Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - United Financial Bancorp, Inc. | d483975d8k.htm |

Forward Looking Statements

Certain

comments

made

in

the

course

of

this

presentation

by

UBNK

may

be

forward-looking

in

nature.

These

include

all

statements

about

realizing

cost

savings

in

connection

with

our

recent

acquisition,

UBNK’s

operating

results

or financial condition for periods ending or on dates occurring after December 31,

2012 and usually use words such as “expect”, “anticipate”, “believe”, and similar expressions. These comments represent management’s current

beliefs, based upon information available to it at the time the statements are made

with regard to the matters addressed. All forward looking statements are

subject to risks and uncertainties that could cause UBNK’s actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors of particular

importance to UBNK include, but are not limited to: (1) changes in general economic

conditions, including interest rates; (2) competition among providers of financial services; (3) changes in the interest rate environment that

reduce

our

margins

or

reduce

the

fair

value

of

financial

instruments;

(4)

adverse

changes

in

the

securities

markets;

and

(5)

our

ability

to

enter

new

markets

successfully

and

capitalize

on

growth

opportunities.

UBNK

does

not

undertake any obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise. Holding

Company for NASDAQ: UBNK

Sterne Agee & Leach Conference

Miami, FL

February 11-13, 2013 |

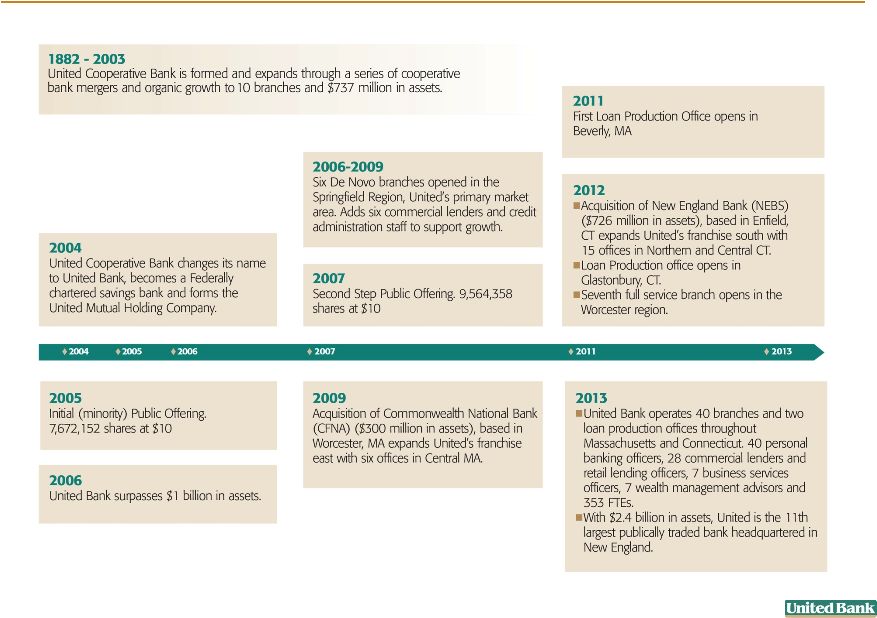

Building a

Regional Community Bank Franchise 2 |

History of

Expansion through Organic Growth and Acquisitions 3 |

Strategic

Rationale for NEBS Merger 4

Strategic Acquisition That Improves Franchise Value

•

Immediate scale and strong footprint in markets with attractive demographic profile

•

Gives UBNK a significant presence along the I-91 Corridor

•

Strategic expansion consistent with UBNK’s business plan

•

Low execution risk given expansion into contiguous market and similar business mix

Improved Scale

•

$2.4 billion in combined assets

•

Larger capital base provides the opportunity to compete for larger lending opportunities

