Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - DUESENBERG TECHNOLOGIES INC. | Financial_Report.xls |

| EX-32 - EXHIBIT 32 - DUESENBERG TECHNOLOGIES INC. | ex32.htm |

| EX-31.2 - EXHIBIT 31.2 - DUESENBERG TECHNOLOGIES INC. | ex31-2.htm |

| EX-16.1 - EXHIBIT 16.1 - DUESENBERG TECHNOLOGIES INC. | ex16-1.htm |

| EX-31.1 - EXHIBIT 31.1 - DUESENBERG TECHNOLOGIES INC. | ex31-1.htm |

| EX-99.1 - EXHIBIT 99.1 - DUESENBERG TECHNOLOGIES INC. | ex99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended October 31, 2012

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File Number 000-54800

VENZA GOLD CORP.

(Exact name of registrant as specified in its charter)

|

British Columbia, Canada

|

99-0364150

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

810-789 West Pender St., Vancouver, BC, V6C1H2

(Address of principal executive offices)

Registrant’s telephone number, including area code: (604) 306-2525

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on

which each is registered

|

|

N/A

|

N/A

|

Securities registered pursuant to Section 12(g) of the Act: Common Stock, without par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ] .

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the issuer is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $370,749.60 as of April 30, 2012, based on the registered offering of securities on Form S-1/A effective September 11, 2012 at a price of $0.075 per share.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. The number of shares of the registrant’s common stock, without par value, outstanding as of January 19, 2013 was 6,916,661.

TABLE OF CONTENTS

|

1

|

|

|

3

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

6

|

|

|

16

|

|

|

17

|

|

|

18

|

|

|

18

|

|

|

18

|

|

|

18

|

|

|

18

|

|

|

18

|

|

|

19

|

|

|

25

|

|

|

25

|

|

|

25

|

|

|

25

|

|

|

25

|

|

|

26

|

|

|

26

|

|

|

30

|

|

|

31

|

|

|

31

|

|

|

32

|

|

|

32

|

|

|

33

|

|

|

33

|

|

|

35

|

|

|

36

|

|

|

37

|

|

|

37

|

|

|

37

|

|

|

38

|

|

|

39

|

The following is a glossary of selected mining terms used in the United States and Canada and referenced in this Annual Report on Form 10-K that may be technical in nature:

Table 1. Glossary

|

Acanthite

|

A mineral that is a source of silver.

|

|

Actinolite

|

A mineral containing magnesium and iron and is commonly formed in metamorphic rocks.

|

|

Albite

|

A plagioclase feldspar mineral.

|

|

Amygdules

|

A small gas bubble in igneous, especially volcanic, rock filled with secondary minerals such as zeolite, calcite, or quartz.

|

|

Andesite

|

An extrusive igneous rock named after the andes mountains where it is very abundant.

|

|

Argentite

|

A metallic lead grey mineral found in veins with silver and sulfide minerals and is an important ore of silver.

|

|

Arsenopyrite

|

An arsenic iron sulphide mineral.

|

|

Augite

|

A common rock-forming mineral in igneous and metamorphic rocks.

|

|

Auriferous

|

Means containing gold or gold-bearing.

|

|

Azurite

|

A mineral found in oxidized parts of copper deposits.

|

|

Banded

|

The property of rocks having thin and nearly parallel bands of different textures, colors, or minerals. Banded coal has alternating bands of different types.

|

|

Biotite

|

A common rock-forming silicate mineral.

|

|

Boudin

|

One of a series of elongate, sausage-shaped segments occurring in boudinage structure, either separate or joined by pinched connections, and having barrel-shaped cross sections.

|

|

Carboniferous

|

The Mississippian and Pennsylvanian periods combined, ranging from about 345 million years to about 280 million years ago; also, the corresponding systems of rocks.

|

|

Cerargyrite

|

A supergene mineral occurring in silver veins; an important source of silver.

|

|

Chalcopyrite

|

A copper iron sulphide mineral.

|

|

Chevron

|

Any V-shaped pattern or device.

|

|

Chloritize

|

The replacement by, conversion into, or introduction of chlorite.

|

|

Cirque

|

A bowl-shaped depression with very steep sides that forms at the head of a mountain glacier.

|

|

Cretaceous

|

A geological period from 145 to 65 million years ago.

|

|

Concordant

|

An intrusive igneous body where the contacts of which are parallel to the bedding or foliation of the country rock.

|

|

Cuprite

|

An oxide mineral composed of copper oxide, and is a minor ore of copper.

|

|

Dacite

|

A common volcanic or intrusive rock type, highly feldspathic but with little free quartz, usually fine grained.

|

|

Delta

|

The flat alluvial area at the mouth of some rivers where the mainstream splits up into several distributaries.

|

|

Diorite

|

A grey to dark grey intermediate intrusive igneous rock composed principally of plagioclase feldspar.

|

|

Discordant

|

A contact between an igneous intrusion and the country rock that is not parallel to the foliation or bedding planes of the latter.

|

|

Epidote

|

An abundant rock forming mineral, but one of secondary origin.

|

|

Flow

|

A tabular-shaped body of lava that consolidated from magma on the surface of the Earth.

|

|

Fluvial

|

Means relating to or occurring in a river.

|

1

|

Fold

|

A planar feature, such as a bedding plane, that has been strongly warped, presumably by deformation.

|

|

Foliated

|

A planar arrangement of textural or structural features in any type of rock.

|

|

Fracture Zone

|

The outer, rigid part of a glacier, in which the ice is much fractured.

|

|

Galena

|

A mineral that is an important source of lead and silver.

|

|

Garnet

|

A group of minerals used as gemstones and abrasives.

|

|

Glacial Drift

|

Boulders, till, gravel, sand, or clay transported and deposited by a glacier or its meltwater.

|

|

Granite

|

A common, coarse-grained, light-colored, hard igneous rock consisting chiefly of quartz, orthoclase or microcline, and mica.

|

|

Granodiorite

|

A medium- to coarse-grained rock that is among the most abundant intrusive igneous rocks.

|

|

Greenstone

|

Igneous rocks that have developed enough chlorite in alteration to give them a green cast.

|

|

Heterogeneous

|

Unlike in character, quality, structure, or composition; consisting of dissimilar elements or ingredients of different kinds; not homogeneous.

|

|

Hornblende

|

An informal name for dark green to black amphiboles.

|

|

Hydrothermal

|

A mineral deposit formed by circulating fluids, usually implies elevated temperatures but is without any particular restrictions of temperature or pressure.

|

|

Intercalated

|

Layered material.

|

|

Intrusive rocks

|

A rock formation that intrudes into a host rock.

|

|

Isoclinal

|

Sloping in the same direction and at the same angle.

|

|

Jurassic

|

The geological period between 190 million years and 135 million years ago.

|

|

Lamina (Laminae)

|

The thinnest recognizable layer in a sedimentary rock.

|

|

Lithologic

|

The gross physical character of a rock or rock formation.

|

|

Limestone

|

A sedimentary rock composed largely of mineral calcite.

|

|

Lode

|

A mineral deposit in solid rock.

|

|

Mafic

|

Silicate minerals, magmas, and volcanic and intrusive igeneous rocks that have relatively high concentrations of the heavier elements.

|

|

Megacryst

|

A crystal or grain that is considerably larger than the encircling matrix. They are found in igneous and metamorphic rock.

|

|

Malachite

|

A carbonate mineral known as copper carbonate.

|

|

Mesozoic

|

The Mesozoic Era is a period from about 250 million years ago to about 67 million years ago.

|

|

Metasediments

|

In geology, metasediment is sediment or sedimentary rock that shows evidence of having been subjected to metamorphism.

|

|

Metavolcanic

|

A partly metamorphosed volcanic rock.

|

|

Molybendum

|

A hard, silvery-white metallic element used to toughen alloy steels and soften tungsten alloy.

|

|

Nepheline

|

A whitish mineral consisting of sodium potassium aluminum silicate used in the manufacture of glass and ceramics.

