Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATON OF CEO PURSUANT TO RULE 13A-14 OR 15D-14 - Spectrum Brands Holdings, Inc. | d472750dex311.htm |

| EX-31.2 - CERTIFICATON OF CFO PURSUANT TO RULE 13A-14 OR 15D-14 - Spectrum Brands Holdings, Inc. | d472750dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

| þ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2012

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO .

Commission file number: 1-4219

Harbinger Group Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 74-1339132 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

450 Park Avenue, 30th Floor, New York NY 10022

(Address of principal executive offices, including zip code)

Registrant’s Telephone Number, Including Area Code: (212) 906-8555

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.01 par value | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known, seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes ¨ No þ

Indicate by check mark whether the Issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ | |||

| Non-accelerated filer |

þ (Do not check if a smaller reporting company) |

Smaller reporting company |

¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the common stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, April 1, 2012, was approximately $49.8 million. For the sole purpose of making this calculation, the term “non-affiliate” has been interpreted to exclude directors and executive officers and other affiliates of the registrant and persons affiliated with Harbinger Capital Partners LLC.

As of January 17, 2013, the registrant had outstanding 143,195,028 shares of common stock, $0.01 par value.

Documents Incorporated By Reference:

None.

Table of Contents

EXPLANATORY NOTE

Unless otherwise indicated or the context requires otherwise, in this disclosure, references to the “Company,” “HGI,” “we,” “us” or “our” refers to Harbinger Group Inc. and, where applicable, its consolidated subsidiaries; “Harbinger Capital” refers to Harbinger Capital Partners LLC; “Harbinger Parties” refers, collectively, to Harbinger Capital Partners Master Fund I, Ltd. (the “Master Fund”), Harbinger Capital Partners Special Situations Fund, L.P. and Global Opportunities Breakaway Ltd.; “Zap.Com” refers to Zap.Com Corporation; “Russell Hobbs” refers to Russell Hobbs, Inc. and, where applicable, its consolidated subsidiaries; “Spectrum Brands” refers to Spectrum Brands Holdings, Inc. and, where applicable, its consolidated subsidiaries; “SBI” refers to Spectrum Brands, Inc. and, where applicable, its consolidated subsidiaries; “HFG” refers to Harbinger F&G, LLC (formerly Harbinger OM, LLC); “HHI” refers to the hardware and home improvement business formerly operated by Stanley Black & Decker and certain of its subsidiaries, which SBI has acquired; “FS Holdco” refers to FS Holdco Ltd.; “HGI Funding” refers to HGI Funding LLC; “Front Street” refers to Front Street Re Ltd; “FGL” refers to Fidelity & Guaranty Life Holdings, Inc. (formerly, Old Mutual U.S. Life Holdings, Inc.) and, where applicable, its consolidated subsidiaries; “Raven Re” refers to Raven Reinsurance Company; “FGL Insurance” refers to Fidelity & Guaranty Life Insurance Company; “FGL NY Insurance” refers to Fidelity & Guaranty Life Insurance Company of New York; “Salus” refers to Salus Capital Partners, LLC; and “HGI Energy” refers to HGI Energy Holdings, LLC; “Fiscal 2009” means the twelve month period ended December 31, 2009; “Fiscal 2010” means the twelve month period ended December 31, 2010; “Fiscal 2011” means the nine month period ended September 30, 2011, which is the date of the Company’s fiscal end for 2011 as a result of the change to the Company’s fiscal year end from December 31 to September 30 during calendar year 2011; “Fiscal 2012” means the twelve month period ended September 30, 2012; and “Fiscal 2013” means the twelve month period ending September 30, 2013.

This Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) to the Annual Report on Form 10-K of the Company for Fiscal 2012, filed with the Securities and Exchange Commission (the “SEC”) on November 28, 2012 (the “Original 10-K”) is being filed solely for the purpose of including the information required by Part III of Form 10-K.

As required by Rule 12b-15, in connection with this Form 10-K/A, the Company’s Chief Executive Officer and Chief Financial Officer are providing Rule 13a-14(a) certifications as included herein.

Except as described above, this Form 10-K/A does not modify or update disclosure in, or exhibits to, the Original 10-K. Furthermore, this Form 10-K/A does not change any previously reported financial results, nor does it reflect events occurring after the date of the Original 10-K. Information not affected by this Form 10-K/A remains unchanged and reflects the disclosures made at the time the Original 10-K was filed.

2

Table of Contents

Page

| Item 10. |

4 | |||||

| Item 11. |

10 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

28 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

31 | ||||

| Item 14. |

34 | |||||

3

Table of Contents

Item 10. Directors, Executive Officers and Corporate Governance

BOARD OF DIRECTORS

Our board of directors (our “Board”) as of the date of this Form 10-K/A consists of eight members, as determined in accordance with our Bylaws (our “Bylaws”). In accordance with our Certificate of Incorporation (our “Charter”), our Board is divided into three classes (designated as Class I, Class II, and Class III, respectively). The three classes are currently comprised of the following directors:

Class I Directors — Term Expiring 2014

Lap Wai Chan, age 46, has served as a director of HGI since October 2009. From September 2009 to September 2010 he was a consultant to MatlinPatterson Global Advisors (“MatlinPatterson”), a private equity firm focused on distressed control investments across a range of industries. From July 2002 to September 2009, Mr. Chan was a Managing Partner at MatlinPatterson. Prior to that, Mr. Chan was a Managing Director at Credit Suisse First Boston H.K. Ltd. (“Credit Suisse”). From March 2003 to December 2007, Mr. Chan served on the board of directors of Polymer Group, Inc. MatlinPatterson, Credit Suisse and Polymer Group, Inc. are not affiliates of HGI.

Keith M. Hladek, age 37, has served as a director of HGI since October 2009. Mr. Hladek is also a director of Zap.Com, a subsidiary of HGI. Mr. Hladek is also the Chief Financial Officer and Co-Chief Operating Officer of Harbinger Capital, an affiliate of HGI. Mr. Hladek is responsible for all accounting and operations of Harbinger Capital (including certain affiliates of Harbinger Capital and their management companies), including portfolio accounting, valuation, settlement, custody, and administration of investments. Prior to joining Harbinger Capital in 2009, Mr. Hladek was Controller at Silver Point Capital, L.P., where he was responsible for accounting, operations and valuation for various funds and related financing vehicles. Mr. Hladek is a Certified Public Accountant in New York. Prior to joining Silver Point Capital, L.P. Mr. Hladek was the Assistant Controller at GoldenTree Asset Management and a fund accountant at Oak Hill Capital Management. Mr. Hladek started his career in public accounting and received his Bachelor of Science in Accounting from Binghamton University. None of the companies Mr. Hladek worked with before joining Harbinger Capital is an affiliate of HGI.

Robin Roger, age 55, has served as a director of HGI since May 2011. From June 2010 until July 2011, Ms. Roger served as a director for Spectrum Brands, a subsidiary of HGI. Ms. Roger is a Managing Director, General Counsel, Co-Chief Operating Officer and Chief Compliance Officer of Harbinger Capital, an affiliate of the Company. Prior to joining Harbinger Capital in 2009, Ms. Roger was General Counsel at Duff Capital Advisors, a multi-strategy investment advisor. She previously served as General Counsel to Jane Street Capital, a proprietary trading firm, and Moore Capital Management. Ms. Roger worked at Morgan Stanley from 1989 to 2006. While there, she headed the equity sales and trading legal practice group and served as General Counsel of the Institutional Securities Division (which encompassed the investment banking as well as sales and trading activities of the firm), and performed other roles at the corporate level. She received a B.A. from Yale College and a J.D. from Harvard Law School. None of the companies Ms. Roger worked with before joining Harbinger Capital is an affiliate of HGI.

