Attached files

| file | filename |

|---|---|

| 8-K - HOWARD BANCORP, INC. 8-K - Howard Bancorp Inc | a50557553.htm |

Slide: 0 Emerald Groundhog Day Investment Forum February 7, 2013

Slide: 1 Forward-Looking Statements Other Placeholder: This presentation contains statements that are forward-looking, as that term is defined by the Private Securities Litigation Reform Act of 1995 or the Securities and Exchange Commission in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe harbors created thereby. All forward-looking statements are based on current expectations regarding important risk factors, including but not limited to real estate values, local and national economic conditions, and the impact of interest rates on financing. Accordingly, actual results may differ from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by the Company or any other person that results expressed therein will be achieved. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Other Placeholder: 1

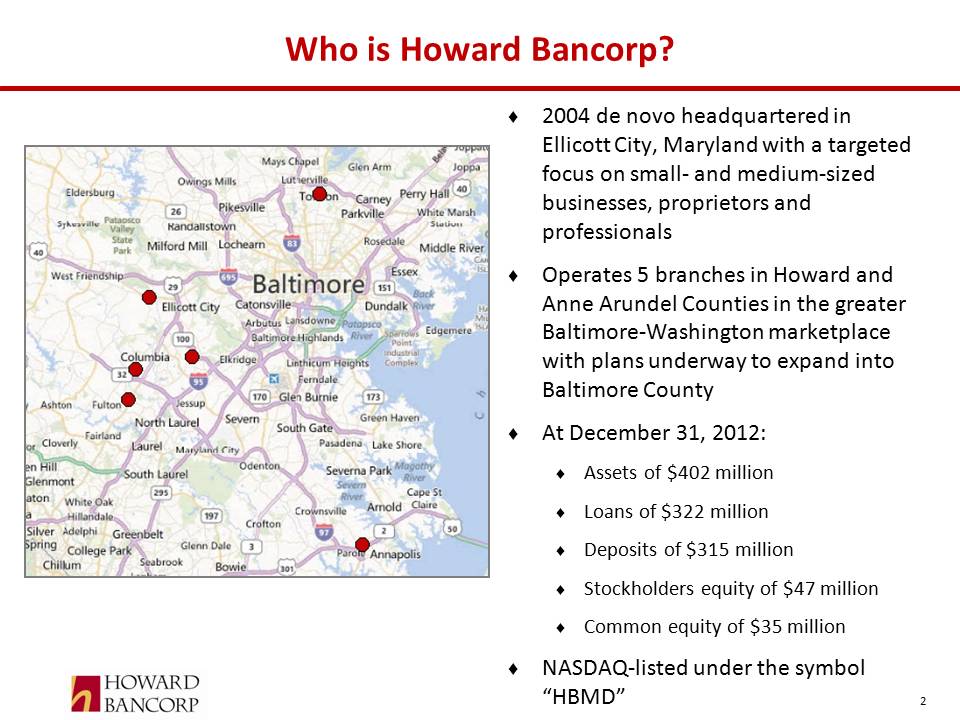

Slide: 2 Title: Who is Howard Bancorp? Other Placeholder: 2004 de novo headquartered in Ellicott City, Maryland with a targeted focus on small- and medium-sized businesses, proprietors and professionals Operates 5 branches in Howard and Anne Arundel Counties in the greater Baltimore-Washington marketplace with plans underway to expand into Baltimore County At December 31, 2012: Assets of $402 million Loans of $322 million Deposits of $315 million Stockholders equity of $47 million Common equity of $35 million NASDAQ-listed under the symbol “HBMD” Other Placeholder: 2

