Attached files

| file | filename |

|---|---|

| EX-3.3 - EX-3.3 - MARIN SOFTWARE INC | d450382dex33.htm |

| EX-4.2 - EX-4.2 - MARIN SOFTWARE INC | d450382dex42.htm |

| EX-3.1 - EX-3.1 - MARIN SOFTWARE INC | d450382dex31.htm |

| EX-10.5 - EX-10.5 - MARIN SOFTWARE INC | d450382dex105.htm |

| EX-23.1 - EX-23.1 - MARIN SOFTWARE INC | d450382dex231.htm |

| EX-10.6 - EX-10.6 - MARIN SOFTWARE INC | d450382dex106.htm |

| EX-10.8 - EX-10.8 - MARIN SOFTWARE INC | d450382dex108.htm |

| EX-10.2 - EX-10.2 - MARIN SOFTWARE INC | d450382dex102.htm |

| EX-10.7 - EX-10.7 - MARIN SOFTWARE INC | d450382dex107.htm |

| EX-21.1 - EX-21.1 - MARIN SOFTWARE INC | d450382dex211.htm |

Table of Contents

As filed with the Securities and Exchange Commission on February 13, 2013

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MARIN SOFTWARE INCORPORATED

(Exact name of registrant as specified in its charter)

| Delaware | 7372 | 20-4647180 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

123 Mission Street, 25th Floor

San Francisco, California 94105

(415) 399-2580

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Christopher A. Lien

Founder, Chief Executive Officer and Director

Marin Software Incorporated

123 Mission Street, 25th Floor

San Francisco, California 94105

(415) 399-2580

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Gordon K. Davidson, Esq. Jeffrey R. Vetter, Esq. Michael A. Brown, Esq. Fenwick & West LLP 801 California Street Mountain View, CA 94041 (650) 988-8500 |

Rashmi Garde, Esq. General Counsel Marin Software Incorporated 123 Mission Street, 25th Floor San Francisco, California 94105 (415) 399-2580 |

Douglas D. Smith, Esq. Stewart L. McDowell, Esq. Gibson Dunn & Crutcher LLP 555 Mission Street San Francisco, CA 94105 (415) 393-8200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum price(1)(2) |

Amount of registration fee | ||

| Common Stock, $0.001 par value per share |

$75,000,000 | $10,230 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated February 13, 2013.

Shares

Common Stock

This is an initial public offering of shares of common stock of Marin Software Incorporated.

Marin Software is offering of the shares to be sold in the offering. The selling stockholders identified in this prospectus are offering an additional shares. Marin Software will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . Marin Software intends to list the common stock on the New York Stock Exchange under the symbol “MRIN.”

We are an “emerging growth company” as defined under federal securities laws. See “Risk Factors” on page 11 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to Marin Software |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from Marin Software and the selling stockholders at the initial public offering price less the underwriting discounts and commissions.

The underwriters expect to deliver the shares against payment in New York, New York on , 2013.

| Goldman, Sachs & Co. | Deutsche Bank Securities | |

| UBS Investment Bank | Stifel | |

| Wells Fargo Securities | ||

Prospectus dated , 2013

Table of Contents

| Page | ||||

| 1 | ||||

| 11 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 39 | ||||

| 41 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

43 | |||

| 72 | ||||

| 93 | ||||

| 101 | ||||

| 110 | ||||

| 114 | ||||

| 117 | ||||

| 122 | ||||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of Common Stock |

124 | |||

| 129 | ||||

| 133 | ||||

| 133 | ||||

| 133 | ||||

| F-1 | ||||

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Persons who come into possession of this prospectus and any applicable free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. Before deciding to invest in shares of our common stock, you should read this summary together with the more detailed information, including our consolidated financial statements and the related notes, provided elsewhere in this prospectus. You should carefully consider, among other things, the matters discussed in “Risk Factors,” our consolidated financial statements and the related notes, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case included elsewhere in this prospectus.

Marin Software Incorporated

Our Business

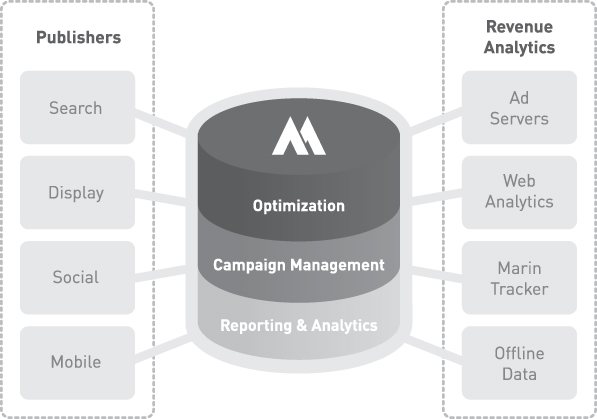

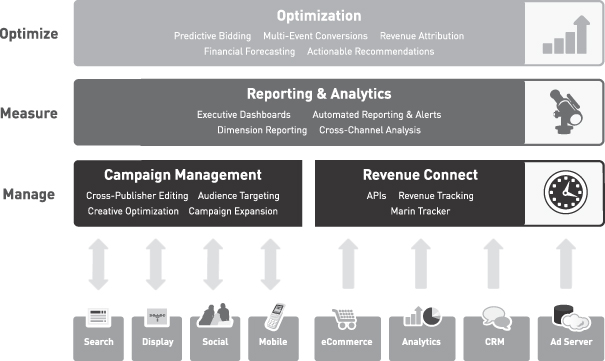

We provide a leading cloud-based digital advertising management platform that enables advertisers and agencies to improve financial performance, realize efficiencies and time savings, and make better business decisions. Our Revenue Acquisition Management platform is an analytics, workflow, and optimization solution for marketing professionals, enabling them to effectively manage their digital advertising spend across search, display, social and mobile advertising channels. Our solution is designed to help our customers:

| Ÿ | measure the effectiveness of their advertising campaigns through our proprietary reporting and analytics capabilities; |

| Ÿ | manage and execute campaigns through our intuitive user interface and underlying technology that streamlines and automates key functions, such as ad creation and bidding, across multiple publishers and channels; and |

| Ÿ | optimize campaigns across multiple publishers and channels in real time based on market and business data to achieve desired revenue outcomes using our predictive bid management technology. |

Advertisers are increasingly focused on performance-based marketing and are seeking ways to gather, analyze and leverage data about the effectiveness of digital advertising to run more impactful and targeted campaigns. Our robust and flexible platform integrates with leading publishers, such as Baidu, Bing, Facebook, Google, Yahoo! and Yahoo! Japan, as well as leading web analytics and ad-serving solutions, and key enterprise applications to enable marketers to measure the return on investment of their marketing programs.