|

|

Placer Mining

|

The extraction and concentration of heavy metals or minerals from placer deposits by various methods, generally using running water.

|

|

Pelitic

|

A metamorphic rock derived from a pelite.

|

|

Pluton

|

A body of medium- to coarse-grained igneous rock that formed beneath the surface by crystallization of a magma.

|

|

Porphyritic granite

|

Granite rock with two grain sizes, containing large crystals (phenocrysts) of orthoclase feldspar (reddish) and smaller granite-size grains of quartz.

|

|

Porphyry

|

A heterogeneous rock characterized by the presence of crustals in a relatively finer- grained matrix.

|

|

Pyrargyrite

|

A trigonal mineral, soft; deep red; in late-primary or secondary-enrichment veins, and an important source of silver.

|

2

|

Pyrite

|

Iron sulphide mineral.

|

|

Pyrrhotite

|

An unusual iron sulphide mineral with variable iron content.

|

|

Quartz

|

A mineral whose composition is silicon dioxide. A crystalline form of silica.

|

|

Quartz Vein

|

A rock composed chiefly of sutured quartz crystals of pegmatitic or hydrothermal origin and commonly of variable size.

|

|

Quartzite

|

A very hard but unmetamorphosed sandstone, consisting chiefly of quartz grains that are so completely cemented with secondary silica that the rock breaks across or through the grains rather than around them; an orthoquartzite.

|

|

Recumbant

|

(of a fold in a rock formation) in which the axial plane is nearly horizontal.

|

|

Regression

|

the retreat of the sea from the land.

|

|

Riparian

|

An area bordering streams, lakes and wetlands that link water to land.

|

|

Schist

|

a strongly foliated crystalline rock that can be readily split into thin flakes or slabs.

|

|

Sericite

|

a term for a fine-grained white, pale green to oily greenish mica, mainly muscovite.

|

|

Shear Zone

|

A tabular zone of rock that has been crushed and brecciated by many parallel fractures due to shear strain. Such an area is often mineralized by ore-forming solutions.

|

|

Sill

|

A bed of lava or tuff between older layer of rocks.

|

|

Skarn

|

A metamorphic rock formed in the thermal aureole of an intrusive body.

|

|

Sphalerite

|

A zinc sulphide mineral.

|

|

Stringer

|

A mineral veinlet or filament, usually one of a number, occurring in a discontinuous subparallel pattern in host rock.

|

|

Syenite

|

A group of plutonic rocks containing alkali feldspar, a small amount of plagioclase, one or more mafic minerals, and quartz, if present, only as an accessory.

|

|

Synkinematic

|

Refers to a geologic process or event occurring during tectonic activity.

|

|

Tactite

|

A rock formed by contact metamorphism and metasomatism of carbonate rocks.

|

|

Terrace

|

A flat area bounded by a short steep slope formed by the down-cutting of a river or by erosion.

|

|

Tetrahedrite

|

A copper iron sulphide mineral.

|

|

Transgression

|

The spread or extension of the sea over land areas, and the consequent evidence of such advance.

|

|

Veinlet

|

Any small vein or venule.

|

This Annual Report on Form 10-K contains “forward-looking statements”. These forward-looking statements are based on our current expectations, assumptions, estimates and projections about our business and our industry. Words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “may,” and other similar expressions identify forward-looking statements. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the sections of this annual report titled “Risk Factors”, “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, as well as the following:

|

·

|

general economic conditions, because they may affect our ability to raise money

|

|

·

|

our ability to raise enough money to continue our operations

|

|

·

|

changes in regulatory requirements that adversely affect our business

|

|

·

|

changes in the prices for minerals that adversely affect our business

|

|

·

|

other uncertainties, all of which are difficult to predict and many of which are beyond our control

|

3

You are cautioned not to place undue reliance on these forward-looking statements, which relate only to events as of the date on which the statements are made. Except as required by applicable securities laws, we undertake no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date of this annual report. You should refer to and carefully review the information in future documents we file with the Securities and Exchange Commission.

We were incorporated on August 4, 2010 under the laws of the State of Nevada under the name “SOS Link Corporation”. On April 15, 2011, we changed our place of incorporation from the State of Nevada to the Province of British Columbia, Canada and concurrently changed our name to “Venza Gold Corp.”. The change from Nevada to British Columbia was approved by our shareholders on April 14, 2011.

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We currently hold a 100% interest in the OS Gold Claim and the Quad Gold Claim. The OS Gold Claim, being our lead mineral project, is comprised of one mineral claim totaling 1,292.5 acres located approximately 7 kilometres west of Osoyoos, British Columbia, Canada. The Quad Gold Claim is comprised of one mineral claim totaling 408.9 acres and is located approximately 16 kilometres north of Campbell River, British Columbia, Canada. We plan to focus our resources on the OS Gold Claim in order to assess whether it possesses mineral deposits capable of commercial extraction. See sections titled “Mineral Properties – OS Gold Claim” and “Mineral Properties – Quad Gold Claim” for additional information.

We previously signed a letter of intent dated November 16, 2010 (the “Letter of Intent”) with EvidencePix Inc. (“EvidencePix”), a company that develops security software applications, and Raymond Sobol. Under the terms of the Letter of Intent, we agreed to acquire all of the shares of EvidencePix subject to the conditions of the Letter of Intent. In conjunction with the proposed acquisition, we advanced loans totaling $195,000 to EvidencePix to provide them with sufficient working capital to commercialize their security software applications. The loans beared interest at a rate of 5% per annum and were due one year from the date of the loan. We were unable to reach a formal agreement with EvidencePix and elected to not proceed with the proposed acquisition. On March 28, 2012, we entered into a British Columbia Supreme Court consent order with EvidencePix whereby EvidencePix agreed to pay us the outstanding loans plus interest and costs as follows: (i) $50,000 on March 31, 2012; (ii) $35,000 on April 30, 2012; (iii) $35,000 on May 31, 2012; (iv) $35,000 on June 30, 2012; and (v) $55,037.84 on July 31, 2012. As of July 31, 2012, we collected the entire amount of the outstanding loans, being $210,037.84.

To date, we have not earned any revenues from our main operations and do not anticipate earning revenues until such time as we enter into commercial production of our properties. We are presently in the exploration stage of our business and we can provide no assurance that commercially viable minerals exist on our properties or that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs.

Overview

In April 2012, the Jumpstart Our Business Startups Act ("JOBS Act") was enacted into law. The JOBS Act provides, among other things:

|

|

·

|

Exemptions for “emerging growth companies” from certain financial disclosure and governance requirements

|

|

|

·

|

Amendments to certain provisions of the federal securities laws to simplify the sale of securities and increase the threshold number of record holders required to trigger the reporting requirements of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended;

|

4

|

|

·

|

Relaxation of the general solicitation and general advertising prohibition for Rule 506 offerings;

|

|

|

·

|

Adoption of a new exemption for public offerings of securities in amounts not exceeding $50 million; and

|

|

|

·

|

Exemption from registration by a non-reporting company of offers and sales of securities of up to $1,000,000 that comply with rules to be adopted by the SEC pursuant to Section 4(6) of the Securities Act and exemption of such sales from state law registration, documentation or offering requirements.

|

Application to Our Company

In general, under the JOBS Act a company is an “emerging growth company” if its initial public offering ("IPO") of common equity securities was effected after December 8, 2011 and such company had less than $1 billion of total annual gross revenues during its last completed fiscal year. A company will no longer qualify as an “emerging growth company” after the earliest of:

|

|

(a)

|

the completion of the fiscal year in which the company has total annual gross revenues of $1 billion or more;

|

|

|

(b)

|

the completion of the fiscal year of the fifth anniversary of the company's IPO;

|

|

|

(c)

|

the company's issuance of more than $1 billion in nonconvertible debt in the prior three-year period; or

|

|

|

(d)

|

the company becoming a "larger accelerated filer" as defined under the Exchange Act, as amended.

|

Exemptions Available

The JOBS Act provides additional new guidelines and exemptions for non-reporting companies and for non-public offerings. Those exemptions that impact the Company are discussed below.

