Attached files

| file | filename |

|---|---|

| EX-99.2 - TRANSCRIPT OF EARNINGS CONFERENCE CALL - AUTOLIV INC | d476777dex992.htm |

| EX-99.1 - PRESS RELEASE - AUTOLIV INC | d476777dex991.htm |

| 8-K - FORM 8-K - AUTOLIV INC | d476777d8k.htm |

©

Autoliv Inc., All Rights Reserved

Teleconference

4

th

Quarter Financial Earnings

January 31, 2013

Driven for Life

Exhibit 99.3 |

ALV

Q4’12

Financial

Earnings

Report

-

2

This report contains statements that are not historical facts but rather

forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995 (PSLRA). All such statements are based upon

our current expectations and various assumptions, and apply only as of the

date of this report. Our expectations and beliefs are expressed in good

faith and we believe there is a reasonable basis for them. However, there

can be no assurance that forward-looking statements will materialize or prove to be

correct. Because such statements involve risks and uncertainties, the outcome could

differ materially from those set out in the statements. For a summary

of such risk factors, please refer to our latest 10-K and 10-Q filed

with the SEC. Except for our ongoing obligation to disclose

information under law, we undertake no obligation to update publicity any

forward-looking statements whether as a result of new information or future

events. For any forward-looking statements contained in this or any other

document, we claim the protection of the safe harbor for forward-looking

statements contained in the PSLRA.

Safe Harbor Statement *

(*) Non-US GAAP reconciliations are disclosed in our 8-K/10-K/10-Q

filings available at www.sec.gov or www.autoliv.com |

Highlights

-

Solid performance in a challenging environment

(*) Excludes legal costs & other charges related to the on-going

anti-trust investigations and alignment costs Sales guidance met

•

organic sales growth 1.5%

Margin* guidance slightly exceeded

•

EBIT margin 9.4%

EPS* $1.58

•

partly driven by lower tax rate and financial net

Cash flow as expected

•

~ $0.25B operating cash flow

ALV Q4’12 Financial Earnings Report

-

3 |

ALV

Q4’12

Financial

Earnings

Report

-

4

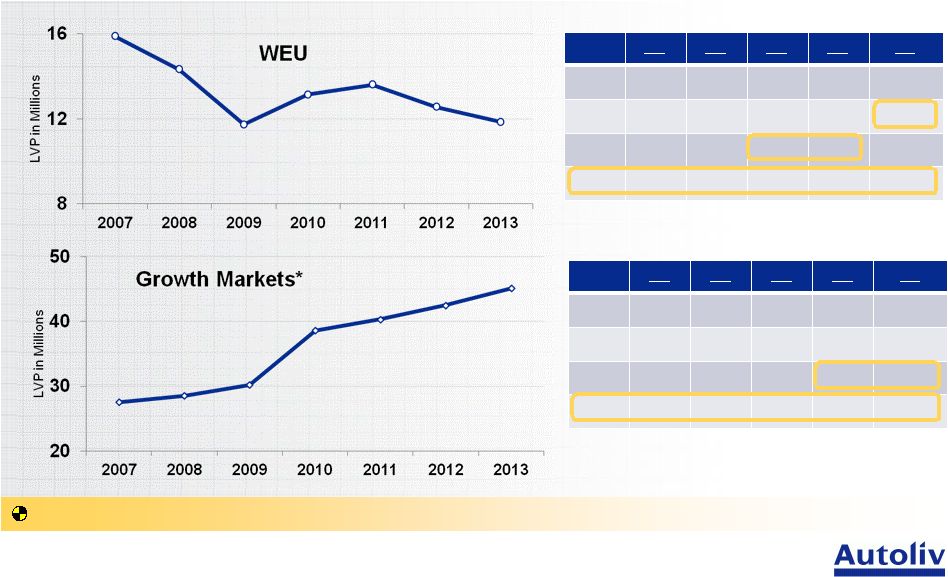

Mixed Market Conditions

-

The tale of two cities

(*) Growth Markets excludes WEU, North America & Japan, CPV (Content per

Vehicle),

(LVP) Light Vehicle Production according

to IHS @ January 16, 2013. 2013 LVP in WEU similar to Q4’12

run rate 000’s

Q1

Q2

Q3

Q4

FY

2008

4,141

4.178

3,250

2.749

14,318

2009

2,471

3,024

2,968

3,271

11,734

2012

3,555

3.230

2,792

2,978

12,554

2013

3,076

3.069

2,642

3,060

11,847

•

LVP declining back to 2009 levels

•

CPV ~ $400

000’s

Q1

Q2

Q3

Q4

FY

2008

7,332

7694

6,890

6,312

28,229

2009

6,022

7,323

7,744

8,853

29,942

2012

10,493

10,630

10,203

11,193

42,519

2013

10,807

11,213

11,217

11,935

45,173

•

LVP setting new record levels

•

CPV ~ $200 |

ALV

Q4’12

Financial

Earnings

Report

-

5

Continued Strategy Execution

-

In a challenging environment

Capacity alignment activities while investing in growth markets

Record order intake

Continued investments in technology and growth markets

Capacity alignment progressing

Strong balance sheet for;

