Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Blackstone Group Inc | d475721d8k.htm |

| EX-99.1 - PRESS RELEASE OF THE BLACKSTONE GROUP L.P. - Blackstone Group Inc | d475721dex991.htm |

Blackstone’s Full Year and Fourth Quarter

2012 Earnings

January 31, 2013

Exhibit 99.2 |

Blackstone

1

Blackstone’s Full Year and Fourth Quarter 2012 Highlights

Economic

Net

Income

(“ENI”)

was

up

30%

in

2012

to

nearly

$2

billion,

or

$1.77

per

unit,

the

highest

full

year total since going public, on strong revenue growth to over

$4 billion.

•

Fourth

quarter

ENI

of

$670

million

was

driven

by

sustained

performance

in

Real

Estate

and

strong

growth

in

Private

Equity,

Credit

and

Hedge

Fund

Solutions,

as

valuation

gains

and

realization

activity

increased considerably.

GAAP

Revenues

were

$4

billion

for

the

year

while

GAAP

Net

Income

was

$219

million

due

to certain non-

cash IPO and transaction related expenses and the exclusion of net income

attributable to insiders. Distributable

Earnings

(“DE”)

surged

48%

in

2012

to

over

$1

billion,

or

$0.85

per

common

unit,

on

a sharp

increase in Fee Related Earnings (“FRE”) and an improving environment

for Realized Performance Fees across all of Blackstone’s investment

businesses. •

Full year Fee Related Earnings of $700 million were up 28% from 2011 on continued

strong inflows which drove Base Management Fees up 24% to $1.6 billion,

Blackstone’s best ever full year total. •

Full

year

Realized

Performance

Fees

of

$629

million

were

up

176%

from

2011,

as

market

levels

and

fund

performance created realization opportunities across the investment

businesses. Total AUM reached a record $210 billion, up $44 billion or 26%

from the prior year, as all of Blackstone’s investment businesses

continued to see net inflows and carrying value appreciation. •

Full year gross inflows were $47 billion including $19 billion in new fund

strategies as Blackstone innovated more ways to find and create fund

investor value. •

Total capital invested was $15.6 billion in 2012, the second highest full year

total in Blackstone’s history. •

Blackstone’s funds returned $18.5 billion of capital to investors during the

year. |

Blackstone

2

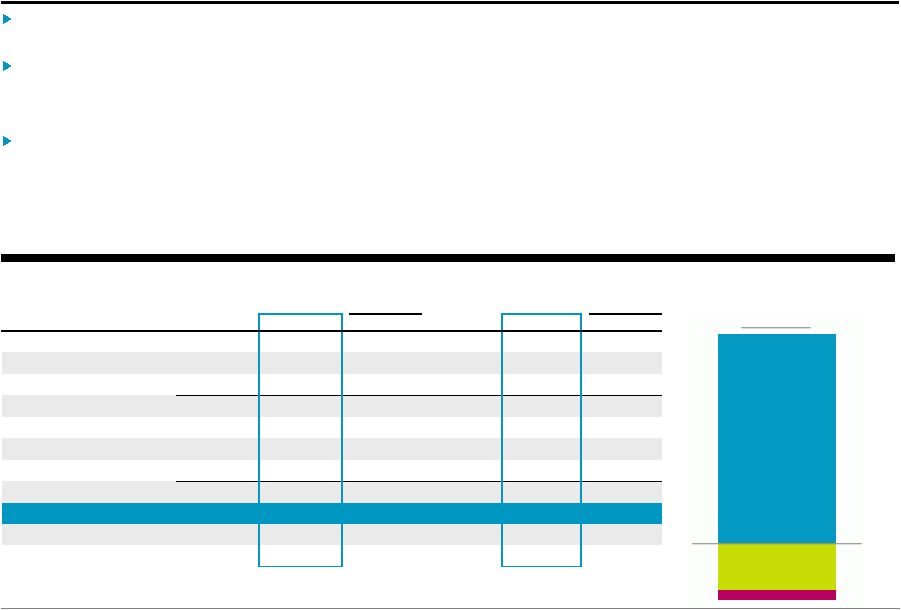

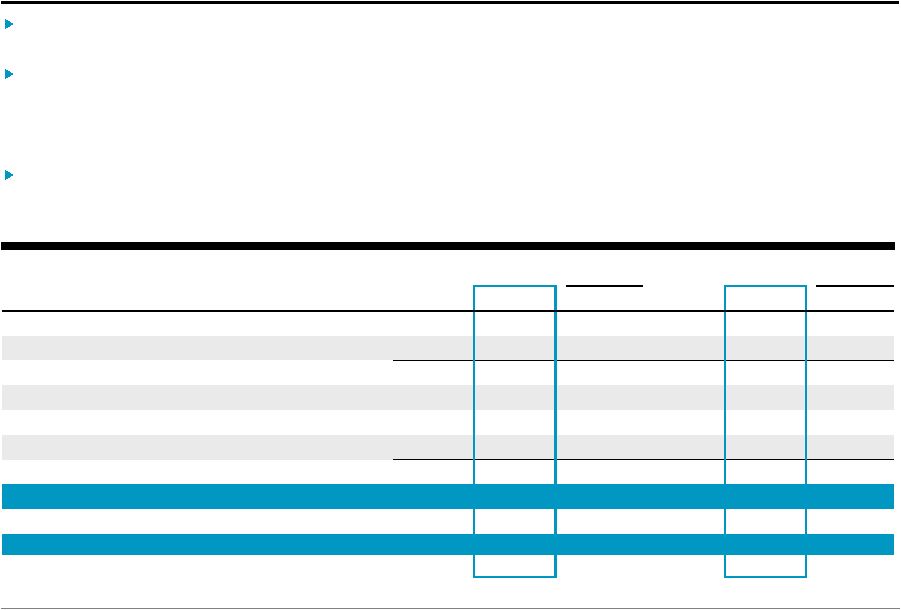

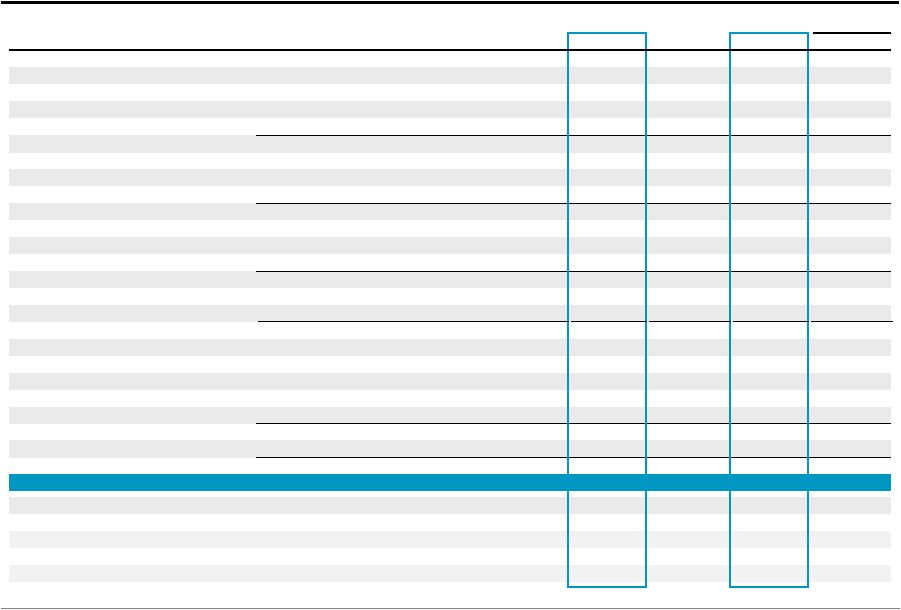

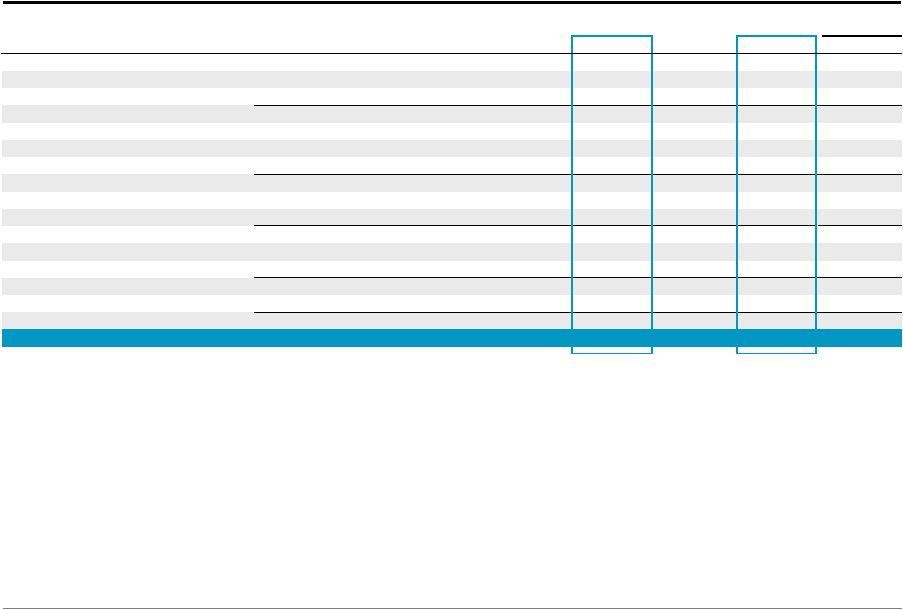

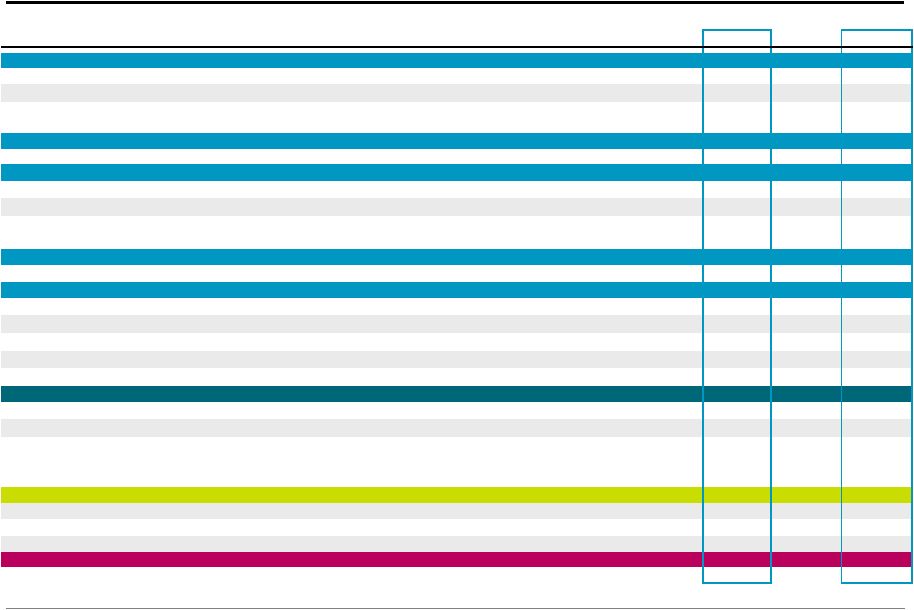

Blackstone’s Fourth Quarter and Full Year 2012 Earnings

(a)

(b)

(c)

% Change

% Change

(Dollars in Thousands, Except per Unit Data)

4Q'11

4Q'12

vs. 4Q'11

FY'11

FY'12

vs. FY'11

Fee Revenues

511,335

$

646,903

$

27%

1,923,804

$

2,186,765

$

14%

Performance Fees

357,950

470,173

31%

1,174,526

1,593,765

36%

Investment Income

55,725

111,670

100%

185,264

286,244

55%

Total Revenues

925,010

$

1,228,746

$

33%

3,283,594

$

4,066,774

$

24%

Total Expenses

442,238

542,733

23%

1,698,623

2,025,767

19%

Taxes

14,618

16,032

10%

45,763

45,708

(0)%

Economic Net Income ("ENI")

(a)

468,154

$

669,981

$

43%

1,539,208

$

1,995,299

$

30%

ENI per Unit

(b)

0.42

$

0.59

$

40%

1.38

$

1.77

$

28%

GAAP Net Income (Loss)

(22,677)

$

106,413

$

n/m

(168,303)

$

218,598

$

n/m

Fee Related Earnings ("FRE")

166,096

$

272,604

$

64%

546,493

$

700,313

$

28%

Distributable Earnings ("DE")

178,186

$

493,765

$

177%

696,724

$

1,033,925

$

48%

DE per Common Unit

(c)

0.16

$

0.39

$

144%

0.60

$

0.85

$

42%

Total Assets Under Management

166,228,504

$

210,219,960

$

26%

166,228,504

$

210,219,960

$

26%

Fee-Earning Assets Under Management

136,756,753

$

167,880,440

$

23%

136,756,753

$

167,880,440

$

23%

Economic Net Income, a segment measure, has been redefined as Economic Income after current

taxes (“Taxes”); it no longer deducts the implied provision for income taxes.

