Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COUSINS PROPERTIES INC | a8-kforpostoakacquisition.htm |

| EX-99.1 - EXHIBIT - COUSINS PROPERTIES INC | final_terminuspocx2713.htm |

Transaction Overview: Terminus and Post Oak Central

2 Disclosure Regarding Forward-Looking Statements *** Certain matters discussed in this presentation are forward-looking statements within the meaning of the federal securities laws and are subject to uncertainties and risk. These include, but are not limited to, availability and terms of capital and financing; national and local economic conditions; the real estate industry in general and in specific markets; the potential for recognition of additional impairments due to continued adverse market and economic conditions or changes in Company business and financial strategy; leasing risks; potential acquisitions, expected 2013 yields on acquisitions or dispositions, new investments and/or dispositions; the failure of purchase, sale or other contracts to ultimately close; the financial condition of existing tenants; competition from other developers or investors; the risks associated with development projects; rising interest and insurance rates; the availability of sufficient development or investment opportunities; environmental matters; the financial condition and liquidity of, or disputes with, joint venture partners; any failure to comply with debt covenants under credit agreements; any failure to continue to qualify for taxation as a real estate investment trust and other risks detailed from time to time in the Company’s filings with the Securities and Exchange Commission, including those described in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2011. The words “believes,” “expects,” “anticipates,” “estimates,” ”plans,” “may,” “intend,” “will” or similar expressions are intended to identify forward-looking statements. Although the Company believes that its plans, intentions and expectations reflected in any forward-looking statement are reasonable, the Company can give no assurance that such plans, intentions or expectations will be achieved. Such forward-looking statements are based on current expectations and speak as of the date of such statements. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information or otherwise, except as required under U.S. federal securities laws.

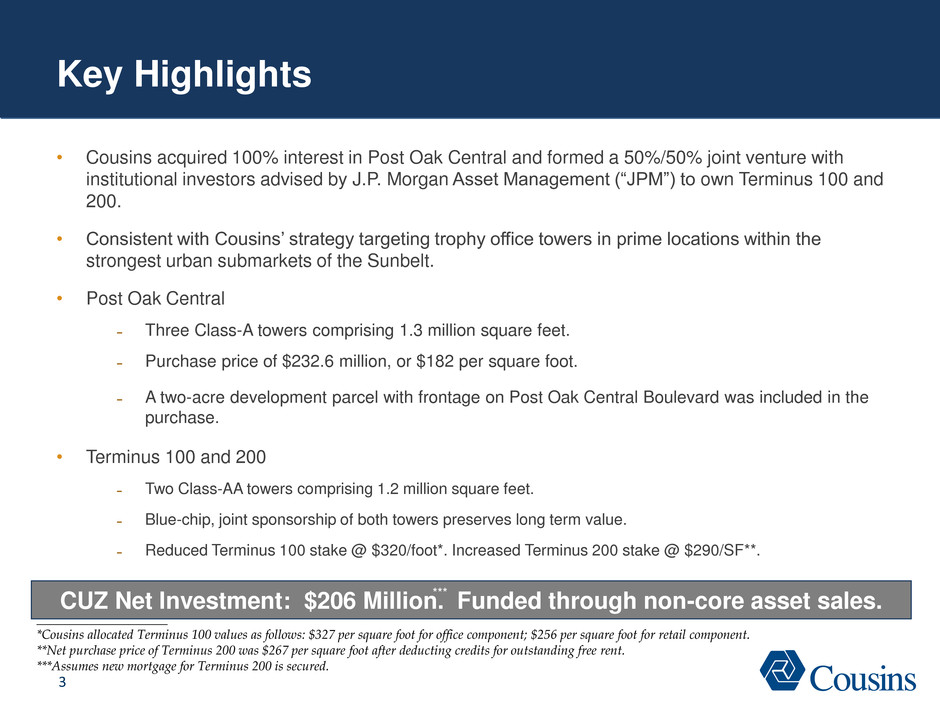

3 Key Highlights • Cousins acquired 100% interest in Post Oak Central and formed a 50%/50% joint venture with institutional investors advised by J.P. Morgan Asset Management (“JPM”) to own Terminus 100 and 200. • Consistent with Cousins’ strategy targeting trophy office towers in prime locations within the strongest urban submarkets of the Sunbelt. • Post Oak Central ˗ Three Class-A towers comprising 1.3 million square feet. ˗ Purchase price of $232.6 million, or $182 per square foot. ˗ A two-acre development parcel with frontage on Post Oak Central Boulevard was included in the purchase. • Terminus 100 and 200 ˗ Two Class-AA towers comprising 1.2 million square feet. ˗ Blue-chip, joint sponsorship of both towers preserves long term value. ˗ Reduced Terminus 100 stake @ $320/foot*. Increased Terminus 200 stake @ $290/SF**. CUZ Net Investment: $206 Million. Funded through non-core asset sales. ____________________ *Cousins allocated Terminus 100 values as follows: $327 per square foot for office component; $256 per square foot for retail component. **Net purchase price of Terminus 200 was $267 per square foot after deducting credits for outstanding free rent. ***Assumes new mortgage for Terminus 200 is secured. ***