Class II Directors — Terms Expiring 2015

Philip A. Falcone, age 50, has served as a director, Chairman of the Board and Chief Executive Officer of HGI since July 2009. From July 2009 to July 2011, Mr. Falcone served as the President of HGI. He is Chief Investment Officer and Chief Executive Officer of Harbinger Capital, an affiliate of HGI, is Chief Investment Officer of the Harbinger Parties and other Harbinger Capital affiliates. Mr. Falcone co-founded the Master Fund in 2001. Mr. Falcone is also the Chairman of the Board, President and Chief Executive Officer of Zap.Com, a subsidiary of HGI. Mr. Falcone has over two decades of experience in leveraged finance, distressed debt and special situations. Prior to joining the predecessor of Harbinger Capital, Mr. Falcone served as Head of High Yield trading for Barclays Capital. From 1998 to 2000, he managed the Barclays High Yield and Distressed trading operations. Mr. Falcone held a similar position with Gleacher Natwest, Inc., from 1997 to 1998. Mr. Falcone began his career in 1985, trading high yield and distressed securities at Kidder, Peabody & Co. Mr. Falcone received an A.B. in Economics from Harvard University. None of the companies Mr. Falcone worked with before co-founding the Master Fund is an affiliate of HGI.

4

Table of Contents

David M. Maura, age 40, has served as Managing Director and Executive Vice President of Investments of HGI effective as of October 2011 and as a director of HGI since May 2011. Mr. Maura has also served as the Chairman of Spectrum Brands, a subsidiary of HGI, since July 2011 and as the interim Chairman of the board of directors of Spectrum Brands and as one of its directors since June 2010. Prior to becoming Managing Director and Executive Vice President of Investments at HGI, Mr. Maura was a Vice President and Director of Investments of Harbinger Capital, an affiliate of HGI. Prior to joining Harbinger Capital in 2006, Mr. Maura was a Managing Director and Senior Research Analyst at First Albany Capital, where he focused on distressed debt and special situations, primarily in the consumer products and retail sectors. Prior to First Albany, Mr. Maura was a Director and Senior High Yield Research Analyst in Global High Yield Research at Merrill Lynch & Co. Mr. Maura was a Vice President and Senior Analyst in the High Yield Group at Wachovia Securities, where he covered various consumer product, service and retail companies. Mr. Maura began his career at ZPR Investment Management as a Financial Analyst. During the past five years, Mr. Maura has served on the board of directors of Russell Hobbs, Inc. (formerly Salton, Inc.) and Applica Incorporated. Mr. Maura received a B.S. in Business Administration from Stetson University and is a CFA charterholder. None of the companies Mr. Maura worked with before joining Harbinger Capital is an affiliate of HGI.

Class III Directors — Terms Expiring 2013

Omar M. Asali, age 42, has served as President of HGI effective as of October 2011, as Acting President since June 2011, and as a director of HGI since May 2011. Mr. Asali is Spectrum Brands and a director of Zap.Com, each a subsidiary of HGI. Prior to becoming President of HGI, Mr. Asali was a Managing Director and Head of Global Strategy of Harbinger Capital, an affiliate of HGI. Prior to joining Harbinger Capital in 2009, Mr. Asali was the co-head of Goldman Sachs Hedge Fund Strategies (“Goldman Sachs HFS”) where he helped manage approximately $25 billion of capital allocated to external managers. Mr. Asali also served as co-chair of the Investment Committee at Goldman Sachs HFS. Before joining Goldman Sachs HFS in 2003, Mr. Asali worked in Goldman Sachs’ Investment Banking Division, providing M&A and strategic advisory services to clients in the High Technology Group. Mr. Asali previously worked at Capital Guidance, a boutique private equity firm. Mr. Asali began his career working for a public accounting firm. Mr. Asali received an MBA from Columbia Business School and a B.S. in Accounting from Virginia Tech. None of the companies Mr. Asali worked with before joining Harbinger Capital is an affiliate of HGI.

Thomas Hudgins, age 73, has served as a director of HGI since October 2009. He is a retired partner of Ernst & Young LLP (“E&Y”). From 1993 to 1998, he served as E&Y’s Managing Partner of its New York office with over 1,200 audit and tax professionals and staff personnel. During his tenure at E&Y, Mr. Hudgins was the coordinating partner for a number of multinational companies, including American Express Company, American Standard Inc., Textron Inc., MacAndrews & Forbes Holdings Inc., and Morgan Stanley, as well as various mid-market and leveraged buy-out companies. As coordinating partner, he had the lead responsibility for the world-wide delivery of audit, tax and management consulting services to these clients. Mr. Hudgins also served on E&Y’s international executive committee for its global financial services practice. Mr. Hudgins previously served on the board of directors and as a member of various committees of Foamex International Inc., Aurora Foods, Inc. and RHI Entertainment, Inc. E&Y, RHI Entertainment Inc., Foamex International Inc. and Aurora Foods, Inc. are not affiliates of HGI.

Robert V. Leffler, Jr., age 67, has served as a director of HGI since May 1995. Mr. Leffler owns The Leffler Agency, Inc., a full service advertising agency founded in 1984. The firm specializes in the areas of sports/entertainment and media. Headquartered in Baltimore, the agency also has offices in Tampa and Providence. It operates in 20 US markets. Leffler Agency also has a subsidiary media buying service, Media Moguls, LLC, which specializes in mass retail media buying. The Leffler Agency and Media Moguls, LLC are not affiliates of HGI.

5

Table of Contents

EXECUTIVE OFFICERS

The following sets forth certain information with respect to the executive officers of the Company, as of the date of this Form 10-K/A. All officers of the Company serve at the discretion of the Company’s Board.

| Name |

Age | Position | ||||

| Philip A. Falcone |

50 | Chairman of the Board and Chief Executive Officer | ||||

| Omar M. Asali |

42 | Director and President | ||||

| Thomas A. Williams |

53 | Executive Vice President and Chief Financial Officer | ||||

| David M. Maura |

40 | Director and Managing Director and Executive Vice President of Investments | ||||

| Michael Sena |

39 | Vice President and Chief Accounting Officer | ||||

For information regarding Messrs. Falcone, Asali and Maura, see “Board of Directors” above.

Thomas A. Williams, age 53, has been the Executive Vice President and Chief Financial Officer of HGI since March 2012. Mr. Williams also serves as the Executive Vice President and Chief Financial Officer of Zap.Com, a position he has held since March 2012. Mr. Williams served as President and Chief Executive Officer of RDA Holding Co. (“RDA Holding”) and its subsidiary Reader’s Digest Association, Inc. (“Reader’s Digest”) from April 2011 until September 2011. He was also a member of RDA Holding’s board of directors and its executive committee from May 2011 until September 2011. Previously, Mr. Williams had served as RDA Holding’s and Reader’s Digest’s Chief Financial Officer since February 2009. Before joining RDA Holding and Reader’s Digest, Mr. Williams served as Executive Vice President and Chief Financial Officer for Affinion Group Holdings, Inc. from January 2007 until February 2009. Previously, Mr. Williams spent more than 21 years with AT&T, Inc., where he held a progression of senior financial and officer positions including Chief Financial Officer of AT&T Networks. None of the companies Mr. Williams worked with before joining HGI is an affiliate of HGI.

Michael Sena, age 39, has been the Vice President and Chief Accounting Officer of HGI since November 2012. Mr. Sena is also the Vice President and Chief Accounting Officer of Zap.Com. From January 2009 until November 2012, Mr. Sena held various accounting and financial reporting positions with the Reader’s Digest Association, last serving as Vice President and North American Controller. Before joining the Reader’s Digest Association, Mr. Sena served as Director of Reporting and Business Processes for Barr Pharmaceuticals from July 2007 until January 2009. Prior to that Mr. Sena held various positions with PricewaterhouseCoopers. Mr. Sena is a Certified Public Accountant and holds a B.S. in Accounting from Syracuse University. None of the companies Mr. Sena worked with before joining HGI is an affiliate of HGI.

