Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Lans Holdings, Inc. | ex31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - Lans Holdings, Inc. | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Lans Holdings, Inc. | ex31_2.htm |

| EX-23.1 - EXHIBIT 32.1 - Lans Holdings, Inc. | ex23_1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Lans Holdings, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

|

For the fiscal year ended November 30, 2012

|

||||||

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT | |||||

|

For the transition period from _________ to ________

|

||||||

| Commission file number: 333-148385 | ||||||

| Lans Holdings, Inc. | |

| (Exact name of registrant as specified in its charter) | |

| Nevada | TBA |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

Penthouse Menara Antara, No 11 Jalan Bukit Ceylon, Kuala Lumpur, Malaysia |

N/A |

| (Address of principal executive offices) | (Zip Code) |

|

Registrant’s telephone number: 001-63-6017-348-8798 |

|

|

Securities registered under Section 12(b) of the Exchange Act:

| |

| Title of each class | Name of each exchange on which registered |

| none | not applicable |

|

Securities registered under Section 12(g) of the Exchange Act:

| |

|

Title of each class none | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [X] No [ ]

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [ ] Yes [X] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [X] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Not available

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 2,150,000 as of February 4, 2013.

| 1 |

| 2 |

PART I

Company Overview

We were incorporated as “Lans Holdings Inc.” (“Lans”) on November 13, 2007 in the State of Nevada for the purpose of developing, manufacturing, and selling hexagon fishing nets produced specifically for fishing equipment retailers in Southeast Asia (our "Product"). Such a product will allow fishers to effectively increase their fishing output without the problems presented by fishing nets presently in use in the Southeast Asian market. We require additional financing in order to continue the process of designing and developing our Product. If we are able to secure financing, we will be able to implement our business plan starting with refining our net through experiments, testing water pressure resistance, extension capability, and sailing speed variations. Once we are satisfied that our Product will compete effectively in the Southeast Asian Fishing Equipment Industry by being the most functional and efficient fishing net, we will begin the manufacture and distribution of the Product to fishing equipment retailers.

Our operations office is located at Penthouse Menara Antara, No 11 Jalan Bukit Ceylon, Kuala Lumpur, Malaysia.

Fishing Methods

Bottom trawling, or Benthic trawling, is a fishing method which involves towing trawl nets along the sea floor, as opposed to pelagic trawling, where a net is towed higher in the water column to catch large schools of fish such as anchovies, shrimp, tuna, and Mackerel. The turbidity produced by bottom trawling can have an environmental impact significant distances from the site of the trawl activity. The absolute magnitude of suspended solids introduced into the water column from bottom trawling activity is much greater than any other man-made source of suspended solid pollution in the world's oceans. The UN Secretary General reported that 95% of damage to seamount ecosystems worldwide is caused by deep sea bottom trawling. Today, most major, responsible fishing countries restrict bottom trawling within their jurisdictions.

Blast fishing or dynamite fishing describes the practice of using dynamite, homemade bombs or other explosives to stun or kill schools of fish for easy collection. This practice can be extremely destructive to the surrounding ecosystem, as the shockwaves often destroy the underlying habitat (such as coral reefs close to a coastline) that supports the fish. The frequently improvised nature of the explosives used also means danger for the fishermen as well, with accidents and injuries a common occurrence. Although outlawed, the practice remains widespread in Southeast Asia. In the Philippines, where the practice is well documented, blast fishing dates back to even before the First World War.

Cyanides are used to capture live fish near coral reefs for the aquarium and seafood market. This illegal fishing occurs mainly in or near the Philippines, Indonesia, and the Caribbean to supply the 2 million marine aquarium owners in the world. Many fish caught in this fashion die either immediately or in shipping. Those that survive often die from shock or from massive digestive damage. The high concentration of cyanide on reefs harvested in this fashion damages the coral polyps and has also resulted in cases of cyanide poisoning among local fishermen and their families.

The environmentally devastating effects and untenable nature of fishing methods such as bottom trawling, blast fishing, and cyanide fishing, in conjunction with governmental regulations and bans on such methods, has led to an increased interest in catching middle-and upper-water level fish with safer and more environmentally friendly fishing gear.

| 3 |

Pelagic Trawling Nets

Pelagic trawling is a method of fishing that involves actively pulling a fishing net through the water behind one or more boats, called trawlers. When two boats are used (pair trawling), the horizontal spread of the net is provided by the boats, with one warp attached to each boat. However, single-boat trawling is more common. Here, the horizontal spread of the net is provided by trawl doors. Trawl doors are available in various sizes and shapes and may be specialized to remain elevated in the water for Pelagic (mid or upper water level) trawling. In all cases, doors essentially act as wings, using a hydrodynamic shape to provide horizontal spread. As with all wings, the towing vessel must go at a certain speed for the doors to remain standing and functional. This speed varies, but is generally in the range of 2.5-4.0 knots.

The vertical opening of a trawl net is created using flotation on the upper edge and weight on the lower edge of the net mouth. Trawls are tunnel shaped nets that with a closed tail where the fish are collected. Trawl nets can be modified by changing variables such as mesh size to meet specific needs.

Our Product

Projections indicate that the Southeast Asian Fishing Industry will continue to rise as a leader in the global fishing market. The rapid expanse of the region’s market combined with increased government regulations on and a heightened awareness of the devastating effects of bottom trawling, blast fishing, and cyanide fishing, have led to a rising demand for fishing equipment designed to catch middle-and upper-water level fish, thus resulting in what we anticipate will be a highly receptive potential market for our Product.

