Attached files

| file | filename |

|---|---|

| EX-10.3 - CLOSING CONFIRMATION AGREEMENT (JANUARY 25, 2013) WITH FIRST POWER & LIGHT, LLC - Volt Solar Systems, Inc. | ex10-3.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (D) OF THE

SECURITIES EXCHANGE ACT OF 1934

January 25, 2013

Date of Report (Date of earliest event reported)

MAINSTREAM ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

|

FLORIDA

|

000-54602

|

20-3687391

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File

Number)

|

(IRS Employer Identification No.)

|

401 East Fourth Street Building 6

Bridgeport, PA 19405

(Address of principal executive offices)

11637 Orpington Street

Orlando, Florida 32817

(Former Address of principal executive offices)

Telephone: (610) 292-0909

(Registrant's telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

1 of 40

FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K (the “Form 8-K”) contains forward-looking statements which involve risks and uncertainties, principally in the sections entitled “Business,” and “Risk Factors.” All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” or “should,” or the negative of these terms or other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements to change. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements, except as expressly required by law.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Before you invest in our securities, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

Unless otherwise indicated, information contained in this Form 8-K concerning our industry, including our market opportunity, is based on information from independent industry analysts, third-party sources and management estimates. Management estimates are derived from publicly-available information released by independent industry analysts and third party sources, as well as data from our internal research, and are based on assumptions made by us using data and our knowledge of such industry and market, which we believe to be reasonable. In addition, while we believe the market opportunity information included in this Form 8-K is generally reliable and is based on reasonable assumptions, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the heading “Risk Factors.”

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

In July 2012, Mainstream Entertainment, Inc. (the “Company”, “we” and “us”) entered into a letter of intent to acquire all the ownership interest in First Power & Light, LLC, a Delaware Limited Liability Company (“First Power” and the “Letter of Intent”) pursuant to which the owners of First Power would receive 50,000,000 shares of the Company’s common stock (representing 94.2% of our outstanding common stock).

On September 20, 2012, the Company entered into a Stock Purchase Agreement in connection with the transactions contemplated by the Letter of Intent, which was subsequently modified and clarified by a First Addendum to Stock Purchase Agreement entered into on January 4, 2013 (collectively, the “Stock Purchase”), whereby it agreed to issue 50,000,000 shares of restricted common stock to the members of First Power at $0.01 per share, for the aggregate sum of $50,000. A total of $37,522 was received prior to September 30, 2012 with the remaining $12,478 received subsequent to September 30, 2012. The shares were physically issued by the Company on October 26, 2012; however, certain closing conditions were required to occur prior to the closing of the Stock Purchase and as such, the shares were held in escrow pending the closing. The conditions which were required to occur prior to the closing of the transaction (unless waived by the parties) included the Company being DTC eligible, First Power obtaining an audit of its financial statements, the Company being current in its periodic filings, the Company not being subject to any legal proceedings and the assumption by First Power of all of the liabilities of the Company.

2 of 40

Effective January 25, 2013, the parties entered into a Closing Confirmation agreement, pursuant to which the parties agreed to waive any closing conditions of the Letter of Intent or Stock Purchase, which had not occurred as of that date and to close the transactions contemplated by the Stock Purchase. As such, effective January 25, 2013, the Stock Purchase closed and the shares were released from escrow (pending the requirement that the members of First Power execute confirmation letters and certify certain representations to enable the Company to claim an exemption from registration provided by Rule 506 of the Securities Act of 1933, as amended for the issuance of the shares).

The closing of the transactions contemplated by the Stock Purchase constituted a change in control of the Company.

In connection with the Closing Confirmation, First Power agreed to indemnify and hold the Company’s current officers and Directors harmless against any liabilities of the Company at closing.

Additionally, the Company’s Directors Charles Camorata, Justin Martin and Karen Aalders have agreed to appoint Malcolm Adler and Thomas Moore as Directors of the Company and then promptly resign as Directors of the Company (the “Change in Directors”) following the filing of a Schedule 14F-1 Information Statement with the Securities and Exchange Commission (the “Commission”) and providing the proper notice to the Company’s shareholders.

Concurrent with the closing of the Stock Purchase, Malcolm N. Adler was appointed Chief Executive Officer and President, and Thomas Moore was appointed as Secretary and Treasurer of the Company filling the vacancies created by the resignations of Charles Camorata as Chief Executive Officer and President, Justin Martin as Vice-President, and Karen Aalders as Chief Financial Officer, Secretary and Treasurer, which prior officers resigned as officers of the Company effective January 25, 2013.

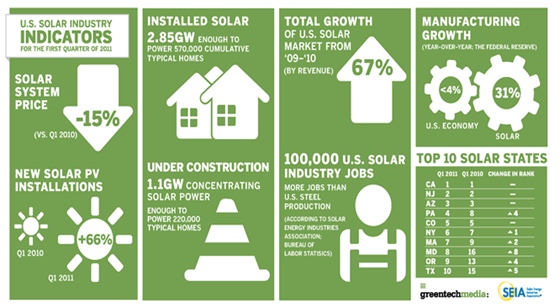

Additionally, the new officers and the upcoming new Directors have decided to undertake a change in business focus of the Company from being a music entertainment production company to a U.S. residential and commercial solar developer. Moving forward, we plan to cease undertaking any music entertainment operations and instead offer solar power solutions to residential and commercial customers across the U.S. One of the reasons for this change in business focus is because the Company believes the outlook for music entertainment production revenues is weak while the demand for residential and commercial solar power energy solutions in the U.S. is increasing - according to a 2012 report by GTM Research and Solar Energy Industries Association, the U.S. solar industry has experienced a 75% growth since 2011.

In connection with this new business focus and to finalize all of the transactions previously contemplated by the terms of the Letter of Intent, the Company currently anticipates entering into an asset purchase agreement with First Power subsequent to the date of this filing to acquire the assets and operations of First Power (which is in the solar power solutions business), which agreement is anticipated to be contingent on First Power obtaining audited financial statements and assuming the closing of such asset purchase agreement, the Company anticipates taking action to change its name to “First Power & Light, Inc.”

