Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BRYN MAWR BANK CORP | d481724d8k.htm |

Exhibit 99.1

Year End 2012

Update

December 31, 2012

(as of February 6, 2013)

Bryn Mawr Bank

Corporation

NASDAQ: BMTC

Strong -

Stable -

Secure |

1

Safe Harbor

This presentation contains statements which, to the extent that they are not

recitations of historical fact may constitute forward-looking statements for

purposes of the Securities Act of 1933, as amended, and the Securities

Exchange Act of 1934, as amended.

Please

see

the

section

titled

Safe

Harbor

begins

on

slide

32

for

more

information

regarding these types of statements.

The information contained in this presentation is correct only as of February 6,

2013. Our business, financial condition, results of operations and

prospects may have changed since that date, and we do not undertake to

update such information. |

2

Bryn Mawr Bank Corporation

Profile

Founded in 1889 –

124 year history

A unique business model with a traditional commercial bank ($2 billion)

and

a

trust

company

($6.7

billion)

under

one

roof

at

December

31,

2012

Wholly-owned subsidiary –

The Bryn Mawr Trust Company

Largest community bank in Philadelphia’s affluent western suburbs

Three wealth acquisitions and two bank acquisitions completed since 2008

Experienced and committed management team |

3

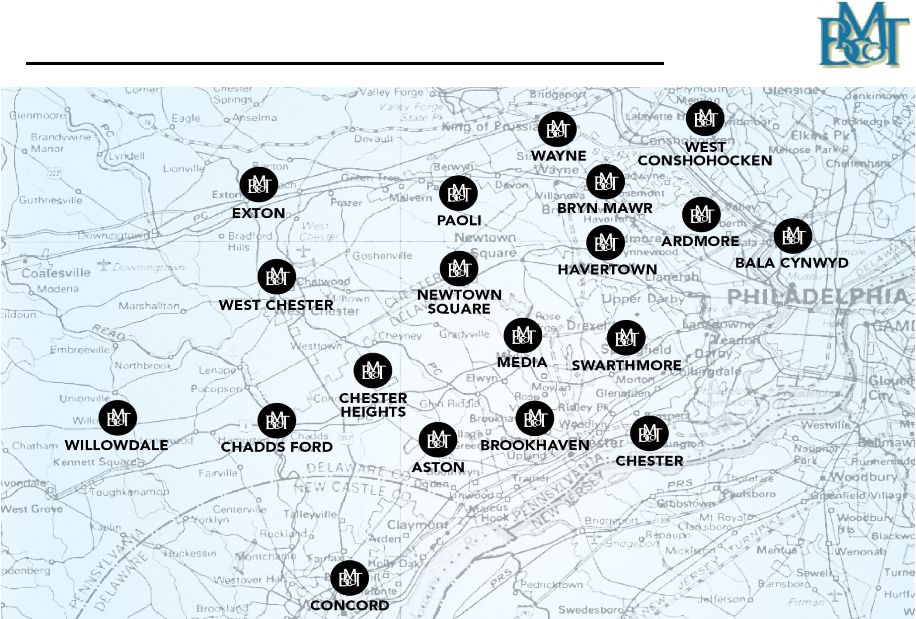

Southeast PA / DE Branch Footprint

•

19 BMTC Full Service Branch Locations |

4

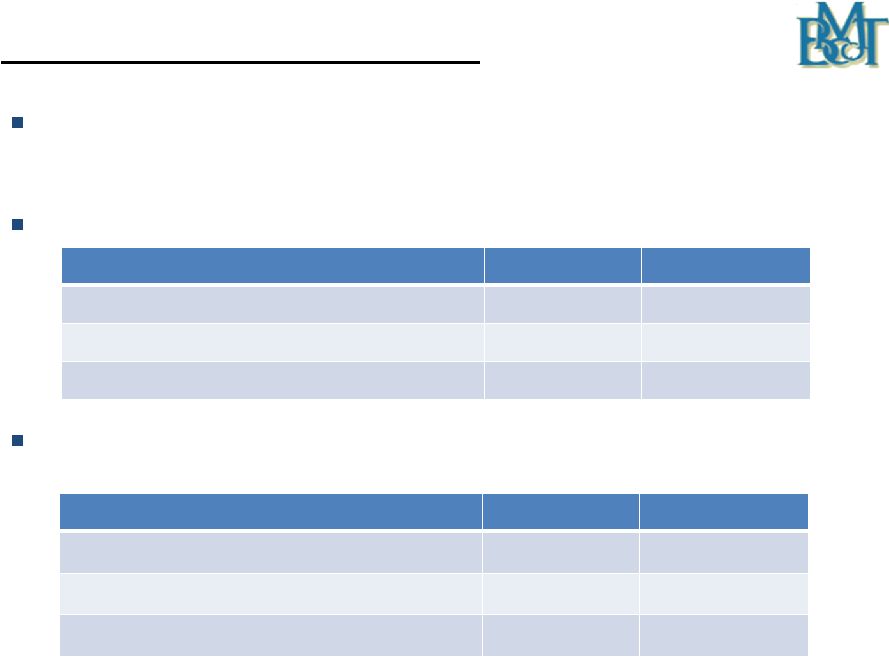

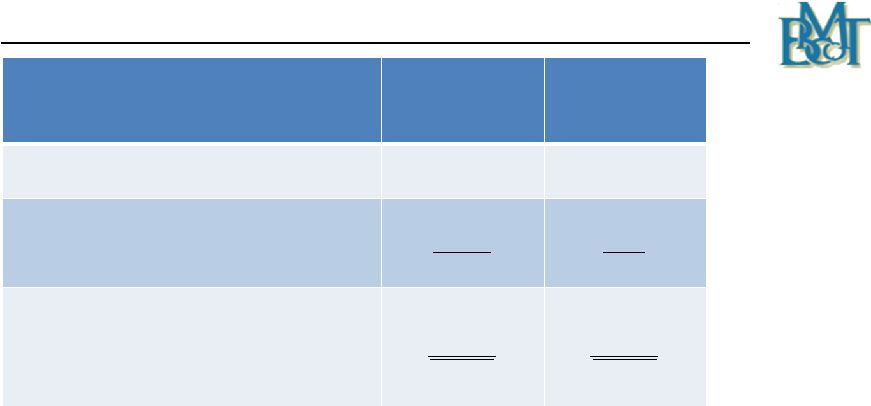

Investment Considerations

2012 dividend of $0.64

per share ($0.16 per quarter); Increased to $0.17

for the first quarter of 2013

Profitability Ratios:

