Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Reef Oil & Gas Drilling & Income Fund, L.P. | a2211187zex-23_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

Table of Contents

As filed with the Securities and Exchange Commission on January 31, 2013

Registration No. 333-172846

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

REEF 2012 - 2013 DRILLING FUND, L.P.

(Exact name of registrant as specified in its charter)

| Texas (State or other jurisdiction of incorporation or organization) |

1381 (Primary Standard Industrial Classification Code Number) |

32-0388630 (IRS Employer Identification Number) |

1901 N. Central Expressway, Suite 300

Richardson, Texas 75080

(972) 437-6792

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

| Agent for Service: Michael J. Mauceli Reef Oil & Gas Partners, L.P. 1901 N. Central Expressway, Suite 300 Richardson, Texas 75080 (972) 437-6792 |

Copy to: Ted Schweinfurth Baker & McKenzie LLP 2001 Ross Avenue, Suite 2300 Dallas, Texas 75201 (214) 978-3000 |

|

| (Name and address, including zip code, and telephone number, including area code, of agent for service) |

||

Approximate date of commencement of proposed sale of securities to the public:

From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company ý |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities, in any state where the offer or sale is not permitted.

Subject to Completion. Preliminary Prospectus Dated January 31, 2012

Reef 2012 - 2013 Drilling Fund, L.P.

338 Units of Limited Partner Interests and

1,912 Units of Additional General Partner Interests*

| Offering Price: $100,000 per unit | Minimum Purchase: $10,000 (1/10th unit) |

Reef 2012 - 2013 Drilling Fund, L.P. (the "Partnership") is a Texas limited partnership formed to drill and own interests in oil and natural gas properties located in the United States with a focus primarily on the Bakken area in North Dakota. The primary purpose of the Partnership will be to generate revenue from the production of oil and gas, distribute cash to the partners, and provide the tax benefits that are available to those that drill for and produce oil and natural gas. We are Reef Oil & Gas Partners, L.P., and we will be the managing general partner of the Partnership.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

These securities are speculative and involve a high degree of risk. Before buying units, you should consider carefully the risk factors beginning on page 10 in this prospectus, which include, but are not limited to the following:

• Because we have not selected any prospects, you will not be able to evaluate the Partnership's prospects before making your investment decision • Oil and natural gas investments are highly risky • Our prior history demonstrates that partnership returns will be adversely affected in the event of dry holes and unproductive or marginal wells • Cash distributions are not guaranteed • Additional general partners have unlimited liability for Partnership obligations • Your ability to resell your units is limited due to the lack of a public market and restrictions contained in the partnership agreement • Our affiliates and we may have conflicts of interest with you and the Partnership • Compensation payable to us will affect distributions • The management of the general partner and of the Partnership is not subject to supervision or review by an independent board or officers • The partnership agreement prohibits your participation in the Partnership's business decisions • Lack of drilling rig availability may increase the Partnership's cost and may result in delays in drilling on Partnership prospects • Partners will have limited ability to remove the managing general partner and may have difficulty in finding a successor managing general partner • Drilling exploratory wells is riskier than drilling developmental wells • Prices of oil and natural gas are volatile • Tax treatment may change.

|

||||||

| |

Per Unit |

Minimum Offering (10 Units) |

Maximum Offering (2,250 Units) |

|||

|---|---|---|---|---|---|---|

Offering Price |

$100,000 | $1,000,000 | $225,000,000 | |||

Organization and Offering Costs, excluding Commissions |

$2,000 | $20,000 | $4,500,000 | |||

Commissions |

$10,000 | $100,000 | $22,500,000 | |||

Management fee (or excess organization and offering costs) |

$3,000 | $30,000 | $6,750,000 | |||

Proceeds to the Partnership |

$85,000 | $850,000 | $191,250,000 | |||

|

||||||

Reef Securities, Inc. is the dealer manager for this offering. The dealer manager and soliciting dealers are offering the units on a "best efforts minimum/maximum" basis. The dealer manager and soliciting dealers must sell the minimum number of units in the Partnership (10) in order for the Partnership to conduct an initial closing and break escrow. The dealer manager and soliciting dealers are required to use only their best efforts to sell the units offered in the Partnership.

Subscription proceeds for the Partnership will be held in an interest-bearing escrow account with Wilmington Trust, National Association, until $1 million has been received, without regard to units subscribed for by our affiliates or us. The offering period for the Partnership began on the date of this prospectus and will terminate on June 30, 2014. If the minimum subscription proceeds are not received by the Partnership's offering termination date, then your subscription will be promptly returned to you from the escrow account with interest and without deduction for any fees.

- *

- The term "Additional General Partner Interests" designates the general partner interests acquired by investors in the Partnership and is used to distinguish the general partner interests represented by units from the general partner interests held by the managing general partner of the Partnership which are not represented by units. The additional general partner interests in the Partnership will be converted into limited partnership interests as soon as practical after the end of the year in which drilling by the Partnership has been substantially completed.

i

ii

iii

The following is a summary that highlights information contained in this prospectus. This summary may not contain all of the information that is important to you. You should read the entire prospectus carefully, including the risk factors, the financial statement and the notes to the financial statement. You will find definitions of many terms, including those relating to the oil and natural gas business, in the "GLOSSARY OF TERMS" beginning on page 120. References to "we," "our," "us," "Reef" and similar terms refer to Reef Oil & Gas Partners, L.P., the managing general partner of the Partnership.

Reef 2012 - 2013 Drilling Fund, L.P., referred to in this prospectus as the "Partnership" or the "Fund," is a Texas limited partnership formed to drill, acquire and own interests in oil and natural gas properties located in the United States. Regardless of location, the properties we select for the Partnership must meet our acquisition criteria. We have a geological and engineering staff that reviews prospects from a diverse number of geographical regions in the continental United States with a focus primarily on the Bakken area in North Dakota. We will evaluate all prospective acquisitions on the basis of their oil and natural gas producing potential, the predictability of their drilling and completion costs and their access to readily available pipeline hookups, among other criteria. See "PROPOSED ACTIVITIES—Acquisition Strategy."