3 of 40

The Company’s management believes that the Company was not a "shell company", as defined in Rule 12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”) prior to the change of control. Notwithstanding that belief, and in an effort to provide the Company’s shareholders and potential shareholders with additional information regarding the Company’s business operations following the change in control, the Company has provided below the information that would be required if the Company were filing a registration statement on Form 10 under the Exchange Act, provided that where such information has been previously reported, the Company has identified the filing in which such disclosure is included below. The following Form 10 information is provided, with reference to the filing made by the Company in which the information is disclosed, where the information is not included in this report:

|

Form 10 Item

|

Description

|

Filing Where

Information Included

|

||

|

Item 1

|

Business

|

Provided below in this Current Report of Form 8-K

|

||

|

Item 1A

|

Risk Factors

|

Provided below in this Current Report of Form 8-K

|

||

|

Item 2

|

Financial Information

|

Form 10-K filed on January 9, 2013

|

||

|

Item 3

|

Properties

|

Provided below in this Current Report of Form 8-K

|

||

|

Item 4

|

Security Ownership of Certain Beneficial Owners and Management

|

Provided below in this Current Report on Form 8-K

|

||

|

Item 5

|

Directors and Executive Officers

|

Provided in Item 5.02 below in this Current Report on Form 8-K and in the Form 10-K filed on January 9, 2013

|

||

|

Item 6

|

Executive Compensation

|

Form 10-K filed on January 9, 2013

|

||

|

Item 7

|

Certain Relationships and Related Transactions, and Director Independence

|

Form 10-K filed on January 9, 2013

|

||

|

Item 8

|

Legal Proceedings

|

Form 10-K filed on January 9, 2013

|

||

|

Item 9

|

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

|

Provided below in this Current Report on Form 8-K.

|

||

|

Item 10

|

Recent Sale of Unregistered Securities

|

Provided in Item 3.02 below in this Current Report on Form 8-K.

|

||

|

Item 11

|

Description of Registrants’ Securities to the Registered

|

Form 10-K filed on January 9, 2013

|

||

|

Item 12

|

Indemnification of Directors and Officers

|

Form S-1/A filed on October 27, 2011

|

||

|

Item 13

|

Financial Statements and Supplementary Data

|

Form 10-K filed on January 9, 2013

|

||

|

Item 14

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

Form 10-K filed on January 9, 2013

|

||

|

Item 15

|

Financial Statements and Exhibits

|

Form 10-K filed on January 9, 2013

|

4 of 40

Item 1 – Business

Organizational History

Mainstream Entertainment, Inc. was originally formed to undertake entertainment production activities as a limited liability company (Skreem Studios, LLC) in Florida, on October 7, 2005. The Company initiated pre-commencement activity in May 2006, renting a studio facility, acquiring equipment, building out two studios and incurring other pre-operational expenses.

On April 1, 2007, the Company was acquired by Insight Management Corporation (f/k/a Skreem Records Corporation) and commenced business operations. In June 2008, the then majority stockholders authorized a name and entity change from Skreem Studios, LLC to Skreem Studios, Inc. On July 1, 2008, Insight Management Corporation commenced a reverse spin-off of Skreem Studios, Inc., whereby the shareholders of record as of July 1, 2008, received one share of Skreem Studios, Inc. for each share owned of Insight Management Corporation. Insight Management Corporation, as of July 1, 2008, is no longer related to the Company. On August 2, 2010 the Company changed its name to Mainstream Entertainment, Inc.

Prior to the closing of the Stock Purchase (described above in Item 1.01), the Company was primarily engaged in music production and distribution in the United States and Europe. Specifically, the Company, a development stage company, leased a recording studio equipped to provide all of the services necessary for recording and editing finished audio products; planned to act as a producer; music licenser and manager. The Company owns rights to certain copyrighted songs and has one client, the music group “3rdWish”, a music group whom Justin Martin, our former Vice President is a member. Justin Martin is the 27 year old son of Jeff Martin, our majority shareholder prior to the closing of the Stock Purchase.

Prior Operations

In May 2011, the Company launched its first song titled “Mom’s Song” which is being offered for sale on iTunes. The song may be heard on YouTube and iTunes. The song was written and performed by Justin Martin.

In December 2011, the Company entered into an understanding with Barton Funeral Services, Inc. to record and produce music for a CD to sell to funeral homes at a total cost of $36,000. The Company received $36,000 in connection with this understanding during the year ended December 31, 2012. The artist(s) engaged to record the music will be compensated as a percentage of sales of the record. The project was completed in the third calendar quarter of 2012.

Moving forward the Company does not anticipate undertaking any additional music or production activities.

New Business Plan

Effective upon the consummation of the Stock Purchase and the change in control described above, the Company changed its business operations to offering solar power solutions to residential and commercial customers across the U.S., as described in greater detail below.

The Company’s goal is to become a market leader in the U.S. for the installation and distribution of small to large scale photovoltaic installations. The Company’s business strategy includes proposed Equipment-Procurement-Construction (EPC) contracts where the Company will be hired to install a solar power system as well as efforts to aggressively target medium to large-scale photovoltaic installations for acquisition “roll-up”. The Company will not be a solar panel manufacturer and consequently will benefit from increasing panel manufacturer competition through lower panel prices. Moving forward, the Company plans to enter into an asset purchase agreement with First Power, acquire First Power’s assets and current operations (which consist of solar power solutions) and add such assets and operations to the currently anticipated operations described below. There can be no assurance that the Company will ever be able to acquire the assets or operations of First Power or that such acquisition and change in business plan will be successful.

5 of 40

Meeting U.S. energy growth demands requires responsible and far-sighted development of sustainable clean-energy alternatives. The Company plans to provide an economically viable and environmentally sustainable energy production solution with the goal of addressing these issues. The Company plans to utilize both federal and state tax credits created by green energy incentives to provide large energy users with the economic benefit of reducing their electricity costs and operating expenses through solar power. The Company’s planned solutions will protect energy users from rising utility rates and provide a long-term, environmentally-friendly and economically attractive way for energy users to hedge a portion of their current and future electricity costs.

The Vision

Pursuant to the U.S. Energy Information Administration’s (the “EIA’s”) Annual Energy Outlook for 2012 (released June 25, 2012), “[o]verall U.S. energy consumption [is projected to grow] at an average annual rate of 0.3 percent from 2010 through 2035.” Additionally, pursuant to the EIA’s Summary Statistics for the United States from 2001 to 2011, total U.S. electricity energy customers, across all sectors, have increased 9% from 2001 to 2011; from 131,359,239 customers in 2001 to 144,509,146 customers in 2011. Rising demand for energy and the ever increasing price of electricity, combined with the political and environmental requirement for clean energy alternatives to fossil fuels, independent of the foreign oil markets, have made clear the need for viable and sustainable energy alternatives.

Additionally, many states are continuing to move toward deregulation of their electric utilities, a trend that we believe will encourage more economic investment in new plants but will also cause significant fluctuations in the price Americans pay for electricity in the next decade. For example, regional electricity prices could be 12 to 13 percent higher or lower depending on the state’s energy production infrastructure (Stanford's Energy Modeling Forum (EMF) study released May 2001).

The Company plans to provide three alternatives for future planned customers to go “green”; (1) Power Purchase Agreement (“PPA”); (2) Power Partnership; and (3) Energy System Development. Each alternative accommodates a varying capital commitment from the customer from zero to the total purchase price. Through a PPA, the Company plans to enter into solar power purchase agreements (PPA) with customers to deliver power to the customer at a fixed energy rate for an agreed upon term. The Company will own and operate the system, earning revenues through the sale of power to the customer and capturing federal and state incentives. The goal will be to provide affordable discounted green energy to customers, perform a valuable community service, and provide these benefits in a sustainable, long-term manner. The Company plans to provide fully-integrated service through the system design, installation, maintenance, and management of custom systems to further the economic and environmental interests of its customers, and the community at-large.

