Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VISA INC. | d481686d8k.htm |

| EX-99.1 - PRESS RELEASE OF VISA INC. - VISA INC. | d481686dex991.htm |

Visa

Inc. Fiscal First Quarter

Financial Results

February 6, 2013

Exhibit 99.2 |

Fiscal First Quarter 2013 Financial Results

2

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995. These statements can be identified by the terms

"believe," "continue," “expect," and similar references to the future.

Examples of such forward-looking statements include, but are not limited to, statements we make

about revenues, client incentives, expenses, operating margin, tax rate, earnings per share,

capital expenditures, free cash flow and the growth of those items.

By their nature, forward-looking statements: (i) speak only as of the date they are made, (ii) are

neither statements of historical fact nor guarantees of future performance and (iii) are

subject to risks, uncertainties, assumptions and changes in circumstances that are difficult to predict or quantify. Therefore, actual results could differ materially and

adversely from those forward-looking statements because of a variety of factors, including the

following:

•

the impact of laws, regulations and marketplace barriers, including: •

rules capping debit interchange reimbursement fees promulgated under the U.S. Wall Street Reform and

Consumer Protection Act, or the Dodd-Frank Act;

•

rules under the Dodd-Frank Act expanding issuers' and merchants' choice among debit payment

networks;

•

increased regulation outside the United States and in other product categories; •

increased government support of national payment networks outside the United States; and •

rules about consumer privacy and data use and security; •

developments in litigation and government enforcement, including •

those affecting interchange reimbursement fees, antitrust and tax and •

our failure to make our multidistrict interchange litigation settlement effective; •

economic factors, such

as: •

an increase or spread of the current European crisis involving sovereign debt and the euro; •

a failure to raise the “debt ceiling” in the United States and its repercussions; •

cross-border activity and currency exchange rates; •

material changes in our clients' performance compared to our estimates; and •

other global economic, political and health conditions; •

industry developments, such as competitive pressure, rapid technological developments and

disintermediation from the payments value stream;

•

system developments, such as: •

disruption of our transaction processing systems or the inability to process transactions

efficiently;

•

account data breaches or increased fraudulent or other illegal activities involving our cards; and •

issues arising at Visa Europe, including failure to maintain interoperability between our systems; •

costs arising if Visa Europe were to exercise its right to require us to acquire all of its

outstanding stock;

•

loss of organizational effectiveness or key employees; •

failure to integrate acquisitions successfully or to effectively launch new products and businesses;

and the

other factors discussed in our most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission. You should not place undue reliance on

such statements. Unless required to do so by law, we do not intend to update or revise any

forward-looking statement, because of new information or future developments or otherwise.