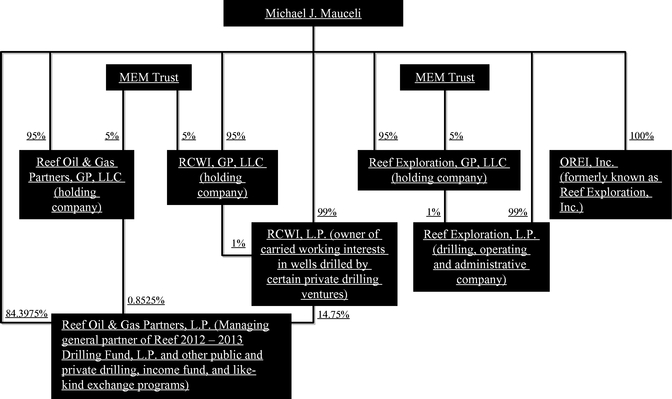

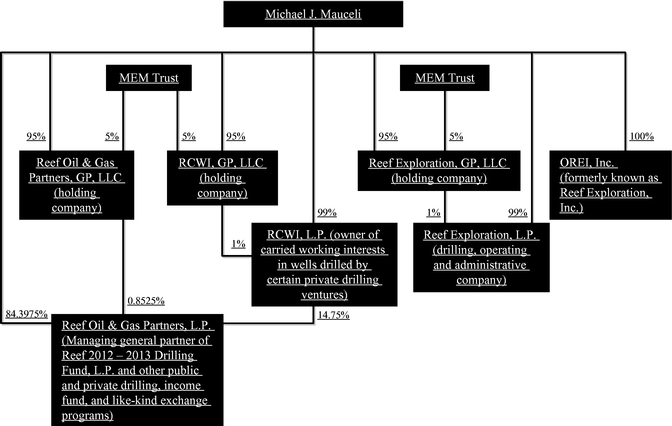

The operator of the Partnership's prospects will be either an unrelated third party or Reef Exploration, L.P. ("RELP"), one of our affiliates. RELP was formed in December 2005 to engage in the business of developing, exploiting, and producing oil and natural gas properties and to serve as operator for the wells drilled by partnerships sponsored by us. RELP's staff consists of the former employees of OREI, Inc. ("OREI"), an affiliate of ours formerly known as Reef Exploration, Inc. OREI was formed in 1987 to engage in the business of developing, exploiting and producing oil and natural gas. RELP has assumed the operation of all wells formerly operated by OREI as well as new acquisitions. OREI and RELP have served as operator of approximately 275 wells. From 1996 through 1999, OREI sponsored 11 private drilling partnerships and two private partnerships engaged in the development and interpretation of three-dimensional seismic data. We were formed in 1999 by the owners of OREI. Since our formation in 1999 until June 30, 2012, we have sponsored 36 private drilling ventures, nine public drilling partnerships, 14 private oil and gas production purchase ventures, one private commercial salt water disposal venture, and one private partnership engaged in the development and interpretation of three-dimensional seismic data. Of the 56 drilling partnerships we and OREI have sponsored since 1996, 25 engaged in drilling multiple wells (including the nine public drilling partnerships). See "PRIOR ACTIVITIES" for a discussion of the 25 multiple-well drilling partnerships sponsored by us or OREI. The following diagram depicts the ownership of Reef, OREI,

1

RELP and certain of their affiliates. It does not include the drilling and income fund ventures of which Reef and its affiliates serve as managing partner.

The Partnership will offer investors the opportunity to participate in an investment in the oil and natural gas industry that has been designed to primarily focus on drilling developmental wells and the acquisition of producing properties, if any, associated with such drilling opportunities, although the Partnership may drill or participate in the drilling of exploratory wells. A developmental well is a well drilled within the proved area of an oil or gas reservoir to the depth of a stratigraphic horizon known to be productive. In contrast, an exploratory well is a well drilled to find a new field or to find a new reservoir in a field previously found to be productive of oil or gas in another reservoir.

The Fund is intended to produce the following benefits for investors:

- •

- Cash distributions from the sale of oil and natural gas. If we drill successful wells and the Partnership's revenues exceed its expenses, or if we acquire interests in producing oil and gas wells in association with the acquisition of drilling opportunities, you will receive periodic distributions of the Partnership's cash profits. If the Partnership drills or participates in the drilling of a successful well or wells, we expect that cash distributions to the partners would begin as soon as practical after the Partnership begins receiving operating income from such well, including, if applicable, during the offering period, with such distributions being made monthly thereafter if practical. Generally, we estimate that acquiring, drilling and completing possible oil and gas wells will take between five to eight months, depending on the well depth and conditions that may arise during operations. After drilling is completed, it is expected to take between two to four months for an investor partner to receive distributions, if any, based on any production from the completed well, including the time taken for hooking the well up to existing infrastructure and engaging in related marketing activities. We may, at our discretion, make distributions less frequently than monthly. We will review the accounts of the Partnership

2

- •

- Single layer of federal income tax on Partnership earnings and tax deductions for intangible

drilling costs, depreciation and depletion. As a partner in the Partnership, you will be required to include on your own federal income tax return your allocable

share of the Partnership's taxable income and deductions, including, under current federal tax law, deductions for intangible drilling costs, depreciation and depletion. As a result, if the

Partnership makes a cash distribution to you that is attributable to the Partnership's net taxable income that is, or has already been, included on your federal income tax return, the distribution

should not be taxable a second time to you for federal income tax purposes. See "Material Federal Income Tax Consequences—Tax Consequences to You," "—Basis and At Risk

Limitations" and "—Partnership Distributions." If you invest as an additional general partner, the tax deductions from the Partnership should reduce your taxable income from the

Partnership and potentially from other so-called "active" sources such as ordinary income from employment. If you invest as a limited partner, these deductions should reduce your taxable

income from the Partnership and from other so-called "passive" business activities that you may participate in, if any. See "Material Federal Income Tax Consequences—Intangible

Drilling Costs," "—Depreciation," "—Depletion," and "—Passive Loss Limitations." There recently have been specific legislative proposals that would change some of

the U.S. federal income tax rules applicable to drilling for and producing oil and natural gas. Those proposals would, among other things, place additional limits on or eliminate the current

deductions for intangible drilling costs and depletion. See "Risk Factors—Tax Risks—The current tax treatment of exploring for and producing oil and gas

may change, and such changes may reduce or eliminate the tax benefits described in this prospectus," and "Material Federal Income Tax Consequences—Possible Changes

in Federal Tax Laws."

- •

- A diversified investment in multiple wells. We expect to include interests in multiple wells in the Partnership so that the impact of less productive properties is balanced by the results of other properties. The number of wells drilled and acquired by the Partnership will depend upon the amount raised by the Partnership, the size of the Partnership's interest in each well and the development costs of each well.

monthly for the purpose of determining the cash available for distribution. The timing and amount of distributions during the offering period will depend primarily on the Partnership's net income as determined under generally accepted accounting principles, and after the offering period the timing and amount of distributions will depend primarily on net cash receipts from its oil and natural gas operations, and will be affected, among other things, by the price of oil and natural gas and the level of production of the Partnership's wells.

For reasons we discuss in this prospectus, including under the section entitled "Risk Factors," you may not realize some or all of these benefits. You should only invest if you can afford the loss of your entire investment.

These securities are speculative and involve a high degree of risk. See "RISK FACTORS" on pages 8 to 26 of this prospectus, together with the other information in this prospectus, in evaluating an investment in the units.

Significant risks associated with the offering include, but are not limited to, the following:

- •

- Because we have not selected any prospects, you will not be able to evaluate the Partnership's prospects before making

your investment decision.

- •

- Oil and natural gas investments are highly risky.

- •

- Our prior history demonstrates that drilling partnership returns will be adversely affected in the event of dry holes and marginal or unproductive wells.

3

- •

- The Partnership's ability to diversify risks depends on the number of units issued, the development costs of each well,

the size of the Partnership's interest in each well and the availability of suitable prospects.

- •

- Cash distributions are not guaranteed.

- •

- Additional general partners have unlimited liability for partnership obligations.

- •

- Your ability to resell your units is limited due to the lack of a public market and restrictions contained in the

partnership agreement.

- •

- Our affiliates and we may have conflicts of interest with you and the Partnership.

- •

- Compensation payable to us will affect distributions.

- •

- The management of the general partner and of the Partnership is not subject to supervision or review by an independent

board or officers.