6

Table of Contents

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”) requires our directors and executive officers, and persons who beneficially own more than 10% of the common stock, par value $0.01 per share, of the Company (the “Common Stock”) and securities convertible into shares of Common Stock (together with the Common Stock, “Subject Shares”), to file with the SEC initial reports of ownership and reports of changes in ownership of Subject Shares. Directors, officers and greater than 10% beneficial owners of the Subject Shares are required by the SEC’s regulations to furnish us with copies of all forms they file with the SEC pursuant to Section 16(a) of the Exchange Act. To our knowledge, based solely upon a review of the copies of such forms furnished to us and written representations that no other reports were required, we believe that, during the fiscal year ended September 30, 2012, all such filings required to be made by such persons were timely made in accordance with the requirements of the Exchange Act.

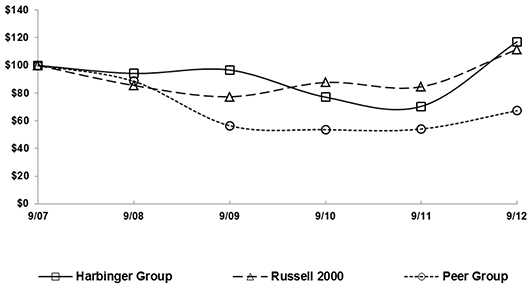

PERFORMANCE GRAPH

Set forth below is a line-graph presentation comparing the cumulative stockholder return on our Common Stock against cumulative total returns of following: (a) the Russell 2000 and (b) a peer group of companies consisting of Leucadia National Corp., Carlisle Companies Inc., Apollo Global Management, LLC and Standex International Corp. The performance graph shows the total return on an investment of $100 for the period beginning September 30, 2007 and ending September 30, 2012. The Company believes that the peer group of companies provides a reasonable basis for comparing total stockholder returns. The stockholder return shown on the graph below is not necessarily indicative of future performance, and we will not make or endorse any predictions as to future stockholder returns. The graph and related data were furnished by Research Data Group, Inc.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Harbinger Group, the Russell 2000 Index, and a Peer Group

| * |

$100 invested on 9/30/07 in stock or index, including reinvestment of dividends. |

|

|

Fiscal year ending September 30. |

7

Table of Contents

CORPORATE GOVERNANCE

Controlled Company

Our Board has determined that HGI is a “controlled company” for the purposes of Section 303A of the New York Stock Exchange Listed Company Manual (the “NYSE Rules”), as the Harbinger Parties control more than 50% of the Company’s voting power. A controlled company may elect not to comply with certain NYSE Rules, including (1) the requirement that a majority of our Board consist of independent directors, (2) the requirement that a nominating/corporate governance committee be in place that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities, and (3) the requirement that a compensation committee be in place that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities. We currently avail ourselves of the “controlled company” exceptions. Our Board has determined that it is appropriate not to have a nominating/corporate governance committee because of our relatively limited number of directors, our limited number of senior executives and our status as a “controlled company” under applicable NYSE rules. In April 2011, our Board formed a compensation committee (the “Compensation Committee”). While our Compensation Committee is composed entirely of independent directors and has a charter addressing the committee’s purpose and responsibilities, we still avail ourselves of the “controlled company” exceptions and are not obligated to comply and may choose to not comply in the future with any of the NYSE rules regarding the composition and governance of compensation committees.

Corporate Governance Guidelines and Code of Ethics and Business Conduct

Our Board has adopted Corporate Governance Guidelines to assist it in the exercise of its responsibilities. These guidelines reflect our Board’s commitment to monitor the effectiveness of policy and decision making both at our Board and management level, with a view to enhancing stockholder value over the long term. The Corporate Governance Guidelines address, among other things, Board composition, director qualifications standards, selection of the Chairman of the Board and the Chief Executive Officer, director responsibilities and the Board committees.

Our Board has adopted a Code of Business Conduct and Ethics for Directors, Officers and Employees and a Code of Ethics for Chief Executive and Senior Financial Officers to provide guidance to all the Company’s directors, officers and employees, including the Company’s principal executive officer, principal accounting officer or controller or persons performing similar functions.

In Fiscal 2013 our Board is expected to adopt an equity retention policy. The Board has adopted a corporate governance policy prohibiting our directors and executive officers from (i) hedging the economic risk associated with the ownership of our common stock, or (ii) pledging our common stock, after the date hereof, unless first pre-approved by the Company’s legal department.

Meetings of Independent Directors

We generally hold executive sessions at each Board and committee meeting. Mr. Hudgins presides over executive sessions of the entire Board and the chairman of each committee presides over the executive session of that committee.

Board Structure and Risk Oversight

Mr. Falcone serves as the Chairman of our Board and our Chief Executive Officer. Mr. Falcone has extensive investment and leadership expertise and is also the Chief Investment Officer and Chief Executive Officer of Harbinger Capital, a fund affiliated with our controlling stockholders. The Board believes that the Company has benefited from this structure and, based upon Mr. Falcone’s extensive investment and leadership expertise, Mr. Falcone’s continuation as our Chairman and Chief Executive Officer is in the best interests of our shareholders.

Our management is responsible for understanding and managing the risks that we face in our business, and our Board is responsible for overseeing management’s overall approach to risk management. Our Board receives reports on the operations of our businesses from members of management and members of management of our subsidiaries as appropriate and discusses related risks. Our Board also fulfills its oversight role through the operations of our Audit Committee and Compensation Committee. As appropriate, these committees of the Board provide periodic reports to our Board on their activities. Our Audit Committee is responsible for oversight of corporate finance and financial reporting related risks, including those related to our accounting, auditing and financial reporting practices. Our Compensation Committee is responsible for the oversight of our compensation policies and practices, including conducting annual risk assessments of our compensation policies and practices.

Governance Documents Availability

We have posted our Corporate Governance Guidelines, Code of Business Conduct and Ethics for Directors, Officers and Employees, Code of Ethics for Chief Executive and Senior Financial Officers, Audit Committee Charter and Compensation Committee Charter on our website under the “Corporate Governance” heading at www.harbingergroupinc.com. We intend to disclose any amendments to, and, if applicable, any waivers of, these governance documents on that section of our website. These governance documents are also available in print without charge to any stockholder of record that makes a written request to the Company. Inquiries must be directed to Harbinger Group Inc., Attn: Investor Relations, 450 Park Avenue, 30th floor, New York, New York 10022.

8

Table of Contents

INFORMATION ABOUT COMMITTEES OF THE BOARD OF DIRECTORS

The Audit Committee and the Compensation Committee are our Board’s only standing committees. In addition, a special committee of our Board functioned in late 2009, throughout 2010, 2011 and 2012 and a Pricing Committee functioned in November 2010 and June 2011. For information regarding our Compensation Committee, see “Corporate Governance – Controlled Company,” above, and “Item 11 – Executive Compensation,” below.

Audit Committee

The Audit Committee currently is composed of Mr. Thomas Hudgins (Chairman), Mr. Lap Wai Chan and Mr. Robert V. Leffler, Jr. Our Board has determined that Messrs. Hudgins and Chan qualify as “audit committee financial experts,” as defined by Item 407(d)(5)(ii) of Regulation S-K. Our Board has determined that Messrs. Hudgins, Chan and Leffler are independent members of this committee under applicable SEC rules, NYSE Rules and the Company’s Corporate Governance Guidelines. The Audit Committee held seven meetings during Fiscal 2012. The Audit Committee operates under, and has the responsibility and authority set forth in, the written charter adopted by our Board, which can be viewed on our website, www.harbingergroupinc.com, under “Corporate Governance.”

Compensation Committee

The Compensation Committee currently is composed of Mr. Robert V. Leffler, Jr. (Chairman), Mr. Lap Wai Chan and Mr. Thomas Hudgins. Our Board has determined that Messrs. Leffler, Chan and Hudgins are independent members of this committee under applicable SEC rules, NYSE Rules and the Company’s Corporate Governance Guidelines. Prior to April 2011, we did not have a compensation committee because of the limited number of our senior executives and our status as a “controlled company” under applicable NYSE Rules. During such time, the entire Board was responsible for determining compensation for our directors and executive officers.

