Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - LIGHTPATH TECHNOLOGIES INC | lpath-8k_013113.htm |

L IGHT P ATH T ECHNOLOGIES , I NC . (NASDAQ: LPTH) A NNUAL SHAREHOLDER P RESENTATION J ANUARY 2013

Leaders in optical and infrared solutions S AFE H ARBOR S TATEMENT This presentation contains forward - looking statements . All statements in this presentation, other than statements of historical facts, which address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as future capital expenditures, growth, product development, sales, business strategy and other similar matters are forward - looking statements . These forward - looking statements are based largely on our current expectations and assumptions and are subject to a number of risks and uncertainties, many of which are beyond our control . Actual results could differ materially from the forward - looking statements set forth herein as a result of a number of factors, including, but not limited to, our products’ current state of development, the need for additional financing, competition in various aspects of its business and other risks described in this report and in our other reports on file with the Securities and Exchange Commission . In light of these risks and uncertainties, all of the forward - looking statements made herein are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized . We undertake no obligation to update or revise any of the forward - looking statements contained in this presentation . NASDAQ: LPTH

Leaders in optical and infrared solutions A N O PTICAL T ECHNOLOGY C OMPANY • All - glass aspheric lenses • All laser systems require this type of optics • Wide - range of applications: well diversified across the photonics space Precision Molded Optics • High - volume process addresses growing demand • Current industry approach is low volume and high touch/high cost • LightPath provides industry leading quality at high volumes and low cost Infrared Optics • Mounted aspheres, OEM modules, shaped lenses • GRADIUM optics • Optical isolators and isolator assemblies • Fiber and Laser collimators Optical Assemblies NASDAQ: LPTH

Leaders in optical and infrared solutions C OMPANY O VERVIEW Corporate HQ - Orlando, FL China Facility – Jiading Shanghai LightPath Manages Light LightPath Technologies designs, develops and manufactures high volume, mid to low cost laser optics, custom optical modules and thermal imaging assemblies . Diversified product base, multiple markets • Glass aspheric optics - visible and infrared • Collimators, mounted lenses • GRADIUM glass lenses Business Strategy – High Volume Supplier • Base Business • 20+ years of market excellence • Low cost structure enabling market expansion • Base Business Growth Drivers • Internet mobility, wireless expansion (4G, etc.) • Imaging and digital projection • Recovery in industrial laser tools • Strategic Growth Opportunity – Infrared Optics • Molded Optics is a key enabling technology for commercialization of new IR growth opportunities • Low Cost Thermal Imaging – Funded by DARPA • Gas sensing, IR lasers, spectroscopy • Security, defense, paramilitary, automotive NASDAQ: LPTH

Leaders in optical and infrared solutions Specialty Optics Glass Aspheres $1.2B 2014 Total Market ~$23.7B T OTAL M ARKETS Drivers: • OEM Laser Modules • Internet Mobility Specialty Optics $500M 2014 Total Market Drivers: • Custom Applications • High Power Lasers • Optical Design Infrared Systems $22B 2014 Total Market Drivers: • Commercial Apps • Molded Lenses • Defense • Precision Molded Optics represent historical “base” business • Market drivers : continued expansion of laser - based applications and IR imaging • Forecasting double - digit growth with new strategy; global growth opportunities well - diversified *Source: LightPath internal estimates, MaxTech Dual Use market survey (April 2011), FLIR Annual Report 2010 NASDAQ: LPTH

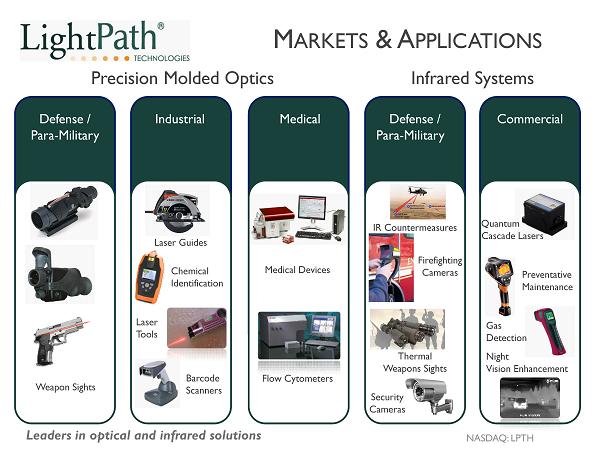

Leaders in optical and infrared solutions M ARKETS & A PPLICATIONS Precision Molded Optics Infrared Systems Defense / Para - Military Defense / Para - Military Industrial Medical Commercial Weapon Sights Laser Guides Chemical Identification Laser Tools Barcode Scanners Medical Devices IR Countermeasures Firefighting Cameras Thermal Weapons Sights Security Cameras Quantum Cascade Lasers Preventative Maintenance Gas Detection Night Vision Enhancement NASDAQ: LPTH Flow Cytometers