•

growth opportunities

•

uncertain environment |

ALV

Q4’12 Financial Earnings Report -

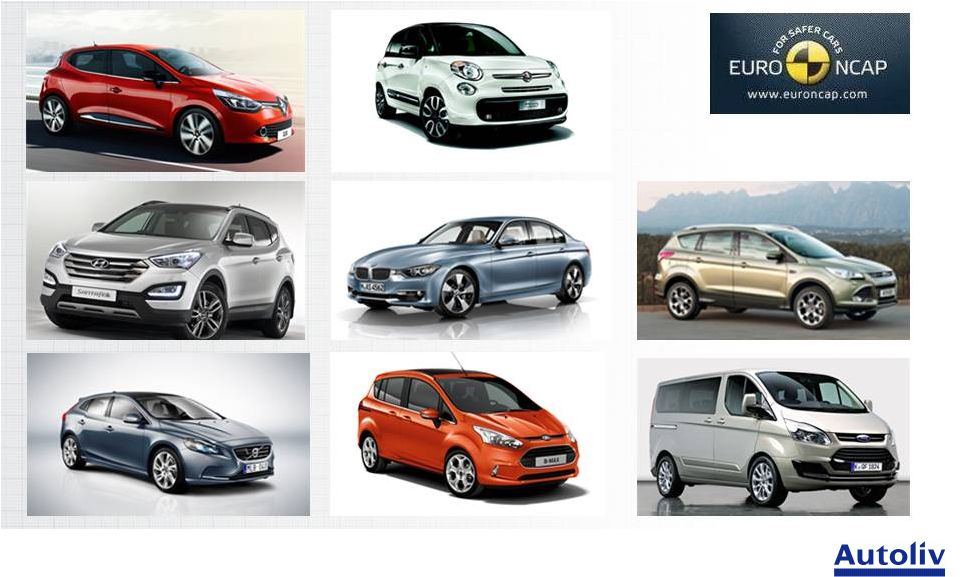

6

Renault Clio

Ford B-Max

Euro NCAP Today

-

2012 Best in Class 5 Star Models

BMW 3-Series

Hyundai Santa Fe

Fiat 500L

Ford Transit

Ford Kuga

Volvo V40 |

ALV

Q4’12 Financial Earnings Report -

7

Euro NCAP in the Future

-

Migration towards Active Safety

2014

•

Active Safety weighting increases from 10% to 20%

•

Active Safety required to achieve 5 Star

•

Euro NCAP points of focus for Active Safety

•

Lane Departure Warning, Autonomous Braking

•

Intelligent Speed Assist (50% urban)

2017

•

Active Safety required to achieve 4 Star

•

Euro NCAP points of focus for Active Safety

•

Lane Departure Warning, Autonomous Braking

•

Intelligent Speed Assist (100% urban)

