Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - HARROW HEALTH, INC. | immy_ex231.htm |

As filed with the Securities and Exchange Commission on February 4, 2013

No. 333-182846

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

Amendment No. 5

Amendment No. 5

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

___________________________

IMPRIMIS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

___________________________

|

Delaware

|

2834

|

45-0567010

|

||

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

437 S. Hwy 101, Suite 209

Solana Beach, CA 92075

(858) 433-2800

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

___________________________

Mark L. Baum

Chief Executive Officer

437 S. Hwy 101, Suite 209

Solana Beach, CA 92075

(858) 433-2800

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

___________________________Copies to:

|

Steven G. Rowles, Esq.

Jeannette V. Filippone, Esq.

Morrison & Foerster LLP

12531 High Bluff Drive, Suite 100

San Diego, California 92130

Tel: (858) 720-5100

Fax: (858) 720-5125

|

Kevin Friedmann, Esq.

|

|

Marc A. Jones, Esq.

|

|

|

Richardson & Patel LLP

|

|

|

750 Third Avenue, 9th Floor

|

|

|

New York, New York 10017

|

|

|

Tel: (212) 561-5559

|

|

|

Fax: (917) 591-6898

|

Approximate date of commencement of proposed sale to the public: As soon as possible after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company þ

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 4, 2013

IMPRIMIS PHARMACEUTICALS, INC.

PRELIMINARY PROSPECTUS

1,619,047 Shares of Common Stock

___________________

We are offering 1,619,047 shares of our common stock in a firm commitment offering, which share number reflects our proposed one-for-five reverse stock split described further in this prospectus. After the effectiveness of the registration statement of which this prospectus is a part and concurrently with the pricing of this offering, we will effect a one-for-five reverse stock split.

Our common stock is quoted on the OTC Markets Group’s OTCQB tier under the symbol “IMMY”. On February 1, 2013, the closing price of our common stock on the OTCQB was $8.25 per share (assuming a one-for-five reverse stock split). We have applied for listing of our common stock on The NASDAQ Capital Market, which listing we expect to occur at the consummation of this offering. No assurance can be given that our application will be approved. If the application is not approved, we will not commence this offering and the shares of our common stock will continue to be traded on the OTC Markets Group’s OTCQB tier.

___________________

Investing in our common stock involves a high degree of risk. Before making any investment in our common stock, you should read and carefully consider the risks described in this prospectus under “Risk Factors” beginning on page 8 of this prospectus.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment thereto. We have not authorized anyone to provide you with different information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Per Share

|

Total

|

|||||||

|

Initial price to public

|

$ | 5.25 | $ | 8,499,997 | ||||

|

Underwriting discount

|

$ | 0.4463 | $ | 722,500 | ||||

|

Proceeds, before expenses, to Imprimis Pharmaceuticals(1)

|

$ | 4.8037 | $ | 7,777,497 | ||||

| (1) | Does not include a non-accountable expense amount of $150,000 payable to the underwriters and up to $10,000 in accountable expenses of the underwriters. See "Underwriting" for a description of compensation payable to the underwriters. |

To the extent that the underwriters sell more than 1,619,047 shares of common stock, the underwriters have the option to purchase up to an additional 242,857 shares from us at the initial price to the public less the underwriting discount (assuming a one-for-five reverse stock split).

The underwriters expect to deliver the shares on or about , 2013.

___________________

| MDB Capital Group LLC | Aegis Capital Corp |

This prospectus is dated , 2013

TABLE OF CONTENTS

|

Page

|

||||

|

PROSPECTUS SUMMARY

|

1 | |||

|

RISK FACTORS

|

8 | |||

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

20 | |||

|

USE OF PROCEEDS

|

21 | |||

|

DESCRIPTION OF CAPITAL STOCK

|

22 | |||

|

CAPITALIZATION

|

25 | |||

|

DILUTION

|

27 | |||

| UNDERWRITING | 29 | |||

|

MARKET PRICE OF AND DIVIDENDS ON COMMON STOCK AND RELATED MATTERS

|

33 | |||

| SHARES AVAILABLE FOR FUTURE SALE | 34 | |||

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 37 | |||

|

DESCRIPTION OF THE BUSINESS

|

48 | |||

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

58 | |||

|

EXECUTIVE COMPENSATION

|

61 | |||

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

67 | |||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

68 | |||

|

LEGAL MATTERS

|

69 | |||

|

EXPERTS

|

69 | |||

|

WHERE YOU CAN FIND MORE INFORMATION

|

69 | |||

|

FINANCIAL STATEMENTS

|

F-1 | |||

About This Prospectus

You should rely only on the information that we have provided or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus or any prospectus supplement. You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement, or any sale of a security.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information.”

We have pending trademark applications for Imprimis Pharmaceuticals, Accudel, Impracor and Generecycle. All other trademarks, tradenames and service marks included in this prospectus or any related prospectus supplement, are the property of their respective owners.

- i -

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that should be considered before investing in our common stock. Investors should read the entire prospectus carefully, including the more detailed information regarding our business, the risks of purchasing our common stock discussed in this prospectus under “Risk Factors” beginning on page 8 of this prospectus, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 37 of this prospectus, and our consolidated financial statements and the accompanying notes beginning on page F-1 of this prospectus.

As used in this prospectus, unless the context requires otherwise, the “Company”, “we”, “us”, and “our” refer to Imprimis Pharmaceuticals, Inc., a Delaware corporation.

Our Company

We are a specialty pharmaceutical company developing non-invasive, topically delivered products. Our innovative patented Accudel cream formulation technology is designed to enable highly targeted site specific treatment. Impracor, our lead pain product candidate, utilizes the Accudel platform technology to deliver the active drug, ketoprofen, a non-steroidal anti-inflammatory drug, through the skin directly into the underlying tissues where the drug exerts its localized anti-inflammatory and analgesic effects.

Through our strategic relationship with Professional Compounding Centers of America, Inc. (“PCCA”), one of the largest drug compounding organizations in the world, we expect to facilitate our future selection, formulation and development of potential product candidates. Our relationship with PCCA is exclusive and provides us with the opportunity to develop new products using PCCA’s proprietary drug formulations and drug delivery technologies, as well as access to an extensive database of market-oriented information related to specific drug development candidates. We plan to use our proprietary Accudel drug delivery technology, coupled with these licensed technologies, formulations and market data, to identify pharmaceutical development opportunities where there is a significant unmet need for a new drug product. We are currently considering potential product candidates in the muscle relaxant and neuropathic pain fields, and we expect those areas may be our next avenues for additional product development.

To better enable us to analyze the myriad of PCCA and PCCA-related development opportunities, we have designed a comprehensive drug development selection methodology. In determining the viability of a potential opportunity, we group all development candidates according to delivery modality and health category. We review intellectual property related to a respective opportunity, as well as manufacturing considerations, various market-related criterion and other clinical development issues. We believe that our review process will aid us in identifying viable development candidates and assist us in determining whether to internally develop a program or seek an appropriate commercialization partner.