Strong Transaction Fundamentals

•

Greater than 20% earnings accretion in 2013 based on realistic and achievable cost savings

and no revenue enhancements

•

Reasonable tangible book value dilution of approximately 9% projected with acceptable

incremental earn back period (approximately 5.5 years) |

Asset

Quality-Non Performing Loans 5

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

5.00%

Non-performing Loans/Total Loans

National average |

Asset

Quality

-

Net

Charge-Offs

6

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2007Y

2008Y

2009Y

2010Y

2011Y

2012Y

Net Charge-offs to Avg Loans

National average |

Credit Mark NEBS

Acquisition (000’s) 7

United Pre-Merger ALLL

$12,089

NEB Pre-Merger ALLL

$ 5,002

Elimination of NEB ALLL

($5,002)

Credit Mark for NEB loans

$12,424

Credit Mark Pre-Merger

$ 1,320

TOTAL “COVERAGE”

$25,833 |

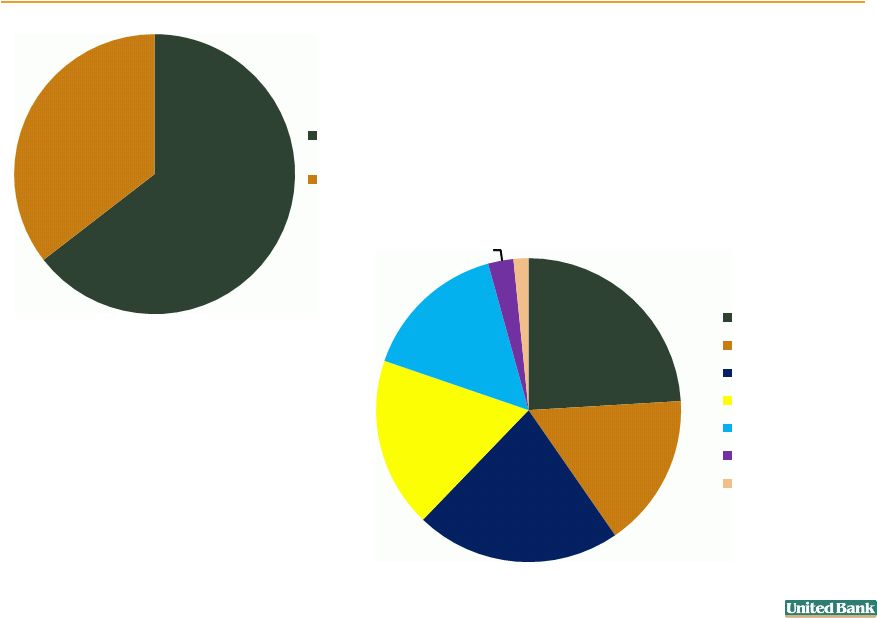

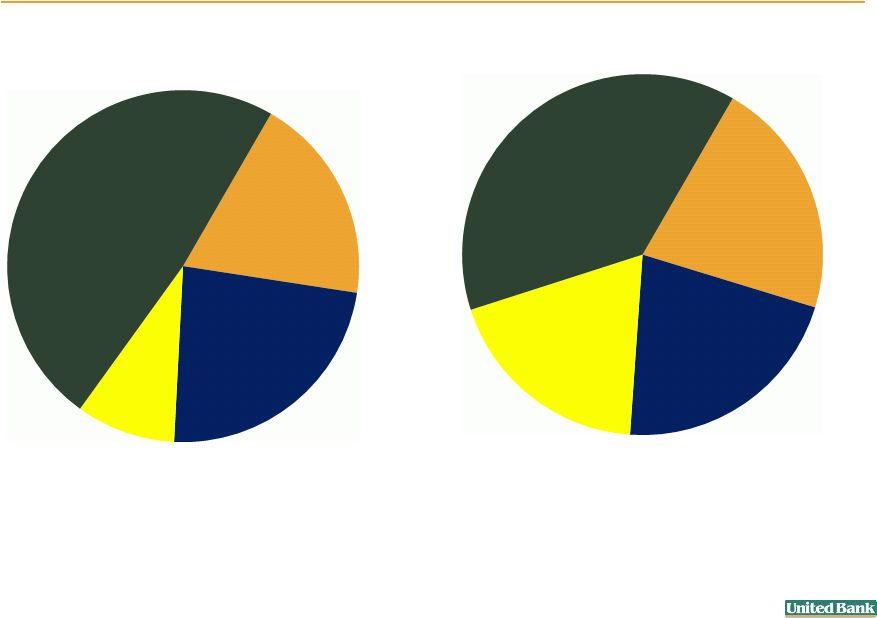

Loan Mix as of

December 31, 2012 (in millions)

Shift Toward Bank-Like Mix for Loans

Total Loans $1,816.1

QTD Yield 4.65%

Loan Mix as of December 31, 2007

(in millions)

Total Loans $824.7

QTD Yield 6.24%

1-4 Family RE

41%

Multifamily &

Commerical RE

26%

Construction

5%

Commercial

10%

Consumer & HE

18%

1-4 Family RE

24%

Multifamily & Commercial RE

45%

Construction

3%

Commercial

17%

Consumer & HE

11%

8

$339.5

$146.8

$81.6

$214.8

$42.0

$441.9

$306.2

$814.7

$200.5

$52.8 |

9

$526

$289

CRE Loans-

Investor

CRE Loans-Owner

Occupied

$196

$133

$178

$147

$126

$22

$13

Other

Apartments

Industrial

Retail

Office

Hospitality

Retail Petroleum

Commercial

Real

Estate

Portfolio

Analysis

–

CRE

Concentration

=

226% |

Deposit Mix as

of December 31, 2012 (in millions)

$395.3

Total Deposits $1,848.2, 62% Core Deposits

QTD Cost of Deposits 0.68%

$137.2

Deposit Mix as of December 31, 2007

(in millions)