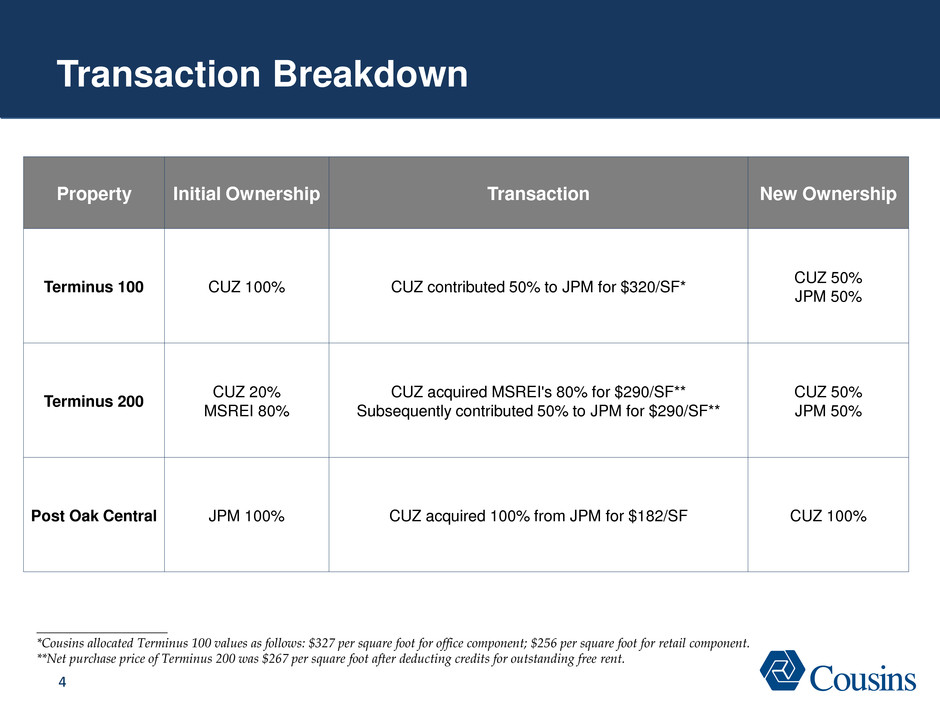

4 Transaction Breakdown ____________________ *Cousins allocated Terminus 100 values as follows: $327 per square foot for office component; $256 per square foot for retail component. **Net purchase price of Terminus 200 was $267 per square foot after deducting credits for outstanding free rent. Property Initial Ownership Transaction New Ownership Terminus 100 CUZ 100% CUZ contributed 50% to JPM for $320/SF* CUZ 50% JPM 50% Terminus 200 CUZ 20% MSREI 80% CUZ acquired MSREI's 80% for $290/SF** Subsequently contributed 50% to JPM for $290/SF** CUZ 50% JPM 50% Post Oak Central JPM 100% CUZ acquired 100% from JPM for $182/SF CUZ 100%