- •

- The partnership agreement prohibits the participation of all partners, including additional general partners and converted

limited partners, in the Partnership's business decisions.

- •

- Lack of drilling rig availability may increase the Partnership's costs and may result in delays in drilling on Partnership

prospects.

- •

- Partners will have limited ability to remove the managing general partner and may have difficulty in finding a successor

managing general partner.

- •

- Drilling exploratory wells is riskier than drilling developmental wells.

- •

- Prices of oil and natural gas are volatile.

- •

- Tax treatment may change.

4

Terms of the Offering (see page 26)

Managing General Partner |

Reef Oil & Gas Partners, L.P., a Nevada limited partnership ("Reef") | |

Securities Offered |

We are offering up to 1,912 units of additional general partner interest ($191,250,000) and 338 units of limited partner interest ($33,750,000) in the Partnership. 85% of the units offered will be for additional general partner interests and 15% will be for limited partner interests. You may elect to buy units as an additional general partner and/or as a limited partner. The minimum offering amount in the Partnership is $1,000,000 (10 units). As long as at least 10 units are sold in the Partnership, and at least one of such units is a unit of limited partner interest, including units we buy, there is no minimum number of additional general partner or limited partner units that must be sold. |

|

Offering Price |

$100,000 per unit |

|

Minimum Investment |

$10,000 (1/10 unit) |

|

No Assessments |

You are not required to make any capital contributions to the Partnership other than payment of the offering price for the units you purchase. |

|

Offering Period |

The offering period for the Partnership began on the date of this prospectus. As of the date of this prospectus, the Partnership has not commenced operations and has no assets or liabilities. We may terminate the offering period for the Partnership at any time after the minimum number of units (10) has been subscribed for in the Partnership, excluding units we buy. Unless we elect to terminate the Partnership's offering period before the maximum number of units in the Partnership has been subscribed for, the offering period for the Partnership will terminate on June 30, 2014. |

|

Suitability Standards |

Investment in the units is suitable for you only if you do not need liquidity in this investment and can afford to lose all or substantially all of your investment. Your subscription for units will be accepted only if you represent that you meet the suitability standards described below under "TERMS OF THE OFFERING—Investor Suitability" on page 30. |

5

Plan of Distribution |

Reef Securities, Inc. ("RSI") is the dealer manager for this offering. It will receive a sales commission, payable in cash equal to 10% of the investor partners' subscriptions. RSI may reallow up to 8% of its commission, which includes a 1% non-accountable marketing fee, in whole or part, to other FINRA-licensed broker-dealers engaged to sell units. RSI also may reallow up to 1.5% of its commission, in whole or in part, to wholesalers. RSI and the soliciting dealers are required to use only their best efforts to sell the units offered in the Partnership. Subscription proceeds for the Partnership will be held in a separate interest-bearing escrow account until the minimum number of units in the Partnership has been subscribed for, without regard to units our affiliates and we buy, and may be released before the end of the Partnership's offering period. If the minimum number of units in the Partnership are not subscribed for prior to the termination of the Partnership's offering period, the Partnership will not break escrow and the Partnership will instruct the escrow agent to promptly return all subscription proceeds from your investment in the Partnership to you, with interest, which in the current economic environment will be at a very low rate, if any. |

|

|

The price to be paid by us for our minimum subscription, and the price to be paid by our affiliates and us for additional units that any of us may subscribe for, if any, is the same price per unit to be paid by investors, net, however, of organization and offering costs (including commissions). This means we will pay a minimum of 85% of the offering price for each unit we purchase, or $85,000 per unit. The net amount of money received by the Partnership will be the same per unit regardless of whether we or an affiliate pays 85% of the offering price. Michael J. Mauceli, the manager of our general partner and the Chief Executive Officer and manager of the general partner of RELP, is the brother of Paul Mauceli, the sole shareholder, director and Chief Executive Officer of RSI. |

6

Participation in Distributions, Profits, Losses, Costs and Revenues. |

Cash distributions, if any, from the Partnership's operations will be distributed 89% to the holders of units and 11% to us, excluding any units purchased by us, until each investor partner has been distributed, in the aggregate, an amount at least equal to its capital contributions. After the investor partners have been distributed amounts at least equal to their capital contributions, cash distributions will be distributed 79% to the investor partners and 21% to us, excluding any units purchased by us. |

|

Management of the Partnership; Voting Rights. |

We will exclusively manage and control all aspects of the business of the Partnership. No investor partner shall have any voice in the day-to-day business operations of the Partnership. However, a vote of a majority of the then outstanding units entitled to vote, without the necessity of our concurrence, will be required to approve certain actions related to the Partnership, including the sale of all or substantially all of the assets of the Partnership, our removal as the managing general partner of the Partnership, dissolution of the Partnership, and any non-ministerial material amendment to the partnership agreement. |

|

Conversion of General Partner Interests |

All additional general partner interests in the Partnership will be converted into limited partner interests on a one-to-one basis as soon as practicable after the end of the year in which drilling by the Partnership has been substantially completed. |

|

Principal Office |

The principal office of the Partnership and Reef is located in North Dallas at 1901 N. Central Expressway, Suite 300, Richardson, Texas 75080, and their telephone numbers are (972) 437- 6792 and (877) 915-REEF ((877) 915-7333). Michael J. Mauceli, the principal executive officer of Reef, makes the final investment decisions for the Partnership. |

7

Our Compensation (see page 39)

The following table summarizes the compensation to be received by us from the Partnership.

Recipient

|

Form of Compensation | Amount | ||

|---|---|---|---|---|

Managing General Partner |

Partnership interest (excluding any partnership interest resulting from the purchase of units) | 10% general partner interest | ||

Managing General Partner |

Subordinated partnership interest (received after the investor partners have been distributed amounts equal to their capital contributions) |

10% general partner interest (subordinated) |

||

Managing General Partner |

Management Fee |

15% of subscriptions, less commissions and other organization and offering costs (non-recurring) |

||

Managing General Partner |

Direct and administrative costs |

Reimbursement at cost |

||

Affiliate of the Managing General Partner |

Operator's per-well charges |

Competitive prices |

||

Managing General Partner and its Affiliates |

Payment for equipment, supplies, marketing, and other services |

Cost or competitive prices |

Our "partnership interest," as described in the table above, refers only to our interest as managing general partner and does not include any interest we will have as a result of our purchase of units, nor the 1% interest we will have as the result of our contribution of 1% of the net capital of the Partnership after payment of all organization and offering costs, which amount will be used to pay lease costs, intangible drilling and development costs, and well completion costs. In addition to the 1% interest described above, we will buy at least 1% of the units issued by the Partnership. Direct costs cannot be quantified until the Partnership begins conducting business. In the event the maximum amount of funds is raised ($225,000,000), we could receive substantial management fees after deducting organization and offering costs and commissions.

Participation in Distributions, Profits, Losses, Costs and Revenues (see page 35)

As the managing general partner of the Partnership, we will determine if and when to make cash distributions to the investor partners. Cash distributions, if any, from the Partnership's operations will be distributed 89% to the holders of units and 11% to us, excluding any units purchased by us, until each investor partner has been distributed, in the aggregate, an amount at least equal to its capital contributions. After the investor partners have been distributed amounts at least equal to their capital contributions, cash distributions will be distributed 79% to the investor partners and 21% to us, excluding any units purchased by us. We will contribute 1% of the net capital of the Partnership after payment of all organization and offering costs and we will buy at least 1% of the units issued by the Partnership at the offering price of $100,000 per unit, net of organization and offering costs (including commissions). This means we will pay a minimum of 85% of the offering price for each unit we purchase, or $85,000 per unit. We will be entitled to a ratable share of distributions, profits and losses for each unit that we purchase.