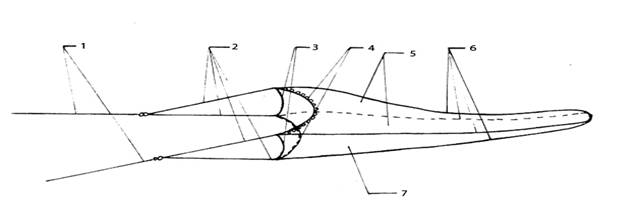

Once we obtain additional financing, we will be able to commence the process of developing a fish net intended for fishing middle-and upper-water level fish. The net is being designed with excellent extension capability and specific qualities to reduce water resistance and damage to the net. By reducing water resistance, we allow ships trawling with our net to sail at higher speeds, thereby increasing their fishing output. Below is a diagram of our Product as currently designed:

- Boat connection cord

- Net fram connection cord

- Left/Right side frames

- Top/Bottom frames

- Side net body pieces

- Backbone frame

- Side net body pieces

| 4 |

To date, we have designed and developed our Product by conducting experiments to improve on quality and cost. These experiments include testing our Product with variant levels of water pressure resistance and sailing speeds, as well as measuring extension capability. We are in the process of refining these essential qualities of our Product, which will be integral to its success. We are searching for the lowest priced components available in the market in our efforts to reduce costs. Refining our Product will ensure that it is durable, efficient, and practicable for large-volume fishing.

Competition

We compete with a number of established manufacturers, importers, and distributors who sell fishing nets to fishing equipment retailers. These companies enjoy brand recognition which exceeds that of our brand name. We compete with several manufacturers, importers, and distributors, who have significantly greater financial, distribution, advertising, and marketing resources than we do, including:

- Wenzhou Fishing Net Factory’s Trammel Nets, made by hanging three webs to a shingle tip and bottom line. There are two outside webs or walls and an inside web of small mesh. The outside webs are larger size mesh. When fish strike the net, they go through the first outside mesh or wall, and then strike the inside web, pushing it through the other outside web, where it forms a pocket and holds the fish. Sometimes several big fish will be found in one pocket, where they have followed each other.

- Wenzhou also makes a nylon monofilament casting net with a knitting type of mesh doubled at every other mesh vertically, and also a nylon monofilament single- and double-knot net.

- Anhui Golden Monkey Science and Technology Co., Ltd. produces a variety of nylon multifilament and monofilament fishing nets.

- Long Xing Plastic Co., Ltd. makes a net that they promote as anti-ultraviolet radiation, thermo-stable, weather-proof, stable in quality, long lifetime, and widely applied in sea water fishing and fresh-water fishing.

- Shantou Qile Silk Screen Industry Co., Ltd., produces nets suitable for deep or shallow fishing that are soft and transparent.

We compete primarily on the basis of quality, brand name recognition, and price. We believe that our success will depend upon our ability to remain competitive in our product areas. The failure to compete successfully in the future could result in a material deterioration of customer loyalty and our image and could have a material adverse effect on our business.

Intellectual Property

Once we determine the final design for our Product, we intend to file a patent on this design. We will file for patent pending status as we design and develop a prototype for our first net. We will apply for patent protection and/or copyright protection in Southeast Asia, the United States, and other jurisdictions.

We intend to aggressively assert our rights under trade secret, unfair competition, trademark and copyright laws to protect our intellectual property, including product design, proprietary manufacturing processes and technologies, product research and concepts and recognized trademarks. These rights are protected through the acquisition of patents and trademark registrations, the maintenance of trade secrets, the development of trade dress, and, where appropriate, litigation against those who are, in our opinion, infringing these rights.

While there can be no assurance that registered trademarks will protect our proprietary information, we intend to assert our intellectual property rights against any infringer. Although any assertion of our rights can result in a substantial cost to, and diversion of effort by, our company, management believes that the protection of our intellectual property rights is a key component of our operating strategy.

| 5 |

Regulatory Matters

We are unaware of and do not anticipate having to expend significant resources to comply with any governmental regulations of the fishing equipment industry. We are subject to the laws and regulations of those jurisdictions in which we plan to sell our product, which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes. In general, the development, manufacture, and sale of our Product in Southeast Asia are not subject to special regulatory and/or supervisory requirements.

Employees

We have no other employees other than our officers and directors. Our President oversees all responsibilities in the areas of corporate administration, business development, and research. We intend to expand our current management to retain skilled directors, officers, and employees with experience relevant to our business focus. Our current management team is highly skilled in technical areas such as researching and developing our product, but not skilled in areas such as marketing our product and business management. Obtaining the assistance of individuals with and in-depth knowledge of operations and markets will allow us to build market share more effectively. We intend on employing sales representatives in Malaysia when our product is ready for production and shipping and in other Southeast Asian nations when we are ready to expand internationally.

Environmental Laws

We have not incurred and do not anticipate incurring any expenses associated with environmental laws.

Our operations office is located at Penthouse Menara Antara, No 11 Jalan Bukit Ceylon, Kuala Lumpur, Malaysia.

We are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is quoted under the symbol “LAHO” on the OTCBB operated by the Financial Industry Regulatory Authority, Inc. (“FINRA”) and the OTCQB operated by OTC Markets Group, Inc. Few market makers continue to participate in the OTCBB system because of high fees charged by FINRA. Consequently, market makers that once quoted our shares on the OTCBB system may no longer be posting a quotation for our shares. The criteria for listing on either the OTCBB or OTCQB are similar and include that we remain current in our SEC reporting. Our reporting is presently current and, since inception, we have filed our SEC reports on time.

| 6 |

We do not have an active trading market for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder may be unable to resell his securities in our company.