In April 2011, our Board formed our Compensation Committee and adopted our Compensation Committee Charter. While our Compensation Committee is composed entirely of independent directors and has a charter addressing the committee’s purpose and responsibilities, we still avail ourselves of the “controlled company” exceptions and are not obligated to comply and may choose to not comply in the future with any of the NYSE Rules regarding the composition and governance of compensation committees. Our Compensation Committee has been delegated the authority to (i) review and recommend to our Board corporate goals and objectives relevant to our executive officer compensation and recommend to our Board the compensation level of our executive officers; (ii) make recommendations to our Board with respect to executive officer compensation and benefits, including incentive-compensation and equity-based plans for executive officers; (iii) review and recommend to the Board any employment agreements or severance or termination arrangements to be made with any of our executive officers; and (iv) review and discuss with management our compensation discussion and analysis disclosure and compensation committee reports in order to comply with our public reporting requirements. The Compensation Committee held 16 meeting during the year ended September 30, 2012. The Compensation Committee operates under, and has the responsibility and authority set forth in, the written charter adopted by the Board of Directors, which can be viewed on our website, www.harbingergroupinc.com, under “Corporate Governance.”

9

Table of Contents

Item 11. Executive Compensation

COMPENSATION DISCUSSION AND ANALYSIS

This section provides an overview and analysis of our compensation program and policies, the material compensation decisions made under those programs and policies, and the material factors considered in making those decisions. The discussion below is intended to help you understand the detailed information provided in our executive compensation tables and put that information into context within our overall compensation program. The series of tables following this Compensation Discussion and Analysis provides more detailed information concerning compensation earned or paid in Fiscal 2011 for the Company’s directors and earned or paid in Fiscal 2012, Fiscal 2011 and Fiscal 2010 for the following individuals (the “named executive officers” as of September 30, 2012):

| • |

Philip A. Falcone, the Chairman of our Board and our Chief Executive Officer; |

| • |

Omar M. Asali, a Director and our President; |

| • |

Thomas A. Williams, our Executive Vice President and Chief Financial Officer, effective as of March 5, 2012; |

| • |

David M. Maura, our Managing Director and Executive Vice President of Investments; |

| • |

Richard H. Hagerup, our former Interim Chief Accounting Officer who was appointed in December 2010 and ceased to be an officer of the Company effective as of December 1, 2012; and |

| • |

Francis T. McCarron, our former Executive Vice President and Chief Financial Officer, who ceased to be an employee of the Company effective as of April 30, 2012. |

Executive Summary

Fiscal Year 2012 Performance Highlights

During 2012, our underlying financial performance exceeded management and board expectations. Shareholders saw their value of the Company’s common stock appreciate which was driven primarily by the growth in the underlying value of our segments. The following are some the most significant developments in our respective businesses during Fiscal 2012 that contributed to our success:

| • |

Our total revenues of $4,480 million for Fiscal 2012 increased $1,002 million, or 29%, from $3,478 million, for Fiscal 2011, primarily driven by growth in our insurance segment, including the benefit of a full year of operations of HFG, which was acquired in April 2011. |

| • |

We received total dividends of approximately $71 million from operating subsidiaries in Fiscal 2012. In September, Spectrum Brands paid a special one-time dividend of $1.00 per share, of which we received approximately $30 million; HFG paid cumulative dividends of $40 million, and Salus paid an inaugural dividend of approximately $1 million in its first year of operation. |

| • |

For Fiscal 2012, our consumer products segment recorded record net sales of $3,252 million, a $65 million, or 2%, increase from $3,187 million for Fiscal 2011. |

| • |

Our consumer products segment operating income grew by $74 million, or 32%, to $302 million, on higher sales, synergy benefits and cost reduction initiatives. |

| • |

Our insurance segment product sales for Fiscal 2012 were $1,884 million, led by the successful introduction of Prosperity EliteSM which resulted in FGL solidifying a top ten market position in the competitive fixed index annuity marketplace. |

| • |

Our insurance segment had a net US GAAP book value of $1,208 million (including accumulated other comprehensive income (“AOCI”) of $434 million), almost double the book value of $667 million (including AOCI of $159 million) at the end of Fiscal 2011. Net unrealized gains on available for sale investments were $1,058 million on a U.S. GAAP basis ($1,245 million on a statutory basis). |

10

Table of Contents

| • |

Salus, in its first year of operation, originated $260 million of asset-backed loan commitments in Fiscal 2012, for which $181 million of loans were outstanding as of September 30, 2012, and contributed approximately $1 million to our consolidated earnings for Fiscal 2012. |

| • |

Our stock price appreciation of 66% from $5.07 to $8.43 per share during Fiscal 2012. |

| • |

The non-cash accretion rate on our preferred stock decreased from 2% for the third and fourth fiscal quarters to 0% commencing in the first quarter of fiscal 2013 due to a 163% increase in the Company’s net asset value since the issuance of our preferred stock in May 2011 as calculated in accordance with the terms of its certificates of designation. |

| • |

We ended the year with corporate cash and short-term investments of approximately $433 million, which supports our business strategy and growth of existing businesses. |

The foregoing is a highlight summary of certain of HGI’s performance measures. For a more complete understanding and evaluation of the business of the Company and its subsidiaries, you are encouraged to read the Company’s other reports filed with the SEC.

Summary of Sound Governance Features of our Compensation Programs

Our compensation programs, practices, and policies are reviewed and re-evaluated on an ongoing basis, and are subject to change from time to time. Our executive compensation philosophy is focused on pay for performance and is designed to reflect appropriate governance practices aligned with the needs of our business. Listed below are some of the Company’s more significant practices and policies, in effect during Fiscal 2012, adopted to drive performance and to align with stockholder interests.

What We Do

| • |

Pay for Performance Philosophy: Our executive compensation programs are designed to pay for performance, with a significant portion of executive compensation not guaranteed. Target compensation is established for our executive officers at the beginning of the performance period by the Compensation Committee. Our named executive officers (excluding Mr. Falcone, who did not receive compensation from the Company in Fiscal 2012, and Messrs. Hagerup and McCarron, who were employed on an interim or transition basis) had an opportunity to earn actual compensation that varied from target, based on achievement against pre-established performance targets. Variable compensation rewards performance and contribution to both short-term and long-term corporate financial performance. For Fiscal 2012, variable pay represented 98%, 95% and 97% of total compensation for Messrs. Asali, Williams and Maura, respectively (not including their one-time initial long term equity grants which are subject to vesting as set forth below), each of whom participated in our 2012 bonus program. It is anticipated that future named executive officers, including Mr. Sena who was hired as our Vice President and Chief Accounting Officer in November 2012, will participate in the annual bonus program with variable pay constituting a significant percentage of their target total compensation. |

| • |

Independent Executive Compensation Consultant: The Compensation Committee works with independent executive compensation consultants which provide no other services to the Company and independent outside counsel. |

| • |

Mitigation of Undue Risk: Our compensation plans have provisions to mitigate undue risk, including bonus plan mechanisms that defer significant portions of awards, partially subject to forfeiture (see Clawback Policy), and relate future target performance to past performance in a manner that closely ties awards to sustainable performance over time. |

| • |

Postemployment Restrictive Covenants: Our employment agreements provide for post employment noncompetition, nonsolicitation and nondisparagement provisions. |

11

Table of Contents

| • |

Clawback Policy: Our equity awards allow the Company to recover payouts in the event that recoupment is required by applicable law (including pursuant to the Sarbanes-Oxley Act and the Dodd-Frank Act) or a participant receives for any reason any amount in excess of what should have been received (including, without limitation, by reason of a financial restatement, mistake in calculations or other administrative error). In addition, our annual bonus program provides for an automatic deferral of payouts in excess of two times the target bonus pool, with cash deferrals subject to reduction if the Company does not meet certain specified performance criteria in subsequent years. |

| • |

Negative Discretion: Our Compensation Committee reserves the right to exercise negative discretion to reduce awards under the annual bonus plan. In Fiscal 2012, the Compensation Committee exercised its negative discretion and reduced the corporate bonus pool by $20.6 million. |

| • |

Award Caps: Amounts that can be earned by any individual under the annual bonus program are capped at $20 million per year. |

| • |

Equity Retention: Our Board is expected to adopt an equity retention policy during Fiscal 2013. |