8

Organization and offering costs that do not exceed an amount equal to 15% of the investor partners' subscriptions will be allocated 100% to the investor partners. We will pay 100% of any excess organization and offering costs, without recourse, and receive 100% of the related tax allocations for those costs.

If the Partnership has a profit or loss without regard to the costs and expenses that are specially allocated as discussed above, (i) the profit will be allocated to the holders of units and to us in accordance with our respective rights to cash distributions from the Partnership, and (ii) the loss will be allocated first to the extent of, and in the same manner as, any prior allocations of undistributed profits, and then to the holders of units and us in accordance with our respective capital contributions to the Partnership (excluding the portion of capital contributions, if any, that are used to pay organization and offering costs).

The Partnership must receive minimum subscriptions of $1,000,000 to have an initial closing, without regard to units bought by our affiliates and us, and the subscription proceeds for the Partnership from the issuance of units cannot exceed $225,000,000, including units we purchase. Approximately 85% of the proceeds from the aggregate contributions to the capital of the Partnership (a minimum of approximately $50,000 and a maximum of approximately $191,250,000) will be applied to acquisition, drilling and completion costs. Approximately 10% of the proceeds from aggregate contributions to partnership capital (a minimum of $100,000 and a maximum of $22,500,000) will be used to pay sales commissions, and the remainder (a minimum of approximately $50,000 and a maximum of approximately $11,225,000) will pay for other organization and offering costs associated with the formation and sale of the partnership interests. We will receive a management fee in an amount equal to the excess of 15% of the subscriptions by investor partners to the Partnership over the sum of all commissions payable to the dealer manager and all organization and offering costs. We will be charged with 100% of the organization and offering costs, excluding sales commissions, for the Partnership to the extent that the costs exceed 15% of the investor partners' subscriptions. At the end of the Partnership's offering period, any future requirements for additional capital for the Partnership may only be satisfied from Partnership production or from borrowings to fund subsequent operations or from the issuance of additional units if approved by the investor partners. Alternatively, the Partnership could farmout or sell Partnership properties.

Material Federal Income Tax Consequences; Opinion of Counsel (see page 89)

We have received an opinion from our counsel, Baker & McKenzie LLP, concerning the material federal income tax considerations applicable to an investment in the Partnership and the discussion under the heading "Material Federal Income Tax Consequences" in this prospectus. The full text of the opinion is attached as Appendix D to this prospectus. We encourage you to read the opinion in its entirety and to read the discussion under the heading "Material Federal Income Tax Consequences" in this prospectus for a full understanding of the opinion, including the assumptions made and matters considered by Baker & McKenzie LLP in providing its opinion. However, please note that Baker & McKenzie LLP's opinion reflects only the opinion of counsel and it and the discussion under the heading "Material Federal Income Tax Consequences" in this prospectus are not binding upon the IRS or courts of applicable jurisdiction. In addition, counsel's opinion and the discussion under the heading "Material Federal Income Tax Consequences" in this prospectus does not address all of the tax aspects that might be relevant to each prospective investor in light of its own circumstances. Therefore, each prospective investor is urged to seek advice from an independent tax advisor based on the investor's own circumstances.

9

Investment in the Partnership involves a high degree of risk and is suitable only for investors of substantial financial means who have no need for liquidity in their investments. You should consider carefully the following factors, in addition to the other information in this prospectus, prior to making your investment decision.

Special Risks of the Partnership

Because we have not yet definitively identified or selected any prospects, you will not be able to evaluate the Partnership's prospects before making your investment decision.

The Partnership is a "blind pool" as we have not definitively selected any prospects for acquisition by the Partnership and may not select prospects for the Partnership until after the initial closing of the Partnership. You will not have an opportunity before purchasing units to evaluate geophysical, geological, economic or other information regarding the prospects to be selected. Delays are likely in the investment of proceeds from your subscription because the offering period for the Partnership can extend over a number of months, and no prospects will be acquired until after the initial closing of the Partnership. If we select a prospect for acquisition by the Partnership during the Partnership's offering period, we will file a prospectus supplement, and a post-effective amendment if necessary, describing the prospect and its proposed acquisition. If you subscribe for units prior to any such supplement you will not be permitted to withdraw your subscription as a result of the selection of any prospect. As the managing general partner, we will have broad discretion in allocating a substantial portion of the proceeds from the offering and selecting prospects. See "PROPOSED ACTIVITIES—Acquisition and Drilling of Undeveloped Prospects."

Our prior history demonstrates that the Partnership's returns will be adversely affected in the event of dry holes and marginal or unproductive wells.

During the period from January 1996 through June 30, 2012, OREI, Inc. ("OREI") and Reef have sponsored 25 multiple-well drilling partnerships, of which 16 were private partnerships and nine were publicly-offered limited partnerships. With respect to the nine publicly-offered limited partnerships engaged in oil and natural gas operations, one was formed in 2002, one in 2003, three in 2004, two in 2005, one in 2006, and one in 2007.

As of June 30, 2012, the nine publicly-offered limited partnerships have not produced revenues in excess of the partners' capital contributions. These partnerships have experienced a significant number of dry holes or unproductive wells and are not expected to achieve payout. In addition, the independent registered public accounting firm's opinions on the 2011 financial statements for Reef Global Energy IV, L.P., Reef Global Energy VII, L.P., and Reef Global Energy VIII, L.P. include an explanatory paragraph indicating substantial doubt about each respective partnership's ability to continue as a going concern. Pursuant to a majority vote of each partnership's respective partners, due to the small operating revenues of each partnership, the financial statements of each of Reef Global Energy I, L.P., Reef Global Energy II, L.P., Reef Global Energy III, L.P., and Reef Global Energy IX, L.P. are no longer audited. However, we believe that if they had been audited, the opinion of independent registered public accounting firm conducting the audit related to each such partnership would have also included disclosures indicating substantial doubt about each such partnership's ability to continue as a going concern. See "PRIOR ACTIVITIES" beginning on page 62 of this prospectus.

As of June 30, 2012, of the 16 private oil and natural gas multiple-well drilling partnerships, (i) two have made distributions to participants in excess of capital originally contributed by the participants and continue to make distributions, (ii) one has made distributions to participants in excess of capital originally contributed by the participants, its wells have reached the end of their economic lives and been plugged, and is being liquidated and dissolved, (iii) one recently commenced drilling

10

operations focused in the Bakken area in North Dakota, (iv) one is producing oil and gas and making distributions to participants, but we are unable to predict with accuracy whether distributions ultimately will exceed capital originally contributed by the participants, (v) four are producing oil and gas but are not expected to achieve payout, (vi) five had wells that, while producing some revenue, were ultimately plugged and abandoned at a substantial loss of the participants' capital contributions, (vii) one drilled three unsuccessful wells, and (viii) one recently commenced drilling operations. See "PRIOR ACTIVITIES—Table One" on page 65 of this prospectus.