Our common stock has been quoted in the over-the-counter market since March 2007 and is currently quoted on OTC Markets Group’s OTCQB tier under the symbol “IMMY”. Our executive offices are located at 437 S. Hwy 101, Suite 209, Solana Beach, CA 92075 and our telephone number is (858) 433-2800. Our website address is www.imprimispharma.com. Information contained on our website is not deemed part of this prospectus.

Reverse Stock Split and NASDAQ Listing Application

On April 25, 2012, our Board of Directors (the “Board of Directors” or the “Board”) and stockholders holding a majority of our outstanding voting power approved a resolution authorizing our Board of Directors to effect a reverse split of our common stock at an exchange ratio of (i) one-for-three, (ii) one-for-four, (iii) one-for-five, or (iv) one-for-six, with our Board of Directors retaining the discretion as to whether to implement the reverse split and which exchange ratio to implement. The action by written consent of the stockholders became effective on May 31, 2012, following our compliance with certain notice requirements under the Securities Exchange Act of 1934 (the “Exchange Act”). We anticipate that immediately following the effectiveness of the registration statement of which this prospectus forms a part, and prior to the closing of this offering, our Board of Directors will effect a reverse stock split at a ratio of one-for-five (the “reverse stock split”).

The reverse stock split is intended to allow us to meet the minimum share price requirement of The NASDAQ Capital Market. We have applied for listing of our common stock on The NASDAQ Capital Market, which listing we expect to occur at the closing of this offering. If the application is not approved, we will not complete this offering or effect the reverse stock split, and the shares of our common stock will continue to be traded on the OTC Markets Group’s OTCQB tier.

Other than as otherwise indicated and except in our consolidated financial statements, all information regarding share amounts of common stock and prices per share of common stock contained in this prospectus assume the consummation of the one-for-five reverse stock split to be effected following effectiveness of the registration statement of which this prospectus forms a part and prior to the closing of this offering.

Impracor

Impracor, our lead drug candidate, is comprised of a transdermal formulation of ketoprofen, a non-steroidal anti-inflammatory drug (NSAID). Impracor is formulated using our proprietary Accudel drug delivery system and is being developed for the treatment of acute musculoskeletal pain. Impracor penetrates the skin barrier to reach the targeted underlying tissues where it exerts its localized anti-inflammatory and analgesic effect. The topical delivery of the drug may minimize systemic exposure, which may in turn lead to fewer concerns pertaining to gastrointestinal, hepatic, cardiovascular and other adverse systemic effects, which are associated with orally administered NSAIDs. We believe that this product may be considered for patients with site specific localized pain and who also (i) have a history of gastrointestinal, cardiovascular, kidney or liver problems, (ii) are geriatric or pediatric and/or (iii) are at risk for drug interactions.

1

Completed Clinical Studies for Impracor

In June 2008, we initiated a Phase 3 clinical trial designed as a randomized, double-blind, placebo-controlled, multi-center study that enrolled a total of 364 patients with acute soft tissue injuries of the upper or lower extremities in 26 centers in the United States. As we reported in October 2009, the top-line results showed that the study demonstrated statistical significance in its primary endpoint in the per protocol analysis and was favorable for Impracor in the Intent-To Treat ("ITT") analysis. Impracor also demonstrated a safety and tolerability profile similar to the placebo used in the study. Of the over 180 patients treated with Impracor, there were no treatment related gastrointestinal, cardiovascular, hepatic or other clinically relevant adverse events reported. Furthermore, Impracor was observed to be well absorbed through the skin and only minimal blood concentrations of ketoprofen were detected in a subset of patients who underwent blood sampling for pharmacokinetic analyses following repeated topical applications.

In January 2010, we reported on further in-depth analyses of the ITT data from the Impracor Phase 3 study. For the modified ITT analysis we identified 35 patients who did not meet study entry criteria at the time of randomization. Excluding the data from these patients who should not have been randomized into the study based on information that was not known at the time of enrollment, the study demonstrated statistical significance (p<0.038) on the primary efficacy endpoint. This post-hoc analysis was confirmed by a third-party statistical expert.

In February 2012, our management conducted an additional analysis of the ITT data and a body weight adjusted modified per protocol (“mPP”) analysis of those participants who completely complied with the Phase 3 Study protocol, including taking the recommended therapeutic quantity of the study drug. This analysis excluded 52 participants from the ITT group who did not take a minimum therapeutic quantity of the study drug, and 20 patients who did not have a valid Day 3 primary endpoint assessment and 4 patients who were misdiagnosed. This mPP analysis on 250 patients demonstrated statistical significance of the primary endpoint (p=0.034).

We believe that the weight of evidence of a treatment effect in this study is further strengthened by a key secondary endpoint (pain intensity recorded three times daily on patient diary cards) that supports the primary endpoint. The patient diary data which yield pain curves over time show consistent separation between treatment groups reaching statistical significance in favor of Impracor using both the original and modified ITT population. Furthermore, the physician's global assessment, using a 7 Point Likert Scale, on day 3 produced statistically significant results (p=0.037), and a later exploratory analysis of the patient's global assessment of treatment satisfaction, using a binomial method, produced statistically significant results (p=0.023).

Proposed Clinical Program for Impracor

For Impracor to be approved by the U.S. Food and Drug Administration ("FDA"), two confirmatory Phase 3 trials with exposure of at least 300 to 500 patients and supportive dermal safety studies are required. We plan to commence two adequate and well-controlled Phase 3 trials of Impracor in patients experiencing pain from osteoarthritis flare in their knees. We plan to discuss the clinical development program for those trials, which has been endorsed by our scientific and regulatory advisory board, with the FDA at a Type C meeting scheduled to occur in April 2013.

Also as required by the FDA, we recently completed a clinical study that measured the amount of ketoprofen found in the bloodstream following topical application of two different doses of the anti-inflammatory cream under different conditions, including normal activities, heat exposure to the application site and standardized exercise, as well as the amount of the drug in the bloodstream after taking an oral dose of ketoprofen (the relative oral bioavailability). The study included a total of 40 healthy volunteers (36 of which completed the study) assigned to one of two cohorts (2g or 4g applications). Subjects were dosed according to a four-sequence, four-treatment randomization schedule in which they received topical Impracor applications under each of the three conditions and an oral ketoprofen dose in weekly intervals. Overall the pharmacokinetic parameters were observed to be consistent between the two different dose cohorts. The application of an occlusive knee bandage with either heat or exercise following topical administration showed faster initial, but lower overall plasma exposure of ketoprofen relative to non-occluded topical administration with no heat or exercise. The extent of bioavailability over 48 hours as measured by the area under the concentration curve from time zero to the time of last measurable concentration (AUC0-t) was 2% or less in cohort 1 (2 g single dose applied to one knee) and 4% or less in cohort 2 (2 g single dose applied to each knee) for the topical treatments relative to the oral treatment. All treatments were observed to be well tolerated. We also expect to initiate a routine supportive trial in healthy subjects related to the potential of contact sensitization. We expect that all of our planned clinical studies for Impracor will be executed with the professional help of clinical research organizations (“CROs”) with experience in clinical trials of similar design. We are in the process of selecting and negotiating arrangements with potential CROs and other third parties in order to initiate our Phase 3 clinical trials.

