Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITED SURGICAL PARTNERS INTERNATIONAL INC | d478272d8k.htm |

| EX-99.1 - PRESS RELEASE - UNITED SURGICAL PARTNERS INTERNATIONAL INC | d478272dex991.htm |

Lenders’

Call

February 5, 2013

Exhibit 99.2 |

2

DISCLAIMERS

SAFE HARBOR STATEMENT

This presentation contains forward-looking statements, including those

regarding United Surgical Partners International, Inc. and the services it

provides. Investors are cautioned not to place an undue reliance on

these forward-looking statements, which will speak only as of the date

of this presentation. United Surgical Partners International, Inc. undertakes no obligation

to publicly revise these forward-looking statements.

NON-GAAP MEASUREMENT

We

have

used

the

non-GAAP

financial

measurement

term

“EBITDA.”

EBITDA

is

calculated

as

operating income plus net gain (loss) on deconsolidations, disposals, impairments

and depreciation

and

amortization.

USPI

uses

EBITDA

and

EBITDA

less

noncontrolling

interests

as

analytical indicators for purposes of allocating resources and assessing

performance. EBITDA is commonly used as an analytical indicator within

the health care industry and also serves as a measure of leverage capacity

and debt service ability. EBITDA should not be considered as a measure of

financial performance under generally accepted accounting principles, and the items

excluded from EBITDA could be significant components in understanding and assessing

financial performance.

Because EBITDA is not a measurement determined in accordance with generally

accepted accounting principles and is thus susceptible to varying

calculation methods, EBITDA as presented by USPI may not be comparable to

similarly titled measures of other companies. |

3

Presenters

United Surgical Partners International

Bill Wilcox, CEO

Jason Cagle, CFO

Mark Kopser, Former CFO

J.P. Morgan

Greg Maxon, Vice President |

4

AGENDA

Greg Maxon, J.P. Morgan

I. Transaction summary

II. Company overview

III. Historical financials

IV. Transaction and credit facility overview

Jason Cagle, CFO USPI

Bill Wilcox, CEO USPI

V. Public Q&A

Greg Maxon, J.P. Morgan |

I.

TRANSACTION SUMMARY |

6

United

Surgical

Partners

International

(“USPI”

or

the

“Company”)

is

seeking

to

amend

its

existing

credit

facilities

USPI seeks to reprice the existing Revolver due 2017, Extended Term Loan due 2017

and the Add-on Term Loan due 2019

–

$125

million

Revolver

due

2017:

L+300-325

1

–

$310

million

Extended

Term

Loan

due

2017:

L+300-325

with

a

0.75%

LIBOR

floor

2

–

$522

million

Add-on

Term

Loan

due

2019:

L+325-350

with

a

1.00%

LIBOR

floor

3

USPI is also seeking to raise a new $150 million Incremental Term Loan due 2019 to

refinance the $144 million Non-extended Term Loan due 2014

–

The tranche will be fungible with the Add-on Term Loan due 2019

The terms of the tranches will remain substantially the same as existing with the

exception of the following: 101 soft call protection will be refreshed on

the Extended and Add-on Term Loans for 6 months The Company is

seeking to increase the maximum incremental debt amount to $200 million The

transaction will be done via an amendment and cashless roll will be accommodated

Lenders

in

the

non-extended

tranche

due

2014

that

do

not

elect

to

roll

into

the

new

$150

million

Incremental Term Loan will be repaid at closing

The transaction is expected to close on April 4, 2013 when the existing 101 soft

call protection expires Lenders

will

be

paid

a

ticking

fee

equal

to

50%

of

the

drawn

spread

on

the

repriced

tranches

and

the

new

$150 million Incremental Term Loan tranche between the allocation date and

closing TRANSACTION SUMMARY

Current pricing on Revolver is L+450

Current pricing on Extended term loan is L+450 with a 0.75% floor

Current pricing on Add-on term loan is L+475 with a 1.25% floor

1

2

3 |

7

Uses

Amount ($mm)

Pay down non-extended term loan

$144.4

Fees & expenses

7.1

Total uses

$151.5

1

Based on 2012E Adjusted EBITDA less minority interest of $238mm

SOURCES AND USES &

PRO FORMA CAPITALIZATION

Sources

Amount ($mm)