What We Don’t Do

| • |

No 280G or Section 409A Excise Tax Gross-Ups: We do not provide “gross-ups” for any taxes imposed with respect to Section 280G (change of control) or Section 409A (nonqualified deferred compensation) of the Internal Revenue Code. |

| • |

No Pensions or Supplemental Pensions: Our named executive officers are not provided with pension or supplemental executive retirement plans. |

| • |

No Significant Perquisites: The benefits our named executive officers receive in the form of health and life insurance and Company matching contributions to the 401(k) Plan are the same benefits generally available to all of our employees. |

| • |

No Change in Control Enhanced Payments or Equity Acceleration: We do not provide “single-trigger” equity vesting or enhanced payments upon a change of control of the Company. |

| • |

No Repricing of Underwater Stock Options without Shareholder Approval: We do not lower the exercise price of any outstanding stock options, unless shareholders approve this. |

| • |

No Discount Stock Options: The exercise price of our stock options is not less than 100% of the fair market value of our common stock on the date of grant. |

| • |

No Unauthorized Hedging/Pledging: The Board has adopted a corporate governance policy prohibiting our directors and executive officers from (i) hedging the economic risk associated with the ownership of our common stock and (ii) pledging our common stock, after the date hereof, unless first pre-approved by the Company’s legal department. |

12

Table of Contents

Compensation Philosophy and General Objectives

Our executive compensation philosophy is focused on pay for performance and is designed to reflect appropriate governance practices aligned with the needs of our business. We grant target levels of compensation that are designed to attract and retain employees who are able to meaningfully contribute to our success. The Compensation Committee considers several factors in designing target levels of compensation, including, but not limited to, historical levels of pay for each executive, actual turnover in the executive ranks, market data on the compensation of executive officers at similar companies, and its judgment about retention risk with regards to each executive relative to their importance to the Company. In reviewing market data, the Compensation Committee has looked at total compensation for each executive officer relative to executives in the same or similar positions in an appropriate market comparison group, which includes sixteen other business development or private equity companies, adjusting the total compensation observed at these peers for their size relative to the Company. The sixteen companies are American Capital, Ltd, Apollo Global Mgmt., Blackstone Group LP, Capital Southwest Corp, Carlyle Group, Compass Diversified Holdings, Harris & Harris Group, Hercules Tech Growth Cap, Icahn Enterprises, KKR, Kohlberg Capital Corp, Leucadia National Corp, Main Street Capital Corp, Mcg Capital Corp, Safeguard Scientifics Inc., and Triangle Capital Corp. While median, size-adjusted total compensation is initially presumed to be competitive market pay, the Compensation Committee does not attempt to target a specific percentile within a peer group or otherwise rely exclusively on that data to determine named executive officer compensation. The Compensation Committee does not use market data to target specific components of total compensation, such as salary or bonuses, and instead determines the target total level of compensation necessary to be competitive for each executive in the relevant market for that executive’s talent.

The Company’s mix of fixed versus variable compensation, within the target total level of pay, is driven by the Company’s emphasis on pay for performance. The Company uses variable compensation, including performance equity grants, as well as management’s accumulated equity holdings, both vested and unvested, to enhance alignment of our named executive officers’ and stockholders’ interests.

Components of Executive Compensation

Our compensation program has four basic elements: salary, initial equity grants, incentive compensation, and other benefits. Salary and benefits are designed to aid in the retention of our employees. Initial equity grants are generally, though not necessarily, awarded upon hiring or promotion, and may consist of restricted stock or stock options with vesting over a period of several years. Incentive compensation generally consists of bonuses for individual and company performance, and may be awarded as cash or equity. Equity awards will typically be vested over a period of years to enhance both retention and alignment of interests.

13

Table of Contents

We believe that the various components of our executive compensation program are effective in attracting and retaining our employees and providing a strong alignment of their interests with those of our stockholders. Although each element of compensation described below is considered separately, our Compensation Committee takes into account the aggregate compensation package for each individual executive officer in its determination of each individual component of that package.

During Fiscal 2012, Mr. Falcone did not receive compensation from the Company for his services. Due to the interim nature of his position, Mr. Hagerup received only a base salary as compensation as well as a discretionary $50,000 cash bonus for Fiscal 2012. In addition, because Mr. McCarron was providing transition services during Fiscal 2012, he received only a base salary and limited perquisites and benefits, and did not participate in our annual bonus plan or receive any equity grants.

The principal elements of compensation for our other named executive officers in Fiscal 2012, Messrs. Asali, Williams and Maura, were:

| • |

base salary; |

| • |

variable compensation potential consisting of cash and equity payouts; |

| • |

an initial long-term equity grant consisting of a stock option and restricted stock award; and |

| • |

limited benefits. |

How We Chose Amounts for Each Element of Compensation

Role of Compensation Committee and Compensation Consultants

The Compensation Committee is responsible for the executive compensation program design and decision-making process. In approving the compensation structure for Fiscal 2012, our Compensation Committee considered a number of factors including, but not limited to, the responsibilities of the position, the executives’ experience and the competitive marketplace for executive talent with a similar skill set. The Compensation Committee does not target any particular percentile of peers or seek to implement particular practices with respect to companies with which it competes for talent, but uses that information to inform its judgment about appropriate compensation programs for the company. See “Compensation Philosophy and General Objectives” above.

Since July 2011 and through the date of this Form 10-K/A, the Compensation Committee has been advised by independent compensation consultants, Hodak Value Advisors (“Hodak”), a consulting and research firm specializing in designing and implementing performance measures and management incentives, and Mercer, Inc. (“Mercer”), a global leader for human resources, in its review of the Company’s compensation elements, levels of pay and potential programs for short and long term compensation and by independent outside counsel, Wilmer Cutler Pickering Hale and Dorr LLP. Throughout Fiscal 2012, Mercer, Hodak and the Compensation Committee’s independent counsel worked in conjunction with one another and the Compensation Committee to design and implement the Company’s compensation program in a manner that strongly aligns compensation with performance for the creation of value for all of our stockholders. The Compensation Committee met 16 times during Fiscal 2012, and in December 2011, the Compensation Committee and the Board approved and adopted a new bonus plan for Fiscal 2012, which was designed with significant input from Hodak and Mercer and legal advice from the Compensation Committee’s independent outside counsel.

In light of new SEC rules and proposed NYSE listing standards, the Compensation Committee considered the independence of each of our compensation consultants, Hodak and Mercer, including assessment of the following factors: (1) other services provided to the Company by the consultant; (2) fees paid as a percentage of the consulting firm’s total revenue; (3) policies or procedures maintained by the consulting firm that are designed to prevent a conflict of interest; (4) any business or personal relationships between the individual consultants involved in the engagement and a member of the Compensation Committee; (5) any Company stock owned by the individual consultants involved in the engagement; and (6) any business or personal relationships between our executive officers and the consulting firm or the individual consultants involved in the engagement. The Compensation Committee has concluded that no conflict of interest exists that would prevent our consultants from independently representing the Compensation Committee.

14

Table of Contents

Base Salary

The base salary of our named executive officers is intended to provide a baseline level of fixed compensation that reflects each named executive officer’s level of responsibility. In reviewing base salary levels for our named executive officers, the Compensation Committee assesses, among other factors, a named executive officer’s current base salary, job responsibilities, leadership and experience, and value to our Company.

During Fiscal 2012, the Company entered into an employment agreement with each of Messrs. Asali, Williams, and Maura, which provide for a fixed base salary. The base salary levels were negotiated in connection with Messrs. Asali, Williams, and Maura joining the Company and were approved by our Compensation Committee.

Mr. Hagerup’s compensation was negotiated in December 2010 and June 2011 by the Chief Financial Officer and approved by our Chief Executive Officer and our Board. In July 2012 his temporary employment arrangement as our Interim Chief Accounting Officer was extended on the same terms and conditions until December 1, 2012. Mr. McCarron’s compensation was negotiated in late 2009 by representatives of Harbinger Capital, and was approved by our Board.

