Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LOCAL Corp | d473415d8k.htm |

CORPORATE OVERVIEW | 1Q2013

1

…………………………..…………………………………….

Local Corporation

We connect local businesses with online consumers

Corporate Overview: 1Q2013

Exhibit 99.1 |

CORPORATE OVERVIEW | 1Q2013

2

………………..…………………………………….

Forward looking statements

Certain matters being discussed by Local Corporation’s management

today include forward looking statements which are made pursuant to

the Safe Harbor provisions of section 21-E of the Securities Exchange

Act of 1934. Investors are cautioned that statements which are not

strictly historical statements, including statements concerning future

expected financial performance, management objectives and plans for

future operations, our relationships with strategic or other partners, the

release of new products or services or enhancements to existing

products or services, our expectations regarding potential acquisitions

and the future performance of past acquisitions including our ability to

realize expected synergies, trends in the market for our current or

planned products or services, and market acceptance of our products or

services, constitute forward looking statements.

The forward looking statements include, but are not limited to, any

statements containing the words “expect”, “anticipate”, “estimates”,

“believes”, “should”, “could”, “may”,

“possibly”, and similar expressions and the negatives thereof. These forward looking

statements involve a number of risks and uncertainties that could cause actual results to

differ materially from the forward looking statements. Those risks and

uncertainties are detailed in the company’s filings from time to time with

the Securities and Exchange Commission. The information contained in

the forward looking statements is provided as of the date of such oral

statements and the company disclaims any obligation to update such

statements.

This document includes the non-GAAP financial measure of “Adjusted

Net Income/Loss” which we define as net income/loss excluding:

provision for income taxes; interest and other income (expense), net;

depreciation; amortization; stock based compensation charges; gain or

loss on warrant revaluation; net income (loss) from discontinued

operations; gain on sale of Rovion; impairment charges; LEC receivables

reserve and severance charges.

Adjusted Net Income/Loss, as defined above, is not a measurement

under GAAP. Adjusted Net Income/Loss is reconciled to net loss and

loss per share, which we believe are the most comparable GAAP

measures, at the end of this presentation. Management believes that

Adjusted Net Income/Loss provides useful information to investors

about the company’s performance because it eliminates the effects of

period-to-period changes in income from interest on the company’s

cash and marketable securities, expense from the company’s

financing transactions and the costs associated with income tax

expense, capital investments, stock-based compensation expense,

warrant revaluation charges, and non-recurring charges which are

not directly attributable to the underlying performance of the

company’s business operations. Management uses Adjusted Net

Income/Loss in evaluating the overall performance of the company’s

business operations.

A limitation of non-GAAP Adjusted Net Income/Loss is that it

excludes items that often have a material effect on the company’s net

income and earnings per common share calculated in accordance

with GAAP. Therefore, management compensates for this limitation

by using Adjusted Net Income/Loss in conjunction with GAAP net

loss and loss per share measures. The company believes that

Adjusted Net Income/Loss provides investors with an additional tool

for evaluating the company’s core performance, which management

uses in its own evaluation of overall performance, and as a base-line

for assessing the future earnings potential of the company. While the

GAAP results are more complete, the company prefers to allow

investors to have this supplemental metric since, with reconciliation

to GAAP (as noted above), it may provide greater insight into the

company’s financial results. The non-GAAP measures should be

viewed as a supplement to, and not as a substitute for, or superior to,

GAAP net income or earnings per share.

|

CORPORATE OVERVIEW | 1Q2013

3

………………………………………………..

Local Corporation Overview

REVENUE IN MILLIONS

Founded/IPO

Ticker

Reach

Flagship Site

Network

Patents

Headquarters

Employees

1999/2004

LOCM (NASDAQ)

~1 million consumers/day

Local.com –

Top 100 US Site

Over 1,000 local sites

11 issued + 9 pending

Irvine, CA

~100

KEY FACTS

*2012 Preliminary; 2013 Estimated |

CORPORATE OVERVIEW | 1Q2013

4

Local searchers are often further along in the buying process,

so they tend to convert to buyers at a higher rate.

Higher conversion rates means businesses will often

pay a premium

to advertise to local searchers.

