Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - POPULAR, INC. | d472057d8k.htm |

Financial

Results Financial Results

Fourth Quarter 2012

Fourth Quarter 2012

Exhibit 99.1 |

The

information

contained

in

this

presentation

includes

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

forward-looking

statements

are

based

on

management’s

current

expectations

and

involve

risks

and

uncertainties

that

may

cause

the

Company's

actual

results

to

differ

materially

from

any

future

results

expressed

or

implied

by

such

forward-looking

statements.

Factors

that

may

cause

such

a

difference

include,

but

are

not

limited

to

(i)

the

rate

of

growth

in

the

economy

and

employment

levels,

as

well

as

general

business

and

economic

conditions;

(ii)

changes

in

interest

rates,

as

well

as

the

magnitude

of

such

changes;

(iii)

the

fiscal

and

monetary

policies

of

the

federal

government

and

its

agencies;

(iv)

changes

in

federal

bank

regulatory

and

supervisory

policies,

including

required

levels

of

capital;

(v)

the

relative

strength

or

weakness

of

the

consumer

and

commercial

credit

sectors

and

of

the

real

estate

markets

in

Puerto

Rico

and

the

other

markets

in

which

borrowers

are

located;

(vi)

the

performance

of

the

stock

and

bond

markets;

(vii)

competition

in

the

financial

services

industry;

(viii)

possible

legislative,

tax

or

regulatory

changes;

(ix)

the

impact

of

the

Dodd-Frank

Act

on

our

businesses,

business

practice

and

cost

of

operations;

and

(x)

additional

Federal

Deposit

Insurance

Corporation

assessments.

Other

than

to

the

extent

required

by

applicable

law,

the

Company

undertakes

no

obligation

to

publicly

update

or

revise

any

forward-looking

statement.

Please

refer

to

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2011

and

other

SEC

reports

for

a

discussion

of

those

factors

that

could

impact

our

future

results.

The

financial

information

included

in

this

presentation

for

the

quarter

ended

December

31,

2012

is

based

on

preliminary

unaudited

data

and

is

subject

to

change.

1

Forward Looking Statements |

Highlights

•

Non performing loans held in portfolio declined by $125 million QoQ and down

$313 million YoY

•

Commercial,

construction

and

legacy

NPL

inflows

decreased

by

$73

million,

or

51%

QoQ, $402 million YoY ; lowest level in three years

•

Strong capital ratios: Common Equity Tier One ratio at 13.18%; excess of $1.9 billion

over well capitalized threshold

•

Well positioned to exceed proposed Basel III capital requirements

•

Tangible Book Value/Share $32.55 and $28.32 (ex TARP discount)

•

$24 million cash dividend from EVERTEC; 48.5% stake carried at $74 million

•

Improved performance from covered loan portfolio

•

Net interest margin of 4.41%

•

Puerto

Rico

mortgage

business

had

its

highest

origination

volume

in

2012

since

2005

•

Fitch recently upgraded Popular’s senior unsecured rating to BB-

2

•

Q4 net income $84 million which includes EVERTEC tax benefit of $27 million*

•

2012 net income $245 million

Earnings

Credit

(excludes covered loans)

Capital

Other

*EVERTEC tax benefit impact of $32 million before tax

Commercial NPLs declined $107 million QoQ driven by improved credit mostly in

PR |

Addressing Key

Areas of Shareholder Focus •

Reducing non-performing loans

Total NPLs held in portfolio declined $313 million in 2012

–

Commercial, mortgage and construction NPLs decreased by $165 million, $56

million and $53 million respectively

Reduced HFS balance (excluding mortgages) to $96 million from $473

million in Q4 2010

Provision expense for the year is 22% lower, declining to $334 million

Continue to actively pursue NPL sales that make economic sense

•

TARP exit framework

No contractual maturity and no US Treasury “call”

Rate reset is not a consideration

–

December

2013

reset

will

have

no

material

impact

on

earnings,

as

the

effective interest expense is approximately 9% of the par value of $935

million

We will exit at appropriate time with least possible dilution

–

Could be series of partial payments, lump-sum or a secondary market

transaction by the US Treasury

3

Credit

(excludes covered loans)

TARP |

Fundamental

Strengths •

Premier franchise in PR with #1 market position in most product categories

and strong revenue generating capacity

PR mortgage business (~32% market share) increased originations by 15%

in Q4 and by 21% for the full year with $1.5 billion

PR commercial loans increased by $113 million during Q4 (ex. covered

loans)