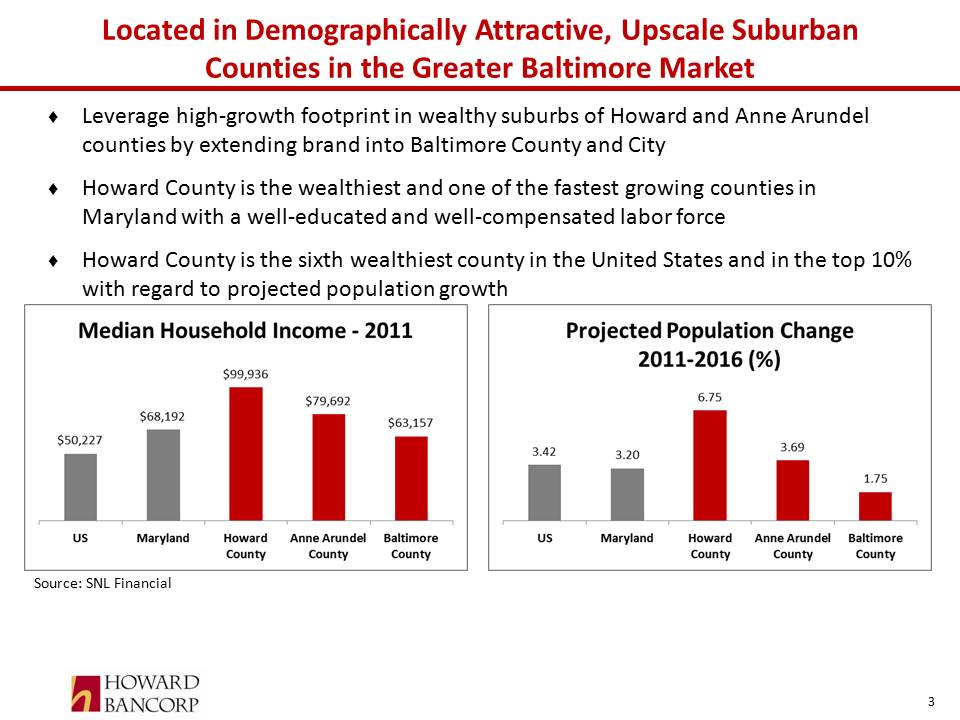

Slide: 3 Title: Located in Demographically Attractive, Upscale Suburban Counties in the Greater Baltimore Market Other Placeholder: Leverage high-growth footprint in wealthy suburbs of Howard and Anne Arundel counties by extending brand into Baltimore County and City Howard County is the wealthiest and one of the fastest growing counties in Maryland with a well-educated and well-compensated labor force Howard County is the sixth wealthiest county in the United States and in the top 10% with regard to projected population growth Source: SNL Financial Other Placeholder: 3