|

Fiscal First Quarter 2013 Financial Results

3

Solid Fiscal First Quarter Results

•

Strong operating revenues of $2.8 billion, up 12% over prior year

•

Quarterly net income of $1.3 billion, up 26%, and diluted earnings

per share of $1.93, up 30% over prior year

•

Continued positive secular trends and spending momentum

contributed to growth in key underlying business drivers

•

Repurchased 9 million shares of class A common stock in the open

market at an average price of $145.40 per share, using $1.3 billion

of cash on hand |

Fiscal First Quarter 2013 Financial Results

4

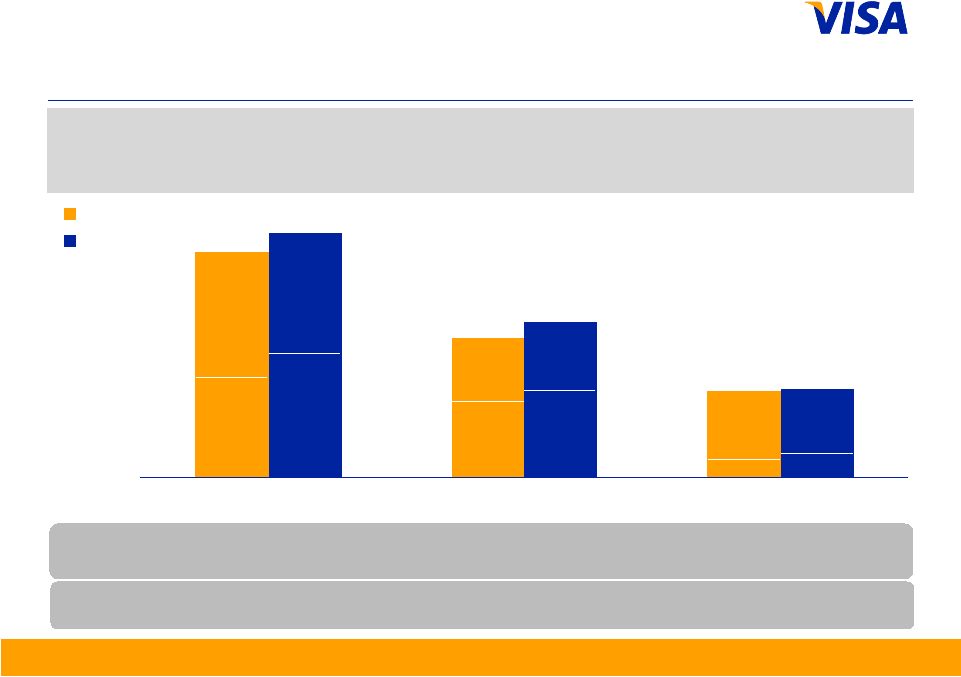

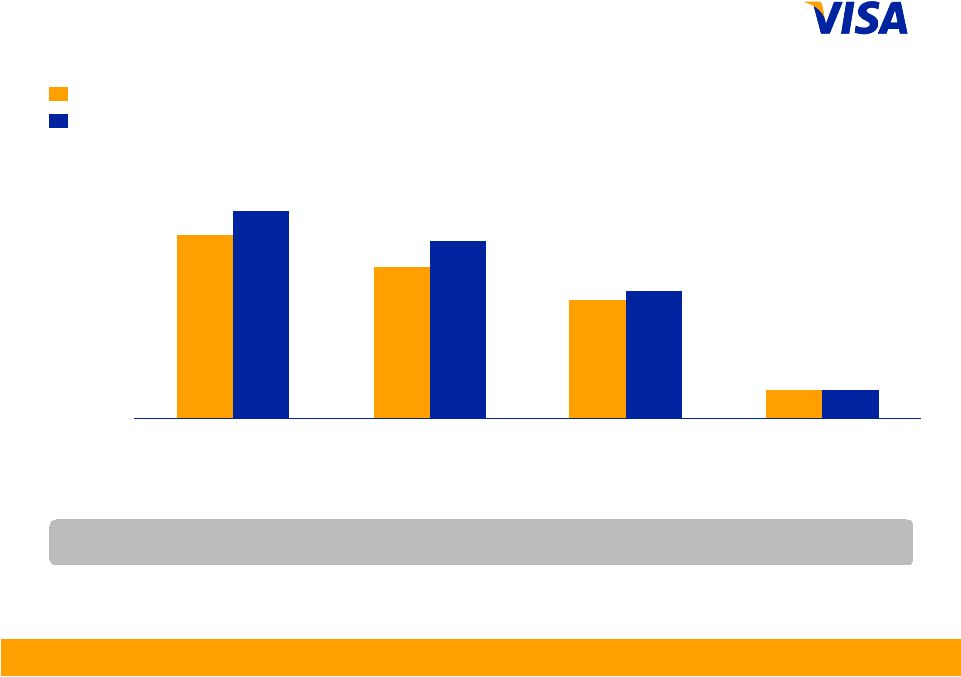

971

598

373

1,008

642

366

Total Visa Inc.

Credit

Debit

2011

2012

U.S.

517

ROW

454

U.S.

229

ROW

369

U.S.

521

ROW

487

U.S.

250

ROW

392

U.S.

271

ROW 95

U.S.

