Attached files

| file | filename |

|---|---|

| 8-K - META FINANCIAL GROUP INC 8-K 2-6-2013 - META FINANCIAL GROUP INC | form8k.htm |

EXHIBIT 99.1

Sterne Agee

Financial Institutions Investor Conference

February 2013

Forward Looking Statements

Corporate Profile: Meta Financial Group, Inc. ®, ("Meta Financial" or the "Company") is the holding company for its wholly-owned subsidiary MetaBank™ (the "Bank"

or "MetaBank"). MetaBank is a federally-chartered savings bank with four market areas: Northwest Iowa Market, Brookings Market, Central Iowa Market, Sioux

Empire Market; and the Meta Payment Systems® prepaid card division. Twelve retail banking offices and one administrative office support customers throughout

northwest and central Iowa, and in Brookings and Sioux Falls, South Dakota.

or "MetaBank"). MetaBank is a federally-chartered savings bank with four market areas: Northwest Iowa Market, Brookings Market, Central Iowa Market, Sioux

Empire Market; and the Meta Payment Systems® prepaid card division. Twelve retail banking offices and one administrative office support customers throughout

northwest and central Iowa, and in Brookings and Sioux Falls, South Dakota.

Meta Financial Group, Inc.®, (“Meta Financial” or “the Company” or “us”) and its wholly-owned subsidiary, MetaBank™ (the “Bank” or “MetaBank”), may from time

to time make written or oral “forward-looking statements,” including this earnings release, statements contained in its filings with the SEC, in its reports to

stockholders, and in other communications by the Company, which are made in good faith by the Company pursuant to the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995.

to time make written or oral “forward-looking statements,” including this earnings release, statements contained in its filings with the SEC, in its reports to

stockholders, and in other communications by the Company, which are made in good faith by the Company pursuant to the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995.

You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,”

“predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should read statements that contain these

words carefully because they discuss our future expectations or state other “forward-looking” information. These forward-looking statements include statements

with respect to the Company’s beliefs, expectations, estimates, and intentions that are subject to significant risks and uncertainties, and are subject to change based

on various factors, some of which are beyond the Company’s control. Such statements address, among others, the following subjects: future operating results;

customer retention; loan and other product demand; important components of the Company’s balance sheet and income statements; growth and expansion; new

products and services, such as those offered by the Bank or Meta Payment Systems® (“MPS”), a division of the Bank; credit quality and adequacy of reserves;

technology; and the Company’s employees. The following factors, among others, could cause the Company’s financial performance to differ materially from the

expectations, estimates, and intentions expressed in such forward looking statements: the strength of the United States economy in general and the strength of the

local economies in which the Company conducts operations; the effects of, and changes in, trade, monetary, and fiscal policies and laws, including interest rate

policies of the Board of Governors of the Federal Reserve System (the “Federal Reserve”), as well as efforts of the United States Treasury in conjunction with bank

regulatory agencies to stimulate the economy and protect the financial system; inflation, interest rate, market, and monetary fluctuations; the timely development

of and acceptance of new products and services offered by the Company as well as risks (including reputational and litigation) attendant thereto and the perceived

overall value of these products and services by users; the risks of dealing with or utilizing third party vendors; the scope of restrictions and compliance requirements

imposed by the supervisory directives and/or the Consent Orders entered into by the Company and the Bank with the Office of Thrift Supervision (the functions of

which were transferred to the Office of the Comptroller of the Currency (“OCC”) and the Federal Reserve) and any other such actions which may be initiated; the

impact of changes in financial services’ laws and regulations, including but not limited to our relationship with our regulators, the OCC and the Federal Reserve;

technological changes, including but not limited to the protection of electronic files or databases; acquisitions; litigation risk in general, including but not limited to

those risks involving the MPS division; the growth of the Company’s business as well as expenses related thereto; changes in consumer spending and saving habits;

and the success of the Company at managing and collecting assets of borrowers in default.

“predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should read statements that contain these

words carefully because they discuss our future expectations or state other “forward-looking” information. These forward-looking statements include statements

with respect to the Company’s beliefs, expectations, estimates, and intentions that are subject to significant risks and uncertainties, and are subject to change based

on various factors, some of which are beyond the Company’s control. Such statements address, among others, the following subjects: future operating results;

customer retention; loan and other product demand; important components of the Company’s balance sheet and income statements; growth and expansion; new

products and services, such as those offered by the Bank or Meta Payment Systems® (“MPS”), a division of the Bank; credit quality and adequacy of reserves;

technology; and the Company’s employees. The following factors, among others, could cause the Company’s financial performance to differ materially from the

expectations, estimates, and intentions expressed in such forward looking statements: the strength of the United States economy in general and the strength of the

local economies in which the Company conducts operations; the effects of, and changes in, trade, monetary, and fiscal policies and laws, including interest rate

policies of the Board of Governors of the Federal Reserve System (the “Federal Reserve”), as well as efforts of the United States Treasury in conjunction with bank

regulatory agencies to stimulate the economy and protect the financial system; inflation, interest rate, market, and monetary fluctuations; the timely development

of and acceptance of new products and services offered by the Company as well as risks (including reputational and litigation) attendant thereto and the perceived

overall value of these products and services by users; the risks of dealing with or utilizing third party vendors; the scope of restrictions and compliance requirements

imposed by the supervisory directives and/or the Consent Orders entered into by the Company and the Bank with the Office of Thrift Supervision (the functions of

which were transferred to the Office of the Comptroller of the Currency (“OCC”) and the Federal Reserve) and any other such actions which may be initiated; the

impact of changes in financial services’ laws and regulations, including but not limited to our relationship with our regulators, the OCC and the Federal Reserve;

technological changes, including but not limited to the protection of electronic files or databases; acquisitions; litigation risk in general, including but not limited to

those risks involving the MPS division; the growth of the Company’s business as well as expenses related thereto; changes in consumer spending and saving habits;

and the success of the Company at managing and collecting assets of borrowers in default.

The foregoing list of factors is not exclusive. Additional discussions of factors affecting the Company’s business and prospects are contained in the Company’s

periodic filings with the SEC. The Company expressly disclaims any intent or obligation to update any forward-looking statement, whether written or oral, that may

be made from time to time by or on behalf of the Company or its subsidiaries.

periodic filings with the SEC. The Company expressly disclaims any intent or obligation to update any forward-looking statement, whether written or oral, that may

be made from time to time by or on behalf of the Company or its subsidiaries.

Other important information about the Company is available at http://www.metafinancialgroup.com

1

Meta Management

2

J. Tyler Haahr

Chairman, President and Chief Executive Officer, Meta Financial Group

Tyler Haahr has been with Meta Financial Group since March 1997. Previously he

was a partner with the law firm of Lewis and Roca LLP, Phoenix, Arizona. Tyler

received his B.S. degree with honors at the University of South Dakota in Vermillion,

SD. He graduated with honors from the Georgetown University Law Center,

Washington, D.C.

was a partner with the law firm of Lewis and Roca LLP, Phoenix, Arizona. Tyler

received his B.S. degree with honors at the University of South Dakota in Vermillion,

SD. He graduated with honors from the Georgetown University Law Center,

Washington, D.C.

Brad C. Hanson

President, Meta Payment Systems and EVP, Meta Financial Group and MetaBank

Brad Hanson founded Meta Payment Systems in May 2004. He has more than 20

years of experience in financial services, including numerous banking, card industry

and technology-related capacities. During his career Brad has played a significant

role in the development of the prepaid card industry. Brad graduated from the

University of South Dakota in Vermillion, SD with a degree in Economics.

years of experience in financial services, including numerous banking, card industry

and technology-related capacities. During his career Brad has played a significant

role in the development of the prepaid card industry. Brad graduated from the

University of South Dakota in Vermillion, SD with a degree in Economics.

David W. Leedom

Chief Financial Officer, Meta Financial Group and MetaBank

Dave Leedom joined Meta Payment Systems in January 2007 and assumed the CFO

responsibilities for Meta Financial Group and MetaBank in October 2007. Dave is a

certified public accountant (CPA) with more than 35 years of professional experience,

including 28 years in the financial services industry. During this time Dave worked at

Coopers & Lybrand (PricewaterhouseCoopers) and Citibank. Dave received a B.S.of

Business Administration in Accounting degree from the University of Iowa.

responsibilities for Meta Financial Group and MetaBank in October 2007. Dave is a

certified public accountant (CPA) with more than 35 years of professional experience,

including 28 years in the financial services industry. During this time Dave worked at

Coopers & Lybrand (PricewaterhouseCoopers) and Citibank. Dave received a B.S.of

Business Administration in Accounting degree from the University of Iowa.