Pay-per-click rates for local versus national keyword terms…

What is ‘Local Search’?

Implicit

No location, but local

Explicit

Actual location

Local searchers are worth more! |

CORPORATE OVERVIEW | 1Q2013

5

…………………………...………………………………………….

The Opportunity

Offline is going digital, and digital is going local

We have assets in all areas

Source: BIA/Kelsey, January 2013 |

CORPORATE OVERVIEW | 1Q2013

6

Our Model

We aggregate local business, product and service

content and syndicate it across over 1,000 sites.

Search engines index this content and show those sites

in their search results, driving local search traffic to us.

We monetize that traffic with various ad units from ad

partners, and we keep most of the revenue generated.

Traffic

‘Consumer Properties’

Traffic x Monetization = Revenue

|

CORPORATE OVERVIEW | 1Q2013

7

Consumer Properties

Business directories powered by Local Corporation include…

A private label local business directory provided to over 1,000

regional media sites nationwide –

typically local newspapers

Network

Local.com

Our flagship

property

Arizona Daily Star

Arkansas News

Boston Herald

Columbia Daily Herald

Cumberland Times News

Daily Herald -

Utah

Daily Princetonian

Daily Tarheel

East Valley Tribune

Honolulu Star Advertiser

Journal Star

Knoxville News Sentinel

LaCrosse Tribune

NC Times

Newsday

Norwich Bulletin

Observer-Reporter

Orange County Register

Pittsburgh Post-Gazette

San Diego Union Tribune

Santa Ynez Valley News

Savannah Morning News

St. Louis Post-Dispatch

Star Banner

The Arizona Republic

The Augusta Chronicle

The Commercial Appeal

The Dispatch

The Examiner

The Florida Times Union

The Gazette

The Record Searchlight

The State Journal-Register

The Telegraph

Treasure Coast

Triangle411

Valley News

Ventura County Star

Vermont Today

Washington Post |

CORPORATE OVERVIEW | 1Q2013

8

Mobile

Mobile Apps and mobile-enabled available

for consumer sites:

•

Local.com

•

Spreebird.com

Launch by Local solution offers a

mobile-optimized website for SMBs

Source: BIA/Kelsey |

CORPORATE OVERVIEW | 1Q2013

9

•

Multi-year traffic growth

•

Organic

traffic

is

low

cost/high

margin

–

at

record

levels

•

Mobile

traffic

at

record

levels

–

still

figuring

out

monetization,

but

we

think

we

have

key

IP

………….................................……………………………….

Great Momentum |

CORPORATE OVERVIEW | 1Q2013

10

…………………………………………...………………………..

IP & Technology

•

Proprietary platform and know-how

»

Real time business, product and services data integration

»

Large scale local/commercial content production and syndication

»

Very large scale CPC ad-serving and distribution

»

Web indexing and local search relevance

»

Very large scale SEO, SEM campaign expertise

»

Local display ad production and syndication

»

Web hosting and local/commercial domain name acquisition

•

11 patents issued, 9 pending

»

Key patents

–

Local web indexing (for indexing local web sites across the web)

–

Pay per call for local and commercial searches via a mobile device (multiple

patents) •

The billion dollar industry question: How do we monetize mobile?

–

Dynamic

cascading

menu

search

(for

product

search

on

tablets

and

smart

phones)

–

Bulk domain registration and content management (for very large scale SEO)

|

CORPORATE OVERVIEW | 1Q2013

11

……………………..……….……….

Experience with Strategy Discipline

Heath Clarke

Founder, Chairman & CEO

20+ yrs exp

Founded Local in ’99

VP eCommerce LanguageForce

CEO/Founder AFP (Australia)

Ken Cragun

CFO

20+ yrs exp

CFO Modtech

SVP MIVA

CFO ImproveNet

CFO NetCharge.com

CPA; Big 4 Exp.

Mike Sawtell

President & COO

20+ yrs exp

Chairman & CEO, DigitalPost Interactive

Pres. & COO , Interchange Corp. (now

Local Corporation)

COO & VP of Sales, Informative Research

Peter Hutto

SVP, Corporate Development

Co-Founder, ZeroDegrees

Managing Director, EDS & MCI

SystemhouseG

Erick Herring

SVP Technology

Founder Townloop

CTO Feedback.com

CTO, VP Product Webvisible

CTO Adapt Technologies

Rob Luskey

VP, Business Development

Director, Business Development,

go2 Systems, Inc.