The following tables set forth the range of high and low prices for our common stock for the each of the periods indicated as reported by the OTCQB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Year Ending November 30, 2012 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| November 30, 2012 | N/A | N/A | ||||||||

| August 31, 2012 | N/A | N/A | ||||||||

| May 31, 2012 | N/A | N/A | ||||||||

| February 28, 2012 | N/A | N/A | ||||||||

| Fiscal Year Ending November 30, 2011 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| November 30, 2011 | N/A | N/A | ||||||||

| August 31, 2011 | N/A | N/A | ||||||||

| May 31, 2011 | N/A | N/A | ||||||||

| February 28, 2011 | N/A | N/A | ||||||||

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

| 7 |

Holders of Our Common Stock

As of November 30, 2012, we had forty (40) shareholders of record.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

1. we would not be able to pay our debts as they become due in the usual course of business, or;

2. our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Further information concerning our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC.

| 8 |

Product Development

Once we secure additional financing, we intend to continue the development and refinement of our Product. We will first focus on our experiments to improve the quality of our Product to increase its appeal to fishing equipment retailers. We feel our final Product will compete effectively in the marketplace due to its advanced extension capability, durability, high-functioning ability at rapid sailing speed, and overall large output potential relative to similar products in the marketplace.

Locate Suitable Manufacturing

We do not currently have any manufacturing facilities. Our management has contacted several fishing net weavers in Malaysia, and has begun negotiations for the manufacture of our Product on a contract basis. We are currently negotiating price, payment, customer guarantee, shipping, inventory, delivery schedule and returns. We plan to pursue this further upon the final development and commercialization of our Product. Production of our fishing net doesn't require any facilities or equipment beyond what is available to any fishing net weaver. We could contract with any fishing net weaver to manufacture our Product by following our instructions. We do not anticipate renting a warehouse at this stage of our business. The fishing net weaver that will work with us will provide packaging, storage, and shipping service for us as part of our agreement. All of the raw materials necessary to produce our Product are available in the public marketplace. We will only accept wholesale orders from wholesale distributors. Once we receive wholesale orders, we will hold the order until certain quantities, which will be pre-negotiated with fishing net weavers, are attained. Then we will contract with the fishing net weaver to produce our Product for us at pre-negotiated prices. Typically the order will be shipped within five business days after we place the order.

Sales and Distribution Strategy

Our goal is for our fishing net to become a leading product in the fishing equipment market in Southeast Asia. In order to achieve our goal, we intend to increase awareness of our Product with potential customers, who we anticipate will be major fishing equipment retailers as wholesale customers and fishers as end users. We intend to do this by engaging in the following:

- Attending national and regional fishing promotional events and conferences. There are events and conferences managed by regional and central institutions and organizations to promote fishing related products. We plan to attend a number of events attended by fishing products merchants and fishing equipment retail representatives in order to further expose our product. These events will include trade meetings, promotional events, seminars, and conferences, which are heavily attended by fishing equipment wholesalers and representatives, in order to further expose our Product.

- Developing direct marketing programs to attract retailers. In addition to attending the foregoing conferences and seminars, we intend to market directly to wholesalers and major fishing equipment retailers. Our marketing will include conducting seminars and the use of online and traditional advertising media such as newspapers and trade publications.

- Promoting to the public through internet-based and traditional media advertising. We intend to use Internet-based and traditional media to promote our product directly to the public to raise public awareness of our product.

- We will also mail our brochure to wholesale distributors, and, initially, we will do special promotions providing small amounts of our Product to a few major stores, while allowing them to pay us after three months. If the market shows an interest in our Product, they will then begin to order from us regularly.

| 9 |

Intellectual Property Protection

We intend to aggressively assert our rights under trade secret, unfair competition, trademark and copyright laws to protect our intellectual property, including product designs, proprietary manufacturing processes and technologies, product research and concepts, and recognized trademarks. These rights are protected through the acquisition of patents and trademark registrations, the maintenance of trade secrets, the development of trade dress, and, where appropriate, litigation against those who are, in our opinion, infringing these rights.

We are currently consulting with law firms to protect our brand name and product design. While there can be no assurance that registered trademarks will protect our proprietary information, we intend to assert our intellectual property rights against any infringer. Although any assertion of our rights can result in a substantial cost to, and diversion of effort by, our company, management believes that the protection of our intellectual property rights is a key component of our operating strategy.

Sales Personnel

We do not currently employ any sales personnel. In the short term, we intend to use the services of our management to sell our Product. As our Product approaches the manufacturing stage, however, we plan to employ sales representatives in Malaysia to promote and sell our product to wholesalers, retailers, and end-user fishers. These sales representatives will be responsible for soliciting, selecting and securing accounts within a particular regional territory. We expect to pay such sales representatives on a commission basis. In addition, we may decide to pay each sales representative a base salary. We expect to provide service and support to our sales representatives, including advertising and sales materials. When we determine to expand our sales internationally, we will employ sales personnel in other Southeast Asian nations.

In the event we hire sales personnel, we do not intend to do so in the next twelve months unless our revenues are enough to absorb the cost of these personnel.

Expenses

We estimate the costs to implement our business strategy over the following twelve months to be:

- Travel and Related expenses, which will consist primarily of our executive officers and directors visiting fishing equipment merchants and resellers in their sales efforts. We estimate travel and related expenses for the next twelve months will be approximately $4,000;

- Initial Marketing, which will consist of the marketing efforts discussed above, including direct marketing and attendance at trade shows. We estimate initial marketing expenses for the next twelve months will be approximately $6,000;

- Research and Development costs consist of developing and testing our Product and determining the best combination of materials and suppliers for production. We estimate that research and development costs for the next twelve months will be approximately $10,000.