Following completion of our clinical trials, we expect to file a New Drug Application for marketing authorization for Impracor under Section 505(b)(2) of the Hatch-Waxman Act of 1984, a regulatory route towards U.S. approval that leverages previously established safety and/or effectiveness of already approved ketoprofen products in other dosage forms. This regulatory path also improves the chances of success over a completely new drug chemical entity.

The timing of Phase 3 trials and the other supportive studies will be dependent on obtaining adequate financing to support the execution of these activities and for other working capital expenditures. Upon receipt of such financing, we anticipate initiating the supportive studies and Phase 3 trials in mid and late 2013, respectively. Assuming successful timely completion and outcome of the additional Phase 3 trials, we would expect to file the New Drug Application for Impracor in the second half of 2014.

We expect that Impracor, if approved by the FDA, could become one of the first NSAID cream products available by prescription in the United States for the topical treatment of acute musculoskeletal pain.

The Accudel Technology

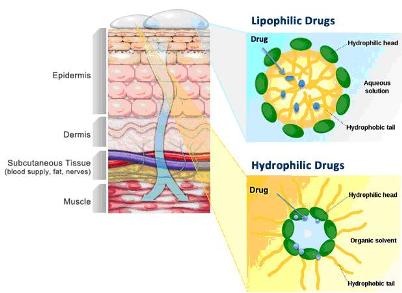

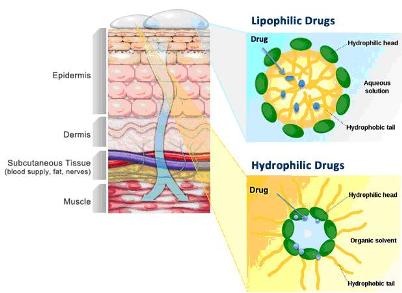

Accudel is our proprietary transdermal cream drug delivery platform which can facilitate the transdermal penetration of drugs, thus enabling the avoidance of first pass metabolism by the liver and minimizing systemic exposure. The following diagram provides a schematic of the Accudel drug delivery system:

2

Accudel has the following properties, which make it a highly versatile vehicle for topical drug administration:

|

●

|

utilizes a pluronic lecithin organogel based matrix which is known to penetrate the stratum corneum and aid in the diffusion of active ingredients through the skin;

|

|

●

|

helps solubilize various types of drugs and its components (lipophilic, hydrophilic and amphiphilic);

|

|

●

|

uses penetration enhancers in a synergistic combination;

|

|

●

|

can incorporate compounds of various molecular sizes;

|

|

●

|

contains biocompatible components which are generally regarded as safe by the FDA;

|

|

●

|

is thermodynamically stable, insensitive to moisture and resistant to microbial contamination;

|

|

●

|

potentially results in decreased safety concerns associated with oral or intravenous drugs;

|

|

●

|

avoids certain limitations associated with transdermal patches;

|

|

●

|

is easy to apply, aesthetically acceptable and odorless; and

|

|

●

|

potentially produces patentable new products when combined with established or new drugs.

|

3

Product Development Program

We believe that the clinical success of Impracor will facilitate the use of the Accudel delivery technology in other products. We have identified development opportunities for potential products in pain management and other therapeutic areas utilizing the Accudel platform technology and we are exploring potential commercial relationships for these identified product candidates. In particular, we are currently considering potential new drug candidates in the muscle relaxant and neuropathic pain fields, and we expect those to be our next avenues for new product development. We estimate that pre-Phase 3 clinical studies for these two potential product candidates could each be completed approximately 18 to 24 months after their commencement, and that costs for such development would range from approximately $2 million to $2.5 million for each proposed drug candidate.

In addition, we expect our new relationship with PCCA to facilitate our future selection, development and formulation of potential product candidates. We plan to use our proprietary Accudel drug delivery technology, coupled with these licensed technologies, formulations and market data, to identify pharmaceutical development opportunities where there is a significant unmet need for a new drug product. We are currently considering potential product candidates in the muscle relaxant and neuropathic pain fields, and we expect those areas may be our next avenues for additional product development.

In the past our product development program has included cosmetic and cosmeceutical products utilizing our patented transdermal delivery system technology, Accudel. Our lead product candidate was an anti-cellulite formulation, for which we have initial clinical information supporting the beneficial effects of this cosmetic product on skin appearance. Our potential pipeline of cosmetic products includes hyperpigmentation and anti-aging formulations. We remain interested in pursuing this business opportunity and continue to consider entering into new relationships with third parties. We may also pursue the out-licensing of our Accudel drug delivery technology for the development and commercialization of additional innovative drug and cosmeceutical products.

Market and Opportunity

According to Wolters-Kluwer PHAST, the U.S. pain market was approximately $39.8 billion in 2011. Of that total, the NSAID market made up approximately $13.5 billion from approximately 155 million written prescriptions. The topical NSAID market in 2011 was over $500 million, averaging an approximately 28% compound annual growth rate since 2007.

According to the Archives of Internal Medicine, NSAIDs are regularly used by more than 60 million Americans. Approximately 70% of people aged 65 or older take NSAIDs weekly. As a result of the widespread usage of oral NSAIDs, according to Bandolier, there are over 100,000 hospitalizations annually and 16,500 deaths in the U.S. due to gastro-intestinal complications annually. In the United Kingdom, there are approximately 12,000 hospitalizations and an estimated 2,600 deaths annually related to GI complications following oral NSAID use per year. One study published in 1998 in the American Journal of Medicine found that NSAID-related gastro-intestinal side effects cause almost as many deaths as asthma, cervical cancer and malignant melanona combined, and another 1999 study published in the Journal of Rheumatology found that death resulting from gastro-intestinal complications was the 15th most common cause of death in the U.S. According to Singh G, Triadafilopoulos G., Epidemiology of NSAID induced gastrointestinal complications, J Rheumatol. 1999, the hospitalizations and deaths related to systemic NSAID use has a financial impact of more than $2 billion per year in the U.S. Therefore, we believe there is a significant demand from physicians and patients for topical pain management products such as Impracor, especially with respect to the treatment of localized, acute musculoskeletal pain, which we believe is driven primarily by the concern of possible negative systemic effects of orally administered NSAIDs.

For more information regarding our business, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” included elsewhere in this prospectus.