BPPR margin was 5.18%

•

US commercial loans (excluding legacy loans) increased by $117 million in

the fourth quarter

•

In 2012, supplemented originations with $800 million in high-quality loan

purchases

$475 million in US mortgages and $321 million in Puerto Rico consumer

and mortgage loans

•

Revenue generating capacity remains strong; gross revenues at $1.8 billion

for 2012

4 |

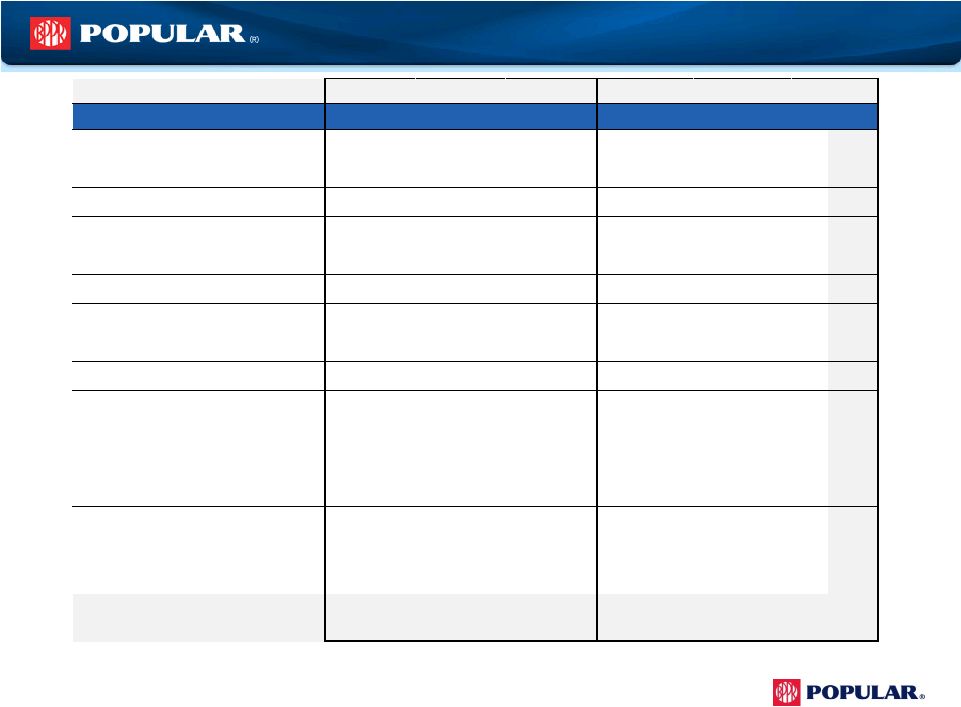

Financial

Results (Unaudited) 5

In thousands, except per share amount

Q4 2012

Q3 2012

Variance

Net interest income

$350,411

$343,426

$6,985

Service fees & other oper. income

150,249

114,840

35,409

Gain on sale of investments, loans & trading profits

19,576

7,576

12,000

FDIC loss-share expense

(36,824)

(6,707)

(30,117)

Gross revenues

483,412

459,135

24,277

Provision for loan losses

(excluding covered loans)

86,256

83,589

2,667

Provision for loan

losses (covered WB loans)

(3,445)

22,619

(26,064)

Net revenues

400,601

352,927

47,674

Personnel costs

116,325

111,550

4,775

Other operating expenses

180,422

178,805

1,617

Total operating expenses

296,747

290,355

6,392

Income before tax

103,854

62,572

41,282

Income tax expense

19,914

15,384

4,530

Net income

$83,940

$47,188

$36,752

EPS

$0.81

$0.45

$0.36

NIM

4.41%

4.37%

0.04%

Tangible book value per share (quarter end)

$32.55

$32.15

$0.40

Market price (quarter end)