New Incremental Term Loan

$150.0

Cash from balance sheet

1.5

Total sources

$151.5

Capitalization as of December 31, 2012E ($mm)

Sources and Uses ($mm)

Current

Pro forma

Total Leverage

1

Net leverage

1

Cash and cash equivalents

$51.2

$49.7

$125mm Revolver

due 2017

$ –

$ –

Non-extended Term Loan

due 2014

144.4

–

Extended Term Loan

due 2017

310.1

310.1

Add-on

Term Loan

B

due 2019

521.8

521.8

New Incremental Term Loan

due 2019

–

150.0

Total facility-level debt

63.2

63.2

Total senior secured debt

$1,039.5

$1,045.1

4.4x

4.2x

Senior Unsecured Notes

due 2020

440.0

440.0

Total debt

$1,479.5

$1,485.1

6.2x

6.0x |

II.

COMPANY OVERVIEW |

9

$2.2+bn of revenues under management 213 facilities that will perform over 900,000

cases by over 8,800 physician utilizers

High quality, low cost provider of surgical services

Leading operator

in an attractive

industry segment

Proven management

team

Attractive business

and payor mix

KEY HIGHLIGHTS

High margin, elective procedures with over half of revenue from orthopedic

specialties 78% private insurance; operating discipline yields bad debt

expense of ~2% of revenues Two-thirds of our facilities are owned in a

partnership with and partially owned by various not- for-profit

healthcare systems (hospital partners) Provides long-term strategic

stability in the market place with strong brand reputation and

stability

Working with existing partners (physicians and hospitals) to grow market share and

enhance strategic positioning

Adjusted EBITDA CAGR of 13% from 2006 to 2012E

Cumulative Free Cash Flow of $330 million from 2009 to 2012

Estimated 2012 adjusted EBITDA of $238mm

Majority of USPI’s senior management has been with the Company over 10

years Consistent financial

performance

Focused on key

strategic markets with

significant share

Unique JV

partnership

strategy

1

Consolidated Adjusted EBITDA less noncontrolling interest

2

Consolidated FCF calculated as adjusted EBITDA less capital expenditures, cash

interest, cash taxes and change in working capital (defined 3

Represents pro forma adjusted EBITDA-MI

1

2

3

as increases (decreases) in cash from changes in operating assets and liabilities,