Recent Developments

All information regarding share amounts of common stock and prices per share of common stock described below assume the consummation of the one-for-five reverse stock split to be effected following the effectiveness of the registration statement of which this prospectus forms a part and prior to the closing of this offering.

PCCA Transaction

On August 30, 2012, we entered into a License Agreement (the “PCCA License Agreement") and a Stock Purchase Agreement (the “PCCA Purchase Agreement”) in a strategic transaction with PCCA (the “PCCA Transaction”).

Pursuant to the terms of the PCCA License Agreement, effective August 30, 2012, PCCA has granted to us and our affiliates certain exclusive rights under PCCA’s proprietary formulations, other technologies and data, and we have agreed to pay to PCCA certain royalties on net sales relating to the sale of certain future products, which royalties range from 4.5% to 9% for each product, subject to certain minimum royalty payments. PCCA may terminate the PCCA License Agreement if we fail to commence efforts to research and develop future products within certain time periods.

Pursuant to the terms of the PCCA Purchase Agreement, closed on August 31, 2012, we issued and sold to PCCA 832,683 shares of our common stock at a per share purchase price of $4.8038, for aggregate gross proceeds to us of $4,000,000. The PCCA Purchase Agreement does not grant to PCCA any registration rights with respect to the shares purchased and sold thereunder. The shares sold to PCCA were sold in reliance on the exemption from the registration requirements of the Securities Act of 1933 (the “Securities Act”) afforded by Section 4(2) thereof.

April Private Placement

On April 20, 2012, we entered into a Securities Purchase Agreement with certain accredited investors relating to the sale and issuance of an aggregate of 2,011,691 shares of our common stock and warrants to purchase up to 502,928 shares of common stock at an exercise price of $5.925 per share, for an aggregate purchase price of approximately $7.95 million (the “April Private Placement”). We closed the April Private Placement on April 25, 2012. The securities sold in the April Private Placement were sold in reliance on the exemption from the registration requirements of the Securities Act afforded by Section 4(2) thereof and Rule 506 of Regulation D.

The investors are not entitled to any registration rights with respect to the common stock and warrants issued in the April Private Placement. The warrants have a term of three years and are exercisable any time after April 25, 2012. We may require that the investors exercise the warrants in whole, but not in part, at any time within 20 business days after all of the following conditions have been satisfied: (i) the volume weighted average price of the our common stock for 10 consecutive trading days is equal to or greater than the exercise price of the warrants; (ii) we have received a Filing Review Notification from the FDA regarding the status of Impracor; and (iii) sufficient shares of common stock are authorized and reserved for issuance upon full exercise of the warrants.

4

Conversion of Convertible Note and Balance Under Line of Credit

Effective immediately following the effective time of the Certificate of Amendment to our Certificate of Incorporation increasing the number of authorized shares of our common stock on February 28, 2012, the entire outstanding balance and all accrued but unpaid interest owing under our $1,000,000 7.5% Convertible Promissory Note issued on April 5, 2010, as well as certain outstanding accounts payable held by DermaStar International, LLC (“DermaStar”), were converted into 1,835,830 shares of common stock, and the convertible promissory note was terminated. DermaStar was the holder of 80% of the convertible promissory note.

On April 25, 2012, the entire outstanding principal balance and all accrued and unpaid interest under our line of credit with DermaStar, an aggregate of $762,534, was converted into 193,047 shares of common stock and warrants to purchase 48,262 shares of our common stock pursuant to a conversion agreement we entered into with DermaStar on April 20, 2012. The warrants have substantially the same terms as the warrants issued in the April Private Placement. The line of credit was terminated upon the completion of the conversion. Director and Chief Executive Officer Mark L. Baum and the Chairman of our Board of Directors, Robert J. Kammer, were the Managing Members of DermaStar prior to its dissolution in July 2012. The conversion agreement was unanimously approved by the Company’s disinterested directors, with Mr. Baum and Dr. Kammer abstaining.

Written Consent of the Stockholders Approving Increase in Option Plan Reserve

On June 29, 2012, stockholders holding a majority of our outstanding voting power approved an amendment to our 2007 Incentive Stock and Awards Plan (the “2007 Plan”) to increase the number of shares available for issuance under the 2007 Plan from 750,000 to 2,400,000. The stockholder approval of the increase became effective upon our compliance with certain notice requirements under the Exchange Act.

Going Concern

Our independent registered public accounting firm issued an unqualified opinion with an explanatory paragraph to the effect that there is substantial doubt about our ability to continue as a going concern in its report included in our consolidated financial statments for the fiscal year ended December 31, 2011. This unqualified opinion with an explanatory paragraph could have a material adverse effect on our business, financial condition, results of operations and cash flows. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources” and Note 2 to our consolidated financial statements for the fiscal year ended December 31, 2011 included elsewhere in this prospectus. We experienced net losses of $(953,936) and $(2,531,228) for the years ended December 31, 2011 and 2010, respectively. As of September 30, 2012, our accumulated deficit was $(22,651,240).

Unless and until we execute an underwriting agreement with the underwriters in connection with this offering, we have no committed sources of capital and do not know whether additional financing will be available when needed on terms that are acceptable, if at all. The going concern statement from our independent registered public accounting firm may discourage some investors from purchasing our stock or from providing alternative capital financing to us. The failure to satisfy our capital requirements would adversely affect our business, financial condition, results of operations and prospects.

Unless we raise additional funds, either through the sale of equity securities such as through this offering or one or more collaborative arrangements, we will not have sufficient funds to continue operations. Even if we take these actions, the funds we raise may be insufficient, particularly if our costs are higher than projected or unforeseen expenses arise.

Risks Related to Our Business

Our business is subject to a number of risks. You should understand these risks before making an investment decision. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our common stock would likely decline, and you may lose all or part of your investment. Below is a summary of some of the principal risks we face. The risks are discussed more fully in the section of this prospectus below entitled “Risk Factors.”

|

●

|

We have a limited operating history since the dismissal of our voluntary petition for reorganization relief under Chapter 11 of the Bankruptcy Code in December 2011, and we may be unable to successfully resume our operations and implement our business plan.

|

5

|

●

|

The report of our independent registered public accounting firm on our 2011 consolidated financial statements contains a going concern modification.

|

|

●

|

We have incurred losses in the research and development of Impracor and our Accudel technology since inception. We may never generate revenue or become profitable.

|

|

●

|

Timing and results of clinical trials to demonstrate the safety and efficacy of products as well as FDA approval of products are uncertain.

|

|

●

|

Delays in the conduct or completion of our clinical and non-clinical trials for Impracor or the analysis of the data from our clinical or non-clinical trials may result in delays in our planned filings for regulatory approvals, and may adversely affect our business.

|

|

●

|

If we are not successful in introducing our products or if the market does not accept our products, or if our proposed product identification and development strategy is not successful, our business, financial position and results of operations may be materially adversely affected and the market price for our common stock would decline.

|

|

●

|

If our patents are determined to be unenforceable or expire, or if we are unable to obtain new patents based on current patent applications or for future inventions, we may not be able to prevent others from using our intellectual property.

|

|

●

|

Our principal stockholders have the ability to exert significant control in matters requiring a stockholder vote and could delay, deter or prevent a change in control of our company.

|

6

THE OFFERING

The following summary contains basic information about the offering and our common stock and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of our common stock, please refer to the section of this prospectus entitled “Description of Capital Stock.”

