Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Nationstar Mortgage Holdings Inc. | d476754d8k.htm |

Investor

Presentation January 31, 2013

Financial data as of September 30, 2012

Exhibit 99.1 |

Forward

Looking Statements 1

Any statements in this presentation that are not historical or current facts are

forward-looking statements. Forward-looking statements include,

without limitation, statements concerning plans, objectives, goals, projections,

strategies, future events or performance, and underlying assumptions and other

statements, which are not statements of historical facts. Forward-looking statements convey Nationstar Mortgage

Holdings Inc.’s (“Nationstar”) current expectations or forecasts of

future events. When used in this presentation, the words “anticipate,”

“appears,”

“believe,”

“foresee,”

“intend,”

“should,”

“expect,”

“estimate,”

“target,”

“project,”

“plan,”

“may,”

“could,”

“will,”

“are likely”

and

similar expressions are intended to identify forward-looking statements. These

statements involve predictions of our future financial condition, performance,

plans and strategies, and are thus dependent on a number of factors including, without limitation, assumptions and data that may

be imprecise

or

incorrect.

Specific

factors

that

may

impact

performance

or

other

predictions

of

future

actions

have,

in

many

but

not

all

cases,

been identified in connection with specific forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties

and other factors that may cause Nationstar’s actual results, performance or achievements to be materially different from any

future results, performances or achievements expressed or implied by the

forward-looking statements. Certain of these risks and uncertainties

are

described

in

the

“Risk

Factors”

section

of

Nationstar

Mortgage

LLC’s

Form

10-K

for

the

year

ended

December

31,

2011,

Nationstar

Mortgage Holdings Inc.’s Form 10-Q for the quarter ended September 30, 2012,

and other reports filed with the SEC, which are available at the SEC’s

website at http://www.sec.gov. We caution you not to place undue reliance on these forward-looking statements that speak only as of

the date they were made. Unless required by law, Nationstar undertakes no obligation to

publicly update or revise any forward-looking statements to reflect

circumstances or events after the date of this presentation. |

Our

Business 1)

Proforma UPB and customers include Q3 ‘12 end of period UPB, $13B UPB BofA

acquisition closed in Q4 ’12, and ~$215B UPB acquired portfolio. Acquired portfolio transfers to occur as investor and

other third-party approvals are received

2)

Annual origination run-rate based on Q3’12 Annualized

3) As of January 29, 2013

$7.2B annual production

(2)

Agency and government

Servicing substantially retained

$425B of UPB

(1)

Service 2.5MM+ customers

(1)

Focused on asset performance

and credit risk management

Servicing

Originations

2

A leading service provider to the residential mortgage market

Economics across mortgage

lifecycle

Settlement

Processing

Asset management

Solutionstar

Corporate Highlights:

Established in 1994 as a division of Centex Homes

Sold to funds managed by Fortress Investment Group in 2006

Publicly traded (NYSE: NSM) with market

capitalization of $3.1B

(3)

Over 4,100 total employees |

Strategically Positioned Platform

3

Balanced real estate services platform designed to drive fee-based income across the

entire economic cycle Low rate environment

Distressed market

Rising rate environment

Improving economy

Servicing

Acquire servicing at attractive multiples

Additional revenue streams

(mod/incentive/late fees)