Total Deposits $718.7, 52% Core Deposits

QTD Cost of Deposits 3.11%

$347.7

$168.1

$65.7

$350.2

$707.4

$395.3

10

Strong and Balanced Deposit Base with 38% Reliance on CDs

Transaction

19%

Money Market

24%

Savings

9%

CDs

48%

Transaction

21%

Money Market

22%

Savings

19%

CDs

38% |

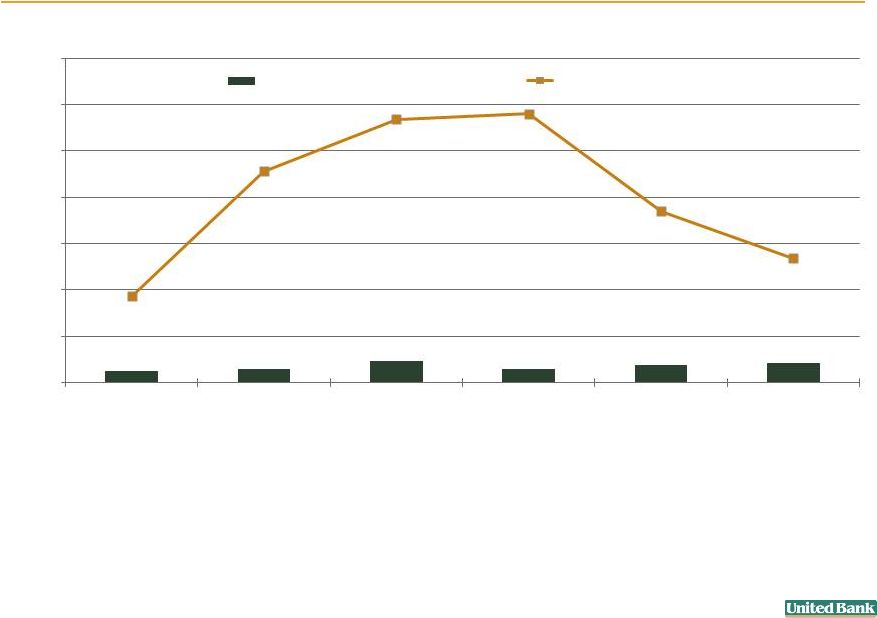

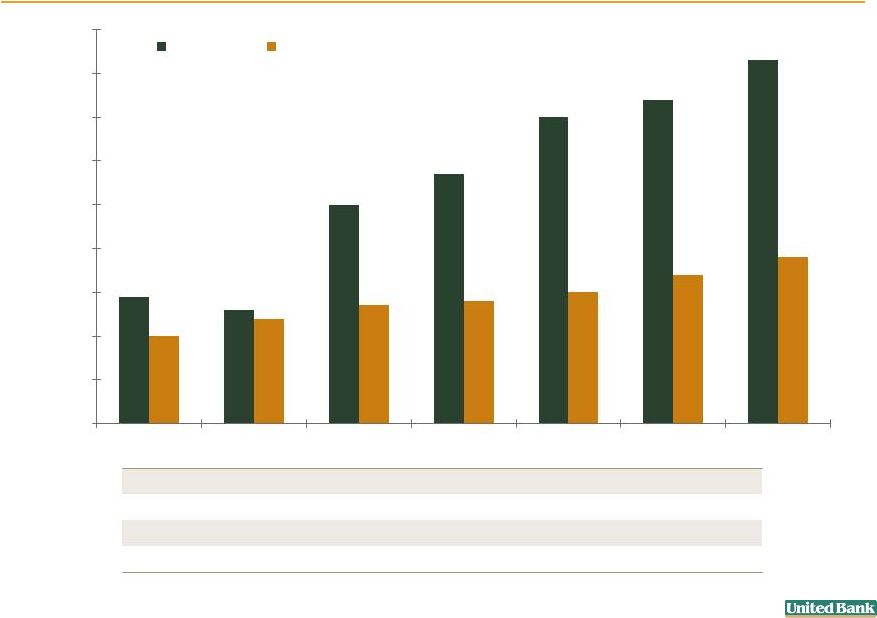

Annual

Core

Net

Income

&

Earnings