Our platform serves as a system-of-record for advertising performance, revenue and conversion data and allows advertisers to correlate advertising spend to subsequent revenue outcomes or business events. Through a single, intuitive interface, designed to meet the daily workflow requirements of online marketers, we enable our customers to simultaneously run large-scale digital advertising campaigns across multiple publishers and channels, making it easy for marketers to create, publish, modify and optimize campaigns in real time. Our predictive bid management and optimization technology also allows advertisers to forecast outcomes and optimize campaigns across multiple publishers and channels to achieve their business goals. Our optimization technology enables advertisers to easily and rapidly increase spend on those campaigns, publishers and channels that are performing while reducing investment in those that are not.

In December 2012, our customers collectively managed $ in annualized advertising spend on our platform and we had active advertisers using our solution globally across a wide

1

Table of Contents

range of industries. We define an active advertiser as an advertiser from whom we recognized revenues in excess of $2,000 in the last month of a quarter. We market and sell our solutions to advertisers directly and through leading advertising agencies. We generate revenues from subscription contracts under which we charge fees generally based upon the amount of advertising spend that our customers manage through our platform. We have achieved 14 consecutive quarters of revenue growth. For 2009, 2010 and 2011, and for the nine months ended September 30, 2012, our revenues were $7.5 million, $19.0 million, $36.1 million and $42.5 million, representing period-over-period growth of 186%, 152%, 90% and 72%, respectively. We had net losses of $9.7 million in 2009, $10.9 million in 2010, $17.4 million in 2011 and $19.2 million for the nine months ended September 30, 2012.

Industry Overview

As audiences have increased their time spent online, the ability to acquire revenue through digital channels has emerged as a strategic priority for marketers. A growing number of consumers and businesses worldwide are relying on the Internet, social media and mobile devices to research products and services and make purchases. These trends are causing an ongoing shift in advertising budgets to digital channels as enterprises increasingly compete to acquire customers and revenues online. This competition for revenue acquisition is driving a need for a new category of enterprise software to help advertisers effectively measure, manage and optimize their digital advertising spend.

Global spend on advertising is expected to grow from $480 billion in 2012 to $619 billion in 2017, according to Magna Global. Rapid growth in online activity and engagement is resulting in a significant and ongoing shift in advertising spend to digital channels with global spend on digital advertising expected to grow from $98 billion in 2012 to $174 billion in 2017, according to Magna Global.

The evolution of a multi-channel and multi-device digital advertising ecosystem creates opportunities for advertisers to more effectively target and reach specific audiences to optimize revenue acquisition and other desired business results. However, as digital advertising becomes increasingly competitive and complex, digital advertisers are faced with several key challenges, such as the need to quickly and efficiently respond to changing market conditions and consistently deliver desired business results across multiple channels, publishers and devices. Existing approaches to digital advertising management are limited in scope and effectiveness. These approaches include: publisher tools, which only manage workflow on a particular publisher platform; spreadsheets, which are not scalable; proprietary internal systems, which are increasingly complex and expensive to build and maintain; and bid management tools, which lack end-to-end workflow and analytics capabilities.

The inadequacy of these existing approaches, coupled with a growing shift in budgets to digital advertising and demand for performance-based marketing, has created the need for a new category of enterprise-class digital advertising management solutions. This category of solutions, which we refer to as Revenue Acquisition Management, enables businesses to intelligently and efficiently measure, manage, and optimize their digital advertising spend to achieve desired business results. We believe there is significant demand for Revenue Acquisition Management solutions among advertisers worldwide.

Our Solution

We believe our Revenue Acquisition Management platform enables advertisers to significantly improve their ability to acquire revenue through digital advertising campaigns.

2

Table of Contents

Business Benefits

Financial lift. As a result of optimization of advertising spend, efficiencies in workflow and better decision making, our customers are able to create and execute successful campaigns that lead to increased revenue and other desired business outcomes. Based on our internal customer surveys, we believe that our customers typically realize financial lift from using our platform through a variety of means such as increased volumes of revenues or leads, higher profits, improved advertising return on investment, and lower costs of customer acquisition.

Efficiencies and time savings. Utilizing our solution, customers are able to automate manual and time-intensive tasks such as reporting, analysis, campaign creation and bidding, allowing advertisers to focus on campaign strategy, expansion and optimization. In June 2012, we conducted an internal survey of employees of our customers that had used our platform at least four times in the last 365 days. Of the 250 responses, representing 149 unique customers, half of the respondents reported time savings of 25% or greater from using our solution.

Better business decision making. Our Revenue Acquisition Management platform enables advertisers to manage campaigns to their business objectives by identifying campaign elements for segmentation and analysis in order to easily categorize, filter and compare data sets that are important to their business. In addition, through our proprietary recommendation engine, we are able to proactively suggest modifications to optimize marketing campaigns.

Key Strengths

Robust and flexible integration. Our platform is architected to enable our customers to aggregate and analyze key data from their digital advertising campaigns and business information systems, creating a system-of-record that marketers can use to attribute revenue to specific marketing spend, gain visibility into the path to purchase, and assess customer lifetime value.

Big data analytics. Our platform provides sophisticated analytics functionality that can parse through massive and growing data sets to enable advertisers to understand their return on advertising investment, easily identify outliers and trends, and take appropriate action.

Real-time, cross-publisher campaign management. Our solution enables customers to simultaneously run large-scale digital advertising campaigns across multiple publishers and channels, making it easy for marketers to create, publish, modify and optimize campaigns in real time using a single interface.

Predictive bid management and optimization. Our bid management technology allows marketers to optimize campaigns across multiple publishers and channels to achieve their business goals, such as increasing revenues or decreasing the cost per lead or cost per customer acquired. Advertisers can also forecast and adjust outcomes using our predictive bidding technology.

Intuitive interface offering visibility and control. Our intuitive interface is designed to simplify the daily workflow requirements of online marketers, including managing multiple campaigns, performing real-time analytics and collaborating with multi-user teams.

Experienced team committed to customer success. We have a global team experienced in the areas of digital advertising and enterprise software, which enables us to provide effective onboarding, best-practice advice and reliable and responsive technology support to our customers.

3

Table of Contents

Highly-scalable and extensible cloud-based architecture. We deliver our cloud-based platform using a purpose-built technology foundation designed to support enterprise-scale data sets and transaction volumes. Our technology allows customers to aggregate, store and process large amounts of data while maintaining high application availability and responsiveness.