We intend to obtain business capital through the use of private equity fundraising or shareholders loans. We anticipate that, in time, the primary source of revenues for our business model will be the sale of our Product.

Significant Equipment

We do not intend to purchase any significant equipment for the next twelve months.

| 10 |

Results of operations for the years ended November 30, 2012 and 2011, and for the period from Inception (November 13, 2007) to November 30, 2012

We have not earned any revenues since our inception on November 13, 2007. We do not anticipate earning revenues until such time that we have fully developed and are able to market our Product.

We incurred operating expenses in the amount of $20,933 for the year ended November 30, 2012, as compared with $15,234 for the year ended November 30, 2011. We incurred operating expenses in the amount of $108,548 for the period from November 13, 2007 (Inception) to November 30, 2012. The entire amount for each mentioned period was attributable to professional fees. We anticipate our operating expenses will increase as we undertake our plan of operations. The increase will be attributable to undertaking development of our Product and the professional fees associating with being a reporting company under the Securities Exchange Act of 1934.

We incurred a net loss in the amount of $20,933 for the year ended November 30, 2012, as compared with $15,234 for the year ended November 30, 2011. We incurred a net loss in the amount of $108,548 for the period from November 13, 2007 (Inception) to November 30, 2012. Our losses for each period are attributable to operating expenses together with a lack of any revenues.

Liquidity and Capital Resources

As of November 30, 2012, we had total current assets of $0 cash. Our total current liabilities as of November 30, 2012 were $65,548. As a result, we have a working capital deficit of $65,548 as of November 30, 2012.

Operating activities used $95,987 in cash for the period from inception (November 13, 2007) to November 30, 2012. Our net loss of $108,548for this period was the main component of our negative operating cash flow. We primarily relied on cash from the sale of our common stock and loans to fund our operations during the period ended November 30, 2012.

The success of our business plan beyond the next 12 months is contingent upon us obtaining additional financing. We intend to fund operations through debt and/or equity financing arrangements, which may be insufficient to fund our capital expenditures, working capital, or other cash requirements. We do not have any formal commitments or arrangements for the sales of stock or the advancement or loan of funds at this time. There can be no assurance that such additional financing will be available to us on acceptable terms, or at all.

Off Balance Sheet Arrangements

As of November 30, 2012, there were no off balance sheet arrangements.

Going Concern

We have negative working capital and have not yet received revenues from sales of products. These factors have caused our accountants to express substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustment that might be necessary if we are unable to continue as a going concern.

Our ability to continue as a going concern is dependent on our generating cash from the sale of our common stock and/or obtaining debt financing and attaining future profitable operations. Management’s plans include selling our equity securities and obtaining debt financing to fund our capital requirement and ongoing operations; however, there can be no assurance we will be successful in these efforts.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

| 11 |

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

Audited Financial Statements:

| 12 |

Silberstein Ungar, PLLC CPAs and Business Advisors

Phone (248) 203-0080

Fax (248) 281-0940

30600 Telegraph Road, Suite 2175

Bingham Farms, MI 48025-4586

www.sucpas.com

Report of Independent Registered Public Accounting Firm

To the Board of Directors of

Lans Holdings, Inc.

Kuala Lumpur, Malaysia

We have audited the accompanying balance sheets of Lans Holdings, Inc. (the “Company”) as of November 30, 2012 and 2011 and the related statements of operations, stockholders’ deficit, and cash flows for the years then ended and the period from November 13, 2007 (Date of Inception) through November 30, 2012. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Lans Holdings, Inc. as of November 30, 2012 and 2011 and the results of its operations and its cash flows for the years then ended and the period from November 13, 2007 (Date of Inception) through November 30, 2012 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 7 to the financial statements, the Company has negative working capital, has not yet received revenue from sales of products or services, and has incurred losses from operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans with regard to these matters are described in Note 7. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Silberstein Ungar, PLLC

Bingham Farms, Michigan

February 1, 2013

| F-1 |

LANS HOLDINGS, INC.

(A DEVELOPMENT STAGE COMPANY)

AS OF NOVEMBER 30, 2012 AND 2011

| 2012 | 2011 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 0 | $ | 0 | ||||

| TOTAL ASSETS | $ | 0 | $ | 0 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Liabilities | ||||||||

| Current Liabilities | ||||||||

| Accrued expenses | $ | 12,561 | $ | 3,923 | ||||

| Due to officer | 52,987 | 40,692 | ||||||

| Total Liabilities | 65,548 | 44,615 | ||||||

| Stockholders’ Deficit | ||||||||

| Common Stock, $.001 par value, 90,000,000 shares authorized, 2,150,000 shares issued and outstanding | 2,150 | 2,150 | ||||||

| Preferred Stock, $.001 par value, 10,000,000 shares authorized, 0 shares issued and outstanding | 0 | 0 | ||||||

| Additional paid-in capital | 40,850 | 40,850 | ||||||

| Deficit accumulated during the development stage | (108,548 | ) | (87,615 | ) | ||||

| Total Stockholders’ Deficit | (65,548 | ) | (44,615 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | 0 | $ | 0 | ||||

See accompanying notes to financial statements.

| F-2 |

LANS HOLDINGS, INC.

