Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - MedClean Technologies, Inc. | form8k.htm |

| Delaware | PAGE 1 |

| The First State |

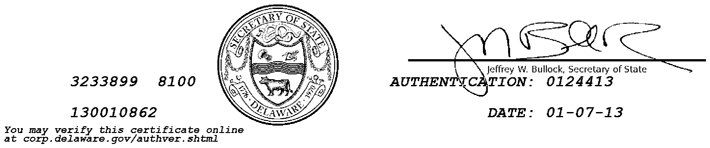

I, JEFFREY W. BULLOCK, SECRETARY OF STATE OF THE STATE OF DELAWARE, DO HEREBY CERTIFY THE ATTACHED IS A TRUE AND CORRECT COPY OF THE CERTIFICATE OF DESIGNATION OF “MEDCLEAN TECHNOLOGIES, INC.”, FILED IN THIS OFFICE ON THE THIRD DAY OF JANUARY, A.D. 2013, AT 4:29 O’CLOCK P.M.

A FILED COPY OF THIS CERTIFICATE HAS BEEN FORWARDED TO THE NEW CASTLE COUNTY RECORDER OF DEEDS.

| State of Delaware |

| Secretary of State |

| Division of Corporations |

| Delivered 04:31 PM 01/03/2013 |

| FILED 04:29 PM 01/03/2013 |

| SRV 130010862 - 3233899 FILE |

MEDCLEAN TECHNOLOGIES, INC.,

a Delaware corporation

CERTIFICATE OF DESIGNATIONS, RIGHTS AND PREFERENCES

OF

SERIES D PREFERRED STOCK

MedClean Technologies, Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), hereby certifies that the following resolution was adopted by the Board of Directors of the Corporation (the “Board”) on December 3, 2012 in accordance with the provisions of its Articles of Incorporation (as may be amended from time to time, the “Articles of Incorporation”) and bylaws. The authorized series of the Corporation’s previously authorized preferred stock shall have the following designations, rights, preferences, privileges, powers and restrictions thereof, as follows:

RESOLVED, that pursuant to the authority granted to and vested in the Board in accordance with the provisions of the Articles of Incorporation and bylaws of the Corporation, the Board hereby authorizes a series of the Corporation’s previously authorized preferred stock (the “Preferred Stock”), and hereby states the designation and number of shares, and fixes the relative rights, preferences, privileges, powers and restrictions thereof, as follows:

I. NAME OF THE CORPORATION

MedClean Technologies, Inc.

II. DESIGNATION AND AMOUNT: DIVIDENDS

A. Designation. The designation of said series of preferred stock shall be Series D Preferred Stock, no par value per share (the “Series D Preferred”).

B. Number of Shares. The number of shares of Series D Preferred authorized shall be fifty-one (51) shares. Each share of Series D Preferred shall have a stated value equal to $0.0001 (as may be adjusted for any stock dividends, combinations or splits with respect to such shares, the “Series D Stated Value”).

C. Dividends: Initially, there will be no dividends due or payable on the Series D Preferred. Any future terms with respect to dividends shall be determined by the Board consistent with the Corporation’s Articles of Incorporation. Any and all such future terms concerning dividends shall be reflected in an amendment to this Certificate of Designation, which the Board shall promptly file or cause to be filed.

III. LIQUIDATION RIGHTS

The holders of Series D Preferred Stock shall have no rights (whether in the form of distributions or otherwise) in respect of any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary, and shall be subordinate to all other classes of the Corporation’s capital stock in respect thereto.

IV. RANK

All shares of the Series D Preferred shall rank (i) senior to the Corporation’s (A) common stock, no par value per share (“Common Stock”), (B) all currently issued outstanding series of preferred stock, no par value per share (“Preferred Stock”), and any other class or series of capital stock of the Corporation hereafter created, except as otherwise provided in clauses (ii) and (iii) of this Article IV, (ii) pari passu with any class or series of capital stock of the Corporation hereafter created and specifically ranking, by its terms, on par with the Series D Preferred (the “Pari Passu Shares”) and (iii) junior to any class or series of capital stock of the Corporation hereafter created specifically ranking, by its terms, senior to the Series D Preferred (the “Senior Shares”), in each case as to distribution of assets upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary.

V. VOTING RIGHTS

Each one (1) share of the Series D Preferred shall have voting rights equal to (x) 0.019607 multiplied by the total issued and outstanding shares of Common Stock eligible to vote at the time of the respective vote (the “Numerator”), divided by (y) 0.49, minus (z) the Numerator. For purposes of illustration only, if the total issued and outstanding shares of Common Stock eligible to vote at the time of the respective vote is 5,000,000, the voting rights of one share of the Series D Preferred shall be equal to 102,036 (0.019607 x 5,000,000) / 0.49) - (0.019607 x 5,000,000) = 102,036).

With respect to all matters upon which stockholders are entitled to vote or to which stockholders are entitled to give consent, the holders of the outstanding shares of Series D Preferred Stock shall vote together with the holders of Common Stock without regard to class, except as to those matters on which separate class voting is required by applicable law or the Articles of Incorporation or bylaws.

VI. PROTECTION PROVISIONS

So long as any shares of Series D Preferred are outstanding, the Corporation shall not, without first obtaining the unanimous written consent of the holders of Series D Preferred, (i) alter or change the rights, preferences or privileges of the Series D Preferred so as to affect adversely the holders of Series D Preferred or (ii) create Pari Passu Shares or Senior Shares.

VII. MISCELLANEOUS

A. Status of Redeemed Stock: In case any shares of Series D Preferred shall be redeemed or otherwise reacquired, the shares so redeemed or reacquired shall resume the status of authorized but unissued shares of preferred stock, and shall no longer be designated as Series D Preferred.

B. Lost or Stolen Certificates: Upon receipt by the Corporation of (i) evidence of the loss, theft, destruction or mutilation of any Preferred Stock certificate(s) and (ii) (A) in the case of loss, theft or destruction, indemnity (with a bond or other security) reasonably satisfactory to the Corporation or (B) in the case of mutilation, the Preferred Stock certificate(s) (surrendered for cancellation), the Corporation shall execute and deliver new Preferred Stock certificate(s).

C. Waiver: Notwithstanding any provision in this Certificate of Designation to the contrary, any provision contained herein and any right of the holders of Series D Preferred granted hereunder may be waived as to all shares of Series D Preferred (and the holders thereof) upon the unanimous written consent of the holders of the Series D Preferred.

D. Notices: Any notices required or permitted to be given under the terms hereof shall be sent by prepaid certified or registered mail (return receipt requested), or delivered personally, by nationally recognized overnight carrier or by confirmed facsimile transmission, and shall be effective five (5) days after being placed in the mail, if mailed, or upon receipt or refusal of receipt, if delivered personally, by nationally recognized overnight carrier or confirmed facsimile transmission, in each case addressed to a party as set forth below, or such other address and telephone and fax number as may be designated in writing hereafter in the same manner as set forth in this Section.

If to the Corporation:

MedClean Technologies, Inc.

57 S Commerce Way, Suite 310

Bethlehem, Pennsylvania 18017

Attention: David Laky, Chief Executive

Telephone: (203) 798-1080

If to the holder of Series D Preferred, to the address listed in the Corporation’s books and records.

IN WITNESS WHEREOF, the undersigned has signed this certificate as of the 2nd day of January, 2013.

| MEDCLEAN TECHNOLOGIES, INC. | |||

| By: | /s/ David Laky | ||

| Name: | David Laky | ||

| Title: | Executive Chairman of the Board of | ||

| MedClean Technologies, Inc. | |||