Financial Disclosure. The financial disclosure in a registration statement filed by an “emerging growth company” pursuant to the Securities Act, will differ from registration statements filed by other companies as follows:

|

|

(a)

|

audited financial statements required for only two fiscal years;

|

|

|

(b)

|

selected financial data required for only the fiscal years that were audited;

|

|

|

(c)

|

executive compensation only needs to be presented in the limited format now required for “smaller reporting companies”.

|

As we are a “smaller reporting company”, we are already provided with the above exemptions under Regulation S-K.

The JOBS Act also exempts our independent registered public accounting firm from having to comply with any rules adopted by the Public Company Accounting Oversight Board ("PCAOB") after the date of the JOBS Act's enactment, except as otherwise required by SEC rule.

The JOBS Act further exempts an “emerging growth company” from any requirement adopted by the PCAOB for mandatory rotation of our accounting firm or for a supplemental auditor report about the audit.

Internal Control Attestation. The JOBS Act also provides an exemption from the requirement of the Company's independent registered public accounting firm to file a report on the Company's internal control over financial reporting, although management of the Company is still required to file its report on the adequacy of the Company's internal control over financial reporting.

5

Section 102(a) of the JOBS Act exempts “emerging growth companies” from the requirements in Sections 14A(a) and (b) of the Exchange Act for companies with a class of securities registered under the Exchange Act, to hold shareholder votes for executive compensation and golden parachutes.

Other Items of the JOBS Act. The JOBS Act also provides that an “emerging growth company” can communicate with potential investors that are qualified institutional buyers or institutions that are accredited to determine interest in a contemplated offering either prior to or after the date of filing the respective registration statement. The JOBS Act also permits research reports by a broker or dealer about an “emerging growth company” regardless of whether such report provides sufficient information for an investment decision. In addition the JOBS Act precludes the SEC and FINRA from adopting certain restrictive rules or regulations regarding brokers, dealers and potential investors, communications with management and distribution of a research reports on the “emerging growth company’s” IPOs.

Section 106 of the JOBS Act permits “emerging growth companies” to submit registration statements under the Securities Act, as amended, on a confidential basis provided that the registration statement and all amendments thereto are publicly filed at least 21 days before the issuer conducts any road show. This is intended to allow “emerging growth companies” to explore the IPO option without disclosing to the market the fact that it is seeking to go public or disclosing the information contained in its registration statement until the company is ready to conduct a roadshow.

Election to Opt Out of Transition Period. Section 102(b)(1) of the JOBS Act exempts “emerging growth companies” from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act, as amended, registration statement declared effective or do not have a class of securities registered under the Exchange Act, as amended) are required to comply with the new or revised financial accounting standard.

The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. The Company has elected not to opt out of the transition period.

We own a 100% interest in our lead mineral project called the OS Gold Claim. We also hold a 100% interest in another mineral property called the Quad Gold Claim.

In April 2012, Grant Crooker, P. Geo, our consulting geologist, visited the OS Gold Claim to examine whether the OS Gold Claim’s access road was still open following a harsh winter in early 2012. Mr. Crooker also visited the area of the historical showing and drill sites. He then made an oral report to Gerald Diakow, a member of our Board of Directors, on the reclamation of these sites. Mr. Crooker wrote a short report on the geology of the area including a review of historical mining exploration on other properties in the area. After receiving, this report, Mr. Diakow, recommended and contracted the geochemical soil sample survey for Phase 1 of our exploration program.

The Quad Gold Claim has not been physically examined by a professional geologist or mining engineer. Notwithstanding the fact that there was not a site visit for the Quad Gold Claim, Mr. Diakow visited the Quad Gold Claim in May 2006.

6

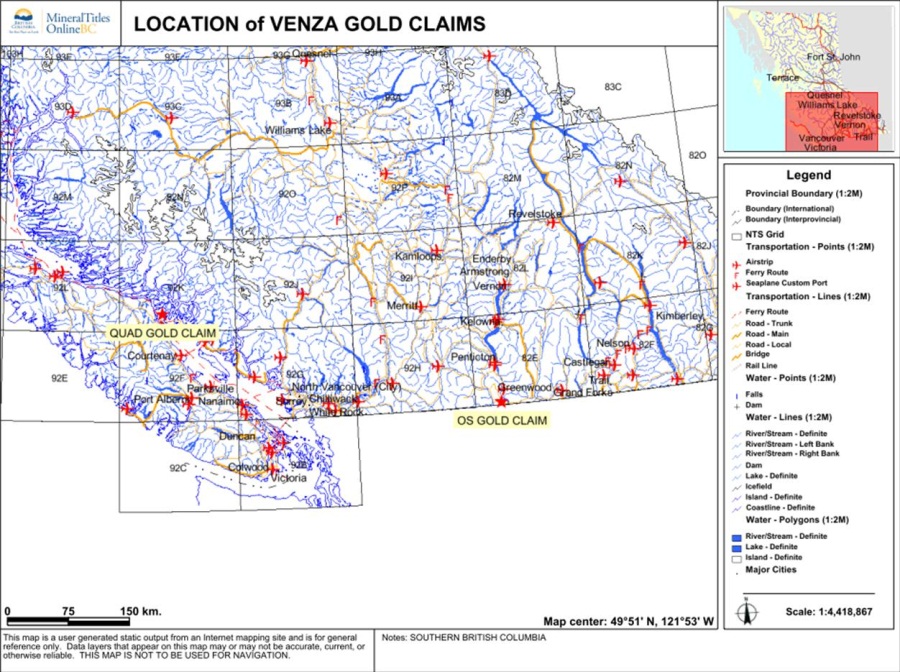

To date, we have focused our resources on the OS Gold Claim. Our properties are illustrated in Figure 1 below.

Figure 1. Location and access to properties.

The OS Gold Claim

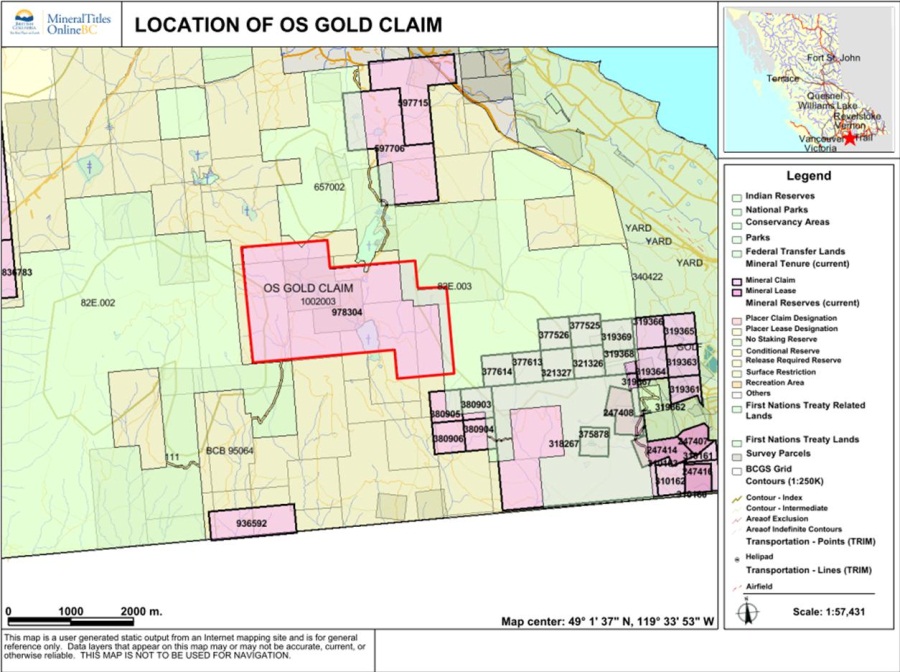

Description of Property

The OS Gold Claim is comprised of one mineral claim totaling 1,292.5 acres, located approximately 7 kilometers west of the town of Osoyoos, British Columbia, Canada. The OS Gold Claim is recorded with the Ministry of Mines as follows:

|

Name of Mineral Claim

|

Tenure Number

|

Expiry Date

|

||

|

OS Gold

|

978304

|

April 5, 2013

|

Gerald Diakow is the registered owner of the OS Gold Claim and holds the OS Gold Claim in trust for our sole benefit. The Province of British Columbia owns the land covered by the mineral claims. To our knowledge, there are no aboriginal land claims that might affect our title to our mineral claims or the Province’s title of the property.