The Partnership's ability to diversify risks depends upon the number of units issued, the development costs of each well, the size of the Partnership's interest in each well and the availability of suitable prospects.

We intend to spread the risk of oil and natural gas drilling and ownership of interests in oil and natural gas properties by purchasing working interests in multiple wells and prospects, possibly participating as a minority working interest owner with major and independent oil and natural gas companies as partners. If the Partnership is subscribed at the minimum level, it will be required to purchase smaller interests in prospects and be able to participate in fewer prospects, which would increase the risk to the partners. As the Partnership size increases, the diversification of the Partnership may increase because the Partnership can obtain interests in and drill on a greater number of wells and prospects. In addition, as the Partnership size increases, the Partnership may have a greater ability to acquire larger interests in oil and gas properties, including majority interests. The numbers of wells developed by the Partnership will depend upon the amount raised by the Partnership, the size of the Partnership's interest in each well, the value of interests in producing wells that may be acquired and the development costs of each well to be drilled.

Additional general partners have unlimited liability for Partnership obligations.

Under Texas law, the state in which the Partnership has been formed, general partners of the Partnership have unlimited liability for obligations and liabilities of the Partnership. If you purchase units as an additional general partner you will be liable for all obligations and liabilities arising from the Partnership's operations if these liabilities exceed both the assets and insurance of the Partnership, and our assets and insurance. Even if you convert your general partner interest into a limited partner interest, you will continue to be liable as a general partner for matters that occurred while you owned a general partner interest. Your liability as an additional general partner may exceed the amount of your subscription. Under the partnership agreement, additional general partners are only liable for their proportionate share of the Partnership's obligations and liabilities. This agreement will not eliminate your liabilities to third parties in the event you invest as an additional general partner and other additional general partners do not pay their proportionate share of the Partnership's obligations and liabilities.

The Partnership will almost always own less than 100% of the working interest in a prospect.

If a court holds you and the other third-party working interest owners of the prospect liable for the development and operation of the prospect and some of the third-party working interest owners do not pay their proportionate share of the costs and liabilities associated with the prospect, then the Partnership and you and the other additional general partners also may be liable for those costs and liabilities.

As an additional general partner you may become subject to the following:

- •

- contract liability, which is not covered by insurance;

- •

- liability for pollution, abuses of the environment, and other environmental damages such as the release of toxic gas, spills or uncontrollable flows of natural gas, oil or fluids, against which we

11

- •

- liability for drilling hazards which result in property damage, personal injury, or death to third-parties in amounts greater than the Partnership's insurance coverage. Drilling hazards include but are not limited to well blowouts, fires, and explosions.

cannot insure because coverage is not available or against which we may elect not to insure because of high premium costs or other reasons; and

If the Partnership's insurance proceeds and assets, our indemnification of you and the other additional general partners, and the liability coverage provided by major subcontractors are not sufficient to satisfy a liability, then we will call for additional funds from you and the other additional general partners to satisfy the liability. See "PROPOSED ACTIVITIES—Insurance." Our ability to indemnify you is dependent upon our financial condition.

You may not receive a return of your investment or any specific rate of return on your investment in the Partnership.

You may not recover all or any of your investment in the Partnership, or if you do recover your investment in the Partnership, you may not receive a rate of return on your investment that is competitive with other types of investments. You will be able to recover your investment only through the Partnership's distributions of the sales proceeds from the production and sale of oil and natural gas from productive wells. The quantity of oil and natural gas in a well, which is referred to as its reserves, decreases over time as the oil and natural gas is produced until the well is no longer economical to operate. The Partnership's distributions may not be enough for you to recover all your investment in the Partnership or to receive a rate of return on your investment that is competitive with other types of investment if you do recover your investment in the Partnership.

Decisions about developmental operations on properties may be made by third parties that you will have no input in selecting. We will manage and control the Partnership's business.

We will exclusively manage and control all aspects of the business of the Partnership and will make all decisions concerning the business of the Partnership. You will not be permitted to take part in the management or in the decision making of the Partnership. Third parties may act as the operator of Partnership prospects, and in many cases, the Partnership may acquire a less than 50% working interest in various oil and natural gas properties. Accordingly, third parties may manage and control the drilling, completion and production operations on the properties. When it acquires a minority interest in a well, the Partnership will not control the selection of the operator or be able to direct operations under the terms of the applicable operating agreement. The success and timing of exploration and development activities operated by third parties will depend on a number of factors that will be largely outside of our control, including:

- •

- the timing and amount of capital expenditures;

- •

- the operator's expertise and financial resources;

- •

- approval of other participants in drilling wells;

- •

- selection of technology; and

- •

- the rate of production of reserves, if any.

As a result, our limited ability to exercise control over the operations of wells in which the Partnership acquires a minority interest may cause a material adverse effect on the Partnership's results of operations and financial condition.

12

The Partnership may not have enough cash to make distributions to its partners.

The Partnership's oil and gas operations may not generate sufficient revenues to the Partnership to enable the Partnership to make cash distributions to its partners. The ability to make cash distributions will depend on the Partnership's future operating performance. See "PARTICIPATION IN DISTRIBUTIONS, PROFITS, LOSSES, COSTS AND REVENUES—Cash Distribution Policy." We will review the accounts of the Partnership at least quarterly to determine the cash available for distribution. Distributions will depend primarily on the Partnership's cash flow from operations, which will be affected, among other things, by the following:

- •

- the price of oil and natural gas;

- •

- the level of production of the Partnership's wells;

- •

- repayment of borrowings;

- •

- drilling costs, cost overruns and operating expenses;

- •

- remedial work to improve a well's producing capability;

- •

- the price and quantity of imports of foreign oil and natural gas;

- •

- the payment of compensation to us;

- •

- direct costs and general and administrative expenses of the Partnership;

- •

- payment of our management fee;

- •

- reserves, including a reserve for the estimated costs of eventually plugging and abandoning the wells; and

- •

- the indemnification of us and our affiliates by the Partnership for losses or liabilities incurred in connection with the Partnership's activities.

Partnership income will be taxable to the additional general and limited partners in the year earned, even if cash is not distributed. See "Risks of Oil and Natural Gas Investments," "PARTICIPATION IN DISTRIBUTIONS, PROFITS, LOSSES, COSTS AND REVENUES—Cash Distribution Policy" and "OUR COMPENSATION."

Our affiliates and we have sponsored ventures in the past that have produced dry holes and abandoned wells.

We and our affiliates have sponsored 74 partnerships and joint ventures since 1996, which include: (i) three 3-D seismic partnerships, (ii) 14 income or income and development funds, (iii) 25 multiple-well drilling partnerships, (iv) 31 single well drilling partnerships, and (v) one salt water disposal well partnership. For a description of partnerships we have previously sponsored, please see "PRIOR ACTIVITIES" beginning on page 62 of this prospectus.