Profitability Ratios, Excluding Tax-Effected Due Diligence and

Merger- Related Expenses (non-GAAP measures)*:

Full Year

12/31/2012

12/31/2011

Return on average assets (“ROA”)

1.15%

1.14%

Return on average equity (“ROE”)

10.91%

11.08%

Return on average tangible equity (“ROTE”)

14.55%

13.85%

Full Year

12/31/2012

12/31/2011

ROA, excluding tax-effected due diligence and merger-related

expenses (a non-GAAP measure)*

1.25%

1.15%

ROE, excluding tax-effected due diligence and merger-related

expenses (a non-GAAP measure)*

11.79%

11.30%

ROTE, excluding tax-effected due diligence and merger-related

expenses (a non-GAAP measure)*

15.73%

14.10%

* See Non-GAAP Measures disclosure beginning on slide 36

|

5

Comments on BMTC from Bank Analysts

“BMTC is a highly attractive franchise with a strong commercial

banking and wealth management focus.”

(Guggenheim, October 2012)

“Bryn Mawr is one of our top picks in the Northeast.”

(Sterne Agee, October 2012)

“The business mix built by the bank remains enviable in suburban

Philadelphia.”

(Keefe, Bruyette & Woods, October 2012)

“Going forward, despite fierce macroeconomic headwinds, we believe

management’s efforts are likely to produce significant core EPS

growth.”

(Merion Research, October 2012) |

6

Year to Date 2012 BMTC Stock Performance

Closing price on December 30, 2011:

$19.49

Closing price on December 31, 2012:

$22.27

Dividends declared per share –

12 months 2012:

$0.64

Security or Index

2012 Total Return

3 Year Annualized

Return**

Trailing 12-Month

Dividend Yield

BMTC*

17.81%

17.40%

2.87%

NASDAQ Bank Index*

18.73%

6.65%

2.29%

KBW Bank Index*

33.05%

8.03%

1.95%

*Source: Bloomberg

** Annualized return -1/1/2010 to 12/31/2012 |

7

Consistent BMTC Annual Dividend

Year

Diluted

Earnings

Per Share

Annual

Dividend

Dividend

Yield Year-

End

Dividend

Payout Ratio

2008

$1.08

$0.54

2.69%

50.0%

2009

$1.18

$0.56

3.71%

47.5%

2010

$0.85

$0.56

3.21%

65.9%

2011

$1.54

$0.60

3.08%

39.0%

2012

$1.60

$0.64

2.87%

40.0% |

Growth

Initiatives |

9

2013 Strategic Initiatives

3-8-3 Strategic Plan

$3 billion in Banking assets -

$8 billion in Wealth assets –

3 years

(December 2014)

