of capital, the financial strength of counterparties to Pioneer's

credit facility and derivative contracts and the purchasers of Pioneer's oil, NGL

and gas production, uncertainties about estimates of reserves and resource

potential and the ability to add proved reserves in the future,

the

assumptions

underlying

production

forecasts,

quality

of

technical

data,

environmental

and weather risks, including the possible impacts of climate change, the risks associated

with the ownership and operation of an industrial sand mining business and acts of

war or terrorism. These and other risks are described in Pioneer's 10-K

and 10-Q Reports and other filings with the Securities and Exchange

Commission. In addition, Pioneer may be subject to currently unforeseen risks that

may have a materially adverse impact on it. Pioneer undertakes no duty to publicly

update these statements except as required by law.

Please see the supplemental information slides included in this presentation for other

important information. |

3

Financial and Operating Highlights

Q4 2012 adjusted income

of $107 MM, or $0.83 per adjusted share

Q4 2012 production: 165 MBOEPD (including Barnett Shale production)

Q4 2012 production: 156 MBOEPD excluding Barnett Shale production

, mid-point of Q4 guidance range

(154 MBOEPD –

158 MBOEPD)

FY 2012 production averaged 156 MBOEPD

(including Barnett Shale production), up 29%

vs. FY 2011 (+54% oil growth)

Top end of full-year guidance range

Strong growth primarily related to successful Spraberry vertical, horizontal Wolfcamp

Shale, Eagle Ford Shale and Barnett Shale Combo drilling programs

Delivered 264% drillbit reserve replacement (161 MMBOE) in 2012 at drillbit F&D cost

of $17.72 per BOE

4

Initiating $1 B horizontal drilling appraisal program of Pioneer’s northern

Wolfcamp/Spraberry acreage for 2013 and 2014

$0.4 B included in 2013 drilling budget of $2.75 billion; remainder expected to be

spent in 2014 Forecasting annual production growth of 12% to 16% from 2012 to

2013 Targeting 13% to 18% compound annual production growth for 2013 to 2015

1)

Adjusted income and the adjusted per share amount are non-GAAP financial

measures. See reconciliation in supplemental information slides 2)

Barnett Shale properties were moved to discontinued operations in Q3 in conjunction

with the divestment announcement; however, they were reclassified to continuing

operations in Q4 after electing to retain these properties 3)

Reflects South Africa as discontinued operations

4)

Excludes price revisions

1

1

2

2

3 |

4

Drilling Highlights

First

PXD

horizontal

Wolfcamp

Shale

well

(B

interval)

in

Midland

County

highly

successful;

demonstrates prospectivity of Pioneer’s northern Wolfcamp/Spraberry acreage

position (>600,000 gross acres)

Announced $1.74 B horizontal Wolfcamp Shale joint interest transaction with

Sinochem Horizontal

Wolfcamp

Shale

results

continuing

to

improve

in

joint

interest

area

—

Includes 1.6 BBOE from southern horizontal Wolfcamp Shale joint interest area and 3.0

BBOE from horizontal drilling in northern Wolfcamp/Spraberry acreage

—

Drilled first ~10,000-foot lateral horizontal Wolfcamp Shale well (Upper B

interval) in Reagan County o

24-hour IP rate of 1,203 BOEPD; peak 20-day average rate of 1,022 BOEPD; oil

content ~80% —

Drilled first horizontal Wolfcamp Shale Lower B interval well and successful horizontal

Wolfcamp Shale A interval well in Reagan County; both currently above 575 MBOE

type curve —

Well performance from existing wells continuing to meet type curve expectations

—

Achieved targeted year-end 2012 horizontal Wolfcamp Shale production exit rate of

~5 MBOEPD Increasing companywide net resource potential from 5.7 BBOE to >8

BBOE —

24-hour

IP

rate

of

1,693

BOEPD;

peak

20-day

average

natural

flow

rate

of

1,510

BOEPD;

oil

content

~75%

—

25 miles

north

of

highly

successful

Giddings

horizontal

Wolfcamp

Shale

wells

—

Equates to ~$21,000 per acre on ~10% of Pioneer’s total Wolfcamp/Spraberry acreage

position |

–

$425 MM southern Wolfcamp joint interest area

2

–

$575 MM Eagle Ford Shale

–

$185 MM Barnett Shale Combo

–

$190 MM Alaska

–

$150

MM

Other

(includes

land

capital

for

existing assets)

–

$2.0 B operating cash flow

–

$0.6 B joint interest cash proceeds

–

$0.4 B capital markets

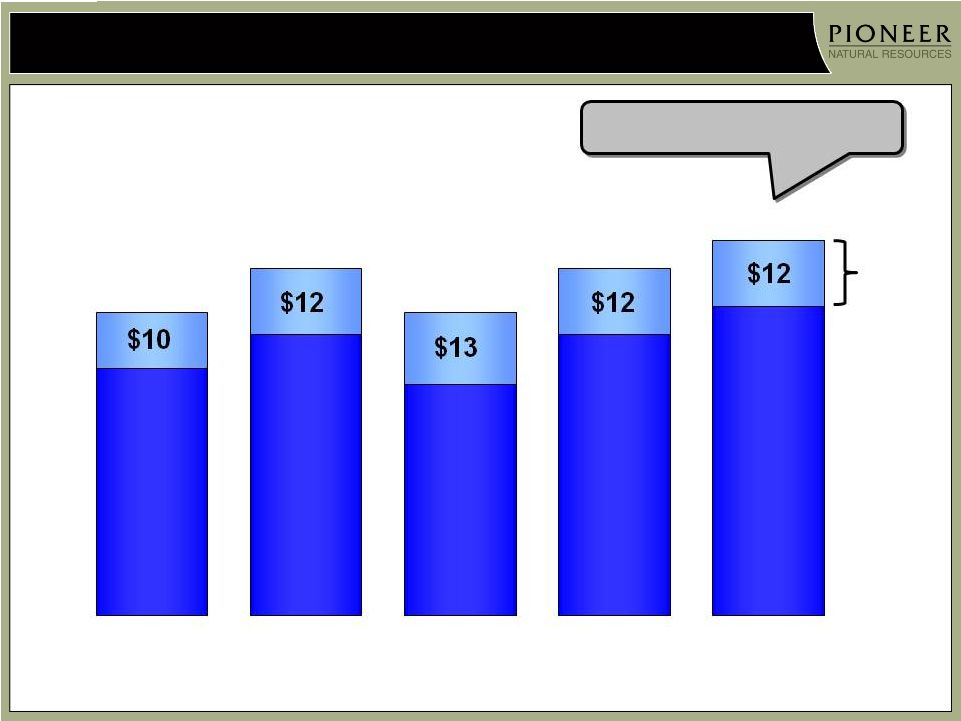

NYMEX Oil Price ($/Bbl)

2013 capital program based on

$85/Bbl oil and $3.25/MMBtu gas

Sensitivity to Commodity Prices ($ MM)

5

2013E Capital Spending and Cash Flow

1

1)

Capital spending excludes acquisitions, asset retirement obligations, capitalized

interest and G&G G&A 2)

Pioneer

incurs

100%

of

capital

costs

from

January

1

st

through

estimated

closing

date

of

June

1

st

;

Pioneer

will

be

reimbursed

by

Sinochem

for

40%

of

this amount as an adjustment at closing (not credited to cost incurred); Sinochem pays

40% of capital costs and carries Pioneer for 75% of Pioneer’s 60% of

capital costs post closing 1.00

2.00

3.00

4.00

5.00

6.00

60.00

70.00

80.00

90.00

100.00

110.00

120.00

2

$240 MM Other Capital

Capital program funded from:

Capital program of $3.0 B includes:

Drilling Capital: $2.75 B

–

$1,225 MM northern Wolfcamp/Spraberry area

•

$400 MM for horizontal program

•

$625 MM for vertical program

•

$200 MM for infrastructure & automation

–

$25 MM vertical integration

–

$70 MM sand mine expansion

–

$145 MM buildings, field offices and other |

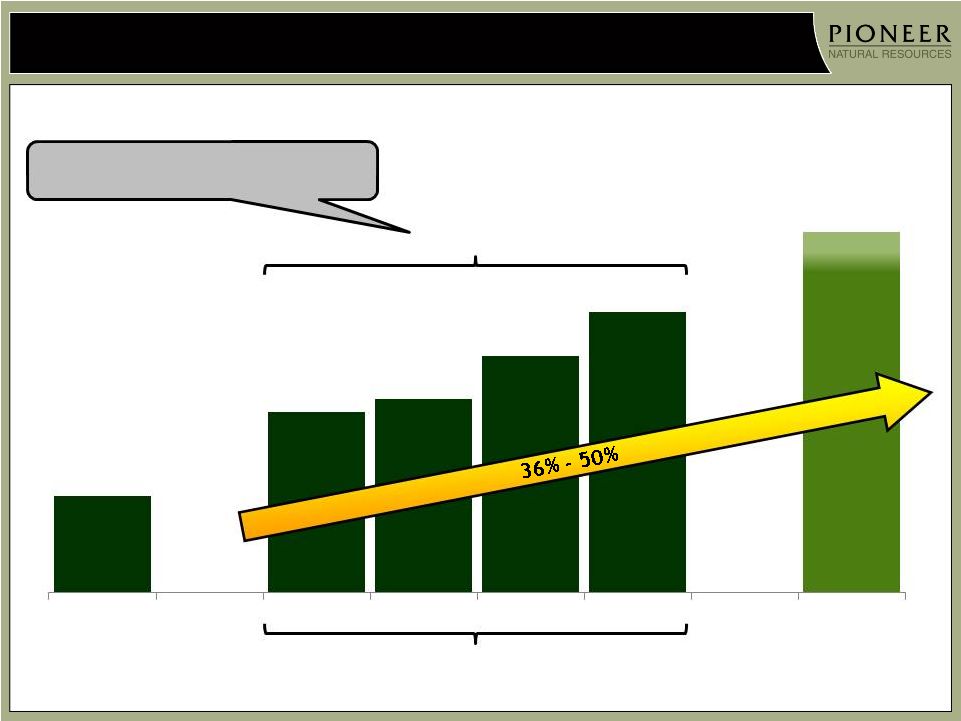

High end

of 2013-2015 growth range assumes $100 oil / $3.75 gas; low end assumes $85 oil / $3.25 gas

6

Targeting 13% -

18% Compound

Annual

Production

Growth

for

2013

-

2015

MBOEPD

147

160

165

58%

Liquids

60%

Liquids

175 -

181

156 MBOEPD

(+29% vs. 2011)

1)

Assumes $85/Bbl oil price and $3.25/MMBtu gas price

2)

Excludes production attributable to the 40% joint interest transaction with Sinochem in

the southern Wolfcamp area assuming a June 1, 2013 closing 3)

Assumes

no

ethane

rejected

into

the

gas

stream

due

to

low

ethane

prices

3

Q1

Q2

Q3

Q4

2013E

2014E

2015E

Excludes annualized 4+ MBOEPD

conveyed

to

Sinochem

post

June

1

st

2,3

2012

151

3 |

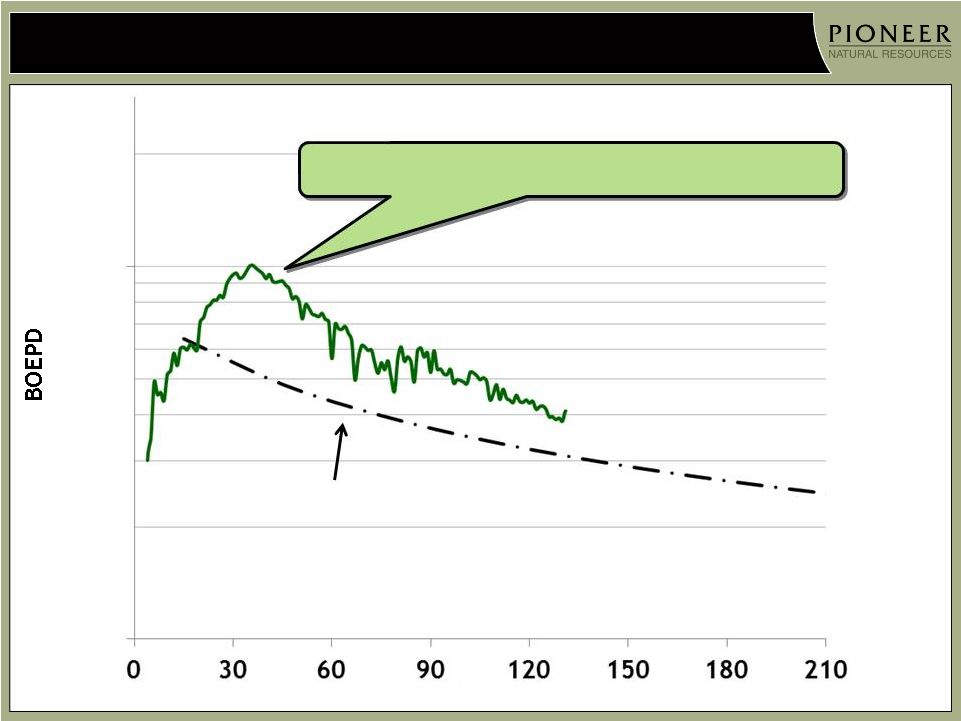

Horizontal

Wolfcamp Shale Well Results Continue to Improve 7

650 MBOE Type Curve

Giddings Wells Average

(southern joint interest area;

2 wells, 5,300’

laterals)

Days

University 10-1 #4H (southern joint interest area)

First ~10,000’

lateral

24-hr IP of 1,203 BOEPD

Peak 20-day average rate of 1,022 BOEPD; ~80% oil

DL Hutt C #1H (Midland County)

First northern acreage horizontal, 7,380’

lateral

24-hr IP natural flow rate of 1,693 BOEPD

Peak 20-day average natural flow rate of 1,510 BOEPD; ~75% oil

Giddings horizontal Wolfcamp Shale B interval wells drilled late

2011/early 2012 tracking 650 MBOE type curve

First

northern

acreage

well

in

Midland

County

and

first

10,000’

lateral

well in Reagan County both substantially above 650 MBOE type curve

2,000

1,000

100

Artificial lift

commenced

0

30

60

90

120

150

180

210

240

270

300

330

360 |

Horizontal

Jo Mill Wells Outperforming 650 MBOE Type Curve 8

Days

2,000

1,000

100

650 MBOE Type Curve

Initial 2 horizontal Jo Mill wells drilled in Q4 2012

(average

production

normalized

to

5,000’

lateral) |

Wolfcamp B

Interval Prospectivity Map 9

Tier 1

Tier 1

Tier 2

Tier 2

Pioneer Land

Pioneer Land

DL Hutt C #1H

24-hr IP: 1,693 BOEPD

Peak 20-day natural flow

rate: 1,510 BOEPD; ~75% oil

7,380’

lateral length

First Martin County B well drilling

7,200’

lateral length

Tier 1 is highest prospectivity

acreage, as determined by several

geologic properties, including:

Original oil in place (OOIP)

Kerogen content

Thermal maturity

Porosity

Brittle mineral fraction (fracability,

low clay content)

Vast majority of Pioneer’s

acreage position is in Tier 1

Reservoir pressure increases with

depth to the north and west

Numerous wells have proven Tier

2 acreage to be productive and

economic

2 Giddings Wells

Avg. 24-hr IP: 845 BOEPD

Avg. peak 20-day natural flow rate:

702 BOEPD: >75% oil

5,300’

avg. lateral length

Third-party well

Peak IP: 892 BOEPD

~3,700’

lateral length

Pioneer Wolfcamp B wells

Pioneer Wolfcamp B wells

Wolfcamp B depth contour

Wolfcamp B depth contour |

10

12/31/12 Proved Reserves: 1.1 BBOE

Additional Net Resource Potential: >8 BBOE

1)

All drilling locations shown on a gross basis

2)

SEC pricing of $94.84/Bbl for oil and $2.76/MMBtu for gas (NYMEX)

3)

Primarily reflects Alaska, Raton and South Texas

4)

Includes vertical well potential from Wolfcamp and deeper intervals

5)