Active Safety technologies are under evaluation by NHTSA for the new US NCAP

|

Investments for Growth

-

Active and Passive Safety Technologies

ACTIVE

SAFETY

NIGHT VISION

Automatic Animal Detection

Dynamic Spot Light

Sensor Fusion NIR / FIR

STEREO VISION

Pedestrian Detection

RADAR

LRR Narrow Band

Multi-Mode

PASSIVE

SAFETY

BAG-IN-BELT

KNEE AIRBAG

ACTIVE SEATBELT

PEDESTRIAN AIRBAG

DUAL PRETENSIONING

Estimate ~ 5% CAGR in our automotive safety market from 2012

thru 2015

ALV Q4’12 Financial Earnings Report

-

8

SAFETY DOMAIN CONTROLLER Brake Controls

Integration with Airbag ECU

|

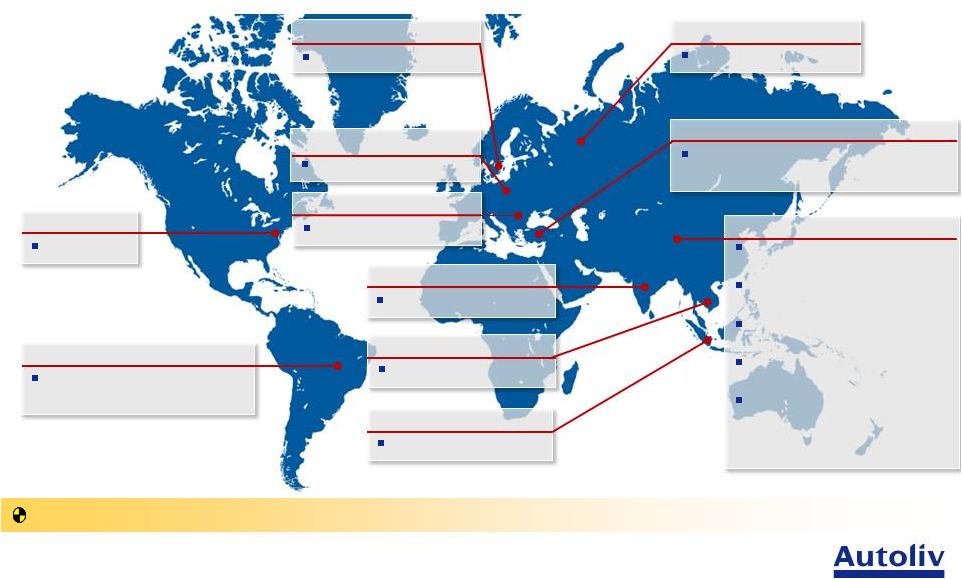

Investments for Growth

-

Facility expansions

China

Jintan

(propellant)

Changchun

Guangzhou

Nanjing

Shanghai

India

Webbing

Thailand

Cushion cut&sewn

Sweden

Radar

U.S.

Radar

Romania

Steering Wheel

Indonesia

Seatbelt & Airbag

Russia

Seatbelt & Airbag

Investing ~ $0.5BM on growth initiatives in 2011 and 2012

Poland

Airbag

Turkey

Airbags, Seatbelts, Steering

Wheel, Component Manufacturing

Brazil

Airbags, Seatbelts, Steering

Wheel, Webbing

ALV Q4’12 Financial Earnings Report

-

9

(seatbelts & airbags)

(seatbelts & airbags)

(seatbelts)

(ECU’s & crash sensors, Tech

Center) |

ALV Q4’12 Financial Earnings Report

-

10

(*) Non US GAAP and restated for ASC 810-10-45.

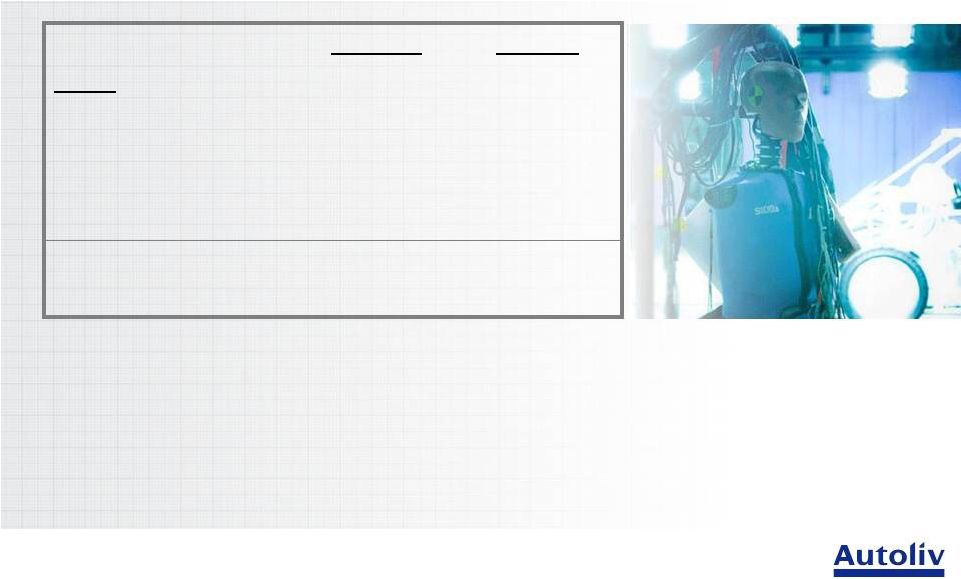

Cash Flow

-

Investments for growth in CapEx and RD&E

(US $ Mil’s unless specified)

Q4

2012

Q4

2011

FY

2012

FY

2011

FY

2010

FY

2009

Net Income

140

160

486

627

596

13

Depreciation & Amortization

69

70

273

268

282

314

Other, net

(4)

1

10

38

57

(41)

Change in operating WC

36

62

(80)

(175)

(11)

207

Operating cash flow

241

293

689

758

924

493

Capital Expenditures, net

(99)

(100)

(360)

(357)

(224)

(130)