In order to maintain the OS Gold Claim in good standing, we must complete minimum exploration work on the properties and file confirmation of the completion of the work with the Ministry of Mines. In lieu of completing this work, we may pay a fee equal to the minimum exploration work that must be performed with the Ministry of Mines. The completion of mineral exploration work or payment in lieu of exploration work in any year will extend the existence of the OS Gold Claim for one additional year. The minimum exploration work that must be performed and/or the fee for keeping the OS Gold Claim current is equal to CDN $5.00 per hectare. As the OS Gold Claim is in good standing until April 5, 2013, we will be required to complete minimum exploration work or pay a minimum fee of CDN $2,615.35 on or before April 5, 2013 and each year thereafter in order to keep the OS Gold Claim current. If we fail to complete the minimum required amount of exploration work or fail to make a payment in lieu of this exploration work, our mineral claim will lapse and we will lose all interest in our mineral claim.

7

The OS Gold Claim is not subject to any royalties.

Location and Access

The OS Gold Claim is located in the Osoyoos Mining Division at approximately 7.2 km (4.5 miles) west of Osoyoos, British Columbia, Canada.

Figure 2. OS Gold Claim.

The OS Gold Claim is accessible by 4 wheel drive vehicle or an all terrain vehicle from Richter Pass on Highway 3. From Highway 3, vehicles travel along the old Richter pass road and then travel along Cougar Creek road to Blue Lake. Once at Blue Lake, vehicles travel 1 kilometre to Kilpoola Lake, which is located on the edge of the OS Gold Claim.

Water for the OS Gold Claim would be sourced from Kipoola Lake (approximately 350 X 220 yards in size) which is enclosed in the claim area. Infrastructure on the claim property includes logging/ranch roads which transect the claim area in a north-south direction. Electrical power could be sourced from the Okanagan Valley transmission line which is 3.2 km (2 miles) northeast of the OS Gold Claim.

8

Climate and Physiography

The climate of the western Okanagan has little precipitation, being less than 10 inches per year. Snowfall may occur in the winter at higher elevations and generally melts by mid-April in the claim area. During the summer months, the climate is warm and dry and thunderstorms may occur. Due to the light snowfall in the OS Gold Claim area, exploration may be undertaken all year.

Vegetation in the OS Gold Claim area consists of grassy slopes and meadows with pine forest on the higher elevation hills especially on the north facing slopes. Lodge pole pine trees are in the forested areas and Ponderosa pine trees are found in the more open areas. Water courses are choked with wild rose bushes and trembling aspen are found along the riparian area.

The topography of the Thompson Okanagan region is extremely varied. The OS Gold Claim area is bounded by the Cascade Mountains to the west and the Okanagan Mountain Range to the east. The 160 km (100 miles) chain of lakes in the Okanagan Valley are the main feature of the landscape. The three largest lakes in the Okanagan Valley north to south are Okanagan Lake, Skaha Lake and Osoyoos Lake, which straddles the USA-Canada border. The OS Gold Claim is situated approximately 7.4 km west of Osoyoos Lake. Low rolling hills make up most of the OS Gold Claim and running through the center is a shallow valley and Kilpoola Lake. Lone Pine Creek flows south into Kilpoola Lake. The elevation on the OS Gold Claim is from 800 to 1000 meters (2600 to 3300 feet).

History

A large number of prospects and three small mines occur within a 20 kilometre radius of the OS Gold Claim in both Canada and the United States. The earliest recorded mining activity in the area is from placer mining for gold on the Similkameen River on the United States side of the border, 5.5 kilometres south of the OS Gold Claim, in 1859. Quartz veins and lodes were recognized in the area at that time but no exploration was carried out on them. Most of the mineralization in the area is related to quartz veins with gold and silver values.

The first significant mine development in the area was at the Fairview gold-silver camp located 19 kilometres north of the OS Gold Claim in the early 1890s. At the Morning Star and Stemwinder mines quartz vein systems containing galena, chalcopyrite, sphalerite and pyrite carry significant gold and silver values. The quartz veins occur within Kobau Group metasedimentary rocks near the contact with the Fairview granodiorite to the south and Oliver granite to the north. Production from the Fairview camp is estimated to be 535,500 tons of ore producing 17,040 ounces of gold and 169,497 ounces of silver between 1898 and 1949 (BC Preliminary Map 64, Gold in British Columbia).

The Dividend-Lakeview property is located approximately 5 kilometres south-east of the OS Gold Claim and was first explored around 1900. The Dividend-Lakeview property is considered a skarn deposit with high temperature replacement of limestone within the Kobau Group. The skarn mineralization consists of massive pyrrhotite, pyrite, chalcopyrite and arsenopyrite which preferentially replace marble. The Dividend-Lakeview produced 104,200 tons of ore yielding 16,216 ounces of gold and 2,805 ounces of silver between 1907 and 1949 (BC Preliminary Map 64, Gold in British Columbia).

The Horn Silver mine is located approximately 11 kilometres east of the OS Gold Claim and was first explored around 1900. The Horn Silver mine lies in biotite-hornblende granodiorite of the Kruger syenite. The mineralization which occurs is discontinuous, narrow east and south-east striking quartz veins within weakly developed easterly striking shear zones and consists of argentite, native silver, cerargyrite, pyrite, galena, sphalerite, tetrahedrite, chalcopyrite, pyrargyrite and acanthite. Production from the Horn Silver mine is recorded as 483,614 tons of ore yielding 10,686 ounces of gold and 4,089,471 ounces of silver between 1915 and 1984 (BC Preliminary Map 64, Gold in British Columbia).

A large porphyry copper-molybdenum type deposit called the Kelsey occurs approximately 9 kilometres south-east of the OS Gold Claim in the state of Washington. The bulk of the mineralization at the Kelsey property occurs within the coarse crystalline quartz diorite of the Jurassic-Cretaceous Silver Nail pluton. At the south end of the property the pluton has been brecciated and Kobau Group metasedimentary and metavolcanic rocks have been incorporated as fragments in the breccia and as slivers in the pluton. The most concentrated copper-molybdenum mineralization is associated with quartz-sericte alteration and intense fracturing and the surrounding country rock is chloritized. Mineralization in greenstone and limey portions of the Kobau group consists of copper-bearing tactite containing pyrrhotite, minor garnet and epidote. Quartz veins contain chalcopyrite rich pods.

9

The sole recorded exploration work on the OS Gold Claim occurred in 1973 by Cone Properties Ltd. (“Cone Properties”). Cone Properties conducted an extensive exploration program on a mineralized occurrence called the “Pass Showing”, which is located within the OS Gold Claim. Historical records indicate that the exploration program consisted of geological mapping, magnetometer geophysical survey, a 3,100 sample geochemical soil survey, and 10 percussion drill holes totaling 821 metres (British Columbia Minfile Databse Number 082ESW111). Results of this work program are not available in the public record.

The above detailed information concerning historical prospects and production within the vicinity of the OS Gold Claim is not necessarily indicative of the mineralization on the OS Gold Claim.

Geology

The OS Gold Claim is located within the Okanagan Terrane of the Intermontane tectonic belt and is mainly underlain by metasediments and metavolcanics of the Carboniferous or older Kobau Group. The Pass showing is reported to occur within the Kobau Group on the OS Gold Claim.

