Attached files

| file | filename |

|---|---|

| EX-23.1 - SINGLE TOUCH SYSTEMS S-1, AUDITORS CONSENT - SITO MOBILE, LTD. | singletouchexh23_1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - SITO MOBILE, LTD. | Financial_Report.xls |

| EX-5.1 - SINGLE TOUCH SYSTEMS S-1, LEGAL OPINION AND CONSENT - SITO MOBILE, LTD. | singletouchexh5_1.htm |

As filed with the Securities and Exchange Commission on February 5, 2013

Registration No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

(Exact name of Registrant as specified in its charter)

|

Delaware

|

7389

|

13-4122844

|

||

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

100 Town Square Place, Suite 204

Jersey City, NJ 07310

(201) 275-0555

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Chief Executive Officer

Single Touch Systems Inc.

100 Town Square Place, Suite 204

Jersey City, NJ 07310

(201) 275-0555

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Hayden Trubitt, Esq.

Stradling Yocca Carlson & Rauth

4365 Executive Drive, Suite 1500

San Diego, California 92121

(858) 926-3000

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

|||

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

Amount to

be Registered (1)

|

Proposed

Maximum

Offering Price

Per Share (2)

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration Fee

|

||||||||||||

|

Common Stock, $0.001 par value per share

|

20,440,000 | $ | 0.91 | $ | 18,600,400 | $ | 2,537.09 | |||||||||

|

(1)

|

In accordance with Rule 416 under the Securities Act, the registrant is also registering hereunder an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions.

|

|

(2)

|

Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) under the Securities Act, using the average of the high and low prices as reported on the OTC Bulletin Board on February 1, 2013.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said section 8(a) may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

ii

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated February 5, 2013

PROSPECTUS

SINGLE TOUCH SYSTEMS INC.

20,440,000 Shares

Common Stock

This prospectus relates to an aggregate of up to 20,440,000 shares of our common stock of which 220,000 are outstanding shares, 10,480,000 are shares that underlie currently outstanding warrants and 9,740,000 are shares that underlie currently outstanding convertible promissory notes, which shares may be resold from time to time by the selling stockholders identified in this prospectus. We issued such securities to the selling stockholders as consideration for cash loaned to us, with the exception that 480,000 shares underlie warrants granted as compensation for services as placement agent.

The selling stockholders may sell such common stock from time to time in the open market (at the prevailing market price) or in negotiated transactions.

You should read this prospectus and any prospectus supplement carefully before you invest. We will not receive any proceeds from the sale of the shares by the selling stockholders. If the warrants overlying certain of such shares of common stock are exercised for cash, we would receive such exercise-price cash proceeds.

Our common stock is traded on the OTC Bulletin Board under the symbol “SITO”. On February 1, 2013, the reported closing sale price of our common stock was $0.92 per share.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 3 for certain risks you should consider before purchasing any shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _________, 2013

TABLE OF CONTENTS

|

Page

|

|

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission. You should rely only on the information contained in this prospectus or to which we have referred you. We have not authorized anyone to provide you with information or to make any representation on behalf of Single Touch Systems Inc. that is different from that contained in this prospectus. You should not rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered by this prospectus under circumstances and in jurisdictions where it is lawful to do so. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the date of delivery of this prospectus or of any sales of these securities. Our business, financial condition, results of operations and prospects may have changed since the date of this prospectus. This prospectus may be used only in jurisdictions where it is legal to sell these securities.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained or incorporated by reference in this prospectus are “forward-looking statements.” These statements are based on the current expectations, forecasts, and assumptions of our management and are subject to various risks and uncertainties that could cause our actual results to differ materially from those expressed or implied by the forward-looking statements. Forward-looking statements are sometimes identified by language

such as “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects,” “future” and similar expressions and may also include references to plans, strategies, objectives, and anticipated future performance as well as other statements that are not strictly historical in nature. The risks, uncertainties, and other factors that could cause our actual results to differ materially from those expressed or implied in this prospectus include, but are not limited to, those noted under the caption “Risk Factors” beginning on page 3 of this prospectus. Readers should carefully review this information as well the risks and other uncertainties described in other filings we may make after the date of this prospectus with the Securities and Exchange Commission.

Readers are cautioned not to place undue reliance on forward-looking statements. They reflect opinions, assumptions, and estimates only as of the date they were made, and we undertake no obligation to publicly update or revise any forward-looking statements in this prospectus, whether as a result of new information, future events or circumstances, or otherwise.

PROSPECTUS SUMMARY

This summary highlights the information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that you should consider before buying shares of our common stock. You should read the entire prospectus and any prospectus supplements carefully, especially the sections entitled “Caution Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” together with our financial statements and the related notes included elsewhere in this prospectus and in any prospectus supplements related hereto, before deciding to purchase shares of our common stock.

Single Touch Systems Inc. is an innovative mobile media solutions provider serving retailers, advertisers and brands. Through patented technologies and a modular, adaptable platform, our multi-channel messaging gateway enables marketers to reach consumers on all types of connected devices, with information that engages interest, drives transactions and strengthens relationships and loyalty.

Our solution is designed to drive return on investment for high-volume clients and/or customized branded advertisers. Our platform and tools are designed to enable large brands or anyone with substantial reach to utilize the mobile device as a new means to communicate. Communication might be in the form of a reminder message, a coupon, an advertisement or a voice call. Regardless of the form, our platform can drive value and cost savings for companies large and small, and we provide the ability to drive contextually relevant advertising messages to the right audience.

We have expanded our relationship with AT&T Services, Inc., through which we retain 11 client relationships representing nearly all of our reported revenue in the fiscal years ended in 2011 and 2012. The bulk of that revenue comes from notifications sent on behalf of 4 separate Walmart corporate programs. These programs and related services continue to develop nationwide, and we continue to experience increasing activity in these programs that have caused our AT&T revenues to grow.

For a more complete description of our business, please see “Business,” beginning on page 13.

All of the shares covered by this prospectus are being offered for resale by the selling stockholders named in this prospectus. We will not receive any proceeds from any sale of the shares.

An investment in our common stock is speculative and involves substantial risks. You should read the “Risk Factors” section of this prospectus for a discussion of certain factors to consider carefully before deciding to invest in shares of our common stock.

Corporate information

Our principal executive offices are located at 100 Town Square Place, Suite 204, Jersey City, NJ 07310 and our telephone number is (201) 275-0555. Our website is www.singletouch.net. The contents of our website are not incorporated by reference into this prospectus.