$20.79

$17.45

$3.34 |

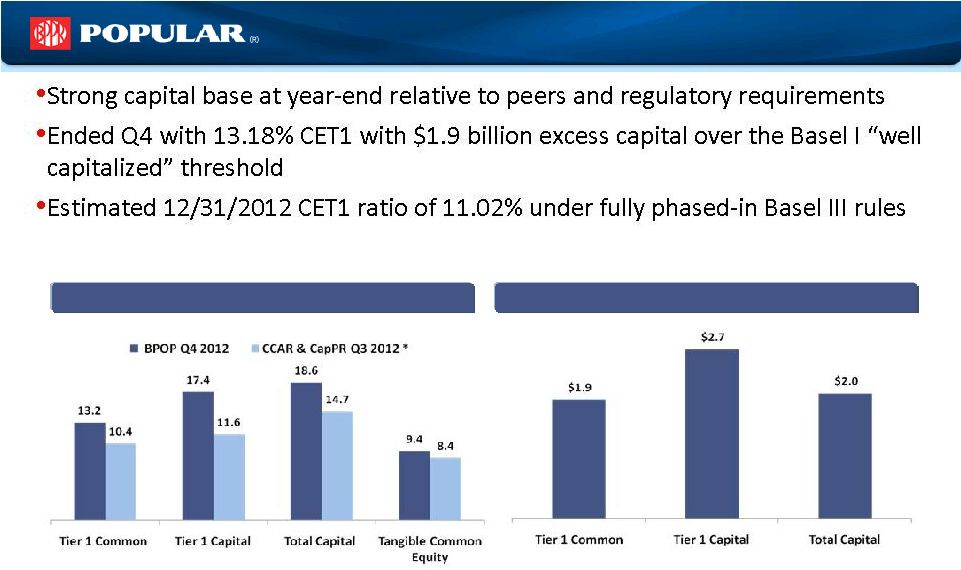

Capital

6

Current Risk Weighted Assets are approximately $23.4 billion at Q4

Capital Ratios %

Excess Capital ($) in billions **

**Excess capital over “well capitalized”

Basel I threshold

*Comprehensive

Capital

Analysis

and

Review

(CCAR)

of

19

firms

as

well

as

the

Capital

Plan

Review

(CapPR)

of

an

additional

11

bank

holding

companies

with

$50

billion

or

more

of

total

consolidated

assets. |

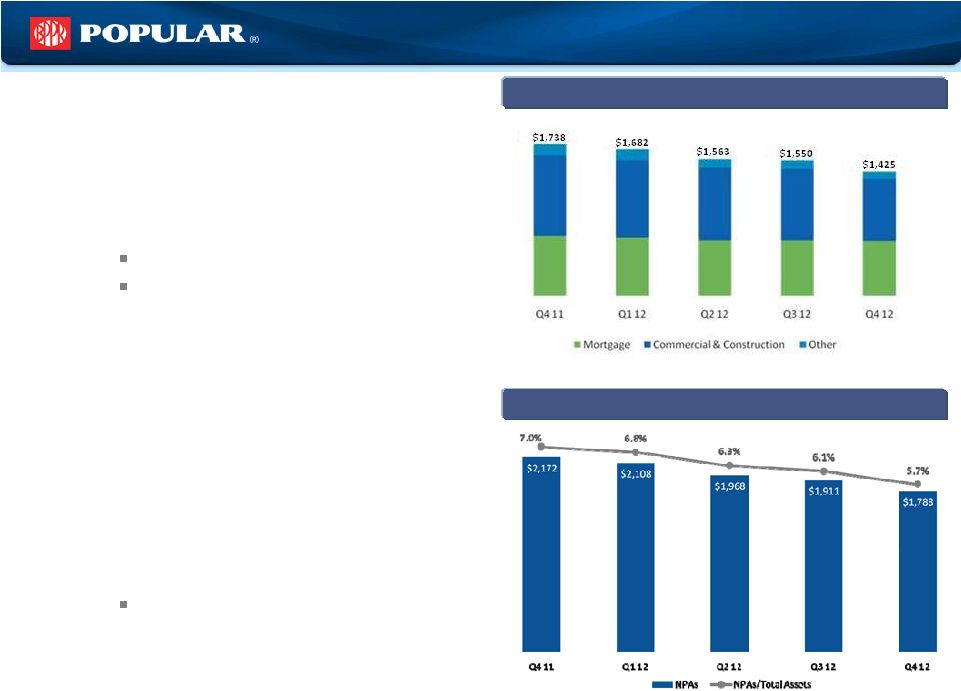

Consolidated

Credit Summary (Excluding Covered Loans) Continued improvement in

key credit quality metrics:

•

Non performing loans held-in-

portfolio declined:

$125 million or 8% QoQ

$313 million or 18% YoY

•

PR Commercial NPLs held-in-portfolio

are down by $90 million QoQ and

$108 million YoY

•

Non performing assets declined by

$123 million, or 6% QoQ and declined

$384 million or 18% YoY

NPLs held for sale are $166

million down YoY

Non-Performing Loans HIP ($M)