net effects from purchases of new businesses) |

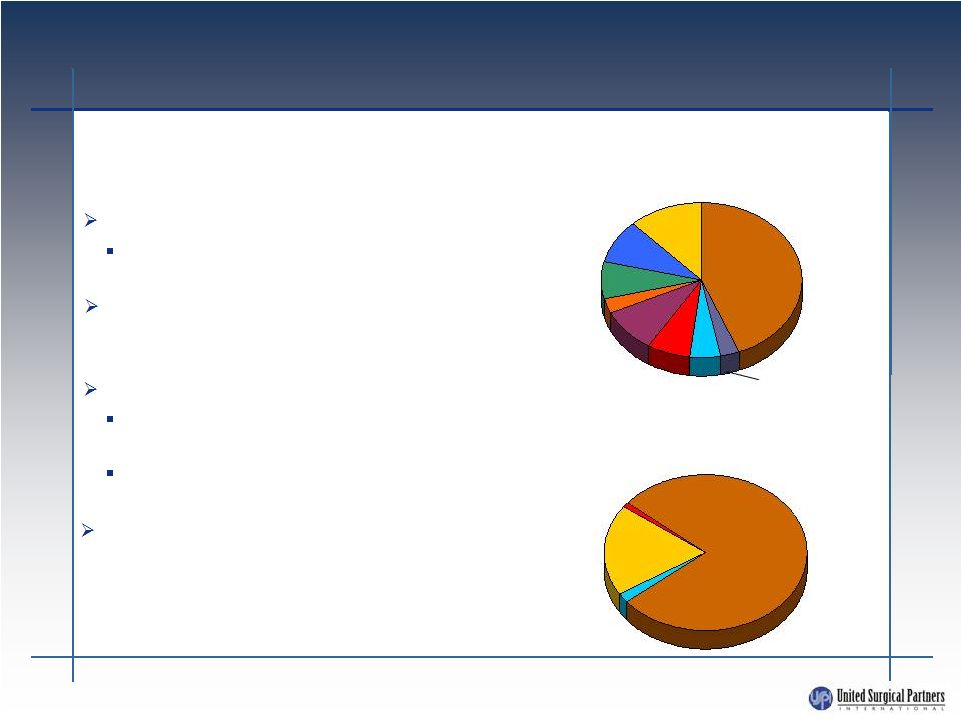

10

FAVORABLE REVENUE AND PAYOR

MIX

High margin, elective procedures

56% of revenue mix from orthopedic

and pain management

Diversification of specialties insulates USPI

from negative utilization and specialty pricing

changes

78% private insurance

Insurance companies favor low cost

providers

Modest exposure to government

reimbursement fluctuations

Reliable payors and operating discipline

yields bad debt expense of ~2% of revenues

and receivable days outstanding is under 35

days

Low risk cash flows from high margin

specialties and reliable payors:

Orthopedic

Gynecology

ENT

GI

Cosmetic

Ophthalmology

Medical/Other

Pain Mgmt

12%

12%

44%

44%

3%

3%

5%

5%

7%

7%

9%

9%

8%

8%

3%

3%

9%

9%

2012 Revenue Mix

Private

Insurance

Self-pay

19%

19%

78%

78%

2%

2%

2012 Payor Mix

Government

General

1%

1%

Other |

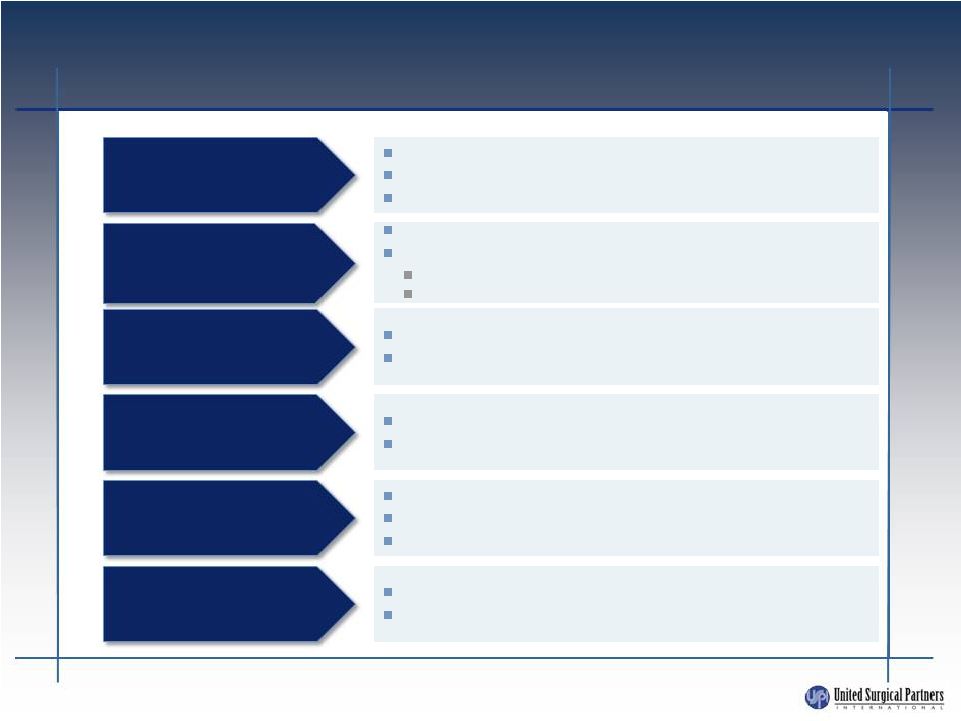

11

STRONG FINANCIAL AND OPERATING

PERFORMANCE POST LBO

86 acquisitions

25 de novo facility development

16 new Health System Partners

Facility revenue CAGR of 13% from 2006 to 2012E

Positive each of the past 5 years

Same facility revenue + 6.2% for 2011

Same facility revenue +5.7% for 2012E

Facility EBITDA CAGR of 13% from 2006 through 2012E

Facility EBITDA margins of 30.5% for 2012E

25% SWB as a % of revenue

3% G&A as a % of system-wide revenue

Installed decision support system

Improved quality management system

EHR Investment

40 facilities divested

75% of revenue from top 10 markets

Expansion

Facility revenue growth

Facility EBITDA

Cost management

System enhancements

Portfolio management

11 |

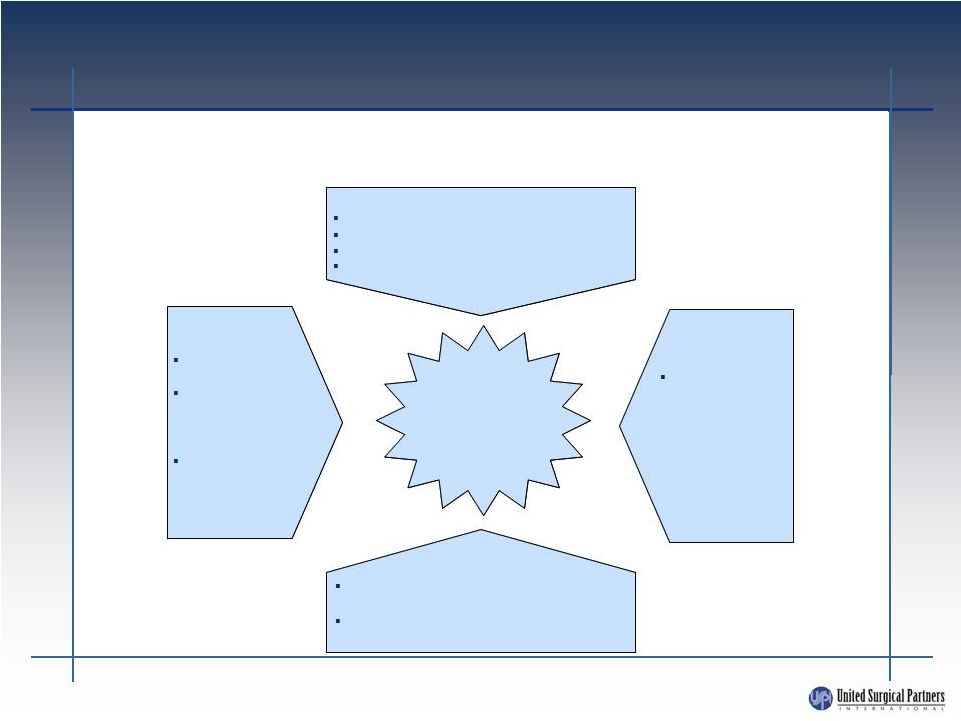

12

POSITIONED FOR REFORM

OPPORTUNITIES

Post-reform, positioned to play an important role in managing increased need

for surgical services due to coverage of previously uninsured lives

Health System Partnerships

Physician

Partners

Professional Management

USPI is proven,

trusted partner

USPI involvement

can alleviate

historical distrust of

hospitals

USPI can help

provide targeted

solutions for

strategic

positioning

JV model in place

Commitment to highest level of quality service

Comfort regarding proper utilization of brand

Ability to assist with out-of-

hospital strategies

Proven ability to execute and operate low

cost, high quality facilities

Proven ability in managing professional

partnerships

Opportunities

for USPI to

assist with

enhancement

of strategic

network

capabilities

Access to

Capital

In a rapidly

changing

environment,

ability to enhance

speed to market

with new models

where there are

capital

constraints |

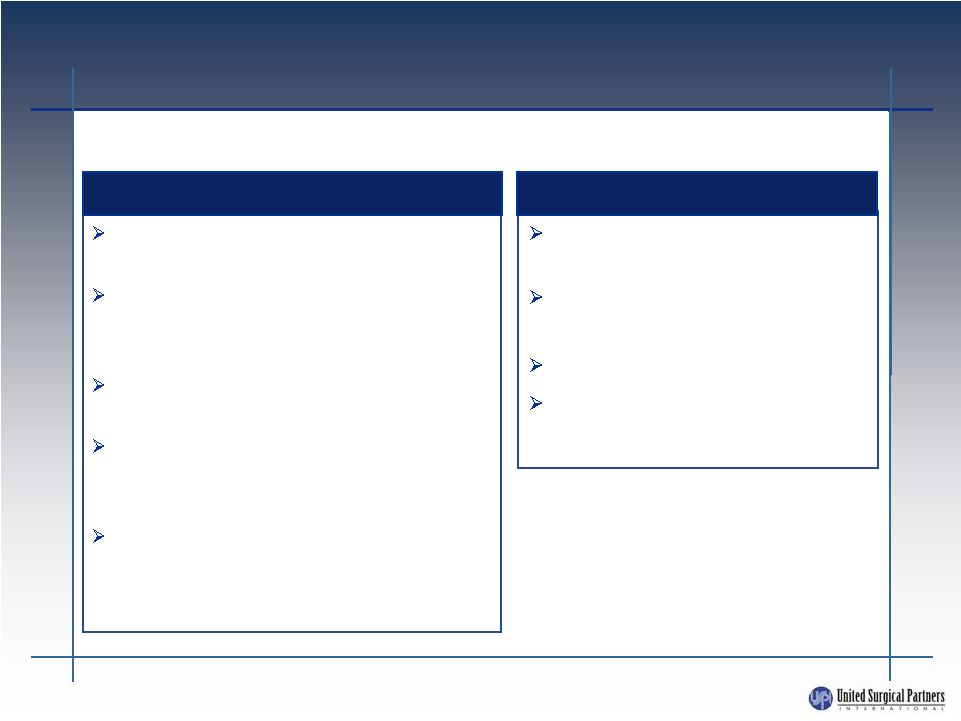

13

HEALTHCARE SYSTEM PARTNERS

Benefits to Healthcare Systems