Leaders in optical and infrared solutions Strategic Financial Growth NASDAQ: LPTH Complete development of molded Infrared lens/assembly product line » A key enabling technology to the full development of the commercial infrared market

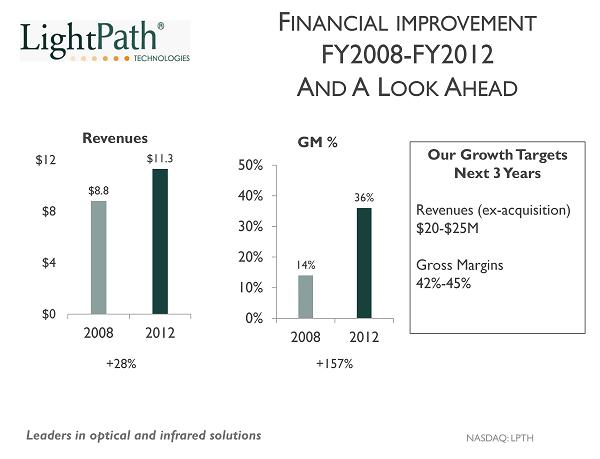

Leaders in optical and infrared solutions F INANCIAL IMPROVEMENT FY2008 - FY2012 A ND A L OOK A HEAD $8.8 $11.3 $0 $4 $8 $12 2008 2012 Revenues +28% 14% 36% 0% 10% 20% 30% 40% 50% 2008 2012 GM % +157% NASDAQ: LPTH Our Growth Targets Next 3 Years Revenues (ex - acquisition) $20 - $25M Gross Margins 42% - 45%

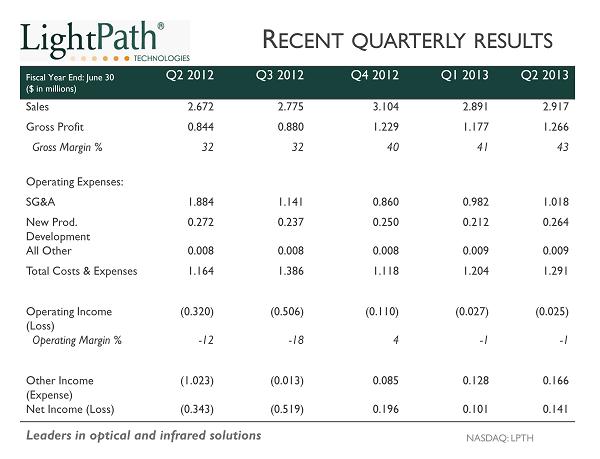

Leaders in optical and infrared solutions R ECENT QUARTERLY RESULTS Fiscal Year End: June 30 ($ in millions) Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Sales 2.672 2.775 3.104 2.891 2.917 Gross Profit 0.844 0.880 1.229 1.177 1.266 Gross Margin % 32 32 40 41 43 Operating Expenses: SG&A 1.884 1.141 0.860 0.982 1.018 New Prod. Development 0.272 0.237 0.250 0.212 0.264 All Other 0.008 0.008 0.008 0.009 0.009 Total Costs & Expenses 1.164 1.386 1.118 1.204 1.291 Operating Income (Loss) (0.320) (0.506) (0.110) (0.027) (0.025) Operating Margin % - 12 - 18 4 - 1 - 1 Other Income (Expense) (1.023) (0.013) 0.085 0.128 0.166 Net Income (Loss) (0.343) (0.519) 0.196 0.101 0.141 NASDAQ: LPTH