Free cash flow *

142

193

329

401

700

363

Dividend payment

48

40

178

154

58

15

Strong operating cash flow and dividend payment increased YoY

|

Dividend Trend

-

Per share and cash payments*

Dividend per share

Dividend Payments

Dividend Payments

* Estimated

dividend

payment

for

Q1

2013

based

on

share

count

at

end

of

4

quarter

2012

Annualized payment to shareholders ~ $190M based on $2.00 per

share

0.5

0.4

0.3

0.2

0.1

0

60

40

20

0

ALV

Q4’12

Financial

Earnings

Report

-

11

th

1997

98

99

2000

01

02

03

04

05

06

07

08

09

2010

11

12

13 |

FY

Financial Overview -

Record sales and dividend per share

Solid result despite LVP decline YoY in WEU ~ 8%

(*) Non

US

GAAP

Earnings

Before

Interest

and

Taxes,

Earnings

per

share,

Return

on

Capital

Employed,

Return

on

Equity

(**) US

GAAP

reported,

Dividend

per

share

(***)

IHS

Global

Light

Vehicle

Production

(US $ Mil’s unless specified)

2012

2011

Sales

$8,267

$8,232

Gross Profit

$1,646

19.9%

$1,728

21.0%

EBIT *

$803

9.7%

$908

11.0%

EPS *

(assuming dilution)

$5.82

$6.80

RoCE *

24%

28%

RoE *

15%

20%

Operating Cash flow

$689

$758

DPS **

$1.89

$1.73

GLVP ***

~ 80M

~ 75M

ALV

Q4’12

Financial

Earnings

Report

-

12 |

(*) Light

Vehicle

Production,

Source

IHS

January

16,

2013,

TRIAD

(WEU,

North

America,

Japan),

(**)

Includes

Acquisitions

Autoliv Production**

-

FY2012

Maintaining ~ 36% global passive safety market share

Units in Millions (unless specified)

2012

Change vs.’11

Seatbelts

139.1

5%

•

Pretensioners

(of which)

[54.9]

[3%]

•

Active Seatbelts

(of which)

1.6

40%

Frontal airbags

35.1

8%

Knee airbags

2.5

89%

Side airbags

72.0

7%

•

Chest (Thorax)

37.3

7%

•

Head (Curtain)

34.7

8%

Steering Wheels

12.9

4%

Electronic Control Units

13.6

1%

Active Safety Units

1.6

79%

LVP* TRIAD

37.2

8%

LVP* GLOBAL

79.7

7%

ALV

Q4’12

Financial

Earnings

Report

-

13 |

Mercedes S-Class

Hyundai Genesis

Toyota Highlander

Acura MDX

GMC Sierra

Citroën C4 Picasso

Jeep Cherokee

BMW X5

Peugeot 309

* Images may not reflect new model

Major Platform Launches

-

FY2013

ALV

Q4’12

Financial

Earnings

Report

-

14 |

Looking Ahead

-

Q1 2013

(*) Earnings Before Interest & Taxes excludes legal costs & other charges

related to the on-going anti-trust investigations & alignment costs

Sales

•

YoY organic sales decline ~ (4%)

EBIT* Margin ~ 8%

•

Sequential change is mainly due to lower engineering income

mainly related to the sharp LVP decline in WEU and Japan

mainly related to Q4 launches

ALV

Q4’12

Financial

Earnings

Report

-

15

•

Sequentially organic sales up slightly

•

YoY change is mainly due to organic sales drop

|

•

2 half improvement due to organic sales growth in active safety,

launches and underlying LVP improvement

•

1

half lower due to higher RD&E and continued low level LVP in WEU

Early Indication

-

FY2013

Sales

EBIT* Margin ~ 9%

•

YoY organic sales effect offset by higher RD&E and temporary margin

effect from increasing vertical integration and growth

H1 vs. H2

(*) Earnings Before Interest & Taxes excludes legal costs & other charges

related to the on-going anti-trust investigations & alignment costs

strong

growth

in

Active

Safety

&

China

favorable launch mix

partially offset by lower LVP in WEU & Japan

st

nd

ALV

Q4’12

Financial

Earnings

Report

-

16

+

1

to

3%

•

YoY

organic

sales

growth |

Financial Outlook

Q1 2013

FY2013

Sales

Organic

(4%)

1 to 3%

Acquisitions /

(Divestitures)

~ (0.4%)

~ (0.2%)

Fx**

~ 0.1%

~ 1.1%

Consolidated Sales

~ (4%)

2 to 4 %

EBIT Margin *

~ 8 %

~ 9 %

(*) Excludes legal costs & other charges related to the on-going

anti-trust investigations and alignment costs

(**) 1 Euro = 1.33 US$, 1 US$ = 89JPY for Q1’13 & FY2013

ALV

Q4’12

Financial

Earnings

Report

-

17 |

Autoliv

Every year, Autoliv’s products

save over 25,000 lives

Passive

Safety

Active

Safety

Autoliv -

Safety Systems

Thank you!

ALV

Q4’12

Financial

Earnings

Report

-

18 |