Approved by the Board of Directors on May 8, 2012

Organic growth –

opportunistic expansion

Inorganic growth criterion -

Acquisitions to be strategic and

accretive to earnings per share in first 12 months (excluding merger

costs) |

10

2013 Strategic Initiatives -

continued

Focus on the net interest margin

Concentrate on growing fee-based income

Continued emphasis on strong credit quality

Integrate, streamline and assimilate recent acquisitions into more

effective and efficient wealth operations

Enhance and upgrade IT infrastructure throughout the organization

|

11

Closed November 17, 2012

Purchased approximately $70 million of deposits and $80 million of

loans providing a positive influence on net interest income and the

net interest margin

Acquired and opened first branch in Delaware

Became the Bank’s 18

full service branch

Loan mark of $3.7 million or 4.6% of loans

th

Purchase of Deposits and Loans from First

Bank of Delaware |

Financial

Review |

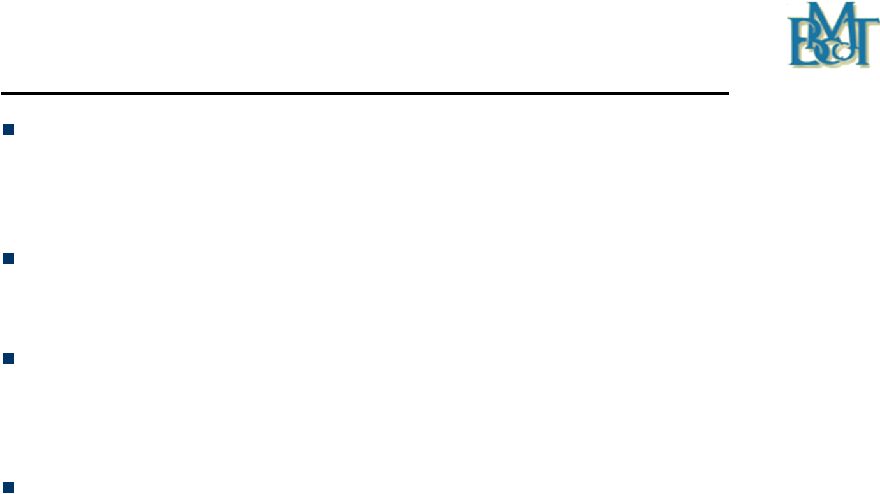

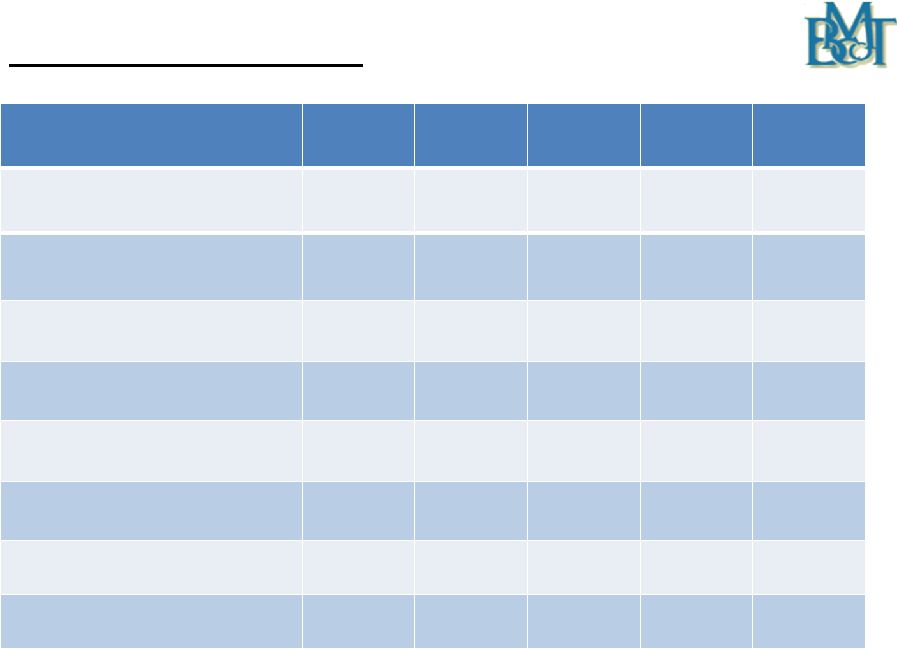

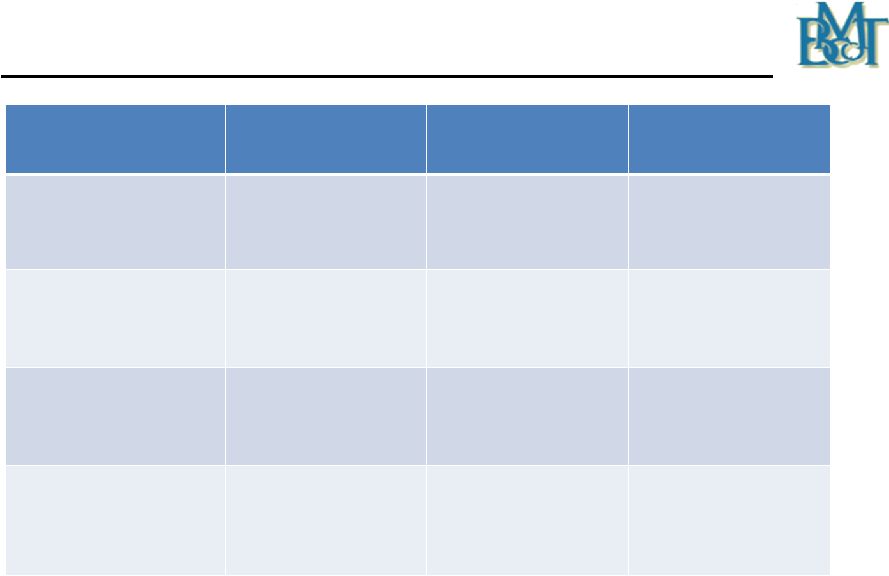

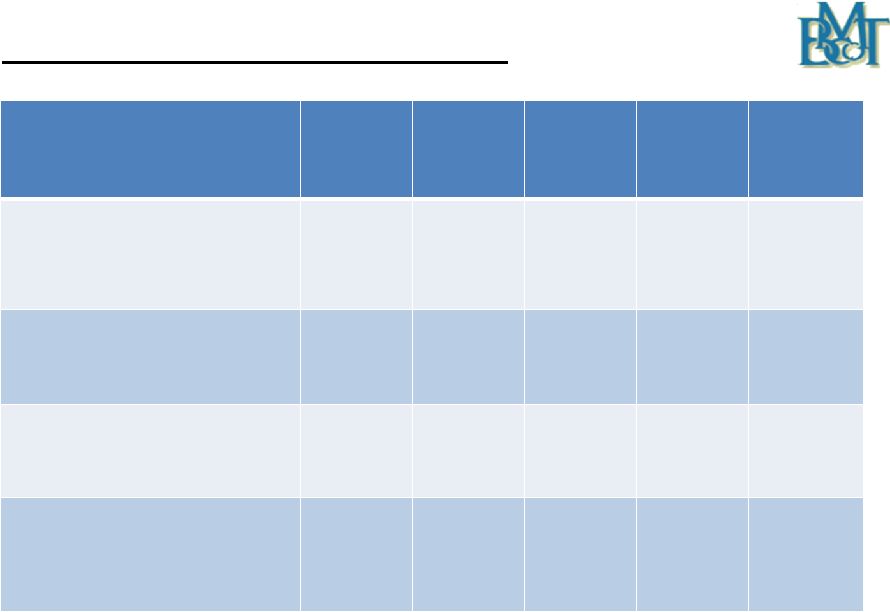

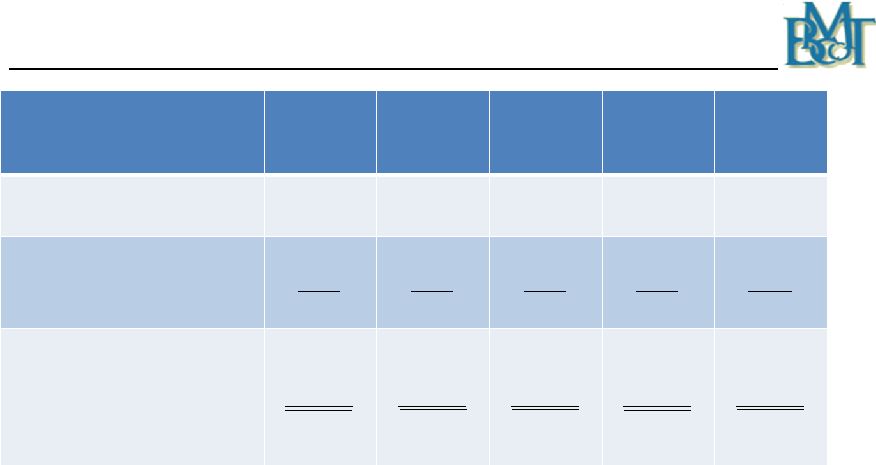

Financial Highlights

4

th

Qtr

2012

3

rd

Qtr

2012

2

nd

Qtr

2012

1

st

Qtr

2012

4

th

Qtr

2011

Total assets

($ in billions)