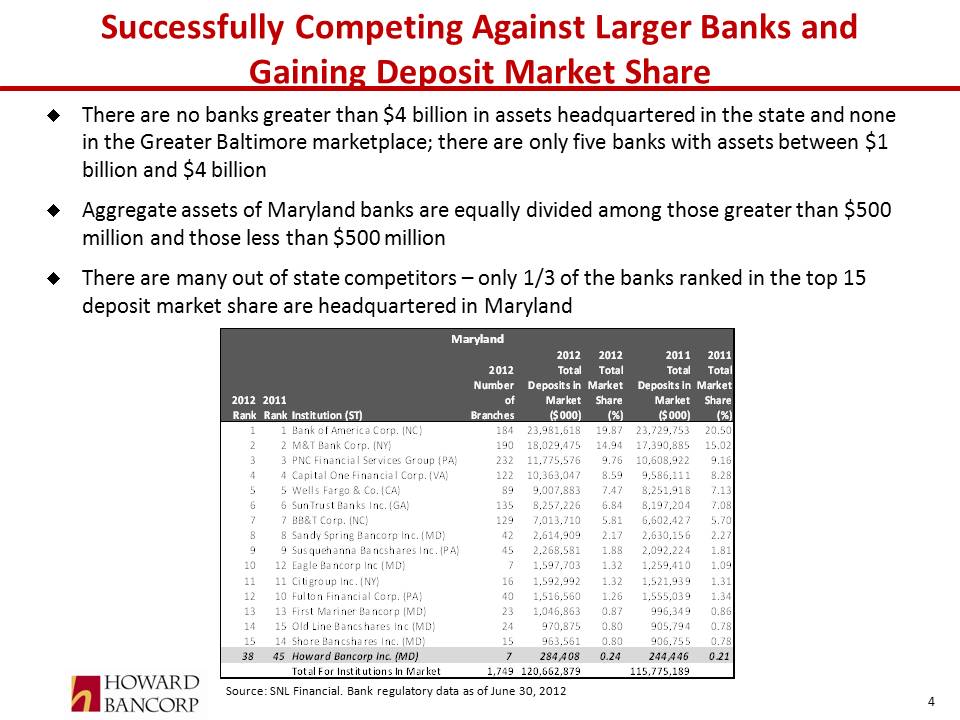

Slide: 4 Title: Successfully Competing Against Larger Banks and Gaining Deposit Market Share Other Placeholder: There are no banks greater than $4 billion in assets headquartered in the state and none in the Greater Baltimore marketplace; there are only five banks with assets between $1 billion and $4 billion Aggregate assets of Maryland banks are equally divided among those greater than $500 million and those less than $500 million There are many out of state competitors – only 1/3 of the banks ranked in the top 15 deposit market share are headquartered in Maryland Source: SNL Financial. Bank regulatory data as of June 30, 2012 Other Placeholder: 4

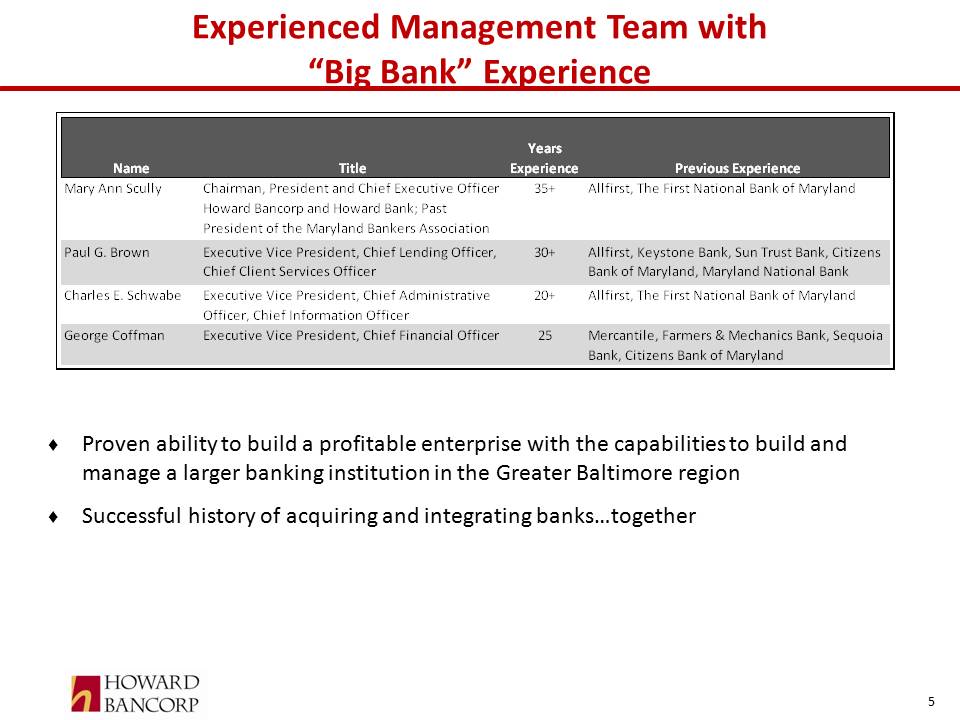

Slide: 5 Title: Experienced Management Team with “Big Bank” Experience Other Placeholder: Proven ability to build a profitable enterprise with the capabilities to build and manage a larger banking institution in the Greater Baltimore region Successful history of acquiring and integrating banks…together Other Placeholder: 5