Senior Manager, Internet Products and

Services, United Yellow Pages

Owner & Publisher, Local Impact

Publishing |

CORPORATE OVERVIEW | 1Q2013

12

Growth Strategy

•

Grow margins in O&O business (largest revenue stream)

»

Margin optimization via new SEM tools

»

Gradually ramping in the UK

•

Grow revenues in Network (most profitable revenue stream)

»

Expand number of sites via business development team (more traffic)

»

New

products

planned…

product

directory,

‘Launch

by

Local’

SMB

private

label,

publisher

dashboard

»

Leverage platform to produce new local/commercial content to grow

traffic/site •

Reduce costs

»

Channel

sales

vs.

direct

sales

–

projected

2013

cost

savings

of

$4.6MM,

beginning

January

2013

•

Developing opportunities

»

Local

display

network

–

leveraging

our

existing

Network

»

Microsites

(insurance,

HVAC,

alarm

systems

and

more)

–

leveraging

out

platform

»

Improved

monetization

via

lead

generation

–

monetization

improvements

»

Mobile

–

leveraging

our

platform |

CORPORATE OVERVIEW | 1Q2013

13

……………………………………..

We Believe the Inflection Point is Now

Note: See reconciliation of Adjusted Net Income to GAAP net income at presentation

end; 2012 Preliminary, 2013 Estimated; *Losses not to scale •

Five material challenges in

24 months withstood

»

Significant cost to the

company in revenue and

earnings

•

Highest revenue per

employee ever

»

Projected growth to about

$900k per employee by

EOY 2013

»

Running lean!

•

Returning to profit

»

Significant cost savings

starting 1Q13

»

Projecting 1Q13 Adjusted

Net Income

»

Forecasting positive cash

from operations from 2Q13

onwards

Material challenges over past 2 years |

CORPORATE OVERVIEW | 1Q2013

14

………………………………...……….

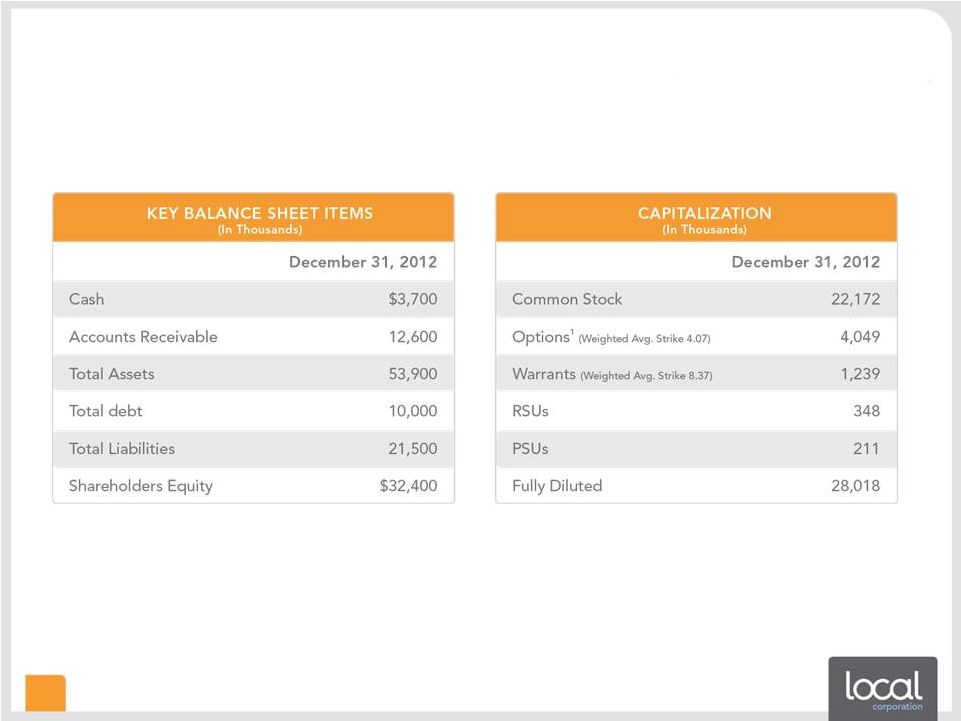

3Q12 Balance Sheet & Cap. Table

Additional

Data:

I.