Per

Share

(1)

5 YR CAGR = EPS 26.1%, Net Income 24.0%

11

(1)

Please refer to appendix for the reconciliation of GAAP and non-GAAP results.

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

$0.26

$0.50

$0.57

$0.70

$0.74

$0.83

$0.00

$0.25

$0.50

$0.75

$1.00

2007Y

2008Y

2009Y

2010Y

2011Y

2012Y

Core Net Income

Core EPS |

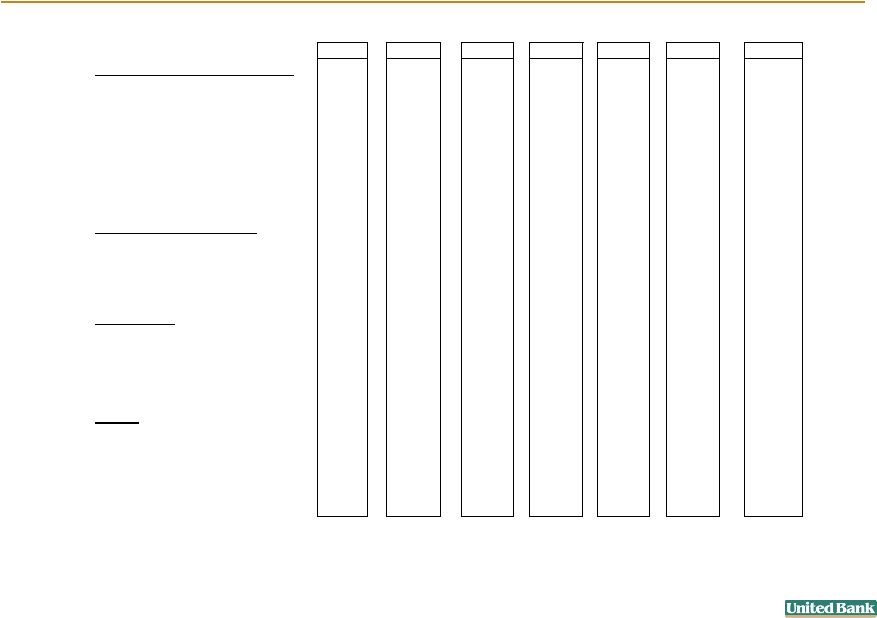

Dividend

History & Share Buybacks (1)