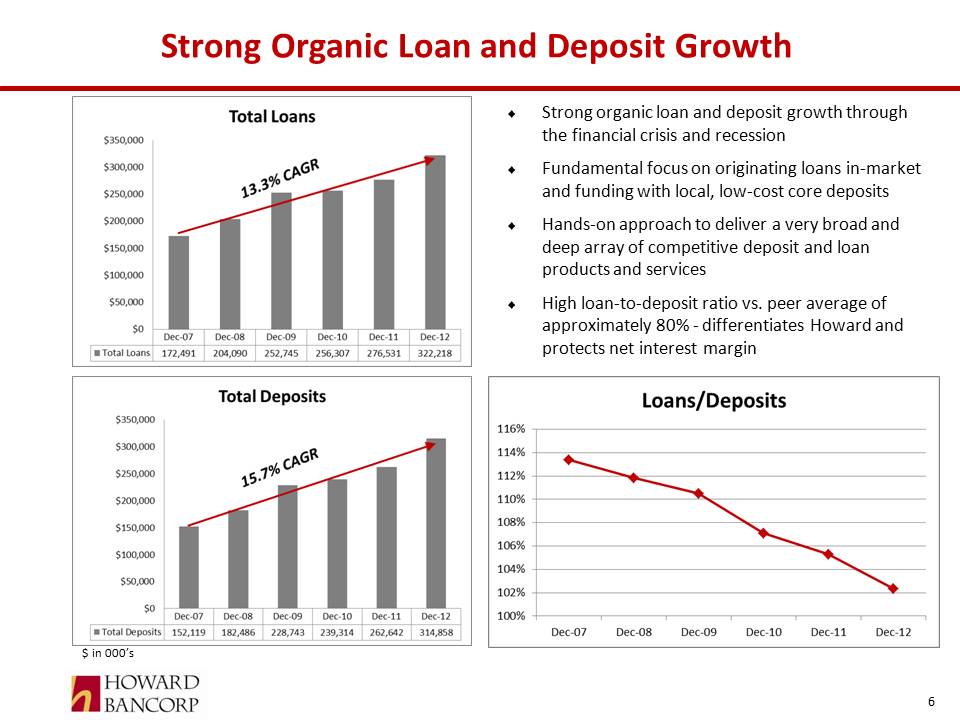

Slide: 6 Title: Strong Organic Loan and Deposit Growth Other Placeholder: Strong organic loan and deposit growth through the financial crisis and recession Fundamental focus on originating loans in-market and funding with local, low-cost core deposits Hands-on approach to deliver a very broad and deep array of competitive deposit and loan products and services High loan-to-deposit ratio vs. peer average of approximately 80% - differentiates Howard and protects net interest margin Other Placeholder: 6 $ in 000’s

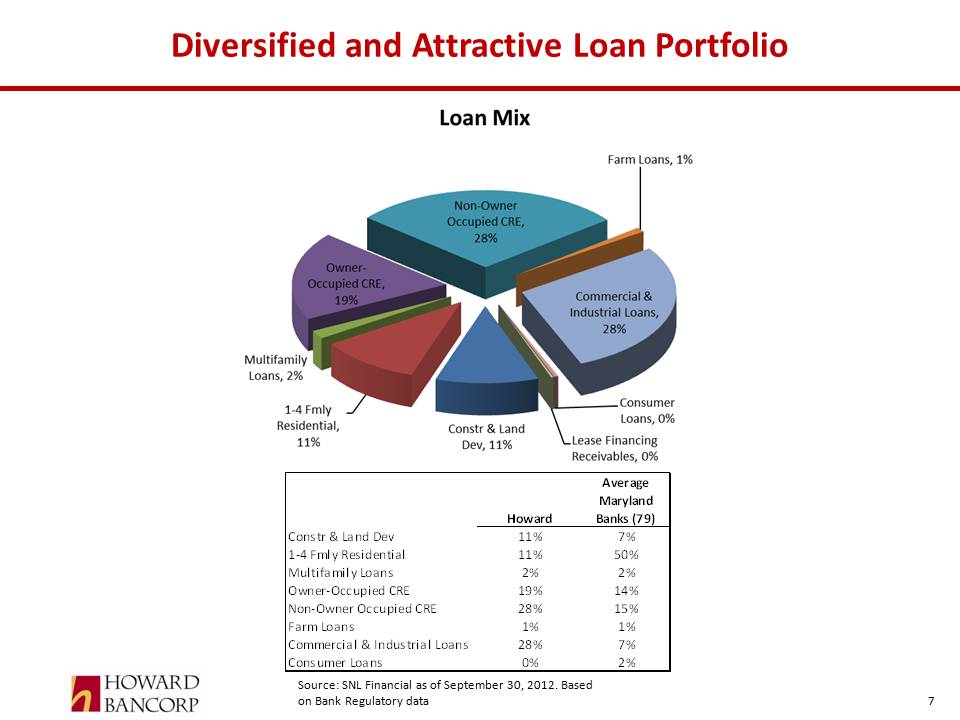

Slide: 7 Title: Diversified and Attractive Loan Portfolio Other Placeholder: 7 Source: SNL Financial as of September 30, 2012. Based on Bank Regulatory data