$12 million credit facility. Interest rate approximately 5%

II.

Total authorized shares 65,000,000 common and 10,000,000 preferred

* Received

$3.5

million

proceeds

from

Rovion

sale

on

October

19,

2012 |

CORPORATE OVERVIEW | 1Q2013

15

……………………….…….

Why Invest in Local Corporation Today?

•

Multi-year track record of 31% CAGR

•

Execs

are

buyers

–

exchanged

bonuses

for

182,000

shares

in

past

18

months

•

Proprietary platform plus IP

•

Well positioned for growth opportunities in a rapidly changing space

•

Expected ANI in 1Q13

•

We

believe

the

inflection

point

is

NOW |

CORPORATE OVERVIEW | 1Q2013

16

Thank You

Heath Clarke

Founder, Chairman & Chief Executive Officer

hclarke@local.com

Ken Cragun

Chief Financial Officer

kcragun@local.com

949.784.0800

http://www.localcorporation.com |

CORPORATE OVERVIEW | 1Q2013

17

Digital Media Landscape

*Partners |

CORPORATE OVERVIEW | 1Q2013

18

…………………….

*Research by Vsplash and BIA/Kelsey: SMB Digital Scope and Audit

Study

The Challenge Our Platform Solves for SMBs

Only

33.4%

of

SMBs

have

a

local

phone

number

on

their home page

Only

22%

have

an

email

address

on

their

website

Just

6.7%

of

SMB

websites

are

mobile-compatible

Only

6%

have

a

Facebook

business

page

Google

changes

its

search

algorithm

500

times per year

Mobile

has

arrived

in

force |

CORPORATE OVERVIEW | 1Q2013

19

Local SMB Customer: Fabi’s Hair Studio

Facebook and Twitter pages engage

customers and increase awareness

Beautiful site design and web hosting with

geo-targeted URL and custom content

Mobile-optimized site

features directions and

click-to-call

A consistent brand and user experience across multiple

channels adds small business credibility

(Murray Hill Hair Salon) |

CORPORATE OVERVIEW | 1Q2013

20

…….

Reconciliation of Adjusted Net Income to GAAP Net Income

Actual

Actual

Actual

Actual

Actual

Actual

Prelim

Forecast

DESCRIPTION

FY-06

FY-07

FY-08

FY-09

FY-10

FY-11

FY-12

FY-13

Adjusted Net income (loss)

(8,882)

$

(7,217)

$

(4,658)

$

3,041

$

13,775

$

(1,734)

$

(600)

$

5,000

$

Plus interest and other income (expense), net

288

(7,030)

312

(27)

(275)

(413)

(400)

(400)

Less provision for income taxes

(1)

(1)

(1)

(158)

(102)

(178)

(100)

(200)

Less amortization of intangibles

(947)

(1,121)

(999)

(2,524)

(5,734)

(5,136)

(4,100)

(1,300)

Less depreciation

(1,213)

(1,085)

(814)

(734)

(1,418)

(3,277)

(3,800)

(4,500)

Less stock-based compensation

(2,531)

(1,748)

(2,402)

(2,364)

(2,911)

(3,663)

(2,800)

(3,800)

Less LEC receivable reserve

-

-

-

-

-

-

(1,400)

-

Less impairment charge

-

-

-

-

-

-

(6,500)

-

Less net loss from discontinued operations

-

-

-

-

-

(1,330)

(1,100)

-

Plus gain on sale of Rovion

-

-

-

-

-

-

1,400

-

Less revaluation of warrants

-

-

-

(2,981)

887

2,633

200

unknown

Less non-recurring charges

-

-

-

(520)

-

(1,461)

(1,100)

(500)

GAAP Net income (loss)

(13,286)

$

(18,202)

$

(8,562)

$

(6,267)

$

4,222

$

(14,559)

$

(20,300)

$

unknown |