Summary of the Offering

|

Shares of common stock offered by us

|

None.

|

|

|

Shares of common stock offered by the Selling Stockholders

|

20,440,000 shares

|

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of common stock covered by this prospectus. If the warrants overlying certain of such shares of common stock are exercised for cash, we would receive such exercise-price cash proceeds.

|

|

|

Risk Factors

|

An investment in our common stock is speculative and involves substantial risks. You should read the “Risk Factors” section of this prospectus for a discussion of certain factors to consider carefully before deciding to invest in shares of our common stock.

|

|

|

Plan of Distribution

|

The shares of common stock covered by this prospectus may be sold by the selling stockholders in the manner described under “Plan of Distribution.”

|

|

|

OTC Bulletin Board Symbol

|

“SITO”

|

RISK FACTORS

Your investment in our common stock involves a high degree of risk. You should consider the risks described below and the other information contained in this prospectus carefully before deciding to invest in our common stock. If any of the following risks actually occur, our business, financial condition and operating results could be harmed. As a result, the trading price of our common stock could decline, and you could lose a part or all of your investment.

RISKS RELATED TO OUR BUSINESS

We currently rely on brand owners, and especially Walmart, to use our programs to satisfy their communication needs and thereby to generate our revenues from wireless carriers indirectly. The loss of or a change in any of these significant relationships could materially reduce our revenues.

Both our present and our future depend heavily on our relationship with Walmart. We must retain our current business there and expand the relationship into augmented programs, both for its own sake and as a reference point for possible similar business with other retailers and brand owners. Our relationship with Walmart is subject to risk based on factors such as performance, reliability, pricing, competition, alternate technological solutions and changes in interpersonal relationships.

Our marketing and sales efforts are significantly impacted by our relationship with AT&T. We have direct to user marketing efforts but currently our primary revenue growth has been through our cooperative marketing with AT&T.

We have had and continue to develop our relationship with AT&T as exemplified by the relations we have with their client Walmart. We have cultivated and intend to work to continue to develop new products and relations with AT&T clients through coordinated marketing efforts with AT&T. This relationship has been beneficial but can be limiting as related to our independent marketing efforts as we believe we need to be careful to not conflict with the business interests of AT&T or its major clients. Should AT&T choose to promote another vendor’s products and services over our own, our current and future business could be negatively impacted. In addition, AT&T has significant influence over the pricing for many of its suppliers, including us. We work cooperatively with AT&T to provide competitive pricing to the end users but AT&T ultimately has the final contracting authority with their clients who benefit from our products and services.

We have a history of losses. Excluding extraordinary non-cash items, we have never been profitable.

Our operations have not been profitable on a GAAP, cash flow, or Adjusted EBITDA basis. We will be unable to achieve profitability unless we experience substantial revenue growth. We may never be able to achieve or maintain profitability.

We may not be able to effectively protect or monetize our patents.

We own a portfolio of patents related to mobile search, commerce, advertising and streaming media, which to date we have not monetized other than by using some of them in the course of our own operations. To monetize some or all of them by sale would require access to potential buyers, which may be difficult for a smaller company such as us to obtain, and would also require completion of a buyer’s due diligence investigation into the strength of the patents, demonstration to the buyer that owning such patents would have defensive or offensive value to it, and negotiation of the price and other terms of transaction documents.

To monetize some or all of the patents by licensing would require similar steps. In addition, we may not be able to monetize our patents as against companies who use our patented inventions unless they respect our ability to enforce our patents against them if they were not to agree to licenses.

We are currently suing Zoove Corporation for patent infringement, but to continue to prosecute the Zoove action, and/or additional patent infringement actions, would require us to incur substantial legal fees and costs. The outcome of litigation is never certain, and the amount of damages that might be awarded to us under any judgment is also uncertain; and even if a judgment is obtained it would be subject to appeal and to the uncertainties of collection.

In addition, companies whose actual or planned activities are blocked by our patents could attempt to develop technological work-arounds in order to avoid compensating us.

There can be no assurance that we will be able to effectively protect or monetize our patents, or that we will be able to obtain a return equal to the fair intrinsic value of the patents. The effort to obtain monetization could entail significant expenses and also opportunity costs, as our executive Chairman Anthony Macaluso devotes a substantial portion of his business efforts to our protection and monetization program.

We currently rely on wireless carriers, and especially AT&T, to market and distribute our products and services and to generate our revenues. The loss of or a change in any of these significant carrier relationships could cause us to lose access to their subscribers and thus materially reduce our revenues.

Our future success is highly dependent upon maintaining successful relationships with wireless carriers. A significant portion of our revenue has always been derived from a very limited number of carriers, and currently nearly all of our revenues are paid to us through AT&T Services, Inc. We expect that we will continue to generate a substantial majority of our revenues through distribution relationships with a limited number of carriers for the foreseeable future. Our failure to maintain our relationships with these carriers would materially reduce our revenues and thus harm our business, operating results and financial condition.

Typically, carrier agreements have a term of one or two years with automatic renewal provisions upon expiration of the initial term, absent a contrary notice from either party. In addition, some carrier agreements, including our key agreement with AT&T Services, Inc., provide that the carrier can terminate the agreement early and, in some instances, at any time without cause, which could give them the ability to renegotiate economic or other terms.

Many factors outside our control could impair our ability to generate revenues through a given carrier, including the following:

|

●

|

the carrier’s preference for our competitors’ products and services rather than ours;

|

|

●

|

the carrier’s decision to discontinue the sale of some or all of our products and services;

|

|

●

|

the carrier’s decision to offer similar products and services to its subscribers without charge or at reduced prices;

|

|

●

|

the carrier’s decision to restrict or alter subscription or other terms for downloading our products and services;

|

|

●

|

a failure of the carrier’s merchandising, provisioning or billing systems;

|

|

●

|

the carrier’s decision to offer its own competing products and services;

|

|

●

|

the carrier’s decision to transition to different platforms and revenue models; and

|

|

●

|

consolidation among carriers.

|

If any of our carriers decides not to market or distribute our products and services or decides to terminate, not renew or modify the terms of its agreement with us or if there is consolidation among carriers generally, we may be unable to replace the affected agreement with acceptable alternatives, causing us to lose access to that carrier’s subscribers and the revenues they afford us, which could materially harm our business, operating results and financial condition.

We may need to raise additional capital to meet our business requirements in the future and such capital raising may be costly or difficult to obtain and could dilute current stockholders’ ownership interests.

We may need to raise additional capital in the future, which may not be available on reasonable terms or at all. Our present cash flow from operations is insufficient to achieve our business plan. We may need to raise additional funds through public or private debt or equity financings to meet various objectives including, but not limited to:

|

●

|

pursuing growth opportunities, including more rapid expansion;

|

| ● | protecting our intellectual property from infringement; |

|

●

|

acquiring complementary businesses;

|

|

●

|

making capital improvements to improve our infrastructure;

|

|

●

|

hiring and/or incentivizing qualified management and key employees;

|

|

●

|

developing new services, programming or products;

|

|

●

|

responding to competitive pressures; and

|

|

●

|

maintaining compliance with applicable laws.

|

As a result of the recent economic recession, and the continuing economic uncertainty, it has been difficult for companies, particularly smaller ones, to obtain equity or debt financing.