(1)

Please refer to appendix for the reconciliation of GAAP and non-GAAP

results (2)

Includes ESOP Plan Termination Share Repurchases as of 12/31/2012

Shares Repurchased

2008

2009

2010

2011

2012

Total

Amount (2)

261,798

1,537,787

798,242

396,209

1,120,274

4,114,310

$ Value (2)

$ 3,496,920

$ 20,593,752

$ 10,849,879

$ 6,042,446

$ 17,446,813

$ 58,429,810

Dividend $ Payout

$ 4,436,000

$ 4,238,000

$ 4,589,000

$ 5,067,000

$ 5,520,806

$ 23,850,806

12

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

$0.90

Core EPS

Dividends per share

$0.29

$0.26

$0.50

$0.57

$0.70

$0.74

$0.83

$0.20

$0.24

$0.27

$0.28

$0.30

$0.34

$0.38

2006Y

2007Y

2008Y

2009Y

2010Y

2011Y

2012Y |

Financial

Performance (1)

2006

2007

2008

2009

2010

2011

2012

Earnings Data (in mm except EPS):

Core Net Income

4.9

$

4.4

$

8.1

$

8.7

$

10.9

$

11.2

$

12.8

$

Core Earnings Per Share

$0.29

$0.26

$0.50

$0.57

$0.70

$0.74

$0.83

Net Interest Income

27.6

$

29.2

$

39.8

$

41.0

$

52.9

$

52.8

$

56.2

$

Provision for Loan Losses

1.0

1.4

1.8

3.0

2.3

3.2

3.1

Normalized Non-interest Income

5.4

5.7

6.6

8.7

8.7

9.3

10.8

Normalized Non-interest Expenses

24.0

26.0

30.7

33.5

42.7

44.1

46.6

Profitability Data and Ratios:

Average Earning Assets (mm)

$926

$1,001

$1,147

$1,208

$1,448

$1,504

$1,893

Net Interest Margin

2.97%

2.91%

3.47%

3.39%

3.65%

3.51%

3.43%

Efficiency Ratio

72.95%

74.02%

66.16%

68.49%

69.55%

71.08%

70.49%

Asset Quality:

Non-performing Assets/Total Assets

0.18%

0.25%

0.46%

1.16%

0.69%

0.65%

0.72%

Allowance for Loan Losses/ Total Loans

(excluding purchased loans)

0.95%

0.94%

0.95%

1.07%

1.18%

1.17%

1.05%

Net Charge-offs/Total Average Loans

0.02%

0.12%

0.15%

0.23%

0.13%

0.19%

0.18%

Capital:

Tangible Equity/Tangible Assets

13.65%

20.95%

18.03%

14.13%

13.54%

13.53%

11.11%

Tangible Book Value Per Share

8.03

$

12.73

$

13.01

$

12.93

$

13.30

$

13.90

$

12.99

$

Dividends Per Share

0.20

$

0.24

$

0.27

$

0.28

$

0.30

$

0.34

$

0.38

$

Period End Stock Price

13.80

$

11.10

$

15.14

$

13.11

$

15.27

$

16.09

$

15.72

$

(1)

Please refer to the appendix for the reconciliation of GAAP and non-GAAP

results. 13 |

Net Interest

Margin 14

2.91%

3.47%

3.39%

3.65%

3.51%

3.43%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

2007Y

2008Y

2009Y

2010Y

2011Y

2012Y |

Efficiency

Ratio (1)