Annual Bonus Plan

In December 2011, the Compensation Committee and the Board approved and adopted a new bonus plan for Fiscal 2012 (the “2012 Bonus Plan”). The 2012 Bonus Plan was designed with significant input from the Compensation Committee’s independent compensation consultants, Hodak and Mercer, and legal advice from the Compensation Committee’s independent outside counsel. In connection with the review and approval of the 2012 Bonus Plan, Hodak, among other things, modeled for the Compensation Committee various possible payout scenarios under the 2012 Bonus Plan. Messrs. Asali, Williams and Maura participated in the 2012 Bonus Plan along with other key employees of the Company.

The 2012 Bonus Plan is designed to (i) offer target variable compensation that provide competitive levels of total pay to executives if they achieve target results and (ii) reward and encourage value creation by executives. It provides for annual bonuses comprised of two components. The first component is an individual bonus (the “individual bonus”) based on the achievement of personal performance goals. The second component is a corporate bonus (the “corporate bonus”) based on the achievement of corporate performance measured in terms of the change in the value of the Company’s “Net Asset Value” (as defined below) from the beginning of the Company’s fiscal year to the end of the Company’s fiscal year end (“NAV Return”). Please see the discussion below for additional details for the calculation of the NAV Return.

NAV Return is believed to be a good proxy for creation of value for the Company and its stockholders because it encourages, among other things, the generation of cash flows by the Company’s subsidiaries and transactions resulting in appreciation of the assets of the Company and its subsidiaries. Corporate bonuses are awarded annually with a portion immediately vested and a portion subject to vesting over a number of years. A portion of the unvested amounts are subject to forfeiture if the NAV Return thresholds are not satisfied in the following years. We believe that paying the corporate bonus consistently based on NAV Return, subject to vesting over a number of years, encourages a long-term focus on value creation for the benefit of our stockholders. Our Compensation Committee believes that executive pay should be strongly aligned with performance of our executives. If in Fiscal 2012, the Company had not produced a positive NAV Return, no corporate bonuses would be earned.

For Fiscal 2012, NAV Return was based on the amount calculated by (i) obtaining the percentage increase (to the extent any) of the Net Asset Value of the Company from the beginning of Fiscal 2012 to the end of Fiscal 2012; and then (ii) multiplying such amount by the Net Asset Value at the beginning of Fiscal 2012. The amount resulting from such calculation is the NAV Return for Fiscal 2012, from which 12% was allocated to fund the corporate bonus pool for bonuses to all named executive officers and other key employees, which amount was reduced (as discussed in greater detail below) by the Compensation Committee pursuant to its exercise of its negative discretion.

15

Table of Contents

For the purpose of the foregoing calculation, the Company’s “Net Asset Value” is generally calculated by (i) starting with the value of the Company’s “Net Asset Value”, as such term is defined in the Company’s Certificate of Designation of Series A Participating Convertible Preferred Stock of the Company dated as of May 12, 2011 (the “Preferred Stock Certificate”), (ii) then subtracting from such amount the Company’s deferred tax liabilities, (iii) then adding to such amount the Company’s capital contributions to fund start-up businesses, which is subject to a $20 million cap, (iii) then adding to such amount the Company’s deferred financing costs, (iv) then adding to such amount the value of the Company’s assets that have not been appraised, which is subject to a $50 million cap, (v) then eliminating the effect of any increase in legacy liabilities associated with our predecessor entity, Zapata Corporation and its subsidiaries, (vi) then adding to such amount expenses incurred in connection with completing any acquisitions by the Company within the past twelve months, and (vii) excluding any accretion on preferred stock (calculated in the manner contained in the Preferred Stock Certificate). The Company then makes adjustments to eliminate the effects of any conversion of preferred stock into common stock.

The Company achieved a NAV Return of $589.0 million during Fiscal 2012. Pursuant to the 2012 Bonus Plan, 12% of the Fiscal 2012 NAV Return, or $70.7 million, was allocated to fund the corporate bonus pool for bonuses to all named executive officers and other key employees. However, after reviewing the outstanding performance for Fiscal 2012, the Compensation Committee exercised its negative discretion and reduced the corporate bonus pool of $70.7 million by $20.6 million. Once the corporate bonus pool was funded at the end of Fiscal 2012, it was distributed based upon each plan participant’s contribution to the corporate bonus pool, less any adjustments to those amounts for particular executives at the discretion of the Compensation Committee. The Compensation Committee did not make any adjustments to the corporate bonus award for any named executive officer in Fiscal 2012.

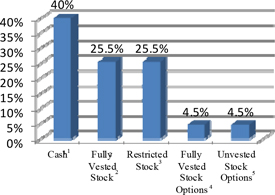

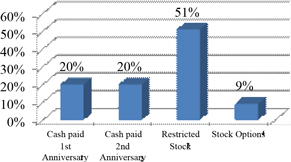

Pursuant to the 2012 Bonus Plan, awards are paid out in a mix of cash (40%) and equity (60%). In addition, the 2012 Bonus Plan was designed so that no more than two times the target corporate bonus pool can be awarded in Fiscal 2013, and amounts in excess of two times the target corporate bonus pool are deferred to subsequent years, in each case, in the proportions as set forth in the charts below. Deferred cash payments may be reduced in subsequent years, if the NAV Return in such years is below a threshold return.

The Net Asset Value at the end of Fiscal 2012 will differ from the Net Asset Value at the beginning of Fiscal 2013, as the Net Asset Value for Fiscal 2013 will be adjusted to reflect the value of the Compensation Committee’s exercise of negative discretion in reducing the Fiscal 2012 corporate bonus pool by $20.6 million. For Fiscal 2013, the Company will also introduce a 7% threshold amount with respect to the corporate bonus pool, which will be a threshold of $96.6 million (the “Threshold Amount”). Accordingly, for Fiscal 2013, the corporate bonus pool will be funded by 12 percent of the portion of the NAV Return (calculated in accordance with the steps outlined above) in excess of the Threshold Amount and will be adjusted to take into account any issuance of Common Stock by the Company (if any). If in Fiscal 2013 the NAV Return does not exceed the Threshold Amount, then no corporate bonus will be earned. For example, if the NAV Return is $80 million in Fiscal 2013 then no corporate bonus will be paid in such year since such amount is less than the Threshold Amount of $96.6 million.

16

Table of Contents

| Up to two times the target corporate bonus pool could be paid

|

Amounts in excess of two times the corporate bonus pool could be paid out in in the following proportion:

| |

|

|

| |

| 1. Cash 2. Fully Vested Stock 3. Restricted stock (subject to continued employment) vests on the first anniversary of the grant date. 4. Fully vested stock options. 5. Stock options (subject to continued employment) vest on the first anniversary of the grant. |

1. Cash paid on the first anniversary of the original payment date. 2. Cash paid on the second anniversary of the original payment date. 3. Restricted stock (subject to continued employment) vests in substantially equal installments on the second and third anniversaries of the grant date. 4. Stock options (subject to continued employment) vest in substantially equal installments on the second and third anniversaries of the grant date. | |

As stated above, a portion of the annual bonus, the individual bonus, is based on individual performance achievement against certain pre-established goals. For Messrs. Asali and Maura, 85% of their target annual bonus is the corporate bonus (based on NAV Return) and 15% is the individual bonus based on performance of individual goals, and for Mr. Williams, 50% of his target annual bonus consists of the corporate bonus and 50% is the individual bonus. The performance goals for the individual bonus are determined by the Compensation Committee on an individual basis. Participants earn between 0-200% of their individual target bonus based on achievement of the individual performance goals and the individual bonus can be earned even if there is no positive NAV Return during Fiscal 2012. Participants earned 200% of their individual target bonuses based on achievement of their individual performance goals during Fiscal 2012.