Any additional capital raised through the sale of equity or equity-backed securities may dilute current stockholders’ ownership percentages and could also result in a decrease in the fair market value of our equity securities. The terms of those securities issued by us in future capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect.

Debt securities, on the other hand, are senior to common stock, might contain onerous restrictive covenants, and must be repaid when they mature; and if we do not profitably use the money raised, we may not have enough cash on hand to repay the debt upon maturity without impairing our operations.

If we raise additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish some rights to our technologies or our services, or grant licenses on terms that are not favorable to us.

Furthermore, any additional debt or equity or other financing that we may need may not be available on terms favorable to us, or at all. If we are unable to obtain required additional capital, we may have to curtail our growth plans or cut back on existing business and, further, we may not be able to continue operating if we do not generate sufficient revenues from operations needed to stay in business.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our reported financial results.

We may not be able to manage our growth effectively.

Our strategy envisions growing our business. There can be no assurance that such growth will occur, either to the extent our strategy envisions or at all. Even if we do grow, if we fail to manage our growth effectively our financial results could be adversely affected. Growth may place a strain on our management systems and resources. We must continue to refine and expand our business development capabilities, our systems and processes and our access to financing sources. As we grow, we must continue to hire, train, supervise and manage new employees. We cannot assure you that we will be able to:

|

●

|

meet our capital needs;

|

|

●

|

implement, improve and expand our operational, financial, management information, risk management and other systems effectively or efficiently or in a timely manner;

|

|

●

|

allocate our human resources optimally;

|

|

●

|

identify, hire, train, motivate and retain qualified managers and employees;

|

|

●

|

develop the management skills of our managers and supervisors; or

|

|

●

|

evolve a corporate culture that is conducive to success.

|

If we are unable to manage our growth and our operations our financial results could be adversely affected.

If we fail to maintain an effective system of internal control over financial reporting and other business practices, and of Board-level oversight, we may not be able to report our financial results accurately or prevent and detect fraud and other improprieties. Consequently, investors could lose confidence in our financial reporting, and this may decrease the trading price of our stock.

We must maintain effective internal controls to provide reliable financial reports and to prevent and detect fraud and other improprieties. We are responsible to review and assess our internal controls and implement additional controls when improvement is needed. Failure to implement any required changes to our internal controls or any others that we identify as necessary to maintain an effective system of internal controls could harm our operating results and cause investors to lose confidence in our reported financial information. Any such loss of confidence would have a negative effect on the market price of our stock.

Because we are relatively small, our internal control procedures may not be fully mature. We have limited internal personnel to implement procedures and must scale our procedures to be compatible with our resources. We also rely on outside professionals including accountants and attorneys to support our control procedures.

Also, and in any event, Sarbanes-Oxley Act requirements regarding internal control over financial reporting, and other internal controls over business practices, are costly to implement and maintain, and such costs are relatively more burdensome for smaller companies such as us than for larger companies.

Until fiscal 2012 we did not have an Audit Committee, a Compensation Committee or a Governance and Nominating Committee, composed of independent directors. Accordingly, these Committees’ oversight procedures and issues familiarity may not yet be fully mature.

We have undergone a management transition and have two centers of management authority.

Until May 16, 2011, Anthony Macaluso served as our Chief Executive Officer, President and Chief Financial Officer. On that date, James Orsini started his employment with us and took on those titles, with Anthony Macaluso remaining employed as our executive Chairman and serving as our Chief Innovation Officer. On September 26, 2011 we employed John Quinn as our Chief Financial Officer. We have also recruited and hired other senior staff. We have moved our executive headquarters from Encinitas, California, to Jersey City, New Jersey, although Mr. Macaluso remains based in California. Such a management transition subjects us to a number of risks, including risks pertaining to coordination of responsibilities and tasks, creation of new management systems and processes, differences in management style, effects on corporate culture, and the need for transfer of historical knowledge. In addition, because both Mr. Macaluso and Mr. Orsini have substantial authority in our affairs, our operations will be adversely affected if they do not work together harmoniously, do not efficiently allocate responsibilities between themselves, or do not implement and abide by effective controls.

Our management ranks are thin, and losing or failing to add key personnel could adversely affect our business.

Our future performance depends substantially on the continued service of our senior management and other key personnel, including personnel which we need to hire. In particular, our success depends upon the continued efforts of our management personnel, Anthony Macaluso, our executive Chairman and Chief Innovation Officer; James Orsini, our President and Chief Executive Officer; John Quinn, our Chief Financial Officer, and other members of the senior management team. We need to identify and hire additional senior managers to perform key tasks and roles. We do not have key man life insurance on any of our personnel.

Lack of remaining available authorized common stock may hamper our ability to meet future corporate needs.

We have a small amount of remaining authorized common stock. Of our 200,000,000 authorized shares of common stock, as of December 31, 2012 there were 132,472,392 shares outstanding, 55,462,675 shares reserved for issuance upon exercise of outstanding stock options and warrants, and 9,960,000 shares reserved for issuance upon conversion of outstanding convertible debt. Because we cannot issue or commit common shares that would exceed the authorized 200,000,000-share threshold, we may be limited in our ability to, among other things, raise cash by selling equity or equity-linked securities, use common stock as currency for acquisitions, use common stock or stock options to recruit new officers and employees and incentivize and compensate new and existing officers and employees, and use common stock or stock options to resolve claims. Even when stock options and warrants expire or convertible debt is repaid, we expect to continue issue new shares, options, warrants or convertible debt in the ordinary course of business. As a result, we expect to continue to have limited available shares until such time as we are able to increase our authorized share limit or significantly reduce the number of outstanding shares through a reverse split or some other appropriate action. We cannot increase the 200,000,000-share limit except by amending our certificate of incorporation, which would require approval by holders of a majority of our outstanding shares. There is no assurance that such stockholders approval could be obtained.

We are subject to competition. And, if technological conditions change, our competitors may be better able to react than we are.

We have many actual and potential competitors, many of whom may have more financial, personnel, intellectual property, development and/or reputational resources than we do. If we and our business do not grow larger, we will not be able to enjoy the brand power and economies of scale that many of our competitors do. In addition, it is likely that our industry will be subject to rapid and profound technological changes. Our competitors may have more ability to react to such changes than we do.

We may be unable to develop and introduce in a timely way new products or services.

The planned timing and introduction of new products and services are subject to risks and uncertainties. Unexpected technical, operational, deployment, distribution or other problems could delay or prevent the introduction of new products and services, which could result in a loss of, or delay in, revenues.

We may experience unexpected expenses or delays in service enhancements if we are unable to license third-party technology on commercially reasonable terms.