7

Non-Performing Assets ($M) |

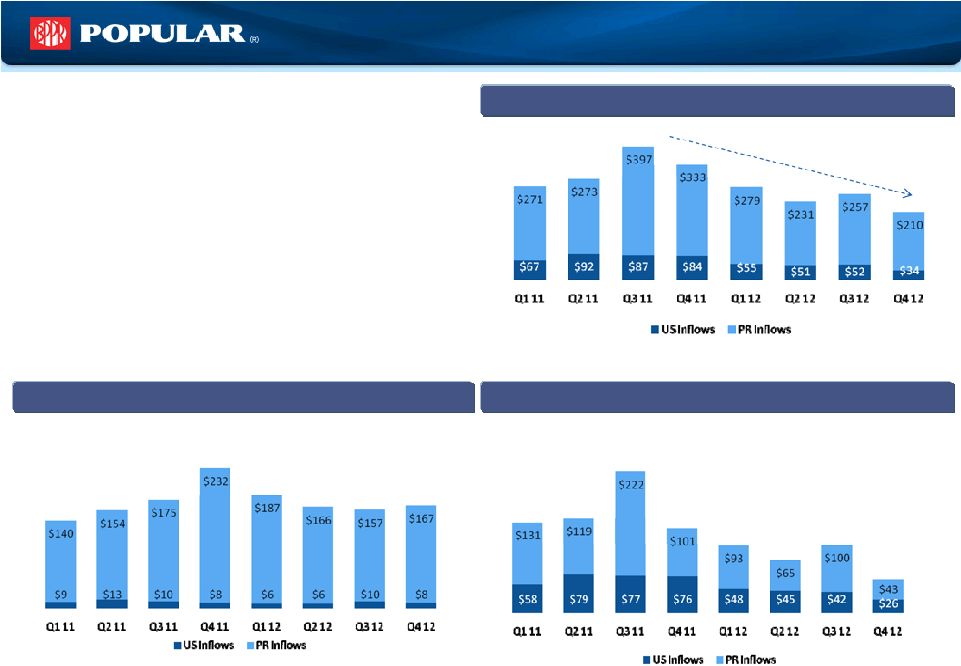

Total NPL

Inflows ($M) NPL inflows at 3-year lows

•

Total NPL inflows decreased by $65 million

QoQ and are at the lowest level in three years

•

Commercial, construction and legacy NPL

inflows decreased by $73 million QoQ driven

by credit improvements in both PR and the US

•

Mortgage NPL inflows increased by $8 million

QoQ but charge offs remain low in Q4

Mortgage NPL Inflows ($M)

Commercial, Construction & Legacy NPL Inflows ($M)