$2.04

$1.81

$1.85

$1.84

$1.77

Portfolio loans & leases

($ in billions)

$1.40

$1.31

$1.30

$1.30

$1.29

Total deposits

($ in billions)

$1.63

$1.40

$1.43

$1.43

$1.38

Total wealth assets

($ in billions)

$6.66

$6.48

$6.28

$5.15

$4.83

Market capitalization

($ in millions)

$298.7

$296.8

$280.1

$297.4

$253.2

Net income

($ in millions)

$5.30

$5.43

$5.35

$5.07

$5.00

Tax-equivalent net interest margin

3.86%

3.78%

3.84%

3.93%

3.91%

Non-interest income as a

percentage of total revenue

42%

43%

42%

37%

37% |

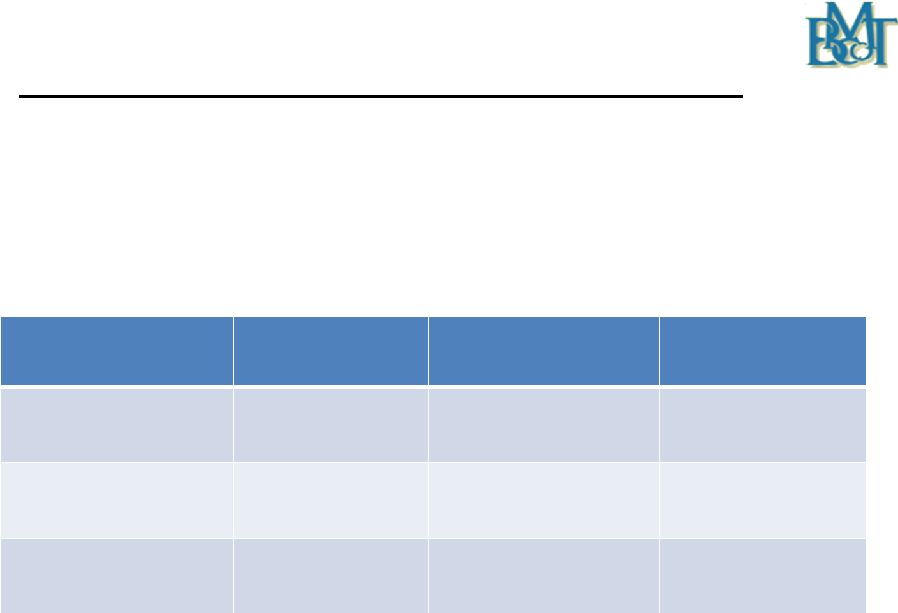

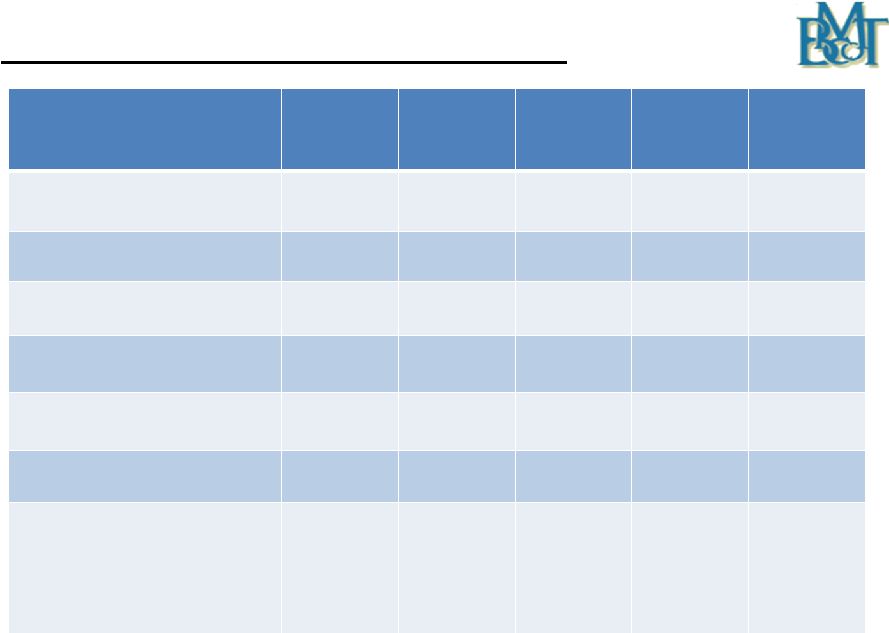

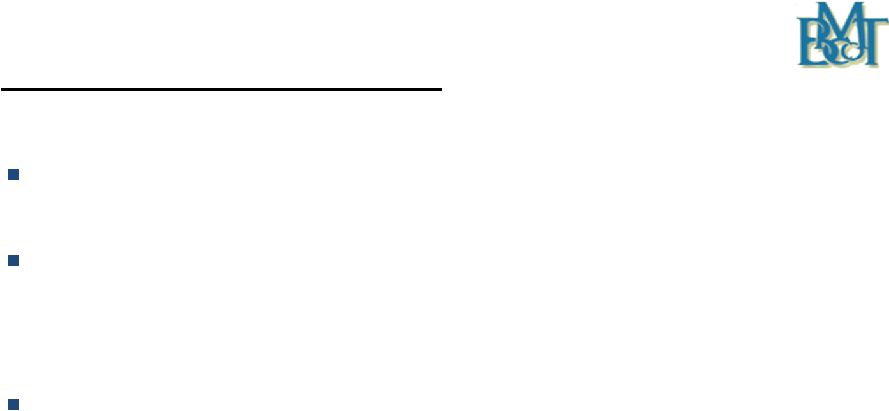

14

Financial Highlights -

continued

4

th

Qtr

2012

3

rd

Qtr

2012

2

nd

Qtr

2012

1

st

Qtr

2012

4

th

Qtr

2011

Diluted earnings per common

share

$0.40

$0.41

$0.40

$0.39

$0.38

Dividends declared

$0.16

$0.16

$0.16

$0.16

$0.15

Book value per share, end of

quarter

$15.17

$15.02

$14.73

$14.40

$14.07

Tangible book value per

share, end of quarter

$11.08

$11.14

$10.77

$11.20

$10.78

Tangible common equity ratio,

end of quarter

7.60%

8.58%

8.07%

8.22%

8.19%

Efficiency ratio