288

ROW 85

Payments Volume

US$ in billions, nominal, except percentages

YOY Change

(nominal)

7%

(2%)

4%

YOY Change

(constant)

6%

10%

(0%)

Note:

Figures

may

not

recalculate

exactly

due

to

rounding.

Percentage

changes

calculated

based

on

whole

numbers,

not

the

rounded

numbers

presented. From time to time, previously submitted volume information may be

updated. Prior period updates are not material. Constant dollar growth

rates

exclude

the

impact

of

foreign

currency

fluctuations

against

the

U.S.

dollar

in

measuring

performance.

ROW

=

Rest

of

World

Quarter ended September |

Fiscal First Quarter 2013 Financial Results

5

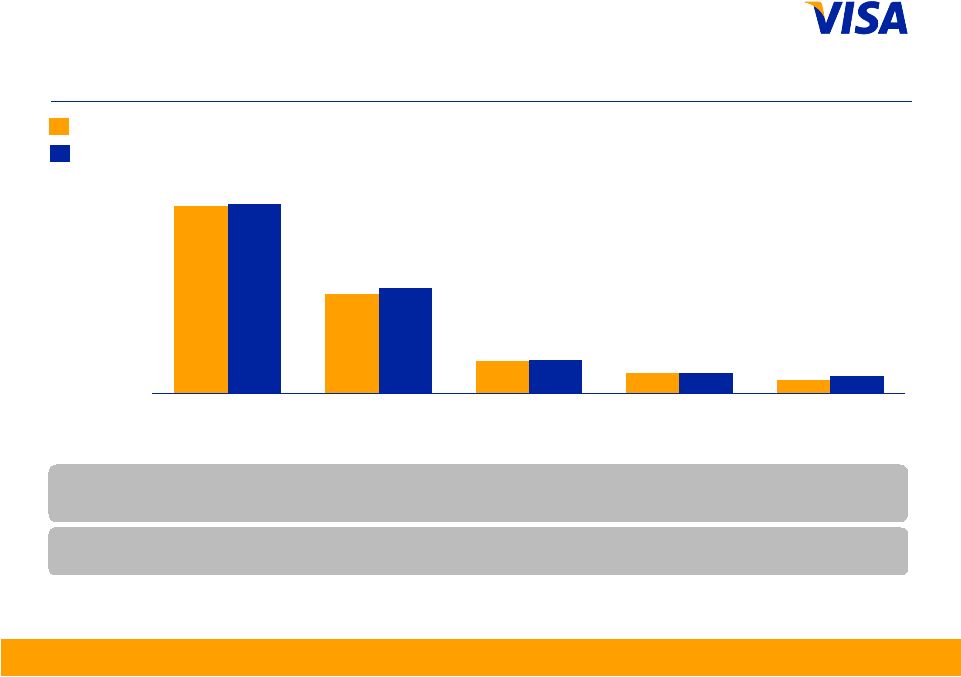

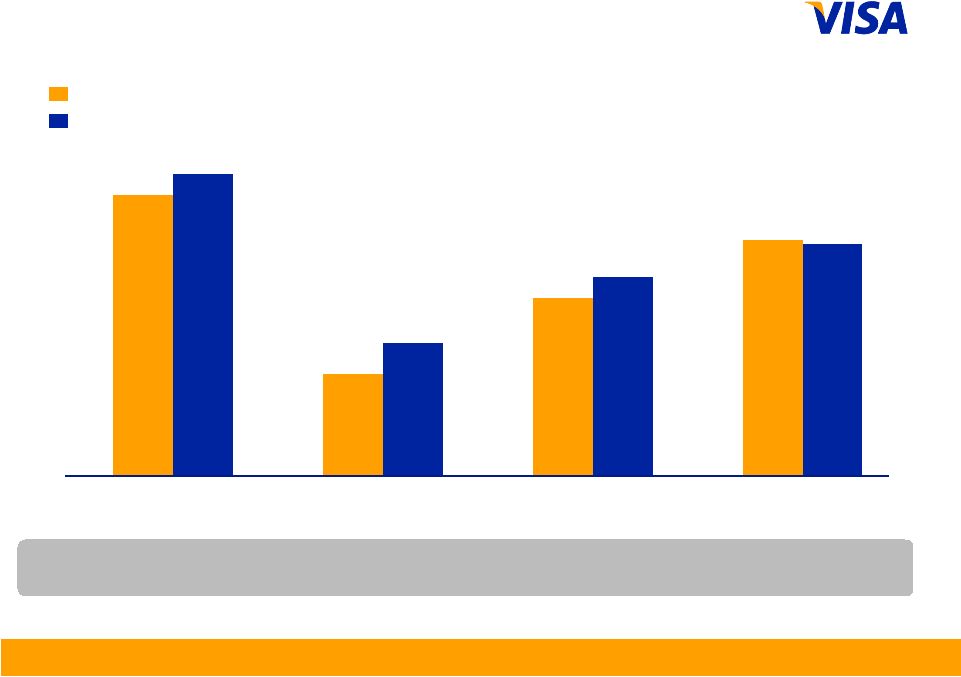

993

616

378

1,075

687

388

Total Visa Inc.

Credit

Debit

2011

2012

U.S.

529

ROW

464

U.S.

237

ROW

379

U.S.

292

ROW 85

U.S.

544

ROW

531

U.S.

262

ROW

425

ROW106

U.S.

282

Payments Volume

US$ in billions, nominal, except percentages