Assumes average EUR of 500 MBOE per well, >600,000 gross acres, 140-acre

spacing, Wolfcamp A, B & D and Jo Mill intervals (excludes Spraberry Shale

interval potential) and 20% royalty 6)

Assumes average EUR of 575 MBOE per well, 5,600 locations, 207,000 net

acres , 140-acre spacing, laterals in all intervals (A, B, C & D),

25% royalty and Pioneer’s 60% share (reduced by ~1 BBOE associated with

joint interest transaction) Permian >7 BBOE

Significant Proved Reserves and Resource Potential

1

2

Proved Reserves + Estimated Net Resource Potential of >9 BBOE and >40,000

Drilling Locations |

11

Southern Wolfcamp Joint Interest Area Drilling Program

Currently running 7 rigs; expect to increase

to 10 rigs in 2014 and 13 rigs in 2015

Equates to 86 wells in 2013, 120 wells in 2014 and

165 wells in 2015

2013 drilling program continues to focus on

delineating acreage

Testing multiple Wolfcamp

intervals

(A, Upper B, Lower B and D)

Targeting $7.5 MM -

$8.0 MM gross development

well cost for 7,800’

lateral

o

Testing laterals as long as 10,000’; ~$1.5 MM additional cost

Expect 50% pad drilling

Optimizing completion techniques

o

Testing slickwater fracs; potential savings of ~$1.0 MM/well

Expect gross science costs of ~$20 MM

Drilling program for 2014 and beyond

primarily focused on development drilling

and accelerating production growth

Expect 75% pad drilling

Expect to evaluate downspacing opportunities

Noteworthy 24-hr IP rates in University Area

10-14 #6H –

712 BOEPD; First Lower B well

10-1#4H –

1,203 BOEPD; First 10,000’

lateral well

10-13#6H –

442 BOEPD; Successful A well

Joint Interest Area

(Wolfcamp and deeper intervals) |

Pioneer’s Highly Prospective Northern Wolfcamp/Spraberry Acreage

12

1 rig currently focused on delineating

northern acreage (>600,000 gross acres)

Drilled first two horizontal Wolfcamp Shale

wells in Midland County

~25 miles north of highly successful Giddings horizontal

Wolfcamp Shale wells

First well completed in B interval (DL Hutt C #1H)

Second well to be completed shortly in the A interval

Rig now drilling first of two Wolfcamp B

interval wells in Martin County

Pioneer’s extensive Midland Basin geologic

analysis, based upon data from thousands of

wells, has identified multiple prospective

horizontal targets with substantial oil in place

throughout Pioneer’s northern acreage

2013 northern Wolfcamp/Spraberry drilling

program accelerates appraisal and delineation

of these targets (Wolfcamp Shales, Jo Mill and

Spraberry Shales) with 4 rigs

Currently drilling first of

two wells in Martin County

Pioneer’s northern

Wolfcamp/Spraberry Acreage

First two Midland

County wells

First two Giddings wells

Joint Interest Area

(Wolfcamp and deeper intervals) |

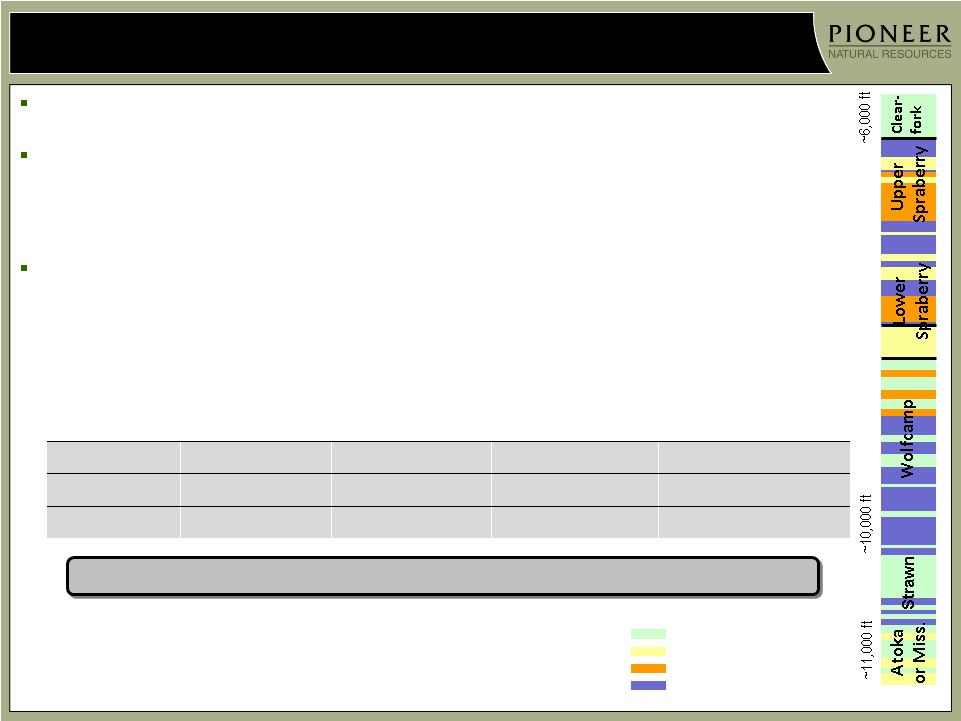

13

Northern Wolfcamp/Spraberry Acreage –

2013 Drilling Plan

Wolfcamp

A

Wolfcamp

B

Wolfcamp

D

Jo Mill

M. Spraberry

Shale

L. Spraberry

Shale

15 to 20 wells

15 to 20 wells

2013 northern Wolfcamp/Spraberry

acreage horizontal drilling program

Running 1 rig currently; ramping to 4 rigs

in Q2

Plan to drill a total of 30 to 40 wells

targeting 6 different intervals

Targeting $7.5 MM -

$8.5 MM well cost

for 7,000’

laterals depending on depth

Excludes science and facilities capital

of ~$80 MM

U. Spraberry

M. Spraberry

Shale

L. Spraberry

Jo Mill

L. Spraberry

Shale

Dean

Wolfcamp A

Wolfcamp Lower B

Wolfcamp C1

Wolfcamp C2

Wolfcamp D

Strawn

Wolfcamp Upper B

Miss/Atoka |

14

Northern

Wolfcamp/Spraberry

Acreage

–

Initiating

$1

B

Appraisal

Program

2013 drilling program expected to cost ~$400 MM

Program expected to:

Appraise prospective acreage and confirm additional

resource potential across 6 stacked intervals on >600,000

gross acres; totals >3 MM gross acres

o

Resource potential in Wolfcamp A, B and D intervals and Jo Mill

interval across northern Wolfcamp/Spraberry acreage estimated

to be 3 BBOE

Deliver year-end 2013 horizontal production exit rate of

5 MBOEPD to 7 MBOEPD

Improve capital efficiency compared to vertical drilling

Expect to ramp up to 6 -

8 rigs during 2014 at a

cost of ~$600 MM

Continue appraisal program and commence development

drilling

May also test horizontal drilling in deeper intervals below

the Wolfcamp Shale

Spending $1 B over 2 years to confirm ~3 BBOE

of resource potential and add substantial NAV

2013 Appraisal Areas

Planned 2013 appraisal

areas; 6 intervals |

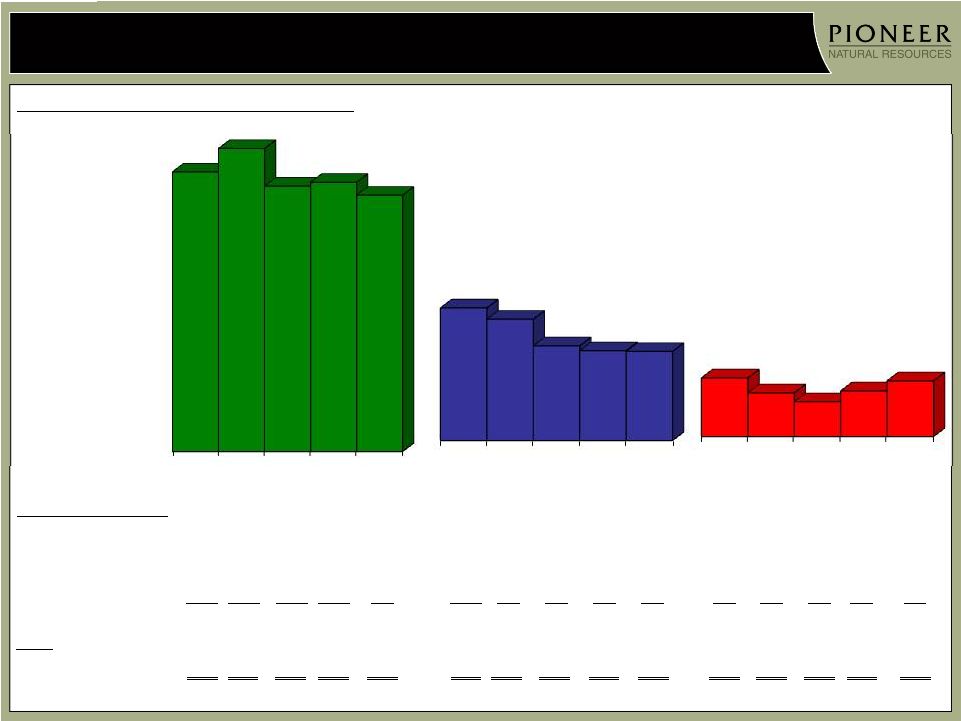

Spraberry

Vertical Drilling Program 15

Limestone Pay

Sandstone Pay

Non-Organic Shale Non-Pay

Organic Rich Shale Pay

Commingled Wells

Placed on

Production in 2012

2012 Average

24-hour IP (BOEPD)

Potential Incremental

EUR (MBOE)

Prospective PXD Acreage

Strawn

208

145

30

up from ~70% to ~85%

Atoka

134

180

50 –

70

40% -

50%

Mississippian

55

140

15 –

40

~20%

1)

Compares to average vertical well completed through the Lower Wolfcamp with an average

EUR of 140 MBOE and an average 24-hour IP of 90 BOEPD

Deeper drilling accounted for 65% of 2012 vertical drilling program; expected to

increase to 90% in 2013

Vertical rig count reduced during 2012 from 40 rigs in Q1 to 20 rigs at year-end as

horizontal activity increased

–

Drilled 132 vertical wells in Q4 and 631 wells in 2012

–

Built frac bank by 57 vertical wells over 2H 2012

2013 drilling program runs 15 vertical rigs and drills ~300 wells

–

Majority of rigs required to meet continuous drilling obligations

–

15 rigs to 20 rigs required to keep vertical production flat

–

Expect

to

draw

down

frac

bank

by

60

-

70

vertical

wells

during

2013

Dean

Deeper drilling provides potential to add up to 100 MBOE to vertical Wolfcamp well

1

1 |

Continuing to Successfully Grow Wolfcamp/Spraberry Production

16

Wolfcamp/Spraberry Net Production

1

(MBOEPD)

1) Includes production from Strawn, Atoka and Mississippian intervals in Spraberry

vertical wells and horizontal Wolfcamp Shale and Jo Mill wells 45

62

2012

64

69

69

75-80

66 MBOEPD

Q4 production flat compared to Q3 due to:

~1,700 BOEPD negative impact related to reduced

ethane recoveries resulting from Spraberry gas

processing facilities operating above capacity due

to greater-than-anticipated industry production

growth

Vertical wells awaiting completion increased by 57

wells during 2H

Reduced ethane recoveries expected to

continue into Q2 2013 until new Driver

plant comes online in April providing

additional capacity of 200 MMCFPD

Negative impact to Pioneer’s Q1 production

expected to be 2,000 BOEPD to 3,000 BOEPD

Vertical rig count decreasing from average

of 32 rigs in 2012 to 15 rigs in 2013

Horizontal rig count increasing from

average of 3 rigs in 2012 to 11 rigs in 2013

Expect horizontal production to increase

from an average of 2 MBOEPD in 2012 to

11 MBOEPD to 14 MBOEPD in 2013

2

2,3

Top end of original FY guidance

range (63 MBOEPD –

67 MBOEPD)

Horizontal production

exit rate: ~5 MBOEPD

2) Production

reduced

after

June

1

st

to

reflect

the

divested

volumes

associated

with

the

southern

Wolfcamp

joint

interest

transaction

3) Assumes no ethane rejected into the gas stream due to low ethane prices

|

Eagle

Ford Shale Operational Update 17

Drilled 30 wells in Q4 2012; 37 wells placed on production

2013 drilling program

Expanding use of white sand proppant to deeper areas to further

define its performance limits (>50% of 2013 program)

~97 wells stimulated using white sand in 2011 and 2012; early well

performance similar to direct offset ceramic-stimulated wells

Reduces frac cost by ~$700 M

Expect to increase lateral length from 5,700’

in 2012 to 6,200’

in

2013; increases cost by $500 M per well

Well cost: $7 MM to $8 MM

11 CGPs on line; adding 12

by end of 2013

th

Expect to drill ~130 wells

Drilling essentially all liquids-rich wells ~80% pad

drilling, up from 45% in 2012; saves $600 M to $700 M per well and allows

130 wells to be drilled with 10 rigs vs. 12 rigs last year |

Eagle

Ford Shale Continues to Set New Production Records 18

Eagle Ford Shale Net Production

(MBOEPD)

12

1)

Reflects Pioneer’s ~35% share of total gross production

2)

Assumes

no

ethane

rejected

into

the

gas

stream

due

to

low

ethane

prices

28 MBOEPD

2012

Top end of original FY guidance

range (25 MBOEPD –

29 MBOEPD)

2

2011

Q1

Q2

Q3

Q4

2013E

1

38 -

42

35

29

24

23 |

Continuing to Grow Barnett Shale Combo Production

19

Barnett Shale Net Production

(MBOEPD)

4

6

2012

7

9 -

12

7

9

7 MBOEPD

Drilled 8 wells in Q4; 8 wells placed on

production

Expect to increase rig count from 1 rig to 2

rigs in Q2 2013 to hold high-graded acreage

~20% of 82,000 net acreage position currently HBP

Drilling data and petrophysical and seismic analysis

have identified highest-return areas across Pioneer’s

acreage (reflects ~45,000 net acres of remaining

~65,000 non-HBP net acres)

Increase in drilling efficiencies requires fewer rigs to

hold acreage

2-rig drilling program required to hold the higher-

return acreage over next 3 years

Well cost for 5,000’

lateral: ~$3 MM

Gross EUR: ~400 MBOE (16% oil, 42% NGLs, 42% gas)

1)

Assumes

no

ethane

rejected

into

the

gas

stream

due

to

low

ethane

prices

1 |

20

Alaska

Q4 net production: ~4 MBOPD

1-rig development program

continues from the Oooguruk island

drill site targeting Nuiqsut and Torok

intervals

Following first successful mechanically

diverted frac on a Nuiqsut well in 2012,

planning similar fracs for 1 Torok and 3

Nuiqsut wells during Q1

2

onshore

Torok

appraisal

well

being drilled

Will be completed with mechanically

diverted frac

Initial onshore Torok well added 50 MMBO

resource potential in 2012; currently

being flow tested and is producing at a

facility-limited rate of 2,800 BOPD gross

Progressing onshore development FEED

study for Torok production

PXD Acreage

Island

Development

Area

Island drill site

(Oooguruk)

Torok Area

1 well to be

frac’d from island

drill site and 1

well to be frac’d

from onshore drill

site

Nuiqsut Area

3 wells to be frac’d

from island drill site

Nuiqsut Wells

Torok Wells

nd

Second onshore

Torok appraisal well

Torok onshore

drill site |

Net

income attributable to common stockholders 29

0.22

Unrealized mark-to-market (MTM) derivative gains ($22 MM before tax)

(14)

(0.11)

Adjusted income excluding unrealized MTM derivative gains

15

0.11

Unusual items included in adjusted income:

Impairment of Barnett Shale assets previously held for sale ($160 MM before tax)

101

0.78

Alaska Petroleum Production Tax credit income ($14 MM before tax)

(9)

(0.06)

Adjusted income excluding unrealized MTM derivative gains and unusual items

107

0.83

21

Q4 2012 Earnings Summary

$ Per Share

$ Millions

(After Tax)