For Fiscal 2012, the Compensation Committee established solely objective performance goals for Mr. Asali’s individual bonus, which were (i) receipt of $40 million of dividends by the Company from its subsidiaries, (ii) the Company’s compliance with all Debt Covenants and (iii) the improvement of the Company’s credit rating by one notch. For Fiscal 2012, Mr. Asali’s total target bonus was $2.5 million. The Compensation Committee determined that Mr. Asali achieved or exceeded each of his individual performance measures. Accordingly, for Fiscal 2012, the Compensation Committee awarded Mr. Asali an individual bonus and corporate bonus in excess of his target amounts, which were comprised of immediately vested and deferred cash and equity. See “Compensation and Benefits – Summary Compensation Table” and “Significant Events after Fiscal 2012 – Equity Grants Pursuant to the 2012 Bonus Plan” for details regarding the amount of Mr. Asali’s individual bonus and corporate bonus and its allocation among immediately vested and deferred cash and equity.

17

Table of Contents

For Fiscal 2012, the Compensation Committee established a mix of objective and subjective performance goals for Mr. Williams’ individual bonus, which were (i) receipt of $40 million of dividends by the Company from its subsidiaries, (ii) the Company’s compliance with all Debt Covenants, (iii) the timely and accurate completion of all external financial reporting, (iv) meeting individual priorities as determined by the President, Chief Executive Officer or the Audit Committee, and (v) fostering growth and teamwork. For Fiscal 2012, Mr. Williams’s total target bonus was $1 million, equally divided between the individual bonus and the corporate bonus. The Compensation Committee determined that Mr. Williams achieved or exceeded each of his individual performance measures. Accordingly, for Fiscal 2012, the Compensation Committee awarded Mr. Williams an individual bonus and corporate bonus in excess of his target amounts, which were comprised of immediately vested and deferred cash and equity. See “Compensation and Benefits – Summary Compensation Table” and “Significant Events after Fiscal 2012 – Equity Grants Pursuant to the 2012 Bonus Plan” for details regarding the amount of Mr. Williams’ individual bonus and corporate bonus and its allocation among immediately vested and deferred cash and equity. While Mr. Williams’ employment agreement provides that his bonus with respect to Fiscal 2012 would be prorated based on his commencement of employment with the Company on March 5, 2012, in light of our strong corporate financial results and Mr. Williams’ extraordinary individual performance during Fiscal 2012, the Compensation Committee determined not to pro-rate his individual bonus, but did pro-rate his corporate bonus.

For Fiscal 2012, the Compensation Committee established solely objective performance goals for Mr. Maura’s individual bonus, which were (i) Spectrum Brands’ achievement of $475 million of adjusted EBITDA (as defined below) and (ii) Spectrum Brands’ achievement of $200 million of adjusted free cash flow. For the purposes of Mr. Maura’s performance measure, “adjusted EBITDA” was defined as reported operating income plus certain defined add-backs for depreciation, amortization, acquisition, integration and restructuring related charges. For Fiscal 2012, Mr. Maura’s total target bonus was $2 million. The Compensation Committee determined that Mr. Maura achieved or exceeded each of his individual performance measures. Accordingly, for Fiscal 2012, the Compensation Committee awarded Mr. Maura an individual bonus and corporate bonus in excess of his target amounts, which were comprised of immediately vested and deferred cash and equity. See “Compensation and Benefits – Summary Compensation Table” and “Significant Events after Fiscal 2012 – Equity Grants Pursuant to the 2012 Bonus Plan” for details regarding the amount of Mr. Maura’s individual bonus and corporate bonus and its allocation among immediately vested and deferred cash and equity.

The 2012 Bonus Plan provides a strong incentive for participants to increase NAV Return, and the amounts of bonus payments can be significantly in excess of target in years in which NAV Return is very large. However, the maximum bonus payment to any individual under the 2012 Bonus Plan with respect to any year is capped at $20 million. Cash amounts payable pursuant to the 2012 Bonus Plan, are included in the column titled “Non-Equity Incentive Plan Compensation” in the Summary Compensation Table. The SEC disclosure rules require that the Summary Compensation Table and the Grants of Plan-Based Awards Table include in each fiscal year the aggregate fair value, as of the grant date, of all stock, option or other equity awards granted during that year. In November 2012, subsequent to the end of our Fiscal 2012, we granted equity to our named executive officers as part of their 2012 compensation, which was earned pursuant to the 2012 Bonus Plan. The awards made in November 2012 are disclosed in this report under the heading “Significant Events after Fiscal 2012 – Equity Grants Pursuant to the 2012 Bonus Plan” and will be disclosed and appear in the Summary Compensation Table and the Grants of Plan-Based Awards Table in next year’s Compensation Discussion and Analysis in accordance with SEC rules for our named executive officers in Fiscal 2013.

Initial Long Term Equity Grant

Our philosophy is that service-based equity is granted to named executive officers when the Compensation Committee determines that it would be to the advantage and in the best interests of the Company and its stockholders to grant such equity as an inducement to enter into or remain in the employ of the Company and as an incentive for increased efforts during such employment. In accordance with the execution of their employment agreements, Messrs. Asali, Williams and Maura each received a one-time initial grant of shares of restricted stock and nonqualified stock options in Fiscal 2012, pursuant to the Harbinger Group Inc. 2011 Omnibus Equity Award Plan (the “2011 Plan”). The number of equity awards granted was determined pursuant to the employment agreements with such named executive officers.

On February 14, 2012, Messrs. Asali and Maura were granted 350,000 and 250,000 shares of restricted stock, respectively, and nonqualified stock options to purchase 1,000,000 and 710,000 shares of our common stock, respectively. Subject to their continued employment, the restricted stock will vest on October 1, 2014 and the option awards will vest 25% per year on the first, second, third and fourth anniversaries of October 1, 2011.

On May 14, 2012, Mr. Williams was granted 50,000 shares of restricted stock and nonqualified stock options to purchase 140,000 shares of our common stock. Subject to his continued employment, Mr. Williams’ restricted stock will vest on March 5, 2015 and his option awards will vest 25% per year on the first, second, third and fourth anniversaries of March 5, 2012.

Benefits

During Fiscal 2012, Messrs. Falcone and Hagerup did not participate in our benefit plans. We provided our other named executive officers with standard medical, dental, vision, disability and life insurance benefits available to employees generally.

We sponsor a 401(k) Retirement Savings Plan (the “401(k) Plan”) in which eligible participants may defer a fixed amount or a

18

Table of Contents

percentage of their eligible compensation, subject to limitations. In Fiscal 2012 we made discretionary matching contributions of up to 4% of eligible compensation.

Risk Review

Our Compensation Committee has generally reviewed, analyzed and discussed our executive compensation. Our Compensation Committee does not believe that any aspect of our executive compensation encourages the named executive officers to take unnecessary or excessive risks.

Compensation in Connection with Termination of Employment and Change-In-Control

In determining our employees’ compensation packages for Fiscal 2012, our Compensation Committee recognized that an appropriate incentive in attracting talent is to provide reasonable protection against loss of income in the event the employment relationship terminates without fault of the employee. Thus, compensation practices in connection with termination of employment generally have been designed as our Compensation Committee deems appropriate to achieve our goal of attracting highly qualified executive talent. Messrs. Asali, Williams and Maura have employment agreements which provide for termination compensation in the form of payment of bonuses and salary and benefit continuation for a moderate period of time following involuntary termination of employment. We do not provide any “golden parachute” tax gross-ups to any named executive officer. We also do not provide any “single-trigger” payments due to the occurrence of a change of control to any of our named executive officers.

You can find additional information regarding our practices in providing compensation in connection with termination of employment to our named executive officers under the heading “Payments Upon Termination and Change of Control” below.