YOY Change

(nominal)

12%

3%

8%

YOY Change

(constant)

9%

12%

4%

Note: Current quarter payments volume and other select metrics are provided in the

operational performance data supplement to provide more recent operating

data. Service revenues continue to be recognized based on payments volume in the prior quarter. From time to time, reported

payments volume information may be updated to reflect revised client submissions or

other adjustments. Prior period updates are not material. Figures may not

recalculate exactly due to rounding. Percentage changes calculated based on whole numbers, not the rounded numbers

presented.

ROW

=

Rest

of

World

Quarter ended December |

Fiscal First Quarter 2013 Financial Results

6

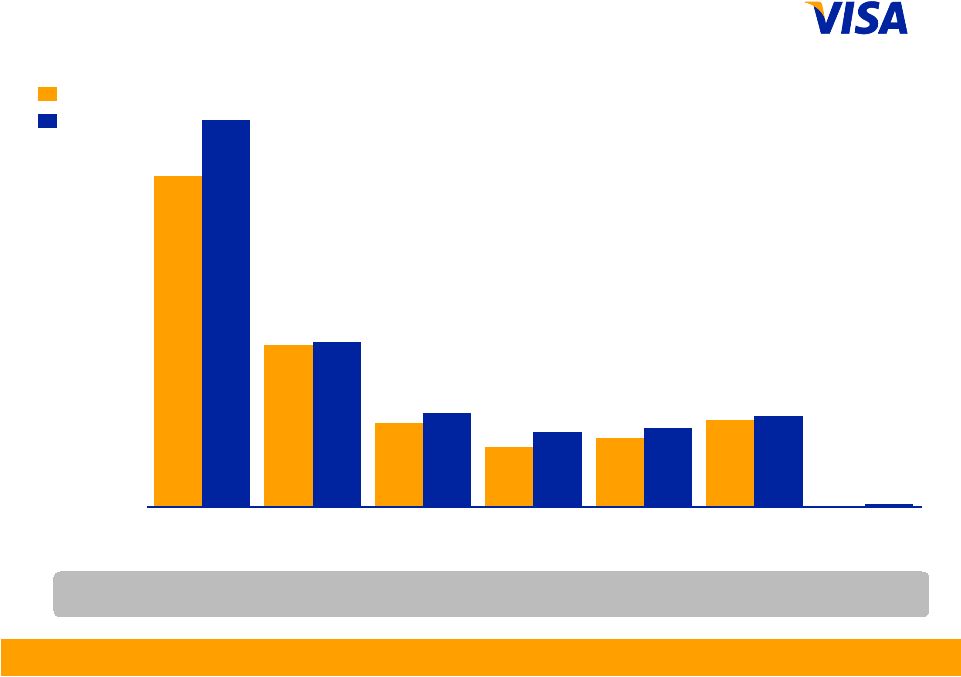

Payments Volume

US$ in billions, nominal, except percentages

YOY Change

(nominal)

6%

3%

1%

4%

27%

YOY Change

(constant)

1%

8%

4%

20%

36%

Note:

Figures

may

not

recalculate

exactly

due

to

rounding.