In order to carry out its full business plan, the Company anticipates needing $2 million in additional funding. The Company hopes to raise these funds through the sale of securities in private placements moving forward. The Company believes it can continue operations at its current level without this funding, but growth will be minimal or stagnant.

The Company anticipates raising funds to finance its PPA projects through Tax Equity Financing. According to the U.S. Partnership for Renewable Energy Finance (in a report dated July 2011), federal clean energy policies have made tax equity a critical component in the private-sector financing of clean energy projects. This is because federal tax credits and other tax benefits are among the government’s main incentives to help drive the adoption of domestic clean energy technologies. Examples of such tax benefits include the 30% investment tax credit (available for solar through 2016 and which was available for wind through 2012); the 2.2 cent production tax credit (which was available through 2012 for wind projects that did not elect the investment tax credit); and accelerated depreciation (including bonus depreciation) that can be used to offset taxable income from other sources.

6 of 40

Power Partnerships are financed by investors and depending on the contract structure, may require little to no capital investment from the Company.

Power Partnerships are business arrangements where the Company partners with investors, the Power Partner, to fund the development of a solar project at a designated location, whereas the produced power is sold to the end user. The Company and the Power Partner earn income from the sale of the power produced to the end user, which can vary from a commercial customer to a utility company.

The Company plans to begin sourcing Power Partnership opportunities and as the Company grows, plans to hire additional personnel dedicated to sourcing Power Partnership opportunities.

Energy System Development is a business channel whereas the Company is contracted to perform the Equipment-Procurement-Construction (EPC) work for a solar project. In an EPC contract, the Company is hired on by another party to source the materials and to install a system. Once the Company has installed the system and it is functioning, the EPC contract ends. However, the Company could be contracted to manage the system as well.

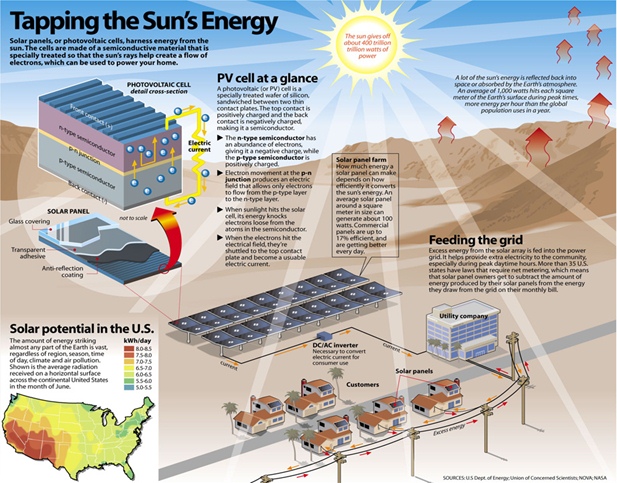

How a Solar Energy System Works:

|

1.

|

Solar photo voltaic (“PV”) panels are installed (usually mounted on a commercial building’s roof), where the panels collect energy from the sun in the form of direct current electricity.

|

|

|

|

2.

|

The direct current electricity is then converted by an inverter into alternating current electricity and sold back to the local or regional power utility.

|

|

|

|

3.

|

The alternating current electricity can be fed directly into the commercial building itself, for use by the tenant and/or owner of the building, similar to its use by the local electricity provider. Since the solar energy system works in tandem with the electricity provider, the commercial user will continue to get electricity from the provider when the user needs more than the solar energy system can provide (e.g. during overcast weather and at night, when the PV panel cannot collect energy from the sun).

|

7 of 40

This process is described in the graphic below from the U.S. Department of Energy, Union of Concerned Scientists:

The Opportunity

The Company has the goal of earning stable and recurring revenues through three primary channels: the sale of electricity generated from large scale photovoltaic installations; sale or asset booking of Solar Renewable Energy Credits (SRECS) generated from projects; and solar energy utility development for customers through Equipment-Procurement-Construction (EPC) contracts. The Company also intends to engage in an aggressive acquisition “roll-up” strategy of medium-to-large scale photovoltaic installations, funding permitting. We believe that this strategy will give the Company the ability to generate revenues and electricity output faster than the traditional time-frames associated with constructing a solar installation.

The Company is currently in the process of attempting to establish relationships with major solar panel manufacturers in the attempt to procure favorable terms and conditions in order to reduce the Company’s capital requirements for future projects (approximately 60% of a solar project costs goes to the price of the panels).

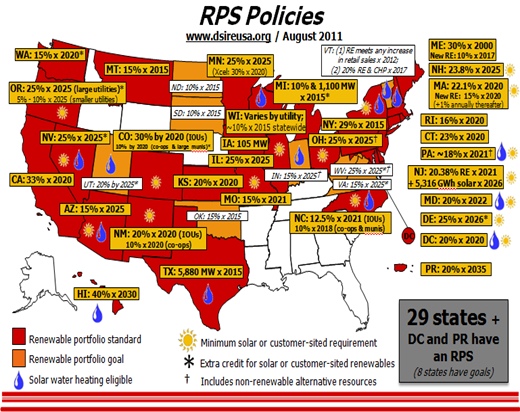

The Company intends to initially market its services in the North Eastern U.S. market due to favorable state and federal tax incentives for solar companies and solar customers, as well as high Renewable Portfolio Standards (RPS) in those states. RPS are the goals a state sets for itself regarding how much of their total energy needs will be derived from alternative energy. Examples of the states the Company intends to target are New Jersey, Maryland, Pennsylvania, Connecticut, Massachusetts, New Hampshire, and North Carolina.

8 of 40

What The Company Plans to Offer

This growth for electrical demand in the United States, coupled with an increasing federal and state emphasis on renewable energy production, has created significant opportunities for alternative energy providers to help address the country’s energy needs. The Company plans to provide an economically viable and environmentally sustainable solution to these issues. The Company plans to utilize tax credits created by green energy to provide large energy users with an economic benefit for installing solar energy projects, and thereby reducing their electricity costs and operating expenses. The Company’s planned solar energy solutions are envisioned to protect energy users from rising utility rates, and provide a long-term, environmentally-friendly and economically attractive way for energy users to hedge a portion of their current and future electricity costs.

Solar engineering costs vary from 1-5% of total project costs depending on the size and complexity of the project.

The Company plans to undertake the following actions as part of any engagement:

|

|

1)

|

Analyze the client’s energy consumption needs and available facilities (through the services of a professional solar engineer);

|

|

|

2)

|

Design a custom solar photovoltaic system to optimize energy savings;

|

|

|

3)

|

Execute a power purchase agreement (similar to a lease);

|

|

|

4)

|

Install custom solar panel systems at no charge to the customer;

|

|

|

5)

|

Maintain and service solar system for the duration of the purchase agreement; and

|

|

|

6)

|

Sell the solar system.

|

There is an option to sell the solar system to the customer at any point during the PPA. Pricing of the system varies system by system and is quantified upon an analysis of multiple factors including the total installation costs, tax equity structure of the project, length of the PPA, and pricing structure within the PPA. Depending on the agreements within the PPA contract, the Company can also have the right to sell the system to a third party who will then assume the contractual roles and responsibilities.