Leaders in optical and infrared solutions B ALANCE SHEET HIGHLIGHTS Fiscal Year End: June 30 December 31, 2012 June 30 , 2012 June 30, 2011 Cash 1,777,530 2,354,087 928,900 Current Assets 6,485,385 6,250,259 4,612,404 Total Assets 8,581,518 8,271,093 7,121,476 Current Liabilities 2,980,287 1,741,204 1,533,813 Total Liabilities 4,104,487 4,268,629 3,085,575 Total Stockholders’ Equity 4,477,031 4,002,464 4,035,901 Total Liabilities & Stockholders’ Equity 8,581,518 8,271,093 7,121,476 NASDAQ: LPTH

Leaders in optical and infrared solutions M AJOR G ROWTH O PPORTUNITY Thermography Commercial Vision Defense • Predictive maintenance • Manufacturing process control • Building inspection • Medical imaging • Gas detection • Security and surveillance • Automotive night vision • Marine applications • Law enforcement • Search and rescue • Force protection • Border patrol • Surveillance and reconnaissance • Targeting and I.D. Infrared Systems represent a $ 22 B global market NASDAQ: LPTH

Leaders in optical and infrared solutions FOCUS ON IR G ROWTH Management • IR Growth is #1 priority • Development f unding in place Sales • Focus is on Top Line Sales Growth • IR Production is ready for volume • Open Position for IR Sales Revamped Production facilities in Orlando • New Preform Processing Equipment • Improved Molding Press Station Design for IR Photo of IR Team accepting the Schwartz Award for Innovative Technologies from the Orlando Economic Development Council 12 Confidential

Leaders in optical and infrared solutions Material: Germanium glass as a raw material; more expensive and has a volatile price history; heavier and has poor thermal characteristics Chalcogenide glass as a raw material is less expensive, lighter weight and more thermally stable over a broader temp range Mass production, repeatable process Much lower capital cost for equipment (10x) Regular machine operator Highly specialized expensive operator required High capital cost for equipment Lenses made one at a time Current Process LightPath Process LightPath proprietary & patented manufacturing and material technology represents disruptive force to address a broad cross section of the IR market M AJOR G ROWTH O PPORTUNITY I N I NFRARED NASDAQ: LPTH

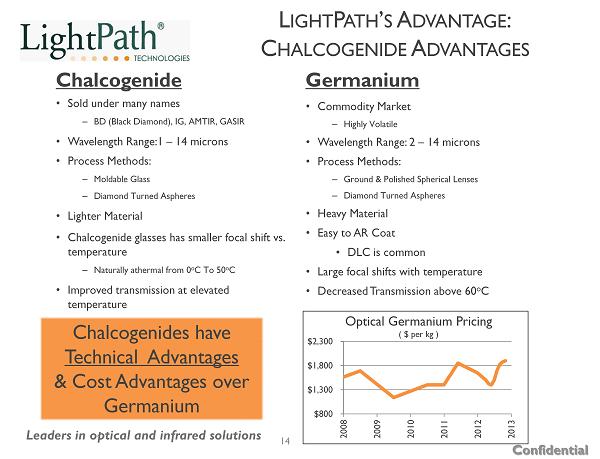

Leaders in optical and infrared solutions Chalcogenide • Sold under many names – BD (Black Diamond), IG, AMTIR, GASIR • Wavelength Range:1 – 14 microns • Process Methods: – Moldable Glass – Diamond Turned Aspheres • Lighter Material • Chalcogenide glasses has smaller focal shift vs. temperature – Naturally athermal from 0 o C To 5 0 o C • Improved transmission at elevated temperature Germanium • Commodity Market – Highly Volatile • Wavelength Range: 2 – 14 microns • Process Methods: – Ground & Polished Spherical Lenses – Diamond Turned Aspheres • Heavy Material • Easy to AR Coat • DLC is common • Large focal shifts with temperature • Decreased Transmission above 60 o C L IGHT P ATH ’ S A DVANTAGE : C HALCOGENIDE A DVANTAGES $800 $1,300 $1,800 $2,300 2008 2009 2010 2011 2012 2013 Optical Germanium Pricing ( $ per kg ) Chalcogenides have Technical Advantages & Cost Advantages over Germanium 14 Confidential