We rely, to an extent, on technology that we license from third parties, and may find a need to license additional technology in the future. These third-party technology licenses might not continue to be available to us on commercially reasonable terms or at all. If we are unable to obtain or maintain these licenses on favorable terms, or at all, we could experience delays in completing and developing our products and services.

We may not be able to adequately safeguard our intellectual property rights from unauthorized use, and we may become subject to claims that we infringe on others’ intellectual property rights.

We rely on a combination of patents, trade secrets, copyrights, trademarks, and other intellectual property laws, nondisclosure agreements and other arrangements with employees, actual and prospective customers and actual or prospective capital providers and their agents and advisors, and other protective measures to preserve our proprietary rights. These measures afford only limited protection and may not preclude competitors from developing products or services similar or superior to ours. Moreover, the laws of certain foreign countries do not protect intellectual property rights to the same extent as the laws of the United States.

Although we implement protective measures and intend to defend our proprietary rights, these efforts may not be successful. From time to time, we may litigate within the United States or abroad to enforce our issued or licensed patents, to protect our trade secrets and know-how or to determine the enforceability, scope and validity of our proprietary rights and the proprietary rights of others. Enforcing or defending our proprietary rights can involve complex factual and legal questions and could be expensive, would require management’s attention and might not bring us timely or effective relief.

Furthermore, third parties may assert that our products or processes infringe their intellectual property rights. Although there are no pending or threatened intellectual property lawsuits against us, we may face litigation or infringement claims in the future. Infringement claims could result in substantial judgments, and could result in substantial costs and diversion of our resources even if we ultimately prevail. A third party claiming infringement may also obtain an injunction or other equitable relief, which could effectively block our use of allegedly infringing items. Although we may seek licenses from third parties covering intellectual property that we are allegedly infringing, we may not be able to obtain any such licenses on acceptable terms and conditions, if at all.

Applicable rules, including those contained in and issued under the Sarbanes-Oxley Act of 2002, may be burdensome to us and/or make it difficult for us to retain or attract qualified officers and directors, which could adversely affect the management of our business.

We may be unable to attract and retain those qualified officers, directors and members of board committees required to provide for our effective management because of the rules and regulations that govern publicly-held companies. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in the issuance of a series of rules and regulations and the strengthening of existing rules and regulations by the SEC, as well as the adoption of new and more stringent rules by national securities exchanges. (Our securities are not currently listed on any national securities exchange.) The perceived increased personal risk associated with these recent changes may deter qualified individuals from accepting roles as directors and executive officers.

Further, some of these recent changes heighten the requirements for board or committee membership, particularly with respect to an individual’s independence from the corporation and level of experience in finance and accounting matters. We may have difficulty attracting and retaining directors with the requisite qualifications. If we are unable to attract and retain qualified officers and directors, the management of our business and our ability to obtain or retain listing of our common stock on any national securities exchange (assuming we elect to seek and are successful in obtaining such listing) could be adversely affected.

We have a history of related-party transactions.

Throughout our history we have engaged in related-party transactions with our directors and officers, including our executive Chairman Anthony Macaluso. In all related-party transactions, there is a risk that even if the Company personnel on the other side of the table from the related party are striving to ensure that the terms of the transaction are arms-length, the related party’s influence may be such that the transaction terms could be viewed as favorable to that related-party. We established committees comprised of independent directors in our most recent fiscal year to review proposed related-party transactions, but even such committees and procedures may be susceptible to the influences inherent to these types of transactions. Our financial statements and other disclosure in this prospectus provide specific information about our prior related-party transactions. We may engage in additional related-party transactions in the future.

RISKS RELATED TO OUR INDUSTRY

Demand for the services we provide is not yet well established.

Brand owners who are potential users of the services we provide must weigh their decisions in the light of limited budgets for marketing and notification, the inertia of dealing with well established providers of well established traditional modalities for marketing and notification, lack of experience with services such as ours and the perception (whether or not well founded) of technological risk and not-fully-demonstrated cost-effectiveness of our services. There are indications that the market among major brand owners for services such as ours may be in an early stage of development.

System or network failures could reduce our sales, increase costs or result in a loss of end users of our products and services.

Any failure of, or technical problem with, carriers’, third parties’ or billing systems, delivery or information systems, or communications networks could result in the inability of end users to receive communications or download our products, prevent the completion of a billing transaction, or interfere with access to some aspects of our products. If any of these systems fails or if there is an interruption in the supply of power, an earthquake, superstorm, fire, flood or other natural disaster, or an act of war or terrorism, end users might be unable to access our offerings. For example, from time to time, our carriers have experienced failures with their billing and delivery systems and communication networks, including gateway failures that reduced the provisioning capacity of their branded e-commerce system. Any failure of, or technical problem with, the carriers’, other third parties’ or our systems could cause us to lose end users or revenues or incur substantial repair costs and distract management from operating our business, or persuade retailers or brand owners that solutions utilizing our programs are not sufficiently reliable. This, in turn, could harm our business, operating results and financial condition.

Our business depends on the growth and maintenance of wireless communications infrastructure.

Our success will depend on the continued growth and maintenance of wireless communications infrastructure in the United States and internationally. This includes deployment and maintenance of reliable next-generation digital networks with the speed, data capacity and security necessary to provide reliable wireless communications services. We have no control over this.

RISKS RELATED TO OUR COMMON STOCK

Our common stock is not traded on any national securities exchange.

Our common stock is currently quoted on the OTC Bulletin Board, which may increase price quotation volatility and could limit the liquidity of the common stock, all of which may adversely affect the market price of the common stock and our ability to raise additional capital.

Trading in our stock has been modest, so investors may not be able to sell as much stock as they want at prevailing prices. Moreover, modest volume can increase stock price volatility.

The average daily trading volume in our common stock for the twelve-month period ended September 30, 2012 was approximately 61,000 shares. If modest trading in our stock continues, it may be difficult for investors to sell or buy substantial quantities of shares in the public market at any given time at prevailing prices. Moreover, the market price for shares of our common stock may be made more volatile because of the relatively low volume of trading in our common stock. When trading volume is low, significant price movement can be caused by the trading in a relatively small number of shares.

Applicable SEC rules governing the trading of “penny stocks” limits the trading and liquidity of the common stock which may affect the trading price of the common stock.

Our common stock is currently quoted on the OTC Bulletin Board, and trades below $5.00 per share, and we have less than $2,000,000 of net tangible assets; therefore, the common stock is currently considered a “penny stock” and so is subject to SEC rules and regulations which impose limitations upon the manner in which such shares may be publicly traded. These regulations require the delivery, before any transaction involving a penny stock, of a disclosure explaining the penny stock market and the associated risks; and certain brokers who recommend such securities to persons other than established customers or certain accredited investors must make a special written suitability determination regarding such a purchaser and receive such purchaser’s written agreement to a transaction before sale. In addition, margin regulations prevent low-priced stocks such as ours from being used as collateral for brokers’ margin loans to investors. These regulations have the effect of limiting the trading activity of the common stock and reducing the liquidity of an investment in our common stock. In addition, many institutional investors, as a matter of policy, do not invest in stocks which are not traded on a national securities exchange and/or which trade for less than $5.00 per share (or some lower price point).