ENI per Unit is based on the Weighted-Average ENI Adjusted Units.

DE per Common Unit equals DE Attributable to Common Unitholders divided by Total GAAP Common

Units Outstanding. Note: Prior period amounts on all pages have been adjusted to conform

to the current period presentation and definitions. See Appendix – Definitions. |

Blackstone

3

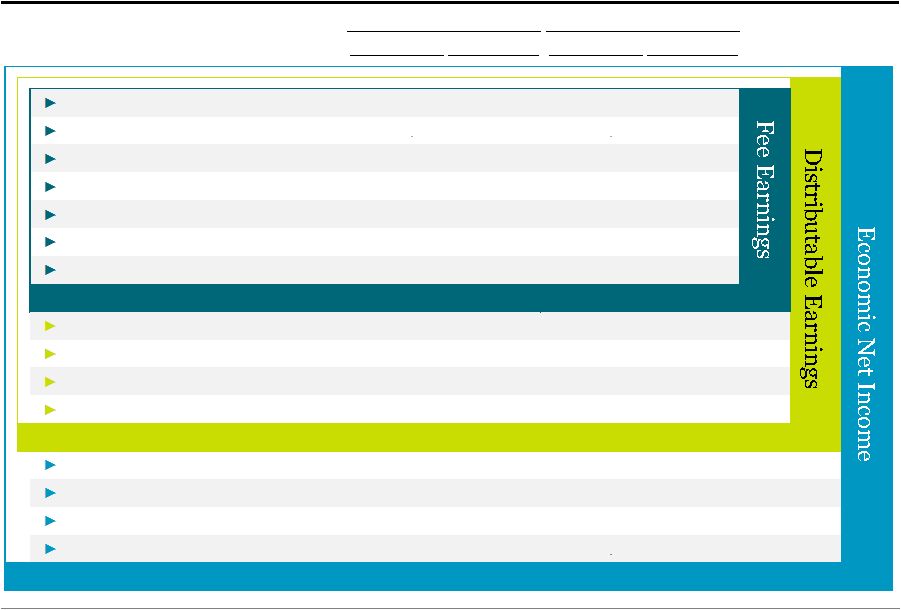

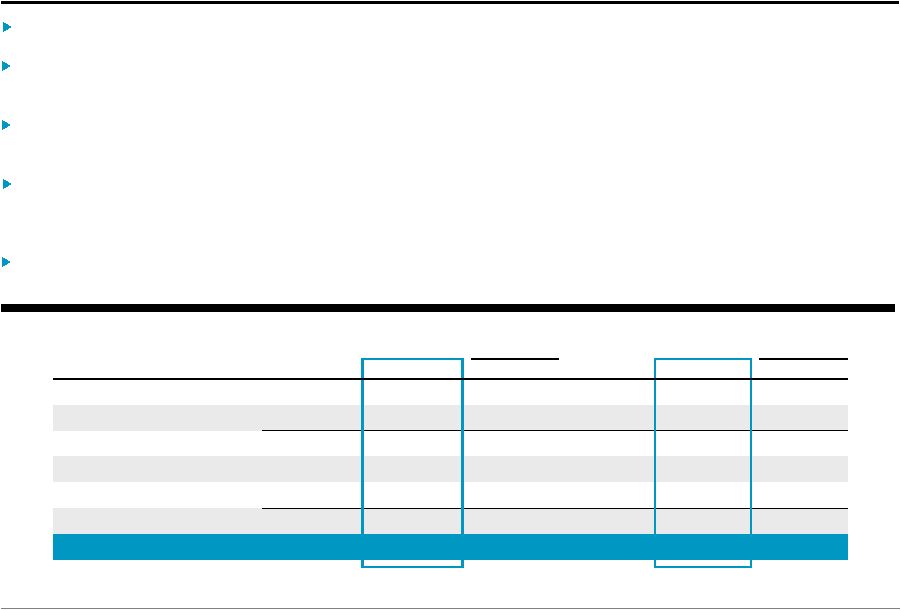

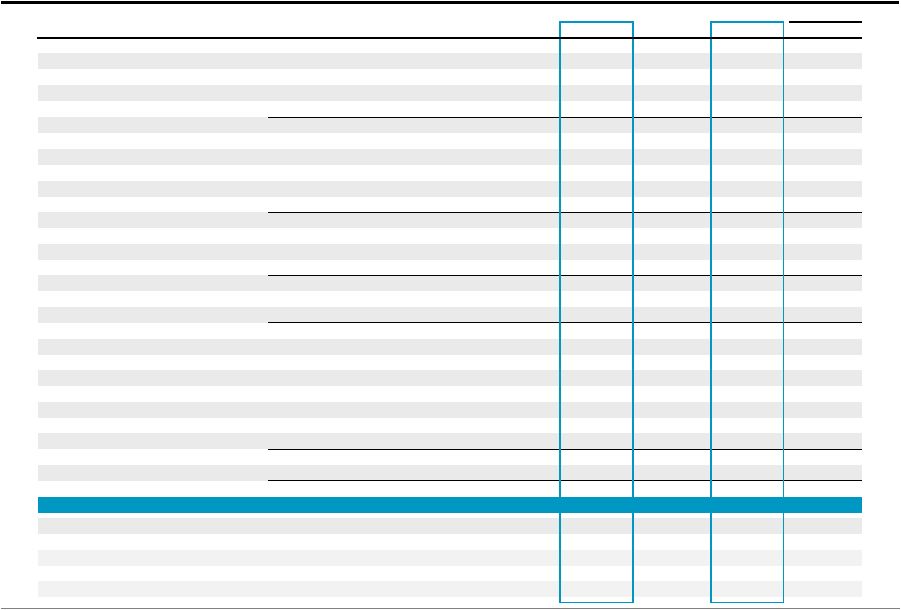

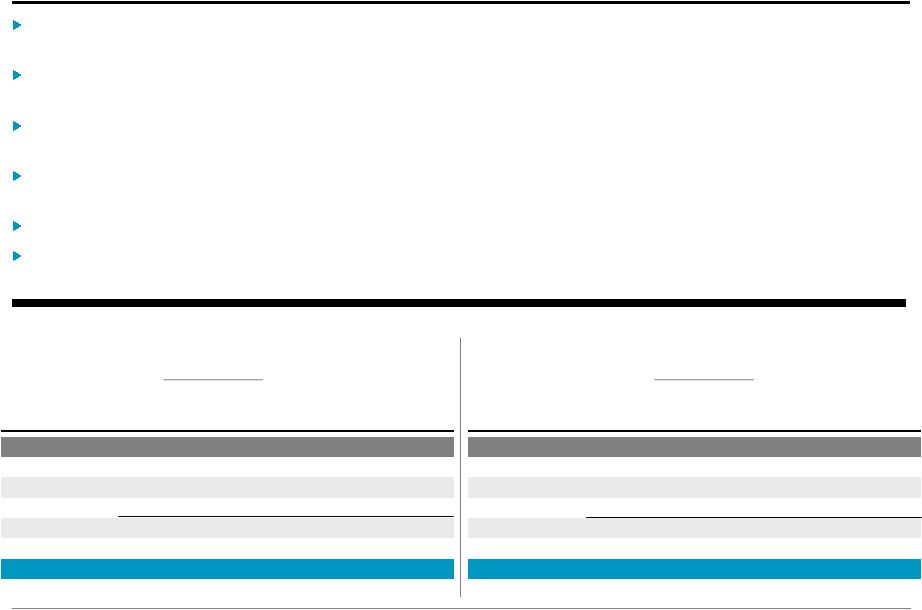

Walkdown of Financial Metrics

4Q'12

FY'12

(Dollars in Thousands, Except per Unit Data)

Results

Per Unit

(a)

Results

Per Unit

(a)

Base Management Fees

416,465

$

1,591,403

$

Advisory Fees

128,248

357,417

Transaction and Other Fees, Net

94,069

227,119

Management Fee Offsets

(11,476)

(40,953)

Interest Income and Other Revenue

24,287

77,548

Compensation

(247,559)

(1,030,776)

Other Operating Expenses

(131,430)

(481,445)

Fee Related Earnings

272,604

$

0.24

$

700,313

$

0.62

$

Net Realized Incentive Fees

147,115

161,422

Net Realized Carried Interest

115,595

230,989

Net Realized Investment Income

31,004

73,526

Taxes and Related Payables

(72,553)

(132,325)

Distributable Earnings

493,765

$

0.39

$

1,033,925

$

0.85

$

Net Unrealized Incentive Fees

(92,542)

15,217

Net Unrealized Carried Interest

136,261

672,591

Net Unrealized Investment Income

75,976

186,949

Add Back: Related Payables

56,521

86,617

Economic Net Income

669,981

$

0.59

$

1,995,299

$

1.77

$

See Appendix - Calculation of Certain Non-GAAP Financial Metric Components for the

calculation of the amounts presented herein that are not the respective captions from the

Total Segment information.

(a)

Fee Related Earnings per Unit is based on DE Units Outstanding; DE per Unit equals DE per

Common Unit; and ENI per Unit is based on Weighted-Average ENI Adjusted Units (See

Appendix - Unit Rollforward). |

Blackstone

4

Private Equity

14.3%

FY’12

Increase

in

Fund

Carrying

Value

(a)

$644 million

Net Accrued Performance Fees at 4Q’12

11%

2012 Increase in Total AUM

Revenues were up 43% to $828 million in 2012 driven by sharp increases in

Performance Fees and Investment Income, resulting in $412 million of

Economic Income, up 71% from 2011. Overall

carrying

value

of

segment

portfolio

assets

(a)

was

up

7.0%

for

the

quarter

and

14.3%

for

the

full

year.

Public holdings appreciated 9.6% for the quarter while private holdings increased

6.0% driven by operating performance

in

the

energy

and

hospitality/leisure

sectors

of

the

portfolios.

Invested $1.9 billion of total capital with an additional $611 million committed

but not yet invested during the quarter, bringing the full year total

capital invested and committed to $5.0 billion, up 9% from 2011 levels.

Returned

$3.5

billion

to

investors

during

the

year

at

an

average

2.1x

Multiple

of

Invested

Capital

(“MOIC”).

Exits occurred through public markets, strategic sales and recapitalizations, as

the environment for exits at attractive valuations continued to

improve. Completed successful initial public offering of PBF Energy at a

robust valuation of 4.7x invested capital as well as a number of secondary

sales in TeamHealth at an average MOIC of 3.9x. Total Assets Under

Management reached a record $51 billion, reflecting the final close for our first energy fund and

closings for our tactical opportunities investment vehicles, which have raised

$1.7 billion through year end. % Change

% Change

(Dollars in Thousands)

4Q'11

4Q'12

vs. 4Q'11

FY'11

FY'12

vs. FY'11

Fee Revenues

106,897

$

134,857

$

26%

453,487

$

458,721

$

1%

Performance Fees

55,385

118,968

115%

70,883

258,178

264%

Investment Income

28,603

64,856

127%

54,464

111,160

104%

Total Revenues

190,885

318,681

67%

578,834

828,059

43%

Compensation

45,611

53,963

18%

217,556

222,709

2%

Performance Fee Compensation

4,094

26,145

n/m

(764)

62,234

n/m

Other Operating Expenses

34,493

40,499

17%

120,918

130,845

8%

Total Expenses

84,198

120,607

43%

337,710

415,788

23%

Economic Income

106,687

$

198,074

$

86%

241,124

$

412,271

$

71%

Total AUM

45,863,673

$

51,002,973

$

11%

45,863,673

$

51,002,973

$

11%

Fee-Earning AUM

37,237,791

$

37,050,167

$

(1)%

37,237,791

$

37,050,167

$

(1)%

(a)

BCP portfolio, BCOM, BEP, Tactical Opportunities and Other Funds (including fee-paying

co-invest). |

Blackstone

5

Real Estate

14.4%

FY’12

Increase

in

Fund

Carrying

Value

(a)

$1.3 billion

Net Accrued Performance Fees at 4Q’12

32%

2012 Increase in Total AUM

(a)

BREP portfolio (including fee-paying co-invest).

(b)

Excludes Capital Trust drawdown funds.