70.1%

67.0%

66.4%

65.7%

65.4%

Efficiency ratio, excluding tax-

effected due diligence and

merger-related expenses

(a non-GAAP measure)*

67.5%

66.3%

64.3%

65.1%

66.0%

* See Non-GAAP Measures Disclosure beginning on slide 36

|

15

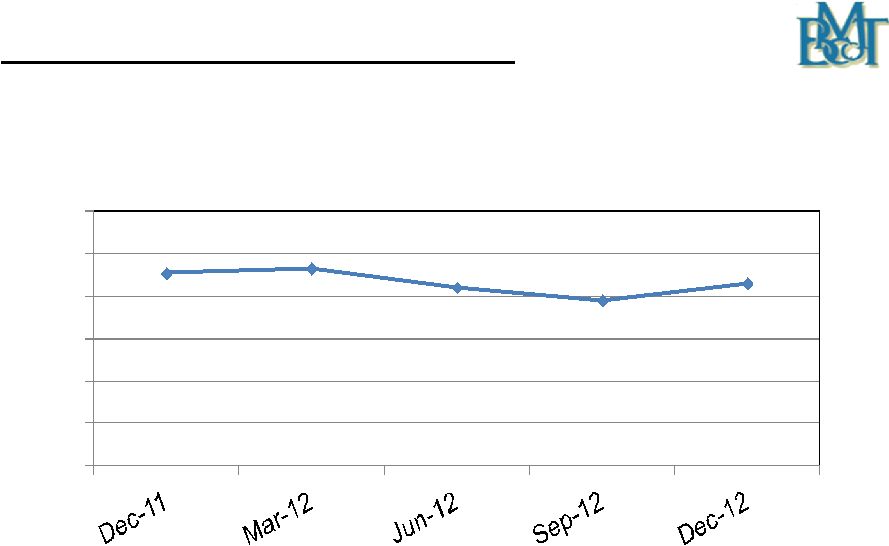

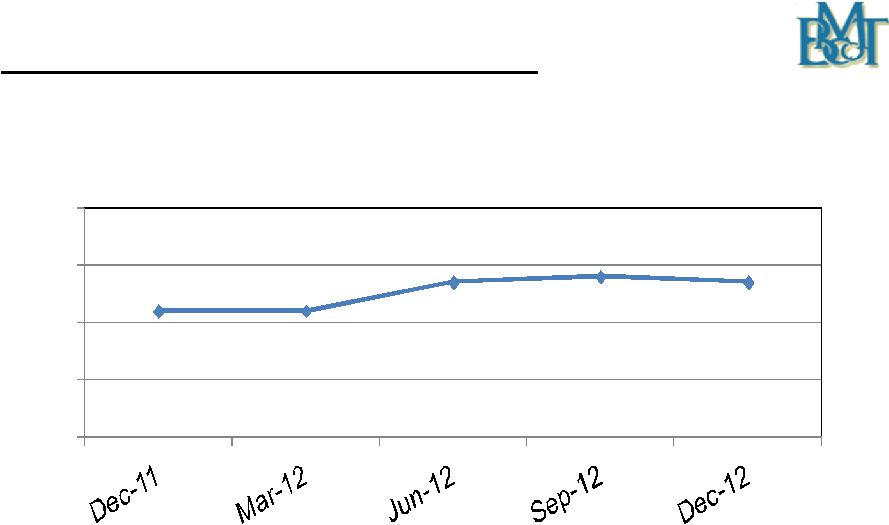

3.91%

3.93%

3.84%

3.78%

3.86%

3.0%

3.2%

3.4%

3.6%

3.8%

4.0%

4.2%

Quarterly Net Interest Margin

On a tax-equivalent basis |

16

37%

37%

42%

43%

42%

15%

25%

35%

45%

55%

Quarterly Non-Interest Income

(As a % of Total Revenue) |

17

Capital Considerations

Maintain a “well capitalized”

capital position including a target tangible

common equity to tangible asset ratio of 8.00%

Selectively add capital to maintain capital levels and fund asset growth and

acquisitions

Strong emphasis on retained earnings going forward

Shelf Registration (Form S-3) of $150 million provides the ability to raise

capital as needed including a Dividend Reinvestment and Direct Stock

Purchase Plan with Waiver |

18

Capital Position -

Bryn Mawr Bank Corporation

12/31/2012

6/30/2012

12/31/2011

Tier I

11.03%

11.30%

11.16%

Total (Tier II)