The 56 drilling partnerships sponsored since 1996 have participated in the drilling of 170 unique wells that have completed drilling, and are currently participating in 80 wells that are currently being drilled or completed. The ventures and partnerships described in this paragraph acquired interests in or conducted operations on exploitation and exploratory wells, in addition to developmental wells. Of these 170 wells drilled by our partnerships since 1996, 57 were exploratory wells, 5 were exploitation wells and 108 were developmental. An "exploitation well" is a well drilled within or as an extension of a proven oil and natural gas reservoir to a depth of a stratigraphic horizon known to be productive. Fifty-five of these wells were dry holes, and two wells were completed but were non-commercial. Of the 114 wells that were commercial, 68 are still owned by our drilling partnerships and producing, 27 have been plugged and abandoned, 13 were sold essentially for salvage value, three were sold for value, one is shut in, and two are currently used as salt water disposal wells. Using this data, approximately 66% of the gross wells in which the drilling partnerships participated in drilling since 1996 were completed

13

as commercially producing and 34% were dry holes (including the two wells that were completed but failed to become commercially productive). Approximately 24% of the wells in which these partnerships participated in drilling were completed successfully but subsequently abandoned or sold essentially for salvage value prior to abandonment. Twelve of the successful wells were drilled in conjunction with the income and development funds. The Partnership may produce dry holes and abandoned wells, reducing the amount of Partnership funds available for distribution to partners. Please see the "PRIOR ACTIVITIES" beginning on page 62 of this prospectus.

The Partnership will have limited external sources of funds, which could result in a shortage of working capital.

The Partnership intends to utilize substantially all available capital from this offering for the acquisition of drilling prospects and the drilling and completion of wells on those prospects. The Partnership will have only nominal funds available for Partnership purposes until there are revenues from Partnership operations. Any future requirement for additional funding will have to come, if at all, from the Partnership's revenues, the sale of Partnership properties or interests therein, or from borrowings.

Occasions may arise in which the Partnership will need to raise additional funds in order to finance costs of:

- •

- drilling and completing wells; and

- •

- providing necessary production equipment and facilities to service productive oil and natural gas wells and plugging and abandoning non-productive wells.

Additional operations requiring funding may include the acquisition of additional oil and natural gas leases, acquisition of interests in producing oil or gas wells, and the drilling, completing and equipping of additional wells to further develop Partnership prospects or to purchase additional prospects. The Partnership agreement provides that outstanding Partnership borrowings may not at any time exceed 25% of the Partnership's aggregate capital contributions without the consent of the investor partners. Furthermore, the Partnership may borrow funds only if the lender agrees that it will have no recourse against individual investor partners. If the above-described methods of financing should prove insufficient to maintain the desired level of Partnership operations, such operations could be continued through farmout arrangements with third parties, including us and/or our affiliates. These farmouts could result in the Partnership giving up a substantial interest in oil and natural gas properties it has developed. The Partnership's operations may not be sufficient to provide the Partnership with necessary additional funding, and the Partnership may not be able to borrow funds from third parties on commercially reasonable terms or at all. If the Partnership expends all of its capital on the acquisition and development of drilling prospects and such operations fail to generate sufficient revenues, then there may be doubt as to the Partnership's ability to continue as a going concern.

Your ability to resell your units is limited due to the lack of a public market and restrictions contained in the partnership agreement. You may not be able to sell your partnership interests.

No public market for the units exists or is likely to develop. Your ability to resell your units also is restricted by the partnership agreement for the Partnership. The Partnership itself may continue in existence for thirty years from its formation, unless earlier terminated. As a result, you should plan on owning your units for an indefinite period. See "TRANSFERABILITY OF UNITS."

The management of the general partner and of the Partnership is not subject to supervision or review by an independent board, independent officers, audit committee or compensation committee.

The principal executive officer of the managing general partner is Mike Mauceli, and Mr. Mauceli also owns and controls the securities of the managing general partner. Also, the officers of the

14

managing general partner and its affiliates are comprised entirely of employees of entities controlled by Mr. Mauceli. As a result, the activities of the managing general partner are not subject to the review and scrutiny of an independent board of directors. In addition, the managing general partner does not have an audit committee or compensation committee. Thus, there is no independent supervision of the management representing the interests of the partners.

Our affiliates and we may have conflicts of interest with you and the Partnership.

The continued active participation by our affiliates and us in oil and natural gas activities individually, and on behalf of other partnerships organized or to be organized by us, and the manner in which partnership revenues are allocated, could create conflicts of interest with the Partnership. See "CONFLICTS OF INTEREST." Our affiliates and we have interests that inherently conflict with those of the unaffiliated partners, including the following:

- •

- Our affiliates and we manage other oil and natural gas drilling funds. We will owe a duty of good faith to each of the

partnerships that we manage. Actions taken with regard to other partnerships may not be advantageous to the Partnership.

- •

- We decide which prospects the Partnership will acquire. We could benefit, as a result of cost savings or reduction of

risk, for instance, by assigning or not assigning particular prospects to the Partnership.

- •

- One of our affiliates may act as operator on some Partnership wells for which it will be compensated (at rates competitive

with the rates charged by unaffiliated persons for similar services). Our affiliate could have an incentive to operate wells that were no longer economical to the Partnership, in order to continue to

receive operating fees.

- •

- The percentage of revenues we receive is greater than the percentage of costs we pay. As a result, there may be a conflict

of interest concerning which wells will be drilled based on the wells' respective risk and profit potential.

- •

- We serve as the tax matters partner for the Partnership. If we represent the Partnership before the Internal Revenue

Service ("IRS"), potential conflicts may include whether or not we should expend Partnership funds to contest a proposed adjustment by the IRS, if any, and the amount of your deduction for intangible

drilling costs.

- •

- There may be a conflict of interest concerning the terms of any acquisitions of producing properties we may purchase from

the Partnership.

- •

- Our purchase of units in the Partnership and/or the purchase of units by one or more of our affiliates for a reduced price could dilute any voting rights you may have regarding your Partnership interest.

We will attempt, in good faith and in accordance with the terms of the partnership agreement, to resolve all conflicts of interest. Any transaction with us may not be on terms as favorable as could have been negotiated with unaffiliated third parties.

Should a legal dispute arise between us, the Partnership, and/or RSI, additional outside counsel may have to be retained in the event of a dispute.

Baker & McKenzie LLP serves as legal counsel to us, our affiliate OREI, our affiliate Reef Exploration, L.P. ("RELP"), and RSI. Because our affiliates have the same legal counsel as we have, there may be conflicts of interest inherent in our legal representation. The Partnership has not engaged its own independent counsel. As a result, in the event of a legal dispute between us, the Partnership, and/or RSI, additional outside counsel may have to be retained. Such outside counsel may not be as

15

familiar with us as Baker & McKenzie LLP, and its costs cannot be estimated and could be in excess of those that would be charged by Baker & McKenzie LLP.

RSI has been the subject of disciplinary proceedings.

If it is subject to future proceedings, its ability to sell units could be limited, which may create a diversification risk. RSI has been the subject of three proceedings brought by state securities agencies (Texas in 1995, Illinois in 1996 and Wisconsin in 2004), alleging that certain general partnerships sold by it, which RSI maintains were not securities under either federal or state law, were securities requiring registration under such states' laws. In two of these cases (Texas and Illinois), RSI settled the cases, without admitting or denying the factual allegations of the relevant state securities administrators, and consented to settlements (in Texas a $15,000 payment and a 180-day probation, and in Illinois, a $10,000 payment and withdrawal of broker dealer registration, which has subsequently been reinstated). With respect to the Wisconsin matter, Wisconsin dismissed the proceeding and vacated the order issued by it. Also in 2004, RSI was fined $3,750 by New Hampshire for failure to timely file documentation regarding a corporate name change effected by RSI in 2003.