Who we are …

Assets

Strong

Economy

and Local

Markets

Economy

and Local

Markets

§ $1,245 M

§ NetSpend

§ Money Network

§ Blackhawk

3

§ $516 M

§ Iowa

§ South Dakota

MetaBank

Retail Bank

Meta Payment

Systems

Systems

Meta Financial

Group

Group

Solid

Partners

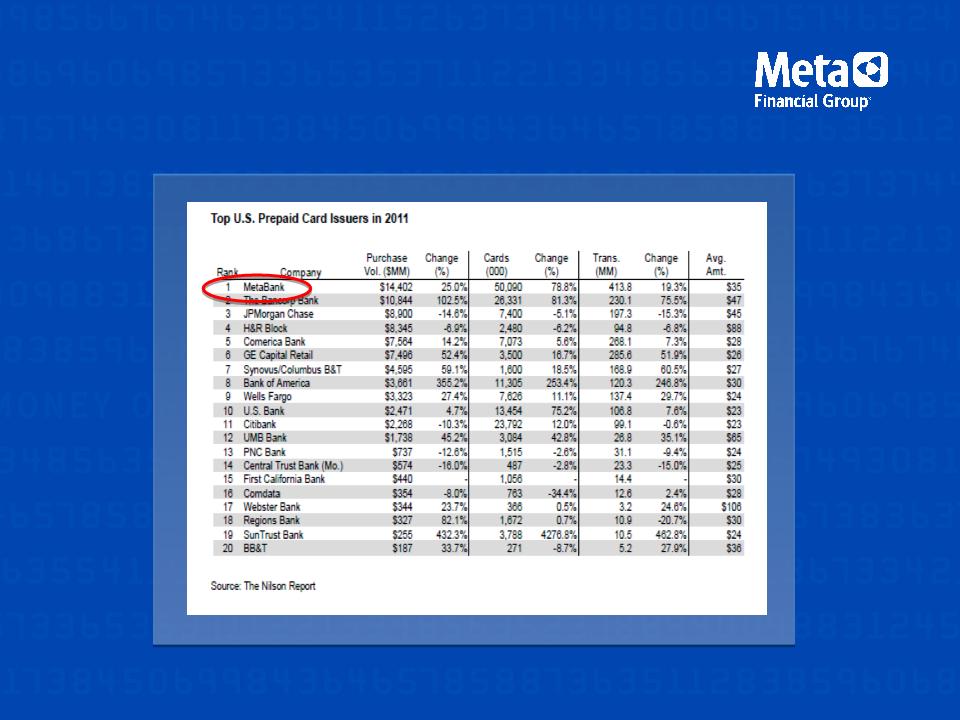

MPS-Top U.S. Prepaid Card Issuer

5

Strategic Direction

➡ Grow MPS Division

➯ Scalable operating infrastructure

➯ Leverage low/no cost funds

➯ Diverse product set: reloadable, payroll, gift, incentive and travel

➯ MPS “financial inclusion” programs for unbanked, underbanked

➡ Exercise “Early Adopter” advantage in regulatory compliance

➡ Ensure strong credit, investment quality

➡ Emphasize asset diversification, yield enhancement

➡ New product initiatives

6

Compliance and Oversight Systems

➡ Early adopter of compliance systems

➡ Investments in program design, training and technology

➯ Implementing enhanced BSA/AML technology

➡ High competitive barriers to entry

➯ Expertise, Capital, Compliance

➯ Operational infrastructure

➯ High start-up costs

7

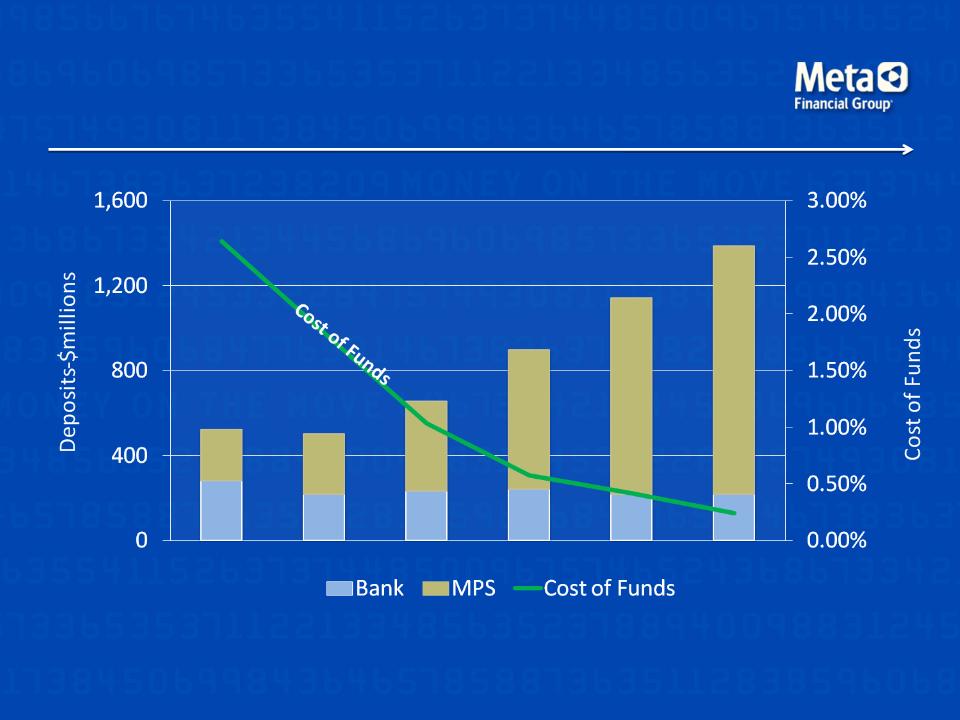

Growing our business

➡ Capitalizing on synergies: community banking, MPS