Percentage

changes

calculated

based

on

whole

numbers,

not

the

rounded

numbers

presented. From time to time, previously submitted volume information may be

updated. Prior period updates are not material. Constant dollar growth

rates

exclude

the

impact

of

foreign

currency

fluctuations

against

the

U.S.

dollar

in

measuring

performance.

Quarter ended September

2011

2012

517

272

89

56

37

521

290

92

57

47

United States

Asia Pacific

Latin America and

Caribbean

Canada

Central and Eastern

Europe, Middle

East and Africa |

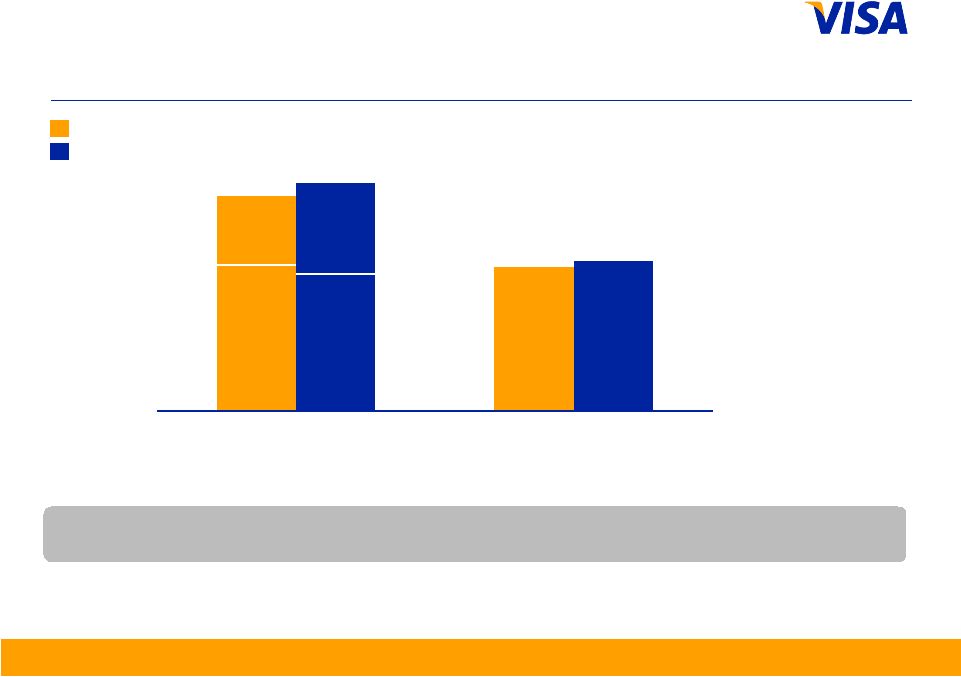

Fiscal First Quarter 2013 Financial Results

7

Payments Volume

US$ in billions, nominal, except percentages

Note: Current quarter payments volume and other select metrics are provided in the

operational performance data supplement to provide more recent operating

data. Service revenues continue to be recognized based on payments volume in the prior quarter. From time to time, reported

payments volume information may be updated to reflect revised client submissions or

other adjustments. Prior period updates are not material. Figures may not

recalculate exactly due to rounding. Percentage changes calculated based on whole numbers, not the rounded numbers

presented.