Securities analysts may not initiate coverage or continue to cover our common stock, and this may have a negative impact on its market price.

Common stock prices are often significantly influenced by the research and reports that securities analysts publish about companies and their business. We do not have any control over these analysts. There is no guarantee that securities analysts will cover our common stock. If securities analysts do not cover our common stock, the lack of research coverage may adversely affect its market price. If we are covered by securities analysts and our stock is downgraded, our stock price will likely decline. If one or more of these analysts ceases to cover us or fails to publish regular reports on us, we can lose visibility in the financial markets, which can cause our stock price or trading volume to decline.

The price of our common stock has been and may continue to be volatile, which could lead to losses by investors and costly securities litigation.

The trading price of our common stock has been and is likely to continue to be volatile and could fluctuate in response to factors such as:

|

●

|

actual or anticipated monetizations of our patents;

|

|

●

|

actual or anticipated variations in our operating results (including whether we have achieved our key business targets and/or earnings estimates) and prospects;

|

|

●

|

announcements of technological innovations by us or our competitors;

|

|

●

|

announcements by us or our competitors of significant acquisitions, business wins, strategic partnerships, joint ventures or capital commitments;

|

|

●

|

additions or departures of key personnel;

|

|

●

|

introduction of new services by us or our competitors;

|

|

●

|

sales of our common stock or other securities in the open market (particularly if overall trading volume is not high);

|

|

●

|

general market conditions and broader political and economic conditions; and

|

|

●

|

other events or factors, many of which are beyond our control.

|

The stock market has experienced significant price and volume fluctuations, which have often been unrelated to the operating performance of companies, and in particular the market prices of stock in smaller companies and technology companies have been highly volatile. The market price of our common stock at any particular time may not remain the market price in the future. In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been initiated against that company. Litigation initiated against us, whether or not successful, could result in substantial costs and diversion of our management’s attention and resources, which could harm our business and financial condition.

We do not expect any cash dividends to be paid on our common stock in the foreseeable future.

We have never declared or paid a cash dividend on our common stock, and we do not anticipate such a declaration or payment for the foreseeable future. We expect to use any future earnings, as well as any capital that may be raised in the future, to fund business growth. Consequently, a stockholder’s only opportunity to achieve a return on investment would be for the price of our common stock to appreciate and that stockholder to sell his or her shares at a profit. We cannot assure stockholders of a positive return on their investment when they sell their shares, nor can we assure that stockholders will not lose the entire amount of their investment.

You may experience dilution of your ownership interests because of the future issuance of additional shares of our common stock and our preferred stock.

We have aggressively issued common stock and other equity-based securities in support of our business objectives and initiatives. In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We are currently authorized to issue an aggregate of 205,000,000 shares of capital stock consisting of 200,000,000 shares of common stock and 5,000,000 shares of preferred stock with preferences and rights to be determined by our Board of Directors. As of December 31, 2012, there were 132,472,392 shares outstanding, 55,462,675 shares reserved for issuance upon exercise of outstanding stock

options and warrants, and 9,960,000 shares reserved for issuance upon conversion of outstanding convertible debt. The holders of such options, warrants, and convertible securities can be expected to exercise (convert) them at a time when our common stock is trading at a price higher than the exercise (conversion) price of these outstanding options, warrants, and convertible securities. If these options or warrants to purchase our common stock are exercised, convertible debt is converted or other equity interests are granted under our 2008, 2009 or 2010 stock plans, or under other plans or agreements adopted in the future, such equity interests will have a dilutive effect on your ownership of common stock. We may also issue additional shares of our common stock or other securities that are convertible into or exercisable for common stock in connection with hiring or retaining employees, future acquisitions, future sales of our securities for capital raising purposes, or for other business purposes. Such securities may be issued at below-market prices or, in any event, prices that are significantly lower than the price at which you may have paid for your shares. The future issuance of any such securities may create downward pressure on, or dampen any upward trend in, the trading price of our common stock.

We are controlled by our executive Chairman/major stockholder Anthony Macaluso.

Anthony Macaluso, our executive Chairman, beneficially owns approximately 21.6% of our outstanding common stock, on a Rule 13d-3 basis, as of December 21, 2012. Such concentrated control of the Company may adversely affect the price of our common stock. Because of his high percentage of beneficial ownership, and his positions as an officer and director, Mr. Macaluso may be able to control matters requiring the vote of stockholders, including the election of our Board of Directors and certain other significant corporate actions. This control could delay, defer or prevent others from initiating a potential merger, takeover or other change in our control, even if these actions would benefit our other stockholders and us. This control could adversely affect the voting and other rights of our stockholders and could depress the market price of our common stock. Actions which Mr. Macaluso determines to be in his best interest might not be in your (or even our) best interest. If you acquire common stock, you may have no effective voice in the management of the Company.

Our certificate of incorporation, bylaws and Delaware law contain provisions that could have the effect of deterring or delaying changes in incumbent management, proxy contests or changes in control.

Anti-takeover provisions of our certificate of incorporation, bylaws and Delaware law may have the effect of deterring or delaying attempts by our stockholders to remove or replace management, engage in proxy contests and/or effect changes in control. The provisions of our charter documents include:

|

●

|

the inability of stockholders to call special meetings of stockholders;

|

|

●

|

the ability of our board of directors to amend our bylaws without stockholder approval; and

|

|

●

|

the ability of our board of directors to issue up to 5,000,000 shares of preferred stock without stockholder approval upon the terms and conditions and with the rights, privileges and preferences as our board of directors may determine.

|

In addition, as a Delaware corporation, we are subject to Delaware law, including Section 203 of the Delaware General Corporation Law. In general, Section 203 prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years following the date that the stockholder became an interested stockholder unless certain specific requirements are met as set forth in Section 203. These provisions, alone or together, could have the effect of deterring or delaying changes in incumbent management, proxy contests or changes in control. We think Section 203 does not currently apply to us, but in the future it might apply to us.

Even though we are not a California corporation, our common stock could still be subject to a number of key provisions of the California General Corporation Law.