Servicing costs are higher due to higher

delinquencies

Extended life of servicing cash flows

Lower portfolio DQs

Lower servicing costs

Originations

Recapture drives strong margins with

no customer acquisition costs

Recapture extends servicing cash flows

Profitably create servicing assets

Robust housing market -

rising purchase

volumes

Stronger builder and broker channels drive

significant purchase money volume

Healthy economy improves employment and

credit -

larger pool of eligible buyers

Ancillary revenue from Solutionstar attractive in every environment

|

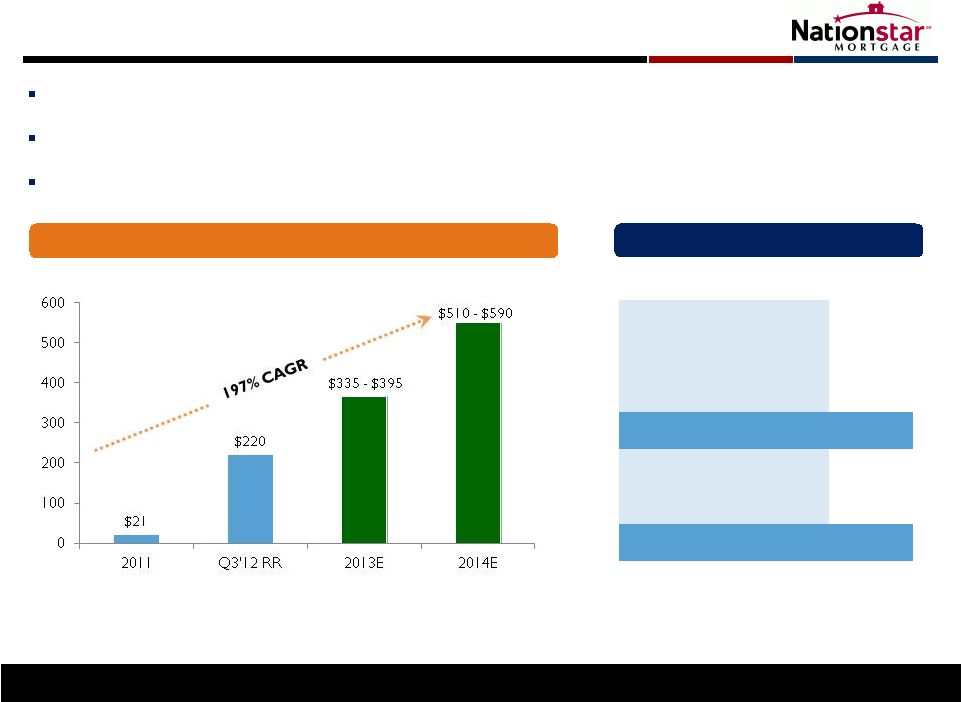

BofA

Portfolio

Acquisition

–

Landmark

Acquisition

4

4

1)

Balances as of Nov. 30, 2012; balances may change prior to closing due to normal

portfolio run-off 2)

Proforma UPB includes Q3 ‘12 end of period UPB, $13B UPB BofA acquisition closed in

Q4 ’12, and ~$215B UPB acquired portfolio. Acquired portfolio transfers to occur as investor and other third-party approvals are

received

3)

Please refer to Endnotes for information regarding 2013E and 2014E Net Income; CAGR and

bar chart amounts for 2013E and 2014E represent midpoint of ranges for proforma combined company

Acquiring $215B

(1)

servicing book; proforma UPB of $425B

(2)

; 1.3MM new customers

Capture multiple revenue streams driving profitability over entire economic cycle

Significant earnings accretion expected

Net Income Growth

(3)

$ in millions

Deal Summary

$ in millions

$ UPB

$215,000

MSRs

$1,345

Servicing Advances

$5,800

Total Assets

$7,145

MSR Price (bps)

63

Average Servicing Fee (bps)

33

MSR Purchase Multiple

1.9x |

Earnings

Estimates 1)

Assumes 90.7 million shares outstanding

2)

Please refer to Endnotes for information regarding 2013E and 2014E AEBITDA, Net Income

and EPS 5

Acquisition highly accretive

2013 estimates reflect year-one portfolio ramp and integration

2014 estimates reflect fully ramped earnings power of the company

AEBITDA per share

(1)(2)

Earnings per share

(1)(2)

2013E

2014E

Acquired Portfolio

Total Company Estimate

Acquired Portfolio

Total Company Estimate

$2.20 -

$2.55

$9.50 -

$11.05

$4.65 -

$5.40

$12.30 -

$14.30

$0.70 -

$0.80

$3.70 -

$4.35

$2.30 -

$2.70

$5.60 -

$6.50 |

Future

Growth Opportunities (1)

1)

The identified

opportunities

referenced

above

are

not

currently

serviced

by

the

Company

and

there

can

be

no

assurance

that

these

potential

servicing

transactions

will

ultimately

be

consummated,

or

will

remain the

same

size.