Impact of Tax Considerations

With respect to taxes, Section 162(m) of the Internal Revenue Code imposes a $1 million limit on the deduction that a company may claim in any tax year with respect to compensation paid to each of its Chief Executive Officer and three other named executive officers (other than the Chief Financial Officer), unless certain conditions are satisfied. Certain types of performance-based compensation are generally exempted from the $1 million limit. Performance-based compensation can include income from stock options, performance-based restricted stock, and certain formula driven compensation that meets the requirements of Section 162(m). One of the factors that we may consider in structuring the compensation for our named executive officers is the deductibility of such compensation under Section 162(m), to the extent applicable. However, this is not the driving or most influential factor. The Compensation Committee may approve non-deductible compensation arrangements after taking into account several factors, including our ability to utilize deductions based on projected taxable income, and specifically reserves the right to do so.

Advisory Vote on Executive Compensation

The Compensation Committee and our Board considered the results of our stockholder vote regarding the non-binding resolution on executive compensation presented at the 2011 Annual Meeting, where 97.31% of votes cast approved the compensation program described in the Company’s proxy statement for the 2011 Annual Meeting. The Compensation Committee and the Board have maintained the same general compensation philosophy but have implemented new compensation plans, including the 2012 Bonus Plan commensurate with the expansion of our roster of executives.

Additionally at the 2011 Annual Meeting, a majority of our stockholders approved, as recommended by our Board, a proposal for our stockholders to be provided with a non-binding advisory vote on compensation of our named executive officers every three years. The Board believed that this frequency is appropriate as a triennial vote would provide the Company with sufficient time to engage with stockholders to understand and respond to the “say-on-pay” vote results. Stockholders who have concerns about executive compensation during the interval between “say-on-pay” votes are encouraged to bring their specific concerns to the attention of our Board. Accordingly, the next stockholder advisory (non-binding) vote on executive compensation will be held at our 2014 Annual Meeting.

Significant Events after Fiscal 2012

In addition to the preceding discussion relating to Fiscal 2012, this section will provide you with a brief review of certain significant events that have occurred since the end of Fiscal 2012. This section, however, is not a summary of all of the compensation decisions made with respect to Fiscal 2013 regarding our named executive officers for Fiscal 2013.

Employment Agreement with Mr. Sena

On November 1, 2012, the Company entered into an employment agreement with Mr. Sena as its Vice President and Chief Accounting Officer, effective as of November 19, 2012. Mr. Sena’s annual base salary will initially be $250,000. Within 150 days following November 19, 2012, Mr. Sena shall be paid a one-time signing bonus of $100,000 and will be granted an initial equity grant of 10,000 shares of restricted stock and nonqualified stock options to purchase 30,000 shares of the Company’s common stock. The restricted

19

Table of Contents

stock will vest and the restrictions will lapse on the third anniversary of November 19, 2012 and the option awards will vest in equal installments on each of the first four anniversaries of November 19, 2012. Mr. Sena will also be eligible for an annual bonus. The employment agreement provides that Mr. Sena’s employment with the Company is at-will and his employment thereunder may be terminated at any time with or without notice. If Mr. Sena’s employment is terminated by the Company with “Cause” (as defined in his agreement) or Mr. Sena resigns without “Good Reason” (as defined in his agreement) prior to the one year anniversary of November 19, 2012, Mr. Sena shall be required to repay the signing bonus.

If during the term of the employment agreement, the Company terminates Mr. Sena’s employment without “Cause” or if Mr. Sena resigns his employment for “Good Reason”, then, subject to receiving a signed separation agreement and general release of claims from Mr. Sena, the Company shall pay or provide Mr. Sena with (i) severance equal to six months base salary in accordance with the terms of the Company’s then current severance plan, and (ii) the initial equity grant shall vest on a pro-rata basis based on the length of time elapsed (calculated as if Mr. Sena worked for an additional six months after the date of termination), (iii) payment of any non-deferred portion of the annual bonus for the prior year which was earned but unpaid, and (iv) eligibility for an annual bonus for the year of termination determined in accordance with the employment agreement. In addition, the Company shall pay Mr. Sena any accrued but unpaid base salary and vacation time and any properly incurred but unreimbursed business expenses. Mr. Sena is also subject to certain non-competition restrictions for six (6) months post termination of employment and certain non-solicitation restrictions for eighteen (18) months post termination of employment, as well as perpetual confidentiality provisions. Mr. Sena is subject to a perpetual non-disparagement covenant and subject to Mr. Sena signing a release of claims, the non-disparagement covenant will be mutual. Mr. Sena’s employment agreement was approved by the Board following its approval and recommendation by the Compensation Committee, who were advised by the Company’s compensation consultants. We may enter into other compensation arrangements (such as salary, bonus and retention arrangements, if any) with existing and future officers and employees depending on the circumstances and relevant factors. In connection with the hiring of Mr. Sena, Mr. Hagerup’s employment as our Interim Chief Accounting Officer terminated on December 1, 2012, and thereafter he provided us with transitional services and may provide additional future services to the Company on a project by project consulting basis.

Equity Grants Pursuant to the 2012 Bonus Plan

As discussed above in the section titled “Annual Bonus Plan”, the equity portion payable pursuant to the 2012 Bonus Plan was awarded in November 2012, after the Compensation Committee certified the Fiscal 2012 performance results.

On November 29, 2012, Mr. Asali was granted (i) $1,267,563, in the form of 148,775 fully vested shares of our common stock, (ii) $8,787,997, in the form of 1,031,455 shares of restricted stock which vests as follows: 148,775 on November 29, 2013, 441,340 on November 29, 2014, and 441,340 on November 29, 2015 and (iii) $1,839,364, in the form of nonqualified stock options to purchase 544,900 shares of our common stock which vests as follows: 71,068 were vested on the date of grant, 71,068 on November 29, 2013, 201,383 on November 29, 2014 and 201,383 on November 29, 2015.

On November 29, 2012, Mr. Williams was granted (i) $507,025, in the form of 59,510 fully vested shares of our common stock, (ii) $1,327,978, in the form of 155,866 shares of restricted stock which vests as follows: 59,510 on November 29, 2013, 48,178 on November 29, 2014, and 48,178 on November 29, 2015 and (iii) $331,177, in the form of nonqualified stock options to purchase 100,821 shares of our common stock which vests as follows: 28,427 were vested on the date of grant, 28,427 on November 29, 2013, 21,984 on November 29, 2014 and 21,984 on November 29, 2015.

On November 29, 2012, Mr. Maura was granted (i) $1,014,050, in the form of 119,020 fully vested shares of our common stock, (ii) $7,030,397, in the form of 825,164 shares of restricted stock which vests as follows: 119,020 on November 29, 2013, 353,072 on November 29, 2014, and 353,072 on November 29, 2015 and (iii) $1,471,492, in the form of nonqualified stock options to purchase 435,920 shares of our common stock which vests as follows: 56,854 were vested on the date of grant, 56,854 on November 29, 2013, 161,106 on November 29, 2014 and 161,106 on November 29, 2015.

These equity grants do not appear in this year’s Summary Compensation Table and the Grants of Plan-Based Awards Table, but will appear in the tables next year as 2013 awards, in accordance with SEC rules for our named executive officers in Fiscal 2013.

20

Table of Contents

COMPENSATION AND BENEFITS

Summary Compensation Table

The following table discloses compensation for Fiscal 2012, Fiscal 2011 and Fiscal 2010 received by Messrs. Falcone, Asali, Williams, Maura, Hagerup and McCarron, each of whom was a “named executive officer” during Fiscal 2012. As disclosed in greater detail elsewhere in this Form 10-K/A, Mr. Hagerup, our Interim Chief Accounting Officer, ceased to be an officer of the Company effective as of December 1, 2012, McCarron, our former Executive Vice President and Chief Financial Officer, ceased to be an employee of the Company effective as of April 30, 2012 and Mr. Williams became our Executive Vice President and Chief Financial Officer effective as of March 5, 2012.

| Name and Principal Position |

Year | Salary ($) | Bonus ($) | Stock Awards ($)(5) |

Option Awards ($)(5) |

Non-Equity Incentive Plan Compensation ($)(6) |

All Other Compensation ($) |

Total ($) | ||||||||||||||||||||||||

| Philip A. Falcone, |

2012 | — | — | — | — | — | — | — | ||||||||||||||||||||||||

| Chairman of the Board and Chief |