Under Section 2115 of the California General Corporation Law, or CGCL, non-listed corporations not organized under California law may still be subject to a number of key provisions of the CGCL. This determination is based on whether the corporation has specific significant business contacts with California and if more than 50% of its voting securities are held of record by persons having addresses in California. Under Section 2115, we could be subject to certain provisions of the CGCL. Among the more important provisions are those relating to the election and removal of directors, cumulative voting, standards of liability and indemnification of directors, distributions, dividends and repurchases of shares, shareholder meetings, approval of certain corporate transactions, dissenters’ rights, and inspection of corporate records. We have not determined whether or not we are, or will be, subject to such CGCL requirements.

USE OF PROCEEDS

We will not receive any proceeds from the sales, if any, of the common stock covered by this prospectus. All net proceeds from the sale of the common stock covered by this prospectus will go to the selling stockholder. See “Selling Stockholder” and “Plan of Distribution” described below. If the warrants overlying certain of such shares are exercised for cash, we would receive such exercise-price cash proceeds, which we would intend to use for general working capital purposes.

Market Information

Our common stock is quoted on the OTC Bulletin Board under the symbol “SITO”. The following table sets forth, for the fiscal quarters indicated, the high and low closing sale prices per share of our common stock. Such quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions. The Closing Sale price of our common stock on January 28, 2013 was $0.92.

|

Quarter Ended

|

High

|

Low

|

||||||

|

December 31, 2012

|

0.65

|

0.25

|

||||||

|

September 30, 2012

|

0.34

|

0.17

|

||||||

|

June 30, 2012

|

0.31

|

0.19

|

||||||

|

March 31, 2012

|

0.37

|

0.23

|

||||||

|

December 31, 2011

|

0.33

|

0.20

|

||||||

|

September 30, 2011

|

0.56

|

0.26

|

||||||

|

June 30, 2011

|

0.75

|

0.45

|

||||||

|

March 31, 2011

|

0.83

|

0.49

|

||||||

|

December 31, 2010

|

1.05

|

0.73

|

||||||

Holders

As of December 31, 2012, there were approximately 244 record holders of our common stock. This does not include the holders of approximately 82 un-exchanged stock certificates or the additional holders of our common stock who held their shares in street name as of that date.

Dividends

We have never paid or declared any cash dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future but rather intend to retain future earnings, if any, for reinvestment in our future business. Any future determination to pay cash dividends will be in compliance with our contractual obligations and otherwise at the discretion of the board of directors and based upon our financial condition, results of operations, capital requirements and such other factors as the board of directors deems relevant.

BUSINESS

General

Single Touch Systems Inc. is an innovative mobile media solutions provider serving retailers, advertisers and brands. Through patented technologies and a modular, adaptable platform, our multi-channel messaging gateway enables marketers to reach consumers on all types of connected devices, with information that engages interest, drives transactions and strengthens relationships and loyalty.

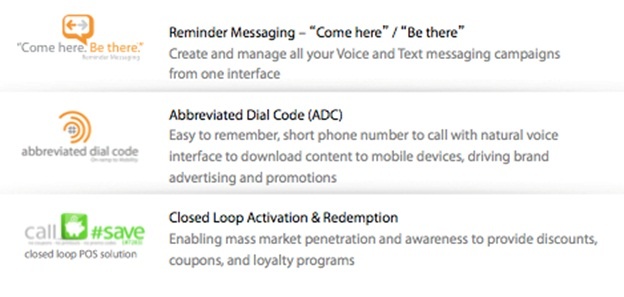

Our solution is designed to drive return on investment for high-volume clients and/or customized branded advertisers. Our platform and tools are designed to enable large brands or anyone with substantial reach to utilize the mobile device as a new means to communicate. Communication might be in the form of a reminder message in voice or Short Message Service (SMS), an abbreviated dial code or a coupon, promotion, or an advertisement. Regardless of the form, our platform can drive value and cost savings for companies large and small and the ability to drive contextually relevant advertising messages to the right audience.

We maintain a website located at http://www.singletouch.net, and electronic copies of our periodic or other reports and any amendments to those reports, are available, free of charge, under the “Company” link on our website as soon as practicable after such material is filed with, or furnished to, the SEC.

Background of Industry Growth and Potential

Across the globe, the mobile channel is growing fast. People in every country are buying more and more advanced mobile devices, and business and consumers alike are using mobile phones for everyday activities like checking the weather, taking advantages of discounts, shopping or sending and receiving financial information. As mobile adoption increases, e-Business and channel strategy professionals are challenged to determine how these devices integrate with their existing sales and service channels. Rapid adoption of the mobile channel is a critical driver of the need for e-business professionals to evolve their strategy and operations to agile commerce.

According to CTIA – The Wireless Association (June 2012), there were 322 million wireless subscribers in the US, more than the entire US population. In the US alone, there were 4.59 trillion combined minutes and messages sent for the year ended June 2012.

Principal Products and Services

Messaging and Notifications – Our Short Message Service (SMS) gateway has proven to be an excellent channel for retailers to communicate with their brand loyalists on a very personal level. This is accomplished through integration with the client’s customer relationship management (CRM) database. With such integration, retailers are able to send targeted mobile coupons and transactional messages based on a shopper’s CRM profile. Targeted mobile coupons can be sent based on past purchase behaviors making the content relevant and timely to a shopper. Transactional messages can add another layer of value by sending shipping and order pick-up alerts, as well as notifications for reorders, layaway and new product releases. The foremost example of our solution running today is Walmart. Walmart pharmacy departments send individualized text and voice messages through our gateway to their customers letting them know when their prescriptions are ready for pick-up.

Abbreviated Dial Codes- Our abbreviated dial codes have been proven to have 10 times the recall of a common keyword-to-short-code solution. We have seen many of our clients using this as an on-ramp to mobility solutions. Walmart is currently using #wmt to make it easier for their customers to locate and download their smartphone mobile app. Forrester Research called this dial code technology one of the top 4 for CMOs to watch. We see the potential for Single Touch customers to leverage the hash tags in the social media space with the # symbol in their abbreviated dial code to enhance brand awareness.

Certain Agreements

Our business agreements consist primarily of customer agreements and carrier agreements. Customer agreements are typically agreements with companies which have sales relationships with the end users of the transacted media content or service application. These agreements typically involve a split of the fees received between the brand owner and us or a fixed fee per transaction. Carrier agreements are infrastructure in nature and establish the connection to the end user that enables us to deliver and collect payment for the transacted media content or service application.

We have expanded our relationship with AT&T Services, Inc., through which we retain 11 client relationships representing nearly all of our reported revenue in the fiscal years ended in 2011 and 2012. The bulk of that revenue comes from notifications sent on behalf of 4 separate Walmart corporate programs. These programs and related services continue to develop nationwide, and we continue to experience increasing activity in these programs that have caused our AT&T revenues to grow.

Research and Development

During the fiscal years ended September 30, 2012 and September 30, 2011 we spent $434,915 and $502,110, respectively, on software development that was capitalized. Software development costs amortized and charged to operations in fiscal 2012 and fiscal 2011 were $446,876 and $412,632, respectively.