(A DEVELOPMENT STAGE COMPANY)

FOR THE YEARS ENDED NOVEMBER 30, 2012 AND 2011

FOR THE PERIOD FROM NOVEMBER 13, 2007 (INCEPTION) TO NOVEMBER 30, 2012

| For the year ended November 30, 2012 | For the year ended November 30, 2011 | For the period from November 13, 2007 (Inception) to November 30, 2012 | ||||||||||

| REVENUES | $ | 0 | $ | 0 | $ | 0 | ||||||

| OPERATING EXPENSES | ||||||||||||

| Professional fees | 20,933 | 15,234 | 108,548 | |||||||||

| TOTAL OPERATING EXPENSES | 20,933 | 15,234 | 108,548 | |||||||||

| LOSS FROM OPERATIONS | (20,933 | ) | (15,234 | ) | (108,548 | ) | ||||||

| PROVISION FOR INCOME TAXES | 0 | 0 | 0 | |||||||||

| NET LOSS | $ | (20,933 | ) | $ | (15,234 | ) | $ | (108,548 | ) | |||

| LOSS PER SHARE: BASIC AND DILUTED | $ | (0.01 | ) | $ | (0.01 | ) | ||||||

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING: BASIC AND DILUTED | 2,150,000 | 2,150,000 | ||||||||||

See accompanying notes to financial statements.

| F-3 |

LANS HOLDINGS, INC.

(A DEVELOPMENT STAGE COMPANY)

STATEMENT OF STOCKHOLDERS’ DEFICIT

FOR THE PERIOD FROM NOVEMBER 13, 2007 (INCEPTION) TO NOVEMBER 30, 2012

| Common stock | Additional paid-in | Deficit accumulated during the development | ||||||||||||||||||

| Shares | Amount | capital | stage | Total | ||||||||||||||||

| Issuance of common stock for cash @ $.001 | 2,150,000 | $ | 2,150 | $ | 40,850 | $ | — | $ | 43,000 | |||||||||||

| Loss for the period ended November 30, 2007 | — | — | — | (4,000 | ) | (4,000 | ) | |||||||||||||

| Balance, November 30, 2007 | 2,150,000 | 2,150 | 40,850 | (4,000 | ) | 39,000 | ||||||||||||||

| Net loss for the year ended November 30, 2008 | — | — | — | (45,000 | ) | (45,000 | ) | |||||||||||||

| Balance, November 30, 2008 | 2,150,000 | 2,150 | 40,850 | (49,000 | ) | (6,000 | ) | |||||||||||||

| Net loss for the year ended November 30, 2009 | — | — | — | (10,000 | ) | (10,000 | ) | |||||||||||||

| Balance, November 30, 2009 | 2,150,000 | 2,150 | 40,850 | (59,000 | ) | (16,000 | ) | |||||||||||||

| Net loss for the year ended November 30, 2010 | — | — | — | (13,381 | ) | (13,381 | ) | |||||||||||||

| Balance, November 30, 2010 | 2,150,000 | 2,150 | 40,850 | (72,381 | ) | (29,381 | ) | |||||||||||||

| Net loss for the year ended November 30, 2011 | — | — | — | (15,234 | ) | (15,234 | ) | |||||||||||||

| Balance, November 30, 2011 | 2,150,000 | 2,150 | 40,850 | (87,615 | ) | (44,615 | ) | |||||||||||||

| Net loss for the year ended November 30, 2012 | — | — | — | (20,933 | ) | (20,933 | ) | |||||||||||||

| Balance, November 30, 2012 | 2,150,000 | $ | 2,150 | $ | 40,850 | $ | (108,548 | ) | $ | (65,548 | ) | |||||||||

See accompanying notes to financial statements.

| F-4 |

LANS HOLDINGS, INC.

(A DEVELOPMENT STAGE COMPANY)

FOR THE YEARS ENDED NOVEMBER 30, 2012 AND 2011

FOR THE PERIOD FROM NOVEMBER 13, 2007 (INCEPTION) TO NOVEMBER 30, 2012

| For the year ended November 30, 2012 | For the year ended November 30, 2011 | For the period from November 13, 2007 (Inception) to November 30, 2012 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||

| Net loss for the period | $ | (20,933 | ) | $ | (15,234 | ) | $ | (108,548 | ) | |||

| Change in non-cash working capital items | ||||||||||||

| Increase in accrued expenses | 8,638 | 542 | 12,561 | |||||||||

| Net Cash Used by Operating Activities | (12,295 | ) | (14,692 | ) | (95,987 | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||||||

| Proceeds from sales of common stock | 0 | 0 | 43,000 | |||||||||

| Increase in due to officer | 12,295 | 14,692 | 52,987 | |||||||||

| Net Cash Provided by Financing Activities | 12,295 | 14,692 | 95,987 | |||||||||

| Net Increase in cash and cash equivalents | 0 | 0 | 0 | |||||||||

| Cash, beginning of period | 0 | 0 | 0 | |||||||||

| Cash, end of period | $ | 0 | $ | 0 | $ | 0 | ||||||

| SUPPLEMENTAL CASH FLOW INFORMATION | ||||||||||||

| Interest paid | $ | 0 | $ | 0 | $ | 0 | ||||||

| Income taxes paid | $ | 0 | $ | 0 | $ | 0 | ||||||

See accompanying notes to financial statements.

| F-5 |

LANS HOLDINGS, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

NOVEMBER 30, 2012

NOTE 1 – NATURE OF BUSINESS

Nature of Business

Lans Holdings, Inc. (“LANS”) is a development stage company and was incorporated in Nevada on November 13, 2007. The Company is developing hexagon fishing nets to manufacture and sell to fishing equipment retailers primarily in Southeast Asia.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America and are presented in US dollars.