Guidance

Q4 2012 Results Excluding

Unrealized MTM Derivative

Gains, Unusual Items and

Barnett Shale Activity

Q4 2012 Results from

Continuing Operations

Daily Production

(MBOEPD)

154 –

158

156

165

Production Costs Including Taxes ($/BOE)

$14.50 -

$16.50

$ 14.48

$ 14.62

Exploration & Abandonment

($ MM)

$25 -

$35

$ 16

$ 89

DD&A ($/BOE)

$13.50 -

$15.50

$ 14.63

$ 14.54

G&A

4

($ MM)

$60 -

$65

$ 68

$ 68

Interest Expense ($ MM)

$53 -

$58

$ 54

$ 54

Other Expense ($ MM)

$25 -

$35

$ 27

$ 27

Accretion of Discount on ARO ($ MM)

$2 -

$4

$ 2

$ 3

Noncontrolling Interest ($ MM)

$8 -

$11

$ 8

5

$ 11

Current Income Taxes /(Benefits) ($ MM)

$2 -

$7

-

-

Effective Tax Rate

6

(%)

35% -

40%

34%

24%

Q4 2012 Guidance vs. Results

1)

Non-GAAP financial measure. See reconciliation in supplemental information

slides 2)

3)

Exploration and abandonments in continuing operations included $72 MM of unproved

impairments on Barnett Shale assets (included in unusual items above) 4)

Includes additional performance-related compensation

5)

Excludes unrealized MTM derivative gains attributable to noncontrolling interest of $ 3

MM in Q4 2012 6)

Excludes income attributable to noncontrolling interest of $ 11 MM in Q4 2012

1

1

2

3

Q4 production was negatively impacted by a total of ~1,700 BOEPD due to reduced ethane

recoveries at Spraberry gas processing facilities |

22

Price Realizations

1

Oil ($/BBL)

NGL ($/BBL)

Gas ($/MCF)

Derivative impact included

in price

1.79

(0.15)

(0.42)

-

-

-

-

-

-

-

-

-

-

-

-

Derivative impact not

included in price

Price

92.74

99.73

87.94

89.77

87.78

44.20

42.57

34.48

32.49

31.48

4.81

4.49

4.43

4.48

4.48

VPP and derivative impact

1.23

0.58

1.07

1.68

3.89

(1.50)

0.76

1.86

1.53

0.79

1.44

1.98

2.43

1.86

1.28

VPPs and Derivatives

Realized Prices (excludes VPPs and derivatives)

Price including VPPs and

all derivatives

VPPs

2.45

1.99

1.87

1.79

1.71

-

-

-

-

-

-

-

-

-

-

1) All periods presented have been restated to exclude discontinued operations

2) Represents cash settlements recorded in net derivative gains or losses excluding

liquidated derivatives 91.51

45.70

3.37

99.15

41.81

2.51

86.87

32.62

2.00

88.09

83.89

30.96

30.69

2.62

3.20

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

(3.01)

(1.26)

(0.38)

(0.11)

2.18

(1.50)

0.76

1.86

1.53

0.79

1.44

1.98

2.43

1.86

1.28

2 |

23

Production Costs (per BOE)

1

VPP-Adjusted

Production Cost

1)

2)

See supplemental information slides

$13.16

$12.99

$13.88

$15.27

$14.32

Q4 production cost decrease vs.

Q3 primarily due to the following

LOE items:

–

Lower salt water disposal costs

–

Lower electricity costs

–

Lower repair and maintenance costs

All periods presented have been restated to exclude discontinued operations and

intercompany eliminations Production

&

Ad Valorem Taxes

Workovers

LOE

Third Party

Transportation

Natural Gas

Processing

Q4 ’11

$13.52

Q1 ’12

$0.30

$13.30

$0.24

Q2 ’12

$14.21

$0.64

Q3 ’12

$0.59

Q4 ’12

$0.42

$15.61

$14.62

$0.68

$3.18

$1.36

$8.00

$7.70

$8.08

$9.61

$8.68

$1.24

$1.28

$1.28

$1.40

$3.43

$3.25

$3.38

$3.14

$0.69

$0.96

$0.75

$0.98 |

24

Q1 2013 Guidance

Daily Production (MBOEPD)

165 –

170

Production Costs ($/BOE)

$14.00 –

$16.00

Exploration & Abandonment ($ MM)

$25 –

$35

Drilling and Acreage

$15

Personnel

and

Seismic

$20

DD&A ($/BOE)

$13.50 –

$15.50

G&A ($ MM)

$60 –

$65

Interest Expense ($ MM)

$53 –

$58

Other Expense ($ MM)

$25 –

$35

Accretion of Discount on ARO ($ MM)

$2 –

$4

Noncontrolling Interest (principally PSE) ($ MM)

$8 –

$11

Current Income Taxes ($ MM)

$2 –

$7

Effective Tax Rate (%)

35% –

40%

Guidance

1

1)

Excludes MTM derivative changes due to increases or decreases in future commodity

prices |

25

Supplemental Information

Supplemental Information Slides

Slide #

2012 Reserve Additions

26

2012 Drilling Capital

27

Liquidity Position

28

Historic Production

29 -

30

Oil and Gas Revenue

31

Derivative Position

32 -

34

Oil, NGL and Gas Differentials

35 -

37

General & Administrative Costs

38

Interest Costs

39

Exploration and Abandonments

40

Income Taxes

41

Supplemental Non-GAAP Financial Measures

42

Supplemental Earnings Per Share Information

43

Supplemental Non-GAAP Financial Measures

44 -

45

VPP -

Adjusted Production Costs

46

Reserves Audit, F&D Costs and Reserve Replacement

47

Certain Reserve Information

48 |

Added

161 MMBOE from the drillbit, or 264% of full-year production, at a drillbit

F&D cost of $17.72 per BOE Reflects significant drilling campaigns in

horizontal Wolfcamp Shale, Spraberry vertical, Eagle Ford Shale and

Barnett Shale Combo plays

All-in reserve replacement of 87 MMBOE, or 144% of full-

year production at an all-in F&D cost of $34.46 per BOE,

including:

Negative pricing revisions of 82 MMBOE due to significant

decline in gas prices

Negative technical revisions of 27 MMBOE; performance

improvements of 53 MMBOE offset by 80 MMBOE of vertical

Spraberry PUDs moved to the probable category as the

Company shifts to more horizontal drilling in the Spraberry

field based on successful horizontal Wolfcamp Shale

drilling results

Reserve mix

100% U.S.

45% oil / 21% NGLs / 34% gas

58% PD / 42% PUD

Proved Reserves / Production: ~18 years

PD Reserves / Production: ~10 years

26

Strong 2012 Reserve Additions

1

Year-end ’12

Proved Reserves

(MMBOE)

627

119

116

101

55

44

23

1

1,086

1)

Reflects 2012 SEC pricing (12-month average) of $94.84/Bbl for oil and $2.76/MMBtu

for gas (NYMEX) as compared to 2011 SEC pricing of $96.13/Bbl for oil and

$4.12/MMBtu for gas (NYMEX) Spraberry

Raton

Eagle Ford

Mid-Continent

Barnett Shale

Alaska

South Texas

Other

Total |

27

2012 Drilling Capital

1

1)

Excludes

acquisitions,

asset

retirement

obligations,

capitalized

interest

and

G&G

G&A

$ Millions

$741

$678

$639

$670

$2,728

Q1 2012

Q2 2012

Q3 2012

Q4 2012

FY 2012 |

28

Liquidity Position (12/31/12)

1

Net debt (net of cash balance of $229 MM):

$3.4 B

Unsecured credit facility availability:

$1.0 B

Net debt-to-book capitalization:

37%

1)

Excludes $126 MM of borrowings under PSE’s $300 MM credit facility that matures in

March 2017 2)

Excludes net discounts and deferred hedge losses of ~$49 MM

3)

Convertible senior notes due 2038; based on trading value, interest rate reduced to

2.375% from 2.875% effective January 15, 2013; holders of $241 MM in principal

amount exercised their right to convert in Q1

4)