Our Growth Strategy

Our goal is to extend our lead in and grow the Revenue Acquisition Management category. Key elements of our growth strategy include:

Enhancing our leadership position by innovating and expanding our platform. We intend to continue to enhance the value of our platform by developing new functionality, optimizing our feature set and platform capabilities, and expanding support for additional publishers and data sources.

Acquiring new advertisers. We intend to continue to make investments to acquire new advertisers. We intend to expand our sales organization by adding sales executives globally and plan to continue to market our platform to new advertisers and agencies.

Expanding within our existing advertiser base. We believe that we can capture additional advertising spend on our platform from our existing advertiser base by expanding our current capabilities as well as offering new features and functionality, providing best practices support and demonstrating our ability to help our advertisers obtain financial lift, time savings and better business results.

Further penetrating display, social and mobile opportunities. We believe that we can increase advertising spend on our platform as mobile, social and display channels grow in scale and complexity. We intend to continue to optimize our solution to handle unique complexities associated with display, social and mobile advertising channels.

Continuing to expand internationally. We plan to continue to grow our international business by supporting additional regional publishers, expanding our global sales team and working with leading agencies and advertisers worldwide.

Growing our partner ecosystem and selectively pursuing acquisitions. We intend to further develop our partner ecosystem with leading publishers, technology partners, advertising agencies, and other sales channel partners. In addition, we intend to selectively pursue acquisitions of complementary businesses and technologies.

Selected Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. Some of these risks include:

| Ÿ | We have a history of losses and we may not achieve or sustain profitability in the future. |

| Ÿ | Our limited operating history makes it difficult to evaluate our current business and future prospects. |

| Ÿ | Our usage-based pricing model makes it difficult to accurately forecast revenues. |

| Ÿ | The market for digital advertising management solutions is relatively new and dependent on growth in digital advertising channels. If this market develops more slowly or differently than we expect, our business, growth prospects and financial condition would be adversely affected. |

| Ÿ | If we are unable to maintain our relationships with, and access to, publishers, our business will suffer. |

4

Table of Contents

| Ÿ | Our growth depends in part on the success of our relationships with advertising agencies. |

| Ÿ | We may not be able to compete successfully against current and future competitors. |

| Ÿ | Our business depends on our customers’ continued willingness to manage advertising spend on our platform. |

| Ÿ | We incur upfront costs associated with onboarding advertisers to our platform and may not recoup our investment if we do not maintain the advertiser relationship over time. |

| Ÿ | Our directors, executive officers and principal stockholders will continue to have substantial control over us after this offering and could delay or prevent a change in corporate control. After this offering, our directors, executive officers and holders of more than 5% of our common stock, together with their affiliates, will beneficially own, in the aggregate, % of our outstanding common stock. |

Corporate Information

We were incorporated in the State of Delaware in March 2006. Our principal executive offices are located at 123 Mission Street, 25th Floor, San Francisco, California 94105, and our telephone number is (415) 399-2580. Our website address is www.marinsoftware.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus. Investors should not rely on any such information in deciding whether to purchase our common stock.

Unless the context indicates otherwise, as used in this prospectus, the terms “Company,” “Marin Software,” “we,” “us” and “our” refer to Marin Software Incorporated, a Delaware corporation, and its subsidiaries taken as a whole, unless otherwise noted.

We have registered the trademark “Marin” in the European Union and have a pending trademark application for the trademark “Marin” pending with the United States Patent and Trademark Office. The Marin Software logo and all product names are our common law trademarks. All other service marks, trademarks and tradenames appearing in this prospectus are the property of their respective owners.

5

Table of Contents

THE OFFERING

| Shares of common stock offered by us |

shares | |

| Shares of common stock offered by the selling stockholders |

shares | |

| Total shares of common stock offered |

shares | |

| Over-allotment option to be offered by us |

shares | |

| Over-allotment option to be offered by the selling stockholders |

shares | |

| Shares of common stock to be outstanding immediately after this offering |

shares ( shares if the over-allotment option is exercised in full) | |

| Use of proceeds |

We intend to use the net proceeds to us for working capital and other general corporate purposes. We may use a portion of the proceeds to acquire complementary businesses or technologies. We will not receive any of the proceeds from the shares of common stock to be sold by the selling stockholders. See “Use of Proceeds.” | |

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. | |

| Proposed New York Stock Exchange symbol |

“MRIN” | |

The number of shares of our common stock to be outstanding following this offering is based on 23,266,995 shares of our common stock outstanding as of September 30, 2012 and excludes:

| Ÿ | 4,273,447 shares of common stock issuable upon the exercise of options outstanding as of September 30, 2012, with a weighted average exercise price of $3.72 per share; |

| Ÿ | 211,000 shares of common stock issuable upon the exercise of options granted between October 1, 2012 and December 10, 2012, with an exercise price of $12.15 per share; |

| Ÿ | 87,692 shares of our common stock issuable upon the exercise of warrants outstanding as of September 30, 2012, with a weighted average exercise price of $2.73 per share; |

| Ÿ | 309,447 shares of our common stock that are issued but were subject to a right of repurchase by us as of September 30, 2012 and therefore are not included in stockholders’ (deficit) equity; and |

| Ÿ | shares of our common stock reserved for future issuance under our equity compensation plans, consisting of (a) 3,263 shares of our common stock reserved for issuance under our 2006 Equity Incentive Plan as of September 30, 2012, (b) shares of our common stock that will be reserved for issuance under our 2013 Equity Incentive Plan, and (c) shares of our common stock reserved for issuance under our 2013 Employee Stock Purchase Plan. On the date of this prospectus, any remaining shares available for issuance under our 2006 Equity Incentive Plan will be added to the shares reserved under our 2013 Equity Incentive Plan and we will cease granting awards under the 2006 Equity Incentive Plan. |

6

Table of Contents

| Our 2013 Equity Incentive Plan and 2013 Employee Stock Purchase Plan also provide for automatic annual increases in the number of shares reserved thereunder, as more fully described in “Executive Compensation—Employee Benefit Plans.” |

Unless otherwise noted, the information in this prospectus reflects and assumes the following:

| Ÿ | the automatic conversion of all outstanding shares of our convertible preferred stock, including shares of our Series F-1 convertible preferred stock issued in November 2012, into an aggregate of 18,752,943 shares of our common stock effective immediately prior to the completion of this offering; |

| Ÿ | the filing of our restated certificate of incorporation and the effectiveness of our restated bylaws, which will occur upon the completion of this offering; |

| Ÿ | no exercise of outstanding options or warrants; and |

| Ÿ | no exercise by the underwriters of their option to purchase up to an additional shares of our common stock from us in this offering. |

7

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables present our summary historical financial data. You should read this information in conjunction with “Selected Consolidated Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements, related notes and other financial information included elsewhere in this prospectus.