Accounting Basis

The Company uses the accrual basis of accounting and accounting principles generally accepted in the United States of America (“GAAP” accounting). The Company has adopted a November 30 fiscal year end.

Development Stage Company

The accompanying financial statements have been prepared under generally accepted accounting principles for development stage companies. A development-stage company is one in which planned principal operations have not commenced or if its operations have commenced, there has been no significant revenues there from.

Fair Value of Financial Instruments

LANS’s financial instruments consist of cash and cash equivalents, accrued expenses and an amount due to an officer. The carrying amount of these financial instruments approximates fair value due either to length of maturity or interest rates that approximate prevailing market rates unless otherwise disclosed in these financial statements.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

LANS considers all highly liquid investments with maturities of three months or less to be cash equivalents. At November 30, 2012 and 2011, the Company had $0 of cash.

Revenue Recognition

The Company will recognize revenue when products are fully delivered or services have been provided and collection is reasonably assured.

| F-6 |

LANS HOLDINGS, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

NOVEMBER 30, 2012

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Income Taxes

The Company utilizes the liability method of accounting for income taxes. Under the liability method deferred tax assets and liabilities are determined based on the differences between financial reporting basis and the tax basis of the assets and liabilities and are measured using enacted tax rates and laws that will be in effect, when the differences are expected to reverse. An allowance against deferred tax assets is recognized, when it is more likely than not, that such tax benefits will not be realized.

Any deferred tax asset is considered immaterial and has been fully offset by a valuation allowance because at this time the Company believes that it is more likely than not that the future tax benefit will not be realized as the Company has no current operations.

Loss Per Common Share

Basic loss per share is calculated using the weighted-average number of common shares outstanding during each reporting period. Diluted loss per share includes potentially dilutive securities such as outstanding options and warrants, using various methods such as the treasury stock or modified treasury stock method in the determination of dilutive shares outstanding during each reporting period. The Company does not have any potentially dilutive instruments.

Stock-Based Compensation

Stock-based compensation is accounted for at fair value in accordance with ASC 718. To date, the Company has not adopted a stock option plan and has not granted any stock options. As of November 30, 2012, the Company has not issued any stock-based payments to its employees.

Recent Accounting Pronouncements

In May 2009, the FASB issued ASC 855-10 entitled “Subsequent Events”. Companies are now required to disclose the date through which subsequent events have been evaluated by management. Public entities (as defined) must conduct the evaluation as of the date the financial statements are issued, and provide disclosure that such date was used for this evaluation. ASC 855-10 provides that financial statements are considered “issued” when they are widely distributed for general use and reliance in a form and format that complies with GAAP. ASC 855-10 is effective for interim and annual periods ending after June 15, 2009 and must be applied prospectively. Management evaluated subsequent events through the date that such financial statements were issued.

In June 2009, the FASB issued ASC 105-10, The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles. ASC 105-10 establishes the Codification as the sole source of authoritative accounting principles recognized by the FASB to be applied by all nongovernmental entities in the preparation of financial statements in conformity with GAAP. ASC 105-10 was prospectively effective for financial statements issued for fiscal years ending on or after September 15, 2009 and interim periods within those fiscal years. The Codification did not change GAAP, however, it did change the way GAAP is organized and presented.

As a result, these changes impact how companies reference GAAP in their financial statements and in their significant accounting policies. The Company implemented the Codification in this Report by providing references to the Codification topics.

| F-7 |

LANS HOLDINGS, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

NOVEMBER 30, 2012

NOTE 3 – ACCRUED EXPENSES

Accrued expenses of $12,561 and $3,923 at November 30, 2012 and 2011, respectively, consist of amounts owed to the Company’s outside legal counsel, transfer agent and independent auditor for services rendered.

NOTE 4 – DUE TO OFFICER

The amount due to officer of $52,987 and $40,692 at November 30, 2012 and 2011, respectively, consisted of amounts owed to an officer and shareholder of the Company for amounts advanced to pay for professional services provided by the Company’s outside independent auditors, attorneys and stock transfer agent for services rendered. The amounts are unsecured, due upon demand, and non-interest bearing.

NOTE 5 – CAPITAL STOCK

The authorized capital of the Company is 90,000,000 common shares with a par value of $ 0.001 per share and 10,000,000 preferred shares with a par value of $0.001.

During the period ended November 30, 2007, the Company issued 2,150,000 shares of common stock for cash proceeds of $43,000.

There were 2,150,000 shares of common stock issued and outstanding as of November 30, 2012.

There were 0 shares of preferred stock issued and outstanding as of November 30, 2012.

NOTE 6 – COMMITMENTS

The Company neither owns nor leases any real or personal property. An officer has provided office services without charge. There is no obligation for the officer to continue this arrangement. Such costs are immaterial to the financial statements and accordingly are not reflected herein. The officers and directors are involved in other business activities and most likely will become involved in other business activities in the future.

NOTE 7 – GOING CONCERN

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As shown in the accompanying financial statements, the Company has negative working capital, has incurred losses of $108,548 since its inception and has not yet produced revenues from operations. These factors raise substantial doubt about the Company's ability to continue as a going concern.

The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the event that the Company cannot continue as a going concern. Management anticipates that it will be able to raise additional working capital through the issuance of stock and through additional loans from investors.