➯ MPS provides MFG over $1.1 billion in no-cost funds

➯ Historical annual deposit growth of 30%+

➯ Material benefits as interest rates normalize

➡ Leveraging MPS leadership in prepaid card segment

➯ Industry growth forecast at 30% annually

➯ Meta sponsors 70% of U.S. “white label” ATMs

➯ Emergent leader in “virtual cards” for electronic settlements

➯ 20 patents with an additional 20 pending

8

Total Deposits

9

FY07 FY08 FY09 FY10 FY11 FY12

Fiscal Year End September 30

Retail Bank

➡ Successful regional enterprise

➯ Over a half-century in business

➯ 12 locations in Iowa and S. Dakota

➯ Stable, profitable operations

➯ Strong, loyal customer base

➡ Diverse customer base

➯ Attractive combination of retail, commercial and agricultural

➡ Very strong and improving credit quality

➡ Loan to deposit ratio at 86th percentile

10

11

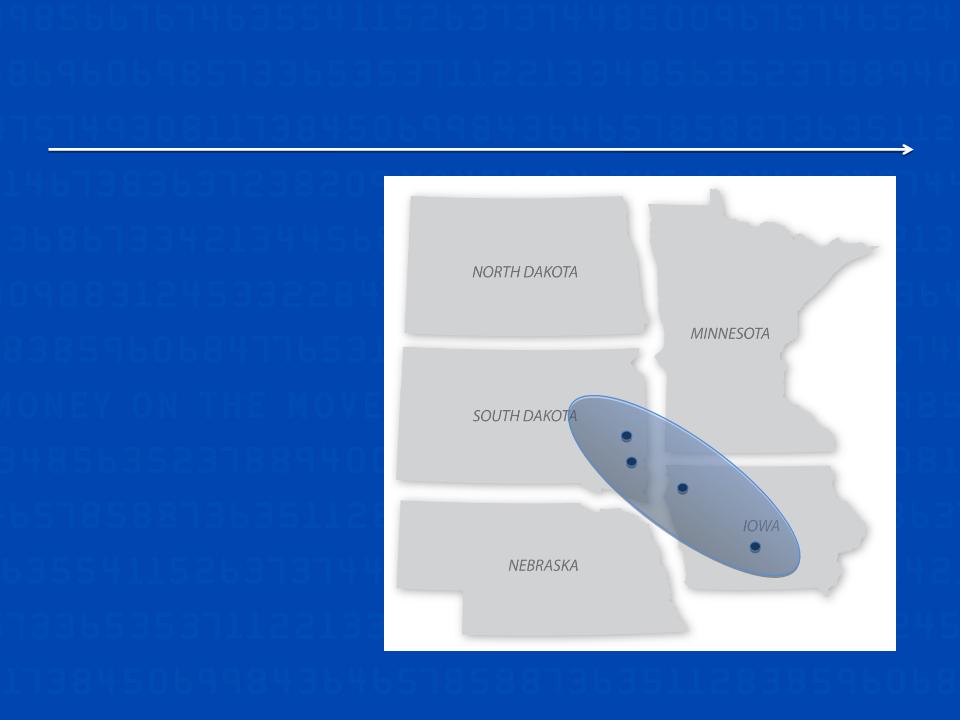

Where MetaBank is located

➡ Brookings

➡ Sioux Falls

➡ Storm Lake

➡ Des Moines

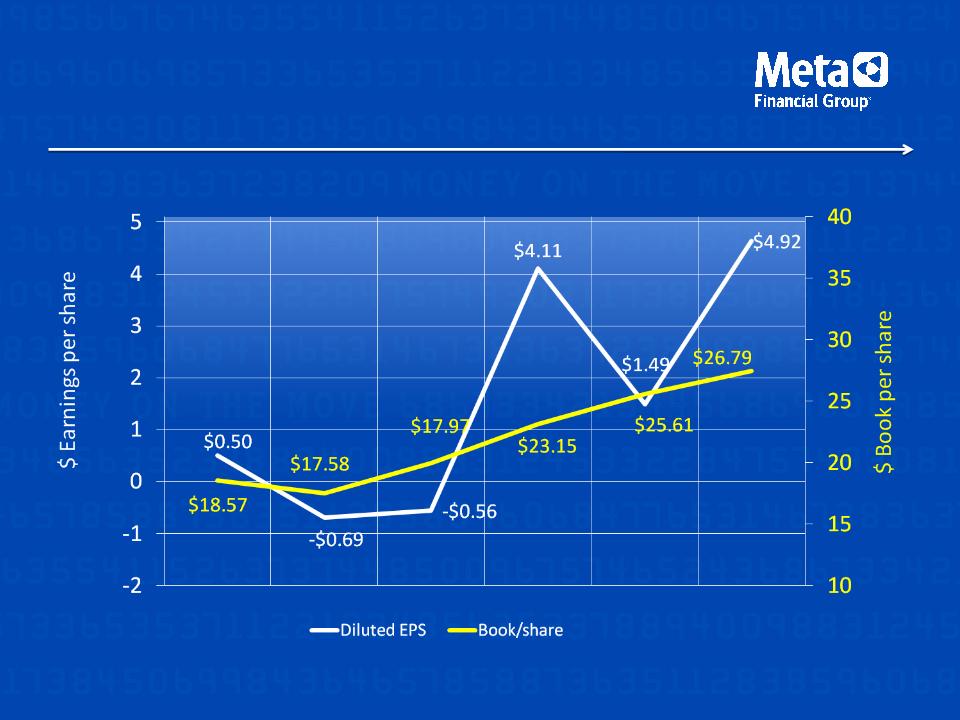

Growing equity

13

FY07 FY08 FY09 FY10 FY11 FY12

Fiscal year end September 30

Capital Management

➡ Private placements raised $47.4 million in new capital