(c)

Revenues for the year were up 3% from 2011 driven by a 22% increase in Fee

Revenues resulting primarily from Base

Management

Fees

generated

by

the

final

close

for

our

latest

global

fund,

which

reached

$13.3

billion

in

total

fund commitments.

BREP investments

(a)

were up 3.7% for the quarter and 14.4% for the full year.

Debt

Strategies

drawdown

funds

(b)

were

up

2.9%

for

the

quarter

and

13.0%

for

the

full

year,

while

the

credit

hedge funds were up 3.7% for the quarter and 18.1% for the full year.

Performance fees were $874 million for the year generated primarily by BREP V,

VI, VII and BREP Europe III. Invested $8.5 billion of total capital during

the year with an additional $923 million committed but not yet invested at

the end of 2012, bringing the full year total capital invested and committed to a record $9.4 billion.

Returned $1.7 billion of capital to investors during the quarter, bringing the

full year amount to over $3.7 billion. Completed the acquisition of Capital

Trust’s investment management business, adding an experienced team with

expertise

in

debt

origination

and

special

servicing,

as

well

as

$2.3

billion

of

Total

AUM

as

of

year

end.

Total Assets Under Management rose 32% during the year to a record $56.7

billion. % Change

% Change

(Dollars in Thousands)

4Q'11

4Q'12

vs. 4Q'11

FY'11

FY'12

vs. FY'11

Fee Revenues

122,639

$

167,924

37%

511,179

$

623,736

$

22%

Performance Fees

243,430

201,527

(17)%

949,549

874,415

(8)%

Investment Income

26,316

34,442

31%

120,620

136,177

13%

Total Revenues

392,385

403,893

3%

1,581,348

1,634,328

3%

Compensation

53,507

54,201

1%

236,771

271,122

15%

Performance Fee Compensation

59,038

66,727

13%

238,913

240,377

1%

Other Operating Expenses

29,027

36,946

27%

103,859

123,714

19%

Total Expenses

141,572

157,874

12%

579,543

635,213

10%

Economic Income

250,813

$

246,019

$

(2)%

1,001,805

$

999,115

$

(0)%

Total AUM

42,852,669

$

56,695,645

$

32%

42,852,669

$

56,695,645

$

32%

Fee-Earning AUM

31,236,540

$

41,931,339

$

34%

31,236,540

$

41,931,339

$

34%

(c)

FY’11 Performance Fees included $248 million due to the impact of the profit allocation

“catch-up” provisions for BREP V and VI. |

Blackstone

6

Hedge Fund Solutions

$24 billion

4Q’12 Incentive Fee-Earning AUM

(b)

Revenues were up 36% for the year driven by a substantial increase in Performance

Fees due to strong fund performance as investors sought stable

risk-adjusted returns. Composite returns

(a)

were up 2.2% net for the quarter and up 8.6% net for the full year.

•

As of year-end, $18.6 billion or 78% of Incentive Fee-Earning AUM was

estimated above its respective High Water

Mark

and/or

Hurdle,

up

from

just

$1.6

billion

or

8%

a

year

ago.

Fee-Earning AUM grew 15% during the year to a record $43.5 billion, driven by

strong net inflows into customized investment products and market

appreciation. •

51% is currently invested in customized portfolios up from 39% five years

ago. •

Fee-Earning net inflows were $2.4 billion for the year.

•

January

1

subscriptions

of

$370

million

are

not

included

in

year-end

Fee-Earning

AUM.

(a)

Represents the BAAM Composite which is the asset-weighted performance of BAAM’s

investments, net of all fees, excluding BAAM's long-only platforms, seed funds and

advisory relationships.

(b)

Represents currently invested incentive fee eligible AUM above or below High Water Mark or

Relevant Benchmark. Totals may not add due to rounding. Above

HWM /

Hurdle

0-5% Below

> 5% Below

% Change

% Change

(Dollars in Thousands)

4Q'11

4Q'12

vs. 4Q'11

FY'11

FY'12

vs. FY'11

Fee Revenues

90,029

$

96,801

$

8%

327,608

$

350,939

$

7%

Performance Fees

2,089

36,524

n/m

12,246

92,475

n/m

Investment Income (Loss)

(750)

3,784

n/m

(1,309)

15,787

n/m

Total Revenues

91,368

137,109

50%

338,545

459,201

36%

Compensation

38,525

28,113

(27)%

128,959

119,731

(7)%

Performance Fee Compensation

(177)

9,766

n/m

3,732

24,397

n/m

Other Operating Expenses

21,568

16,491

(24)%

65,072

57,809

(11)%

Total Expenses

59,916

54,370

(9)%

197,763

201,937

2%

Economic Income

31,452

$

82,739

$

163%

140,782

$

257,264

$

83%

Total AUM

40,534,768

$

46,092,505

$

14%

40,534,768

$

46,092,505

$

14%

Fee-Earning AUM

37,819,636

$

43,478,791

$

15%

37,819,636

$

43,478,791

$

15%

$0.9B / 4%

$4.2B / 18%

$18.6B / 78%

st |

Blackstone

7

Credit

$56 billion

4Q’12 Total AUM

Customized

Credit Strategies

(c)

Rescue

Lending

Mezzanine

Funds

Hedge Fund

Strategies

CLOs

Economic Income for the year was up 130% to a record $325 million reflecting

substantial increases in Fee Revenues and Performance Fees as inflows and

returns continued to outperform the market. Total AUM grew 53% during the

year to a record $56.4 billion, driven by new product launches, strong net

inflows, market appreciation and the Harbourmaster acquisition in the first

quarter. Fund returns remained strong across the platform:

•

Hedge Funds

(a)

were up 3.8% net for the quarter and 13.4% net for the full year.

•

Mezzanine Funds

(a)

were up 7.3% net for the quarter and 26.2% net for the full year.

•

Rescue Lending Funds

(a)

were up 3.1% net for the quarter and 15.7% net for the full year.

Invested

$349

million

of

total

capital

with

an

additional

$566

million

committed

but

not

yet

invested

in

4Q’12,

bringing 2012 total capital invested and committed to $3.5 billion as deployment

opportunities remained strong. Priced

third

CLO

of

the

year

at

$515

million,

bringing

full

year

CLO

AUM

raised

to

nearly

$1.6

billion.

Held

first

close

for

our

most

recent

rescue

lending

fund

with

$2.5

billion

(b)

at

year-end

and

closed

on

an

additional

$810 million in January.

% Change

% Change

(Dollars in Thousands)

4Q'11

4Q'12

vs. 4Q'11

FY'11

FY'12

vs. FY'11

Fee Revenues

66,919

$

117,081

$

75%

242,553

$

389,304

$

61%

Performance Fees

57,046

113,154

98%

141,848

368,697

160%

Investment Income

1,144

8,043

n/m

10,591

20,380

92%

Total Revenues

125,109

238,278

90%

394,992

778,381

97%

Compensation

25,435

51,853

104%

128,588

182,077

42%

Performance Fee Compensation

31,773

61,106

92%

74,831

186,538

149%

Other Operating Expenses

13,162

18,116

38%

49,955

84,488

69%

Total Expenses

70,370

131,075

86%

253,374

453,103

79%

Economic Income

54,739

$

107,203

$

96%

141,618

$

325,278

$

130%

Total AUM

36,977,394

$

56,428,837

$

53%

36,977,394

$

56,428,837

$

53%

Fee-Earning AUM

30,462,786

$

45,420,143

$

49%

30,462,786

$

45,420,143

$

49%

$24.5

$8.5

$6.3

$4.0

$13.1

Totals may not add due to rounding. (a) Represents weighted average returns for the onshore and offshore

funds (if applicable) for the respective flagship funds.

(b)

Represents total commitments, which are included in Total AUM as of year end 2012, but none of

which are included in Fee-Earning AUM.

(c)

Includes business development companies (“BDCs”), closed-end funds, commingled

funds and separately managed accounts. |

Blackstone

8

Financial Advisory

Collectively, the firm’s advisory businesses outperformed the broader market

which saw sharp declines in 2012. Revenues for the quarter were up 4% from

the same period a year ago and were down 6% for the year primarily from

delays in deal closings, particularly in our Park Hill placement services business, despite a steady backlog.

Restructuring

kept

its

#1

ranking

for

U.S.

completed

restructurings

(a)

,

earned

2012

revenue

above

2011

levels

and

won the prestigious 2012 International Financing Review award for Restructuring

House of the Year. Blackstone Advisory Partners had a record level of

revenue in the fourth quarter driven by a significant number of

transaction

closings

prior

to

year end.

Overall,

2012

revenue

was

modestly

lower

vs.

2011,

however

the

2013

pipeline for deal activity is higher than the same time last year with several

high profile mandates in process. Park Hill’s pipeline remains solid

as challenging fundraising market conditions are driving demand for placement

services; revenues were down year-over-year reflecting timing more than

recurring activity levels. (a)

Source: 2012 Thomson Reuters U.S. Distressed Debt & Bankruptcy Restructuring

Rankings. % Change

% Change

(Dollars in Thousands)