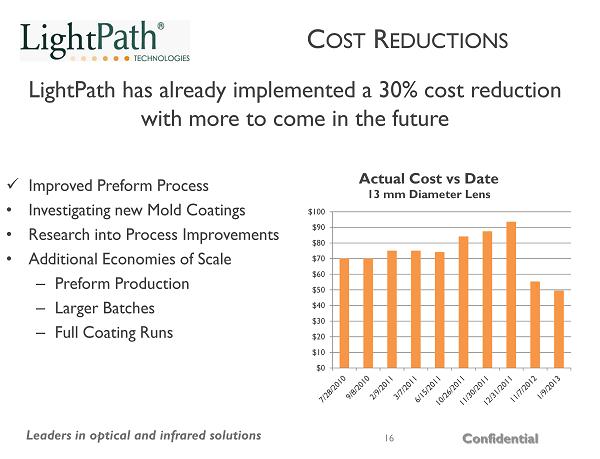

Leaders in optical and infrared solutions C OST R EDUCTIONS x Improved Preform Process • Investigating new Mold Coatings • Research into Process Improvements • Additional Economies of Scale – Preform Production – Larger Batches – Full Coating Runs $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 Actual Cost vs Date 13 mm Diameter Lens LightPath has already implemented a 30% cost reduction with more to come in the future 16 Confidential

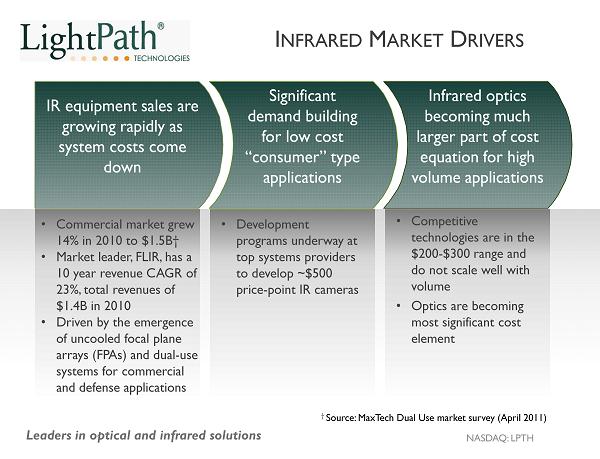

Leaders in optical and infrared solutions • Commercial market grew 14% in 2010 to $1.5B† • Market leader, FLIR, has a 10 year revenue CAGR of 23%, total revenues of $1.4B in 2010 • Driven by the emergence of uncooled focal plane arrays (FPAs) and dual - use systems for commercial and defense applications • Competitive technologies are in the $200 - $300 range and do not scale well with volume • Optics are becoming most significant cost element IR equipment sales are growing rapidly as system costs come down I NFRARED M ARKET D RIVERS Significant demand building for low cost “consumer” type applications • Development programs underway at top systems providers to develop ~$500 price - point IR cameras Infrared optics becoming much larger part of cost equation for high volume applications † Source: MaxTech Dual Use market survey (April 2011) NASDAQ: LPTH

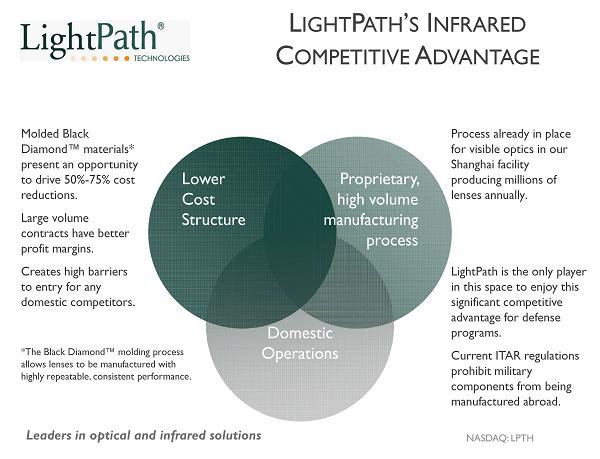

Leaders in optical and infrared solutions L IGHT P ATH ’ S I NFRARED C OMPETITIVE A DVANTAGE LightPath is the only player in this space to enjoy this significant competitive advantage for defense programs. Current ITAR regulations prohibit military components from being manufactured abroad. Lower Cost Structure Proprietary, high volume manufacturing process Domestic Operations Molded Black Diamond™ materials* present an opportunity to drive 50% - 75% cost reductions. Large volume contracts have better profit margins. Creates high barriers to entry for any domestic competitors. Process already in place for visible optics in our Shanghai facility producing millions of lenses annually . NASDAQ: LPTH *The Black Diamond™ molding process allows lenses to be manufactured with highly repeatable, consistent performance.