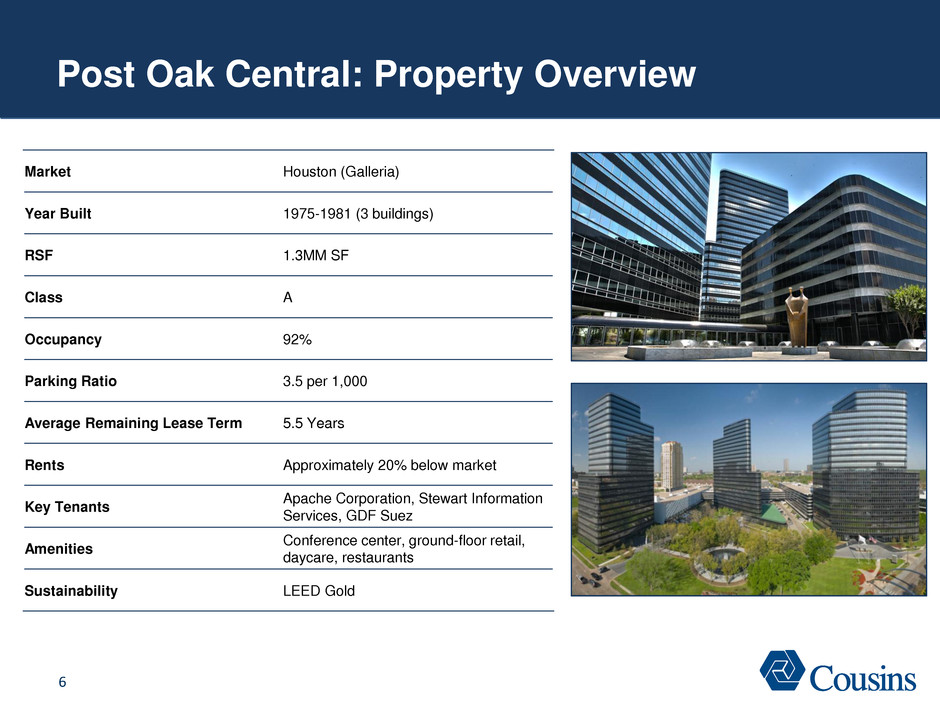

5 Post Oak Central: Transaction Overview • Scale provides attractive entry into Houston • Purchase Price $232.6 Million ($182/SF) ˗ 45% discount to replacement cost. ˗ Expected 2013 GAAP NOI yield of 7.5%. • Significant future development opportunity ˗ 2.1 acres of land on Post Oak Boulevard. ˗ One of last remaining undeveloped parcels with Post Oak Boulevard frontage. • Centrally located office property in the Galleria ˗ Benefits from 3.2 Million SF of retail within ½ mile, including Galleria Mall (largest in Texas). ˗ Strongest office submarket in Houston, exceptional underlying supply/demand characteristics.

6 Post Oak Central: Property Overview Market Houston (Galleria) Year Built 1975-1981 (3 buildings) RSF 1.3MM SF Class A Occupancy 92% Parking Ratio 3.5 per 1,000 Average Remaining Lease Term 5.5 Years Rents Approximately 20% below market Key Tenants Apache Corporation, Stewart Information Services, GDF Suez Amenities Conference center, ground-floor retail, daycare, restaurants Sustainability LEED Gold

7 Galleria Market Overview • 18MM RSF of office ‒ Class A vacancy: 8.3% • 4.9MM SF of retail ‒ 99% occupancy Under Contract for $278/SF 50% interest recently sold ~$265/SF