4Q'11

4Q'12

vs. 4Q'11

FY'11

FY'12

vs. FY'11

Fee Revenues

124,851

$

130,240

$

4%

388,977

$

364,065

$

(6)%

Investment Income

412

545

32%

898

2,740

205%

Total Revenues

125,263

130,785

4%

389,875

366,805

(6)%

Compensation

62,360

59,429

(5)%

248,695

235,137

(5)%

Other Operating Expenses

23,822

19,378

(19)%

81,538

84,589

4%

Total Expenses

86,182

78,807

(9)%

330,233

319,726

(3)%

Economic Income

39,081

$

51,978

$

33%

59,642

$

47,079

$

(21)% |

Blackstone

9

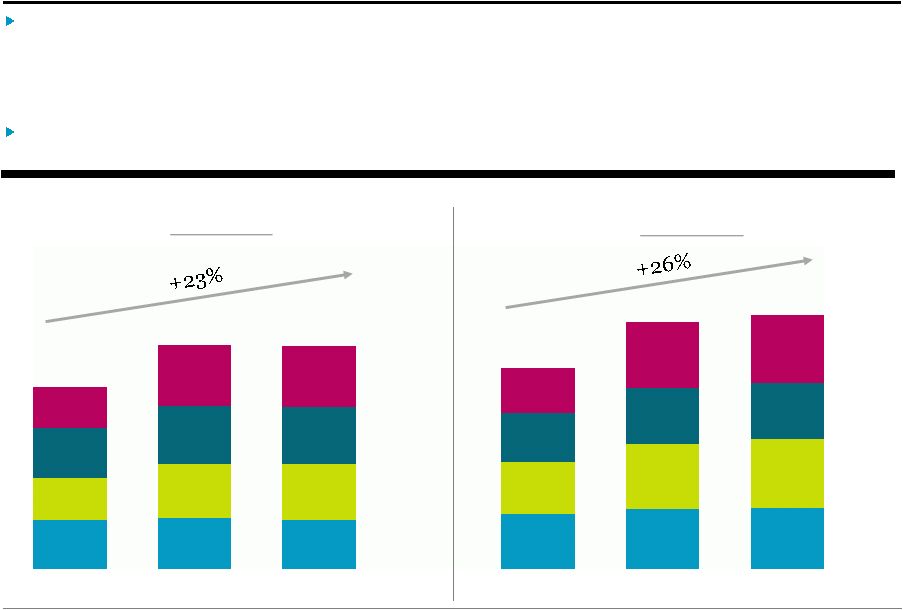

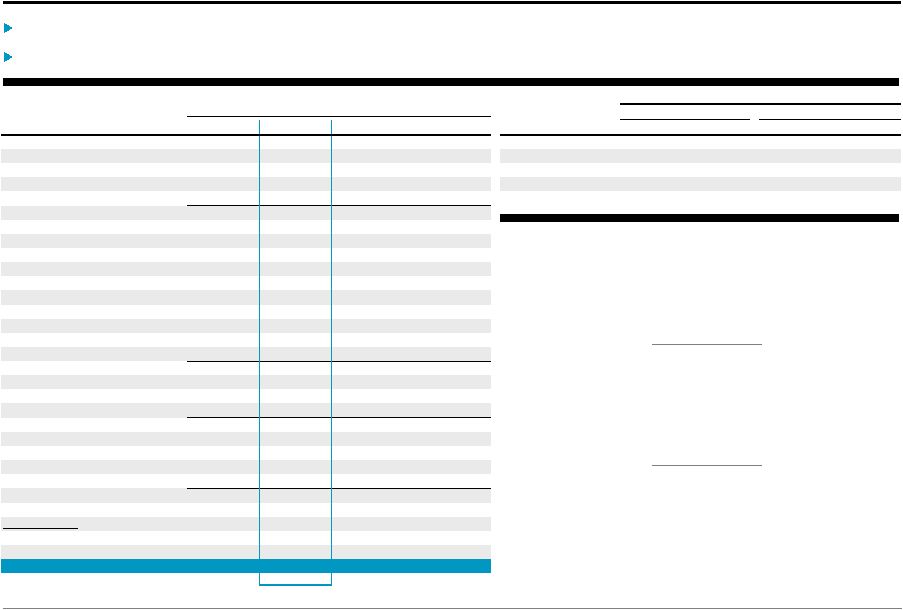

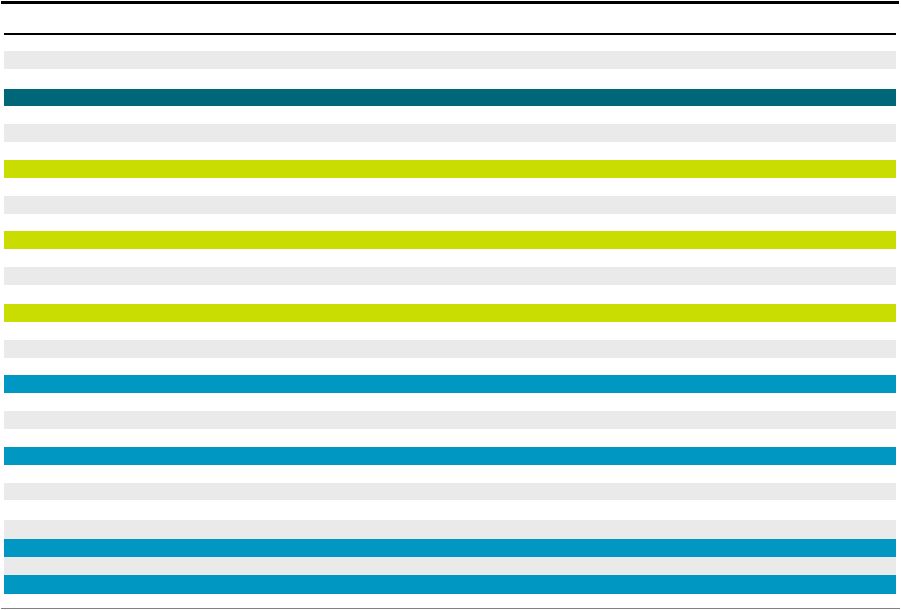

Assets Under Management

Fee-Earning

AUM

was

up

23%

in

2012

to

$168

billion,

as

$42.7

billion

of

gross

inflows

and

$4.8

billion

of

market

appreciation more than offset $16.4

billion of outflows and realizations.

•

Including

commitments,

not

yet

earning

fees,

Fee-Earning

AUM

was

$180

billion,

up

32%

from

2011.

•

The

slight

decrease

from

last

quarter

end

was

driven

primarily

by

an

increase

in

realization

activity.

Total

AUM

increased

26%

in

2012

to

a

record

$210

billion

driven

by

strong

organic

net

inflows

and

market

appreciation

across

all

investment

businesses,

each

of

which

are

at

or

near

record

levels

of

AUM.

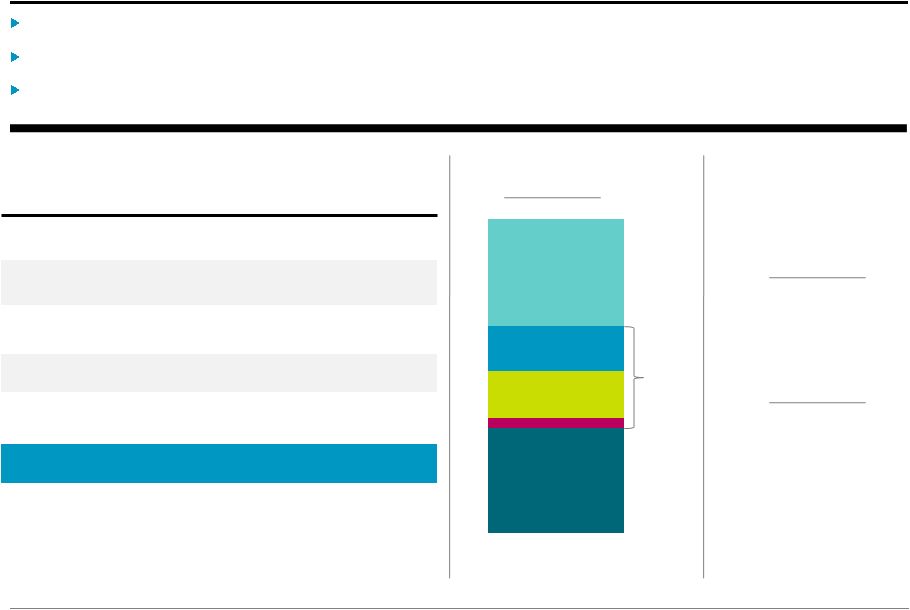

Fee-Earning AUM by Segment

$136.8

$168.6

$167.9

Total AUM by Segment

$166.2

$204.6

$210.2

Credit

Hedge Fund

Solutions

Real

Estate

Private

Equity

Credit

Hedge Fund

Solutions

Real

Estate

Private

Equity

Totals may not add due to rounding.

$37.2

$38.5

$37.1

$31.2

$40.6

$

41.9

$37.8

$43.6

$43.5

$30.5

$45.9

$45.4

4Q'11

3Q'12

4Q'12

$45.9

$50.2

$51.0

$42.9

$53.5

$56.7

$40.5

$46.2

$46.1

$37.0

$54.6

$56.4

4Q'11

3Q'12

4Q'12

(Dollars in Billions)

(Dollars in Billions) |

Blackstone

10

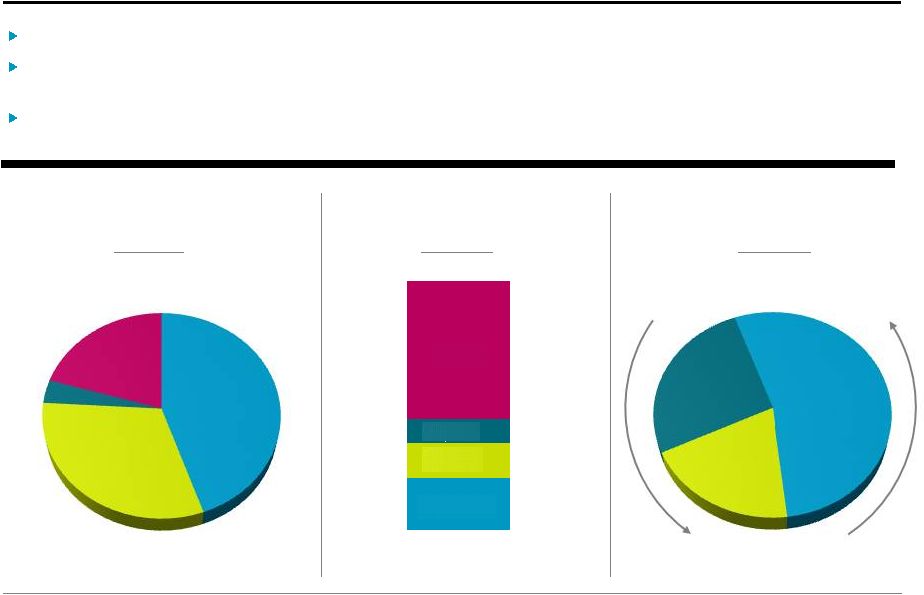

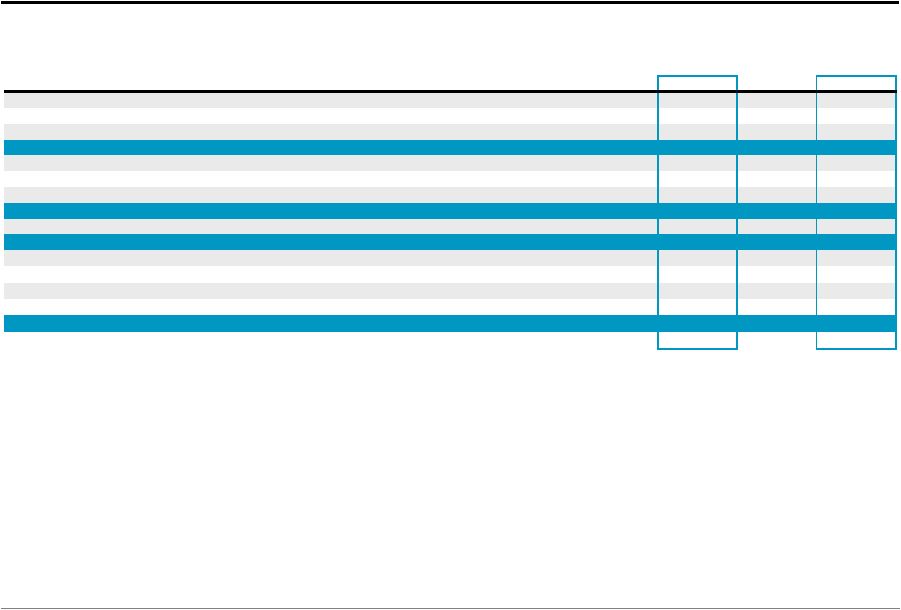

4Q’12 Available Capital Summary

$35 billion Dry Powder

(a)

Credit

Hedge Fund

Solutions

Private

Equity

Real

Estate

Currently Earning

Performance Fees

Invested/Committed Not Yet

Earning Performance Fees

To Be Invested

$12 billion Not Yet Earning

Base Management Fees

(b)

$127 billion Performance

Fee Eligible AUM

(c)

Maintained

substantial

levels

of

committed

undrawn

capital

(“dry

powder”)

with

$35

billion

at

year

end.

$12 billion of Total AUM was not yet earning Base Management Fees at year end due

largely to fund structures with fees that are triggered by the investment

of capital. Performance Fee Eligible AUM was $127 billion at year end,

including over $68 billion ($81 billion at fair value) currently earning

Performance Fees. Credit

Hedge Fund

Solutions

Real

Estate

Private

Equity

$15.7

$11.0

$1.3

$7.2

$68.3

$25.3

$33.7

$1.8

$6.9

$1.2

$2.6

(a)

Represents illiquid drawdown funds only; excludes marketable vehicles; includes both

Fee-Earning (third party) capital and GP/employee commitments which do not earn fees. Amounts reduced by

outstanding commitments to invest, but for which capital has not been called.

(b)

Represents (i) committed uninvested capital of our Private Equity and Real Estate drawdown

funds with closed investment periods, and (ii) committed uninvested capital for our Real Estate debt

strategies drawdown funds, our Credit Mezzanine and Rescue Lending funds and our Hedge Fund

Solutions Strategic Alliance Fund. (c)

Represents invested and to be invested capital, including closed commitments for funds whose

investment period has not yet commenced, on which performance fees could be earned if certain

hurdles are met.