8

Excludes consumer loans |

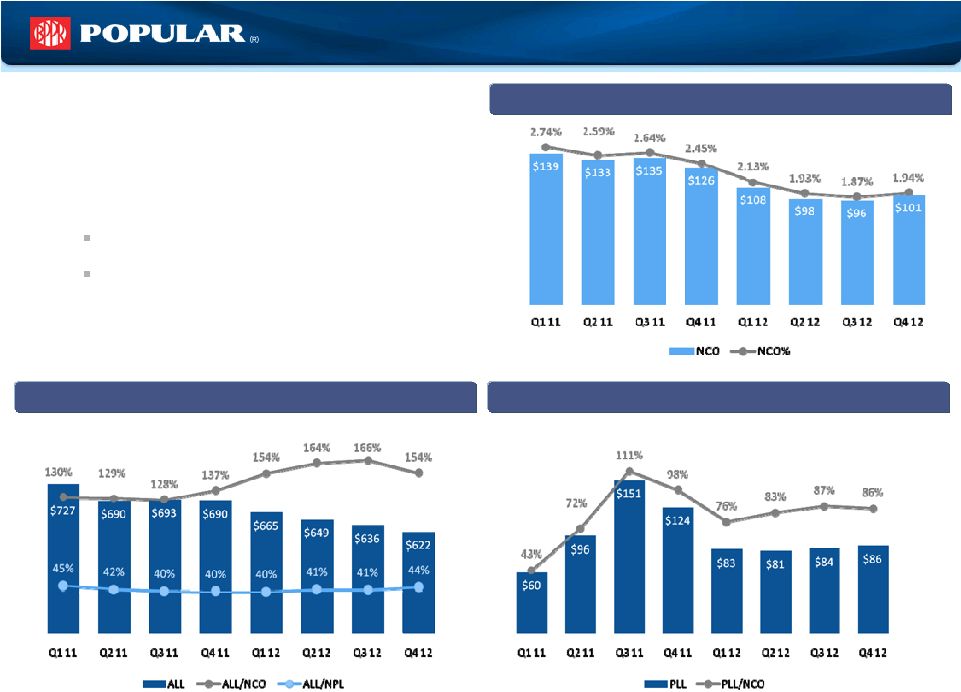

Credit Quality

Overview (Excluding Covered Loans) •

NCO ratio under 2% for the year; at lowest

point since 2007

•

Provision increased slightly to $86 million

driven by PR

PR PLL/NCO –

100%

US PLL/NCO –

36%

•

ALL/NPL increased to 44% driven by the

reduction in NPLs

ALLL ($M), ALLL-to-NCO and ALLL-to-NPL Ratios

NCO ($M) and NCO-to-HIP Loan Ratio

Provision ($M) and Provision-to-NCO Ratio

9 |

Continue to

Leverage Strengths and Drive Value •

Drivers of shareholder value in 2013

Continue to reduce NPLs through aggressive loss

mitigation efforts and sales that make economic sense

Capitalize on our leading market position to drive

originations and sustain above average margins

Make further improvements in our US franchise

Continue to build financial strength and flexibility

•

Investor Day March 1

, 2013 in San Juan, PR

10

st |

Appendix

Appendix |

12

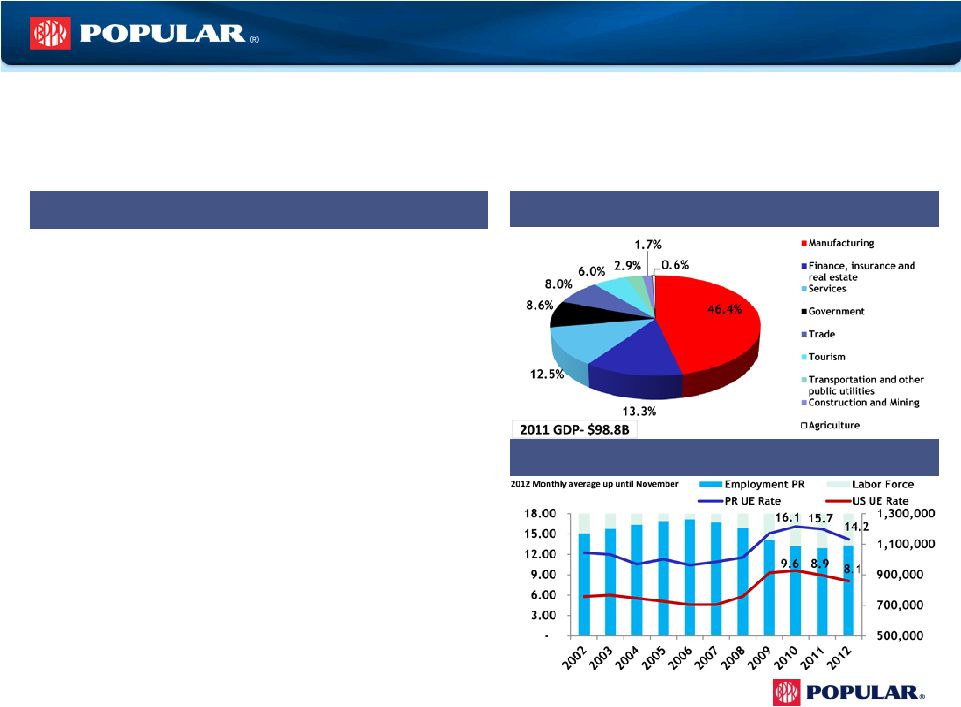

PR Economic Overview

•

11.5% increase of real gross domestic investment in FY

2010-11 marks largest increase in more than a decade

•

Housing Stimulus: extended through 6/30/13

•

Public/Private Partnerships (PPPs): $2.6B Airport, $1.4B toll

roads, $878 million schools

•

Unemployment rate for December 14%; down 12% from

the peak

•

Hotel registration of non-residents registered highest

occupancy rates in the last few years

•

GDB-EAI for the month of October registered a 0.2% YoY

increase, maintaining the upward trend started in

December 2011

GDP –

Composition by sector

Recent Trends

•

Official forecast calls for first positive GNP growth since 2005. Forecast is +0.4% (fiscal

2012) and +0.6% (fiscal 2013)