The Kobau Group rocks comprise of banded, foliated quartzite lithologies with minor mafic schists, and thick, compositionally layered mafic schist units with intercalated quartzite bands. Minor meta-carbonates and mafic meta-volcanic flows or sills occur within the quartzites and schists.

The quartzites range from layered, foliated quartzite with thin, biotite rich laminae to boudins of massive, pure quartzite and range in colour from opaque black to translucent grey to green to blue. The beds generally vary from one to thirty metres in thickness, but range down to several centimetres or less in thickness, interbedded with other rocks.

The schists are generally fine grained, strongly foliated, generally chloritic and range in colour from light to dark green to grey-green and rarely black. The individual units are themselves heterogeneous sequences marked by irregular finer scale alterations of thin beds of slightly different character.

The meta-carbonate unit is similar in character to the schist unit in so much as it is green, fine grained, chloritic and strongly foliated. Its distinction is it is host to concordant and discordant carbonate veinlets as well as containing indigenous carbonate material. The unit also hosts white to light blue marble boudins generally less than 10 metres in thickness. The meta-volcanic units consist of greyish-green lenses of augite-porphyritic mafic flows or sills, sometimes weakly foliated.

Immediately to the north and east of the OS Gold Claim, the Kobau Group metamorphic rocks have been intruded by the Middle Jurassic Osoyoos granodiorite and associated rock types of the Nelson Plutonic Suite. A second pluton of similar age, the Fairview granodiorite intrudes the Kobau Group approximately nineteen kilometres north of the OS Gold Claim. Immediately north of the Fairview granodiorite is the Oliver granite of Jurassic or younger age. The Fairview granodiorite and Oliver granite are very significant as they spatially are related to the auriferous quartz veins at the Fairview gold-silver camp. The western portion of the OS Gold Claim is underlain by Jurassic aged, megacrystic coarse grained syenite of the Kruger syenite.

The regional metamorphism of the Kobau group in the study area is syn-kinematic with the respect to the main phases of pre-Jurassic deformation. Peak metamorphic conditions of greenschist grade are documented by actinolite-biotite-epidote-albite assemblages in mafic schists and calcite-tremolite assemblages in some carbonate rocks. Garnet occurrences are limited to semi-pelitic layers. Contact metamorphism adjacent to the Jurassic plutons overprinted schistocities with secondary, non-oriented growth of greenschist minerals.

The Kobau Group have undergone three distinct phases of deformation. The earliest phase produced near isoclinals folding and shearing accompanied by metamorphism to greenschist facies. The second phase resulted in overturned and normal folds. The third phase of deformation caused doming and gentle folding, along with fracturing and is considered to possibly be contemporaneous with the Mesozoic intrusions. As each period of folding has been successively overprinted on the previous event, the result is a sequence of complex tight, isoclinals, over turned recumbent, chevron and refolded folds.

10

Quartz veins are ubiquitous in the metasedimentary rocks and display varying degrees of deformation according to their time of emplacement. Auriferous quartz veins occur within the Kobau group adjacent to and parallel to the Fairview granodiorite contact. Near the Stemwinder mine, these veins form two sets at distances of approximately 50 metres and 100 metres from the intrusive contact. Near the Fairview mine, veins occur at structurally higher levels near the contact between quartzite and mafic schist, as well as close to or within the Fairview granodiorite. All veins are locally concordant to the regional foliation but cut lithologic contacts on the map scale. In general, they form planar bodies striking north-westerly and dipping to the south-east. Individual veins pinch and swell greatly, attain thicknesses up to 5 metres, and may be traced up to 500 metres along strike.

Mineralization

In the Southern Portion of the OS Gold Claim the pluton has been brecciated and Kobau Group metasedimentary and metavolcanic rocks have been incorporated as fragments in the breccia and as slivers in the pluton. The most concentrated copper-molybdenum mineralization is associated with quartz-sericte alteration and intense fracturing and the surrounding country rock is chloritized. Mineralization in greenstone and limey portions of the Kobau group consists of copper-bearing tactite containing pyrrhotite, minor garnet and epidote. Quartz veins contain chalcopyrite rich pods.

Mineralization at the Pass showing is described as consisting of quartz lenses and veins containing copper, lead, gold and silver mineralization. The proximity to the Kelsey deposit and that Porphyry Copper systems commonly occur in clusters and align along convergent plate boundaries suggests that the the Pass showings may be an apophysis where leakage of a much larger porphyry system is occurring.

Current Exploration Program

We have made a determination to implement the three-phase exploration program set forth below to test the potential of the OS Gold Claim. As of the date of this Annual Report, we have completed Phase 1 of our exploration program. However, we have not commenced Phase 2 of our exploration program due to the fact that we have focused our financial resources on the filing of our Registration Statement on Form S-1, including, but not limited to, corresponding with our legal counsel and the Securities and Exchange Commission.

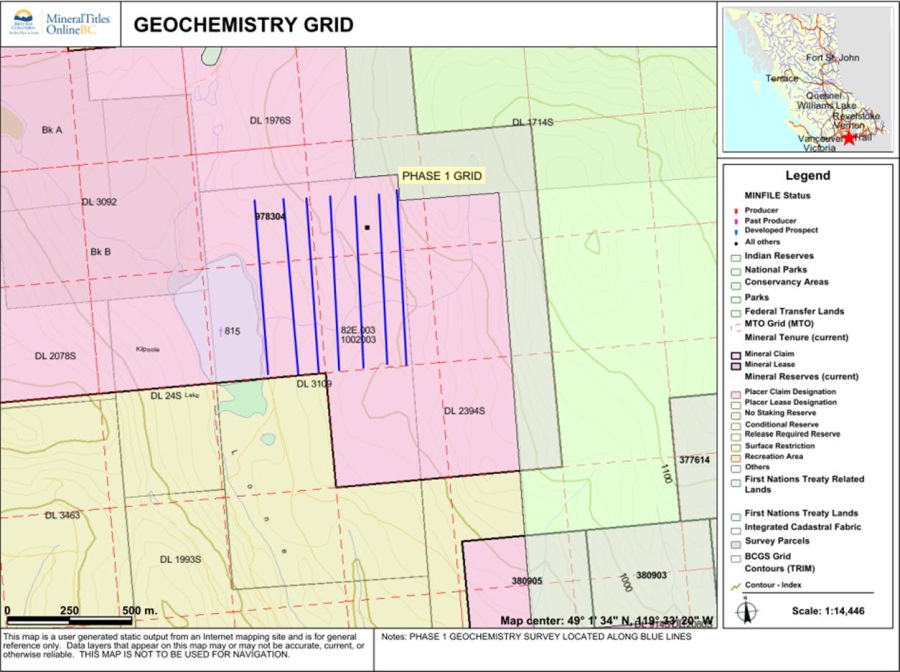

Phase 1 – Filed Work Sampling

Phase 1 of our exploration program involved sending a suitably equipped experienced prospecting team for about one week performing a reconnaissance survey of the entire claim. In April 2012, we sent up a geological team to prospect the claim area and to complete a geochemical soil survey covering a grid area of 4.9 kilometers (3 miles). In total, 56 soil samples were collected and sent to Acme Analytical Laboratories (Vancouver) Ltd. The samples were analyzed using a standard ICP (Inductive Couple Plasma) Mass Spectrometer aqua regia Digestion which yields a 36 element analysis. The geochemical soil grid is illustrated in Figure 3 below.

11

Figure 3. Geochemical soil grid.

The geochemistry survey was successful in delineating both copper and gold anomalies on the OS Gold Claim. The copper soil samples show a large geochemical anomaly covering the eastern third of the grid area. This zone starts at the most north eastern sample collected on the grid and extends south for a length of 800 meters (2600 feet) and a width over 300 meters (1000 feet). The copper anomaly is open along the eastern boundary of the grid area.