➯ $13.2 million in May 2012

➯ $34.2 million in September 2012

➯ Investors include existing shareholders, strategic partners, others

➡ Maintain strong capital ratios

➯ Tier 1 at least 8%

➯ Risk-Based over 20%

➡ Support current and expected growth

14

Balance Sheet ($000s)

15

|

|

Sep08

|

Sep09

|

Sep10

|

Sep11

|

Sep12

|

Dec12*

|

|

Cash And Cash Equivalents

|

2,963

|

6,168

|

87,503

|

276,893

|

145,051

|

32,745

|

|

Investments and MBS

|

203,834

|

364,838

|

506,852

|

619,248

|

1,116,692

|

1,323,992

|

|

Loans Receivable Net

|

427,928

|

391,609

|

366,045

|

314,410

|

326,981

|

317,258

|

|

Other Assets

|

75,511

|

72,162

|

69,366

|

64,930

|

60,174

|

89,275

|

|

Assets

|

710,236

|

834,777

|

1,029,766

|

1,275,481

|

1,648,898

|

1,763,270

|

|

|

|

|

|

|

|

|

|

Liabilities

|

664,503

|

787,432

|

957,722

|

1,194,904

|

1,503,039

|

1,617,276

|

|

Shareholders' Equity

|

45,733

|

47,345

|

72,044

|

80,577

|

145,859

|

145,994

|

|

Liabilities and Equity

|

710,236

|

834,777

|

1,029,766

|

1,275,481

|

1,648,898

|

1,763,270

|

*Quarter End December 31

Income Statement ($000s)