15

(1)

Please refer to the appendix for the reconciliation of GAAP and non-GAAP

results. 74.02%

66.16%

68.49%

69.55%

71.08%

70.49%

50.00%

55.00%

60.00%

65.00%

70.00%

75.00%

80.00%

2007Y

2008Y

2009Y

2010Y

2011Y

2012Y |

Total Assets (5

Year CAGR = 17.4%) 16

$1,079,281

$1,263,134

$1,541,040

$1,584,877

$1,623,522

$2,402,464

$600,000

$900,000

$1,200,000

$1,500,000

$1,800,000

$2,100,000

$2,400,000

2007Y

2008Y

2009Y

2010Y

2011Y

2012Y |

Tangible

Equity/Tangible

Assets

(1)

17

(1)

Please refer to the appendix for the reconciliation of GAAP and non-GAAP

results. 20.95%

18.03%

14.13%

13.54%

13.53%

11.11%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

2007Y

2008Y

2009Y

2010Y

2011Y

2012Y |

Summary

–

Why

Invest

In

UBNK?

18

Acquisition of CNB Financial in November, 2009

Acquisition of New England Bancshares in November, 2012

New loan production offices: Beverly, MA (2011) and Glastonbury,

CT (Q3 2012)

New branch opened in Northborough, MA (December, 2012)

Strategic transactions that further demonstrate UBNK’s strategy to expand its franchise

into attractive markets Successful stock repurchase program (acquired 4.1 million

shares at an average price of $14.20 since June 2008)

Competitive dividend yield (2.67% as of 01/31/13)

Superior

return

on

your

investment:

CAGR

6.8%

vs.

S&P

CAGR

2.1%

August,

2005

–

December,

2012

(excl.

dividends)

Good track record of increasing dividends (quarterly dividends increased 100% since February,

2006) Increased quarterly cash dividend by 11% to $0.10 per share in July, 2012

Ability and capacity to continue to execute capital deployment strategies

Well positioned for organic and strategic growth opportunities

Largest five NPLs comprise 39% of 12/31/12 total (workout strategies in place)

85%

of Investment portfolio is agency backed |

Appendix

19 |

Reconciliation

of GAAP and Non-GAAP Results 20

($ in thousands)

2006

2007

2008

2009

2010

2011

2012

Non-Interest Income (GAAP)

5,392

5,735

5,220

8,676

8,716

9,343

10,623

Other Than Temporary Impairment Charge

-

-

1,377

-

-

-

202

Adjusted Non-Interest Income (Non-GAAP)

5,392

5,735

6,597

8,676

8,716

9,343

10,825

Non-Interest Expense (GAAP)

24,036

26,039

30,690

36,858

43,841

44,062

56,240

Acquisition Costs

-

-

-

(2,863)

(1,148)

-

(4,952)

ESOP Plan Termination

-

-

-

-

-

-

(4,482)

FHLBB Prepayment Penalty

-

-

-

-

-

-

(207)

Special FDIC Insurance Assessment

-

-

-

(538)

-

-

-

Adjusted Non-Interest Expense (Non-GAAP)

24,036

26,039

30,690

33,458

42,693

44,062

46,599

Net Income (GAAP)

4,924

4,377

7,298

5,806

10,032

11,184

3,628

Adjustments to GAAP Net Income:

Other Than Temporary Impairment Charge

-

-

1,377

-

-

-

202

Acquisition Costs

-

-

-

2,863

1,148

-

4,952

ESOP Plan Termination

-

-

-

-

-

-

4,482

FLHBB Prepayment Penalty

-

-

-

-

-

-

207

Special FDIC Assessment

-

-

-

538

-

-

-

Income

Tax

Effect

-

All

Items

-

-

(527)

(556)

(329)

-

(660)

Core Net Income (Non-GAAP)

4,924

4,377

8,148

8,650

10,851

11,184

12,811

Per Share Data:

Diluted earnings per share (GAAP)

0.29

$

0.26

$

0.44

$

0.38

$

0.65

$

0.74

$

0.24

$

Core Diluted earnings per share (Non-GAAP)

0.29

$

0.26

$

0.50

$

0.57

$

0.70

$

0.74

$

0.83

$

Performance Ratios (annualized):

Return on average assets (GAAP)

0.51%

0.42%

0.62%

0.46%

0.65%

0.70%

0.21%

Return on average assets (Normalized)

0.51%

0.42%

0.69%

0.68%

0.71%

0.70%

0.73%

Return on average equity (GAAP)

3.59%

2.99%

3.23%

2.67%

4.49%

4.94%

1.51%

Return on average equity (Normalized)

3.59%

2.99%

3.60%

3.97%

4.85%

4.94%

5.34%

Efficiency ratio (GAAP)

72.95%

74.02%

66.16%

75.45%

71.42%

71.08%

85.08%

Efficiency ratio (Normalized)

72.95%

74.02%

66.16%

68.49%

69.55%

71.08%

70.49%

At or For the Years Ended December 31,

The following table presents reconciliations of the company's GAAP and

Non-GAAP (Normalized) results for the applicable periods. |

Reconciliation

of GAAP and Non-GAAP Results 21

($ in thousands)

2006

2007

2008

2009

2010

2011

2012

Total Loans (Gross)

762,113

824,695

870,276

1,122,241

1,074,111

1,121,879

1,816,076

Acquired Loans

-

-

-

(242,930)

(209,785)

(148,925)

(659,614)

Purchased Loans (GE Loans)

-

-

-

(22,655)

(21,448)

(19,066)

(5,021)

Total Loans (Non-GAAP)

762,113

824,695

870,276

856,656

842,878

953,888

1,151,441

Total Equity

137,711

226,120

227,714

225,246

222,576

227,361

307,189

Goodwill

-

-

-

(7,844)

(8,192)

(8,192)

(40,824)

Other Intangible Assets

-

-

-

(927)

(976)

(752)

(4,514)

Tangible Equity (Non-GAAP)

137,711

226,120

227,714

216,475

213,408

218,417

261,851

Total Assets

1,009,433

1,079,281

1,263,134

1,541,040

1,584,877

1,623,522

2,402,464

Goodwill

-

-

-

(7,844)

(8,192)

(8,192)

(40,824)

Other Intangible Assets

-

-

-

(927)

(976)

(752)

(4,514)

Tangible Assets (Non-GAAP)

1,009,433

1,079,281

1,263,134

1,532,269

1,575,709

1,614,578

2,357,126

Asset Quality:

Allowance for Loan Losses/Total Loans

0.95%

0.94%

0.95%

0.82%

0.93%

0.99%

0.67%

Allowance for Loan Losses/Total Loans excl. Purchased Loans

0.95%

0.94%

0.95%

1.07%

1.18%

1.17%

1.05%

Capital:

Total Equity/Total Assets

13.65%

20.95%

18.03%

14.62%

14.04%

14.00%

12.79%

Tangible Equity/Tangible Assets

13.65%

20.95%

18.03%

14.13%

13.54%

13.53%

11.11%

Book Value Per Share

8.03

$

12.73

$

13.01

$

13.38

$

13.82

$

14.47

$

15.24

$

Tangible Book Value Per Share

8.03

$

12.73

$

13.01

$

12.93

$

13.30

$

13.90

$

12.99

$

At or For the Years Ended December 31,

The following table presents reconciliations of the company's GAAP and

Non-GAAP (Normalized) results for the applicable periods. |

FOR

QUESTIONS, PLEASE CONTACT: Dena M. Hall, SVP, Marketing and Investor Relations

(413) 787-

1292

dhall@bankatunited.com

Mark A. Roberts, EVP and Chief Financial Officer

(413) 787-1201

mroberts@bankatunited.com

Thank you.

22 |