Excludes ~$2 MM of outstanding letters of credit on credit facility; credit facility

balance as of January 31, 2013 was $750 MM Maturities

and

Balances

2

Unsecured credit facility matures in 2017

Investment grade rated

Expect to call convertible senior notes due 2038 for redemption during 2013

2012

2016

$600 MM

3.95%

2017

$455 MM

5.875%

2022

$450 MM

6.875%

$474 MM

4

of

$1.5 B unsecured credit facility

2018

$485 MM

6.65%

2013

$480 MM

3

2.375%

$450 MM

7.50%

2020

$250 MM

7.20%

2028 |

29

Production (MBOEPD)

1

Q4 ’11

Q1 ’12

Q2 ’12

Q3 ’12

Q4 ’12

Spraberry

53

62

64

2

69

3

69

4

Eagle Ford Shale

20

23

24

29

35

Raton

26

26

25

25

24

South Texas

7

7

6

6

6

Mid-Continent

19

18

18

18

17

Barnett

6

6

7

7

9

Alaska

4

4

5

5

4

Other

2

1

2

1

1

Total

137

147

151

160

165

1)

2)

Q2 ‘12 production negatively impacted by ~4,800 BOEPD due to unplanned third party

fractionation capacity shortfalls at Mont Belvieu 3)

continuing

ethane

rejection

and

3

rd

party

fractionation

capacity

constraints

at

Mont

Belvieu

4)

All periods presented have been restated to exclude discontinued operations Q4 production was negatively impacted by a total of

~1,700 BOEPD due to reduced ethane recoveries at Spraberry gas processing facilities

Q3 ’12 production benefited by ~1,800 BPD from partial NGL inventory drawdown at

Mont Belvieu, but offset by a production loss of ~4,000 BOEPD due to |

PXD

Production

By

Commodity

By

Area

1

30

1)

All periods presented have been restated to exclude discontinued operations |

31

Oil and Gas Revenue

1

$ Millions

VPP Deferred

Revenue

$665

$719

$642

$716

$735

$654

$710

$632

$706

$725

$11

$9

$10

$10

$10

Q4 '11

Q1 '12

Q2 '12

Q3 '12

Q4 '12

1)

All periods presented have been restated to exclude discontinued operations |

32

Swaps –

WTI (BPD)

3,000

3,000

3,000

3,000

-

-

NYMEX WTI Price ($/BBL)

$ 81.02

$ 81.02

$ 81.02

$ 81.02

-

-

Three

Way

Collars

–

(BPD)

1

66,750

68,750

72,750

75,750

69,000

26,000

NYMEX Call Price ($/BBL)

$ 119.31

$ 119.42

$ 119.74

$ 120.47

$ 114.05

$ 104.45

NYMEX Put Price ($/BBL)

$ 92.30

$ 92.38

$ 92.53

$ 91.90

$ 93.70

$ 95.00

NYMEX Short Put Price ($/BBL)

$ 74.01

$ 74.19

$ 74.51

$ 74.39

$ 77.61

$ 80.00

% Total Oil Production

~95%

~95%

~95%

~95%

~75%

~25%

Three

Way

Collars

–

(BPD)

1

1,064

1,064

1,064

1,064

1,000

-

NYMEX Call Price ($/BBL)

$ 105.28

$ 105.28

$ 105.28

$ 105.28

$ 109.50

-

NYMEX Put Price ($/BBL)

$ 89.30

$ 89.30

$ 89.30

$ 89.30

$ 95.00

-

NYMEX Short Put Price ($/BBL)

$ 75.20

$ 75.20

$ 75.20

$ 75.20

$ 80.00

-

% Total NGL Production

<5%

<5%

<5%

<5%

<5%

-

% Total Liquids

~65%

~65%

~65%

~65%

~55%

~15%

Midland/Cushing Swaps (BPD)

3,278

5,000

-

-

-

-

Price Differential ($/BBL)

$ (5.75)

$ (5.75)

-

-

-

-

Cushing/LLS Swaps (BPD)

-

-

-

1,000

-

-

Price Differential ($/BBL)

-

-

-

$(7.60)

-

-

Spraberry Fixed Differential

2

24,000

26,000

28,000

30,000

33,000

35,000

Price Differential ($/BBL)

$ (1.75)

$ (1.75)

$ (1.75)

$ (1.75)

$ (1.75)

$ (1.75)

Oil Basis Protection

Q1 2013

Q2 2013

Q3 2013

Q4 2013

2014

2015

Natural Gas Liquids

Q1 2013

Q2 2013

Q3 2013

Q4 2013

2014

2015

Q1 2013

Q2 2013

Q3 2013

Q4 2013

2014

2015

Oil

PXD Open Commodity Derivative Positions as of 2/8/2013 (includes

PSE)

1) When NYMEX price is above call price, PXD receives call price. When NYMEX

price is between put price and call price, PXD receives NYMEX price. When NYMEX price is between the put price and the

short put price, PXD receives put price. When NYMEX price is below the short put

price, PXD receives NYMEX price plus the difference between the short put price and put price

2) Market transaction representing Midland/Cushing differential; not a derivative |

33

Swaps -

(MMBTUPD)

162,500

162,500

162,500

162,500

105,000

-

NYMEX Price ($/MMBTU)

1

$ 5.13

$ 5.13

$ 5.13

$ 5.13

$ 4.03

-

Collars -

(MMBTUPD)

150,000

150,000

150,000

150,000

-

-

NYMEX Call Price ($/MMBTU)

1

$ 6.25

$ 6.25

$ 6.25

$ 6.25

-

-

NYMEX Put Price ($/MMBTU)

1

$ 5.00

$ 5.00

$ 5.00

$ 5.00

-

-

Three

Way

Collars

–

(MMBTUPD)

1,2

-

-

-

-

25,000

225,000

NYMEX Call Price ($/MMBTU)

-

-

-

-

$4.70

$ 5.09

NYMEX Put Price ($/MMBTU)

-

-

-

-

$4.00

$ 4.00

NYMEX Short Put Price ($/MMBTU)

-

-

-

-

$3.00

$ 3.00

% Total Gas Production

~80%

~80%

~80%

~80%

~30%

~55%

Spraberry

(MMBTUPD)

52,500

52,500

52,500

52,500

-

-

Price Differential ($/MMBTU)

$ (0.23)

$ (0.23)

$ (0.23)

$ (0.23)

-

-

Mid-Continent (MMBTUPD)

50,000

50,000

50,000

50,000

10,000

-

Price Differential ($/MMBTU)

$ (0.30)

$ (0.30)

$ (0.30)

$ (0.30)

$ (0.19)

-

Gulf Coast

(MMBTUPD)

60,000

60,000

60,000

60,000

-

-

Price Differential ($/MMBTU)

$ (0.14)

$ (0.14)

$ (0.14)

$ (0.14)

-

-

Gas Basis Swaps

Q1 2013

Q2 2013

Q3 2013

Q4 2013

2014

2015

Q1 2013

Q2 2013

Q3 2013

Q4 2013

2014

2015

Gas

PXD Open Commodity Derivative Positions as of 2/8/2013 (includes

PSE)

1) Represents the NYMEX Henry Hub index price or approximate NYMEX price based on

historical differentials to the index price at the time the derivative was entered into

2) When NYMEX price is above call price, PXD receives call price. When NYMEX

price is between put price and call price, PXD receives NYMEX price. When NYMEX price is

between the put price and the short put price, PXD receives put price. When NYMEX

price is below the short put price, PXD receives NYMEX price plus the difference

between short put price and put price |

34

1)

When NYMEX price is above call price, PSE receives call price. When NYMEX price

is between put price and call price, PSE receives NYMEX price. When NYMEX price is between the put price and the short put price,

2) Approximate NYMEX price based on differentials to index prices at the date the

derivative was entered into Oil

Q1 2013

Q2 2013

Q3 2013

Q4 2013

2014

2015

Swaps

(BPD)

3,000

3,000

3,000

3,000

-

-

NYMEX Price ($/BBL)

$81.02

$81.02

$81.02

$81.02

-

-

Three-Way

Collars

(BPD)

1,750

1,750

1,750

1,750

5,000

-

NYMEX Call Price ($/BBL)

$116.00

$116.00

$116.00

$116.00

$105.74

-

NYMEX Put Price ($/BBL)

$88.14

$88.14

$88.14

$88.14

$100.00

-

NYMEX Short Put Price ($/BBL)