YOY Change

(nominal)

13%

11%

3%

12%

34%

YOY Change

(constant)

13%

7%

3%

22%

37%

Quarter ended December

2011

2012

529

276

93

56

39

544

313

104

62

52

United States

Asia Pacific

Latin America and

Caribbean

Canada

Central and

Eastern Europe,

Middle East and

Africa |

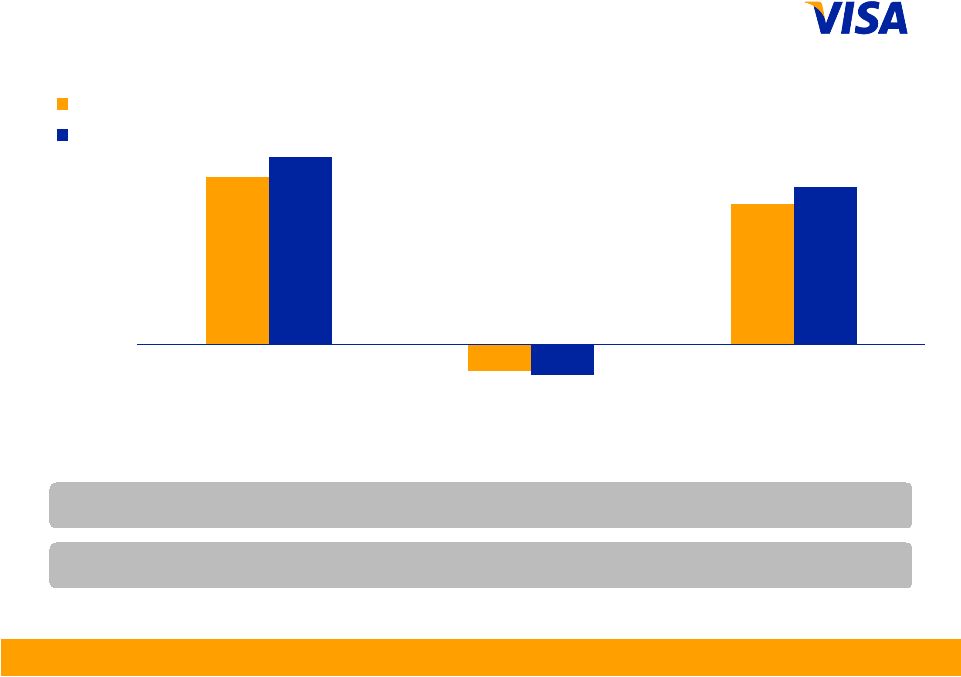

Fiscal First Quarter 2013 Financial Results

8

Transactions

in millions, except percentages

Note: Processed transactions represent transactions involving Visa, Visa Electron,

Interlink and Plus cards processed on Visa’s networks. Total transactions

represent payments and cash transactions as reported by Visa clients on their

operating certificates. From time to time, previously submitted transaction

information may be updated. Prior period updates are not material. Figures may not

recalculate exactly due to rounding. Percentage changes calculated based on

whole numbers, not the rounded numbers presented.

YOY

Change

6%

4%

2011

2012

Quarter ended December

20,348

13,600

21,553

14,159

Total

Transactions

Processed

Transactions

Credit

36%

Debit

64%

Credit

38%

Debit

62% |

Fiscal First Quarter 2013 Financial Results

9

Total Cards

in millions, except percentages

YOY

Change

12%

8%

2%

Note: From time to time, previously submitted card information may be

updated. Prior period updates are not material. Figures may not recalculate

exactly due to rounding. Percentage changes calculated based on whole numbers, not

the rounded numbers presented. Quarter ended September

2011

2012

774

1,157

1,930

788

1,293

2,081

Credit

Debit

Visa Inc. |

Fiscal First Quarter 2013 Financial Results

10

Revenue –

Q1 2013

US$ in millions, except percentages

YOY

Change

15%

12%

12%

Note:

Figures

may

not

recalculate

exactly

due

to

rounding.

Percentage

changes

calculated

based

on

whole

numbers,

not

the

rounded

numbers

presented.