In addition, RSI was censured in 1995 by FINRA (then known as the NASD) and fined $2,500 for failure to maintain certain minimal net capital. In 2000, FINRA fined RSI $5,000 for failure to maintain a specific written policy regarding FINRA's continuing education policy, and in 2004 for failure to maintain specific written policies regarding FINRA's anti-money laundering policy (required even though RSI did not handle any investor money) and continuing education policy, for which RSI paid a fine of $17,500 without admitting or denying any of FINRA's factual allegations.

If RSI were to become involved in future disciplinary proceedings, its ability to sell the units could be limited. This could result in the Partnership being formed with less offering proceeds than if the dealer manager's sales activities were not limited by such proceedings. The Partnership subscribed at the minimum level would be able to participate in fewer prospects, which would increase the risk to the partners. As Partnership size increases, the diversification of the Partnership will increase because the Partnership can drill or obtain interests in multiple prospects.

We may rely upon a small number of marketers to purchase a majority of oil and gas from the Partnership, which could pose a credit risk in the event one or more of them fails to pay in a timely manner or at all.

We sell oil and natural gas on credit terms to refiners, pipelines, marketers, and other users of petroleum commodities. Revenues are received directly from these parties or, in certain circumstances, are paid to the operator of the property who disburses to us our percentage share of the revenues. During the year ended December 31, 2011, two marketers accounted for approximately 81% of our oil and natural gas revenues for our public drilling partnerships. The two marketers, PetroQuest Energy, LLC and Cokinos Energy Corporation, account for approximately 68% and 13% of our oil and natural gas revenues for our public drilling partnerships, respectively. Despite the competitive nature of the market for oil and natural gas, the loss of any particular purchaser could have a material adverse impact on the Partnership or us by affecting prices, delaying sales of production or increasing costs. In total, our public drilling partnerships received revenues from 15 different marketers. Our reliance upon one marketer to purchase approximately 68% percent of the oil and natural gas from our public drilling partnerships, as well as our reliance on another marketer to purchase approximately 13% of the oil and natural gas from our public drilling partnerships, poses a credit risk in the event one or more of such marketers should fail to pay in a timely manner or at all. In such event, the amount of distributions available to the investor partners could be substantially diminished, even if the Partnership's properties are successfully producing.

16

Compensation payable to us will affect distributions.

We will receive compensation from the Partnership throughout the life of the Partnership. The managing general partner and its affiliates will profit from their services in drilling, completing, and operating the Partnership's wells, and will receive the other fees and reimbursement of direct costs described in "OUR COMPENSATION," regardless of the success of the Partnership's wells. These fees and direct costs will reduce the amount of cash distributions to you and the other investors. The amount of the fees is subject to the complete discretion of the managing general partner, other than the fees must not exceed competitive prices and terms as determined by reference to charges of unaffiliated companies providing similar services, supplies, and equipment. See "OUR COMPENSATION." With respect to direct costs, the managing general partner has sole discretion on behalf of the Partnership to select the provider of the services or goods and the provider's compensation as discussed in "OUR COMPENSATION."

A lengthy offering period may result in delays in the investment of your subscription and any cash distributions from the Partnership to you.

Because the offering period for the Partnership can extend for many months, it is likely that there will be a delay in the investment of your subscription proceeds. This may create a delay in the Partnership's cash distributions to you, which will be paid only if there is sufficient cash available. See "TERMS OF THE OFFERING" for a discussion of the procedures involved in the offering of the units and the formation of the Partnership.

Your subscription for units is irrevocable.

Your execution of the subscription agreement is a binding offer to buy units in the Partnership. Once you subscribe for units, you will not be able to revoke your subscription.

Drilling prospects in one area may increase the Partnership's risk.

To the extent that prospects are drilled in one area at the same time, this may increase the Partnership's risk of loss. For example, if multiple wells in one area are drilled at approximately the same time, then there is a greater risk of loss if the wells are marginal or nonproductive since we will not be using the drilling results of one or more of those wells to decide whether or not to continue drilling prospects in that area or to substitute other prospects in other areas. This is compared with the situation in which we drill one well and assess the drilling results before we decide to drill a second well in the same area or to substitute a different prospect in another area.

Lack of drilling rig availability or hydraulic fracture equipment may increase the Partnership's costs and may result in delays in drilling on Partnership prospects, and therefore, delay the investor partners' ability to deduct intangible drilling costs in the year of their investment.

Due to increases in oil and natural gas prices in the United States, the amount of drilling activity within the United States and in U.S. waters has increased substantially. As a result of this increase in drilling activities, there may be shortages of drilling rigs and personnel available to drill on prospects we acquire. Such shortages could result in delays in the drilling of wells on such prospects and, therefore, delay the investor partners' ability to deduct intangible drilling costs in the year of their investment. Such shortages could also result in increased costs to the Partnership for drilling rigs and personnel used in Partnership operations, and, as a result, decrease the amount of cash, if any, available for distribution to the partners in the Partnership.

17

The Partnership may become liable for joint activities of other working interest owners, which could jeopardize full development of the prospects.

The Partnership may often acquire less than the full working interest in prospects and, as a result, may engage in joint activities with other working interest owners. Additionally, it is possible that the Partnership may purchase less than a 50% working interest in some or all of prospects acquired for the Partnership, with the result that someone other than the Partnership or us may control such prospects. The Partnership could be held liable for the joint activity obligations of the other working interest owners, such as nonpayment of costs and liabilities arising from the actions of the working interest owners. Full development of the prospects may be jeopardized in the event other working interest owners cannot pay their shares of drilling and completion costs.

Other partnerships we sponsor will compete with the Partnership for prospects, equipment, contractors, and personnel.

We plan to offer interests in other partnerships to be formed for substantially the same purposes as those of the Partnership. Therefore, multiple partnerships with unexpended capital funds, including partnerships formed before and after the Partnership, may exist at the same time. Due to competition among the partnerships for suitable prospects and availability of equipment, contractors, and our personnel, the fact that partnerships previously organized by our affiliates and us may still be purchasing prospects when the Partnership is attempting to purchase prospects may make the completion of prospect acquisition activities by the Partnership more difficult. In addition, multiple partnerships sponsored by us may invest in the same oil and gas property, creating a potential conflict of interest between the Partnership and us, if, among other scenarios, the Partnership is unable to fulfill its financial obligations relating to the property. Furthermore, as we continue to sponsor more partnerships, we will need to increase our personnel in order to meet the staffing needs associated with our additional administrative responsibilities as managing partner of these partnerships. If we are unable to find suitable personnel to meet such needs, our ability to effectively manage the Partnership could be impacted.

Because investors bear the Partnership's acquisition, drilling and development costs, they bear most of the risk of non-productive operations.

Under the cost and revenue sharing provisions of the Partnership agreement, we will share costs with you differently than the way we will share revenues with you. Because investor partners will bear a substantial amount of the costs of acquiring, drilling and developing the Partnership's prospects, investor partners will bear a substantial amount of the costs and risks of drilling dry holes and marginally productive wells.

The partnership agreement will prohibit the participation of all partners, including general partners and converted limited partners, in the Partnership's business decisions.