The ability of the Company to continue as a going concern is dependent upon the Company’s ability to attain a satisfactory level of profitability and obtain suitable and adequate financing. There can be no assurance that management's plan will be successful.

| F-8 |

LANS HOLDINGS, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

NOVEMBER 30, 2012

NOTE 8 – INCOME TAXES

For the period ended November 30, 2012, the Company has incurred net losses and, therefore, has no tax liability. The net deferred tax asset generated by the loss carry-forward has been fully reserved. The cumulative net operating loss carry-forward is approximately $108,548 at November 30, 2012, and will expire beginning in the year 2027.

The provision for Federal income tax consists of the following at November 30, 2012 and 2011:

| 2012 | 2011 | |||||||

| Federal income tax benefit attributable to: | ||||||||

| Current Operations | $ | 7,117 | $ | 5,180 | ||||

| Less: valuation allowance | (7,117 | ) | (5,180 | ) | ||||

| Net provision for Federal income taxes | $ | 0 | $ | 0 | ||||

The cumulative tax effect at the expected rate of 34% of significant items comprising our net deferred tax amount is as follows as of November 30, 2012 and 2011:

| 2012 | 2011 | |||||||

| Deferred tax asset attributable to: | ||||||||

| Net operating loss carryover | $ | 36,907 | $ | 29,790 | ||||

| Less: valuation allowance | (36,907 | ) | (29,790 | ) | ||||

| Net deferred tax asset | $ | 0 | $ | 0 | ||||

Due to the change in ownership provisions of the Tax Reform Act of 1986, net operating loss carry forwards of approximately $108,548 for Federal income tax reporting purposes are subject to annual limitations. Should a change in ownership occur net operating loss carry forwards may be limited as to use in future years.

NOTE 9 – SUBSEQUENT EVENTS

In accordance with ASC Topic 855-10, the Company has analyzed its operations subsequent to November 30, 2012 to the date these financial statements were issued, and has determined that it does not have any material subsequent events to disclose in these financial statements.

| F-9 |

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

No events occurred requiring disclosure under Item 304 of Regulation S-K during the fiscal year ending November 30, 2012.

Item 9A. Controls and Procedures

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in company reports filed or submitted under the Securities Exchange Act of 1934 (the “Exchange Act”) is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include without limitation, controls and procedures designed to ensure that information required to be disclosed in company reports filed or submitted under the Exchange Act is accumulated and communicated to management, including our chief executive officer and treasurer, as appropriate to allow timely decisions regarding required disclosure.

As required by Rules 13a-15 and 15d-15 under the Exchange Act, our chief executive officer and chief financial officer carried out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures as of November 30, 2012. Based on their evaluation, they concluded that our disclosure controls and procedures were effective.

Management is responsible for establishing and maintaining adequate internal control over our financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act). Our internal control over financial reporting is a process designed by, or under the supervision of, our chief executive officer and chief financial officer and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of our financial statements for external purposes in accordance with generally accepted accounting principles. Internal control over financial reporting includes policies and procedures that pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets; provide reasonable assurance that transactions are recorded as necessary to permit preparation of our financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with the authorization of our board of directors and management; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements.

Under the supervision and with the participation of our management, including our chief executive officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting based on the criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Based on this evaluation under the criteria established in Internal Control – Integrated Framework, our management concluded that our internal control over financial reporting was effective as of November 30, 2012.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to an exemption for non-accelerated filers set forth in Section 989G of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

During the most recently completed fiscal quarter, there has been no change in our internal control over financial reporting that has materially affected or is reasonably likely to materially affect, our internal control over financial reporting.

None

| 13 |

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Our executive officers and directors and their respective ages as of November 30, 2012 are as follows:

| Name | Age | Position Held with the Company |

|

Eng Kok Yap Penthouse Menara Antara, No 11 Jalan Bukit Ceylon Kuala Lumpur, Malaysia |

32 | President, Chief Executive Officer, Principal Executive Officer, Chief Financial Officer, Principal Financial Officer, Principal Accounting Officer and Director |

|

Tan Sin Siong Penthouse Menara Antara, No 11 Jalan Bukit Ceylon Kuala Lumpur, Malaysia |

39 | Director |

Set forth below is a brief description of the background and business experience of our sole executive officer and director.

Eng Kok Yap is our President, Chief Executive Officer, Principal Executive Officer, Chief Financial Officer, Principal Financial Officer, Principal Accounting Officer and Director. He has worked as an Engineer for Psyon Engineering Corporation since 2000.

Tan Sin Siong is our director. Mr. Yap obtained his Bachelor’s Degree in Engineering from Warwick University in England in 1999. Tan Sin Siong obtained a Bachelor’s Degree from Excel Institute in Kuala Lumpur, Malaysia in 1997. Since 2002, Tan Sin Siong has worked as a manager for Siemens Incorporated.

Term of Office

Our directors are appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Significant Employees

We do not currently have any significant employees aside from Eng Kok Yap and Tan Sin Siong.

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past ten years, none of the following occurred with respect to our present or former director, executive officer, or employee: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; and (4) being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

| 14 |

Audit Committee

We do not have a separately-designated standing audit committee. The entire Board of Directors performs the functions of an audit committee, but no written charter governs the actions of the Board when performing the functions of what would generally be performed by an audit committee. The Board approves the selection of our independent accountants and meets and

Code of Ethics

As of November 30, 2012, we had not adopted a Code of Ethics for Financial Executives, which would include our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

Item 11. Executive Compensation

Summary Compensation Table

The table below summarizes all compensation awarded to, earned by, or paid to both to our officers and to our directors for all services rendered in all capacities to us for our fiscal years ended November 30, 2012 and 2011.

| SUMMARY COMPENSATION TABLE | ||||||||

|

Name and principal position |

Year |

Salary ($) |

Bonus ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

| Eng Kok Yap President, Chief Executive Officer, Principal Executive Officer, Chief Financial Officer, Principal Financial Officer, Principal Accounting Officer and Director |

2012

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

Narrative Disclosure to the Summary Compensation Table

We have not entered into any employment agreement or consulting agreement with our executive officers. There are no arrangements or plans in which we provide pension, retirement or similar benefits for executive officers.