The Company also plans to help future customers arrange project financing of panels, their installation, maintenance and management.

Growth Strategy

The Company’s goal will be to establish and build an industry-leading position and become one of the largest solar energy integrators in the United States. The Company intends to pursue the following strategies in an attempt to achieve this goal:

|

*

|

Build, Enhance and Leverage the Company brand name to increase our market presence: The Company intends to build, enhance and leverage the Company’s planned “First Power” brand name.

|

||

|

|

*

|

Enter markets with favorable solar energy legislation and government incentives: The Company intends to enter jurisdictions and regions which adopt new or improve existing incentive programs that enhance the economics of solar energy systems for a broader customer base. In addition to a $3.4 billion California Solar Initiative, twenty-nine states, including Arizona, Colorado, Connecticut, Hawaii, Massachusetts, Nevada, New Jersey and New York have adopted legislation and incentives favorable to solar energy, and additional states are considering adopting such legislation and incentives.

|

|

|

*

|

Market Consolidation: With a highly fragmented U.S. solar energy system installer market, the Company intends to aggressively implement consolidation activities. Through consolidation efforts, the Company hopes to penetrate new markets while further enhancing the Company’s brand and leveraging future national marketing programs. We also hope that consolidation activities create economies of scale in order to increase operating efficiencies, with a goal of improving margins and profitability.

|

9 of 40

Benefits of solar energy systems:

Solar energy as a source of electrical power offers the following benefits compared to conventional energy sources:

° Economic — Solar systems provide fixed costs of generating electricity over the lifespan of the system and system owners are not at risk if fuel price escalations or shortages develop. Cash paybacks for systems range from five to twenty-five years, depending on the level of state and federal incentives, electric rates, annualized sun intensity and installation costs. Additionally, solar power systems may qualify for net metering (i.e., where electricity meters record outflows of electricity from the power grid to the customer and from the customer to the power grid (in both directions), allowing a no-cost method of effectively banking excess electricity production for future credit).

° Lower energy prices — Electricity costs generated by a solar energy system are essentially fixed at the time of installation, providing a hedge against utility electricity price increases and inflation. Much of the energy generated by a solar system is during the afternoon when the sun’s rays are strongest and when electricity demand for air conditioning peaks. A customer’s solar energy system can replace peak time conventional electricity, which can be more expensive and less reliable than electricity purchased during non-peak times. Additionally, solar energy systems typically have low operating expenses because the systems require minimal maintenance over their expected lives.

° Convenient and adaptable — Solar power systems can be installed in a variety of location including: small residential roofs, canopy covered parking structures, large industrial buildings, or mounted on the ground. Solar power systems benefit from having few moving parts, generally resulting in low maintenance and operating costs. Additionally, solar panel systems generally have manufacturer warranty guarantees to operate at certain efficiencies for twenty to twenty-five years.

° Versatile locations and ease of installation — Any location that receives sunlight can generate electricity from a solar energy system. Relatively fewer locations have both the infrastructure and natural resources required to support other forms of renewable energy, including hydroelectric, wind and geothermal. Solar energy systems can be installed directly at sites where power is needed, reducing conventional electrical transmission and distribution costs.

° Environmental — Solar power systems are one of the most environmentally friendly ways of generating electricity. There are no harmful greenhouse gas emissions, no wasted water, no noise, no waste generation and no particulates. Such benefits continue for the life of the system.

US Solar Market

The United States is rapidly becoming a solar powerhouse as domestic and international companies rush to invest in new projects. Electric power is used to operate businesses, industries, homes and offices and provides the power for our communications, entertainment, transportation and medical needs. As our energy supply and distribution mix changes, electricity is likely to be used more for local transportation (electric vehicles) and space/water heating needs. According to the summary of the Electric Services Industry as prepared by Highbeam Business, the electric power industry in the U.S. was over $218 billion in size in 1998, and will continue to grow with our economy.

10 of 40

A recent study by the GTM Research and Solar Energy Industries Association (“GTM Research”), a market analysis company focusing on renewable energy industries, estimated that the U.S. solar market could grow eightfold to $8 billion by 2015. Driving such growth are state mandated regulations requiring power companies to generate a certain portion of their electricity from renewable sources.

Declining solar panel costs and stronger tax and investment incentives, such as the 30% Investment Tax Credit, are making solar power more cost competitive with the fuels that America's utilities have traditionally used to generate electricity, whereas 30% of the total system cost is reimbursed by the federal government upon completion of the system and power being generated. Federal reimbursement funds are allocated from the 2009 American Recovery and Reinvestment Act, in which Congress authorized $840 billion in stimulus spending. Generous federal and state government tax credits aimed at spurring clean energy sector growth have also made such investments more competitive with already-subsidized, traditional fossil fuel plants.

Drivers of Solar Energy Industry Growth

The Company believes that it is likely that the demand for solar power systems will continue to grow due to escalating fuel costs, environmental concerns, energy security and increasingly favorable solar incentives. Federal and state governments have created a variety of alternative energy incentive programs for the installation of grid-tied solar power systems, so customers can “purchase” their own power generating system rather than “renting” power from a local utility. We expect a number of factors will contribute to growth in the solar energy industry, including the following:

|

*

|

Legislative initiatives — A number of initiatives have been enacted by the federal and state governments, municipalities and utility companies that encourage or require the installation of grid-tied solar energy systems. In 1996, the state of California enabled individual energy systems to tie into the conventional utility grid and began to require that various rebates and incentives be provided to support the use of solar energy systems. According to Solar Electric Power Association (SEPA), by early 2010, California had over 80,000 installed residential solar energy systems and accounted for approximately two-thirds of the U.S. residential market for solar energy systems. California is the largest solar installation market in the United States, accounting for more than 50% of total installations. The California Solar Initiative (CSI) provides for the expenditure of up to $3.4 billion in incentives for installation of solar energy systems with generation capacity of 3 gigawatts (GW) of electricity by 2017. California has also mandated an increase in the percentage of renewable energy retail sales by certain utilities to 20%, with a goal of 33% by 2020. Additionally, Colorado has enacted a Renewable Portfolio Standard (RPS) goal of 20% for investor-owned utilities and 10% for electric cooperatives and municipal utilities serving more than 40,000 customers by 2020. In some jurisdictions, such as Colorado, operation of a solar energy system that is located on the property of a utility customer can satisfy a portion of the utility’s RPS requirements.

|

||

|

*

|

Solar Renewable Energy Credits — the Company anticipates a significant portion of its future revenues will be generated from the sale of Solar Renewable Energy Credits (SREC’s) as well as the ability to book SREC values as an asset (see the description of SREC’s below).

|

11 of 40

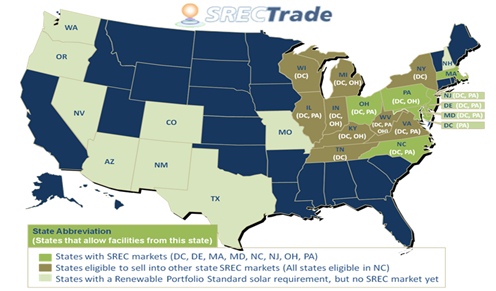

Solar Renewable Energy Credits:

An SREC is a certificate, issued by that state in which the solar system is operating, representing the “green attributes” of one megawatt-hour (MWh) of electricity generated from a solar energy system. SREC’s are bought and sold in each state’s SREC market like a commodity and can even be sold from certain state-to-state markets. The Company plans to capture the SREC’s from its installation projects, providing a valuable, liquid commodity that can be sold or booked as an asset.