We derived the summary consolidated statements of operations data for 2009, 2010 and 2011 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the unaudited consolidated statements of operations data for the nine months ended September 30, 2011 and 2012, and the unaudited consolidated balance sheet data as of September 30, 2012 from our unaudited consolidated financial statements included elsewhere in this prospectus. Our unaudited consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and, in the opinion of management, reflect all adjustments, which consist only of normal recurring adjustments, necessary for the fair statement of those unaudited consolidated financial statements. Our historical results are not necessarily indicative of the results to be expected in the future, and the results for the nine months ended September 30, 2012 are not necessarily indicative of operating results to be expected for the full year ending December 31, 2012 or any other period.

| Years Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Revenues |

$ | 7,527 | $ | 19,005 | $ | 36,121 | $ | 24,711 | $ | 42,507 | ||||||||||

| Cost of revenues(1) |

5,101 | 11,040 | 18,691 | 13,523 | 17,728 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

2,426 | 7,965 | 17,430 | 11,188 | 24,779 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expenses: |

||||||||||||||||||||

| Sales and marketing(1) |

6,146 | 8,884 | 20,357 | 14,474 | 23,615 | |||||||||||||||

| Research and development(1) |

3,410 | 4,568 | 7,071 | 5,027 | 9,651 | |||||||||||||||

| General and administrative(1) |

2,171 | 5,195 | 6,679 | 4,132 | 10,001 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

11,727 | 18,647 | 34,107 | 23,633 | 43,267 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(9,301 | ) | (10,682 | ) | (16,677 | ) | (12,445 | ) | (18,488 | ) | ||||||||||

| Interest expense, net |

(212 | ) | (230 | ) | (378 | ) | (276 | ) | (349 | ) | ||||||||||

| Other income (expenses), net |

(92 | ) | 78 | (229 | ) | (143 | ) | (222 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before provision for income taxes |

(9,605 | ) | (10,834 | ) | (17,284 | ) | (12,864 | ) | (19,059 | ) | ||||||||||

| Provision for income taxes |

(103 | ) | (23 | ) | (139 | ) | (96 | ) | (167 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (9,708 | ) | $ | (10,857 | ) | $ | (17,423 | ) | $ | (12,960 | ) | $ | (19,226 | ) | |||||

| Redemption of preferred stock in connection with the Series D financing and deemed dividend |

— | (1,033 | ) | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss available to common stockholders |

$ | (9,708 | ) | $ | (11,890 | ) | $ | (17,423 | ) | $ | (12,960 | ) | $ | (19,226 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share available to common stockholders (basic and diluted)(2) |

$ | (2.74 | ) | $ | (3.27 | ) | $ | (4.29 | ) | $ | (3.26 | ) | $ | (4.46 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares used to compute net loss per share attributable to common stockholders, basic and diluted(2) |

3,540 | 3,639 | 4,058 | 3,978 | 4,312 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net loss per share available to common stockholders, basic and diluted(2) |

$ | (0.96 | ) | $ | (0.84 | ) | ||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Weighted average pro forma shares used to compute pro forma net loss per share attributable to common stockholders, basic and diluted(2) |

18,108 | 22,809 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Adjusted EBITDA(3) |

$ | (9,100 | ) | $ | (8,715 | ) | $ | (15,208 | ) | $ | (11,408 | ) | $ | (13,367 | ) | |||||

(footnotes on next page)

8

Table of Contents

| (1) | Stock-based compensation included in the consolidated statements of operations data above was allocated as follows: |

| Years Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cost of revenues |

$ | 66 | $ | 90 | $ | 165 | $ | 119 | $ | 292 | ||||||||||

| Sales and marketing |

81 | 66 | 226 | 162 | 817 | |||||||||||||||

| Research and development |

26 | 58 | 163 | 120 | 648 | |||||||||||||||

| General and administrative |

19 | 1,172 | 143 | 82 | 2,490 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | 192 | $ | 1,386 | $ | 697 | $ | 483 | $ | 4,247 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (2) | See Note 12 of consolidated financial statements included elsewhere in this prospectus for an explanation of the calculations of basic and diluted net loss per share available to common stockholders and pro forma net loss per share available to common stockholders. |

| (3) | We define Adjusted EBITDA as net loss, adjusted for stock-based compensation expense, depreciation and amortization, capitalized internal-use software development costs, interest expense, net, provision for income taxes and other income (expenses), net. Adjusted EBITDA is a financial measure that is not calculated in accordance with U.S. generally accepted accounting principles (GAAP). |

| As of September 30, 2012 | ||||||||||||

| Actual | Pro Forma(1) |

Pro Forma As Adjusted(2) |

||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 16,990 | $ | 36,890 | $ | |||||||

| Property and equipment, net |

8,479 | 8,479 | ||||||||||

| Total assets |

40,300 | 60,200 | ||||||||||

| Debt, current and long-term |

10,185 | 10,185 | ||||||||||

| Convertible preferred stock, net of issuance costs |

85,808 | — | ||||||||||

| Total stockholders’ (deficit) equity |

(66,760 | ) | 39,272 | |||||||||

| (1) | The pro forma consolidated balance sheet data as of September 30, 2012 reflects (i) the issuance of 1,478,064 shares of Series F-1 preferred stock and receipt of the related net proceeds of $19.9 million, (ii) the automatic conversion of all our outstanding convertible preferred stock into common stock upon the completion of this offering and (iii) the conversion of all outstanding convertible preferred stock warrants into common stock warrants. |

| (2) | The pro forma as adjusted column in the summary consolidated balance sheet data above reflects the effect of our sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the front cover of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. |

Adjusted EBITDA

Adjusted EBITDA should not be considered as an alternative to net loss, operating loss or any other measure of financial performance calculated and presented in accordance with GAAP. We prepare Adjusted EBITDA to eliminate the impact of items that we do not consider indicative of our core operating performance. You are encouraged to evaluate these adjustments and the reason we consider them appropriate.