|

Blackstone

11

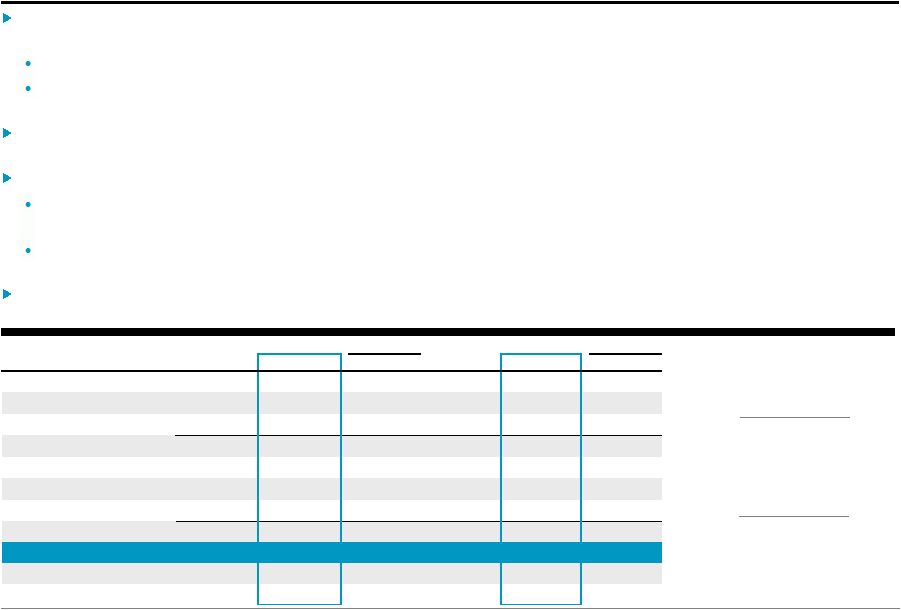

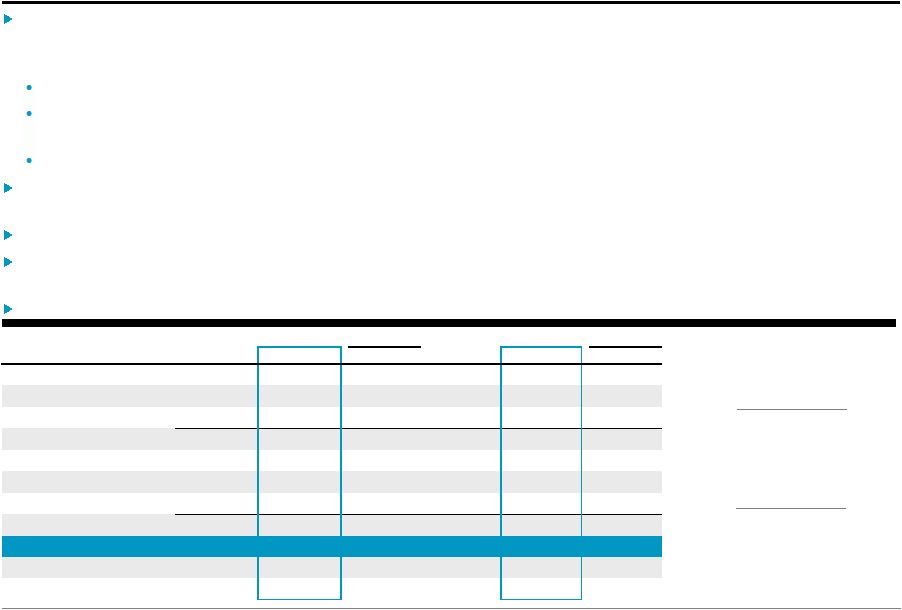

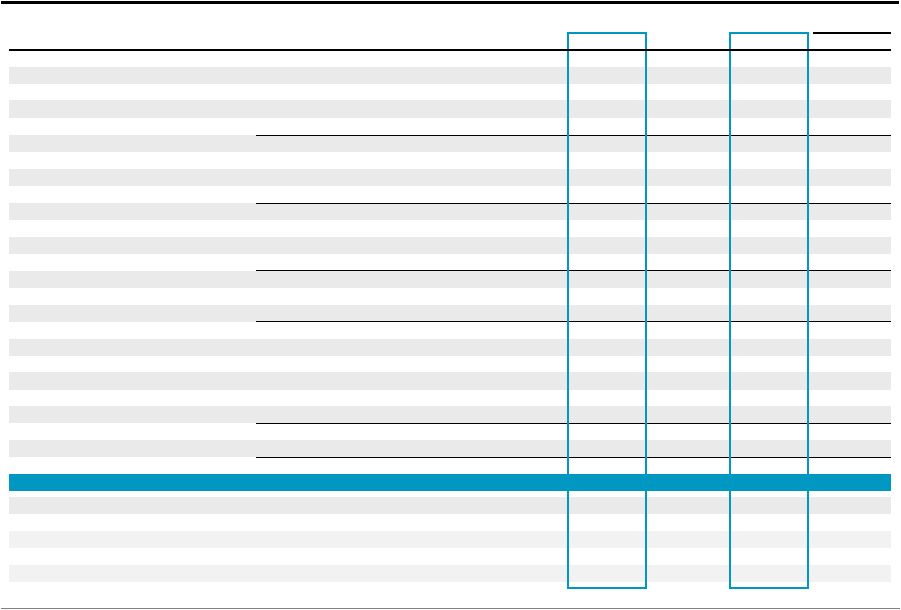

Distribution Calculation

Earned $0.39 of Distributable Earnings per common unit during the fourth quarter,

bringing full year Distributable Earnings to $0.85 per common unit, up 42%

year-over-year. Declared a quarterly distribution of $0.42 per

common unit to record holders as of February 11, 2013; payable on February

19, 2013. •

Quarterly

record

and

payment

dates

reflect

a

timing

acceleration

relative

to

historic

practice,

which

will

be

effective prospectively.

For 2013, Blackstone intends to increase its base quarterly distribution to $0.12

per unit, up 20% from $0.10 per unit. Any excess Net Cash Available for

Distribution to Common Unitholders will also be distributed each quarter

as earned.

(a)

(a)

A detailed description of Blackstone’s distribution policy can be found in Appendix

– Distribution Policy.

(b)

DE before Certain Payables represents Distributable Earnings before the deduction for Payable

under the Tax Receivable Agreement and tax expense (benefit) of wholly-owned subsidiaries.

(c)

Per Unit calculations are based Total Common Units Outstanding (see Appendix – Unit

Rollforward); actual distributions are paid to applicable unitholders as of the record date.

(d)

Retained capital is withheld pro-rata from common and Blackstone Partnership

unitholders. Common unitholders’ share was $26.8 million for 4Q’12 and $68.5 million for the full year.

% Change

% Change

(Dollars in Thousands, Except per Unit Data)

4Q'11

4Q'12

vs. 4Q'11

FY'11

FY'12

vs. FY'11

Distributable Earnings ("DE")

178,186

$

493,765

$

177%

696,724

$

1,033,925

$

48%

Add: Other Payables Attributable to Common Unitholders

5,859

61,237

n/m

30,154

91,633

204%

DE

before

Certain

Payables

(b)

184,045

555,002

202%

726,878

1,125,558

55%

Percent to Common Unitholders

45%

51%

44%

49%

DE before Certain Payables Attributable to Common Unitholders

82,596

281,207

240%

317,656

550,360

73%

Less: Other Payables Attributable to Common Unitholders

(5,859)

(61,237)

n/m

(30,154)

(91,633)

(204)%

DE Attributable to Common Unitholders

76,737

219,970

187%

287,502

458,727

60%

DE

per

Common

Unit

(c)

0.16

$

0.39

$

144%

0.60

$

0.85

$

42%

Less:

Retained

Capital

per

Unit

(d)

(0.02)

$

(0.05)

$

(150)%

(0.08)

$

(0.13)

$

(63)%

Net

Cash

Available

for

Distribution

per

Common

Unit

(c)

0.14

$

0.34

$

143%

0.52

$

0.72

$

38%

Actual

Distribution

per

Common

Unit

(c)

0.22

$

0.42

$

91%

0.52

$

0.72

$

38% |

Blackstone

12

Balance Sheet Highlights

(a)

At December 31, 2012, Blackstone had $2.3 billion in total cash and liquid

investments. In total, Blackstone had $6.7 billion or $5.95 per unit in cash

and investments at quarter end. There are currently no borrowings

outstanding against the $1.1 billion revolving credit facility. (a)

Preliminary, excludes the consolidated Blackstone funds. Totals

may not add due to rounding.

(b)

Primarily Blackstone investments in Hedge Fund Solutions and non-drawdown Credit.

(c)

Illiquids include Blackstone investments in all drawdown funds in Private Equity, Real Estate

and Credit. (d)

Senior notes of $600 million issued August 2009 maturing on August 15, 2019 (6.625% coupon),

$400 million issued September 2010 maturing on March 15, 2021 (5.875% coupon), $400 million issued August 2012 maturing on

February

15,

2023

(4.750%

coupon)

and

$250

million

issued

August

2012

maturing

on

August

15,

2042

(6.250%

coupon),

net

of

$15

million

held

by

Blackstone.

(Dollars in Millions)

4Q’12

Cash and Cash Equivalents

$

710

Treasury Cash Management Strategies

1,407

Liquid Investments

(b)

135

Illiquid Investments

(c)

2,186

Net Performance Fees

2,238

Total Net Value

$

6,676

Outstanding Bonds (at par)

(d)

$

1,635

A/A+

rated by S&P / Fitch

$1.1 billion

undrawn credit revolver

$2.3 billion

total cash and liquid investments

$5.95

Net Performance

Fees

Total Cash

and Liquids

Private Equity

Real Estate

Other

Cash and Investments per Unit

$1.95

Illiquids

$6.7 billion

Total Net Value

$1.99

$0.19

$0.92

$0.84

$2.01 |

Blackstone

13

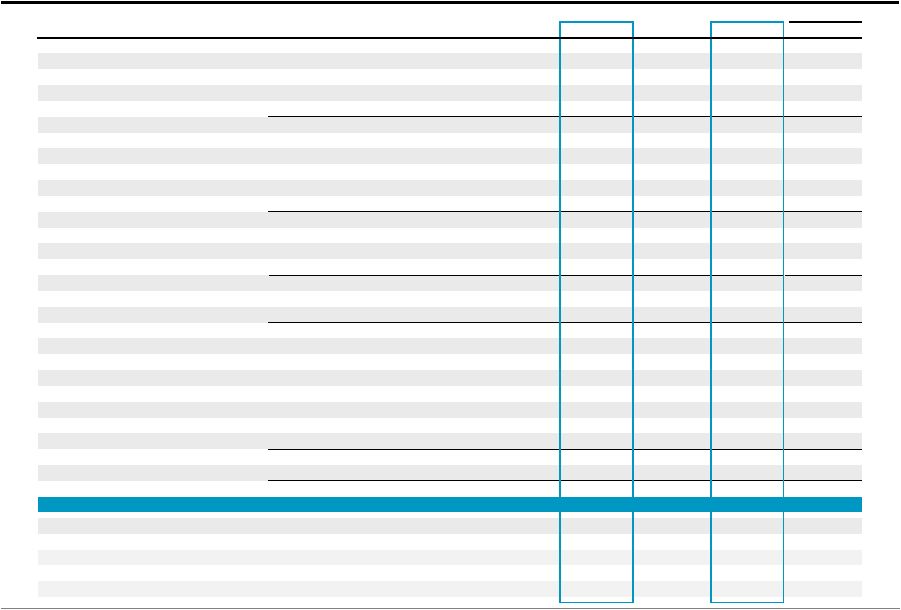

GAAP Statement of Operations

% Change

% Change

(Dollars in Thousands, Except per Unit Data) (Unaudited)

4Q'11

4Q'12

vs. 4Q'11

FY'11

FY'12

vs. FY'11

Revenues

Management and Advisory Fees, Net

475,779

$

601,860

$

26%

1,811,750

$

2,030,693

$

12%

Performance Fees

Realized Carried Interest

12,387

174,168

n/m

138,907

327,422

136%

Realized Incentive Fees

52,048

273,304

n/m

90,099

301,801

235%

Unrealized Carried Interest

311,162

207,639

(33)%

971,518

994,190

2%

Unrealized Incentive Fees

(17,495)

(185,372)

n/m

(17,864)

(30,361)

(70)%

Total Performance Fees

358,102

469,739

31%

1,182,660

1,593,052

35%

Investment Income

Realized

9,860

53,311

n/m

87,542

93,963

7%

Unrealized

55,665

74,325

34%

125,781

256,231

104%

Total Investment Income

65,525

127,636

95%

213,323

350,194

64%

Interest and Dividend Revenue

10,004

13,173

32%

37,427

40,354

8%

Other

5,695

4,705

(17)%

7,416

5,148

(31)%

Total Revenues

915,105

1,217,113

33%

3,252,576

4,019,441

24%

Expenses

Compensation and Benefits

Compensation

568,319

559,781

(2)%

2,421,712

2,091,698

(14)%

Performance Fee Compensation

Realized Carried Interest

13,206

58,573

n/m

43,615

96,433

121%

Realized Incentive Fees

33,524

125,758

275%

55,912

140,042

150%

Unrealized Carried Interest

62,399

71,378

14%

237,945

321,599

35%

Unrealized Incentive Fees

(14,401)

(91,965)

n/m

(20,759)

(44,528)

(114)%

Total Compensation and Benefits

663,047

723,525

9%

2,738,425

2,605,244

(5)%

General, Administrative and Other

185,880

131,063

(29)%

566,313

548,738

(3)%

Interest Expense

16,051

25,505

59%

57,824

72,870

26%

Fund Expenses

6,462

5,586

(14)%

25,507

33,829

33%

Total Expenses

871,440

885,679

2%

3,388,069

3,260,681

(4)%

Other Income (Loss)

Reversal of Tax Receivable Agreement Liability

197,816

-

(100)%

197,816

-

(100)%

Net Gains (Losses) from Fund Investment Activities

464,179

(144,267)

n/m

14,935

256,145

n/m

Income Before Provision for Taxes

705,660

$

187,167

$

(73)%

77,258

$

1,014,905

$

n/m

Provision for Taxes

250,299

65,696

(74)%

345,711

185,023

(46)%

Net Income (Loss)

455,361

$

121,471

$

(73)%

(268,453)

$

829,882

$

n/m

Net Income (Loss) Attributable to Redeemable Non-Controlling Interests in Consolidated

Entities 111

25,151

n/m

(24,869)

103,598

n/m

Net Income (Loss) Attributable to Non-Controlling Interests in Consolidated Entities

456,706

(180,011)

n/m

7,953

99,959

n/m

Net Income (Loss) Attributable to Non-Controlling Interests in Blackstone Holdings

21,221

169,918

n/m

(83,234)

407,727

n/m

Net Income (Loss) Attributable to The Blackstone Group L.P.