•

In

the

last

several

quarters,

indicators

such

as

retail

and

auto

sales,

home

sales,

cement

sales

and

sales

&

use

tax

among others show stabilization

Source: Government Development Bank of PR bgfpr.com, PR Finance

Housing Authority, PR commissioner of Financial Institutions

PR Labor Market |

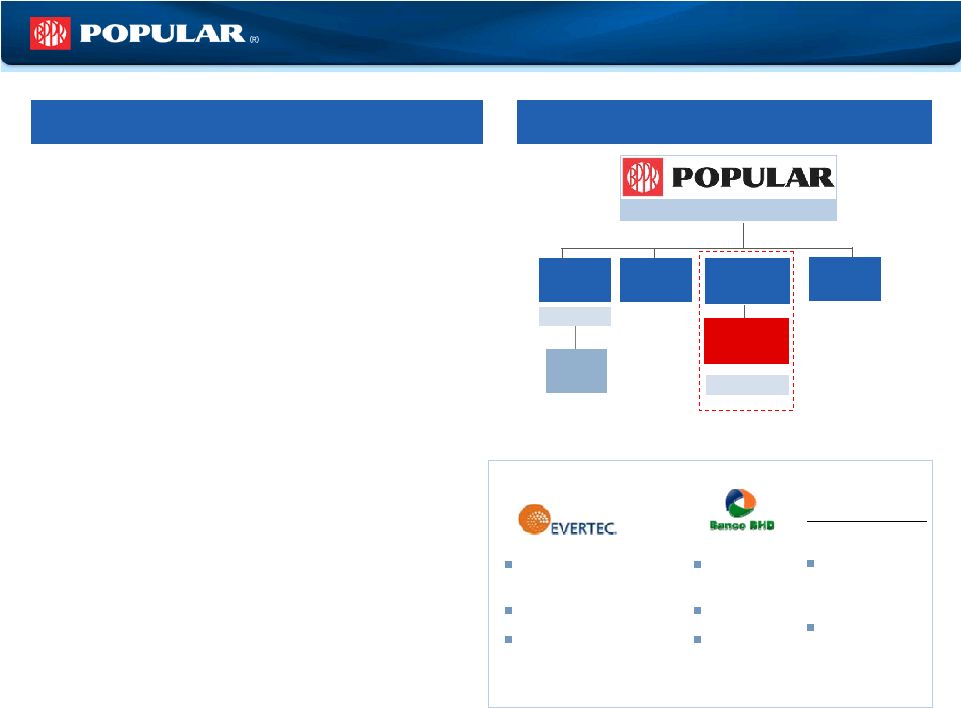

Who We Are

– Popular, Inc.

Franchise

•

Financial services company

•

Headquartered in San Juan, Puerto Rico

•

$37 billion in assets (top 50 bank holding company in

the U.S.)

•

$25 billion in total loans

•

$27 billion in total deposits

•

279 branches serving customers in Puerto Rico, New

York, California, Florida, Illinois, U.S. Virgin Islands,

and New Jersey

•

NASDAQ ticker symbol: BPOP

•

Market Cap: $2.1 billion¹

1

As of December 31, 2012

*Doing business as Popular Community Bank.

Summary Corporate Structure

Assets = $36.5bn

Popular Auto,

Inc.

Banco Popular

de Puerto Rico

Popular

Securities, Inc.

Assets = $27.6 bn

Assets = $8.7bn

Banco Popular

North America*

Puerto Rico operations

Selected

equity

investments

(first

two

under

“corporate”

segment

and

third

under

PR):

Popular

Insurance, Inc.

Popular North

America, Inc.