We believe Adjusted EBITDA is useful to investors in evaluating our operating performance for the following reasons:

| Ÿ | Adjusted EBITDA is widely used by investors and securities analysts to measure a company’s operating performance without regard to items, such as stock-based compensation expense, |

9

Table of Contents

| depreciation and amortization, capitalized internal-use software development costs, interest expense, net, provision for income taxes and other income or expense, net, that can vary substantially from company to company depending upon their financing, capital structures and the method by which assets were acquired; |

| Ÿ | Our management uses Adjusted EBITDA in conjunction with GAAP financial measures for planning purposes, including the preparation of our annual operating budget, as a measure of operating performance and the effectiveness of our business strategies and in communications with our board of directors concerning our financial performance; and |

| Ÿ | Adjusted EBITDA provides consistency and comparability with our past financial performance, facilitates period-to-period comparisons of operations and also facilitates comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results. |

We understand that, although Adjusted EBITDA is frequently used by investors and securities analysts in their evaluations of companies, Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results of operations as reported under GAAP. These limitations include:

| Ÿ | Depreciation and amortization are non-cash charges, and the assets being depreciated or amortized will often have to be replaced in the future; Adjusted EBITDA does not reflect any cash requirements for these replacements; |

| Ÿ | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs or contractual commitments; |

| Ÿ | Adjusted EBITDA does not reflect cash requirements for income taxes and the cash impact of other income or expense; and |

| Ÿ | Other companies may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. |

The following table presents a reconciliation of net loss, the most comparable GAAP measure, to Adjusted EBITDA for each of the periods indicated:

| Years Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net loss |

$ | (9,708 | ) | $ | (10,857 | ) | $ | (17,423 | ) | $ | (12,960 | ) | $ | (19,226 | ) | |||||

| Depreciation and amortization |

382 | 1,016 | 1,800 | 1,268 | 2,148 | |||||||||||||||

| Interest expense, net |

212 | 230 | 378 | 276 | 349 | |||||||||||||||

| Provision for income taxes |

103 | 23 | 139 | 96 | 167 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

(9,011 | ) | (9,588 | ) | (15,106 | ) | (11,320 | ) | (16,562 | ) | ||||||||||

| Other (income) expenses, net |

92 | (78 | ) | 229 | 143 | 222 | ||||||||||||||

| Capitalized internal-use software development costs |

(373 | ) | (435 | ) | (1,028 | ) | (714 | ) | (1,274 | ) | ||||||||||

| Stock-based compensation |

192 | 1,386 | 697 | 483 | 4,247 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | (9,100 | ) | $ | (8,715 | ) | $ | (15,208 | ) | $ | (11,408 | ) | $ | (13,367 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

10

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including the consolidated financial statements and the related notes included elsewhere in this prospectus, before deciding whether to invest in shares of our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of may also become important factors that adversely affect our business. If any of the following risks actually occur, our business, financial condition, results of operations and future prospects could be materially and adversely affected. In that event, the market price of our stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business

We have a history of losses and we may not achieve or sustain profitability in the future.

We have incurred significant losses in each fiscal year since our incorporation in 2006. We experienced net losses of $17.4 million during 2011 and $19.2 million during the nine months ended September 30, 2012. As of September 30, 2012, we had an accumulated deficit of $70.1 million. The losses and accumulated deficit were due to the substantial investments we made to grow our business and acquire customers. We anticipate that our cost of revenues and operating expenses will increase substantially in the foreseeable future as we continue to invest to grow our business and acquire customers and develop our platform and new functionality. These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenues sufficiently to offset these higher expenses. Many of our efforts to generate revenues from our business are new and unproven, and any failure to increase our revenues or generate revenues from new solutions could prevent us from attaining or increasing profitability. Furthermore, to the extent we are successful in increasing our customer base, we could also incur increased losses because costs associated with entering into customer contracts are generally incurred up front, while customers are billed over the term of the contract generally through our usage-based pricing model. We do not expect to be profitable in the foreseeable future and we cannot be certain that we will be able to attain profitability on a quarterly or annual basis, or if we do, that we will sustain profitability.

Our limited operating history makes it difficult to evaluate our current business and future prospects.

Although we began our operations in March 2006, we did not begin generating substantial revenues until 2009. Our limited operating history may make it difficult to evaluate our current business and our future prospects. We have encountered and will continue to encounter risks and difficulties frequently experienced by growing companies in rapidly developing and changing industries, including challenges in forecasting accuracy, determining appropriate investments of our limited resources, market acceptance of our existing and future solutions, competition from established companies with greater financial and technical resources, acquiring and retaining customers, managing customer deployments and developing new solutions. Our current operations infrastructure may require changes in order for us to achieve profitability and scale our operations efficiently. For example, we may need to automate portions of our solution to decrease our costs, ensure our marketing infrastructure is designed to drive highly qualified leads cost effectively and implement changes in our sales model to improve the predictability of our sales and reduce our sales cycle. If we fail to implement these changes on a timely basis or are unable to implement them due to factors beyond our control, our business may suffer. We cannot assure you that we will be successful in addressing these and other challenges we may face in the future.

11

Table of Contents

Our usage-based pricing model makes it difficult to evaluate our current business and future prospects.

We have a usage-based pricing model where most of our fees are calculated as a percentage of customers’ advertising spend managed on our platform. This pricing model makes it difficult to accurately forecast revenues because our customers’ advertising spend managed by our platform may vary from month to month based on the variety of industries in which our advertisers operate, the seasonality of those industries and fluctuations in our customers’ advertising budgets or other factors. Our contracts with our direct advertiser customers generally contain a minimum monthly fee, which is generally one-half of our estimated monthly revenues from the customer at the time the contract is signed, and, as a result, the monthly minimum may not be a good indicator of our revenues from that customer. In addition, advertisers that use our platform through our agency customers typically do not have a minimum monthly spend amount or a minimum term during which they must use our platform and, as a result, the ability to forecast revenues from these advertisers is difficult. Additionally, if we overestimate usage, we may incur additional expenses in adding infrastructure, without a commensurate increase in revenues, which would harm our gross margins and other operating results.

The market for digital advertising management solutions is relatively new and dependent on growth in various digital advertising channels. If this market develops more slowly or differently than we expect, our business, growth prospects and financial condition would be adversely affected.

The market for digital advertising management solutions such as ours is relatively new and these solutions may not achieve or sustain high levels of demand and market acceptance. While search and display advertising has been used successfully for several years, marketing via new digital advertising channels such as mobile and social media is not as well established. The future growth of our business could be constrained by both the level of acceptance and expansion of emerging digital advertising channels, as well as the continued use and growth of existing channels, such as search and display advertising. Even if these channels become widely adopted, advertisers and agencies may not make significant investments in solutions such as ours that help them manage their digital advertising spend across publisher platforms and advertising channels. It is difficult to predict customer adoption rates, customer demand for our platform, the future growth rate and size of the digital advertising management solutions market or the entry of competitive solutions. Any expansion of the market for digital advertising management solutions depends on a number of factors, including the growth of the digital advertising market, the growth of social and mobile as advertising channels and the cost, performance and perceived value associated with digital advertising management solutions. If digital advertising management solutions do not achieve widespread adoption, or there is a reduction in demand for digital advertising caused by weakening economic conditions, decreases in corporate spending or otherwise, it could result in reduced usage, which could decrease revenues or otherwise adversely affect our business.