For example, if the Company were to construct and own a 2-MegaWatt plant in New Jersey, which has the maximum ability to produce 2 Mega-Watts of power, every hour - 2 MWh - for one year, based on 2,000 hours of available sunlight over the course of the year, the Company could earn the following:

2 MWh x 2,000 hours = 4,000 SREC’s.

New Jersey’s Current Weighted Average SREC Price: $312

Total Potential SREC Annual Valuation for Sale or Asset Booking: $1,248,000

4,000 SRECS X $312 = $1,104,000

[Note the above calculation is only an example.]

In SREC states, the Renewable Portfolio Standard (RPS) requires electricity suppliers to secure a portion of their electricity from solar generators. The sale of SRECs is intended to promote the growth of distributed solar by shortening the time it takes to earn a return on investment. The SREC is sold separately from the electricity and represents the "solar" aspect of the electricity that was produced. The value of an SREC is determined by the market subject to supply and demand constraints. SRECs can be sold to electricity suppliers needing to meet their solar Renewable Portfolio Standards (RPS) requirement. The market is typically capped by a fine or solar alternative compliance payment (SACP) paid by any electricity suppliers for every SREC they fall short of in connection with applicable requirements.

12 of 40

SREC MARKET

The information above comes from srec trade.

1. RPS Solar Carve-Out: The RPS solar requirement distinguishes solar from other renewable energy resources and in most cases will value solar electricity at a higher rate than other renewables. Most states set a target for solar, either as a percentage of the total electricity sold into the state, as a fixed capacity target in megawatts (MW) or as a solar energy target measured in megawatt hours (MWh) or SREC’s produced in a year.

2. Unbundled, Tradeable SRECs: A state must allow the SRECs to be owned and traded by the generating facility. In some states, the utility company owns the SRECs. This is a common stipulation in state solar grant or rebate programs. Other states have a budget for solar. For example, California is currently not a viable SREC market because the state requires that utilities purchase the SRECs bundled with the electricity that the system produces. These SREC’s cannot be unbundled and sold separately.

3. Penalty for Non-Compliance: Finally, in order to have a robust SREC market, the state must implement some sort of fine or penalty for non-compliance. This is commonly known as a solar alternative compliance payment (SACP). The SACP is what drives the values of SRECs above any other type of Renewable Energy Credits. Without the SACP, it is difficult to incentivize buyers to pay prices that promote solar growth.

Renewable Portfolio Standards:

States have Renewable Portfolio Standards (RPS) and goals in which they have to obtain certain percentages of their annual energy output from renewable sources. States’ RPS goals provide the Company with a direct framework from which to target future states for solar installations. States with the highest RPS standards indicate a greater demand for alternative energy production.

The Department of Energy, via the Office of Electricity Delivery (OE) and the Smart Grid Investment Grants and Rebates (SGIG) program, will be delivering over $10 Billion in state/federal rebates, grants and tax incentives over the next several years to spur growth and help states achieve their RPS goals. The Company hopes to capitalize on this extensive funding to lower production costs.

13 of 40

|

Financial incentives — Through the implementation of these RPS programs, financial incentives are usually made available, making the purchase of solar energy systems more affordable and opening additional solar markets in the United States.

|

||||||||

|

°

|

Rebates — Rebates help to reduce the initial cost of solar energy systems for customers and integrators. For example, several states, including California and Colorado, require certain utilities to offer rebates that can substantially reduce the costs of installing solar energy systems. California’s residential rebate is currently $0.35 to $1.10 per watt while Colorado’s largest utility currently offers a total effective rebate of $2.01 per watt. The rebate and tax credits incentive system were designed to substantially reduce the customer’s out-of-pocket cost for purchasing a solar energy system.

|

|||||||

|

°

|

PPA's — Power Purchase Agreements, or agreements between a solar power system purchaser and an electricity user under which electricity is sold/purchased on a long-term basis.

|

|||||||

|

°

|

Leases — The solar equipment is owned by a third party entity and repaid over time by the host customer.

|

|||||||

|

°

|

Tax credits — There is currently a 30% federal tax credit for residential and commercial solar energy systems, and in October 2008 Congress extended the availability of this credit for both residential and commercial solar installations for another eight years and eliminated the $2,000 cap on the tax credit for residential installations.

|

|||||||

|

°

|

Accelerated Depreciation — Solar power systems installed for businesses (including applicable home offices) are generally eligible for accelerated depreciation.

|

|||||||

14 of 40

|

Additional incentives — There is a variety of additional incentives, such as net metering, time-of-use credits, performance-based incentives, feed-in tarrifs, renewable energy credits and property tax exemptions that are provided to consumers based on the amount of electricity their solar energy systems generate. Currently, over three quarters of the states have required some of their utility providers to accept net metering.

|

|||

|

°

|

Net Metering — provides residential and small-scale commercial solar energy producers the ability to sell excess power generated by their systems to their utility companies, through existing electric meters, at standard retail prices.

|

||

|

°

|

Time-of-use metering— allows customers to sell solar power to their utility for higher rates during peak times when traditional loads are at their highest demand. These customers can then buy back electricity from the utilities during off-peak times at a much lower rate, providing them an additional financial benefit for solar installations.

|

||

|

°

|

Performance-based incentives (PBIs) — reward system in which customers benefit based on the generation of their solar energy over time, as opposed to through an initial rebate. The rewards system time-length varies by state. For example, the California Solar Initiative currently requires that residential customers who choose not to accept the purchase rebate be provided a PBI of $0.05 to $0.15 per kilowatt-hour for a period of five years. This PBI amount declines in steps as the aggregate number of residential solar energy systems increases.

|

||

|

°

|

Feed-in Tariffs — popular system in which additional credits are allocated to consumers based on how much energy their solar power system generates. Feed-in Tariffs set at appropriate rates have been successfully used in Europe to accelerate growth.

|

||

|

°

|

Property tax exemptions — In certain jurisdictions, such as California, assessors are prohibited from increasing a solar energy system owner’s property tax assessment as a result of the added value of qualified solar energy systems.

|

||

Sales and Marketing

Revenues are planned to be generated through PPA’s, Power Partnerships, and EPC contracts. The sales and marketing efforts described below outline the various methods we plan to use to recruit customers. Solar consumer and tradeshows are massive events with tens of thousands of people, where deals are made every minute. At these events, the Company’s management and personnel will attempt to forge new relationships and engage in business opportunities.