All information regarding share amounts of common stock and prices per share of common stock described below assume the consummation of the one-for-five reverse stock split to be effected following the effectiveness of the registration statement of which this prospectus forms a part and prior to the closing of this offering.

|

Issuer

|

Imprimis Pharmaceuticals, Inc.

|

|

Securities offered

|

Up to 1,619,047 shares of common stock

|

|

Common stock outstanding prior to offering

|

6,772,125 (1)

|

|

Common stock outstanding after the offering

|

8,391,172 (1)(2)

|

|

Use of Proceeds

|

We expect to use the net proceeds received from the offering, to fund our clinical trials and for working capital and general corporate purposes. See “Use of Proceeds” for more information.

|

|

OTC Markets Group Symbol

|

“IMMY”

|

|

Proposed NASDAQ Symbol

|

“IMMY”

|

|

Risk Factors

|

See “Risk Factors” beginning on page 8 and other information in this prospectus for a discussion of the factors you should consider before you decide to invest in our common stock.

|

|

Underwriters common stock purchase warrant

|

In connection with this offering, we have also agreed to sell to the underwriters and their respective designees a warrant to purchase up to 8.5% of the shares of common stock sold in this offering. If the warrants are exercised, each share may be purchased by the holder thereof at $5.25 per share (100% of the price of the shares sold in this offering.)

|

|

Lock-Up Agreements

|

Each of our officers, directors and shareholders beneficially owning 5% or more of our common stock have agreed that for a period of 180 days from the effective date of this offering, they will be subject to a lockup prohibiting any sales, transfers or hedging transactions in our securities held by them. See section titled “Lock-Up Agreements” in this prospectus.

|

(1) Excludes (i) 556,872 shares of common stock issuable upon the exercise of outstanding warrants with exercise prices ranging from $5.925 to $176.00 per share, (ii) 917,235 shares of our common stock issuable upon exercise of outstanding options with a weighted average exercise price of $5.30 per share outstanding under the 2007 Plan, and (iii) 200,000 shares of common stock underlying restricted stock units granted outside the 2007 Plan.

(2) Excludes any shares of common stock issuable pursuant to the exercise of the underwriters' over-allotment option and any shares of common stock issuable upon the exercise of warrants issuable to the underwriters upon the closing of this offering.

7

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors in addition to the other information contained in this prospectus. This prospectus contains forward-looking statements. Our business, financial condition, results of operations and stock price could be materially adversely affected by any of these risks. Additional risks not presently known to us or that we currently deem immaterial may also impair our business financial condition, results of operations and stock price.

Risks Related to Our Business

We have a limited operating history since the dismissal of our voluntary petition for reorganization relief under Chapter 11 of the Bankruptcy Code in December 2011, and we may be unable to successfully resume our operations and implement our business plan.

On June 26, 2011, we suspended our operations and filed a voluntary petition for reorganization relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Southern District of California (the “Bankruptcy Court”), Case No. 11-10497-11 (the “Chapter 11 Case”). On November 21, 2011, in connection with our entry into a line of credit agreement and securities purchase agreement with DermaStar International, LLC (“DermaStar”), we requested that the Bankruptcy Court dismiss the Chapter 11 Case. On December 8, 2011, the Bankruptcy Court entered an order dismissing the Chapter 11 Case, and since that date we have engaged a new management team, appointed new directors to fill certain vacancies on our Board and worked towards re-initiating our Phase 3 clinical trials for Impracor. However, we have a limited operating history since the dismissal of the Chapter 11 Case, and we may not be successful in our efforts to resume our operations. We did not receive any type of discharge of debts, claims or obligations in the Chapter 11 Case, and prior unknown or contingent liabilities could have a material adverse effect on our financial condition. Prior to the filing of the Chapter 11 Case, we were unable to successfully pursue our business plan due to a lack of funding. We will require additional capital to pursue our clinical trials and maintain our operations. We may be unable to obtain such funds when necessary. In addition, by September 2011 we employed no full-time employees and had retained the consulting services of one former employee in order to manage any matters related to the Chapter 11 Case. We have had to re-assemble an executive management team and a research and development team, and other employees to assist with our general operations. We currently have five employees, a number of whom are former employees, and we will need to hire additional employees in order to execute our business plan. Given our operating history, we may be unable to maintain an effective management team, or hire and retain the additional qualified individuals we will need. As a result, we may be unable to successfully pursue our business plan.

We must raise additional capital in order to continue operating our business, and such additional funds may not be available on acceptable terms or at all.

We do not generate any cash from operations and, although we believe we have sufficient cash reserves to execute our business plan for the next twelve months, we must raise additional funds in order to continue operating our business and fully execute our business plan. Even following our recent issuance of securities to PCCA in the PCCA Transaction and the completion of this offering, based on our use of proceeds from the PCCA Transaction and our proposed use of proceeds from this offering, we will likely need significant additional capital, which we may seek to raise through, among other things, public and private equity offerings and debt financings. If we are not able to generate significant revenues and attain profitable operations, we will need to continue to seek further additional financing. In addition, estimates of our operating expenses and working capital requirements could be incorrect, and we could be required to seek additional financing earlier than we anticipate. We expect to continue to fund our operations primarily through equity and debt financings in the future, and could also pursue funding from corporate partnerships or licensing arrangements (as we did with the PCCA Transaction) or similar financings. If additional capital is not available when necessary, we may not be able to continue to operate our business pursuant to our business plan or we may have to discontinue our operations entirely.

We expect our total expenditures over the next 12 months to be approximately $9.3 million. However, our estimate of total expenditures could increase if we encounter unanticipated difficulties. In addition, our estimates of the amount of cash necessary to fund our business may prove to be wrong and we could spend our available financial resources much faster than we currently expect. If we do not have sufficient funds to continue to develop our business, we will be forced to delay, scale back or eliminate some or all of our proposed operations. If any of these events were to occur, there is a substantial risk that our business would fail. Sources of additional funds may not be available on acceptable terms or at all. Weak economic and capital market conditions could result in increased difficulties in raising capital for our operations. We may not be able to raise money through the sale of our equity securities or through borrowing funds on terms we find acceptable, or at all. If we cannot raise the funds that we need, we will be unable to continue our operations, and our stockholders could lose their entire investment in our company.