Notwithstanding

the

above,

it

is

possible

that

these

potential

servicing

transactions,

if

consummated,

could

result

in

a

partial

or

total

loss

of

any

invested

capital.

2)

All pipeline deals are under a signed non-disclosure agreement between Nationstar

and the counter-party. 3)

Proforma

UPB

and

customers

include

Q3

‘12

end

of

period

UPB,

$13B

BofA

acquisition

closed

in

Q4

’12,

and

~$215B

acquired

portfolio.

Acquired

portfolio

transfers

to

occur

as

investor

and

other third-party approvals are

received

Servicing

Originations

Bulk Servicing

Flow Servicing

Channel Development

MSRs and subservicing

Multiple lenders

Already executed

agreements ~ $10B for

‘13

KB Home/Builder

Wholesale

Correspondent

$300 billion+

$25-50 billion annually

Potential Opportunity Size:

Macro-thesis of secular shift remains intact; legal, regulatory and headline risk

for banks persists Growth of customer base presents opportunity for expansion of

Solutionstar Solutionstar

2.5 million customers in

servicing portfolio

(3)

Data-rich environment

Multiple fee-based opportunities

$425 billion portfolio

(3)

6

Pipeline of opportunities remains elevated for the foreseeable future

|

Prospective Opportunities for Nationstar

Focus on core customers

Shedding non-core assets

Capital constraints and pressures

Legal, regulatory, headline risk

7

…Creating a Need for a Strategic Service Partner

Financial Institutions Re-evaluating Their Mortgage Business Models…

Complete outsourcing

Credit risk management

Origination/fulfillment

Default servicing

Core/non-core servicing

Solutionstar

Multiple Fee-Based Revenue Streams

Long-term partner of choice to financial institutions

|

Servicing

Profitability Ramp 8

Expense Reduction (bps)

EPS

Impact

$0.30 EPS per 1 bps

improvement in servicing

expenses

1)

Notes to replace $300 million in existing Agency servicing advance facilities that

carried a weighted average floating rate of Libor plus 2.86%, or 3.10% in total, resulting in a reduction in rate of 1.65% as of Jan. 24, 2013.

2)

For illustrative purposes only. This illustration uses assumptions that affect

results shown, including assumptions that are based on factors that are beyond NSM’s control. Actual results could differ from this illustration. Assumes

marginal tax rate of 35%

Illustrative

Cost

Reduction

Example

(2)

Servicing portfolio:

$425B

Targeted Improvement: 8 bps

Targeting 8 bps servicing expense reduction by Q3 ‘14

Assumptions

Multiple initiatives underway:

Cost per loan:

Strategic sourcing of non-customer facing functions

Portfolio performance:

Reduced Aurora 60+ DQ rate by 250 bps since boarding

Reduce advance costs:

$300MM GSE advance securitization (reducing funding cost by >1.65%)

(1)

Opportunity for non-agency securitizations (significant potential savings)