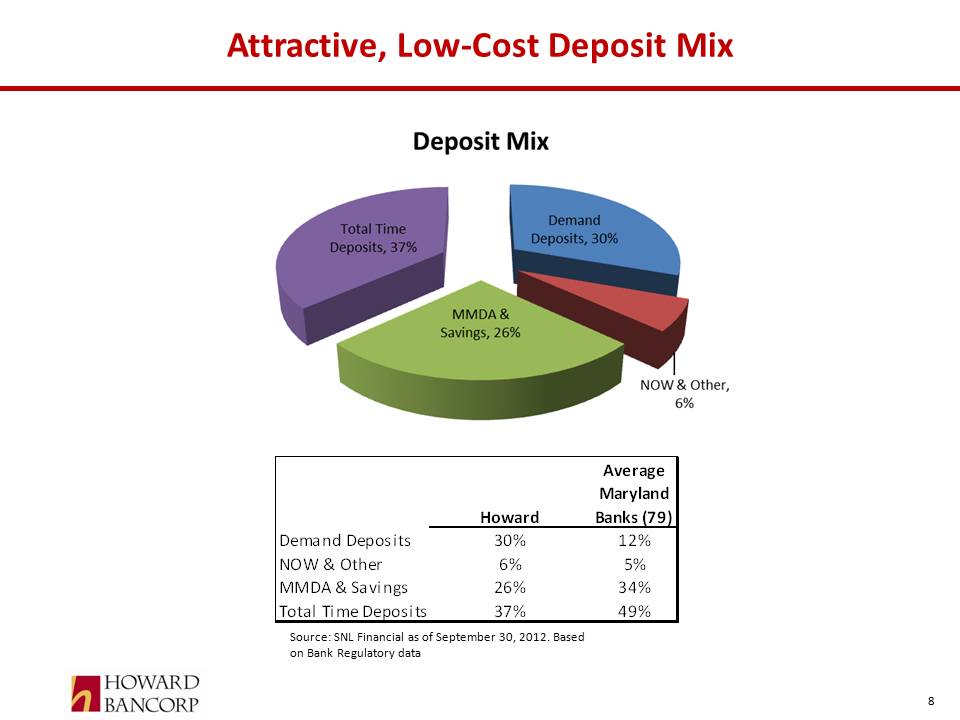

Slide: 8 Title: Attractive, Low-Cost Deposit Mix Other Placeholder: 8 Source: SNL Financial as of September 30, 2012. Based on Bank Regulatory data