If we are unable to maintain our relationships with, and access to, publishers, our business will suffer.

We currently depend on relationships with various publishers, including Baidu, Bing, Facebook, Google, Yahoo! and Yahoo! Japan. Our subscription services interface with these publishers’ platforms through application programming interfaces (API), such as the Google AdWords API. We are subject to the publishers’ standard API terms and conditions, which govern the use and distribution of data from these publishers’ platforms. Our business significantly depends on having access to these APIs, particularly the Google AdWords API, which the substantial majority of our customers use, on commercially reasonable terms and our business would be harmed if any of these publishers discontinue or limit access to their platforms, modify their terms of use or other policies or place additional restrictions on us as API users, or charge API license fees for API access. Moreover, some

12

Table of Contents

of these publishers, such as Google, market competitive solutions for their platforms. Because the publishers control their APIs, they may develop competitive offerings that are not subject to the limits imposed on us through the API terms and conditions. Currently, restrictions in these API agreements limit our ability to implement certain functionality, require us to implement functionality in a particular manner or require us to implement certain required minimum functionality, causing us to devote development resources to implement certain functionality that we would not otherwise include in our subscription services and to incur costs for personnel to provide services to implement functionality that we are prohibited from automating. Publishers update their API terms of use from time to time and new versions of these terms could impose additional restrictions on us. In addition, publishers continually update their APIs, which requires us to modify our software to accommodate these changes. Any of these outcomes could cause demand for our products to decrease, our research and development costs to increase, and our results of operations and financial condition to be harmed.

Our growth depends in part on the success of our relationships with advertising agencies.

Our future growth will depend, in part, on our ability to enter into successful relationships with advertising agencies. Identifying agencies and negotiating and documenting relationships with them requires significant time and resources. These relationships may not result in additional customers or enable us to generate significant revenues. Our contracts for these relationships are typically non-exclusive and do not prohibit the agency from working with our competitors or from offering competing services. We generally bill agencies for their customers’ use of our platform, but the agency’s customer has no direct contractual commitment to make payment to us. Furthermore, some of these agency contracts include provisions whereby the agency is not liable for making payment to us for our subscription services if the agency does not receive a corresponding payment from its client on whose behalf the subscription services were rendered. These provisions may result in longer collections periods or our inability to collect payment for some of our subscription services. If we are unsuccessful in establishing or maintaining our relationships with these agencies on commercially reasonable terms, or if these relationships are not profitable for us, our ability to compete in the marketplace or to grow our revenues could be impaired and our operating results would suffer.

We may not be able to compete successfully against current and future competitors.

The overall market for digital advertising management solutions is rapidly evolving, highly competitive, complex, fragmented, and subject to changing technology and shifting customer needs. We face significant competition in this market and we expect competition to intensify in the future. We currently compete with large, well-established companies, such as Adobe Systems Incorporated and Google Inc. (through its wholly-owned subsidiary DoubleClick), and privately-held companies, such as Acquisio Inc., which focuses solely on agencies, and Kenshoo Ltd. We also compete with in-house proprietary tools and custom solutions, including spreadsheets. Increased competition may result in reduced pricing for our solutions, longer sales cycles or a decrease of our market share, any of which could negatively affect our revenues and future operating results and our ability to grow our business.

A number of competitive factors could cause us to lose potential sales or to sell our solutions at lower prices or at reduced margins, including, among others:

| Ÿ | potential customers may choose to develop or continue to use internal solutions rather than paying for our solutions; |

| Ÿ | companies may enter our market by expanding their platforms or acquiring a competitor; |

| Ÿ | some of our competitors, such as Adobe and Google, have greater financial, marketing and technical resources than we do, allowing them to leverage a larger installed customer base, |

13

Table of Contents

| adopt more aggressive pricing policies, and devote greater resources to the development, promotion and sale of their products and services than we can; and |

| Ÿ | companies marketing search, social, display, mobile or web analytics services could bundle digital advertising management solutions or offer such products at a lower price as part of a larger product sale. |

We cannot assure you that we will be able to compete successfully against current and future competitors. If we cannot compete successfully, our business, results of operations and financial condition could be negatively impacted.

Our business depends on our customers’ continued willingness to manage advertising spend on our platform.

In order for us to improve our operating results, it is important that our customers continue to manage their advertising spend on our platform, increase their usage and also purchase additional solutions from us. In the case of our direct advertiser customers, we offer our solutions primarily through subscription contracts and generally bill customers over the related subscription period, which is typically in the range of six months to one year. During the term of their contracts, our direct advertiser customers generally have no obligation to maintain or increase their advertising spend on our platform beyond a specified minimum monthly fee, which is typically set at the time the contract is signed and is half of the monthly amount we anticipate the customer will spend. Our direct advertiser customers have no renewal obligation after the initial or then-current renewal subscription period expires, and even if customers renew contracts, they may decrease the level of their digital advertising spend managed through our platform, resulting in lower revenues from that customer. Advertisers that we serve through our arrangements with our advertising agencies generally do not have any contractual commitment to use our platform. Our customers’ usage may decline or fluctuate as a result of a number of factors, including, but not limited to, their satisfaction with our platform and our customer support, the frequency and severity of outages, the pricing of our, or competing, solutions, the effects of global economic conditions, and reductions in spending levels or changes in our customers’ strategies regarding digital advertising. Due to our limited historical experience, we may not be able to accurately predict future usage trends. If our customers renew on less favorable terms or reduce their advertising spend on our platform, our revenues may grow more slowly than expected or decline.

We incur upfront costs associated with onboarding advertisers to our platform and may not recoup our investment if we do not maintain the advertiser relationship over time.

Our operating results may be negatively affected if we are unable to recoup our upfront costs for onboarding new advertisers to our platform. Upfront costs when adding new advertisers generally include sales commissions for our sales force, expenses associated with entering customer data into our platform and other implementation-related costs. Because our customers, including direct advertisers and agencies, are billed over the term of the contract, if new customers sign contracts with short initial subscription periods and do not renew their subscriptions, or otherwise do not continue to use our platform to a level that generates revenues in excess of our upfront expenses, our operating results could be negatively impacted. In cases in which the implementation process is particularly complex, the revenues resulting from the customer under our typical six-month or one-year contract may not cover the upfront investment, so if a significant number of these customers do not renew their contracts, it could negatively affect our operating results.