Through planned web based techniques, residential or commercial customers will be able to seek us out and contact us regarding a solar installation.

The Company, over the course of the next 12 months, intends to develop a dedicated sales and marketing staff, whose sole function will be conducting marketing and sales efforts.

The Company’s marketing program is planned to include management sales and networking efforts, presentation booths at tradeshows and consumer shows, Internet search engine optimization, social media optimization, Internet banner advertisements, affiliate marketing programs, community involvement initiatives and customer referrals.

The Company is currently in the process of creating its website for brand promotion and awareness in order to enhance its planned solar energy integration business by generating leads for potential solar energy system customers. Additionally, the Company hopes that future customers will provide referrals, promoting the Company’s brand, and helping to drive down customer acquisition and marketing costs. Since the Company is just entering the solar industry, it has no true benchmark of its average customer acquisition costs. The Company firmly believes that once operations are fully activated, with customers being acquired and serviced, that those said customers will provide avenues to new customers via satisfactory reviews of performance and telling other friends, businesses, associates of the service they received and their satisfaction with their solar system.

15 of 40

At this current moment, there are no plans to begin large scale storage of panels, inverters, or other parts required in a solar system. As the Company grows, and it is deemed cost effective to begin purchasing these parts en masse and storing them, the Company may take appropriate measures to do so.

Employees

The Company currently employs two full-time people which are its current officers and no part-time employees.

The Company, in the near term, plans on hiring two full-time employees. One employee is anticipated to serve as the Director of Southeast Sales. The second employee is expected to serve as the Director of Communications.

Distribution methods of the products or services

The Company does not plan to produce any product or good for sale; instead it plans to only be an installer and EPC solar contractor. Depending on the contract, the Company may act as an arranger, an organizer, or a manager of a solar installation; sometimes all three roles. All personnel required to conduct site analysis, permitting, engineering, and installation will be hired out by the Company, with the Company organizing and overseeing the process.

The Company does not plan on building or manufacturing any products or goods. Any machinery, parts, components, or panels required for a solar project will be purchased directly from suppliers.

Need For Any Government Approval of Principal Products or Services

The Company plans to secure development contracts, then sub-contract out all construction and installation work that requires government licensing and registrations. The Company plans to enter into a developer agreement with First Power (until such time, if ever, as the Company can consummate the acquisition of First Power’s assets and operations), whereby First Power will be responsible for the electrical, structural and environmental engineering where needed and procure products and then construct installations. First Power has the necessary licenses and registrations to conduct solar developments in the Company's target markets.

If First Power lacks the necessary licensing and registrations to construct or install a solar development in a particular state, the Company will identify another company with the proper licenses and registrations to sub-contract to.

Effect of Existing or Probable Governmental Regulations on the Business

The installation of solar energy systems is subject to oversight and regulation under local ordinances; building, zoning and fire codes; environmental protection regulation; utility interconnection requirements for metering; and other rules and regulations. The Company plans to attempt to keep up-to-date about these requirements on a national, state and local level and will be required to design and install solar energy systems to comply with varying standards. Certain jurisdictions may have ordinances that prevent or increase the cost of installation of our solar energy systems. In addition, new government regulations or utility policies pertaining to the installation of solar energy systems are unpredictable and may result in significant additional expenses or delays, which could cause a significant reduction in demand for solar energy systems.

16 of 40

Customers

The Company anticipates acquiring residential and commercial customers across the United States who desire to supplement their energy needs through solar. The Company anticipates its commercial customers will share a number of characteristics - they will tend to be established, Triple-A rated and are generally motivated both by environmental and economic reasons to install a solar energy system. The Company anticipates its commercial solar energy systems will generally be 500 kilowatt (kw) or larger in size. Initial construction costs depend on the nature of the contract. Depending on the contract, the customer pays a minimum deposit of 60 percent when the Company starts the permitting process with the township, with the remaining 40 percent paid through staggered payments until contract completion.

For an EPC contract, all materials and supplies will be paid for by the contracting entity. If it is a Power Partnership, the investor segment of the Partnership will finance part, if not all, of the costs. If it is a PPA, the Company will utilize tax equity investors to finance the installation costs.

Suppliers

The Company will not manufacture solar PV modules, inverters or other components used in its solar energy systems itself, but will instead purchase those components directly from manufacturers or, in some cases, from third-party distributors. The Company intends to purchase solar PV modules manufactured by Kyocera, Sharp, SunTech, SunPower and others. The Company plans to purchase inverters manufactured by SMA, Enphase and others. The Company plans to purchase the components used in its solar energy systems on a purchase order basis from a select group of manufacturers or suppliers.

If the Company is unable to purchase from any of these sources, the Company believes it would not have difficulty in securing alternative supply sources, because all of the components used in its solar energy systems will be available from a number of different sources globally. With that said, the world-wide market for solar PV modules has from time to time experienced shortages of supply that have increased prices and affected availability.

Intellectual Property

The Company has no patents, trademarks, licenses or other intellectual property.

Competition

The solar energy industry is in its early stages of development and is highly fragmented, consisting of many small, privately held companies with limited resources and operating histories; some of which benefit from operating efficiencies or low overhead requirements. A number of public and private competitors exist in the solar installation market, including companies such as First Solar, Westinghouse Solar, SolarCity and Real Goods Solar.

Additionally, the Company believes the expiration of the U.S. Department of Treasury 1603 Grant Program on December 31, 2011, which offered grant programs to entities making use of clean energy equipment, has reduced the Company’s potential competition. The 1603 Grant Program, which provided developer/owners the option to earn solar investment tax credits or receive a one-time cash payment equal to 30% of the total development soft and hard cost, has been a primary financing leverage which numerous medium-to-large solar installers have relied on. With the expiration of the grant, weaker solar installers should fall off, allowing the Company the opportunity to capture a greater market share.

The solar energy industry is intensely competitive and rapidly evolving. The number of PV product manufacturers, suppliers and installers has rapidly increased due to the growth of actual and forecasted demand for PV products and the relatively low barriers to entry. The weakened demand for PV modules due to weakened macroeconomic conditions, combined with the increased supply of PV modules due to production capacity expansion by PV module manufacturers worldwide in recent years, has caused the price of PV modules to decline. We expect that the prices of PV products, including PV modules, may continue to decline over time due to increased supply of PV products, reduced manufacturing costs from economies of scale, and the advancement of manufacturing technologies. If we fail to attract and retain customers in our target markets for our future planned products and services, our results of operations, if any, will be adversely affected.