12.02%

13.90%

13.74%

Tier I Leverage

8.72%

8.80%

8.89%

Tangible Common

Equity

7.60%

8.07%

8.19% |

19

Events Reducing Capital Ratios in 2012

Asset growth was better than expected; anticipated loan growth can be

funded from cash and investment securities

Paid off $22.5 million of subordinated debt in 2012 reducing Tier II capital

and ongoing interest expense

Pension OCI changes due to lower discount rate

Davidson Trust Company acquisition on May 15, 2012

First Bank of Delaware transaction on November 17, 2012

Anticipated retained earnings over the next six months should raise the TCE

ratio back to 8.00%+, as the benefits of the subordinated debt payoffs and the

full-year impact of the acquisitions run through the income

statement. |

Wealth

Division

Review |

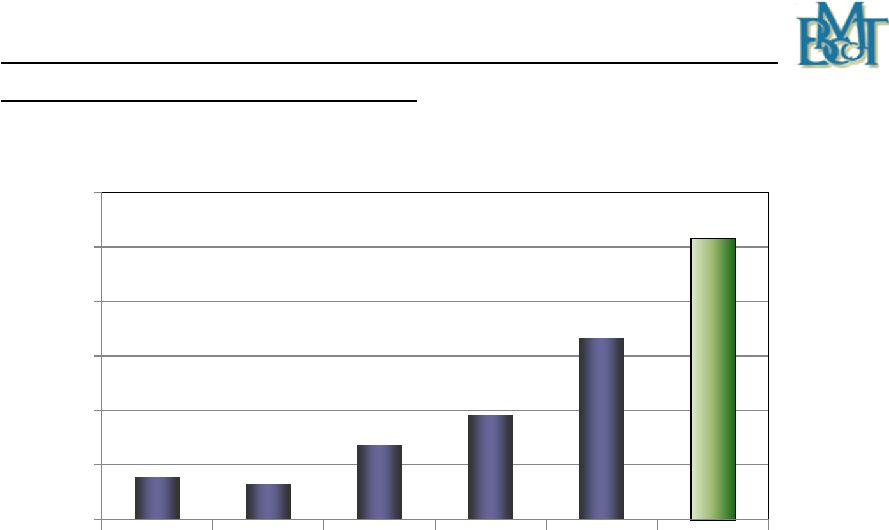

21

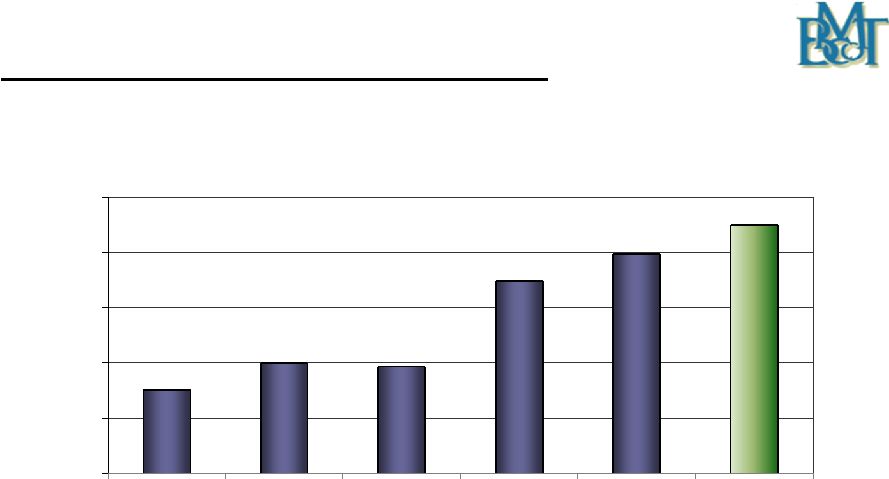

$2.28

$2.15

$2.87

$3.41

$4.83

$6.66

$1.5

$2.5

$3.5

$4.5

$5.5

$6.5

$7.5

2007

2008

2009

2010

2011

2012

Wealth Assets Under Management, Administration,

Supervision and Brokerage

($ in billions) |

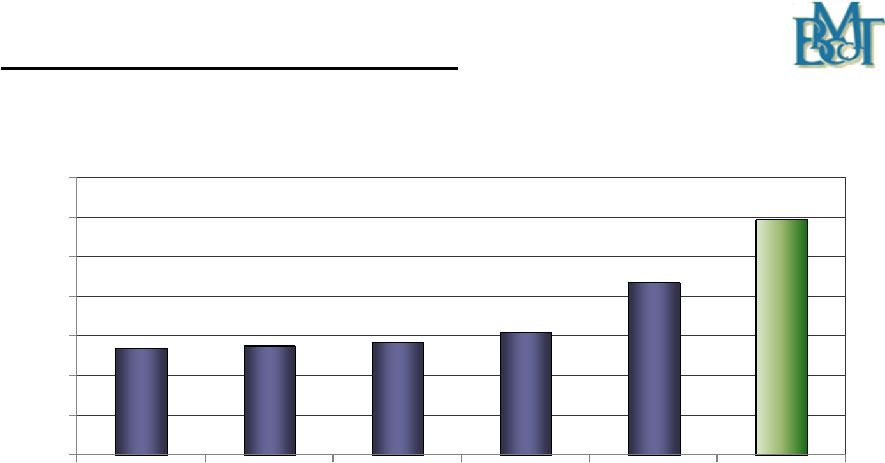

22

$13.5

$13.8

$14.2

$15.5

$21.7

$29.8

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

2007

2008

2009

2010

2011

2012

Wealth Management Fees

($ in millions) |

23

Wealth Division Highlights

Wealth Management

(Bryn Mawr, Hershey and Devon, PA)

$4.36 billion in assets

Integrated solutions to protect and preserve wealth

Financial Planning

Estate Planning

Retirement Planning

Investment Management

Custody Services

Philanthropic Services

Fiduciary Trust Services

Multi-family Office

Tax Services

Long-standing client relationships

Integration of operations of all three trust entities is underway

|

24

Wealth Division Highlights -

continued

Bryn Mawr Asset Management (Bryn Mawr, PA)

$306 million in assets

Brokerage services, asset allocation, open platform with objective advice

“Lift Out”

strategy with other opportunities being continuously evaluated

BMTC of Delaware (Greenville, DE)

$1.4 billion in assets

Provides

corporate

fiduciary

and

administrative

trustee

services

under

Delaware law and the full spectrum of tax advantaged strategies

Lower margin business with full year profitability expected in 2013

Lau Associates (Greenville, DE)

$594 million in assets

Fee-only, independent multi-family office providing highly personalized

service and sophisticated financial planning |

Credit

Review |

26

Portfolio Loan & Lease Growth

$803

$900

$886

$1,197

$1,295

$1,398

$500

$700

$900

$1,100

$1,300

$1,500

2007

2008

2009

2010*

2011

2012**

($ in millions)

* From 2010 forward, includes the addition of the First Keystone

loan portfolio.