14

Table of Contents

Because we generally bill our customers over the term of the contract, near term decline in new or renewed subscriptions may not be reflected immediately in our operating results.

Most of our revenues in each quarter are derived from contracts entered into with our customers during previous quarters. Consequently, a decline in new or renewed subscriptions in any one quarter may not be fully reflected in our revenues for that quarter. Such declines, however, would negatively affect our revenues in future periods and the effect of significant downturns in sales and market acceptance of our solutions, and potential changes in our rate of renewals or renewal terms, may not be fully reflected in our results of operations until future periods. In addition, we may be unable to adjust our cost structure rapidly, or at all, to take account of reduced revenues. Our subscription model also makes it difficult for us to rapidly increase our total revenues through additional sales in any period, as revenues from new customers must be earned over the applicable subscription term based on the value of their monthly advertising spend.

We have been dependent on our customers’ use of search advertising. Any decrease in the use of search advertising or our inability to further penetrate mobile, social and display advertising channels would harm our business, growth prospects, operating results and financial condition.

Historically, our customers have primarily used our solutions for managing their search advertising, including mobile search advertising, and the substantial majority of our revenues are derived from advertisers that use our platform to manage their search advertising. We expect that search advertising will continue to be the primary channel used by our customers for the foreseeable future. Should our customers lose confidence in the value or effectiveness of search advertising, the demand for our solutions may decline. In addition, our failure to achieve market acceptance of our solution for the management of mobile, social and display advertising spend would harm our growth prospects, operating results and financial condition.

Our sales cycle can be long and unpredictable and require considerable time and expense, which may cause our operating results to fluctuate.

The sales cycle for our solutions, from initial contact with a potential lead to contract execution and implementation, varies widely by customer, but is typically one to nine months. Some of our customers undertake a significant evaluation process that frequently involves not only our solutions but also those of our competitors, which has in the past resulted in extended sales cycles. Our sales efforts involve educating our customers about the use, technical capabilities and benefits of our platform. In addition, we offer an initial term, typically of a few months in duration, to new customers who may terminate their subscription at any time during this initial period before the fixed term contract commences. We have no assurance that the substantial time and money spent on our sales efforts will produce any sales. If our sales efforts result in a new customer subscription, the customer may terminate its subscription during the initial period, after we have incurred the expenses associated with entering the customer’s data in our platform and related training and support. If sales expected from a customer are not realized in the time period expected or not realized at all, or if a customer terminates during the initial period, our business, operating results and financial condition could be adversely affected.

Material defects or errors in our software platform could harm our reputation, result in significant costs to us and impair our ability to sell our subscription services.

Our customers collectively managed $ in annualized advertising spend on our platform in December 2012. The software applications underlying our subscription services are inherently complex and may contain material defects or errors, which may cause disruptions in availability, misallocation of advertising spend or other performance problems. Any such errors, defects, disruptions in service or other performance problems with our software platform could negatively impact our customers’ businesses or the success of their advertising campaigns and cause harm to our reputation. If we have

15

Table of Contents

any errors, defects, disruptions in service or other performance problems with our software platform, customers could elect not to renew or reduce their usage or delay or withhold payment to us, which could result in an increase in our provision for doubtful accounts or an increase in the length of collection cycles for accounts receivable. Errors, defects, disruptions in service or other performance problems could also result in customers making warranty or other claims against us, our giving credits to our customers toward future advertising spend or costly litigation. As a result, material defects or errors in our platform could have a material adverse impact on our business and financial performance.

The costs incurred in correcting any material defects or errors in our software platform may be substantial and could adversely affect our operating results. After the release of new versions of our software, defects or errors may be identified from time to time by our internal team and by our customers. We implement bug fixes and upgrades as part of our regularly scheduled system maintenance. If we do not complete this maintenance according to schedule or if customers are otherwise dissatisfied with the frequency and/or duration of our maintenance services, customers could elect not to renew, or delay or withhold payment to us, or cause us to issue credits, make refunds or pay penalties.

We derive our revenues from a single software platform and any factor adversely affecting subscriptions to our platform could harm our business and operating results.

We derive our revenues from sales of a single software platform. As such, any factor adversely affecting subscriptions to our platform, including product release cycles, market acceptance, product competition, performance and reliability, reputation, price competition, and economic and market conditions, could harm our business and operating results.

We use a single third-party data center to deliver our services. Any disruption of service at this facility could harm our business.

We manage our services and serve substantially all of our customers from a single third-party data center facility. While we control the actual computer, network and storage systems upon which our platform runs, and deploy them to the data center facility, we do not control the operation of the facility. The owner of the facility has no obligation to renew the agreement with us on commercially reasonable terms, or at all. If we are unable to renew the agreement on commercially reasonable terms, we may be required to transfer to a new facility or facilities, and we may incur significant costs and possible service interruption in connection with doing so.

The facility is vulnerable to damage or service interruption resulting from human error, intentional bad acts, earthquakes, hurricanes, floods, fires, war, terrorist attacks, power losses, hardware failures, systems failures, telecommunications failures and similar events. Moreover, we have not implemented a disaster recovery capability whereby we maintain a back-up copy of our software platform permitting us to immediately switch over to the back-up software platform in the event of damage or service interruption at our data center. The occurrence of a natural disaster or an act of terrorism, any outages or vandalism or other misconduct, or a decision to close the facility without adequate notice or other unanticipated problems could result in lengthy interruptions in our services.

Any changes in service levels at the facility or any errors, defects, disruptions or other performance problems at or related to the facility that affect our services could harm our reputation and may damage our customers’ businesses. Interruptions in our services might reduce our revenues, subject us to potential liability, or result in reduced usage of our platform. In addition, some of our customer contracts require us to issue credits for downtime in excess of certain levels and in some instances give our customers the ability to terminate their subscriptions.

16

Table of Contents

We also depend on third-party Internet-hosting providers and continuous and uninterrupted access to the Internet through third-party bandwidth providers to operate our business. If we lose the services of one or more of our Internet-hosting or bandwidth providers for any reason or if their services are disrupted, for example due to viruses or “denial-of-service” or other attacks on their systems, or due to human error, intentional bad acts, power loss, hardware failures, telecommunications failures, fires, wars, terrorist attacks, floods, earthquakes, hurricanes, tornadoes or similar events, we could experience disruption in our ability to offer our solutions or we could be required to retain the services of replacement providers, which could increase our operating costs and harm our business and reputation.

If we cannot efficiently implement our solutions for customers, we may lose customers.