|

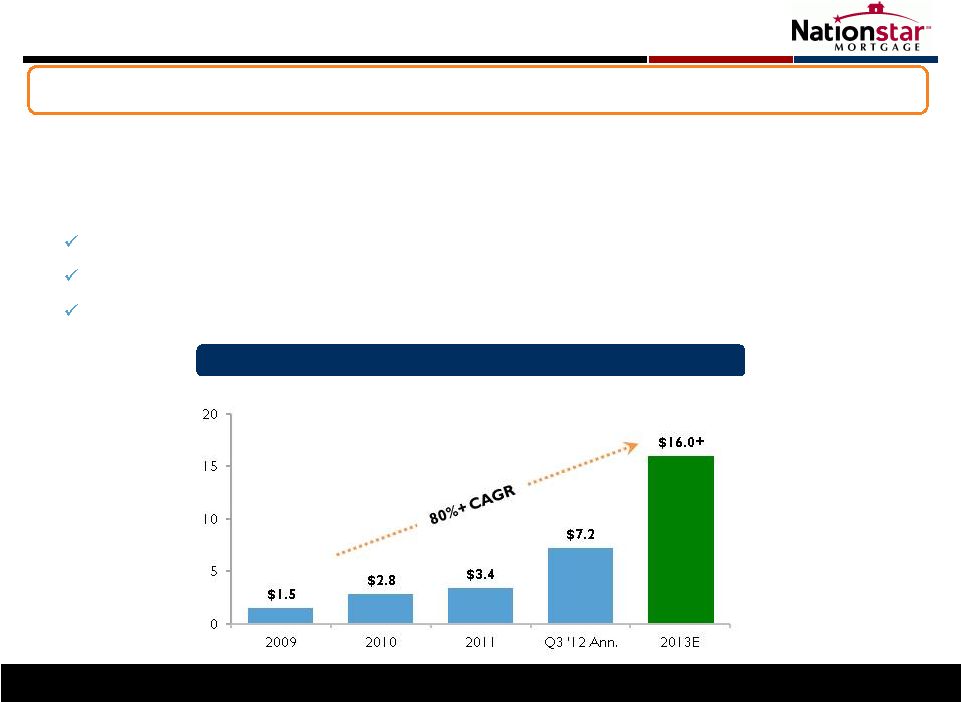

Originations: Enhances Core Servicing Platform

9

Origination

Volume

(1)

($bn of UPB)

Capitalize on market dislocation; wide margins & limited supply

1)

2012 data as of 9/30/12

2013/2014 Objectives:

HARP:

Exhaust portfolio of HARP/recapture opportunities to capitalize on margin

premium Build Out Channels:

Wholesale, correspondent, direct-to-consumer

Builder:

Execute additional ventures with homebuilders; set stage for return of purchase

money Recapture

of refinanced Nationstar loans

Cash flow-positive, cost-effective creation of servicing assets

Primary Strategy:

|

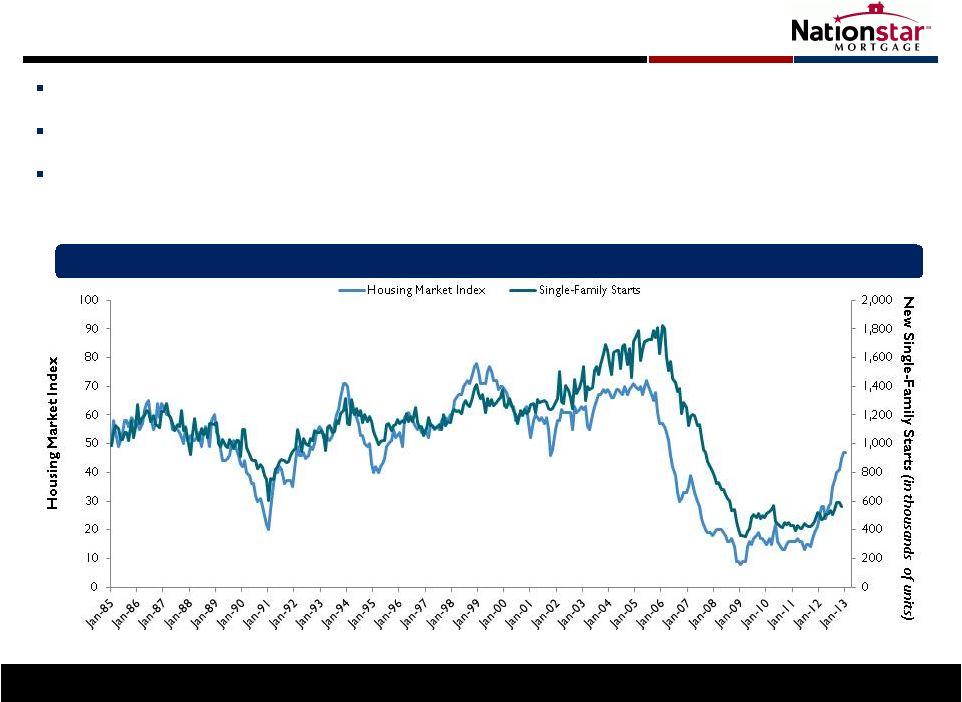

Housing

Market – Return of Residential Investment

10

December ’12 housing starts highest level since 2008

Homebuilder sentiment highest since 2006

2012 building permits up 30% year over year

NAHB/Wells Fargo Housing Market Index (HMI) and New Single-Family Starts

1)