Our research and development activities relate primarily to general coding of software and product development. These activities consist of both new products and support or improvements to existing products.

We believe that we may need to increase our current level of dedicated research and development resources by adding both hardware and engineers as our business continues to develop.

Patents and Licenses

We currently hold rights to multiple patents relating to certain aspects of accessing information on a mobile device, sending information to and between mobile devices, advertising and media streaming. We believe the ownership of such patents is an important factor in our existing and future business.

We regularly file patent applications to protect innovations arising from our research, development and design, and are currently pursuing multiple patent applications. Over time, we have accumulated a portfolio of issued patents primarily in the U.S. No single patent is solely responsible for protecting our systems and services. We believe the duration of our patents is adequate relative to the expected lives of our systems and services.

Some of our systems and services may include intellectual property obtained from third parties. It may be necessary in the future to seek or renew licenses relating to various aspects of our systems and services. There is no guarantee that such licenses could be obtained on reasonable terms or at all. Because of technological changes in the industries in which we compete, current extensive patent coverage, and the rapid rate of issuance of new patents, it is possible that certain components of our systems and services may unknowingly infringe existing patents or intellectual property rights of others.

Government Regulation

We provide value-added and enabling platforms for carrier-based distribution of various software and media content, as well as notifications and other communications. Applicable regulations are primarily under the Federal Communications Commission and related to the operations policies and procedures of the wireless communications carriers. Messaging and safeguarding Personal Health Information, moreover, is regulated by, among other things, the Privacy Rule of the Health Insurance Portability and Accountability Act, otherwise known as HIPAA. The wireless carriers are primarily responsible for regulatory compliance. Given the growing and dynamic evolution of digital wireless products that can be offered to consumers over a wireless communication network, regulators could impose rules, requirements and standards of conduct on third-party content and infrastructure providers such as us. We are not currently aware of any pending regulations that would materially impact our operations.

Employees

We currently have 16 full-time and no part-time employees including our chairman, our chief executive officer, our chief financial officer, 6 persons serving as programmers and technical staff operators, 5 persons in sales and marketing, 1 person in accounting and 1 administrative assistant. We expect to increase our future employee levels on an as-needed basis in connection with our expected growth.

Properties

Our executive offices are located at 100 Town Square Place, Suite 204, Jersey City, NJ 07310. We have a five-year lease for this space at a rate of $8,925 per month. The facilities comprise approximately 3500 square feet consisting entirely of administrative office space.

We have additional offices located at 2235 Encinitas Blvd., Suite 210, Encinitas, CA 92024. We have a month-to-month renewal lease for this space at a rate of $3,027 per month. The facilities comprise approximately 1900 square feet consisting entirely of administrative and software development office space.

We have additional offices located at 3310 Market Street, Suite 204, Rogers, AK 72758. We have a five-year lease for this space at a rate of $3,645 per month. The facilities comprise approximately 2100 square feet consisting entirely of sales, client service, and administrative office space.

We have additional offices located at 12301 West Explorer Drive, Suite 210, Boise, ID 83713. We have a two-year lease for this space at a rate of $1,204 per month, which has been extended on a month-to-month basis. The facilities comprise approximately 1445 square feet consisting entirely of software development office space.

Our servers are housed at CoreSite, 900 N. Alameda Street, Los Angeles, CA 90012, Paetec, 100 W. La Palma, Anaheim, CA 92801 and CoreSite, 427 North La Salle, Chicago, IL 60605.

Legal Proceedings

On February 21, 2012, we filed a complaint against Zoove Corporation in the United States District Court, Northern District of California. The complaint alleges patent infringement, in which we seek preliminary and permanent injunctive relief as well as damages resulting from Zoove’s infringement of U.S. Patent No. 7,813,716 and U.S. Patent No. 8,041,341. The Complaint has been served, and Zoove has filed an answer. We had a case management conference on June 25, 2012. We filed our Claim Construction Brief on December 20, 2012, and are currently in the claim construction period. A claim construction hearing is set for February 20, 2013.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis should be read in conjunction with our financial statements and the related notes thereto included elsewhere in this prospectus. The Management’s Discussion and Analysis contains forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives, expectations and intentions. Any statements that are not statements of historical fact are forward-looking statements. When used, the words “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect,” and the like, and/or future-tense or conditional constructions (“will,” “may,” “could,” “should,” etc.), or similar expressions, identify certain of these forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements in this prospectus. Our actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of several factors such as those noted under “Risk Factors” on page 3 of this prospectus. We do not undertake any obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this prospectus.

Overview

Single Touch Systems Inc. is an innovative mobile media solutions provider serving retailers, advertisers and brands. Through patented technologies and a modular, adaptable platform, our multi-channel messaging gateway enables marketers to reach consumers on all types of connected devices, with information that engages interest, drives transactions and strengthens relationships and loyalty.

Our solution is designed to drive return on investment for high-volume clients and/or customized branded advertisers. Our platform and tools are designed to enable large brands or anyone with substantial reach to utilize the mobile device as a new means to communicate. Communication might be in the form of a reminder message, a coupon, an advertisement or a voice call. Regardless of the form, our platform can drive value and cost savings for companies large and small, and we provide the ability to drive contextually relevant advertising messages to the right audience.

Our business has focused on leveraging our solution in the areas of messaging/notifications and Abbreviated Dial Codes. These solutions are enhanced when we deploy imbedded advertisements, sponsorship and couponing.

“For the first time in history with near 322 million wireless subscribers in the USA, wireless penetration exceeds the U.S. population” (1)

“Short Messaging Service, simply known as SMS, sent in the USA for the 12 months ended June 2012 totaled 2.27 trillion up 3% from 2011” (1)

“SMS capable handsets on carriers networks rose to 268.5 million for the same period up 7.7% from 2011” (1)

“In 2011 worldwide SMS traffic topped 8 trillion messages”

We have developed and are deploying advertisements, sponsorships and couponing within our product offerings. This development is significant in that our per-message revenue increases significantly for each message that includes an advertisement or sponsorship. We see these expanded offerings, including those not based directly on messaging volume, as important steps in our continued program to creating both consumer and advertiser demand for our mobile media platform, accessing mobile notifications, advertisements, sponsorships, coupons and commerce transactions from the mobile phone.

“53% of companies surveyed have or are deploying a dedicated team assigned to mobile programs, and 51% are looking for ways to further mobile marketing capabilities”(2)

We have expanded our relationship with AT&T Services, Inc., through which we retain 11 client relationships representing nearly all of our reported revenue in the fiscal years ended in 2011 and 2012. The bulk of that revenue comes from notifications sent on behalf of 4 separate Walmart corporate programs. These programs and related services continue to develop nationwide, and we continue to experience increasing activity in these programs that have caused our AT&T revenues to grow.

