Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hyatt Hotels Corp | d477560d8k.htm |

| EX-99.1 - PRESS RELEASE - Hyatt Hotels Corp | d477560dex991.htm |

Management Agreements for

four hotels in france

February 1, 2013

Exhibit 99.2 |

Forward looking Statements

2

Forward-looking statements in this presentation, which are not

historical facts, are forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements include, among other things, statements

about our plans and strategies, market trends in France, anticipated renovations and

dates by which such renovations will be completed, market share trends,

expected funding under the performance guarantee and depreciation and amortization

expense or future events and involve known and unknown risks that are

difficult to predict. As a result, our actual results, performance or achievements may differ

materially from those expressed or implied by these forward-looking

statements. In some cases, you can identify forward-looking statements by the use of words such as

“may,” “could,” “expect,” “intend,”

“plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and

variations of these terms and similar expressions, or the negative of these

terms or similar expressions. Such forward-looking statements are necessarily based upon

estimates and assumptions that, while considered reasonable by us and our

management, are inherently uncertain. Factors that may cause actual results to differ

materially from current expectations include, among others, general economic

uncertainty in key global markets including Europe and a worsening of global economic

conditions or low levels of economic growth; levels of spending in business

and leisure segments as well as consumer confidence; declines in occupancy and average

daily rate; limited visibility with respect to short and medium-term

group bookings; our ability to successfully achieve certain levels of operating profit at hotels that

have performance guarantees with our third-party owners; the

impact of hotel renovations; the impact of rebranding efforts; our ability to successfully execute and

implement our organizational realignment and the costs associated with such

organizational realignment; our ability to successfully execute and implement our

common stock repurchase program; loss of key personnel, including as a

result of our organizational realignment; hostilities, including future terrorist attacks, or fear

of hostilities that affect travel; travel-related accidents; changes in

the tastes and preferences of our customers; relationships with associates and labor unions and

changes in labor law; the financial condition of, and our relationships

with, third-party property owners, franchisees and hospitality venture partners; if our third-

party owners franchisees or development partners are unable to access

the capital necessary to fund current operations or implement our plans for growth; risk

associated with potential acquisitions and dispositions and the introduction

of new brand concepts; changes in the competitive environment in our industry and the

markets where we operate; outcomes of legal proceedings; changes in federal,

state, local or foreign tax law; foreign exchange rate fluctuations or currency

restructurings; general volatility of the capital markets; our ability to

access the capital markets; and other risks discussed in the Company's filings with the U.S.

Securities and Exchange Commission, including our Annual Report on Form

10-K, which filings are available from the SEC. We caution you not to place undue

reliance on any forward-looking statements, which are made as of the

date of this presentation. We undertake no obligation to update publicly any of these forward-

looking statements to reflect actual results, new information or future

events, changes in assumptions or changes in other factors affecting forward-looking statements,

except to the extent required by applicable laws. If we update one or more

forward-looking statements, no inference should be drawn that we will make additional

updates with respect to those or other forward-looking statements.

|

Overview

•

Hyatt

a

to re-brand four hotels in France as follows:

Current name:

To be re-branded as:

Concorde La Fayette

Hyatt Regency Paris Etoile

Hotel du Louvre

Andaz following renovation

Hotel Martinez

Grand Hyatt Cannes Hotel Martinez

Palais de la Mediterranee

Hyatt Regency Nice Palais de la Mediterranee

•

1,712 rooms after renovation

•

Long-term management agreements with renewal options

•

Iconic, well-known properties in high-barrier-to-entry

markets •

Hyatt to commence management services for hotels in 2Q13

•

Owner to complete a significant portfolio renovation by mid-year

2016 3

a

Hyatt refers to Hyatt Hotels Corporation or one of its affiliates

|

High Demand Markets

4

Paris:

•

One

of

the

most

successful

and

largest

hotel

markets

in

Europe

with

high

barriers

to

entry

a

•

36.9M hotel nights, 15.6M arrivals in 2011

b

•

81,139 Rooms / 1,549 hotels

b

•

Total market RevPAR + 4.7% YTD November 2012

b

•

Attracts a large number of meetings, congresses and exhibitions and has

the largest provision

of

covered

exhibition

space

in

Europe

(600,000+

square meters)

a

•

Approximately

40%

of

the

350

international

trade

fairs

organized in

France

each

year

are

held in the capital

a

a

Source: Paris Chamber of Commerce

b

Source: MKG Hospitality, Hotel Industry Trends Report Nov 2012

|

High Demand Markets

Cannes:

•

France’s 2

nd

most important city for business, tourism and a strong group

destination •

2M visitors annually

a

•

120 hotels / 7,500 rooms in 2011

a

•

Total market RevPAR + 5.9% YTD November 2012

b

5

a

Source: Cannes Convention Bureau

b

Source: MKG Hospitality, Hotel Industry Trends Report Nov 2012

c

Source: Nice Cote Azur –

Convention and Visitors Bureau

Nice:

Fifth largest city in France with nearly 4M visitors annually

c

1/3

of

French

Riviera’s

hotel

accommodations

with

nearly

200

hotels

and

10,000

rooms

c

Total

market

RevPAR

+1.4%

YTD

November

2012

b

•

•

• |

Strong Portfolio Attributes

•

Diverse earnings mix

•

44% Group

•

56% Transient

•

Opportunity to increase inbound business

Current Mix:

•

69% Europe

•

12% U.S.

•

8% Rest of World excluding Europe

•

7% Middle East

•

Strong current market share, expected to grow

•

Owner to complete a significant portfolio renovation by mid-year

2016 6 |

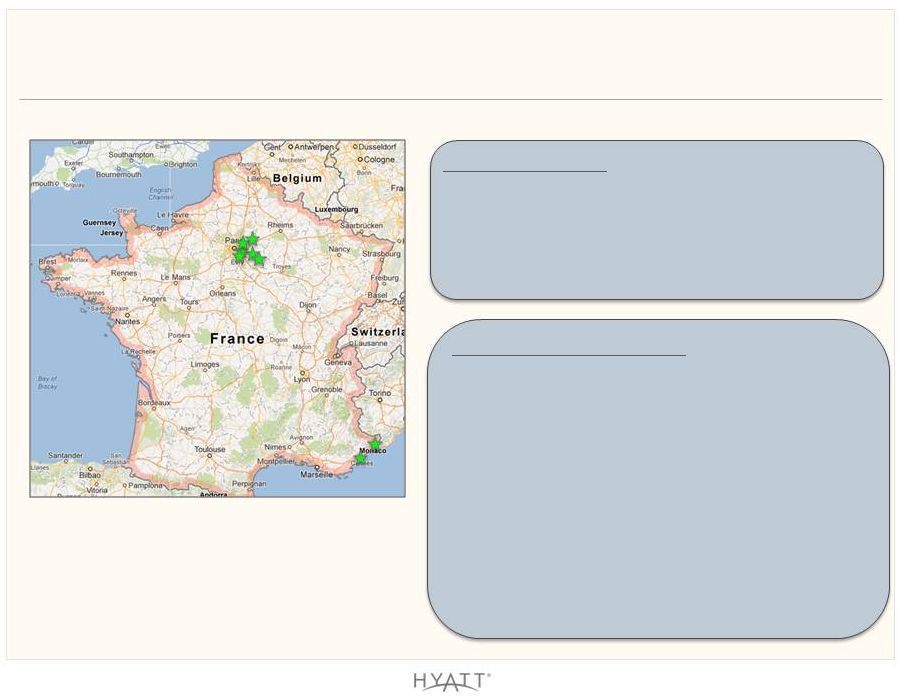

Expanding our Footprint In France

7

Additions to the portfolio:

Paris

Hyatt Regency Paris Etoile (950 rooms)

Hotel du Louvre (177 rooms, Andaz following

renovation)

Cannes

Grand Hyatt Cannes Hotel Martinez (409

rooms)

Nice

Hyatt Regency Nice Palais de la Mediterranee

(188 rooms)

Source: Bing maps

Existing portfolio:

Paris

Park Hyatt Paris Vendome (158 rooms)

Hyatt Paris Madeleine (86 rooms)

Hyatt Regency Paris Charles De Gaulle (388

rooms)

•

•

•

•

•

•

• |

8

950 rooms

37,000 square feet of meeting space

Strong group business as proximate to Palais des

Congres, the largest meeting venue in Europe

Tallest hotel in Central Paris (35 stories)

Located between historical city center and

business area of La Defense

2012 RevPAR increased 8.1%

409 rooms

Nearly 27,000 square feet of conference space; one of

the largest conference facilities in Cannes

1929 art deco building

Located on French Riviera

One of only three “palace”

hotels in Cannes

2012 RevPAR increased 3.2%

188 rooms

20,000 square feet of meeting space

Directly facing the sea, the hotel stands on the

world renowned Promenade des Anglais

Highly visible due to its prominent historic Art-

Deco facade

2012 RevPAR increased 10.6%

177 rooms

Strong demand from both corporate and leisure

guests

Built in 1855 as Paris’s first luxury hotel

1

st

Arrondissement location opposite Louvre

Museum

2012 RevPAR increased 9.2%

HOTEL DU LOUVRE (ANDAZ FOLLOWING

RENOVATION)

HYATT REGENCY PARIS ETOILE

HYATT REGENCY NICE PALAIS DE LA

MEDITERRANEE

GRAND HYATT CANNES HOTEL MARTINEZ

Portfolio detail |

Management Agreement and FEE Terms

•

Long-term management agreements with renewal options

•

Fixed base fee percentage

•

First 12 months: approximately €5M

•

Expected to increase over time

•

Performance guarantee covers first seven years of management

agreements •

No annual guarantee cap, maximum cumulative cap of €377M

•

•

If profits are above annual guarantee level, excess is retained by Hyatt as

incentive fee •

If

profits

are

below

annual

guarantee

level,

Hyatt

does

not

earn

incentive

fee

and

Hyatt

funds up to annual guarantee level

•

From and after the seventh year, annual incentive fee equals fixed

percentage above owner return threshold

•

Expected to be approximately €1.5M per year from and after the seventh

year and increase over time

9

•

Hyatt expects to earn between €10M and €15M in total management

fees over the first twelve months Incentive management fee:

•

During the first seven years, annual incentive fee expected to be between

€0M and €15M as follows: |

Performance Guarantee accounting

Liability of approximately €90M to be recorded upon inception of the

performance guarantee; represents the fair value of the performance

guarantee liability with an offsetting intangible asset

The performance guarantee liability will be amortized as income over the

term of the guarantee (recorded as other income)

The intangible asset will be amortized over the initial term of the

management agreements (recorded as amortization expense)

Quarterly, we will assess the likelihood of payment under the guarantee and

to the extent a payment is probable within the year, we will record a

separate liability and a corresponding expense (recorded

as other loss)

Our current expectation is that the likelihood of a payment under the

performance guarantee in 2013 or 2014 is low

Any income or loss related to the liabilities or intangible asset will not

impact Adjusted EBITDA 10

•

•

•

•

•

• |

Summary

•

Agreements are consistent with strategy to increase long-term brand

presence in key gateway locations

•

Unique opportunity given high-barrier-to-entry markets

•

Iconic, well-known, well-performing hotels with diverse customer

base •

Ability to immediately brand and manage under Hyatt brands

•

Owner has committed capital to renovate properties

•

Attractive economics, particularly post re-branding and renovation

•

Expected to have relatively low levels of Hyatt capital outlay

11 |

12 |