$73.14

$73.14

$73.14

$73.14

$80.00

-

% Oil Production

~85%

~85%

~85%

~85%

~85%

-

Gas

Swaps

(MMBTUPD)

2,500

2,500

2,500

2,500

5,000

-

NYMEX Price ($/MMBTU)

$6.89

$6.89

$6.89

$6.89

$4.00

-

Three-Way

Collars

(MMBTUPD)

-

-

-

-

-

5,000

NYMEX Call Price ($/MMBTU)

-

-

-

-

-

$5.00

NYMEX Put Price ($/MMBTU)

-

-

-

-

-

$4.00

NYMEX Short Put Price ($/MMBTU)

-

-

-

-

-

$3.00

% Gas Production

~35%

~35%

~35%

~35%

~70%

~65%

% Total Production

~65%

~65%

~65%

~65%

~70%

~10%

Gas Basis Swaps

Q1 2013

Q2 2013

Q3 2013

Q4 2013

2014

2015

Spraberry

(MMBTUPD)

2,500

2,500

2,500

2,500

-

-

Price Differential ($/MMBTU)

(0.31)

(0.31)

(0.31)

(0.31)

-

-

PSE Derivative Position as of 2/8/2013

1,

2

2

1

PSE receives put price. When NYMEX price is below the short put price, PSE

receives NYMEX price plus the difference between the short put price and put price |

Q4

’11 Q1 ’12

Q2 ’12

Q3 ’12

Q4 ’12

NYMEX calendar month average

$ 94.06

$ 102.93

$ 93.49

$ 92.22

$ 88.18

NYMEX differential

(2.55)

(3.78)

(6.62)

(4.13)

(4.29)

Realized prices excluding

VPPs and derivatives

91.51

99.15

86.87

88.09

83.89

Impact of VPPs and derivatives included in price

VPPs

2.45

1.99

1.87

1.79

1.71

Derivatives included in price

1.79

(0.15)

(0.42)

-

-

Reported prices including

VPPs and derivatives

included in price

95.75

100.99

88.32

89.88

85.60

Derivatives not included in price

(3.01)

(1.26)

(0.38)

(0.11)

2.18

Price including VPPs and all derivatives

$ 92.74

$ 99.73

$ 87.94

$ 89.77

$ 87.78

35

Oil Differentials (per BBL)

2

1

1)

All periods presented have been restated to exclude discontinued operations

2)

Represents cash settlements recorded in net derivative gains or losses excluding

liquidated derivatives |

36

NGL

Differentials

(per

BBL)

Q4 ’11

Q1 ’12

Q2 ’12

Q3 ’12

Q4 ’12

NYMEX oil calendar month average

$ 94.06

$ 102.93

$ 93.49

$ 92.22

$ 88.18

NYMEX differential

(48.36)

(61.12)

(60.87)

(61.26)

(57.49)

Realized prices excluding derivatives

45.70

41.81

32.62

30.96

30.69

Impact of derivatives included in price

-

-

-

Reported prices including derivatives included in price

45.70

41.81

32.62

30.96

30.69

Derivatives

not

included

in

price

(1.50)

0.76

1.86

1.53

0.79

Price including all derivatives

$ 44.20

$ 42.57

$ 34.48

$ 32.49

$ 31.48

Realized NGL prices excluding derivatives as a

percentage of NYMEX oil calendar month average

49%

41%

35%

34%

35%

1

2

1)

All periods presented have been restated to exclude discontinued operations 2) Represents cash settlements recorded in net derivative

gains or losses excluding liquidated derivatives |

37

Gas Differentials (per MCF)

1

Q4 ’11

Q1 ’12

Q2 ’12

Q3 ’12

Q4 ’12

NYMEX bid week average

$ 3.55

$ 2.72

$ 2.21

$ 2.80

$ 3.41

NYMEX differential

(0.18)

(0.21)

(0.21)

(0.18)

(0.21)

Realized prices excluding

derivatives

3.37

2.51

2.00

2.62

3.20

Impact of derivatives included in price

-

-

-

-

-

Reported prices including

derivatives included in price

3.37

2.51

2.00

2.62

3.20

Derivatives not included in price

2

1.44

1.98

2.43

1.86

1.28

Price including all derivatives

$ 4.81

$ 4.49

$ 4.43

$ 4.48

$ 4.48

1)

All

periods

presented

have

been

restated

to

exclude

discontinued

operations

2)

Represents cash settlements recorded in net derivative gains or losses excluding

liquidated derivatives |

38

General & Administrative Costs

1

$ Millions

Noncash

Q4

2011

1) All periods presented have been restated to exclude discontinued operations

Q1

2012

$55

Q2

2012

$63

Q3

2012

$55

Q4

2012

$63

$68

Includes performance-based

compensation awards for 2012 |

39

Interest Costs

1

$ Millions

Q4

2011

1) All periods presented have been restated to exclude discontinued operations

$46

Q1

2012

Q2

2012

$47

$49

Q3

2012

Q4

2012

$54

Noncash

$54 |

40

Exploration & Abandonments

Drilling & Acreage

Barnett Shale

$ 72

Acreage & Other

1

73

Geological & Geophysical

Seismic

2

Personnel & Other

14

16

4

th

Quarter 2012 Total

$ 89

$ Millions |

41

Quarter Ended December 31, 2012

($ Millions)

Current tax benefit

Deferred tax provision

Income Taxes Attributable to Continuing Operations $ -

(9)

$ (9) |

Net

Income $ 40

Depletion, depreciation and amortization

220

Exploration and abandonments

89

Impairment

88

Accretion of discount on asset retirement obligations

3

Interest expense

54

Income tax provision

9

Gain on disposition of assets, net

(1)

Derivative related activity

(24)

Amortization of stock-based compensation

16

Amortization of deferred revenue

(11)

Other noncash items

(19)

EBITDAX

464

Cash interest expense

(45)

Discretionary cash flow

419

Cash exploration expense

(16)

Changes in operating assets and liabilities

77

Net cash provided by operating activities

$ 480

42

Supplemental Non-GAAP Financial Measures

EBITDAX and discretionary cash flow (“DCF”) are disclosed by Pioneer, and

reconciled to the generally accepted accounting principle (“GAAP”)

measures of net income and net cash provided by operating activities because of their

wide acceptance by the investment community as financial indicators of a

company’s ability to internally fund exploration and development activities and to service or incur

debt.

The

Company

also

views

the

non-GAAP

measures

of

EBITDAX

and

DCF

as

useful

tools

for

comparisons

of

the

Company’s

financial

indicators

with

those

of

peer

companies

that

follow

the

full

cost

method

of

accounting.

EBITDAX

and

DCF

should

not

be

considered

as

alternatives

to

net

income

or

net

cash

provided

by

operating

activities,

as

defined

by

GAAP.

Q4 ’12

($ Millions) |

Weighted

average basic and diluted common shares outstanding Basic

123,240

Dilutive common stock options

143

Contingently issuable performance unit shares

196

Convertible senior notes dilution

3,366

Diluted

126,945

43

Supplemental Earnings Per Share Information

Q4 2012

Q4 2012

Net income attributable to common stockholders

$ 28,834

Participating share-

and unit-based basic earnings

(516)

Basic net income attributable to common stockholders

Diluted effect of participating securities

24

Diluted net income attributable to common stockholders

$ 28,342

The Company uses the two-class method of calculating basic and diluted earnings per

share. Under the two-class method of calculating earnings per share,

GAAP provides that share- and unit-based awards with guaranteed dividend or distribution participation rights qualify as “participating securities”

during their vesting periods. The Company’s basic net income per share

attributable to common stockholders is computed as (i) net income attributable to

common stockholders, (ii) less participating share- and unit-based basic earnings (iii) divided by weighted average basic shares outstanding. The

Company’s diluted net income per share attributable to common stockholders is

computed as (i) basic net income attributable to common stockholders, (ii) plus

the dilutive effect, if any, of participating securities (iii) divided by weighted average diluted shares outstanding. During periods in which the

Company realizes a loss from continuing operations attributable to common stockholders,

securities or other contracts to issue common stock are dilutive to loss per

share; therefore, conversion into common stock is assumed not to occur.