8

If we issue equity or convertible debt securities to raise additional funds, our existing stockholders may experience substantial dilution, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. In addition, if we raise additional funds through collaboration and licensing arrangements, we may be required to relinquish potentially valuable rights to our product candidates or proprietary technologies, or grant licenses on terms that are not favorable to us. If we incur additional debt, it may increase our leverage relative to our earnings or to our equity capitalization, requiring us to pay additional interest expenses. Obtaining commercial loans, assuming those loans would be available, would increase our liabilities and future cash commitments. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as options, convertible notes and warrants, which would adversely impact our financial results.

The report of our independent registered public accounting firm on our 2011 consolidated financial statements contains a going concern modification, and we will need additional financing to execute our business plan, fund our operations and to continue as a going concern.

We have limited remaining funds to support our operations. We have prepared our consolidated financial statements for the fiscal year ended December 31, 2011 and the nine months ended September 30, 2012 on a going-concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The report of our independent registered public accounting firm included in our December 31, 2011 consolidated financial statements includes an explanatory paragraph stating that the recurring losses incurred from operations and a working capital deficiency raise substantial doubt about our ability to continue as a going concern. In the nine months ended September 30, 2012, we received proceeds, net of related costs, of approximately $7.93 million in the April Private Placement and $3.98 million in connection with the PCCA Transaction. We expect to use those funds and any funds we may receive from this offering to pursue obtaining regulatory approval to market Impracor and pursue our business plan, but we will need to secure additional funds in order to complete our clinical trials and pursue other product development opportunities. As a result of our recent capital raising transactions and in light of our current cash and cash equivalents position as of the date of this prospectus, we expect to have adequate resources in order to operate our business through the next twelve months. However, our auditors may have doubt about our ability to continue as a going concern in future periods, and our financial statements relating to those periods may not be prepared on a going-concern basis based on any such doubts. Further, even with our current cash position as a result of our recent financings, we will need to secure additional funds in order to complete our clinical trials and pursue other product development opportunities. If adequate financing is not available, we will not be able to meet FDA requirements to obtain regulatory approval to market Impracor. In addition, if one or more of the risks discussed in these risk factors occur or our expenses exceed our expectations, we may be required to raise further additional funds sooner than anticipated. The inclusion of a going concern modification in our independent registered public accounting firm’s report for the year ended December 31, 2011, or in any future report, may materially and adversely affect our stock price or our ability to raise new capital.

We have incurred losses in the research and development of Impracor and our Accudel technology since inception. We may never generate revenue or become profitable.

We have incurred losses in every year of our operations, including net losses of $(953,936) and $(2,531,228) for the years ended December 31, 2011 and 2010, respectively. As of September 30, 2012, our accumulated deficit was $(22,651,240). In addition, we expect to incur increasing operating losses for the foreseeable future as we continue to incur costs for research and development and clinical trials, and in other development activities. Our ability to generate revenue and achieve profitability depends upon our ability, alone or with others, to complete the development of our proposed products, obtain the required regulatory approvals and manufacture, market and sell our proposed products. Development is costly and requires significant investment. In addition, we may choose to in-license rights to particular drugs or active ingredients for use in cosmetic products. The license fees for such drugs or active ingredients may increase our costs.

9

As we continue to engage in the development of Impracor and develop other products, we may never be able to achieve or sustain market acceptance, profitability or positive cash flow. Our ultimate success will depend on many factors, including whether Impracor receives FDA approval. We cannot be certain that we will receive FDA approval for Impracor, or that we will reach the level of sales and revenues necessary to achieve and sustain profitability. Unless we raise additional capital, we will not be able to execute our business plan or fund business operations. Furthermore, we will be forced to reduce our expenses and cash expenditures to a material extent, which would impair or delay our ability to execute our business plan.

We may not be able to correctly estimate our future operating expenses, which could lead to cash shortfalls.

Our operating expenses may fluctuate significantly in the future as a result of a variety of factors, many of which are outside of our control. These factors include:

|

●

|

the time and resources required to develop, conduct clinical trials and obtain regulatory approvals for our drug candidates;

|

|

●

|

the costs to rebuild our management team following the dismissal of the Chapter 11 Case, including attracting and retaining personnel with the skills required for effective operations; and

|

|

●

|

the costs of preparing, filing, prosecuting, defending and enforcing patent claims and other patent related costs, including litigation costs and the results of such litigation.

|

If our estimates of our operating expenses prove to be wrong, we could spend our available financial resources much faster than we currently expect. If we do not have sufficient funds to continue to develop our business, we will be forced to delay, scale back or eliminate some or all of our proposed operations.

Our clinical trials may not demonstrate the safety and efficacy of our product candidates.

We are subject to extensive government regulations. The process of obtaining FDA approval is costly, time consuming, uncertain and subject to unanticipated delays. Before obtaining regulatory approvals for the sale of any of our product candidates, we must demonstrate through preclinical studies and clinical trials that the product candidate is safe and effective for each intended use. Preclinical and clinical studies may fail to demonstrate the safety and effectiveness of our product candidates. Even promising results from preclinical and early clinical studies do not always accurately predict results in later, large scale trials. A failure to demonstrate safety and efficacy would result in our failure to obtain regulatory approvals. Moreover, if the FDA grants regulatory approval of a product candidate, the approval may be limited to specific indications or limited with respect to its distribution, which could limit revenues.

The FDA or other regulatory agencies may not approve any product candidates developed by us on a timely basis or at all, and, if granted, such approval may subject the marketing of our product candidates to certain limits on indicated use. In particular, the outcome of the final analyses of the data from the Phase 3 clinical trials for Impracor may vary from our initial conclusions or the FDA may not agree with our interpretation of such results or may challenge the adequacy of our clinical trial design or the execution of the clinical trial. The FDA has required two adequate and well controlled Phase 3 clinical trials for Impracor before we can submit a New Drug Application under Section 505(b)(2) of the Hatch-Waxman Act of 1984. We have not yet initiated these Phase 3 clinical trials, although in September 2012 we commenced certain supportive studies relating to Impracor that are also required by the FDA. The results of any future clinical trials or studies may not be favorable and we may never receive regulatory approval for Impracor. Any limitation on use imposed by the FDA or delay in or failure to obtain FDA approvals of product candidates developed by us would adversely affect our ability to generate product revenue, as well as the price of our common stock.

Delays in the conduct or completion of our clinical and non-clinical trials for Impracor or the analysis of the data from our clinical or non-clinical trials may adversely affect our business.