Leaders in optical and infrared solutions Installed capacity ready for FY2014 forecast Preforms • Invested in Preform Capacity • Easily scalable • Additional capacity from external vendors if necessary Mold Stations • Next Generation IR Press Station is undergoing testing for increased yield and lower costs IR P RODUCTION LightPath IR Production Team is Ready to Go! 19 Confidential

Leaders in optical and infrared solutions M ANAGEMENT T EAM Alan Symmons Vice President, Engineering Over 25 years of business and manufacturing experience in volume component manufacturing in electronics and optics industries . Prior to joining LightPath Mr . Gaynor was Director of Operations for Puradyn Filter Technologies . Previous to that he was Vice president of Operations and General Manager for JDS Uniphase Corporation’s Transmission Systems Division from March 2000 to April 2002 . His global business experience encompasses strategic planning, budgets, capital investment, employee development, cost reduction, acquisitions and business start - up and turnaround success J. James Gaynor CEO Dorothy Cipolla Chief Financial Officer Robert Ripp Chairman of the Board Ms . Cipolla has served as a CFO for both public and private companies . including Chief Financial Officer and Secretary of LaserSight Technologies, Inc . , and Network Six, Inc . , a NASDAQ - listed professional services firm . Ms . Cipolla was Vice President of Finance with Goliath Networks, Inc . , a privately held network consulting company . From 2002 to 2003 , Ms . Cipolla was Department Controller of Alliant Energy Corporation, a regulated utility . Mr . Symmons has been the Company’s Director of Engineering since October 2006 . In September 2010 , he was promoted to Corporate Vice President of Engineering . Prior to joining LightPath . Mr . Symmons was Engineering Manager for Aurora Optical, a subsidiary of Multi - Fineline Electronix, (MFLEX), dedicated to the manufacture of cell phone camera modules . From 2000 – 2006 , Mr . Symmons worked for Applied Image Group – Optics, (AIG/O), a recognized leader in precision injection molded plastic optical components and assemblies Mr . Ripp has served as Chairman of LightPath since November 1999 . During portions of fiscal years 2002 and 2003 he also served as the Company's Interim President and Chief Executive Officer . Mr . Ripp was Chairman and CEO of AMP Incorporated from August 1998 until April 1999 , when AMP was sold to TYCO International Ltd . Mr . Ripp held various executive positions at AMP from 1994 to August 1999 . Mr . Ripp previously spent 29 years with IBM of Armonk, NY . He held positions in all aspects of operations within IBM culminating in the last four years as Vice President and Treasurer and he retired from IBM in 1993 . NASDAQ: LPTH

Leaders in optical and infrared solutions R ECENT H IGHLIGHTS January 30 , 2013 LightPath Technologies announces profitable fiscal second quarter January 14 , 2013 LightPath Technologies provides quarterly update on infrared initiatives November 29 , 2012 LightPath Technologies enters into supply contract with leading digital camera manufacturer November 8, 2012 LightPath Technologies announces profitable fiscal first quarter October 31, 2012 LightPath Technologies p rovides q uarterly u pdate on infrared initiatives October 11, 2012 LightPath Technologies grants GRADIUM® technology license to Hubei, New HuaGuang Information Materials Company, Ltd. ( NHG) August 30, 2012 LightPath Technologies announces profitable fiscal fourth quarter March 15, 2012 LightPath Technologies signs $1.1 million development contract with major defense contractor NASDAQ: LPTH

Leaders in optical and infrared solutions Company Highlights

• Public Company - NASDAQ Listing • Optics and photonics company with wholly owned manufacturing facility in China – Low cost manufacturing platform – Direct access to Asian markets – World class custom design capability • Low cost, high volume manufacturer of laser optics and thermal imaging assemblies – Diversified product mix, Global sales footprint – Blue Chip Customer Base – Taking 20+ years of market experience to new, high volume customers and applications, larger markets • Significant growth opportunities – New cost structure offers access to larger markets • Telecommunications, digital imaging, industrial tools, medical – Have key enabling technology to the commercialization of new applications in infrared systems • Low Cost Thermal Imaging – Funded by DARPA • Gas sensing, IR lasers, spectroscopy • Security , defense, paramilitary, automotive night vision NASDAQ: LPTH