The following table is a reconciliation of the Company’s net income attributable to

common stockholders to basic net income attributable to common stockholders and to

diluted net income attributable to common stockholders for the three months ended December 31, 2012 (in thousands):

28,318 |

44

Supplemental Non-GAAP Financial Measures

$ Per Share

$ Millions

(After Tax)

Net income attributable to common stockholders

29

0.22

Unrealized MTM derivative gains ($22 MM before tax)

(14)

(0.11)

Adjusted income excluding unrealized MTM derivative gains

15

0.11

Unusual items included in adjusted income:

Impairment of Barnett Shale assets previously held for sale ($160 MM before tax)

101

0.78

Alaska Petroleum Production Tax credit income ($14 MM before tax)

(9)

(0.06)

Adjusted income excluding unrealized MTM derivative gains and unusual items

Adjusted income excluding unrealized MTM derivative gains and adjusted income

excluding unrealized MTM derivative gains and unusual items, as presented in the Q4 2012

Earnings Summary slide, is presented and reconciled to Pioneer’s net income

attributable to common stockholders and diluted common shares outstanding (determined in

accordance with GAAP) because Pioneer believes that these non-GAAP financial measures

reflect an additional way of viewing aspects of Pioneer’s business that, when viewed

together with its financial results computed in accordance with GAAP, provides a more

complete understanding of factors and trends affecting its historical financial

performance and future operating results, greater transparency of underlying trends and

greater comparability of results across periods. In addition, management believes

that these non-GAAP measures may enhance investors’ ability to assess

Pioneer’s historical and future financial performance. These non-GAAP financial measures are not

intended to be substitutes for the comparable GAAP measures and should be read only in

conjunction with Pioneer’s consolidated financial statements prepared in accordance

with GAAP. Unrealized MTM derivative gains and losses and unusual items will recur in

future periods; however, the amount and frequency can vary significantly from period

to period. The table below reconciles Pioneer’s net income attributable to common

stockholders for the three months ended December 31, 2012, as determined in

accordance with GAAP, to adjusted income excluding unrealized MTM derivative gains and

adjusted income excluding unrealized MTM derivative gains and unusual items for

that quarter.

0.83

107 |

Supplemental Non-GAAP Financial Measures

Q4 2012 Results from

Continuing Operations

Adjustments to Exclude

Barnett Shale Q4 2012

Operating Results

(1)

Adjustments to Exclude

Unrealized MTM Derivative

Gains and Unusual Items

Q4 2012 Results Excl.

Unrealized MTM Derivative

Gains, Unusual Items and

Barnett Shale Activity

Daily Production (MBOEPD)

165

(9)

156

Production Costs ($/BOE)

14.62

(0.14)

14.48

Exploration & Abandonment ($ MM)

89

(73)

16

DD&A ($/BOE)

14.54

0.09

14.63

G&A ($ MM)

68

68

Interest Expense ($ MM)

54

54

Other Expense ($ MM)

27

27

Accretion of Discount on ARO ($ MM)

3

(1)

2

Noncontrolling Interest

11

(3)

8

Current Tax Provision (Benefit)

-

-

Effective Tax Rate

2

(%)

24%

(10%)

34%

(1)

The Company’s Barnett Shale properties were reclassified to discontinued

operations during the third quarter of 2012 as a result of the Company’s decision to

divest of these properties

(2) The effective tax rates in the adjustment columns represent the

effective tax rates attributable to the results or adjustments applicable to that column

45

Selected Q4 2012 results excluding Barnett Shale activity and excluding unrealized MTM derivative gains

and unusual items, as presented in the Q4 2012 Earnings Summary Slide, are presented and

reconciled to the comparable GAAP results in the table below because Pioneer believes that these

non-GAAP financial measures reflect an additional way of viewing aspects of Pioneer’s

business that, when viewed together with its financial results computed in accordance with GAAP, provide a more

complete understanding of factors and trends affecting its historical financial performance and future

operating results, greater transparency of underlying trends and greater comparability of results

across periods. In addition, management believes that these non-GAAP measures may

enhance investors’ ability to assess Pioneer’s historical and future financial performance. These

non-GAAP financial measures are not intended to be substitutes for the comparable GAAP measure and

should be read only in conjunction with Pioneer’s consolidated financial statements prepared

in accordance with GAAP. |

46

VPP –

Adjusted Production Costs

Pioneer presents VPP-Adjusted Production Costs (per BOE) to assist

investors in considering the Company’s costs in relation to the total BOEs

(reported sales volumes plus VPP delivered volumes) in connection with

which those costs were incurred. VPP-Production Costs (per BOE) are

calculated as follows:

Q4 ’11

Q1 ’12

Q2 ’12

Q3 ’12

Q4 ‘12

Production costs as reported (thousands)

$ 170,000

$ 177,579

$ 194,574

$ 229,467

$ 221,781

Production (MBOE):

As reported

12,576

13,352

13,696

14,710

15,163

VPP deliveries

345

319

319

322

322

VPP-adjusted production

12,921

13,671

14,015

15,032

15,485

Production costs per BOE:

As reported

$ 13.52

$ 13.30

$ 14.21

$ 15.61

$14.62

VPP-adjusted

$ 13.16

$ 12.99

$ 13.88

$ 15.27

$14.32

1) All periods presented have been restated to exclude discontinued operations and

intercompany eliminations 1 |

47

An audit of proved reserves follows the general principles set forth in the standards

pertaining to the estimating and auditing of oil and gas reserve information

promulgated by the Society of Petroleum Engineers ("SPE"). A reserve audit

as defined by the SPE is not the same as a financial audit. Please see the Company's Annual Report on Form 10-

K for a general description of the concepts included in the SPE's definition of a reserve

audit. "Finding and development cost per BOE," or “all-in F&D

cost per BOE,” means total costs incurred divided by the

summation of annual proved reserves, on a BOE basis, attributable to revisions of

previous estimates, purchases of minerals-in-place, discoveries and

extensions and improved recovery. Consistent with industry practice, future

capital costs to develop proved undeveloped reserves are not included in costs

incurred. "Drillbit finding and development cost per BOE," or

“drillbit F&D cost per BOE,” means the summation of exploration

and development costs incurred divided by the summation of annual proved reserves,

on a BOE basis, attributable to technical revisions of previous estimates,

discoveries and extensions and improved recovery. Consistent with industry

practice, future capital costs to develop proved undeveloped reserves are not included in

costs incurred. “Reserve replacement”

is the summation of annual proved reserves, on a BOE basis, attributable to revisions of

previous estimates, purchases of minerals-in-place, discoveries and

extensions and improved recovery divided by annual production of oil, NGLs and

gas, on a BOE basis. “Drillbit reserve replacement”

is the summation of annual proved reserves, on a BOE basis, attributable to technical

revisions of previous estimates, discoveries and extensions and improved recovery

divided by annual production of oil, NGLs and gas, on a BOE basis.

Reserves

Audit,

F&D

Costs

and

Reserve

Replacement |

48

Certain Reserve Information

Cautionary Note to U.S. Investors --The U.S. Securities and Exchange Commission

(the "SEC") prohibits oil and gas companies, in their filings with the

SEC, from disclosing estimates

of

oil

or

gas

resources

other

than

“reserves,”

as

that

term

is

defined

by

the

SEC. In this presentation, Pioneer includes estimates of quantities of oil and gas using

certain

terms,

such

as

“resource,”

“resource

potential,”

“EUR”,

“oil

in

place”

or

other

descriptions of volumes of reserves, which terms include quantities of oil and gas that

may not meet the SEC’s definitions of proved, probable and possible reserves,

and which the

SEC's

guidelines

strictly

prohibit

Pioneer

from

including

in

filings

with

the

SEC.

These

estimates

are

by

their

nature

more

speculative

than

estimates

of

proved

reserves

and

accordingly are subject to substantially greater risk of being recovered by Pioneer. U.S.

investors are urged to consider closely the disclosures in the Company’s

periodic filings with the SEC. Such filings are available from the Company at 5205

N. O'Connor Blvd., Suite 200, Irving, Texas 75039, Attention Investor Relations,

and the Company’s website at www.pxd.com. These filings also can be obtained

from the SEC by calling 1-800-SEC- 0330. |