You may not participate in the management of the Partnership business. The partnership agreement will forbid you from acting in a manner harmful to the business of the Partnership. If you violate the terms of the partnership agreement, you may have to pay the Partnership or other partners for all damages resulting from your breach of the partnership agreement.

18

The partnership agreement will limit our liability to you and the Partnership and will require the Partnership to indemnify us against certain losses.

We will have no liability to the Partnership or to any partner for any loss suffered by the Partnership, and will be indemnified by the Partnership against loss sustained by us in connection with the Partnership if:

- •

- we determine in good faith that our action was in the best interest of the Partnership;

- •

- we were acting on behalf of or performing services for the Partnership; and

- •

- our action did not constitute negligence or misconduct by us.

The indemnification provisions of the partnership agreement do not waive or diminish your rights under state and federal securities laws.

Because we will act as general partner of several partnerships, other commitments may adversely affect our financial condition.

As a result of our commitments as general partner of several partnerships and because of the unlimited liability of a general partner to third parties, our net worth is at risk of reduction. Because we are primarily responsible for the conduct of the Partnership's affairs, a significant adverse financial reversal for us could have an adverse effect on the Partnership and the value of its units, and could impair our ability to fulfill our obligation to indemnify the additional general partners for certain losses.

You should not rely on the financial status of other additional general partners as a limitation on your liability.

No financial information will be provided to you concerning any investor who has elected to invest in the Partnership as an additional general partner. In no event should you rely on the financial wherewithal of additional general partners, including in the event we should become bankrupt or are otherwise unable to meet our financial commitments.

Lack of an independent underwriter may reduce the due diligence investigation conducted on the Partnership and us.

There has not been an extensive in-depth "due diligence" investigation of the existing and proposed business activities of the Partnership and us that would be provided by independent underwriters. Our dealer manager, RSI, has an ongoing relationship with our affiliates and us. Furthermore, Michael J. Mauceli, our limited partner, the manager of our general partner, and the Chief Executive Officer of RELP, is the brother of Paul Mauceli, the sole shareholder, director and Chief Executive Officer of RSI. RSI's due diligence examination concerning the Partnership cannot be considered to be independent or as comprehensive as an investigation that would be conducted by a broker-dealer that is involved in selling offerings of unaffiliated companies. See "CONFLICTS OF INTEREST."

We expect to incur costs in connection with Exchange Act compliance and we may become subject to liability for any failure to comply, which will reduce our cash available for distribution.

As a result of our obligation to register our securities with the Securities and Exchange Commission ("SEC") under the Securities Act of 1933 ("the Securities Act"), we will be subject to the rules and related reporting requirements of the Securities Exchange Act of 1934 ("the Exchange Act"). This compliance with the reporting requirements of the Exchange Act will require timely filing of quarterly reports on Form 10-Q, annual reports on Form 10-K and current reports on Form 8-K, among other actions. Further, recently enacted and proposed laws, regulations and standards relating to corporate governance and disclosure requirements applicable to public companies, including the

19

Sarbanes-Oxley Act of 2002, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and new SEC regulations, have increased the costs of corporate governance, reporting and disclosure practices which are now required of us. In addition, these laws, rules and regulations create new legal grounds for administrative enforcement and civil and criminal proceedings against us in case of non-compliance, which increases our risks of liability and potential sanctions. All of the additional compliance costs described above, whether from meeting the compliance requirements or as a result of liabilities related to a failure of such compliance, will decrease the amount of cash available to us to distribute to the partners.

Partners have a limited ability to remove the managing general partner and may encounter difficulty in finding a successor managing general partner.

We may be removed from our position as the managing general partner only by the affirmative vote of investors holding a majority of the then outstanding units of the Partnership. The general and limited partners in certain circumstances must, in order to continue the Partnership, elect a successor to the removed managing general partner if the removal of the managing general partner causes a dissolution of the Partnership. There is a risk that the general and limited partners could not find a new managing general partner or program manager if we were to be removed from such positions.

We may delegate or subcontract our duties under the partnership agreement to others, including our affiliates.

The partnership agreement authorizes us to delegate and subcontract our duties under the partnership agreement to others, including entities related to us. We anticipate that the staff of RELP will assist us in performing our duties under the partnership agreement. Our principal executive officer, Mr. Michael J. Mauceli, also the principal executive officer of RELP, enables us to monitor RELP to ensure, among other things, that it is performing the delegated duties consistent with our fiduciary duties to the Partnership. In addition, Mr. Mauceli will be in a position to monitor the financial condition of RELP. In the event it is determined by us that RELP's ability to perform the delegated or subcontracted duties is impaired as a result of its adverse financial condition, then we will assume the performance of those duties to the extent they are delegated.

Unauthorized acts of general partners could be binding against the Partnership, and such unauthorized acts could be contrary to the best interests of the Partnership.

Under Texas law, the act of a general partner of the Partnership apparently carrying on the business of the Partnership binds the Partnership, unless the general partner in fact has no authority to act for the Partnership and the person with whom the partner is dealing has knowledge in good faith of the fact that such general partner has no such authority. There is a risk that a general partner might bind the Partnership by his acts. Under the partnership agreement for the Partnership, the managing general partner will have such exclusive control over the conduct of the business of the Partnership that it is unlikely that a third party, in the absence of bad faith, would deal with a general partner in connection with the Partnership's business. The participation by a general partner in the management and control of the Partnership's business is expressly prohibited by the partnership agreement, and a violation of such prohibition would give rise to a cause of action by the Partnership against such general partner. Nevertheless, there is always the possibility that a general partner could attempt to take unauthorized actions on behalf of the Partnership, and if a court were to hold that such actions were binding against the Partnership, such unauthorized actions could be contrary to the best interests of the Partnership and could adversely impact the Partnership.

20

Risks of Oil and Natural Gas Investments

Oil and natural gas investments are highly risky, and there is a possibility you will lose all of your investment in the Partnership.

The selection of prospects for oil and natural gas drilling, the drilling, ownership and operation of oil and natural gas wells, and the ownership of non-operating interests in oil and natural gas properties are highly speculative. There is a possibility you will lose all or substantially all of your investment in the Partnership. We cannot predict whether any prospect will produce oil or natural gas or commercial quantities of oil or natural gas, nor can we predict the amount of time it will take to recover any oil or natural gas we do produce. Drilling activities may be unprofitable, not only from non-productive wells, but from wells that do not produce oil or natural gas in sufficient quantities or quality to return a profit. Delays and added expenses may also be caused by poor weather conditions affecting, among other things, the ability to lay pipelines. In addition, ground water, various clays, lack of porosity and permeability may hinder, restrict or even make production impractical or impossible.

Drilling exploratory wells is riskier than drilling developmental wells.

The proceeds from the offering that are spent on drilling activities will be used primarily for developmental wells, but the Partnership will also acquire interests in exploratory wells. Drilling exploratory wells involves greater risks of dry holes and loss of the partners' investment than the drilling of developmental wells. Drilling developmental wells generally involves less risk of dry holes. As a result, sometimes developmental acreage is more expensive and subject to greater royalties and other burdens on production. This investment is suitable for you only if you are financially able to withstand a loss of all or substantially all of your investment.

The Partnership may be required to pay delay rentals to hold drilling prospects, which may deplete partnership capital.