16

|

Meta Financial Group

|

2009

|

2010

|

2011

|

2012

|

1Q13*

|

1Q12*

|

|

Net Interest Income After Provision

|

9,106

|

17,299

|

34,034

|

32,685

|

8,797

|

7,939

|

|

Total Non Interest Income

|

79,969

|

97,444

|

57,491

|

69,574

|

13,410

|

15,682

|

|

Compensation and Benefits

|

32,743

|

32,529

|

30,467

|

31,104

|

8,277

|

7,176

|

|

Card Processing Expense

|

33,540

|

38,242

|

23,286

|

17,373

|

3,685

|

5,322

|

|

All Other Expense

|

24,798

|

24,159

|

29,509

|

26,986

|

6,116

|

6,293

|

|

Net Income (Loss) Before Taxes

|

(2,006)

|

19,813

|

8,263

|

26,796

|

4,129

|

4,830

|

|

Income Tax Expense (Benefit)

|

(543)

|

7,420

|

3,623

|

9,682

|

1,004

|

1,739

|

|

Net Income (Loss)

|

(1,463)

|

12,393

|

4,640

|

17,114

|

3,125

|

3,091

|

*Quarter End December 31

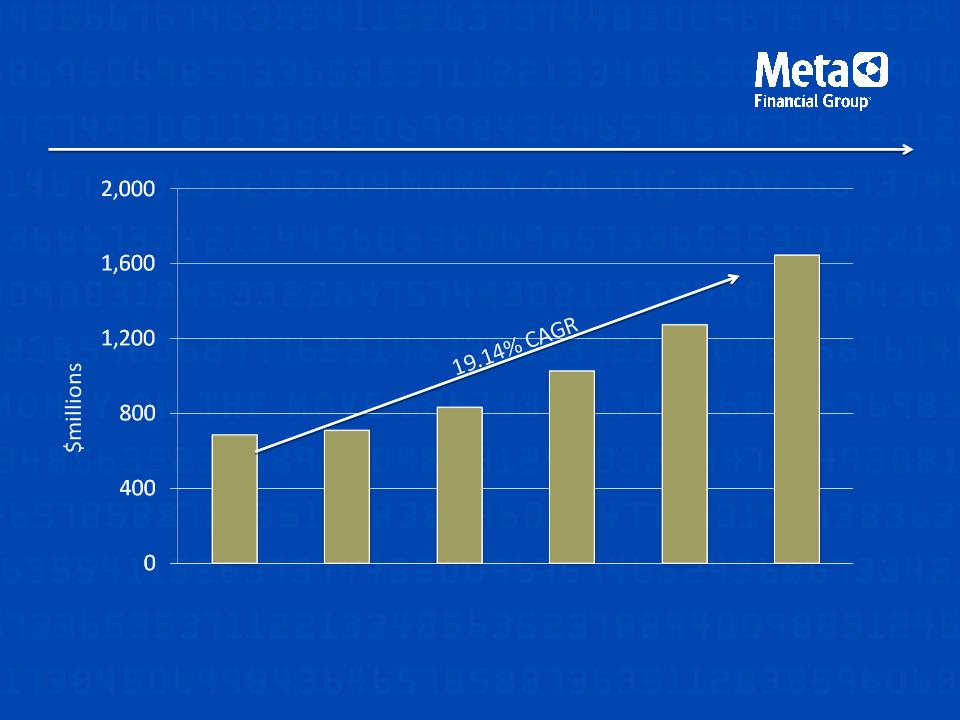

Total Assets

17

FY07 FY08 FY09 FY10 FY11 FY12

Fiscal Year End September 30

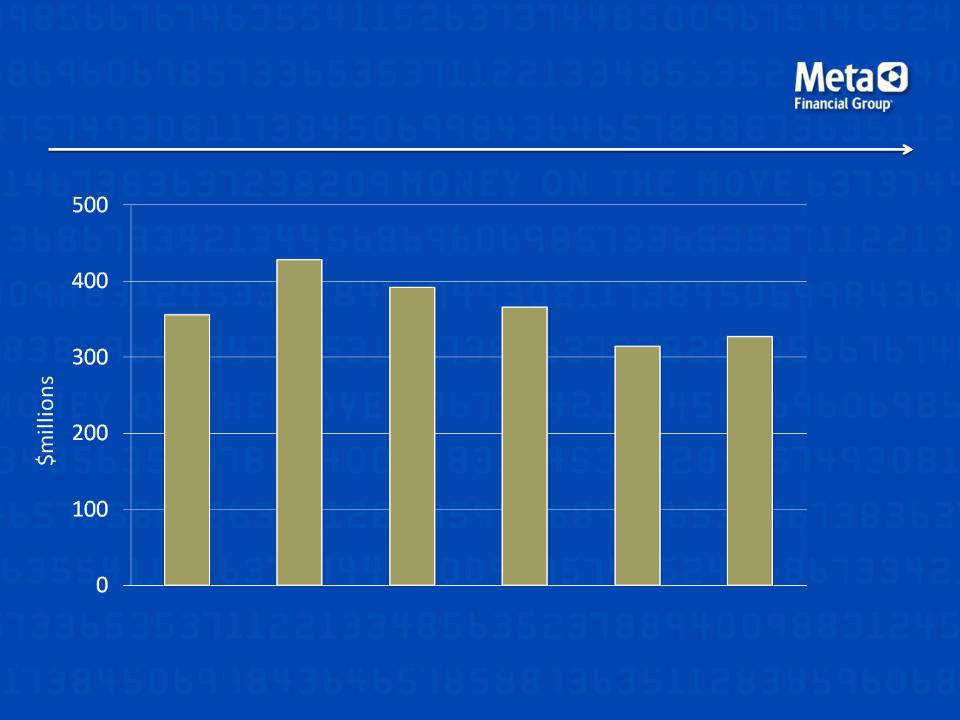

Total Net Loans

18

FY07 FY08 FY09 FY10 FY11 FY12

Fiscal Year End September 30

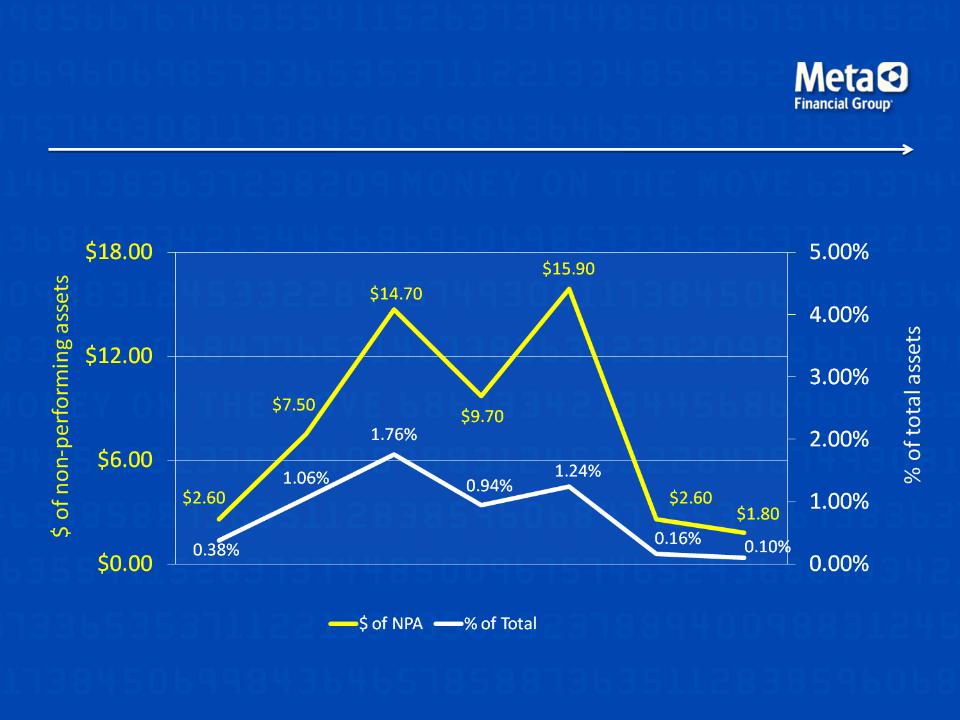

Non-Performing Assets

19

FY07 FY08 FY09 FY10 FY11 FY12 Q113

Fiscal Year End September 30