17 of 40

Many of our existing and potential competitors have substantially greater financial, technical, manufacturing and other resources than we do. The greater size of many of our competitors provides them with cost advantages as a result of their economies of scale and their ability to obtain volume discounts and purchase raw materials at lower prices. As a result, such competitors may have stronger bargaining power with their suppliers and have an advantage over us in pricing as well as securing sufficient supply of PV during times of shortage. Many of our competitors also have better brand name recognition, more established distribution networks, larger customer bases or more in-depth knowledge of the target markets. As a result, they may be able to devote greater resources to the research and development, promotion and sale of their products and respond more quickly to evolving industry standards and changes in market conditions as compared to us. Our failure to adapt to changing market conditions and to compete successfully with existing or future competitors would have a material adverse effect on our business, prospects and results of operations.

Challenges to the Solar Industry

The Company believes growth in the solar energy industry faces the following challenges:

|

*

|

Customer economics and financing — Installing a solar energy system represents a significant investment if purchased outright, for the typical corporation. Solar energy system financing, including loans and system leases, are not always available depending upon the state and the customer’s credit rating. A customer’s rate of return on investment in a solar energy system will occur over a different period or at a different rate depending upon individual circumstances. A potential purchaser has to weigh the initial investment decision against the longer-term utility cost reductions, increased property value and low system maintenance costs provided by a solar energy system.

|

||

|

*

|

Evolving regulatory landscape — The changing federal, state and local regulatory landscape presents significant unknown variables. Changes in regulations and incentives could adversely affect the economic viability of solar energy systems.

|

||

|

*

|

Supply of solar PV modules — Global PV module supply has fluctuated over the previous years, which has resulted in some price increases and limited availability for solar PV modules. While the risk factors of future shortages have lessened due to multiple manufacturing circumstances, we believe it is always a possibility that has to be taken into account.

|

||

|

*

|

Cost of traditional energy sources — Appropriately, the cost of solar power generation is often compared by customers to the cost of traditional sources of electricity generation such as coal. For example, traditional power plants are relatively cheap to build but expensive to operate, especially when the price of their environmental impact is considered. Solar power plants are more expensive to build but cheaper to operate over the long-term, with minimal environmental impact. The growth of the US solar power industry is dependent on how consumers weigh construction and operations cost for both types of electricity production.

|

||

|

*

|

Economic environment challenges — The current national and international financial instability has created a challenging business climate for the purchase of solar systems.

|

18 of 40

Regulations

Solar integrator services are subject to oversight and regulation by national and local ordinances, including building, zoning and fire codes, environmental protection regulations, utility interconnection requirements for metering and other rules and regulations. The Company plans to engage design and engineering teams to design and install solar energy systems to comply with these varying standards as well as to minimize the installation and operating costs of each system. The Company’s planned operations will also be subject to generally applicable laws and regulations relating to discharge of materials into the environment and protection of the environment; however, because the Company’s operations are not planned to typically involve any such discharge, we believe that there will be no material effects on our business relating to our compliance with such environmental laws and regulations.

Plan of Operations For the Next 12 Months

The Company’s business plan over the next 12 months entails initially entering the Northeast US residential and commercial solar installation market and aggressively targeting states such as New Jersey, Pennsylvania, Massachusetts, New Hampshire and Connecticut. The Company will additionally target states with high solar incentives such as North Carolina, Louisiana and New York. In order to efficiently target the Southeast US markets, the Company intends to establish an office in Orlando, Florida.

The Company intends to aggressively seek out federal installation clients, i.e., federal buildings equipped with solar installations. Examples of this include General Services Administration buildings and military facilities.

The Company intends to engage in a “roll-up” campaign of small to medium sized solar installers that will boost its market presence and reach, grow its balance sheet, and increase sales, which it hopes to begin after completing the planned acquisition of First Power (as described above).

The Company will build its sales force in order to better penetrate these markets and increase business volume. The Company will additionally implement online marketing campaigns and attend prominent solar trade shows held by leading solar organizations such as Solar Power International and Solar Energy Power Association in order to source business opportunities and facilitate relationship building. The Company will target small to mid-sized solar installers for acquisition opportunities. The Company believes that acquiring other small to mid-sized solar installers will allow it to grow and enter new markets more efficiently and allow it to accept increased business volume.

The Company anticipates needing $2 million in funding over the next 12 months to carry out its business plan. The Company intends on raising the required funds through sales of securities in private placements. If the Company cannot source the required funds, it believes that it can continue operations at its current level, but it will not be able to fully carry out the described business plan, and growth with will be minimal or stagnant.

Item 1A – Risk Factors

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

19 of 40

Risks Related our Company

We will continue to lose money, and if we do not achieve profitability, we may not be able to continue our business.

We have, in our history, generated limited revenues from operations, have incurred substantial expenses and have sustained losses. In addition, we expect to continue to incur significant operating expenses. As a result, we will need to generate significant revenues to achieve profitability, which may not occur.

We have a history of financial losses. We had no revenue during 2011 or 2010 and only $471 of revenue during 2009.

We had net losses of $41,422 and $72,161 for the years ending September 30, 2012 and 2011. As of September 30, 2012, we had a working capital deficit of $297,863 and a deficit accumulated during the development stage of $722,091.

We have no history of operations in the solar power industry and will need to raise significant additional funding in order to purchase required assets and supplies to complete, arrange and design solar power arrays.

The Company has historically been completely dependent on Jeff Martin for its funding, provided that it is not anticipated that Mr. Martin will provide the Company any additional funding subsequent to the consummation of the Stock Purchase. As such, we will need to raise significant additional funding moving forward from third parties.

We plan to seek out debt and/or equity financing in the future; however, we do not currently have any specific plans to raise such additional financing at this time, and such additional funding may not be available on favorable terms, if at all. The sale of additional equity securities, if undertaken by the Company and if accomplished, may result in dilution to our shareholders.

Even if we do achieve revenues in the future, we may be unable to obtain, sustain or increase profitability on a quarterly or annual basis in the future. We expect to have quarter-to-quarter fluctuations in revenues, expenses, losses and cash flow, some of which could be significant. Results of operations will depend upon numerous factors, some beyond our control, including regulatory actions, market acceptance of our products and services, new products and service introductions, and competition. If we do not raise the additional capital, the value of any investment in our Company may become worthless. In the event we do not raise additional capital from conventional sources, it is likely that we may need to scale back or curtail implementing our business plan.

20 of 40

We may never complete the acquisition of First Power.

As described above, we currently anticipate entering into an asset purchase agreement with First Power shortly after the filing of this report with the goal of acquiring First Power’s assets and operations. The closing of that transaction will be dependent on several factors, including, but not limited to First Power obtaining an audit of its financial statements. In the event we are not able to acquire First Power, or such acquisition proves too costly, we may be forced to abandon our planned solar power solutions operations, may not be able to realize our planned business plan as described above, and may be forced to further modify our planned business plan. As a result, in the event we are unable to acquire the assets and operations of First Power, any investment in the Company could become worthless.