We have a portfolio of intellectual property relevant to our industry related to mobile search, commerce, advertising and streaming media. This portfolio represents our many years’ innovation in the wireless industry through patented technology developed by us, as well as patented technology we purchased from Microsoft and others.

We have law firms engaged to protect our patented technology rights against unauthorized users and infringers. We have sent letters of notification to several companies making them aware of our patent portfolio and have commenced litigation.

We have assigned 16 of our 18 patents and all of our intellectual property rights to Single Touch Interactive R&D IP, Inc., a wholly owned subsidiary who will conduct all research, development, patent filings, patent maintenance and who will continue to identify, notify, and, where circumstances warrant, enforce against companies we believe may be infringing on the intellectual property protected by our growing patent portfolio under the guidance of our Executive Chairman.

As we expand operational activities, we may continue to experience operating losses and/or negative cash flows from operations and may be required to obtain additional financing to fund operations.

Throughout our history our operations have been constrained by our ability to raise funds, and our liquidity has been an ongoing issue. We have received debt and equity investments both from insiders and from private investors. We have always had negative cash flows from operations and net operating losses, although the size of the net operating losses has been magnified by a variety of non-cash accounting charges. As we expand operational activities, we may continue to experience operating losses and/or negative cash flows from operations and may be required to obtain additional financing to fund operations.

Our operating history makes predictions of future operating results difficult to ascertain. Our revenue is concentrated with a single customer. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies in our stage of development. Such risks include, but are not limited to, an evolving business model and the management of growth. To address these risks we must, among other things, diversify our customer base, implement and successfully execute our business and marketing strategy, continue to develop and upgrade technology and products, respond to competitive developments, and attract, retain and motivate qualified personnel. There can be no assurance that we will be successful in addressing such risks, and the failure to do so can have a material adverse effect on our business prospects, financial condition and results of operations.

|

(1)

|

Source: June 2012 CTIA Semi Annual Wireless Survey

|

|

(2)

|

Source: October 2012 CMO Council Study

|

Results of Operations

Years Ended September 30, 2012 and 2011

During the fiscal year ended September 30, 2012, the Company had an increase in revenue of approximately 39% over revenue generated during the previous fiscal year ($6,346,919 in 2012 compared to $4,579,862 in 2011). The growth, all of which is organic, is attributable to continuing consumer adoption of our programs from existing client relationships. The Company’s net loss for the fiscal year ended September 30, 2012 was $3,255,186. This is lower than the net loss incurred during the fiscal year ended September 30, 2011 of $7,985,163. Under the metrics employed by management to evaluate the underlying business explained below, Adjusted EBITDA, that underlying loss was reduced by $507,464 from the fiscal year ended September 30, 2011 to the fiscal year ended September 30, 2012.

We define Adjusted EBITDA as consolidated operating income before depreciation, amortization of intangible assets, stock-based compensation, and special charges. We use Adjusted EBITDA to evaluate the underlying performance of our business, and a summary of Adjusted EBITDA, reconciling GAAP amounts (i.e., items reported in accordance with U.S. Generally Accepted Accounting Principles) to Adjusted EBITDA amounts (i.e., items included within Adjusted EBITDA as defined directly above) for the fiscal years ended September 30, 2012 and 2011 follows:

|

For the Year Ended September 30,

|

||||||||||||||||||||||||||||||||||||||||

|

2012

|

2011

|

GAAP

|

Adjusted EBITDA

|

|||||||||||||||||||||||||||||||||||||

|

Adjust-

|

Adjusted

|

Adjust-

|

Adjusted

|

Change

|

Change

|

|||||||||||||||||||||||||||||||||||

|

GAAP

|

ments

|

EBITDA

|

GAAP

|

ments

|

EBITDA

|

$ | % | $ | % | |||||||||||||||||||||||||||||||

|

Revenue

|

||||||||||||||||||||||||||||||||||||||||

|

Wireless Applications

|

$ | 6,346,919 | $ | - | $ | 6,346,919 | $ | 4,579,862 | $ | - | $ | 4,579,862 | $ | 1,767,057 | 39 | % | $ | 1,767,057 | 39 | % | ||||||||||||||||||||

|

Operating Expenses

|

||||||||||||||||||||||||||||||||||||||||

|

Royalties and Application Costs

|

$ | 2,907,110 | $ | - | $ | 2,907,110 | $ | 2,543,885 | $ | - | $ | 2,543,885 | $ | 363,225 | 14 | % | $ | 363,225 | 14 | % | ||||||||||||||||||||

|

Research and Development

|

$ | 84,658 | $ | - | $ | 84,658 | $ | 78,860 | $ | - | $ | 78,860 | $ | 5,798 | 7 | % | $ | 5,798 | 7 | % | ||||||||||||||||||||

|

Compensation expense (including

|

||||||||||||||||||||||||||||||||||||||||

|

stock-based compensation)

|

$ | 3,044,430 | $ | (365,422 | ) | $ | 2,679,008 | $ | 5,468,643 | $ | (3,634,268 | ) | $ | 1,834,375 | * | $ | (2,424,213 | ) | -44 | % | $ | 844,633 | 46 | % | ||||||||||||||||

|

Depreciation and amortization

|

$ | 690,293 | $ | (690,293 | ) | $ | - | $ | 633,535 | $ | (633,535 | ) | $ | - | $ | 56,758 | 9 | % | ||||||||||||||||||||||

|

General and administrative (including

|

||||||||||||||||||||||||||||||||||||||||

|

stock-based compensation)

|

$ | 2,386,694 | $ | (137,169 | ) | $ | 2,249,525 | $ | 3,161,751 | $ | (958,163 | ) | $ | 2,203,588 | $ | (775,057 | ) | -25 | % | $ | 45,937 | 2 | % | |||||||||||||||||

| $ | 9,113,185 | $ | (1,192,884 | ) | $ | 7,920,301 | $ | 11,886,674 | $ | (5,225,966 | ) | $ | 6,660,708 | $ | (2,773,489 | ) | -23 | % | $ | 1,259,593 | 19 | % | ||||||||||||||||||

|

Loss from Operations/Adjusted EBITDA

|

$ | (2,766,266 | ) | $ | 1,192,884 | $ | (1,573,382 | ) | $ | (7,306,812 | ) | $ | 5,225,966 | $ | (2,080,846 | ) | $ | 4,540,546 | -62 | % | $ | 507,464 | -24 | % | ||||||||||||||||

Royalties and Application Costs represent the direct out-of-pocket costs associated with revenue. Royalties and Application Costs vary substantially in line with revenue and totaled $2,907,110 in 2012, compared to $2,543,885 in 2011, an increase of 14%. Because a portion of Royalties and Application Costs are fixed and all such costs are being monitored and reduced wherever possible, net margin continues to increase.