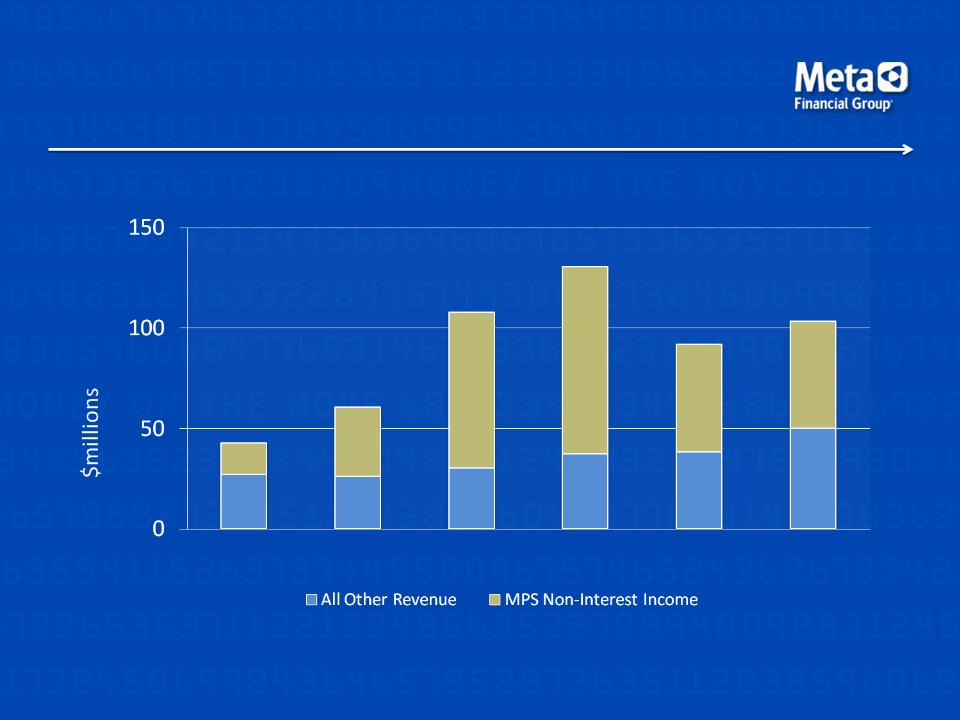

Total Revenue

20

FY07 FY08 FY09 FY10 FY11 FY12

Fiscal Year End September 30

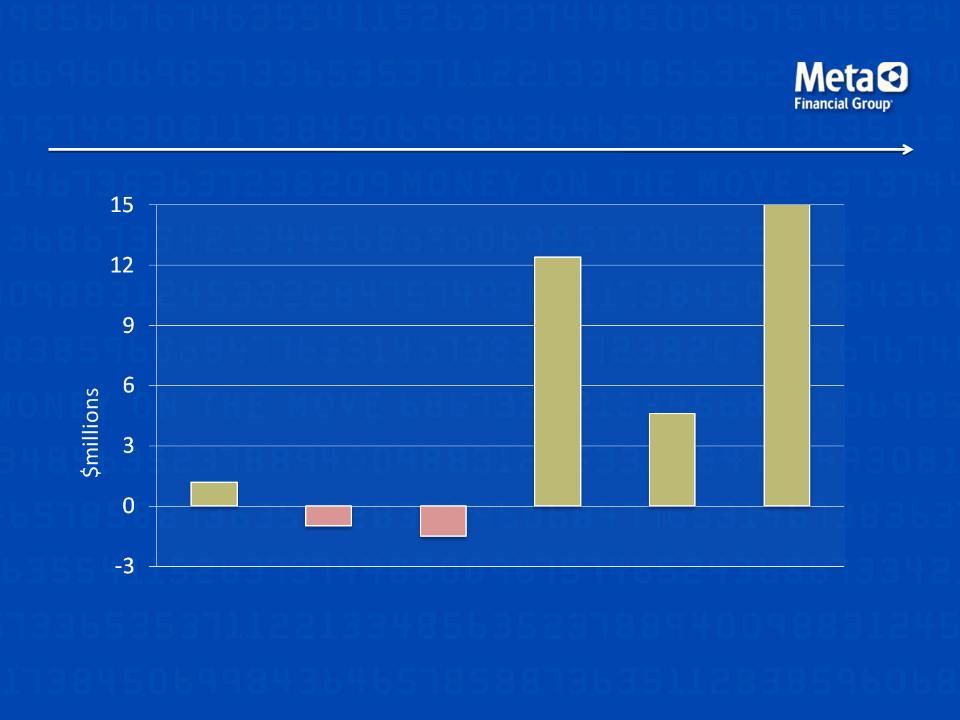

Total Net Income (Loss)

21

FY07 FY08 FY09 FY10 FY11 FY12

Fiscal Year End September 30

Meta Value Proposition

➡ No. 1 issuer of debit cards

➯ Springboard into other products and services

➡ Strong capital position

➯ Capacity to fund significant growth objectives

➡ Steady dividend policy

➯ Yield of 2.4% at current rates

➡ Poised for sharp upward trend in earnings

➯ Normalized interest rates and asset diversification

➡ P/E at relatively low 5.3x

22

23

NASDAQ: CASH