** From 2012 forward, includes the addition of the loans acquired from First Bank

of Delaware. |

27

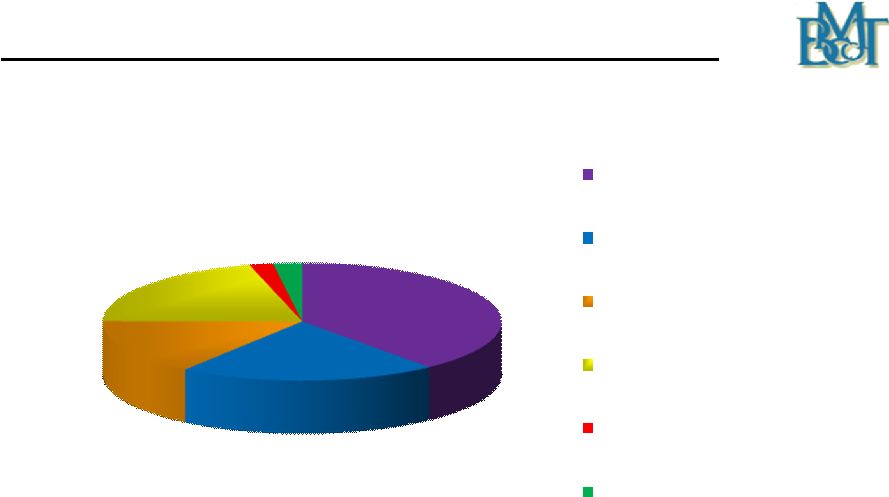

Loan Composition at December 31, 2012

$546

$292

$212

$288

$27

$33

Commercial Mortgages

(39%)

Commercial & Industrial

(21%)

Home Equity & Consumer

Loans (15%)

Residential Mortgages

(21%)

Construction

(2%)

Leases

(2%)

($ in millions)

Total loans and leases of $1,398 million |

28

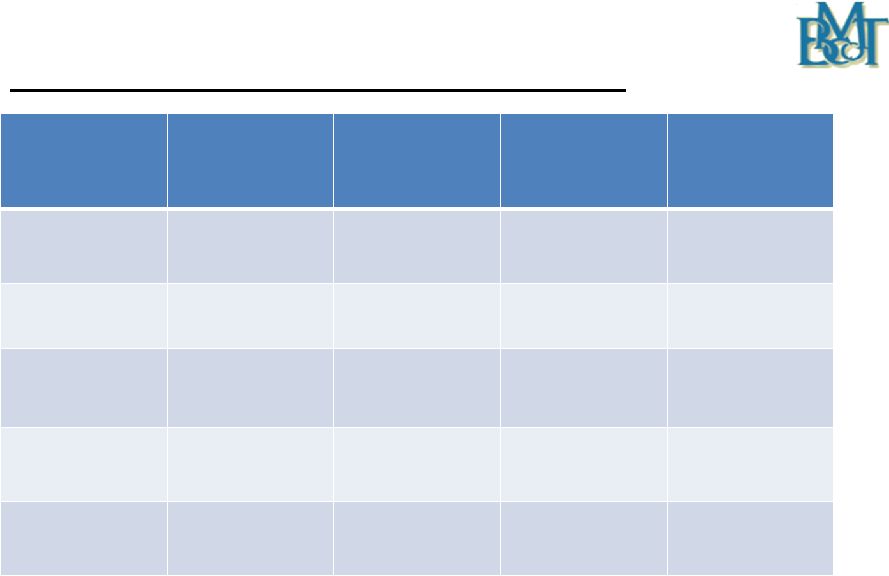

Quarterly Asset Quality Data

4

th

Qtr

2012

3

rd

Qtr

2012

2

nd

Qtr

2012

1

st

Qtr

2012

4

th

Qtr

2011

Non-performing loans and leases as

a % of portfolio loans and leases

1.06%

1.05%

1.41%

1.73%

1.11%

Allowance as a % of portfolio loans

and leases

1.03%

1.04%

1.01%

1.00%

0.98%

Non-performing assets as a % of

total assets

0.77%

0.78%

1.03%

1.25%

0.84%

Annualized net loan and lease

charge-offs as a % of average

quarterly loans and leases

0.07%

0.16%

0.28%

0.23%

-0.01% |

29

Loan and Lease Updates

1st quarter 2013 loan pipeline looks promising.

Recent hires of experienced lenders coupled with the new team in

Delaware from the recent acquisition has increased new loan

opportunities.

The lease portfolio at December 31, 2012 is $33 million, has an average

yield of 9.83% and a delinquency rate of 0.22%. |

30

Summary

Outstanding franchise in a stable market

Focus on Wealth Services, Business Banking and Residential Mortgage

Diversified income base –

non interest income 42% of total revenue for

the twelve months ended December 21, 2012

Outstanding loan quality in a difficult economic environment

Sound business strategy, strong asset quality, well capitalized and solid

risk management procedures serve as a foundation for potential strategic

expansion

Focus on earnings per share growth

Making IT infrastructure investments that will provide longer term benefits

|

31

Ted Peters, Chairman

610-581-4800

tpeters@bmtc.com

Frank Leto, EVP

610-581-4730

fleto@bmtc.com

Joseph Keefer, EVP

610-581-4869

jkeefer@bmtc.com

Duncan Smith, CFO

610-526 –2466

jdsmith@bmtc.com

Chad Fortenbaugh –

Shareholder Relations –

610-581-4823 –

cfortenbaugh@bmtc.com |

32

This presentation contains statements which, to the extent that they are not

recitations of historical fact may constitute forward-looking statements

for purposes of the Securities Act of 1933, as amended, and the Securities

Exchange Act of 1934, as amended. Such forward-looking statements may

include financial and other projections as well as statements regarding Bryn

Mawr Bank Corporation’s (the “Corporation”) that may include future

plans, objectives, performance, revenues, growth, profits, operating

expenses or the Corporation’s underlying assumptions. The words

“may”, “would”, “should”, “could”, “will”, “likely”, “possibly”, “expect,”

“anticipate,”

“intend”, “estimate”, “target”,

“potentially”, “probably”, “outlook”, “predict”,

“contemplate”,

“continue”,

“plan”,

“forecast”,

“project”

and

“believe”

or

other

similar

words,

phrases

or concepts may identify forward-looking statements. Persons reading or present

at this presentation are cautioned that such statements are only

predictions, and that the Corporation’s actual future results or

performance may be materially different. Such forward-looking statements

involve known and unknown risks and uncertainties. A number of factors, many

of which are beyond the Corporation’s control, could cause our actual results,

events or developments, or industry results, to be materially different from any

future results, events

or

developments

expressed,

implied

or

anticipated

by

such

forward-looking

statements,

and so our business and financial condition and results of operations could be

materially and adversely affected.