Although we do not currently compensate our officers, we reserve the right to provide compensation at some time in the future. Our decision to compensate officers depends on the availability of our cash resources with respect to the need for cash to further our business purposes.

| 15 |

Outstanding Equity Awards at Fiscal Year-End

The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named executive officer as of November 30, 2012.

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | |||||||||

| OPTION AWARDS | STOCK AWARDS | ||||||||

|

Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares or Units of Stock That Have Not Vested (#) |

Market Value of Shares or Units of Stock That Have Not Vested ($) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

| Eng Kok Yap | - | - | - | - | - | - | - | - | - |

Stock Option Grants

We have not granted any stock options to the executive officers or directors since our inception.

Director Compensation

We do not pay any compensation to our directors at this time. However, we reserve the right to compensate our directors in the future with cash, stock, options, or some combination of the above.

We have not reimbursed our directors for expenses incurred in connection with attending board meetings nor have we paid any directors fees or other cash compensation for services rendered as a director in the year ended November 30, 2012.

Stock Option Plans

We did not have a stock option plan as of November 30, 2012.

| 16 |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth, as of November 30, 2012, certain information as to shares of our common stock owned by (i) each person known by us to beneficially own more than 5% of our outstanding common stock, (ii) each of our directors, and (iii) all of our executive officers and directors as a group:

| Name and Address of Beneficial Owners of Common Stock | Title of Class | Amount and Nature of Beneficial Ownership1 |

% of Common Stock2 |

|

Eng Kok Yap Penthouse Menara Antara, No 11 Jalan Bukit Ceylon Kuala Lumpur, Malaysia |

Common Stock |

600,000 | 27.9% |

|

Tan Sin Siong Penthouse Menara Antara, No 11 Jalan Bukit Ceylon Kuala Lumpur, Malaysia |

Common Stock | 600,000 | 27.9% |

| DIRECTORS AND OFFICERS – TOTAL | 1,200,000 | 55.8% | |

| 5% SHAREHOLDERS | |||

| NONE | Common Stock | NONE | NONE |

1. As used in this table, "beneficial ownership" means the sole or shared power to vote, or to direct the voting of, a security, or the sole or shared investment power with respect to a security (i.e., the power to dispose of, or to direct the disposition of, a security). In addition, for purposes of this table, a person is deemed, as of any date, to have "beneficial ownership" of any security that such person has the right to acquire within 60 days after such date.

2. The percentage shown is based on denominator of 2,150,000 shares of common stock issued and outstanding for the company as of November 30, 2012.

Item 13. Certain Relationships and Related Transactions, and Director Independence

None of our directors or executive officers, nor any proposed nominee for election as a director, nor any person who beneficially owns, directly or indirectly, shares carrying more than 5% of the voting rights attached to all of our outstanding shares, nor any members of the immediate family (including spouse, parents, children, siblings, and in-laws) of any of the foregoing persons has any material interest, direct or indirect, in any transaction over the last two years or in any presently proposed transaction which, in either case, has or will materially affect us.

Item 14. Principal Accounting Fees and Services

Below is the table of Audit Fees (amounts in US$) billed by our auditor in connection with the audit of the Company’s annual financial statements for the years ended:

| Financial Statements for the Year Ended November 30 |

Audit Services | Audit Related Fees | Tax Fees | Other Fees |

| 2012 | $7,350 | - | - | - |

| 2011 | $9,000 | - | - | - |

| 17 |

PART IV

Item 15. Exhibits, Financial Statements Schedules

| (a) | Financial Statements and Schedules |

The following financial statements and schedules listed below are included in this Form 10-K.

Financial Statements (See Item 8)

| (b) | Exhibits |

| Exhibit Number | Description |

| 3.1 | Articles of Incorporation, as amended (1) |

| 3.2 | Bylaws, as amended (1) |

| 23.1 | Consent of Silberstein Ungar, PLLC, Certified Public Accountants |

| 31.1 | Certification of Chief Executive Officer pursuant to Securities Exchange Act Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 31.2 | Certification of Chief Financial Officer pursuant to Securities Exchange Act Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1 | Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 101** | The following materials from the Company’s Annual Report on Form 10-K for the year ended November 30, 2012 formatted in Extensible Business Reporting Language (XBRL). |

| 1 | Incorporated by reference to the Registration Statement on Form SB-2 filed on December 28, 2007. | |

| ** | Provided herewith |

| 18 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Lans Holdings, Inc.

| By: | /s/ Eng Kok Yap |

|

Eng Kok Yap President, Chief Executive Officer, Principal Executive Officer, Chief Financial Officer, Principal Financial Officer, Principal Accounting Officer and Director | |

| February 5, 2013 |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Eng Kok Yap |

|

Eng Kok Yap President, Chief Executive Officer, Principal Executive Officer, Chief Financial Officer, Principal Financial Officer, Principal Accounting Officer and Director | |

| February 5, 2013 |

| By: | /s/ Tan Sin Siong |

|

Tan Sin Siong Director | |

| February 5, 2013 |

| 19 |