(22,677)

$

106,413

$

n/m

(168,303)

$

218,598

$

n/m

Net Income (Loss) per Common Unit, Basic and Diluted

(0.05)

$

0.19

$

n/m

(0.35)

$

0.41

$

n/m |

Appendix |

Blackstone

15

Total Segments

(a)

Transaction and Other Fees, Net, are net of amounts, if any, shared with limited partners

including, for Private Equity, broken deal expenses. (b)

Primarily placement fees.

% Change

(Dollars in Thousands)

4Q'11

1Q'12

2Q'12

3Q'12

4Q'12

FY'11

FY'12

vs. FY'11

Revenues

Management and Advisory Fees, Net

Base Management Fees

336,753

$

395,506

$

381,344

$

398,088

$

416,465

$

1,281,185

$

1,591,403

$

24%

Advisory Fees

123,567

75,846

93,372

59,951

128,248

382,240

357,417

(6)%

Transaction and Other Fees, Net

(a)

43,796

38,471

49,453

45,126

94,069

247,513

227,119

(8)%

Management Fee Offsets

(b)

(8,479)

(13,050)

(7,973)

(8,454)

(11,476)

(33,393)

(40,953)

(23)%

Total Management and Advisory Fees, Net

495,637

496,773

516,196

494,711

627,306

1,877,545

2,134,986

14%

Performance Fees

Realized Carried Interest

12,387

13,560

55,929

83,765

174,168

138,907

327,422

136%

Realized Incentive Fees

51,837

5,279

11,692

11,620

272,873

89,029

301,464

239%

Unrealized Carried Interest

311,162

298,796

84,290

403,465

207,639

971,518

994,190

2%

Unrealized Incentive Fees

(17,436)

68,121

(17,074)

104,149

(184,507)

(24,928)

(29,311)

(18)%

Total Performance Fees

357,950

385,756

134,837

602,999

470,173

1,174,526

1,593,765

36%

Investment Income (Loss)

Realized

16,697

23,492

9,360

25,098

37,448

102,575

95,398

(7)%

Unrealized

39,028

59,914

(25,624)

82,334

74,222

82,689

190,846

131%

Total Investment Income (Loss)

55,725

83,406

(16,264)

107,432

111,670

185,264

286,244

55%

Interest Income and Dividend Revenue

10,003

9,345

10,391

12,004

14,890

38,844

46,630

20%

Other

5,695

(1,207)

(828)

2,477

4,707

7,415

5,149

(31)%

Total Revenues

925,010

974,073

644,332

1,219,623

1,228,746

3,283,594

4,066,774

24%

Expenses

Compensation

225,438

254,772

268,884

259,561

247,559

960,569

1,030,776

7%

Performance Fee Compensation

Realized Carried Interest

13,206

7,938

7,899

22,023

58,573

43,615

96,433

121%

Realized Incentive Fees

33,524

4,252

5,575

4,457

125,758

55,912

140,042

150%

Unrealized Carried Interest

62,399

84,543

36,815

128,863

71,378

237,944

321,599

35%

Unrealized Incentive Fees

(14,401)

12,779

(9,596)

44,254

(91,965)

(20,759)

(44,528)

(114)%

Total Compensation and Benefits

320,166

364,284

309,577

459,158

411,303

1,277,281

1,544,322

21%

Other Operating Expenses

122,072

109,521

113,038

127,456

131,430

421,342

481,445

14%

Total Expenses

442,238

473,805

422,615

586,614

542,733

1,698,623

2,025,767

19%

Economic Income

482,772

$

500,268

$

221,717

$

633,009

$

686,013

$

1,584,971

$

2,041,007

$

29%

Economic Net Income

468,154

$

491,217

$

212,349

$

621,752

$

669,981

$

1,539,208

$

1,995,299

$

30%

Fee Related Earnings

166,096

$

146,928

$

145,729

$

135,052

$

272,604

$

546,493

$

700,313

$

28%

Distributable Earnings

178,186

$

162,121

$

188,404

$

189,635

$

493,765

$

696,724

$

1,033,925

$

48%

Total Assets Under Management

166,228,504

$

190,074,167

$

190,267,831

$

204,551,572

$

210,219,960

$

166,228,504

$

210,219,960

$

26%

Fee-Earning Assets Under Management

136,756,753

$

156,261,446

$

157,646,521

$

168,630,082

$

167,880,440

$

136,756,753

$

167,880,440

$

23%

Weighted Average Fee-Earning AUM

136,876,758

$

154,354,070

$

156,426,744

$

162,377,631

$

168,328,454

$

129,473,025

$

160,130,295

$

24%

LP Capital Invested

3,406,264

$

2,719,433

$

2,403,623

$

3,085,441

$

5,690,474

$

13,529,766

$

13,898,971

$

3%

Total Capital Invested

3,992,488

$

3,134,385

$

2,525,648

$

3,754,061

$

6,200,755

$

14,664,407

$

15,614,849

$

6% |

Blackstone

16

Private Equity

(a)

Transaction and Other Fees, Net, are net of amounts, if any, shared with limited partners

including, for Private Equity, broken deal expenses. (b)

Primarily placement fees.

% Change

(Dollars in Thousands)

4Q'11

1Q'12

2Q'12

3Q'12

4Q'12

FY'11

FY'12

vs. FY'11

Revenues

Management Fees, Net

Base Management Fees

84,231

$

85,789

$

87,475

$

86,136

$

89,194

$

331,997

$

348,594

$

5%

Transaction

and

Other

Fees,

Net

(a)

23,879

18,097

14,951

25,693

41,339

133,004

100,080

(25)%

Management

Fee

Offsets

(b)

(5,057)

(3,782)

(672)

(767)

(705)

(27,073)

(5,926)

78%

Total Management Fees, Net

103,053

100,104

101,754

111,062

129,828

437,928

442,748

1%

Performance Fees

Realized Carried Interest

(28,392)

3,933

28,781

31,592

45,491

37,393

109,797

194%

Unrealized Carried Interest

83,777

34,051

(87,893)

128,746

73,477

33,490

148,381

n/m

Total Performance Fees

55,385

37,984

(59,112)

160,338

118,968

70,883

258,178

264%

Investment Income (Loss)

Realized

3,512

13,911

(6,195)

7,189

10,918

44,988

25,823

(43)%

Unrealized

25,091

16,469

(28,337)

43,267

53,938

9,476

85,337

n/m

Total Investment Income (Loss)

28,603

30,380

(34,532)

50,456

64,856

54,464

111,160

104%

Interest Income and Dividend Revenue

3,651

2,420

3,114

3,413

4,609

13,749

13,556

(1)%

Other

193

(215)

562

1,650

420

1,810

2,417

34%

Total Revenues

190,885

170,673

11,786

326,919

318,681

578,834

828,059

43%

Expenses

Compensation

45,611

52,547

53,775

62,424

53,963

217,556

222,709

2%

Performance Fee Compensation

Realized Carried Interest

(3,859)

320

804

1,048

1,507

1,465

3,679

151%

Unrealized Carried Interest

7,953

(1,052)

(8,259)

43,228

24,638

(2,229)

58,555

n/m

Total Compensation and Benefits

49,705

51,815

46,320

106,700

80,108

216,792

284,943

31%

Other Operating Expenses

34,493

28,881

30,521

30,944

40,499

120,918

130,845

8%

Total Expenses

84,198

80,696

76,841

137,644

120,607

337,710

415,788

23%

Economic Income (Loss)

106,687

$

89,977

$

(65,055)

$

189,275

$

198,074

$

241,124

$

412,271

$

71%

Total Assets Under Management

45,863,673

$

47,624,013

$

46,633,552

$

50,222,312

$

51,002,973

$

45,863,673

$

51,002,973

$

11%

Fee-Earning Assets Under Management

37,237,791

$

37,323,635

$

37,159,452

$

38,505,497

$

37,050,167

$

37,237,791

$

37,050,167

$

(1)%

Weighted Average Fee-Earning AUM

37,147,118

$

37,491,735

$

37,434,520

$

38,096,139

$

38,507,697

$

36,119,173

$

38,126,640

$

6%

LP Capital Invested

1,093,745

$

643,044

$

102,899

$

1,015,605

$

1,461,987

$

3,848,954

$

3,223,535

$

(16)%

Total Capital Invested

1,563,912

$

680,035

$

108,977

$

1,427,871

$

1,860,738

$

4,465,030

$

4,077,621

$

(9)% |

Blackstone

17

Real Estate

(a)

Transaction and Other Fees, Net, are net of amounts, if any, shared with limited

partners. (b)

Primarily placement fees.

% Change

(Dollars in Thousands)

4Q'11

1Q'12

2Q'12

3Q'12

4Q'12

FY'11

FY'12

vs. FY'11

Revenues

Management Fees, Net

Base Management Fees

103,947

$

147,802

$

127,817

$

135,659

$

140,044

$

394,778

$

551,322

$

40%

Transaction and Other Fees, Net

(a)

19,128

14,412

25,151

14,937

31,181

109,510

85,681

(22)%

Management Fee Offsets

(b)

(2,820)

(8,627)

(5,357)

(6,034)

(8,591)

(4,950)

(28,609)

n/m

Total Management Fees, Net

120,255

153,587

147,611

144,562

162,634

499,338

608,394

22%

Performance Fees

Realized Carried Interest

3,538

8,617

13,539

51,845

91,113

22,844

165,114

n/m

Realized Incentive Fees

202

(1)

7,766

4,879

13,012

9,629

25,656

166%

Unrealized Carried Interest

237,884

221,500

144,510

207,695

110,059

913,418

683,764

(25)%

Unrealized Incentive Fees

1,806

7,914

(1,526)

6,150

(12,657)

3,658

(119)

n/m

Total Performance Fees

243,430

238,030

164,289

270,569

201,527

949,549

874,415

(8)%

Investment Income

Realized

6,346

7,812

9,067

10,324

18,099

27,972

45,302

62%

Unrealized

19,970

25,912

14,944

33,676

16,343

92,648

90,875

(2)%

Total Investment Income

26,316

33,724

24,011

44,000

34,442

120,620

136,177

13%

Interest Income and Dividend Revenue

3,430

2,552

3,277

3,581

5,038

12,902

14,448

12%

Other

(1,046)

(709)

(590)

1,941

252

(1,061)

894

n/m

Total Revenues

392,385

427,184

338,598

464,653

403,893

1,581,348

1,634,328

3%

Expenses

Compensation

53,507

68,889

76,576

71,456

54,201

236,771

271,122

15%

Performance Fee Compensation

Realized Carried Interest

1,713

4,077

3,401

19,822

35,118

10,103

62,418

n/m

Realized Incentive Fees

91

2

3,871

2,570

6,617

4,564

13,060

186%

Unrealized Carried Interest

57,866

54,275

31,677

47,940

31,590

221,140

165,482

(25)%

Unrealized Incentive Fees

(632)

3,768

(629)

2,876

(6,598)

3,106

(583)

n/m

Total Compensation and Benefits

112,545

131,011

114,896

144,664

120,928

475,684

511,499

8%

Other Operating Expenses

29,027

28,924

26,560

31,284

36,946

103,859

123,714

19%

Total Expenses

141,572

159,935

141,456

175,948

157,874

579,543

635,213

10%

Economic Income

250,813

$

267,249

$

197,142

$

288,705

$

246,019

$

1,001,805

$

999,115

$

(0)%

Total Assets Under Management

42,852,669

$

48,322,760

$

50,225,950

$

53,546,023

$

56,695,645

$

42,852,669

$

56,695,645

$

32%

Fee-Earning Assets Under Management

31,236,540

$

36,647,462

$

38,476,123

$

40,609,286

$

41,931,339

$

31,236,540

$

41,931,339

$

34%

Weighted Average Fee-Earning AUM

31,474,333

$

35,983,336

$

36,882,087

$

38,947,049

$

40,164,238

$

28,377,319

$

37,730,563

$

33%

LP Capital Invested

995,643

$

1,143,555

$

1,855,108

$

1,342,811

$

3,876,701

$

6,141,416

$

8,218,175

$

34%

Total Capital Invested

1,064,690

$

1,172,883

$

1,954,731

$

1,397,249

$

3,990,620

$

6,500,464

$

8,515,483

$

31% |

Blackstone

18

Hedge Fund Solutions

(a)

Transaction and Other Fees, Net, are net of amounts, if any, shared with limited

partners. (b)

Primarily placement fees.