Leverage USPI’s operational expertise

and singular focus

Provides a strategy to promote

physician alignment and strategic

network capabilities

Provides defensive mechanism to

maintain short-stay surgical business

Provides capital and spreads risk

through USPI and physicians’

investment

Provides an opportunity to expand in

new markets at lower capital outlay

than a hospital

Benefits to USPI

Provides long-term strategic

stability in the marketplace

Provides brand, image,

reputation and credibility

Accelerates growth

Enhances relationships with

managed care payors

148 facilities are in a partnership with a healthcare system

|

USPI’s

strategy

of

partnering

with

not-for-profit

healthcare

systems

aligns the Company’s facilities with strong networks of physicians

and hospitals that are prominent in their communities and known

for providing high quality care

HEALTHCARE SYSTEM PARTNERS

14

BON SECOURS HEALTH SYSTEM, INC. |

15

GROWTH STRATEGY

Work with existing partners (physicians and hospitals) to grow market

share and enhance strategic positioning

Poised

to

react

to

current

economic

conditions

and

legislative

changes

Acquisition of troubled facilities

Selective acquisition of strong facilities

Selective de novo development

Selective acquisition of multi-facility companies

Selectively enter new markets with existing or new partners

Attractive demographics and/or payor characteristics

Prominent health system that embraces physician

alignment

strategy

Prominent physicians who are influential in the market

|

III. HISTORICAL FINANCIALS |

17

Operating performance

Cases increased 2.5% from prior year

Consolidated net revenues increased 8% to $540.2 million compared with

$499.2 million in the prior year period

Systemwide revenue increased 12% and consolidated revenue increased 8%

Net revenue per case increased 3.2%

EBITDA less minority interests was $204.0 million, a $20.7 million, or 11.3%,

increase as compared to 2011

Development activity

Acquired 14 facilities and opened 2 de novo facilities

Summary of 2012E results |

18

2012E FINANCIAL UPDATE

Estimated GAAP Financials ($mm)

Year Ended December 31,

Variance

($mm)