Source: NAHB/Wells Fargo Housing Market Index. U.S. Census Bureau.

|

HARP Rich

Servicing Portfolio 11

HARP within BofA portfolio

“Nationstar Express”

(HARP streamline) launch in Q1‘13

Nationstar

Applications through December ‘13

Funding until mid-2014

Administration contemplating extension/expansion

HARP Program

Significant HARP opportunities available; execution prices remain attractive

LTV

107%

FICO

747

DTI

37%

Coupon

4.1%

Benefits Borrower and Servicer

Interest expense savings make payments more

affordable for borrower

Underwater borrowers see clearer path back to

equity -

mitigates strategic default

HARP loans have slower prepay speeds

Few refinancing opportunities outside of HARP

Borrower unlikely to sell home when underwater

NSM Q3 Agency Orig. Credit Profile |

Solutionstar

2013 Expectations:

$200 million in revenue

15% of revenue from third-party customers

12

Processing

Recovery Services

BK Processing

FCL Processing

Claims Processing

Real Estate

Traditional REO

REO and SPO Auctions

Brokerage

Field Services

Settlement

Valuation Services

Title Services

Closing Services

Opportunity to capture economics across the entire mortgage lifecycle

16,000 REO properties in portfolio presents

significant management/disposition opportunities

Attractive, capital-light, fee-based earnings stream

linked to UPB growth |

At

Current Levels, NSM Represents Value Proposition 13

‘14E P/E

Multiple

1)

Fee-based service peer group of Fidelity National, Old Republic, Lender Processing

Services, Corelogic, First American Financial, Altisource. Average of ‘14 P/E multiples based on share prices as of 1/29/13

2)

Sterne Agee Industry Report, 1/10/13

3)

Peer group consists of OCN and WAC. Average for ‘14 P/E multiple based on

share prices as of 1/29/13 4)

Based on 1/29/13 closing price of $34.31 and mid-point of ’14E EPS guidance of

$6.05 NSM Discount

-

35%

Average for fee-based service providers 12–14x

(1)

Historical average P/E ratio for mortgage companies

has been 8-10x

(2)

Peers trading at discount to historical multiples for

originators/servicers and fee-based providers

5x

6x

7x

8x

9x

10x

12x

14x

Peer Average

(3)

7.7x

Nationstar

(4)