% Change

(Dollars in Thousands)

4Q'11

1Q'12

2Q'12

3Q'12

4Q'12

FY'11

FY'12

vs. FY'11

Revenues

Management Fees, Net

Base Management Fees

81,606

$

81,821

$

84,278

$

87,334

$

92,777

$

315,863

$

346,210

$

10%

Transaction

and

Other

Fees,

Net

(a)

470

92

65

4

27

2,798

188

(93)%

Management

Fee

Offsets

(b)

(402)

(335)

(375)

(382)

(322)

(980)

(1,414)

(44)%

Total Management Fees, Net

81,674

81,578

83,968

86,956

92,482

317,681

344,984

9%

Performance Fees

Realized Incentive Fees

4,148

3,298

1,175

2,637

76,323

11,472

83,433

n/m

Unrealized Incentive Fees

(2,059)

23,187

(10,981)

36,635

(39,799)

774

9,042

n/m

Total Performance Fees

2,089

26,485

(9,806)

39,272

36,524

12,246

92,475

n/m

Investment Income (Loss)

Realized

2,503

503

929

637

5,201

17,722

7,270

(59)%

Unrealized

(3,253)

8,371

(3,636)

5,199

(1,417)

(19,031)

8,517

n/m

Total Investment Income (Loss)

(750)

8,874

(2,707)

5,836

3,784

(1,309)

15,787

n/m

Interest Income and Dividend Revenue

537

386

495

540

718

2,025

2,139

6%

Other

7,818

(127)

27

315

3,601

7,902

3,816

(52)%

Total Revenues

91,368

117,196

71,977

132,919

137,109

338,545

459,201

36%

Expenses

Compensation

38,525

28,233

34,559

28,826

28,113

128,959

119,731

(7)%

Performance Fee Compensation

Realized Incentive Fees

688

1,378

(345)

1,062

20,985

3,498

23,080

n/m

Unrealized Incentive Fees

(865)

7,294

(2,820)

8,062

(11,219)

234

1,317

n/m

Total Compensation and Benefits

38,348

36,905

31,394

37,950

37,879

132,691

144,128

9%

Other Operating Expenses

21,568

13,934

14,506

12,878

16,491

65,072

57,809

(11)%

Total Expenses

59,916

50,839

45,900

50,828

54,370

197,763

201,937

2%

Economic Income

31,452

$

66,357

$

26,077

$

82,091

$

82,739

$

140,782

$

257,264

$

83%

Total Assets Under Management

40,534,768

$

43,351,275

$

42,888,946

$

46,218,618

$

46,092,505

$

40,534,768

$

46,092,505

$

14%

Fee-Earning Assets Under Management

37,819,636

$

40,543,772

$

40,161,179

$

43,601,541

$

43,478,791

$

37,819,636

$

43,478,791

$

15%

Weighted Average Fee-Earning AUM

38,452,740

$

39,904,474

$

40,528,701

$

42,005,752

$

43,709,019

$

37,372,569

$

41,698,402

$

12%

LP Capital Invested

288,237

$

4,661

$

-

$

196,180

$

-

$

889,259

$

200,841

$

(77)%

Total Capital Invested

304,500

$

5,502

$

-

$

207,250

$

-

$

943,327

$

212,752

$

(77)% |

Blackstone

19

Credit

(a)

Transaction and Other Fees, Net, are net of amounts, if any, shared with limited

partners. (b)

Primarily placement fees.

% Change

(Dollars in Thousands)

4Q'11

1Q'12

2Q'12

3Q'12

4Q'12

FY'11

FY'12

vs. FY'11

Revenues

Management Fees, Net

Base Management Fees

66,969

$

80,094

$

81,774

$

88,959

$

94,450

$

238,547

$

345,277

$

45%

Transaction and Other Fees, Net

(a)

312

5,725

9,184

4,486

21,480

1,880

40,875

n/m

Management Fee Offsets

(b)

(200)

(306)

(1,569)

(1,271)

(1,858)

(390)

(5,004)

n/m

Total Management Fees, Net

67,081

85,513

89,389

92,174

114,072

240,037

381,148

59%

Performance Fees

Realized Carried Interest

37,241

1,010

13,609

328

37,564

78,670

52,511

(33)%

Realized Incentive Fees

47,487

1,982

2,751

4,104

183,538

67,928

192,375

183%

Unrealized Carried Interest

(10,499)

43,245

27,673

67,024

24,103

24,610

162,045

n/m

Unrealized Incentive Fees

(17,183)

37,020

(4,567)

61,364

(132,051)

(29,360)

(38,234)

(30)%

Total Performance Fees

57,046

83,257

39,466

132,820

113,154

141,848

368,697

160%

Investment Income (Loss)

Realized

4,021

683

5,638

6,697

2,593

11,299

15,611

38%

Unrealized

(2,877)

9,211

(9,156)

(736)

5,450

(708)

4,769

n/m

Total Investment Income (Loss)

1,144

9,894

(3,518)

5,961

8,043

10,591

20,380

92%

Interest Income and Dividend Revenue

610

2,425

1,752

2,673

2,480

3,369

9,330

177%

Other

(772)

(238)

(787)

(678)

529

(853)

(1,174)

(38)%

Total Revenues

125,109

180,851

126,302

232,950

238,278

394,992

778,381

97%

Expenses

Compensation

25,435

37,143

42,845

50,236

51,853

128,588

182,077

42%

Performance Fee Compensation

Realized Carried Interest

15,352

3,541

3,694

1,153

21,948

32,047

30,336

(5)%

Realized Incentive Fees

32,745

2,872

2,049

825

98,156

47,850

103,902

117%

Unrealized Carried Interest

(3,420)

31,320

13,397

37,695

15,150

19,033

97,562

n/m

Unrealized Incentive Fees

(12,904)

1,717

(6,147)

33,316

(74,148)

(24,099)

(45,262)

(88)%

Total Compensation and Benefits

57,208

76,593

55,838

123,225

112,959

203,419

368,615

81%

Other Operating Expenses

13,162

17,096

15,749

33,527

18,116

49,955

84,488

69%

Total Expenses

70,370

93,689

71,587

156,752

131,075

253,374

453,103

79%

Economic Income

54,739

$

87,162

$

54,715

$

76,198

$

107,203

$

141,618

$

325,278

$

130%

Total Assets Under Management

36,977,394

$

50,776,119

$

50,519,383

$

54,564,619

$

56,428,837

$

36,977,394

$

56,428,837

$

53%

Fee-Earning Assets Under Management

30,462,786

$

41,746,577

$

41,849,767

$

45,913,758

$

45,420,143

$

30,462,786

$

45,420,143

$

49%

Weighted Average Fee-Earning AUM

29,802,567

$

40,974,525

$

41,581,436

$

43,328,691

$

45,947,499

$

27,603,964

$

42,574,690

$

54%

LP Capital Invested

1,028,639

$

928,173

$

445,616

$

530,845

$

351,786

$

2,650,137

$

2,256,420

$

(15)%

Total Capital Invested

1,059,386

$

1,275,965

$

461,940

$

721,691

$

349,397

$

2,755,586

$

2,808,993

$

2% |

Blackstone

20

Financial Advisory

% Change

(Dollars in Thousands)

4Q'11

1Q'12

2Q'12

3Q'12

4Q'12

FY'11

FY'12

vs. FY'11

Revenues

Advisory Fees

123,567

75,846

93,372

59,951

128,248

382,240

357,417

(6)%

Transaction and Other Fees, Net

7

145

102

6

42

321

295

(8)%

Total Advisory and Transaction Fees

123,574

75,991

93,474

59,957

128,290

382,561

357,712

(6)%

Investment Income

Realized

315

583

(79)

251

637

594

1,392

134%

Unrealized

97

(49)

561

928

(92)

304

1,348

n/m

Total Investment Income

412

534

482

1,179

545

898

2,740

205%

Interest Income and Dividend Revenue

1,775

1,562

1,753

1,797

2,045

6,799

7,157

5%

Other

(498)

82

(40)

(751)

(95)

(383)

(804)

(110)%

Total Revenues

125,263

78,169

95,669

62,182

130,785

389,875

366,805

(6)%

Expenses

Compensation

62,360

67,960

61,129

46,619

59,429

248,695

235,137

(5)%

Total Compensation and Benefits

62,360

67,960

61,129

46,619

59,429

248,695

235,137

(5)%

Other Operating Expenses

23,822

20,686

25,702

18,823

19,378

81,538

84,589

4%

Total Expenses

86,182

88,646

86,831

65,442

78,807

330,233

319,726

(3)%

Economic Income (Loss)

39,081

$

(10,477)

$

8,838

$

(3,260)

$

51,978

$

59,642

$

47,079

$

(21)% |

Blackstone

21

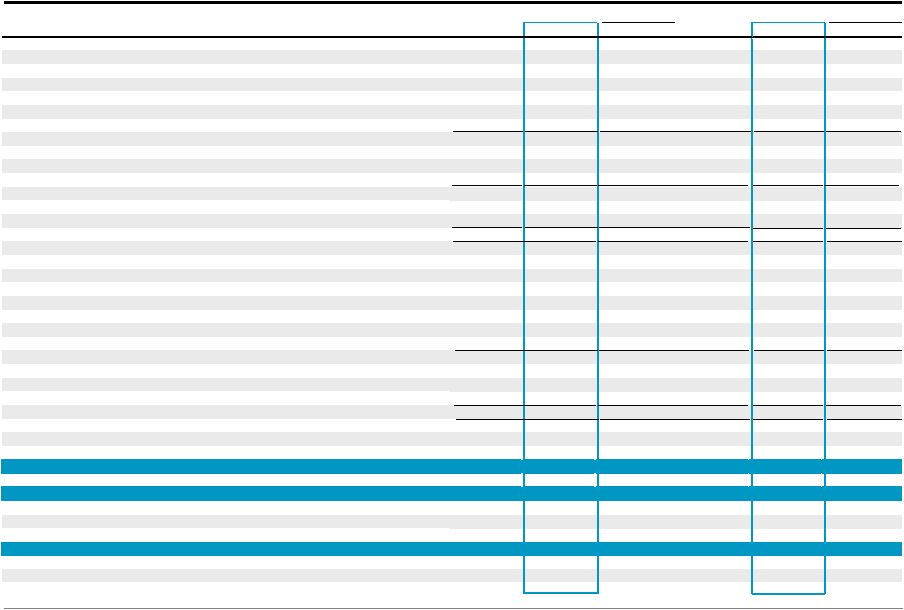

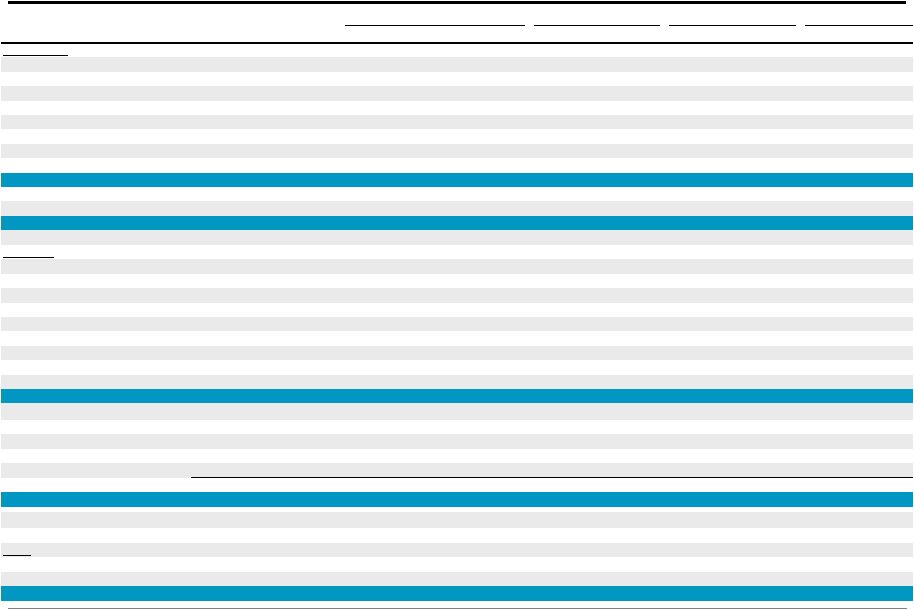

Fee-Earning AUM Net Flows

Fee-Earning AUM was up $31 billion or 23% from a year ago driven mainly by

continued strong net inflows and to a lesser extent market

appreciation. The fourth quarter saw an increase in exit activity with

realizations exceeding half of the full year’s amount. Private Equity

includes our tactical opportunities investment vehicles, which had $1.0 billion of uninvested capital at

year end that will be included in Fee-Earning AUM once invested.