We cannot predict whether we will encounter problems with any of our completed or planned clinical or non-clinical studies that will cause us or regulatory authorities to delay or suspend planned clinical and non-clinical studies. Any of the following could delay the completion of our planned clinical studies:

|

●

|

failure of the FDA to approve the scope or design of our clinical or non-clinical trials or manufacturing plans;

|

|

●

|

delays in enrolling volunteers in clinical trials;

|

|

●

|

insufficient supply or deficient quality of materials necessary for the performance of clinical or non-clinical trials;

|

|

●

|

negative results of clinical or non-clinical studies; and

|

|

●

|

adverse side effects experienced by study participants in clinical trials relating to a specific product.

|

10

There may be other circumstances other than the ones described above, over which we may have no control that could materially delay the successful completion of our clinical and non-clinical studies.Furthermore, we expect to rely on CROs to ensure the proper and timely conduct of our clinical trials, and while we expect to enter into agreements governing their committed activities, we have limited influence over their actual performance.

If our patents are determined to be unenforceable or expire, or if we are unable to obtain new patents based on current patent applications or for future inventions, we may not be able to prevent others from using our intellectual property.

Our success will depend in part on our ability to:

|

●

|

obtain and maintain patent protection with respect to our products;

|

|

●

|

prevent third parties from infringing upon our proprietary rights;

|

|

●

|

maintain trade secrets;

|

|

●

|

operate without infringing upon the patents and proprietary rights of others; and

|

|

●

|

obtain appropriate licenses to patents or proprietary rights held by third parties if infringement would otherwise occur.

|

We obtained a patent from the United States Patent and Trademark Office on our Accudel technology in 1998, which affords protection of Accudel through 2016 in the United States. We may not be successful in our efforts to extend the date of our patent protection beyond 2016. Failure to maintain or extend the patent could adversely affect our business. We will only be able to protect our drug candidates and our technologies from unauthorized use by third parties to the extent that valid and enforceable patents cover them

The patent and intellectual property positions of specialty pharmaceutical companies, including ours, are uncertain and involve complex legal and factual questions. There is no guarantee that we have or will develop or obtain the rights to products or processes that are patentable, that patents will issue from any pending applications or that claims allowed will be sufficient to protect the technology we develop or have developed or that is used by us, our contract manufacturing organizations or our other service providers. In addition, we cannot be certain that patents issued to us will not be challenged, invalidated, infringed or circumvented, including by our competitors, or that the rights granted thereunder will provide competitive advantages to us.

Furthermore, patent applications in the U.S. are confidential for a period of time until they are published, and publication of discoveries in scientific or patent literature typically lags actual discoveries by several months. As a result, we cannot be certain that the inventors listed in any patent or patent application owned by us were the first to conceive of the inventions covered by such patents and patent applications or that such inventors were the first to file patent applications for such inventions.

We also may rely on unpatented trade secrets and know-how and continuing technological innovation to develop and maintain our competitive position, which we seek to protect, in part, by confidentiality agreements with current employees, consultants, collaborators and others. We also have invention or patent assignment agreements with our current employees and certain consultants. There can be no assurance, however, that binding agreements will not be breached, that we will have adequate remedies for any breach, or that trade secrets will not otherwise become known or be independently discovered by competitors. In addition, there can be no assurance that inventions relevant to us will not be developed by a person not bound by an invention assignment agreement with us.

Our product development program may not be successful.

In addition to the development of Impracor, we expect to pursue development of potential products in pain management and other therapeutic areas. In particular, we are currently considering potential new product candidates in the muscle relaxant and neuropathic pain fields. We also expect to utilize our relationship with PCCA to identify development opportunities where we perceive an unmet need for a new drug product, and thereby facilitate our future selection, formulation and development of potential product candidates. In addition, our product development program has included cosmetic products, which utilizes the basis of our patented transdermal delivery system technology, Accudel. Since our primary focus will remain seeking FDA approval for Impracor, we currently expect to use limited resources on our other development programs.

None of our potential pharmaceutical product candidates have commenced any clinical trials and there are a number of FDA requirements that we must satisfy in order to commence clinical trials. These requirements will require substantial time, effort and financial resources. We may never satisfy these requirements. In addition, prior to commencing any trials of a drug candidate, we must evaluate whether a market exists for the drug candidate. This is costly and time consuming, and any market studies we rely on may not be accurate. We may expend significant capital and other resources on a drug candidate and find that no commercial market exists for the drug. Further, our relationship with PCCA, on which we intend to rely to facilitate our evaluation of the potential market for future products we may develop, is terminable if we fail to commence efforts to research and develop future products within certain time periods, as set forth in the PCCA License Agreement. We may not be able to meet such requirements within the required time periods or at all, and our relationship with PCCA could be terminated. If we do commence clinical trials of our other potential product candidates, such product candidates may never be approved by the FDA. Even if we are not required to obtain FDA pre-market approval for our potential cosmeceutical product candidates, we will still be subject to a number of federal and state regulations, including regulation by the FDA and the Federal Trade Commission on any marketing claims we make, and we may be unable to satisfy these requirements. Any cosmeceutical products we develop may cause undesirable side effects that could limit their use, require their removal from the market and subject us to adverse regulatory action and product liability claims. As a result, we may never successfully develop and obtain approval to market and sell any of our potential product candidates. Even if we do develop and obtain approval to market and sell such product candidates, we may be unable to compete against the many products and treatments currently being offered or under development by other established, well known and well-financed cosmetic, health care and pharmaceutical companies.

11

If approved, failure to comply with continuing federal and state regulations could result in the loss of approvals to market our drugs.

Following initial regulatory approval of any drugs we may develop, we will be subject to continuing regulatory review, including review of adverse drug experiences and clinical results that are reported after our drug products become commercially available. This would include results from any post-marketing tests or continued actions required as a condition of approval. The manufacturer and manufacturing facilities we use to make any of our drug candidates will be subject to periodic review and inspection by the FDA. If a previously unknown problem or problems with a product or a manufacturing and laboratory facility used by us is discovered, the FDA may impose restrictions on that product or on the manufacturing facility, including requiring us to withdraw the product from the market. Any changes to an approved product, including the way it is manufactured or promoted, often requires FDA approval before the product, as modified, can be marketed. In addition, we and our contract manufacturers will be subject to ongoing FDA requirements for submission of safety and other post-market information. If we or our contract manufacturers fail to comply with applicable regulatory requirements, a regulatory agency may:

|

●

|

issue warning letters;

|

|

●

|

impose civil or criminal penalties;

|

|

●

|

suspend or withdraw our regulatory approval;

|

|

●

|

suspend or terminate any of our ongoing clinical trials;

|

|

●

|

refuse to approve pending applications or supplements to approved applications filed by us;

|

|

●

|

impose restrictions on our operations;

|

|

●

|

close the facilities of our contract manufacturers; or

|

|

●

|

seize or detain products or require a product recall.

|

Regulatory review also covers a company’s activities in the promotion of its drugs, with significant potential penalties and restrictions for promotion of drugs for an unapproved use. Sales and marketing programs are under scrutiny for compliance with various mandated requirements, such as illegal promotions to health care professionals. We are also required to submit information on our open and completed clinical trials to public registries and databases. Failure to comply with these requirements could expose us to negative publicity, fines and penalties that could harm our business.