2011

2012E

$

%

Revenues

$499.2

$540.2

$41.1

8.2%

% change

5.3%

8.2%

Operating expenses

$289.5

$326.0

$36.6

12.6%

% of sales

58.0%

60.3%

General and administrative expenses

38.0

41.4

3.4

9.0%

Total operating costs

$327.5

$367.4

$40.0

12.2%

Equity in earnings of unconsolidated affiliates

83.1

96.4

13.3

15.9%

Depreciation and amortization

21.2

24.0

2.8

13.1%

Operating income

$233.7

$245.2

$11.6

5.0%

% margin

46.8%

45.4%

EBITDA less noncontrolling interests

$183.4

$204.1

$20.7

11.3%

% margin

36.7%

37.8%

% growth

16.9%

11.3% |

19

SUSTAINED REVENUE GROWTH

Facilities

operated

at year end

165

185

200

213

12%

13%

7%

9%

6%

6%

5%

8%

0%

3%

6%

9%

12%

15%

2009

2010

2012E

2011

Same facility revenue growth

Systemwide revenue growth

Systemwide revenue growth and same facility revenue growth ($mm)

|

20

2012E ADJUSTED EBITDA

1

BRIDGE

1

Adjusted EBITDA less noncontrolling interest

2

USPI is in discussions to sell a portion of its ownership in several facilities to

a health system partner. If completed, this will reduce our EBITDA by $10-13mm, final

terms have not been determined

1

($mm)

20

-

$204.0

$238.0

2

$0.5

$2.2

$2.0

$1.7

$27.6

EBITDA -

MI

De novo hospital

losses

Transaction Costs

Management Fees Equity compensation

WCAS

Acquisitions

completed by

12/31/12

MI as of 12/31/12

Proforma EBITDA |

IV.

TRANSACTION AND CREDIT FACILITY OVERVIEW |

22

SUMMARY TERMS AND CONDITIONS

1

Current pricing on Revolver is L+450

2

Current pricing on Extended term loan is L+450 with a 0.75% floor

3

Current pricing on Add-on term loan is L+475 with a 1.25% floor

Borrower

United Surgical Partners International, Inc. (the “Borrower”)

Facility

Facility

Amt ($mm)

Maturity

Spread

Floor

Revolver

1

$125

4/3/17

L+300-325

-

Extended term loan

2

$310

4/19/17

L+300-325

0.75%

Add-on term loan

3

$522

4/3/19

L+325-350

1.00%

Incremental term loan

$150

4/3/19

L+325-350

1.00%

Expected corporate credit

ratings

B2 / B

Purpose

Reprice

existing

$125mm

revolver, $310mm

extended

term

loan

and

$522mm

add-on

term

loan;

refinance

$144mm

non-extended

term

loan

and

pay

related

fees

and

expenses

Lead Arranger

J.P. Morgan Securities LLC

JPMorgan Chase Bank, N.A.

Security

Same as existing

Guarantors

Same as existing

Financial covenants

Same as existing

Negative covenants

Same as existing

Mandatory prepayments

Same as existing

Incremental facility

The Company is seeking to increase the maximum incremental debt amount to $200

million Soft call protection

101 soft call protection will be refreshed for 6 months with respect to the

extended term loan Administrative Agent

Ticking fee

Lenders will be paid a ticking fee equal to 50% of the drawn spread on the

repriced tranches and the new $150 million Incremental

Term Loan tranche between the allocation date and closing

Delayed closing

Transaction is expected to close on 4/4/2013

tranche

maturing

in

2017

and

the

add-on

term

loan

tranche

maturing

in

2019 |

23

TRANSACTION TIMETABLE

2/12/13

Commitments and

signature pages due at 12:00pm

4/4/13

Expected closing

date February 2013

March 2013

April 2013

S

M

T

W

T

F

S

S

M

T

W

T

F

S

S

M

T

W

T

F

S

1

2

1

2

1

2

3

4

5

6

3

4

5

6

7

8

9

3

4

5

6

7

8

9

7

8

9

10

11

12

13

10

11

12

13

14

15

16

10

11

12

13

14

15

16

14

15

16

17

18

19

20

17

18

19

20

21

22

23

17

18

19

20

21

22

23

21

22

23

24

25

26

27

24

25

26

27

28

24

25

26

27

28

29

30

28

29

30

31

Bank Holiday

Key transaction date

Date

Event |

V.

PUBLIC Q&A |