5.7x

Mortgage Cos. –

Historical Average

Fee-Based Service

Providers

NSM trading at significant discount to peers, historical valuations

|

Focused

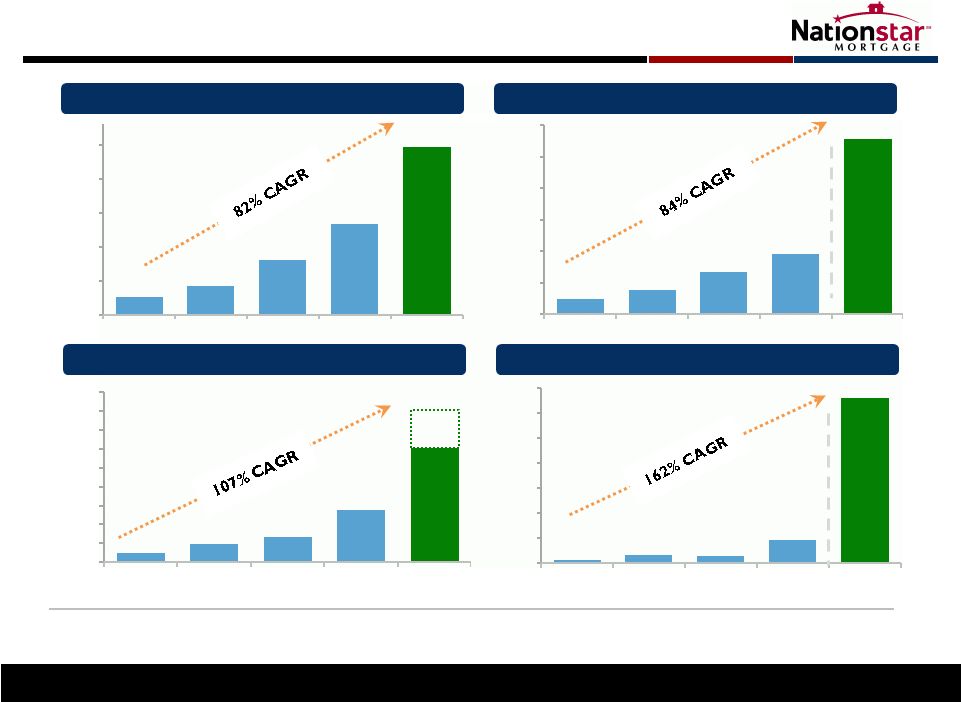

on Profitable Growth UPB Growth ($bn)

Revenue Growth ($mm)

(1)

Margin (%)

22%

30%

24%

36%

7%

11%

6%

30%

12%

9M

14

1) Revenue, AEBITDA and pre-tax income from operating

segments 2) Please see

Endnotes for information on AEBITDA and reconciliations on pg 15 $21

$34

$64

$107

$198

0

80

120

160

200

2008

2009

2010

2011

Q3 '12

40

$97

$156

$267

$ 379

$1,108

0

200

400

800

1,000

1,200

2008

2009

2010

2011

Q3 '12 RR

600

$7

$16

$15

$46

$331

0

50

100

150

200

250

300

350

2008

2009

2010

2011

Q3 '12 RR

$22

$46

$65

$136

$301

0

50

100

150

200

250

300

350

400

450

2008

2009

2010

2011

2012

Estimate

$400+

Pre-Tax Income Growth ($mm)

(1)

AEBITDA Growth ($mm)

(1)(2) |

($ in

thousands) Nine Months

Ended

Adjust for:

Net loss from Legacy Portfolio and Other

164,738

97,263

24,806

24,892

2,874

18,294

Interest expense from unsecured senior notes

-

-

24,628

30,464

17,656

39,714

Depreciation and amortization

1,172

1,542

1,873

3,395

2,772

5,773

Change in fair value of MSRs

11,701

27,915

6,043

39,000

22,430

42,810

Amortization of mortgage servicing obligations

-

-

-

-

(2,652)

(3,276)

Fair value changes on excess spread financing

-

-

-

3,060

(2,213)

5,050

Share-based compensation

1,633

579

8,999

14,764

2,623

11,371

Exit costs

-

-

-

1,836

-

-

Fair value changes on interest rate swaps

-

-

9,801

(298)

(236)

(424)

Ineffective portion of cash flow hedge

-

-

(930)

(2,032)

-

-

Income tax expense

-

-

-

-

24,714

40,639

AEBITDA Reconciliation

15

1)

For Operating Segments

Adjusted EBITDA

(1)

$ 21,634

$ 46,422

$ 65,306

$ 135,968

$ 123,035

$ 301,479

9/30/12

Q3 ’12

FY 2008

FY 2009

FY 2010

FY 2011

Net Income (loss)

$ (157,610)

$ (80,877)

$ (9,914)

$ 20,887

$ 55,067

$ 141,528 |

Endnotes

Pro-forma

Earnings

Per

Share

(“Pro-forma

EPS”)

This

disclaimer

applies

to

every

usage

of

pro-forma

EPS

in

this

presentation.

Pro-forma

EPS

is

a

metric

that

is

used

by

management to exclude certain non-recurring items in an attempt to provide a better

earnings per share comparison to prior periods. Pro-forma Q3 ‘12 EPS excludes certain expenses

related

to

ResCap

and

other

transactions.