The gold anomalies resulting from the geochemical soil survey shows two distinct zones the largest is located on the northern 1/3 of the grid area. This anomaly is approximately 500 meters (1600 feet) in a east-west direction and 200 meters (650 feet) north to south. The second anomaly is located in the southeastern corner of the grid area. This anomaly is smaller in area at approximately 200 meters (650 feet) north to south and 100 meters (325 feet) east to west, this anomaly is open to the east and further geochemical surveying east ward may enlarge this anomaly.

The geochemical soil survey has successfully picked up the reclaimed Pass Showing’s location and also located a new area of interest. Because of this success and that the anomalies for both copper and gold are open the geochemical exploration program should be expanded. A second phase of geochemical sampling is recommended. The phase 2 geochemical survey will extend the phase 1 grid eastward and south to the claim boundaries. The second geochemical survey will extend the grid area to approximately 2.5 times the area initially surveyed.

The total cost of Phase 1 was $7,125

12

Phase 2 – Follow Up Geophysical Work

Based on the results of Phase I, we have elected to proceed with Phase 2 of our exploration program on the OS Gold Claim. Phase 2 will involve an induced potential geophysical survey. Further rock and soil geochemistry sampling, including a visit to the Kelsey property. A budget of about US $25,000 will likely be required but depending upon efficiencies, field conditions and the scope of surveys, trenching, etc. may approach US $35,000.

Completion of Phase 2 should be followed again by a thorough review of data obtained. One or more areas of mineral potential should be recognized and at least partially defined. Depending on the results from Phase 1 and 2, an additional soil sampling grid may be recommended to constrain anomalies produced from the Phase 1. Following this stage a geological mapping, a coincident Induced Potential Geophysical survey will be undertaken over the same grid that the soil samples were collected from.

Phase 3 – Geochemical Surveys and Diamond Drilling

Selected target areas will have to be more carefully detailed in order to identify drill sites. Geophysical surveys, either of a different method or on a more dense grid, should clarify the type of structure being investigated and will ensure that diamond drill holes are placed in the most prospective areas. Speculatively, an initial drill program of 1500 to 2000 meters is likely to be required.

If the results of Phase 2 of our exploration program on the OS Gold Claim are sufficiently positive, of which there is no assurance, we will implement Phase 3 of our exploration program on the OS Gold Claim. We have estimated that Phase 3 will cost approximately $150,000 to $250,000. Even if we sell all of the shares offered under the Primary Offering, we will have insufficient funds to pay the anticipated costs of Phase 3 of our exploration program. As a result, we will be required to raise additional financing, of which there is no assurance, in order to fund this exploration program.

After we receive results and recommendations at the end of each phase, Mr. Diakow, after consulting with Mr. Crooker, or another consulting geologist, will recommend to the Board of Directors whether it is feasible to proceed with further exploration. The Board of Directors will evaluate the results as explained by Mr. Diakow and ultimately decide whether it is appropriate to proceed with further exploration.

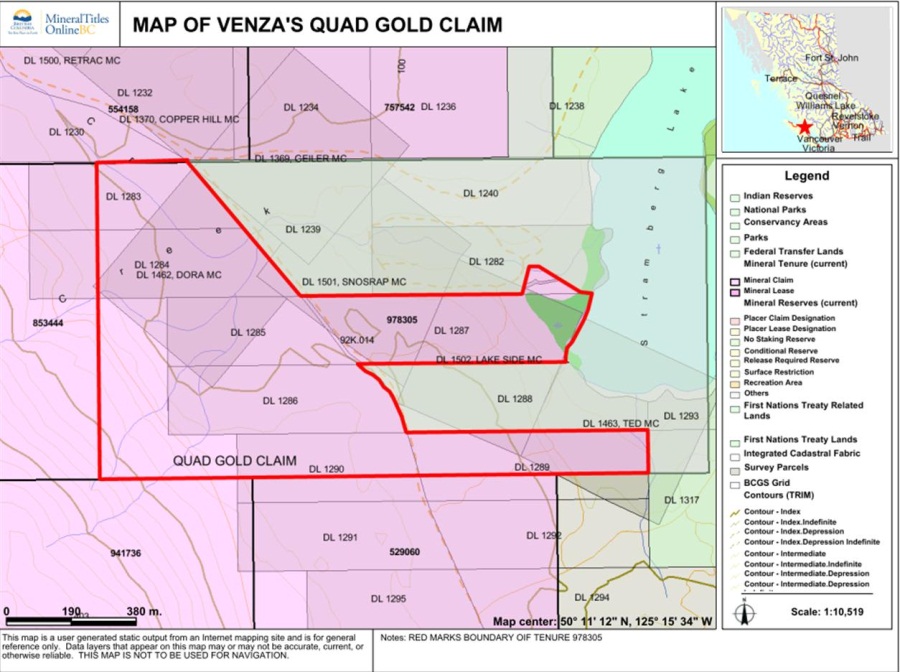

The Quad Gold Claim

Description of Property

The Quad Gold Claim comprises an area of 408.9 acres and is located approximately 16.2km north of the City of Campbell River, British Columbia, Canada. The Quad Gold Claim is recorded with the Ministry of Mines as follows:

|

Name of Mineral Claim

|

Tenure Number

|

Expiry Date

|

||

|

Quad Gold

|

978305

|

April 5, 2013

|

Gerald Diakow is the registered owner of the Quad Gold Claim and holds the Quad Gold Claim in trust for our sole benefit. The Province of British Columbia owns the land covered by the mineral claims. To our knowledge, there are no aboriginal land claims that might affect our title to our mineral claims or the Province’s title of the property.

In order to maintain the Quad Gold Claim in good standing, we must complete minimum exploration work on the properties and file confirmation of the completion of the work with the Ministry of Mines. In lieu of completing this work, we may pay a fee equal to the minimum exploration work that must be performed with the Ministry of Mines. The completion of mineral exploration work or payment in lieu of exploration work in any year will extend the existence of the Quad Gold Claim for one additional year. The minimum exploration work that must be performed and/or the fee for keeping the Quad Gold Claim current are equal to CDN $5.00 per hectare. As the Quad Gold Claim is in good standing until April 5, 2013, we will be required to complete minimum exploration work or pay a minimum fee of CDN $827.45 on or before April 5, 2013 and each year thereafter in order to keep the Quad Gold Claim current. If we fail to complete the minimum required amount of exploration work or fail to make a payment in lieu of this exploration work, our mineral claim will lapse and we will lose all interest in our mineral claim.

13

The Quad Gold Claim is not subject to any royalties.

Location and Access

The Quad Gold Claim is located in the Nanaimo Mining Division located on Quadra Island and is 16.2 km (10 miles) north of the City of Campbell River, British Columbia, Canada.

Figure 4. Quad Gold Claim.

Access to the Quad Gold Claim is done by vehicle ferry from Campbell River to Quathiaski Cove on Quadra Island. From Quathiaski Cove, it is a 6 km (3.5 mile) drive to Heriot Bay on paved road and then a 9.7 km drive on unpaved logging road to the Quad Gold Claim.

Water for the Quad Gold Claim would be sourced from Stramberg Lake (approximately 1.0 X 0.3 miles in size) which forms the eastern border of the claim area. The only infrastructures on the claim property are logging roads which transect the claim area in both an east-west and north-south direction. Electrical power could be sourced from the Blodell pulp and paper mill transmission line which is 12.5 km (8 miles) west south west of the Quad Gold Claim.

Climate and Physiography

The Quad Gold Claim is located on the west coast of British Columbia, which generally receives higher rainfall than the interior of the province. The Campbell River area receives 32 inches of rain a year the majority falling between November and May. Snow on Quadra Island stays until mid May especially in the forest under the tree canopy. Winters along the coast near sea level vary from year to year depending on the number of mid Pacific storms that come ashore carried by what is locally called the “Japanese Current”, these weather systems may be frequent or rare, although they tend to be frequent most years. Mining exploration may continue throughout the year on the Quad Gold Claims because of the claims low elevation. However, field work should be done between May and October because of the short daylight during winter months restricts outside activities to between the hours of 8:00 AM and 4:00 PM.