Safe Harbor |

33

Safe Harbor (continued)

Such factors include, among others, our need for capital, our ability to control

operating costs and expenses, and to manage loan and lease delinquency

rates; the credit risks of lending activities and overall quality of the

composition of our loan, lease and securities portfolio; the impact of

economic conditions, consumer and business spending habits, and real estate market

conditions on

our

business

and

in

our

market

area;

changes

in

the

levels

of

general

interest

rates,

deposit

interest rates, or net interest margin and funding sources; changes in banking

regulations and policies and the possibility that any banking agency

approvals we might require for certain activities will not be obtained in a

timely manner or at all or will be conditioned in a manner that would impair

our ability to implement our business plans; changes in accounting policies and

practices; the inability of key third-party providers to perform their

obligations to us; our ability to attract and retain key personnel;

competition in our marketplace; war or terrorist activities; material

differences in the actual financial results, cost savings and revenue enhancements

associated with our acquisitions including our contemplated acquisition of

the First Bank of Delaware; and other factors as described in our securities

filings. All forward-looking statements and information made herein are

based on Management’s current beliefs and assumptions as of February 06,

2013

and speak only as of that date. The Corporation does not undertake to update

forward- looking statements. |

34

Safe Harbor (continued)

For a complete discussion of the assumptions, risks and uncertainties related to

our business, you are encouraged to review our filings with the Securities

and Exchange Commission, including our most recent annual report on Form

10-K, as well as any changes in risk factors that we may identify in our

quarterly or other reports filed with the SEC. This

presentation

is

for

discussion

purposes

only,

and

shall

not

constitute

any

offer

to

sell

or

the

solicitation

of

an

offer

to

buy

any

security,

nor

is

it

intended

to

give

rise

to

any

legal

relationship

between

the

Corporation

and

you

or

any

other

person,

nor

is

it

a

recommendation

to

buy

any

securities or enter into any transaction with the Corporation.

The information contained herein is preliminary and material changes to such

information may be made at any time. If any offer of securities is made, it

shall be made pursuant to a definitive offering memorandum or prospectus

(“Offering Memorandum”) prepared by or on behalf of the

Corporation, which would contain material information not contained herein and

which shall supersede, amend and supplement this information in its

entirety. Any decision to invest in the Corporation’s securities

should be made after reviewing an Offering Memorandum, conducting such

investigations as the investor deems necessary or appropriate, and consulting the investor’s

own legal, accounting, tax, and other advisors in order to make an independent

determination of the suitability and consequences of an investment in such

securities. |

35

Safe Harbor (continued)

No offer to purchase securities of the Corporation will be made or accepted prior

to receipt by an investor of an Offering Memorandum and relevant

subscription documentation, all of which must be reviewed together with the

Corporation’s then-current financial statements and, with respect to

the subscription documentation, completed and returned to the Corporation in its

entirety. Unless purchasing in an offering of securities registered

pursuant to the Securities Act of 1933, as amended,

all

investors

must

be

“accredited

investors”

as

defined

in

the

securities

laws

of

the

United States before they can invest in the Corporation.

|

36

*Non GAAP Measures

Our management uses non-GAAP financial measures in their analysis of

our performance and believes that they provide useful supplemental

information that is essential to an investor’s understanding of Bryn Mawr

Bank Corporation’s operating results. These non-GAAP

financial measures should not be viewed as a substitute for financial

measures determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP performance measures that may be presented by

other companies. A reconciliation from GAAP measures to non-GAAP measures

related to the exclusion of tax-effected due diligence and

merger-related expenses is provided on the following two slides:

|

37

*Reconciliation of GAAP Measures to Non-GAAP Measures

$ in thousands

Full Year 2012

Full Year 2011

Net income (a GAAP measure)

$21,147

$19,602

Add: Tax-effected due diligence and

merger-related expenses (35% tax rate)

$1,709

$349

Net income, excluding tax-effected due

diligence and merger-related expenses

(a non-GAAP measure)

$22,856

$19,951

•Return on average assets, excluding tax-effected due diligence and

merger-related expenses (a non-GAAP measure) is calculated by

dividing net income, excluding tax-effected due diligence and merger-related expenses

(a non-GAAP measure) by average assets.

•Return on average equity, excluding tax-effected due diligence and

merger-related expenses (a non-GAAP measure) is calculated by

dividing net income, excluding tax-effected due diligence and merger-related expenses

(a non-GAAP measure) by average equity.

•Return on tangible common equity, excluding tax-effected due diligence

and merger-related expenses (a non- GAAP measure) is calculated by

dividing net income, excluding tax-effected due diligence and merger-related

expenses (a non-GAAP measure) by average tangible common equity.

|

38

*Reconciliation of GAAP Measures to Non-GAAP Measures (cont’d)

$ in thousands

4

th

Qtr

2012

3

rd

Qtr

2012

2

nd

Qtr

2012

1

st

Qtr

2012

4

th

Qtr

2011

Non-interest expense

(a GAAP measure)

$21,089

$18,889

$18,128

$16,795

$16,739

Less: Tax-effected due

diligence and merger-related

expenses (35% tax rate)

$774

$205

$594

$136

($51)

Non-interest expense,

excluding tax-effected due

diligence and merger-related

expenses (a non-GAAP

measure)

$20,315

$18,684

$17,534

$16,659

$16,790

•The efficiency ratio, excluding tax-effected due diligence and

merger-related expenses (a non-GAAP measure), is calculated by

dividing non-interest expense, excluding tax-effected due diligence and merger-related expenses

(a non-GAAP measure) by the sum of net interest income and non-interest

income. |