Real Estate Fee-Earning AUM grew 34% during the past year driven by capital

committed to our latest global fund, invested capital in our Debt

Strategies funds and the Capital Trust transaction with $2.2 billion of Fee-Earning AUM.

Hedge Fund Solutions continued its solid growth with $2.4 billion of net inflows

during the year; net outflows during the quarter reflect the cyclical

timing of redemptions which typically exceed half of the full year amount.

Credit Fee-Earning AUM, which does not yet reflect capital raised for our

most recent rescue lending fund, grew 49% during the year due to capital

invested in our carry funds, new product launches and the Harbourmaster acquisition.

4Q’12 Fee-Earning AUM Rollforward

(Dollars in Millions)

FY’12 Fee-Earning AUM Rollforward

(Dollars in Millions)

Totals may not add due to rounding.

(a)

Inflows: include contributions, capital raised, other increases in available capital, purchases

and acquisitions. (b)

Outflows: represent redemptions, client withdrawals and other decreases in available

capital. (c)

Realizations: represent realizations from the disposition of assets.

(d)

Market Activity: gains (losses) on portfolio investments and impact of foreign exchange rate

fluctuations. Private

Real

Hedge Fund

Private

Real

Hedge Fund

Equity

Estate

Solutions

Credit

Total

Equity

Estate

Solutions

Credit

Total

3Q'12

38,505

$

40,609

$

43,602

$

45,914

$

168,630

$

4Q'11

37,238

$

31,237

$

37,820

$

30,463

$

136,757

$

Inflows

(a)

433

3,798

866

2,205

7,302

Inflows

(a)

2,629

14,584

5,460

20,055

42,728

Outflows

(b)

-

(1,372)

(1,668)

(828)

(3,868)

Outflows

(b)

-

(1,486)

(3,015)

(1,700)

(6,201)

Realizations

(c)

(1,906)

(1,093)

-

(2,529)

(5,528)

Realizations

(c)

(2,845)

(2,530)

-

(4,811)

(10,186)

Net Inflows (Outflows)

(1,473)

1,333

(802)

(1,152)

(2,094)

Net Inflows (Outflows)

(216)

10,568

2,445

13,544

26,341

Market Activity

(d)

18

(10)

679

658

1,345

Market Activity

(d)

29

127

3,214

1,414

4,784

4Q'12

37,050

$

41,931

$

43,479

$

45,420

$

167,880

$

4Q'12

37,050

$

41,931

$

43,479

$

45,420

$

167,880

$

QoQ Inc (Dec)

(4)%

3%

(0)%

(1)%

(0)%

YoY Inc (Dec)

(1)%

34%

15%

49%

23% |

Blackstone

22

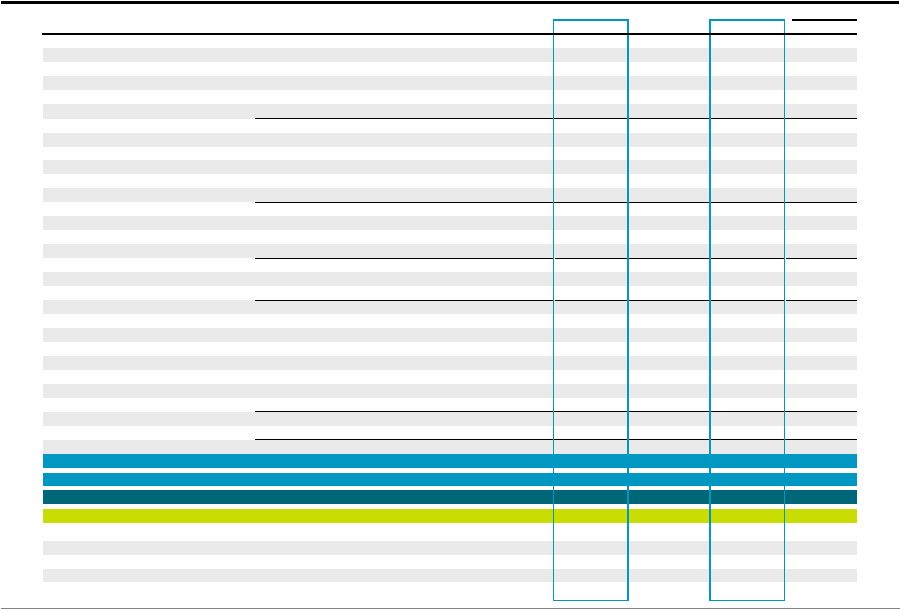

Total AUM Net Flows

Total AUM was up $44 billion or 26% for the year driven by strong net inflows and

market appreciation across all of Blackstone’s investment

segments. Realization activity continued to improve and we returned $9.3

billion to our investors during the quarter and $18.5 billion during the

year. Private Equity AUM was up 11% over the prior year driven by

fundraising and market appreciation, resulting from positive performance

of our public holdings as well as mark-ups across our private holdings.

Real Estate AUM grew 32% during the year driven by capital committed to our

latest global buyout fund, solid market appreciation and the Capital Trust

transaction adding $2.3 billion of Total AUM. Hedge Fund Solutions had

market appreciation of $3.4 billion during the year driven by solid returns.

Credit AUM grew 53% during the year through significant organic net inflows

including the first close of our most recent

rescue

lending

fund,

the

acquisition

of

Harbourmaster

and

solid

market

performance.

4Q’12 Total AUM Rollforward

(Dollars in Millions)

FY’12 Total AUM Rollforward

(Dollars in Millions)

Totals may not add due to rounding.

(a)

Inflows: include contributions, capital raised, other increases in available capital, purchases

and acquisitions. (b)

Outflows: represent redemptions, client withdrawals and other decreases in available

capital. (c)

Realizations: represent realizations from the disposition of assets.

(d)

Market Activity: gains (losses) on portfolio investments and impact of foreign exchange rate

fluctuations. Private

Real

Hedge Fund

Private

Real

Hedge Fund

Equity

Estate

Solutions

Credit

Total

Equity

Estate

Solutions

Credit

Total

3Q'12

50,222

$

53,546

$

46,219

$

54,565

$

204,552

$

4Q'11

45,864

$

42,853

$

40,535

$

36,977

$

166,229

$

Inflows

(a)

642

3,562

875

4,570

9,649

Inflows

(a)

4,234

12,566

5,339

24,489

46,628

Outflows

(b)

(31)

(40)

(1,725)

(972)

(2,768)

Outflows

(b)

(76)

(262)

(3,168)

(2,429)

(5,935)

Realizations

(c)

(1,949)

(1,789)

-

(2,775)

(6,513)

Realizations

(c)

(3,453)

(3,927)

-

(5,179)

(12,559)

Net Inflows (Outflows)

(1,338)

1,733

(850)

823

368

Net Inflows

705

8,377

2,171

16,881

28,134

Market Activity

(d)

2,119

1,417

723

1,042

5,301

Market Activity

(d)

4,435

5,466

3,387

2,571

15,859

4Q'12

51,003

$

56,696

$

46,093

$

56,429

$

210,220

$

4Q'12

51,003

$

56,696

$

46,093

$

56,429

$

210,220

$

QoQ Inc (Dec)

2%

6%

(0)%

3%

3%

YoY Increase

11%

32%

14%

53%

26% |

Blackstone

23

Net

Accrued

Performance

Fees

and

Carried

Interest

Status

(a)

(a)

Preliminary. Totals may not add due to rounding.

(b)

Net Accrued Performance Fees are presented net of performance fee compensation and do not

include clawback amounts, if any, which are disclosed in the 10-K/Q. As of 4Q’12, $167 million of Net Accrued Performance Fees, primarily

attributable to Hedge Fund Solutions and Credit, were realized and included in 2012

Distributable Earnings. When these fees are received, the receivable will be reduced without further impacting Distributable Earnings.

(c)

Per Unit calculations are based on quarter-end Distributable Earnings Units Outstanding

(see Appendix – Unit Rollforward).

(d)

Represents the required increase in equity at the fund level (excluding side-by-side

investments) for funds with expired investment periods which are currently not generating performance fees.

Blackstone had $2.2 billion of accrued performance fees, net of performance fee

compensation, as of year end. BCP V and BREP Int’l II were below their

respective carried interest thresholds as of year end. $2.2 billion

4Q’12 Net Accrued Performance Fees

$1.99 per unit

4Q’12 Net Accrued Performance Fees

52% increase

in Net Accrued Performance Fees since 4Q’11

Carried Interest Status (excl. SBS)

(d)

Net Accrued Performance Fees

(b)

Remaining Capital

Gain to Cross Carry Threshold

(Dollars in Millions, Except per Unit Data)

3Q'12

4Q'12

Per Unit

(c)

Change vs. 3Q'12

(Dollars / Euros In Millions)

@ FMV

@ Cost

Amount

% Change in TEV

Private Equity

Private Equity

BCP IV Carried Interest

551

$

582

$

0.52

$

31

$

BCP V

17,930

$

16,036

$

5,649

$

12%

BCP VI Carried Interest

8

22

0.02

14

BEP Carried Interest

30

38

0.03

8

Real Estate

Tactical Opportunities Carried Interest

2

2

0.00

-

BREP Int'l II

1,026

€

1,130

€

991

€

23%

Total Private Equity

591

644

0.57

53

Real Estate

BREP V Carried Interest

434

448

0.40

14

BREP VI Carried Interest

590

610

0.54

20

BREP VII Carried Interest

44

82

0.07

38

BREP Int'l I Carried Interest

3

2

0.00

(1)

BREP Europe III Carried Interest

66

74

0.07

8

BREDS Carried Interest

19

19

0.02

-

BREDS Incentive Fees

5

7

0.01

2

Asia Platform Incentive Fees

28

23

0.02

(5)

Total Real Estate

1,189

1,265

1.13

76

Hedge Fund Solutions

Incentive Fees

42

67

0.06

25

Total Hedge Fund Solutions

42

67

0.06

25

Credit

Carried Interest

142

144

0.13

2

Incentive Fees

85

118

0.11

33

Total Credit

227

262

0.23

35

Total Blackstone

Carried Interest

1,889

2,023

1.80

134

Incentive Fees

160

215

0.19

55

Net Accrued Performance Fees

2,049

$

2,238

$

1.99

$

189

$

|

Blackstone

24

Investment

Records

as

of

December

31,

2012

(a)

Notes on next page.

Total Credit

9,373,143

$

3,695,183

$

7,539,740

$

1.3x

-

2,840,414

$

1.4x

10,380,154

$

1.3x

-

-

Committed

Available

Unrealized Investments

Realized Investments

Total Investments

Net IRRs

(d)

(Dollars in Thousands, Except Where Noted)

Capital

Capital

(b)

Value

MOIC

(c)

% Public

Value

MOIC

(c)

Value

MOIC

(c)

Realized

Total

Private Equity

BCP I (Oct 1987 / Oct 1993)

859,081

$

-

$

-

$

n/a

-

1,741,738

$

2.6x

1,741,738

$

2.6x

19%

19%

BCP II (Oct 1993 / Aug 1997)

1,361,100

-

-

n/a

-

3,256,819

2.5x

3,256,819

2.5x

32%

32%

BCP III (Aug 1997 / Nov 2002)

3,973,378

167,776

-

n/a

100%

9,181,266

2.3x

9,181,266

2.3x

14%

14%

BCOM (Jun 2000 / Jun 2006)

2,137,330

202,433

347,362

0.9x

52%

2,463,892

1.4x

2,811,254

1.3x

9%

6%

BCP IV (Nov 2002 / Dec 2005)

6,773,138

250,890

5,946,433

2.1x

60%

14,246,559

3.0x

20,192,992

2.7x

57%

37%

BCP V (Dec 2005 / Jan 2011)

21,020,395

1,370,953

19,354,620

1.2x

20%

3,910,358

1.1x

23,264,978

1.2x

1%

2%

BCP VI (Jan 2011 / Jan 2016)

15,220,745

11,418,584

3,502,548

1.2x

28%

35,962

1.3x

3,538,510

1.2x

21%

11%

BEP (Aug 2011 / Aug 2017)