14

The vegetation on Quadra Island is typical of the British Columbia coastal areas where large forests once dominated the landscape. The accessible areas have long since been logged and the second growth on Quadra Island is actively been logged by small independent logging contractors. These forests which are being logged generally consist of Douglas fir, spruce and balsam in the well drained areas and cedar and hemlock in the wet or swampy areas. The undergrowth is dominated by Pacific salal, and in the sunnier areas blackberry, salmonberry and grasses are common.

The Quad Gold Claim area lies within two major northwest –trending physiographic divisions, namely, the Vancouver Island Ranges and the Coastal Trough. Between the front ranges of the Vancouver Island Ranges and Strait of Georgia, which occupies most of the Coastal Trough, is the Coastal Lowland. This lowland extends about 80 miles northwest from Nanoose Harbour to Campbell River and averages 4 miles wide, but widens to a maximum of about 12 miles in the Courtenay-Comox area. The lowland rises gently from the sea to meet the front ranges at elevations of 700 to 1000 feet.The Front ranges include Forbidden Plateau, with summits approaching an altitude of 7,000 feet above sea-level, the Beaufort Range with summits 3,000 to 5,000 feet and Mount Arrowsmith, which reaches an altitude of 5,962 feet.

Quadra Island is mainly mountainous, but the southern peninsula has a gently undulating suface150 to 300 feet above sea-level. This peninsula from Heriot Bay to Cape Mudge is about 7 miles long and 2 miles wide.

The major physiographic features are related to the bedrock, but at least two major ice-sheets have covered the area. Upon retreat of the ice, the mountains were left glacially sculptured with cirques and U-shaped valleys and over the lowland, glacial drift, with an undulating surface, accumulated. Transgressing and regressing seas further modified the lowland surface and, with lowering of sea-level, rivers cut or incised their valleys into the glacial and interglacial deposits and built terraces, deltas, and fluvial plains. In places along the coast bold cliffs have been left that expose 200 feet or more of glacial and interglacial deposits, and at sea-level benches and terraces have been cut by wave action on the exposed bedrock.

History

Historical work on the Quad Gold Claim has focused on two mineral properties: (i) the White Swan copper/silver prospect and the (ii) Condor copper/gold/silver prospect.

Previous work on the White Swan prospect includes the sinking of a 3.4 by 2.6 metre (11ft by 8ft) shaft 15 metres (50 feet), driving 30 metres (100 feet) or more at the bottom of the shaft. In addition, considerable surface work in the shape of pits, trenches and open-cuts has been done. Several bodies of pyrrhotite occur in limestone and andesite near their contact. A large pit, about 4 metres (12.5 feet) deep, has exposed three parallel mineralized fracture zones which strike about 72 degrees, all of which are included within a width of 5.5 metres (17 feet). The larger central zone is about 1.2 metres (4 feet) thick, and the smaller deposits on either side range from 5 to 40 centimetres (2 to 16 inches) in thickness. These mineralized zones or deposits are composed mainly of pyrrhotite, chalcopyrite, arsenopyrite, pyrite, quartz, garnets and epidote, the better ore material consisting mainly of quartz, pyrrhotite and chalcopyrite. An average sample was taken across the central deposit, 1.2 metres (4 feet) from the surface. This was assayed and proved to contain trace gold, no silver and 0.62 per cent copper (Geological Survey of Canada Summary Report 1913, page 73).

A mass of pyrrhotite about 3.6 metres (12.4 feet) thick was exposed in the old water filled shaft in 1913. An average sample was taken across this width and it assayed trace gold, no silver and 0.70 per cent copper (Geological Survey of Canada Summary Report 1913, page 73).

15

A 6-metre (20 feet) wide quartz vein containing pyrite and chalcopyrite was exposed at the northwest end of the old White Swan prospect. A sample of pyrrhotite from the surface assayed trace gold, 6.86 grams per tonne silver and 1.0 per cent copper (British Columbia Minister of Mines Annual Report 1913, page 285).

At the Condor showing a body of pyrrhotite with quartz about 1 metre (3 ft) wide has been exposed at the mouth of a tunnel that has been driven 33 metres (100 ft) south- west in limestone. The Condor occurrence is situated to the north- west of the Anaconda, which exhibits similar geology. The latter occurs at the contact of andesitic rock and limestone. The intrusive contact occurs within a few hundred metres to the northeast.

A sample of pyrrhotite and quartz assayed 0.69 grams per tonne gold, 6.86 grams per tonne silver and 0.9 per cent copper (British Columbia Minister of Mines Annual Report 1913, page 285).

The above detailed information concerning historical exploration work on the Quad Gold Claim is not necessarily indicative of the mineralization on the Quad Gold Claim.

Geology

The western-half of Quadra Island is underlain primarily by andesitic volcanic rocks of the Upper Triassic Karmutsen Formation which are overlain and bounded on the east by a northwest trending belt of Upper Triassic Quatsino Formation limestone, both of the Vancouver Group.

The area is underlain by highly fractured and sheared Karmutsen Formation amygdaloidal andesitic flow rocks interlayered with dense, fine to medium grained andesitic units and minor thin beds of sedimentary and tuffaceous material. The flow rocks dip gently south and southeast and range in thickness from 0.3 to 3.6 metres (1 to 12 ft) and more. Many of the flows are highly amygdaloidal with the amygdules filled with calcite, quartz, chlorite, actinolite or prehnite. The rocks are chloritized and cut by numerous stringers and veinlets of quartz, calcite and epidote.

Chalcocite is the most abundant mineral with native copper and chalcopyrite in lesser amounts. Bornite and pyrite are rare. Malachite, azurite and cuprite are confined to oxidized and weathered surfaces. The distribution of the mineralization is erratic. It is found along fracture plane surfaces and within irregular quartz- calcite veinlets, less commonly it occurs within amygdules or is otherwise locally disseminated. The mineralization tends to be more concentrated where fracture density is high. The White Swan area is underlain by Upper Triassic Karmutsen Formation volcanics of the Vancouver Group. These are interbedded with, and overlain to the northeast by a northwest trending belt of Quatsino Formation limestone (Vancouver Group) known historically as the "lime-belt". The Vancouver Group rocks are in fault and/or intrusive contact to the northeast with intrusive rocks of the Coast Plutonic Complex.

Property Geology

The Quad Gold Claims are underlain by upper Triassic Karmutsen Formation volcanics of the Vancouver Group. The Quad Gold Claims are well situated near numerous historic copper-gold-silver past producers, prospects and showings.

Current Exploration Activities

To date, we have not conducted any exploration work on the Quad Gold Claims. We are focusing our resources on the exploration of the OS Gold Claims

We are an exploration stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

16

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the Province of British Columbia, Canada. The main agency that governs the exploration of minerals in British Columbia is the Ministry of Energy and Mines (“Ministry of Mines”). The Ministry of Mines manages the development of British Columbia’s mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the Ministry of Mines regulates and inspects the exploration and mineral production industries in British Columbia to protect workers, the public and the environment.

The material legislation applicable to us is the Mineral Tenure Act (British Columbia), administered by the Mineral Titles Branch of the Ministry of Mines, and the Mines Act (British Columbia), as well as the Health, Safety and Reclamation Code and the Mineral Exploration Code. The Mineral Tenure Act and its regulations govern the procedures involved in the location, recording and maintenance of mineral titles in British Columbia. The Mineral Tenure Act also governs the issuance of leases which are long term entitlements to minerals.

All mineral exploration activities carried out on a mineral claim or mining lease in British Columbia must be in compliance with the Mines Act. The Mines Act applies to all mines during exploration, development, construction, production, closure, reclamation and abandonment. It outlines the powers of the Chief Inspector of Mines, to inspect mines, the procedures for obtaining permits to commence work in, on or about a mine and other procedures to be observed at a mine. Additionally, the provisions of the Health, Safety and Reclamation Code for mines in British Columbia contain standards for employment, occupational health and safety, accident investigation, work place conditions, protective equipment, training programs, and site supervision. Also, the Mineral Exploration Code contains standards for exploration activities including construction and maintenance, site preparation, drilling, trenching and work in and about a water body.