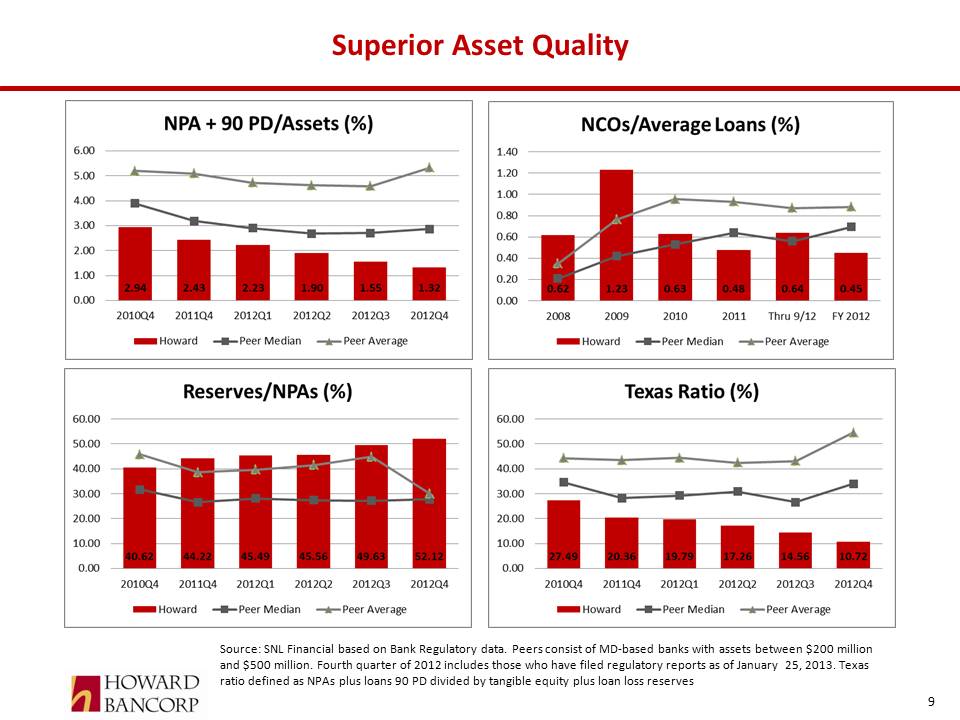

Slide: 9 Title: Superior Asset Quality Other Placeholder: 9 Source: SNL Financial based on Bank Regulatory data. Peers consist of MD-based banks with assets between $200 million and $500 million. Fourth quarter of 2012 includes those who have filed regulatory reports as of January 25, 2013. Texas ratio defined as NPAs plus loans 90 PD divided by tangible equity plus loan loss reserves

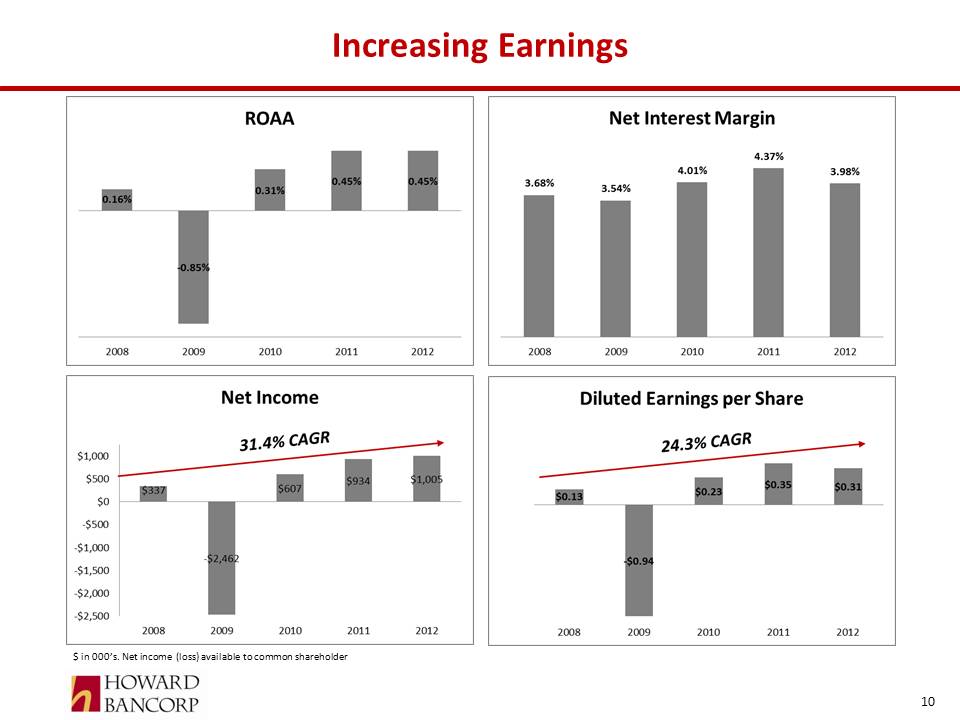

Slide: 10 Title: Increasing Earnings Other Placeholder: 10 $ in 000’s. Net income (loss) available to common shareholder