FY13 % of

Gross Revenues

16%

84%

3,028

(481)

2,547

3,399

(553)

2,846

Gross Revenues

Incentives

Net Operating

Revenues

Fiscal 2012

Fiscal 2013 |

Fiscal First Quarter 2013 Financial Results

11

Revenue Detail –

Q1 2013

US$ in millions, except percentages

Note: Figures may not recalculate exactly due to rounding. Percentage changes

calculated based on whole numbers, not the rounded numbers presented.

YOY

Change

17%

8%

13%

1%

Fiscal 2012

Fiscal 2013

1,151

951

748

178

1,300

1,115

805

179

Service

Revenues

Data Processing

Revenues

International

Transaction

Revenues

Other Revenues |

Fiscal First Quarter 2013 Financial Results

12

Operating Margin –

Q1 2013

US$ in millions, except percentages

Note:

Operating

margin

is

calculated

as

operating

income

divided

by

total

operating

revenues.

Figures

may

not

recalculate

exactly

due

to rounding. Percentage changes calculated based on whole numbers, not the rounded

numbers presented. YOY

Change

13%

11%

12%

(1 ppt)

Fiscal 2012

Fiscal 2013

2,547

929

1,618

64%

2,846

1,046

1,800

63%

Net Operating

Revenues

Total Operating

Expenses

Operating

Income

Operating

Margin |

Fiscal First Quarter 2013 Financial Results

13

Operating Expenses –

Q1 2013

US$ in millions, except percentages

Note: Figures may not recalculate exactly due to rounding. Percentage changes

calculated based on whole numbers, not the rounded numbers presented. YOY

Change

12%

25%

17%

4%

16%

2%

NM

Fiscal 2012

Fiscal 2013

389

190

98

70

80

102

0

454

193

110

88

92

106

3

Personnel

Marketing

Network

&

Professional Fees

Depreciation

&

General

&

Litigation

Provision

Administrative

Amortization

Processing |

Fiscal First Quarter 2013 Financial Results

14

Other Financial Results

•

Cash, cash equivalents and available-for-sale investment securities

of $6.1 billion at the end of the fiscal first quarter

•

Free cash flow of $1.6 billion for the fiscal first quarter

•

Capital expenditures of $100 million during the fiscal first quarter

•

During the quarter we made payments totaling $4.4 billion in

connection with the covered litigation. These payments will enable

us to deduct these amounts in our fiscal 2013 U.S. income tax

returns, increasing free cash flow for the year. This is reflected on

our balance sheet at December 31, 2012 as a reclassification of

$1.6 billion from deferred tax assets to income tax receivable.

|

Fiscal First Quarter 2013 Financial Results

15

Under $1

billion

Marketing expenses

Financial Metrics for Fiscal Year 2013

Annual operating margin

About 60%

18% to 18.5%

range

Client incentives as % of gross revenues

Annual net revenue growth

Low double

digits |

Fiscal First Quarter 2013 Financial Results

16

$425 million to

$475 million

range

Capital expenditures

Financial Metrics for Fiscal Year 2013

Annual free cash flow

About $6

billion

High teens

Adjusted annual diluted class A common stock

earnings per share growth

Tax rate

30% to 32%

range |

Appendix

Reconciliation of

Non-GAAP Measures |

Fiscal First Quarter 2013 Financial Results

Calculation of Free Cash Flow

US$ in millions

A1

(1) Includes changes in client incentives, trade receivable/payable, settlement

receivable/payable, and personnel incentives. Additions (+) /

Reductions (-)

to Net income

attributable to

Visa Inc.

Net income attributable to Visa Inc. (as reported)

1,293

Capital Assets

+

Depreciation and amortization

92

-

Capital expenditures

(100)

(8)

Litigation

+

Litigation provision

3

-

Settlement payments

(4,384)

+

Settlement payments funded by litigation escrow

4,383

2

Share-based Compensation

+

Share-based compensation

48

Pension

+

Pension expense

7

-

Pension contribution

-

7

Taxes

+

Income tax provision

508

-

Income taxes paid

(45)

463

Changes in Working Capital

+/-

Changes in other working capital accounts

(255)

Total Free Cash Flow

1,550

Three Months Ended

December 31, 2012

(1) |