U.S. banking operations

Transaction processing,

business processes outsourcing

48.5% stake

Adjusted EBITDA of $117.8

million for the first 9 months of

2012

Dominican

Republic bank

19.99% stake

2011 approximate

income $100

million

PRLP 2011 Holdings

Construction and

commercial loans

vehicle

24.9% stake

13 |

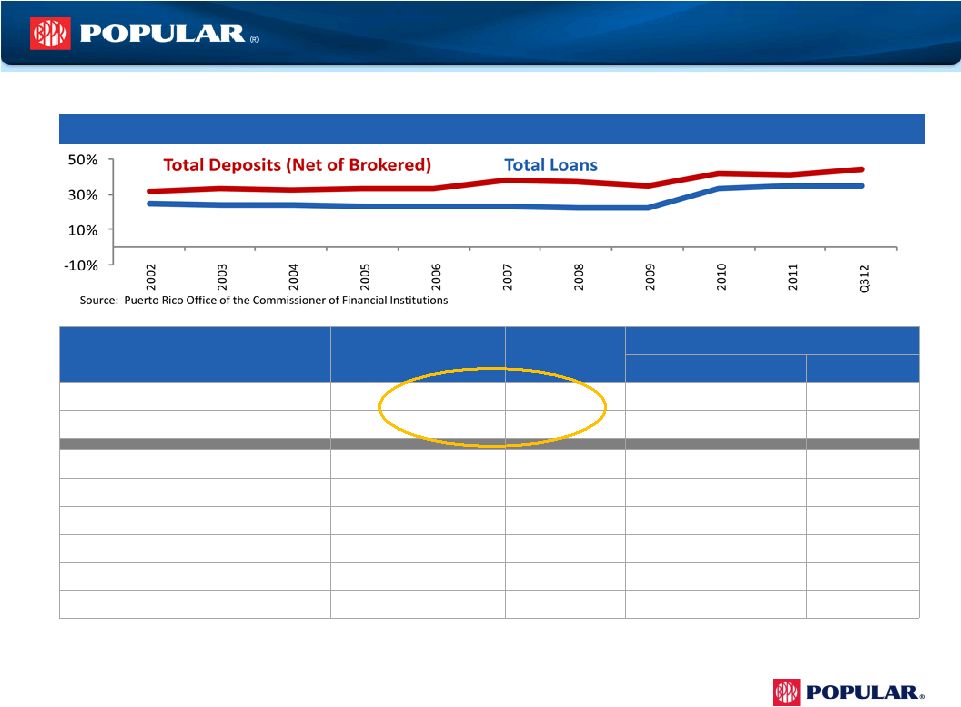

PR Franchise

Value Built Over 119 Years Category

Market Position as of

Q3 2012

Market Share

as of Q3 2012

Top Competitor

Institution/Group

Share

Total Deposits (Net of Brokered)

1

38%

Santander

14%

Total Loans

1

35%

FirstBank

16%

Commercial & Construction Loans

1

41%

FirstBank

18%

Credit Cards

1

50%

FirstBank

15%

Mortgage Loan Production

1

30%

Doral

16%

Personal Loans

1

35%

FirstBank

9%

Auto Loans/Leases

3

16%

Reliable

26%

Assets Under Management

3

13%

UBS

47%

•

Indisputable, sustained market leadership

Market Share Trend (2002–

2012)

14

Source: Puerto Rico Office of the Commissioner of Financial Institutions & 10K

reports Credit Unions: A total of 115 credit unions were in business as of

September 30, 2012, guaranteed by the (COSSEC). Total loans $4.3

billion with a 8% market share (49.% in personal loans; market share 50%).

1

1

1 |

$ in millions

(Unaudited) Q4 12

Q3 12

Variance

Q4 12

Q3 12

Variance

Net Interest Income

$309

$300

$9

$68

$70

($2)

Non Interest Income

90

114

(24)

15

11

4

Gross Revenues

399

414

(15)

83

81

2

Provision (non-covered)

78

69

9

8

14

(6)

Provision (covered WB)

(3)

23

(26)

-

-

-

Provision for loan losses

75

92

(17)

8

14

(6)

Expenses

240

232

8

57

57

0

Tax Expense

19

17

2

1

1

0

Net Income

$65

$73

($8)

$17

$9

$8

NPLs (HIP) ¹

$1,192

$1,284

($92)

$233

$266

($33)

NPLs (HIP + HFS) ¹

1,286

1,387

(101)

235

272

(37)

Loan loss reserve ¹

445

445

- 176

191

(15)

Assets

$27,600

$27,683

($83)

$8,652

$8,573

$79

Loans (HIP)

18,959

18,948

11

5,751

5,710

41

Loans (HIP + HFS)