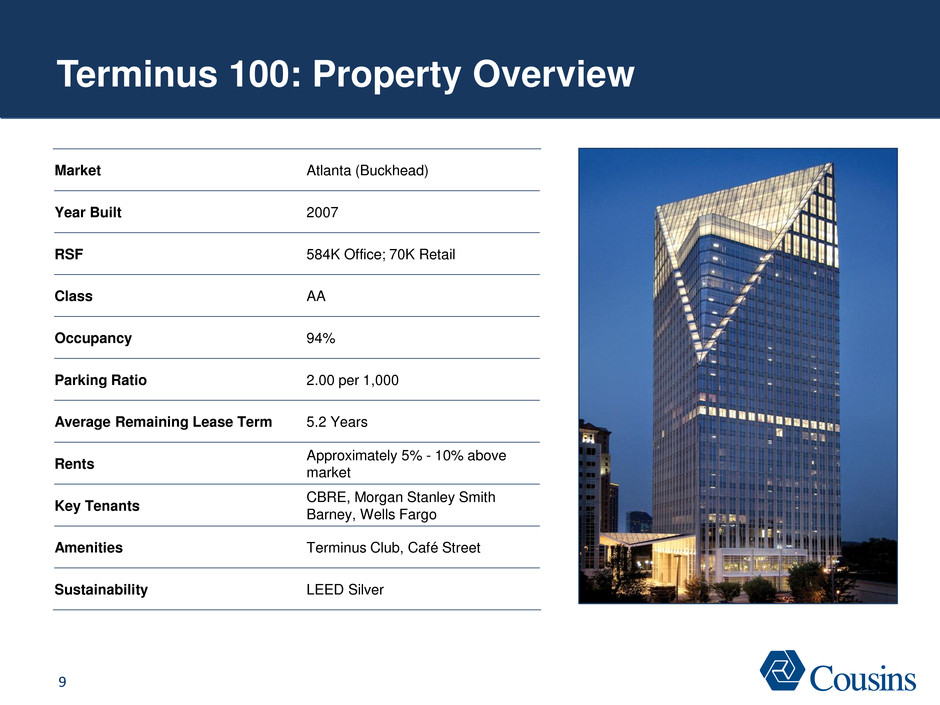

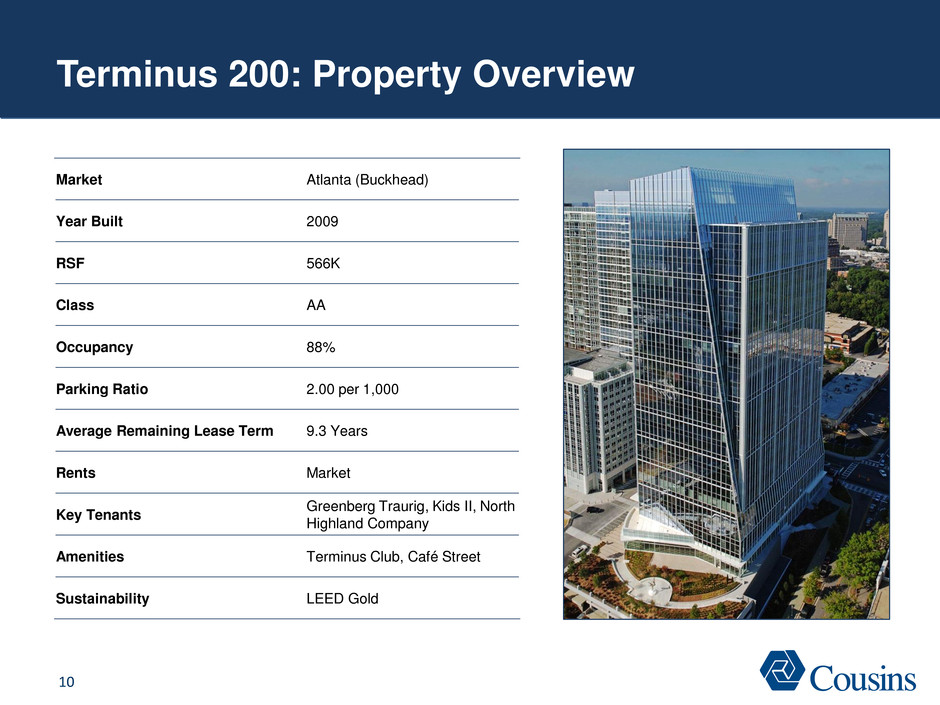

8 Terminus: Transaction Overview • Reduced overall economic ownership of Terminus 100 and Terminus 200 from 65% to 50% ˗ Increased ownership interest in Terminus 200 @ $290/SF. Reduced ownership interest in Terminus 100 @ $320/SF. ˗ Venture assumed the existing $136 million loan on Terminus 100. ˗ Venture repaid the $75 million loan on Terminus 200 and anticipates securing a new long-term non- recourse mortgage post-closing. 72.4% 82.4% 70% 72% 74% 76% 78% 80% 82% 84% Buckhead Class A Occupancy Inventory: Unchanged Net Absorption: 1.4 million SF 2010 2011 2012

9 Terminus 100: Property Overview Market Atlanta (Buckhead) Year Built 2007 RSF 584K Office; 70K Retail Class AA Occupancy 94% Parking Ratio 2.00 per 1,000 Average Remaining Lease Term 5.2 Years Rents Approximately 5% - 10% above market Key Tenants CBRE, Morgan Stanley Smith Barney, Wells Fargo Amenities Terminus Club, Café Street Sustainability LEED Silver

10 Terminus 200: Property Overview Market Atlanta (Buckhead) Year Built 2009 RSF 566K Class AA Occupancy 88% Parking Ratio 2.00 per 1,000 Average Remaining Lease Term 9.3 Years Rents Market Key Tenants Greenberg Traurig, Kids II, North Highland Company Amenities Terminus Club, Café Street Sustainability LEED Gold

11 Development/Value Creation Opportunity Competitive Advantage through Expertise and Relationships Acquire Below Replacement Cost Executing the Strategy Class-A Office TX, GA, NC Exceptional Urban Location Post Oak Central. Promenade. 2100 Ross. Post Oak Central Houston, TX 2013 Promenade Atlanta, GA 2011 2100 Ross Dallas, TX 2012