We lack an operating history which you can use to evaluate us, making any investment in our company risky.

We lack an operating history which investors can use to evaluate our previous earnings, as we were only incorporated in May 2008 and only recently changed our business plan to solar energy installations. Therefore, an investment in us is risky because we have no business history and it is hard to predict what the outcome of our business operations will be in the future.

We will require significant additional funds, the amount of which will depend upon our working capital and general corporate needs and the size, timing and structure of future acquisitions.

We estimate that we will need approximately $2,000,000 of additional funding to implement our current business plan. Additionally, our operations will not, at least initially, generate sufficient cash to enable us to operate or expand our business and adequate financing may not be available if and when we need it or may not be available on terms acceptable to us. Any borrowings made to finance future acquisitions or for operations could make us more vulnerable to a downturn in our operating results, a downturn in economic conditions or increases in interest rates on future borrowings. If our cash flow from operations is insufficient to meet our debt service requirements, we could be required to sell equity securities, refinance our obligations or dispose of assets in order to meet our debt service requirements. In addition, our operations may not generate sufficient cash for our acquisition plans. The extent to which we would be able or willing to use our equity to consummate future acquisitions will depend on the market price of our equity from time to time and the willingness of potential sellers to accept our equity as full or partial payment. Using our equity for this purpose also may result in significant dilution to our shareholders. To the extent that we are unable to use our equity to make future acquisitions, our ability to grow through acquisitions may be limited by the extent to which we are able to raise capital for this purpose through debt or equity financings. The failure to obtain sufficient financing on favorable terms and conditions could have a material adverse effect on our business, financial condition, operating results and growth prospects.

Our independent registered public accounting firm issued a report for the year ended September 30, 2012 that contained a “going concern” explanatory paragraph.

Our independent registered public accounting firm issued a report on their audit of our financial statements as of and for the year ended September 30, 2012 containing a “going concern” paragraph. Our notes to the financial statements disclose that our cash flows have been absorbed in operating activities and we have incurred net losses for the period ended September 30, 2012, and have a working capital deficiency. In the event that funding from internal sources or from public or private financing is insufficient to fund the business at current levels, we will have to substantially cut back our level of spending which could substantially curtail our operations. The independent registered public accounting firm’s report contains an explanatory paragraph indicating that these factors raise substantial doubt about our ability to continue as a going concern. Our going concern uncertainty may affect our ability to raise additional capital, and may also affect our relationships with suppliers and customers. Investors should carefully read the independent registered public accounting firm's report and examine our financial statements.

21 of 40

Our success depends heavily on our management who have limited experience in managing the day to day operations of a public company and, as a result, we may incur additional expenses associated with the management of our company.

The management team, including Malcolm N. Adler, our Chief Executive Officer and President, and planned Director and Thomas Moore, our Secretary and Treasurer and planned Director are responsible for the operations and reporting of the Company. The requirements of operating as a small public company are new to the management team. This may require us to obtain outside assistance from legal, accounting, investor relations, or other professionals that could be more costly than anticipated. We may also be required to hire additional staff to comply with additional SEC reporting requirements and compliance under the Sarbanes-Oxley Act of 2002. Our failure to comply with reporting requirements and other provisions of securities laws could negatively affect our stock price and adversely affect our results of operations, cash flow and financial condition. Presently, given our limited operations, we estimate that our annual costs to comply with SEC reporting requirements will be between $50,000 and $100,000.

We are subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended, which will require us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs could reduce or eliminate our ability to earn a profit.

We are required to file periodic reports with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder. In order to comply with these requirements, our independent registered public accounting firm will have to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports.

The costs charged by these professionals for such services cannot be accurately predicted at this time because factors such as the number and type of transactions that we engage in and the complexity of our reports cannot be determined at this time and will have a major effect on the amount of time to be spent by our auditors and attorneys. However, the incurrence of such costs will obviously be an expense to our operations and thus have a negative effect on our ability to meet our overhead requirements and earn a profit. We may be exposed to potential risks resulting from any new requirements under Section 404 of the Sarbanes-Oxley Act of 2002. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly.

Presently, given our limited operations, we estimate that our annual costs to comply with SEC reporting requirements will be between $50,000 and $100,000.

22 of 40

Our internal controls are ineffective and may continue to be ineffective or inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: (i) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or Directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. Our internal controls were not effective as of September 30, 2012 and may continue to be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision.

Having only a limited number of Directors limits our ability to establish effective independent corporate governance procedures and increases the control of our President.

We currently have only three Directors and will have only two Directors, once Malcolm Adler and Thomas Moore are appointed as our Directors as discussed above under Item 1.01. Accordingly, we cannot establish board committees comprised of independent members to oversee functions like compensation or audit issues. Until we have a larger board of Directors that would include some independent members, if ever, there will be limited oversight of our president’s decisions and activities and little ability for minority shareholders to challenge or reverse those activities and decisions, even if they are not in the best interests of minority shareholders.

If we fail to develop new customer relationships, our ability to grow our business will be impaired.

Our growth depends to a significant degree upon our ability to develop new customer relationships. We cannot guarantee that new customers will be added, or that any such new relationships will be successful when they are in place. Failure to develop and expand such relationships could have a material adverse effect on our business, results of operations and financial condition.

Some of our competitors may be able to use their financial strength to dominate the market, which may affect our ability to generate revenues.

Some of our competitors are much larger companies and better capitalized. They could choose to use their greater resources to finance their continued participation and penetration of this market, which may impede our ability to generate sufficient revenue to cover our costs. Their better financial resources could allow them to significantly out spend us on marketing. We might not be able to maintain our ability to compete in this circumstance.

Risks Related to Our Common Stock and Its Market

Sharon Altman owns approximately 66% of our outstanding common stock, and has significant influence over our corporate decisions, and as a result, her interest could conflict with yours.

Sharon Altman holds 35 million shares of our common stock, representing approximately 66% of the outstanding shares of our common stock. Accordingly, Ms. Altman will have significant influence over all matters requiring stockholder approval, including the election of Directors and approval of significant corporate transactions, as well as determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control, as Ms. Altman will likely continue to be our largest shareholder. Such concentration of ownership may also have the effect of delaying or preventing a change in control, which may be to the benefit of the Directors and executive officers but not in the interest of the shareholders. As a result, Ms. Altman has absolute control over all matters requiring stockholder approval, including the election of Directors and approval of significant corporate transactions. The interests of Ms. Altman may differ from the interests of the other stockholders and thus result in corporate decisions that are adverse to other shareholders. Additionally, potential investors should take into account the fact that any vote of shares purchased will have limited effect on the outcome of corporate decisions.

23 of 40

We expect to issue additional stock in the future to finance our business plan and the potential dilution caused by the issuance of stock in the future may cause the price of our common stock to drop.