Our customers have a variety of different data formats, enterprise applications and infrastructure and our platform must support our customers’ data formats and integrate with complex enterprise applications and infrastructures. If our platform does not currently support a customer’s required data format or appropriately integrate with a customer’s applications and infrastructure, then we must configure our platform to do so, which increases our expenses. Additionally, we do not control our customers’ implementation schedules. As a result, as we have experienced in the past, if our customers do not allocate internal resources necessary to meet their implementation responsibilities or if we face unanticipated implementation difficulties, the implementation may be delayed. Further, in the past, our implementation capacity has at times constrained our ability to successfully implement our solutions for our customers in a timely manner, particularly during periods of high demand. If the customer implementation process is not executed successfully or if execution is delayed, we could incur significant costs, customers could become dissatisfied and decide not to increase usage of our platform, not to use our platform beyond an initial period prior to their term commitment or, in some cases, revenue recognition could be delayed. In addition, competitors with more efficient operating models with lower implementation costs could penetrate our customer relationships.

Additionally, large customers may request or require specific features or functions unique to their particular business processes, which increase our upfront investment in sales and deployment efforts and the revenues resulting from the customers under our typical contract length may not cover the upfront investments. If prospective large customers require specific features or functions that we do not offer, then the market for our solution will be more limited and our business could suffer. In addition, supporting large customers could require us to devote significant development services and support personnel and strain our personnel resources and infrastructure. If we are unable to address the needs of these customers in a timely fashion or further develop and enhance our solution, these customers may not renew their subscriptions, seek to terminate their relationship with us, renew on less favorable terms, or reduce their advertising spend on our platform. If any of these were to occur, our revenues may decline and our operating results could be adversely affected.

If we are unable to maintain or expand our sales and marketing capabilities, we may not be able to generate anticipated revenues.

Increasing our customer base and achieving broader market acceptance of our software platform will depend to a significant extent on our ability to expand our sales and marketing operations and activities. We expect to be substantially dependent on our sales force to obtain new customers. We currently plan to expand our sales team in order to increase revenues from new and existing customers and to further penetrate our existing markets and expand into new markets. Our solutions require a sophisticated sales force with specific sales skills and technical knowledge. Competition for qualified sales personnel is intense, and we may not be able to retain our existing sales personnel or attract, integrate or retain sufficient highly qualified sales personnel.

17

Table of Contents

Our ability to achieve revenue growth in the future will depend, in large part, on our success in recruiting, training and retaining sufficient numbers of sales personnel. These new employees require significant training and experience before they achieve full productivity. For internal planning purposes, we assume that it will take approximately three months before a newly hired sales representative is fully trained and productive in selling our solutions. This amount of time may be longer for sales personnel focused on new geographies or specific market segments. As a result, the cost of hiring and carrying new representatives cannot be offset by the revenues they produce for a significant period of time. Our recent hires and planned hires may not become productive as quickly as we would like, and we may not be able to hire or retain sufficient numbers of qualified individuals in the markets where we do business. Our business will be seriously harmed if these expansion efforts do not work as planned or generate a corresponding significant increase in revenues.

Any failure to offer high-quality technical support services may adversely affect our relationships with our customers and harm our financial results.

Our customers depend on our support organization to resolve any technical issues relating to our solutions. In addition, our sales process is highly dependent on the quality of our solutions, our business reputation and on strong recommendations from our existing customers. Any failure to maintain high-quality technical support, or a market perception that we do not maintain high-quality support, could harm our reputation, adversely affect our ability to sell our solutions to existing and prospective customers, and harm our business, operating results and financial condition.

We offer technical support services with our solutions and may be unable to respond quickly enough to accommodate short-term increases in customer demand for support services. We also may be unable to modify the format of our support services to compete with changes in support services provided by competitors. It is difficult to predict customer demand for technical support services and if customer demand increases significantly, we may be unable to provide satisfactory support services to our customers. Additionally, increased customer demand for these services, without corresponding revenues, could increase costs and adversely affect our operating results.

If our security measures are breached or unauthorized access to customer data or our data is otherwise obtained, our solutions may be perceived as not being secure, customers may reduce the use of or stop using our solutions and we may incur significant liabilities.

Security breaches could result in the loss of information, litigation, indemnity obligations and other liability. While we have security measures in place, our systems and networks are subject to ongoing threats and therefore these security measures may be breached as a result of third-party action, including cyber-attacks or other intentional misconduct by computer hackers, employee error, malfeasance or otherwise. This could result in one or more third parties obtaining unauthorized access to our customers’ data or our data, including intellectual property and other confidential business information. Because techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. Third parties may also attempt to fraudulently induce employees or customers into disclosing sensitive information such as user names, passwords or other information in order to gain access to our customers’ data or our data, including intellectual property and other confidential business information. If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security measures could be harmed, we could lose potential sales and existing customers or we could incur other liability.

18

Table of Contents

We must develop and introduce enhancements and new features that achieve market acceptance or that keep pace with technological developments to remain competitive in our evolving industry.

We operate in a dynamic market characterized by rapidly changing technologies and industry and legal standards. The introduction of new Revenue Acquisition Management solutions by our competitors, the market acceptance of solutions based on new or alternative technologies, or the emergence of new industry standards could render our platform obsolete. Our ability to compete successfully, attract new customers and increase revenues from existing customers depends in large part on our ability to enhance and improve our existing Revenue Acquisition Management platform and to continually introduce or acquire new features that are in demand by the market we serve. We also must update our software to reflect changes in publishers’ APIs and terms of use. The success of any enhancement or new solution depends on several factors, including timely completion, adequate quality testing, appropriate introduction and market acceptance. Any new platform or feature that we develop or acquire may not be introduced in a timely or cost-effective manner, may contain defects or may not achieve the broad market acceptance necessary to generate significant revenues. If we are unable to anticipate or timely and successfully develop or acquire new offerings or features or enhance our existing platform to meet customer requirements, our business and operating results will be adversely affected.

Our growth depends in part on the success of our strategic relationships with third parties.

Our future growth will depend on our ability to enter into successful strategic relationships with third parties. For example, we are seeking to establish relationships with third parties to develop integrations with complementary technology and content. These relationships may not result in additional customers or enable us to generate significant revenues. Identifying partners and negotiating and documenting relationships with them require significant time and resources. Our contracts for these relationships are typically non-exclusive and do not prohibit the other party from working with our competitors or from offering competing services. If we are unsuccessful in establishing or maintaining our relationships with these third parties, our ability to compete in the marketplace or to grow our revenues could be impaired and our operating results would suffer.