We will not be required to obtain a permit for the exploration carried out under Phase 2 of our exploration program as it involves geophysical work. In the event that we wish to proceed with Phase 3 of our exploration program, we will be required to file a permit application with the Ministry of Mines in order to conduct drilling on the OS Gold Claim. As of the date of this Annual Report, we have not applied for such a permit.

The Mines Act also provides that a company planning to mine a property must submit a detailed “Mine Plan and Reclamation Program” must be submitted to the Mining Operations Branch Regional Manager for proposed coal or hardrock mineral mines, major expansions or modifications of producing coal and hardrock mineral mines, and large pilot projects, bulk samples, trial cargoes or test shipments. Information requirements for these applications are summarized in the Act. Mines Act permit applications are required whether or not proposed developments fall under the Environmental Assessment Act ("EAA").

Additional approvals and authorizations may be required from other government agencies, depending upon the nature and scope of the proposed exploration program. If the exploration activities require the falling of timber, then either a free use permit or a license to cut must be issued by the Ministry of Forests. Items such as waste approvals may be required from the Ministry of Environment, Lands and Parks if the proposed exploration activities are significantly large enough to warrant them. Waste approvals refer to the disposal of rock materials removed from the earth which must be reclaimed. An environmental impact statement may be required.

In order to maintain our mineral claims in good standing, we must complete exploration work on the mineral claims and file confirmation of the completion of work on the mineral claims with the applicable mining recording office of the Ministry of Mines. In British Columbia, the recorded holder of a mineral claim is required to perform a minimum amount of exploration work on a claim or make payment in the equivalent sum in lieu of work. We will be required to pay a fee of CDN $5.00 (USD $5.05) per hectare per year during the initial two year period, CDN $10.00 (USD $10.10) per hectare per year during years three and four, CDN $15.00 (USD $15.15) per hectare per year during years five and six and CDN $20.00 (USD $20.20) per hectare per year for each year thereafter. There is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. The completion of mineral exploration work or payment in lieu of exploration work in any year will extend the existence of our mineral claims for one additional year. If we fail to complete the minimum required amount of exploration work or fail to make a payment in lieu of this exploration work, then our mineral claims will lapse, and we will lose all interest that we have in our mineral claims.

17

We will have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on earnings, our competitive position or us in the event that a potentially economic deposit is discovered.

Prior to undertaking mineral exploration activities, we must make application for a permit, if we anticipate disturbing land. A permit is issued after review of a complete and satisfactory application. We do not anticipate any difficulties in obtaining a permit, if needed. If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

(i) Water discharge will have to meet drinking water standards;

(ii) Dust generation will have to be minimal or otherwise re-mediated;

(iii)Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation;

(iv)An assessment of all material to be left on the surface will need to be environmentally benign;

(v) Ground water will have to be monitored for any potential contaminants;

(vi)The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and

(vii)There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species.

We have not incurred any research and development expenditures since our inception.

We do not own, either legally or beneficially, any patent or trademark.

The raw materials for our exploration programs include camp equipment, hand exploration tools, sample bags, first aid supplies, groceries and propane. All of these types of materials are readily available from a variety of local suppliers.

We have no customers.

18

We have no employees other than our executive officers. We contract for the services of geologists, prospectors and other consultants as we require them to conduct our exploration programs.

In addition to the factors discussed elsewhere in this annual report, the following risks and uncertainties could materially adversely affect our business, financial condition and results of operations. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations and financial condition.

We lack an operating history and have losses which we expect to continue into the future. As a result, we may have to suspend or cease exploration activities and if we do not obtain sufficient financing, our business will fail.

We were incorporated on August 4, 2010 and to date have been involved primarily in the acquisition and exploration of our mineral properties. We have no exploration history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon: (i) our ability to locate a profitable mineral property, and (ii) our ability to generate revenues.

For the next twelve months, management anticipates that the minimum cash requirements to fund our proposed exploration program and our continued operations will be approximately $82,830. Accordingly, we have sufficient funds to meet our planned expenditures over the next twelve months. In the event that we decide to proceed with phase three of our exploration program, of which there is no assurance, we will be required to raise additional financing.

Obtaining financing would be subject to a number of factors, including the market prices for the mineral property and base and precious metals. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. Since our inception, we have used our common shares to raise money for our operations and for our property acquisitions. We have not attained profitable operations and are dependent upon obtaining financing to pursue our plan of operation.

Because we are an exploration stage company, our business has a high risk of failure.

We are an exploration stage company that has incurred net losses since inception, we have not attained profitable operations and we are dependent upon obtaining adequate financing to complete our exploration activities. The success of our business operations will depend upon our ability to obtain further financing to complete our planned exploration program and to attain profitable operations. If we are not able to complete a successful exploration program and attain sustainable profitable operations, then our business will fail.

Our auditors have expressed substantial doubt about our ability to continue as a going concern; as a result we could have difficulty finding additional financing.

Our financial statements have been prepared assuming that we will continue as a going concern. Except for the interest revenue, we have not generated any revenue from our main operations since inception and have accumulated losses. As a result, our auditors have expressed substantial doubt about our ability to continue as a going concern. Our ability to continue our operations depends on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that could result from the outcome of this uncertainty.

19

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

You should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Our mineral properties do not contain a known body of commercial ore and, therefore, any program conducted on our mineral properties would be an exploratory search of ore. There is no certainty that any expenditures made in the exploration of our mineral properties will result in discoveries of commercial quantities of ore. Most exploration projects do not result in the discovery of commercially mineable deposits of ore. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration program do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon our possessing sufficient capital resources to purchase such claims. If we do not have sufficient capital resources and are unable to obtain sufficient financing, we may be forced to abandon our operations.

We have no known mineral reserves and if we cannot find any, we may have to cease operations.

We are in the initial phase of our exploration program for the OS Gold Claim. It is unknown whether this property contains viable mineral reserves. If we do not find a viable mineral reserve, or if we cannot exploit the mineral reserve, either because we do not have the money to do it or because it will not be economically feasible to do it, we may have to cease operations and you may lose your investment. Mineral exploration is a highly speculative endeavor. It involves many risks and is often non-productive. Even if mineral reserves are discovered on our properties, our production capabilities will be subject to further risks and uncertainties including:

|

|

(i)

|

Costs of bringing the property into production including exploration work, preparation of production feasibility studies, and construction of production facilities, all of which we have not budgeted for;

|

|

|

(ii)

|

Availability and costs of financing;

|

|

|

(iii)

|

Ongoing costs of production; and

|

|

|

(iv)

|

Environmental compliance regulations and restraints.

|

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the lack of milling facilities and processing equipment near the OS Gold Claim and the Quad Gold Claim, and such other factors as government regulations, including regulations relating to allowable production, importing and exporting of minerals, and environmental protection.

Because we have not commenced business operations, we face a high risk of business failure.

We have not earned any revenues from business operations as of the date of this Annual Report. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may result in our inability to complete our planned exploration program and/or obtain additional financing to fund our exploration program.

20

Because the prices of metals fluctuate, if the price of metals for which we are exploring decreases below a specified level, it may no longer be profitable to explore for those metals and we will cease operations.

Metal prices are determined by such factors as expectations for inflation, the strength of the United States dollar, global and regional supply and demand, and political and economic conditions and production costs in metals producing regions of the world. The aggregate effect of these factors on metal prices is impossible for us to predict. In addition, the prices of metals such as lead, zinc, copper, silver, gold or uranium are sometimes subject to rapid short-term and/or prolonged changes because of speculative activities. The current demand for and supply of these metals affect the metal prices, but not necessarily in the same manner as current supply and demand affect the prices of other commodities. The supply of these metals primarily consists of new production from mining. If the prices of the metals are, for a substantial period, below our foreseeable cost of production, it may not be economical for us to continue operations and you could lose your entire investment.