19,309

19,277

32

5,755

5,718

37

Deposits

20,989

20,351

638

6,076

6,029

47

NIM

5.18%

5.11%

0.07%

3.51%

3.57%

-0.06%

PR

US

PR & US Business

15

1

Excludes covered loans |

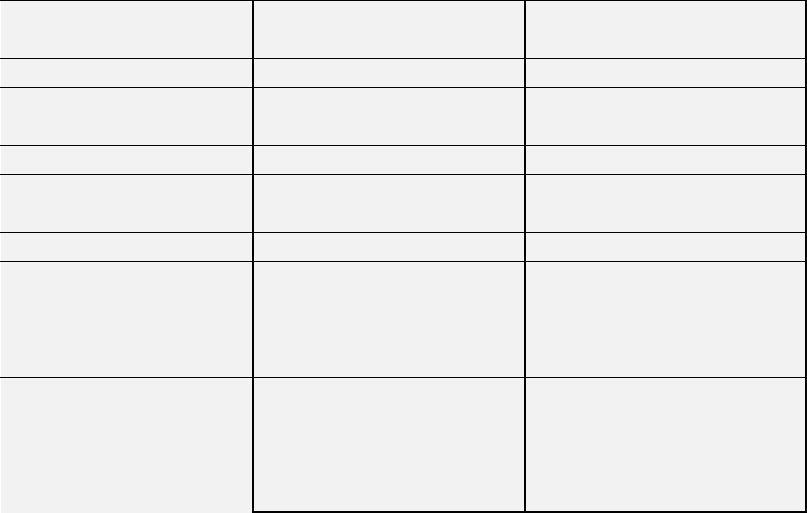

16

Consolidated Credit Summary (Excluding Covered Loans)

$ in millions

Q4 12

Q3 12

Q4 11

Loans Held in Portfolio (HIP)

$20,984

$20,754

$230

1.1%

$20,603

$381

1.9%

Performing HFS

258

228

30

13.2%

101

157

155.4%

NPL HFS

96

109

(13)

-11.6%

262

(166)

-63.3%

Total Non Covered Loans

21,338

21,091

$247

1.2%

20,966

$372

1.8%

Non-performing loans (NPLs)

$1,425

$1,551

($126)

-8.1%

$1,738

($314)

-18.0%

Commercial

$665

$772

($107)

-13.8%

$830

($165)

-19.9%

Construction

$43

$50

($7)

-13.3%

$96

($53)

-55.0%

Legacy

$41

$49

($8)

-16.9%

$76

($35)

-46.2%

Mortgage

$630

$632

($2)

-0.3%

$687

($56)

-8.2%

Consumer

$46

$48

($2)

-5.0%

$49

($4)

-7.5%

NPLs HIP to loans HIP

6.79%

7.47%

-0.7%

-9.1%

8.44%

-1.64%

-19.5%

Net charge-offs (NCOs)

$101

$96

$5

5.1%

$126

($25)

-20.0%

Commercial

$49

$47

$2

3.4%

$72

($23)

-32.1%

Construction

($2)

($1)

($1)

NM

$5

($7)

NM

Legacy

$3

$4

($1)

-15.8%

$6

($2)

-42.1%

Mortgage

$20

$16

$4

27.1%

$9

$12

NM

Consumer

$31

$30

$1

3.3%

$35

($4)

-11.4%

NCOs to average loans HIP

1.94%

1.87%

0.1%

3.7%

2.46%

-0.5%

-21.1%

Provision for loan losses (PLL)

$86

$84

$2

2.9%

$124

($38)

-30.6%

PLL to average loans HIP

1.66%

1.63%

0.0%

1.8%

2.42%

-0.8%

-31.4%

PLL to NCOs

0.86x

0.87x

-0.01x

-1.2%

0.98x

-0.12x

-12.6%

Allowance for loan losses (ALL)

$622

$636

($14)

-2.3%

$690

($68)

-9.9%

ALL to loans HIP

2.96%

3.07%

-0.1%

-3.6%

3.35%

-0.4%

-11.6%

ALL to NPLs HIP

43.62%

41.04%

2.6%

6.3%

39.73%

3.9%

9.8%

Q4 12 vs Q3 12

Q4 12 vs Q4 11 |

Credit Ratings

Update •

Our senior unsecured ratings have been gradually improving since

2010:

Moody’s:

B1

Stable Outlook (Revised December 2012)

S&P:

B+

Stable Outlook (No Change)

Fitch:

BB-

Stable Outlook (Revised January 2013)

•

January 2013: Fitch raised to BB-

from B+; outlook revised to stable

•

December 2012: Moody’s downgraded BPOP by two notches to B1; stable outlook

assigned

•

April 2012: Moody’s placing most of the PR banks under review with the possibility

of

downgrades, due to the state of the Puerto Rico economy

•

January 2012: Fitch raised BPOPs outlook to positive

•

December 2011: S&P raised its ratings on BPPR to BB from BB-

and changed outlook to

stable given revised bank criteria to Regional banks

•

July 2011: S&P raised our senior unsecured rating by one notch to B+

•

As the P.R. economy stabilizes and our credit metrics improve, we should see upward

pressure on the ratings

17 |

Financial

Results Financial Results

Fourth Quarter 2012

Fourth Quarter 2012 |