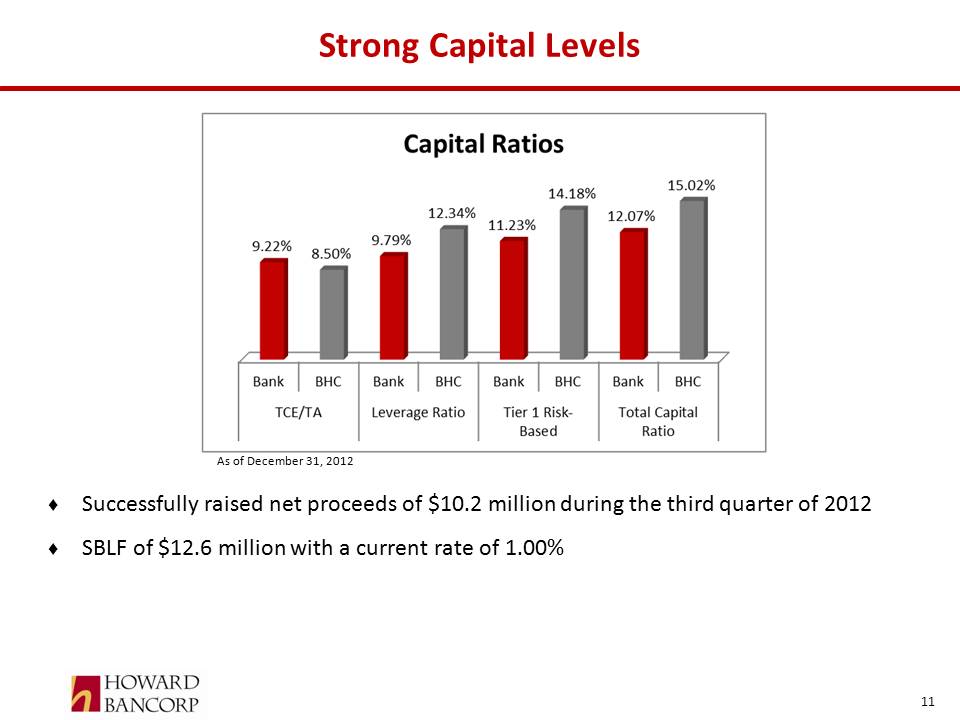

Slide: 11 Title: Strong Capital Levels Other Placeholder: 11 As of December 31, 2012 Other Placeholder: Successfully raised net proceeds of $10.2 million during the third quarter of 2012 SBLF of $12.6 million with a current rate of 1.00%

Slide: 12 Title: Successful and Innovative Capital Offering Objectives: Provide shareholder base with liquidity Raise sufficient capital to support growth objectives and be prepared to participate in strategic opportunities Gain institutional investor support for common equity Offering:Raised $10.2 million in a bad market for bank stocks The offering consisted of three parts: A $4.2 million institutional private placement at $7.30 per share (80% of TBV and 140% of its market price on date of completion of the private placement). This private placement provided a “smart money” endorsement of the bank and justification for its higher than market pricing; A rights offering which attracted $2.0 million from management, board members and current shareholders (an additional smart money endorsement); and A public offering of the shares which were unsubscribed in the rights offering, which attracted an additional $4.0 million, all at $7.30 per share Howard also became an SEC ’34 Act reporting company and listed its shares on NASDAQ under the symbol “HMBD” Other Placeholder: 12

Slide: 13 Title: Howard’s Growth Strategy Other Placeholder: Organic / De Novo Growth Strategy Grow organically through customer acquisition of select market segments Expand market reach into Baltimore County through new relationship management team and branch opening Towson branch expected to open in 2013 Relationship management team put in place early 2012 Leverage opportunities into new markets by placing personnel in markets to “test the waters” before embarking on de novo strategy Opened branch in Annapolis in May of 2012; however, placed lending personnel in market in October of 2009 Increase fee income through the addition of a mortgage banking platform Other Placeholder: Acquisition Strategy Extend market presence through strategic M&A Opportunity to create a very relevant billion dollar plus banking franchise in the Greater Baltimore-Washington market Target rich environment with over 70 banks in market with assets under $1 billion, most of which are not relevant to the very few larger banks in the region Non-bank acquisition opportunities to enhance fee income Other Placeholder: 13

Slide: 14 Title: Summary Other Placeholder: Howard has enjoyed substantial growth and has performed well since its inception, even during the recession and financial crisis Viable and relevant franchise, with a balanced business mix and a moderate credit risk profile Howard is well positioned for growth and believes it must grow to achieve the size and scale sufficient to continue to generate superior returns for its investors notwithstanding the state of the national and regional economies, Dodd Frank and competitive pressures There are a number of potential partners in the Greater Baltimore-Washington market Howard has a “big bank” caliber management team who has successfully acquired, integrated and operated billion dollar banks for Allfirst Bank and Mercantile Bank There are few-to-none “Greater Baltimore” based banks with the capital and size and scale as Howard’s Opportunity to fill the current void in the marketplace by building a super regional “Greater Baltimore” bank via both organic growth and acquisition