If we violate regulatory requirements at any stage, whether before or after marketing approval is obtained, we may be fined, be forced to remove a product from the market or experience other adverse consequences, including delay, which would materially harm our financial results. We may not be able to obtain the labeling claims necessary or desirable for product promotion.

If approved, there is no guarantee that the market will accept our products. If we are not successful in introducing our products or if the market does not accept our products, our business, financial position and results of operations may be materially adversely affected and the market price for our common stock would decline.

Even if we obtain regulatory approvals, uncertainty exists as to whether the market will accept our products or if the market for our products is as large as we anticipate. A number of factors may limit the market acceptance of our products, including the timing of regulatory approvals and market entry relative to competitive products, the availability of alternative products, the price of our products relative to alternative products, the availability of third party reimbursement and the extent of marketing efforts by third party distributors or agents that we retain. We cannot assure you that our products will receive market acceptance in a commercially viable period of time, if at all. We cannot be certain that any investment made in developing products will be recovered, even if we are successful in commercialization. To the extent that we expend significant resources on research and development efforts and are not able, ultimately, to introduce successful new products as a result of those efforts, our business, financial position and results of operations may be materially adversely affected, and the market value of our common stock could decline.

12

We may be subject to product liability claims.

The development, manufacture, and sale of pharmaceutical and cosmetic products expose us to the risk of significant losses resulting from product liability claims. Although we have obtained and intend to maintain product liability insurance to offset some of this risk, we may be unable to maintain such insurance or it may not cover certain potential claims against us.

In the future, we may not be able to afford to obtain insurance due to rising costs in insurance premiums in recent years. Currently we have been able to secure insurance coverage; however, we may be faced with a successful claim against us in excess of our product liability coverage that could result in a material adverse impact on our business. If insurance coverage is too expensive or is unavailable to us in the future, we may be forced to self-insure against product-related claims. Without insurance coverage, a successful claim against us and any defense costs incurred in defending ourselves may have a material adverse impact on our operations.

We may not be successful in receiving additional patents based on our intellectual property strategy.

We have undertaken an effort to examine our intellectual property assets and have or shall file certain patents in certain jurisdictions, with the goal of attaining additional protections for our technologies and any related future products. The applications we have filed or we expect to file may never yield patents that protect our inventions and intellectual property assets. Failure to obtain additional patents may limit our protection against generic drug manufacturers and other parties who may seek to copy or otherwise produce products substantially similar to ours using technologies that may be substantially similar to those we own.

The use of our technologies could potentially conflict with the rights of others.

The manufacture, use or sale of our proprietary products may infringe on the patent rights of others. If we are unable to avoid infringement of the patent rights of others, we may be required to seek a license, defend an infringement action or challenge the validity of the patents in court. Patent litigation is costly and time consuming and may divert management’s attention and our resources. We may not have sufficient resources to bring these actions to a successful conclusion. In such case, we may be required to alter our products, pay licensing fees or cease activities. If our products conflict with patent rights of others, third parties could bring legal actions against us claiming damages and seeking to enjoin manufacturing and marketing of affected products. If these legal actions are successful, in addition to any potential liability for damages, we could be required to obtain a license in order to continue to manufacture or market the affected products. We may not prevail in any legal action and a required license under the patent may not available on acceptable terms, if at all.

We will be dependent on outside manufacturers in the event that we successfully develop our product candidates into commercial products; therefore, we will have limited control of the manufacturing process, access to raw materials, timing for delivery of finished products and costs. One manufacturer may constitute the sole source of one or more of our products.

We expect that third party manufacturers will manufacture all of our products, in the event that we successfully develop our product candidates into commercial products. Currently, certain of our contract manufacturers constitute the sole source of one or more of our products. If any of our existing or future manufacturers cease to manufacture or are otherwise unable to deliver any of our products or any of the components of our products, we may need to engage additional manufacturing partners. Because of contractual restraints and the lead-time necessary to obtain FDA approval of a new manufacturer, replacement of any of these manufacturers may be expensive and time consuming and may disrupt or delay our ability to supply our products and reduce our revenues.

Because all of our products, in the event that we successfully develop our product candidates into commercial products, will be manufactured by third parties, we have a limited ability to control the manufacturing process, access to raw materials, the timing for delivery of finished products or costs related to this process. There can be no assurance that our contract manufacturers will be able to produce finished products in quantities that are sufficient to meet demand or at all, in a timely manner, which could result in decreased revenues and loss of market share. There may be delays in the manufacturing process over which we will have no control, including shortages of raw materials, labor disputes, backlog or failure to meet FDA standards. Increases in the prices we pay our manufacturers, interruptions in our supply of products or lapses in quality could adversely impact our financial condition. We are reliant on our third-party manufacturers to maintain their manufacturing facilities in compliance with FDA and other federal, state and/or local regulations including health, safety and environmental standards. If they fail to maintain compliance with FDA or other critical regulations, they could be ordered to curtail operations, which would have a material adverse impact on our business, results of operations and financial condition.

13

We also rely on our outside manufacturers to assist us in the preparation of key documents such as drug master files and other relevant documents that are required by the FDA as part of the drug approval process and post-approval oversight. Failure by our outside manufacturers to properly prepare and retain these documents could cause delays in obtaining FDA approval of our drug candidates.

We are dependent on third parties to conduct clinical trials and non-clinical studies of our drug candidates and to provide services for certain core aspects of our business. Any interruption or failure by these third parties to meet their obligations pursuant to various agreements with us could have a material adverse effect on our business, results of operations and financial condition.

We do not employ personnel or possess the facilities necessary to conduct many of the activities associated with our programs. We expect to engage consultants, advisors, CROs and others to design, conduct, analyze and interpret the results of studies in connection with the research and development of our product candidates. As a result, many important aspects of our product candidates’ development are outside our direct control. Such third parties may not perform all of their obligations under arrangements with us or may not perform those obligations satisfactorily.

The CROs with whom we expect to contract for execution of our clinical studies will play a significant role in the conduct of our anticipated clinical studies or assist with our analysis of completed studies and to develop corresponding regulatory strategies. Individuals working at the CROs with whom we expect to contract, as well as investigators at the sites at which our studies are conducted, are not our employees, and we cannot control the amount or timing of resources that they devote to our programs. If these CROs fail to devote sufficient time and resources to our studies, or if their performance is substandard, it would delay the approval of our applications to regulatory agencies and the introduction of our products. Failure of these CROs to meet their obligations could adversely affect development of our product candidates and as a result could have a material adverse effect on our business, financial condition and results of operations. Moreover, these CROs may have relationships with other commercial entities, some of which may compete with us. If they assist our competitors at our expense, it could harm our competitive position.