These

expenses

include

the

advance

hiring

of

servicing

staff,

recruiting

expenses

and

travel

and

licensing

expenses.

Pro-forma

Q2

‘12 EPS

excluded certain expenses incurred in advance of the closing of the Aurora transaction.

Pro-forma

AEBITDA

Per

Share

This

disclaimer

applies

to

every

usage

of

pro-forma

AEBITDA

per

share

in

this

presentation.

Pro-forma

AEBITDA

per

share

is

a

metric

that

is

used

by management to exclude certain non-recurring items in an attempt to provide a

better earnings per share comparison to prior periods. Pro-forma Q3 ‘12 AEBITDA per share

excludes certain expenses related to ResCap and other transactions. These

expenses include the advance hiring of servicing staff, recruiting expenses and travel and licensing expenses.

Pro-forma Q2 ‘12 AEBITDA per share excluded certain expenses incurred in

advance of the closing of the Aurora transaction. 2013

Estimate

Net

Income

2013

Estimate

Net

Income

is

based

on

our

expectations

of

continued

growth,

current

market

conditions

and

increased

operating

efficiencies

in

our

business in addition to our financial targets for 2013. Our actual Net Income for 2013

on an annualized basis may differ from our 2013(E) Net Income. 2014

Estimate

Net

Income

2014

Estimate

Net

Income

is

based

on

our

expectations

of

continued

growth,

current

market

conditions

and

increased

operating

efficiencies

in

our

business in addition to our financial targets for 2014. Our actual Net Income for 2014

on an annualized basis may differ from our 2014(E) Net Income. Adjusted

EBITDA

(“AEBITDA”)

This

disclaimer

applies

to

every

usage

of

“Adjusted

EBITDA”

or

“AEBITDA”

in

this

presentation.

Adjusted

EBITDA

is

a

key

performance

metric

used

by management in evaluating the performance of our segments. Adjusted EBITDA

represents our Operating Segments' income (loss), and excludes income and expenses that relate to

the financing of our senior notes, depreciable (or amortizable) asset base of the

business, income taxes (if any), exit costs from our restructuring and certain non-cash items. Adjusted

EBITDA also excludes results from our legacy asset portfolio and

certain securitization trusts that were consolidated upon adoption of the accounting

guidance eliminating the concept of a qualifying special purpose entity

("QSPE“). 2013

Estimate

AEBITDA

2013

Estimate

AEBITDA

is

based

on

our

expectations

of

continued

growth,

current

market

conditions

and

increased

operating

efficiencies

in

our

business

in addition to our financial targets for 2013. Target for all non-GAAP

figures excludes the same items as we excluded in our 2011/2012 non-GAAP reconciliation, as follows: income

and expenses that relate to the financing of the senior notes, depreciable (or

amortizable) asset base and several other relevant items. Our actual AEBITDA for 2013 on an annualized

basis may differ from our 2013(E) AEBITDA.

2014

Estimate

AEBITDA

2014

Estimate

AEBITDA

is

based

on

our

expectations

of

continued

growth,

current

market

conditions

and

increased

operating

efficiencies

in

our

business

in addition to our financial targets for 2014. Target for all non-GAAP

figures excludes the same items as we excluded in our 2011/2012 non-GAAP reconciliation, as follows: income

and expenses that relate to the financing of the senior notes, depreciable (or

amortizable) asset base and several other relevant items. Our actual AEBITDA for 2014 on an annualized

basis may differ from our 2014(E) AEBITDA.

NOTE:

2013

and

2014

Estimate

Net

Income

and

2013

and

2014

Estimate

AEBITDA

are

forward-looking

and

subject

to

significant

business,

economic,

regulatory

and

competitive

uncertainties,

many

of

which

are

beyond

control

of

Nationstar

and

its

management,

and

are

based

upon

assumptions

with

respect

to

future

decisions,

which

are

subject

to

change.

Actual results will vary and those variations may be material. Nothing in this

presentation should be regarded as a representation by any person that this target will be achieved and

Nationstar undertakes no duty to update this target.

16 |